Automotive Engine Management System Market by Vehicle Type (Passenger Car, LCV, & HCV), Engine Type (Gasoline & Diesel), Components (ECU, Sensors- Temperature, Position, Oxygen, & Knock), Communication Bus & Region - Industry Trends & Forecast to 2025

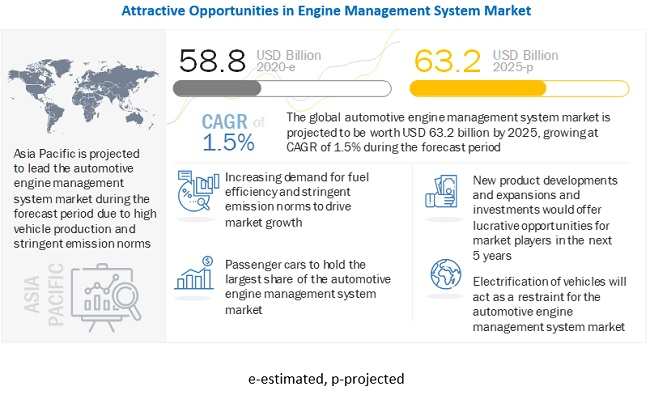

[186 Pages Report] The automotive engine management system market size was valued at USD 63.2 billion by 2025 and is expected to reach USD 58.8 billion in 2020, at a CAGR of 1.5% during the forecast period. The demand for automotive engine management system is driven by the implementation of stringent emission norms, fuel efficiency regulations, growing vehicle production around the globe. The rising demand for improved engine performance across all vehicle segments and developments in ECU, sensor, and lightweight components are expected to further boost the market. Asia-Pacific remains the key market for automotive engine management system, though the demand is also increasing in Europe, and North America.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Driver: Stringent emission and fuel economy standards

Increasing levels of greenhouse gases and decreasing deposits of conventional fuel globally have forced legislative bodies of different countries to implement emission and fuel economy standards. Vehicle emissions contribute to the air pollution in the environment. According to a study carried out at the Massachusetts Institute of Technology, approximately 53,000 early deaths occur every year in the US due to harmful vehicle emissions. According to the US EPA, vehicles account for 56% (up to 95% in cities) of carbon monoxide emissions in the country. Governments across the world have implemented stringent fuel emission and fuel economy norms and duty-bound OEMs are mandated to meet these standards. In April 2020, US National Highway Traffic Safety Administration and Environmental Protection agency mandated the greenhouse gas emission and Corporate Average Fuel Economy (CAFE) standards for passenger cars & light trucks and established new less stringent standards, model years 2017 to 2025 in phase 2. The launching of this mandate will further act as a major driver for the adoption of engine control systems technology.

To meet these norms, OEMs have been working at developing improved and efficient automotive engine management system. The EMS monitors proper functioning of the engine by controlling fuel injection so that proper combustion takes place. This reduces the amount of fuel intake and decreases emissions. Major OEMs are involved in the R&D of advanced automotive engine management systems so that an automobile can run on minimum fuel intake and with minimum exhaust emissions. Consumers are now inclined toward purchase of vehicles that are environment-friendly and consume less fuel, and thus, the demand for automotive engine management systems is increasing globally.

Restraint: Decreasing diesel passenger car sales

The increasing pollution has been a key factor for drop in sales of diesel vehicles across the globe. Air quality concerns and taxation changes have led to a big drop in diesel vehicle sales, contributing to a 7% fall in new car registrations in the UK alone in 2018. Moreover, auto manufacturers will have to pay higher fines in the European region if their fleet violates regulated emission limits that are expected to get tougher. Moreover, OEMs have started discontinuing the diesel versions of their passenger cars. For an instance, considering Bharat VI mandates, OEMs such as Maruti Suzuki, Hyundai, and Nissan have stopped or in plans to stop the production of diesel vehicles in India. To reduce the emissions due to public transport, countries such as China, South Korea, and India, have started mass adoption of electric buses. Also, decrease in diesel vehicle sales have fueled the demand for alternate fuel vehicle. Emission concerns and growing environmental awareness have increased the sales of BEVs and FCEVs. This growth is estimated to increase further in the coming years. Increase in electric vehicle sales will directly impact the EMS market as these vehicles do not require EMS.

Therefore, low preference for diesel engine vehicles and increasing sales of electric vehicles will halt the growth of the market in coming years.

Opportunities: Replacement of ECUs due to increasing average life of vehicles

An automobile is made of complex components, each of which has its own life span and longevity characteristics. Car longevity is an important aspect and depends on several factors such as maximum service life and relationship of components to this lifespan. With the advancements in technology, lifespan of vehicles is increasing. Studies reveal that the average life of light vehicles on the road stood at a record high of 12 years in 2018. It is up from 11.2 years in 2012, and 10.9 years in 2010. With this, the replacement cycle of an engine management ECU repeats itself and it becomes necessary for the consumer to make this replacement.

The price of the engine control module in the replacement market or aftermarket proves to be a strong revenue pocket globally. Therefore, the aftermarket has many players expanding their businesses and leveraging opportunities.

Challenges: Design and development of a system that complies with increasingly tougher emission standards.

Automotive manufacturers are continuously involved in the R&D of EMS to improve engine performance measures such as power output, fuel consumption, and emissions. The main challenge for OEMs today is design and development of a system that complies with increasingly tougher emission standards. However, developing such a system that can provide high output, keeping fuel consumption and emissions to minimum is challenging, since when one parameter is controlled the other one tends to deviate. For instance, if the fuel intake is limited to reduce fuel consumption, it reduces power output. Thus, to develop an optimized EMS, OEMs are rigorously involved in R&D of such systems. New technologies are being introduced for engineers to tailor-make designs and developments of EMS. These OEMs require control units that are flexible and enable ease of implementation of control system functions.

Owing to the rising emissions levels from vehicles, regulatory authorities in many regions have implemented stringent emission standards. The Corporate Average Fuel Economy (CAFE) law in the US has set certain standards for automakers. Stringent emission norms across the globe have compelled OEMs to reduce the overall weight and increase fuel economy, resulting in lower operating costs of transportation. This also provides advantages such as improved mobility, speed and acceleration, and higher payload capacity. Carbon emissions are lowered because of improved fuel efficiency, thereby reducing the environmental impacts caused by emissions. An increase in demand for reduction in CO2 emissions, government mandates for the emission regulations, and the rising trend of weight reduction further challenges the design and development of the system.

For instance, Hyundai engineers first use SimuQuest Enginuity to develop an accurate dynamic model of a four-cylinder engine. Control engineers then, using SimuQuest UniPhi with Simulink and State flow, model the control strategy for the ECU. Using this system model, they conduct simulations in Simulink to debug and calibrate strategy. After developing and tuning the control system through simulations, Hyundai engineers use Embedded Coder and SimuQuest QuantiPhi to generate the code automatically for the production-level target hardware from their Simulink model.

