Vehicle Intelligence Systems Market by Road Scene Understanding (RTS, RSD, NVS & PDS), Advanced Driver Assistance & Monitoring (ACC, BSD, PA TJA & DMS), Component, Vehicle Type (Passenger Cars & CV), and by Region - Industry Trends and Forecast to 2021

[160 Pages Report] The global vehicle intelligence systems market is primarily driven by the growing concerns regarding pedestrian safety, the demand for an enhanced driving experience, and the rising sales of premium vehicles in developing economies. The vehicle intelligence systems market is projected to grow from USD 11.29 billion in 2016 to USD 20.11 billion by 2021, at a CAGR of 12.24%.

The objective of the study is to define and segment the global vehicle intelligence systems market for the passenger car and commercial vehicle segments. The report segments the market on the basis of road scene understanding, advanced driver assistance and driver monitoring systems, components, vehicle type, and region. The various intelligence systems considered for the study include adaptive cruise control, road/lane tracking, blind spot detection, and traffic jam assist systems. The primary aim of the research study is to strategically analyze the market with respect to individual growth trends and future prospects. The report includes a competitive study of various market leaders and an opportunity assessment for various stakeholders. The base year considered for the study is 2015, and the forecast has been provided for the period between 2016 and 2021.

Vehicle Intelligence Systems Market Dynamics

Drivers

- Increasing awareness regarding stringent safety regulations

- Increasing demand for luxury cars in developing countries

Restraints

- High cost of integration

Opportunities

- Trend of autonomous cars

Challenges

- Effective Functioning of the vehicle intelligence systems

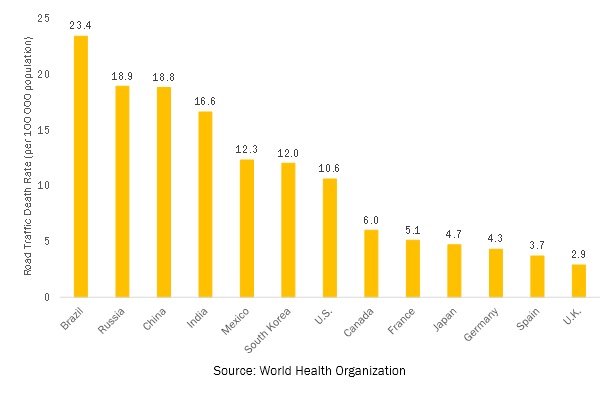

Increasing awareness regarding stringent safety regulations drives the global vehicle intelligence system market

Safety is one of the important factors driving consumer buying behaviour. Today there has been a significant increase in the number of vehicles, which has led to problems such as traffic congestion, and accidents. The primary reason for accidents is speeding, not following traffic rules, lack of focus due to drowsiness, among others. For instance, according to the Association for Safe International Road Travel approximately 1.3 million people die in road crashes each year. In order to reduce the probability of accidents, OEMs are incorporating vehicle intelligence systems. These vehicle intelligence systems send an alert signal or automatically intervene and take the necessary action which reduces the chances of an accident. These systems have gained significant importance in past few years and the demand for such systems will always increase owing to the stringent safety regulations.

The following are the major objectives of the study.

- To define, and segment the global vehicle intelligence systems market for the passenger car and commercial vehicle segments

- To analyze and forecast (2016 to 2021) the OE market size, by volume (‘000 units) and value (USD million/billion)

- To forecast the vehicle intelligence systems market size, by volume and value, with respect to four main regions—namely, North America, Europe, Asia-Pacific, and the Rest of the World (RoW)

- To offer detailed information on the major factors influencing growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze vehicle intelligence systems markets with respect to individual growth trends, future prospects, and contribution to the total market

- To analyze opportunities in vehicle intelligence systems market for stakeholders and details of the competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their market presence and core competencies.

- To track and analyze competitive developments such as expansions, joint ventures, new product launches, and research & developments in the global vehicle intelligence systems market.

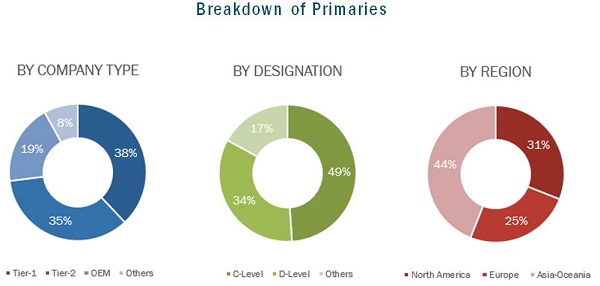

The research methodology used in the report involves primary and secondary sources. Secondary sources include paid databases and directories. In the primary research process, experts from related industries and suppliers have been interviewed to understand the future trends of the global vehicle intelligence systems market. The global vehicle intelligence systems market, in terms of volume (thousand units) and value (USD million), for various regions and applications has been derived using forecasting techniques based on automobile demand and production trends. The OEM prices of vehicle intelligence systems and sensors have been verified through primary sources. Both, the bottom-up and top-down approaches have been followed to derive the market size, in terms of volume and value.

