Automatic Tire Inflation System Market by Type (Central, Continuous), On-highway Vehicle (LDV, HDV), Off-highway (Agriculture, Construction), Electric Vehicles (Truck, Bus), Sales Channel (OEM, Aftermarket), Component, Region - Global Forecast to 2028

Automatic Tire Inflation System Market Insights

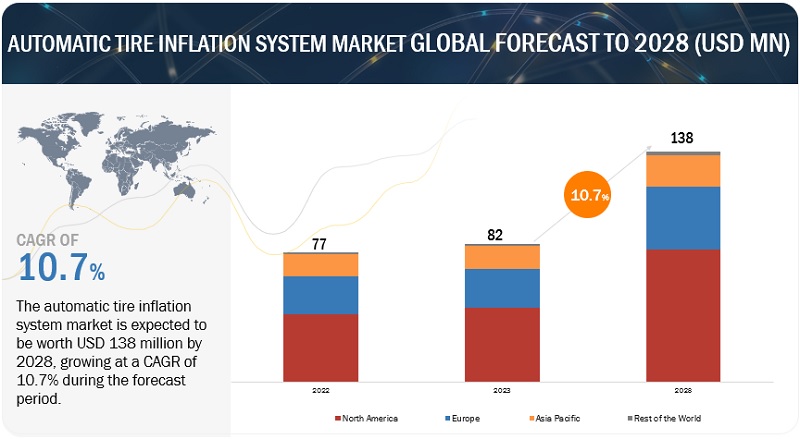

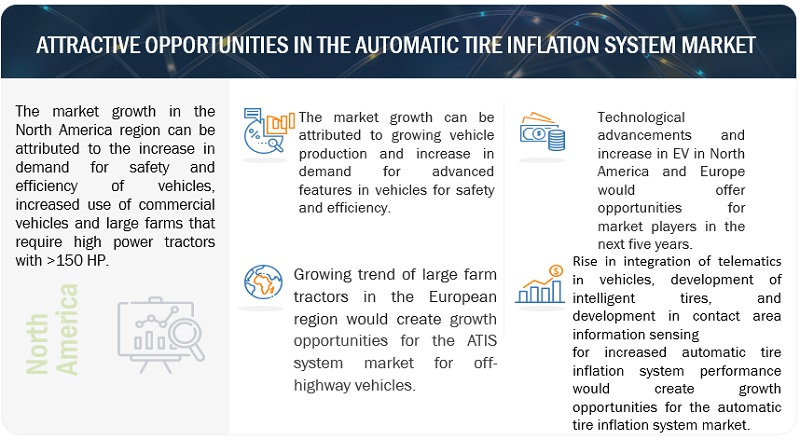

[316 Pages Report] The automatic tire inflation system market size was valued at USD 82 million in 2023 and is expected to reach USD 138 million by 2028, at a CAGR of 10.7% during the forecast period. The increased demand for heavy-duty vehicles and farm tractors would create growth opportunities for the ATIS market. North America and Europe remain the key market for ATIS, though the demand is also increasing in Asia-Pacific.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

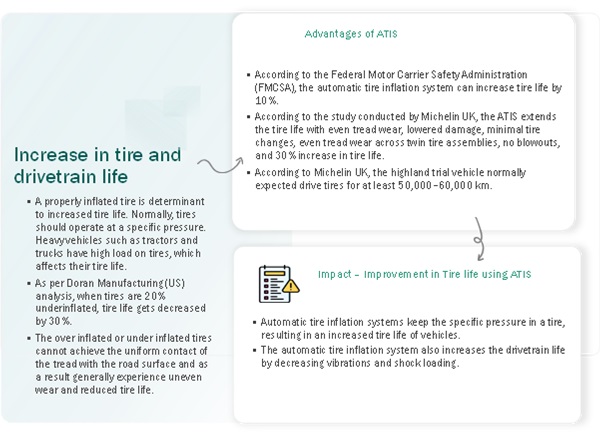

DRIVER: Increase in tire and drivetrain life.

Tire Inflation Pressure and Life of tire

|

Pressure Variance |

Potential Reduction in Tire Life |

|

>15% Over-inflated |

20% |

|

11-15% Over-inflated |

13% |

|

6-10% Over-inflated |

5% |

The tire of a vehicle is designed in such a way that it has uniform contact with the road surface across its width and can spread the load it carries across the full width of the tread. This condition only happens when there is even and optimal wear across its tire tread, producing maximum tire life. The over-inflated or under-inflated tires cannot achieve uniform contact of the tread with the road surface and, as a result, generally experience uneven wear and reduced tire life. The tire depends on factors like tire heating, tire sidewalls crack, even out-of-tread segments, and road conditions. Low tire pressure allows side walls to flex excessively; there can create heat. A moderate amount of heat affects the tire tread wear. Even high heat leads to loss of tread segments or even blowout.

According to the research study conducted by Federal Motor Carrier Safety Administration (FMCSA), improper tire inflation accounts for 80% of tread separations, bruises, cuts, blowouts, and crushes. A pressure drop of only 5 PSI reduces tire life by 25%. According to the American Trucking Associations Technology & Maintenance Council, a constant 20% underinflation will reduce tire life by 30%, and 40% underinflation will reduce tire life by 50%.

Thus, the growing demand for fuel efficiency in vehicles, along with the comfort and convenience offered by the ATIS, and rising demand for tires with less maintenance and repair, further raise the demand for automatic tire inflation system during the forecast period.

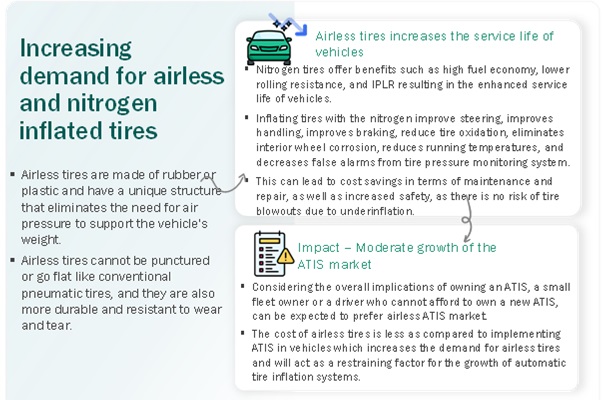

RESTRAINT: Increasing Demand For Airless And Nitrogen-Inflated Tires

Tubeless and nitrogen tires do not support the automatic tire inflation system. Nitrogen tires offer benefits such as high fuel economy, lower rolling resistance, and IPLR resulting in the enhanced service life of vehicles. The market for nitrogen tires is growing as many manufacturers prefer nitrogen as an inflation gas. Companies such as Goodyear (US) and Continental (Germany) support nitrogen as an inflation gas in tires. Inflating tires with nitrogen improves steering, improves handling, improves braking, reduces tire oxidation, eliminates interior wheel corrosion, reduces running temperatures, and decreases false alarms from the tire pressure monitoring system.

Tubeless tires work at an optimum level in better road conditions. Governments in developed and emerging economies worldwide are making significant investments in constructing better road networks. India and China are investing in developing road infrastructure. In 2020, the US government announced USD 63 billion for infrastructure and granted an additional USD 83 billion in infrastructure funding to states that would build strong connectivity. In 2020, the European Commission invested USD 2 billion in 140 transport projects to boost the transport infrastructure in the region. The European Union will seek to mobilize USD 340 billion in public and private infrastructure investments by 2027 to offer emerging countries.

According to Organization for Economic Co-operation and Development (OECD), China's Belt and Road Initiative (BRI) development strategy aims to build connectivity and cooperation across six main economic corridors encompassing China and: Mongolia and Russia; Eurasian countries; Central and West Asia; Pakistan; other countries of the Indian sub-continent; and Indochina. Asia needs USD 26 trillion in infrastructure investment by 2030. In India, the government announced road projects worth USD 13.48 billion (Rs. 1 lakh crore) to develop road infrastructure in Jammu and Kashmir. The region has also witnessed growth in national highways, from 7 in 2014 to 11 in 2021.

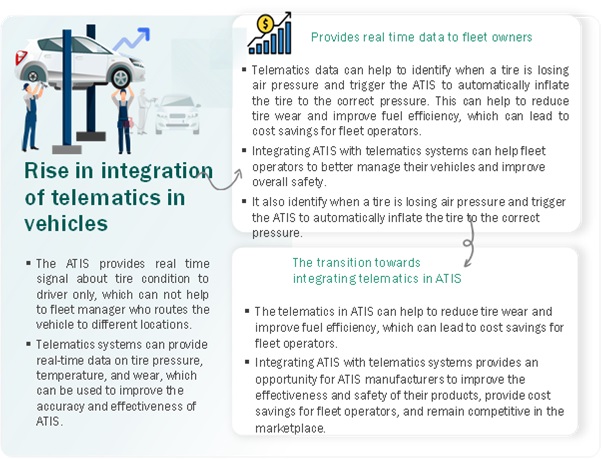

OPPORTUNITY : Rise in the integration of telematics in vehicles

Telematics has merged into the automotive mainstream at a rapid rate. Car telematics help improves driving behavior, road safety, vehicle function monitoring, and preventive maintenance check-up. According to the Global System for Mobile Communications (GSMA), the telematics industry is expected to reach USD 750 billion by 2030. There are two major reasons for the growth of the telematics industry. First is governments' increasing willingness to mandate telematics services such as emergency-call capabilities, which is already happening in the European Union and Russia—the second is the increasing demand for greater connectivity and intelligence in vehicles.

Major technology giants are partnering with tire inflation system manufacturers to offer telematics features, which improve the driving experience and enhance the comfort and safety of vehicles. In 2019, Phillips Connect Technologies partnered with Pressure Systems International to offer telematics solutions for P.S.I.’s Automatic Tire Inflation System and TireView products. The system proactively pre-checks the status of a transportation asset remotely from any device connected to the internet. It can be helpful for fleet owners to monitor the tire check-up remotely. Pirelli Cyberfleet, for example, includes sensors in the tires (of any type and brand if they are tubeless) that detect the operational parameters and send them to an app for smartphones/tablets.

According to a trial demonstrated by Matrix Telematics, with the use of telematics, there was a reduction in monthly miles driven by the truck fleet and a significant average increase in MPG fuel efficiency by more than 14%, while speeding offenses also reduced significantly. Thus, the growing application of connectivity and data transmission and implementation of stringent emission standards is expected to drive the adoption of telematics, ultimately driving vehicle tire inflation systems.

