Automotive Tires Market for OE & Replacement By Rim (13-15, 16-18, 19-21,>21”), Aspect Ratio(<60, 60-70, >70), Section Width (<200, 200-230,>230 mm), Season (Summer, Winter-Studded Non-Studded & All Season), Vehicle Type, Retreading & Region - Global Forecast to 2028

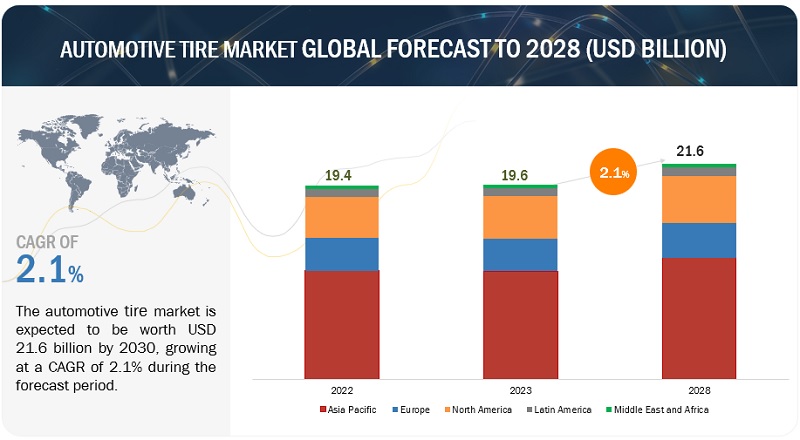

[354 Pages Report] Automotive tire market is estimated to grow from USD 19.6 billion in 2023 to USD 21.6 billion by 2028 at a CAGR of 2.1% over the forecast period. The key factors driving the automotive tire market are the vehicle’s increased life and the miles driven every year due to regular maintenance of the car, customer awareness, and advancement in new tire technology, which has led to longer life of the automotive tires.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

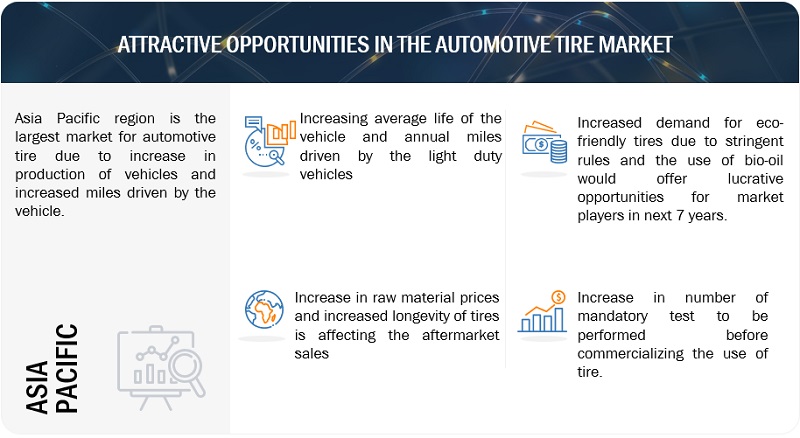

DRIVER: Increase in the vehicle’s average life and annual miles driven by light-duty vehicles

The average life of a vehicle has increased over the past few years due to technological advancements, improving road infrastructure, better driving conditions, and other factors. The increase in a vehicle's average life and annual miles driven per year have created growth opportunities for tire manufacturers in the aftermarket. According to the Federal Highway Administration of the US Department of Transportation, a passenger car is driven, on average, 13,476 miles per year. This comes to more than 1,000 miles every month. The increased life of vehicles and the increased miles driven by vehicles have had a mixed impact on the automotive tire industry where the decrease in the demand for tires has put pressure on the industry, whereas on the other side, it has also led to an increased focus on tire performance and sustainability, by increasing the investments in research and development.

RESTRAINT: Highly volatile raw material prices and increased longevity of tire is affecting aftermarket sales

The raw material in the automotive tire industry plays a vital role in setting the component’s price. The raw materials for manufacturing tires include natural rubber, synthetic rubber, carbon black, steel, fabric, and plasticizers. As natural and synthetic rubber are the most critical raw materials, their demand, consumption, and price fluctuations significantly impact tire prices. According to the Association of Natural Rubber Producing Countries, in 2017, there was a natural rubber supply shortfall of about 700,000 metric tons. In contrast, the global supply of natural rubber then improved by 991,000 tons in May 2022. Over the decade, there has been a considerable variation in natural rubber pricing, which impacts automotive tire pricing and tire manufacturers to a great extent.

Increasing the longevity of tires has led to a decrease in the demand for new tires, as cars are lasting longer and being driven fewer miles. This has put pressure on the aftermarket tire industry, which has seen a decline in sales. Also, on the other hand, the increase in tire longevity has led to a rise in the demand for tire maintenance and repair services. As tires last longer, they are more likely to be rotated, balanced, or repaired. This has created new opportunities for the automotive tire aftermarket market, which has seen increased sales of these services. Overall, the increase in tire longevity has had a net negative impact on the aftermarket tire industry. However, the industry has been able to adapt by focusing on tire maintenance and repair services. This has helped offset the decline in new tire sales and allowed the industry to remain profitable.

OPPORTUNITY: Increase in eco-friendly tires due to stringent regulation and increase in bio-oils for the manufacturing process

Stringent rules and regulations are driving the global tire market for eco-friendly tires. Governments worldwide are enacting laws that require tires to be more fuel-efficient and less polluting. These regulations are being put in place to reduce greenhouse gas emissions and improve air quality. For instance, the European government has set a target of reducing CO2 emissions from cars by 37.5% by 2030. This target will require car manufacturers to use more fuel-efficient tires. Also, the US has set a fuel economy standard for vehicles requiring an average of 54.5 miles per gallon by 2025. This standard will also require the use of more fuel-efficient tires. In addition to this, many key players have invested heavily in R&D to bring eco-friendly automobile tires. Michelin Energy Saver A/S, where the tire is designed to reduce fuel consumption by up to 6%. It is made with a low rolling resistance compound that helps improve the tire’s efficiency.

Bio-oil is used as a substitute for petroleum-based oil in the production of tire rubber. This helps to reduce the environmental impact of tire production, as bio-oil is a renewable resource. For instance, orange oils, extracted from orange peels, help reduce the amount of petroleum used in tires. Tire companies are cutting down on using materials harmful to the environment while reducing friction and increasing fuel efficiency. As a result, less fuel is consumed, CO2 emissions are reduced, and the car becomes greener. Companies like Bridgestone have successfully created synthetic rubber using plant-derived materials rather than petroleum products. Other companies are also experimenting with synthetic rubber made from biomass (plant-derived material or agricultural waste). Also, Goodyear showcased that soybean oil has great potential as a natural ingredient in tires, increasing tread life by 10% and reducing the use of petroleum-based oil by up to 8.5 million gallons per year. Hence, using bio-oil will help reduce the environmental impact of tire production. As the demand for more sustainable tires grows, bio-oil will likely become an increasingly popular ingredient in tire rubber.

CHALLENGE: Increased number of mandatory tests for commercializing the tires

Regulatory organizations such as the US Department of Transportation (DOT), National Highway Traffic Safety Administration (NHTSA), European Tyre and Rim Technical Organization (ETRTO), Japanese Automobile Tire Manufacturers Association (JATMA), and others have made it mandatory for tire manufacturers to conduct specific tests on tires before commercializing. These tests include durability, endurance, traction, rolling resistance, and load carrying. Tire manufacturers have to bear the cost of mandatory tests, which are expensive. Suppose a tire fails to fulfill the requirement of any of these mandatory tests. In that case, the manufacturer cannot sell that tire in the market and suffers a complete loss on R&D. These tests indirectly increase the total cost of tires, which negatively affects their demand in the OE as well as aftermarket.

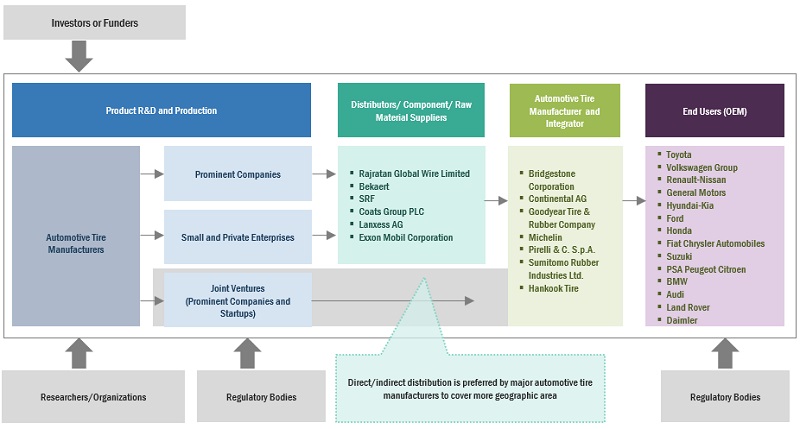

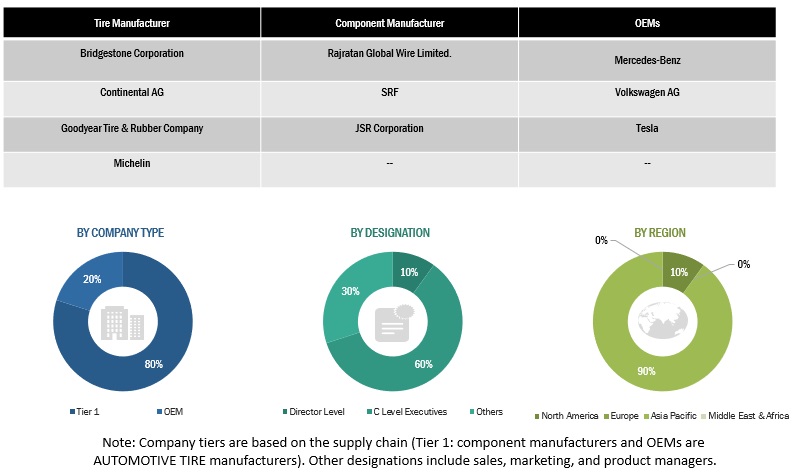

Automotive Seats Market Ecosystem.

The major OEMs of the automotive tire market have the latest technologies, diversified portfolios, and strong distribution networks globally. The major players in the global automotive tire market include Bridgestone Corporation (Japan), Continental AG (Germany), Goodyear Tire & Rubber Company (U.S.), Michelin (France), and Pirelli & C. S.p.A (Italy).

The 13”-15” rim size segment, by vehicle type, holds the largest market share.