The figure below indicates the break-up of the profile of industry experts who participated in primary discussions.

To know about the assumptions considered for the study, download the pdf brochure

The global vehicle intelligence systems market eco-system comprises established global manufacturers. Major manufacturers include Continental AG (Germany), Denso Corporation (Japan), Delphi Automotive PLC (U.K.), Robert Bosch GmbH (Germany), and Autoliv Inc. (Sweden). The eco-system also includes vehicle manufacturers such as General Motors (U.S.), BMW (Germany), Toyota Motors (Japan), and Hyundai Motors (South Korea), and regional automotive associations such as Society of Indian Automotive Manufacturers (SIAM), Japan Automotive Manufacturers Association (JAMA), and the European Automobile Manufacturers Association (ACEA).

Major Developments in Vehicle Intelligence Systems Market

- In April 2016, Infineon Technologies AG developed a 24-GHz radar solution, which is an integrated system that contains a 24-GHz radar chip and AURIX microcontroller. The microcontroller used in the system is customized for radar applications. The newly developed radar-based solution is best suited for trucks and construction machines.

- In March 2016, WABCO Holdings Inc. launched a new generation on lane departure warning system. The upgraded system incorporates video recording and near real-time video analysis. It also has improved lane marking recognition due to an intelligent lane-tracking algorithm.

- In October 2015, Denso developed a new front-camera-based active safety system that uses Toshiba’s TMPV7506XBG image recognition processor. The processor will process images from the camera for lane detection, vehicle detection, pedestrian detection, and traffic sign recognition. The power consumption of the processor is low.

- In September 2015, Continental AG developed a highly accurate route information database. The Continental Road database enables advanced driver assistance systems in vehicles to operate at a high efficiency. The database has improved the predicative capabilities of various systems.

Target Audience of Vehicle Intelligence Systems Market

- Automobile original equipment manufacturers (OEMs)

- Manufacturers of vehicle intelligence systems and their components

- Raw material suppliers for system manufacturing

- Sensor manufacturers

- Semiconductor manufacturers

- Research institutes

- Traders, distributors, and suppliers of vehicle intelligence system components

- Market research and consulting firms

Scope of the Vehicle Intelligence Systems Market Report

The scope of the global vehicle intelligence systems market is as follows:

This market study covers the passenger car and commercial vehicle segments of the global vehicle intelligence systems market to arrive at the global vehicle intelligence systems market for the period 2016 to 2021

Vehicle Intelligence Systems Market, By Region

- Asia-Oceania

- North America

- Europe

- Rest of the World

Vehicle Intelligence Systems Market, By Component

- Sensor

- Analog ICs

- Processor

- Memory

Vehicle Intelligence Systems Market, By Advanced Driver Assistance and Driver Monitoring Systems

- Adaptive cruise control system

- Blind spot detection system

- Park assist system

- Traffic jam assist system

- Drowsiness monitoring/alertness sensing system

Vehicle Intelligence Systems Market, By Road Scene Understanding

- Road/lane tracking system

- Road sign detection system

- Night vision system

- Pedestrian detection system

Critical questions which the report answers

- What are new application areas which the vehicle intelligence system companies are exploring?

- Which are the key players in the market and how intense is the competition?

Available Customizations of Vehicle Intelligence Systems Market

With the given market data, MarketsandMarkets offers customizations in accordance with companies’ specific needs.

- Profiling of additional market players (Up to 3)

- Commercial vehicle intelligence system market, by intelligence system

- The following technologies will be considered for the study

- Road/lane tracking system

- Drowsiness warning/ alertness sensing system

- Blind spot detection system

The global vehicle intelligence systems market is projected to grow from USD 11.29 billion in 2016 to USD 20.11 billion by 2021, registering a CAGR of 12.24% during the forecast period.

