Automotive Gearbox Market by Application (Automatic Transmission, Automated Manual Transmission, Dual Clutch Transmission, Manual), Number of Gears (3–5, 6–8, above 8), Electric Vehicle Type, Off-Highway vehicle, Vehicle Type, Region - Global Forecast to 2025

Automotive Gearbox Market

Growing consumer preference towards enhanced driving experience and smoother gear shifting are the prime factors support the automotive gearbox market growth. Another major factor supporting the market growth is the increasing demand for lightweight transmission systems. With continued improvement in automotive transmission systems such as AMT, AT and DCT, the automotive gearbox market is expected to consistent growth in terms of demand as well as product development. Nevertheless, rapidly growing potential of electric vehicles is expected to emerge as a potent challenge for the market.

Key Drivers:

- Increasing consumer preference towards enhanced driving experience and smooth gear shifting

- Growing demand for AMT and AT in heavy commercial vehicles

Key Restraints:

- Growing electric vehicles market worldwide

- Emergence of CVT as a key technology

Top 10 Players:

- ZF Friedrichshafen: ZF Friedrichshafen was established in 1915 and is headquartered in Friedrichshafen, Germany. The company operates in Europe, Africa, North America, South America, and Asia, with an employee base of 146,148 as of 2017 across 40 countries. The company operates through seven business segments, namely, active & passive safety technology, car powertrain technology, car chassis technology, commercial vehicle technology, industrial technology, ZF services and e-mobility. The automotive gearbox is offered in the car powertrain and commercial vehicle technology segments. The company has supply agreements with several major automobile manufacturers such as Volkswagen, Renault, BMW and Toyota.

- Aisin Seiki: Aisin Seiki was founded in 1949 and is headquartered in Aichi, Japan. The company is regarded as one of the leading automotive component suppliers in Asia. Aisin Seiki has presence in over 40 countries through manufacturing sites, technical centers and support centers. The company operates through four segments: Aisin Seiki group for powertrain, chassis, body product & electronics, Aisin Takaoka group for engine parts & audio systems, Aisin AW group for automatic transmission & car navigation and Advics group for brakes. The group has major focus on geographic expansion and has over 207 companies across the world.

- Magna (GETRAG): Magna was established in 1957 and is headquartered in Aurora, Canada. The company manufactures and sells automotive systems, assemblies, modules and components for light duty vehicles and heavy commercial vehicles. The company offer transmission products through its subsidiary GETRAG, a part of Magna since January, 2016. GETRAG offers manual gearbox and dual-clutch gearbox for passenger cars, CUVs, SUVs, vans and light trucks. The company also offers hybrid transmission for electric and hybrid vehicles. Magna has 335 manufacturing operations and 96 product development, engineering and sales centers across 28 countries.

- Schaeffler: Schaeffler was founded in 1883 and is headquartered in Herzogenaurach, Germany. The company manufactures and sells automotive parts primarily in Europe, the Americas and China. Schaeffler operates through two segments – automotive and industrial. For automotive sector, it manufactures high-precision components and systems for engines, transmission and chassis applications. The company offers gearbox system and components through its automotive division. Automotive division is the largest business segment for the company accounting for over 77% of the total company’s revenue in the year 2017. The company has major focus on geographic expansion and has over 74 manufacturing facilities across 22 countries.

- Borgwarner: Borgwarner was established in 1880 and is headquartered in Michigan, US. The company operates through two major segments – engine and drivetrain. In the drivetrain segment, the company manufactures products for all-wheel drive and automatic transmission and components for hybrid and electric vehicles such as starter motors, electric motors, alternators and torque converters. The drivetrain segment contributed 38.5% towards revenue in 2017. Borgwarner has presence across North America, Europe and Asia with over 66 manufacturing, assembly and technical locations. The company has emphasis on expanding its network of manufacturing facilities across the world.

