Aroma Ingredients Market for Personal Care Industry by Type (Synthetic Ingredients, Natural Ingredients), Application (Fine Fragrances, Toiletries, and Cosmetics), and Region (APAC, Europe, North America) - Global Forecast to 2023

[110 Pages Report] Aroma Ingredients Market was valued at USD 2.20 billion in 2017 and is projected to reach USD 2.83 billion by 2023, at a CAGR of 4.5% during the forecast period. In this report, 2017 has been considered the base year for the study of the aroma ingredients market while the forecast period is from 2018 to 2023.

Objectives of this Study on the aroma ingredients market are as follows:

- To analyze and forecast the size of the aroma ingredients market, in terms of value

- To provide detailed information regarding the major factors, such as drivers, restraints, and opportunities influencing the growth of the aroma ingredients market

- To define, describe, and forecast the aroma ingredients market based on type, application, and region

- To forecast sizes of different segments of the market in 5 major regions, namely, APAC, Europe, North America, the Middle East & Africa, and South America and their respective key countries

- To analyze the markets with respect to individual growth trends, prospects, and their contribution to the overall aroma ingredients market

- To analyze opportunities in the aroma ingredients market for stakeholders by identifying the high-growth segments of the market

- To track and analyze competitive developments, such as acquisitions, new product launches, agreements, and expansions in the aroma ingredients market

- To strategically profile the key players operating in the aroma ingredients market and comprehensively analyze their growth strategies

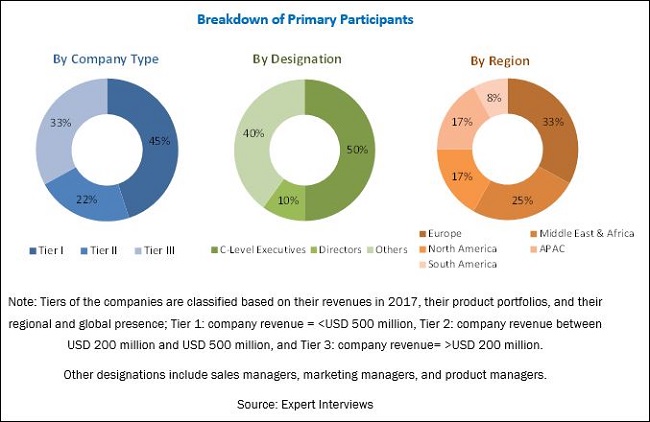

This technical, market-oriented, and commercial research study on the aroma ingredients market involved the extensive use of secondary sources, directories, and databases, such as Hoovers, Bloomberg BusinessWeek, and Factiva to identify and collect information on the aroma ingredients market. Primary sources mainly included several industry experts from the core and related industries and suppliers, manufacturers, distributors, service providers, and organizations related to different segments of the supply chain of the aroma ingredients industry. After arriving at the overall size of the aroma ingredients market, the total market was split into several segments. The figure below illustrates the breakdown of primary interviews, which were conducted during the research study on the aroma ingredients market, based on company type, designation, and region.

To know about the assumptions considered for the study, download the pdf brochure

The key market players profiled in this report include Symrise (Germany), Takasago International Corporation (Japan), Sensient Technologies Corporation (US), MANE (France), Robertet SA (France), T. Hasegawa Co., Ltd. (Japan), Frutarom (Israel), Givaudan (Switzerland), Firmenich SA (Switzerland), and International Flavors & Fragrances Inc. (US).

The Target Audiences for the aroma ingredients market report are:

- Manufacturers of Aroma Ingredients

- Raw Material Suppliers

- Investment Banks

- Distributors of Aroma Ingredients

- Government Bodies

Scope of the Report

This report categorizes the aroma ingredients market based on type, application, and region.