There is a growing demand for small cars, such as hatchbacks and subcompacts. These cars typically have smaller rims and tires than larger cars, such as SUVs and trucks. The smaller rim-size vehicles usually have GVWRs under 3.0 tons, with 13” – 15” rim sizes. Furthermore, these vehicles are most popular in shared transportation, such as Uber and Lyft, typically in small cars equipped with 13”-to 15”-inch rim size tires. Cars such as the Hyundai Avante, Volkswagen Polo, Volkswagen Rapid, Hyundai Accent, and others are a few examples of 13” – 15” rim size tires.

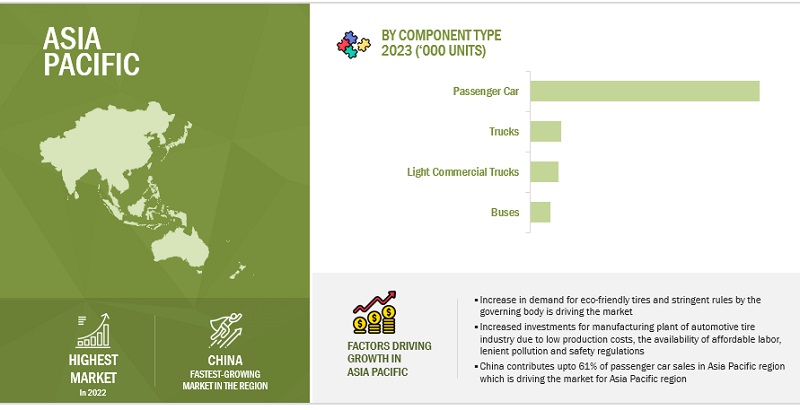

Regarding sales, passenger cars lead the market with smaller rim sizes globally. In the Asia Pacific region, China has the highest market share of ~61% for passenger cars (i.e., 23.83 million units), where vehicles such as Hyundai Avante, Nissan Bluebird, Toyota Corolla, Ford Escort, and VW Santana are among the top-selling passenger cars which come with the tires that range in size from 13” to 15". Hence, factors such as improved fuel efficiency and less rolling resistance are driving the 13”-15” rim size tire market.

Tire having an aspect ratio >70 holds the largest market share in the tire replacement market.

These tires have a higher sidewall, which provides more comfort and a smoother ride. They also have a wider footprint, which provides better traction and stability. Higher aspect ratio tires provide better cargo protection in big vehicles and a more comfortable ride and protection from potholes on the road in buses. >70 aspect ratio tires are often more affordable than tires with a lower aspect ratio. This is because they are less complex to manufacture. Also, newer tires with a higher aspect ratio have safety features, such as run-flat technology. This technology allows the tires to continue to be driven even after they have lost air pressure, which can help to prevent accidents. Around the world, 80%–90% of heavy commercial vehicles have tires with >70 aspect ratios, which also cost more to replace than tires with lower aspect ratios. Therefore, the demand for tires with an aspect ratio of >70 is anticipated to account for the significant market share of trucks and buses over the next few years.

Retreading of Light Commercial Vehicles (LCV) is the fastest-growing segment of the automotive tire market.

Retreaded tires provide the same mileage as new replacement tires, costing 30%–50% less, and come with the same warranties. A Light commercial vehicle tire typically needs 26 liters of oil to manufacture a new tire. However, tire retreading uses only 9 liters of oil or around 34% of the new manufacturing process. On the other hand, a new set of four tires for pickup trucks costs nearly twice as much as retreaded tires, according to the Retread Tire Association. For example, the Goodyear Tire and Rubber Company (U.S.) has more than 1,700 tire retreading and servicing centers worldwide for commercial trucks. Few of the top tire manufacturers have entered the tire retreading sector. Thus, the trend of tire retreading in LCVs is gradually growing to reduce costs.

Asia-Pacific holds the largest market share for automotive tires for the original equipment (OE).

This region has well-established automobile players like BMW AG (Germany) and Volkswagen Group (Germany), Tata (India), BYD (China), Nissan (Japan), and Mitsubishi (Japan), where Asia-Pacific has become a center for the production of automobiles. The large investment in Asia Pacific has been driven by factors like low production costs, the availability of affordable labor, lenient pollution and safety regulations, and government incentives for FDIS. The Yokohama Rubber Co., Ltd. (Japan), Bridgestone Corporation (Japan), Kumho Tyre Co. (South Korea), Hankook Tyres (South Korea), Sumitomo Rubber Industries Ltd. (Japan), and other Tier-I suppliers are among the notable tire manufacturers with significant operations in the Asia-Pacific region. The companies in this location invest in expanding their manufacturing plant to cater to the increasing demand for automotive tires. For instance, Bridgestone invested USD 250 million in November 2022 to expand and renovate its tire manufacturing plant, which is located in Heredia, Costa Rica. Hence, these investments and developments in the Asia Pacific region are projected to be driven by the factors mentioned above.

Key Market Players

The automotive tire market is consolidated with players such as Bridgestone Corporation (Japan), Continental AG (Germany), Goodyear Tire & Rubber Company (US), Michelin (France), and Pirelli & C. S.p.A (Italy) is the key company operating in automotive tire manufacturing. These companies adopted new product launches, partnerships, and joint ventures to gain traction in the automotive tire market.

Scope of the Report

|

Report Attribute |

Details |

|

Market size available for years |

2019–2028 |

|

Base year considered |

2022 |

|

Market Growth forecast |

USD 21.6 Billion by 2028 from USD 19.6 Billion in 2023 at 2.1% CAGR |

|

Forecast period |

2023–2028 |

|

Forecast units |

Volume (Units) and Value (USD Million/Billion) |

|

Segments Covered |

Automotive Tire Aftermarket, By Section Width and Vehicle Type, Automotive Tire Aftermarket, By Aspect Ratio And Vehicle Type, Automotive Tire Aftermarket, By Rim Size And Vehicle Type, Automotive Tire Retreading Market, By Vehicle Type, Automotive Tire Oe Market, By Vehicle Type And Rim Size, Automotive Tire Aftermarket Market, By Season Type, Automotive Tire Aftermarket, By Vehicle Type, and Automotive Tire OE Market, By Type. |

|

Geographies covered |

Asia Pacific, North America, Europe, and Rest of the World. |

|

Top Players |

Bridgestone Corporation (Japan), Goodyear Tire & Rubber Company (United States), Continental AG (Germany), Michelin (France) and Sumitomo Rubber Industries (Japan) |

With the given market data, MarketsandMarkets offers customizations per the company’s specific needs.

The study segments the tire market:

Automotive Tire Aftermarket, By Section Width and Vehicle Type

- <200mm

- 200-230mm

- >230mm

Automotive Tire Aftermarket, By Aspect Ratio and Vehicle Type

- <60

- 60–70

- >70

Automotive Tire Aftermarket, By Rim Size and Vehicle Type

- 13–15"

- 16–18”

- 19–21"

- > 21"

Automotive Tire Aftermarket, By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

Automotive Tire Retreading Market, By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Buses

- Trucks

Automotive Tire Aftermarket, By Season Type

- Summer Tire

- Winter Tire (Studded and Non-studded)

- All-season Tire

Automotive Tire Oe Market, By Vehicle Type and Rim Size

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

Automotive Tire Oe Market, By Tire Type

- Radial Tire (Tube and Tubeless)

- Bias Tire

Recent Developments

- In June, Continental AG launched their new tire named UltraContact NXT, which comprises 65% renewable material made from agriculture waste and has ISCC PLUS mass balance certified materials. These are available in 19” sizes. These tires are made for both electric and combustion engines. For instance, Kia (South Korea) Niro, Volkswagen (Germany) ID.3, Mercedes-Benz (Germany) EQA, Tesla (US) Model 3, Audi (Germany) Q4 E-TRON, Skoda (Czech Republic) Octavia, Volkswagen (Germany) Golf 8, Audi (Germany) A3.

- In May 2023, Bridgestone Corporation launched the R192E, an electric bus tire designed explicitly for electric-powered buses. Electric buses have unique performance requirements due to their heavier battery packs and increased torque. The R192E tire is engineered to address these specific needs and provide enhanced durability, traction, and energy efficiency for electric buses.

- In May 2023, Bridgestone Corporation’s new Potenza Race tire is offered in 13 sizes between 17 and 20 inches and was developed and made in Europe. These tires are primarily used in sports cars and supercars for the roads and racing tracks for some OEMs such as Maserati (Italy), Ferrari (Italy), Porsche (Germany), McLaren (UK), Lamborghini (Italy), BMW (Germany), Audi (Germany) RS, Mercedes (Germany), and others, are supported by Potenza Race.

- In March 2023, Continental AG showcased its digital tire management system, Conti Connect 2.0. The system enables fleet managers to monitor tire condition continuously, saving fuel and reducing CO2 emissions. This monitoring feature helps prevent early tire replacements and unscheduled downtime, improving fleets' operational efficiency.

- In March 2023, Michelin showcased a tire designed for SUVs and crossovers. It is all-season specially designed to handle various conditions, including snow and ice. It features a new tread compound that provides a better grip in wet and snowy conditions. It also features a new tread pattern designed to reduce road noise.

Frequently Asked Questions (FAQ):

How does the OE and Aftermarket demand vary by region and vehicle type?

The OEM market refers to the sale of tires by original equipment manufacturers (OEMs) to vehicle manufacturers. The aftermarket market refers to selling tires to consumers after purchasing the vehicle. The aftermarket demand for automotive tires is driven by a number of factors, including the age of the vehicle, the driving conditions, and the vehicle's intended use.

What would be the demand for tire rim size by vehicle type and region?

The type of vehicle will determine the size of the needed rim. 13”–15” rim size tires drive the market due to high sales of passenger cars in the Asia Pacific region. However, some high-performance cars may have rims that are 17-inch tires.

How will the tire retreading market shape up in the future?

Retreading tires is an environmentally friendly way to extend the life of tires. It reduces the need to produce new tires, which saves energy and reduces greenhouse gas emissions. Retreading tires is a sustainable way to manage tire waste. It reduces the amount of tires that end up in landfills and helps conserve natural resources.

What are the current and future tire material trends in the market?

There is a growing demand for tires made from sustainable materials that are derived from trees. It is a renewable resource that can be harvested without harming the environment. Recycled materials, such as tire rubber and plastic, can also be used to make tires. Bio-based materials, such as cornstarch and soybeans, can also be used to make tires. Tire manufacturers are developing new tire compounds that can improve the performance of tires in a variety of conditions. For example, new compounds can be designed to improve fuel efficiency, traction, and durability.

How does the penetration of all-season tires, winter tires, and summer tires vary by region?

