Automotive Gesture Recognition Systems Market by Component Type (Touch Based Systems, and Touchless Systems), Authentication Type (Hand/Fingerprint/Leg, Face, Vision/iris), Application (Lighting System), and Region - Global Forecast to 2021

The global automotive gesture recognition systems market size was valued at USD 829.5 billion in 2016 and is expected to reach USD 3144.8 billion by 2021 at a CAGR of 30.5% during the forecast period 2016-2021. The objective of the study is to analyze and forecast (2016 to 2021) the market size, in terms of volume ('000 Units) and value (USD million), of the automotive GRS market. The report segments the market by authentication type, by component type, by Application and by region namely, North America, Europe, Asia-Pacific, and the Rest of the World (RoW). A detailed study of various market leaders has been done and opportunity analysis has been provided in the report.

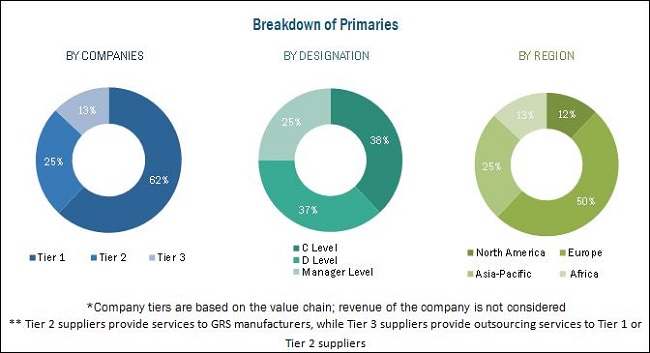

Various secondary sources, such as company annual reports/presentations, press releases, industry association publications, magazine articles, encyclopedias, directories, technical handbooks, world economic outlook, trade websites, technical articles, and databases have been used to identify and collect information useful for an extensive study of the automotive market. The primary sources experts from related industries, automotive GRS manufacturers, and GRS experts-have been interviewed to obtain and verify critical information, as well as to assess future prospects and market estimations. Bottom-up approach has been used for market estimation and calculation of the automotive gesture recognition systems market size. The figure given below illustrates the break-up of the profile of industry experts who participated in primary discussions.

To know about the assumptions considered for the study, download the pdf brochure

The automotive gesture recognition systems market consists of various major system manufacturers. Companies such as Continental AG (Germany), HARMAN International Industries (U.S.), SoftKinetic (Belgium), Synaptics Incorporated (U.S), Visteon Corp (U.S), NXP Semiconductors (Netherlands), Omek Interactive Ltd. (Israel), Qualcomm Inc. (U.S.), eyeSight Technologies Ltd. (Israel) and Cognitec Systems GmbH (Germany) are the major manufacturers of gesture recognition systems globally.

Target Audience

- Automotive component manufacturers

- Raw material suppliers

- Automotive manufacturers

- Distributors and suppliers of automotive components/parts

- Industry associations and experts

Scope of the Report

-

Market, By Region

- North America

- Europe

- Asia-Pacific

- RoW

-

Market, By Authentication Type

- Hand/finger print/leg recognition

- Face recognition

- Vision/iris recognition

- Others

-

Market, By Component Type

- Touch Based System

- Touchless System

-

Market, By Application

- Multimedia/infotainment/navigation

- Lighting systems

- Others (door & window opening/closing, gear shifting etc.)

Available Customizations

- Country-level analysis of automotive gesture recognition systems market, by Authentication type

- Country-level analysis of automotive GRS market, by Application

- Profiling of additional market players (Up to 3)

The automotive gesture recognition systems (GRS) market is projected to grow at a CAGR of 30.5%, from USD 829.5 Million in 2016 to USD 3144.8 Million by 2021. The rise in consumer preference for application based technologies and increasing awareness about driver safety and regulations in automobile industry have fueled the growth of the market. The increase in demand for autonomous and electric vehicles is also a major factor that will contribute to the growth of the automotive GRS market.

The Hand/ Fingerprint authentication type is estimated to record the largest market size in market, by authentication type. Factors such as innovations in technological advancement, and increased safety regulations are prompting the growth of the visual interface market.

The Multimedia/ infotainment /navigation segment is estimated be the fastest growing during the forecast period. With the increased focus on reducing driver distraction factors, a majority of the gesture recognition systems manufacturers and OEMs are focusing on enhancing the user experience while operating these infotainment or navigation systems and providing convenience and comfort to the driver.

