Advanced Tires Market by Type (Pneumatic, Run-Flat, Airless), Technology (Self-Inflating, Chip-Embedded, Multi-chamber, All-in-one, Self-Sealing), Vehicle (ICE, Electric, Hybrid, Off-highway), Niche Technology, Material & Region - Global Forecast to 2030

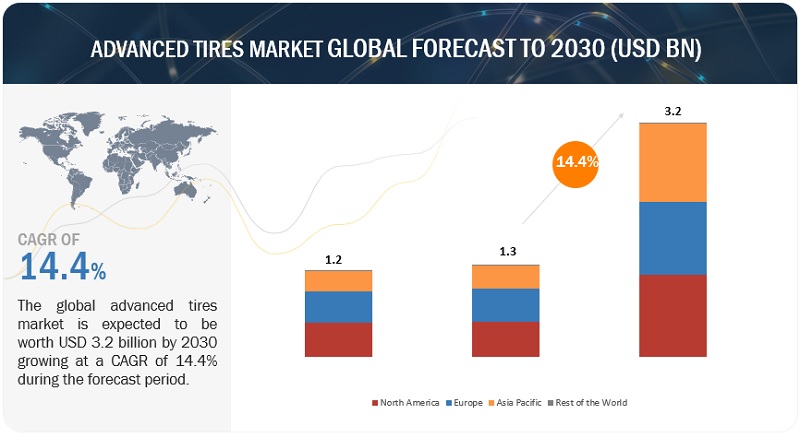

[297 Pages Report] The advanced tires market is projected to reach USD 3.2 billion by 2030 from an estimated USD 1.3 billion in 2023, at a CAGR of 14.4% from 2023 to 2030. The growth of the advanced tires market is influenced by factors such as growing consumer priority towards safety and performance in their vehicle. Advanced tires offer improved traction, handling, and braking capabilities on all-terrain roads. Further, Rapid advancements in tire technology have led to the development of advanced features such as intelligent sensors, RFID tags, self-sealing, and self-inflating capabilities. In addition, Further, low rolling resistance tires require low fuel, increasing the vehicle's overall fuel efficiency and reducing carbon emissions.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

DRIVER: Increased focus on reduction of Carbon Dioxide (CO2) and Nitrogen Oxide (NOx)

Natural rubber, synthetic rubber, sulfur, elastomers, and other carbon compounds are the main materials used to make automotive tires. These raw materials are responsible for the carbon emissions during tire manufacturing. Owing to stringent emission regulations, the uses of these raw materials need to be reduced. Apart from carbon emissions during manufacturing, OEMs are also focusing on reducing vehicle weight to achieve rigorous tailpipe emission standards. As a result, all major players are launching advanced tires by considering solutions like lowering tire weight, utilizing more eco-friendly materials, and implementing new raw material production technologies.

According to the International Energy Agency (IEA), adopting low-rolling-resistance tires may lead to a potential reduction of up to 7% and 6% in fuel consumption and CO2 emissions, respectively, from passenger cars. Nonetheless, the degree of emission reductions may vary depending on multiple factors, such as the type of vehicle, driving conditions, and maintenance of the tires.

Recycling tires is a key trend for tire manufacturers in recent years. According to Recycled Rubber Facts, recycling tires not just reduces the cost of raw materials and energy used in manufacturing but also brings down the carbon footprint of the tire manufacturing industry by 20%.

Further, green materials are increasingly used in advanced tires to curb overall carbon emissions. Tire companies are trying to use materials such as silica instead of carbon black and plant-derived materials such as sunflower oil instead of petroleum oil and flora-derived latex instead of rubber in advanced tires. Some companies are also replacing toxic materials used in the tire manufacturing process with oil derived from orange seeds and other organic materials. All these developments have laid the foundation for advanced eco-friendly tires. Hence, tire manufacturers are looking to optimize the usage of raw materials and make them more environmentally friendly. This drives the demand for advanced tires made of durable, fully-recycled materials.

DRIVER: Rising focus on convenience and driver assistance feature

Advanced tire technologies have improved convenience and driver assistance through various means. For instance, smart tires that incorporate sensors can provide real-time information on tire performance and road conditions, which the vehicle's computer system can utilize to enhance safety and convenience for the driver. Additionally, the development of run-flat tires has allowed drivers to continue driving on a punctured tire, saving time and providing more convenience. High-performance tires provide better traction and grip in harsh weather conditions, while low-rolling-resistance tires help to increase fuel efficiency and reduce emissions. Moreover, tire manufacturers are developing adaptive tires that adjust their tread patterns and rubber compounds to changing road conditions, providing optimal grip and handling, further improving driver safety and convenience.

RESTRAINT: High initial investment, high cost, and difficulty in mass production

The tire manufacturing industry faces disruption due to changes in the automotive industry. Tire manufacturers must make substantial investments to keep up with these changes because tires are a crucial component of automobiles. In addition, to adjust to the evolving needs of the automotive industry, tires must undergo significant modifications in areas such as shape, raw materials, and manufacturing processes. These changes require substantial investment, and the resulting high initial costs will likely be reflected in the prices of advanced tires.

There have been no significant changes to the tires' shape, material, or overall structure. Despite the emergence of innovative tire designs such as 3D printed, spherical, oxygen, moss, and shape-shifting tires, they are currently impractical for commercial use. Companies are developing these tires to explore their potential applications and possibilities. However, to make these advanced tire designs commercially viable, a complete ecosystem of raw material manufacturers, tire manufacturers, and OEMs must collaborate. Due to the low commercial viability of advanced tires, many OEMs and raw material manufacturers may not be enthusiastic about investing their time and resources into such projects. As a result, the concerns about the commercialization of advanced tires will impede the market's growth.

OPPORTUNITY: Increased Demand for Industrial equipment and warehouse automation

Industrial vehicles used in warehouses require tires resistant to failures and inefficiencies. This has spurred the development of non-pneumatic and chip-enabled tires that can transmit real-time information about their condition to the vehicle. This innovative technology is expected to enhance efficiency, reduce costs, and minimize downtime by enabling constant monitoring of tire health and lowering failure rates. Industrial vehicles, such as forklifts, pallet jacks, and terminal tractors, are critical industry components and do not face the same budgetary constraints as other vehicles, further highlighting the importance of these advanced tire solutions in the coming years.

Additionally, autonomous vehicles must have advanced tires as tire pressure monitoring will be an important tracking aspect. This data will help the vehicle understand multiple information related to the overall vehicle environment. This information includes the applicable speed limit on a particular terrain, tire pressure monitoring, tire alignment data, and other crucial data which can be gathered using advanced tires in autonomous vehicles.

CHALLENGE: Real-life implementation and lower customer acceptance for advanced tires

Several cutting-edge tire designs are currently in their early stages. One example is the Goodyear Eagle 360 Urban tire, which will be produced using 3D printing technology. Another innovation by Goodyear is an airless tire at center mass. These tires and several others from top industry players have been introduced as concepts. The main obstacle facing manufacturers is figuring out how to mass-produce these advanced tires and address other concerns, such as their shape and longevity.

Moreover, this tire's overall load-carrying capacity will be low as eco-friendly raw materials do not provide the strength and flexibility that rubber and other petroleum compounds do. This will be a challenge because the lack of mass production capacity will increase the cost and time required to produce such tires for passenger or commercial vehicles.

Elastomer material accounted for the largest market in the on-highway advanced tires market from 2020 to 2030.

Elastomers hold the largest share of the advanced tire market based on material type as elastomers consist of a maximum share (around 40-45%) of total tire weight. They are used in various components throughout the tire, including the tread, sidewalls, and inner liner. With growing concern for environmental sustainability and waste reduction, there are growing trends for using organically produced or recyclable natural and synthetic rubber. Using sustainable material helps in economic advantages, enhanced traction, durability, and rolling resistance. Furthermore, most tire manufacturing companies are focusing on developing advanced elastomers for advanced tires. For instance, in 2021, Bridgestone and Versalis collaborated to develop new types of elastomer grades, including Styrene Butadiene Rubber (SBR) for high-performance tires. Thus, newly developed elastomers used in producing advanced tires are specifically tailored for the premium consumer tire market segment, aiming to deliver superior performance and sheer comfort.

The chip-Embedded technology segment for on-highway vehicles accounted for the largest market share during the forecast period.

For ICE vehicles, chip-embedded tires hold the largest market by technology segment. These tires are installed with advanced sensors, microchips, RFID tags, and other connectivity features, enabling real-time tire conditions and performance monitoring. For instance, some chip-based tires can measure tire pressure, temperature, and tread wear, providing accurate data for optimal tire management. Further, these tires enhance safety by alerting drivers to potential tire issues, such as low pressure or tread wear, preventing accidents, and improving road safety. Lastly, chip-based advanced tires offer convenience and efficiency by enabling remote tire monitoring and providing tire-related data to connected vehicles or fleet management systems. These technological advancements enhance the driving experience, reduce maintenance costs, and contribute to sustainable mobility in the evolving automotive industry. Michelin, a major player in the advanced tires market, has a prominent range of tires fitted with chip-embedded tires and is expected to increase its market share in the coming years.

