Digital Temperature and Humidity Sensor Market for Automotive Application by Technology (CMOS, MEMS, TFPT), Packaging Type (SMT, Pin Type), Application (Powertrain, Body Electronics, Alternative Fuel Vehicle), & Geography Forecast to 2020

The automotive vehicle sensor market is being driven by the increased demand for convenience, comfort, safety, efficiency, and environmental protection. Sensors known as digital sensors are poised to witness significant growth.

Digital sensors are defined as a combination of a sensing element, an analog to digital converter (ADC), and an analog interface along with bus interface in one housing.

The various advantages offered by digital sensors over their conventional counterparts include high performance, accuracy, low cost, easy implementation, no complex calibration required, and low power requirement among others.

Scope of the report

This research report categorizes the digital temperature & humidity sensor market for automotive application based on different technologies, packaging type, applications, and geography; it also covers the revenue forecast from 2013 to 2020. It describes the demand for digital temperature & humidity sensors for automotive application in various regions. The report describes the application mapping in the automotive vehicle sensor market with respect to the growth potential.

On the basis of technology

On the basis of technology, automotive temperature & humidity sensors are divided into CMOS, MEMS, and TFPT.

On the basis of packaging type

The different types of packaging covered in this report include surface mount technology (SMT) and pin type packaging.

On the basis of automotive application

The report segments the digital temperature & humidity sensor market by automotive application into three major applications which include powertrain, body electronics, and alternative fuel vehicle (AFV).

On the basis of the geographical regions

The geographical analysis of the said market covers the Americas, Europe, Asia-Pacific, and RoW. In this report, APAC is the biggest market as the demand and supply of automobiles is the largest in the region. It is followed by the Americas and Europe.

Digital sensors are defined as a combination of a sensing element, an analog to digital converter (ADC), and an analog interface along with bus interface in one housing.

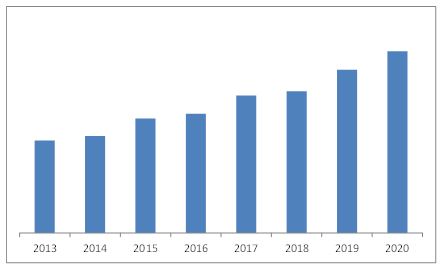

The market size of digital temperature & humidity sensors for automotive applications was worth $1,084.38 Million in 2013 and is expected to reach $2,129.68 Million, at a CAGR of 11.05% between 2014 and 2020.

In the automotive industry, temperature & humidity sensors are utilized in applications like powertrain, body electronics, and alternative fuel vehicles (AFV). Rising demand for alternative powertrains along with alternative fuel vehicles is expected to drive the market for smart sensors in the automotive industry.

The market associated with the digital temperature & humidity sensors for automotive application is poised to witness tremendous growth. Applications such as powertrain and AFV are expected to be high growth areas for smart relative humidity sensors.

This report covers the overall digital temperature & humidity sensors market on the basis of different types of technology, packaging type, application, and geography. The major automotive applications considered for this study are powertrain, body electronics, and alternative fuel vehicles. The body electronics application has been further segmented into automatic HVAC control and auto defogger system.

Considering the geographical scenario of the digital temperature & humidity sensors market for automotive application, APAC occupied the top position, followed by the Americas in 2013. The APAC region is also expected to exhibit the fastest growth, during the forecast period between 2014 and 2020.

Some of the major industry players in the said market are Sensirion AG (Switzerland), STMicroelectronics (Switzerland), Analog Devices Inc. (U.S.), Melexis NV (Belgium), NXP Semiconductor (Netherlands), Continental AG (Germany), and Robert Bosch GmbH (Germany) among others.

