Automotive Axle & Propeller Shaft Market by Axle Type (Live, Dead & Tandem), Axle Position (Front & Rear), Propeller Shaft Type (Single & Multi-Piece), Passenger Car Propeller Shaft Material (Alloy & Carbon Fiber) and Region - Global Forecast to 2025

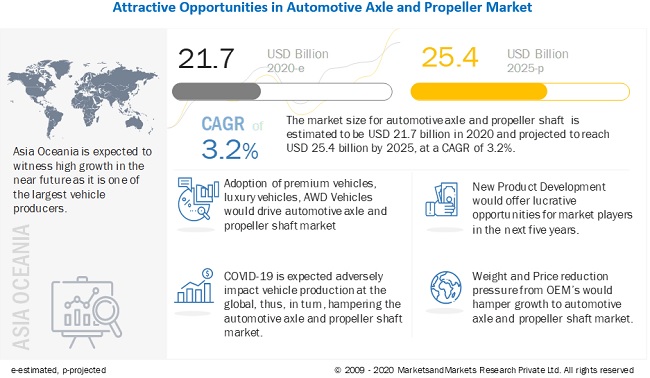

The Automotive Axle & Propeller Shaft Market was valued at $21.7 billion in 2020 and is expected to reach $25.4 billion by 2025, at a CAGR of 3.2% during the forecast period 2020-2025. As per our post-COVID forecasts, the market is estimated to reach US$ 21.7 billion in 2020 and is projected to achieve US$ 25.4 billion by 2025. Post-COVID, factors that push the market forward are a steady increase in vehicle production, demand for luxury vehicles, AWD vehicles, and commercialization of new technologies towards light-weighting of the overall vehicle is expected to drive the global market. Along with the rise in production, the automotive market is witnessing increasing demand for fuel efficient vehicles owing to an increased focus on sustainability. The OEMs and Tier I suppliers are joining forces to develop innovative fuel-efficient technologies and lightweight solutions to enhance vehicle performance. These factors are estimated to play a vital role in the global automotive axle & propeller shaft market.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on Automotive Axle & Propeller Shaft Market

The automotive axle & propeller shaft market includes major Tier I and II suppliers like ZF, GKN Automotive, Dana Incorporated, Meritor, Automotive axle & manufacturing, and others. These suppliers have their manufacturing facilities spread across various countries across Asia Pacific, Europe, North America, South America, and Middle East & Africa. COVID-19 has impacted all of its businesses globally; these players have announced a temporary shutdown of production due to lockdown and also to protect the safety of their employees, which basically created lowered demand and supply chain disruptions in US, France, Germany, Italy, and Spain during the COVID-19 pandemic. Component manufacturing was also suspended during the COVID-19 outbreak, with small Tier II and Tier III manufacturers facing liquidity issues. As a result, the demand for overall automotive production has decline, which directly affects the automotive axle & propeller shaft market. The COVID-19 crisis has brought about transformations such as digital platforms, touchless payments, and virtual dealerships in the automotive industry. The industry is also expected to face one more change, with some suppliers planning to shift their plants from China to nearby countries such as Japan, India, Indonesia, Vietnam, or the Philippines. For instance, Japan announced an initiative to set up a fund of USD 2.2 billion to encourage Japanese companies to move out of China. Further, manufacturers are likely to adjust production to prevent bottlenecks and plan production according to demand from OEMs and tier 1 manufacturers.

Market Dynamics:

Driver: Changing end user preference

Axles and propeller shafts play a vital role in the drivetrain of the vehicle. The rising end-user demand for a comfortable and pleasurable driving experience has resulted in an increasing amount of research in improving the vehicle’s overall NVH properties. Axle and propeller shafts manufacturers have to design their products which do not transmit noise and vibrations generated by engine or wheels due to their contact to the ground. The products are thoroughly tested for NVH performance and properties in manufacturing as well as assembly level process. This helps improve the overall structural performance of the vehicle and offers passenger comfort. For example, for premium vehicles, the growing demand for comfort will largely affect the demand for axles and advanced propeller shafts that helped in reducing the vibration of the vehicle. Advanced technologies of axle and propeller shaft have helped in attaining a certain level of security for the passengers by reducing the friction coefficient and maintaining the control of the vehicle.