The touchless system segment in market, by component type is estimated be the fastest growing during the forecast period. This is due to factors such as enhanced user experience in the various applications offered by touchless gesture recognition systems and convenience to the driver.

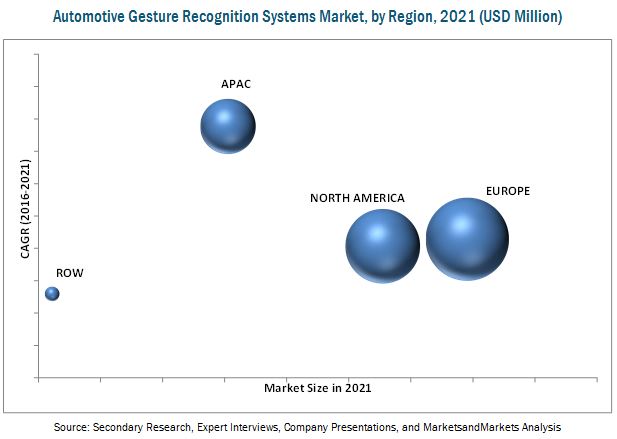

The European region is estimated to be the largest market with the highest share of the market, by value and volume. The European market is projected to be the largest market owing to the high penetration of gesture recognition systems as well as high vehicle production and sales due to high disposable income in countries like Germany and U.K.

The major restraint considered in the study is the high cost of integration of gesture recognition systems systems. In addition, the processing of gestures requires a high level of software algorithms, which results in high battery consumption and increased usage of processor space. The Automotive gesture recognition systems market is dominated by many international as well as domestic players, and some of them are Continental AG (Germany), Visteon Corp (U.S.), and Synaptics Incorporated (U.S).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 11)

1.1 Objectives of the Study

1.2 Automotive Gesture Recognition Systems Market Definition

1.2.1 Market Scope

1.2.2 Markets Covered

1.2.3 Years Considered for the Study

1.3 Currency & Pricing

1.4 Limitations

1.5 Stakeholders

2 Research Methodology (Page No. - 15)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.3 Data From Secondary Sources

2.4 Primary Data

2.4.1 Sampling Techniques & Data Collection Methods

2.4.2 Primary Participants

2.5 Factor Analysis

2.5.1 Introduction

2.5.2 Demand Side Analysis

2.5.2.1 Increase in Demand of HEV & PHEV Vehicles

2.5.2.2 Growth in Luxury Vehicle Sales

2.5.3 Supply-Side Analysis

2.5.3.1 Technological Advancements

2.5.3.2 Continuous Changing Preferences in GRS System Design

2.5.4 Market Size Estimation

2.6 Data Triangulation

2.7 Assumptions

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 29)

4.1 Attractive Opportunities in the Automotive Gesture Recognition Systems Market

4.2 Market, By Region, 2016 vs 2021

4.3 Market, By Authentication Type, 2016 vs 2021

4.4 Market, By Component Type, 2016 vs 2021

4.5 Market, By Apcation

4.6 Market: Rise in Demand for GRS Application in Emerging Economies

5 Automotive Gesture Recognition Systems Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Gesture Recognition Sysytems Market,By Application

5.2.2 Gesture Recognition Market,By Authentication Type

5.2.3 HMI Market,By Component Type

5.2.4 Gesture Recognition Market, By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Consumer Preference for Application Based Technologies

