Bronchoscopy Market Size, Growth by Product Bronchoscopes (Flexible, Rigid, EBUS), Imaging Systems (Video Processors), Accessories (Cytology Brushes), Application (Bronchial Treatment), Usability (Reusable), End Users (Hospital, ACSs/Clinic) & Region - Global Forecast to 2027

Updated on : May 22, 2023

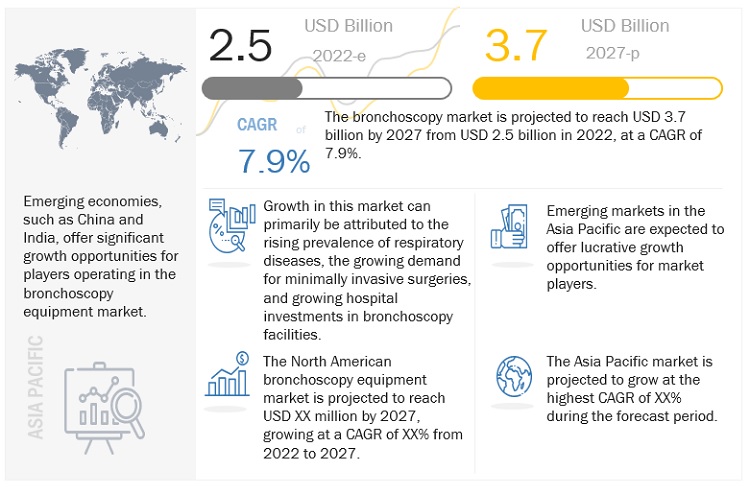

The global bronchoscopy market in terms of revenue was estimated to be worth $2.5 billion in 2022 and is poised to reach $3.7 billion by 2027, growing at a CAGR of 7.9% from 2022 to 2027. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. Market growth is largely driven by the rising prevalence of respiratory diseases, growing hospital investments in bronchoscopy facilities, and technological improvement in bronchoscopes. On the other hand, risk associated with the bronchoscopy procedures is a major restrains to the growth of this market.

To know about the assumptions considered for the study, Request for Free Sample Report

Bronchoscopy Market Dynamics

Driver: Rising prevalence of respiratory diseases

The prevalence of various respiratory diseases, such as lung cancer, asthma, COPD, and emphysema, is on the rise globally. Chronic obstructive pulmonary disease (COPD) and asthma are the most prevalent respiratory disorders across the globe. According to the report published by Lancet, there were 391 million cases of COPD worldwide in 2019 among adults aged 30-79. According to the WHO, COPD is expected to become the world’s third-biggest health threat by 2030. Some of the major causes of COPD are long-term asthma and prolonged exposure to tobacco smoke, indoor and outdoor air pollution, and occupational fumes and dust. According to the WHO, about 262 million people suffer from asthma. The disease resulted in 455,000 deaths in 2019.

The growing geriatric population across the globe is a major factor responsible for the rising prevalence of respiratory diseases. According to the CDC, one in seven older adults is affected by lung diseases. Over the years, with an increase in life expectancy, the geriatric population has witnessed significant growth. According to the UN, the global population of individuals aged 80 years and over is projected to increase by more than threefold, from 143 million in 2019 to 426 million by 2050. Asia, Latin America, and the Caribbean are the world’s fastest-aging regions (Source: UN Population Division, World Population Prospects: The 2004 Revision).

Bronchoscopy remains important not only in diagnosis and staging but also in airway restoration in patients with central airway obstruction and the treatment of early central airway cancers. As a result, the rising prevalence of these chronic respiratory diseases is expected to drive the demand for bronchoscopes.

Increasing cases of lung cancer

The second most frequent cancer worldwide is lung cancer. It is the second most prevalent cancer in women and the most prevalent cancer in men. In 2020, there were about 2.2 million new cases of lung cancer. The American Cancer Society’s estimates for lung cancer in the United States for 2022 are:

- About 236,740 new cases of lung cancer (117,910 in men and 118,830 in women)

- About 130,180 deaths from lung cancer (68,820 in men and 61,360 in women)

Bronchoscopy remains important in the diagnosis and the treatment of early detection of lung cancers. As a result, the rising cases of lung cancer are expected to drive the demand for bronchoscopes.

ASR stands for age-standardized rates. These serve as a summary indicator of the prevalence of the disease that would exist in a population if its age distribution were uniform. Age has a significant impact on the probability of developing cancer; hence standardization is required when comparing groups that vary in age.

Restraint: High overhead cost of bronchoscopy procedures

According to a thorough analysis, the price per case for reusable flexible bronchoscopes (RFBs) and single-use flexible bronchoscopes (SUFBs) was USD 281–803 and USD 220–315, respectively. The average cost of maintenance and repair of reusable bronchoscopes is USD 2,524 per bronchoscope per year. Two therapeutic RFBs have an average age of 6.38 years and have repair costs of USD 90,658 in total. The second smallest RFB (Olympus BF-P190) had the greatest single-scope repair cost of USD 72,009. Two of the diagnostic RFBs were greater than 12 years old and had no repair costs. This finding likely reflects minimal to no usage, as opposed to impressive durability. Data on the number of times each individual bronchoscope was used are unavailable. During the three-year period in question, approximately 4,500 flexible bronchoscopies were performed with these RFBs. This translates into repair costs of about USD 62 per case. With the availability of disposable bronchoscopes, low-volume centers are most likely to achieve cost savings. Healthcare providers—particularly in developing countries such as India, Brazil, and Mexico—have low financial resources to invest in such costly technologies. Moreover, the staff should be trained for the efficient handling and maintenance of bronchoscopy systems and equipment. Maintaining bronchoscopy equipment is of vital importance as improperly reprocessed bronchoscopes can lead to cross-contamination and potentially expose patients to infections. This can incur additional costs. Moreover, constant heating and cooling during disinfection procedures can cause wear and tear on the insertion and light guide tubes, which can hamper the durability of bronchoscopy equipment. All these factors add to the cost of bronchoscopy procedures.

Owing to the high capital, training, and maintenance costs, bronchoscopy procedures are generally expensive. For instance, the average cost of a bronchoscopy procedure ranges from USD 200–400 in many developing countries. Also, in most Asian countries, there is limited or no reimbursement for bronchoscopy procedures from governments, which is one of the major factors responsible for physicians and patients opting for cheaper alternative options such as manual surgical or diagnostic procedures.

Risks associated with bronchoscopy

Bronchoscope-associated infections due to contaminated bronchoscopes continue to be reported worldwide. Despite adequate measures to conduct the reprocessing of bronchoscopes, cases of infections caused due to the use of bronchoscopes have been significantly high.

Recent studies have assessed duodenoscope contamination incidence rates ranging from 0.3% to 30%, although linear echoendoscopes with a similar complex design, gastroscope, bronchoscopes, and colonoscopes can also be contaminated. Klebsiella pneumoniae and Pseudomonas aeruginosa are frequently involved in endoscopy-related outbreaks, probably due to their persistence in biofilms. Subject to heavy wear and tear, damaged parts such as biopsy channels are vulnerable to biofilm formation.

Patients who have a bronchoscopy have a slightly higher 30-day readmission rate than patients who do not have one, and their length of stay (LOS) is also somewhat longer during successive readmissions in this group than it is for patients who do not have a bronchoscopy in IA. There are several social, personal, and medical aspects that have an impact on the readmission rate in COPD patients. A patient’s risk of readmission is increased if they have many medical comorbidities. According to our understanding, bronchoscopy in a patient with an acute COPD exacerbation should only be performed on a small number of people, and the reasoning behind it needs to be explained because it influences the overall length of stay and cost of care.

