Antimicrobial Packaging Market by Base Material (Plastics, Biopolymer, Paperboard, Others), Antimicrobial Agents (Organic acid, Bacteriocins, Others), Technology (Controlled release, Active), Pack Type (Bags, Pouches, Others), Application - Forecast to 2021

[294 Pages Report] The antimicrobial packaging market size is estimated to grow from USD 7.28 Billion in 2015 to USD 10.00 Billion by 2021, at a CAGR of 5.54%. The antimicrobial packaging market is growing rapidly in accordance with the growth in the packaging market, globally. Antimicrobial packaging is widely used in the food industry as a result of the rising consumer demand for products that are perishable, preservative-free, and minimally processed, and also due to the need to increase the shelf life of the products. This application is projected to foster the demand for antimicrobial packaging solutions during the forecast period. The report aims at estimating the market size and future growth potential of the antimicrobial packaging market across different segments such as base material, pack type, antimicrobial agents, technology, end-user industry, and region. The base year considered for the study is 2015 and the market size is projected from 2016 to 2021. Factors such as growing demand in Asia-Pacific, growth in the food & beverage and healthcare sectors, and growing health-related awareness among consumers are the major drivers of the antimicrobial packaging market in the next five years. The base year considered for the report is 2015, whereas the forecast period considered for the report is 20162021.

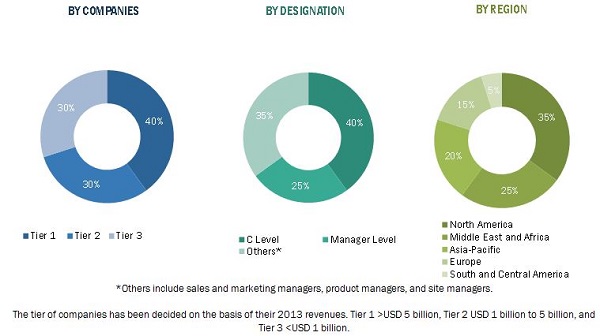

The research methodology used to estimate and forecast the antimicrobial packaging market was with both the top-down and bottom-up approaches. The total market size of antimicrobial packaging was calculated based on the percentage split of antimicrobial packaging out of the overall active & intelligent packaging as well as on the percentage spilt of different materials and antimicrobial agents used in manufacturing antimicrobial packaging. The allotment and calculation were done on the basis of extensive primary interviews and secondary research. Primary research involved in this report includes extensive interviews with key people such as CEOs, VPs, directors, and executives. After arriving at the overall market size, the total market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of profiles of primary sources is depicted in the following figure:

To know about the assumptions considered for the study, download the pdf brochure

The market ecosystem includes various stakeholders involved in the supply chain of the antimicrobial packaging industry starting from raw materials suppliers, research & development, manufacturing, and the assembly team. After this, the marketing and sales of the finished products take place which is only possible if an efficient distribution channel is developed. Finally, the end-products are made available to the consumers. The global market for antimicrobial packaging is dominated by players such as BASF SE (Germany), The Dow Chemical Company (U.S.), Mondi Plc (South Africa), PolyOne Corporation (U.S.), Biocote Limited (U.K.), Dunmore Corporation (U.S.), Linpac Senior Holdings (U.K.), Microban International (U.S.), Oplon Pure Sciences Ltd. (Israel), and Takex Labo Co. Ltd.

This report estimates the size of the antimicrobial packaging market in terms of volume (kilotons) and value (USD million). In this report, the market has been segmented broadly on the basis of base material, technology, antimicrobial agents, pack type, application, and region. The market drivers, restraints, opportunities, challenges, and product price trends have also been discussed in detail.

Target Audience

- Packaging manufacturers

- Raw material suppliers

- End users

- Consulting firms

Scope of the Report

The research report segments the antimicrobial packaging market into the following submarkets:

Antimicrobial Packaging Market: By Base Material

- Plastics

- Biopolymer

- Paper & paperboard

- Others (aluminum foil, non-woven fabrics, and glass)

Antimicrobial Packaging Market: By Pack Type

- Bags

- Pouches

- Trays

- Carton packages

- Cups & lids

- Others (cans & blister packs)

Antimicrobial Packaging Market: By Antimicrobial Agents

- Organic acid

- Bacteriocins

- Enzymes

- Essential oil

- Metal ions & oxidizers

- Others (gas, fungicides, natural extract, and antibiotics)

