Drive Shaft Market by Type (Rigid & Hollow Drive Shaft), Position (Rear & Front Drive Shaft), Vehicle Type (Passenger Car (Hatchback, Sedan, SUV/MUV/MPV, Others) & LCV), & by Region - Global Forecast and Trends to 2020

[151 Pages Report] Automotive sideshafts play a vital role in the operation of any vehicle. It ensures optimum delivery of power to the wheels of the vehicle. Based on the application and position, the sideshaft serves the function of comfortable driving, and accommodating suspension vibrations and steering. Stringent fuel-efficiency demands from government regulations and end-users, following an increase in fuel prices have driven the need for lightweight automotive components. Sideshafts are designed to be as lightweight as possible, without compromising on its performance and NVH accommodation characteristics, as these components handle harsh working conditions such as mechanical wear and tear while optimizing fuel-efficiency.

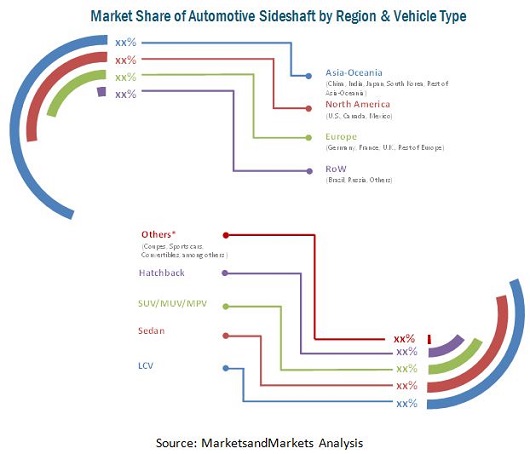

Based on the available types in the market, this report covers qualitative and quantitative market sizing and forecasting till 2020 for hollow and rigid market for key countries in Europe, North America, Asia-Oceania, and the rest of the world. The report also covers market sizing and forecast based on the position (front, and rear), and vehicle type (passenger car, including hatchbacks, sedans, SUV/MUV/MPV, and others, and LCV).

Since the inception of automotive sideshafts, they have evolved based on performance requirements of vehicle applications. Hollow sideshafts are slowly gaining preference over rigid sideshafts, even in the light commercial vehicles segment. The major reasons for this shift in preference is fuel efficiency, increasing demand for vehicle performance, and increasing comfort levels offered by the hollow sideshafts. OEMs are also adopting efficient technologies to comply with various regional emission norms in the developed economies. The increasing vehicle production, stringent carbon emission regulations and norms, enhanced driving experience, and increase in fuel efficiency provided by these sideshafts has driven the growth of the global automotive sideshaft market. However, fluctuating prices of raw materials used to produce the automotive sideshafts in high-volume markets have restrained growth of the automotive sideshaft market.

Manufacturers of sideshafts are striving to offer cost-efficient solutions without compromising on the performance of the vehicle through their product offerings. Suppliers are concentrating on globalization and developing products to comply with the present and upcoming emission norms in the market. For this purpose, suppliers are closely working with local partners and OEMs to develop new technologies to save development costs and offer efficient technologies in the sideshaft market.

In terms of type, the market size for hollow sideshafts is estimated to be the largest, given its usage in almost all passenger cars across the world. Their lightweight further helps in improving fuel efficiency of vehicles. The rigid sideshafts are basically used in light commercial vehicles and have a major market in the North American region. The major players in the automotive sideshaft market have been identified as GKN Plc. (U.K.), Nexteer Automotive (U.S.), NTN Corporation (Japan), Hyundai WIA Corporation (South Korea), and Trelleborg AB (Sweden) among others.

This report aims to estimate the global automotive sideshaft market for 2015 and to project demand for the same by 2020 for the industry professionals into the automotive sideshaft market, suppliers of sideshafts, OEMs, and distributors of drivetrain components. The report also provides a comprehensive review of market drivers, restraints, opportunities, challenges, and key issues in the global automotive sideshaft market. Key players in the market for automotive sideshaft market have also been identified and profiled. Apart from a quantitative analysis, the report also covers qualitative aspects, such as value analysis, PEST analysis, and Porters Five Force Analysis for the global automotive sideshaft market.