Additionally, OEMs are focusing on developing chip-embedded tires for HDVs; for instance, in 2023, Continental introduced generation 5 truck tires equipped with Gen II sensors and RFID tags to track and maintain transparency for fleet managers. Similarly, Bridgestone announced in 2022 to launch Truck and Bus tires by 2024 and plans to use these new tires entirely by 2030. Thus, a rising focus on safety and convenience features and OEM's effort towards developing chip-embedded tires with real-time monitoring of the dynamics of vehicle tires will drive the demand for this technology in the future.

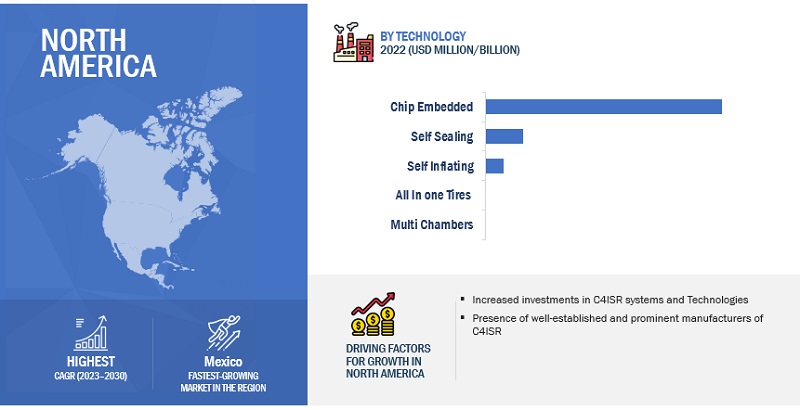

North America hold the largest market share in the advanced tires market in 2030.

North America accounted for the largest share of the advanced tires market with ~40% of the global market in 2023. The growth of advanced tires in North America can be attributed to factors such as the growing preference of consumers towards safety and convenience features, the government supports, and regulations related to the adoption of advanced tires. For instance, European Union has introduced a labeling scheme for consumers to choose the best tires in terms of fuel efficiency, noise, and wet grip. Further, Euro 7 has also proposed emission regulations for tires to reduce air pollution from tire wear and tear. In addition to this, the OEMs from this region are focusing on collaborations with tire manufacturing companies to develop advanced tires. For instance, General Motors (US), and Michelin (France) teamed up to develop airless tires and these airless tires have been tested on Chevrolet Bolt EV. The tested airless tires will be rolled out in the market by 2024. Further, the growing adoption of connected and autonomous vehicles witnessing significant growth for chip-embedded tires in this region.

Key Market Players & Startups

The advanced tire market is dominated by players such as Bridgestone Corporation (Japan), Michelin (France), Continental AG (Germany), Pirelli & C. S.p.A (Italy), The Goodyear Tyre and Rubber Company (US), Sumitomo Rubber Industries Ltd (Japan), Yokohama Tire Corporation (Japan), Hankook Tire & Technology Co., Ltd., (South Korea), and Nokian Tyres plc (Finland). These companies offer advanced tires and have strong distribution networks at the global level. These companies have adopted comprehensive expansion strategies; and undertaken collaborations, partnerships, and mergers & acquisitions to gain traction in the growing market for advanced tires market.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2020–2030 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2030 |

|

Forecast volume |

Units |

|

Forecast value |

USD Million/Billion |

|

Segments Covered |

On-Highway By Technology, Vehicle Type, Type, material type, By Niche Technology, Electric & Hybrid Vehicle By Type, EV type, Off-Highway Vehicle By Technology, Equipment Type, and Region |

|

Geographies Covered |

Asia Pacific, Europe, North America, and the Rest of the World |

|

Companies Covered |

Bridgestone Corporation (Japan), Michelin (France), Continental AG (Germany), Pirelli & C. S.p.A (Italy), The Goodyear Tyre and Rubber Company (US), Sumitomo Rubber Industries Ltd (Japan), Yokohama Tire Corporation (Japan), Hankook Tire & Technology Co., Ltd., (South Korea), and Nokian Tyres plc (Finland). (Total of 23 companies) |

The study categorizes the advanced tires market based on the on-highway vehicle, by technology, type, vehicle type, material type, niche technology, electric & hybrid by type, EV Type, Off-Highway Vehicle by technology, and Equipment Type, by regional and global levels.

On-Highway Vehicle, By Type

- Pneumatic

- Run-Flat

- Airless

On-Highway Vehicle, By Technology

- Self-Inflating

- Chip-Embedded

- Multichamber

- All-In-One

- Self-Sealing

On-Highway Vehicle, By Material Type

- Elastomer

- Fillers

- Steel

- Others

On-Highway Vehicle, By Niche Technology

- 3D Printed Tires

- Autonomous Vehicle Advanced Tires

On-Highway Vehicle, By Vehicle Type

- LDV

- HDV

Electric and Hybrid Vehicle, By Type

- Pneumatic

- Run-Flat

- Airless

Electric and Hybrid Vehicle, By EV Type

- BEV

- PHEV

- FCEV

Off-Highway Vehicle, By Technology

- Self-Inflating

- Chip-Embedded

- Multichamber

Off-Highway Vehicle, By Equipment Type

- Agricultural Tractors

- Industrial Vehicle

- Construction and Mining

By Region

- Asia Pacific

- Europe

- North America

- Rest of the World

Recent Developments

- In March 2023, Continental AG announced the introduction of its intelligent tires in the Indian market. This tire is focused especially on commercial vehicles and can be useful in tubeless tires. Additionally, this company will focus on upgrading its existing offerings in the Indian market.

- In March 2023, The Goodyear Tire & Rubber Company announced the launch of its next addition to the purpose-driven Fuel Max lineup. The Fuel Max 1 AD is developed for single-axle drive tractors capable of handling super regional, less than truckload, or LTD applications. The tire is made to provide the traction capabilities, mileage, and fuel efficiency that today's fleets demand.

- In February 2023, The Goodyear Tire & Rubber Company unveiled the RangeMax RSD EV, the first Goodyear tire ready for electric vehicles compatible with regional work vehicles powered by gas or diesel.

- In October 2022, Continental launched Premiumcontact 7 tires, the 7th generation of its premium tires. Depending on the vehicle's weight, dimensions, and driving system, the PremiumContact 7 is specifically designed for various vehicle designs. The PremiumContact 7's parameters have been modified for each vehicle class because big vehicles require different tire solutions than light passenger cars. The PremiumContact 7 offers strong grip and short stopping distances for vehicles with various drives.

- In September 2022, Bridgestone launched Firehawk AS V2, an All-season Ultra-High-performance tire designed to deliver sporty and high performance. The tire delivers faster lap durations even during wet conditions. Large outboard tread blocks and interlocking lugs ensure secure wet handling and hydroplaning resistance. The 3D full-depth sipes allow the Firehawk AS V2 to excel in snow throughout the tire's life. Its INDYCAR-inspired tread pattern also gives the Firehawk AS V2 the signature sport grip and responsive handling.

- In September 2022, Designed for passenger cars and Cinturato weather, active tires perform in all weather conditions despite snow, rain, or scorching heat. The tire is backed by the Three Peak Mountain Snowflake rating (3PMSF), meaning it can work even under severe snow conditions owing to its superior grip. Cinturato Weather's active tire features make it an ideal touring choice.

- In May 2022, Bridgestone launched radial tires specially designed for electric buses. The R192E offers ultra-low rolling resistance, high load capacity, increased daily ranges, and maximum operation on a single charge while remaining compatible with all bus types. The tire comes with multiple gripping edges, cross rib sipes, and wide grooves to maintain a solid grip on the road; groove fence to aid handling and grip in wet conditions while reducing noise for a quieter ride, Groove fence to aid handling and grip in wet conditions while reducing noise for a quieter ride: thick tread gauges and an advanced base tread compound for enhanced re-treadability. All-steel casing, belts, and reinforced sidewalls minimize tire damage and promote long original life.

- In April 2022, Bridgestone Corporation launched a drive guard plus premium tire with run-flat technology. These tires allow vehicles to drive up to 50 miles at a speed of 50 miles per hour, even after a puncture.

- In March 2022, Michelin launched its 5th generation sport tires designed to amplify sports performance and comes with high precision steering, maximized grip, and braking on wet and dry roads. With Max touch construction Pilot Sport 5 evenly distributes forces of acceleration and longer tread life without compromising performance.

- In February 2022, Pirelli & CSPA launched scorpion tires designed for SUVs with excellent traction and wear resistance. Scorpion tires perform well in both off-road and on-road conditions. Scorpion tires come with innovative tire construction technology that enables continued use without air pressure loss, even when a foreign item has punctured the tire. Being an all-seasoned tire, it can work well under all weather conditions.

- In September 2021, Michelin conducted a test on its airless tire UPTIS. This tire was fitted to the e-mini at the Munich motor show. The result of the test conducted was positive for the performance of tires.

Frequently Asked Questions (FAQ):

What is the current size of the global advanced tires market?

The current global advanced tires market size is USD 1.3 billion in 2023.

Which adjacent market will be impacted due to the advanced tire market?

Sensor Manufacturers, Hardware and software developers, IoT platform providers, and Chip Manufacturers.

