Car Door Latch Market by Application (Side Door Latch, Hood Latch, Tailgate Latch, and Back Seat Latch), Lock Type (Electronic and Non-Electronic), Vehicle Type (Passenger Car and Light Commercial Vehicle) and Region - Global Forecast to 2021

The global car door latch market was valued at USD 4.97 billion in 2016 and is expected to reach USD 6.59 billion by 2021 at a CAGR of 5.80 % during the forecast period 2016-2021. The objective of the study is to analyze and forecast (2016 to 2021) the market size, in terms of volume (’000 units) and value (USD billion), of the global automotive latch market. The report segments the market by lock type, application, and vehicle type based on region namely, North America, Europe, Asia-Pacific, and the Rest of the World (RoW). A detailed study of various market leaders has been conducted and opportunity analyses have been provided in the report.

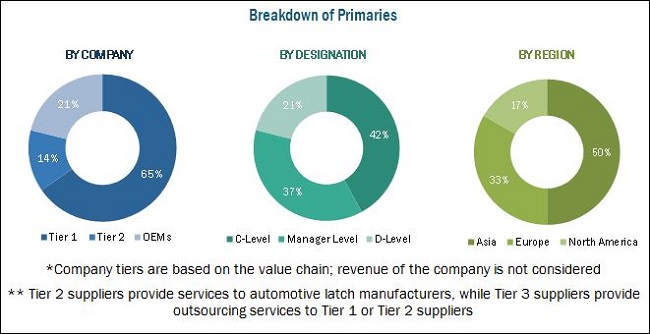

Various secondary sources, such as company annual reports/presentations, press releases, industry association publications, automobile magazine articles, encyclopedias, directories, technical handbooks, World Economic Outlook, trade websites, technical articles, and databases have been used to identify and collect information useful for an extensive study of the global automotive latch market. The primary sources experts from related industries, automobile manufacturers, and automotive body component suppliers—have been interviewed to obtain and verify critical information, as well as to assess future prospects and market estimations. Both bottom-up and top-down approaches have been used for market estimation and to calculate the size of the market.

The figure given below illustrates the break-up of the profiles of industry experts who participated in the primary discussions.

To know about the assumptions considered for the study, download the pdf brochure

The major players in the car door latch market include Aisin Seiki Co., Ltd (Japan), Mitsui Mining and Smelting Co., Ltd.(Japan), Kiekert AG (Germany), Magna International, Inc. (U.S.), Strattec Security Corporation (U.S.), Brose Fahrzeugteile Gmbh & Co. (Germany), U-Shin, Ltd. (Japan), Shivani Locks Pvt. Ltd. (India), Inteva Products, Llc (U.S.), and Minda VAST Access Systems Pvt. Ltd. (India). These companies collectively account for the major share of the automotive latch market.

Target Audience

- Automobile OEMs

- Automotive body and closure system associations

- Automotive Parts Manufacturers’ Association (APMA)

- Manufacturers of automotive latches

- Manufacturers of automotive latch actuators

- Raw material suppliers

“This study answers several questions for the stakeholders, primarily, which market segments to focus in the next two to five years (depending on range of forecast period) to prioritize efforts and investments”.

Scope of the Report

-

Market, By Region

- North America

- Europe

- Asia-Pacific

- RoW

-

Market, By Vehicle Type

- Passenger car

- Light commercial vehicle

-

Market, By Application

- Side door latch

- Hood latch

- Tail gate latch

- Back seat latch

-

Market, By Lock Type

- Electronic

- Non-Electronic

Available Customizations

- Car Door Latch Market, Heavy Commercial Vehicle, by Region

- Exhaustive Study on the Indian Car Door Latch Market

The car door latch market is projected to grow at a CAGR of 5.80%, from USD 4.97 Billion in 2016 to USD 6.59 Billion by 2021. Global automobile demand is increasing continuously due to reasons such as increase in population, developments in suburbs, and infrastructural expansions, which are major driving factors for the market. As increase in global automobile demand will directly impact the production of car door latches.

