Automotive Elastomers Market by Type (Natural Rubber, SBR, Nitrile Elastomer, EPDM, Silicone Rubber, Fluoroelastomer, Styrene Block Copolymers, TPU, TPO, TPV, TPC), Application (Tire and Non-Tire), and Region - Global Forecast to 2022

[129 Pages Report] Automotive Elastomers Market size was USD 44.25 Billion in 2016 and is projected to reach USD 58.82 Billion by 2022, at a CAGR of 5.0% between 2017 and 2022. The base year considered for the study is 2016, while the forecast period is between 2017 and 2022. The automotive elastomers market is driven due to the increasing lightweight vehicles, stringent regulatory environment, and rising demand in emerging nations.

Report Objectives

- To analyze and forecast the size of the automotive elastomers market, in terms of both, volume and value

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To define, describe, and forecast the market by type and application. To forecast the market size in terms of value and volume of segments with respect to five key regions namely, North America, Europe, Asia Pacific, Middle East & Africa, and South America

- To strategically analyze micromarkets with respect to individual growth trends, future prospects, and their contribution to the market

- To analyze competitive developments such as expansions, investments, mergers & acquisitions, new product developments, and research & developments in the market

- To analyze the opportunities in the market for stakeholders and draw the competitive landscape for market leaders

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

Both, top-down and bottom-up approaches have been used to estimate and validate the size of the global automotive elastomers market and to estimate the size of various other dependent submarkets. Extensive secondary sources, directories, and databases such as Hoover’s, Bloomberg, Chemical Weekly, Factiva, Composite Panel Association (CPA), World Bank, Securities and Exchange Commission (SEC), and other government and private websites were referred to identify and collect information useful for this technical, market-oriented, and commercial study of the automotive elastomers market.

To know about the assumptions considered for the study, download the pdf brochure

Some of the major market players in the global automotive elastomers market include Arlanxeo (Netherlands), Dow (US), ExxonMobil (US), JSR Corporation (Japan), DuPont (US), BASF (Germany), LG Chem (South Korea), SABIC (Saudi Arabia), Teknor Apex (US), and Zeon Corporation (Japan).

Key Target Audience:

- Manufacturers of Automotive Elastomer Materials

- Original Equipment Manufacturers

- Automotive and Transportation Manufacturers

- Traders, Distributors, and Suppliers of Automotive Elastomers

- Regional Manufacturers Associations and General Automotive Elastomer Associations

- Government and Regional Agencies and Research Organizations

- Investment Research Firms

“This study answers several questions for stakeholders, primarily which market segments they need to focus upon during the next two to five years, to prioritize their efforts and investments.”

Scope of the Report:

This research report categorizes the global automotive elastomers market on the basis of type, end-use industry, and region.

On the Basis of Type:

- Natural Rubbers (NR)

- Butyl Elastomers (IIR)

- Butadiene (BR) (Polybutadiene) Elastomers

- Ethylene-propylene (EPM/EPDM) Elastomers

- Polyisoprene (IR) Elastomers

- Nitrile (NBR) Elastomers

- Silicones (Q)

- Polychloroprene (CR) (Neoprene) Elastomers

- Acrylic (ACM) Elastomers

- Fluoroelastomers

- Styrene Block Copolymers (SBC)

- Thermoplastic Polyolefins

- Thermoplastic Polyurethanes

- Thermoplastic Vulcanizates

- Thermoplastic Copolyesters

- Thermoplastic Polyether Block Amides

On the Basis of Application:

- Tire

- Non-tire

On the Basis of Region:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

The market is further analyzed for the key countries in each of these regions.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Application Sector Analysis

- Product matrix that provides a detailed analysis of various types of automotive elastomers in each application

Regional Analysis

- Further breakdown of a region with respect to a particular country

Company Information

- Detailed analysis and profiles of additional market players (up to 5)

The global size of the automotive elastomers market was USD 46.13 Billion in 2017 and is projected to reach USD 58.82 Billion by 2022, at a CAGR of 5.0% between 2017 and 2022. The automotive elastomers market has witnessed significant growth in recent years, due to the excellent properties of automotive elastomers, such as heat resistance, weathering and ozone resistance, flexibility, durability, aging resistance, variety, chemical resistance, and oil & gas resistance. The superior properties of automotive elastomers over traditional rubber drive the global automotive elastomers market.