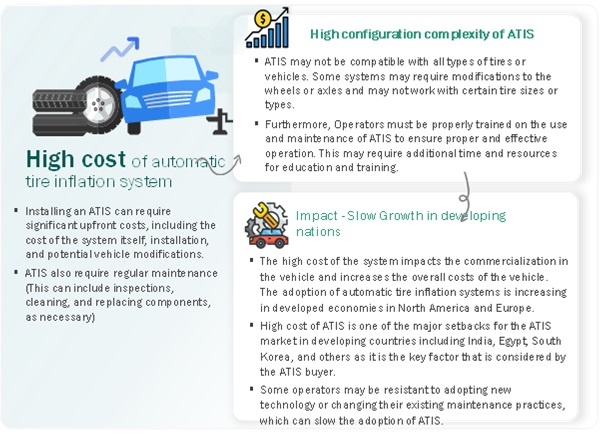

CHALLENGE: High Cost of Automatic Tire Inflation System

The growth of the advanced tire inflation system has been restricted to large load-carrying vehicles as high manufacturing and maintenance costs are involved. For example, an inflation system such as central tire inflation costs more than three times the tire pressure monitoring system in heavy commercial vehicles. Vehicles with an automatic tire inflation system are more expensive than others. Therefore, an automatic tire inflation system adds to the overall cost of the vehicle. Advanced tire inflation system involves multiple electronic components, which helps it for proper inflation. However, this increases the overall cost of the system. These tire inflation systems are manufactured with various components such as wheel valves, electronic control units (ECU), air delivery systems, operator control panels, and speed and pressure sensors with various switches. The pressure sensor is placed in an automatic tire inflation system to track tire pressure status. The air delivery system is responsible for delivering adequate pressure to the tires.

The high cost of the system impacts the commercialization of the vehicle and increases the overall costs of the vehicle. Adopting automatic tire inflation systems is increasing in developed economies in North America and Europe. Manufacturers such as Goodyear (US) and Michelin (France) have strong distribution networks for selling automatic tire inflation systems in developed economies. Additionally, the governments in these developed countries have started promoting automatic tire inflation systems.

Central Tire Inflation System is estimated as the largest type over the forecast period

The central tire inflation system segment is estimated to lead the market owing to its high fuel efficiency and increased safety. Central tire inflation systems provide smooth driving conditions for the driver. They offer an advantage over continuous tire inflation systems by creating a larger area between the tire and the surface that limits tire damage.

Furthermore, many leading tire inflation system providers such as EnPro Industries (US), Michelin (France), IDEX Corporation (US), SAF-HOLLAND (Germany), and Dana Incorporated (US), and others are offering central tire inflation systems for heavy-duty vehicles applications. For instance, In April 2023, BFGoodrich Tires introduced a new product called BFGoodrich® ActivAir, a fully integrated tire inflation system designed to enhance off-road capabilities. This system enables drivers to adjust tire pressure without leaving their seats, offering convenience and flexibility in various off-road situations. In 2019, Inside Trelleborg Wheel Systems and Dana Incorporated jointly developed a product called CTIS+ Inside. The central pressure control system will enable tractor drivers to inflate or deflate tire pressures directly from the tractor cabin, according to the recommended pressure calculated by the advanced Trelleborg Load Calculator (TLC) software.

The ECU segment will dominate the market

DURING THE FORECAST PERIOD, the ECU segment is estimated to lead the ATIS market.

The ECU is responsible for monitoring each tire's tire pressure on a vehicle and alerting the driver if the pressure falls below a certain threshold. ECUs used in automatic tire inflation systems are increasingly designed to integrate with other vehicle systems, such as telematics and vehicle control units. This integration allows for more comprehensive monitoring and control, providing real-time tire pressure data and enabling proactive maintenance and diagnostics. In a typical automatic tire inflation system, the cost of the ECU can range from around 25% to 30% of the system's total cost. ECU costs more than other components used in the overall automatic tire inflation system.

The need for improved safety, regulatory compliance, fuel efficiency, and tire longevity drives the rising demand for ECUs in automatic tire inflation systems. As the automotive industry prioritizes these aspects, adopting automatic tire inflation systems with ECUs is expected to increase further.

North America is expected to dominate the component segment during the forecast period. North America has implemented regulations that mandate using tire pressure monitoring systems (TPMS) in vehicles. TPMS typically rely on ECUs to monitor tire pressure and provide alerts to drivers in case of deviations. These regulations, such as the US Federal Motor Vehicle Safety Standard (FMVSS) 138, have driven the widespread adoption of ECUs in automatic tire inflation systems.

ECU plays a crucial role in the tire inflation system by integrating sensor inputs, monitoring tire pressure, controlling the inflation and deflation process, regulating pressure levels, performing diagnostics, and facilitating communication with the driver and other vehicle systems. It ensures optimal tire pressure, improving safety, fuel efficiency, and performance. ECU enables the automation of inflation and deflation and the interface between all other system components. Hence, with the increasing demand for ATIS in North America, there will be an increase in the demand for ECUs. The cost of the ECU is declining rapidly owing to the advancements in semiconductor technology.

Agricultural Tractors to Dominate the automatic tire inflation system market

During the forecast period, agricultural tractors dominate the automotive automatic tire inflation system market. This is mainly because the tire inflation system in agriculture tractors has proven effective. Many OEMs are investing in R&D activities to develop new and efficient tire inflation systems, driving the growth of this segment. Companies such as Dana Incorporated (US), TI Systems (Germany), Michelin (France), and Haltec Corporation are some of the major companies that have invested in R&D and developed CTIS products, especially farm tractors and construction equipment. John Deere has its CTIS system for its farm tractors, an optional feature in certain regions such as the Middle East & Africa and Europe. The >250 HP farm tractor market is expected to hold the largest market in Europe during the forecast period. The increasing popularity of commercial farming and new product launches by various major players is expected to boost the market in the region. For instance, John Deere has launched the John Deere 8 Series Tractor MY22's new central tire inflation system (CTIS) allows for quick tire pressure adjustments from the cab.

The need for optimal traction, soil protection, increased efficiency, and crop preservation drives the demand for tire inflation systems in agriculture tractors. While tire inflation systems can also benefit construction equipment, the specific requirements and priorities in the construction industry may differ, leading to relatively lower demand than agriculture tractors. Large farm tractors are used by professional farmers who have large landholdings. The adoption of ATIS in these tractors having above 150 HP is expected to witness high growth. Europe and North America are expected to be potential markets for these tractors equipped with ATIS.

Companies like Michelin (France), Dana Incorporated (US), CLAAS (Germany), and John Deere (US) use their CTIS in farm tractors. In 2019, Michelin launched the ZEN@TERRA CTIS, the first project resulting from its collaboration with PTG. This solution allows farmers to change the tire pressure from the tractor cab to low pressure in the fields and switch to higher road pressure for higher speeds. Dana offers the Spicer® CTIS (Central Tire Inflation System), designed for agriculture tractors. It allows operators to adjust tire pressure on the go, improving traction, fuel efficiency, and tire life. Michelin (US) launched Michelin Auto Inflate, allowing off-road vehicles such as tractors to maintain an ideal tire pressure automatically. Michelin Auto Inflate can save USD 2,400 per tractor-trailer annually by decreasing tire-related downtime, increasing tire life, improving fuel economy, and enhancing vehicle safety. These benefits are expected to drive off-road vehicles' automatic tire inflation system market.

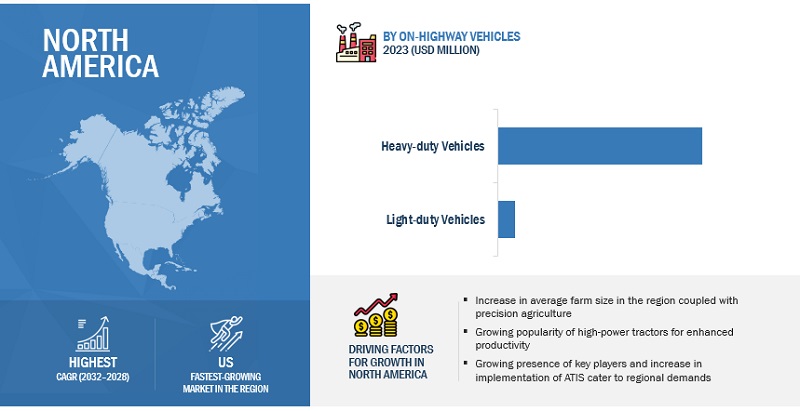

North America is estimated to be the largest market in 2023

American automotive manufacturers such as EnPro Industries, Goodyear Tire & Rubber Company, Dana Incorporated, IDEX Corporation, The Boler Company, Airgo Systems, Aperia Technologies, Haltec Corporation, Pressure Systems International, Opladen LLC, Trans Technologies Company, Servitech Industries, Vigia, and Velocity offer automatic tire inflation systems.

In 2023, the US was the largest market for automatic tire inflation systems for on-highway vehicles in the region, with a market share of >90%, followed by Canada (~4%) and Mexico (~2%). North America is the largest manufacturer of light commercial vehicles. The region is expected to grow in the automatic tire inflation system market for all vehicle types in the coming years.

Many accidents related to tire malfunction occur in the US every year. According to NHTSA, 733 traffic fatalities occurred due to tire malfunctioning in 2016. The NHTSA also estimated that automatic tire inflation systems could save 260,000 accidents annually.

Key Market Players

The ATIS market is led by established players, such as Dana Incorporated (US), MICHELIN (France), IDEX Corporation (US), Enpro Industries (US), MERITOR (US), SAF-HOLLAND (Germany), and CLAAS (Germany). These companies have adopted several strategies to gain traction in the market. They have expanded in various geographical locations through mergers & acquisitions and expansions and entered into joint ventures/collaborations with other industry players to sustain their position in the market.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2018–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Volume (Units) and Value (USD Million) |

|

Segments Covered |

Automatic Tire Inflation System Market by Type, Component, On-Highway Vehicles, Off-Highway Vehicles, Electric Trucks, Electric Buses, Sales Channel, Agriculture Tractors, By Type, Construction Equipment, By Type, and Region |

|

Geographies covered |

Asia Pacific, North America, Europe, and the Rest of the World [RoW] |

|

Companies covered |

Dana Incorporated (US), MICHELIN (France), IDEX Corporation (US), Enpro Industries (US), MERITOR (US), and SAF-HOLLAND (Germany) |

With the given market data, MarketsandMarkets offers customizations per the company’s specific needs.