Antimicrobial Packaging Market: By Technology

- Controlled release packaging

- Active packaging

Antimicrobial Packaging Market: By End-User Industry

- Food & beverages

- Healthcare

- Personal care

- Others (consumer goods and agricultural products)

Antimicrobial Packaging Market: By Region

- North America

- Europe

- Asia-Pacific

- RoW

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of product portfolio of each company

Geographic Analysis

- Further analysis of the antimicrobial packaging market for additional countries

Company Information

- Detailed analysis and profiling of additional market players

MarketsandMarkets projects that the antimicrobial packaging market size will grow from USD 7.28 Billion in 2015 to USD 10.00 Billion by 2021, at an estimated CAGR of 5.54%. The rising concerns toward food wastage, growing consumer awareness about health-related issues, rising consumption of products with shorter shelf life such as meat products, and increasing demand by various end-user industries such as food & beverage, healthcare, personal care, consumer goods, and agricultural products are the major factors driving the growth of the antimicrobial packaging market. Additionally, with rapid urbanization and demand for better quality products across the globe, there is a rapidly increasing need for antimicrobial packaging. Food & beverages is projected to have the largest market share and dominate the antimicrobial packaging market from 2016 to 2021. Healthcare is the next application to play a key role in changing the antimicrobial packaging landscape and is projected to grow at the second-highest rate during the forecast period.

The segmentation for this report is based on base material, technology, antimicrobial agents, pack type, application, and region. Pouches are projected to form the fastest-growing pack type in the antimicrobial packaging market as it can be used to pack various types of products belonging to different industries. The next pack type that has the largest market share is carton packages as they are widely used across the food & beverages industry. Other types of pack types are trays, bags, cups & lids, cans, and blister packs.

The market share of organic acids is the largest as per antimicrobial agents. This is closely followed by bacteriocins which has the highest growth rate. The other type of antimicrobial agents that are widely used are enzymes, essential oils, metal ions & oxidizers, gas, fungicides, natural extracts, and antibiotics.

Antimicrobial packaging solutions are used in various industries due to their utility. The antimicrobial packaging solutions offer various advantages such as maintaining the quality of the products, increasing the shelf-life of the commodity, and keeping them fresh. These are some of the main reasons which have led to the increase in the share of antimicrobial packaging in the packaging industry. The major industries having a healthy demand for antimicrobial packaging are food & beverages, healthcare, personal care, consumer goods, and agricultural products. The food & beverages industry, for a long time, has been the major contributor to the rising demand for antimicrobial packaging. But in recent times, this has been closely competed by other industries such as healthcare.

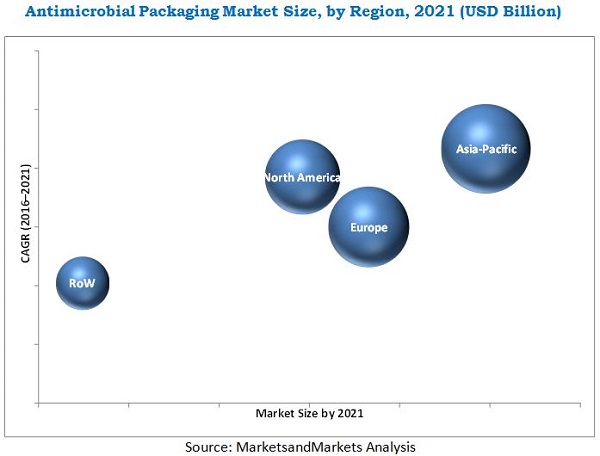

Asia-Pacific is projected to have the largest market share and dominate the antimicrobial packaging market from 2016 to 2021. Asia-Pacific offers potential growth opportunities, as developing countries such as China and India are projected to be emerging markets, making this region also the fastest-growing market for antimicrobial packaging. The growth of the antimicrobial packaging market in this region is propelled by factors such as the growth of the food & beverage, healthcare, personal care, consumer goods, and agricultural products industry. Also growing population and economic development are other factors.