Restraint: Fluctuating prices of raw materials

The global commodity market has been experiencing price volatility in the current years. This has adversely affected commodities like steel and aluminum, the principle raw materials of the axle, and the propeller shaft market. Along with raw materials, the prices of semi-finished products such as castings, forgings, bearings, and other components have also witnessed a similar trend. Suppliers, as well as manufacturers, are also under constant pressure from OEMs to reduce their prices. This trend might affect the automotive axle & propeller shaft market. However, the impact will be limited. The price of high strength steel is higher than regular steel but lower than aluminum, fiber composites, and magnesium. Established. Tier I suppliers have pricing adjustment programs with OE customers. Thus, with fluctuations in raw material prices, manufacturers face pricing pressure from OEMs which becomes a restraint for the axle and propeller shaft market.

Opportunity: Growing demand for aluminum propeller shaft

The manufacture of automotive materials which are light in weight have reduced the overall vehicle weight, thus reducing fuel consumption per vehicle and reducing overall emissions. There has been a rising trend towards the use of lightweight materials in light-duty vehicles such as aluminum, high strength steel, and others in the automotive industry. Propeller shaft market has experienced a new trend of demand for aluminum propeller shafts because of the need for weight reduction. The main advantage of the aluminum propeller shaft is the cost effectiveness compared to carbon fiber. In recent years, the huge demand for lightweight fiber materials reinforced the wide usage of polymer composites for manufacturing advanced propeller shafts. This new technology is devised to improve reliability and reduce manufacturing costs. The conventional use of steel drive shafts in two pieces usually increases the total weight of the vehicle and reduces fuel efficiency.

Challenges: Growing demand for aluminium propeller shaft

The manufacture of automotive materials which are light in weight have reduced the overall vehicle weight, thus reducing fuel consumption per vehicle and reducing overall emissions. There has been a rising trend towards the use of lightweight materials in light-duty vehicles such as aluminum, high strength steel, and others in the automotive industry. Propeller shaft market has experienced a new trend of demand for aluminum propeller shafts because of the need for weight reduction. The main advantage of the aluminum propeller shaft is the cost effectiveness compared to carbon fiber. In recent years, the huge demand for lightweight fiber materials reinforced the wide usage of polymer composites for manufacturing advanced propeller shafts. This new technology is devised to improve reliability and reduce manufacturing costs. The conventional use of steel drive shafts in two pieces usually increases the total weight of the vehicle and reduces fuel efficiency. Aluminum propeller shafts are also helpful in reducing weight and attaining optimal NHV. Various automotive OEMs are shifting towards advance technological components which are lighter in weight such as aluminum and high strength steel in their systems and components. Thus, the US government’s future goals of reducing the mass of LDVs is expected to directly boost the demand for the use of aluminum propeller shafts in the automotive industry.

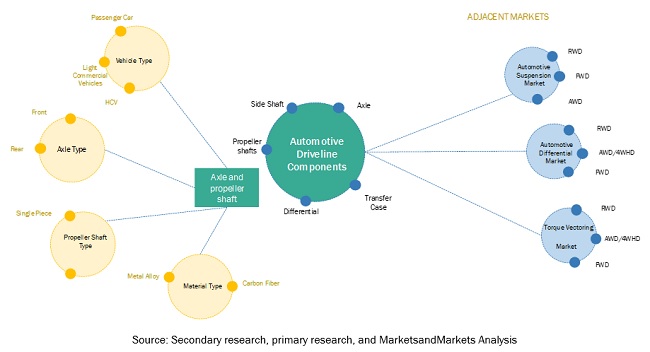

Ecosystem Analysis:

To know about the assumptions considered for the study, download the pdf brochure

Single piece leads the automotive propeller shaft segment under the forecast period

The single piece is estimated to be the largest market for automotive propeller shaft market during the forecast period. The single-piece propeller shaft is usually preferred in light-duty vehicles owing to the lesser distance between the engine and the rear axle along with benefits such as minimal frictional as well as mechanical losses. Also, these single-piece shafts are lighter in weight than multi-piece, which offers efficient performance at a higher speed. Due to these factors, the single-piece propeller shaft holds the largest share during the forecast period. The conventional materials such as steel SM45C, stainless steel, and composite materials such as HS carbon epoxy, e-glass polyester, and Kevlar epoxy are used to manufacture this type of propeller shaft. The weight of single piece propeller shafts is being reduced to enhance performance and design.

Live axle segment is expected to be the largest market, by axle type, during the forecast period

The live axle segment is set to register the largest market as compared with dead and tandem axles. Increasing focus towards optimizing vehicle performance and delivering higher torque would augment the live axle market. Also, growing vehicle production, as well as engineering advancements to cater to the changing customers' needs, would drive the market. Technological advancements such as the new design of axle components which use gear positions optimally, efficient placement of bearings is expected to help reduce the weight of axles and improve vehicle efficiency. Thus, the market for live axle is expected to grow during the forecast period.

Alloy is estimated to be the highest consumed material during the forecast period

Alloys hold the maximum market share in the passenger car propeller industry. Most of the vehicles employ propeller shafts made from steel alloy which gratifies their strength and stiffness requirements. A majority of passenger car and light commercial vehicles are installed with propeller shaft made up of alloy material owing to its benefits such as satisfactory strength, stiffness, and lower cost. However, in case of high-speed performance, and efficient torque requirement, either the diameter of the metal shaft needs to be increased, or manufactured in the form of two or three-piece component. The shaft joints and couplings handle the service loads, high angles, terrain change, and need to have a support structure that further results in increased weight. Hence, the ongoing trend is shifting to design and develop propeller shafts, which are lightweight and cost-effective. As a result, suppliers are now more inclined toward using lightweight materials (carbon fiber) with high durability and comfort factors while designing drivetrain components, especially propeller shafts.

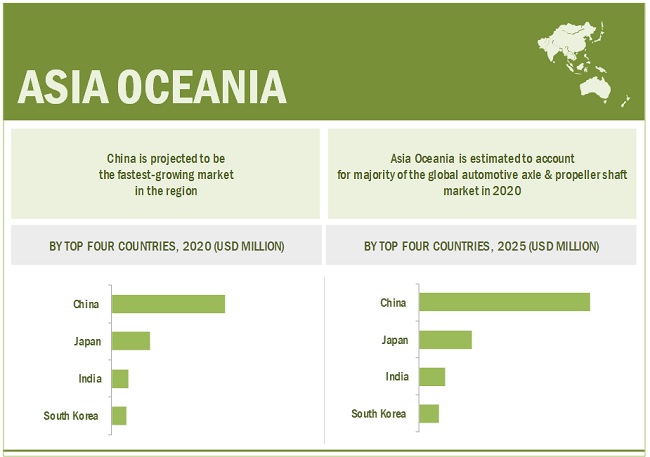

Asia Oceania is expected to account for the largest market during the forecast period

Europe is estimated to be the second-largest and established market for automotive axle and propeller shafts and is projected to witness stable growth in the coming years. The major growth driver is expected to be stringent fuel-economy norms, which would encourage companies to invest in R&D to develop lightweight solutions for vehicles. The high demand for vehicles in Germany, the UK, and France compared with other countries, along with the rise in premium vehicle sales, are estimated to drive the demand for axle and propeller shafts. Rising preference for comfort in vehicles by end-users would also positively impact the demand for a better quality of axles and propellers. Also, ZF Friedrichshafen AG (Germany), Dana Incorporated (US), GKN PLC (UK), IFA Rotorion (Germany), and Gestamp (Spain) are the key suppliers in the European market which are continually making R&D efforts to extend further the growth of automotive axle & propeller shaft market in Europe. The Chinese market is the largest in Asia Oceania and is witnessing significant growth in demand for premium vehicles. China is one of the major markets for premium vehicles, given the rising disposable income in the country. Nearly all major OEMs have invested in the Chinese market, which is inclined toward small and affordable passenger vehicles. Furthermore, a surge in demand is expected, as the current vehicle penetration is lower than in developed countries. The growing automotive production levels in China have raised the demand for automotive axles and propeller shafts.