The report will enable both, established firms as well as new entrants/smaller firms to gauge the pulse of the market, which in turn helps these firms to gain a larger market share. Firms purchasing this report could use any one or a combination of the below-mentioned five strategies (market penetration, product development/innovation, market development, market diversification, and competitive assessment) to strengthen their position in the market.

The report provides insights with reference to the following points:

Product Development/Innovation: Detailed insights into upcoming technologies, R&D activities, and new product launches in the global automotive sideshaft market.

Market Development: Comprehensive information about lucrative emerging markets. The report analyzes the markets for automotive sideshaft across regions.

Market Diversification: Exhaustive information about new products, untapped markets, recent developments, and investments in the global automotive sideshaft market.

Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the global automotive sideshaft market.

Available customizations:

- Regional analysis: For further countries such as Spain, Portugal, Belgium, The Netherlands, and Sweden among others

- Automotive Sideshaft Material Market by Type, Automotive CVJ market by Type, and detailed analysis

- Company profiles: Profiling of additional market players (up to 3).

Scope of the Report

The global automotive sideshaft market is analyzed in terms of volume (000 units) and value (USD million) for the mentioned segments.

- By Region

- Asia-Oceania

- Europe

- North America

- RoW

- By Type

- Hollow

- Rigid

- By Vehicle Type

- Passenger Cars

- Hatchback

- Sedan

- SUV/MUV/MPV

- Others* (includes sportscars, coupes, convertibles, among others)

- Light Commercial Vehicles

- Passenger Cars

- By Position

- Front

- Rear

The global automotive drive shaft market has been broadly classified into hollow and rigid types. The hollow drive shaft market is estimated to account for the larger share of the global automotive sideshaft types market in 2015. A sideshaft transmits power from the engine through the differential or transfer case to the wheels of an automobile. The development of drive shaft is in tandem with the development of the automotive industry all across the globe. As the market of vehicles is growing all over the world, the global market for automotive drive shaft is estimated to grow at a CAGR of 5.79%. Key factors responsible for growth in the automotive drive shaft market include demand for low carbon footprint, enhanced driving experience, and fuel-efficient vehicles.

Automotive Drive shafts: The market size, in terms of value, is projected to grow at a promising CAGR of 6.37% to reach USD 7.2 Billion by 2020.

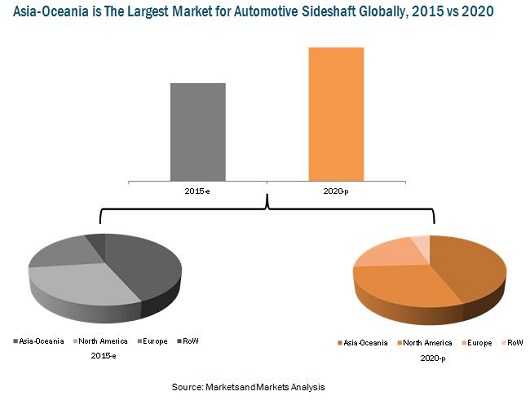

The favorable macro factors, such as economical labor, government support for the manufacturing industry, and a large local market have boosted the market for automotive drive shafts in this region. Asia-Oceania, the largest vehicle producer, is also estimated to be the largest sideshaft market in terms of market value. It comprises countries, such as China, India, Japan, and South Korea, where majority of the production is concentrated. OEMs have established their production bases in China, given the attractiveness of the domestic market and the low cost of production. Increasing demand for comfort and stringent fuel efficiency norms are also expected to drive the market for automotive drive shafts.