- Eaton

- Allison Transmission

- Continental AG

- Magneti Marelli

- Hyundai Dymos

- JATCO

Other Players:

- GKN

- Bonfiglioli

- Oerlikon Graziano

- Punch Powertrain

- Tremec

- AVTEC

- Aichi Machine

- Fuji

- Hewland

Top Segment by Number of Gears:

- 3-5 Gears

- 6-8 Gears

-

Above 8 Gears

- 6-8 gears segment currently dominate the market; above 8 gears segment is expected to register highest growth rate, in terms of volume

- 6-8 gears is the most popularly used gearbox across passenger vehicles as well as commercial vehicles and hence would continue dominating the market

- Passenger cars is the most lucrative segment for 6-8 gears segment due to continuously growing demand for semi-luxury and luxury cars

The automotive gearbox market was valued at USD 99.74 Billion in 2017 and is projected to reach USD 138.52 Billion by 2025, at a CAGR of 4.24% during the forecast period. The base year for the report is 2017 and the forecast period is 2018 to 2025.

Objectives of the report

- To define, segment, and forecast the automotive gearbox market (2018–2025), in terms of volume (thousand units) and value (USD million)

- To provide detailed analyses of the various forces acting in the market (drivers, restraints, opportunities, and challenges)

- To segment the automotive gearbox market and forecast its size, by application, number of gears, vehicle type, electric vehicle, off-highway vehicle, and region (Asia Pacific, Europe, North America, and the Rest of the World)

- To segment the automotive gearbox market and forecast the market size, by volume and value, based on application automatic transmission (AT), automated manual transmission (AMT), dual clutch transmission (DCT), and manual transmission

- To segment the automotive gearbox market and forecast the market size, by volume and value, based on the number of gears 3–5, 6–8, and above 8

- To segment the automotive gearbox market and forecast the market size, by volume and value, based on vehicle type passenger cars, light commercial vehicles, trucks, and buses

- To segment the market and forecast the market size, by volume and value, based on electric vehicle type HEVs, and PHEVs

- To segment the market and forecast the market size, by volume and value, based on off-highway vehicles agricultural tractors and construction equipment

- To track and analyze competitive developments in the market, such as joint ventures, mergers & acquisitions, new product launches, expansions, and other activities carried out by key industry participants

The research methodology used in the report involves primary and secondary sources and follows a bottom-up approach for data triangulation. The study involves the country-level OEM and model-wise analysis of automotive gearbox market. This analysis involves historical trends as well as existing market penetrations, by country as well as vehicle type. The analysis is projected based on various factors such as growth trends in vehicle production and adoption rate by OEMs. The analysis has been discussed with and validated by primary respondents, which include experts from the automotive industry, manufacturers, and suppliers. Secondary sources include associations such as China Association of Automobile Manufacturers (CAAM), International Organization of Motor Vehicle Manufacturers (OICA), European Automobile Manufacturers Association (ACEA), Environmental Protection Agency (EPA), Society of Indian Automotive Manufacturers, SAE International, and paid databases and directories such as Factiva.

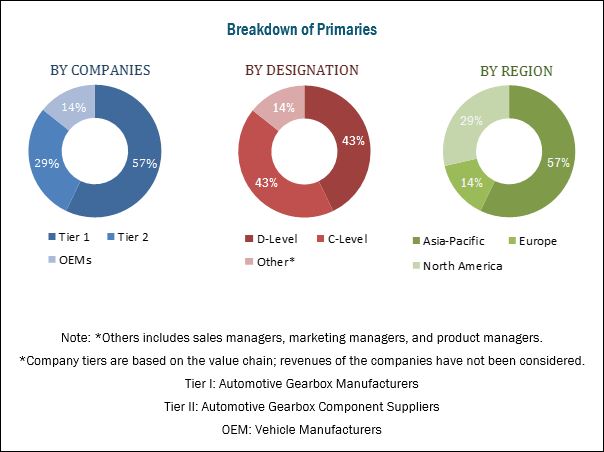

The figure below illustrates the break-up of the profile of industry experts who participated in primary discussions.

To know about the assumptions considered for the study, download the pdf brochure

The ecosystem of the automotive gearbox market consists of automotive gearbox manufacturers such as ZF Friedrichshafen (Germany), Aisin Seiki (Japan), Magna (Getrag) (Canada), Schaeffler (Germany), Eaton (Ireland), and BorgWarner (US). The automotive gearboxes are supplied to the automotive OEMs.