The recent COVID-19 pandemic has impacted the global automotive industry, and many manufacturing companies had supply chain disruptions due to China lockdown, where partially most of the parts are imported. For instance, the UK, France, and Spain, which account for significant vehicle sales in Europe, is severely impacted by pandemic. Tier 1 suppliers around the globe have placed production lines on halt or shut them down completely. Also, legal and trade restrictions, such as sealed borders, increased the shortage of required parts. Such disruptions in the supply chain are expected to affect the assembly of OEMs in Europe and North America.

`

Key Market Players

Some of the key players in the automotive axle & propeller shaft market are ZF Friedrichshafen AG (Germany), Dana Incorporated (US), GKN Automotive (UK), American Axle & Manufacturing, Inc. (US), Meritor, Inc. (U.S.), Showa Corporation (Japan), Hyundai Wia Corporation (South Korea), JTEKT Corporation (Japan), and GKN plc (UK). ZF and GKN adopted the strategies of expansion, and new product development, to retain its leading position in the automotive axle and propeller market.

Scope of the Report:

|

Report Metric |

Details |

|

Market Size Available for years |

2016-2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD Million) and Volume (Thousand Units) |

|

Segments covered |

By axle type, axle position, propeller shaft type, propeller shaft by position, passenger car propeller shaft material & by Region |

Automotive Axle Market, By Type

- Dead

- Live

- Tandem

Automotive Axle Market, By Axle Position

- Front

- Rear

Automotive Propeller Shaft Market, By Position

- Front

- Rear

- Interaxle

Automotive Propeller Shaft Market, By Type

- Single piece

- Multi-piece

Passenger Car Propeller Shaft Market, By Material

- Alloy

- Carbon fiber

Automotive Axle & Propeller Shaft market, By Region

- Asia Oceania

- Europe

- North America

- RoW

Recent Developments

- In February 2020, Dana Launched the production of the Spicer Electrified eS9000r e-Axle for class 4 and class 5 commercial vehicles in North America and is the only supplier to manufacture all components in a system such as an axle, motor, gear, and invertor.

- In January 2020, GKN Automotive and Delta Electronics Inc. announced their collaboration on the joint development that is expected to enable the rapid acceleration of next-generation integrated 3-in-1 eDrive systems of power classes from 80kW to 155kW. The joint development of advanced eDrive technology is expected to see inverters supplied by Delta Electronics Inc. integrated with GKN Automotive's eMotor and gearbox systems in a 3-in-1 solution.

- In July 2019, JTEKT Corporation and Toyota Motor Corporation announced that Toyota-owned shares of Yutaka Seimitsu Kogyo, Ltd. (Yutaka Seimitsu) related to drive components were expected to be transferred to JTEKT corporation in 2020. This is expected to further strengthen the competitiveness of JTEKT Corp & Toyota Corp driveline operations.

- In February 2020, Gestamp has developed a lightweight chassis, which meets safety norms and is expected to be supplied for the upcoming vehicle models, Skoda and Volkswagen from 2021 in India. Gestamp is expected to supply subframe and front control arms for both German OEM vehicle models.

- In December-2019, Axle Manufacturing (AAM) announced the expansion of the driveline segment for RAM heavy duty trucks and supplies both, front & rear axles and driveshafts for Ram 2500 Heavy Duty, Ram 3500 Heavy Duty, Ram 3500 Chassis Cab, Ram 4500 Chassis Cab, and Ram 5500 Chassis Cab trucks.