However, due to fluctuations in the raw material prices, stringent compliance to regulations, and need for continuous technological advancements and research & development, the organizations are exposed to potential risks and are restraining the growth of the antimicrobial packaging market. The global market for antimicrobial packaging is dominated by players such as BASF SE (Germany), The Dow Chemical Company (U.S.), Mondi Plc (South Africa), PolyOne Corporation (U.S.), Biocote Limited (U.K.), Dunmore Corporation (U.S.), Linpac Senior Holdings (U.K.), Microban International (U.S.), Oplon Pure Sciences Ltd. (Israel), and Takex Labo Co. Ltd. These players adopted various strategies such as agreements, acquisitions, and new product developments to cater to the needs of the antimicrobial packaging market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 30)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered

1.4 Currency Considered

1.5 Unit Considered

1.6 Stakeholders

1.7 Limitations

2 Research Methodology (Page No. - 33)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.2.1 Breakdown of Primaries By Company Type, Designation, and Region

2.2 Market Size Estimation

2.3 Market Breakdown and Data Triangulation

2.4 Market Share Estimation

2.5 Research Assumptions and Limitations

2.5.1 Assumptions

2.5.2 Limitations

3 Executive Summary (Page No. - 42)

3.1 Rising Concerns About Food Safety Drive the Growth of the Antimicrobial Packaging Market

4 Premium Insights (Page No. - 47)

4.1 Attractive Opportunities in the Antimicrobial Packaging Market

4.2 Asia-Pacific Antimicrobial Packaging Market, By Antimicrobial Agent and Country, 2015

4.3 Leading Countries in the Antimicrobial Packaging Market, 2015

4.4 Antimicrobial Packaging Market, By Base Material

4.5 Antimicrobial Packaging Market, By Pack Type

4.6 Average Price Analysis

5 Market Overview (Page No. - 54)

5.1 Introduction

5.2 Evolution

5.3 Antimicrobial Market Segmentation

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Rising Concerns About Food Wastage

