Truck Platooning Market by Type (DATP, Autonomous), Systems (ACC, AEB, FCW, GPS, HMI, LKA, BSW), Sensor (Lidar, Radar, Image), Services (Telematics- ECall, ACE, Tracking, Diagnostics, & Platooning- Pricing, Match Making), Region - Global Forecast to 2030

The global truck platooning market size was valued at USD 37.6 million in 2021 and is expected to reach USD 2,728.7 million by 2030, at a CAGR of 60.96%, during the forecast period 2021-2030. The forecast period considered for the study is 2021 to 2030. Growing demand for road safety & security and increasing focus toward reducing the operating cost of transportation have triggered the growth of the market.

Objectives of the Report

- To analyze and forecast (2021–2030) the truck platooning market, in terms of volume (Units) and value (USD million)

- To define, describe, and project the market based on platooning type, systems, services, sensor type, and region

- To analyze and forecast the market across four key regions, namely, Asia Oceania, Europe, Americas, and the Middle East and Africa (MEA)

- To analyze the regional markets for growth trends, prospects, and their contribution to the total market

- To strategically profile key players in the market and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments such as joint ventures, mergers and acquisitions, new product launches, expansions, and other industry activities carried out by the key industry participants

- To analyze the competitive landscape which includes recent developments (new product developments, expansion, mergers & acquisitions, supply contracts/joint ventures) by the OEMs, software/solution providers, Tier-1 companies, and startups

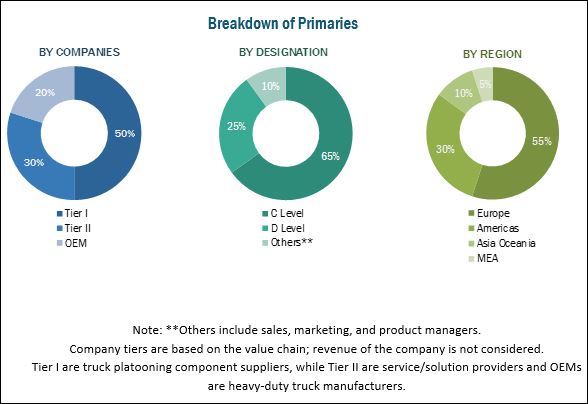

The research methodology used in the report involves primary and secondary sources and follows a bottom-up and top-down approach for data triangulation. The study involves the study of country-level sales of heavy-duty trucks and penetration of different types of platooning (autonomous truck platooning, DATP). The penetration and analysis are projected based on various factors such as autonomous vehicle index, infrastructure readiness, truck platooning testing & development, consumer acceptance, OEMs presence, and government regulations. The analysis has been discussed and validated by primary respondents, which include experts from the truck platooning industry, research professionals & consultants, and software & hardware suppliers. Secondary sources include associations such as European Automobile Manufacturers Association (ACEA), American Trucking Associations, Connected Vehicle Trade Association, truck platooning software & hardware suppliers’ websites and annual reports, and paid databases and directories such as Factiva and Bloomberg.

The figure given below illustrates the break-up of the profile of industry experts who participated in primary discussions.

To know about the assumptions considered for the study, download the pdf brochure

The ecosystem of the truck platooning market consists of Tier I suppliers and software/service providers such as Continental (Germany), Bosch (Germany), NVIDIA (US), and PELOTON (US). Platooning systems and technologies are supplied to automotive OEMs such as Volvo (Sweden), Daimler (Germany), and others.

Target Audience

- Automotive electronic component suppliers

- Automotive OEMs

- Autonomous platform providers

- Autonomous vehicle manufacturers

- Technology providers

- The automobile industry as an end-user industry and regional automobile associations

- Traders, distributors, and suppliers of materials used for truck platooning systems

- Truck platooning service providers

- Truck platooning component manufacturers

- Truck platooning system suppliers

- Research institutes and government organizations

Scope of the Report

Market, By Platooning Type

- Autonomous Truck Platooning

- DATP

Market, By Services

-

Telematics-Based Services

- Automatic Crash Notification

- Emergency Calling

- Navigation & Infotainment

- On-road Assistance

- Remote Diagnostics

- Vehicle Tracking

-

Platooning-Based Services

- Pricing

- Financial Transaction

- Match Making

Market, By Systems

- Adaptive Cruise Control (ACC)

- Automated Emergency Braking (AEB)

- Blind Spot Warning (BSW)

- Forward Collision Warning (FCW)

- Global Positioning System (GPS)

- Human Machine Interface (HMI)

