Automotive Engine Encapsulation Market by Product Type (Engine Mounted & Body Mounted), Material Type (Carbon Fibre, Glasswool, PA, PP & PU), Vehicle Class (Economic, Mid-Priced & Luxury), Fuel Type (Diesel & Gasoline) and Region - Global Forecast to 2025

[133 Pages Report] The global automotive engine encapsulation market size was valued at USD 3.98 billion in 2017 and is expected to reach USD 6.30 billion by 2025, at a CAGR of 6.13% during the forecast period. The base year for the report is 2017 and the forecast period is 2018 to 2025.

Objectives of the Report

- To define, segment, and forecast the market (2018–2025), in terms of volume (thousand units) and value (USD million)

- To provide a detailed analysis of the various forces impacting the market (drivers, restraints, opportunities, and challenges)

- To segment the market and forecast the market size, by volume and value, based on product type (engine-mounted and body-mounted)

- To segment the market and forecast the market size, by value, based on material type (polypropylene, polyurethane, polyamide, glasswool, and carbon fiber)

- To segment the market and forecast the market size, by volume and value, based on fuel type (gasoline and diesel)

- To segment the market and forecast the market size, by volume and value, based on vehicle class (economic light-duty vehicles, mid-priced light-duty vehicles, and luxury light-duty vehicles)

- To segment the market and forecast the market size in four major regions including the Asia Pacific, Europe, North America, and the Rest of the World (RoW)

- To track and analyze competitive developments such as joint ventures, mergers & acquisitions, new product launches, expansions, and other activities carried out by the key industry participants

The research methodology used in the report involves primary and secondary sources and follows a bottom-up approach for the purpose of data triangulation. The study involves the country-level OEM and model-wise analysis of the market. This analysis involves historical trends as well as existing market penetrations by country as well as vehicle class. The analysis is projected based on various factors such as growth trends in vehicle production and adoption rate by OEMs. The analysis has been discussed and validated by primary respondents, which include experts from the automotive industry, manufacturers, and suppliers. Secondary sources include associations such as China Association of Automobile Manufacturers (CAAM), International Organization of Motor Vehicle Manufacturers (OICA), European Automobile Manufacturers Association (ACEA), Environmental Protection Agency (EPA), Society of Indian Automotive Manufacturers, SAE International, and paid databases and directories such as Factiva.

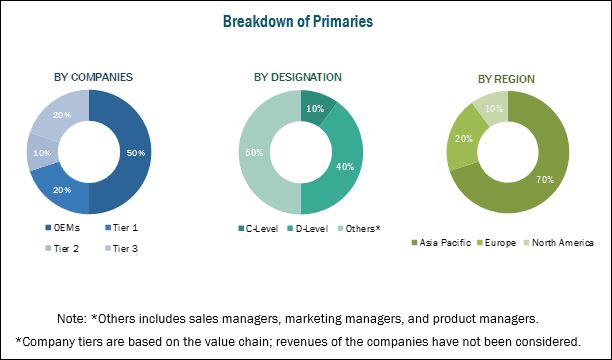

The figure below illustrates the break-up of the profile of industry experts who participated in primary discussions.

To know about the assumptions considered for the study, download the pdf brochure

The ecosystem of the market consists of established engine encapsulation manufacturers such as Autoneum (Switzerland), Continental (Germany), Roechling (Germany), ElringKlinger (Germany), and Greiner (Austria). It also comprises a few other players and suppliers such as Furukawa Electric (Japan), Woco (Germany), Adler Pelzer (Germany), SA Automotive (US), Hennecke (Germany), BASF (Germany), 3M (Germany), Saint-Gobain (France), Polytec (Austria), Evonik (Germany), Carcoustics (Germany), Uniproducts (India), and UGN (US).