To know about the assumptions considered for the study, download the pdf brochure

LCV is expected to be the fastest-growing segment of the automotive engine management system market, by vehicle type, during the forecast period

Rapid urbanization has provided opportunities for new retail and ecommerce platforms that require efficient logistics, which has resulted in growth of the LCV segment. LCVs are used in a wide range of applications such as parcel and courier, ecommerce, white goods, fruits & vegetables, market loads, and FMCG.

Increasing demand for fuel efficiency has triggered the need for automotive engine management systems in LCVs. These factors are excepted to drive the LCV automotiveengine management system market. demand from India, China and Japan for LCVs is estimated to drive the market at the fastest CAGR for automotive engine management system market.

Gasoline is the fastest-growing segment for automotive engine management system as it is witnessing increasing demand in passenger car segment

The Gasoline engine management system market segment is estimated to grow at the fastest CAGR during the forecast period. In addition, the implementation of Euro 6 and EPA Tier 3 norms, have forced OEMs to decrease the production of diesel powered passenger cars. Alternatively, the adoption of EV is facing challenges such as limited battery range and higher charging time. Owing to which, the gasoline passenger cars is witnessing growth mainly North America and Europe region.

Moreover, similar trend can be seen in Asia Pacific region owing to upcoming regulations like China 6 a and 6b and India’s BS-VI, the markets for gasoline vehicle are expected grow at a prominent rate in the coming years and boost the market for automotive engine management system for gasoline vehicles.

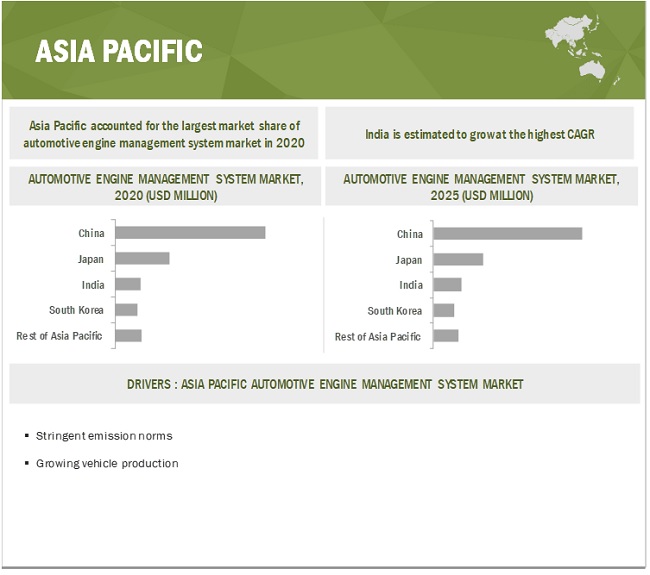

Asia Pacific is estimated to be the largest geographical segment of the automotive engine management system market

The upcoming emission norms in Asia Pacific are the most prominent driving forces for the engine management system market for automotive. For instance, China implemented China 6a & 6b, India implemented BS VI norms in 2020. Also, At the same time, the demand for luxury cars has increased considerably. The increase in demand for vehicles, especially premium passenger cars, has accentuated the need for better emission technologies and better engine performance. Thus, the market for automotive engine management systems in the region is expected to grow significantly in the coming years.

China is estimated to dominate the Asia-Pacific automotive engine management system market during the forecast period. China is the world’s largest vehicle manufacturer and has presence of key OEMs and engine suppliers. For instance, Chery’s ACTECO 1.6TGDI engine is the first engine model that uses Chery's five core technologies i.e iHEC combustion system, thermal management system, fast-responding supercharging technology, friction-reducing technology, and lightweight technology, to avoid the engine oil problem. Such developments by the key OEMs of China helps the EMS market to grow in the Asia Pacific region.

Key Market Players

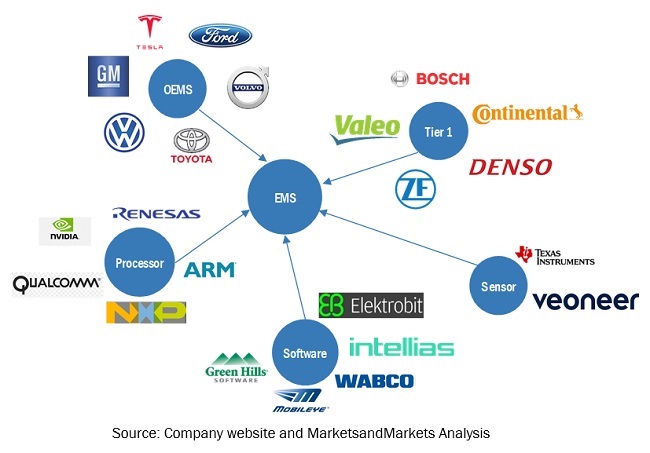

The automotive engine management system market is dominated by global players and comprises several regional players as well. The key players in the market are Robert Bosch (Germany), Continental AG (Germany), Denso (Japan), BorgWarner (US), and Hitachi Automotive (Japan).

These companies adopted new product launches, partnership, and joint venture to gain traction in the global market.

Scope of the Report

|

Report Metric |

Details |

|

Market Size Available for Years |

2018–2025 |

|

Base Year Considered |

2019 |

|

Forecast Period |

2020–2025 |

|

Forecast Units |

Value (USD million) and Volume (000’ units) |

|

Segments Covered |

Automotive engine management system by Component, Sensor Type, Fuel Type, Communication Technology, Vehicle, and Region |

|

Geographies Covered |

Asia Pacific, Europe, North America, and RoW |

|

Companies Covered |

The automotive engine management system market is led by globally established players such as Robert Bosch (Germany), Continental AG (Germany), Denso (Japan), and BorgWarner (US), Hitachi Automotive (Japan), Infineon technologies (Germany), Hella (Germany), Sanken (Japan), NGK spark plug (Japan). |

This research report categorizes the automotive engine management system market based on Component, Sensor Type, Fuel Type, Communication Technology, Vehicle, and Region.

By Component

- ECU

- Sensors

By Sensor Type

- Oxygen Sensor

- Temperature Sensor

- Position Sensor

- Knock Sensor

- Others

By Fuel Type

- Gasoline

- Diesel

By Communication Technology

- CAN (Local Interconnect Network)

- LIN (Local Interconnect Network)

- Flexray

By Vehicle Type

- Passenger Car

- Light Commercial Vehicle (LCV)

- Heavy Commercial Vehicle (HCV)

By Region

-

Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of Asia Pacific

-

Europe

- France

- Germany

- Spain

- UK

- Russia

- Italy

- Rest of Europe

-

North America

- US

- Canada

- Mexico

-

Rest of the World

- Brazil

- Argentina

Recent Developments

- In December 2021, Dover Corp. launched new DMP Magnetostrictive Flex Probe, a fuel management system which offers the precise readings of fuel and other tank liquids. The new product is compatible with all other probes and consoles in the DFS product portfolio, making it simple to integrate with existing fuel management solutions.

- In April 2021, Dover Corp. launched the DX Wetstock, a fuel management system which helps the owners and fleet operators delivering real-time fuel loss identification and notification, including leaks, fraud, theft, evaporation, meter drift and initial fuel delivery errors. The system also helps to enhance the profit margins and save money over the early detection, reconciliation and alerting of fuel loss.