Target Audience

- Automotive gearbox manufacturers

- Automotive component manufacturers

- Automotive powertrain manufacturers

- Transmission components manufacturers

- E-drive system manufacturers

- Industry associations and experts

- Raw material suppliers for automotive gearbox manufacturers

- The automobile industry as an end-user, traders, distributors, and suppliers of automotive gearbox

Scope of the Report

Automotive Gearbox Market, By Application

Automotive Gearbox Market, By Number of Gears

Automotive Gearbox Market, By Vehicle Type

Automotive Gearbox Market, By Electric Vehicle Type

Automotive Gearbox Market, By Off- Highway Vehicle Type

Automotive Gearbox Market, By Region

-

- Automatic Transmission (AT)

- Automated Manual Transmission (AMT)

- Dual Clutch Transmission (DCT)

- Manual Transmission

- 3–5

- 6–8

- Above 8

- Passenger Cars

- LCVs

- Trucks

- Buses

- HEV

- PHEV

- Agricultural Tractors

- Construction Equipment

- Asia Pacific (China, India, Japan, South Korea, and RoA)

- Europe (Germany, France, Italy, Spain, UK, and RoE)

- North America (US, Mexico, and Canada)

- Rest of the World (Brazil, Russia, and South Africa)

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance with company-specific needs.

The following customization options are available for the report:

-

Additional company profiles

- Business Overview

- SWOT analysis

- Recent developments

- MnM view

- Detailed Analysis of gearbox by application

- Detailed Analysis of gearbox by vehicle type

Growing demand for automatic transmission are driving the automotive gearbox market and is expected to be close to USD 40.03 Billion by 2025.

A gearbox is a system that uses integrated gears with a specific arrangement to transmit the power. In automotive, a transmission gearbox is most frequently positioned at the junction point of a power shaft and provides a range of gearing to multiply the engine’s torque. The different types of gearbox used are manual gearbox, automatic gearbox, automatic manual gearbox, dual clutch transmission gearbox, and hybrid gearbox.

The automatic gearbox is preferred over the others, as these gearboxes reduce driver fatigue as they eliminate the need to repeatedly use a clutch shifting gears however, increasing demand for battery electric vehicles will eliminate the need for automotive gearbox.

Growing demand for the smoothness of the gear shift along with the high-performance level of the vehicle incentivize the transmission manufacturers to develop more advanced transmission systems for vehicles.

Market Dynamics

Drivers

- Consumer preference for enhanced driving experience and smooth gear shifting

Restraints

- Increasing demand for battery electric vehicle

Opportunities

- Increasing demand for AT and AMTs in HCVs

Challenges

- Emergence of CVT as a key technology

Critical Questions:

- How will the industry optimise the cost of automatic and dual clutch gearbox in order to push them in mid-priced and economy light duty vehicles?

- Is hybrid e-drive future for the automotive gearbox market? How are the industry players addressing this challenge?

- In which regions, companies can create new revenue pockets for short as well as long term?

The automotive gearbox market is projected to grow at a CAGR of 4.24% from 2018 to 2025. The market for automotive gearbox is estimated to be USD 103.55 Billion in 2018 and is projected to reach USD 138.52 Billion by 2025. The increasing preference for enhanced driving experience and smooth gear shifting is driving the growth of the market.

Plug-in Hybrid Electric Vehicle (PHEV) is projected to be the fastest growing segment of the market, by electric vehicle. PHEV segment is estimated to have the highest growth potential in the gearbox market across the globe. Growing environmental concerns, rising fossil fuel prices, and stringent government regulations for emission have accelerated the growth of the electric vehicles market.

By vehicle type, the passenger cars segment is estimated to hold the largest share of the market. The rise in the production of passenger cars globally, high demand for premium vehicles and SUVs, and expectation of high performance from personal vehicles are fueling the growth of this market. The global demand for passenger cars is larger than that for commercial vehicles and is expected to grow further in the future. Additionally, factors such as the sizeable number of luxury light-duty vehicles in Europe and North America and the increasing demand for these vehicles in the Asia Pacific region are increasing the demand for automotive gearbox.