- Lane Keep Assist (LKA)

- Others

Market, By Sensor Type

- Image

- Radar

- LiDAR

Market, By Region & Country

- Asia Oceania (Australia, Japan, Singapore, and Others)

- Europe (Germany, France, UK, Sweden, Belgium, The Netherlands, Spain, Austria, and Others)

- Americas (US, Canada, and Others)

- Middle East and Africa (UAE, Kuwait, and Others)

Available Customizations

Telematics-based services market for truck platooning, By Platooning Type

- Autonomous Truck Platooning

- DATP

* the study considered automatic crash notification, emergency calling, navigation & infotainment, on-road assistance, remote diagnostics, and vehicle tracking under the telematics based services segment

Platooning-based services market for truck platooning, By Platooning Type

- Autonomous Truck Platooning

- DATP

** the study considered match making, pricing, and financial transaction services under platooning based services segment.

Truck platooning systems market, By Platooning Type

- Autonomous Truck Platooning

- DATP

** the study considered Adaptive Cruise Control (ACC), Automated Emergency Braking (AEB), Blind Spot Warning (BSW), Global Positioning System (GPS), Human Machine Interface (HMI), Lane Keep Assist (LKA), and others under truck platooning systems

Drivers

Reduction in operating cost

Reduction in fuel consumption

According to Scania, the fuel cost accounts for more than 30% of the operational cost in normal European transport operations. A small reduction in fuel consumption would have significant impact on the overall freight cost in the transportation industry, which operates on small profit margins. The use of platooning in the trucking industry can help to reduce fuel cost incurred by vehicle manufacturers and transportation service providers. According to Peloton, the reduction in aerodynamic drag of two-truck platoons provides unprecedented fuel savings for both the trailing and the leading truck. For instance, in December 2015, tests conducted by Scania showed that a convoy of truck platooning can reduce fuel consumption by up to 12%. Similarly, the North American Council for Freight Efficiency (NACFE) and the US Departments of Energy & Transportation have shown double digit fuel savings in truck platooning tests. Therefore, truck platooning can help increase revenue and, ultimately, the benefits could be passed on to the customers in the form of low cost of traveling or low cost of goods. Additionally, truck platooning could offer increased vehicle utilization, lower crash cost, reduction in thefts, and reduced repair and maintenance cost. For instance, predictive maintenance system helps to predict and avoid machine failure by combining data from advanced Internet of Things (IoT) sensors and maintenance logs as well as external sources.

Lowering the CO2 emission

The rising stringency in emission norms has forced OEMs and Tier-1 manufacturers to adopt new technologies in heavy-duty vehicles. Similarly, government agencies such as the US Department of Transportation (US DOT) have also implemented new policies and programs to reduce vehicle emissions. According to the European Union, heavy-duty vehicles in Europe are responsible for moving 75% of the freight ton kilometers and account for 30% of on-road CO2 emissions.

Road safety

Road safety and security is one of the prime concerns for transport authorities and service providers. Most of the road accidents occur as the driver is either distracted or has lost focus owing to drowsiness. According to European Truck Platooning Challenge, human error is responsible for more than 90% of traffic accidents. The World Health Organization’s (WHO) Third Global Status Report on Road Safety 2015 estimated that more than 1.2 million road traffic deaths occur globally each year. The drivers are working more than the prescribed duration of driving, which results in the loss of concentration and causes accidents. As per the European Union drivers’ working hour regulations, the daily driving period should not exceed 9 hours, and daily rest period shall be 11 hours. In the US, drivers of large trucks are permitted by federal hours-of-service regulations to drive up to 11 hours at a stretch and up to 77 hours over a seven-day period. Following table shows the number of deaths caused due to the collision between large trucks and different vehicle types.

Restraints

High cost of hardware and technologies

The platoon trucks are anticipated to be highly priced chiefly due to the introduction of commercialized technological systems into the vehicles. The installation of advanced features such as adaptive cruise control (ACC), blind spot warning (BSW), lane keep assist (LKA), and forward collision warning (FCW) eventually increases the overall cost of the vehicle. Though most of these technologies to enable truck platooning are already available, the constant improvement is necessary to make them more reliable. This is because technologies embedded in the truck platooning must support the vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communications.

Lack of infrastructure

Truck platooning is also driving smart transportation, which needs integrated application of internet of things (IoT) technologies and surrounding infrastructure in transportation systems. The current road infrastructure is constraining the development of the possible routes for long-haul truck platoons. For instance, unsuited lane markings and bridges could block the optimal routing of platoons. This, in turn, is expected to increase the cost of developing the infrastructure to adapt to the changes in vehicle technologies and support them..