- In February 2021, Denso Corporation subsidiary DENSO MALAYSIA expanding its production capacity in Selangor, Malaysia. The production facility producing the air conditioning systems, airbag electronic control units, electric power steering, and engine control units.

- In December 2020, Bosch announced that its subsidiary Bosch Rexroth (Xi'an) Electric Drives and Controls Co., Ltd. completed the second-phase construction of the Xi’an plant. The second-phase project covers an area of 74,000 square m2 and received a total investment of nearly CNY 500 million. After completion of the second-phase project, the Xi’an plant will become an integrated intelligent manufacturing and industrial automation solution provider of Bosch Rexroth Group across the world.

- In April 2020, Hitachi Automotive Systems, Ltd., completed the acquisition of all shares of seneos GmbH ("seneos") on April 15, 2020. Through this transaction, seneos, a German automotive device software developer, became a wholly owned subsidiary of Hitachi Automotive Systems.

- In February 2020, Bosch launched its new range of automotive engine management systems with the components for ignition and exhaust-gas treatment, fuel injection and supply, air management, and engine control units.

- In July 2019, HELLA opened a second electronics plant in India. The new production facility in Mehsana, India, north of the city of Ahmedabad in the state of Gujarat, will meet the growing demand for electronic components and strengthen proximity to local customers. Production at the new location will initially focus on sensor solutions for accelerator pedal sensors and will gradually be expanded to further electronic products.

- In 2018, Continental announced the groundbreaking of its greenfield plant in Talegaon, Pune, dedicated to its powertrain business. It plans to invest USD 36.3 million in infrastructure and buildings through 2020. The start of production is scheduled to occur in early 2020 for various drivetrain products, including automotive engine management systems, sensors, actuators, and fuel and exhaust management components for passenger cars, 2-wheelers, and commercial vehicles.

Frequently Asked Questions (FAQ):

What is the current size of the automotive engine management system market?

The automotive engine management system market is estimated to be USD 58.8 billion in 2020 and is projected to reach USD 63.2 billion by 2025 at a CAGR of 1.5%.

Who are the top key players in the automotive engine management system market?

Robert Bosch (Germany), Continental AG (Germany), Denso (Japan), BorgWarner (US), and Hitachi Automotive (Japan) are top key players in the automotive engine management system market. Moreover, these companies develop new products as per market demands and have effective supply chain strategies. Such advantages give these companies an edge over other companies that are component providers.

What is the COVID-19 impact on the automotive engine management system market?

The lockdowns, shutdown of manufacturing facilities, and closing of international borders for exports of automotive components have impacted the automotive engine management system market significantly in the first half of 2020. However, normalcy returning globally in the automotive supply chain due to lockdown relaxations has resulted in recovering automotive production and sales (but not with the same growth as pre-COVID). Also, recent safety-related developments such as the N95-certified Intelligent Air Purification System could prove to be a key consideration for buying vehicles. Taking all these factors into consideration, 2020 is expected to witness a decline in the market growth and will rebound by early 2021.

What are the trends in the automotive engine management system market?

Increasing stringency in vehicle emission are anticipated to create new revenue pockets for the automotive engine management system market.

Increasing vehicle production is projected to drive the demand for ECUs and Sensors for engine management systems.

What is the future of the automotive engine management system market?

Implementation of stringent emission standards, demand for enhanced fuel economy and growing demand of premium vehicles is expected to drive automotive engine management system market. Additionally, growth of BEV and FCEV sales is expected to impact the market for market as it doesn not require engine management system .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 20)

1.1 OBJECTIVES OF THE STUDY

1.2 PRODUCT DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

TABLE 1 INCLUSIONS & EXCLUSIONS FOR AUTOMOTIVE ENGINE MANAGEMENT SYSTEM MARKET

1.3 MARKET SCOPE

FIGURE 1 AUTOMOTIVE ENGINE MANAGEMENT SYSTEM: MARKET SEGMENTATION

1.3.1 YEARS CONSIDERED FOR THE STUDY

1.4 PACKAGE SIZE

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 26)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

FIGURE 3 RESEARCH METHODOLOGY MODEL

2.1.1 SECONDARY DATA

2.1.1.1 List of key secondary sources

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

2.1.2.1 List of primary participants

2.2 MARKET ESTIMATION METHODOLOGY

FIGURE 5 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

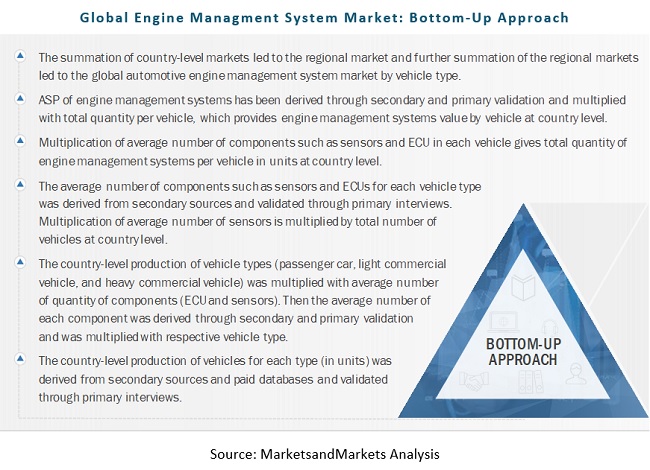

2.2.1 BOTTOM-UP APPROACH

FIGURE 6 AUTOMOTIVE ENGINE MANAGEMENT SYSTEM MARKET SIZE: BOTTOM-UP APPROACH

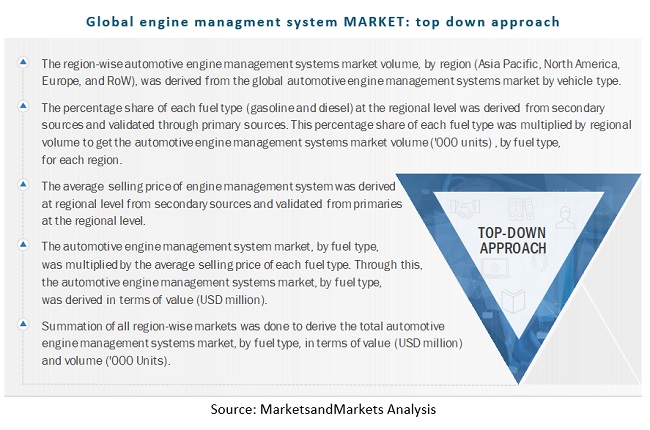

2.2.2 TOP-DOWN APPROACH

FIGURE 7 MARKET: RESEARCH DESIGN & METHODOLOGY

2.2.3 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY SIDE

2.3 DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION METHODOLOGY

2.4 FACTOR ANALYSIS

2.5 RESEARCH ASSUMPTIONS

2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 38)

3.1 PRE- & POST-COVID-19 SCENARIO

FIGURE 9 PRE- & POST-COVID-19 SCENARIO: AUTOMOTIVE ENGINE MANAGEMENT SYSTEM MARKET, 2018–2025 (USD MILLION)