The main types of automotive elastomers are [NR, SR (SBR, IIR, BR, CR, NBR, ACM, EPDM, IR, Silicone, and fluoroelastomer) and TPE (SBC, TPU, TPO, TPV, TPC, and PEBA)]. Based on type, the NR segment led the automotive elastomers market in 2016 due to the use of NR in tire applications, owing to its excellent properties and distinct varieties. The demand for general purpose NR is high in all regions because of its superior properties and growing automotive industry globally.

Automotive elastomers are used in tire and non-tire applications. Among these two applications, the tire application is projected to lead the automotive elastomers market during the forecast period. Because of the implementation of stringent environmental regulations regarding emission levels, vehicle design has been changing drastically over the past few decades. Manufacturers are designing compact, lightweight, and more efficient vehicles, which require automotive elastomers, and this demand is driving the automotive elastomers market.

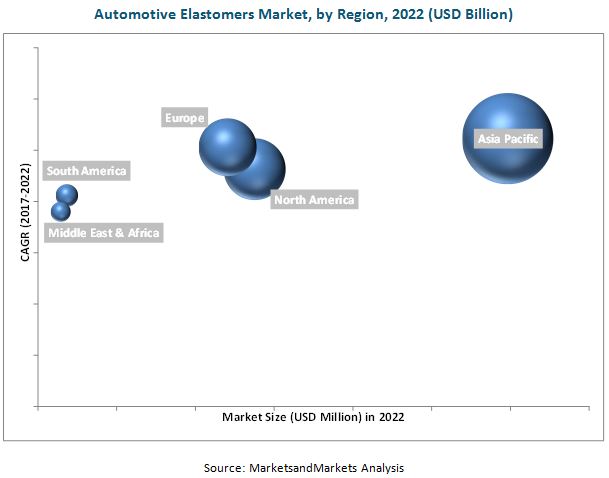

North America, Europe, Asia Pacific, Middle East & Africa, and South America have been considered as key markets for automotive elastomers in the report. Asia Pacific is projected to lead the automotive elastomers market due to the rising demand for automotive elastomers from the automotive and transportation industry. In the Asia Pacific, different countries follow different norms, such as China currently follows China4, India is following the BS4 norms, and South Korea follows EPA tier2 for gasoline and Euro 6 for diesel engines. The Asia Pacific region comprises emerging economies such as China and India, along with developed nations such as Japan, and is the largest market for automobiles. In recent years, the region has emerged as a hub for automobile production. The growing purchasing power of the population has triggered the demand for automobiles.

The automotive elastomers market is expected to witness significant growth in the coming years. However, factors such as high production cost of high temperature elastomers may hinder the growth of the market.

Arlenxeo (The Netherlands), Dow (US), ExxonMobil (US), JSR Corporation (Japan), DuPont (US) are the key companies in the automotive elastomers market. Targeting new markets will enable automotive elastomer manufacturers to overcome the effects of volatile economies, leading to diversified business portfolios and increase in revenue. Other major manufacturers of automotive elastomers are BASF (Germany), LG Chem (South Korea), SABIC (Saudi Arabia), Teknor Apex (US), and Zeon Corporation (Japan).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Unit Considered

1.7 Research Limitations

1.8 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

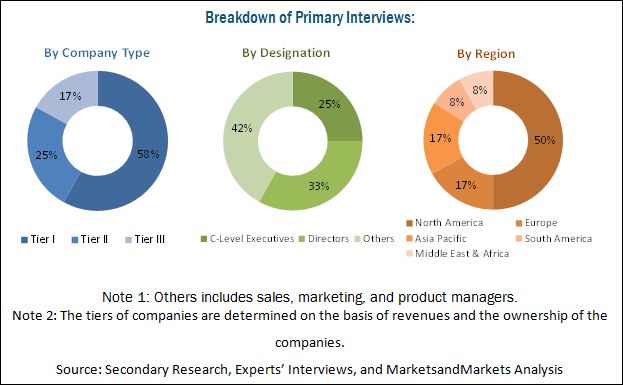

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 31)