The study segments the Automatic tire inflation system market:

By Type:

- Central Tire Inflation

- Continuous Tire Inflation

By Component

- Rotary Union

- Compressor

- Pressure Sensor

- Housing

- Air Delivery System

- ECU

- Buffer Tank

By On-Highway Vehicle

- Light Duty Vehicle

- Heavy-Duty Vehicle

By Off-Highway Vehicle

- Agriculture tractors

- Construction Equipment

Electric Truck Automatic Tire Inflation System Market, By Propulsion

- Battery Electric Truck

- Plug-In Hybrid Electric Truck

- Fuel Cell Electric Truck

Electric Bus Automatic Tire Inflation System Market, By Propulsion

- Battery Electric Bus

- Plug-In Hybrid Electric Bus

- Fuel Cell Electric Bus

Automatic tire inflation system market for Agriculture Tractors, By Type

- Central Tire Inflation

- Continuous Tire Inflation

Automatic tire inflation system market for Construction Equipment, By Type

- Central Tire Inflation

- Continuous Tire Inflation

By Sales Channel

- OEM

- Aftermarket

By Region

- Asia Pacific

- North America

- Europe

- Rest of the World [RoW)

Recent Developments

- In April 2023, BFGoodrich Tires has recently introduced a new tire-inflation system, ActivAir, which allows off-roaders to change their tire pressure without leaving the driver's seat. ActivAir is fully integrated and enables drivers to adjust their tire pressure to specifications. The patented technology has been pressure-tested and developed by some experienced builders in the most challenging terrains, such as the Dakar Rally and the Ultra4 Racing circuit. The driver can choose from four operating terrains, and the system automatically inflates or deflates the tires. Skilled drivers can manually select their desired pressure. ActivAir helps drivers to maximize traction and transfer all available power to the ground for an optimized off-road driving experience.

- In March 2023, SAF-HOLLAND SE completed its acquisition of Haldex AB in Sweden and now owns 100% of the firm. Haldex manufactures braking systems and air suspension solutions that improve commercial vehicle safety, performance, and longevity.

- In October 2022, Spicer Electrified eSP502 e-Transmission, a versatile platform created to support the electrification of vehicles across the construction, mining, material handling, and forestry markets, was introduced by Dana Incorporated.

- In 2021, John Deere(US) launched its 8R series tractor with home-built ATIS integrated into them as an option.

Frequently Asked Questions (FAQ):

What is the current size of the global ATIS market?

The global Automatic tire inflation system market is projected to grow from USD 82 Million in 2023 to USD 138 Million by 2028, at a CAGR of 10.7% during the forecast period.

Which type is currently leading the ATIS market?

Central Tire Inflation System type is leading in the ATIS market.

Many companies are operating in the ATIS market space across the globe. Do you know who the front leaders are and what strategies they have adopted?

The ATIS market is led by established players, such as The ATIS market is led by established players, such as Dana Incorporated (US), MICHELIN (France), IDEX Corporation (US), Enpro Industries (US), MERITOR (US), SAF-HOLLAND (Germany), and CLAAS (Germany). These companies adopted new product launches, acquisitions, and joint venture strategies to gain traction in the ATIS market.

How is the demand for the ATIS varies by region?

North America is estimated to be the largest market for ATIS during the forecast period. The growth of North America's Farm tractors and heavy-duty commercial trailers market is mainly attributed to the higher demand for ATIS.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increase in performance and fuel economy of vehicles- Favorable government regulations for tire inflationRESTRAINTS- Increasing demand for airless and nitrogen-inflated tiresOPPORTUNITIES- Rising integration of telematics in vehiclesCHALLENGES- High cost of automatic tire inflation systems

-

5.3 TRADE ANALYSISEXPORTS- China- Germany- US- CanadaIMPORTS- US- Canada- China- Germany

-

5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.5 CASE STUDIESCASE STUDY: CENTRAL TIRE INFLATION SYSTEM FOR OFF-HIGHWAY VEHICLESCASE STUDY: CENTRAL TIRE INFLATION SYSTEM FOR FARMING EQUIPMENTCASE STUDY: BOOSTING YIELDS, EFFICIENCY, AND TIRE LIFE WITH PUSH BUTTONSCASE STUDY: CTIS BEST CHOICE FOR OPERATORS TO CHECK TIRE INFLATION PRESSURE REGULARLYCASE STUDY: SUSTAINABILITY – WORKING TOWARDS A GREENER PLANETCASE STUDY: HUB GROUP LOOKS FOR PARTNER IN SAFETY AND SUSTAINABILITYCASE STUDY: HALO TIRE INFLATOR REVIEW – C&S HAULS PERISHABLE GOODS AND SEEKS PARTNER TO ASSIST IN CUTTING DOWNTIME

-

5.6 PATENT ANALYSIS

- 5.7 SUPPLY CHAIN ANALYSIS

-

5.8 AUTOMATIC TIRE INFLATION SYSTEM MARKET ECOSYSTEMATIS MANUFACTURERSRAW MATERIAL SUPPLIERSCOMPONENT MANUFACTURERSATIS SYSTEM SOFTWARE PROVIDERSATIS SYSTEM FLEET USERSATIS END USERS (OEMS)

-

5.9 REGULATORY ANALYSIS: AUTOMATIC TIRE INFLATION SYSTEM STANDARDSAUTOMATIC TIRE INFLATION SYSTEM STANDARDSREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS, BY REGION

-

5.10 AVERAGE SELLING PRICE (ASP) ANALYSISON-HIGHWAY VEHICLE ATISOFF-HIGHWAY VEHICLE ATIS

-

5.11 TECHNOLOGICAL TRENDSINTELLIGENT TIRESCONTACT AREA INFORMATION SENSINGTRACK TEMPERATURE MEASUREMENT SYSTEMSDEVELOPMENT IN ATIS

- 5.12 KEY CONFERENCES AND EVENTS IN 2023–2024

-

5.13 KEY STAKEHOLDERS AND BUYING CRITERIABUYING CRITERIA

-

6.1 INTRODUCTIONINDUSTRY INSIGHTS

-

6.2 CENTRAL TIRE INFLATION SYSTEMDEMAND FOR CENTRAL TIRE INFLATION SYSTEMS IN HEAVY-DUTY VEHICLES TO DRIVE MARKET

-

6.3 CONTINUOUS TIRE INFLATION SYSTEMNORTH AMERICA TO BE FASTEST-GROWING MARKET FOR CONTINUOUS TIRE INFLATION SYSTEMS

-

7.1 INTRODUCTIONINDUSTRY INSIGHTS

- 7.2 AIR DELIVERY SYSTEM

- 7.3 BUFFER TANK

- 7.4 COMPRESSOR

- 7.5 ECU

- 7.6 HOUSING

- 7.7 PRESSURE SENSOR

- 7.8 ROTARY UNION

-

8.1 INTRODUCTIONINDUSTRY INSIGHTS

-

8.2 LIGHT-DUTY VEHICLESINCREASING DEMAND FOR VEHICLE SAFETY AND FUEL EFFICIENCY TO DRIVE SEGMENT

-

8.3 HEAVY-DUTY VEHICLESINCREASING DEMAND FOR BETTER TIRE LIFE AND LESS DOWNTIME FOR COMMERCIAL VEHICLES TO DRIVE SEGMENT

-

9.1 INTRODUCTIONINDUSTRY INSIGHTS

-

9.2 AGRICULTURAL TRACTORSINCREASING DEMAND FOR CENTRAL TIRE INFLATION SYSTEMS IN HIGH HP TRACTORS TO DRIVE SEGMENT

-

9.3 CONSTRUCTION EQUIPMENTRISING DEMAND FOR LOADERS AND DUMP TRUCKS TO DRIVE SEGMENT

-

10.1 INTRODUCTIONINDUSTRY INSIGHTS

-

10.2 OEMINCREASED DEMAND FOR IN-BUILT AUTOMATIC TIRE INFLATION SYSTEMS TO DRIVE SEGMENT

-

10.3 AFTERMARKETAVAILABILITY OF LOW-COST AUTOMATIC TIRE INFLATION SYSTEMS TO DRIVE AFTERMARKET

-

11.1 INTRODUCTIONINDUSTRY INSIGHTS

-

11.2 CENTRAL TIRE INFLATION SYSTEMRISING DEMAND FOR CENTRAL TIRE INFLATION SYSTEMS IN HEAVY-DUTY VEHICLES TO DRIVE MARKET

-

11.3 CONTINUOUS TIRE INFLATION SYSTEMGROWING DEMAND FOR HIGH HP TRACTORS TO DRIVE MARKET

-

12.1 INTRODUCTIONINDUSTRY INSIGHTS

-

12.2 CENTRAL TIRE INFLATION SYSTEMDEMAND FOR CENTRAL TIRE INFLATION SYSTEMS IN HEAVY-DUTY VEHICLES TO DRIVE MARKET

-

12.3 CONTINUOUS TIRE INFLATION SYSTEMRISING DEMAND FOR FUEL EFFICIENCY, SAFETY, AND ENHANCED LOAD-CARRYING CAPACITY TO DRIVE MARKET

-

13.1 INTRODUCTIONINDUSTRY INSIGHTS

-

13.2 PLUG-IN HYBRID ELECTRIC BUSESDEMAND FOR BETTER FUEL ECONOMY AND INCREASED TIRE LIFE TO DRIVE SEGMENT

-

13.3 BATTERY ELECTRIC BUSESGROWING CHARGING INFRASTRUCTURE AND SUPPORTING POLICIES TO DRIVE SEGMENT

-

13.4 FUEL CELL ELECTRIC BUSESINCREASED SALES OF FUEL CELL ELECTRIC BUSES OWING TO BETTER FUEL ECONOMY TO DRIVE MARKET

-

14.1 INTRODUCTIONINDUSTRY INSIGHTS

-

14.2 PLUG-IN HYBRID ELECTRIC TRUCKSINCREASING CHARGING INFRASTRUCTURE AND GOVERNMENT INCENTIVES TO DRIVE MARKET

-

14.3 BATTERY ELECTRIC TRUCKSINCREASING DEMAND FOR ZERO-EMISSION VEHICLES TO DRIVE SEGMENT

-

14.4 FUEL CELL ELECTRIC TRUCKSINCREASING SALES OF FUEL CELL ELECTRIC TRUCKS OWING TO BETTER FUEL ECONOMY TO DRIVE MARKET

-

15.1 INTRODUCTIONINDUSTRY INSIGHTS

-

15.2 NORTH AMERICAUS- Increasing number of safety features in light-duty and heavy-duty vehicles to drive demand for automatic tire inflation systemsCANADA- Increasing construction activities to drive marketMEXICO- Increase in demand for trucks to boost demand for automatic tire inflation systems

-

15.3 EUROPEGERMANY- Adoption of ATIS in all vehicle types to grow at moderate rateFRANCE- Incorporation of premium features in on-highway and off-highway vehicles to drive marketUK- Rise in construction and agriculture activities to drive marketSPAIN- Heavy-duty vehicles to lead market in terms of valueRUSSIA- Rising demand for off-road vehicles to boost marketITALY- Rising production and sales of on-highway vehicles to drive demand for automatic tire inflation systemsREST OF EUROPE

-

15.4 ASIA PACIFICCHINA- Increasing production of passenger cars to drive marketJAPAN- Introduction of advanced technologies and demand for enhanced safety and comfort in passenger cars to drive marketSOUTH KOREA- Increasing demand for passenger cars to drive marketINDIA- Limited penetration of premium vehicles to affect market growthTHAILAND- High production of LCVs to drive marketINDONESIA- Favorable government policies to drive marketREST OF ASIA PACIFIC