TABLE 2 MARKET: PRE- VS. POST-COVID-19 SCENARIO, 2018–2025 (USD MILLION)

3.2 REPORT SUMMARY

FIGURE 10 MARKET, BY REGION, 2020 VS. 2025 (USD MILLION)

4 PREMIUM INSIGHTS (Page No. - 41)

4.1 ATTRACTIVE OPPORTUNITIES IN MARKET

FIGURE 11 STRINGENT EMISSION NORMS TO DRIVE THE MARKET

4.2 AUTOMOTIVE ENGINE MANAGEMENT SYSTEM MARKET, BY SENSOR TYPE

FIGURE 12 POSITION SENSORS TO HOLD SECOND LARGEST SHARE IN 2020 (USD MILLION)

4.3 MARKET, BY FUEL TYPE

FIGURE 13 GASOLINE EXPECTED TO DOMINATE THE MARKET (USD MILLION)

4.4 MARKET, BY VEHICLE TYPE

FIGURE 14 PASSENGER CAR TO HOLD LARGEST SHARE IN 2020 (USD MILLION)

4.5 MARKET, BY COMPONENT

FIGURE 15 SENSORS TO DOMINATE THE MARKET (USD MILLION)

4.6 MARKET, BY REGION

FIGURE 16 ASIA PACIFIC ESTIMATED TO HAVE LARGEST SHARE IN 2020

5 MARKET OVERVIEW (Page No. - 44)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 STRINGENT FUEL EMISSIONS & ECONOMY STANDARDS TO DRIVE THE GLOBAL ENGINE MANAGEMENT SYSTEM MARKET

5.2.1 DRIVERS

5.2.1.1 Improved vehicle performance

5.2.1.2 Stringent emission and fuel economy standards

FIGURE 18 OVERVIEW OF EMISSION & FUEL ECONOMY REGULATION SPECIFICATIONS FOR PASSENGER CARS

5.2.2 RESTRAINTS

5.2.2.1 Decreasing diesel passenger car sales

5.2.2.2 High cost

5.2.3 OPPORTUNITIES

5.2.3.1 Benefits to related markets

5.2.3.2 Replacement of ECUs due to increasing average life of vehicles

5.2.4 CHALLENGES

5.2.4.1 Design and development of a system that complies with increasingly tougher emission standards

FIGURE 19 DIFFERENT PHASES OF OPTIMIZATION OF ENGINE CONTROL UNIT

5.2.5 BURNING ISSUE

5.2.5.1 Fault in components

5.3 AUTOMOTIVE ENGINE MANAGEMENT SYSTEM MARKET SCENARIO

FIGURE 20 MARKET SCENARIO, 2018–2025 (USD MILLION)

5.3.1 MOST LIKELY SCENARIO

TABLE 3 MARKET (MOST LIKELY SCENARIO), BY REGION, 2018–2025 (USD MILLION)

5.3.2 LOW IMPACT SCENARIO

TABLE 4 MARKET (LOW IMPACT SCENARIO), BY REGION, 2018–2025 (USD MILLION)

5.3.3 HIGH IMPACT SCENARIO

TABLE 5 MARKET (HIGH IMPACT SCENARIO), BY REGION, 2018–2025 (USD MILLION)

5.4 SUPPLY CHAIN ANALYSIS

5.5 AUTOMOTIVE ENGINE MANAGEMENT SYSTEMS MARKET ECOSYSTEM

5.6 AVERAGE SELLING PRICE TREND

FIGURE 21 AVERAGE SELLING PRICE TREND: MARKET

6 INDUSTRY TRENDS (Page No. - 54)

6.1 INTRODUCTION

6.2 VALUE CHAIN ANALYSIS

FIGURE 22 AUTOMOTIVE EMS: VALUE CHAIN

6.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 23 PORTER’S FIVE FORCES ANALYSIS

6.3.1 THREAT OF NEW ENTRANTS

6.3.1.1 Forward/backward integration by Tier-I suppliers and OEMs

6.3.1.2 High capital investments

6.3.2 THREAT OF SUBSTITUTES

6.3.2.1 Only technologically advanced components can replace older versions

6.3.3 BARGAINING POWER OF BUYERS

6.3.3.1 Long-term supply contracts

6.3.3.2 Customized products

6.3.4 BARGAINING POWER OF SUPPLIERS

6.3.4.1 Well-established players with excellent supply and distribution network

6.3.4.2 Technological expertise

6.3.5 INTENSITY OF COMPETITIVE RIVALRY

6.4 REGULATORY LANDSCAPE

6.4.1 PEST ANALYSIS

6.4.1.1 Political factors

FIGURE 24 PEST ANALYSIS RATINGS

6.4.1.2 Economic factors

6.4.1.3 Social factors

6.4.1.4 Technological factors

6.4.2 KEY POINTERS WHILE ENTERING MARKET

6.4.3 REGULATORY IMPACT ON THE MARKET

6.4.3.1 Decreased tail-pipe emission limits leading to vehicle light-weighting trend

TABLE 6 ON-ROAD VEHICLE EMISSION REGULATION OUTLOOK FOR PASSENGER CARS, 2016–2021

FIGURE 25 ON-ROAD VEHICLE EMISSION REGULATION OUTLOOK FOR HEAVY-DUTY VEHICLES, 2014–2025

6.5 ENGINE MANAGEMENT SYSTEM

FIGURE 26 ENGINE MANAGEMENT SYSTEM ARCHITECTURE

FIGURE 27 ADVANCEMENT OF THE ENGINE CONTROL MICROCOMPUTER

6.6 TECHNOLOGY ANALYSIS

6.6.1 COMPLEMENTARY TECHNOLOGY

6.6.1.1 Powertrain control module

6.6.2 KEY TECHNOLOGY

6.6.2.1 Role of OBD in engine management system

FIGURE 28 OBD SYSTEM LAYOUT

6.6.2.2 OBD-I link

6.6.2.2.1 OBD-II

FIGURE 29 OBD-I VS OBD-II

6.6.3 ADJACENT TECHNOLOGY

6.6.3.1 Programmable & non-programmable engine control unit

6.7 PATENT ANALYSIS

TABLE 7 APPLICATIONS AND PATENTS GRANTED, 2013-2020

6.8 CASE STUDY ANALYSIS

6.8.1 ARTIFICIAL INTELLIGENCE ENTERS AUTOMOTIVE COMPONENT DEVELOPMENT

6.8.2 FORD MOTORS WORKING ON MACHINE LEARNING FOR ENGINE COMPONENTS

7 ENGINE MANAGEMENT SYSTEM MARKET, BY COMMUNICATION TECHNOLOGY (Page No. - 68)

7.1 INTRODUCTION

7.2 CAN (CONTROLLER AREA NETWORK)

7.2.1 CAN PHYSICAL LAYERS

7.2.1.1 High-speed/FD

7.2.1.2 Low-speed/fault-tolerant CAN hardware:

7.2.1.3 Single-wire CAN hardware:

7.2.1.4 Software-selectable CAN hardware:

7.2.2 CAN TERMINOLOGY

FIGURE 30 THE STANDARD CAN FRAME FORMAT

FIGURE 31 THE STANDARD CAN 6 BYTE FRAME FORMAT

7.2.3 CAN DATABASE FILES:

7.3 LIN (LOCAL INTERCONNECT NETWORK)

TABLE 8 COMPARISON OF GENERAL FEATURES OF LIN AND CAN [2]