5.4.1.2 Growing Consumer Awareness About Health Related Issues

5.4.2 Restraints

5.4.2.1 Fluctuations in Raw Material Prices

5.4.3 Opportunities

5.4.3.1 Rising Consumption of Products With Shorter Shelf Life

5.4.3.2 Increasing Demand From the Healthcare Sector

5.4.4 Challenges

5.4.4.1 Variations in Laboratory Viability Results and Actual/Practical Food Conditions

5.4.4.2 Compliance to Stringent Regulations

6 Industry Trends (Page No. - 66)

6.1 Introduction

6.2 Supply Chain

6.3 Porters Five Forces Analysis

6.3.1 Bargaining Power of Suppliers

6.3.2 Bargaining Power of Buyers

6.3.3 Threat of New Entrants

6.3.4 Threat of Substitutes

6.3.5 Intensity of Competitive Rivalry

7 Antimicrobial Packaging Market, By Base Material (Page No. - 72)

7.1 Introduction

7.2 Plastic

7.2.1 Polyethylene (PE)

7.2.2 Low-Density Polyethylene (LDPE)

7.2.3 High-Density Polyethylene (HDPE)

7.2.4 Polyethylene Terephthalate (PET)

7.2.5 Polyvinyl Chloride (PVC)

7.2.6 Others

7.2.7 Antimicrobial Plastic Packaging Market Size, By Type

7.2.7.1 LDPE is Projected to Be the Fastest-Growing Plastic Segment in the Antimicrobial Packaging Market

7.2.8 Antimicrobial Plastic Packaging Market Size, By Pack Type

7.2.8.1 Pouches Segment Dominated the Antimicrobial Plastic Packaging Market in 2015

7.2.9 Antimicrobial Plastic Packaging Market Size, By Application

7.2.9.1 Food & Beverage Segment Dominated the Antimicrobial Plastic Packaging Market in 2015

7.3 Paper & Paperboard

7.3.1 Antimicrobial Paper & Paperboard Packaging Market Size, By Pack Type

7.3.1.1 Carton Packages is Projected to Be the Second-Fastest Growing Segment From 2016 to 2021

7.3.2 Antimicrobial Paper & Paperboard Packaging Market Size, By Application

7.3.2.1 Food & Beverage Segment Dominated the Antimicrobial Paper & Paperboard Packaging Market in 2015

7.4 Biopolymer

7.4.1 Antimicrobial Biopolymer Packaging Market Size, By Pack Type

7.4.1.1 Pouches Segment is Projected to Grow at the Highest CAGR During the Forecast Period

7.4.2 Antimicrobial Biopolymer Packaging Market Size, By Application

7.4.2.1 Biopolymer is Widely Used for Antimicrobial Packaging in the Food & Beverage Segment

7.5 Others

7.5.1 Antimicrobial Other Base Material Packaging Market Size, By Pack Type

7.5.1.1 Trays Segment Dominated the Others Market, By Pack Type, in 2015

7.5.2 Antimicrobial Other Base Material Packaging Market Size, By Application

7.5.2.1 Food & Beverage Segment is Projected to Grow at the Highest CAGR During the Forecast Period

8 Antimicrobial Packaging Market, By Antimicrobial Agent (Page No. - 89)

8.1 Introduction

8.2 Organic Acids

8.2.1 Organic Acids in Antimicrobial Packaging Market, By Application

8.2.1.1 Organic Acids are Most Widely Used in the Food & Beverage Segment

8.3 Bacteriocins

8.3.1 Bacteriocins in Antimicrobial Packaging Market, By Application

8.3.1.1 Food & Beverage Industry is Estimated as the Largest Consumer of Bacteriocins

8.4 Enzymes

8.4.1 Enzymes in Antimicrobial Packaging Market, By Application

8.4.1.1 Enzymes are Widely Used in the Antimicrobial Packaging of Food & Beverage Products

8.5 Essential Oils

8.5.1 Essential Oils in Antimicrobial Packaging Market, By Application

8.5.1.1 Essential Oils Find Widest Application in the Packaging of Food & Beverages

8.6 Metal Ions & Oxidizers

8.6.1 Metal Ions & Oxidizers in Antimicrobial Packaging Market, By Application

8.6.1.1 Healthcare Industry Was the Second-Largest Consumer of Metal Ions & Oxidizer Antimicrobial Agents in 2015

8.7 Others

8.7.1 Others in Antimicrobial Packaging Market Size, By Application

8.7.1.1 Food & Beverage Dominated the Others Segment in 2015

9 Antimicrobial Packaging Market, By Pack Type (Page No. - 103)

9.1 Introduction

9.2 Pouches

9.2.1 Antimicrobial Pouch Packaging Market, By Application

9.2.1.1 Pouches are Widely Used in the Food & Beverage Segment

9.3 Carton Packages

9.3.1 Antimicrobial Carton Packaging Market, By Application

9.3.1.1 Food & Beverage Projected to Be the Fastest-Growing Segment From 2016 to 2021

9.4 Trays

9.4.1 Antimicrobial Tray Packaging Market, By Application

9.4.1.1 Trays are the Most Preferred Option in the Food & Beverage Industry

9.5 Bags

9.5.1 Antimicrobial Bags Market, By Application

9.5.1.1 Food & Beverage Dominated the Bags Segment in 2015

9.6 Cups & Lids

9.6.1 Antimicrobial Cup & Lid Packaging Market, By Application