The electronic latch segment is estimated to be the fastest growing segment in the market. The demand for electronic latches has increased because of technological advancements and an increase in vehicle safety and security concerns. Technologically advanced features such as hands-free opening, collision avoidance, LED-sensors, super locking, selective locking, electric child safety, and power door releasing and closing are in demand by OEMs.

The side door latch segment is estimated to be the fastest growing segment in the market in 2016, owing to a global rise in demand for automobiles. The per vehicle usage of side door latches is the highest, at 4 compared to 1 to 2 for other latch types such as tail gate, hood, and seat, per vehicle. Hence, the side door latch segment is the fastest growing segment. The active inertia latch and LED latch are estimated to dominate the automotive latch market in 2017.

The passenger vehicle type segment is growing at the highest CAGR as mentioned in report, during the forecast period from 2016 to 2021. However, an emerging trend of extended cab type light commercial vehicles (LCV) has also helped the latch market grow, as they have four side doors against the two in standard LCVs.

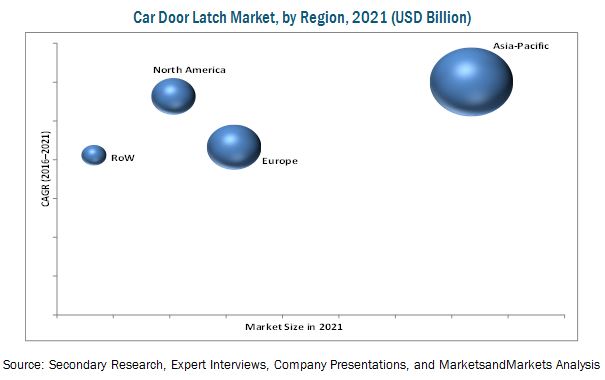

The Asia-Pacific market is estimated to be the largest market with the highest market share of in the car door latch market, by value and volume. The Asian automotive latch market is projected to be the largest market owing to increasing vehicle production and sales due to an increase in disposable income in countries like India and China.

A major restraint considered in the study includes fluctuations in global automotive production and sales. This fluctuating trend in the global automotive industry might impact the production of automotive latches and the latch market. The global car door latch market is dominated by many international as well as domestic players, such as Kiekert AG (Germany), Magna International, Inc. (U.S.), Strattec Security Co. (U.S.), U-Shin Ltd. (Japan), Shivani Locks Pvt. Ltd. (India), Brose Fahrzeugteile Gmbh & Co. (Germany), Inteva Products, Llc (U.S.), and Minda VAST Access Systems Pvt. Ltd. (India).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.2.2 Data From Secondary Sources

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.4 Factor Analysis

2.4.1 Introduction

2.4.2 Demand-Side Analysis

2.4.2.1 Increase in Global Production of Automobiles

2.4.2.2 Rising Concerns Towards Vehicle Safety & Security

2.4.3 Supply-Side Analysis

2.4.3.1 Technological Advancements in Automotive Latch Market

2.5 Market Size Estimation

2.6 Data Triangulation

2.7 Assumptions

3 Executive Summary (Page No. - 26)

3.1 Introduction

3.2 Car Door Latch Market, By Region

3.3 MarketMarket, By Vehicle Type

3.4 MarketMarket, By Application

3.5 MarketMarket, By Lock Type

3.6 MarketMarket — Growth Trends

4 Premium Insights (Page No. - 31)

4.1 Attractive Opportunities in Car Door Latch MarketMarket

4.2 Global MarketMarket Share, By Region (Value), 2016 - 2021

4.3 MarketMarket, By Vehicle Type (Value), 2016 - 2021

4.4 MarketMarket, By Lock Type, (Value), 2016 - 2021

4.5 Global Market: Rise in Demand for Automotive Latches in Emerging Economies

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Market Segmentation

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Stringent Emission Norms Leading to Light Weighting/Downsizing of Automotive Components