Who are the winners in the global advanced tires market?

The advanced tires market is dominated by global players such as Michelin (France), Continental AG (Germany), The Goodyear Tire and Rubber Company (US), Bridgestone Corporation (Japan), and Pirelli & C. S.p.A (Italy). Other than these players, regional-level players such as MRF, Guizhou Tyre Co. Ltd., Nokian Tyres, and Yokohama Rubbers are playing a significant role in the advanced tire market

What are the future revenue shift for conventional tires during the forecast period?

Smart tires, connected tires, self-Inflating tires, and Multi-chamber tires would be the future revenue shift for companies operating in the advanced tires segment.

What are the key applications of advanced tires?

Light duty vehicles such as Passenger cars, light duty vehicles inclusive of passenger cars and light commercial vehicles, heavy-duty trucks, buses, off-highway vehicles like agricultural tractors, industrial vehicles, and construction and mining equipment.

Self-inflating tire technology and advanced tires are expected to change the market dynamics. How will this transform the overall market?

Self-inflating tire technology will eliminate the manual tire pressure check and inflation of tires. Further, the self-inflating tire technology will improve the overall safety of the vehicle as properly inflated tires with the help of self-inflating tire technology will help in enhancing vehicle stability, handling, and braking capabilities. It will also help in increasing fuel efficiency. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increased focus on reducing CO2 and NOx- Focus on convenience and driver assistance features- High maintenance and replacement costs of OTR tiresRESTRAINTS- High initial investment, high cost, and difficulty in mass productionOPPORTUNITIES- Increased demand for industrial equipment and warehouse automation- Rising electric vehicle sales and developments in autonomous vehiclesCHALLENGES- Real-life implementation and lower customer acceptance

-

5.3 TRENDS/DISRUPTIONS IMPACTING BUYERS

-

5.4 ADVANCED TIRES MARKET ECOSYSTEMTIRE MANUFACTURERSTECHNOLOGY PROVIDERSIOT PLATFORM PROVIDERSAUTOMOTIVE OEMS

- 5.5 SUPPLY CHAIN ANALYSIS

-

5.6 PRICING ANALYSISBY REGION, 2022BY TECHNOLOGY, 2022

-

5.7 CASE STUDY ANALYSISUSE CASE 1: EMBRAER CASE STUDYUSE CASE 2: FERRARI CASE STUDYUSE CASE 3: NEW TIRE MOBILITY SOLUTIONSUSE CASE 4: MERCEDES CASE STUDY

-

5.8 TRADE ANALYSISIMPORT DATA- US- Mexico- China- Japan- India- Germany- France- SpainEXPORT DATA- US- China- Japan- India- Germany- France- Spain

-

5.9 KEY CONFERENCES AND EVENTS IN 2023–2024ADVANCED TIRES MARKET: UPCOMING CONFERENCES AND EVENTS

-

5.10 PATENT ANALYSISAPPLICATIONS AND PATENTS, 2019–2022

- 5.11 BUYING CRITERIA

-

5.12 REGULATORY FRAMEWORKNORTH AMERICAEUROPEASIA PACIFIC

-

5.13 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS, BY REGIONNORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSEUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

5.14 TECHNOLOGY TRENDS3D-PRINTED TIRESRADIO FREQUENCY IDENTIFICATION (RFID)GREEN TIRESORGANIC TIRESSHAPE-SHIFTING TIRES

-

6.1 INTRODUCTIONINDUSTRY INSIGHTS

-

6.2 SELF-INFLATINGOFFERS IMPROVED SAFETY AND ENHANCED FUEL EFFICIENCY

-

6.3 CHIP-EMBEDDEDFEATURES ELECTRONIC CHIPS EMBEDDED WITHIN RUBBER

-

6.4 ALL-IN-ONEREDUCES VEHICLE WEIGHT TO IMPROVE FUEL EFFICIENCY

-

6.5 MULTI-CHAMBEROFFERS BETTER PERFORMANCE AND SAFETY THAN CONVENTIONAL TIRES

-

6.6 SELF-SEALINGPREVENTS AIR LEAKAGE TO MAINTAIN IDEAL TIRE PRESSURE

-

7.1 INTRODUCTIONINDUSTRY INSIGHTS

-

7.2 PNEUMATICRISING LUXURY VEHICLE DEMAND FITTED WITH HIGH-PERFORMANCE ALL-SEASON AND ALL-TERRAIN TIRESPNEUMATIC HIGH-PERFORMANCE TIRESPNEUMATIC ULTRA-HIGH-PERFORMANCE TIRESPNEUMATIC ALL-SEASON HIGH-PERFORMANCE TIRES

-

7.3 AIRLESSOFFERS REDUCED MAINTENANCE AND INCREASED SAFETY

-

7.4 RUN-FLATINCREASE SAFETY AND BETTER RIDE COMFORT

-

8.1 INTRODUCTIONINDUSTRY INSIGHTS

-

8.2 ELASTOMERSIMPROVES DURABILITY, FUEL EFFICIENCY, AND ENVIRONMENTAL SUSTAINABILITY

-

8.3 FILLERSENHANCES STIFFNESS AND STRENGTH

-

8.4 STEELGROWING TREND OF USING LIGHTWEIGHT MATERIAL TO IMPACT DEMAND

-

8.5 OTHER MATERIALSINCREASES LIFESPAN OF TIRES AND OFFERS HIGH ELASTICITY

-

9.1 INTRODUCTIONINDUSTRY INSIGHTS

-

9.2 LIGHT-DUTY VEHICLESDEVELOPMENTS IN TIRE TECHNOLOGY TO ACHIEVE IMPROVED FUEL EFFICIENCY AND DURABILITY

-

9.3 HEAVY-DUTY VEHICLESADVANCED TIRES TO PROVIDE EFFICIENT PERFORMANCE TO ENSURE BETTER FLEET OPERATIONS

-

10.1 INTRODUCTIONINDUSTRY INSIGHTS

-

10.2 PNEUMATICWIDESPREAD ADOPTION IN ELECTRIC AND HYBRID VEHICLES

-

10.3 RUN-FLATRISE IN NUMBER OF PREMIUM ELECTRIC VEHICLES INSTALLED WITH RUN-FLAT TECHNOLOGY

-

10.4 AIRLESSLIMITS RISK OF PUNCTURES AND BLOWOUTS

-

11.1 INTRODUCTIONINDUSTRY INSIGHTS

-

11.2 BATTERY ELECTRIC VEHICLESINCREASED DEMAND TO COMBAT EMISSIONS AND RISING COSTS

-

11.3 PLUG-IN HYBRID ELECTRIC VEHICLESEQUIPPED WITH ALL-SEASON TIRES

-

11.4 FUEL CELL ELECTRIC VEHICLESRISING R&D EFFORTS FOR NEW MODELS

-

12.1 INTRODUCTIONINDUSTRY INSIGHTS

-

12.2 SELF-INFLATINGADJUSTS TIRE PRESSURE AS PER TERRAIN AND DRIVING CONDITIONS

-

12.3 CHIP-EMBEDDEDCOLLECTS AND TRANSMITS DATA ON TIRE PARAMETERS

-

12.4 MULTI-CHAMBERELEVATES OFF-ROAD PERFORMANCE

-

13.1 INTRODUCTIONINDUSTRY INSIGHTS

-

13.2 INDUSTRIAL VEHICLESOPERATE IN WAREHOUSING AND MANUFACTURING FACILITIES

-

13.3 CONSTRUCTION AND MINING EQUIPMENTINCREASED USAGE DUE TO INFRASTRUCTURE DEVELOPMENT

-

13.4 AGRICULTURAL TRACTORSHIGH DEMAND DUE TO INCREASED PRODUCTION OF CASH-RICH CROPS

-

14.1 INTRODUCTIONINDUSTRY INSIGHTS

-

14.2 3D-PRINTED TIRESIDEAL OPTION FOR LONG-TERM USAGE

-

14.3 AUTONOMOUS VEHICLE ADVANCED TIRESSUPPORT CONNECTED MOBILITY WITH IMPROVED SELF-DRIVING EXPERIENCE

-

15.1 INTRODUCTIONINDUSTRY INSIGHTS

-

15.2 ASIA PACIFICRECESSION IMPACTCHINA- Large-scale vehicle production with increased adoption of safety featuresINDIA- Rising demand due to increased sales of premium vehiclesJAPAN- R&D investments to cater to various industriesSOUTH KOREA- Increased demand for advanced tire solutionsREST OF ASIA PACIFIC- Investments from major tire manufactures

-

15.3 EUROPERECESSION IMPACTGERMANY- Increased sales of luxury cars and growing consumer awareness about safety and comfortFRANCE- Focus on R&D investments, technological innovations, and government regulationsUK- Advancements in technology, OEM collaborations, and demand for fleet managementSPAIN- Rising government initiatives toward safety and OEM focus on adoption of advanced tiresITALY- Consistent demand for advanced tiresRUSSIA- Decline in demand due to disruptions in supply chainREST OF EUROPE

-

15.4 NORTH AMERICARECESSION IMPACTUS- Customer demand for safety and comfortCANADA- Heavy-duty vehicles to provide steady growthMEXICO- US-Mexico trade to support development of technologically advanced vehicles