-

15.5 REST OF THE WORLDBRAZIL- Increasing export of tractors to drive marketSOUTH AFRICA- Rising production and sales of heavy-duty vehicles to drive marketIRAN- Government support and presence of automotive OEMs to fuel market growthARGENTINA- Growing production of light commercial vehicles to increase demand for automatic tire inflation systemsOTHERS

- 16.1 OVERVIEW

- 16.2 AUTOMATIC TIRE INFLATION SYSTEM MARKET SHARE ANALYSIS, 2022

- 16.3 STRATEGIES ADOPTED BY KEY PLAYERS/RIGHT TO WIN, 2021–2023

- 16.4 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS

-

16.5 COMPANY EVALUATION QUADRANT: AUTOMATIC TIRE INFLATION SYSTEM SUPPLIERSSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSAUTOMATIC TIRE INFLATION SYSTEM COMPONENT SUPPLIERS: COMPETITIVE EVALUATION MATRIX, 2022

-

16.6 COMPETITIVE SCENARIONEW PRODUCT DEVELOPMENTSDEALS

- 16.7 COMPETITIVE BENCHMARKING

- 16.8 WHO SUPPLIES TO WHOM

-

17.1 KEY PLAYERSMERITOR- Business overview- Products offered- Recent developments- MnM viewMICHELIN- Business overview- Products offered- Recent developments- MnM viewENPRO INDUSTRIES- Business overview- Products offered- Recent developments- MnM viewGOODYEAR TIRE & RUBBER COMPANY- Business overview- Products offered- Recent developments- MnM viewDANA INCORPORATED- Business overview- Products offered- Recent developments- MnM viewSAF-HOLLAND- Business overview- Products offered- MnM viewIDEX CORPORATION- Business overview- Products offered- Recent developments- MnM viewTHE BOLER COMPANY- Business overview- Products offered- Recent developmentsAIRGO SYSTEMS- Business overview- Products offeredHALTEC CORPORATION- Business overview- Products offeredTI SYSTEMS- Business overview- Products offered- Deals- OthersCLAAS- Business overview- Products offered- Deals- Others

-

17.2 OTHER PLAYERSTIBUS OFFROADNEXTER SYSTEMSRAYTECH GROUPBIGFOOT EQUIPMENTAIR CTIPARKER HANNIFIN CORPORATIONPRESSURE SYSTEMS INTERNATIONALTRANS TECHNOLOGIES COMPANYVIGIAROTEX AUTOMATION

- 18.1 NORTH AMERICA TO DOMINATE AUTOMATIC TIRE INFLATION SYSTEM MARKET

- 18.2 CENTRAL TIRE INFLATION SYSTEM – KEY FOCUS AREA

- 18.3 CONCLUSION

- 19.1 INSIGHTS FROM INDUSTRY EXPERTS

- 19.2 DISCUSSION GUIDE

- 19.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

-

19.4 CUSTOMIZATION OPTIONSAUTOMATIC TIRE INFLATION SYSTEM MARKET, BY COUNTRY- Asia Pacific- Europe- North America- Rest of the WorldAUTOMATIC TIRE INFLATION SYSTEM MARKET FOR TRAILERS, BY REGION- Asia Pacific- Europe- North America- Rest of the WorldDETAILED ANALYSIS AND PROFILING OF ADDITIONAL MARKET PLAYERS (UP TO 3)

- 19.5 RELATED REPORTS

- 19.6 AUTHOR DETAILS

- TABLE 1 ASSUMPTIONS

- TABLE 2 ADVANTAGES OF ATIS ON DIFFERENT DRIVING SURFACES

- TABLE 3 VEHICLE TYPES AND FEATURES

- TABLE 4 TIRE INFLATION PROPERTIES

- TABLE 5 TIRE INFLATION PRESSURE AND LIFE OF TIRE

- TABLE 6 CHINA: EXPORT DATA, BY VALUE, 2018–2022 (%)

- TABLE 7 GERMANY: EXPORT DATA, BY VALUE, 2018–2022 (%)

- TABLE 8 US: EXPORT DATA, BY VALUE, 2018–2022 (%)

- TABLE 9 CANADA: EXPORT DATA, BY VALUE, 2018–2022 (%)

- TABLE 10 US: IMPORT DATA, BY VALUE, 2018–2022 (%)

- TABLE 11 CANADA: IMPORT DATA, BY VALUE, 2018–2022 (%)

- TABLE 12 CHINA: IMPORT DATA, BY VALUE, 2018–2022 (%)

- TABLE 13 GERMANY: IMPORT DATA, BY VALUE, 2018–2022 (%)

- TABLE 14 ROLE OF COMPANIES IN AUTOMATIC TIRE INFLATION SYSTEM MARKET ECOSYSTEM

- TABLE 15 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ON-HIGHWAY VEHICLE ATIS - AVERAGE REGIONAL PRICE TREND

- TABLE 19 OFF-HIGHWAY VEHICLE ATIS - AVERAGE REGIONAL PRICE TREND

- TABLE 20 AUTOMATIC TIRE INFLATION SYSTEM MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- TABLE 21 KEY BUYING CRITERIA FOR TOP FOUR AUTOMATIC TIRE INFLATION SYSTEM APPLICATIONS

- TABLE 22 AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY TYPE, 2018–2022 (‘000 UNITS)

- TABLE 23 AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY TYPE, 2023–2028 (‘000 UNITS)

- TABLE 24 AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 25 AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 26 CENTRAL TIRE INFLATION SYSTEM MARKET, BY REGION, 2018–2022 ('000 UNITS)

- TABLE 27 CENTRAL TIRE INFLATION SYSTEM MARKET, BY REGION, 2023–2028 ('000 UNITS)

- TABLE 28 CENTRAL TIRE INFLATION SYSTEM MARKET, BY REGION, 2018–2022 (USD MILLION))

- TABLE 29 CENTRAL TIRE INFLATION SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 30 CONTINUOUS TIRE INFLATION SYSTEM MARKET, BY REGION, 2018–2022 ('000 UNITS)

- TABLE 31 CONTINUOUS TIRE INFLATION SYSTEM MARKET, BY REGION, 2023–2028 ('000 UNITS)

- TABLE 32 CONTINUOUS TIRE INFLATION SYSTEM MARKET, BY REGION, 2018–2022 (USD MILLION))

- TABLE 33 CONTINUOUS TIRE INFLATION SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 34 AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY COMPONENT, 2018–2022 ('000 UNITS)

- TABLE 35 AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY COMPONENT, 2023–2028 ('000 UNITS)

- TABLE 36 AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 37 AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 38 AIR DELIVERY SYSTEM: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY REGION, 2018–2022 ('000 UNITS)

- TABLE 39 AIR DELIVERY SYSTEM: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY REGION, 2023–2028 ('000 UNITS)

- TABLE 40 AIR DELIVERY SYSTEM: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 41 AIR DELIVERY SYSTEM: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 42 BUFFER TANK: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY REGION, 2018–2022 ('000 UNITS)

- TABLE 43 BUFFER TANK: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY REGION, 2023–2028 ('000 UNITS)

- TABLE 44 BUFFER TANK: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 45 BUFFER TANK: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 46 COMPRESSOR: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY REGION, 2018–2022 ('000 UNITS)

- TABLE 47 COMPRESSOR: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY REGION, 2023–2028 ('000 UNITS)

- TABLE 48 COMPRESSOR: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 49 COMPRESSOR: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 50 ECU: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY REGION, 2018–2022 ('000 UNITS)

- TABLE 51 ECU: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY REGION, 2023–2028 ('000 UNITS)

- TABLE 52 ECU: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 53 ECU: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 54 HOUSING: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY REGION, 2018–2022 ('000 UNITS)

- TABLE 55 HOUSING: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY REGION, 2023–2028 ('000 UNITS)

- TABLE 56 HOUSING: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 57 HOUSING: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 58 PRESSURE SENSOR: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY REGION, 2018–2022 ('000 UNITS)

- TABLE 59 PRESSURE SENSOR: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY REGION, 2023–2028 ('000 UNITS)

- TABLE 60 PRESSURE SENSOR: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 61 PRESSURE SENSOR: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 62 ROTARY UNION: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY REGION, 2018–2022 ('000 UNITS)

- TABLE 63 ROTARY UNION: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY REGION, 2023–2028 ('000 UNITS)

- TABLE 64 ROTARY UNION: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 65 ROTARY UNION: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 66 AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2018–2022 (‘000 UNITS)

- TABLE 67 AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2023–2028 (‘000 UNITS)

- TABLE 68 AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2018–2022 (USD MILLION)

- TABLE 69 AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLES 2023–2028 (USD MILLION)

- TABLE 70 LIGHT-DUTY VEHICLES: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY REGION, 2018–2022 ('000 UNITS)

- TABLE 71 LIGHT-DUTY VEHICLES: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY REGION, 2023–2028 ('000 UNITS)

- TABLE 72 LIGHT-DUTY VEHICLES: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY REGION, 2018–2022 (USD MILLION))

- TABLE 73 LIGHT-DUTY VEHICLES: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 74 HEAVY-DUTY VEHICLES: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY REGION, 2018–2022 ('000 UNITS)

- TABLE 75 HEAVY-DUTY VEHICLES: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY REGION, 2023–2028 ('000 UNITS)

- TABLE 76 HEAVY-DUTY VEHICLES: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY REGION, 2018–2022 (USD MILLION))

- TABLE 77 HEAVY-DUTY VEHICLES: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 78 AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2018–2022 (‘000 UNITS)

- TABLE 79 AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2023–2028 (‘000 UNITS)

- TABLE 80 AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2018–2022 (USD MILLION)

- TABLE 81 AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2023–2028 (USD MILLION)

- TABLE 82 AGRICULTURAL TRACTORS: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY REGION, 2018–2022 ('000 UNITS)

- TABLE 83 AGRICULTURAL TRACTORS: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY REGION, 2023–2028 ('000 UNITS)

- TABLE 84 AGRICULTURAL TRACTORS: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 85 AGRICULTURAL TRACTORS: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 86 CONSTRUCTION EQUIPMENT: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY REGION, 2018–2022 ('000 UNITS)

- TABLE 87 CONSTRUCTION EQUIPMENT: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY REGION, 2023–2028 ('000 UNITS)

- TABLE 88 CONSTRUCTION EQUIPMENT: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY REGION, 2018–2022 (USD MILLION))

- TABLE 89 CONSTRUCTION EQUIPMENT: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 90 AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY SALES CHANNEL, 2018–2022 (USD MILLION)

- TABLE 91 AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY SALES CHANNEL, 2023–2028 (USD MILLION)