New Product Developments

|

Company |

Date |

Description |

MnM Analysis |

|

Xevo |

June 2017 |

Xevo has launched new Journeyware suite of automotive products. This is the only data-management software solution which uses machine learning, and powerful data analysis tools to give automakers a better understanding of their customers. With the unique data analysis, the software suite allows advanced safety measures to avoid dangers, limit distracted driving, and improve vehicle maintenance. |

Data analysis plays an important role in truck platooning. |

|

Continental |

July 2017 |

Continental developed a modular, scalable, and interlinked MFC 500 camera platform. The modular kit consists of the intelligent MFC 500 camera, various satellite cameras, and a central computer for assisted or automated driving [Assisted & Automated Driving Control Unit, (ADCU)]. The environment recognition and driving functions are optionally integrated in the camera platform though V2V and V2I communications. |

The MFC 500 camera platform is an important contribution to the truck platooning industry. |

Supply Contracts/Collaboration//Partnerships/Joint Ventures

|

Company |

Date |

Description |

MnM Analysis |

|

Peloton |

December 2017 |

Peloton demonstrated the driver-assistive truck platooning pilot project in Florida. The demonstration took place in collaboration with the Michigan Department of Transportation, Michigan State Police, and Michigan Economic Development Corporation. The convoy of 2 Volvo VNL670 class 8 trucks covered more than 1,000 miles during the pilot project. |

- |

|

Scania |

June 2017 |

Scania collaborated in a new 3-year Swedish research truck platooning project. In this project, Sweden4Platooning, Scania would work with DB Schenker, Volvo, the Royal Institute of Technology, RISE, and the Swedish Transport Administration in multi-brand platoons on public roads. The aim of Sweden4Platooning is to explore the full potential of a technology that could reduce carbon emissions and make goods transport more efficient. |

- |

The truck platooning market is projected to grow at a CAGR of 60.96% from 2021 to 2030, and the market size is projected to grow from USD 37.6 million in 2021 to USD 2,728.7 million by 2030. The increasing government regulations for vehicle safety, growing adoption of advanced driver assistance systems (ADAS), and significant testing of on-highway platooning are expected to play a significant role in the growth of the market.

The driver-assistive truck platooning (DATP) segment is projected to hold the largest share in the truck platooning market, by platooning type. Developed countries such as the US, Netherlands, Sweden, and the UK are likely to deploy DATP on roads in the near future. In June 2018, Volvo Trucks North America joined hands with FedEx and the North Carolina Turnpike Authority to demonstrate on-highway truck platooning in North Carolina.

Adaptive cruise control (ACC) is projected to be the fastest growing segment of the market, by systems. ACC is an essential system for truck platooning operations. ACC helps to automate the speed of the trucks with the help of V2V communication.

Image sensor is projected to be the largest segment of the market, by sensor type. In truck platooning, image sensors are used in several applications such as driver drowsiness, blind spot warning, road sign recognition, front monitoring, and lane keep assist. Due to the increasing accuracy of object detection, the number of image sensors used in truck platooning is expected to increase in the future.

The telematics-based services segment is projected to be the largest segment in the truck platooning market, by services. The adoption rate of telematics-based services is projected to grow in truck platooning owing to the rising concerns regarding maintenance notifications, duration of maintenance services, and reduced operational costs.

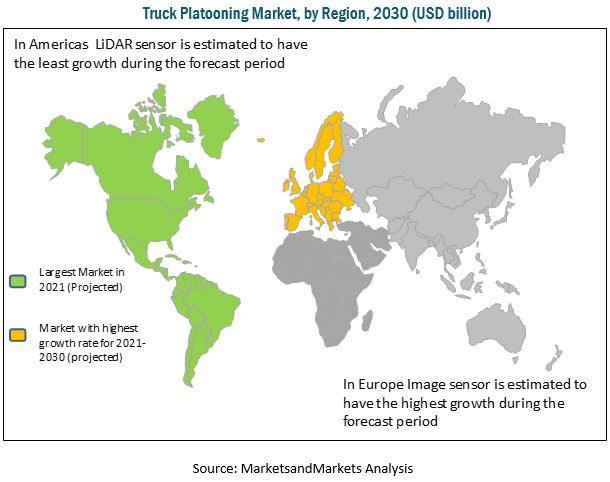

The Americas region is estimated to be the largest market for truck platooning. Trucks are the major contributor to the transportation sector of the Americas. The regulatory developments such as Compliance, Safety, and Accountability (CSA) and Hours of Service Solution (HOS) revisions are expected to drive the growth of the trucking industry in the region. Hence, the market is expected to see substantial growth. Also, the strong financial position of this region allows these countries to invest heavily in leading technologies such as truck platooning.