Aroma Ingredients Market, by Type:

- Synthetic Ingredients

- Natural Ingredients

Aroma Ingredients Market, by Application:

- Fine Fragrances

- Toiletries

- Cosmetics

Aroma Ingredients Market, by Region:

- APAC

- Europe

- North America

- Middle East & Africa

- South America

Available Customizations:

Along with the market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Regional Analysis

- A further breakdown of the regional aroma ingredients market at the country level based on type or application

Country Information

- Additional country information (up to 3)

Company Information

- Detailed analysis and profiles of additional market players (up to 5)

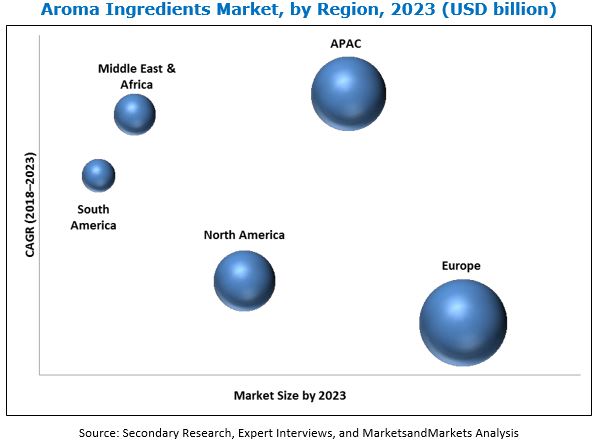

The aroma ingredients market is expected to grow from USD 2.27 billion in 2018 to USD 2.83 billion by 2023, at a CAGR of 4.5% between 2018 and 2023. Rising demand for personal care products and changes in lifestyles and consumer preferences is expected to drive the growth of the aroma ingredients market during the forecast period.

Based on type, the aroma ingredients market has been segmented into synthetic ingredients and natural ingredients. The synthetic ingredients segment is projected to lead the aroma ingredients market in terms of value during the forecast period. Growth of this segment of the market can be attributed to the low cost of synthetic ingredients, easy availability, and consistency in quality.

Based on application, the aroma ingredients market has been segmented into fine fragrances, toiletries, and cosmetics. The fine fragrances segment is projected to lead the aroma ingredients market in terms of value during the forecast period. Fine fragrance is a term used for products diluted with alcohol and contain a high concentration of aroma ingredients. Fine fragrances include major application fields, such as perfumes, colognes, body mists, and deodorants. Aroma ingredients are key components used in formulations of fine fragrances. These are used in the highest quantities in fine fragrance formulations than any other applications. Hence, the increasing demand for perfumes, colognes, deodorants, and body mists across the globe is expected to drive the demand for aroma ingredients in the fine fragrance application.

The aroma ingredients market has been studied for APAC, Europe, North America, the Middle East & Africa, and South America. The European region is the largest market for the aroma ingredients market across the globe due to the presence of leading manufacturers of aroma ingredients and personal care products. The major countries driving the growth of the Europe aroma ingredients market are France, Germany, Italy, and UK. Moreover, the European perfume industry is highly innovative. Hence, these players produce a wide variety of fragrances, which create a high demand for aroma ingredients in the region.

The manufacture of personal care products is regulated by government entities worldwide. These regulatory systems vary with each country; however, these have the common goal of ensuring safety and proper labeling of personal care products. The European Commission Cosmetics Directive (ECCD) and other state government agencies have implemented regulations on the manufacture and use of personal care products. Regulations implemented by the China Food and Drugs Administration (CFDA) do not allow the use of new unregistered ingredients. This restricts the use of new ingredients globally, thus hindering the development of personal care products.