Although bronchoscopy is generally risk-free, there are certain dangers. There is a slight possibility that someone could acquire an arrhythmia (an irregular heartbeat), breathing issues, fever, and pneumonia, especially following a biopsy, as well as mild bleeding and low blood oxygen levels during the process. A history of cardiac problems may also enhance the chance of a heart attack in a person.

Rarely a pneumothorax, also known as a lung collapse, can be brought on by a bronchoscopy. If the lung is pierced while doing the surgery, this occurs. If a doctor is utilizing a stiff scope as opposed to a flexible one, the likelihood increases.

Bronchoscopy complications are uncommon and typically minor; however, they are serious. If a condition has damaged or irritated the airways, complications may be more likely. Complications could arise from the surgery itself, the sedative, or the topical anesthetic.

- Bleeding. If a biopsy is taken, bleeding is more likely to occur. The majority of the time, mild bleeding ceases on its own.

- Lung collapse. Rarely can bronchoscopy cause injury to an airway. When the lung is pierced, air can build up in the area surrounding it and lead to lung collapse. Although this issue is typically simple to resolve, hospitalization can be necessary.

- Fever. After bronchoscopy, fever is quite typical but not always an indication of infection. Treatment is typically not needed.

- Blood pressure changes

- Muscle pain

- Nausea

- A slow heart rate

- Vomiting

The brochoscopes are accounted to hold the highest CAGR of the bronchoscopy market, by product during forecasted period.

Based on product, the market is segmented into bronchoscopes, imaging systems, accessories, and other bronchoscopy equipment. The bronchoscopes segment accounted for the highest CAGR of the bronchoscopy equipment market in 2021. The highest CAGR of this segment can be attributed to the high cost of bronchoscopes compared to imaging systems and accessories, the increasing prevalence of lung cancer, and technological advancements

The disposable equipments are accounted to hold the highest CAGR of the bronchoscopy market, by usability during forecasted period.

Based on usability, the market is segmented into reusable equipment and disposable equipment. The highest CAGR of this segment can be attributed to the risk of infection associated with the use of reusable equipment has driven attention toward disposable equipment and is the major factor driving market growth in this segment, particularly given the increasing demand for minimally invasive techniques with the growing threat of multidrug antibiotic resistance

The adult patients are accounted to hold the highest CAGR of the bronchoscopy market, by patients forecasted period.

Based on On the basis of patients, the market is segmented into adult patients and pediatric patients. The adult patients segment accounted for the highest CAGR of the bronchoscopy equipment market forecasted period. The highest CAGR of this segment can be attributed to the high image quality achieved through reusable bronchoscopes and the availability of reusable accessories.

To know about the assumptions considered for the study, download the pdf brochure

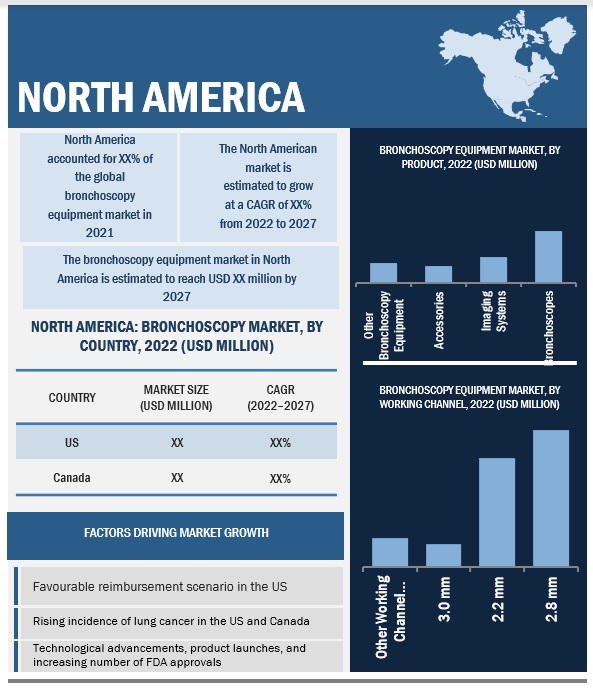

North America accounted the largest share of the bronchoscopy market.

The large share of the North American market can be attributed to the increasing incidence and prevalence of chronic respiratory diseases, favorable reimbursement scenario in the US, the rising incidence of lung cancer in Canada, rapid increase in healthcare expenditure, easy accessibility to advanced technologies, and the strong presence of market players in the region

The major players operating in this market are Olympus Corporation (Japan), KARL STORZ (Germany), Ambu A/S (Denmark), Boston Scientific Corporation (US), Ethicon (US), FUJIFILM Holdings Corporation (Japan), Medtronic (Ireland), HOYA Corporation (Japan), Richard Wolf GmbH (Germany), Cook Medical (US), Broncus Medical Inc. (China), CONMED (US), Roper Technologies (US), Teleflex Incorporated (US), Laborie Medical Technologies Corp. (Canada), EFER Endoscopy (France), EMOS Technology GmbH (Germany), VBM Medizintechnik GmbH (Germany), Hunan Vathin Medical Instrument Co., Ltd. (China), and Machida Endoscope Co., Ltd. (China)

Bronchoscopy Market Report Scope

|

Report Metrics |

Details |

|

Market Revenue in 2022 |

$2.5 billion |

|

Projected Revenue by 2027 |

$3.7 billion |

|

Revenue Rate |

Poised to grow at a CAGR of 7.9% |

|

Market Driver |

Rising prevalence of respiratory diseases |

|

Market Opportunity |

Growing healthcare market in emerging countries |

This research report categorizes the global bronchoscopy market to forecast revenue and analyze trends in each of the following submarkets:

By Product

-

Bronchoscopes

- By Type

- Flexible bronchoscope

- Rigid bronchoscopes

- EBUS bronchoscopes

-

By Working Channel Diameter

- 2.8 mm

- 2.2 mm

- 3.0 mm

- Other Working Channel Diameters

-

Imaging Systems

- Video Processors

- Light Sources

- Camera Heads

- Wireless Displays & Monitors

- Other Components

-

Accessories

- Cytology Brushes

- Transbronchial Aspiration Needles

- Biopsy Forceps

- Biopsy Valves

- Cleaning Brushes

- Mouthpieces

- Other Accessories

- Other Bronchoscopy Equipment

By Application

- Bronchial Treatment

- Bronchial Diagnosis

By Usability

- Reusable Bronchoscopes

- Disposable Bronchoscopes

By Patient

- Adult Patients

- Pediatric/Neonate Patients

By End User

- Adult Patients

- Pediatric/Neonate Patients

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Australia

- Rest of Asia Pacific

-

Rest of the World

- Latin America

- Middle East & Africa

Key developments:

- In 2022, Ethicon, a Johnson & Johnson MedTech firm, declared today that the FDA granted 510(k) approval for its Monarch robotic surgery platform. The FDA has given Ethicon’s subsidiary Auris Health permission to use Monarch for endourological treatments. According to company representatives, it is currently the first and only versatile multispecialty robotic solution for use in both urology and bronchoscopy

- In 2022, Olympus announced the expansion of its respiratory portfolio with the launch of H-SteriScopes. In order to address the demands of infection prevention campaigns, Olympus announced the availability of its line of single-use foreign body retrieval devices, which gives doctors alternatives for a variety of purposes.

- In 2021, The EXALT Model B Single-use Bronchoscope, a single-use device intended for bedside operations in the intensive care unit, operating room, and bronchoscopy suite, received CE Mark approval

- In 2022, Olympus announced the strategic co-marketing agreement with Bracco Diagnostics Inc., which is a US subsidiary of Bracco Imaging S.p.A., a major international player in the diagnostic imaging industry. Bracco Imaging S.p.A. is a leader in the creation and delivery of new solutions for medical and surgical operations.