Target Audience

- Original Equipment Manufacturers (OEMs) of Automobiles

- Manufacturers of automotive engine encapsulation units

- Material providers for automotive engine encapsulation units

- Automotive Parts Manufacturers’ Association (APMA)

- Chemicals and plastic manufacturers

- Suppliers of automotive acoustics

Scope of the Report

Market, By Material Type

- Polypropylene

- Polyurethane

- Polyamide

- Glasswool

- Carbon fiber

Market, By Product Type

- Engine-mounted

- Body-mounted

Market, By Vehicle class

- Economic light-duty vehicles

- Mid-priced light-duty vehicles

- Luxury light-duty vehicles

Market, By Fuel Type

- Gasoline

- Diesel

Market, By Region

- Asia Pacific (China, India, Japan, South Korea, and Rest of Asia Pacific)

- Europe (Germany, France, Italy, Spain, UK, and Rest of Europe)

- North America (US, Mexico, and Canada)

- Rest of the World (Brazil, Russia, and South Africa)

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance with the company’s specific needs.

- Market, By Fuel Type, By Country

- Market, By Product Type, By Country

Growing demand for vehicles with better acoustics and fuel economy to drive the global market close to USD 6 billion by 2025

Engine encapsulation is a combination of shells and thermoplastics, which are mounted around the engine to insulate it from the cold environment, thereby keeping it warm for a long duration of time. These Low Weight Reinforced Thermoplastics (LWRT) not only reduce unwanted engine friction but also lower fuel consumption of vehicles by keeping engines warm. Thus, thermal engine encapsulation of internal combustion engines enables environmental preservation as every gram of fuel, which is saved from burning, reduces our environmental footprint.

Carbon fiber is an advanced material used in automotive engine encapsulation. Though carbon fiber is expensive, it is popular as it is capable of providing lightweight engine covers and shields. As body-mounted engine encapsulations cover all the sides of the engine and are generally installed in luxury vehicles, a lightweight material is preferred for their manufacturing. Considering all the above factors, carbon fiber is mostly preferred in high-end vehicles.

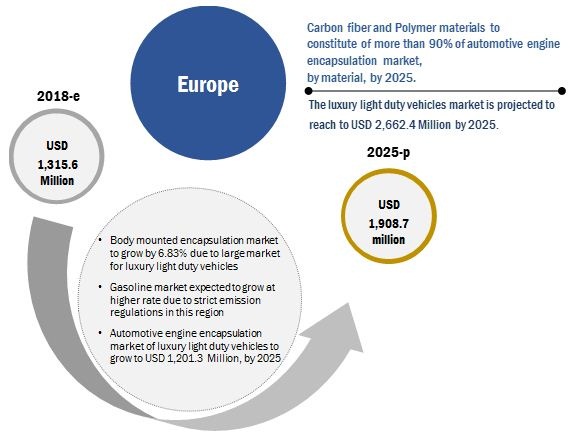

The body-mounted encapsulation is also mainly found in luxury vehicles. However, some of the high end mid-variant vehicles also tend to use this system. The body-mounted encapsulation units for the luxury vehicles are mainly made up of carbon fiber materials. The body-mounted encapsulation is estimated to grow at a faster CAGR rate than the engine-mounted system and is projected to reach USD 3,193.7 million by 2025.

Market Dynamics

Drivers

- Need to minimize engine noise and CO2 emission

- Reduction in piston-cylinder wear

Restraints

- Increased demand for electric and hybrid vehicles eliminates the need for engine components

Opportunities

- Increased demand for fuel-efficient and energy-saving vehicles

Challenges

- Increased vehicle weight and fuel consumption

Critical Questions:

- How will the market cope with the rise in electric vehicle sales?

- How are OEMs planning to increase penetration of automotive engine encapsulations in economic vehicles without having a significant effect on their price?

- How can the price of body mounted engine encapsulations be reduced, while still maintaining its performance, to increasingly incorporate them in mid-priced and economy light duty vehicles?