- TABLE 92 OEM: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 93 OEM: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 94 AFTERMARKET: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 95 AFTERMARKET: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 96 AUTOMATIC TIRE INFLATION SYSTEM MARKET FOR AGRICULTURAL TRACTORS, BY TYPE, 2018–2022 (‘000 UNITS)

- TABLE 97 AUTOMATIC TIRE INFLATION SYSTEM MARKET FOR AGRICULTURAL TRACTORS, BY TYPE, 2023–2028 (‘000 UNITS)

- TABLE 98 AUTOMATIC TIRE INFLATION SYSTEM MARKET FOR AGRICULTURAL TRACTORS, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 99 AUTOMATIC TIRE INFLATION SYSTEM MARKET FOR AGRICULTURAL TRACTORS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 100 AGRICULTURAL TRACTORS: CENTRAL TIRE INFLATION SYSTEM MARKET, BY REGION, 2018–2022 ('000 UNITS)

- TABLE 101 AGRICULTURAL TRACTORS: CENTRAL TIRE INFLATION SYSTEM MARKET, BY REGION, 2023–2028 ('000 UNITS)

- TABLE 102 AGRICULTURAL TRACTORS: CENTRAL TIRE INFLATION SYSTEM MARKET, BY REGION, 2018–2022 (USD MILLION))

- TABLE 103 AGRICULTURAL TRACTORS: CENTRAL TIRE INFLATION SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 104 AGRICULTURAL TRACTORS: CONTINUOUS TIRE INFLATION SYSTEM MARKET, BY REGION, 2018–2022 ('000 UNITS)

- TABLE 105 AGRICULTURAL TRACTORS: CONTINUOUS TIRE INFLATION SYSTEM MARKET, BY REGION, 2023–2028 ('000 UNITS)

- TABLE 106 AGRICULTURAL TRACTORS: CONTINUOUS TIRE INFLATION SYSTEM MARKET, BY REGION, 2018–2022 (USD MILLION))

- TABLE 107 AGRICULTURAL TRACTORS: CONTINUOUS TIRE INFLATION SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 108 AUTOMATIC TIRE INFLATION SYSTEM MARKET FOR CONSTRUCTION EQUIPMENT, BY TYPE, 2018–2022 (‘000 UNITS)

- TABLE 109 AUTOMATIC TIRE INFLATION SYSTEM MARKET FOR CONSTRUCTION EQUIPMENT, BY TYPE, 2023–2028 (‘000 UNITS)

- TABLE 110 AUTOMATIC TIRE INFLATION SYSTEM MARKET FOR CONSTRUCTION EQUIPMENT, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 111 AUTOMATIC TIRE INFLATION SYSTEM MARKET FOR CONSTRUCTION EQUIPMENT, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 112 CONSTRUCTION EQUIPMENT: CENTRAL TIRE INFLATION SYSTEM MARKET, BY REGION, 2018–2022 ('000 UNITS)

- TABLE 113 CONSTRUCTION EQUIPMENT: CENTRAL TIRE INFLATION SYSTEM MARKET, BY REGION, 2023–2028 ('000 UNITS)

- TABLE 114 CONSTRUCTION EQUIPMENT: CENTRAL TIRE INFLATION SYSTEM MARKET, BY REGION, 2018–2022 (USD MILLION))

- TABLE 115 CONSTRUCTION EQUIPMENT: CENTRAL TIRE INFLATION SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 116 CONSTRUCTION EQUIPMENT: CONTINUOUS TIRE INFLATION SYSTEM MARKET, BY REGION, 2018–2022 ('000 UNITS)

- TABLE 117 CONSTRUCTION EQUIPMENT: CONTINUOUS TIRE INFLATION SYSTEM MARKET, BY REGION, 2023–2028 ('000 UNITS)

- TABLE 118 CONSTRUCTION EQUIPMENT: CONTINUOUS TIRE INFLATION SYSTEM MARKET, BY REGION, 2018–2022 (USD MILLION))

- TABLE 119 CONSTRUCTION EQUIPMENT: CONTINUOUS TIRE INFLATION SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 120 AUTOMATIC TIRE INFLATION SYSTEM MARKET FOR ELECTRIC BUSES, BY PROPULSION TYPE, 2023–2028 (UNITS)

- TABLE 121 AUTOMATIC TIRE INFLATION SYSTEM MARKET FOR ELECTRIC BUSES, BY PROPULSION TYPE, 2023–2028 (USD)

- TABLE 122 PLUG-IN HYBRID ELECTRIC BUSES: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY REGION, 2023–2028 (UNITS)

- TABLE 123 PLUG-IN HYBRID ELECTRIC BUSES: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY REGION, 2023–2028 (USD)

- TABLE 124 BATTERY ELECTRIC BUSES: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY REGION, 2023–2028 (UNITS)

- TABLE 125 BATTERY ELECTRIC BUSES: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY REGION, 2023–2028 (USD)

- TABLE 126 FUEL CELL ELECTRIC BUSES: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY REGION, 2023–2028 (UNITS)

- TABLE 127 FUEL CELL ELECTRIC BUSES: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY REGION, 2023–2028 (USD)

- TABLE 128 AUTOMATIC TIRE INFLATION SYSTEM MARKET FOR ELECTRIC TRUCKS, BY PROPULSION TYPE, 2023–2028 (UNITS)

- TABLE 129 AUTOMATIC TIRE INFLATION SYSTEM MARKET FOR ELECTRIC TRUCKS, BY PROPULSION TYPE, 2023–2028 (USD)

- TABLE 130 PLUG-IN HYBRID ELECTRIC TRUCKS: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY REGION, 2023–2028 (UNITS)

- TABLE 131 PLUG-IN HYBRID ELECTRIC TRUCKS: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY REGION, 2023–2028 (USD)

- TABLE 132 BATTERY ELECTRIC TRUCKS: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY REGION, 2023–2028 (UNITS)

- TABLE 133 BATTERY ELECTRIC TRUCKS: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY REGION, 2023–2028 (USD)

- TABLE 134 FUEL CELL ELECTRIC TRUCKS: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY REGION, 2023–2028 (UNITS)

- TABLE 135 FUEL CELL ELECTRIC TRUCKS: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY REGION, 2023–2028 (USD)

- TABLE 136 AUTOMATIC TIRE INFLATION SYSTEM MARKET FOR ON-HIGHWAY VEHICLES, BY REGION, 2018–2022 (‘000 UNITS)

- TABLE 137 AUTOMATIC TIRE INFLATION SYSTEM MARKET FOR ON-HIGHWAY VEHICLES, BY REGION, 2023–2028 (‘000 UNITS)

- TABLE 138 AUTOMATIC TIRE INFLATION SYSTEM MARKET FOR ON-HIGHWAY VEHICLES, BY REGION, 2018–2022 (USD MILLION)

- TABLE 139 AUTOMATIC TIRE INFLATION SYSTEM MARKET FOR ON-HIGHWAY VEHICLES, BY REGION, 2023–2028 (USD MILLION)

- TABLE 140 AUTOMATIC TIRE INFLATION SYSTEM MARKET FOR OFF-HIGHWAY VEHICLES, BY REGION, 2018–2022 (‘000 UNITS)

- TABLE 141 AUTOMATIC TIRE INFLATION SYSTEM MARKET FOR OFF-HIGHWAY VEHICLES, BY REGION, 2023–2028 (‘000 UNITS)

- TABLE 142 AUTOMATIC TIRE INFLATION SYSTEM MARKET FOR OFF-HIGHWAY VEHICLES, BY REGION, 2018–2022 (USD MILLION)

- TABLE 143 AUTOMATIC TIRE INFLATION SYSTEM MARKET FOR OFF-HIGHWAY VEHICLES, BY REGION, 2023–2028 (USD MILLION)

- TABLE 144 NORTH AMERICA: AUTOMATIC TIRE INFLATION SYSTEM MARKET FOR ON-HIGHWAY VEHICLES, BY COUNTRY, 2018–2022 (‘000 UNITS)

- TABLE 145 NORTH AMERICA: AUTOMATIC TIRE INFLATION SYSTEM MARKET FOR ON-HIGHWAY VEHICLES, BY COUNTRY, 2023–2028 (‘000 UNITS)

- TABLE 146 NORTH AMERICA: AUTOMATIC TIRE INFLATION SYSTEM MARKET FOR ON-HIGHWAY VEHICLES, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 147 NORTH AMERICA: AUTOMATIC TIRE INFLATION SYSTEM MARKET FOR ON-HIGHWAY VEHICLES, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 148 NORTH AMERICA: AUTOMATIC TIRE INFLATION SYSTEM MARKET FOR OFF-HIGHWAY VEHICLES, BY COUNTRY, 2018–2022 (‘000 UNITS)

- TABLE 149 NORTH AMERICA: AUTOMATIC TIRE INFLATION SYSTEM MARKET FOR OFF-HIGHWAY VEHICLES, BY COUNTRY, 2023–2028 (‘000 UNITS)

- TABLE 150 NORTH AMERICA: AUTOMATIC TIRE INFLATION SYSTEM MARKET FOR OFF-HIGHWAY VEHICLES, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 151 NORTH AMERICA: AUTOMATIC TIRE INFLATION SYSTEM MARKET FOR OFF-HIGHWAY VEHICLES, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 152 US: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2018–2022 (‘000 UNITS)

- TABLE 153 US: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2023–2028 (‘000 UNITS)

- TABLE 154 US: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2018–2022 (USD MILLION)

- TABLE 155 US: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2023–2028 (USD MILLION)

- TABLE 156 US: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2018–2022 (‘000 UNITS)

- TABLE 157 US: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2023–2028 (‘000 UNITS)

- TABLE 158 US: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2018–2022 (USD MILLION)

- TABLE 159 US: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2023–2028 (USD MILLION)

- TABLE 160 CANADA: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2018–2022 (‘000 UNITS)

- TABLE 161 CANADA: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2023–2028 (‘000 UNITS)

- TABLE 162 CANADA: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2018–2022 (USD MILLION)

- TABLE 163 CANADA: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2023–2028 (USD MILLION)

- TABLE 164 CANADA: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2018–2022 (‘000 UNITS)

- TABLE 165 CANADA: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2023–2028 (‘000 UNITS)

- TABLE 166 CANADA: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2018–2022 (USD MILLION)

- TABLE 167 CANADA: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2023–2028 (USD MILLION)

- TABLE 168 MEXICO: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2018–2022 (‘000 UNITS)

- TABLE 169 MEXICO: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2023–2028 (‘000 UNITS)

- TABLE 170 MEXICO: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2018–2022 (USD MILLION)

- TABLE 171 MEXICO: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2023–2028 (USD MILLION)

- TABLE 172 MEXICO: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2018–2022 (‘000 UNITS)