- In 2022, Olympus announced that its line of single-use bronchoscopes had been selected for the new Vizient Single-use Visualization Devices contract.

- In 2021, FUJIFILM Holdings Corporation announced that its complete portfolio of endoscopy and endosurgery products is available to members of Vizient.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global bronchoscopy market?

The global bronchoscopy market boasts a total revenue value of $3.7 billion by 2027.

What is the estimated growth rate (CAGR) of the global bronchoscopy market?

The global bronchoscopy market has an estimated compound annual growth rate (CAGR) of 7.9% and a revenue size in the region of $2.5 billion in 2022.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 39)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 44)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 2 PRIMARY SOURCES

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

FIGURE 5 REVENUE SHARE ANALYSIS ILLUSTRATION

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY – BOTTOM-UP APPROACH (SUPPLY SIDE): COLLECTIVE REVENUE OF BRONCHOSCOPY EQUIPMENT MARKET

FIGURE 7 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

FIGURE 8 TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 9 DATA TRIANGULATION METHODOLOGY

2.4 MARKET SHARE ANALYSIS

2.5 STUDY ASSUMPTIONS

2.6 RISK ASSESSMENT/FACTOR ANALYSIS

TABLE 1 RISK ANALYSIS

3 EXECUTIVE SUMMARY (Page No. - 55)

FIGURE 10 BRONCHOSCOPY MARKET, BY PRODUCT, 2022 VS. 2027 (USD MILLION)

FIGURE 11 BRONCHOSCOPY MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 12 BRONCHOSCOPY MARKET, BY USABILITY, 2022 VS. 2027 (USD MILLION)

FIGURE 13 BRONCHOSCOPY MARKET, BY PATIENT, 2022 VS. 2027 (USD MILLION)

FIGURE 14 BRONCHOSCOPY MARKET, BY END USER, 2022 VS. 2027 (USD MILLION)

FIGURE 15 BRONCHOSCOPY MARKET, BY REGION, 2022 VS. 2027 (USD MILLION)

4 PREMIUM INSIGHTS (Page No. - 59)

4.1 BRONCHOSCOPY MARKET OVERVIEW

FIGURE 16 RISING PREVALENCE OF RESPIRATORY DISEASES TO DRIVE MARKET

4.2 ASIA PACIFIC: BRONCHOSCOPY MARKET, BY PRODUCT AND COUNTRY (2021)

FIGURE 17 BRONCHOSCOPES SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

4.3 GEOGRAPHICAL SNAPSHOT OF BRONCHOSCOPY MARKET

FIGURE 18 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 62)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 BRONCHOSCOPY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Rising prevalence of respiratory diseases

5.2.1.2 Increasing cases of lung cancer

TABLE 2 LUNG CANCER INCIDENCE, BY COUNTRY, 2020

5.2.1.3 Growing demand for minimally invasive surgeries

5.2.1.4 Growing hospital investments in bronchoscopy facilities

5.2.1.5 Technological advancements

5.2.2 RESTRAINTS

5.2.2.1 High overhead cost of bronchoscopy procedures

TABLE 3 AGE, NUMBER OF REPAIRS, AVERAGE REPAIR COST PER BREAKAGE, RANGE OF REPAIR COST, AND TOTAL REPAIR COST BY SCOPE OVER A 3-YEAR PERIOD (MAY 2018–APRIL 2021)

5.2.2.2 Risks associated with bronchoscopy

5.2.3 OPPORTUNITIES

5.2.3.1 Growing healthcare market in emerging economies

FIGURE 20 GROWTH IN CURRENT HEALTHCARE EXPENDITURE PER CAPITA IN BRICS COUNTRIES, 2012–2019

5.2.4 CHALLENGES

5.2.4.1 Dearth of trained physicians and pulmonologists

5.2.5 BURNING ISSUES

5.2.5.1 Product recalls

TABLE 4 LIST OF PRODUCT RECALLS

5.3 RANGES/SCENARIOS

FIGURE 21 REALISTIC SCENARIO

FIGURE 22 PESSIMISTIC SCENARIO

FIGURE 23 OPTIMISTIC SCENARIO

5.4 REGULATORY ANALYSIS

TABLE 5 LIST OF REGULATORY AUTHORITIES

5.4.1 NORTH AMERICA

5.4.1.1 US

TABLE 6 US: FDA MEDICAL DEVICE CLASSIFICATION

TABLE 7 US: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

5.4.1.2 Canada

TABLE 8 CANADA: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

5.4.2 EUROPE

5.4.3 ASIA PACIFIC

5.4.3.1 Japan

TABLE 9 JAPAN: CLASSIFICATION OF MEDICAL DEVICES

5.4.3.2 China

TABLE 10 CHINA: CLASSIFICATION OF MEDICAL DEVICES

5.4.3.3 India

5.5 PORTER’S FIVE FORCES ANALYSIS

5.5.1 THREAT OF NEW ENTRANTS

5.5.1.1 High capital requirement

5.5.1.2 High preference for products from well-established brands

5.5.2 THREAT OF SUBSTITUTES

5.5.2.1 Substitute therapies for bronchoscopy

5.5.3 BARGAINING POWER OF SUPPLIERS

5.5.3.1 Presence of several raw material suppliers

5.5.3.2 Supplier switching cost

5.5.4 BARGAINING POWER OF BUYERS

5.5.4.1 Few companies offer premium products at global level

5.5.5 INTENSITY OF COMPETITIVE RIVALRY

5.5.5.1 Increasing demand for high-quality and innovative products

5.5.5.2 Lucrative growth potential in emerging markets

5.6 SUPPLY CHAIN ANALYSIS

FIGURE 24 DIRECT DISTRIBUTION—PREFERRED STRATEGY OF PROMINENT COMPANIES

5.7 VALUE CHAIN ANALYSIS

FIGURE 25 VALUE CHAIN ANALYSIS: MAJOR VALUE ADDED DURING MANUFACTURING AND ASSEMBLY PHASES

5.8 ECOSYSTEM ANALYSIS

FIGURE 26 ECOSYSTEM ANALYSIS OF BRONCHOSCOPY MARKET

5.8.1 ROLE IN ECOSYSTEM

FIGURE 27 KEY PLAYERS IN BRONCHOSCOPY MARKET ECOSYSTEM

5.9 TECHNOLOGY ANALYSIS

5.10 KEY CONFERENCES AND EVENTS IN 2022–2023

TABLE 11 BRONCHOSCOPY EQUIPMENT MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

5.11 PATENT ANALYSIS

5.11.1 PATENT TRENDS FOR BRONCHOSCOPY EQUIPMENT

FIGURE 28 PATENT TRENDS FOR BRONCHOSCOPES, JANUARY 2011–AUGUST 2022

5.11.2 JURISDICTION AND TOP APPLICANT ANALYSIS

FIGURE 29 TOP APPLICANTS AND OWNERS (COMPANIES/INSTITUTES) FOR BRONCHOSCOPES PATENTS, JANUARY 2011— AUGUST 2022

5.12 TRADE ANALYSIS

TABLE 12 IMPORT DATA FOR HS CODE 901890, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 13 EXPORT DATA FOR HS CODE 901890, BY COUNTRY, 2017–2021 (USD MILLION)

5.13 PRICING ANALYSIS

TABLE 14 AVERAGE SELLING PRICE OF BRONCHOSCOPES

TABLE 15 COST OF BRONCHOSCOPY EQUIPMENT

5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 30 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END USERS