The market is projected to grow at a CAGR of 6.13% from 2018 to 2025. The market for automotive engine encapsulation is estimated to be USD 4.16 Billion in 2018 and is projected to reach USD 6.30 Billion by 2025. The key growth drivers of this market are the growing demand for silent vehicles, the stringent emission norms for the automotive industry, and the rise in demand for fuel-efficient and aerodynamically efficient vehicles.

Body mounted encapsulation is projected to have the highest market share, by value, in the market by 2025. This can be attributed to two major reasons—price and coverage. The price of these systems is quite high, as they are made of premium materials such as carbon fiber. Also, unlike engine mounted encapsulations that cover only selected parts of the engine, the components of body mounted encapsulation system are placed all around the engine.

Carbon fiber is an advanced, high-quality material used for automotive engine encapsulations. Though carbon fiber is expensive, it is preferred by luxury vehicle OEMs because of its lightweight and excellent noise cancellation and thermal insulation properties. Also, the increase in disposable income in developing countries such as India and China is increasing the market for luxury vehicles, which in turn is influencing the market of carbon fiber positively.

The gasoline engine vehicle segment is estimated to be the fastest growing market during the forecast period. Gasoline vehicles produce a lesser volume of exhaust from their engines as compared to diesel engine vehicles. In addition, environment-friendly mandates imposed by several governments have led to a global decline in the production of diesel vehicles. Hence, the OEMs are focusing on making their gasoline models thermally and acoustically efficient by incorporating engine encapsulations.

The luxury light-duty vehicle segment is estimated to be the largest and fastest growing segment in the market, by vehicle class. All luxury vehicles are equipped with engine encapsulation systems, which help in acoustic and thermal management in the vehicle and enhance stylish looks and aerodynamic efficiency.

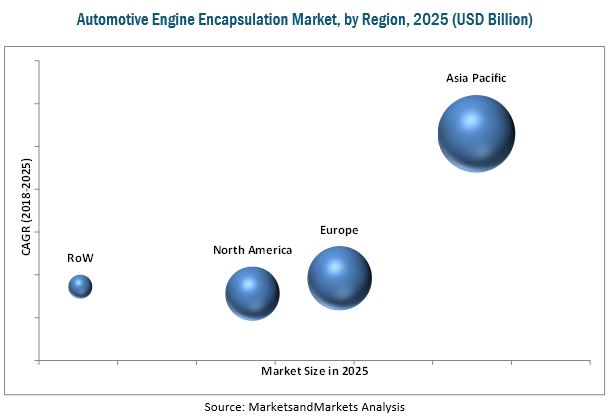

The Asia Pacific region is estimated to dominate the market, by volume as well as value. The Asia Pacific region currently accounts for more than 50% of the global automobile production. The region comprises emerging economies such as China and India along with developed nations such as Japan and South Korea. The increase in disposable income in developing countries such as India and China and growing stringency of emission regulations are the key factors driving the market in the Asia Pacific region.

A key factor restraining the growth of the market is the increasing demand for electric and hybrid vehicles.

Some of the key players in the automotive engine encapsulation market are Autoneum (Switzerland), Continental (Germany), Roechling (Germany), ElringKlinger (Germany), and Greiner (Austria).

The thirst of OEMs to make their models increasingly quieter and eco-friendly, to drive the industry forward

Body mounted encapsulations

The body mounted encapsulation systems are boxy structures that cover the engine from all the sides to ensure better thermal insulation and fuel savings in the vehicle. The body mounted encapsulation is currently majorly found in luxury vehicles. The body mounted encapsulation units for the luxury vehicles are mainly made up of carbon fiber materials. The body mounted encapsulation is estimated to grow at a faster CAGR than the engine mounted system as it is said to be a favorable advancement in the engine encapsulation market.

Engine mounted encapsulations

The engine mounted systems help to obtain the optimal temperature in a quick span of time, which ultimately reduces fuel consumption and carbon emissions. This system comprises of multi-layered thermoplastic materials for the engine undershield systems. These low-weight, reinforced thermoplastics are ideal for an insulation system as they have a high enclosed air pore volume.