5.3.1.2 Increase in Global Automobile and Alternate Fuel Vehicle Demand

5.3.2 Restraints

5.3.2.1 Fluctuations in the Global Automotive Production as Well as Sales

5.3.3 Opportunities

5.3.3.1 Emerging Door Latch Technologies

5.3.3.2 Increasing Demand for LCVS

5.3.4 Challenges

5.3.4.1 Maintaining Balance Between Cost & Technology

5.3.4.2 Increase in Advanced Vehicle Safety and Security

5.4 Porter’s Five Forces Analysis

5.4.1 Market

5.4.1.1 Intensity of Competitive Rivalry

5.4.1.2 Threat of Substitutes

5.4.1.3 Bargaining Power of Buyers

5.4.1.4 Bargaining Power of Suppliers

5.4.1.5 Threat of New Entrants

6 Car Door Latch Market, By Vehicle Type and Region (Page No. - 47)

6.1 Introduction

6.2 Asia-Pacific: Market, By Country

6.2.1 China: Market Size, By Vehicle Type

6.2.2 Japan: Market Size, By Vehicle Type

6.2.3 India: Market Size, By Vehicle Type

6.2.4 South Korea: Market Size, By Vehicle Type

6.2.5 Rest of Asia-Pacific: Market Size, By Vehicle Type

6.3 Europe: Market, By Country

6.3.1 Germany: Market Size, By Vehicle Type

6.3.2 France: Market Size, By Vehicle Type

6.3.3 U.K.: Market Size, By Vehicle Type

6.3.4 Spain: Market Size, By Vehicle Type

6.3.5 Rest of Europe: Market Size, By Vehicle Type

6.4 North America: Market, By Country

6.4.1 The U.S.: Market Size, By Vehicle Type

6.4.2 Mexico: Market Size, By Vehicle Type

6.4.3 Canada: Market Size, By Vehicle Type

6.5 RoW: Market, By Country

6.5.1 Brazil: Market Size, By Vehicle Type

6.5.2 Russia: Market Size, By Vehicle Type

6.5.3 South Africa: Market Size, By Vehicle Type

7 Car Door Latch Market, By Application Type (Page No. - 84)

7.1 Introduction

7.2 Side Door Latch Market, By Region

7.3 Hood Latch Market, By Region

7.4 Tailgate Latch Market, By Region

7.5 Back Seat Latch Market, By Region

8 Car Door Latch Market, By Lock Type (Page No. - 91)

8.1 Introduction

8.2 Electronic Latch Market, By Region

8.3 Non-Electronic Latch Market, By Region 2014-2021

9 Competitive Landscape (Page No. - 96)

9.1 Introduction

9.2 Competitive Situation & Trends

9.3 New Product Launches

9.4 Mergers & Acquisitions

9.5 Supply Contracts/Joint Ventures/Collaborations/ Partnerships

9.6 Expansions

10 Company Profiles (Page No. - 102)

(Company at A Glance, Business Overview, Products Offered, Key Strategy, Recent Developments, SWOT Analysis & MnM View)*

10.1 Magna International Inc.

10.2 Kiekert AG

10.3 Aisin Seiki Co., Ltd.

10.4 Mitsui Mining and Smelting Co. Ltd.

10.5 Strattec Security Corporation

10.6 U-Shin Ltd.

10.7 Shivani Locks Pvt. Ltd.

10.8 Inteva Products, LLC

10.9 Brose Fahrzeugteile GmbH & Co.

10.10 Minda Vast Access Systems.

*Details on Company at A Glance, Recent Financials, Products Offered, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 127)