5.3.1.2 Increasing Awareness Regarding Driver Safety and Regulations

5.3.1.3 Enhanced User Experience in the Various Applications

5.3.2 Restraints

5.3.2.1 High Cost of Integration

5.3.2.2 High Power Consumption

5.3.3 Opportunities

5.3.3.1 Trend of Autonomous and Electric Vehicles

5.3.3.2 Integration of Multiple Technologies

5.3.4 Challenges

5.3.4.1 Technology Awareness

5.3.4.2 Illumination Problems

5.4 Porter’s Five Forces Analysis

5.4.1 Intensity of Competitive Rivalry

5.4.2 Threat of Substitutes

5.4.3 Bargaining Power of Buyers

5.4.4 Bargaining Power of Suppliers

5.4.5 Threat of New Entrants

6 Automotive Gesture Recognition Systems Market, By Region (Page No. - 48)

6.1 Introduction

6.1.1 North America

6.1.2 U.S.

6.1.3 Mexico

6.1.4 Canada

6.1.5 Europe

6.1.5.1 Germany

6.1.6 France

6.1.7 U.K.

6.1.8 Italy

6.1.9 Asia-Pacific

6.1.10 China

6.1.11 Japan

6.1.12 South Korea

6.1.13 India

6.1.14 Rest of the World

6.1.15 Brazil

6.1.16 Russia

7 Automotive Gesture Recognition Systems Market, By Component Type (Page No. - 73)

7.1 Introduction

7.2 Touch Based Systems

7.3 Touchless Systems

8 Automotive Gesture Recognition Systems Market, By Authentication Type (Page No. - 79)

8.1 Introduction

8.2 Hand/Finger Print/Leg Recognition

8.3 Facial Recognition

8.4 Vision/IRIS Recognition

8.5 Others (Voice Recognition/Head Recognition/Eyelids Blinkrates/Etc)

9 Automotive Gesture Recognition Systems Market, By Application (Page No. - 88)

9.1 Introduction

9.2 Multimedia/Infotainment/Navigation

9.3 Lighting Systems

9.4 Others (Door & Window Opening/Closing, Gear Shifting Etc.)

10 Competitive Landscape (Page No. - 95)

10.1 Automotive Gesture Recognition Systems Market Ranking Analysis: Global Market

10.2 Competitive Situation & Trends

10.3 New Product Launches and Expansion

10.4 Mergers & Acquisitions

10.5 Supply Contracts/Collaborations/Partnerships/Joint Venture

10.6 Expansion

11 Company Profiles (Page No. - 103)

11.1 Continental AG

11.1.1 Business Overview

11.1.2 Products Offered

11.1.3 Developments, 2015–2016

11.1.4 SWOT Analysis

11.1.5 MnM View

11.2 Synaptics Incorporated

11.2.1 Business Overview

11.2.2 Products Offered

11.2.3 Developments, 2015–2016

11.2.4 Synaptics Incorporated :SWOT Analysis

11.2.5 MnM View

11.3 Visteon Corp.

11.3.1 Business Overview

11.3.2 Products Offered

11.3.3 Developments, 2015–2016

11.3.4 SWOT Analysis

11.3.5 MnM View

11.4 Harman International Industries, Inc.

11.4.1 Business Overview

11.4.2 Products Offered

11.4.3 Developments, 2015–2016

11.4.4 SWOT Analysis:Harman International Industries

11.4.5 MnM View

11.5 Qualcomm Inc.

11.5.1 Business Overview

11.5.2 Products Offered

11.5.3 Developments, 2015–2016

11.5.4 SWOT Analysis

11.5.5 MnM View

11.6 NXP Semiconductors N.V.

11.6.1 Business Overview

11.6.2 Products Offered

11.6.3 Developments, 2015–2016

11.7 Eyesight Technologies Ltd.

11.7.1 Business Overview

11.7.2 Products Offered

11.7.3 Developments, 2015–2016

11.8 Softkinetic Inc.

11.8.1 Business Overview

11.8.2 Products Offered

11.8.3 Developments, 2015–2016

11.9 Omek Interactive Ltd.

11.9.1 Business Overview

11.9.2 Products Offered

11.9.3 Developments, 2015–2016

11.10 Cognitec Systems GmbH

11.10.1 Business Overview

11.10.2 Products Offered

11.10.3 Developments, 2015–2016

List of Tables (67 Tables)

Table 1 Government Incentives for Electric Vehicles

Table 2 Automotive Gesture Recognition Systems Market: Porter’s Five Forces Analysis

Table 3 GRS Market for Automotive, By Region, 2014–2021 (000’ Units)

Table 4 GRS Market for Automotive, By Region, 2014–2021 (USD Million)

Table 5 North America: Market, By Country, 2014–2021 (‘000 Units)

Table 6 North America: Automotive GRS Market, By Country, 2014–2021 (USD Million)

Table 7 U.S.: Market, By Authentication Type, 2014–2021 (‘000 Units)

Table 8 U.S.: Automotive GRS Market, By Authentication Type, 2014–2021 (USD Million)

Table 9 Mexico: Market, By Authentication Type, 2014–2021 (‘000 Units)

Table 10 Mexico: Market, By Authentication Type, 2014–2021 (USD Million)

Table 11 Canada: Market, By Authentication Type, 2014–2021 (‘000 Units)

Table 12 Canada: Automotive GRS Market, By Authentication Type, 2014–2021 (USD Million)

Table 13 Europe: Market, By Country, 2014–2021 (‘000 Units)

Table 14 Europe: Automotive GRS Market, By Country, 2014–2021 (USD Million)