The report covers two major vehicle categories for vehicle intelligence systems—that is, passenger cars and commercial vehicles. Changing consumer preferences and growing safety and environmental concerns have played a crucial role in the evolution of automobile safety. The demand for passenger cars is influenced by economic conditions, changing government policies, and inflation levels. Owing to the high integration cost, vehicle intelligent systems are predominantly found in premium or luxury cars. However, the commercial vehicle segment is expected to offer promising growth opportunities.

Advanced driver assistance and driver monitoring systems constitute the largest segment of the vehicle intelligence systems market. This segment includes systems such as adaptive cruise control, blind spot detection, park assist, traffic jam assist, and drowsiness warning/alertness sensing. The park assist segment is estimated to occupy the largest share of the advanced driver assistance and driver monitoring systems market. The low cost of the system has enabled it to be integrated in all vehicle segments. The adaptive cruise control segment is projected to register the highest CAGR, owing to the increasing demand for an enhanced driving experience.

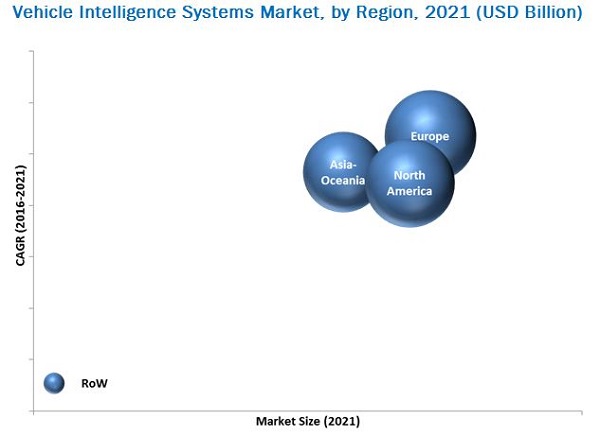

The Asia-Oceania market for vehicle intelligence systems is expected to grow at a promising CAGR during the forecast period. The region comprise countries such as China, India, Japan, and South Korea, which have been considered for the study. China and India are estimated to account for more than 30% of the global vehicle production. Additionally, Japan and South Korea are technologically advanced nations. Asia-Oceania offers vehicle intelligence system manufacturers key advantages such as low-cost labor and raw materials. Additionally, the increasing adoption of vehicle intelligence systems in developing economies, prompted by the growing awareness about vehicle safety, will likely boost the vehicle intelligence systems market in the region. However, the global market is currently dominated by Europe and North America, owing to the stringent safety norms in these regions.

Vehicle Intelligence system applications in advanced driver assistance and driver monitoring drive the growth of vehicle intelligence system market

Adaptive Cruise Control

Adaptive cruise control is basically an advanced version of standard cruise control. The system works in accordance with the external environment, the system helps the vehicle in maintaining a safe distance from the preceding vehicle, when the cruise control feature is active. However, one of the major drawbacks of the system is that it not able to clearly differentiate between a stopped vehicle on the road and stationary objects off the road.

Blind Spot Detection System

The blind spot detection system assists the driver while changing lanes as the side view mirror don’t provide complete coverage If the system detects any object in the parallel lane, it alerts the driver by providing a flashing light on the side view mirror, even after the vehicle moves into the adjacent lane, then a beep sounds or the steering wheel vibrates, to signal the driver. This technology was developed by Volvo, and is a very useful feature as it aids the driver in providing a 360 degree coverage around the vehicle.

Park Assist System

The park assist system is mainly used when the vehicle needs to be parked in a confined space. There are two main types of park assist systems. One where the system guides the driver and provides information related to the surroundings. The second is where the system takes full control of the steering mechanism and executes the required parking sequence. The system uses a number of sensors and cameras to generate the output. The system assess the surrounding environment using odometry, while the vehicle is in action.

Traffic Jam Assist system

The traffic jam assist system is partially automated system. The system supports the driver while the vehicle is driving through a traffic jam. In such cases the vehicle is subjected to low speed driving and halting. When the driver activates the system, the system takes control over the functioning of the vehicle such as braking, starting, and accelerating. However the system does need some human intervention to work perfectly.

Drowsiness Warning/Alertness Sensing System

The drowsiness warning/alertness sensing system primarily monitors the driver. It detects the state of the driver’s consciousness, and alertness, which are an important factor while driving. During long journeys, the driver tends to fall asleep at the wheel, which can cause an accident. To prevent such traffic accidents, the drowsiness warning system analyses images of the driver’s face. The drowsiness warning/alertness sensing system, also monitors steering pattern and vehicle position in the lane in order to derive an accurate output. The systems sends an alert signal when driver shows signs of being drowsy, which helps to prevent accidents.

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming industry applications for vehicle intelligence system market?