11.1 Key Insights of Industry Experts

11.2 Discussion Guide

11.3 Available Customizations

11.3.1 Automotive Latch Market, Heavy Commercial Vehicle, By Region

11.3.1.1 Introduction

11.3.1.2 North America

11.3.1.3 Europe

11.3.1.4 Asia-Pacific

11.3.1.5 RoW

11.3.2 Exhaustive Study on Indian Latch Market

11.4 Knowledge Store: Marketsandmarkets’ Subscription Portal

11.5 Introducing RT: Real Time Market Intelligence

11.6 Related Reports

11.7 Author Details

List of Tables (75 Tables)

Table 1 Weight Reduction Strategies Followed to Achieve Cafe Targets

Table 2 Fluctuation in Automobile Sales for Selected Countries, 2012-2016

Table 3 Car Door Latch MarketMarket: Porter’s Five Forces Analysis

Table 4 Global MarketMarket, By Region, 2014–2021 (’000 Units)

Table 5 MarketMarket, By Region, 2014–2021 (USD Million)

Table 6 Global MarketMarket, By Vehicle Type, 2014–2021 (’000 Units)

Table 7 MarketMarket, By Vehicle Type, 2014–2021 (USD Million)

Table 8 Asia-Pacific: Market, By Country, 2014–2021 (’000 Units)

Table 9 Asia-Pacific: Market, By Country, 2014–2021 (USD Million)

Table 10 Asia-Pacific: Market, By Vehicle Type, 2014–2021 (’000 Units)

Table 11 Asia-Pacific: Market, By Vehicle Type, 2014–2021 (USD Million)

Table 12 China: Market, By Vehicle Type, 2014–2021 (’000 Units)

Table 13 China: Market, By Vehicle Type, 2014–2021 (USD Million)

Table 14 Japan: Market, By Vehicle Type, 2014–2021 (’000 Units)

Table 15 Japan: Market, By Vehicle Type, 2014–2021 (USD Million)

Table 16 India: Market, By Vehicle Type, 2014–2021 (’000 Units)

Table 17 India: Market, By Vehicle Type, 2014–2021 (USD Million)

Table 18 South Korea: Market, By Vehicle Type, 2014–2021 (’000 Units)

Table 19 South Korea: Market, By Vehicle Type, 2014–2021 (USD Million)

Table 20 Rest of Asia-Pacific: Market, By Vehicle Type, 2014–2021 (’000 Units)

Table 21 Rest of Asia-Pacific: Market, By Vehicle Type, 2014–2021 (USD Million)

Table 22 Europe: Market, By Country, 2014–2021 (‘000 Units)

Table 23 Europe: Market, By Country, 2014–2021 (USD Million)

Table 24 Europe: Market, By Vehicle Type, 2014–2021 (‘000 Units)

Table 25 Europe: Market, By Vehicle Type, 2014–2021 (USD Million)

Table 26 Germany: Market, By Vehicle Type, 2014–2021 (‘000 Units)

Table 27 Germany: Market, By Vehicle Type, 2014–2021 (USD Million)

Table 28 France: Market, By Vehicle Type, 2014–2021 (‘000 Units)

Table 29 France: Market, By Vehicle Type, 2014–2021 (USD Million)

Table 30 U.K.: Market, By Vehicle Type, 2014–2021 (‘000 Units)

Table 31 U.K.: Market, By Vehicle Type, 2014–2021 (USD Million)

Table 32 Spain: Market, By Vehicle Type, 2014–2021 (‘000 Units)

Table 33 Spain: Market, By Vehicle Type, 2014–2021 (USD Million)

Table 34 Rest of Europe: Market, By Vehicle Type, 2014–2021 (‘000 Units)

Table 35 Rest of Europe: Market, By Vehicle Type, 2014–2021 (USD Million)

Table 36 North America: Market, By Country, 2014–2021 (‘000 Units)

Table 37 North America: Market, By Country, 2014–2021 (USD Million)

Table 38 North America: Market, By Vehicle Type, 2014–2021 (‘000 Units)

Table 39 North America: Market, By Vehicle Type, 2014–2021 (USD Million)