Automotive engine encapsulations would be seeing a higher installation growth in gasoline vehicles, due to decreasing diesel vehicle production worldwide:

Gasoline engine vehicles

Gasoline vehicles produce a lesser amount of exhaust from their engines than diesel vehicles do. Hence, the need for encapsulation of gasoline engines is lesser than that for diesel engines. However, there is a global decline in the production of diesel vehicles because of the environment-friendly mandates imposed by various governments. Hence, the OEMs are diverting their attention toward making their gasoline models more efficient by incorporating engine encapsulations.

Diesel engine vehicles

Diesel engine vehicles are the ideal application for automotive engine encapsulations. Hence, automotive engine encapsulations are majorly used in diesel engine vehicles. However, various countries are becoming increasingly cautious of the noise and CO2 emissions pertaining to diesel engines. For instance, Germany has banned its older diesel cars, and the UK is imposing surcharges on diesel vehicles. Hence, in the near future, market for diesel vehicles is estimated to decline, while that of gasoline vehicles is estimated to grow.

Critical questions would be;

- Where will all these developments take the industry in the mid to long term?

- Will the suppliers continue to explore new avenues in automotive engine encapsulations, with the increasing electric vehicle sales?

- Which geographical markets have lower penetrations of automotive engine encapsulations where there is a good growth potential?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Automotive Engine Encapsulation Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.2 Secondary Data

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.4 Data Triangulation

2.5 Assumptions

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 32)

4.1 Attractive Opportunities in the Automotive Engine Encapsulation Market

4.2 Market, By Region

4.3 Market, By Country

4.4 Market, By Fuel Type

4.5 Market, By Product Type

4.6 Market, By Material

5 Automotive Engine Encapsulation Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Need to Minimize Engine Noise and CO2 Emission