By number of gears, the above 8 gears gearbox segment is estimated to grow at the highest rate during the forecast period. This type is mostly used in commercial and off-highway vehicles which require a high degree of durability. Factors such as the development of infrastructure and increasing demand for commercial vehicles for freight transport are driving the growth of this segment.

By off-highway vehicle type, the construction equipment vehicle segment is estimated to be the fastest growing segment of automotive gearbox market. Infrastructure development, especially in countries such as China and India, is supporting the growth of this market.

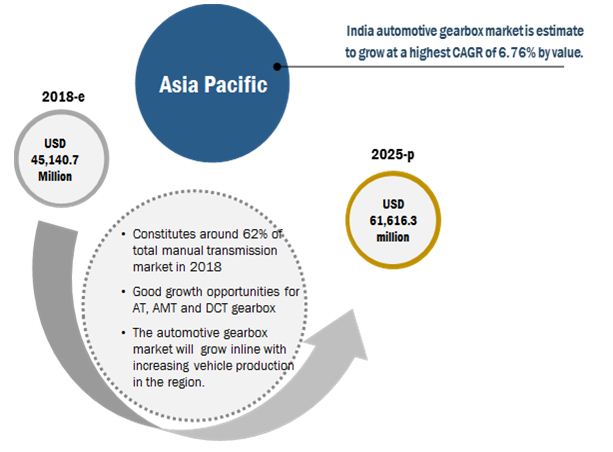

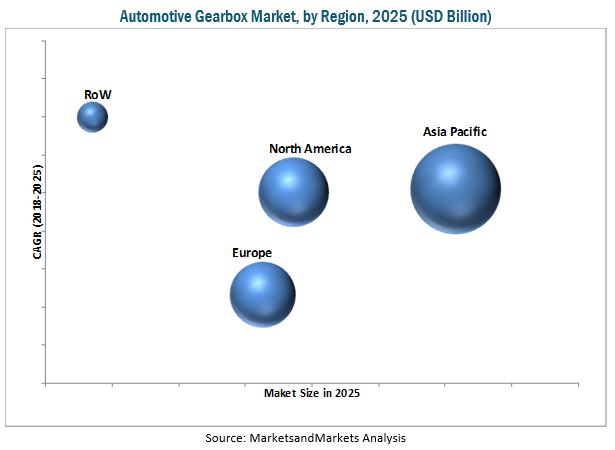

Asia Pacific is estimated to be the largest market for automotive gearbox, in terms of value. The Asia Pacific region is estimated to be the most promising market for automotive gearbox in the next five years due to strong growth in the passenger car sales year on year. Demand in the developing countries such as India and China is driving the growth of the market in the region.

The increasing demand for battery electric vehicles can hamper the growth of market. Gearbox is not used in these vehicles. Instead, electric vehicles use electric motor and e-drive for the torque transmission.

Some of the key players in the automotive gearbox market are ZF Friedrichshafen (Germany), Aisin Seiki (Japan), Magna (Getrag) (Canada), Schaeffler (Germany), and BorgWarner (US).

Leading aerodynamic application manufacturers and OEMs are developing lightweight transmission gearbox for increased mileage and minimum carbon emissions, to drive the industry forward

Automatic Transmission

The automatic transmission gearbox system in a vehicle that changes gears at different speeds without direct control by the driver. In automatic transmissions, gear selection decisions are made by an automatic control system. Instead of a manual clutch to connect and disconnect the engine from the transmission, automatic transmissions use fluid couplings or torque converters to transfer power from the engine to the transmission.

Manual Transmission

Manual transmission is a type of transmission in which the gears are changed by a lever operated by the driver of a vehicle. The manual transmission transfers power from the engine to the propeller shaft. It converts and multiplies rotational speed, allowing engine RPM to remain in it’s limited optimal power range while providing a wide range of RPM to the propeller shaft; which, in turn, controls vehicle speed.

Dual clutch transmission

Dual clutch transmission is a type of automatic transmission device in the field of automotive automatic transmission. It realizes power transmission and interruption, and shifting without power interruption through respective connection between the two-transmission shaft and two clutches. It also combines the advantages of manual transmission and traditional torque mechanic transmission so as to equip the vehicle with the same convenience and comfort with manual transmission vehicles, but better fuel economy.

