Rear Spoiler Market by Fuel (ICE, BEV), Vehicle Type (Hatchback, SUV, MPV), Material (ABS, Carbon Fibre, Fibre Glass, Sheet Metal), Technology (Blow, Injection and Reaction Injection Molding), and Region - Global Forecast to 2022

The rear spoiler market was valued at USD 2.33 Billion in 2016 and is projected to grow at a CAGR of 7.40% during the forecast period. The base year considered for the study is 2016 and the forecast period is 2017 to 2022. Factors such as increasing stringency of emission norms, regulations about fuel economy, and growing demand for SUVs and MPVs across the globe are driving the growth of the automotivemarket.

Objectives of the Study:

- To segment and forecast the global automotive rear spoiler market size, in terms of value (USD million) and volume (million units)

- To segment and forecast the automotive market size on the basis of the type of technology (blow molding, injection molding, and reaction injection molding)

- To segment and forecast the market size on the basis of the type of material (ABS, Fiberglass, and Carbon fiber)

- To segment and forecast the market size on the basis of vehicle type (hatchback, SUV, and MPV)

- To segment and forecast the market size on the basis of fuel type (ICE, BEV, HEV, and PHEV)

- To forecast the automotive market size for four key regions, namely, North America, Europe, Asia-Pacific, and the Rest of the World (RoW)

- To strategically profile key players and comprehensively analyze their market shares and core competencies

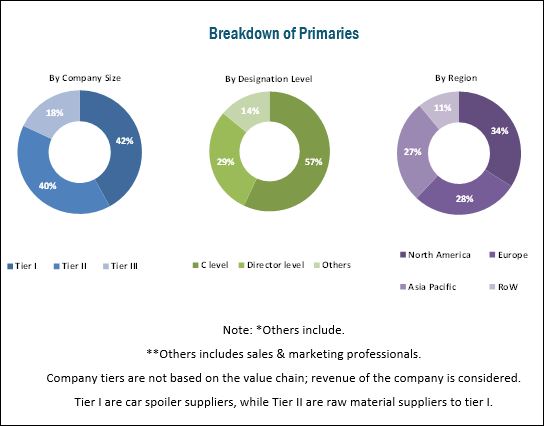

The research methodology used in the report involves primary and secondary sources. Secondary sources include associations such as International Organization of Motor Vehicle Manufacturers (OICA), Emission Controls Manufacturers Association (ECMA), European Automobile Manufacturers Association (ACEA), Environmental Protection Agency (EPA), and International Council on Clean Transportation (ICCT) and paid databases and directories such as Factiva and Bloomberg. In the primary research stage, experts from related industries, manufacturers, and suppliers have been interviewed to understand the present situation and future trends in the rear spoiler market. The market, in terms of volume (thousand units) and value (USD billion), has been derived from forecasting techniques based on vehicle production and rear spoiler penetration.

The figure below illustrates the break-up of the profile of industry experts who participated in primary discussions.

To know about the assumptions considered for the study, download the pdf brochure

The rear spoiler market ecosystem consists of manufacturers such as Magna International Inc. (Canada), Plastic Omnium (France), SMP Automotive (Germany), and Polytec Group (Austria). The rear spoiler is supplied to major OEMs in the automotive industry including Toyota Motor Corporation (Japan), General Motors (U.S.), Honda Motor Co., Ltd. (Japan), and others.

Target Audience

- Rear spoiler market suppliers

- Raw material suppliers

- Automotive OEMs

- Distributors and suppliers of rear spoiler

- Industry associations and experts

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2017–2022 |

|

Base year considered |

2016 |

|

Forecast period |

2017–2022 |

|

Forecast units |

Volume (‘000 units) and Value (USD) |

|

Segments covered |

Fuel, Vehicle Type, Material, Technology, and Region |

|

Geographies covered |

Asia Pacific, Europe, North America, and the Rest of the World |

|

Companies covered |

Magna International (Canada), Plastic Omnium (France), SMP Automotive (Germany), Polytec Group (Austria), Thai Rung Union Car Plc (Thailand), and INOAC Corporation (Japan) among others. |

This research report categorizes the market based on Fuel, Vehicle Type, Material, Technology, and Region

-

Market, By Technology Type

- Blow Molding

- Injection Molding

- Reaction Injection Molding

-

Market, By Material Type

- ABS

- Carbon Fiber

- Fiberglass

- Sheet Metal

-

Market, By Fuel Type

- BEV

- ICE

- Others (Hybrid)