The climate is the most important factor that affects the penetration of different types of tires. Regions with cold winters will have a higher penetration of winter tires, while regions with warm winters will have a higher penetration of summer tires. Some governments have regulations that require the use of winter tires in certain areas. This can increase the penetration of winter tires in those regions.

Which are the key players in the global tire market?

Bridgestone Corporation (Japan), Continental AG (Germany), The Goodyear Tire & Rubber Company (U.S.), Michelin (France), and Pirelli & C. S.p.A (Italy) is the key player in the global automobile tire market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing average life of vehicles and average annual miles driven by light-duty vehicles- Increase in demand for high-performance tires- High demand for low rolling resistance tiresRESTRAINTS- Volatility in raw material prices- Increasing longevity of tires affecting aftermarket salesOPPORTUNITIES- Rising popularity of eco-friendly tires owing to stringent regulations- Increased use of bio-oil in tire manufacturing processes- Rising demand for connected/smart tires for autonomous carsCHALLENGES- Increasing number of mandatory tests for tires before commercialization- Need for investment in R&D for effective and sustainable waste management solutions

-

5.3 CASE STUDYMRF TYRESJK TYRE & INDUSTRIES LTD.

-

5.4 PATENT ANALYSIS

-

5.5 TRADE ANALYSISIMPORT DATA- US- Canada- China- Japan- India- Germany- FranceEXPORT DATA- US- Canada- China- Japan- India- Germany- France

- 5.6 SUPPLY CHAIN ANALYSIS

-

5.7 MARKET ECOSYSTEM

-

5.8 PRICING ANALYSISBY REGION & RIM SIZE, 2022 (USD)BY REGION & VEHICLE TYPE, 2022 (USD)BY RAW MATERIAL

-

5.9 TRENDS/DISRUPTIONS IMPACTING MARKET

-

5.10 REGULATORY FRAMEWORKREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS- North America- Europe- Asia Pacific

-

5.11 TECHNOLOGY TRENDSSMART TIRES3D-PRINTED TIRESRUN-FLAT TIRESINTELLIGENT TIRES

- 5.12 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.13 KEY STAKEHOLDERS AND BUYING CRITERIABUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESS, BY VEHICLE TYPE

- 6.1 ASIA PACIFIC: KEY MARKET FOR AUTOMOTIVE TIRE MANUFACTURERS

- 6.2 COMPANIES TO ENHANCE FOCUS ON HIGH-PERFORMANCE AND GREEN TIRES

- 6.3 CONCLUSION

-

7.1 INTRODUCTIONINDUSTRY INSIGHTS

-

7.2 <200 MMGROWING DEMAND FOR COMPACT AND SUBCOMPACT VEHICLES TO DRIVE MARKET

-

7.3 200–230 MMRISING SALES OF LIGHT COMMERCIAL VEHICLES TO DRIVE MARKET

-

7.4 >230 MMINCREASING SALES OF HEAVY COMMERCIAL VEHICLES TO DRIVE MARKET

-

8.1 INTRODUCTIONINDUSTRY INSIGHTS

-

8.2 <60INCREASING DEMAND FOR PERFORMANCE CARS AND SEDANS TO DRIVE MARKET FOR <60 ASPECT RATIO TIRES

-

8.3 60–70RISING SALES OF SUVS AND CROSSOVERS TO DRIVE MARKET

-

8.4 >70GROWING E-COMMERCE INDUSTRY TO DRIVE MARKET

-

9.1 INTRODUCTIONINDUSTRY INSIGHTS

-

9.2 13–15”GROWING DEMAND FOR AFFORDABLE CARS TO DRIVE MARKET

-

9.3 16–18”GROWTH OF LOGISTICS INDUSTRY TO DRIVE MARKET

-

9.4 19–21”RISING DEMAND FOR LUXURY AND SPORTS CARS TO DRIVE MARKET

-

9.5 >21"INCREASING GLOBAL MEGA PROJECTS TO DRIVE MARKET

-

10.1 INTRODUCTIONINDUSTRY INSIGHTS

-

10.2 SUMMER TIRESRISE IN PERFORMANCE VEHICLES EQUIPPED WITH SUMMER TIRES TO DRIVE MARKET

-

10.3 WINTER TIRESGOVERNMENT REGULATIONS FOR USE OF WINTER TIRES IN CERTAIN COUNTRIES DURING WINTER MONTHS TO DRIVE MARKETSTUDDED TIRESNON-STUDDED TIRES

-

10.4 ALL-SEASON TIRESINCREASING SALES OF PASSENGER CARS AND SUVS TO DRIVE DEMAND FOR ALL-SEASON TIRES

-

11.1 INTRODUCTIONINDUSTRY INSIGHTS

-

11.2 PASSENGER CARSGROWING RENTAL CAR AND RIDE-SHARING BUSINESSES TO DRIVE MARKET

-

11.3 LIGHT COMMERCIAL VEHICLESGROWING FLEET AND DELIVERY SERVICES TO DRIVE MARKET

-

11.4 HEAVY COMMERCIAL VEHICLESGROWING CONSTRUCTION AND MINING INDUSTRIES TO DRIVE MARKET

-

12.1 INTRODUCTIONINDUSTRY INSIGHTS

-

12.2 PASSENGER CARSRISING DEMAND FOR USED CARS TO DRIVE MARKET

-

12.3 LIGHT COMMERCIAL VEHICLESINCREASED MILES DRIVEN BY LIGHT COMMERCIAL VEHICLES TO DRIVE MARKET

-

12.4 HEAVY COMMERCIAL VEHICLESHIGH COST OF NEW TIRES TO DRIVE DEMAND FOR RETREADED TIRES

-

13.1 INTRODUCTIONINDUSTRY INSIGHTS

-

13.2 PASSENGER CARSDECREASING COST OF RIMS DUE TO INCREASED COMPETITION TO DRIVE MARKET13–15”16–18”19–21”>21”

-

13.3 LIGHT COMMERCIAL VEHICLESUSE OF LIGHTWEIGHT MATERIALS IN RIMS WITH IMPROVED TECHNOLOGY TO DRIVE MARKET13–15”16–18”19–21”>21”

-

13.4 BUSESRISING DEMAND FOR ELECTRIC BUSES WITH VARIOUS RIM SIZES TO DRIVE MARKET16–18”19–21”>21”

-

13.5 TRUCKSINCREASE IN LAST-MILE DELIVERIES AND INFRASTRUCTURE DEVELOPMENT TO DRIVE MARKET16–18”19–21”>21”

-

14.1 INTRODUCTIONINDUSTRY INSIGHTS

-

14.2 RADIAL TIRESRISING SALES OF COMMERCIAL VEHICLES TO DRIVE DEMAND FOR RADIAL TIRESTUBE TIRESTUBELESS TIRES

-

14.3 BIAS TIRESRISING SALES OF TRACTORS AND TRUCKS TO DRIVE DEMAND FOR BIAS TIRES

- 15.1 INTRODUCTION

-

15.2 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTCHINA- Increasing presence and investment by foreign tire manufacturers to drive marketINDIA- Increasing demand for premium vehicles to drive marketJAPAN- Increasing demand for fuel-efficient tires to drive marketSOUTH KOREA- Heavy investment in R&D and manufacturing plant expansions to drive marketTHAILAND- High production of pickup trucks to drive marketREST OF ASIA PACIFIC

-

15.3 NORTH AMERICANORTH AMERICA: RECESSION IMPACTCANADA- Decreased production of passenger cars to impact marketMEXICO- Increasing demand for pickup trucks and SUVs to drive marketUS- Rising sales of pickup trucks to drive market

-

15.4 EUROPEEUROPE: RECESSION IMPACTGERMANY- Increasing sales of buses to drive demand for larger tiresFRANCE- Increasing demand for subcompact cars to drive marketUK- Implementation of Low Emission Zone (LEZ) to drive marketSPAIN- Rising popularity of small-sized SUVs and compact cars to drive marketRUSSIA- Rise of domestic automotive industry due to Russia-Ukraine war to drive marketITALY- Shift in customer preference toward larger rim-sized vehicles to drive marketTURKEY- Growing use of trucks in mining industry to drive marketREST OF EUROPE

-

15.5 LATIN AMERICALATIN AMERICA: RECESSION IMPACTBRAZIL- Rising demand for pickup trucks and LCVs with larger rim-sized tires to drive marketARGENTINA- Scrappage policy for old vehicles to drive marketREST OF LATIN AMERICA

-

15.6 MIDDLE EAST AND AFRICAMIDDLE EAST AND AFRICA: RECESSION IMPACTSOUTH AFRICA- Increasing awareness about safety to drive demand for radial tiresIRAN- Government subsidies to reduce car shortage to drive marketREST OF MIDDLE EAST AND AFRICA

- 16.1 OVERVIEW

- 16.2 REVENUE ANALYSIS OF KEY PLAYERS, 2020–2022

-

16.3 COMPANY EVALUATION MATRIX: PASSENGER CAR AND LCV TIRE MANUFACTURERSSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

16.4 COMPANY EVALUATION MATRIX: TRUCK AND BUS TIRE MANUFACTURERSSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

16.5 COMPETITIVE SCENARIOPRODUCT LAUNCHES

- 16.6 DEALS

- 16.7 EXPANSIONS

- 16.8 STRATEGIES ADOPTED BY KEY PLAYERS, 2022–2023

- 16.9 COMPETITIVE BENCHMARKING

-

17.1 KEY PLAYERSBRIDGESTONE CORPORATION- Business overview- Products offered- Recent developments- MnM viewCONTINENTAL AG- Business overview- Products offered- Recent developments- MnM viewGOODYEAR TIRE & RUBBER COMPANY- Business overview- Products offered- Recent developments- MnM viewMICHELIN- Business overview- Products offered- Recent developments- MnM viewPIRELLI & C. S.P.A.- Business overview- Products offered- Recent developments- MnM viewSUMITOMO RUBBER INDUSTRIES LTD.- Business overview- Products offered- Recent developmentsHANKOOK TIRE & TECHNOLOGY- Business overview- Products offered- Recent developmentsYOKOHAMA RUBBER CO., LTD.- Business overview- Products offered- Recent developmentsCOOPER TIRE & RUBBER COMPANY- Business overview- Products offered- Recent developmentsTOYO TIRE CORPORATION- Business overview- Products offered- Recent developments

-

17.2 OTHER PLAYERSZHONGCE RUBBER GROUP CO., LTD.MAXXIS INTERNATIONALDUNLOPKUMHO TIRENOKIAN TYRES PLCAPOLLO TYRES LTD.MRF LTD.JK TYRE & INDUSTRIES LTD.CEAT LTD.NEXEN TIRE CORPORATION