- TABLE 173 MEXICO: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2023–2028 (‘000 UNITS)

- TABLE 174 MEXICO: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2018–2022 (USD MILLION)

- TABLE 175 MEXICO: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2023–2028 (USD MILLION)

- TABLE 176 EUROPE: AUTOMATIC TIRE INFLATION SYSTEM MARKET FOR ON-HIGHWAY VEHICLES, BY COUNTRY, 2018–2022 (‘000 UNITS)

- TABLE 177 EUROPE: AUTOMATIC TIRE INFLATION SYSTEM MARKET FOR ON-HIGHWAY VEHICLES, BY COUNTRY, 2023–2028 (‘000 UNITS)

- TABLE 178 EUROPE: AUTOMATIC TIRE INFLATION SYSTEM MARKET FOR ON-HIGHWAY VEHICLES, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 179 EUROPE: AUTOMATIC TIRE INFLATION SYSTEM MARKET FOR ON-HIGHWAY VEHICLES, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 180 EUROPE: AUTOMATIC TIRE INFLATION SYSTEM MARKET FOR OFF-HIGHWAY VEHICLES, BY COUNTRY, 2018–2022 (‘000 UNITS)

- TABLE 181 EUROPE: AUTOMATIC TIRE INFLATION SYSTEM MARKET FOR OFF-HIGHWAY VEHICLES, BY COUNTRY, 2023–2028 (‘000 UNITS)

- TABLE 182 EUROPE: AUTOMATIC TIRE INFLATION SYSTEM MARKET FOR OFF-HIGHWAY VEHICLES, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 183 EUROPE: AUTOMATIC TIRE INFLATION SYSTEM MARKET FOR OFF-HIGHWAY VEHICLES, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 184 GERMANY: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2018–2022 (‘000 UNITS)

- TABLE 185 GERMANY: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2023–2028 (‘000 UNITS)

- TABLE 186 GERMANY: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2018–2022 (USD MILLION)

- TABLE 187 GERMANY: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2023–2028 (USD MILLION)

- TABLE 188 GERMANY: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2018–2022 (‘000 UNITS)

- TABLE 189 GERMANY: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2023–2028 (‘000 UNITS)

- TABLE 190 GERMANY: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2018–2022 (USD MILLION)

- TABLE 191 GERMANY: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2023–2028 (USD MILLION)

- TABLE 192 FRANCE: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2018–2022 (‘000 UNITS)

- TABLE 193 FRANCE: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2023–2028 (‘000 UNITS)

- TABLE 194 FRANCE: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2018–2022 (USD MILLION)

- TABLE 195 FRANCE: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2023–2028 (USD MILLION)

- TABLE 196 FRANCE: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2018–2022 (‘000 UNITS)

- TABLE 197 FRANCE: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2023–2028 (‘000 UNITS)

- TABLE 198 FRANCE: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2018–2022 (USD MILLION)

- TABLE 199 FRANCE: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2023–2028 (USD MILLION)

- TABLE 200 UK: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2018–2022 (‘000 UNITS)

- TABLE 201 UK: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2023–2028 (‘000 UNITS)

- TABLE 202 UK: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2018–2022 (USD MILLION)

- TABLE 203 UK: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2023–2028 (USD MILLION)

- TABLE 204 UK: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2018–2022 (‘000 UNITS)

- TABLE 205 UK: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2023–2028 (‘000 UNITS)

- TABLE 206 UK: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2018–2022 (USD MILLION)

- TABLE 207 UK: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2023–2028 (USD MILLION)

- TABLE 208 SPAIN: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2018–2022 (‘000 UNITS)

- TABLE 209 SPAIN: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2023–2028 (‘000 UNITS)

- TABLE 210 SPAIN: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2018–2022 (USD MILLION)

- TABLE 211 SPAIN: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2023–2028 (USD MILLION)

- TABLE 212 SPAIN: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2018–2022 (‘000 UNITS)

- TABLE 213 SPAIN: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2023–2028 (‘000 UNITS)

- TABLE 214 SPAIN: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2018–2022 (USD MILLION)

- TABLE 215 SPAIN: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2023–2028 (USD MILLION)

- TABLE 216 RUSSIA: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2018–2022 (‘000 UNITS)

- TABLE 217 RUSSIA: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2023–2028 (‘000 UNITS)

- TABLE 218 RUSSIA: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2018–2022 (USD MILLION)

- TABLE 219 RUSSIA: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2023–2028 (USD MILLION)

- TABLE 220 RUSSIA: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2018–2022 (‘000 UNITS)

- TABLE 221 RUSSIA: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2023–2028 (‘000 UNITS)

- TABLE 222 RUSSIA: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2018–2022 (USD MILLION)

- TABLE 223 RUSSIA: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2023–2028 (USD MILLION)

- TABLE 224 ITALY: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2018–2022 (‘000 UNITS)

- TABLE 225 ITALY: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2023–2028 (‘000 UNITS)

- TABLE 226 ITALY: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2018–2022 (USD MILLION)

- TABLE 227 ITALY: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2023–2028 (USD MILLION)

- TABLE 228 ITALY: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2018–2022 (‘000 UNITS)

- TABLE 229 ITALY: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2023–2028 (‘000 UNITS)

- TABLE 230 ITALY: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2018–2022 (USD MILLION)

- TABLE 231 ITALY: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2023–2028 (USD MILLION)

- TABLE 232 REST OF EUROPE: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2018–2022 (‘000 UNITS)

- TABLE 233 REST OF EUROPE: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2023–2028 (‘000 UNITS)

- TABLE 234 REST OF EUROPE: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2018–2022 (USD MILLION)

- TABLE 235 REST OF EUROPE: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2023–2028 (USD MILLION)

- TABLE 236 REST OF EUROPE: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2018–2022 (‘000 UNITS)

- TABLE 237 REST OF EUROPE: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2023–2028 (‘000 UNITS)

- TABLE 238 REST OF EUROPE: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2018–2022 (USD MILLION)

- TABLE 239 REST OF EUROPE: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2023–2028 (USD MILLION)

- TABLE 240 ASIA PACIFIC: AUTOMATIC TIRE INFLATION SYSTEM MARKET FOR ON-HIGHWAY VEHICLES, BY COUNTRY, 2018–2022 (‘000 UNITS)

- TABLE 241 ASIA PACIFIC: AUTOMATIC TIRE INFLATION SYSTEM MARKET FOR ON-HIGHWAY VEHICLES, BY COUNTRY, 2023–2028 (‘000 UNITS)

- TABLE 242 ASIA PACIFIC: AUTOMATIC TIRE INFLATION SYSTEM MARKET FOR ON-HIGHWAY VEHICLES, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 243 ASIA PACIFIC: AUTOMATIC TIRE INFLATION SYSTEM MARKET FOR ON-HIGHWAY VEHICLES, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 244 ASIA PACIFIC: AUTOMATIC TIRE INFLATION SYSTEM MARKET FOR OFF-HIGHWAY VEHICLES, BY COUNTRY, 2018–2022 (‘000 UNITS)

- TABLE 245 ASIA PACIFIC: AUTOMATIC TIRE INFLATION SYSTEM MARKET FOR OFF-HIGHWAY VEHICLES, BY COUNTRY, 2023–2028 (‘000 UNITS)

- TABLE 246 ASIA PACIFIC: AUTOMATIC TIRE INFLATION SYSTEM MARKET FOR OFF-HIGHWAY VEHICLES, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 247 ASIA PACIFIC: AUTOMATIC TIRE INFLATION SYSTEM MARKET FOR OFF-HIGHWAY VEHICLES, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 248 CHINA: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2018–2022 (‘000 UNITS)

- TABLE 249 CHINA: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2023–2028 (‘000 UNITS)

- TABLE 250 CHINA: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2018–2022 (USD MILLION)

- TABLE 251 CHINA: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2023–2028 (USD MILLION)

- TABLE 252 CHINA: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2018–2022 (‘000 UNITS)

- TABLE 253 CHINA: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2023–2028 (‘000 UNITS)

- TABLE 254 CHINA: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2018–2022 (USD MILLION)

- TABLE 255 CHINA: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2023–2028 (USD MILLION)

- TABLE 256 JAPAN: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2018–2022 (‘000 UNITS)

- TABLE 257 JAPAN: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2023–2028 (‘000 UNITS)

- TABLE 258 JAPAN: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2018–2022 (USD MILLION)

- TABLE 259 JAPAN: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2023–2028 (USD MILLION)

- TABLE 260 JAPAN: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2018–2022 (‘000 UNITS)

- TABLE 261 JAPAN: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2023–2028 (‘000 UNITS)

- TABLE 262 JAPAN: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2018–2022 (USD MILLION)

- TABLE 263 JAPAN: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2023–2028 (USD MILLION)

- TABLE 264 SOUTH KOREA: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2018–2022 (‘000 UNITS)

- TABLE 265 SOUTH KOREA: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2023–2028 (‘000 UNITS)

- TABLE 266 SOUTH KOREA: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2018–2022 (USD MILLION)

- TABLE 267 SOUTH KOREA: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2023–2028 (USD MILLION)

- TABLE 268 SOUTH KOREA: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2018–2022 (‘000 UNITS)

- TABLE 269 SOUTH KOREA: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2023–2028 (‘000 UNITS)

- TABLE 270 SOUTH KOREA: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2018–2022 (USD MILLION)

- TABLE 271 SOUTH KOREA: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2023–2028 (USD MILLION)

- TABLE 272 INDIA: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2018–2022 (‘000 UNITS)

- TABLE 273 INDIA: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2023–2028 (‘000 UNITS)

- TABLE 274 INDIA: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2018–2022 (USD MILLION)

- TABLE 275 INDIA: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2023–2028 (USD MILLION)

- TABLE 276 INDIA: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2018–2022 (‘000 UNITS)

- TABLE 277 INDIA: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2023–2028 (‘000 UNITS)

- TABLE 278 INDIA: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2018–2022 (USD MILLION)

- TABLE 279 INDIA: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2023–2028 (USD MILLION)

- TABLE 280 THAILAND: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2018–2022 (‘000 UNITS)

- TABLE 281 THAILAND: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2023–2028 (‘000 UNITS)

- TABLE 282 THAILAND: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2018–2022 (USD MILLION)

- TABLE 283 THAILAND: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2023–2028 (USD MILLION)

- TABLE 284 THAILAND: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2018–2022 (‘000 UNITS)

- TABLE 285 THAILAND: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2023–2028 (‘000 UNITS)

- TABLE 286 THAILAND: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2018–2022 (USD MILLION)

- TABLE 287 THAILAND: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2023–2028 (USD MILLION)

- TABLE 288 INDONESIA: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2018–2022 (‘000 UNITS)

- TABLE 289 INDONESIA: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2023–2028 (‘000 UNITS)

- TABLE 290 INDONESIA: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2018–2022 (USD MILLION)