4.1 Attractive Opportunities in the Automotive Elastomers Market

4.2 Automotive Elastomers Market, By Application, 2016

4.3 Automotive Elastomers Market Size, By Region

4.4 Automotive Elastomers Market, By Type

4.5 APAC Automotive Elastomers Market Share, By Application and Country

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Automotive Industry in APAC

5.2.1.2 Increasing Demand for High-Performance and Lightweight Materials in the Automotive Industry

5.2.1.3 Stringent Emission Regulations

5.2.2 Restraints

5.2.2.1 High Cost Involved in Processing of High-Temperature Elastomers

5.2.3 Opportunities

5.2.3.1 Development of New Grades of Automotive Elastomers

5.2.3.2 Development of Eco-Friendly Automotive Elastomers

5.2.4 Challenges

5.2.4.1 Fluctuating Raw Material Prices

5.3 Porter’s Five Force Analysis

5.3.1 Bargaining Power of Suppliers

5.3.2 Bargaining Power of Buyers

5.3.3 Threat of New Entrants

5.3.4 Threat of Substitutes

5.3.5 Intensity of Competitive Rivalry

5.4 Macroeconomic Overview and Key Trends

5.4.1 Introduction

5.4.2 Trends and Forecast of GDP

5.4.3 Trends in Global Automotive Industry in Last 5 Years

6 Automotive Elastomers Market, By Type (Page No. - 43)

6.1 Introduction

6.2 Thermoset Elastomer

6.2.1 Natural Rubber(NR)

6.2.2 Synthetic Rubber (SR)

6.2.2.1 Styrene-Butadiene Rubber (SBR)

6.2.2.2 Butyl Rubber (IIR)

6.2.2.3 Poly Butadiene Rubber (BR)

6.2.2.4 Neoprene Rubber / Polychloroprene Rubber (CR)

6.2.2.5 Nitrile Butadiene Rubber (NBR)

6.2.2.6 Acrylic Rubber (ACM)

6.2.2.7 Ethylene Propylene Diene Monomer (EPDM)

6.2.2.8 Polyisoprene Rubber (IR)

6.2.2.9 Silicone (Q) Elastomers

6.2.2.10 Fluoroelastomers

6.2.2.10.1 Fluorocarbon (FKM) Elastomer

6.2.2.10.2 Fluorosilicone (FQ) Elastomer

6.2.2.10.3 Perfluorocarbon (FFKM) Elastomer

6.3 Thermoplastic Elastomer (TEP)

6.3.1 Styrene Block Copolymer (SBC)

6.3.2 Thermoplastic Polyurethane (TPU)

6.3.3 Thermoplastic Polyolefins (TPO)

6.3.4 Thermoplastic Vulcanizates (TPV)

6.3.5 Thermoplastic Polyester Elastomers (TPC)

6.3.6 Polyether Block Amide (PEBA)

7 Automotive Elastomers Market, By Application (Page No. - 52)

7.1 Introduction

7.2 Tire

7.3 Non-Tire

7.3.1 Interior

7.3.2 Exterior

7.3.3 Under the Hood

8 Automotive Elastomers Market, By Region (Page No. - 59)

8.1 Introduction

8.2 North America

8.2.1 US

8.2.2 Canada

8.2.3 Mexico

8.3 APAC

8.3.1 China

8.3.2 Japan

8.3.3 India

8.3.4 South Korea

8.3.5 Rest of APAC

8.4 Europe

8.4.1 Germany

8.4.2 France

8.4.3 UK

8.4.4 Spain

8.4.5 Rest of Europe

8.5 South America

8.5.1 Brazil

8.5.2 Rest of South America

8.6 Middle East & Africa

8.6.1 Turkey

8.6.2 South Africa

8.6.3 Rest of Middle East & Africa

9 Competitive Landscape (Page No. - 89)

9.1 Overview

9.2 Market Ranking of Key Players

9.3 Competitive Scenario

9.3.1 New Product Launches

9.3.2 Expansions

9.3.3 Joint Ventures

9.3.4 Acquisitions

10 Company Profiles (Page No. - 94)

(Overview, Financial*, Products & Services, Strategy, and Developments)

10.1 Arlanxeo

10.2 DOW

10.3 Exxonmobil

10.4 JSR Corporation

10.5 Dupont

10.6 BASF

10.7 LG Chem

10.8 Sabic

10.9 Teknor Apex

10.10 Zeon Corporation

10.11 Other Market Players

10.11.1 Nizhnekamskneftekhim Pjsc

10.11.2 Versalis

10.11.3 Covestro

10.11.4 Daikin

10.11.5 Mitsubishi Chemicals

10.11.6 Kraiburg TEP GmbH & Co. Kg

10.11.7 Mitsui Chemicals

10.11.8 DSM

10.11.9 Shin-Etsu

10.11.10 Solvay

10.11.11 Sumitomo

10.11.12 Kraton

10.11.13 TSRC Corporation

10.11.14 Wacker Chemie

10.11.15 Kuraray

*Details Might Not Be Captured in Case of Unlisted Companies

11 Appendix (Page No. - 122)

11.1 Insights From Industry Experts

11.2 Discussion Guide

11.3 Knowledge Store: Marketsandmarkets Subscription Portal

11.4 Introducing RT: Real-Time Market Intelligence

11.5 Related Reports

11.6 Author Details

List of Tables (64 Tables)