The demand for safety features has increased as consumers expect higher quality products. However, the cost of developing vehicle intelligence systems is very high. The system contains a number of software-driven electronic components, which increases the overall cost of the vehicle. This makes it difficult for OEMs to incorporate these systems in all vehicle segments. Thus, the high integration cost could restrain the growth of the vehicle intelligence systems market.

The global vehicle intelligence systems market is dominated by key manufacturers such as Continental AG (Germany), Denso Corporation (Japan), Delphi Automotive PLC (U.K.), Robert Bosch GmbH (Germany), and Autoliv Inc. (Sweden). Continental AG is a strong competitor, and has a wide geographical presence. It has a broad product portfolio for vehicle intelligence technologies, and provides these technologies for almost all ranges of vehicles. The above-mentioned companies have been focusing on developing new products and forming partnerships and collaborations with key organizations to expand their presence in the global vehicle intelligence systems market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives

1.2 Vehicle Intelligence Systems Market Definition

1.3 Vehicle Intelligence Systems Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.3 Data From Secondary Sources

2.4 Primary Data

2.4.1 Sampling Techniques & Data Collection Methods

2.4.2 Primary Participants

2.5 Factor Analysis

2.5.1 Introduction

2.5.2 Demand Side Analysis

2.5.2.1 Impact of Disposable Income on Total Vehicle Sales

2.5.2.2 Infrastructure Roadways

2.5.3 Supply Side Analysis

2.5.3.1 Rising Demand for Hybrid and Electric Vehicles

2.5.3.2 Technological Advancements in Vehicle Safety and Security

2.6 Vehicle Intelligence Systems Market Size Estimation

2.7 Data Triangulation

2.8 Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insight (Page No. - 31)

4.1 Opportunities in the Global Vehicle Intelligence System Market

4.2 Regional Analysis for the Global Vehicle Intelligence System Market

4.3 Global Advanced Driver Assistance and Driver Monitoring Market, By Intelligence System

4.4 Global Road Scene Understanding Market, By Technology

4.5 Global Vehicle Intelligence System Market, By Vehicle Type

4.6 Global Vehicle Intelligence System Market, By Component

5 Vehicle Intelligence Systems Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Global Vehicle Intelligence System Market

5.2.1.1 Global Vehicle Intelligence System Market, By Road Scene Understanding

5.2.1.2 Global Vehicle Intelligence System Market, By Advance Driver Assistance and Driver Monitoring

5.2.1.3 Global Vehicle Intelligence System Market, By Components

5.2.1.4 Global Vehicle Intelligence System Market, By Vehicle Type

5.2.1.5 Global Vehicle Intelligence System Market, By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Awareness Regarding Stringent Safety Regulations