Frequently Asked Questions (FAQ):

Who are the key players in the global automotive axle & propeller shaft market? What strategies have these companies adopted?

Some of the key players in the automotive axle & propeller shaft market are ZF Friedrichshafen AG (Germany), Dana Incorporated (US), GKN Automotive (UK), American Axle & Manufacturing, Inc. (US), Meritor, Inc. (U.S.), Showa Corporation (Japan), Hyundai Wia Corporation (South Korea), JTEKT Corporation (Japan), and GKN plc (UK). ZF and GKN adopted the strategies of expansion, and new product development, to retain its leading position in the automotive axle and propeller market.

The study indicates that the live axle dominates the axle market. How is the demand is anticipated to be significant in the next few years?

With rise in sales of AWD vehicles, it is expected market for live axle would also rise in near future. Further, North America passenger cars and SUV are preferred with RWD or AWD. Hence, the demand for live axles has grown consistently in North America.

The study indicates that a single piece holds the maximum share of the automotive propeller shaft market. How would change in market trends impact the usage of materials for shaft manufacturing? What would be the regional growth rate for the next five years?

Automotive OEMs are focused on developing lightweight material to improvise vehicle efficiency. Thus, tier 1 and raw material supplier manufacture shaft which are lighter in weight from convention steel. The single-piece propeller shaft is projected to grow at the highest CAGR from 2020 to 2025.

What are the current market dynamics in the automotive axle & propeller shaft market?

Technological advancement such as integrated axle, customer preference for all-wheel drive (AWD) vehicles, adoption of electric mobility, adoption of lightweight aluminum propeller shaft are few current market trends, which would likely to boost automotive axle & propeller shaft market.

What is the average cost of a single piece and multi-piece propeller shaft?

With different types of vehicles such as passenger cars sedans, SUV’s, others with varied vehicle models available, the average cost of single-piece and multi-piece propeller shaft would vary. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

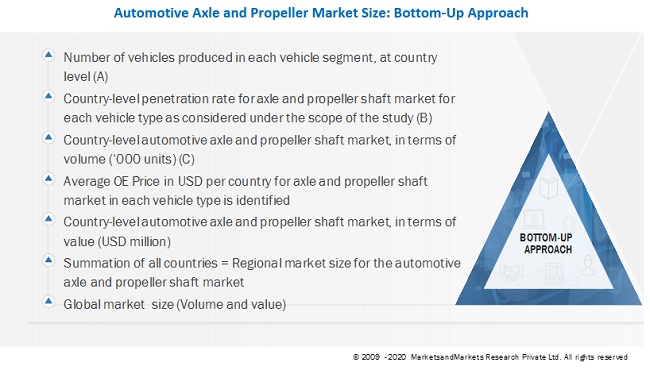

The study involves key activities to estimate the current size for the automotive axle & propeller shaft market. The first step defines the scope of the research study, which includes axle types, propeller shaft types, axle positions, materials, and regions to be considered in the study along with the assumptions and limitations to derive the market numbers. The next step was to validate these findings, assumptions, and market analysis with industry experts across value chains through primary research. The bottom-up approach has been used for market estimation and calculating the size of the automotive axle and propeller shaft.

Secondary Research

The secondary sources referred for this research study include company annual reports/presentations, press releases, industry association publications such as International Organization of Motor Vehicle Manufacturers (OICA), Canada Automobile Association (CAA), Europe Automobile Manufacturers Association (EAMA), investor presentations, and annual reports of key market players. Secondary data has been collected and analyzed to arrive at the overall market size, which is further validated by primary research.