Digital Temperature & Humidity Sensor Market Size ($Million), 2013-2020

Source: MarketsandMarkets Analysis

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.4 Stakeholders

1.5 Market Scope

1.5.1 Year

1.5.2 Currency

1.5.3 Package

1.5.4 Limitations

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.1.2 Primary Data

2.1.1.3 Key Data From Primary Sources

2.1.1.4 Key Industry Insights

2.1.1.5 Breakdown of Primaries

2.2 Demand Side Analysis

2.2.1 Introduction

2.2.2 Demand Side Analysis

2.2.2.1 Powertrain

2.2.2.1.1 Growth in Fuel Efficient Powertrain Market

2.2.2.2 Body Electronics

2.2.2.2.1 Advancements in Body Electronics

2.2.2.3 Alternative Fuel Vehicle

2.2.2.3.1 Growth in Electric Vehicle Market

2.3 Market Size Estimation

2.4 Market Breakdown & Data Triangulation

2.5 Research Assumptions

2.5.1 Assumptions

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 30)

4.1 Attractive Market Opportunities in the Automotive Humidity & Temperature Sensor Market

4.2 Automotive Temperature Sensor Market, By Automotive Application

4.3 Automotive Humidity Sensor Market, By Automotive Application

4.4 Automotive Humidity & Temperature Sensor Market, By Application & Geography

4.5 Automotive Temperature & Humidity Sensor Market, Value ($Million) & Volume (Million Units), 2020

4.6 Automotive Temperature & Humidity Sensor Market For Automtoive Applications, By Geography

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Type

5.2.2 By Technology

5.2.3 By Packaging Type

5.2.4 By Application

5.2.5 By Geography

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increase in Global Sales of Light Vehicles