Table 1 Trends and Forecast of GDP, USD Billion (2016–2022)

Table 2 Total Vehicle Production in 15 Countries (2012-2016)

Table 3 Automotive Elastomers Market Size, By Type, 2015-2022 (Kiloton)

Table 4 Automotive Elastomers Market Size, By Type, 2015-2022 (USD Million)

Table 5 Automotive Elastomers Market, By Application 2015-2022 (Kiloton)

Table 6 Automotive Elastomers Market, By Application, 2015-2022 (USD Million)

Table 7 Automotive Elastomers Market Size, By Region, 2015-2022 (Kiloton)

Table 8 Automotive Elastomers Market Size, By Region, 2015-2022 (USD Million)

Table 9 North America: Automotive Elastomers Market Size, By Country, 2015-2022 (Kiloton)

Table 10 North America: Automotive Elastomers Market Size, By Country, 2015-2022 (USD Million)

Table 11 North America: Automotive Elastomers Market Size, By Application, 2015-2022 (Kiloton)

Table 12 North America: Automotive Elastomers Market Size, By Application, 2015-2022 (USD Million)

Table 13 US: Automotive Elastomers Market Size, By Application, 2015-2022 (Kiloton)

Table 14 US: Automotive Elastomers Market Size, By Application, 2015-2022 (USD Million)

Table 15 Canada: Automotive Elastomers Market Size, By Application, 2015-2022 (Kiloton)

Table 16 Canada: Automotive Elastomers Market Size, By Application, 2015-2022 (USD Million)

Table 17 Mexico: Automotive Elastomers Market Size, By Application, 2015-2022 (Kiloton)

Table 18 Mexico: Automotive Elastomers Market Size, By Application, 2015-2022 (USD Million)

Table 19 APAC: Automotive Elastomers Market Size, By Country, 2015-2022 (Kiloton)

Table 20 APAC: Automotive Elastomers Market Size, By Country, 2015-2022 (USD Million)

Table 21 APAC: Automotive Elastomers Market Size, By Application, 2015-2022 (Kiloton)

Table 22 APAC: Automotive Elastomers Market Size, By Application, 2015-2022 (USD Million)

Table 23 China: Automotive Elastomers Market Size, By Application, 2015-2022 (Kiloton)

Table 24 China: Automotive Elastomers Market, By Application, 2015-2022 (USD Million)

Table 25 Japan: Automotive Elastomers Market Size, By Application, 2015-2022 (Kiloton)

Table 26 Japan: Automotive Elastomers Market Size, By Application, 2015-2022 (USD Million)

Table 27 India: Automotive Elastomers Market Size, By Application, 2015-2022 (Kiloton)

Table 28 India: By Market Size, By Application, 2015-2022 (USD Million)

Table 29 South Korea: By Market Size, By Application, 2015-2022 (Kiloton)

Table 30 South Korea: By Market Size, By Application, 2015-2022 (USD Million)

Table 31 Rest of APAC: By Market Size, By Application, 2015-2022 (Kiloton)

Table 32 Rest of APAC: By Market Size, By Application, 2015-2022 (USD Million)

Table 33 Europe: By Market Size, By Country, 2015-2022 (Kiloton)

Table 34 Europe: By Market Size, By Country, 2015-2022 (USD Million)

Table 35 Europe: By Market Size, By Application, 2015-2022 (Kiloton)

Table 36 Europe: By Market Size, By Application, 2015-2022 (USD Million)

Table 37 Germany: By Market Size, By Application, 2015-2022 (Kiloton)

Table 38 Germany: By Market Size, By Application, 2015-2022 (USD Million)

Table 39 France: By Market Size, By Application, 2015-2022 (Kiloton)

Table 40 France: By Market Size, By Application, 2015-2022 (USD Million)

Table 41 UK: By Market Size, By Application, 2015-2022 (Kiloton)

Table 42 UK: By Market Size, By Application, 2015-2022 (USD Million)