5.3.1.2 Increasing Demand for Luxury Cars in Developing Countries

5.3.2 Restraint

5.3.2.1 High Cost of Integration

5.3.3 Challenges

5.3.3.1 Effective Functioning of the Vehicle Intelligence Systems

5.3.4 Opportunities

5.3.4.1 Trend of Autonomous Cars

5.4 Value Chain

5.5 Porters Five Forces Analysis

5.5.1 Intensity of Rivalry

5.5.1.1 Rising Number of Competitors

5.5.2 Threat of New Entrants

5.5.2.1 High-Level of Technological Capabilities and High Capital Investment

5.5.3 Threat of Substitutes

5.5.3.1 No Direct Substitutes But Improvement in Technology Will Affect the Adoption Rate

5.5.4 Bargaining Power of Suppliers

5.5.4.1 Limited Number of Established Players

5.5.5 Bargaining Power of Buyers

5.5.5.1 Limited Number of Choices

6 Global Vehicle Intelligence Systems Market, By Road Scene Understanding (Page No. - 49)

6.1 Introduction

6.2 Road/Lane Tracking System

6.3 Road Sign Detection System

6.4 Night Vision System

6.5 Pedestrian Detection System

7 Global Vehicle Intelligence Systems Market, By Advanced Driver Assistance and Driver Monitoring (Page No. - 67)

7.1 Introduction

7.2 Adaptive Cruise Control

7.3 Blind Spot Detection System

7.4 Park Assist System

7.5 Traffic Jam Assist System

7.6 Drowsiness Warning/Alertness Sensing System

8 Global Vehicle Intelligence System Market, By Component (Page No. - 88)

8.1 Introduction

8.2 Sensors

8.2.1 Image Sensors

8.2.1.1 Complementary Metal-Oxide Semiconductor

8.2.1.2 Charge-Coupled Devices

8.2.2 Inertial Sensors

8.2.2.1 Accelerometers

8.2.2.2 Gyroscopes

8.2.3 Radars

8.2.4 Ultrasonic Sensors

8.3 Processors

8.3.1 Microprocessor Units

8.3.2 Microcontroller Units

8.3.3 Digital Signal Processors

8.3.4 Graphic Processing Units

8.4 Analog Integrated Circuits

8.4.1 Amplifiers

8.4.2 Converters

8.4.3 Comparators

8.4.4 Logic Integrated Circuits

8.5 Memory

8.5.1 Dynamic Random-Access Memory

8.5.2 Static Random-Access Memory

9 Global Vehicle Intelligence Systems Market, By Vehicle Type (Page No. - 106)

9.1 Introduction

9.2 Passenger Cars

9.3 Commercial Vehicle

10 Global Vehicle Intelligence Systems Market, By Region (Page No. - 111)

10.1 Introduction

10.2 North America

10.3 Europe

10.4 Asia-Oceania

10.5 RoW

11 Competitive Landscape (Page No. - 121)

11.1 Market Ranking: Global Vehicle Intelligence Systems Market

11.2 New Product Launch/Development

11.3 Agreements/Joint Ventures/Supply Contracts /Partnerships & Others

11.4 Expansion

11.5 Mergers & Acquisitions

12 Company Profiles (Page No. - 127)

12.1 Introduction

(Overview, Financials, Products & Services, Strategy, and Developments)*

12.2 Continental AG

12.3 Denso Corporation

12.4 Delphi Automotive PLC

12.5 Robert Bosch GmbH

12.6 Valeo SA

12.7 Autoliv Inc.

12.8 Wabco Holdings Inc.

12.9 Mobileye NV

12.10 Magna International Inc.

12.11 Infineon Technologies AG

*Details on Overview, Financials, Product & Services, Strategy, and Developments Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 153)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Available Customization

13.4.1 Company Information

13.4.2 Commercial Vehicle Intelligence System Market, By Intelligence System

13.5 Related Reports

List of Tables (118 Tables)

Table 1 Road Scene Understanding Technologies Considered in the Study

Table 2 Advance Driver Assistance and Driver Monitoring Technologies Considered in the Study

Table 3 Components Considered for the Study

Table 4 Vehicle Type Considered for the Study

Table 5 Key Regions Considered for the Study

Table 6 Global Road Scene Understanding Market, By Intelligence System, 2014-2021 (‘000 Units)

Table 7 Global Road Scene Understanding Market, By Intelligence System, 2014-2021 (USD Million)

Table 8 Asia-Oceania Road/Lane Tracking System Market, By Country 2014-2021 (‘000 Units)

Table 9 Asia-Oceania Road/Lane Tracking System Market, By Country 2014-2021 (USD Million)

Table 10 European Road/Lane Tracking System Market, By Country 2014-2021 (‘000 Units)

Table 11 European Road/Lane Tracking System Market, By Country, 2014-2021 (USD Million)

Table 12 North American Road/Lane Tracking System Market, By Country 2014-2021 (‘000)

Table 13 North American Road/Lane Tracking System Market, By Country, 2014-2021 (USD Million)

Table 14 RoW Road/Lane Tracking System Market, By Country, 2014-2021 (‘000 Units)

Table 15 RoW Road/Lane Tracking System Market, By Country, 2014-2021 (USD Million)

Table 16 Asia-Oceania Road Sign Detection System Market, By Country, 2014-2021 (‘000 Units)

Table 17 Asia-Oceania Road Sign Detection System Market, By Country, 2014-2021 (USD Million)

Table 18 European Road Sign Detection System Market, By Country 2014-2021 (‘000 Units)

Table 19 European Road Sign Detection System Market, By Country 2014-2021 (USD Million)

Table 20 North American Road Sign Detection System Market, By Country, 2014-2021 (‘000 Units)

Table 21 North American Road Sign Detection System Market, By Country, 2014-2021 (USD Million)

Table 22 RoW Road Sign Detection System Market, By Country, 2014-2021 (‘000 Units)

Table 23 RoW Road Sign Detection System Market, By Country, 2014-2021 (USD Million)

Table 24 Asia-Oceania Night Vision System Market, By Country, 2014-2021 (‘000 Units)

Table 25 Asia-Oceania Night Vision System Market, By Country, 2014-2021 (USD Million)

Table 26 European Night Vision System Market, By Country, 2014-2021 (‘000 Units)