In context with vehicle type, the automotive drive shaft market in the passenger cars segment is accounted to hold the maximum share followed by light commercial vehicles. In the passenger car segment, the hollow sideshafts are used to offer comfort and fuel efficiency to the driver. As of 2015, global market for hollow drive shaft is estimated to be largest, with market share of 65% in terms of volume. In case of rigid drive shafts, the market for this segment is driven by the light commercial vehicles. OEMs are adopting light weight sideshafts that offer better fuel efficiency when compared with a rigid drive shaft.

The global drive shaft market is dominated by some international as well as local players, and some of them are GKN Plc. (U.K.), Nexteer Automotive (U.S.), NTN Corporation (Japan), Hyundai WIA Corporation (South Korea), and Trelleborg AB (Sweden) among others.

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.3 Data From Secondary Sources

2.4 Primary Data

2.4.1 Sampling Techniques & Data Collection Methods

2.4.2 Primary Participants

2.5 Factor Analysis

2.5.1 Introduction

2.5.2 Demand Side Analysis

2.5.2.1 Urbanization vs. Passenger Cars Per 1000 People

2.5.2.2 Infrastructure: Roadways

2.5.2.3 Increasing Vehicle Production in Developing Countries

2.5.3 Supply Side Analysis

2.5.3.1 Influence of Other Factors

2.6 Market Size Estimation

2.7 Data Triangulation

2.8 Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 32)