Automated manual transmission

Automated manual transmission is an automobile transmission that combines manual transmission and automatic transmission. It allows driver control of gear selection. It enhanced gear selection features by providing either steering wheel mounted paddle shifters or a modified shift lever, allowing the driver to enter a "manual mode" and select any available gear, usually in a sequential "up shift/downshift" manner. In this transmission, the clutch operation is controlled by electronically operated devices.

Critical Questions would be:

- Where will the developments in the gearbox market will take the industry in the mid to long term?

- What are the adjacencies companies can leverage or explore?

- Which geographical markets are unexplored for automatic and dual clutch transmission in the automotive gearbox market where there is a good growth potential?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.4 Data Triangulation

2.5 Market Size Estimation

2.6 Assumptions

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 33)

4.1 Attractive Opportunities in the market

4.2 Automotive Gearbox Market, By Region

4.3 Market, By Application

4.4 Market, By Number of Gear

4.5 Market, By Vehicle Type

4.6 Market, By Off-Highway Vehicle Type

4.7 Market, By Electric Vehicle Type

5 Market Overview (Page No. - 38)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Consumer Preference for Enhanced Driving Experience and Smooth Gear Shifting

5.2.2 Restraints

5.2.2.1 Increasing Demand for Battery Electric Vehicles Will Eliminate the Need for Automotive Gearbox

5.2.3 Opportunities

5.2.3.1 Increasing Demand for at and AMTS in Hcvs

5.2.4 Challenges

5.2.4.1 Emergence of CVT as A Key Technology

6 Automotive Gearbox Market, By Application (Page No. - 42)

6.1 Introduction

6.2 Automatic Transmission (AT)

6.3 Automated Manual Transmission (AMT)

6.4 Dual Clutch Transmission (DCT)

6.5 Manual Transmission (MT)

7 Automotive Gearbox Market, By Number of Gear (Page No. - 49)

7.1 Introduction

7.2 3–5 Gears

7.3 6–8 Gears

7.4 Above 8 Gears

8 Automotive Gearbox Market, By Vehicle Type (Page No. - 55)

8.1 Introduction

8.2 Passenger Cars

8.3 Light Commercial Vehicles

8.4 Trucks

8.5 Buses

9 Automotive Gearbox Market, By Electric Vehicle (Page No. - 62)

9.1 Introduction

9.2 HEV

9.3 PHEV

10 Automotive Gearbox Market, By Off-Highway Vehicle Type (Page No. - 68)

10.1 Introduction

10.2 Agricultural Tractors

10.3 Construction Equipment

11 Automotive Gearbox Market, By Region (Page No. - 73)

11.1 Introduction

11.2 Asia Pacific

11.2.1 China

11.2.2 India

11.2.3 Japan

11.2.4 South Korea

11.2.5 Rest of Asia Pacific (RoA)

11.3 Europe

11.3.1 France

11.3.2 Germany

11.3.3 Italy

11.3.4 Spain

11.3.5 UK

11.3.6 Rest of Europe (RoE)

11.4 North America

11.4.1 Canada

11.4.2 Mexico

11.4.3 US

11.5 Rest of the World

11.5.1 Brazil

11.5.2 Russia

11.5.3 South Africa

12 Competitive Mapping (Page No. - 105)

12.1 Overview

12.2 Market Ranking Analysis

12.3 Competitive Situation & Trends

12.3.1 New Product Developments

12.3.2 Expansions

12.3.3 Partnerships/Supply Contracts/Collaborations/ Joint Ventures

12.3.4 Acquisitions/Agreements

13 Company Profiles (Page No. - 113)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

13.1 Zf Friedrichshafen

13.2 Aisin Seiki

13.3 Magna (Getrag)

13.4 Schaeffler

13.5 Borgwarner

13.6 Eaton

13.7 Allison Transmission

13.8 Continental

13.9 Jatco

13.10 Magneti Marelli

13.11 GKN

13.12 Bonfiglioli

13.13 Hyundai Dymos

13.14 Oerlikon Graziano

13.15 Punch Powertrain

13.16 Tremec

13.17 Avtec

13.18 Aichi Machine Industry

13.19 Fuji Machinery Co. Ltd.

13.20 Hewland

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 142)