Europe is projected to be the fastest growing market for truck platooning. The major factors driving the growth of the market include pioneering efforts in truck platooning, technological advancements, and stringent vehicle safety norms in the region. Countries such as Sweden and the Netherlands have seen pioneering efforts in DATP with top rank in the autonomous vehicle index. In 2016, during its Presidency of the European Union (EU), the Netherlands started a European Truck Platooning Challenge. Hence, these developments are expected to drive the growth of truck platooning in the region in the near future.

The key factors restraining the growth of the truck platooning market are the high cost of truck platooning systems and lack of infrastructure. The installation of advanced features such as blind spot warning (BSW), lane keep assist (LKA), adaptive cruise control (ACC), and forward collision warning (FCW) system increases the overall cost of the truck. Truck platooning needs integrated application of internet of things (IoT) technologies and surrounding infrastructure in transportation systems. The current road infrastructure is constraining the development of the possible routes for long-haul truck platoons. The market is dominated by a few global players. Some of the key manufacturers operating in the market are Volvo (Sweden), Daimler (Germany), Scania (Sweden), Continental (Germany), Peloton (US), and NVIDIA (US).

Opportunities

Self-driving trucks

Autonomous vehicles are developing at a rapid pace. The self-driving truck is one of the most disruptive innovations in the transportation industry that will reduce shipping costs, increase supply chain efficiency, overcome the issue of truck driver shortage, and increase road safety with fewer accidents. Additionally, autonomous and semi-autonomous trucks can help reduce traffic congestion. The Texas A&M Transportation Institute’s 2015 Urban Mobility Scorecard reported that traffic congestion causes drivers to waste more than 3 billion gallons of fuel and be stuck in their vehicles for nearly 7 billion extra hours. Autonomous vehicles could redefine road capacity with an increase in the number of vehicles that can travel safely in a lane. Elderly and physically disabled people who are unable to drive will also have a chance to get around more freely.

Challenges

Gaining user/public acceptance

One of the major concerns in truck platooning is that of user acceptance, which includes acceptance by the transporters, drivers, as well as all other road users or public. The effective implementation of truck platooning requires close cooperation between transporters, private fleet owners, and individual owner-operators. According to the American Transportation Research Institute (ATRI) survey on “Willingness of different truck/fleet owners to cooperate in order to form inter-company platoons”, transport companies are least cooperative to work with other transport companies. Similarly, owner-operators are not willing to work with transporters and private fleet operators. However, private fleets are positive towards cooperation. The intense competition between transporters, data privacy concerns, and fear of delay in shipment due to cooperative scheduling of the platoons are some of the factors that restrain user/public acceptance.

Concern over data privacy and cyber security regulations

Truck platooning would create significant opportunities to improve road freight transport. However, it can also raise concerns about data privacy and security. Truck platooning uses wireless technologies such as V2V and V2I communication, which increase the risk of cyber threats for automotive electronics. The increase in vehicle connectivity through carry-in devices such as smartphones, music players, and tablets has also increased the vehicle’s cyber risk. Excessive connectivity also increases the risk of hacking. Even if external devices are not connected to the vehicle, there is still a possibility of getting hacked. This is because advanced Human-Machine Interface (HMI) systems are connected to the Internet and data is stored in the cloud database or at the research center of the OEMs. External interaction generally carries with it the risk of personal data being exposed. Although OEMs understand and agree to data privacy policies, there are uncertainties regarding the protection of this data.

Expansions

|

Company |

Date |

Description |

MnM Analysis |

|

NVIDIA |

August 2017 |

NVIDIA invested USD 20 million in a Chinese start-up TuSimple. TuSimple uses NVIDIA’s, DRIVE PX2 platform, Jetson TX2, CUDA, TensorRT and cuDNN to develop its autonomous driving solution. |

Autonomous platform is an important part of truck platooning. Hence, this development would contribute to the truck platooning industry. |

|

Bosch |

June 2017 |

Bosch Group established a research and technology office in Tel Aviv, Israel. Its aim is to work more closely with universities and scientific institutions at an early stage, to recognize innovative start-ups working in fields such as machine learning, deep learning, robotics, connectivity, cybersecurity, and the Internet of Things (IoT). |

By establishing an R&D center, Bosch is contributing to the truck platooning market by offering innovative solutions. |