7.4 FLEXRAY

8 AUTOMOTIVE ENGINE MANAGEMENT SYSTEM MARKET, BY FUEL TYPE (Page No. - 72)

8.1 INTRODUCTION

8.1.1 RESEARCH METHODOLOGY

8.1.2 ASSUMPTIONS

8.1.3 INDUSTRY INSIGHTS

FIGURE 32 MARKET, BY FUEL TYPE, 2020 VS. 2025 (USD MILLION)

TABLE 9 MARKET, BY FUEL TYPE, 2018–2025 (THOUSAND UNITS)

TABLE 10 MARKET, BY FUEL TYPE, 2018–2025 (USD MILLION)

8.2 GASOLINE ENGINE MANAGEMENT SYSTEM

TABLE 11 GASOLINE: GASOLINE ENGINE MANAGEMENT SYSTEM MARKET, BY REGION, 2018–2025 (THOUSAND UNITS)

TABLE 12 GASOLINE: GASOLINE ENGINE MANAGEMENT SYSTEM MARKET, BY REGION, 2018–2025 (USD MILLION)

8.3 DIESEL ENGINE MANAGEMENT SYSTEM

TABLE 13 DIESEL: DIESEL ENGINE MANAGEMENT SYSTEM MARKET, BY REGION, 2018–2025 (THOUSAND UNITS)

TABLE 14 DIESEL: DIESEL ENGINE MANAGEMENT SYSTEM MARKET, BY REGION, 2018–2025 (USD MILLION)

9 AUTOMOTIVE ENGINE MANAGEMENT SYSTEM MARKET, BY COMPONENT (Page No. - 78)

9.1 INTRODUCTION

9.1.1 RESEARCH METHODOLOGY

9.1.2 ASSUMPTIONS

9.1.3 INDUSTRY INSIGHTS

FIGURE 33 MARKET, BY COMPONENT, 2020 VS. 2025 (USD MILLION)

TABLE 15 MARKET, BY COMPONENT, 2018–2025 (‘000 UNITS)

TABLE 16 MARKET, BY COMPONENT, 2018–2025 (USD MILLION)

9.2 AUTOMOTIVE ECU

TABLE 17AUTOMOTIVE ECU: MARKET, BY REGION, 2018–2025 (‘000 UNITS)

TABLE 18 AUTOMOTIVE ECU: MARKET, BY REGION, 2018–2025 (USD MILLION)

9.3 SENSORS

TABLE 19 SENSORS: AUTOMOTIVE ENGINE MANAGEMENT SYSTEM MARKET, BY REGION, 2018–2025 (‘000 UNITS)

TABLE 20 SENSORS: MARKET, BY REGION, 2018–2025 (USD MILLION)

10 ENGINE MANAGEMENT SYSTEM MARKET, BY SENSOR TYPE (Page No. - 84)

10.1 INTRODUCTION

FIGURE 34 ENGINE MANAGEMENT SYSTEM MARKET, BY SENSOR TYPE, 2020 VS. 2025

TABLE 21 ENGINE MANAGEMENT SYSTEM MARKET, BY SENSOR TYPE, 2018–2025 (THOUSAND UNITS)

TABLE 22 ENGINE MANAGEMENT SYSTEM MARKET, BY SENSOR TYPE, 2018–2025 (USD MILLION)

10.1.1 RESEARCH METHODOLOGY FOR SENSOR TYPE SEGMENT

10.1.2 ASSUMPTIONS

10.1.3 KEY INDUSTRY INSIGHT

10.2 OXYGEN SENSOR

TABLE 23 COMPANIES OFFERING OXYGEN SENSOR

TABLE 24 CAR OXYGEN SENSOR: ENGINE MANAGEMENT SYSTEM MARKET, BY REGION, 2018–2025 (THOUSAND UNITS)

TABLE 25 CAR OXYGEN SENSOR: ENGINE MANAGEMENT SYSTEM MARKET, BY REGION, 2018–2025 (USD MILLION)

10.3 TEMPERATURE SENSOR

TABLE 26 COMPANIES OFFERING TEMPERATURE SENSOR

TABLE 27 TEMPERATURE SENSOR: ENGINE MANAGEMENT SYSTEM MARKET, BY REGION, 2018–2025 (THOUSAND UNITS)

TABLE 28 TEMPERATURE SENSOR: ENGINE MANAGEMENT SYSTEM MARKET, BY REGION, 2018–2025 (USD MILLION)

10.4 POSITION SENSOR

TABLE 29 COMPANIES OFFERING POSITION SENSOR

TABLE 30 POSITION SENSOR: ENGINE MANAGEMENT SYSTEM MARKET, BY REGION, 2018–2025 (THOUSAND UNITS)

TABLE 31 POSITION SENSOR: ENGINE MANAGEMENT SYSTEM MARKET, BY REGION, 2018–2025 (USD MILLION)

10.5 KNOCK SENSOR

TABLE 32 COMPANIES OFFERING KNOCK SENSOR

TABLE 33 KNOCK SENSOR: KNOCK SENSORMARKET, BY REGION, 2018–2025 (THOUSAND UNITS)

TABLE 34 KNOCK SENSOR: KNOCK SENSOR MARKET, BY REGION, 2018–2025 (USD MILLION)

10.6 OTHER SENSORS

TABLE 35 OTHER SENSORS: ENGINE MANAGEMENT SYSTEM MARKET, BY REGION, 2018–2025 (THOUSAND UNITS)

TABLE 36 OTHER SENSORS: ENGINE MANAGEMENT SYSTEM MARKET, BY REGION, 2018–2025 (USD MILLION)

11 AUTOMOTIVE ENGINE MANAGEMENT SYSTEM MARKET, BY VEHICLE TYPE (Page No. - 94)

11.1 INTRODUCTION

11.1.1 RESEARCH METHODOLOGY

11.1.2 ASSUMPTIONS

11.1.3 INDUSTRY INSIGHTS

FIGURE 35 MARKET, BY VEHICLE TYPE, 2020 VS. 2025 (USD MILLION)

TABLE 37 MARKET, BY VEHICLE TYPE, 2018–2025 (‘000 UNITS)

TABLE 38 MARKET, BY VEHICLE TYPE, 2018–2025 (USD MILLION)

11.2 PASSENGER CAR

TABLE 39 PASSENGER CAR: MARKET, BY REGION, 2018–2025 (‘000 UNITS)

TABLE 40 PASSENGER CAR: MARKET, BY REGION, 2018–2025 (USD MILLION)

11.3 LIGHT COMMERCIAL VEHICLE (LCV)

TABLE 41 LIGHT COMMERCIAL VEHICLE: MARKET, BY REGION, 2018–2025 (‘000 UNITS)