Table 15 Germany: Market, By Authentication Type, 2014–2021 (‘000 Units)

Table 16 Germany: Market, By Authentication Type, 2014–2021 (USD Million)

Table 17 France: Market, By Authentication Type, 2014–2021 (‘000 Units)

Table 18 France: Automotive GRS Market, By Authentication Type, 2014–2021 (USD Million)

Table 19 U.K.: Market, By Authentication Type, 2014–2021 (‘000 Units)

Table 20 U.K.: Automotive GRS Market, By Authentication Type, 2014–2021 (USD Million)

Table 21 Italy: Market, By Authentication Type, 2014–2021 (‘000 Units)

Table 22 Italy: Automotive GRS Market, By Authentication Type, 2014–2021 (USD Million)

Table 23 Asia-Pacific: Market, By Country, 2014–2021 (‘000 Units)

Table 24 Asia-Pacific: Automotive GRS Market, By Country, 2014–2021 (USD Million)

Table 25 China: Market, By Authentication Type, 2014–2021 (‘000 Units)

Table 26 China: Automotive GRS Market, By Authentication Type, 2014–2021 (USD Million)

Table 27 Japan: Market, By Authentication Type, 2014–2021 (‘000 Units)

Table 28 Japan: Automotive GRS Market, By Authentication Type, 2014–2021 (USD Million)

Table 29 South Korea: Market, By Authentication Type, 2014–2021 (‘000 Units)

Table 30 South Korea: Market, By Authentication Type, 2014–2021 (USD Million)

Table 31 India: Market, By Authentication Type, 2014–2021 (‘000 Units)

Table 32 India: Automotive GRS Market, By Authentication Type, 2014–2021 (USD Million)

Table 33 RoW Market, By Country, 2014–2021 (‘000 Units)

Table 34 RoW: Market, By Country, 2014–2021 (USD Million)

Table 35 Brazil: Market, By Authentication Type, 2014–2021 (‘000 Units)

Table 36 Brazil: Automotive GRS Market, By Authentication Type, 2014–2021 (USD Million)

Table 37 Russia: Market, By Authentication Type, 2014–2021 (‘000 Units)

Table 38 Russia: Automotive GRS Market, By Authentication Type, 2014–2021 (USD Million)

Table 39 Market, By Component Type, 2014–2021 (‘000 Units)

Table 40 Automotive Gesture Recognition Systems Market, By Component Type, 2014–2021 (USD Thousand)

Table 41 Touch Based Systems: Market, By Region, 2014–2021 (‘000 Units)

Table 42 Touch Based Systems: Automotive GRS Market, By Region, 2014–2021 (USD Thousand)

Table 43 Touchless Systems: Automotive GRS Market, By Region, 2014–2021 (‘000 Units)

Table 44 Touchless Systems: Automotive GRS Market, By Region, 2014–2021 (USD Thousand)

Table 45 Market, By Authentication Type, 2014–2021 (‘000 Units)

Table 46 Automotive GRS Market, By Authentication Type, 2014–2021 (USD Million)

Table 47 Hand/Finger Print/Leg Recognition: Automotive GRS Market, By Region, 2014–2021 (‘000 Units)

Table 48 Hand/Finger Print/Leg Recognition: Automotive GRS Market, By Region, 2014–2021 (USD Million)

Table 49 Facial Recognition: Market, By Region, 2014–2021 (‘000 Units)

Table 50 Facial Recognition: Automotive GRS Market, By Region, 2014–2021 (USD Million)

Table 51 Vision/IRIS Recognition: Automotive GRS Market, By Region, 2014–2021 (‘000 Units)

Table 52 Vision/IRIS Recognition: Automotive GRS Market, By Region, 2014–2021 (USD Million)

Table 53 Others: Automotive GRS Market, By Region, 2014–2021 (‘000 Units)

Table 54 Others: Automotive GRS Market, By Region, 2014–2021 (USD Million)

Table 55 Market, By Application, 2014–2021 (‘000 Units)

Table 56 Automotive GRS Market, By Application, 2014–2021 (USD Million)

Table 57 Multimedia/Infotainment/Navigation: Automotive GRS Market, By Region, 2014–2021 (‘000 Units)

Table 58 Multimedia/Infotainment/Navigation: Automotive GRS Market, By Region, 2014–2021 (USD Million)

Table 59 Lighting Systems: Automotive GRS Market, By Region, 2014–2021 (‘000 Units)

Table 60 Lighting Systems: Market, By Region, 2014–2021 (USD Million)