9.6.1.1 Personal Care Segment to Grow at A Considerable Rate During 2016 to 2021

9.7 Others

9.7.1 Other Antimicrobial Packaging Market, By Application

9.7.1.1 Food & Beverage Segment to Grow at the Highest Rate From 2016 to 2021

10 Antimicrobial Packaging Market, By Technology (Page No. - 116)

10.1 Introduction

10.2 Controlled Release Packaging

10.3 Active Packaging

11 Antimicrobial Packaging Market, By Application (Page No. - 119)

11.1 Introduction

11.2 Food & Beverage

11.3 Healthcare

11.4 Personal Care

11.5 Others

12 Antimicrobial Packaging Market, By Region (Page No. - 125)

12.1 Introduction

12.2 North America

12.2.1 North America: Antimicrobial Packaging Market Size, By Country

12.2.1.1 U.S. Dominated the Antimicrobial Packaging Market in the North American Region in 2015

12.2.2 North America: Antimicrobial Packaging Market Size, By Base Material

12.2.2.1 Plastic Projected to Be the Fastest-Growing Base Material Segment

12.2.3 North America: Antimicrobial Packaging Market Size, By Antimicrobial Agent

12.2.3.1 Organic Acids Segment Dominated the North American Market in 2015

12.2.4 North America: Antimicrobial Packaging Market Size, By Technology

12.2.4.1 Controlled Release Packaging Segment Projected to Be the Fastest-Growing in North America

12.2.5 North America: Antimicrobial Packaging Market Size, By Pack Type

12.2.5.1 Pouches Segment Dominated the North American Antimicrobial Packaging Market in 2015

12.2.6 North America: Antimicrobial Packaging Market Size, By Application

12.2.6.1 Food & Beverage Segment Dominated the North American Antimicrobial Packaging Market in 2015

12.2.7 U.S.

12.2.7.1 U.S.: Antimicrobial Packaging Market Size, By Base Material

12.2.7.1.1 the Plastic Segment Projected to Be the Fastest-Growing Base Material

12.2.8 U.S.: Antimicrobial Packaging Market Size, By Antimicrobial Agent

12.2.8.1 Organic Acids Segment Dominated the U.S. Antimicrobial Packaging Market in 2015

12.2.9 U.S.: Antimicrobial Packaging Market Size, By Technology

12.2.9.1 Controlled Release Packaging Projected to Be the Fastest-Growing Segment in the U.S.

12.2.10 U.S.: Antimicrobial Packaging Market Size, By Pack Type

12.2.10.1 the Pouches Segment Dominated the U.S. Antimicrobial Packaging Market in 2015

12.2.11 U.S.: Antimicrobial Packaging Market Size, By Application

12.2.11.1 the Food & Beverages Segment Dominated the U.S. Antimicrobial Packaging Market in 2015

12.2.12 Canada

12.2.12.1 Canada: Antimicrobial Packaging Market Size, By Base Material

12.2.12.1.1 the Plastic Segment Projected to Be the Fastest-Growing Base Material

12.2.12.2 Canada: Antimicrobial Packaging Market Size, By Antimicrobial Agent

12.2.12.2.1 the Organic Acids Segment Dominated the Canadian Antimicrobial Packaging Market in 2015

12.2.12.3 Canada: Antimicrobial Packaging Market Size, By Technology

12.2.12.3.1 Active Packaging Technology Projected to Be the Second-Fastest-Growing Segment in Canada

12.2.12.4 Canada: Antimicrobial Packaging Market Size, By Pack Type

12.2.12.4.1 the Pouches Segment Dominated the Canadian Antimicrobial Packaging Market in 2015

12.2.12.5 Canada: Antimicrobial Packaging Market Size, By Application

12.2.12.5.1 the Food & Beverages Segment Dominated the Canadian Antimicrobial Packaging Market in 2015

12.2.13 Mexico

12.2.13.1 Mexico: Antimicrobial Packaging Market Size, By Base Material

12.2.13.1.1 the Plastic Segment Projected to Be the Fastest-Growing Base Material

12.2.13.2 Mexico: Antimicrobial Packaging Market Size, By Antimicrobial Agent

12.2.13.2.1 the Bacteriocins Segment Projected to Be the Fastest-Growing From 2016 to 2021

12.2.13.3 Mexico: Antimicrobial Packaging Market Size, By Technology

12.2.13.3.1 Controlled Release Packaging Technology Projected to Be the Fastest-Growing in Mexico

12.2.13.4 Mexico: Antimicrobial Packaging Market Size, By Pack Type

12.2.13.4.1 the Carton Packages Segment Held the Second-Largest Share in the Mexican Antimicrobial Packaging Market in 2015

12.2.13.5 Mexico: Antimicrobial Packaging Market Size, By Application

12.2.13.5.1 the Healthcare Segment Projected to Be the Second-Fastest Growing Application in 2015

12.3 Europe

12.3.1 Europe: Antimicrobial Packaging Market Size, By Country

12.3.1.1 Germany is Projected to Be the Fastest-Growing Antimicrobial Packaging Market in Europe During the Forecast Period