TABLE 16 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END USERS

5.14.2 BUYING CRITERIA

31 KEY BUYING CRITERIA FOR END USERS OF BRONCHOSCOPY EQUIPMENT

TABLE 17 KEY BUYING CRITERIA FOR END USERS OF BRONCHOSCOPY EQUIPMENT

5.15 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

5.15.1 REVENUE POCKETS FOR BRONCHOSCOPY EQUIPMENT MANUFACTURERS

FIGURE 32 REVENUE SHIFT FOR BRONCHOSCOPY EQUIPMENT

6 BRONCHOSCOPY MARKET, BY PRODUCT (Page No. - 93)

6.1 INTRODUCTION

TABLE 18 BRONCHOSCOPY MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

6.2 BRONCHOSCOPES

TABLE 19 FLEXIBLE VS. RIGID BRONCHOSCOPY

TABLE 20 INDICATIONS FOR FLEXIBLE AND RIGID BRONCHOSCOPY

TABLE 21 BRONCHOSCOPY MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 22 BRONCHOSCOPES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.2.1 BY TYPE

6.2.1.1 Flexible bronchoscopes

6.2.1.1.1 Most widely adopted bronchoscopes

TABLE 23 ADVANTAGES AND DISADVANTAGES OF FLEXIBLE BRONCHOSCOPES

TABLE 24 FLEXIBLE BRONCHOSCOPY MARKET, BY REGION, 2020–2027 (USD MILLION)

6.2.1.2 Rigid bronchoscopes

6.2.1.2.1 Complications associated with rigid bronchoscopy to limit adoption

TABLE 25 ADVANTAGES AND DISADVANTAGES OF RIGID BRONCHOSCOPES

TABLE 26 RIGID BRONCHOSCOPES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.2.1.3 EBUS bronchoscopes

6.2.1.3.1 EBUS bronchoscopes to register steady growth during forecast period

TABLE 27 EBUS BRONCHOSCOPES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.2.2 BY WORKING CHANNEL DIAMETER

TABLE 28 BRONCHOSCOPES MARKET, BY WORKING CHANNEL DIAMETER, 2020–2027 (USD MILLION)

6.2.2.1 2.8 mm

6.2.2.1.1 2.8 mm segment to account for largest market share

TABLE 29 2.8 MM-DIAMETER BRONCHOSCOPES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.2.2.2 2.2 mm

6.2.2.2.1 2.2 mm bronchoscopes mainly used in pediatric patients

TABLE 30 2.2 MM-DIAMETER BRONCHOSCOPES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.2.2.3 3.0 mm

6.2.2.3.1 Patient discomfort associated with 3.0 mm diameters limits market growth

TABLE 31 3.0 MM-DIAMETER BRONCHOSCOPES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.2.2.4 Other working channel diameters

TABLE 32 BRONCHOSCOPES MARKET FOR OTHER WORKING CHANNEL DIAMETERS, BY REGION, 2020–2027 (USD MILLION)

6.3 IMAGING SYSTEMS

TABLE 33 BRONCHOSCOPY IMAGING SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 34 BRONCHOSCOPY IMAGING SYSTEMS MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3.1 VIDEO PROCESSORS

6.3.1.1 Video processors to register highest growth during forecast period

TABLE 35 VIDEO PROCESSORS MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3.2 LIGHT SOURCES

6.3.2.1 Light sources essential components of bronchoscopy visualization systems

TABLE 36 LIGHT SOURCES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3.3 CAMERA HEADS

6.3.3.1 Technological advancements support market growth

6.3.3.2 Single-chip cameras

6.3.3.3 3-chip cameras

6.3.3.4 HD cameras

6.3.3.5 3D cameras

6.3.3.6 4K camera heads

TABLE 37 CAMERA HEADS MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3.4 WIRELESS DISPLAYS AND MONITORS

6.3.4.1 Essential in diagnostic and therapeutic procedures

TABLE 38 WIRELESS DISPLAYS AND MONITORS MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3.5 OTHER COMPONENTS

TABLE 39 OTHER COMPONENTS MARKET, BY REGION, 2020–2027 (USD MILLION)

6.4 ACCESSORIES

TABLE 40 BRONCHOSCOPY ACCESSORIES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 41 BRONCHOSCOPY ACCESSORIES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.4.1 CYTOLOGY BRUSHES

6.4.1.1 Used to collect cell samples from bronchus

TABLE 42 CYTOLOGY BRUSHES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.4.2 TRANSBRONCHIAL ASPIRATION NEEDLES

6.4.2.1 Transbronchial aspiration needles projected to witness highest growth during forecast period

TABLE 43 TRANSBRONCHIAL ASPIRATION NEEDLES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.4.3 BIOPSY FORCEPS

6.4.3.1 Biopsy forceps aid in diagnosing malignant and nonmalignant disorders

TABLE 44 BIOPSY FORCEPS MARKET, BY REGION, 2020–2027 (USD MILLION)

6.4.4 BIOPSY VALVES

6.4.4.1 Biopsy valves designed for one-time use

TABLE 45 BIOPSY VALVES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.4.5 CLEANING BRUSHES

6.4.5.1 Stringent regulations for cleaning bronchoscopes to drive market

TABLE 46 CLEANING BRUSHES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.4.6 MOUTHPIECES

6.4.6.1 Growing number of bronchoscopy procedures performed to support adoption of mouthpieces

TABLE 47 MOUTHPIECES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.4.7 OTHER ACCESSORIES

TABLE 48 OTHER ACCESSORIES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.5 OTHER BRONCHOSCOPY EQUIPMENT

TABLE 49 OTHER BRONCHOSCOPY MARKET, BY REGION, 2020–2027 (USD MILLION)

7 BRONCHOSCOPY MARKET, BY APPLICATION (Page No. - 114)

7.1 INTRODUCTION

TABLE 50 DIAGNOSTIC AND THERAPEUTIC APPLICATIONS OF BRONCHOSCOPY

TABLE 51 BRONCHOSCOPY MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

7.2 BRONCHIAL TREATMENT

7.2.1 LARGEST AND FASTEST-GROWING MARKET SEGMENT

TABLE 52 BRONCHOSCOPY MARKET FOR BRONCHIAL TREATMENT, BY REGION, 2020–2027 (USD MILLION)

7.3 BRONCHIAL DIAGNOSIS

7.3.1 INCREASING NUMBER OF DIAGNOSTIC PROCEDURES TO DRIVE MARKET

TABLE 53 NUMBER OF DIAGNOSTIC BRONCHOSCOPY PROCEDURES WITH OR WITHOUT BIOPSY, BY COUNTRY, 2014–2018

TABLE 54 BRONCHOSCOPY EQUIPMENT MARKET FOR BRONCHIAL DIAGNOSIS, BY REGION, 2020–2027 (USD MILLION)

8 BRONCHOSCOPY MARKET, BY USABILITY (Page No. - 118)

8.1 INTRODUCTION

TABLE 55 BRONCHOSCOPY MARKET, BY USABILITY, 2020–2027 (USD MILLION)

8.2 REUSABLE EQUIPMENT

8.2.1 REUSABLE EQUIPMENT OFFERS HIGH IMAGE QUALITY

TABLE 56 REUSABLE BRONCHOSCOPY-EQUIPMENT MARKET, BY REGION, 2020–2027 (USD MILLION)

8.3 DISPOSABLE EQUIPMENT

8.3.1 DISPOSABLE EQUIPMENT SEGMENT TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

TABLE 57 DISPOSABLE BRONCHOSCOPY-EQUIPMENT MARKET, BY REGION, 2020–2027 (USD MILLION)