Mergers & Acquisitions

|

Company |

Date |

Description |

MnM Analysis |

|

Wabco |

October 2017 |

WABCO purchased the Meritor, Inc.’s (NYSE:MTOR) stake in the Meritor WABCO joint venture and, thereby, taking ownership of the enterprise. This acquisition helps them to expand operations in the North America region. |

Meritor WABCO is the leading player in the truck platooning industry. |

|

Wabco |

July 2017 |

WABCO acquired AssetTrackr, a Bangalore-based start-up FMS provider, to strengthen its Fleet Management Systems (FMS) business in India. AssetTrackr uses an advanced software for managing cloud-based fleet management, which helps fleet operators to connect their vehicles, cargo, and manage other relevant data. |

The combination of AssetTrackr and WABCO India would accelerate the development of innovative solutions that improve the performance and safety regarding autonomous driving and truck platooning in the near future. |

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Product and Market Definition

1.3 Truck Platooning Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered in the Study

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Secondary Sources

2.1.1.2 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Sampling Techniques & Data Collection Methods

2.1.2.2 Primary Participants

2.2 Truck Platooning Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 32)

4.1 Truck Platooning – Global Market Trends

4.2 Truck Platooning Market, By Platooning Type

4.3 Market, By Systems

4.4 Market, By Sensor Type

4.5 Market, By Services

4.6 Market, By Country

4.7 Market, By Region

5 Truck Platooning Market Overview (Page No. - 37)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Reduction in Operating Cost

5.2.1.1.1 Reduction in Fuel Consumption

5.2.1.1.2 Lowering the Co2 Emission

5.2.1.2 Road Safety

5.2.1.3 Shortage of Skilled Drivers

5.2.2 Restraints

5.2.2.1 High Cost of Hardware and Technologies

5.2.2.2 Lack of Infrastructure

5.2.2.3 Ambiguity Over Regulations and Legislative Environment

5.2.3 Opportunities

5.2.3.1 Self-Driving Trucks

5.2.4 Challenges

5.2.4.1 Gaining User/Public Acceptance

5.2.4.2 Concern Over Data Privacy and Cyber Security Regulations

6 Truck Platooning Market, By Platooning Type (Page No. - 48)

Note: The Chapter is Further Segmented By Region (Asia Oceania. Europe, Americas, and Mea)

6.1 Introduction

6.2 Driver-Assistive Tuck Platooning (DATP)

6.3 Autonomous Truck Platooning

7 Truck Platooning Market, By Systems (Page No. - 54)

Note: The Chapter is Further Segmented By Region (Asia Oceania. Europe, Americas, and Mea)

7.1 Introduction

7.2 Adaptive Cruise Control (ACC)

7.3 Blind Spot Warning (BSW)

7.4 Global Positioning System (GPS)

7.5 Forward Collision Warning (FCW)

7.6 Lane Keep Assist (LKA)

7.7 Autonomous Emergency Braking (AEB)

7.8 Human Machine Interface (HMI)

7.9 Others

8 Truck Platooning Market, By Sensor Type (Page No. - 64)

Note: The Chapter is Further Segmented By Region (Asia Oceania. Europe, Americas, and Mea)

8.1 Introduction

8.2 Image

8.3 Radar

8.4 LiDAR

9 Truck Platooning Market, By Services (Page No. - 71)

Note: The Chapter is Further Segmented By Telematics-Based Services(Automatic Crash Notification, Emergency Calling,Navigation & Infotainment, On-Road Assistance, Remote Diagnostics, and Vehicle Tracking), By Platooning-Based Services (Pricing,Financial Transaction, and Match Making), and Region (Asia Oceania. Europe, Americas, and Mea)

9.1 Introduction

9.2 Telematics-Based

9.3 Platooning-Based

10 Truck Platooning Market, By Region (Page No. - 83)

Note: The Chapter is Further Segmented By Platooning Type (Dat & Autonomous)