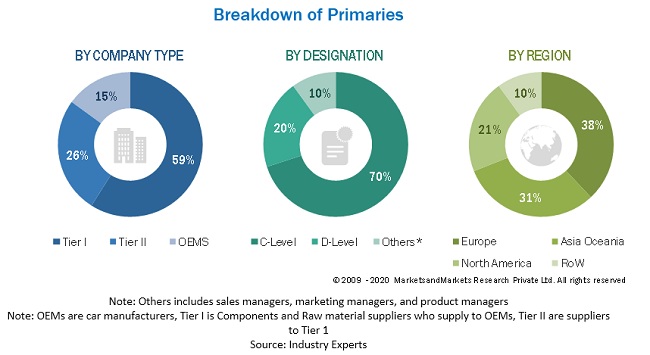

Primary Research

Extensive primary research was conducted after acquiring an understanding of the automotive axle & propeller shaft market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand (OEM) and supply-side (automotive axle and propeller shaft manufacturers and distributors) players across four major regions, namely, North America, Europe, Asia Oceania, and Rest of the World (South Africa and Brazil). Approximately 15% and 85% of primary interviews were conducted from both the demand and supply side, respectively. Primary data was collected through questionnaires, emails, and telephonic interviews. In our canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, administration, etc. to provide a holistic viewpoint in our reports.

After interactions with industry participants, we have also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

The below figure shows the break-up of the profile of industry experts who participated in primary discussions.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up approach has been used to estimate and validate the size of the automotive axle & propeller shaft market.

- In this approach, the vehicle production statistics for each vehicle type have been considered at a country and regional level.

- Market analysis based on industry experts and OEMs has been considered to understand overall automotive vehicle production forecasts on the post-COVID scenario.

- Extensive secondary and primary research has been carried out to understand the global market scenario for various segments used in the automotive industry.

- Several primary interviews have been conducted with key opinion leaders related to the automotive axle & propeller shaft market development, including key OEMs and Tier I suppliers.

- Qualitative aspects such as market drivers, restraints, opportunities, and challenges have been taken into consideration while calculating and forecasting the market size.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All parameters that are said to affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated, enhanced with detailed inputs and analysis from MarketsandMarkets, and presented in the report. The following figure is an illustrative representation of the overall market size estimation process employed for this study.

Report Objectives

- To define, describe, and forecast (2020 to 2025) the automotive axle & propeller shaft market, in terms of volume (thousand units), and value (USD million) at country, and regional level

- To define, describe, and forecast the automotive axle market, by volume and value, based on the type (dead, live, and tandem) at the regional level

- To analyze and forecast the automotive axle market, in terms of volume and value based on the axle position (front and rear) at the regional level

- To analyze and forecast the market for automotive propeller shaft market, by volume, and value, based on the type (single piece and multi-piece) at the regional level

- To analyze and forecast the market for automotive propeller shaft market, by volume, and value, based on the position (Front and Rear axle) at the regional level

- To forecast the passenger car propeller shaft market, by volume and value, based on the material (alloy and carbon fiber) at the regional level

- To forecast the volume and value of the market segments with respect to four regions namely – North America, Europe, Asia Oceania, and RoW

- To understand the market dynamics (drivers, restraints, opportunities, and challenges) of the market

- To analyze the market share of the key players operating in the market

- To analyze the competitive landscape and competitive leadership mapping for the global players operating in the market

- To track and analyze competitive developments such as joint ventures, mergers & acquisitions, new product developments, and expansions in the automotive axle & propeller shaft market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Automotive Axle Market, By Vehicle Type

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

Note: Axle types include dead, live, and tandem

Detailed analysis and profiling of additional market players (Up To three)

Growth opportunities and latent adjacency in Automotive Axle & Propeller Shaft Market

We are interested in carbon fiber automotive axle market report of propeller shaft type – single and multi-piece. Looking specifically at the North American drive shaft market. Kindly send a sample report to understand if it matches our requirements.

Does this Report cover explicitly: - side shafts / half shafts - solid shafts vs. hollow shafts (volumes, market Shares etc) - Focus should be Europe (=must); NA and China would be optional In case this report does not answer these questions, do you offer customized reports which do?