- 18.1 INSIGHTS FROM INDUSTRY EXPERTS

- 18.2 DISCUSSION GUIDE

- 18.3 PRODUCT DEVELOPMENTS

- 18.4 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

-

18.5 CUSTOMIZATION OPTIONSADDITIONAL COMPANY PROFILES (BUSINESS OVERVIEW, RECENT DEVELOPMENT, AND MNM VIEW)AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE (COUNTRY LEVEL)- Passenger Cars- Light Commercial Vehicles- Heavy Commercial VehiclesAUTOMOTIVE TIRE OE MARKET, BY SEASON- Summer Tires- Winter Tires- All-season TiresAUTOMOTIVE TIRE OE MARKET, BY SECTION WIDTH- <200 MM- 200–230 MM- >230 MMAUTOMOTIVE TIRE OE MARKET, BY ASPECT RATIO- <60- 60–70- >70AUTOMOTIVE TIRE OE MARKET, BY MATERIAL- Polymers- Fillers- Softeners- Curatives- OthersAUTOMOTIVE TIRE RETREADING MARKET, BY RETREAD PROCESS (COMMERCIAL VEHICLE)- Mold Cure- Pre-cure

- 18.6 RELATED REPORTS

- 18.7 AUTHOR DETAILS

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- TABLE 2 TIRE EFFICIENCY CLASSIFICATION

- TABLE 3 TIRE MANUFACTURERS FOCUS ON ECO-FRIENDLY MATERIALS

- TABLE 4 PATENT ANALYSIS

- TABLE 5 US: TIRES IMPORT SHARE, BY COUNTRY (VALUE %)

- TABLE 6 CANADA: TIRES IMPORT SHARE, BY COUNTRY (VALUE %)

- TABLE 7 CHINA: TIRES IMPORT SHARE, BY COUNTRY (VALUE %)

- TABLE 8 JAPAN: TIRES IMPORT SHARE, BY COUNTRY (VALUE %)

- TABLE 9 INDIA: TIRES IMPORT SHARE, BY COUNTRY (VALUE %)

- TABLE 10 GERMANY: TIRES IMPORT SHARE, BY COUNTRY (VALUE %)

- TABLE 11 FRANCE: TIRES IMPORT SHARE, BY COUNTRY (VALUE %)

- TABLE 12 US: TIRES EXPORT SHARE, BY COUNTRY (VALUE %)

- TABLE 13 CANADA: TIRES EXPORT SHARE, BY COUNTRY (VALUE %)

- TABLE 14 CHINA: TIRES EXPORT SHARE, BY COUNTRY (VALUE %)

- TABLE 15 JAPAN: TIRES EXPORT SHARE, BY COUNTRY (VALUE %)

- TABLE 16 INDIA: TIRES EXPORT SHARE, BY COUNTRY (VALUE %)

- TABLE 17 GERMANY: TIRES EXPORT SHARE, BY COUNTRY (VALUE %)

- TABLE 18 FRANCE: TIRES EXPORT SHARE, BY COUNTRY (VALUE %)

- TABLE 19 ROLE OF COMPANIES IN AUTOMOTIVE TIRE MARKET ECOSYSTEM

- TABLE 20 AVERAGE PRICE OF AUTOMOTIVE OE TIRES, BY REGION & RIM SIZE, 2022 (USD)

- TABLE 21 AVERAGE PRICE OF AUTOMOTIVE AFTERMARKET TIRES, BY REGION & VEHICLE TYPE, 2022 (USD)

- TABLE 22 AVERAGE PRICE OF AUTOMOTIVE TIRES, BY REGION & RAW MATERIAL, 2022 (USD)

- TABLE 23 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 24 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 25 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 26 KEY BUYING CRITERIA FOR AUTOMOTIVE TIRES

- TABLE 27 KEY STAKEHOLDERS IN BUYING PROCESS FOR VEHICLE TYPES

- TABLE 28 AUTOMOTIVE TIRE AFTERMARKET, BY SECTION WIDTH, 2019–2022 (MILLION UNITS)

- TABLE 29 AUTOMOTIVE TIRE AFTERMARKET, BY SECTION WIDTH, 2023–2028 (MILLION UNITS)

- TABLE 30 AUTOMOTIVE TIRE AFTERMARKET, BY SECTION WIDTH, 2019–2022 (USD MILLION)

- TABLE 31 AUTOMOTIVE TIRE AFTERMARKET, BY SECTION WIDTH, 2023–2028 (USD MILLION)

- TABLE 32 <200 MM SECTION WIDTH: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2019–2022 (MILLION UNITS)

- TABLE 33 <200 MM SECTION WIDTH: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2023–2028 (MILLION UNITS)

- TABLE 34 <200 MM SECTION WIDTH: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2019–2022 (USD MILLION)

- TABLE 35 <200 MM SECTION WIDTH: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2023–2028 (USD MILLION)

- TABLE 36 200–230 MM SECTION WIDTH: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2019–2022 (MILLION UNITS)

- TABLE 37 200–230 MM SECTION WIDTH: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2023–2028 (MILLION UNITS)

- TABLE 38 200–230 MM SECTION WIDTH: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2019–2022 (USD MILLION)

- TABLE 39 200–230 MM SECTION WIDTH: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2023–2028 (USD MILLION)

- TABLE 40 >230 MM SECTION WIDTH: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2019–2022 (MILLION UNITS)

- TABLE 41 >230 MM SECTION WIDTH: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2023–2028 (MILLION UNITS)

- TABLE 42 >230 MM SECTION WIDTH: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2019–2022 (USD MILLION)

- TABLE 43 >230 MM SECTION WIDTH: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2023–2028 (USD MILLION)

- TABLE 44 AUTOMOTIVE TIRE AFTERMARKET, BY ASPECT RATIO, 2019–2022 (MILLION UNITS)

- TABLE 45 AUTOMOTIVE TIRE AFTERMARKET, BY ASPECT RATIO, 2023–2028 (MILLION UNITS)

- TABLE 46 AUTOMOTIVE TIRE AFTERMARKET, BY ASPECT RATIO, 2019–2022 (USD MILLION)

- TABLE 47 AUTOMOTIVE TIRE AFTERMARKET, BY ASPECT RATIO, 2023–2028 (USD MILLION)

- TABLE 48 <60 ASPECT RATIO: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2019–2022 (MILLION UNITS)

- TABLE 49 <60 ASPECT RATIO: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2023–2028 (MILLION UNITS)

- TABLE 50 <60 ASPECT RATIO: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2019–2022 (USD MILLION)

- TABLE 51 <60 ASPECT RATIO: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2023–2028 (USD MILLION)

- TABLE 52 60–70 ASPECT RATIO: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2019–2022 (MILLION UNITS)

- TABLE 53 60–70 ASPECT RATIO: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2023–2028 (MILLION UNITS)

- TABLE 54 60–70 ASPECT RATIO: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2019–2022 (USD MILLION)

- TABLE 55 60–70 ASPECT RATIO: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2023–2028 (USD MILLION)

- TABLE 56 >70 ASPECT RATIO: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2019–2022 (MILLION UNITS)

- TABLE 57 >70 ASPECT RATIO: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2023–2028 (MILLION UNITS)

- TABLE 58 >70 ASPECT RATIO: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2019–2022 (USD MILLION)

- TABLE 59 >70 ASPECT RATIO: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2023–2028 (USD MILLION)

- TABLE 60 AUTOMOTIVE TIRE AFTERMARKET, BY RIM SIZE, 2019–2022 (MILLION UNITS)

- TABLE 61 AUTOMOTIVE TIRE AFTERMARKET, BY RIM SIZE, 2023–2028 (MILLION UNITS)

- TABLE 62 AUTOMOTIVE TIRE AFTERMARKET, BY RIM SIZE, 2019–2022 (USD MILLION)

- TABLE 63 AUTOMOTIVE TIRE AFTERMARKET, BY RIM SIZE, 2023–2028 (USD MILLION)

- TABLE 64 13–15” RIM SIZE: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2019–2022 (MILLION UNITS)

- TABLE 65 13–15” RIM SIZE: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2023–2028 (MILLION UNITS)

- TABLE 66 13–15” RIM SIZE: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2019–2022 (USD MILLION)

- TABLE 67 13–15” RIM SIZE: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2023–2028 (USD MILLION)

- TABLE 68 16–18” RIM SIZE: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2019–2022 (MILLION UNITS)

- TABLE 69 16–18” RIM SIZE: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2023–2028 (MILLION UNITS)

- TABLE 70 16–18” RIM SIZE: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2019–2022 (USD MILLION)

- TABLE 71 16–18” RIM SIZE: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2023–2028 (USD MILLION)

- TABLE 72 19–21” RIM SIZE: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2019–2022 (MILLION UNITS)

- TABLE 73 19–21” RIM SIZE: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2023–2028 (MILLION UNITS)

- TABLE 74 19–21” RIM SIZE: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2019–2022 (USD MILLION)

- TABLE 75 19–21” RIM SIZE: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2023–2028 (USD MILLION)

- TABLE 76 MEGAPROJECTS REQUIRING COMMERCIAL VEHICLES WITH >21” RIM-SIZED TIRES

- TABLE 77 >21” RIM SIZE: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2019–2022 (MILLION UNITS)

- TABLE 78 >21” RIM SIZE: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2023–2028 (MILLION UNITS)

- TABLE 79 >21” RIM SIZE: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2019–2022 (USD MILLION)

- TABLE 80 >21” RIM SIZE: AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE & REGION, 2023–2028 (USD MILLION)

- TABLE 81 AUTOMOTIVE TIRE AFTERMARKET, BY SEASON, 2019–2022 (MILLION UNITS)

- TABLE 82 AUTOMOTIVE TIRE AFTERMARKET, BY SEASON, 2023–2028 (MILLION UNITS)

- TABLE 83 AUTOMOTIVE TIRE AFTERMARKET, BY SEASON, 2019–2022 (USD MILLION)

- TABLE 84 AUTOMOTIVE TIRE AFTERMARKET, BY SEASON, 2023–2028 (USD MILLION)

- TABLE 85 SUMMER TIRE LAUNCHES, 2022–2023

- TABLE 86 SUMMER TIRES: AUTOMOTIVE TIRE AFTERMARKET, BY REGION, 2019–2022 (MILLION UNITS)

- TABLE 87 SUMMER TIRES: AUTOMOTIVE TIRE AFTERMARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 88 SUMMER TIRES: AUTOMOTIVE TIRE AFTERMARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 89 SUMMER TIRES: AUTOMOTIVE TIRE AFTERMARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 90 WINTER TIRE LAUNCHES, 2022–2023