10.1 Introduction

10.2 Americas

10.2.1 Canada

10.2.2 US

10.2.3 Rest of Americas

10.3 Europe

10.3.1 Austria

10.3.2 Belgium

10.3.3 Germany

10.3.4 France

10.3.5 UK

10.3.6 Spain

10.3.7 Sweden

10.3.8 The Netherlands

10.3.9 Rest of Europe

10.4 Asia Oceania

10.4.1 Australia

10.4.2 Japan

10.4.3 Singapore

10.4.4 Rest of Asia Oceania

10.5 Middle East and Africa (MEA)

10.5.1 Kuwait

10.5.2 UAE

10.5.3 Rest of Mea

11 Competitive Landscape (Page No. - 110)

11.1 Introduction

11.2 Truck Platooning: Market Ranking Analysis

11.3 Competitive Situation & Trends

11.3.1 New Product Developments

11.3.2 Supply Contracts/Collaborations/Partnerships/ Joint Ventures

11.3.3 Expansions

11.3.4 Mergers & Acquisitions

12 Company Profiles (Page No. - 116)

(Overview, Products Offered, Services Offered, Recent Developments, Funding Details & SWOT Analysis)*

12.1 Original Equipment Manufacturers (OEMS)

12.1.1 Volvo

12.1.2 Daimler

12.1.3 Scania

12.2 Tier-1 Suppliers

12.2.1 Continental

12.2.2 Bosch

12.2.3 ZF

12.2.4 Wabco

12.3 Software Suppliers

12.3.1 Intel

12.3.2 Nvidia

12.3.3 Peloton

12.4 Service Providers

12.4.1 Omnitracs

12.4.2 Trimble

12.4.3 Tomtom

12.5 Other Players

12.5.1 Asia Oceania

12.5.1.1 Toyota Tsusho

12.5.1.2 Hino Motors

12.5.2 Europe

12.5.2.1 Man

12.5.2.2 Telefonica

12.5.3 North America

12.5.3.1 Otto

12.5.3.2 Paccar

12.5.4 RoW

12.5.4.1 Cargox

*Details on Overview, Products Offered, Services Offered, Recent Developments, Funding Details & SWOT Analysis Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 154)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Available Customizations

13.4.1 Truck Platooning: Telematics Based Services Market, By Platooning Type

13.4.1.1 DATP

13.4.1.2 Autonomous Truck Platooning

13.4.2 Truck Platooning: Telematics Based Services Market, By Platooning Type

13.4.2.1 DATP

13.4.2.2 Autonomous Truck Platooning

13.4.3 Truck Platooning Systems Market, By Platooning Type

13.4.3.1 DATP

13.4.3.2 Autonomous Truck Platooning

13.5 Related Reports

13.6 Author Details

List of Tables (90 Tables)

Table 1 Currency Exchange Rates (W.R.T. USD)

Table 2 US Department of Transportation's Fatality Analysis Reporting System (Fars), 1990–2015

Table 3 Regulatory Framework for Truck Platooning

Table 4 Truck Platooning Market, By Platooning Type, 2021–2030 (‘000 Units)

Table 5 Truck PlatooningMarket, By Platooning Type, 2021–2030 (USD Million)

Table 6 DATP: Market, By Region, 2021–2030 (‘000 Units)

Table 7 DATP: Market, By Region, 2021–2030 (USD Million)

Table 8 Autonomous Truck Platooning: Market, By Region, 2021–2030 (‘000 Units)

Table 9 Autonomous Truck Platooning: Market, By Region, 2021–2030 (USD Million)

Table 10 Market, By Systems, 2021–2030 (USD Million)

Table 11 Adaptive Cruise Control: Market, By Region, 2021–2030 (USD Million)

Table 12 Blind Spot Warning: Market, By Region, 2021–2030 (USD Million)

Table 13 Global Positioning System: Market, By Region, 2021–2030 (USD Million)

Table 14 Forward Collision Warning: Market, By Region, 2021–2030 (USD Million)

Table 15 Lane Keep Assist: Market, By Region, 2021–2030 (USD Million)

Table 16 Autonomous Emergency Braking: Market, By Region, 2021–2030 (USD Million)

Table 17 Human Machine Interface: Market, By Region, 2021–2030 (USD Million)

Table 18 Other Systems: Market, By Region, 2021–2030 (USD Million)

Table 19 Market, By Sensor Type, 2021–2030 (‘000 Units)

Table 20 Market, By Sensor Type, 2021–2030 (USD Million)

Table 21 Image Sensor: Market, By Region, 2021–2030 (‘000 Units)

Table 22 Image Sensor: Market, By Region, 2021–2030 (USD Million)

Table 23 Radar Sensor: Market, By Region, 2021–2030 (‘000 Units)

Table 24 Radar Sensor: Market, By Region, 2021–2030 (USD Million)

Table 25 LiDAR Sensor: Market, By Region, 2021–2030 (‘000 Units)

Table 26 LiDAR Sensor: Market, By Region, 2021–2030 (USD Million)

Table 27 Market, By Services, 2021–2030 (USD Million)