5.3.1.2 Growth of Electronics Content Per Vehicle

5.3.2 Restraints

5.3.2.1 Unavailability of Aftermarket

5.3.3 Opportunities

5.3.3.1 Increase in Demand of Electric Vehicles

5.3.4 Challenges

5.3.4.1 Ineffective Collaboration Between Semiconductor Manufacturers, OEMS, and Tier 1 Suppliers

5.3.5 Winning Imperative

5.3.5.1 Automotive Demand in Emerging Markets

6 Industry Trends (Page No. - 44)

6.1 Introduction

6.2 Strategic Benchmarking

6.2.1 Product Innovation and Development

6.3 Value Chain Analysis

6.4 Porter’s Five Forces Analysis

6.4.1 Threat of New Entrants

6.4.2 Threat of Substitutes

6.4.3 Bargaining Power of Suppliers

6.4.4 Bargaining Power of Buyers

6.4.5 Intensity of Competitive Rivalry

6.5 Pricing and Cost Analysis

7 Automotive Temperature & Humidity Sensor Market, By Sensor Type (Page No. - 53)

7.1 Introduction

7.2 Temperature Sensors

7.2.1 Electrical Temperature Sensor

7.2.1.1 Resistive Temperature Sensor

7.2.1.1.1 Thermistor

7.2.1.1.2 Thermocouple

7.2.1.1.3 Resistance Temperature Detector (RTD)

7.2.1.2 CAPACitive Temperature Sensor

7.3 Humidity Sensor

7.3.1 Capcitive Humidity Sensor

7.3.2 Resistive Humidity Sensor

8 Market By Technology (Page No. - 61)

8.1 Introduction

8.2 Microelectromechanical Systems (MEMS)

8.2.1 Advantages of MEMS Technology

8.3 Complementary Metal-Oxide Semsiconductor (CMOS)

8.3.1 Advantages of CMOS Technology

8.4 Thin-Film Polymer Technology (TFPT)

9 Market By Packaging Type (Page No. - 65)

9.1 Introduction

9.2 Surface Mount Technology (SMT)

9.2.1 Flat-No-Leads (FNL) Package

9.3 Pin-Type Packaging

10 Market By Application (Page No. - 69)

10.1 Introduction

10.2 Powertrain

10.2.1 Typical Powertrain System & Its Components

10.3 Body Electronics

10.3.1 Automatic HVAC Control

10.3.2 Auto Defogger System

10.3.2.1 Primary Defoggers

10.3.2.2 Secondary Defoggers

10.3.3 Alternative Fuel Vehicle (AFV)

11 Market By Geography (Page No. - 80)

11.1 Introduction

11.2 Americas

11.3 Europe

11.4 Asia-Pacific

11.5 RoW

12 Competitive Landscape (Page No. - 94)

12.1 Overview

12.2 Market Share Analysis

12.3 Competitive Situation and Trends

12.3.1 New Product Launches, Devlopments, and Upgrades

12.3.2 Acquisitions, Collaborations, and Partnerships

12.3.3 Other Developments

13 Company Profiles (Page No. - 100)

(Overview, Products and Services, Financials, Strategy & Development)*

13.1 Introduction

13.2 Analog Devices, Inc.

13.3 Continental AG

13.4 Delphi Automotive Plc

13.5 Epcos AG

13.6 Honeywell International Inc.

13.7 Measurement Specialities Inc.

13.8 Melexis NV

13.9 NXP Semiconductors

13.10 On Semiconductor Corporation

13.11 Robert Bosch GMBH

13.12 Sensata Technologies, Inc.

13.13 Sensirion AG

13.14 Stmicroelectronics

13.15 Texas Instruments (TI)

*Details on Overview, Products and Services, Financials, Strategy & Development Might Not be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 134)

14.1 Insights of Industry Experts

14.2 Discussion Guide

14.3 Introducing RT: Real-Time Market Intelligence

14.4 Available Customizations

14.5 Related Reports

List of Tables (72 Tables)

Table 1 Increase in Sales of Vehicles is Expected to Propel the Growth of the Automotive Temperature & Humidity Sensor Market

Table 2 Unavailability of Aftermarket a Key Restraint

Table 3 Electric Vehicles a Key Opportunity For Smart Sensor

Table 4 Collaboration Concerns Between Semiconductor Manufacturers and OEMS: a Key Challenge For Smart Sensor Market

Table 5 Automotive Temperature Sensor Market Size, By Type, 2013-2020

Table 6 Automotive Temperature Sensor Market Size, By Application, 2013-2020 ($Million)

Table 7 Automotive Temperature Sensor Market Size, By Application, 2013-2020 (Million Units)

Table 8 Automotive Temperature Sensor Market Size, By Geography, 2013-2020 ($Million)

Table 9 Automotive Temperature Sensor Market Size, By Geography, 2013-2020 (Million Units)

Table 10 Automotive Humidity Sensor Market Size, By Type, 2013-2020

Table 11 Automotive Humidity Sensor Market Size, By Application, 2013-2020 ($Million)

Table 12 Automotive Humidity Sensor Market Size, By Application, 2013-2020 (Million Units)

Table 13 Automotive Humidity Sensor Market Size, By Geography, 2013-2020 ($Million)

Table 14 Automotive Humidity Sensor Market Size, By Geography, 2013-2020 (Million Units)

Table 15 CMOS: Automotive Temperature & Humidity Sensor Market Size, By Type, 2013-2020 ($Million)

Table 16 CMOS: Market Size, By Type, 2013-2020 (Million Units)

Table 17 SMT: Market Size, By Type, 2013-2020 ($Million)

Table 18 SMT: Market Size, By Type, 2013-2020 (Million Units)

Table 19 Pin Type: Market Size, By Type, 2013-2020 ($Million)

Table 20 Pin Type: Market Size, By Type, 2013-2020 (Million Units)

Table 21 Automotive Sensor Market Size, By Application, 2013-2020 ($Million)

Table 22 Automotive Temperature & Humidity Sensor Market Size, By Application, 2013-2020 (Million Units)

Table 23 Powertrain: Market Size, By Type, 2013-2020 ($Million)

Table 24 Powertrain: Market Size, By Type, 2013-2020 (Million Units)

Table 25 Powertrain: Automotive Temperature Sensor Market Size, By Geography, 2013-2020 ($Million)