- TABLE 91 WINTER TIRES: AUTOMOTIVE TIRE AFTERMARKET, BY REGION, 2019–2022 (MILLION UNITS)

- TABLE 92 WINTER TIRES: AUTOMOTIVE TIRE AFTERMARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 93 WINTER TIRES: AUTOMOTIVE TIRE AFTERMARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 94 WINTER TIRES: AUTOMOTIVE TIRE AFTERMARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 95 STUDDED TIRE LAUNCHES, 2022–2023

- TABLE 96 STUDDED WINTER TIRE AFTERMARKET, BY REGION, 2019–2022 (MILLION UNITS)

- TABLE 97 STUDDED WINTER TIRE AFTERMARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 98 STUDDED WINTER TIRE AFTERMARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 99 STUDDED WINTER TIRE AFTERMARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 100 NON-STUDDED TIRE LAUNCHES, 2022–2023

- TABLE 101 NON-STUDDED WINTER TIRE AFTERMARKET, BY REGION, 2019–2022 (MILLION UNITS)

- TABLE 102 NON-STUDDED WINTER TIRE AFTERMARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 103 NON-STUDDED WINTER TIRE AFTERMARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 104 NON-STUDDED WINTER TIRE AFTERMARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 105 ALL-SEASON TIRE LAUNCHES, 2022–2023

- TABLE 106 ALL-SEASON TIRES: AUTOMOTIVE TIRE AFTERMARKET, BY REGION, 2019–2022 (MILLION UNITS)

- TABLE 107 ALL-SEASON TIRES: AUTOMOTIVE TIRE AFTERMARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 108 ALL-SEASON TIRES: AUTOMOTIVE TIRE AFTERMARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 109 ALL-SEASON TIRES: AUTOMOTIVE TIRE AFTERMARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 110 AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE, 2019–2022 (MILLION UNITS)

- TABLE 111 AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE, 2023–2028 (MILLION UNITS)

- TABLE 112 AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 113 AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 114 RIDE-SHARING, TAXI, AND RENTAL CAR SERVICES, 2022

- TABLE 115 PASSENGER CARS: AUTOMOTIVE TIRE AFTERMARKET, BY REGION, 2019–2022 (MILLION UNITS)

- TABLE 116 PASSENGER CARS: AUTOMOTIVE TIRE AFTERMARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 117 PASSENGER CARS: AUTOMOTIVE TIRE AFTERMARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 118 PASSENGER CARS: AUTOMOTIVE TIRE AFTERMARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 119 LIGHT COMMERCIAL VEHICLES: AUTOMOTIVE TIRE AFTERMARKET, BY REGION, 2019–2022 (MILLION UNITS)

- TABLE 120 LIGHT COMMERCIAL VEHICLES: AUTOMOTIVE TIRE AFTERMARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 121 LIGHT COMMERCIAL VEHICLES: AUTOMOTIVE TIRE AFTERMARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 122 LIGHT COMMERCIAL VEHICLES: AUTOMOTIVE TIRE AFTERMARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 123 EUROPE AND US REGULATIONS AND STANDARDS FOR HCVS, 2022

- TABLE 124 HEAVY COMMERCIAL VEHICLES: AUTOMOTIVE TIRE AFTERMARKET, BY REGION, 2019–2022 (MILLION UNITS)

- TABLE 125 HEAVY COMMERCIAL VEHICLES: AUTOMOTIVE TIRE AFTERMARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 126 HEAVY COMMERCIAL VEHICLES: AUTOMOTIVE TIRE AFTERMARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 127 HEAVY COMMERCIAL VEHICLES: AUTOMOTIVE TIRE AFTERMARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 128 AUTOMOTIVE TIRE RETREADING MARKET, BY VEHICLE TYPE, 2019–2022 (MILLION UNITS)

- TABLE 129 AUTOMOTIVE TIRE RETREADING MARKET, BY VEHICLE TYPE, 2023–2028 (MILLION UNITS)

- TABLE 130 AUTOMOTIVE TIRE RETREADING MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 131 AUTOMOTIVE TIRE RETREADING MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 132 PASSENGER CARS TIRE RETREADING MARKET, BY REGION, 2019–2022 (MILLION UNITS)

- TABLE 133 PASSENGER CARS TIRE RETREADING MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 134 PASSENGER CARS TIRE RETREADING MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 135 PASSENGER CARS TIRE RETREADING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 136 LIGHT COMMERCIAL VEHICLES TIRE RETREADING MARKET, BY REGION, 2019–2022 (MILLION UNITS)

- TABLE 137 LIGHT COMMERCIAL VEHICLES TIRE RETREADING MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 138 LIGHT COMMERCIAL VEHICLES TIRE RETREADING MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 139 LIGHT COMMERCIAL VEHICLES TIRE RETREADING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 140 HEAVY COMMERCIAL VEHICLES TIRE RETREADING MARKET, BY REGION, 2019–2022 (MILLION UNITS)

- TABLE 141 HEAVY COMMERCIAL VEHICLES TIRE RETREADING MARKET, BY REGION, 2023–2028 (MILLION UNITS

- TABLE 142 HEAVY COMMERCIAL VEHICLES TIRE RETREADING MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 143 HEAVY COMMERCIAL VEHICLES TIRE RETREADING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 144 AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019–2022 (MILLION UNITS)

- TABLE 145 AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023–2028 (MILLION UNITS)

- TABLE 146 AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 147 AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 148 PASSENGER CAR TIRE OE MARKET, BY RIM SIZE, 2019–2022 (MILLION UNITS)

- TABLE 149 PASSENGER CAR TIRE OE MARKET, BY RIM SIZE, 2023–2028 (MILLION UNITS)

- TABLE 150 PASSENGER CAR TIRE OE MARKET, BY RIM SIZE, 2019–2022 (USD MILLION)

- TABLE 151 PASSENGER CAR TIRE OE MARKET, BY RIM SIZE, 2023–2028 (USD MILLION)

- TABLE 152 13–15”: PASSENGER CAR TIRE OE MARKET, BY REGION, 2019–2022 (MILLION UNITS)

- TABLE 153 13–15”: PASSENGER CAR TIRE OE MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 154 13–15”: PASSENGER CAR TIRE OE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 155 13–15”: PASSENGER CAR TIRE OE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 156 16–18”: PASSENGER CAR TIRE OE MARKET, BY REGION, 2019–2022 (MILLION UNITS)

- TABLE 157 16–18”: PASSENGER CAR TIRE OE MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 158 16–18”: PASSENGER CAR TIRE OE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 159 16–18”: PASSENGER CAR TIRE OE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 160 19–21”: PASSENGER CAR TIRE OE MARKET, BY REGION, 2019–2022 (MILLION UNITS)

- TABLE 161 19–21”: PASSENGER CAR TIRE OE MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 162 19–21”: PASSENGER CAR TIRE OE MARKET, BY REGION, 2019–2028 (USD MILLION)

- TABLE 163 19–21”: PASSENGER CAR TIRE OE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 164 >21”: PASSENGER CAR TIRE OE MARKET, BY REGION, 2019–2022 (MILLION UNITS)

- TABLE 165 >21”: PASSENGER CAR TIRE OE MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 166 >21”: PASSENGER CAR TIRE OE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 167 >21”: PASSENGER CAR TIRE OE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 168 LIGHT COMMERCIAL VEHICLES TIRE OE MARKET, BY RIM SIZE, 2019–2022 (MILLION UNITS)

- TABLE 169 LIGHT COMMERCIAL VEHICLES TIRE OE MARKET, BY RIM SIZE, 2023–2028 (MILLION UNITS)

- TABLE 170 LIGHT COMMERCIAL VEHICLES TIRE OE MARKET, BY RIM SIZE, 2019–2022 (USD MILLION)

- TABLE 171 LIGHT COMMERCIAL VEHICLES TIRE OE MARKET, BY RIM SIZE, 2023–2028 (USD MILLION)

- TABLE 172 13–15”: LIGHT COMMERCIAL VEHICLE TIRE OE MARKET, BY REGION, 2019–2022 (MILLION UNITS)

- TABLE 173 13–15”: LIGHT COMMERCIAL VEHICLE TIRE OE MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 174 13–15”: LIGHT COMMERCIAL VEHICLE TIRE OE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 175 13–15”: LIGHT COMMERCIAL VEHICLE TIRE OE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 176 16–18”: LIGHT COMMERCIAL VEHICLE TIRE OE MARKET, BY REGION, 2019–2022 (MILLION UNITS)

- TABLE 177 16–18”: LIGHT COMMERCIAL VEHICLE TIRE OE MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 178 16–18”: LIGHT COMMERCIAL VEHICLE TIRE OE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 179 16–18”: LIGHT COMMERCIAL VEHICLE TIRE OE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 180 19–21”: LIGHT COMMERCIAL VEHICLE TIRE OE MARKET, BY REGION, 2019–2022 (MILLION UNITS)

- TABLE 181 19–21”: LIGHT COMMERCIAL VEHICLE TIRE OE MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 182 19–21”: LIGHT COMMERCIAL VEHICLE TIRE OE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 183 19–21”: LIGHT COMMERCIAL VEHICLE TIRE OE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 184 >21”: LIGHT COMMERCIAL VEHICLE TIRE OE MARKET, BY REGION, 2019–2022 (MILLION UNITS)

- TABLE 185 >21”: LIGHT COMMERCIAL VEHICLE TIRE OE MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 186 >21”: LIGHT COMMERCIAL VEHICLE TIRE OE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 187 >21”: LIGHT COMMERCIAL VEHICLE TIRE OE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 188 BUSES: TIRE OE MARKET, BY RIM SIZE, 2019–2022 (MILLION UNITS)

- TABLE 189 BUSES TIRE OE MARKET, BY RIM SIZE, 2023–2028 (MILLION UNITS)

- TABLE 190 BUSES TIRE OE MARKET, BY RIM SIZE, 2019–2022 (USD MILLION)

- TABLE 191 BUSES TIRE OE MARKET, BY RIM SIZE, 2023–2028 (USD MILLION)

- TABLE 192 16–18”: BUS TIRE OE MARKET, BY REGION, 2019–2022 (MILLION UNITS)

- TABLE 193 16–18”: BUS TIRE OE MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 194 16–18”: BUS TIRE OE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 195 16–18”: BUS TIRE OE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 196 19–21”: BUS TIRE OE MARKET, BY REGION, 2019–2022 (MILLION UNITS)