5.2.1.2 Reduction in Piston-Cylinder Wear

5.2.2 Restraints

5.2.2.1 Increased Demand for Electric and Hybrid Vehicles Eliminates the Need for Engine Components

5.2.3 Opportunities

5.2.3.1 Increased Demand for Fuel-Efficient and Energy-Saving Vehicles

5.2.4 Challenges

5.2.4.1 Increased Vehicle Weight and Fuel Consumption

6 Technological Overview (Page No. - 41)

6.1 Introduction

6.2 Advantages of Engine Encapsulation Systems

6.3 Engine Encapsulation Product Types

6.3.1 Market, By Product Type

6.3.1.1 Engine-Mounted Encapsulation

6.3.1.2 Body-Mounted Encapsulation

7 Automotive Engine Encapsulation Market, By Fuel Type (Page No. - 44)

7.1 Introduction

7.2 Gasoline

7.3 Diesel

8 Automotive Engine Encapsulation Market, By Material (Page No. - 49)

8.1 Introduction

8.2 Carbon Fiber

8.3 Polyurethane

8.4 Polypropylene

8.5 Polyamide

8.6 Glasswool

9 Automotive Engine Encapsulation Market, By Product Type (Page No. - 57)

9.1 Introduction

9.2 Engine Mounted

9.3 Body Mounted

10 Automotive Engine Encapsulation Market, By Vehicle Class

10.1 Introduction

10.2 Economic

10.3 Mid-Priced

10.4 Luxury

11 Automotive Engine Encapsulation Market, By Vehicle Class & Region (Page No. - 62)

11.1 Introduction

11.2 Asia Pacific

11.2.1 China

11.2.2 India

11.2.3 Japan

11.2.4 South Korea

11.2.5 Rest of Asia Pacific

11.3 Europe

11.3.1 France

11.3.2 Germany

11.3.3 Italy

11.3.4 Spain

11.3.5 UK

11.3.6 Rest of Europe

11.4 North America

11.4.1 Canada

11.4.2 Mexico

11.4.3 US

11.5 Rest of the World

11.5.1 Brazil

11.5.2 Russia

11.5.3 South Africa

12 Competitive Landscape (Page No. - 97)

12.1 Overview

12.2 Market Ranking Analysis

12.3 Competitive Situations & Trends

12.3.1 New Product Developments

12.3.2 Expansions

13 Company Profiles (Page No. - 103)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

13.1 Autoneum Holding AG

13.2 Continental AG

13.3 RoEchling SE & Co. Kg

13.4 Elringklinger AG

13.5 Greiner Group

13.6 Furukawa Electric Co., Ltd.

13.7 Woco Industrietechnik GmbH

13.8 Adler Pelzer Holding GmbH

13.9 SA Automotive

13.10 Hennecke GmbH

13.11 BASF Corporation

13.12 3M Deutschland GmbH

13.13 Saint-Gobain Isover SA

13.14 Polytec Holding AG

13.15 Evonik

13.16 Carcoustics Shared Services GmbH

13.17 Uniproducts (India) Ltd.

13.18 UGN, Inc.

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 125)

14.1 Insights From Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.4 Introducing RT: Real-Time Market Intelligence

14.5 Available Customizations

14.5.1 Market, By Fuel Type, By Country

14.5.2 Market, By Product Type, By Country

14.6 Related Reports

14.7 Author Details

List of Tables (81 Tables)

Table 1 Currency Exchange Rates (Wrt USD)

Table 2 Automotive Engine Encapsulation Market, By Fuel Type, 2016–2025 (Thousand Units)

Table 3 Market, By Fuel Type, 2016–2025 (USD Million)

Table 4 Gasoline: Market, By Region, 2016–2025 (Thousand Units)

Table 5 Gasoline: Market, By Region, 2016–2025 (USD Million)

Table 6 Diesel: Market, By Region, 2016–2025 (Thousand Units)

Table 7 Diesel: Market, By Region, 2016–2025 (USD Million)

Table 8 Market, By Material, 2016–2025 (USD Million)

Table 9 Carbon Fiber: Market, By Region, 2016–2025 (USD Million)

Table 10 Carbon Fiber: Market, By Vehicle Class, 2016–2025 (USD Million)

Table 11 Polyurethane: Market, By Region, 2016–2025 (USD Million)

Table 12 Polyurethane: Market, By Vehicle Class, 2016–2025 (USD Million)

Table 13 Polypropylene: Market, By Region, 2016–2025 (USD Million)

Table 14 Polypropylene: Market, By Vehicle Class, 2016–2025 (USD Million)

Table 15 Polyamide: Market, By Region, 2016–2025 (USD Million)

Table 16 Polyamide: Market, By Vehicle Class, 2016–2025 (USD Million)

Table 17 Glasswool: Market, By Region, 2016–2025 (USD Million)

Table 18 Glasswool: Market, By Vehicle Class, 2016–2025 (USD Million)

Table 19 Market, By Product Type, 2016–2025 (000’ Units)

Table 20 Market, By Product Type, 2016–2025 (USD Million)

Table 21 Engine Mounted System: Market, By Region, 2016–2025 (000’ Units)

Table 22 Engine Mounted System: Market, By Region, 2016–2025 (USD Million)

Table 23 Body Mounted System: Market, By Region, 2016–2025 (000’ Units)

Table 24 Body Mounted System: Market, By Region, 2016–2025 (USD Million)

Table 25 Automotive Engine Encapsulation Market, By Region, 2016–2025 (000’ Units)

Table 26 Market, By Region, 2016–2025 (USD Million)

Table 27 Market, By Vehicle Class, 2016–2025 (000’ Units)

Table 28 Market, By Vehicle Class, 2016–2025 (USD Million)

Table 29 Asia Pacific: Market, By Country, 2016–2025 (000’ Units)

Table 30 Asia Pacific: Market, By Country, 2016–2025 (USD Million)

Table 31 Asia Pacific: Market, By Vehicle Class, 2016–2025 (000’ Units)

Table 32 Asia Pacific: Market, By Vehicle Class, 2016–2025 (USD Million)