-

Market, By Vehicle Type

- Hatchback

- SUV

- MPV

-

Market, By Region

- Asia-Pacific

- Europe

- North America

- RoW

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Detailed analysis and profiling of additional market players (up to 3)

- Detailed analysis of market vehicle type

- Detailed analysis of electric vehicle types spoilers market

The rear spoiler market is projected to grow at a CAGR of 7.40% during the forecast period and is projected to reach USD 3.69 Billion by 2022. The key factor driving the automotive rear spoiler market is the increasing demand for hatchback, MPV, and SUV, which account for a major share of the market. Due to low cost and compact design, the demand for hatchback cars is expected to increase significantly in the Asia-Pacific region.

The hatchback car segment is estimated to be the largest market, by volume, and SUV segment is estimated to be the largest market, by value, for the automotive spoiler market. The hatchback car segment has a high growth opportunity in the future due to its affordable price and compact size.

The ICE segment is expected to be the largest segment of the automotive spoiler market, by fuel type, during the forecast period. ICE is the most common type of combustion engine owing to its low-cost production and cheap fuel. Purchasing ICE vehicles is cheaper than other fuel type segments. Also, customers in emerging regions such as Asia-Pacific prefer ICE vehicles due to the lower price. Despite the expected growth of the BEV segment in the next 5 years, the ICE segment will continue to be the preferred mode of engine and fuel.

Acrylonitrile butadiene styrene (ABS) is expected to be the largest segment of the automotive rear spoiler market, by material type. ABS is the most widely used material for rear spoiler manufacturing because it is cheap and easily available. Further, the penetration of ABS in the market is high as it is used in a majority of vehicles such as hatchbacks and MPVs. Other materials are used for making spoilers for high-end cars because of their high cost.

The blow molding technology is estimated to be the largest segment of the market during the forecast period. The growth of this technology can be attributed to its low price as compared to other technologies used in the manufacture of rear spoilers. Blow molding has an advantage over other technologies as it has an option for the use of different raw materials simultaneously.

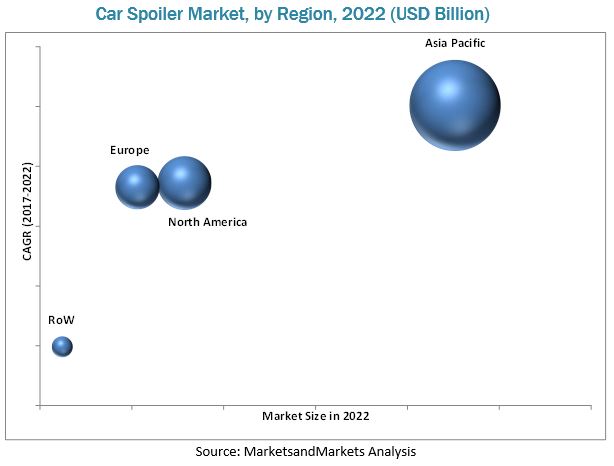

Asia-Pacific is estimated to be the largest automotive spoiler market due to the increasing vehicle production in countries such as China and India. According to MarketsandMarkets analysis, the passenger car production in Asia-Pacific is expected to grow by 6.08% from 2017 to 2022. The growing vehicle production in India and China would result in the increased penetration of rear spoilers in vehicles.

Integrated spoilers, which are attached to the vehicle body parts, are now becoming common in the automotive industry. This new trend can have a negative impact on the rear spoiler market. The market is dominated by a few global players and comprises several regional players. Some of the key manufacturers operating in the market are Magna International (Canada), Plastic Omnium (France), and SMP Automotive (Germany).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.2.2 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.4 Factor Analysis

2.4.1 Introduction

2.4.2 Demand-Side Analysis

2.4.2.1 Growing Vehicle Production

2.4.2.2 Increasing Demand for Aesthetics

2.4.3 Supply-Side Analysis

2.4.3.1 Focus on Stringent Emission Norms in the Automotive Industry Globally

2.5 Market Size Estimation

2.5.1 Bottom-Up Approach

2.5.2 Market Breakdown & Data Triangulation

2.5.3 Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 32)