4.1 Automotive Sideshaft Market Share, By Region and Vehicle Type, 2015 (USD Million)

4.2 Key Countries of Automotive Sideshaft Market

4.3 Front and Rear Sideshaft Market, By Region

4.4 Automotive Sideshaft Market Snapshot for Passenger Cars and LCVs

4.5 Hollow Sideshafts Estimated to Hold the Largest Share, By Volume, in the Automotive Sideshaft Market

4.6 Top 4 Countries to Dominate Automotive Sideshaft Market

4.7 Key Market Players: Who Supplies to Whom

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Segmentation

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Global Vehicle Production

5.3.1.2 Growing Demand for Lightweight Sideshafts

5.3.2 Restraints

5.3.2.1 Fluctuations in Raw Material Prices

5.3.2.2 Economic Instability

5.3.3 Opportunities

5.3.3.1 Sizable Demand for Sideshafts From Growing Markets

5.3.3.2 Increasing Demand for Awd Vehicles

5.3.4 Challenges

5.3.4.1 Manufacturing Lightweight Yet Cost-Effective Sideshafts

5.4 Value Chain Analysis

5.4.1 Average Oe Selling Price (ASP) Analysis

5.5 Porters Five Forces Analysis

5.5.1 Threat of New Entrants

5.5.2 Threat of Substitutes

5.5.3 Bargaining Power of Buyers

5.5.4 Bargaining Power of Suppliers

5.5.5 Intensity of Competitive Rivalry

5.6 Sideshaft Technologies

5.7 Market Lifecycle

5.8 Counter Measures for Economic Impact

6 Global Automotive Sideshaft Market, By Position (Page No. - 50)

6.1 Introduction

6.2 Front Sideshaft

6.3 Rear Sideshaft

7 Automotive Sideshaft Market, By Vehicle Type (Page No. - 72)

7.1 Introduction

7.2 Passenger Car

7.2.1 Hatchback

7.2.2 Sedan

7.2.3 SUV/MUV/MPV

7.2.4 Rest of Passenger Cars (Others)

7.3 Light Commercial Vehicle (LCV)

8 Global Automotive Sideshaft Market, By Type (Page No. - 95)

8.1 Introduction

8.2 Rigid Sideshaft

8.3 Hollow Sideshafts

9 Global Sideshaft Market, By Region (Page No. - 101)

9.1 Introduction

9.2 Pest Analysis

9.2.1 Political Factors

9.2.1.1 Europe

9.2.1.2 Asia-Oceania

9.2.1.3 North America

9.2.1.4 RoW

9.2.2 Economic Factors

9.2.2.1 Europe

9.2.2.2 Asia-Oceania

9.2.2.3 North America

9.2.2.4 RoW

9.2.3 Social Factors

9.2.3.1 Europe

9.2.3.2 Asia-Oceania

9.2.3.3 North America

9.2.3.4 RoW

9.2.4 Technological Factors

9.2.4.1 Europe

9.2.4.2 Asia-Oceania

9.2.4.3 North America

9.2.4.4 RoW

9.3 Asia-Oceania

9.4 Europe

9.5 North America

9.6 RoW

10 Competitive Landscape (Page No. - 115)

10.1 Overview

10.2 Market Share Analysis, Automotive Sideshaft Market

10.2.1 Leadership Analysis

10.3 Competitive Situation and Trends

10.4 Battle for Market Share: Expansion Was the Key Strategy

10.5 Expansion

10.6 New Product Launch and Development

10.7 Mergers & Acquisitions

10.8 Agreements, Partnerships, Collaborations, & Joint Ventures

11 Company Profiles (Page No. - 123)

11.1 Introduction

(Overview, Financials, Products & Services, Strategy, and Developments)*

11.2 GKN PLC

11.3 Nexteer Automotive Group Limited

11.4 NTN Corporation

11.5 American Axle & Manufacturing Holdings, Inc.

11.6 Hyundai Wia Corporation

11.7 Neapco Holdings LLC

11.8 Ifa Rotorion - Holding GmbH

11.9 Trelleborg AB

11.10 NKN, Ltd.

11.11 Yamada Manufacturing Co., Ltd.

*Details on Overview, Financials, Product & Services, Strategy, and Developments Might Not Be Captured in Case of Unlisted Companies

12 Appendix (Page No. - 144)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Other Developments

12.4 Introducing RT: Real Time Market Intelligence

12.5 Available Customizations

12.5.1 Regional Analysis

12.5.2 Automotive Sideshaft Material Market, By Type

12.5.3 Automotive CV Joints Market, By Type

12.5.4 Additional Company Information

12.6 Related Reports

List of Tables (88 Tables)

Table 1 Key Market Players: Who Supplies to Whom, 2014

Table 2 Increasing Vehicle Production and Growing Demand for Lightweight Hollow Sideshafts are Propelling the Growth of the Automotive Sideshaft Market

Table 3 Commodity Prices

Table 4 Fluctuations in Raw Material Prices Restraining the Growth of the Market

Table 5 Reduction of Both, Weight and Cost is Proving to Be A Challenge for Tier-I Suppliers

Table 6 Automotive Sideshaft Market Size, By Position, 20132020 (000 Units)

Table 7 Automotive Sideshaft Market Size, By Position, 20132020 (USD Million)

Table 8 Front Sideshaft Market Size, By Region, 20132020 (000 Units)

Table 9 Front Sideshaft Market Size, By Region, 20132020 (USD Million)

Table 10 Asia-Oceania: Front Sideshaft Market Size, By Country,20132020 (000 Units)

Table 11 Asia-Oceania: Front Sideshaft Market Size, By Country,20132020 (USD Million)

Table 12 Europe: Front Sideshaft Market Size, By Country,20132020 (000 Units)

Table 13 Europe: Front Sideshaft Market Size, By Country,20132020 (USD Million)

Table 14 North America: Front Sideshaft Market Size, By Country,20132020 (000 Units)

Table 15 North America: Front Sideshaft Market Size, By Country, 20132020 (USD Million)

Table 16 RoW: Front Sideshaft Market Size, By Country, 20132020 (000 Units)

Table 17 RoW: Front Sideshaft Market Size, By Country, 20132020 (USD Million)

Table 18 Rear Sideshaft Market Size, By Region, 20132020 (000 Units)

Table 19 Rear Sideshaft Market Size, By Region, 20132020 (USD Million)

Table 20 Asia-Oceania: Rear Sideshaft Market Size, By Country,20132020 (000 Units)

Table 21 Asia-Oceania: Rear Sideshaft Market Size, By Country,20132020 (USD Million)

Table 22 Europe: Rear Sideshaft Market Size, By Country, 20132020 (000 Units)