Table 27 European Night Vision System Market, By Country, 2014-2021 (USD Million)

Table 28 North American Night Vision System Market, By Country, 2014-2021 (‘000 Units)

Table 29 North-American Night Vision System Market, By Country, 2014-2021 (USD Million)

Table 30 RoW Night Vision System Market, By Country, 2014-2021 (‘000 Units)

Table 31 RoW Night Vision System Market, By Country, 2014-2021 (USD Million)

Table 32 Asia-Oceania Pedestrian Detection System Market, By Country, 2014-2021 (‘000 Units)

Table 33 Asia-Oceania Pedestrian Detection System Market, By Country, 2014-2021 (USD Million)

Table 34 Europe Pedestrian Detection System Market, By Country, 2014-2021 (‘000 Units)

Table 35 European Pedestrian Detection System Market, By Country, 2014-2021 (USD Million)

Table 36 North American Pedestrian Detection System Market, By Country, 2014-2021 (‘000 Units)

Table 37 North American Pedestrian Detection System Market, By Country, 2014-2021 (USD Million)

Table 38 RoW Pedestrian Detection System Market, By Country, 2014-2021 (‘000 Units)

Table 39 RoW Pedestrian Detection System Market, By Country, 2014-2021 (USD Million)

Table 40 Global Advanced Driver Assistance and Driver Monitoring Market, By Intelligence System (‘000 Units)

Table 41 Global Advanced Driver Assistance and Driver Monitoring Market, By Intelligence System (USD Million)

Table 42 Asia-Oceania Adaptive Cruise Control Market, By Country, (‘000 Units)

Table 43 Asia-Oceania Adaptive Cruise Control Market, By Country, (USD Million)

Table 44 European Adaptive Cruise Control Market, By Country, (‘000 Units)

Table 45 European Adaptive Cruise Control Market, By Country, (USD Million)

Table 46 North American Adaptive Cruise Control Market, By Country, (‘000 Units)

Table 47 North American Adaptive Cruise Control Market, By Country, (USD Million)

Table 48 RoW Adaptive Cruise Control Market, By Country, (‘000 Units)

Table 49 RoW Adaptive Cruise Control Market, By Country, (USD Million)

Table 50 Asia-Oceania Blind Spot Detection System Market, By Country, (‘000 Units)

Table 51 Asia-Oceania Blind Spot Detection System Market, By Country, (USD Million)

Table 52 European Blind Spot Detection System Market, By Country, (‘000 Units)

Table 53 European Blind Spot Detection System Market, By Country, (USD Million)

Table 54 North American Blind Spot Detection System Market, By Country, (‘000 Units)

Table 55 North American Blind Spot Detection System Market, By Country, (USD Million)

Table 56 RoW Blind Spot Detection System Market, By Country, (‘000 Units)

Table 57 RoW Blind Spot Detection System Market, By Country, (USD Million)

Table 58 Asia-Oceania Park Assist System Market, By Country, (‘000 Units)

Table 59 Asia-Oceania Park Assist System Market, By Country, (USD Million)

Table 60 European Park Assist System Market, By Country, (‘000 Units)

Table 61 European Park Assist System Market, By Country, (USD Million)

Table 62 North American Park Assist System Market, By Country, (‘000 Units)

Table 63 North American Park Assist System Market, By Country, (USD Million)

Table 64 RoW Park Assist System Market, By Country, (‘000 Units)

Table 65 RoW Park Assist System Market, By Country, (USD Million)

Table 66 Asia-Oceania Traffic Jam Assist System Market, By Country, (‘000 Units)

Table 67 Asia-Oceania Traffic Jam Assist System Market, By Country, (USD Million)

Table 68 European Traffic Jam Assist System Market, By Country, (‘000 Units)

Table 69 European Traffic Jam Assist System Market, By Country, (USD Million)

Table 70 North American Traffic Jam Assist System Market, By Country, (‘000 Units)

Table 71 North American Traffic Jam Assist System Market, By Country, (USD Million)

Table 72 RoW Traffic Jam Assist System Market, By Country, (‘000 Units)

Table 73 RoW Traffic Jam Assist System Market, By Country, (USD Million)

Table 74 Asia-Oceania Drowsiness Warning/Alertness Sensing System Market, By Country, (‘000 Units)

Table 75 Asia-Oceania Drowsiness Warning/Alertness Sensing System Market, By Country, (USD Million)

Table 76 European Drowsiness Warning/Alertness Sensing System Market, By Country, (‘000 Units)

Table 77 European Drowsiness Warning/Alertness Sensing System Market, By Country, (USD Million)