14.1 Discussion Guide

14.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.3 Introducing RT: Real Time Market Intelligence

14.4 Available Customizations

14.4.1 Additional Company Profiles

14.4.1.1 Business Overview

14.4.1.2 SWOT Analysis

14.4.1.3 Recent Developments

14.4.1.4 MnM View

14.4.2 Detaled Analysis of Gearbox By Automotive Application

14.4.3 Detaled Analysis of Gearbox By Vehicle Type

14.5 Related Reports

14.6 Author Details

List of Tables (98 Tables)

Table 1 Currency Exchange Rates (WRT USD)

Table 2 Comparison Between at and MT Systems

Table 3 Automotive Gearbox Market, By Application, 2016–2025 (‘000 Units)

Table 4 Market, By Application, 2016–2025 (USD Million)

Table 5 Automatic Transmission: Market, By Region, 2016–2025 (‘000 Units)

Table 6 Automatic Transmission: Market, By Region, 2016–2025 (USD Million)

Table 7 Automated Manual Transmission: Market, By Region, 2016–2025 (‘000 Units)

Table 8 Automated Manual Transmission: Market, By Region, 2016–2025 (USD Million)

Table 9 Dual Clutch Transmission: Market, By Region, 2016–2025 (‘000 Units)

Table 10 Dual Clutch Transmission: Market, By Region, 2016–2025 (USD Million)

Table 11 Manual Transmission: Market, By Region, 2016–2025 (‘000 Units)

Table 12 Manual Transmission: Market, By Region, 2016–2025 (USD Million)

Table 13 Automotive Gearbox Market, By Number of Gears, 2016–2025 (Thousand Units)

Table 14 Market, By Number of Gears, 2016–2025 (USD Million)

Table 15 3–5 Gears: Market, By Region, 2016–2025 (Thousand Units)

Table 16 3–5 Gears: Market, By Region, 2016–2025 (USD Million)

Table 17 6–8 Gears: Market, By Region, 2016–2025 (Thousand Units)

Table 18 6–8 Gears: Market, By Region, 2016–2025 (USD Million)

Table 19 Above 8 Gears: Market, By Region, 2016–2025 (Thousand Units)

Table 20 Above 8 Gears: Market, By Region, 2016–2025 (USD Million)

Table 21 Automotive Gearbox Market, By Vehicle Type, 2016–2025 (Thousand Units)

Table 22 Market, By Vehicle Type, 2016–2025 (USD Million)

Table 23 Passenger Car: Gearbox Market, By Region, 2016–2025 (Thousand Units)

Table 24 Passenger Car: Gearbox Market, By Region, 2016–2025 (USD Million)

Table 25 Light Commercial Vehicles: Gearbox Market, By Region, 2016–2025 (Thousand Units)

Table 26 Light Commercial Vehicles: Gearbox Market, By Region, 2016–2025 (USD Million)

Table 27 Trucks Gearbox Market, By Region, 2016–2025 (Thousand Units)

Table 28 Trucks Gearbox Market, By Region, 2016–2025 (USD Million)

Table 29 Buses Gearbox Market, By Region, 2016–2025 (Thousand Units)

Table 30 Buses Gearbox Market, By Region, 2016–2025 (USD Million)

Table 31 Automotive Gearbox Market, By Electric Vehicle, 2016–2025 (Thousand Units)

Table 32 Market, By Electric Vehicle, 2016–2025 (USD Million)

Table 33 Hev: Market, By Region, 2016–2025 (Thousand Units)

Table 34 Hev: Market, By Region, 2016–2025 (USD Million)

Table 35 Phev: Market, By Region, 2016–2025 (Thousand Units)

Table 36 Phev: Market, By Region, 2016–2025 (USD Million)

Table 37 Automotive Gearboxmarket: By Off-Highway Vehicle Type, 2016–2025 (Thousand Units)

Table 38 Automotive Gearbox Market, By Off-Highway Vehicle Type, 2016–2025 (USD Million)

Table 39 Agricultural Tractors: Market Size, By Region, 2016–2025 (Thousand Units)