- TABLE 291 INDONESIA: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2023–2028 (USD MILLION)

- TABLE 292 INDONESIA: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2018–2022 (‘000 UNITS)

- TABLE 293 INDONESIA: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2023–2028 (‘000 UNITS)

- TABLE 294 INDONESIA: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2018–2022 (USD MILLION)

- TABLE 295 INDONESIA: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2023–2028 (USD MILLION)

- TABLE 296 REST OF ASIA PACIFIC: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2018–2022 (‘000 UNITS)

- TABLE 297 REST OF ASIA PACIFIC: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2023–2028 (‘000 UNITS)

- TABLE 298 REST OF ASIA PACIFIC: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2018–2022 (USD MILLION)

- TABLE 299 REST OF ASIA PACIFIC: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2023–2028 (USD MILLION)

- TABLE 300 REST OF ASIA PACIFIC: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2018–2022 (‘000 UNITS)

- TABLE 301 REST OF ASIA PACIFIC: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2023–2028 (‘000 UNITS)

- TABLE 302 REST OF ASIA PACIFIC: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2018–2022 (USD MILLION)

- TABLE 303 REST OF ASIA PACIFIC: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2023–2028 (USD MILLION)

- TABLE 304 REST OF THE WORLD: AUTOMATIC TIRE INFLATION SYSTEM MARKET FOR ON-HIGHWAY VEHICLES, BY COUNTRY, 2018–2022 (‘000 UNITS)

- TABLE 305 REST OF THE WORLD: AUTOMATIC TIRE INFLATION SYSTEM MARKET FOR ON-HIGHWAY VEHICLES, BY COUNTRY, 2023–2028 (‘000 UNITS)

- TABLE 306 REST OF THE WORLD: AUTOMATIC TIRE INFLATION SYSTEM MARKET FOR ON-HIGHWAY VEHICLES, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 307 REST OF THE WORLD: AUTOMATIC TIRE INFLATION SYSTEM MARKET FOR ON-HIGHWAY VEHICLES, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 308 REST OF THE WORLD: AUTOMATIC TIRE INFLATION SYSTEM MARKET FOR OFF-HIGHWAY VEHICLES, BY COUNTRY, 2018–2022 (‘000 UNITS)

- TABLE 309 REST OF THE WORLD: AUTOMATIC TIRE INFLATION SYSTEM MARKET FOR OFF-HIGHWAY VEHICLES, BY COUNTRY, 2023–2028 (‘000 UNITS)

- TABLE 310 REST OF THE WORLD: AUTOMATIC TIRE INFLATION SYSTEM MARKET FOR OFF-HIGHWAY VEHICLES, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 311 REST OF THE WORLD: AUTOMATIC TIRE INFLATION SYSTEM MARKET FOR OFF-HIGHWAY VEHICLES, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 312 BRAZIL: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2018–2022 (‘000 UNITS)

- TABLE 313 BRAZIL: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2023–2028 (‘000 UNITS)

- TABLE 314 BRAZIL: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2018–2022 (USD MILLION)

- TABLE 315 BRAZIL: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2023–2028 (USD MILLION)

- TABLE 316 BRAZIL: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2018–2022 (‘000 UNITS)

- TABLE 317 BRAZIL: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2023–2028 (‘000 UNITS)

- TABLE 318 BRAZIL: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2018–2022 (USD MILLION)

- TABLE 319 BRAZIL: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2023–2028 (USD MILLION)

- TABLE 320 SOUTH AFRICA: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2018–2022 (‘000 UNITS)

- TABLE 321 SOUTH AFRICA: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2023–2028 (‘000 UNITS)

- TABLE 322 SOUTH AFRICA: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2018–2022 (USD MILLION)

- TABLE 323 SOUTH AFRICA: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2023–2028 (USD MILLION)

- TABLE 324 IRAN: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2018–2022 (‘000 UNITS)

- TABLE 325 IRAN: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2023–2028 (‘000 UNITS)

- TABLE 326 IRAN: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2018–2022 (USD MILLION)

- TABLE 327 IRAN: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2023–2028 (USD MILLION)

- TABLE 328 ARGENTINA: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2018–2022 (‘000 UNITS)

- TABLE 329 ARGENTINA: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2023–2028 (‘000 UNITS)

- TABLE 330 ARGENTINA: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2018–2022 (USD MILLION)

- TABLE 331 ARGENTINA: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2023–2028 (USD MILLION)

- TABLE 332 OTHERS: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2018–2022 (‘000 UNITS)

- TABLE 333 OTHERS: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2023–2028 (‘000 UNITS)

- TABLE 334 OTHERS: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2018–2022 (USD MILLION)

- TABLE 335 OTHERS: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2023–2028 (USD MILLION)

- TABLE 336 OTHERS: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2018–2022 (‘000 UNITS)

- TABLE 337 OTHERS: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2023–2028 (‘000 UNITS)

- TABLE 338 OTHERS: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2018–2022 (USD MILLION)

- TABLE 339 OTHERS: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2023–2028 (USD MILLION)

- TABLE 340 AUTOMATIC TIRE INFLATION SYSTEM MARKET SHARE ANALYSIS, 2022

- TABLE 341 COMPANIES ADOPTED NEW PRODUCT DEVELOPMENTS, PARTNERSHIPS, AND SUPPLY CONTRACTS AS KEY GROWTH STRATEGIES FROM 2021 TO 2023

- TABLE 342 AUTOMATIC TIRE INFLATION SYSTEM MARKET: COMPANY PRODUCT FOOTPRINT, 2022

- TABLE 343 AUTOMATIC TIRE INFLATION SYSTEM MARKET: APPLICATION FOOTPRINT, 2022

- TABLE 344 AUTOMATIC TIRE INFLATION SYSTEM MARKET: COMPANY REGION FOOTPRINT, 2022

- TABLE 345 NEW PRODUCT DEVELOPMENTS, 2021–2023

- TABLE 346 DEALS, 2021–2023

- TABLE 347 AUTOMATIC TIRE INFLATION SYSTEM MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 348 AUTOMATIC TIRE INFLATION SYSTEM MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [STARTUPS/SMES]

- TABLE 349 WHO SUPPLIES TO WHOM: AUTOMATIC TIRE INFLATION SYSTEM MANUFACTURERS TO AUTOMOTIVE OEMS

- TABLE 350 MERITOR: BUSINESS OVERVIEW

- TABLE 351 MERITOR: PRODUCTS OFFERED

- TABLE 352 MERITOR: DEALS

- TABLE 353 MICHELIN: BUSINESS OVERVIEW

- TABLE 354 MICHELIN: PRODUCTS OFFERED

- TABLE 355 MICHELIN: NEW PRODUCT DEVELOPMENTS

- TABLE 356 MICHELIN: DEALS

- TABLE 357 ENPRO INDUSTRIES: BUSINESS OVERVIEW

- TABLE 358 ENPRO INDUSTRIES: PRODUCTS OFFERED

- TABLE 359 ENPRO INDUSTRIES: NEW PRODUCT DEVELOPMENTS

- TABLE 360 GOODYEAR TIRE & RUBBER COMPANY: BUSINESS OVERVIEW

- TABLE 361 GOODYEAR TIRE & RUBBER COMPANY: PRODUCTS OFFERED

- TABLE 362 DANA INCORPORATED: BUSINESS OVERVIEW

- TABLE 363 DANA INCORPORATED: PRODUCTS OFFERED

- TABLE 364 DANA INCORPORATED: NEW PRODUCT DEVELOPMENTS

- TABLE 365 DANA INCORPORATED: DEALS

- TABLE 366 ENPRO INDUSTRIES: OTHERS

- TABLE 367 SAF-HOLLAND: BUSINESS OVERVIEW

- TABLE 368 SAF-HOLLAND: PRODUCTS OFFERED

- TABLE 369 RECENT DEVELOPMENTS SAF-HOLLAND: DEALS

- TABLE 370 IDEX CORPORATION: BUSINESS OVERVIEW

- TABLE 371 IDEX CORPORATION: PRODUCTS OFFERED

- TABLE 372 IDEX CORPORATION: DEALS

- TABLE 373 THE BOLER COMPANY: BUSINESS OVERVIEW

- TABLE 374 THE BOLER COMPANY: PRODUCTS OFFERED

- TABLE 375 THE BOLER COMPANY: NEW PRODUCT DEVELOPMENTS

- TABLE 376 AIRGO SYSTEMS: BUSINESS OVERVIEW

- TABLE 377 AIRGO SYSTEMS: PRODUCTS OFFERED

- TABLE 378 HALTEC CORPORATION: BUSINESS OVERVIEW

- TABLE 379 HALTEC CORPORATION: PRODUCTS OFFERED

- TABLE 380 TI SYSTEMS: BUSINESS OVERVIEW

- TABLE 381 TI SYSTEMS: PRODUCTS OFFERED

- TABLE 382 TI SYSTEMS: DEALS

- TABLE 383 TI SYSTEMS: OTHERS

- TABLE 384 CLAAS: BUSINESS OVERVIEW

- TABLE 385 CLAAS: PRODUCTS OFFERED

- TABLE 386 CLAAS: DEALS

- TABLE 387 CLAAS: OTHERS

- TABLE 388 TIBUS OFFROAD: COMPANY OVERVIEW

- TABLE 389 NEXTER SYSTEMS: COMPANY OVERVIEW

- TABLE 390 RAYTECH GROUP: COMPANY OVERVIEW

- TABLE 391 BIGFOOT EQUIPMENT: COMPANY OVERVIEW

- TABLE 392 AIR CTI: COMPANY OVERVIEW

- TABLE 393 PARKER HANNIFIN CORPORATION: COMPANY OVERVIEW

- TABLE 394 PRESSURE SYSTEMS INTERNATIONAL: COMPANY OVERVIEW

- TABLE 395 TRANS TECHNOLOGIES COMPANY: COMPANY OVERVIEW

- TABLE 396 VIGIA: COMPANY OVERVIEW

- TABLE 397 ROTEX AUTOMATION: COMPANY OVERVIEW

- FIGURE 1 MARKET SEGMENTATION: AUTOMATIC TIRE INFLATION SYSTEM MARKET

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 RESEARCH METHODOLOGY MODEL

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 6 AUTOMATIC TIRE INFLATION SYSTEM MARKET: BOTTOM-UP APPROACH (ON-HIGHWAY VEHICLE AND REGION)

- FIGURE 7 AUTOMATIC TIRE INFLATION SYSTEM MARKET: TOP-DOWN APPROACH (TYPE)