Table 28 Market, By Telematics-Based Services, 2021–2030 (USD Million)

Table 29 Automatic Crash Notification: Telematics-Based Services Market, By Region, 2021–2030 (USD Million)

Table 30 Emergency Calling: Telematics-Based Services Market, By Region, 2021–2030 (USD Million)

Table 31 Navigation & Infotainment: Telematics-Based Services Market, By Region, 2021–2030 (USD Million)

Table 32 On-Road Assistance: Telematics-Based Services Market, By Region, 2021–2030 (USD Million)

Table 33 Remote Diagnostics: Telematics-Based Services Market, By Region, 2021–2030 (USD Million)

Table 34 Vehicle Tracking: Telematics-Based Services Market, By Region, 2021–2030 (USD Million)

Table 35 Market, By Platooning-Based Services, 2021–2030 (USD Million)

Table 36 Match Making: Platooning-Based Services Market, By Region, 2021–2030 (USD Million)

Table 37 Financial Transaction: Platooning-Based Services Market, By Region, 2021–2030 (USD Million)

Table 38 Pricing: Platooning-Based Services Market, By Region, 2021–2030 (USD Million)

Table 39 Global Market, By Region, 2021–2030 (Units)

Table 40 Global Market, By Region, 2021–2030 (USD Million)

Table 41 Americas: Market, By Country, 2021–2030 (Units)

Table 42 Americas: Market, By Country, 2021–2030 (USD Million)

Table 43 Canada: Market, By Platooning Type, 2021–2030 (Units)

Table 44 Canada: Market, By Platooning Type, 2021–2030 (USD Million)

Table 45 US: Market, By Platooning Type, 2021–2030 (Units)

Table 46 US: Market, By Platooning Type, 2021–2030 (USD Million)

Table 47 Rest of Americas: Market, By Platooning Type, 2021–2030 (Units)

Table 48 Rest of Americas: Market, By Platooning Type, 2021–2030 (USD Million)

Table 49 Europe: Market, By Country, 2021–2030 (Units)

Table 50 Europe: Market, By Country, 2021–2030 (USD Million)

Table 51 Austria: Market, By Platooning Type, 2021–2030 (Units)

Table 52 Austria: Market, By Platooning Type, 2021–2030 (USD Million)

Table 53 Belgium: Market, By Platooning Type, 2021–2030 (Units)

Table 54 Belgium: Market, By Platooning Type, 2021–2030 (USD Million)

Table 55 Germany: Market, By Platooning Type, 2021–2030 (Units)

Table 56 Germany: Market, By Platooning Type, 2021–2030 (USD Million)

Table 57 France: Market, By Platooning Type, 2021–2030 (Units)

Table 58 France: Market, By Platooning Type, 2021–2030 (USD Million)

Table 59 UK: Market, By Platooning Type, 2021–2030 (Units)

Table 60 UK: Market, By Platooning Type, 2021–2030 (USD Million)

Table 61 Spain: Market, By Platooning Type, 2021–2030 (Units)

Table 62 Spain: Market, By Platooning Type, 2021–2030 (USD Million)

Table 63 Sweden: Market, By Platooning Type, 2021–2030 (Units)

Table 64 Sweden: Market, By Platooning Type, 2021–2030 (USD Million)

Table 65 The Netherlands: Market, By Platooning Type, 2021–2030 (Units)

Table 66 The Netherlands: Market, By Platooning Type, 2021–2030 (USD Million)

Table 67 Rest of Europe: Market, By Platooning Type, 2021–2030 (Units)

Table 68 Rest of Europe: Market, By Platooning Type, 2021–2030 (USD Million)

Table 69 Asia Oceania: Market, By Country, 2021–2030 (Units)

Table 70 Asia Oceania: Market, By Country, 2021–2030 (USD Million)

Table 71 Australia: Market, By Platooning Type, 2021–2030 (Units)

Table 72 Australia: Market, By Platooning Type, 2021–2030 (USD Million)

Table 73 Japan: Market, By Platooning Type, 2021–2030 (Units)

Table 74 Japan: Market, By Platooning Type, 2021–2030 (USD Million)

Table 75 Singapore: Market, By Platooning Type, 2021–2030 (Units)

Table 76 Singapore: Market, By Platooning Type, 2021–2030 (USD Million)

Table 77 Rest of Asia Oceania: Market, By Platooning Type, 2021–2030 (Units)

Table 78 Rest of Asia Oceania: Market, By Platooning Type, 2021–2030 (USD Million)

Table 79 MEA: Market, By Country, 2021–2030 (Units)