TABLE 42 LIGHT COMMERCIAL VEHICLE: MARKET, BY REGION, 2018–2025 (USD MILLION)

11.4 HEAVY COMMERCIAL VEHICLE (HCV)

TABLE 43 HEAVY COMMERCIAL VEHICLE: MARKET, BY REGION, 2018–2025 (‘000 UNITS)

TABLE 44 HEAVY COMMERCIAL VEHICLE: MARKET, BY REGION, 2018–2025 (USD MILLION)

12 AUTOMOTIVE ENGINE MANAGEMENT SYSTEM MARKET, BY REGION (Page No. - 101)

12.1 INTRODUCTION

12.1.1 RESEARCH METHODOLOGY

12.1.2 ASSUMPTIONS

FIGURE 36 MARKET, BY REGION, 2020 VS. 2025 (USD MILLION)

TABLE 45 MARKET, BY REGION, 2018–2025 (THOUSAND UNITS)

TABLE 46 MARKET, BY REGION, 2018–2025 (USD MILLION)

12.2 ASIA PACIFIC

FIGURE 37 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 47 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2025 (THOUSAND UNITS)

TABLE 48 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

12.2.1 CHINA

12.2.1.1 Largest vehicle production to drive the market

12.2.1.2 China vehicle production

TABLE 49 CHINA: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2016–2019 (‘000 UNIT)

TABLE 50 CHINA: MARKET, BY VEHICLE TYPE, 2018–2025 (THOUSAND UNITS)

TABLE 51 CHINA: MARKET, BY VEHICLE TYPE, 2018–2025 (USD MILLION)

12.2.2 INDIA

12.2.2.1 Post pandemic recovery in vehicle production to drive the market

12.2.2.2 India vehicle production

TABLE 52 INDIA: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2016–2019 (‘000 UNIT)

TABLE 53 INDIA: MARKET, BY VEHICLE TYPE, 2018–2025 (THOUSAND UNITS)

TABLE 54 INDIA: MARKET, BY VEHICLE TYPE, 2018–2025 (USD MILLION)

12.2.3 JAPAN

12.2.3.1 Passenger car to account for the largest market share

12.2.3.2 Japan vehicle production

TABLE 55 JAPAN: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2016–2019 (‘000 UNIT)

TABLE 56 JAPAN: MARKET, BY VEHICLE TYPE, 2018–2025 (THOUSAND UNITS)

TABLE 57 JAPAN: MARKET, BY VEHICLE TYPE, 2018–2025 (USD MILLION)

12.2.4 SOUTH KOREA

12.2.4.1 Growing ecommerce industry to drive the HCV segment

12.2.4.2 South Korea vehicle production

TABLE 58 SOUTH KOREA: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2016–2019 (‘000 UNIT)

TABLE 59 SOUTH KOREA: MARKET, BY VEHICLE TYPE, 2018–2025 (THOUSAND UNITS)

TABLE 60 SOUTH KOREA: MARKET, BY VEHICLE TYPE, 2018–2025 (USD MILLION)

12.2.5 REST OF ASIA PACIFIC

12.2.5.1 Rest of Asia Pacific vehicle production

TABLE 61 REST OF ASIA PACIFIC: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2016–2019 (‘000 UNIT)

TABLE 62 REST OF ASIA PACIFIC: MARKET, BY VEHICLE TYPE, 2018–2025 (THOUSAND UNITS)

TABLE 63 REST OF ASIA PACIFIC: MARKET, BY VEHICLE TYPE, 2018–2025 (USD MILLION)

12.3 EUROPE

FIGURE 38 EUROPE: MARKET SNAPSHOT

TABLE 64 EUROPE: MARKET, BY COUNTRY, 2018–2025 (THOUSAND UNITS)

TABLE 65 EUROPE: MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

12.3.1 GERMANY

12.3.1.1 Largest premium car production to drive the market

12.3.1.2 Germany vehicle production

TABLE 66 GERMANY: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2016–2019 (‘000 UNIT)

TABLE 67 GERMANY: MARKET, BY VEHICLE TYPE, 2018–2025 (THOUSAND UNITS)

TABLE 68 GERMANY: MARKET, BY VEHICLE TYPE, 2018–2025 (USD MILLION)

12.3.2 FRANCE

12.3.2.1 Growing demand for LCVs to drive the market

12.3.2.2 France vehicle production

TABLE 69 FRANCE: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2016–2019 (‘000 UNIT)

TABLE 70 FRANCE: MARKET, BY VEHICLE TYPE, 2018–2025 (THOUSAND UNITS)

TABLE 71 FRANCE: MARKET, BY VEHICLE TYPE, 2018–2025 (USD MILLION)

12.3.3 UK

12.3.3.1 Stringent emission norms to drive the market

12.3.3.2 UK vehicle production

TABLE 72 UK: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2016–2019 (‘000 UNIT)

TABLE 73 UK: MARKET, BY VEHICLE TYPE, 2018–2025 (THOUSAND UNITS)

TABLE 74 UK: MARKET, BY VEHICLE TYPE, 2018–2025 (USD MILLION)

12.3.4 ITALY

12.3.4.1 Increasing share of gasoline passenger cars to drive the market

12.3.4.2 Italy vehicle production

TABLE 75 ITALY: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2016–2019 (‘000 UNIT)

TABLE 76 ITALY: MARKET, BY VEHICLE TYPE, 2018–2025 (THOUSAND UNITS)

TABLE 77 ITALY: MARKET, BY VEHICLE TYPE, 2018–2025 (USD MILLION)

12.3.5 SPAIN

12.3.5.1 Passenger car sales to drive the market

12.3.5.2 Spain vehicle production

TABLE 78 SPAIN: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2016–2019 (‘000 UNIT)

TABLE 79 SPAIN: MARKET, BY VEHICLE TYPE, 2018–2025 (THOUSAND UNITS)

TABLE 80 SPAIN: MARKET, BY VEHICLE TYPE, 2018–2025 (USD MILLION)

12.3.6 RUSSIA

12.3.6.1 Decline in diesel vehicles to impact the market

12.3.6.2 Russia vehicle production

TABLE 81 RUSSIA: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2016–2019 (‘000 UNIT)

TABLE 82 RUSSIA: MARKET, BY VEHICLE TYPE, 2018–2025 (THOUSAND UNITS)

TABLE 83 RUSSIA: MARKET, BY VEHICLE TYPE, 2018–2025 (USD MILLION)

12.3.7 REST OF EUROPE

12.3.7.1 Rest of Europe vehicle production

TABLE 84 REST OF EUROPE: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2016–2019 (‘000 UNIT)

TABLE 85 REST OF EUROPE: MARKET, BY VEHICLE TYPE, 2018–2025 (THOUSAND UNITS)

TABLE 86 REST OF EUROPE: MARKET, BY VEHICLE TYPE, 2018–2025 (USD MILLION)

12.4 NORTH AMERICA

FIGURE 39 NORTH AMERICA: MARKET

TABLE 87 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2025 (THOUSAND UNITS)