Table 33 China: Market, By Vehicle Class, 2016–2025 (000’ Units)

Table 34 China: Market, By Vehicle Class, 2016–2025 (USD Million)

Table 35 India: Market, By Vehicle Class, 2016–2025 (000’ Units)

Table 36 India: Market, By Vehicle Class, 2016–2025 (USD Million)

Table 37 Japan: Market, By Vehicle Class, 2016–2025 (000’ Units)

Table 38 Japan: Market, By Vehicle Class, 2016–2025 (USD Million)

Table 39 South Korea: Market, By Vehicle Class, 2016–2025 (000’ Units)

Table 40 South Korea: Market, By Vehicle Class, 2016–2025 (USD Million)

Table 41 Rest of Asia Pacific: Market, By Vehicle Class, 2016–2025 (000’ Units)

Table 42 Rest of Asia Pacific: Market, By Vehicle Class, 2016–2025 (USD Million)

Table 43 Europe: Market, By Country, 2016–2025 (000’ Units)

Table 44 Europe: Market, By Country, 2016–2025 (USD Million)

Table 45 Europe: Market, By Vehicle Class, 2016–2025 (000’ Units)

Table 46 Europe: Market, By Vehicle Class, 2016–2025 (USD Million)

Table 47 France: Market, By Vehicle Class, 2016–2025 (000’ Units)

Table 48 France: Market, By Vehicle Class, 2016–2025 (USD Million)

Table 49 Germany: Automotive Engine Encapsulation Market, By Vehicle Class, 2016–2025 (000’ Units)

Table 50 Germany: Market, By Vehicle Class, 2016–2025 (USD Million)

Table 51 Italy: Market, By Vehicle Class, 2016–2025 (000’ Units)

Table 52 Italy: Market, By Vehicle Class, 2016–2025 (USD Million)

Table 53 Spain: Market, By Vehicle Class, 2016–2025 (000’ Units)

Table 54 Spain: Market, By Vehicle Class, 2016–2025 (USD Million)

Table 55 UK: Market, By Vehicle Class, 2016–2025 (000’ Units)

Table 56 UK: Market, By Vehicle Class, 2016–2025 (USD Million)

Table 57 Rest of Europe: Market, By Vehicle Class, 2016–2025 (000’ Units)

Table 58 Rest of Europe: Market, By Vehicle Class, 2016–2025 (USD Million)

Table 59 North America: Market, By Country, 2016–2025 (000’ Units)

Table 60 North America: Market, By Country, 2016–2025 (USD Million)

Table 61 North America: Market, By Vehicle Class, 2016–2025 (000’ Units)

Table 62 North America: Market, By Vehicle Class, 2016–2025 (USD Million)

Table 63 Canada: Market, By Vehicle Class, 2016–2025 (000’ Units)

Table 64 Canada: Market, By Vehicle Class, 2016–2025 (USD Million)

Table 65 Mexico: Market, By Vehicle Class, 2016–2025 (000’ Units)

Table 66 Mexico: Market, By Vehicle Class, 2016–2025 (USD Million)

Table 67 US: Market, By Vehicle Class, 2016–2025 (000’ Units)

Table 68 US: Market, By Vehicle Class, 2016–2025 (USD Million)

Table 69 RoW: Market, By Country, 2016–2025 (000’ Units)

Table 70 RoW: Market, By Country, 2016–2025 (USD Million)

Table 71 RoW: Market, By Vehicle Class, 2016–2025 (000’ Units)

Table 72 RoW: Market, By Vehicle Class, 2016–2025 (USD Million)

Table 73 Brazil: Automotive Engine Encapsulation Market, By Vehicle Class, 2016–2025 (000’ Units)

Table 74 Brazil: Market, By Vehicle Class, 2016–2025 (USD Million)

Table 75 Russia: Market, By Vehicle Class, 2016–2025 (000’ Units)