9 BRONCHOSCOPY MARKET, BY PATIENT (Page No. - 122)

9.1 INTRODUCTION

ABLE 58 BRONCHOSCOPY MARKET, BY PATIENT, 2020–2027 (USD MILLION)

9.2 ADULT PATIENTS

9.2.1 HIGH PREVALENCE OF CHRONIC RESPIRATORY DISEASES IN ADULT PATIENTS MAJOR FACTOR DRIVING MARKET GROWTH

TABLE 59 BRONCHOSCOPY MARKET FOR ADULT PATIENTS, BY REGION, 2020–2027 (USD MILLION)

9.3 PEDIATRIC PATIENTS

9.3.1 IMPROVING HEALTHCARE INFRASTRUCTURE IN EMERGING COUNTRIES TO SUPPORT MARKET GROWTH

TABLE 60 RIGID BRONCHOSCOPE SIZES FOR CHILDREN

TABLE 61 BRONCHOSCOPY EQUIPMENT MARKET FOR PEDIATRIC PATIENTS, BY REGION, 2020–2027 (USD MILLION)

10 BRONCHOSCOPY MARKET, BY END USER (Page No. - 126)

10.1 INTRODUCTION

TABLE 62 MEDICARE NATIONAL AVERAGE COVERAGE FOR BRONCHOSCOPY PROCEDURES AT HOSPITALS, AMBULATORY SURGERY CENTERS, AND IN-OFFICE FACILITIES, 2019

TABLE 63 BRONCHOSCOPY MARKET, BY END USER, 2020–2027 (USD MILLION)

10.2 HOSPITALS

10.2.1 LARGE PATIENT VOLUME IN HOSPITALS TO INCREASE DEMAND FOR BRONCHOSCOPY EQUIPMENT

TABLE 64 BRONCHOSCOPY MARKET FOR HOSPITALS, BY REGION, 2020–2027 (USD MILLION)

10.3 AMBULATORY SURGERY CENTERS/CLINICS

10.3.1 COST-EFFECTIVENESS OF ASCS TO DRIVE MARKET

TABLE 65 US: NUMBER OF MEDICARE-CERTIFIED AMBULATORY SURGERY CENTERS, 2013–2017

TABLE 66 US: AMBULATORY SURGERY CENTER PROCEDURES, 2015–2021 (MILLION)

TABLE 67 US: AMBULATORY SURGERY CENTERS, BY STATE, 2019

TABLE 68 BRONCHOSCOPY EQUIPMENT MARKET FOR AMBULATORY SURGERY CENTERS/CLINICS, BY REGION, 2020–2027 (USD MILLION)

11 BRONCHOSCOPY MARKET, BY REGION (Page No. - 132)

11.1 INTRODUCTION

TABLE 69 LUNG CANCER CASES, BY REGION, 2020

TABLE 70 DEATHS DUE TO LUNG CANCER, BY REGION, 2020

TABLE 71 FIVE-YEAR PREVALENCE OF LUNG CANCER, BY REGION, 2020

TABLE 72 BRONCHOSCOPY MARKET, BY REGION, 2020–2027 (USD MILLION)

11.2 NORTH AMERICA

FIGURE 33 NORTH AMERICA: BRONCHOSCOPY MARKET SNAPSHOT

TABLE 73 NORTH AMERICA: BRONCHOSCOPY MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 74 NORTH AMERICA: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 75 NORTH AMERICA: BRONCHOSCOPES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 76 NORTH AMERICA: BRONCHOSCOPY MARKET, BY WORKING CHANNEL DIAMETER, 2020–2027 (USD MILLION)

TABLE 77 NORTH AMERICA: BRONCHOSCOPY IMAGING SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 78 NORTH AMERICA: BRONCHOSCOPY ACCESSORIES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 79 NORTH AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 80 NORTH AMERICA: MARKET, BY USABILITY, 2020–2027 (USD MILLION)

TABLE 81 NORTH AMERICA: MARKET, BY PATIENT, 2020–2027 (USD MILLION)

TABLE 82 NORTH AMERICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.2.1 US

11.2.1.1 Largest market for bronchoscopy equipment due to high healthcare spending

TABLE 83 US: LUNG CANCER INCIDENCE, 2020 VS. 2040

TABLE 84 US: KEY MACROINDICATORS

TABLE 85 MEDICARE COVERAGE FOR BRONCHOSCOPY PROCEDURES

TABLE 86 US: BRONCHOSCOPY MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 87 US: BRONCHOSCOPES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 88 US: BRONCHOSCOPY MARKET, BY WORKING CHANNEL DIAMETER, 2020–2027 (USD MILLION)

TABLE 89 US: BRONCHOSCOPY IMAGING SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 90 US: BRONCHOSCOPY ACCESSORIES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 91 US: BRONCHOSCOPY MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 92 US: MARKET, BY USABILITY, 2020–2027 (USD MILLION)

TABLE 93 US: MARKET, BY PATIENT, 2020–2027 (USD MILLION)

TABLE 94 US: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.2.2 CANADA

11.2.2.1 Long waiting period for bronchoscopy procedures to restrain market growth

TABLE 95 CANADA: LUNG CANCER INCIDENCE, 2018 VS. 2025

TABLE 96 CANADA: KEY MACROINDICATORS

TABLE 97 CANADA: MEDIAN PATIENT WAITING PERIODS FOR TREATMENT AFTER APPOINTMENT WITH SPECIALISTS FOR BRONCHOSCOPY (2018)

TABLE 98 CANADA: BRONCHOSCOPY MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 99 CANADA: BRONCHOSCOPES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 100 CANADA: BRONCHOSCOPY MARKET, BY WORKING CHANNEL DIAMETER, 2020–2027 (USD MILLION)

TABLE 101 CANADA: BRONCHOSCOPY IMAGING SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 102 CANADA: BRONCHOSCOPY ACCESSORIES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 103 CANADA: BRONCHOSCOPY MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 104 CANADA: MARKET, BY USABILITY, 2020–2027 (USD MILLION)

TABLE 105 CANADA: MARKET, BY PATIENT, 2020–2027 (USD MILLION)

TABLE 106 CANADA: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.3 EUROPE

TABLE 107 EUROPE: ESTIMATED AGE-STANDARDIZED INCIDENCE RATE OF LUNG CANCER, BY COUNTRY, 2020

TABLE 108 EUROPE: BRONCHOSCOPY MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 109 EUROPE: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 110 EUROPE: BRONCHOSCOPES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 111 EUROPE: BRONCHOSCOPY MARKET, BY WORKING CHANNEL DIAMETER, 2020–2027 (USD MILLION)

TABLE 112 EUROPE: BRONCHOSCOPY IMAGING SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 113 EUROPE: BRONCHOSCOPY ACCESSORIES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 114 EUROPE: BRONCHOSCOPY EQUIPMENT MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 115 EUROPE: MARKET, BY USABILITY, 2020–2027 (USD MILLION)

TABLE 116 EUROPE: MARKET, BY PATIENT, 2020–2027 (USD MILLION)

TABLE 117 EUROPE: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.3.1 GERMANY

11.3.1.1 Germany dominates European bronchoscopy market

TABLE 118 GERMANY: LUNG CANCER INCIDENCE, 2018 VS. 2025

TABLE 119 GERMANY: KEY MACROINDICATORS

TABLE 120 GERMANY: BRONCHOSCOPY MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 121 GERMANY: BRONCHOSCOPES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 122 GERMANY: BRONCHOSCOPY MARKET, BY WORKING CHANNEL DIAMETER, 2020–2027 (USD MILLION)

TABLE 123 GERMANY: BRONCHOSCOPY IMAGING SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 124 GERMANY: BRONCHOSCOPY ACCESSORIES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 125 GERMANY: BRONCHOSCOPY MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 126 GERMANY: MARKET, BY USABILITY, 2020–2027 (USD MILLION)