TABLE 88 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

12.4.1 US

12.4.1.1 Growing popularity of premium LCVs to drive the market

12.4.1.2 US vehicle production

TABLE 89 US: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2016–2019 (‘000 UNIT)

TABLE 90 US: MARKET, BY VEHICLE TYPE, 2018–2025 (THOUSAND UNITS)

TABLE 91 US: MARKET, BY VEHICLE TYPE, 2018–2025 (USD MILLION)

12.4.2 MEXICO

12.4.2.1 Free trade agreements with US to drive the market

12.4.2.2 Mexico vehicle production

TABLE 92 MEXICO: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2016–2019 (‘000 UNIT)

TABLE 93 MEXICO: MARKET, BY VEHICLE TYPE, 2018–2025 (THOUSAND UNITS)

TABLE 94 MEXICO: MARKET, BY VEHICLE TYPE, 2018–2025 (USD MILLION)

12.4.3 CANADA

12.4.3.1 Declining diesel vehicle production to impact the market

12.4.3.2 Canada vehicle production

TABLE 95 CANADA: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2016–2019 (‘000 UNIT)

TABLE 96 CANADA: MARKET, BY VEHICLE TYPE, 2018–2025 (THOUSAND UNITS)

TABLE 97 CANADA: MARKET, BY VEHICLE TYPE, 2018–2025 (USD MILLION)

12.5 REST OF THE WORLD

TABLE 98 REST OF THE WORLD: MARKET, BY COUNTRY, 2018–2025 (THOUSAND UNITS)

TABLE 99 REST OF THE WORLD: MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

12.5.1 BRAZIL

12.5.1.1 Trade agreements with US and Canada to drive the market

12.5.1.2 Brazil vehicle production

TABLE 100 BRAZIL: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2016–2019 (‘000 UNIT)

TABLE 101 BRAZIL: MARKET, BY VEHICLE TYPE, 2018–2025 (THOUSAND UNITS)

TABLE 102 BRAZIL: MARKET, BY VEHICLE TYPE, 2018–2025 (USD MILLION)

12.5.2 ARGENTINA

12.5.2.1 Government plans to strengthen automobile investments to drive the market

12.5.2.2 Argentina vehicle production

TABLE 103 ARGENTINA: VEHICLE PRODUCTION, BY VEHICLE TYPE, 2016–2019 (‘000 UNIT)

TABLE 104 ARGENTINA: MARKET, BY VEHICLE TYPE, 2018–2025 (THOUSAND UNITS)

TABLE 105 ARGENTINA: MARKET, BY VEHICLE TYPE, 2018–2025 (USD MILLION)

13 COMPETITIVE LANDSCAPE (Page No. - 130)

13.1 OVERVIEW

13.2 AUTOMOTIVE ENGINE MANAGEMENT SYSTEM MARKET SHARE ANALYSIS, 2019

FIGURE 40 AUTOMOTIVE ENGINE MANAGEMENT SYSTEMS MARKET SHARE, 2019

13.3 REVENUE ANALYSIS OF TOP 5 PLAYERS

FIGURE 41 ENGINE MANAGEMENT SYSTEM MARKET REVENUE ANALYSIS, 2019

13.4 MARKET EVOLUTION FRAMEWORK

FIGURE 42 MARKET EVALUATION FRAMEWORK

13.5 COMPANY EVALUATION QUADRANT

13.5.1 STAR

13.5.2 EMERGING LEADERS

13.5.3 PERVASIVE

13.5.4 PARTICIPANTS

FIGURE 43 COMPETITIVE EVALUATION MATRIX, 2019

13.6 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 44 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN MARKET

13.7 BUSINESS STRATEGY EXCELLENCE

FIGURE 45 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN MARKET

FIGURE 46 MAJOR DEVELOPMENTS IN MARKET

13.8 COMPETITIVE SCENARIO

13.8.1 EXPANSION

TABLE 106 EXPANSIONS, 2017-2020

13.8.2 ACQUISITIONS

TABLE 107 ACQUISITIONS, 2017-2020

13.8.3 SUPPLY CONTRACT/AGREEMENT/COLLABORATION

TABLE 108 SUPPLY CONTRACT/AGREEMENT/ COLLABORATIONS ACQUISITIONS, 2017-2020

13.8.4 JOINT VENTURE

TABLE 109 JOINT VENTURE, 2017-2020

13.8.5 NEW PRODUCT DEVELOPMENT

TABLE 110 NEW PRODUCT DEVELOPMENT, 2017-2020

13.9 RIGHT TO WIN

TABLE 111 RIGHT TO WIN, 2017-2020

14 COMPANY PROFILES (Page No. - 146)

(Business overview, Products offerings, Supplier contracts, Recent developments & MnM View)*

14.1 ROBERT BOSCH GMBH

FIGURE 47 ROBERT BOSCH GMBH: COMPANY SNAPSHOT

TABLE 112 ROBERT BOSCH: ORGANIC DEVELOPMENTS

TABLE 113 ROBERT BOSCH: INORGANIC DEVELOPMENTS

14.2 CONTINENTAL AG

FIGURE 48 CONTINENTAL AG: COMPANY SNAPSHOT

TABLE 114 CONTINENTAL AG: ORGANIC DEVELOPMENTS

TABLE 115 CONTINENTAL AG: INORGANIC DEVELOPMENTS

14.3 DENSO CORPORATION

FIGURE 49 DENSO CORPORATION: COMPANY SNAPSHOT

TABLE 116 DENSO: ORGANIC DEVELOPMENT

TABLE 117 DENSO: INORGANIC DEVELOPMENT

14.4 BORGWARNER

FIGURE 50 BORGWARNER: COMPANY SNAPSHOT

TABLE 118 BORGWARNER: ORGANIC DEVELOPMENTS

TABLE 119 BORGWARNER: INORGANIC DEVELOPMENTS

14.5 HELLA KGAA HUECK & CO.

FIGURE 51 HELLA KGAA HUECK & CO.: COMPANY SNAPSHOT

TABLE 120 HELLA: ORGANIC DEVELOPMENTS

14.6 HITACHI AUTOMOTIVE SYSTEMS, LTD.

FIGURE 52 HITACHI AUTOMOTIVE SYSTEMS, LTD.: COMPANY SNAPSHOT

TABLE 121 HITACHI AUTOMOTIVE: ORGANIC DEVELOPMENTS

TABLE 122 HITACHI AUTOMOTIVE: INORGANIC DEVELOPMENTS

14.7 VALEO S.A.

FIGURE 53 VALEO S.A.: COMPANY SNAPSHOT

14.8 INFINEON TECHNOLOGIES AG

FIGURE 54 INFINEON TECHNOLOGIES AG: COMPANY SNAPSHOT

TABLE 123 INFINEOEN TECHNOLOGIES: ORGANIC DEVELOPMENTS

TABLE 124 INFINEON TECHNOLOGIES: INORGANIC DEVELOPMENTS

14.9 SENSATA TECHNOLOGIES HOLDING NV

FIGURE 55 SENSATA TECHNOLOGIES HOLDING NV: COMPANY SNAPSHOT

14.10 NGK SPARK PLUG CO., LTD

FIGURE 56 NGK SPARK PLUG CO., LTD.: COMPANY SNAPSHOT

TABLE 125 NGK SPARK PLUG: ORGANIC DEVELOPMENTS

14.11 SANKEN ELECTRIC CO., LTD.

FIGURE 57 SANKEN ELECTRIC CO., LTD.: COMPANY SNAPSHOT

*Details on Business overview, Products offerings, Supplier contracts, Recent developments & MnM View might not be captured in case of unlisted companies.