- TABLE 197 19–21”: BUS TIRE OE MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 198 19–21”: BUS TIRE OE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 199 19–21”: BUS TIRE OE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 200 >21”: BUS TIRE OE MARKET, BY REGION, 2019–2022 (MILLION UNITS)

- TABLE 201 >21”: BUS TIRE OE MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 202 >21”: BUS TIRE OE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 203 >21”: BUS TIRE OE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 204 TRUCK TIRE OE MARKET, BY RIM SIZE, 2019–2022 (MILLION UNITS)

- TABLE 205 TRUCK TIRE OE MARKET, BY RIM SIZE, 2023–2028 (MILLION UNITS)

- TABLE 206 TRUCK TIRE OE MARKET, BY RIM SIZE, 2019–2022 (USD MILLION)

- TABLE 207 TRUCK TIRE OE MARKET, BY RIM SIZE, 2023–2028 (USD MILLION)

- TABLE 208 16–18”: TRUCK TIRE OE MARKET, BY REGION, 2019–2022 (MILLION UNITS)

- TABLE 209 16–18”: TRUCK TIRE OE MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 210 16–18”: TRUCK TIRE OE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 211 16–18”: TRUCK TIRE OE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 212 19–21”: TRUCK TIRE OE MARKET, BY REGION, 2019–2022 (MILLION UNITS)

- TABLE 213 19–21”: TRUCK TIRE OE MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 214 19–21”: TRUCK TIRE OE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 215 19–21”: TRUCK TIRE OE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 216 >21”: TRUCK TIRE OE MARKET, BY REGION, 2019–2022 (MILLION UNITS)

- TABLE 217 >21”: TRUCK TIRE OE MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 218 >21”: TRUCK TIRE OE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 219 >21”: TRUCK TIRE OE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 220 AUTOMOTIVE TIRE OE MARKET, BY TIRE TYPE, 2019–2022 (MILLION UNITS)

- TABLE 221 AUTOMOTIVE TIRE OE MARKET, BY TIRE TYPE, 2023–2028 (MILLION UNITS)

- TABLE 222 AUTOMOTIVE TIRE OE MARKET, BY TIRE TYPE, 2019–2022 (USD MILLION)

- TABLE 223 AUTOMOTIVE TIRE OE MARKET, BY TIRE TYPE, 2023–2028 (USD MILLION)

- TABLE 224 PROS AND CONS OF RADIAL AND BIAS TIRES

- TABLE 225 RADIAL TIRES OE MARKET, BY REGION, 2019–2022 (MILLION UNITS)

- TABLE 226 RADIAL TIRE OE MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 227 RADIAL TIRE OE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 228 RADIAL TIRE OE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 229 TUBE RADIAL TIRE OE MARKET, BY REGION, 2019–2022 (MILLION UNITS)

- TABLE 230 TUBE RADIAL TIRE OE MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 231 TUBE RADIAL TIRE OE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 232 TUBE RADIAL TIRE OE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 233 TUBELESS RADIAL TIRE OE MARKET, BY REGION, 2019–2022 (MILLION UNITS)

- TABLE 234 TUBELESS RADIAL TIRE OE MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 235 TUBELESS RADIAL TIRE OE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 236 TUBELESS RADIAL TIRE OE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 237 BIAS TIRES OE MARKET, BY REGION, 2019–2022 (MILLION UNITS)

- TABLE 238 BIAS TIRES OE MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 239 BIAS TIRES OE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 240 BIAS TIRES OE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 241 AUTOMOTIVE TIRE OE MARKET, BY REGION, 2019–2022 (MILLION UNITS)

- TABLE 242 AUTOMOTIVE TIRE OE MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 243 AUTOMOTIVE TIRE OE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 244 AUTOMOTIVE TIRE OE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 245 ASIA PACIFIC: AUTOMOTIVE TIRE OE MARKET, BY COUNTRY, 2019–2022 (MILLION UNITS)

- TABLE 246 ASIA PACIFIC: AUTOMOTIVE TIRE OE MARKET, BY COUNTRY, 2023–2028 (MILLION UNITS)

- TABLE 247 ASIA PACIFIC: AUTOMOTIVE TIRE OE MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 248 ASIA PACIFIC: AUTOMOTIVE TIRE OE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 249 CHINA: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019–2022 (MILLION UNITS)

- TABLE 250 CHINA: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023–2028 (MILLION UNITS)

- TABLE 251 CHINA: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 252 CHINA: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 253 INDIA: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019–2022 (MILLION UNITS)

- TABLE 254 INDIA: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023–2028 (MILLION UNITS)

- TABLE 255 INDIA: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 256 INDIA: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 257 JAPAN: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019–2022 (MILLION UNITS)

- TABLE 258 JAPAN: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023–2028 (MILLION UNITS)

- TABLE 259 JAPAN: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 260 JAPAN: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 261 SOUTH KOREA: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019–2022 (MILLION UNITS)

- TABLE 262 SOUTH KOREA: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023–2028 (MILLION UNITS)

- TABLE 263 SOUTH KOREA: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 264 SOUTH KOREA: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 265 THAILAND: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019–2022 (MILLION UNITS)

- TABLE 266 THAILAND: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023–2028 (MILLION UNITS)

- TABLE 267 THAILAND: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 268 THAILAND: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 269 NORTH AMERICA: AUTOMOTIVE TIRE OE MARKET, BY COUNTRY, 2019–2022 (MILLION UNITS)

- TABLE 270 NORTH AMERICA: AUTOMOTIVE TIRE OE MARKET, BY COUNTRY, 2023–2028 (MILLION UNITS)

- TABLE 271 NORTH AMERICA: AUTOMOTIVE TIRE OE MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 272 NORTH AMERICA: AUTOMOTIVE TIRE OE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 273 CANADA: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019–2022 (MILLION UNITS)

- TABLE 274 CANADA: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023–2028 (MILLION UNITS)

- TABLE 275 CANADA: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 276 CANADA: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 277 MEXICO: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019–2022 (MILLION UNITS)

- TABLE 278 MEXICO: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023–2028 (MILLION UNITS)

- TABLE 279 MEXICO: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 280 MEXICO: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 281 US: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019–2022 (MILLION UNITS)

- TABLE 282 US: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023–2028 (MILLION UNITS)

- TABLE 283 US: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 284 US: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 285 EUROPE: AUTOMOTIVE TIRE OE MARKET, BY COUNTRY, 2019–2022 (MILLION UNITS)

- TABLE 286 EUROPE: AUTOMOTIVE TIRE OE MARKET, BY COUNTRY, 2023–2028 (MILLION UNITS)

- TABLE 287 EUROPE: AUTOMOTIVE TIRE OE MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 288 EUROPE: AUTOMOTIVE TIRE OE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 289 GERMANY: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019–2022 (MILLION UNITS)

- TABLE 290 GERMANY: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023–2028 (MILLION UNITS)

- TABLE 291 GERMANY: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 292 GERMANY: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 293 FRANCE: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019–2022 (MILLION UNITS)

- TABLE 294 FRANCE: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023–2028 (MILLION UNITS)

- TABLE 295 FRANCE: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 296 FRANCE: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 297 UK: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019–2022 (MILLION UNITS)

- TABLE 298 UK: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023–2028 (MILLION UNITS)

- TABLE 299 UK: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 300 UK: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 301 SPAIN: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019–2022 (MILLION UNITS)

- TABLE 302 SPAIN: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023–2028 (MILLION UNITS)

- TABLE 303 SPAIN: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 304 SPAIN: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 305 RUSSIA: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019–2022 (MILLION UNITS)

- TABLE 306 RUSSIA: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023–2028 (MILLION UNITS)

- TABLE 307 RUSSIA: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 308 RUSSIA: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 309 ITALY: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019–2022 (MILLION UNITS)

- TABLE 310 ITALY: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023–2028 (MILLION UNITS)

- TABLE 311 ITALY: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 312 ITALY: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 313 TURKEY: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019–2022 (MILLION UNITS)

- TABLE 314 TURKEY: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023–2028 (MILLION UNITS)

- TABLE 315 TURKEY: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 316 TURKEY: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 317 LATIN AMERICA: AUTOMOTIVE TIRE OE MARKET, BY COUNTRY, 2019–2028 (MILLION UNITS)

- TABLE 318 LATIN AMERICA: AUTOMOTIVE TIRE OE MARKET, BY COUNTRY, 2023–2028 (MILLION UNITS)

- TABLE 319 LATIN AMERICA: AUTOMOTIVE TIRE OE MARKET, BY COUNTRY, 2019–2028 (USD MILLION)

- TABLE 320 LATIN AMERICA: AUTOMOTIVE TIRE OE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 321 BRAZIL: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019–2022 (MILLION UNITS)

- TABLE 322 BRAZIL: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023–2028 (MILLION UNITS)

- TABLE 323 BRAZIL: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 324 BRAZIL: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 325 ARGENTINA: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019–2022 (MILLION UNITS)

- TABLE 326 ARGENTINA: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023–2028 (MILLION UNITS)

- TABLE 327 ARGENTINA: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 328 ARGENTINA: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 329 MIDDLE EAST AND AFRICA: AUTOMOTIVE TIRE OE MARKET, BY COUNTRY, 2019–2022 (MILLION UNITS)

- TABLE 330 MIDDLE EAST AND AFRICA: AUTOMOTIVE TIRE OE MARKET, BY COUNTRY, 2023–2028 (MILLION UNITS)

- TABLE 331 MIDDLE EAST AND AFRICA: AUTOMOTIVE TIRE OE MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 332 MIDDLE EAST AND AFRICA: AUTOMOTIVE TIRE OE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 333 SOUTH AFRICA: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019–2022 (MILLION UNITS)

- TABLE 334 SOUTH AFRICA: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023–2028 (MILLION UNITS)

- TABLE 335 SOUTH AFRICA: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 336 SOUTH AFRICA: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 337 IRAN: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019–2022 (MILLION UNITS)

- TABLE 338 IRAN: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023–2028 (MILLION UNITS)

- TABLE 339 IRAN: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 340 IRAN: AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 341 KEY STRATEGIES ADOPTED BY MARKET PLAYERS, 2022–2023

- TABLE 342 PRODUCT LAUNCHES, FEBRUARY 2022–JULY 2023

- TABLE 343 DEALS, FEBRUARY 2022–JUNE 2023

- TABLE 344 EXPANSIONS, SEPTEMBER 2022–APRIL 2023

- TABLE 345 KEY GROWTH STRATEGIES, 2022–2023

- TABLE 346 AUTOMOTIVE TIRE MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