Table 43 Spain: By Market Size, By Application, 2015-2022 (Kiloton)

Table 44 Spain: By Market Size, By Application, 2015-2022 (USD Million)

Table 45 Rest of Europe: By Market Size, By Application, 2015-2022 (Kiloton)

Table 46 Rest of Europe: By Market Size, By Application, 2015-2022 (USD Million)

Table 47 South America: By Market Size, By Country, 2015-2022 (Kiloton)

Table 48 South America: By Market Size, By Country, 2015-2022 (USD Million)

Table 49 South America: By Market Size, By Application, 2015-2022 (Kiloton)

Table 50 South America: By Market Size, By Application, 2015-2022 (USD Million)

Table 51 Brazil: By Market Size, By Application, 2015-2022 (Kiloton)

Table 52 Brazil: By Market Size, By Application, 2015-2022 (USD Million)

Table 53 Rest of South America: By Market Size, By Application, 2015-2022 (Kiloton)

Table 54 Rest of South America: By Market Size, By Application, 2015-2022 (USD Million)

Table 55 Middle East & Africa: Automotive Elastomers Market Size, By Country, 2015-2022 (Kiloton)

Table 56 Middle East & Africa: By Market Size, By Country, 2015-2022 (USD Million)

Table 57 Middle East & Africa: By Market Size, By Application, 2015-2022 (Kiloton)

Table 58 Middle East & Africa: By Market Size, By Application, 2015-2022 (USD Million)

Table 59 Turkey: By Market Size, By Application, 2015-2022 (Kiloton)

Table 60 Turkey: By Market Size, By Application, 2015-2022 (USD Million)

Table 61 South Africa: By Market Size, By Application, 2015-2022 (Kiloton)

Table 62 South Africa: By Market Size, By Application, 2015-2022 (USD Million)

Table 63 Rest of Middle East & Africa: By Market Size, By Application, 2015-2022 (Kiloton)

Table 64 Rest of Middle East & Africa: Automotive Elastomers Market Size, By Application, 2015-2022 (USD Million)

List of Figures (31 Figures)

Figure 1 Automotive Elastomers Market: Research Design

Figure 2 Bottom-Up Approach

Figure 3 Top-Down Approach

Figure 4 Data Triangulation: Automotive Elastomers Market

Figure 5 NR to Dominate the Automotive Elastomers Market Between 2017 and 2022

Figure 6 Tire Application Will Continue to Drive the Automotive Elastomers Market By 2022

Figure 7 APAC to Be the Largest Market for Auto Elastomer in 2016

Figure 8 Significant Opportunities in the Automotive Elastomers Market, 2017 vs 2022

Figure 9 Tires Accounted for the Largest Market Share

Figure 10 APAC to Be the Fastest Growing Market for Auto Elastomers During the Forecast Period

Figure 11 Natural Rubbers to Dominate the Automotive Elastomers Market Between 2017 and 2022

Figure 12 Tire Application Accounted for the Largest Share in the APAC Automotive Elastomers Market in 2016

Figure 13 Factors Governing the Automotive Elastomers Market

Figure 14 Porter’s Five Force Analysis

Figure 15 Natural Rubber to Dominate the Automotive Elastomers Market Between 2017 and 2022

Figure 16 Automotive Elastomers Market in Tire Application Segment to Grow Rapidly Between 2017 and 2022

Figure 17 Automotive Elastomers Types Used in Various Tire Applications

Figure 18 India is Emerging as the New Hotspot in the Automotive Elastomers Market Between 2016 and 2022

Figure 19 Tire Application to Drive the Automotive Elastomers Market in North America Between 2017 and 2022

Figure 20 US to Remain the Leading Player in the Automotive Elastomers Market in North America Between 2017 and 2022

Figure 21 Tire Application to Drive the APAC Automotive Elastomers Market Between 2017 and 2022

Figure 22 China to Remain the Leading Country in the APAC Automotive Elastomers Market Between 2017 and 2022

Figure 23 Market Ranking of Key Players in 2016

Figure 24 DOW: Company Snapshot

Figure 25 Exxonmobil: Company Snapshot

Figure 26 JSR Corporation: Company Snapshot

Figure 27 Dupont: Company Snapshot

Figure 28 BASF: Company Snapshot

Figure 29 LG Chem: Company Snapshot

Figure 30 Sabic: Company Snapshot

Figure 31 Zeon Corporation: Company Snapshot

Growth opportunities and latent adjacency in Automotive Elastomers Market