TABLE 127 GERMANY: MARKET, BY PATIENT, 2020–2027 (USD MILLION)

TABLE 128 GERMANY: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.3.2 UK

11.3.2.1 Supportive reimbursement policies to drive market

TABLE 129 UK: KEY MACROINDICATORS

TABLE 130 REIMBURSEMENT FOR BRONCHOSCOPY PROCEDURES IN THE UK

TABLE 131 UK: BRONCHOSCOPY MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 132 UK: BRONCHOSCOPES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 133 UK: BRONCHOSCOPY MARKET, BY WORKING CHANNEL DIAMETER, 2020–2027 (USD MILLION)

TABLE 134 UK: BRONCHOSCOPY IMAGING SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 135 UK: BRONCHOSCOPY ACCESSORIES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 136 UK: BRONCHOSCOPY MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 137 UK: MARKET, BY USABILITY, 2020–2027 (USD MILLION)

TABLE 138 UK: MARKET, BY PATIENT, 2020–2027 (USD MILLION)

TABLE 139 UK: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.3.3 FRANCE

11.3.3.1 Favorable health insurance system to drive market for bronchoscopy equipment

TABLE 140 FRANCE: LUNG CANCER INCIDENCE, 2020 VS. 2040

TABLE 141 FRANCE: KEY MACROINDICATORS

TABLE 142 FRANCE: BRONCHOSCOPY MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 143 FRANCE: BRONCHOSCOPES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 144 FRANCE: BRONCHOSCOPY MARKET, BY WORKING CHANNEL DIAMETER, 2020–2027 (USD MILLION)

TABLE 145 FRANCE: BRONCHOSCOPY IMAGING SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 146 FRANCE: BRONCHOSCOPY ACCESSORIES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 147 FRANCE: BRONCHOSCOPY MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 148 FRANCE: MARKET, BY USABILITY, 2020–2027 (USD MILLION)

TABLE 149 FRANCE: MARKET, BY PATIENT, 2020–2027 (USD MILLION)

TABLE 150 FRANCE: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.3.4 SPAIN

11.3.4.1 Well-organized and efficient healthcare system to offer growth opportunities

TABLE 151 SPAIN: LUNG CANCER INCIDENCE, 2018 VS. 2025

TABLE 152 SPAIN: KEY MACROINDICATORS

TABLE 153 SPAIN: BRONCHOSCOPY MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 154 SPAIN: BRONCHOSCOPES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 155 SPAIN: BRONCHOSCOPY MARKET, BY WORKING CHANNEL DIAMETER, 2020–2027 (USD MILLION)

TABLE 156 SPAIN: BRONCHOSCOPY IMAGING SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 157 SPAIN: BRONCHOSCOPY ACCESSORIES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 158 SPAIN: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 159 SPAIN: MARKET, BY USABILITY, 2020–2027 (USD MILLION)

TABLE 160 SPAIN: BRONCHOSCOPY MARKET, BY PATIENT, 2020–2027 (USD MILLION)

TABLE 161 SPAIN: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.3.5 ITALY

11.3.5.1 Growing medical tourism and rising geriatric population key factors driving market

TABLE 162 ITALY: LUNG CANCER INCIDENCE, 2018 VS. 2025

TABLE 163 ITALY: KEY MACROINDICATORS

TABLE 164 ITALY: BRONCHOSCOPY MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 165 ITALY: BRONCHOSCOPES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 166 ITALY: BRONCHOSCOPY MARKET, BY WORKING CHANNEL DIAMETER, 2020–2027 (USD MILLION)

TABLE 167 ITALY: BRONCHOSCOPY IMAGING SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 168 ITALY: BRONCHOSCOPY ACCESSORIES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 169 ITALY: BRONCHOSCOPY MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 170 ITALY: MARKET, BY USABILITY, 2020–2027 (USD MILLION)

TABLE 171 ITALY: MARKET, BY PATIENT, 2020–2027 (USD MILLION)

TABLE 172 ITALY: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.3.6 REST OF EUROPE

TABLE 173 REST OF EUROPE: LUNG CANCER INCIDENCE, 2020 VS. 2040

TABLE 174 REST OF EUROPE: HEALTHCARE EXPENDITURE, BY COUNTRY, 2010 VS. 2020 (% OF GDP)

TABLE 175 REST OF EUROPE: BRONCHOSCOPY MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 176 REST OF EUROPE: BRONCHOSCOPES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 177 REST OF EUROPE: BRONCHOSCOPY MARKET, BY WORKING CHANNEL DIAMETER, 2020–2027 (USD MILLION)

TABLE 178 REST OF EUROPE: BRONCHOSCOPY IMAGING SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 179 REST OF EUROPE: BRONCHOSCOPY ACCESSORIES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 180 REST OF EUROPE: BRONCHOSCOPY MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 181 REST OF EUROPE: MARKET, BY USABILITY, 2020–2027 (USD MILLION)

TABLE 182 REST OF EUROPE: MARKET, BY PATIENT, 2020–2027 (USD MILLION)

TABLE 183 REST OF EUROPE: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.4 ASIA PACIFIC

TABLE 184 ASIA PACIFIC: ESTIMATED AGE-STANDARDIZED INCIDENCE RATE FOR LUNG CANCER, BY COUNTRY, 2020

FIGURE 34 ASIA PACIFIC: BRONCHOSCOPY EQUIPMENT MARKET SNAPSHOT

TABLE 185 ASIA PACIFIC: BRONCHOSCOPY MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 186 ASIA PACIFIC: BRONCHOSCOPY MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 187 ASIA PACIFIC: BRONCHOSCOPES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 188 ASIA PACIFIC: BRONCHOSCOPY MARKET, BY WORKING CHANNEL DIAMETER, 2020–2027 (USD MILLION)

TABLE 189 ASIA PACIFIC: BRONCHOSCOPY IMAGING SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 190 ASIA PACIFIC: BRONCHOSCOPY ACCESSORIES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 191 ASIA PACIFIC: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 192 ASIA PACIFIC: MARKET, BY USABILITY, 2020–2027 (USD MILLION)

TABLE 193 ASIA PACIFIC: MARKET, BY PATIENT, 2020–2027 (USD MILLION)

TABLE 194 ASIA PACIFIC: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.4.1 CHINA

11.4.1.1 Large patient population to favor market growth

TABLE 195 CHINA: KEY MACROINDICATORS

TABLE 196 CHINA: BRONCHOSCOPY MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 197 CHINA: BRONCHOSCOPES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 198 CHINA: BRONCHOSCOPY MARKET, BY WORKING CHANNEL DIAMETER, 2020–2027 (USD MILLION)

TABLE 199 CHINA: BRONCHOSCOPY IMAGING SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 200 CHINA: BRONCHOSCOPY ACCESSORIES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 201 CHINA: BRONCHOSCOPY MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 202 CHINA: MARKET, BY USABILITY, 2020–2027 (USD MILLION)

TABLE 203 CHINA: MARKET, BY PATIENT, 2020–2027 (USD MILLION)

TABLE 204 CHINA: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.4.2 JAPAN

11.4.2.1 Growing geriatric population to support market growth

TABLE 205 JAPAN: LUNG CANCER INCIDENCE, 2020 VS. 2040

TABLE 206 JAPAN: KEY MACROINDICATORS

TABLE 207 JAPAN: BRONCHOSCOPY MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 208 JAPAN: BRONCHOSCOPES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 209 JAPAN: BRONCHOSCOPY MARKET, BY WORKING CHANNEL DIAMETER, 2020–2027 (USD MILLION)