Table 76 Russia: Market, By Vehicle Class, 2016–2025 (USD Million)

Table 77 South Africa: Market, By Vehicle Class, 2016–2025 (000’ Units)

Table 78 South Africa: Market, By Vehicle Class, 2016–2025 (USD Million)

Table 79 New Product Developments, 2015–2017

Table 80 Expansions, 2016-2018

Table 81 Partnerships/Supply Contracts/Collaborations/Joint Ventures/Agreements/Mergers & Acquisitions, 2015–2018

List of Figures (43 Figures)

Figure 1 Automotive Engine Encapsulation Market Segmentation

Figure 2 Research Design

Figure 3 Research Methodology Model

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 5 Market, By Vehicle Class: Bottom-Up Approach

Figure 6 Market, By Product Type: Top-Down Approach

Figure 7 Body-Mounted Encapsulations to Have the Highest Growth in the Market, 2018 vs 2025 (USD Million)

Figure 8 Luxury Light-Duty Vehicle Segment to Be the Largest Contributor to the Market, 2018 vs 2025 (USD Million)

Figure 9 Carbon Fiber to Be the Largest Segment of the Market, 2018 vs 2025 (USD Million)

Figure 10 Gasoline Segment to Grow at the Highest Rate in the Market, 2018 vs 2025 (USD Million)

Figure 11 Asia Pacific to Hold the Largest Share of the Market, 2018 vs 2025 (USD Million)

Figure 12 Increasing Adoption of Engine Encapsulation for Better Thermal Insulation to Drive the Market in the Next 7 Years

Figure 13 Asia Pacific to Be the Largest Market, 2018 vs 2025 (By Value)

Figure 14 Indian Market Expected to Witness the Highest CAGR During the Forecast Period (By Value)

Figure 15 Gasoline Segment Expected to Dominate Overall Market Between 2018 and 2025 (By Value)

Figure 16 Body Mounted Encapsulation to Grow at the Highest CAGR, 2018 vs 2025 (By Value)

Figure 17 Carbon Fiber Segment Expected to Lead the Market During the Forecast Period (By Value)

Figure 18 Piston-Cylinder Wear With Engine Temperature Fluctuations

Figure 19 BEV Sales in Major Regions, 2017 & 2022

Figure 20 Engine-Mounted Encapsulation

Figure 21 Body-Mounted Encapsulation

Figure 22 Market, By Fuel Type, 2018 vs 2025 (USD Million)

Figure 23 Market, By Material, 2018 vs 2025 (USD Million)

Figure 24 Market, By Product Type, 2018 vs 2025 (USD Million)

Figure 25 Market, By Region, 2018 vs 2025

Figure 26 Asia Pacific: Market Snapshot

Figure 27 Europe: Market, By Country, 2018 vs 2025 (000’ Units)

Figure 28 North America: Automotive Engine Encapsulation, By Country, 2018 vs 2025 (USD Million)

Figure 29 RoW: Market, By Country, 2018 vs 2025 (USD Million)

Figure 30 Key Developments By Leading Players in the Market for 2015–2018

Figure 31 Automotive Engine Encapsulation Market Ranking: 2017

Figure 32 Company Snapshot: Autoneum Holding AG

Figure 33 SWOT Analysis: Autoneum Holding AG

Figure 34 Company Snapshot: Continental AG

Figure 35 SWOT Analysis: Continental AG

Figure 36 Company Snapshot: RoEchling Se & Co. Kg

Figure 37 SWOT Analysis: RoEchling Se & Co. Kg

Figure 38 Company Snapshot: Elringklinger AG

Figure 39 SWOT Analysis: Elringklinger AG

Figure 40 Company Snapshot: Greiner Group

Figure 41 SWOT Analysis: Greiner Group

Figure 42 Company Snapshot: Furukawa Electric Co., Ltd.

Figure 43 Company Snapshot: Woco Industrietechnik GmbH

Growth opportunities and latent adjacency in Automotive Engine Encapsulation Market