Table 23 Europe: Rear Sideshaft Market Size, By Country,20132020 (USD Million)

Table 24 North America: Rear Sideshaft Market Size, By Country,20132020 (000 Units)

Table 25 North America: Rear Sideshat Market Size, By Country,20132020 (USD Million)

Table 26 RoW: Rear Sideshaft Market Size, By Country, 20132020 (000 Units)

Table 27 RoW: Rear Sideshaft Market Size, By Country, 20132020 (USD Million)

Table 28 Global: Automotive Sideshaft Market Size, By Vehicle Type, 20132020 (000 Units)

Table 29 Global: Automotive Sideshaft Market Size, By Vehicle Type, 20132020 (USD Million)

Table 30 Asia-Oceania: Hatchback Sideshaft Market Size, By Country, 20132020 (000 Units)

Table 31 Asia-Oceania: Hatchback Sideshaft Market Size, By Country, 20132020 (USD Million)

Table 32 Europe: Hatchback Sideshaft Market Size, By Country,20132020 (000 Units)

Table 33 Europe: Hatchback Sideshaft Market Size, By Country,20132020 (USD Million)

Table 34 North America: Hatchback Sideshaft Market Size, By Country, 20132020 (000 Units)

Table 35 North America: Hatchback Sideshaft Market Size, By Country, 20132020 (USD Million)

Table 36 RoW: Hatchback Sideshaft Market Size, By Country,20132020 (000 Units)

Table 37 RoW: Hatchback Sideshaft Market Size, By Country,20132020 (USD Million)

Table 38 Asia-Oceania: Sedan Sideshaft Market Size, By Country,20132020 (000 Units)

Table 39 Asia-Oceania: Sedan Sideshaft Market Size, By Country,20132020 (USD Million)

Table 40 Europe: Sedan Sideshaft Market Size, By Country,20132020 (000 Units)

Table 41 Europe: Sedan Sideshaft Market Size, By Country,20132020 (USD Million)

Table 42 North America: Sedan Sideshaft Market Size, By Country,20132020 (000 Units)

Table 43 North America: Sedan Sideshaft Market Size, By Country, 20132020 (USD Million)

Table 44 RoW: Sedan Sideshaft Market Size, By Country, 20132020 (000 Units)

Table 45 RoW: Sedan Sideshaft Market Size, By Country, 20132020 (USD Million)

Table 46 Asia-Oceania: SUV/MUV/MPV Sideshaft Market Size, By Country, 20132020 (000 Units)

Table 47 Asia-Oceania: SUV/MUV/MPV Sideshaft Market Size, By Country, 20132020 (USD Million)

Table 48 Europe: SUV/MUV/MPV Sideshaft Market Size, By Country,20132020 (000 Units)

Table 49 Europe: SUV/MUV/MPV Sideshaft Market Size, By Country, 20132020 (USD Million)

Table 50 North America: SUV/MUV/MPV Sideshaft Market Size, By Country, 20132020 (000 Units)

Table 51 North America: SUV/MUV/MPV Sideshaft Market Size, By Country, 20132020 (USD Million)

Table 52 RoW: SUV/MUV/MPV Sideshaft Market Size, By Country,20132020 (000 Units)

Table 53 RoW: SUV/MUV/MPV Sideshaft Market Size, By Country,20132020 (USD Million)

Table 54 Asia-Oceania: Others Sideshaft Market Size, By Country,20132020 (000 Units)

Table 55 Asia-Oceania: Others Sideshaft Market Size, By Country, 20132020 (USD Million)

Table 56 Europe: Others Sideshaft Market Size, By Country,20132020 (000 Units)

Table 57 Europe: Others Sideshaft Market Size, By Country,20132020 (USD Million)

Table 58 North America: Others Sideshaft Market Size, By Country, 20132020 (000 Units)

Table 59 North America: Others Sideshaft Market Size, By Country, 20132020 (USD Million)

Table 60 RoW: Others Sideshaft Market Size, By Country, 20132020 (000 Units)