TABLE 210 JAPAN: BRONCHOSCOPY IMAGING SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 211 JAPAN: BRONCHOSCOPY ACCESSORIES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 212 JAPAN: BRONCHOSCOPY MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 213 JAPAN: MARKET, BY USABILITY, 2020–2027 (USD MILLION)

TABLE 214 JAPAN: MARKET, BY PATIENT, 2020–2027 (USD MILLION)

TABLE 215 JAPAN: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.4.3 INDIA

11.4.3.1 Healthcare infrastructural development and favorable government initiatives key factors supporting market growth

TABLE 216 INDIA: LUNG CANCER INCIDENCE, 2018 VS. 2025

TABLE 217 INDIA: KEY MACROINDICATORS

TABLE 218 INDIA: BRONCHOSCOPY MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 219 INDIA: BRONCHOSCOPES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 220 INDIA: BRONCHOSCOPY MARKET, BY WORKING CHANNEL DIAMETER, 2020–2027 (USD MILLION)

TABLE 221 INDIA: BRONCHOSCOPY IMAGING SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 222 INDIA: BRONCHOSCOPY ACCESSORIES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 223 INDIA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 224 INDIA: MARKET, BY USABILITY, 2020–2027 (USD MILLION)

TABLE 225 INDIA: MARKET, BY PATIENT, 2020–2027 (USD MILLION)

TABLE 226 INDIA: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.4.4 AUSTRALIA

11.4.4.1 High prevalence of cancer to drive demand for bronchoscopy

TABLE 227 AUSTRALIA: BRONCHOSCOPY MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 228 AUSTRALIA: BRONCHOSCOPES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 229 AUSTRALIA: BRONCHOSCOPY MARKET, BY WORKING CHANNEL DIAMETER, 2020–2027 (USD MILLION)

TABLE 230 AUSTRALIA: BRONCHOSCOPY IMAGING SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 231 AUSTRALIA: BRONCHOSCOPY ACCESSORIES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 232 AUSTRALIA: BRONCHOSCOPY MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 233 AUSTRALIA: MARKET, BY USABILITY, 2020–2027 (USD MILLION)

TABLE 234 AUSTRALIA: MARKET, BY PATIENT, 2020–2027 (USD MILLION)

TABLE 235 AUSTRALIA: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.4.5 REST OF ASIA PACIFIC

TABLE 236 REST OF ASIA PACIFIC: BRONCHOSCOPY MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 237 REST OF ASIA PACIFIC: BRONCHOSCOPES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 238 REST OF ASIA PACIFIC: BRONCHOSCOPY MARKET, BY WORKING CHANNEL DIAMETER, 2020–2027 (USD MILLION)

TABLE 239 REST OF ASIA PACIFIC: BRONCHOSCOPY IMAGING SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 240 REST OF ASIA PACIFIC: BRONCHOSCOPY ACCESSORIES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 241 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 242 REST OF ASIA PACIFIC: MARKET, BY USABILITY, 2020–2027 (USD MILLION)

TABLE 243 REST OF ASIA PACIFIC: MARKET, BY PATIENT, 2020–2027 (USD MILLION)

TABLE 244 REST OF ASIA PACIFIC: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.5 REST OF THE WORLD

TABLE 245 REST OF THE WORLD: ESTIMATED AGE-STANDARDIZED INCIDENCE RATE FOR LUNG CANCER, BY COUNTRY, 2020

TABLE 246 REST OF THE WORLD: BRONCHOSCOPY MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 247 REST OF THE WORLD: BRONCHOSCOPY MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 248 REST OF THE WORLD: BRONCHOSCOPES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 249 REST OF THE WORLD: BRONCHOSCOPY MARKET, BY WORKING CHANNEL DIAMETER, 2020–2027 (USD MILLION)

TABLE 250 ROW: BRONCHOSCOPY IMAGING SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 251 ROW: BRONCHOSCOPY ACCESSORIES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 252 REST OF THE WORLD: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 253 REST OF THE WORLD: MARKET, BY USABILITY, 2020–2027 (USD MILLION)

TABLE 254 REST OF THE WORLD: MARKET, BY PATIENT, 2020–2027 (USD MILLION)

TABLE 255 REST OF THE WORLD: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.5.1 LATIN AMERICA

11.5.1.1 Increasing purchasing power and healthcare affordability to favor market growth

TABLE 256 LUNG CANCER INCIDENCE FOR KEY LATIN AMERICAN COUNTRIES, 2018 VS. 2025

TABLE 257 LATIN AMERICA: BRONCHOSCOPY MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 258 LATIN AMERICA: BRONCHOSCOPES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 259 LATIN AMERICA: BRONCHOSCOPY MARKET, BY WORKING CHANNEL DIAMETER, 2020–2027 (USD MILLION)

TABLE 260 LATIN AMERICA: BRONCHOSCOPY IMAGING SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 261 LATIN AMERICA: BRONCHOSCOPY ACCESSORIES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 262 LATIN AMERICA: BRONCHOSCOPY EQUIPMENT MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 263 LATIN AMERICA: MARKET, BY USABILITY, 2020–2027 (USD MILLION)

TABLE 264 LATIN AMERICA: MARKET, BY PATIENT, 2020–2027 (USD MILLION)

TABLE 265 LATIN AMERICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.5.2 MIDDLE EAST AND AFRICA

11.5.2.1 Healthcare infrastructural development to drive market

TABLE 266 AFRICA: LUNG CANCER INCIDENCE, 2018 VS. 2025

TABLE 267 MIDDLE EAST AND AFRICA: BRONCHOSCOPY MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 268 MIDDLE EAST AND AFRICA: BRONCHOSCOPES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 269 MIDDLE EAST AND AFRICA: BRONCHOSCOPY MARKET, BY WORKING CHANNEL DIAMETER, 2020–2027 (USD MILLION)

TABLE 270 MIDDLE EAST AND AFRICA: BRONCHOSCOPY IMAGING SYSTEMS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 271 MIDDLE EAST AND AFRICA: BRONCHOSCOPY ACCESSORIES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 272 MIDDLE EAST AND AFRICA: BRONCHOSCOPY EQUIPMENT MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 273 MIDDLE EAST AND AFRICA: MARKET, BY USABILITY, 2020–2027 (USD MILLION)

TABLE 274 MIDDLE EAST AND AFRICA: MARKET, BY PATIENT, 2020–2027 (USD MILLION)

TABLE 275 MIDDLE EAST & AFRICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 215)