12.3.1.2 Europe: Antimicrobial Packaging Market Size, By Base Material

12.3.1.2.1 Plastic Segment is Projected to Be the Fastest-Growing Base Material

12.3.1.3 Europe: Antimicrobial Packaging Market Size, By Antimicrobial Agent

12.3.1.3.1 Organic Acids Segment Dominated the European Market in 2015

12.3.1.4 Europe: Antimicrobial Packaging Market Size, By Technology

12.3.1.4.1 Controlled Release Packaging is Projected to Be the Fastest-Growing Segment in Europe

12.3.1.5 Europe: Antimicrobial Packaging Market Size, By Pack Type

12.3.1.5.1 Pouches Segment is Projected to Grow at the Second-Highest Rate From 2016 to 2021

12.3.1.6 Europe: Antimicrobial Packaging Market Size, By Application

12.3.1.6.1 Food & Beverage Segment Dominated the European Antimicrobial Packaging Market in 2015

12.3.2 Germany

12.3.2.1 Germany: Antimicrobial Packaging Market Size, By Base Material

12.3.2.1.1 Biopolymer Projected to Be the Second-Fastest-Growing Base Material Segment

12.3.2.2 Germany: Antimicrobial Packaging Market Size, By Antimicrobial Agent

12.3.2.2.1 Essential Oils is Projected to Be the Second-Fastest-Growing Segment From 2016 to 2021

12.3.2.3 Germany: Antimicrobial Packaging Market Size, By Technology

12.3.2.3.1 Controlled Release Packaging is Projected to Be the Fastest-Growing Segment in Germany

12.3.2.4 Germany: Antimicrobial Packaging Market Size, By Pack Type

12.3.2.4.1 Trays Segment is Projected to Grow at the Second-Highest CAGR From 2016 to 2021

12.3.2.5 Germany: Antimicrobial Packaging Market Size, By Application

12.3.2.5.1 Healthcare Segment Accounted for the Second-Largest Share in the German Antimicrobial Packaging Market in 2015