Table 40 Agricultural Tractors: Market Size, By Region, 2016–2025 (USD Million)

Table 41 Construction Equipment: Market, By Region, 2016–2025 (Thousand Units)

Table 42 Construction Equipment: Market, By Region, 2016–2025 (USD Million)

Table 43 Automotive Gearbox Market, By Region, 2016–2025 (Thousand Units)

Table 44 Automotive Gearbox Market, By Region, 2016–2025 (USD Million)

Table 45 Asia Pacific: Market, By Application, 2016–2025 (Thousand Units)

Table 46 Asia Pacific: Market, By Application, 2016–2025 (USD Million)

Table 47 Asia Pacific: Market, By Country, 2016–2025 (Thousand Units)

Table 48 Asia Pacific: Market, By Country, 2016–2025 (USD Million)

Table 49 China: Automotive Gearbox Market, By Application, 2016–2025 (Thousand Units)

Table 50 China: Market, By Application, 2016–2025 (USD Million)

Table 51 India: Market, By Application, 2016–2025 (Thousand Units)

Table 52 India: Market, By Application, 2016–2025 (USD Million)

Table 53 Japan: Market, By Application, 2016–2025 (Thousand Units)

Table 54 Japan: Market, By Application, 2016–2025 (USD Million)

Table 55 South Korea: Market, By Application, 2016–2025 (Thousand Units)

Table 56 South Korea: Market, By Application, 2016–2025 (USD Million)

Table 57 RoA: Market, By Application, 2016–2025 (Thousand Units)

Table 58 RoA: Market, By Application, 2016–2025 (USD Million)

Table 59 Europe: Automotive Gearbox Market, By Application, 2016–2025 (Thousand Units)

Table 60 Europe: Market, By Application, 2016–2025 (USD Million)

Table 61 Europe: Market, By Country, 2016–2025 (Thousand Units)

Table 62 Europe: Market, By Country, 2016–2025 (USD Million)

Table 63 France: Market, By Application, 2016–2025 (Thousand Units)

Table 64 France: Market, By Application, 2016–2025 (USD Million)

Table 65 Germany: Market, By Application, 2016–2025 (Thousand Units)

Table 66 Germany: Market, By Application, 2016–2025 (USD Million)

Table 67 Italy: Market, By Application, 2016–2025 (Thousand Units)

Table 68 Italy: Market, By Application, 2016–2025 (USD Million)

Table 69 Spain: Market, By Application, 2016–2025 (Thousand Units)

Table 70 Spain: Market, By Application, 2016–2025 (USD Million)

Table 71 UK: Market, By Application, 2016–2025 (Thousand Units)

Table 72 UK: Market, By Application, 2016–2025 (USD Million)

Table 73 RoE: Market, By Application, 2016–2025 (Thousand Units)

Table 74 RoE: Market, By Application, 2016–2025 (USD Million)

Table 75 North America: Automotive Gearbox Market, By Application, 2016–2025 (Thousand Units)

Table 76 North America: Market, By Application, 2016–2025 (USD Million)

Table 77 North America: Market, By Country, 2016–2025 (Thousand Units)

Table 78 North America: Market, By Country, 2016–2025 (USD Million)

Table 79 Canada: Market, By Application, 2016–2025 (Thousand Units)

Table 80 Canada: Market, By Application, 2016–2025 (USD Million)

Table 81 Mexico: Market, By Application, 2016–2025 (Thousand Units)

Table 82 Mexico: Market, By Application, 2016–2025 (USD Million)

Table 83 US: Automotive Gearbox Market, By Application, 2016–2025 (Thousand Units)

Table 84 US: Market, By Application, 2016–2025 (USD Million)

Table 85 RoW: Market, By Application, 2016–2025 (Thousand Units)

Table 86 RoW: Market, By Application, 2016–2025 (USD Million)

Table 87 Rest of the World (RoW): Market, By Country, 2016–2025 (Thousand Units)

Table 88 Rest of the World (RoW): Market, By Country, 2016–2025 (USD Million)

Table 89 Brazil: Market, By Application, 2016–2025 (Thousand Units)