14.12 ADDITIONAL COMPANY PROFILES

14.12.1 NORTH AMERICA

14.12.1.1 CTS Corporation

14.12.1.2 KSR International

14.12.1.3 Dura Automotive Systems

14.12.2 EUROPE

14.12.2.1 NXP Semiconductor

14.12.2.2 TE Connectivity

14.12.2.3 STMicroelectronics

14.12.2.4 ZF Friedrichshafen

14.12.3 ASIA PACIFIC

14.12.3.1 Nissan Corporation

14.12.3.2 JTEKT Corporation

14.13 ENGINE MANAGEMENT SYSTEMS COMPONENT SUPPLIERS

14.13.1 ALLEGRO MICROSYSTEMS, LLC

14.13.2 ANALOG DEVICES

14.13.3 ON SEMICONDUCTOR

14.13.4 S&T MOTIV CO., LTD.

14.13.5 MELEXIS

14.13.6 ELMOS SEMICONDUCTOR AG

14.13.7 ALLIED MOTION, INC.

14.13.8 SCHAEFFLER TECHNOLOGIES AG & CO. KG

14.13.9 NTN CORPORATION

14.13.10 SORL AUTO PARTS, INC.

15 RECOMMENDATIONS BY MARKETSANDMARKETS (Page No. - 178)

15.1 ASIA PACIFIC WILL BE KEY MARKET FOR AUTOMOTIVE ENGINE MANAGEMENT SYSTEMS

15.2 GROWING GASOLINE MARKET

15.3 CONCLUSION

16 APPENDIX (Page No. - 180)

16.1 DISCUSSION GUIDE

16.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

16.3 AVAILABLE CUSTOMIZATIONS

16.4 RELATED REPORTS

16.5 AUTHOR DETAILS

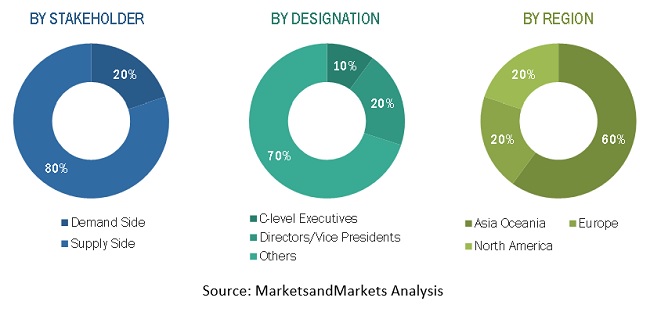

The study involves four main activities to estimate the current size of the automotive engine management system market. Exhaustive secondary research was done to collect information on the market, such as automotive engine management system type and usage of different components in an automotive engine management system. The next step was to validate these findings, assumptions, and market analysis with industry experts across value chains through primary research. Bottom-up approaches were employed to estimate the complete market size for different segments considered under this study. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

The secondary sources referred to for this research study include publications from government sources [such as country level automotive associations and organizations, Organisation for Economic Co-operation and Development (OECD), World Bank, CDC, and Eurostat]; corporate and regulatory filings (such as annual reports, SEC filings, investor presentations, and financial statements); business magazines and research journals; press releases; free and paid automotive databases [Organisation Internationale des Constructeurs d'Automobiles (OICA), MarkLines, etc.] and trade, business, and professional associations; among others. Trade websites, and technical articles have been used to identify and collect information useful for an extensive commercial study of the automotive engine management system market.

Primary Research

In the primary research process, various primary sources from both supply side and demand side and other stakeholders were interviewed to obtain qualitative and quantitative information on the market. Primary interviews have been conducted to gather insights such as automotive engine management system penetration demand by equipment type, fuel type, type, and highest potential region for the automotive engine management system market. The primary sources from the supply side included various industry experts, such as CXOs, vice presidents, directors from business development, marketing, product development/innovation teams, vehicle architecture experts and related key executives from various key companies. Below is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

A detailed market estimation approach was followed to estimate and validate the value of the automotive engine management system market and other dependent submarkets, as mentioned below:

- Key players in the market were identified through secondary research, and their global market shares were determined through primary and secondary research.

- The research methodology included study of annual and quarterly financial reports and regulatory filings of major market players (public) as well as interviews with industry experts for detailed market insights.

- All industry-level penetration rates, percentage shares, splits, and breakdowns for the market were determined using secondary sources and verified through primary sources.

- All key macro indicators affecting the revenue growth of the market segments and subsegments have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the validated and verified quantitative and qualitative data.

- The gathered market data was consolidated and added with detailed inputs, analyzed, and presented in this report.

- Qualitative aspects such as market drivers, restraints, opportunities, and challenges have been taken into consideration while calculating and forecasting the market size.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size of the global market through the above-mentioned methodology, this market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact data for the market by value for the key segments and subsegments. The extrapolated market data was triangulated by studying various macro indicators and regional trends from both the demand- and supply-side participants.

Report Objectives

- To define, describe, and forecast the global market based on type, vehicle type, component, sensor type, fuel type, communication bus, and region

- To analyze the impact of COVID-19 on the market (pre-COVID vs. post-COVID)

- To forecast the market in terms of volume and value, based on:

- Vehicle type (Passenger cars, LCV and HCV)

- Component (ECU and Sensor)

- Fuel Type (Gasoline and Diesel)

- Sensor Type (temperature, oxygen, knock, position and others)

- Key Regions—Asia Pacific (China, India, Japan, South Korea, and Rest of Asia Pacific), Europe (France, Germany, Russia, Spain, Italy, the UK, and Rest of Europe), North America (Canada, Mexico, and the US), and RoW (Brazil and Argentina)

- To provide detailed information about major factors influencing the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the market with respect to individual growth trends and prospects and determine the contribution of each segment to the total market

- To present various parameters such as average selling price analysis, supply chain analysis, ecosystem, technology analysis, case study, market evaluation framework, value chain analysis, market share analysis, revenue analysis of top 5 players, regulatory landscape, and Porter’s five forces.

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments, such as joint ventures, mergers & acquisitions, new product developments, and R&D, in the automotive engine management system market

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance with the company’s specific needs.

Country Information

- Market by components (ECU and Sensors) at country level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Pricing Analysis

- Detailed pricing analysis for each type of sensors in the engine

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Automotive Engine Management System Market

How does the Automotive Engine Management System Market help to enhance the profit margins and save money over the early detection, reconciliation, and alerting of fuel loss?

Which firms in the Automotive Engine Management System Market are the most innovative?

Selection of engine oil depends onafter treatment technologies being used, expected oil life, fuel economy requirements etc and hence I feel that this report would be useful.