Table 26 Powertrain: Automotive Temperature Sensor Market Size, By Geography, 2013-2020 (Million Units)

Table 27 Powertrain: Automotive Humidity Sensor Market Size, By Geography, 2013-2020 ($Million)

Table 28 Powertrain: Automotive Humidity Sensor Market Size, By Geography, 2013-2020 (Million Units)

Table 29 Body Electronics: Automotive Temperature & Humidity Sensor Market Size, By Type, 2013-2020 ($Million)

Table 30 Body Electronics: Market Size, By Type, 2013-2020 (Million Units)

Table 31 Body Electronics: Market Size, By Application, 2013-2020 ($Million)

Table 32 Body Electronics: Market Size, By Application, 2013-2020 (Million Units)

Table 33 Body Electronics: Automotive Temperature Sensor Market Size, By Geography, 2013-2020 ($Million)

Table 34 Body Electronics: Automotive Temperature Sensor Market Size, By Geography, 2013-2020 (Million Units)

Table 35 Body Electronics: Automotive Humidity Sensor Market Size, By Geography, 2013-2020 ($Million)

Table 36 Body Electronics: Automotive Humidity Sensor Market Size, By Geography, 2013-2020 (Million Units)

Table 37 AFV: Automotive Temperature & Humidity Sensor Market Size, By Type, 2013-2020 ($Million)

Table 38 AFV: Market Size, By Type, 2013-2020 (Million Units)

Table 39 AFV: Automotive Temperature Sensor Market Size, By Geography, 2013-2020 ($Million)

Table 40 AFV: Automotive Temperature Sensor Market Size, By Geography, 2013-2020 (Million Units)

Table 41 AFV: Automotive Humidity Sensor Market Size, By Geography, 2013-2020 ($Million)

Table 42 AFV: Automotive Humidity Sensor Market Size, By Geography, 2013-2020 (Million Units)

Table 43 Automotive Temperature & Humidity Sensor Market Size, By Geography, 2013-2020 ($Million)

Table 44 Market Size, By Geography, 2013-2020 (Million Units)

Table 45 Americas: Automotive Temperature Sensor Market Size, By Geography, 2013-2020 ($Million)

Table 46 Americas: Automotive Temperature Sensor Market Size, By Geography, 2013-2020 (Million Units)

Table 47 Americas: Automotive Humidity Sensor Market Size, By Geography, 2013-2020 ($Million)

Table 48 Americas: Automotive Humidity Sensor Market Size, By Geography, 2013-2020 (Million Units)

Table 49 North America: Automotive Temperature Sensor Market Size, By Country, 2013-2020 ($Million)

Table 50 North America: Automotive Temperature Sensor Market Size, By Country, 2013-2020 (Million Units)

Table 51 North America: Automotive Humidity Sensor Market Size, By Country, 2013-2020 ($Million)

Table 52 North America: Automotive Humidity Sensor Market Size, By Country, 2013-2020 (Million Units)

Table 53 South America: Automotive Temperature Sensor Market Size, By Country, 2013-2020 ($Million)

Table 54 South America: Automotive Temperature Sensor Market Size, By Country, 2013-2020 (Million Units)

Table 55 South America: Automotive Relative Humidity Sensor Market Size, By Country, 2013-2020 ($Million)

Table 56 South America: Automotive Humidity Sensor Market Size, By Country, 2013-2020 (Million Units)

Table 57 Europe: Automotive Temperature Sensor Market Size, By Country, 2013-2020 ($Million)

Table 58 Europe: Automotive Temperature Sensor Market Size, By Country, 2013-2020 (Million Units)

Table 59 Europe: Automotive Humidity Sensor Market Size, By Country, 2013-2020 ($Million)

Table 60 Europe: Automotive Humidity Sensor Market Size, By Country, 2013-2020 (Million Units)

Table 61 APAC: Automotive Temperature Sensors Market Size, By Country, 2013-2020 ($Million)