Table 61 Others (Door & Window Opening/Closing, Gear Shifting Etc.): Automotive GRS Market, By Region, 2014–2021 (‘000 Units)

Table 62 Others (Door & Window Opening/Closing, Gear Shifting Etc.): Automotive GRS Market, By Region, 2014–2021 (USD Million)

Table 63 Global Market Ranking: 2015

Table 64 New Product Development & Expansion, 2016

Table 65 Mergers & Acquisitions, 2015–2016

Table 66 Supply Contracts/Collaborations/Partnerships, 2016–2017

Table 67 Expansion, 2016

List of Figures (51 Figures)

Figure 1 Automotive Gesture Recognition Systems: Markets Covered

Figure 2 Research Design

Figure 3 Research Methodology Model

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 5 HEV & PHEV Sales Data (2016-2021)

Figure 6 Market Size Estimation Methodology: Bottom-Up Approach

Figure 7 Hand/Fingerprint Segment to Drive the Growth of Automotive Gesture Recognition Systems Market, 2016 vs 2021 (USD Million)

Figure 8 Touchless GRS Segment to Be the Largest Contributor to the Automotive GRS Market, 2016 vs 2021 (USD Million)

Figure 9 Asia-Pacific to Hold the Largest Share in the Automotive GRS Market, By Region, in 2016

Figure 10 Touchless Systems is Expected to Drive the Automotive GRS Market

Figure 11 Europe to Hold the Largest Market, By Value

Figure 12 Hand/Fingerprint Authentication to Hold the Largest Size, By Value

Figure 13 Touchless Systems is Estimated to Occupy the Largest Size, By Value,

Figure 14 Multimedia Segment to Hold the Largest Market Share, By Value

Figure 15 Market: All Regions Yet in Initial Growth Stage

Figure 16 Market Segmentation

Figure 17 Gesture Recognition Systems Market, By Tecnology

Figure 18 Gesture Recognition Market, By Authentication Type

Figure 19 HMI Market, By Component Type

Figure 20 Gesture Recognition Market, By Region

Figure 21 Gesture Recognition Market: Market Dynamics

Figure 22 Gesture Recognition Systems Market: Poerter’s Five Forces Analysis

Figure 23 Competitive Rivalry is Medium in Automotive HMI Market

Figure 24 New Product Launch and Innovation in Markets Leads to A Balanced Competition in the GRS Market

Figure 25 Limited Availability of Substitutes Makes the Threat of the Same Low

Figure 26 The Buyer Concentration and Product Differentiation Makes the Buyer’s Bargaining Power to Be Medium

Figure 27 Technology Factor and Importance of Volume to Supplier Makes the Bargaining Power of Suppliers High

Figure 28 Established Firms and High Initial Cost Making the Threat of New Entrants Low

Figure 29 Market Outlook, By Region

Figure 30 North America: Automotive GRS Market Snapshot

Figure 31 North America: Automotive GRS Market Snapshot

Figure 32 Europe: Market, By Country, 2014–2021 (USD Million)

Figure 33 RoW: Automotive GRS Market, By Country, 2016–2021 (‘000 Units)

Figure 34 Hand/Fingerprint Recognition Authentication Type to Have the Largest Market Size in Gesture Recognition Market in 2021

Figure 35 Multimedia Application to Account for the Largest Market Size in Gesture Recognition Market in 2021

Figure 36 Companies Adopted New Product Developments as the Key Growth Strategy From 2013 to 2016

Figure 37 Market Evaluation Framework: New Product Development Fuelled Market Growth From 2014–2016

Figure 38 Battle for Market Share: New Product Developments Was the Key Strategy

Figure 39 Continental AG: Company Snapshot

Figure 40 Continental AG: SWOT Analysis

Figure 41 Company Snapshot: Synaptics Incorporated

Figure 42 Company Snapshot: Visteon Corporation

Figure 43 Visteon Corporation: SWOT Analysis

Figure 44 Harman International Industries, Incorporated:Company Snapshot

Figure 45 Company Snapshot: Qualcomm Inc.

Figure 46 Qualcomm: SWOT Analysis

Figure 47 Company Snapshot: NXP Semiconductors N.V.

Figure 48 Company Snapshot

Figure 49 Softkinetic Inc: Company Snapshot

Figure 50 Company Snapshot: Omek Interactive Ltd.

Figure 51 Company Snapshot

Growth opportunities and latent adjacency in Automotive Gesture Recognition Systems Market