Some key players in the aroma ingredients market include Symrise (Germany), Takasago International Corporation (Japan), Sensient Technologies Corporation (US), MANE (France), Robertet SA (France), T. Hasegawa Co., Ltd. (Japan), Frutarom (Israel), Givaudan (Switzerland), Firmenich SA (Switzerland), and International Flavors & Fragrances Inc. (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 30)

4.1 Significant Opportunities in the Aroma Ingredients Market

4.2 Aroma Ingredients Market, By Type

4.3 Aroma Ingredients Market, By Application

4.4 Aroma Ingredients Market in Europe, By Application and Country

4.5 Aroma Ingredients Market Attractiveness

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Rising Consumption of Personal Care Products

5.2.1.2 Change in Lifestyle and Consumer Preferences

5.2.1.3 Increasing Demand for Natural Aroma Ingredients

5.2.2 Restraints

5.2.2.1 High Production and R&D Costs

5.2.2.2 Stringent Government Regulations

5.2.3 Opportunities

5.2.3.1 High Growth Potential From Emerging Economies

5.3 Porter’s Five Forces Analysis

5.3.1 Threat of New Entrants

5.3.2 Threat of Substitutes

5.3.3 Bargaining Power of Suppliers

5.3.4 Bargaining Power of Buyers

5.3.5 Intensity of Competitive Rivalry

6 Aroma Ingredients Market, By Type (Page No. - 41)

6.1 Introduction

6.2 Synthetic Ingredients

6.3 Natural Ingredients

7 Aroma Ingredients Market, By Application (Page No. - 46)

7.1 Introduction

7.2 Fine Fragrances

7.3 Toiletries

7.4 Cosmetics

8 Aroma Ingredients Market, By Region (Page No. - 53)

8.1 Introduction

8.2 Europe

8.2.1 France

8.2.2 Germany

8.2.3 Italy

8.2.4 UK

8.3 APAC

8.3.1 China

8.3.2 Japan

8.3.3 India

8.3.4 Singapore

8.3.5 South Korea

8.4 North America

8.4.1 US

8.4.2 Canada

8.4.3 Mexico

8.5 Middle East & Africa

8.5.1 Turkey

8.5.2 Saudi Arabia

8.5.3 UAE

8.6 South America

8.6.1 Brazil

8.6.2 Argentina

8.6.3 Colombia

9 Competitive Landscape (Page No. - 80)

9.1 Introduction

9.2 Market Ranking

9.2.1 Givaudan

9.2.2 Firmenich SA

9.2.3 IFF

9.3 Competitive Scenario

9.3.1 Expansion

9.3.2 Acquisition

9.3.3 New Product Launch

9.3.4 Collaboration, Contract & Agreement

9.3.5 Investment

10 Company Profiles (Page No. - 86)

10.1 Givaudan

10.1.1 Business Overview

10.1.2 Products Offered

10.1.3 Recent Developments

10.1.4 SWOT Analysis

10.2 Firmenich SA

10.2.1 Business Overview

10.2.2 Products Offered

10.2.3 Recent Developments

10.3 International Flavors & Fragrances Inc. (IFF)

10.3.1 Business Overview

10.3.2 Products Offered

10.3.3 Recent Developments

10.3.4 SWOT Analysis

10.3.5 MnM View

10.4 Symrise

10.4.1 Business Overview

10.4.2 Products Offered

10.4.3 Recent Developments

10.4.4 SWOT Analysis

10.4.5 MnM View

10.5 Takasago International Corporation

10.5.1 Business Overview

10.5.2 Products Offered

10.5.3 Recent Developments

10.5.4 SWOT Analysis

10.5.5 MnM View

10.6 Frutarom

10.6.1 Business Overview

10.6.2 Products Offered

10.6.3 Recent Developments

10.6.4 MnM View

10.7 Mane

10.7.1 Business Overview

10.7.2 Products Offered

10.7.3 Recent Developments

10.8 Robertet SA

10.8.1 Business Overview

10.8.2 Products Offered

10.8.3 Recent Developments

10.9 Sensient Technologies Corporation

10.9.1 Business Overview

10.9.2 Products Offered

10.9.3 Recent Developments

10.9.4 SWOT Analysis

10.9.5 MnM View

10.10 T. Hasegawa Co., Ltd.

10.10.1 Business Overview

10.10.2 Products Offered

10.11 Other Key Players

10.11.1 Bel Flavors & Fragrances

10.11.2 Ogawa & Co., Ltd

10.11.3 Huabao

10.11.4 Solvay

10.11.5 Kao Corporation

10.11.6 Vigon International, Inc.

10.11.7 Yingyang (China) Aroma Chemical Group

10.11.8 S H Kelkar and Company Limited

11 Appendix (Page No. - 106)

11.1 Discussion Guide

11.2 Introducing RT: Real-Time Market Intelligence

11.3 Available Customizations

11.4 Related Reports

List of Tables (64 Tables)