- TABLE 347 BRIDGESTONE CORPORATION: COMPANY OVERVIEW

- TABLE 348 BRIDGESTONE CORPORATION: PRODUCTS OFFERED

- TABLE 349 BRIDGESTONE CORPORATION: PRODUCT LAUNCHES

- TABLE 350 BRIDGESTONE CORPORATION: DEALS

- TABLE 351 BRIDGESTONE CORPORATION: OTHERS

- TABLE 352 CONTINENTAL AG: COMPANY OVERVIEW

- TABLE 353 CONTINENTAL AG: PRODUCTS OFFERED

- TABLE 354 CONTINENTAL AG: PRODUCT LAUNCHES

- TABLE 355 CONTINENTAL AG: DEALS

- TABLE 356 CONTINENTAL AG: OTHERS

- TABLE 357 GOODYEAR TIRE & RUBBER COMPANY: COMPANY OVERVIEW

- TABLE 358 GOODYEAR TIRE & RUBBER COMPANY: PRODUCTS OFFERED

- TABLE 359 GOODYEAR TIRE & RUBBER COMPANY: PRODUCT LAUNCHES

- TABLE 360 GOODYEAR TIRE & RUBBER COMPANY: DEALS

- TABLE 361 MICHELIN: COMPANY OVERVIEW

- TABLE 362 MICHELIN: PRODUCTS OFFERED

- TABLE 363 MICHELIN: PRODUCT LAUNCHES

- TABLE 364 MICHELIN: DEALS

- TABLE 365 PIRELLI & C. S.P.A.: COMPANY OVERVIEW

- TABLE 366 PIRELLI & C. S.P.A.: PRODUCTS OFFERED

- TABLE 367 PIRELLI & C. S.P.A.: PRODUCT LAUNCHES

- TABLE 368 PIRELLI & C. S.P.A.: DEALS

- TABLE 369 SUMITOMO RUBBER INDUSTRIES LTD.: COMPANY OVERVIEW

- TABLE 370 SUMITOMO RUBBER INDUSTRIES LTD.: PRODUCTS OFFERED

- TABLE 371 SUMITOMO RUBBER INDUSTRIES LTD.: PRODUCT LAUNCHES

- TABLE 372 HANKOOK TIRE & TECHNOLOGY: COMPANY OVERVIEW

- TABLE 373 HANKOOK TIRE & TECHNOLOGY: PRODUCTS OFFERED

- TABLE 374 HANKOOK TIRE & TECHNOLOGY: PRODUCT LAUNCHES

- TABLE 375 HANKOOK TIRE & TECHNOLOGY: DEALS

- TABLE 376 HANKOOK TIRE & TECHNOLOGY: OTHERS

- TABLE 377 YOKOHAMA RUBBER CO., LTD.: COMPANY OVERVIEW

- TABLE 378 YOKOHAMA RUBBER CO., LTD.: PRODUCTS OFFERED

- TABLE 379 YOKOHAMA RUBBER CO., LTD.: PRODUCT LAUNCHES

- TABLE 380 YOKOHAMA RUBBER CO., LTD.: DEALS

- TABLE 381 YOKOHAMA RUBBER CO., LTD.: OTHERS

- TABLE 382 COOPER TIRE & RUBBER COMPANY: COMPANY OVERVIEW

- TABLE 383 COOPER TIRE & RUBBER COMPANY: PRODUCTS OFFERED

- TABLE 384 COOPER TIRE & RUBBER COMPANY: PRODUCT LAUNCHES

- TABLE 385 COOPER TIRE & RUBBER COMPANY: DEALS

- TABLE 386 COOPER TIRE & RUBBER COMPANY: OTHERS

- TABLE 387 TOYO TIRE CORPORATION: COMPANY OVERVIEW

- TABLE 388 TOYO TIRE CORPORATION: PRODUCTS OFFERED

- TABLE 389 TOYO TIRE CORPORATION: PRODUCT LAUNCHES

- TABLE 390 TOYO TIRE CORPORATION: DEALS

- TABLE 391 TOYO TIRE CORPORATION: OTHERS

- TABLE 392 ZHONGCE RUBBER GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 393 MAXXIS INTERNATIONAL: COMPANY OVERVIEW

- TABLE 394 DUNLOP: COMPANY OVERVIEW

- TABLE 395 KUMHO TIRE: COMPANY OVERVIEW

- TABLE 396 NOKIAN TYRES PLC: COMPANY OVERVIEW

- TABLE 397 APOLLO TYRES LTD.: COMPANY OVERVIEW

- TABLE 398 MRF LTD.: COMPANY OVERVIEW

- TABLE 399 JK TYRE & INDUSTRIES LTD.: COMPANY OVERVIEW

- TABLE 400 CEAT LTD.: COMPANY OVERVIEW

- TABLE 401 NEXEN TIRE CORPORATION: COMPANY OVERVIEW

- TABLE 402 PRODUCT DEVELOPMENTS, 2022

- FIGURE 1 AUTOMOTIVE TIRE MARKET OE & REPLACEMENT SEGMENTATION

- FIGURE 2 AUTOMOTIVE TIRE MARKET: RESEARCH DESIGN

- FIGURE 3 RESEARCH DESIGN MODEL

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 5 AUTOMOTIVE TIRE OE MARKET (RIM SIZE AND REGIONAL/COUNTRY LEVEL)

- FIGURE 6 AUTOMOTIVE TIRE AFTERMARKET (BY VEHICLE TYPE AND REGION)

- FIGURE 7 AUTOMOTIVE TIRE RETREADING MARKET (BY REGION AND VEHICLE TYPE)

- FIGURE 8 AUTOMOTIVE TIRE OE MARKET (TIRE TYPE)

- FIGURE 9 AUTOMOTIVE TIRE AFTERMARKET (BY SECTION WIDTH, ASPECT RATIO, RIM SIZE, AND SEASON)

- FIGURE 10 DATA TRIANGULATION

- FIGURE 11 AUTOMOTIVE TIRE MARKET OUTLOOK

- FIGURE 12 AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 13 AUTOMOTIVE TIRE AFTERMARKET MARKET, BY VEHICLE TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 14 INCREASING DEMAND FOR HIGH-PERFORMANCE TIRES TO DRIVE MARKET

- FIGURE 15 NORTH AMERICA TO DOMINATE AUTOMOTIVE TIRE AFTERMARKET FROM 2023 TO 2028

- FIGURE 16 WINTER TIRES SEGMENT TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- FIGURE 17 >230 MM SEGMENT TO LEAD AUTOMOTIVE TIRE AFTERMARKET DURING FORECAST PERIOD

- FIGURE 18 >70 SEGMENT TO LEAD AUTOMOTIVE TIRE AFTERMARKET DURING FORECAST PERIOD

- FIGURE 19 19–21” SEGMENT TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- FIGURE 20 LIGHT COMMERCIAL VEHICLES SEGMENT TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- FIGURE 21 HEAVY COMMERCIAL VEHICLES SEGMENT TO DOMINATE AUTOMOTIVE TIRE RETREADING MARKET FROM 2023 TO 2028

- FIGURE 22 PASSENGER CARS SEGMENT TO LEAD AUTOMOTIVE TIRE MARKET DURING FORECAST PERIOD

- FIGURE 23 RADIAL TIRES SEGMENT TO LEAD AUTOMOTIVE TIRE OE MARKET DURING FORECAST PERIOD

- FIGURE 24 ASIA PACIFIC ESTIMATED TO DOMINATE AUTOMOTIVE TIRE OE MARKET IN 2023

- FIGURE 25 AUTOMOTIVE TIRE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 26 EU VEHICLE FLEET AVERAGE AGE (YEARS)

- FIGURE 27 SUPPLY CHAIN ANALYSIS: AUTOMOTIVE TIRE MARKET

- FIGURE 28 AUTOMOTIVE TIRE MARKET ECOSYSTEM

- FIGURE 29 REVENUE SHIFT FOR AUTOMOTIVE TIRE MARKET

- FIGURE 30 KEY BUYING CRITERIA FOR AUTOMOTIVE TIRES

- FIGURE 31 AUTOMOTIVE TIRE AFTERMARKET, BY SECTION WIDTH, 2023 VS. 2028 (USD MILLION)

- FIGURE 32 AUTOMOTIVE TIRE AFTERMARKET, BY ASPECT RATIO, 2023 VS. 2028 (USD MILLION)

- FIGURE 33 AUTOMOTIVE TIRE AFTERMARKET, BY RIM SIZE, 2023 VS. 2028 (USD MILLION)

- FIGURE 34 AUTOMOTIVE TIRE AFTERMARKET, BY SEASON, 2023 VS. 2028 (USD MILLION)

- FIGURE 35 AUTOMOTIVE TIRE AFTERMARKET, BY VEHICLE TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 36 AUTOMOTIVE TIRE RETREADING MARKET, BY VEHICLE TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 37 AUTOMOTIVE TIRE OE MARKET, BY VEHICLE TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 38 AUTOMOTIVE TIRE OE MARKET, BY TIRE TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 39 AUTOMOTIVE TIRE MARKET: BY REGION, 2023–2028

- FIGURE 40 INDUSTRY INSIGHTS

- FIGURE 41 ASIA PACIFIC: AUTOMOTIVE TIRE OE MARKET SNAPSHOT

- FIGURE 42 NORTH AMERICA: AUTOMOTIVE TIRE OE MARKET SNAPSHOTS

- FIGURE 43 MARKET SHARE ANALYSIS, 2022

- FIGURE 44 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS, 2020–2022

- FIGURE 45 COMPANY EVALUATION MATRIX (PASSENGER CAR AND LCV TIRE MANUFACTURERS), 2022

- FIGURE 46 COMPANY EVALUATION MATRIX (TRUCK AND BUSE TIRE MANUFACTURERS), 2022

- FIGURE 47 BRIDGESTONE CORPORATION: COMPANY SNAPSHOT

- FIGURE 48 CONTINENTAL AG: COMPANY SNAPSHOT

- FIGURE 49 GOODYEAR TIRE & RUBBER COMPANY: COMPANY SNAPSHOT

- FIGURE 50 MICHELIN: COMPANY SNAPSHOT

- FIGURE 51 PIRELLI & C. S.P.A.: COMPANY SNAPSHOT

- FIGURE 52 SUMITOMO RUBBER INDUSTRIES LTD.: COMPANY SNAPSHOT

- FIGURE 53 HANKOOK TIRE & TECHNOLOGY: COMPANY SNAPSHOT

- FIGURE 54 YOKOHAMA RUBBER CO., LTD.: COMPANY SNAPSHOT

- FIGURE 55 COOPER TIRE & RUBBER COMPANY: COMPANY SNAPSHOT

- FIGURE 56 TOYO TIRE CORPORATION: COMPANY SNAPSHOT

The research study involved various secondary sources, such as company annual reports/presentations, industry association publications, automotive tire magazine articles, directories, technical handbooks, world economic outlook, trade websites, technical articles, and databases, which were used to identify and collect information for an extensive study of the automotive tire market. Primary sources experts from related industries, automobile OEMs, and suppliers were interviewed to obtain and verify critical information and assess prospects and market estimations.