-

15.5 REST OF THE WORLD (ROW)RECESSION IMPACTBRAZIL- Growing presence of well-established players and increasing consumer awareness about advanced tiresIRAN- Growing expansion of leading companies to expand production

- 16.1 ASIA PACIFIC TO DOMINATE ADVANCED TIRES MARKET

- 16.2 SELF-INFLATING TIRE TECHNOLOGY TO BE KEY FOCUS FOR MANUFACTURERS

- 16.3 CONCLUSION

- 17.1 OVERVIEW

- 17.2 MARKET SHARE ANALYSIS, 2022

- 17.3 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS

-

17.4 COMPETITIVE EVALUATION QUADRANTTERMINOLOGYSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

17.5 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSEXPANSIONS

- 17.6 STRATEGIES ADOPTED BY KEY PLAYERS/RIGHT TO WIN, 2018–2022

-

17.7 COMPETITIVE BENCHMARKINGKEY PLAYERS MANUFACTURING ADVANCED TIRES AND THEIR PRODUCT RANGE

-

18.1 ADVANCED TIRES MARKET - KEY PLAYERSCONTINENTAL AG- Business overview- Products offered- Recent developments- MnM viewBRIDGESTONE CORPORATION- Business overview- Products offered- Recent developments- MnM viewMICHELIN- Business overview- Products offered- Recent developments- MnM viewGOODYEAR TYRE AND RUBBER COMPANY- Business overview- Products offered- Recent developments- MnM viewPIRELLI & C. SPA- Business overview- Products offered- Recent developments- MnM viewSUMITOMO RUBBER INDUSTRIES, LTD.- Business overview- Products offered- Recent developmentsYOKOHAMA TIRE CORPORATION- Business overview- Products offered- Recent developmentsHANKOOK TIRE & TECHNOLOGY CO., LTD.- Business overview- Products offered- Recent developmentsNOKIAN TYRES PLC- Business overview- Products offered- Recent developmentsTOYO TIRE CORPORATION- Business overview- Products offered- Recent developments

-

18.2 ADVANCED TIRES MARKET – ADDITIONAL PLAYERSPETLAS TIRESFALKEN TIRESKUMHO TIREJK TYRE & INDUSTRIES LTD.TITAN INTERNATIONAL, INC.ZHONGCE RUBBER GROUP CO., LTD.MAXXIS TYRESMRF TYRESGUIZHOU TYRE CO., LTD.APOLLO TYRES LIMITEDKENDA TIRES

- 19.1 INSIGHTS FROM INDUSTRY EXPERTS

-

19.2 OTHER STRATEGIC DEVELOPMENTSOTHER PRODUCT LAUNCHESOTHER DEALS

- 19.3 DISCUSSION GUIDE

- 19.4 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

-

19.5 CUSTOMIZATION OPTIONSADVANCED TIRES MARKET, BY TYPE & COUNTRY- Pneumatic- Run-flat- AirlessOFF-HIGHWAY ADVANCED TIRES MARKET, BY MATERIAL TYPE- Elastomers- Fillers- Steel- Other Materials

- 19.6 RELATED REPORTS

- 19.7 AUTHOR DETAILS

- TABLE 1 ADVANCED TIRES MARKET DEFINITION, BY TYPE

- TABLE 2 MARKET DEFINITION, BY TECHNOLOGY TYPE

- TABLE 3 INCLUSIONS AND EXCLUSIONS

- TABLE 4 CURRENCY EXCHANGE RATES

- TABLE 5 ASSUMPTIONS, ASSOCIATED RISKS, AND IMPACT

- TABLE 6 MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 7 ADVANCED TIRES AVERAGE PRICE TREND

- TABLE 8 ADVANCED TIRES AVERAGE PRICE TREND

- TABLE 9 US: PNEUMATIC TIRE IMPORTS SHARE, BY COUNTRY (VALUE %)

- TABLE 10 MEXICO: PNEUMATIC TIRE IMPORTS SHARE, BY COUNTRY (VALUE %)

- TABLE 11 CHINA: PNEUMATIC TIRE IMPORTS SHARE, BY COUNTRY (VALUE %)

- TABLE 12 JAPAN: PNEUMATIC TIRE IMPORTS SHARE, BY COUNTRY (VALUE %)

- TABLE 13 INDIA: PNEUMATIC TIRE IMPORTS SHARE, BY COUNTRY (VALUE %)

- TABLE 14 GERMANY: PNEUMATIC TIRE IMPORTS SHARE, BY COUNTRY (VALUE %)

- TABLE 15 FRANCE: PNEUMATIC TIRE IMPORTS SHARE, BY COUNTRY (VALUE %)

- TABLE 16 SPAIN: PNEUMATIC TIRE IMPORTS SHARE, BY COUNTRY (VALUE %)

- TABLE 17 US: PNEUMATIC TIRE EXPORTS SHARE, BY COUNTRY (VALUE %)

- TABLE 18 CHINA: PNEUMATIC TIRE EXPORTS SHARE, BY COUNTRY (VALUE %)

- TABLE 19 JAPAN: PNEUMATIC TIRE EXPORTS SHARE, BY COUNTRY (VALUE %)

- TABLE 20 INDIA: PNEUMATIC TIRE EXPORTS SHARE, BY COUNTRY (VALUE %)

- TABLE 21 GERMANY: PNEUMATIC TIRE EXPORTS SHARE, BY COUNTRY (VALUE %)

- TABLE 22 FRANCE: PNEUMATIC TIRE EXPORTS SHARE, BY COUNTRY (VALUE %)

- TABLE 23 SPAIN: PNEUMATIC TIRE EXPORTS SHARE, BY COUNTRY (VALUE %)

- TABLE 24 KEY BUYING CRITERIA FOR DIFFERENT TIRE TYPES: ON-HIGHWAY VEHICLE

- TABLE 25 ON-HIGHWAY MARKET, BY TECHNOLOGY, 2020–2022 (‘000 UNITS)

- TABLE 26 ON-HIGHWAY ADVANCED TIRES MARKET, BY TECHNOLOGY, 2023–2030 (‘000 UNITS)

- TABLE 27 ON-HIGHWAY ADVANCED TIRES MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 28 ON-HIGHWAY ADVANCED TIRES MARKET, BY TECHNOLOGY, 2023–2030 (USD MILLION)

- TABLE 29 SELF-INFLATING TIRES MARKET, BY REGION, 2020–2022 (‘000 UNITS)

- TABLE 30 SELF-INFLATING TIRES MARKET, BY REGION, 2023–2030 (‘000 UNITS)

- TABLE 31 SELF-INFLATING TIRES MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 32 SELF-INFLATING TIRES MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 33 CHIP-EMBEDDED TIRES MARKET, BY REGION, 2020–2022 (‘000 UNITS)

- TABLE 34 CHIP-EMBEDDED TIRES MARKET, BY REGION, 2023–2030 (‘000 UNITS)

- TABLE 35 CHIP-EMBEDDED TIRES MARKET, BY REGION, 2020–2022 (‘USD MILLION)

- TABLE 36 CHIP-EMBEDDED TIRES MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 37 ALL-IN-ONE TIRES MARKET, BY REGION, 2023–2030 (‘000 UNITS)

- TABLE 38 ALL-IN-ONE TIRES MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 39 MULTI-CHAMBER TIRES MARKET, BY REGION, 2023–2030 (‘000 UNITS)

- TABLE 40 MULTI-CHAMBER TIRES MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 41 SELF-SEALING TIRES MARKET, BY REGION, 2020–2022 (‘000 UNITS)

- TABLE 42 SELF-SEALING TIRES MARKET, BY REGION, 2023–2030 (‘000 UNITS)

- TABLE 43 SELF-SEALING TIRES MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 44 SELF-SEALING TIRES MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 45 ON-HIGHWAY: MARKET, BY TYPE, 2020–2022 (‘000 UNITS)

- TABLE 46 ON-HIGHWAY: MARKET, BY TYPE, 2023–2030 (‘000 UNITS)

- TABLE 47 ON-HIGHWAY: MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 48 ON-HIGHWAY: MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 49 PNEUMATIC: MARKET, BY REGION, 2020–2022 (‘000 UNITS)

- TABLE 50 PNEUMATIC: MARKET, BY REGION, 2023–2030 (‘000 UNITS)

- TABLE 51 PNEUMATIC: MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 52 PNEUMATIC: MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 53 AIRLESS: MARKET, BY REGION, 2023–2030 (‘000 UNITS)

- TABLE 54 AIRLESS: MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 55 RUN-FLAT: MARKET, BY REGION, 2020–2022 (‘000 UNITS)

- TABLE 56 RUN-FLAT: MARKET, BY REGION, 2023–2030 (‘000 UNITS)

- TABLE 57 RUN-FLAT: MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 58 RUN-FLAT: MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 59 ON-HIGHWAY: MARKET, BY MATERIAL TYPE, 2020–2022 (THOUSAND KG)

- TABLE 60 ON-HIGHWAY: MARKET, BY MATERIAL TYPE, 2023–2030 (THOUSAND KG)