Table 62 APAC: Automotive Temperature Sensor Market Size, By Country, 2013-2020 (Million Units)

Table 63 APAC: Automotive Humidity Sensor Market Size, By Country, 2013-2020 ($Million)

Table 64 APAC: Automotive Humidity Sensor Market Size, By Country, 2013-2020 (Million Units)

Table 65 RoW: Automotive Temperature Sensors Market Size, By Country, 2013-2020 ($Million)

Table 66 RoW: Automotive Temperature Sensor Market Size, By Country, 2013-2020 (Million Units)

Table 67 RoW: Automotive Humidity Sensor Market Size, By Country, 2013-2020 ($Million)

Table 68 RoW: Automotive Humidity Sensor Market Size, By Country, 2013-2020 (Million Units)

Table 69 Automotive Temperature & Humidity Sensor Market For Automtoive Application: Market Share Ranking, By Key Player, 2014

Table 70 New Product Launches, Developments & Expansions in the Smart Sensor Market, 2014-2015

Table 71 Acquisitions, Collaborations, Partnerships, and Agreements in the Smart Sensor Market, 2014-2015

Table 72 Other Developments, 2014

List of Figures (63 Figures)

Figure 1 Global Automotive Temperature & Humidity Sensor Market, By Application

Figure 2 Research Design

Figure 3 Growth of Electrical Vehicles

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Market Breakdown & Data Triangulation

Figure 7 Assumptions of the Research Study

Figure 8 Market Value ($Million) & Volume (Million Units)

Figure 9 Global Automotive Temperature & Humidity Sensor Market, By Automotive Application, 2014

Figure 10 Market Snapshot (2014 vs 2020): Powertrain Application is Expected to Dominate the Market During the Forecast Period

Figure 11 Automotive Humidity Sensor Market Snapshot (2014 vs 2020): Body Electronics Application is Expected to Dominate the Market During the Forecast Period

Figure 12 Global Automotive Temperature & Humidity Sensor Market Share, By Region, 2013

Figure 13 The Smart Sensor Market Presents Lucrative Opportunities in the Forecast Period

Figure 14 Powertrain Will Continue to Dominate the Market During the Forecast Period

Figure 15 Body Electronics Will Continue to Dominate Over the Market During the Forecast Period

Figure 16 Body Electronics & Powertrain Accounted For the Majority of the Market Share in 2013

Figure 17 The Smart Temperature Sensor Market Would be Larger Than That of Automotive Humidity Sensor By 2020

Figure 18 APAC is Expected to Dominate the Market During the Forecast Period

Figure 19 Automotive Temperature & Humidity Sensor Market, By Type

Figure 20 Market, By Technology

Figure 21 Market, By Packaging Type

Figure 22 Market, By Application

Figure 23 Market, By Geography

Figure 24 Growth in Global Sales of Light Vehicles: Key Enabler of Smart Sensor For Automotive Application

Figure 25 Worldwide Light Vehicle Sales (Million Units)

Figure 26 Average Semiconductor Content Per Vehicle, 2012-2017

Figure 27 Strategic Benchmarking: Companies Largely Adopted Organic Growth Strategies to Drive Product Innovation & Enhancement

Figure 28 Value Chain Analysis

Figure 29 Porter’s Five Forces Analysis, 2013

Figure 30 Graphical Representation of Porter’s Five Force Analysis, 2013

Figure 31 Threat of New Entrants

Figure 32 Threat of Substitutes

Figure 33 Bargaining Power of Suppliers

Figure 34 Bargaining Power of Buyers

Figure 35 Intensity of Competitive Rivalry

Figure 36 Automotive Temperature & Humidity Sensor Pricing Trend (2014-2020) : By Sensor Type

Figure 37 Smart Temperature & Relative Humidity Sensor Market Size, By Volume 2014-2020

Figure 38 Automotive Temperature & Humidity Sensor Market Size, By Value ($Million) & Volume (Million Units), 2014-2020