Table 78 North American Drowsiness Warning/Alertness Sensing System Market, By Country, (‘000 Units)

Table 79 North American Drowsiness Warning/Alertness Sensing System Market, By Country, (USD Million)

Table 80 RoW Drowsiness Warning/Alertness Sensing System Market, By Country, (‘000 Units)

Table 81 RoW Drowsiness Warning/Alertness Sensing System Market, By Country, (USD Million)

Table 82 Functions Performed By Image Sensors in Automobile Applications

Table 83 Difference Between Charge-Coupled Device & Complementary Metal-Oxide Semiconductor Image Sensors

Table 84 Sensor Market, By Road Scene Understanding, 2014-2021 ('000 Units)

Table 85 Sensor Market, By Road Scene Understanding, 2014-2021 (USD Million)

Table 86 Sensor Market, By Advanced Driver Assistance & Driver Monitoring, 2014-2021 (USD Million)

Table 87 Processor Market, By Road Scene Understanding, 2014-2021 ('000 Units)

Table 88 Processor Market, By Road Scene Understanding, 2014-2021 (USD Million)

Table 89 Processor Market, By Advanced Driver Assistance & Driver Monitoring, 2014-2021 ('000 Units)

Table 90 Processor Market, By Advanced Driver Assistance & Driver Monitoring, 2014-2021 (USD Million)

Table 91 Analog Integrated Circuits Market, By Road Scene Understanding, 2014-2021 ('000 Units)

Table 92 Analog Integrated Circuits Market, By Road Scene Understanding, 2014-2021 (USD Million)

Table 93 Analog Integrated Circuits Market, By Advanced Driver Assistance & Driver Monitoring, 2014-2021 ('000 Units)

Table 94 Analog Integrated Circuits Market, By Advanced Driver Assistance & Driver Monitoring, 2014-2021 (USD Million)

Table 95 Memory Market, By Road Scene Understanding, 2014-2021 ('000 Units)

Table 96 Memory Market, By Road Scene Understanding, 2014-2021 (USD Million)

Table 97 Memory Market, By Advanced Driver Assistance & Driver Monitoring, 2014-2021 ('000 Units)

Table 98 Memory Market, By Advanced Driver Assistance & Driver Monitoring, 2014-2021 (USD Million)

Table 99 Vehicle Intelligence Systems Market, By Vehicle Type 2014-2021 (‘000 Units)

Table 100 Vehicle Intelligence Systems Market, By Vehicle Type 2014-2021 (USD Million)

Table 101 Passenger Car Intelligence Systems Market, By Region 2014-2021 (‘000 Units)

Table 102 Passenger Car Intelligence Systems Market, By Region 2014-2021 (USD Million)

Table 103 Commercial Vehicle Intelligence Systems Market, By Region 2014-2021 (‘000 Units)

Table 104 Commercial Vehicle Intelligence Systems Market, By Region 2014-2021(USD Million)

Table 105 Vehicle Intelligence Systems Market, By Region, 2014–2021 (‘000 Units)

Table 106 Vehicle Intelligence Systems Market, By Region, 2014–2021 (USD Million)

Table 107 North America: Vehicle Intelligence Systems Market, By Intelligence System, 2014–2021 (‘000 Units)

Table 108 North America: Vehicle Intelligence Systems Market, By Intelligence System, 2014–2021 (USD Million)

Table 109 Europe: Vehicle Intelligence Systems Market, By Intelligence System, 2014–2021 (‘000 Units)

Table 110 Europe: Vehicle Intelligence Systems Market, By Intelligence System, 2014–2021 (USD Million)

Table 111 Asia-Oceania: Vehicle Intelligence Systems Market, By Intelligence System, 2014–2021 (‘000 Units)

Table 112 Asia-Oceania: Vehicle Intelligence Systems Market, By Intelligence System, 2014–2021 (USD Million)

Table 113 RoW: Vehicle Intelligence Systems Market, By Intelligence System, 2014–2021 (‘000 Units)

Table 114 RoW: Vehicle Intelligence Systems Market, By Intelligence System, 2014–2021 (USD Million)

Table 115 New Product Launches/Developments, 2011–2016

Table 116 Agreements/Joint Ventures/Supply Contracts/Partnerships, 2011–2016

Table 117 Expansions, 2011–2016

Table 118 Mergers & Acquisitions, 2011–2016

List of Figures (57 Figures)

Figure 1 Global Vehicle Intelligence Systems Market: Markets Covered

Figure 2 Research Design

Figure 3 Research Methodology Model

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 5 Impact of Disposable Income on Vehicle Sales, 2014