Table 80 MEA: Market, By Country, 2021–2030 (USD Million)

Table 81 Kuwait: Market, By Platooning Type, 2021–2030 (Units)

Table 82 Kuwait: Market, By Platooning Type, 2021–2030 (USD Million)

Table 83 UAE: Market, By Platooning Type, 2021–2030 (Units)

Table 84 UAE: Market, By Platooning Type, 2021–2030 (USD Million)

Table 85 Rest of MEA: Market, By Platooning Type, 2021–2030 (Units)

Table 86 Rest of MEA: Market, By Platooning Type, 2021–2030 (USD Million)

Table 87 New Product Developments, 2017

Table 88 Supply Contracts/Collaboration//Partnerships/Joint Ventures, 2017

Table 89 Expansions, 2016–2017

Table 90 Mergers & Acquisitions, 2016–2017

List of Figures (50 Figures)

Figure 1 Market Segments of Truck Platooning Market

Figure 2 Truck Platooning: Research Design

Figure 3 Research Design Model

Figure 4 Breakdown of Primary Interviews

Figure 5 Truck Platooning: Bottom-Up Approach

Figure 6 Truck Platooning: Top-Down Approach

Figure 7 Data Triangulation

Figure 8 Market: Market Outlook

Figure 9 Market, By Region, 2021 vs 2025 vs 2030 (USD Million)

Figure 10 Increasing Concern Toward Road Safety, Security, & Operating Cost Efficiency to Drive the Market During the Forecast Period

Figure 11 DATP is Projected to Be the Leading Market From 2021–2030 (USD Million)

Figure 12 ACC is Projected to Dominate the Market, 2021 vs 2025 vs 2030 (USD Million)

Figure 13 Image Sensor is Projected to Hold the Largest Share of Market in 2030 (USD Million)

Figure 14 Telematics-Based Services Segment is Projected to Be the Largest Market, 2021 vs 2030 (USD Million)

Figure 15 US is Projected to Be the Largest Market in 2030 (USD Million)

Figure 16 Americas is Projected to Be the Largest Market, 2021 vs 2030 (USD Million)

Figure 17 Market: Market Dynamics

Figure 18 Potential Global Co2 Reduction Using Truck Platooning

Figure 19 US: Increasing Driver Shortage, 2014–2024

Figure 20 Level of Automation

Figure 21 Willingness of Different Truck/Fleet Owners to Cooperate in Order to Form Inter-Company Platoons

Figure 22 Market, By Platooning Type, 2021 vs 2026 vs 2030 (USD Million)

Figure 23 Market, By Systems, 2021 vs 2025 vs 2030 (USD Million)

Figure 24 Market, By Sensor Type, 2021 vs 2025 vs 2030 (USD Million)

Figure 25 Market, By Services, 2021 vs 2025 vs 2030 (USD Million)

Figure 26 Market, By Telematics-Based Services, 2021 vs 2025 vs 2030 (USD Million)

Figure 27 Market, By Platooning-Based Services, 2021 vs 2025 vs 2030 (USD Million)

Figure 28 Global Market, By Region: Americas Account for the Largest Market Share, By Value, 2021 vs 2025 vs 2030 (USD Million)

Figure 29 Americas: Market Snapshot

Figure 30 Europe: Market Snapshot

Figure 31 Asia Oceania: Japan is Projected to Be the Largest Market, 2021 vs 2025 vs 2030 (USD Million)

Figure 32 MEA: UAE is Projected to Be the Largest Market, 2021 vs 2025 vs 2030 (USD Million)

Figure 33 Key Development By Leading Players in the Truck Platooning Market

Figure 34 Truck Platooning: Market Ranking Analysis of OEMS

Figure 35 Volvo: Company Snapshot

Figure 36 Volvo: SWOT Analysis

Figure 37 Daimler: Company Snapshot

Figure 38 Daimler: SWOT Analysis

Figure 39 Scania: Company Snapshot

Figure 40 Continental: Company Snapshot

Figure 41 Bosch: Company Snapshot

Figure 42 ZF: Company Snapshot

Figure 43 ZF: SWOT Analysis

Figure 44 Wabco: Company Snapshot

Figure 45 Intel: Company Snapshot

Figure 46 Nvidia: Company Snapshot

Figure 47 Nvidia: SWOT Analysis

Figure 48 Peloton: SWOT Analysis

Figure 49 Trimble: Company Snapshot

Figure 50 Tomtom: Company Snapshot

Growth opportunities and latent adjacency in Truck Platooning Market