Figure 39 Market Size, By Packaging Type, 2014-2020

Figure 40 Automotive Application Market Size For Automotive Temperature & Humidity Sensor, 2014 & 2020

Figure 41 Smart Relative Humidity & Temperature Sensor Market: APAC is the Fastest Growing Region Between 2014 and 2020

Figure 42 Americas Automotive Temperature & Humidity Sensor Market Snapshot, 2013

Figure 43 APAC Automotive Temperature & Humidity Sensor Market Snapshot, 2013

Figure 44 Companies That Adopted Product Innovation As the Key Growth Strategy, 2012-2015

Figure 45 Battle For Market Share: New Product Launches Comprise the Key Strategy

Figure 46 Geography Revenue Mix of Top Market Players

Figure 47 Analog Devices, Inc.: Company Snapshot

Figure 48 Continental AG: Company Snapshot

Figure 49 Continental AG: SWOT Analysis

Figure 50 Delphi Automotive Plc: Company Snapshot

Figure 51 Honeywell International Inc.: Company Snapshot

Figure 52 Measurement Specialities Inc.:Company Snapshot

Figure 53 Melexis Nv:Company Snapshot

Figure 54 NXP Semiconductors: Company Snapshot

Figure 55 NXP Semiconductors: SWOT Analysis

Figure 56 On Semiconductor Corporation:Company Snapshot

Figure 57 Robert Bosch GMBH: Company Snapshot

Figure 58 Robert Bosch: SWOT Analysis

Figure 59 Sensata Technologies Inc.: Company Snapshot

Figure 60 Stmicroelectronics: Company Snapshot

Figure 61 Stmicroelectronics: SWOT Analysis

Figure 62 Texas Instruments: Company Snapshot

Figure 63 Texas Instruments: SWOT Analysis

This Digital Temperature and Humidity Sensor Market Research Report utilizes a well-defined and systematic methodology to deliver comprehensive insights into the global market. The study aims to assess current market trends, key drivers, competitive landscape, and growth opportunities across various applications and regions. A combination of qualitative and quantitative research methods was employed to ensure accuracy, depth, and relevance of findings.

The research process began with extensive secondary research to collect background information and industry data. Key sources included market databases, company financials, technical whitepapers, government publications, and trade journals. Reports and data from organizations such as the IEEE, World Bank, and environmental regulatory agencies were also consulted. This phase helped define market scope, identify industry benchmarks, and establish historical market trends.

Primary research was then conducted to validate secondary data and gather firsthand information from key industry stakeholders. Interviews and surveys were carried out with sensor manufacturers, distributors, end-users, and industry experts. These interactions provided direct insights into market dynamics, technological developments, pricing trends, supply chain factors, and strategic initiatives being undertaken by leading players in the industry.

For market sizing and forecasting, the study used both top-down and bottom-up approaches. The bottom-up approach involved calculating the revenue of individual sensor categories and aggregating them to determine the overall market size. The top-down approach cross-verified this data by referencing broader industry metrics and macroeconomic indicators. Forecasts were generated using statistical models, including time-series analysis and scenario-based forecasting, to estimate future growth over the forecast period.

The market was segmented based on type (e.g., capacitive, resistive, and thermal sensors), application (e.g., HVAC, healthcare, industrial, consumer electronics), and geography (e.g., North America, Europe, Asia-Pacific, and others). Each segment was analyzed for market share, growth potential, and technological impact. Regional factors such as regulatory policies, climate conditions, and industrial development were also considered to provide localized insights.

Finally, a rigorous data validation and triangulation process was applied to ensure consistency and reliability. Findings from primary and secondary research were cross-checked, and the final data set was reviewed by internal experts to eliminate discrepancies. This comprehensive methodology ensures that the report provides accurate, strategic insights for decision-makers across the digital temperature and humidity sensor market.

Growth opportunities and latent adjacency in Digital Temperature and Humidity Sensor Market