Table 40 U.S.: Market, By Vehicle Type, 2014–2021 (‘000 Units)

Table 41 U.S.: Market, By Vehicle Type, 2014–2021 (USD Million)

Table 42 Mexico: Market, By Vehicle Type, 2014–2021 (‘000 Units)

Table 43 Mexico: Market, By Vehicle Type, 2014–2021 (USD Million)

Table 44 Canada: Market, By Vehicle Type, 2014–2021 (‘000 Units)

Table 45 Canada: Market, By Vehicle Type, 2014–2021 (USD Million)

Table 46 RoW: Market, By Country, 2014–2021 (’000 Units)

Table 47 RoW: Market, By Country, 2014–2021 (USD Million)

Table 48 RoW: Market, By Vehicle Type, 2014–2021 (’000 Units)

Table 49 RoW: Market, By Vehicle Type, 2014–2021 (USD Million)

Table 50 Brazil: Market, By Vehicle Type, 2014–2021 (’000 Units)

Table 51 Brazil: Market, By Vehicle Type, 2014–2021 (USD Million)

Table 52 Russia: Market, By Vehicle Type, 2014–2021 (’000 Units)

Table 53 Russia: Market, By Vehicle Type, 2014–2021 (USD Million)

Table 54 South Africa: Market, By Vehicle Type, 2014–2021 (’000 Units)

Table 55 South Africa: Market, By Vehicle Type, 2014–2021 (USD Million)

Table 56 Car Door Latch Market, By Application, 2014–2021 (‘000 Units)

Table 57 MarketMarket, By Application, 2014–2021 (USD Million)

Table 58 Side Door Latch Market, By Region, 2014–2021 (‘000 Units)

Table 59 Side Door Latch Market, By Region, 2014–2021 (USD Million)

Table 60 Hood Latch: Market Size, By Region, 2014–2021 (‘000 Units)

Table 61 Hood Latch: Market Size, By Region, 2014–2021 (USD Million)

Table 62 Tailgate Latch Market Size, By Region, 2014–2021 (‘000 Units)

Table 63 Tailgate Latch Market Size, By Region, 2014–2021 (USD Million)

Table 64 Back Seat Latch Market Size, By Region, 2014–2021 (‘000 Units)

Table 65 Back Seat Latch Market Size, By Region, 2014–2021 (USD Million)

Table 66 Market, By Lock Type, 2014–2021 (‘000 Units)

Table 67 MarketMarket, By Lock Type, 2014–2021 (USD Million)

Table 68 Electronic Latch Market, By Region, 2014–2021 (‘000 Units)

Table 69 Electronic Latch Market, By Region, 2014–2021 (USD Million)

Table 70 Non-Electronic Latch Market Size, By Region, 2014–2021 (‘000 Units)

Table 71 Non-Electronic Latch Market Size, By Region, 2014–2021 (USD Million)

Table 72 New Product Launches, 2014–2016

Table 73 Mergers & Acquisitions, 2014–2016

Table 74 Supply Contracts/Joint Ventures/Collaborations/Partnerships, 2013

Table 75 Expansions, 2015–2016

List of Figures (56 Figures)

Figure 1 Car Door Latch Market: Segmentations Covered

Figure 2 Research Design

Figure 3 Research Design Model

Figure 4 Market: Secondary Sources

Figure 5 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 6 Global Automobile Production, 2010-2015

Figure 7 Car Door Latch – Market Size Estimation Approach

Figure 8 Market: Data Triangulation

Figure 9 Market: Assumptions

Figure 10 The Asia-Pacific Market is Estimated to Hold the Largest Size, (Value), 2016-2021

Figure 11 Passenger Vehicle Type is Estimated to Hold the Larger Market Share, (Value), 2016-2021

Figure 12 Side Door Latch Accounts for the Largest Share in Market, (Value), 2016-2021

Figure 13 Electronic Latch Projected to Be the Fastest Growing Market, (Value), 2016-2021

Figure 14 Market: China is Projected to Be the Fastest Growing Market (By Volume) During the Forecast Period

Figure 15 Attractive Opportunities in the Global Market

Figure 16 Asia-Pacific to Hold the Largest Market Share for Global Market During the Forecast Period.