- TABLE 61 ON-HIGHWAY: MARKET, BY MATERIAL TYPE, 2020–2022 (USD MILLION)

- TABLE 62 ON-HIGHWAY: MARKET, BY MATERIAL TYPE, 2023–2030 (USD MILLION)

- TABLE 63 ELASTOMERS: MARKET, BY REGION, 2020–2022 (THOUSAND KG)

- TABLE 64 ELASTOMERS: MARKET, BY REGION, 2023–2030 (THOUSAND KG)

- TABLE 65 ELASTOMERS: MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 66 ELASTOMERS: ADVANCED TIRES MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 67 FILLERS: MARKET, BY REGION, 2020–2022 (THOUSAND KG)

- TABLE 68 FILLERS: MARKET, BY REGION, 2023–2030 (THOUSAND KG)

- TABLE 69 FILLERS: MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 70 FILLERS: MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 71 STEEL: MARKET, BY REGION, 2020–2022 (THOUSAND KG)

- TABLE 72 STEEL: MARKET, BY REGION, 2023–2030 (THOUSAND KG)

- TABLE 73 STEEL: MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 74 STEEL: MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 75 OTHER MATERIALS: MARKET, BY REGION, 2020–2022 (THOUSAND KG)

- TABLE 76 OTHER MATERIALS: MARKET, BY REGION, 2023–2030 (THOUSAND KG)

- TABLE 77 OTHER MATERIALS: MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 78 OTHER MATERIALS: MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 79 ON-HIGHWAY VEHICLE MARKET, BY VEHICLE TYPE, 2020–2022 (‘000 UNITS)

- TABLE 80 ON-HIGHWAY VEHICLE MARKET, BY VEHICLE TYPE, 2023–2030 (‘000 UNITS)

- TABLE 81 ON-HIGHWAY VEHICLE MARKET, BY VEHICLE TYPE, 2020–2022 (USD MILLION)

- TABLE 82 ON-HIGHWAY VEHICLE ADVANCED TIRES MARKET, BY VEHICLE TYPE, 2023–2030 (USD MILLION)

- TABLE 83 LIGHT-DUTY VEHICLES: MARKET, BY REGION, 2020–2022 (‘000 UNITS)

- TABLE 84 LIGHT-DUTY VEHICLES: MARKET, BY REGION, 2023–2030 (‘000 UNITS)

- TABLE 85 LIGHT-DUTY VEHICLES: MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 86 LIGHT-DUTY VEHICLES: MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 87 HEAVY-DUTY VEHICLES: MARKET, BY REGION, 2020–2022 (‘000 UNITS)

- TABLE 88 HEAVY-DUTY VEHICLES: MARKET, BY REGION, 2023–2030 (‘000 UNITS)

- TABLE 89 HEAVY-DUTY VEHICLES: MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 90 HEAVY-DUTY VEHICLES: MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 91 ADVANCED TIRES FOR ELECTRIC AND HYBRID VEHICLES, BY TYPE, 2020–2022 (‘000 UNITS)

- TABLE 92 ADVANCED TIRES FOR ELECTRIC AND HYBRID VEHICLES, BY TYPE, 2023–2030 (‘000 UNITS)

- TABLE 93 ADVANCED TIRES FOR ELECTRIC AND HYBRID VEHICLES, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 94 ADVANCED TIRES FOR ELECTRIC AND HYBRID VEHICLES, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 95 ELECTRIC AND HYBRID VEHICLE PNEUMATIC TIRES, BY REGION, 2020–2022 (‘000 UNITS)

- TABLE 96 ELECTRIC AND HYBRID VEHICLE PNEUMATIC TIRES, BY REGION, 2023–2030 (‘000 UNITS)

- TABLE 97 ELECTRIC AND HYBRID VEHICLE PNEUMATIC TIRES, BY REGION, 2020–2022 (USD MILLION)

- TABLE 98 ELECTRIC AND HYBRID VEHICLE PNEUMATIC TIRES, BY REGION, 2023–2030 (USD MILLION)

- TABLE 99 ELECTRIC AND HYBRID VEHICLE RUN-FLAT TIRES, BY REGION, 2020–2022 (‘000 UNITS)

- TABLE 100 ELECTRIC AND HYBRID VEHICLE RUN-FLAT TIRES, BY REGION, 2023–2030 (‘000 UNITS)

- TABLE 101 ELECTRIC AND HYBRID VEHICLE RUN-FLAT TIRES, BY REGION, 2020–2022 (USD MILLION)

- TABLE 102 ELECTRIC AND HYBRID VEHICLE RUN-FLAT TIRES, BY REGION, 2023–2030 (USD MILLION)

- TABLE 103 ELECTRIC AND HYBRID VEHICLE AIRLESS TIRES, BY REGION, 2020–2022 (‘000 UNITS)

- TABLE 104 ELECTRIC AND HYBRID VEHICLE AIRLESS TIRES, BY REGION, 2023–2030 (‘000 UNITS)

- TABLE 105 ELECTRIC AND HYBRID VEHICLE AIRLESS TIRES, BY REGION, 2020–2022 (USD MILLION)

- TABLE 106 ELECTRIC AND HYBRID VEHICLE AIRLESS TIRES, BY REGION, 2023–2030 (USD MILLION)

- TABLE 107 ADVANCED TIRES FOR ELECTRIC AND HYBRID VEHICLES, BY VEHICLE TYPE, 2020–2022 (‘000 UNITS)

- TABLE 108 ADVANCED TIRES FOR ELECTRIC AND HYBRID VEHICLES, BY VEHICLE TYPE, 2023–2030 (‘000 UNITS)

- TABLE 109 ADVANCED TIRES FOR ELECTRIC AND HYBRID VEHICLES, BY VEHICLE TYPE, 2020–2022 (USD MILLION)

- TABLE 110 ADVANCED TIRES FOR ELECTRIC AND HYBRID VEHICLES, BY VEHICLE TYPE, 2023–2030 (USD MILLION)

- TABLE 111 BATTERY ELECTRIC VEHICLES: MARKET, BY REGION, 2020–2022 (‘000 UNITS)

- TABLE 112 BATTERY ELECTRIC VEHICLES: MARKET, BY REGION, 2023–2030 (‘000 UNITS)

- TABLE 113 BATTERY ELECTRIC VEHICLES: MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 114 BATTERY ELECTRIC VEHICLES: MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 115 PLUG-IN HYBRID ELECTRIC VEHICLES: MARKET, BY REGION, 2020–2022 (‘000 UNITS)

- TABLE 116 PLUG-IN HYBRID ELECTRIC VEHICLES: MARKET, BY REGION, 2023–2030 (‘000 UNITS)

- TABLE 117 PLUG-IN HYBRID ELECTRIC VEHICLES: MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 118 PLUG-IN HYBRID ELECTRIC VEHICLES: MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 119 FUEL CELL ELECTRIC VEHICLES: MARKET, BY REGION, 2020–2022 (‘000 UNITS)

- TABLE 120 FUEL CELL ELECTRIC VEHICLES: MARKET, BY REGION, 2023–2030 (‘000 UNITS)

- TABLE 121 FUEL CELL ELECTRIC VEHICLES: MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 122 FUEL CELL ELECTRIC VEHICLES: MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 123 OFF-HIGHWAY VEHICLE MARKET, BY TECHNOLOGY, 2020–2022 (‘000 UNITS)

- TABLE 124 OFF-HIGHWAY VEHICLE: ADVANCED TIRES MARKET, BY TECHNOLOGY, 2023–2030 (‘000 UNITS)

- TABLE 125 OFF-HIGHWAY VEHICLE: MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 126 OFF-HIGHWAY VEHICLE: MARKET, BY TECHNOLOGY, 2023–2030 (USD MILLION)

- TABLE 127 SELF-INFLATING: ADVANCED TIRES MARKET, BY REGION, 2020–2022 (‘000 UNITS)

- TABLE 128 SELF-INFLATING: MARKET, BY REGION, 2023–2030 (‘000 UNITS)

- TABLE 129 SELF-INFLATING: MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 130 SELF-INFLATING: MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 131 CHIP-EMBEDDED: MARKET, BY REGION, 2020–2022 (‘000 UNITS)

- TABLE 132 CHIP-EMBEDDED: MARKET, BY REGION, 2023–2030 (‘000 UNITS)

- TABLE 133 CHIP-EMBEDDED: MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 134 CHIP-EMBEDDED: MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 135 MULTI-CHAMBER: MARKET, BY REGION, 2023–2030 (‘000 UNITS)

- TABLE 136 MULTI-CHAMBER: MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 137 MARKET, BY OFF-HIGHWAY VEHICLE TYPE, 2020–2022 (‘000 UNITS)

- TABLE 138 MARKET, BY OFF-HIGHWAY VEHICLE TYPE, 2023–2030 (‘000 UNITS)

- TABLE 139 MARKET, BY OFF-HIGHWAY VEHICLE TYPE, 2020–2022 (USD MILLION)

- TABLE 140 MARKET, BY OFF-HIGHWAY VEHICLE TYPE, 2023–2030 (USD MILLION)

- TABLE 141 INDUSTRIAL VEHICLES: MARKET, BY REGION, 2020–2022 (‘000 UNITS)