Table 1 Aroma Ingredient Market Size, By Type, 2016–2023 (USD Million)

Table 2 Synthetic Aroma Ingredient Market Size, By Region, 2016–2023 (USD Million)

Table 3 Natural Aroma Ingredient Market Size, By Region, 2016–2023 (USD Million)

Table 4 By Market Size, By Application, 2016–2023 (USD Million)

Table 5 By Market Size in Fine Fragrances Application, By Region, 2016–2023 (USD Million)

Table 6 By Market Size in Toiletries Application, By Region, 2016–2023 (USD Million)

Table 7 By Market Size in Cosmetics Application, By Region, 2016–2023 (USD Million)

Table 8 By Market Size, By Region, 2016–2023 (USD Million)

Table 9 Europe: By Country, 2016–2023 (USD Million)

Table 10 Europe: By Type, 2016–2023 (USD Million)

Table 11 Europe: By Application, 2016–2023 (USD Million)

Table 12 France: By Application, 2016–2023 (USD Million)

Table 13 France: By Type, 2016–2023 (USD Million)

Table 14 Germany: By Application, 2016–2023 (USD Million)

Table 15 Germany: By Type, 2016–2023 (USD Million)

Table 16 Italy: By Application, 2016–2023 (USD Million)

Table 17 Italy: By Type, 2016–2023 (USD Million)

Table 18 UK: By Application, 2016–2023 (USD Million)

Table 19 UK: By Type, 2016–2023 (USD Million)

Table 20 APAC: By Country, 2016–2023 (USD Million)

Table 21 APAC: By Type, 2016–2023 (USD Million)

Table 22 APAC: By Market Size, By Application, 2016–2023 (USD Million)

Table 23 China: By Application, 2016–2023 (USD Million)

Table 24 China: By Type, 2016–2023 (USD Million)

Table 25 Japan: By Application, 2016–2023 (USD Million)

Table 26 Japan: By Type, 2016–2023 (USD Million)

Table 27 India: By Application, 2016–2023 (USD Million)

Table 28 India: By Type, 2016–2023 (USD Million)

Table 29 Singapore: By Application, 2016–2023 (USD Million)

Table 30 Singapore: By Type, 2016–2023 (USD Million)

Table 31 South Korea: By Application, 2016–2023 (USD Million)

Table 32 South Korea: By Type, 2016–2023 (USD Million)

Table 33 North America: By Country, 2016–2023 (USD Million)

Table 34 North America: By Type, 2016–2023 (USD Million)

Table 35 North America: By Application, 2016–2023 (USD Million)

Table 36 US: By Application, 2016–2023 (USD Million)

Table 37 US: By Type, 2016–2023 (USD Million)

Table 38 Canada: By Application, 2016–2023 (USD Million)

Table 39 Canada: By Type, 2016–2023 (USD Million)

Table 40 Mexico: By Application, 2016–2023 (USD Million)

Table 41 Mexico: By Type, 2016–2023 (USD Million)

Table 42 Middle East & Africa: By Country, 2016–2023 (USD Million)

Table 43 Middle East & Africa: By Type, 2016–2023 (USD Million)

Table 44 Middle East & Africa: By Application, 2016–2023 (USD Million)

Table 45 Turkey: By Application, 2016–2023 (USD Million)

Table 46 Turkey: By Type, 2016–2023 (USD Million)

Table 47 Saudi Arabia: By Application, 2016–2023 (USD Million)

Table 48 Saudi Arabia: By Type, 2016–2023 (USD Million)

Table 49 UAE: By Application, 2016–2023 (USD Million)