Secondary Research

The secondary sources referred for this research study include associations such as the Tire Industry Association, Tire and Rim Association, Inc., Rubber Manufacturers Association, Organization Internationale des Constructeurs d'Automobiles (OICA); corporate filings (such as annual reports, investor presentations, and financial statements), trade, business, and automotive associations. Secondary data has been collected and analyzed to arrive at the overall market size, which is further validated through primary research.

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the automotive tire market through secondary research. Several primary interviews have been conducted with tires market experts from both the demand- (Automotive OEMs and Retreading Organizations) and supply-side (rubber suppliers, steel suppliers, oil companies, and others) players across four major regions—namely, North America, Europe, Asia-Pacific, and RoW (Latin America, the Middle East, and Africa). Approximately 20% and 80%, respectively, of primary interviews have been conducted from both the demand and supply side. Primary data has been collected through questionnaires, e-mails, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, including sales, operations, and administration, to provide a holistic viewpoint in our reports.

After interacting with industry participants, we have also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

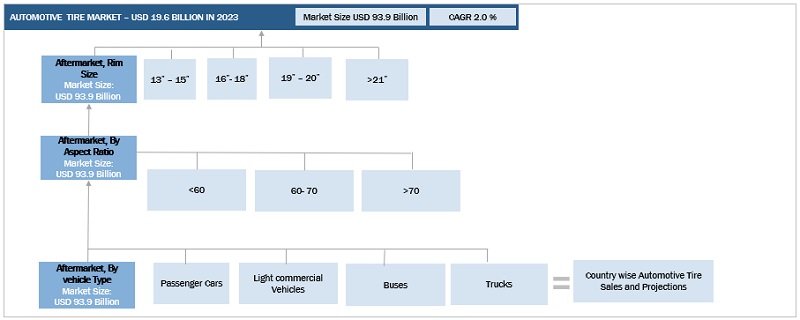

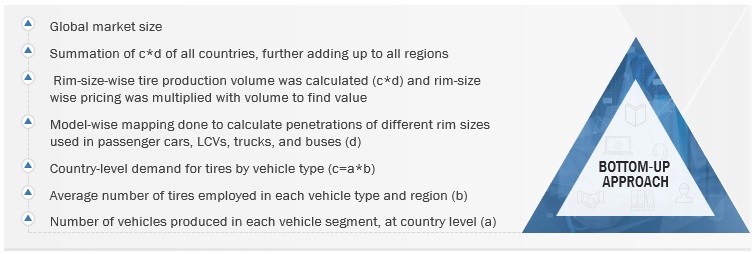

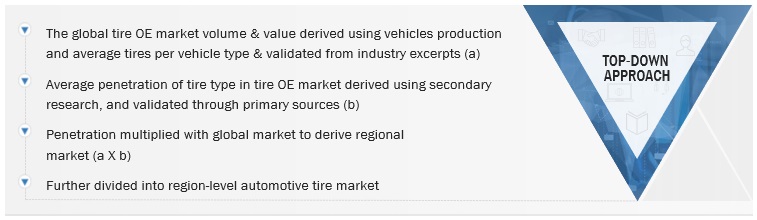

The bottom-up approach has been used to estimate and validate the market size of the automotive tires OE market as well as aftermarket. The market size of the automotive tires OE market by rim size and by country has been derived by multiplying the country-level penetrations of different rim sizes calculated using model-wise mapping with the country-wise production data of passenger cars, LCVs, trucks, and buses. The market size, by value, has been derived by multiplying the rim size-wise OE pricing with the volume of the tire calculated in a million units. The total volume of each region is then summed up to estimate the total volume of the global automotive tires OE market for each vehicle type. The data has been validated through primary interviews with industry experts.

Tires aftermarket volume has been calculated using the vehicles on the road, average miles driven by each vehicle type in a year, replacement miles of tire for each vehicle type, and the average number of tires getting replaced at a single service. The market value has been derived using the aftermarket prices found from various secondary and primary sources. The tires aftermarket is further segmented into section width, rim size, season, and aspect ratio, which has been calculated using the bottom-up approach. The penetrations for section width, rim size, season, and aspect ratio have been derived from secondary sources and primary interviews and are applied to the tires aftermarket. Also, the retreading market is estimated using the retreading penetration by vehicle type in each region. The same is validated through primary respondents.

Automotive Tire Market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

The bottom-up approach has been used to estimate and validate the size of the automotive tire OE market and automotive tire aftermarket. The size of the automotive tire OE market, by rim size and country, has been derived by multiplying the country-level penetration of different rim sizes calculated using model-wise mapping with the country-wise production data of passenger cars, LCVs, trucks, and buses. The market size, by value, has been derived by multiplying the rim size-wise OE pricing with the tire volume calculated in million units. The total market volume of each region is then added to arrive at the total volume of the global automotive tire market for each vehicle type. The data has been validated through primary interviews with industry experts. The tire OE market is further segmented by tire type. The penetration of tire type has been derived from secondary research as well as primary interviews.

The volume of the automotive tire aftermarket has been calculated using the vehicles on the road, average miles driven by each vehicle type in a year, replacement miles of tire for each vehicle type, and the average number of tires getting replaced in a single service. The market value has been derived using the aftermarket prices found from various secondary and primary sources. The tire aftermarket is further segmented by section width, rim size, and aspect ratio using the bottom-up approach. The penetrations for section width, rim size, and aspect ratio have been derived from secondary sources and primary interviews and are applied to the tire aftermarket.

Bottom-Up Approach Automotive Tire OE Market (Rim Size and Regional/Country Level)

Top-Down Approach Automotive Tire Aftermarket (Aspect Ratio, Rim Size, Season Type, and Section Width)

Data Triangulation

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified by primary sources. All parameters that are said to affect the markets covered in this research study have been accounted for, viewed in extensive detail, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated, enhanced with detailed inputs and analysis from MarketsandMarkets, and presented in the report. The data was triangulated by studying various factors and trends from both the demand and supply sides of the automotive tire market.

Market Definition

Automotive Tire: A tire is a ring-shaped component made of rubber, which is used to cover the rim of the wheel of a vehicle. Tires provide better vehicle-to-road interface, support the overall vehicle load, provide better friction for movement, and absorb shock to provide comfortable ride and cargo protection.

Retreading Vs. Aftermarket: Retreading is defined as the recycling of the original tire casing and applying new treads to increase the service life of the tire. Retreading helps protect the environment by reducing oil consumption. As the cost of retreading is less than the cost of a new tire, commercial fleets and trucks prefer retreading. On the other hand, the aftermarket or replacement market supplies new tires that replace the original tires of a vehicle. The cost of replacement tires is higher than retread tires.

Stakeholders

- Aftermarket & Tire Retreading Associations

- Automotive OEMs

- Manufacturers of Automotive Tires

- National and Regional Environmental Regulatory Agencies or Organizations

- Organized and Unorganized Aftermarket Suppliers

- Raw Material Manufacturers of Tires/Tire Components (suppliers for tier I)

- Regional Manufacturer Associations

- Tire Retreading Companies

- Traders, Distributors, and Suppliers of Tires, Tire Components, or Raw Materials

- Component Suppliers for Automotive Tier

- Automotive Industry as an End-use Industry and Regional Automobile Associations

Report Objectives

- To analyze and forecast (2019–2028) the automotive tire market in terms of value (USD million) and volume (million units).

- To segment and forecast the automotive tire aftermarket, in terms of value and volume, based on section width and vehicle type (<200 mm, 200–230 mm, and >230 mm). This market has been further segmented at the regional level.

- To segment and forecast the automotive tire aftermarket, in terms of value and volume, based on aspect ratio and vehicle type (<60, 60–70, and >70). This market has been further segmented at the regional level.

- To segment and forecast the automotive tire aftermarket, in terms of value and volume, based on rim size and vehicle type (13–15”, 16–18”, 19–21”, and >21”). This market has been further segmented at the regional level.

- To segment and forecast the automotive tire aftermarket, in terms of value and volume, based on vehicle type (passenger cars, light commercial vehicles, and heavy commercial vehicles)

- To segment and forecast the automotive tire retreading market, in terms of value and volume, based on vehicle type (passenger cars, light commercial vehicles, and heavy commercial vehicles). This market has been further segmented at the regional level.

- To segment and forecast the automotive tire OE market, in terms of value and volume, based on vehicle type (passenger cars, light commercial vehicles, buses, and trucks) and rim size (13–15”, 16–18”, 19–21”, and >21”)

- To segment and forecast the automotive tire OE market, in terms of value and volume, based on tire type (radial [tube and tubeless] and bias)

- To segment and forecast the automotive tire aftermarket, in terms of value and volume, based on season (summer, winter [studded and non-studded], and all-season)

- To forecast the automotive tire OE market and aftermarket, in terms of value and volume, based on region (Asia Pacific, Europe, North America, and Rest of World)

- To understand the market dynamics (drivers, restraints, opportunities, and challenges) and to understand patent analysis, case study analysis, supply chain analysis, regulatory analysis, and ecosystem analysis.

- To understand the dynamics of the market players and distinguish them into stars, emerging leaders, pervasive players, and participants according to their product portfolio strength and business strategies.

- To strategically analyze markets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze the competitive landscape, market ranking, market overview, and industry overview of the market

- To analyze the current joint ventures, mergers and acquisitions, and partnerships of various players engaged in the automotive tire market.

Available Customizations

Along with the market data, MarketsandMarkets offers customizations in accordance with company-specific needs.

The following customization options are available for the report:

Automotive Tire Oe Market, By Season & Region

- Winter

- Summer

- All-Season

Automotive Tires Oe, By Section Width & Region

- <200 mm

- 200-300 mm

- >300 mm

Automotive Tires Who Supplies Whom, By Region & OEM

- Europe

- Americas

- Asia

Note: This will be further segmented by region.

Growth opportunities and latent adjacency in Automotive Tires Market

I would need chapters 9,11 and 12 of the tires report. Would it further be possible to reduce the price by receiving chapter 12 only on the basis of a region instead of a country basis? It would be great to hear back from you today.

What is the tyre segment this report is concentrating on? Is it original equipment or replacement? Is it car CV 2wheeler OTR? What is the no. 666.66 Mn units?