Figure 17 Passenger Vehicle is Estimated to Occupy the Largest Size, By Value, in the Global Market, By Vehicle Type, (2016 - 2021 )

Figure 18 Non Electronic Latch to Hold the Larger Share, By Value, in the Global Market, By Lock Type (2016 - 2021)

Figure 19 Asia-Pacific Countries to Enter High Growth Trajectory in Electronic Locks Segment, 2016

Figure 20 Market: Market Dynamics

Figure 21 Increase in Global Passenger Cars and Electric Vehicle Sales, 2013-2016 (Million Units)

Figure 22 Increasing Demand for Light Commercial Vehicles, 2012-2016

Figure 23 Car Door Latch: Porter’s Five Forces Analysis

Figure 24 Competitive Rivalry is Medium in Market

Figure 25 High Number of Players in Markets Leads to Medium Degree of Competition in the Car Door Latch Market

Figure 26 Low Availability of Substitutes Makes the Threat of the Same Low

Figure 27 Large Number of Suppliers and Concentration of Buyers Makes the Buyer’s Bargaining Power Medium

Figure 28 Intense Competition Among Existing Suppliers Makes the Bargaining Power of Suppliers Low

Figure 29 Established Firms and High Initial Cost Making the Threat of New Entrants Medium

Figure 30 Market Outlook, By Region, (Volume), 2016–2021

Figure 31 Global Market, By Region, 2014–2021 (USD Million)

Figure 32 Asia-Pacific: Market Snapshot

Figure 33 Asia-Pacific Market, By Country, 2016 vs 2021 (USD Million)

Figure 34 Europe Market, By Country, 2016 vs 2021 (USD Million)

Figure 35 North America: Market Snapshot

Figure 36 North America Market, By Country, 2016 vs 2021 (USD Million)

Figure 37 RoW , By Country, 2016 vs 2021 (USD Million)

Figure 38 Side Door Latches to Constitute the Largest Share of the Latch Market, (Value) 2016-2021

Figure 39 Electronic vs Non-Electronic Latch: Market 2014-2021

Figure 40 Companies Adopted New Product Launches as the Key Growth Strategy From 2013 to 2016

Figure 41 Market Evaluation Framework: New Product Launches Fueled Market Growth From 2014–2016

Figure 42 Battle for Market Share: New Product Launch Was the Key Strategy

Figure 43 Magna International Inc.: Company Snapshot

Figure 44 Magna International Inc.: SWOT Analysis

Figure 45 Kiekert AG: Company Snapshot

Figure 46 Kiekert AG: SWOT Analysis

Figure 47 Aisin Seiki Co., Ltd: Company Snapshot

Figure 48 Aisin Seiki Co., Ltd: SWOT Analysis

Figure 49 Mitsui Kinzoku : Company Snapshot

Figure 50 Mitsui Kinzoku: SWOT Analysis

Figure 51 Strattec Security Corporation: Company Snapshot

Figure 52 Strattec Security Corporation: SWOT Analysis

Figure 53 U-Shin Ltd.: Company Snapshot

Figure 54 Shivani Locks Pvt. Ltd.: Company Snapshot

Figure 55 Inteva Products, LLC: Company Snapshot

Figure 56 Brose Fahrzeugteile GmbH & Co.: Company Snapshot

Growth opportunities and latent adjacency in Car Door Latch Market

Is it possible to customize the report only for the Europe (EEA) market with market size break-up by country? Please share the TOC, timeline and fees for the customized report.

Could I get Table of Content for the report? Thanks. I am interested in all countries (global, U.S. and by major regions)