4.1 Attractive Opportunities in Rear Spoiler Market

4.2 Market, By Region

4.3 Market, By Country

4.4 Market, By Technology

4.5 Market, By Fuel Type

4.6 Market, By Vehicle Type

4.7 Market, By Material

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Stringency of Fuel Economy and Emission Norms

5.2.1.2 Growing Demand for SUVs and MPVS Across the Globe

5.2.2 Restraints

5.2.2.1 Rising Trend of Integrated Roof Spoilers May Hinder the Growth of the Separated Roof Spoilers

5.2.3 Opportunities

5.2.3.1 Increasing Penetration of Active Spoiler

5.2.3.2 Increasing Production of Electric Vehicles Across the Globe

5.2.4 Challenges

5.2.4.1 Speed Limits on Highways By Governments of Countries Such as India, Canada, and Other Major Automotive Markets

6 Market, By Technology Type (Page No. - 41)

6.1 Introduction

6.1.1 Blow Molding

6.1.2 Injection Molding

6.1.3 Reaction Injection Molding

7 Market, By Material Type (Page No. - 47)

7.1 Introduction

7.1.1 ABS

7.1.2 Fiberglass

7.1.3 Carbon Fiber

7.1.4 Sheet Metal

8 Market, By Fuel Type (Page No. - 52)

8.1 Introduction

8.1.1 ICE

8.1.2 BEV

8.1.3 Others (Hybrid)

9 Market, By Vehicle Type (Page No. - 57)

9.1 Introduction

9.1.1 Hatchback

9.1.2 MPV

9.1.3 SUV

10 Market, By Region (Page No. - 63)

10.1 Introduction

10.2 Asia-Pacific

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.3 Europe

10.3.1 France

10.3.2 Germany

10.3.3 Spain

10.3.4 U.K.

10.4 North America

10.4.1 Canada

10.4.2 Mexico

10.4.3 U.S.

10.5 RoW

10.5.1 Brazil

10.5.2 Russia

11 Competitive Landscape (Page No. - 85)

11.1 Competitive Situation & Trends

11.2 Expansions

11.3 Mergers & Acquisitions

11.4 Supply Contracts/Agreements/Collaborations/ Partnerships/Joint Ventures

12 Company Profiles (Page No. - 90)

(Business Overview, Products Offered, Developments, SWOT Analysis)*

12.1 Magna International

12.2 Plastic Omnium

12.3 SMP Automotive

12.4 Polytec Group

12.5 Thai Rung Union Car PLC

12.6 Rehau Ltd

12.7 SRG Global

12.8 Jiangnan Mould and Plastic Technology Co., Ltd.

12.9 AP Plasman Inc

12.10 Albar Industries Inc.

12.11 P.U. Tech Spoiler

12.12 Inoac Corporation

*Details on Business Overview, Products Offered, Developments, SWOT Analysis Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 107)

13.1 Key Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Introducing RT: Real Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

13.7 Author Details

List of Tables (72 Tables)

Table 1 Currency Exchange Rates (W.R.T. USD)

Table 2 SUV and MPV Production in China, India, Japan, and U.S., 2015–2016, (Units)

Table 3 Electric Vehicle Production, 2015–2017

Table 4 Speed Limits in Countries

Table 5 Rear Spoiler Market Size, By Technology Type, 2015–2022 (Thousand Units)

Table 6 Market Size, By Technology Type, 2015–2022 (USD Million)

Table 7 Blow Molding: Automotive Spoiler Market Size, By Region, 2015–2022 (Thousand Units)

Table 8 Blow Molding: Automotive Spoiler Market Size, By Region, 2015–2022 (USD Million)

Table 9 Injection Molding: Automotive Spoiler Market Size, By Region, 2015–2022 (Thousand Units)

Table 10 Injection Molding: Automotive Spoiler Market Size, By Region, 2015–2022 (USD Million)

Table 11 Reaction Injection Molding: Automotive Spoiler Market Size, By Region, 2015–2022 (Thousand Units)

Table 12 Reaction Injection Molding: Automotive Spoiler Market Size, By Region, 2015–2022 (USD Million)

Table 13 Automotive Spoiler Market Size, By Material Type, 2015–2022 (Thousand Units)

Table 14 ABS: Automotive Spoiler Market Size, By Region, 2015–2022 (Thousand Units)

Table 15 Fiberglass: Automotive Spoiler Market Size, By Region, 2015–2022 (Thousand Units)

Table 16 Carbon Fiber: Automotive Spoiler Market Size, By Region, 2015–2022 (Thousand Units)