Table 61 RoW: Others Sideshaft Market Size, By Country,20132020 (USD Million)

Table 62 Asia-Oceania: LCV Sideshaft Market Size, By Country,20132020 (000 Units)

Table 63 Asia-Oceania: LCV Sideshaft Market Size, By Country,20132020 (USD Million)

Table 64 Europe: LCV Sideshaft Market Size, By Country, 20132020 (000 Units)

Table 65 Europe: LCV Sideshaft Market Size, By Country, 20132020 (USD Million)

Table 66 North America: LCV Sideshaft Market Size, By Country,20132020 (000 Units)

Table 67 North America: LCV Sideshaft Market Size, By Country,20132020 (USD Million)

Table 68 RoW: LCV Sideshaft Market Size, By Country, 20132020 (000 Units)

Table 69 RoW: LCV Sideshaft Market Size, By Country, 20132020 (USD Million)

Table 70 Global Automotive Sideshaft Market, By Type, 20132020 (000 Units)

Table 71 Global Automotive Rigid Sideshaft Market, By Region and Vehicle Type, 20132020 (000 Units)

Table 72 Global Automotive Hollow Sideshaft Market, By Region and Vehicle Type, 20132020 (000 Units)

Table 73 Automotive Sideshaft Market Size, By Region, 20122020 (000 Units)

Table 74 Automotive Sideshaft Market Size, By Region, 20122020 (USD Million)

Table 75 Asia-Oceania: Automotive Sideshaft Market Size, By Country, 20122020 (000 Units)

Table 76 Asia-Oceania: Automotive Sideshaft Market Size, By Country, 20122020 (USD Million)

Table 77 Europe: Automotive Sideshaft Market Size, By Country,20122020 (000 Units)

Table 78 Europe: Automotive Sideshaft Market Size, By Country,20122020 (USD Million)

Table 79 North America: Automotive Sideshaft Market Size, By Country, 20122020 (000 Units)

Table 80 North America: Automotive Sideshaft Market Size, By Country, 20122020 (USD Million)

Table 81 RoW: Automotive Sideshaft Market Size, By Country,20152020 (000 Units)

Table 82 RoW: Automotive Sideshaft Market Size, By Country,20122020 (USD Million)

Table 83 Leadership Analysis GKN PLC, 2014

Table 84 Expansion is the Key Strategy Adopted By Automotive Sideshaft Market Players

Table 85 Expansions, 20142015

Table 86 New Product Launches and Developments, 20102014

Table 87 Mergers & Acquisitions, 20102014

Table 88 Agreements, Partnerships, Collaborations, & Joint Ventures, 2011

List of Figures (65 Figures)

Figure 1 Automotive Sideshaft Market: Markets Covered

Figure 2 Research Design

Figure 3 Research Methodology Model

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 5 Urbanization vs. Passenger Cars Per 1,000 People

Figure 6 Roadways Infrastructure: Road Network (KM), By Country, 2011

Figure 7 Significant Growth in Global Passenger Car Production

Figure 8 Economic Factor Analysis

Figure 9 Market Size By Position Estimation: Bottom-Up Approach

Figure 10 Market Size By Vehicle Type Estimation: Bottom-Up Approach

Figure 11 Asia-Oceania: Largest Market for Automotive Sideshafts

Figure 12 North American Automotive Sideshaft Market Set to Grow at the Highest CAGR

Figure 13 The Sedan Segment Dominates the Passenger Car Sideshaft Market

Figure 14 Front Sideshafts Estimated to Lead the Automotive Sideshaft Market in 2015 (USD Million)

Figure 15 Hollow Sideshafts to Dominate the Automotive Sideshaft Market (000 Units)

Figure 16 Asia-Oceania to Lead the Automotive Sideshaft Market in 2015

Figure 17 China and U.S. are Estimated to Be the Fastest-Growing Markets for Automotive Sideshafts From 2015 to 2020 (USD Million)