Table 90 Brazil: Market, By Application, 2016–2025 (USD Million)

Table 91 Russia: Market, By Application, 2016–2025 (Thousand Units)

Table 92 Russia: Market, By Application, 2016–2025 (USD Million)

Table 93 South Africa: Market, By Application, 2016–2025 (Thousand Units)

Table 94 South Africa: Market, By Application, 2016–2025 (USD Million)

Table 95 New Product Developments, 2014–2018

Table 96 Expansions, 2014–2018

Table 97 Partnerships/Supply Contracts/Collaborations/Joint Ventures, 2014–2018

Table 98 Acquisitions/Agreements, 2015–2018

List of Figures (40 Figures)

Figure 1 Automotive Gearbox Market: Segmentations Covered

Figure 2 Market: Research Design

Figure 3 Research Design Model

Figure 4 Breakdown of Primary Interviews

Figure 5 Automotive Gearbox Market: Bottom-Up Approach

Figure 6 Automatic Transmission Segment to Be the Fastest Growing Automotive Gearbox Market, 2018 vs 2025 (USD Billion)

Figure 7 Passenger Cars Segment to Be the Largest market, 2018 vs 2025 (USD Billion)

Figure 8 PHEVS to Be the Fastest Growing Automotive Gearbox Market, 2018 vs 2025 (USD Billion)

Figure 9 6–8 Gears Segment to Be the Largest market, 2018 vs 2025 (USD Billion)

Figure 10 Asia Pacific to Hold the Largest Share of the market, By Region, 2018 vs 2025 (USD Billion)

Figure 11 Agricultural Tractors Segment to Drive the Growth of the market, 2018 vs 2025 (USD Billion)

Figure 12 Increasing Consumer Preference for Enhanced Driving Experience and Smooth Gear Shifting to Drive the market, 2018–2025

Figure 13 Asia Pacific is Expected to Hold the Largest Share of the market, By Value, 2018–2025

Figure 14 Battery System is Estimated to Be the Fastest Growing Market By Application, 2018 vs 2025 (USD Billion)

Figure 15 6–8 Gear Segment to Hold the Largest Market Share, 2018 vs 2025

Figure 16 Passenger Cars Segment is Estimated to Be the Largest Segment of the market, By Value, 2018 vs 2025 (USD Billion)

Figure 17 Agricultural Tractor Segment is Estimated to Be the Largest Market for Automotive Gearbox, By Off-Highway Vehicle Type, 2018 vs 2025 (USD Billion)

Figure 18 HEV Segment is Estimated to Be the Largest Market for Automotive Gearbox, 2018 vs 2025 (USD Million)

Figure 19 BEV Sales in Key Regions, 2017–2022

Figure 20 Global Market, By Application, 2018 vs 2025 (USD Million)

Figure 21 Market, By Number of Gears, 2018 vs 2025 (Thousand Units)

Figure 22 Market, By Vehicle Type, 2018 vs 2025 (Thousand Units)

Figure 23 Market, By Electric Vehicle, 2018 vs 2025 (USD Million)

Figure 24 Off-Highway Vehicles: Market, 2018 vs 2025 (USD Million)

Figure 25 Market, By Region, 2018 vs 2025

Figure 26 Asia Pacific: Market Snapshot

Figure 27 Europe: Market, By Country, 2018 vs 2025 (Thousand Units)

Figure 28 North America: Market Snapshot

Figure 29 Rest of the World (RoW): Market, By Country, 2018 vs 2025 (Thousand Units)

Figure 30 Key Developments By Leading Players in the market, 2014–2018

Figure 31 Automotive Gearbox Market Ranking: 2017

Figure 32 Company Snapshot: ZF Friedrichshafen

Figure 33 Company Snapshot: Aisin Seiki

Figure 34 Company Snapshot: Magna (Getrag)

Figure 35 Company Snapshot: Schaeffler

Figure 36 Company Snapshot: Borgwarner

Figure 37 Company Snapshot: Eaton

Figure 38 Company Snapshot: Allison Transmission

Figure 39 Company Snapshot: Continental

Figure 40 Company Snapshot: Jatco

Growth opportunities and latent adjacency in Automotive Gearbox Market