12.1 OVERVIEW

12.2 STRATEGIES ADOPTED BY KEY PLAYERS/RIGHT TO WIN

TABLE 276 OVERVIEW OF STRATEGIES ADOPTED BY KEY MANUFACTURERS

12.3 REVENUE ANALYSIS

FIGURE 35 REVENUE ANALYSIS OF KEY PLAYERS IN BRONCHOSCOPY MARKET

12.4 MARKET SHARE ANALYSIS

FIGURE 36 BRONCHOSCOPY MARKET SHARE ANALYSIS, 2021

TABLE 277 BRONCHOSCOPY MARKET: DEGREE OF COMPETITION

12.5 COMPANY EVALUATION MATRIX (KEY PLAYERS)

12.5.1 STARS

12.5.2 EMERGING LEADERS

12.5.3 PARTICIPANTS

12.5.4 PERVASIVE PLAYERS

FIGURE 37 BRONCHOSCOPY MARKET: COMPETITIVE LEADERSHIP MAPPING, 2021

12.6 COMPETITIVE LEADERSHIP MAPPING (STARTUPS AND SMES)

12.6.1 PROGRESSIVE COMPANIES

12.6.2 STARTING BLOCKS

12.6.3 RESPONSIVE COMPANIES

12.6.4 DYNAMIC COMPANIES

FIGURE 38 BRONCHOSCOPY MARKET: COMPETITIVE LEADERSHIP MAPPING FOR SMES/STARTUPS, 2021

12.7 COMPETITIVE BENCHMARKING

TABLE 278 BRONCHOSCOPY MARKET: DETAILED LIST OF KEY SMES/STARTUPS

TABLE 279 BRONCHOSCOPY MARKET: COMPETITIVE BENCHMARKING OF SMES/STARTUPS

12.8 COMPANY FOOTPRINT ANALYSIS

TABLE 280 OVERALL FOOTPRINT OF COMPANIES

TABLE 281 PRODUCT FOOTPRINT OF COMPANIES

TABLE 282 REGIONAL FOOTPRINT OF COMPANIES

12.9 COMPETITIVE SCENARIO AND TRENDS

12.9.1 PRODUCT LAUNCHES AND APPROVALS

TABLE 283 PRODUCT LAUNCHES AND APPROVALS, JANUARY 2019–JULY 2022

12.9.2 DEALS

TABLE 284 DEALS, JANUARY 2019–JULY 2022

12.9.3 OTHER DEVELOPMENTS

TABLE 285 OTHER DEVELOPMENTS, JANUARY 2019–JULY 2022

13 COMPANY PROFILES (Page No. - 234)

13.1 KEY PLAYERS

(Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)*

13.1.1 OLYMPUS CORPORATION

TABLE 286 OLYMPUS CORPORATION: BUSINESS OVERVIEW

FIGURE 39 OLYMPUS CORPORATION: COMPANY SNAPSHOT (2021)

13.1.2 AMBU A/S

TABLE 287 AMBU A/S: BUSINESS OVERVIEW

FIGURE 40 AMBU A/S: COMPANY SNAPSHOT (2021)

13.1.3 BOSTON SCIENTIFIC CORPORATION

TABLE 288 BOSTON SCIENTIFIC CORPORATION: BUSINESS OVERVIEW

FIGURE 41 BOSTON SCIENTIFIC CORPORATION: COMPANY SNAPSHOT (2021)

13.1.4 ETHICON (SUBSIDIARY OF JOHNSON & JOHNSON)

TABLE 289 JOHNSON & JOHNSON: BUSINESS OVERVIEW

FIGURE 42 JOHNSON & JOHNSON: COMPANY SNAPSHOT (2021)

13.1.5 MEDTRONIC

TABLE 290 MEDTRONIC: BUSINESS OVERVIEW

FIGURE 43 MEDTRONIC: COMPANY SNAPSHOT (2021)

13.1.6 FUJIFILM HOLDINGS CORPORATION

TABLE 291 FUJIFILM HOLDINGS CORPORATION: BUSINESS OVERVIEW

FIGURE 44 FUJIFILM HOLDINGS CORPORATION: COMPANY SNAPSHOT (2021)

13.1.7 KARL STORZ

TABLE 292 KARL STORZ: BUSINESS OVERVIEW

13.1.8 HOYA CORPORATION

TABLE 293 HOYA CORPORATION: BUSINESS OVERVIEW

FIGURE 45 HOYA CORPORATION: COMPANY SNAPSHOT (2020)

13.1.9 RICHARD WOLF GMBH

TABLE 294 RICHARD WOLF GMBH: BUSINESS OVERVIEW

13.1.10 COOK MEDICAL

TABLE 295 COOK MEDICAL: BUSINESS OVERVIEW

13.1.11 CONMED

TABLE 296 CONMED: BUSINESS OVERVIEW

FIGURE 46 CONMED: COMPANY SNAPSHOT (2021)

13.1.12 ROPER TECHNOLOGIES

TABLE 297 ROPER TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 47 ROPER TECHNOLOGIES: COMPANY SNAPSHOT (2021)

13.1.13 TELEFLEX INCORPORATED

TABLE 298 TELEFLEX INCORPORATED: BUSINESS OVERVIEW

FIGURE 48 TELEFLEX INCORPORATED: COMPANY SNAPSHOT (2021)

13.1.14 LABORIE MEDICAL TECHNOLOGIES CORP.

TABLE 299 LABORIE MEDICAL TECHNOLOGIES CORP.: BUSINESS OVERVIEW

13.1.15 EFER ENDOSCOPY

TABLE 300 EFER ENDOSCOPY: BUSINESS OVERVIEW

13.1.16 BRONCUS MEDICAL INC.

TABLE 301 BRONCUS MEDICAL INC.: BUSINESS OVERVIEW

*Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

13.2 OTHER PLAYERS

13.2.1 EMOS TECHNOLOGY GMBH

13.2.2 VBM MEDIZINTECHNIK GMBH

13.2.3 HUNAN VATHIN MEDICAL INSTRUMENT CO., LTD.

13.2.4 MACHIDA ENDOSCOPE CO., LTD.

14 APPENDIX (Page No. - 282)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 CUSTOMIZATION OPTIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

The study involved four major activities to estimate the current size of the bronchoscopy market. Exhaustive secondary research was done to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to in order to identify and collect information for this study.

Primary Research

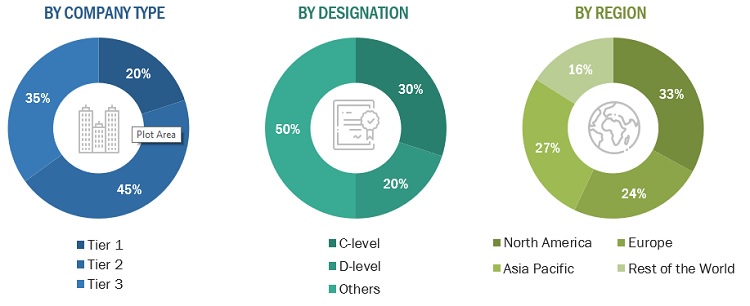

Several stakeholders such as bronchoscopy equipment manufacturers, vendors, distributors, and physicians from hospitals and clinics were consulted for this report. The demand side of this market is characterized by increasing preference for side effects of bronchoscopy procedures, growing geriatric population and the subsequent increase of bronchoscopy procedures, and increasing emphasis on improving technology. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is a breakdown of the primary respondents:

Breakdown of Primary Participants:

*Others include sales managers, marketing managers, and product managers.

Note: Companies are classified into tiers based on their total revenues. As of 2020, Tier 1= >USD 1 billion, Tier 2 = USD 100 million to USD 1 billion, and Tier 3 = < USD million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the bronchoscopy equipment market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the bronchoscopy equipment industry.

Report Objectives

- To define, describe, and forecast the bronchoscopy market based on product, usability, patient, end user, and region.

- To provide detailed information regarding the major factors influencing market growth (such as drivers, restraints, and opportunities)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall bronchoscopy equipment market

- To analyse market opportunities for stakeholders and provide details of the competitive landscape for key players.

- To forecast the size of the market segments in four geographical regions, namely, North America, Europe, the Asia Pacific, and Rest of the World.

- To profile the key players and comprehensively analyse their product portfolios, market positions, and core competencies.

- To track and analyse competitive developments such as product launches and approvals, deals and expansions in the bronchoscopy market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

- Geographic Analysis: Further breakdown of the bronchoscopy equipment market into specific countries/regions in the Rest of Europe, Rest of Asia Pacific, Middle East & African, and Latin American countries

-

Company Information: Detailed analysis and profiling of additional market players (up to 5) inclusive of:

- Business Overview

- Financial Information

- Product Portfolio

- Developments (last three years)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Bronchoscopy Market