Figure 6 Roadways Infrastructure: Road Network (Km), By Country, 2011

Figure 7 Global Vehicle Intelligence Market, By System: Bottom-Up Approach

Figure 8 Road Scene Understanding Intelligence Systems Market Estimated to Grow at the Highest CAGR From 2016 to 2021

Figure 9 Park Assist & Blind Spot Detection Systems to Hold the Largest Share in the Advanced Driver Assistance & Driver Monitoring System Market, 2016 vs 2021 (USD Billion)

Figure 10 Road/Lane Tracking System Estimated to Hold the Largest Market Share By 2021 (USD Billion)

Figure 11 Europe to Dominate the Global Vehicle Intelligence Systems Market During the Forecast Period

Figure 12 Growing Trend of Autonomous Cars Will Provide Attractive Growth Opportunities

Figure 13 Road Traffic Death Rate, 2013

Figure 14 Luxury Car Sales in India, 2014-2015

Figure 15 Value Chain Analysis: Major Value is Added During the Manufacturing and Assembly Phases

Figure 16 Porter’s Five Force Analysis : Global Vehicle Intelligence System Market

Figure 17 Competitive Rivalry is Moderate to High in the Global Vehicle Intelligence System Market

Figure 18 Threat of New Entrants (Low)

Figure 19 Threat of Substitutes (Low)

Figure 20 Bargaining Power of Suppliers (Moderate-To-High)

Figure 21 Bargaining Power of Buyers (Low-To-Moderate)

Figure 22 Road/Land Tracking System is Projected to Have the Largest Share in 2021

Figure 23 Europe is Estimated Tobe the Largest Road/Lane Tracking System Market in 2016

Figure 24 Us is the Largest Market in the North American Road Sign Detection System Market By 2021

Figure 25 European Night Vision System Market is Projected to Grow at the Highest CAGR

Figure 26 Germany is Projected to Account for the Largest Share in the European Pedestrian Detection System Market

Figure 27 Adaptive Cruise Control Will Grow at the Highest CAGR From 2016 to 2021

Figure 28 U.S. is Estimated to Have the Largest Market Size in the North American Adaptive Cruise Control Market

Figure 29 Germany Will Dominate the European Blind Spot Detection System Market in 2021

Figure 30 China is Expected to Dominate the Asia-Oceania Park Assist System Market From 2016 to 2021

Figure 31 Application of Image Sensors in the Automotive Sector

Figure 32 Night Vision System to Have the Highest CAGR for the Road Scene Understanding Sensor Market From 2016 to 2021

Figure 33 Park Assist System to Account for the Largest Market Size in the Advanced Driver Assistance & Driver Monitoring Processors Market

Figure 34 Commercial Vehicle Intelligence Systems Market Projected to Grow at A Higher CAGR From 2016 to 2021

Figure 35 Europe Projected to Grow at the Highest CAGR From 2016 to 2021

Figure 36 North America: Vehicle Intelligence Systems Market Snapshot

Figure 37 Europe: Vehicle Intelligence Systems Market Snapshot

Figure 38 Companies Adopted New Product Development as the Key Growth Strategy From 2011 to 2016

Figure 39 Global Vehicle Intelligence Systems Market, 2015

Figure 40 Vehicle Intelligence Systems Market Evaluation Framework for 2014 to 2016

Figure 41 Battle for Market Share: New Product Development/Launch is the Key Strategy

Figure 42 Region-Wise Revenue Mix of Top Five Market Players

Figure 43 Continental AG: Company Snapshot

Figure 44 SWOT Analysis: Continental AG

Figure 45 Denso Corporation: Company Snapshot

Figure 46 SWOT Analysis: Denso Corporation

Figure 47 Delphi Automotive PLC: Company Snapshot

Figure 48 SWOT Analysis: Delphi Automotive PLC

Figure 49 Robert Bosch GmbH: Company Snapshot

Figure 50 SWOT Analysis: Robert Bosch GmbH

Figure 51 Valeo SA: Company Snapshot

Figure 52 SWOT Analysis: Valeo SA

Figure 53 Autoliv Inc.: Company Snapshot

Figure 54 Wabco Holdings Inc.: Company Snapshot

Figure 55 Mobileye NV: Company Snapshot

Figure 56 Magna International Inc.: Company Snapshot

Figure 57 Infineon Technologies AG: Company Snapshot

Growth opportunities and latent adjacency in Vehicle Intelligence Systems Market