Table 17 Sheet Metal: Automotive Spoiler Market Size, By Region, 2015–2022 (Thousand Units)

Table 18 Automotive Spoiler Market Size, By Fuel Type, 2015–2022 (Thousand Units)

Table 19 Automotive Spoiler Market Size, By Fuel Type, 2015–2022 (USD Million)

Table 20 ICE: Automotive Spoiler Market Size, By Region, 2015–2022 (Thousand Units)

Table 21 ICE: Automotive Spoiler Market Size, By Region, 2015–2022 (USD Million)

Table 22 BEV: Automotive Spoiler Market Size, By Region, 2015–2022 (Thousand Units)

Table 23 BEV: Automotive Spoiler Market Size, By Region, 2015–2022 (USD Million)

Table 24 Others (Hybrid): Automotive Spoiler Market Size, By Region, 2015–2022 (Thousand Units)

Table 25 Others (Hybrid): Automotive Spoiler Market Size, By Region, 2015–2022 (USD Million)

Table 26 Automotive Spoiler Market Size, By Vehicle Type, 2015–2022 (Thousand Units)

Table 27 Automotive Spoiler Market Size, By Vehicle Type, 2015–2022 (USD Million)

Table 28 Hatchback Car: Automotive Spoiler Market Size, By Region, 2015–2022 (Thousand Units)

Table 29 Hatchback Car: Automotive Spoiler Market Size, By Region, 2015–2022 (USD Million)

Table 30 MPV: Automotive Spoiler Market Size, By Region, 2015–2022 (Thousand Units)

Table 31 MPV: Automotive Spoiler Market Size, By Region, 2015–2022 (USD Million)

Table 32 SUV: Automotive Spoiler Market Size, By Region, 2015–2022 (Thousand Units)

Table 33 SUV: Automotive Spoiler Market Size, By Region, 2015–2022 (USD Million)

Table 34 Global Rear Spoiler Market Size, By Region, 2015–2022 (Thousand Units)

Table 35 Global Market Size, By Region, 2015–2022 (USD Million)

Table 36 Asia-Pacific: Market Size, By Country, 2015–2022 (Thousand Units)

Table 37 Asia-Pacific: Market Size, By Country, 2015–2022 (USD Million)

Table 38 China: Market Size, By Vehicle Type, 2015–2022 (Thousand Units)

Table 39 China: Market Size, By Vehicle Type, 2015–2022 (USD Million)

Table 40 India: Market Size, By Vehicle Type, 2015–2022 (Thousand Units)

Table 41 India: Market Size, By Vehicle Type, 2015–2022 (USD Million)

Table 42 Japan: Market Size, By Vehicle Type, 2015–2022 (Thousand Units)

Table 43 Japan: Market Size, By Vehicle Type, 2015–2022 (USD Million)

Table 44 South Korea: Rear Spoiler Market Size, By Vehicle Type, 2015–2022 (Thousand Units)

Table 45 South Korea: Market Size, By Vehicle Type, 2015–2022 (USD Million)

Table 46 Europe: Market Size, By Country, 2015–2022 (Thousand Units)

Table 47 Europe: Market Size, By Country, 2015–2022 (USD Million)

Table 48 France: Market Size, By Vehicle Type, 2015–2022 (Thousand Units)

Table 49 France: Market Size, By Vehicle Type, 2015–2022 (USD Million)

Table 50 Germany: Market Size, By Vehicle Type, 2015–2022 (Thousand Units)

Table 51 Germany: Market Size, By Vehicle Type, 2015–2022 (USD Million)

Table 52 Spain: Market Size, By Vehicle Type, 2015–2022 (Thousand Units)

Table 53 Spain: Market Size, By Vehicle Type, 2015–2022 (USD Million)

Table 54 U.K.: Rear Spoiler Market Size, By Vehicle Type, 2015–2022 (Thousand Units)

Table 55 U.K.: Market Size, By Vehicle Type, 2015–2022 (USD Million)

Table 56 North America: Market Size, By Country, 2015–2022 (Thousand Units)

Table 57 North America: Market Size, By Country, 2015–2022 (USD Million)

Table 58 Canada: Market Size, By Vehicle Type, 2015–2022 (Thousand Units)

Table 59 Canada: Market Size, By Vehicle Type, 2015–2022 (USD Million)