- TABLE 142 INDUSTRIAL VEHICLES: MARKET, BY REGION, 2023–2030 (‘000 UNITS)

- TABLE 143 INDUSTRIAL VEHICLES: MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 144 INDUSTRIAL VEHICLES: MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 145 CONSTRUCTION AND MINING EQUIPMENT: MARKET, BY REGION, 2020–2022 (‘000 UNITS)

- TABLE 146 CONSTRUCTION AND MINING EQUIPMENT: MARKET, BY REGION, 2023–2030 (‘000 UNITS)

- TABLE 147 CONSTRUCTION AND MINING EQUIPMENT: MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 148 CONSTRUCTION AND MINING EQUIPMENT: MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 149 AGRICULTURAL TRACTORS: MARKET, BY REGION, 2020–2022 (‘000 UNITS)

- TABLE 150 AGRICULTURAL TRACTORS: MARKET, BY REGION, 2023–2030 (‘000 UNITS)

- TABLE 151 AGRICULTURAL TRACTORS: MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 152 AGRICULTURAL TRACTORS: MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 153 MARKET, BY NICHE TECHNOLOGY, 2020–2022 (‘000 UNITS)

- TABLE 154 MARKET, BY NICHE TECHNOLOGY, 2023–2030 (‘000 UNITS)

- TABLE 155 MARKET, BY NICHE TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 156 MARKET, BY NICHE TECHNOLOGY, 2023–2030 (USD MILLION)

- TABLE 157 3D-PRINTED TIRES MARKET, BY REGION, 2023–2030 (‘000 UNITS)

- TABLE 158 3D-PRINTED TIRES MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 159 AUTONOMOUS VEHICLE MARKET, BY REGION, 2020–2022 (‘000 UNITS)

- TABLE 160 AUTONOMOUS VEHICLE ADVANCED TIRES MARKET, BY REGION, 2023–2030 (‘000 UNITS)

- TABLE 161 AUTONOMOUS VEHICLE ADVANCED TIRES MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 162 AUTONOMOUS VEHICLE ADVANCED TIRES MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 163 MARKET, BY REGION, 2020–2022 (‘000 UNITS)

- TABLE 164 MARKET, BY REGION, 2023–2030 (‘000 UNITS)

- TABLE 165 MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 166 MARKET, BY REGION, 2023–2030 (‘000 UNITS)

- TABLE 167 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2022 (‘000 UNITS)

- TABLE 168 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2030 (‘000 UNITS)

- TABLE 169 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 170 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 171 CHINA: MARKET, BY TECHNOLOGY, 2020–2022 (‘000 UNITS)

- TABLE 172 CHINA: MARKET, BY TECHNOLOGY, 2023–2030 (‘000 UNITS)

- TABLE 173 CHINA: MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 174 CHINA: MARKET, BY TECHNOLOGY, 2023–2030 (USD MILLION)

- TABLE 175 INDIA: MARKET, BY TECHNOLOGY, 2023–2030 (‘000 UNITS)

- TABLE 176 INDIA: MARKET, BY TECHNOLOGY, 2023–2030 (USD MILLION)

- TABLE 177 JAPAN: MARKET, BY TECHNOLOGY, 2020–2022 (‘000 UNITS)

- TABLE 178 JAPAN: MARKET, BY TECHNOLOGY, 2023–2030 (‘000 UNITS)

- TABLE 179 JAPAN: MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 180 JAPAN: MARKET, BY TECHNOLOGY, 2023–2030 (USD MILLION)

- TABLE 181 SOUTH KOREA: MARKET, BY TECHNOLOGY, 2020–2022 (‘000 UNITS)

- TABLE 182 SOUTH KOREA: MARKET, BY TECHNOLOGY, 2023–2030 (‘000 UNITS)

- TABLE 183 SOUTH KOREA: MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 184 SOUTH KOREA: MARKET, BY TECHNOLOGY, 2023–2030 (USD MILLION)

- TABLE 185 REST OF ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2023–2030 (‘000 UNITS)

- TABLE 186 REST OF ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2023–2030 (USD MILLION)

- TABLE 187 EUROPE: MARKET, BY COUNTRY, 2020–2022 (‘000 UNITS)

- TABLE 188 EUROPE: MARKET, BY COUNTRY, 2023–2030 (‘000 UNITS)

- TABLE 189 EUROPE: MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 190 EUROPE: MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 191 GERMANY: MARKET, BY TECHNOLOGY, 2020–2022 (‘000 UNITS)

- TABLE 192 GERMANY: MARKET, BY TECHNOLOGY, 2023–2030 (‘000 UNITS)

- TABLE 193 GERMANY: MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 194 GERMANY: MARKET, BY TECHNOLOGY, 2023–2030 (USD MILLION)

- TABLE 195 FRANCE: MARKET, BY TECHNOLOGY, 2020–2022 (‘000 UNITS)

- TABLE 196 FRANCE: MARKET, BY TECHNOLOGY, 2023–2030 (‘000 UNITS)

- TABLE 197 FRANCE: MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 198 FRANCE: MARKET, BY TECHNOLOGY, 2023–2030 (USD MILLION)

- TABLE 199 UK: MARKET, BY TECHNOLOGY, 2020–2022 (‘000 UNITS)

- TABLE 200 UK: MARKET, BY TECHNOLOGY, 2023–2030 (‘000 UNITS)

- TABLE 201 UK: MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 202 UK: MARKET, BY TECHNOLOGY, 2023–2030 (USD MILLION)

- TABLE 203 SPAIN: MARKET, BY TECHNOLOGY, 2020–2022 (‘000 UNITS)

- TABLE 204 SPAIN: MARKET, BY TECHNOLOGY, 2023–2030 (‘000 UNITS)

- TABLE 205 SPAIN: MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 206 SPAIN: MARKET, BY TECHNOLOGY, 2023–2030 (USD MILLION)

- TABLE 207 ITALY: MARKET, BY TECHNOLOGY, 2020–2022 (‘000 UNITS)

- TABLE 208 ITALY: MARKET, BY TECHNOLOGY, 2023–2030 (‘000 UNITS)

- TABLE 209 ITALY: MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 210 ITALY: MARKET, BY TECHNOLOGY, 2023–2030 (USD MILLION)

- TABLE 211 RUSSIA: MARKET, BY TECHNOLOGY, 2020–2022 (‘000 UNITS)

- TABLE 212 RUSSIA: MARKET, BY TECHNOLOGY, 2023–2030 (‘000 UNITS)

- TABLE 213 RUSSIA: MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 214 RUSSIA: MARKET, BY TECHNOLOGY, 2023–2030 (USD MILLION)

- TABLE 215 REST OF EUROPE: MARKET, BY TECHNOLOGY, 2020–2022 (‘000 UNITS)

- TABLE 216 REST OF EUROPE: MARKET, BY TECHNOLOGY, 2023–2030 (‘000 UNITS)

- TABLE 217 REST OF EUROPE: MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 218 REST OF EUROPE: MARKET, BY TECHNOLOGY, 2023–2030 (USD MILLION)

- TABLE 219 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2022 (‘000 UNITS)

- TABLE 220 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2030 (‘000 UNITS)

- TABLE 221 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 222 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 223 US: MARKET, BY TECHNOLOGY, 2020–2022 (‘000 UNITS)

- TABLE 224 US: MARKET, BY TECHNOLOGY, 2023–2030 (‘000 UNITS)

- TABLE 225 US: MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 226 US: MARKET, BY TECHNOLOGY, 2023–2030 (USD MILLION)

- TABLE 227 CANADA: MARKET, BY TECHNOLOGY, 2020–2022 (‘000 UNITS)

- TABLE 228 CANADA: MARKET, BY TECHNOLOGY, 2023–2030 (‘000 UNITS)

- TABLE 229 CANADA: MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 230 CANADA: MARKET, BY TECHNOLOGY, 2023–2030 (USD MILLION)

- TABLE 231 MEXICO: MARKET, BY TECHNOLOGY, 2020–2022 (‘000 UNITS)

- TABLE 232 MEXICO: MARKET, BY TECHNOLOGY, 2023–2030 (‘000 UNITS)

- TABLE 233 MEXICO: MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 234 MEXICO: MARKET, BY TECHNOLOGY, 2023–2030 (USD MILLION)

- TABLE 235 REST OF THE WORLD: MARKET, BY COUNTRY, 2020–2022 (‘000 UNITS)

- TABLE 236 REST OF THE WORLD: MARKET, BY COUNTRY, 2023–2030 (‘000 UNITS)

- TABLE 237 REST OF THE WORLD: MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 238 REST OF THE WORLD: MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 239 BRAZIL: MARKET, BY TECHNOLOGY, 2020–2022 (‘000 UNITS)

- TABLE 240 BRAZIL: MARKET, BY TECHNOLOGY, 2023–2030 (‘000 UNITS)

- TABLE 241 BRAZIL: MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 242 BRAZIL: MARKET, BY TECHNOLOGY, 2023–2030 (USD MILLION)

- TABLE 243 IRAN: MARKET, BY TECHNOLOGY, 2020–2022 (‘000 UNITS)

- TABLE 244 IRAN: MARKET, BY TECHNOLOGY, 2023–2030 (‘000 UNITS)