- FIGURE 8 AUTOMATIC TIRE INFLATION SYSTEM MARKET: RESEARCH DESIGN & METHODOLOGY

- FIGURE 9 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY SIDES

- FIGURE 10 DATA TRIANGULATION METHODOLOGY

- FIGURE 11 AUTOMATIC TIRE INFLATION SYSTEM MARKET FOR ON-HIGHWAY VEHICLE, BY TYPE, 2023 VS. 2028

- FIGURE 12 AUTOMATIC TIRE INFLATION SYSTEM MARKET FOR OFF-HIGHWAY VEHICLE, BY TYPE, 2023 VS. 2028

- FIGURE 13 INCREASED DEMAND FOR SAFETY FEATURES AND FUEL EFFICIENCY TO DRIVE MARKET

- FIGURE 14 CENTRAL TIRE INFLATION SYSTEM SEGMENT ESTIMATED TO LEAD MARKET IN 2023

- FIGURE 15 ECU SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 16 HEAVY-DUTY VEHICLES SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 17 AGRICULTURAL TRACTORS SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 18 BATTERY ELECTRIC TRUCKS SEGMENT TO LEAD MARKET FROM 2023 TO 2028

- FIGURE 19 BATTERY ELECTRIC BUSES SEGMENT TO LEAD MARKET FROM 2023 TO 2028

- FIGURE 20 OEM SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 21 CENTRAL TIRE INFLATION SYSTEM SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 22 CENTRAL TIRE INFLATION SYSTEM SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 23 NORTH AMERICA ESTIMATED TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

- FIGURE 24 AUTOMATIC TIRE INFLATION SYSTEM MARKET: MARKET DYNAMICS

- FIGURE 25 IMPACT OF UNDERINFLATION ON FUEL ECONOMY

- FIGURE 26 REVENUE SHIFT FOR AUTOMATIC TIRE INFLATION SYSTEM MARKET

- FIGURE 27 SUPPLY CHAIN ANALYSIS: AUTOMATIC TIRE INFLATION SYSTEM MARKET

- FIGURE 28 AUTOMATIC TIRE INFLATION SYSTEM MARKET: ECOSYSTEM ANALYSIS

- FIGURE 29 KEY BUYING CRITERIA FOR TOP FOUR AUTOMATIC TIRE INFLATION SYSTEM APPLICATIONS

- FIGURE 30 AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 31 AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY COMPONENT, 2023 VS. 2028 (USD MILLION)

- FIGURE 32 AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY ON-HIGHWAY VEHICLE, 2023 VS. 2028 (USD MILLION)

- FIGURE 33 AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY OFF-HIGHWAY VEHICLE, 2023 VS. 2028 (USD MILLION)

- FIGURE 34 AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY SALES CHANNEL, 2023 VS. 2028 (USD MILLION)

- FIGURE 35 AUTOMATIC TIRE INFLATION SYSTEM MARKET FOR AGRICULTURAL TRACTORS, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 36 AUTOMATIC TIRE INFLATION SYSTEM MARKET FOR CONSTRUCTION EQUIPMENT, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 37 AUTOMATIC TIRE INFLATION MARKET FOR ELECTRIC BUSES, BY PROPULSION TYPE, 2024 VS. 2028 (USD)

- FIGURE 38 AUTOMATIC TIRE INFLATION MARKET FOR ELECTRIC TRUCKS, BY PROPULSION TYPE, 2024 VS. 2028 (USD)

- FIGURE 39 AUTOMATIC TIRE INFLATION SYSTEM MARKET FOR ON-HIGHWAY VEHICLES, BY REGION, 2023 VS. 2028 (USD MILLION)

- FIGURE 40 AUTOMATIC TIRE INFLATION SYSTEM MARKET FOR OFF-HIGHWAY VEHICLES, BY REGION, 2023 VS. 2028 (USD MILLION)

- FIGURE 41 NORTH AMERICA: AUTOMATIC TIRE INFLATION SYSTEM MARKET SNAPSHOT

- FIGURE 42 EUROPE: AUTOMATIC TIRE INFLATION SYSTEM MARKET SNAPSHOT

- FIGURE 43 ASIA PACIFIC: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY COUNTRY, 2023 VS. 2028 (USD MILLION)

- FIGURE 44 REST OF THE WORLD: AUTOMATIC TIRE INFLATION SYSTEM MARKET, BY COUNTRY, 2023 VS. 2028 (USD MILLION)

- FIGURE 45 AUTOMATIC TIRE INFLATION SYSTEM MARKET SHARE, 2022

- FIGURE 46 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS, 2020–2022

- FIGURE 47 COMPETITIVE EVALUATION MATRIX: AUTOMATIC TIRE INFLATION SYSTEM SUPPLIERS, 2022

- FIGURE 48 AUTOMATIC TIRE INFLATION SYSTEM COMPONENT SUPPLIERS: COMPETITIVE EVALUATION MATRIX, 2022

- FIGURE 49 MERITOR: COMPANY SNAPSHOT

- FIGURE 50 MICHELIN: COMPANY SNAPSHOT

- FIGURE 51 ENPRO INDUSTRIES: COMPANY SNAPSHOT

- FIGURE 52 GOODYEAR TIRE & RUBBER COMPANY: COMPANY SNAPSHOT

- FIGURE 53 DANA INCORPORATED: COMPANY SNAPSHOT

- FIGURE 54 SAF-HOLLAND: COMPANY SNAPSHOT

- FIGURE 55 IDEX CORPORATION: COMPANY SNAPSHOT

- FIGURE 56 CLAAS: COMPANY SNAPSHOT

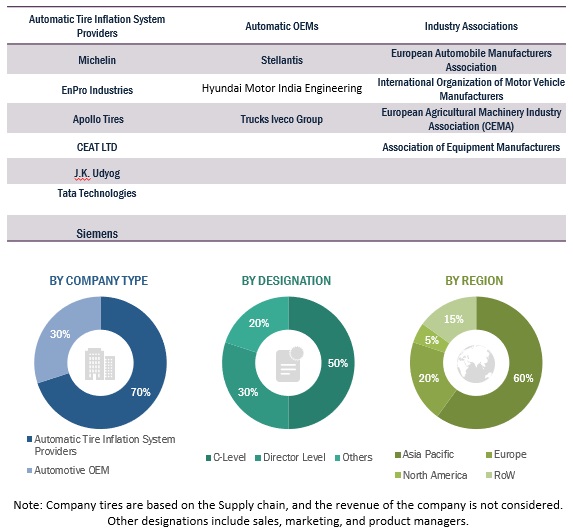

The study involves four main activities to estimate the current size of the automatic tire inflation system market.

- Exhaustive secondary research was done to collect information on the market, such as the Automatic tire inflation system market by Type, Component, On-Highway Vehicles, Off-Highway Vehicles, Electric Trucks, Electric Bus, Sales Channel, Agriculture Tractor, By Type, Construction Equipment, By Type, and Region.

- The next step was to validate these findings, assumptions, and market analysis with industry experts across value chains through primary research.

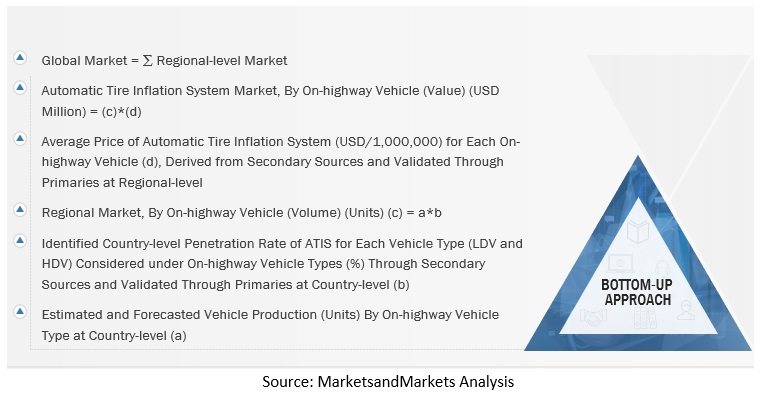

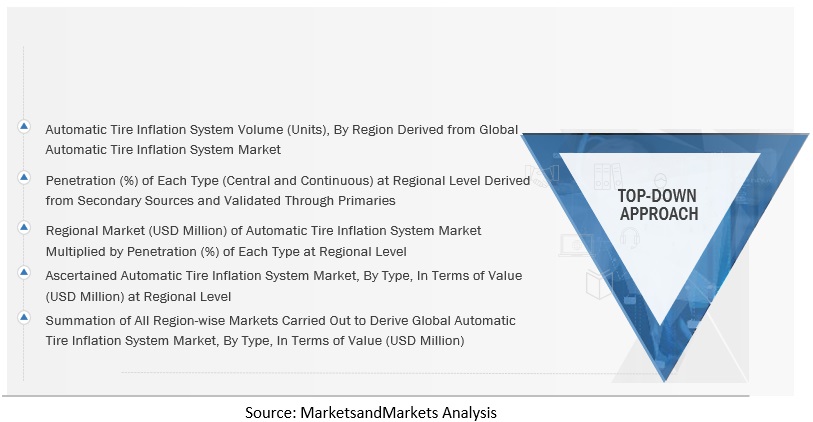

- Bottom-up and top-down approaches were employed to estimate the total market size for different segments considered in this study.

- After that, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to in this research study include automotive industry organizations such as the Organization Internationale des Constructeurs d'Automobiles (OICA); corporate filings (such as annual reports, investor presentations, and financial statements); and trade, business, and automatic tire inflation system associations. The secondary data was collected and analyzed to determine the overall market size, further validated by primary research.

Primary Research

- Extensive primary research was conducted after understanding the ATIS market scenario through secondary research. Approximately 80% of the primary interviews were conducted with the automatic tire inflation system providers and component/system providers and 20% of the automotive OEMs across North America, Europe, and Asia Pacific. The primary data was collected through questionnaires, emails, and telephonic interviews. Various departments within organizations, including sales, operations, and administration, were contacted to provide a holistic viewpoint in the report while canvassing primaries.

- After interacting with industry participants, some brief sessions were conducted with experienced independent consultants to reinforce the findings from the primaries. This and the opinions of in-house subject matter experts led to the findings delineated in the report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

- A detailed market estimation approach was followed to estimate and validate the value and volume of the automatic tire inflation system market and other dependent submarkets:

- The bottom-up approach was used to estimate and validate the size of the market. The ATIS market size for on-highway vehicles, in terms of volume, was derived by multiplying the country-level breakup for each vehicle category light-duty vehicle and heavy-duty vehicle) with regional vehicle production.

- The regional market for on-highway vehicles, by volume, was multiplied by the regional-level average selling price (ASP) for each on-highway vehicle to get the market for each on-highway vehicle by value.

- The summation of the regional-level market would give the global market for on-highway vehicles. The total value of each region was then summed up to derive the total value of the market for on-highway vehicles.

- All key macro indicators affecting the revenue growth of the market segments and subsegments were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the validated and verified quantitative and qualitative data.

- The gathered market data was consolidated and added with detailed inputs, analyzed, and presented in this report.