Table 50 UAE: By Type, 2016–2023 (USD Million)

Table 51 South America: By Country, 2016–2023 (USD Million)

Table 52 South America: By Type, 2016–2023 (USD Million)

Table 53 South America: By Application, 2016–2023 (USD Million)

Table 54 Brazil: By Application, 2016–2023 (USD Million)

Table 55 Brazil: By Type, 2016–2023 (USD Million)

Table 56 Argentina: By Application, 2016–2023 (USD Million)

Table 57 Argentina: By Type, 2016–2023 (USD Million)

Table 58 Colombia: By Application, 2016–2023 (USD Million)

Table 59 Colombia: By Type, 2016–2023 (USD Million)

Table 60 Expansion, 2014–2018

Table 61 Acquisition, 2014–2018

Table 62 New Product Launch, 2014–2018

Table 63 Collaboration, Contract & Agreement, 2014–2018

Table 64 Investment, 2014–2018

List of Figures (41 Figures)

Figure 1 Aroma Ingredient Market Segmentation

Figure 2 Aroma Ingredient Market: Research Design

Figure 3 Aroma Ingredient Market: Data Triangulation

Figure 4 Synthetic Ingredients to Be the Largest Type of Aroma Ingredients

Figure 5 Fine Fragrances to Be the Largest Application of Aroma Ingredients

Figure 6 Europe to Be the Largest Aroma Ingredients Market

Figure 7 Growth in Personal Care Industry to Drive the Demand for Aroma Ingredients

Figure 8 Synthetic Ingredients Segment to Register the Highest CAGR

Figure 9 Fine Fragrances Application to Lead the Aroma Ingredient Market

Figure 10 France Accounted for the Largest Market Share in 2017

Figure 11 APAC to Be the Fastest-Growing Aroma Ingredient Market

Figure 12 Overview of Factors Governing the Aroma Ingredient Market

Figure 13 Aroma Ingredient Market: Porter’s Five Forces Analysis

Figure 14 Synthetic Ingredients to Be the Largest Type of Aroma Ingredients

Figure 15 Europe to Be the Largest Synthetic Aroma Ingredient Market

Figure 16 Europe to Be the Largest Natural Aroma Ingredient Market

Figure 17 Fine Fragrances to Be the Largest Application of Aroma Ingredients

Figure 18 Europe to Be the Largest Aroma Ingredient Market in Fine Fragrances Application

Figure 19 APAC to Be the Largest Aroma Ingredient Market in Toiletries Application

Figure 20 Europe to Be the Largest Aroma Ingredient Market in Cosmetics Application

Figure 21 India to Be the Fastest-Growing Aroma Ingredients Market

Figure 22 Europe: Aroma Ingredient Market Snapshot

Figure 23 APAC: Aroma Ingredient Market Snapshot

Figure 24 North America: Aroma Ingredient Market Snapshot

Figure 25 Expansion Was the Most Adopted Strategy Between 2014 and 2018

Figure 26 Ranking of Key Market Players in 2016

Figure 27 Givaudan: Company Snapshot

Figure 28 Givaudan: SWOT Analysis

Figure 29 Firmenich SA: Company Snapshot

Figure 30 International Flavors & Fragrances Inc.: Company Snapshot

Figure 31 International Flavors & Fragrances Inc.: SWOT Analysis

Figure 32 Symrise: Company Snapshot

Figure 33 Symrise: SWOT Analysis

Figure 34 Takasago International Corporation: Company Snapshot

Figure 35 Takasago International Corporation: SWOT Analysis

Figure 36 Frutarom: Company Snapshot

Figure 37 Mane: Company Snapshot

Figure 38 Robertet SA: Company Snapshot

Figure 39 Sensient Technologies Corporation: Company Snapshot

Figure 40 Sensient Technologies Corporation: SWOT Analysis

Figure 41 T. Hasegawa Co., Ltd.: Company Snapshot

Growth opportunities and latent adjacency in Aroma Ingredients Market