- TABLE 245 IRAN: MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 246 IRAN: MARKET, BY TECHNOLOGY, 2023–2030 (USD MILLION)

- TABLE 247 MARKET: COMPANY FOOTPRINT, 2022

- TABLE 248 MARKET: COMPANY PRODUCT FOOTPRINT, 2022

- TABLE 249 MARKET: COMPANY REGION FOOTPRINT, 2022

- TABLE 250 PRODUCT LAUNCHES, 2022–2023

- TABLE 251 DEALS, 2022–2023

- TABLE 252 EXPANSIONS, 2022–2023

- TABLE 253 KEY GROWTH STRATEGIES, 2018–2022

- TABLE 254 MARKET: KEY PLAYERS

- TABLE 255 CONTINENTAL AG: BUSINESS OVERVIEW

- TABLE 256 CONTINENTAL AG: PRODUCT LAUNCHES

- TABLE 257 BRIDGESTONE CORPORATION: BUSINESS OVERVIEW

- TABLE 258 BRIDGESTONE CORPORATION: PRODUCT LAUNCHES

- TABLE 259 BRIDGESTONE CORPORATION: DEALS

- TABLE 260 BRIDGESTONE: OTHERS

- TABLE 261 BRIDGESTONE CORPORATION: EXPANSIONS

- TABLE 262 MICHELIN: BUSINESS OVERVIEW

- TABLE 263 MICHELIN: PRODUCT LAUNCHES

- TABLE 264 MICHELIN: DEALS

- TABLE 265 MICHELIN: EXPANSIONS

- TABLE 266 GOODYEAR TYRE AND RUBBER COMPANY: BUSINESS OVERVIEW

- TABLE 267 GOODYEAR TYRE AND RUBBER COMPANY: PRODUCT LAUNCHES

- TABLE 268 GOODYEAR TYRE AND RUBBER COMPANY: DEALS

- TABLE 269 PIRELLI & C. SPA: BUSINESS OVERVIEW

- TABLE 270 PIRELLI & C. SPA: PRODUCT LAUNCHES

- TABLE 271 PIRELLI & C. SPA: EXPANSIONS

- TABLE 272 SUMITOMO RUBBER INDUSTRIES, LTD.: BUSINESS OVERVIEW

- TABLE 273 SUMITOMO RUBBER INDUSTRIES, LTD.: PRODUCT LAUNCHES

- TABLE 274 SUMITOMO RUBBER INDUSTRIES, LTD.: DEALS

- TABLE 275 SUMITOMO RUBBER INDUSTRIES, LTD.: EXPANSIONS

- TABLE 276 YOKOHAMA TIRE CORPORATION: BUSINESS OVERVIEW

- TABLE 277 YOKOHAMA TIRE CORPORATION: PRODUCT LAUNCHES

- TABLE 278 YOKOHAMA TIRE CORPORATION: DEALS

- TABLE 279 YOKOHAMA TIRE CORPORATION: EXPANSIONS

- TABLE 280 HANKOOK TIRE & TECHNOLOGY CO., LTD.: BUSINESS OVERVIEW

- TABLE 281 HANKOOK TIRE & TECHNOLOGY CO., LTD.: PRODUCT LAUNCHES

- TABLE 282 HANKOOK TIRE & TECHNOLOGY CO., LTD.: DEALS

- TABLE 283 HANKOOK TIRE & TECHNOLOGY CO., LTD.: EXPANSIONS

- TABLE 284 NOKIAN TYRES PLC: BUSINESS OVERVIEW

- TABLE 285 NOKIAN TYRES PLC: PRODUCT LAUNCHES

- TABLE 286 NOKIAN TYRES PLC: EXPANSIONS

- TABLE 287 TOYO TIRE CORPORATION: BUSINESS OVERVIEW

- TABLE 288 TOYO TIRE CORPORATION: PRODUCT LAUNCHES

- TABLE 289 TOYO TIRE CORPORATION: DEALS

- TABLE 290 TOYO TYRES CORPORATION: EXPANSIONS

- TABLE 291 PETLAS TIRES: COMPANY OVERVIEW

- TABLE 292 FALKEN TIRES: COMPANY OVERVIEW

- TABLE 293 KUMHO TIRE: COMPANY OVERVIEW

- TABLE 294 JK TYRE & INDUSTRIES LTD.: COMPANY OVERVIEW

- TABLE 295 TITAN INTERNATIONAL, INC.: COMPANY OVERVIEW

- TABLE 296 ZHONGCE RUBBER GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 297 MAXXIS TYRES: COMPANY OVERVIEW

- TABLE 298 MRF TYRES: COMPANY OVERVIEW

- TABLE 299 GUIZHOU TYRE CO., LTD.: COMPANY OVERVIEW

- TABLE 300 APOLLO TYRES LIMITED: COMPANY OVERVIEW

- TABLE 301 KENDA TIRES: COMPANY OVERVIEW

- TABLE 302 OTHER PRODUCT LAUNCHES, 2018–2021

- TABLE 303 OTER DEALS, 2018–2021

- FIGURE 1 MARKETS COVERED

- FIGURE 2 RESEARCH DESIGN: ADVANCED TIRES MARKET

- FIGURE 3 RESEARCH METHODOLOGY MODEL

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 5 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 6 MARKET: BOTTOM-UP APPROACH

- FIGURE 7 DATA TRIANGULATION METHODOLOGY

- FIGURE 8 MARKET: MARKET OUTLOOK

- FIGURE 9 MARKET, BY REGION, 2023 VS. 2030 (USD MILLION)

- FIGURE 10 RISE IN DEMAND FOR SAFETY AND PERFORMANCE AND INCREASED GOVERNMENT INITIATIVES EXPECTED TO DRIVE GLOBAL MARKET

- FIGURE 11 LIGHT-DUTY VEHICLES (LDV) TO ACCOUNT FOR LARGER MARKET SHARE (BY VALUE)

- FIGURE 12 RUN-FLAT TIRE SEGMENT TO HAVE FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 13 CHIP-EMBEDDED TIRES TO REGISTER LARGEST SHARE IN 2023

- FIGURE 14 ELASTOMERS SEGMENT TO WITNESS HIGHEST GROWTH IN 2023

- FIGURE 15 AUTONOMOUS VEHICLE ADVANCED TIRES TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 16 BEV SEGMENT TO HOLD LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 17 PNEUMATIC TIRES TO ACCOUNT FOR HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 18 INDUSTRIAL VEHICLES SEGMENT TO HAVE HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 19 CHIP-EMBEDDED TIRES TECHNOLOGY SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD (2023–2030)

- FIGURE 20 ASIA PACIFIC DOMINATED MARKET IN 2022

- FIGURE 21 MARKET: MARKET DYNAMICS

- FIGURE 22 MARKET ECOSYSTEM

- FIGURE 23 SUPPLY CHAIN ANALYSIS: MARKET

- FIGURE 24 KEY BUYING CRITERIA FOR ON-HIGHWAY AND OFF-HIGHWAY VEHICLES

- FIGURE 25 3D-PRINTED TIRES

- FIGURE 26 RFID TAG TIRES

- FIGURE 27 SHAPE-SHIFTING TIRES

- FIGURE 28 MARKET, BY TECHNOLOGY, 2023 VS. 2030 (USD MILLION)

- FIGURE 29 MARKET FOR ON-HIGHWAY VEHICLES, BY TYPE, 2023 VS. 2030 (USD MILLION)

- FIGURE 30 MARKET, BY MATERIAL TYPE, 2023 VS. 2030 (USD MILLION)

- FIGURE 31 MARKET, BY ON-HIGHWAY VEHICLE TYPE, 2023 VS. 2030 (USD MILLION)

- FIGURE 32 ADVANCED TIRES FOR ELECTRIC AND HYBRID VEHICLES MARKET, BY TYPE, 2023 VS. 2030 (USD MILLION)

- FIGURE 33 ADVANCED TIRES FOR ELECTRIC AND HYBRID VEHICLES, BY VEHICLE TYPE, 2023 VS. 2030 (USD MILLION)

- FIGURE 34 OFF-HIGHWAY VEHICLE MARKET, BY TECHNOLOGY, 2023 VS. 2030 (USD MILLION)

- FIGURE 35 MARKET, BY OFF-HIGHWAY VEHICLE TYPE, 2023 VS. 2030 (USD MILLION)

- FIGURE 36 MARKET, BY NICHE TECHNOLOGY, 2023 VS. 2030 (USD MILLION)

- FIGURE 37 MARKET, BY REGION, 2023–2030 (USD MILLION)

- FIGURE 38 ASIA PACIFIC: MARKET, 2023–2030 (USD MILLION)

- FIGURE 39 EUROPE: MARKET SNAPSHOT

- FIGURE 40 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 41 REST OF THE WORLD: MARKET, 2023 VS. 2030 (USD MILLION)