Figure 18 Rear Sideshafts to Dominate the North American Market in 2015

Figure 19 North America Estimated to Lead the LCV Sideshaft Market in 2015

Figure 20 Asia-Oceania to Dominate the Hollow Sideshaft Market in 2015

Figure 21 Top 4 Countries to Contribute Around 66% of the Automotive Sideshaft Market From 2015 to 2020

Figure 22 Market Segmentation

Figure 23 Automotive Sideshaft Market Dynamics

Figure 24 Global Light Vehicle Production Snapshot (2015 vs. 2020)

Figure 25 Per Year Increase in Curb Weight Rate Reduced to Around 10kg/Year From 18kg/Year

Figure 26 Global Hollow Sideshaft Market Share, 2015 vs. 2020 (000 Units)

Figure 27 Asia-Oceania and North America Set to Grow at Promising CAGRs

Figure 28 Global All-Wheel Drive Light Vehicle Production

Figure 29 Automotive Sideshaft: Value Chain

Figure 30 ASP Analysis of Sideshaft, 2014 (USD)

Figure 31 Porters Five Forces Analysis

Figure 32 Regional Market Lifecycle

Figure 33 Automotive Sideshaft Market, By Position, 2015 vs. 2020 (USD Million)

Figure 34 Front Sideshaft Market, By Region, 2015 vs. 2020 (USD Million)

Figure 35 Rear Sideshaft Market, By Region, 2015 vs. 2020 (USD Million)

Figure 36 Automotive Sideshaft Market Share, By Vehicle Type, 2015 (USD Million)

Figure 37 Hatchback Sideshaft Market Share, By Region, 20152020 (USD Million)

Figure 38 Sedan Sideshaft Market Share, By Region, 20152020 (USD Million)

Figure 39 SUV/MUV/MPV: Sideshaft Market Share, By Region, 20152020 (USD Million)

Figure 40 Others: Sideshaft Market Share, By Region, 20152020 (USD Million)

Figure 41 LCV: Sideshaft Market Share, By Region, 20152020 (USD Million)

Figure 42 Global Automotive Sideshaft Market, By Type, 2015 vs. 2020 (000 Units)

Figure 43 North America to Be the Largest Market for Rigid Sideshafts (2015)

Figure 44 Global Hollow Sideshaft Market, By Vehicle Type, 2015 vs. 2020 (000 Units)

Figure 45 Global Sideshaft Market Share, By Volume (%): Asia Oceania Estimated to Hold Largest Market Share (2015)

Figure 46 Asia-Oceania Sideshaft Market: Regional Snapshot (2015)

Figure 47 European Sideshaft Market: Regional Snapshot (2015)

Figure 48 North American Sideshaft Market: Regional Snapshot (2015)

Figure 49 RoW Sideshaft Market: Regional Snapshot (2015)

Figure 50 Companies Adopted Expansions as A Key Growth Strategy From2010 to 2015

Figure 51 Nexteer Automotive Grew at the Fastest Rate From 2012 to 2014

Figure 52 Automotive Sideshaft Market Share, By Key Player, 2014

Figure 53 Region-Wise Revenue Mix of Top 4 Market Players

Figure 54 Competitive Benchmarking of Key Market Players (20112014):

Figure 55 GKN PLC: Company Snapshot

Figure 56 GKN PLC: SWOT Analysis

Figure 57 Nexteer Automotive Group Limited: Company Snapshot

Figure 58 Nexteer Automotive : SWOT Analysis

Figure 59 NTN Corporation: Company Snapshot

Figure 60 NTN Corp. : SWOT Analysis

Figure 61 American Axle & Manufacturing Holdings, Inc.: Company Snapshot

Figure 62 American Axle & Manufacturing Holdings, Inc.: SWOT Analysis

Figure 63 Hyundai Wia Corporation: Company Snapshot

Figure 64 Hyundai Wia Corporation: SWOT Analysis

Figure 65 Trelleborg AB: Company Snapshot

Growth opportunities and latent adjacency in Drive Shaft Market