Table 60 Mexico: Market Size, By Vehicle Type, 2015–2022 (Thousand Units)

Table 61 Mexico: Market Size, By Vehicle Type, 2015–2022 (USD Million)

Table 62 U.S.: Market Size, By Vehicle Type, 2015–2022 (Thousand Units)

Table 63 U.S.: Market Size, By Vehicle Type, 2015–2022 (USD Million)

Table 64 RoW: Rear Spoiler Market Size, By Country, 2015–2022 (Thousand Units)

Table 65 RoW: Market Size, By Country, 2015–2022 (USD Million)

Table 66 Brazil: Market Size, By Vehicle Type, 2015–2022 (Thousand Units)

Table 67 Brazil: Market Size, By Vehicle Type, 2015–2022 (USD Million)

Table 68 Russia: Market Size, By Vehicle Type, 2015–2022 (Thousand Units)

Table 69 Russia: Market Size, By Vehicle Type, 2015–2022 (USD Million)

Table 70 Expansions, 2015–2017

Table 71 Mergers & Acquisitions, 2014–2017

Table 72 Supply Contracts/Collaborations/Partnerships/Joint Ventures, 2015–2017

List of Figures (40 Figures)

Figure 1 Global Rear Spoiler Market Segmentation

Figure 2 Market: Research Design

Figure 3 Research Design Model

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 5 Growing Vehicle Production & Sales to Drive the Market for Automotive, 2010-2021

Figure 6 Market for Automotive, By Type: Bottom-Up Approach

Figure 7 Data Triangulation

Figure 8 Market, By Region, 2017 vs 2022

Figure 9 Market, By Technology, 2017 vs 2022

Figure 10 Market, By Fuel Type, 2017 vs 2022

Figure 11 Market, By Vehicle Type, 2017 vs 2022

Figure 12 Increasing Production of Electric Vehicles and SUV to Drive the Rear Spoiler Market

Figure 13 Asia-Pacific to Hold the Largest Share of the Market in 2022, (Value)

Figure 14 China to Grow at the Highest CAGR During the Forecast Period (Value)

Figure 15 Blow Molding is Estimated to Hold the Largest Market Share During the Forecast Period, 2017 vs 2022 (Value)

Figure 16 ICE is Expected to Have the Largest Market Size During the Forecast Period, 2017 vs 2022 (Value)

Figure 17 SUV Segment is Estimated to Lead the Market During the Forecast Period, 2017 vs 2022 (Value)

Figure 18 ABS is Expected to Have the Largest Market Size During the Forecast Period, 2017 vs 2022 (Volume)

Figure 19 Market: Market Dynamics

Figure 20 Blow Molding Estimated to Be the Largest Technology Segment in the Market, 2017 vs 2022

Figure 21 Carbon Fiber Estimated to Be the Fastest Growing Material Segment in the Automotive Spoiler Market

Figure 22 BEV is Estimated to Be the Fastest Growing Vehicle Segment in the Automotive Spoiler Market, 2017 vs 2022

Figure 23 MPV Estimated to Be the Fastest Growing Vehicle Segment of the Market, 2017 vs 2022

Figure 24 Asia-Pacific to Be the Fastest Growing Market for Automotive Rear Spoiler From 2017–2022

Figure 25 Asia-Pacific: Market Snapshot

Figure 26 Europe: Market Snapshot

Figure 27 U.S. Accounts for the Largest Share of the Rear Spoiler Market, 2017 vs 2022

Figure 28 Brazil to Account for the Largest Market Share in RoW, 2017 vs 2022

Figure 29 Companies Adopted Expansion as the Key Growth Strategy From 2014 to 2017

Figure 30 Market Evaluation Framework: Expansion Fueled the Automotive Spoiler Market Growth From 2014–2017

Figure 31 Battle for Market Share: Expansion Was the Key Strategy

Figure 32 Magna International: Company Snapshot

Figure 33 Magna International: SWOT Analysis

Figure 34 Plastic Omnium: Company Snapshot

Figure 35 Plastic Omnium: SWOT Analysis

Figure 36 SMP Automotive: SWOT Analysis

Figure 37 Polytec Group: Company Snapshot

Figure 38 Polytec Group: SWOT Analysis

Figure 39 Thai Rung Union Car PLC: Company Snapshot

Figure 40 Thai Rung Union Car PLC: SWOT Analysis

Growth opportunities and latent adjacency in Rear Spoiler Market