- FIGURE 42 MARKET SHARE ANALYSIS, 2022

- FIGURE 43 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS, 2020–2022

- FIGURE 44 ADVANCED TIRE MANUFACTURERS: COMPETITIVE EVALUATION MATRIX, 2022

- FIGURE 45 CONTINENTAL AG: COMPANY SNAPSHOT

- FIGURE 46 BRIDGESTONE CORPORATION: COMPANY SNAPSHOT

- FIGURE 47 MICHELIN: COMPANY SNAPSHOT

- FIGURE 48 GOODYEAR TYRE AND RUBBER COMPANY: COMPANY SNAPSHOT

- FIGURE 49 PIRELLI & C. SPA: COMPANY SNAPSHOT

- FIGURE 50 SUMITOMO RUBBER INDUSTRIES, LTD.: COMPANY SNAPSHOT

- FIGURE 51 YOKOHAMA TIRE CORPORATION: COMPANY SNAPSHOT

- FIGURE 52 HANKOOK TIRE & TECHNOLOGY CO., LTD.: COMPANY SNAPSHOT

- FIGURE 53 NOKIAN TYRES PLC: COMPANY SNAPSHOT

- FIGURE 54 TOYO TIRE CORPORATION: COMPANY SNAPSHOT

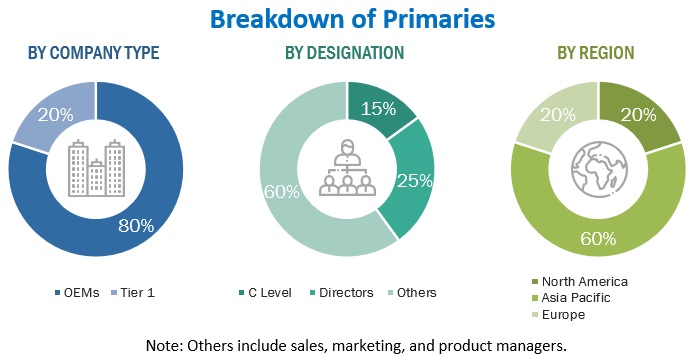

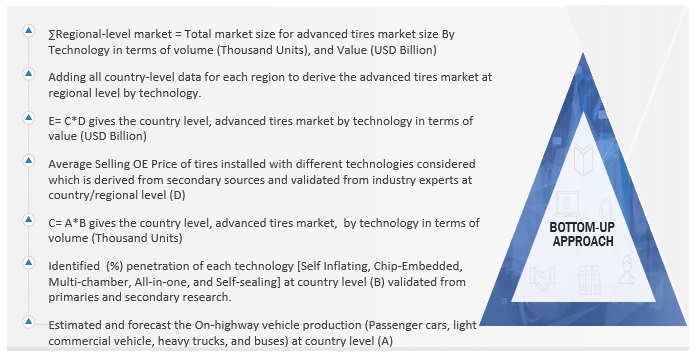

The study involved four major activities in estimating the current size of the advanced tires market. Exhaustive secondary research was carried out to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The bottom-up and top-down approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources were used to identify and collect information for this study on the advanced tires market. Secondary sources included annual reports, press releases, and investor presentations of companies; whitepapers, certified publications, and articles from recognized authors; directories; databases; and articles from recognized associations and government publishing sources.

Primary Research

Extensive primary research was conducted after acquiring an understanding of the advanced tires market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand (OEMs) and supply (tire manufacturers) sides across major regions, namely, North America, Europe, and Asia Pacific. Approximately 20% and 80% of primary interviews were conducted from the demand and supply sides, respectively. Primary data was collected through questionnaires, emails, and telephonic interviews.

In the canvassing of primaries, various departments within organizations, such as sales, operations, and marketing, were covered to provide a holistic viewpoint in the report. After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from primaries. This, along with the in-house subject matter experts’ opinions, led to the findings described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up approach was used to estimate and validate the size of the advanced tires market by type, technology, vehicle type (on-highway and off-highway), and niche technology and region. Whereas the top-down approach was used to derive market size by material. To determine the country-level market size by technology in terms of volume, country-level vehicle production (Passenger cars, light commercial vehicles, heavy trucks, and buses) is multiplied by (%) penetration rate of each technology considered (Self Inflating, Chip-Embedded, Multi-chamber, All-in-one, and Self-sealing). Further, this country-level market, by technology is multiplied by the country-level OE price of different advanced tire technologies considered to get the country-level advanced tire market, by technology in terms of value (USD Million). Further summation of the country-level market will provide regional-level and global Advanced tire market, by technology in terms of volume (Thousand Units), and Value (USD Million). A similar approach is followed to analyze the market sizing and forecast of other segments – type (pneumatic, run-flat, and airless), vehicle type (on-highway (LDV, HDV), Electric and Hybrid vehicle by EV Type (BEV, PHEV, and FCEV), and off-highway (construction & mining equipment, agricultural tractors, and industrial vehicles), and niche technology (3D printing and autonomous vehicles).

Advanced Tires Market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Advanced Tires Market: Top-Down Approach

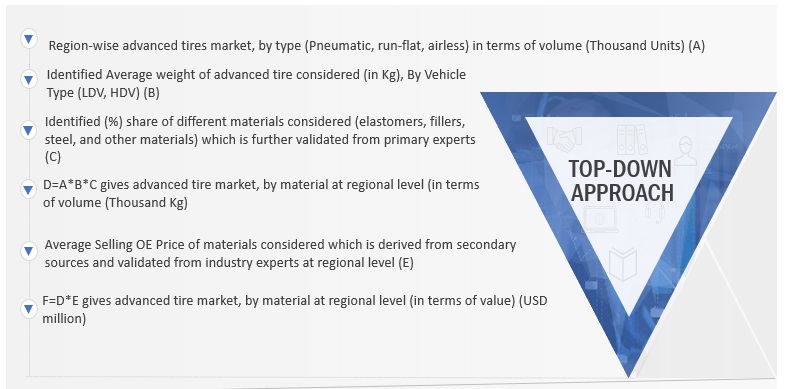

The top-down approach was followed to determine the market size of advanced tires by material type, in terms of volume and value. The regional-level advanced tires market, by type in terms of volume, is considered and it has been multiplied with identified average weight of advanced tires considered (in Kg), by vehicle type (LDV, HDV) and percentage (%) share of different materials considered (elastomers, fillers, steel, and other materials). This provided a regional-level market, by material (elastomers, fillers, steel, and other materials) in terms of volume (Thousand KG). Further, the volume market is multiplied by the average selling OE Price of different materials considered which is derived from secondary sources and validated by industry experts at the regional level to get the regional-level market, by material (elastomers, fillers, steel, and other materials) in terms of value (USD Million/Billion).

Data Triangulation

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All parameters that are expected to affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, supplemented with detailed inputs and analysis from MarketsandMarkets, and presented in the report.

Market Definition:

Advanced tires are tire designs that utilize state-of-the-art technologies and innovative features to improve performance, safety, and efficiency. Developed with cutting-edge materials, these tires offer enhanced traction, handling, durability, and fuel efficiency when compared to conventional tires.

Key Stakeholders:

- Sales Head

- Marketing Head

- OEM Purchase Head

- Design Manager

- R&D Head

- R&D Manager

Report Objectives

- To define, describe, and forecast the advanced tires market in terms of value (USD million) and volume (thousand units) based on the following segments:

- To segment the market and forecast its size, by volume and value, based on region (Asia Pacific, Europe, North America, and Rest of the World)

- To segment and forecast the market for on-highway vehicles based on vehicle type (Light Duty Vehicle, and Heavy-Duty Vehicle)

- To segment and forecast the market for on-highway vehicles based on material type (elastomers, steels, synthetic rubbers, natural rubber, and others)

- To segment and forecast the market for on-highway vehicles based on technology (Chip-embedded Tires, Self-inflating tires, multi-chamber tires, and all-in-one tires)

- To segment and forecast the market for on-highway vehicles based on type (Pneumatic tires, run-flat tires, and airless tires)

- To segment and forecast the market based on niche technology (3D printed tires, and autonomous vehicle)

- To segment and forecast the market for electric & hybrid vehicles based on EV type (BEV, PHEV, and FCEV)

- To segment and forecast the market for electric & hybrid vehicles based on type (Pneumatic tires, run-flat tires, and airless tires)

- To segment and forecast the market for off-highway vehicles based on vehicle type (Agricultural Tractors, Construction & Mining Equipment, Industrial Vehicle)

- To segment and forecast the market for off-highway vehicles based on technology type (Chip-embedded Tires, Self-inflating tires, multi-chamber tires, and all-in-one tires)

Available Customizations

Along with the market data, MarketsandMarkets offers customizations per company-specific needs.

The following customization options are available for the report:

Advanced Tires Market, By Type & Country

- Pneumatic

- Run-Flat

- Airless

Note: The market will be provided for countries considered by region (Asia-Pacific, Europe, North America, RoW) under on-highway vehicles.

Off-Highway Advanced Tires Market, By Material Type

- Elastomers

- Fillers

- Steel

- Others

Note: The market will be provided at a regional level - Asia-Pacific, Europe, North America, and RoW. No further split at the country level will be provided.

Growth opportunities and latent adjacency in Advanced Tires Market

I’m a Tire retail and service centre. I’ve been servicing TPMS and Runflat Tires since 1989, and work closely with Bartecusa and Schrader Sensors. I like to find out more information about TPMS LDWS.