12.3.3 France

12.3.3.1 France: Antimicrobial Packaging Market Size, By Base Material

12.3.3.1.1 Biopolymer Segment is Projected to Be the Second-Fastest-Growing Base Material

12.3.3.2 France: Antimicrobial Packaging Market Size, By Antimicrobial Agent

12.3.3.2.1 Organic Acids Segment Dominated the French Antimicrobial Packaging Market in 2015

12.3.3.3 France: Antimicrobial Packaging Market Size, By Technology

12.3.3.3.1 Controlled Release Packaging Segment is Projected to Be the Fastest-Growing Segment in France

12.3.3.4 France: Antimicrobial Packaging Market Size, By Pack Type

12.3.3.4.1 Pouches Segment Projected to Grow at the Highest Rate From 2016 to 2021

12.3.3.5 France: Antimicrobial Packaging Market Size, By Application

12.3.3.5.1 Food & Beverage Segment Dominated the French Antimicrobial Packaging Market in 2015

12.3.4 U.K.

12.3.4.1 U.K.: Antimicrobial Packaging Market Size, By Base Material

12.3.4.1.1 Plastic Segment is Projected to Be the Fastest-Growing Base Material

12.3.4.2 U.K.: Antimicrobial Packaging Market Size, By Antimicrobial Agent

12.3.4.2.1 Metal Ions & Oxidizers Segment Projected to Grow at A Significant Rate From 2016 to 2021

12.3.4.3 U.K.: Antimicrobial Packaging Market Size, By Technology

12.3.4.3.1 Controlled Release Packaging Projected to Be the Fastest-Growing Segment in the U.K.

12.3.4.4 U.K.: Antimicrobial Packaging Market Size, By Pack Type

12.3.4.4.1 Pouches Segment Dominated the U.K. Antimicrobial Packaging Market in 2015

12.3.4.5 U.K.: Antimicrobial Packaging Market Size, By Application

12.3.4.5.1 Food & Beverage Segment Dominated the U.K. Antimicrobial Packaging Market in 2015

12.3.5 Italy

12.3.5.1 Italy: Antimicrobial Packaging Market Size, By Base Material

12.3.5.1.1 Plastic Segment Projected to Be the Fastest-Growing Base Material

12.3.5.2 Italy: Antimicrobial Packaging Market Size, By Antimicrobial Agent

12.3.5.2.1 Organic Acids Segment Dominated the Italian Antimicrobial Packaging Market in 2015

12.3.5.3 Italy: Antimicrobial Packaging Market Size, By Technology

12.3.5.3.1 Controlled Release Packaging Segment Projected to Be the Fastest-Growing Segment in Italy

12.3.5.4 Italy: Antimicrobial Packaging Market Size, By Pack Type

12.3.5.4.1 Bags Augment Projected to Be the Second-Fastest-Growing Segment From 2016 to 2021

12.3.5.5 Italy: Antimicrobial Packaging Market Size, By Application

12.3.5.5.1 Food & Beverage Segment Dominated the Italian Antimicrobial Packaging Market in 2015

12.3.6 Rest of Europe

12.3.6.1 Rest of Europe: Antimicrobial Packaging Market Size, By Base Material

12.3.6.1.1 Biopolymer Segment Projected to Be the Second-Fastest-Growing Base Material

12.3.6.2 Rest of Europe: Antimicrobial Packaging Market Size, By Antimicrobial Agent

12.3.6.2.1 Organic Acids Segment Projected to Grow at the Second-Highest CAGR From 2016 to 2021

12.3.6.3 Rest of Europe: Antimicrobial Packaging Market Size, By Technology

12.3.6.3.1 Controlled Release Packaging Segment Projected to Be the Fastest-Growing Segment in Rest of Europe

12.3.6.4 Rest of Europe: Antimicrobial Packaging Market Size, By Pack Type

12.3.6.4.1 Pouches Segment Dominated the Rest of Europe Antimicrobial Packaging Market in 2015

12.3.6.5 Rest of Europe: Antimicrobial Packaging Market Size, By Application

12.3.6.5.1 Food & Beverage Segment Dominated the Rest of Europe Antimicrobial Packaging Market in 2015

12.4 Asia-Pacific

12.4.1 Asia-Pacific: Antimicrobial Packaging Market, By Country

12.4.1.1 China is Projected to Be the Fastest-Growing Antimicrobial Packaging Market in the Asia-Pacific Region

12.4.1.2 Asia-Pacific: Antimicrobial Packaging Market, By Base Material

12.4.1.2.1 Plastic is Projected to Be the Fastest-Growing Base Material Segment

12.4.1.3 Asia-Pacific: Antimicrobial Packaging Market, By Antimicrobial Agent

12.4.1.3.1 the Organic Acids Segment Projected to Grow at A Highest CAGR During 2016 to 2021

12.4.1.4 Asia-Pacific: Antimicrobial Packaging Market, By Technology

12.4.1.4.1 Controlled Release Packaging Projected to Be the Fastest-Growing Segment in Asia-Pacific

12.4.1.5 Asia-Pacific: Antimicrobial Packaging Market, By Pack Type

12.4.1.5.1 the Pouches Segment Dominated the Asia-Pacific Antimicrobial Packaging Market in 2015

12.4.1.6 Asia-Pacific: Antimicrobial Packaging Market, By Application

12.4.1.6.1 the Food & Beverage Segment Dominated the Asia-Pacific Antimicrobial Packaging Market in 2015

12.4.2 China

12.4.2.1 China: Antimicrobial Packaging Market, By Base Material

12.4.2.1.1 Plastic Projected to Be the Fastest-Growing Base Material Segment

12.4.2.2 China: Antimicrobial Packaging Market, By Antimicrobial Agent

12.4.2.2.1 the Organic Acids Segment Dominated the Chinese Antimicrobial Packaging Market in 2015

12.4.2.3 China: Antimicrobial Packaging Market, By Technology

12.4.2.3.1 Controlled Release Packaging Projected to Be the Fastest-Growing Segment in China

12.4.2.4 China: Antimicrobial Packaging Market, By Pack Type

12.4.2.4.1 the Pouches Segment Dominated the Chinese Antimicrobial Packaging Market in 2015

12.4.2.5 China: Antimicrobial Packaging Market, By Application

12.4.2.5.1 the Food & Beverage Segment Dominated the Chinese Antimicrobial Packaging Market in 2015

12.4.3 Japan

12.4.3.1 Japan: Antimicrobial Packaging Market, By Base Material

12.4.3.1.1 Biopolymer Projected to Be the Second-Fastest-Growing Base Material Segment

12.4.3.2 Japan: Antimicrobial Packaging Market, By Antimicrobial Agent

12.4.3.2.1 the Bacteriocins Segment Projected to Grow at the Highest CAGR During 2016 to 2021

12.4.3.3 Japan: Antimicrobial Packaging Market, By Technology

12.4.3.3.1 Controlled Release Packaging Projected to Be the Fastest-Growing Segment in Japan

12.4.3.4 Japan: Antimicrobial Packaging Market, By Pack Type

12.4.3.4.1 Carton Packages Was the Second-Largest Segment in the Japanese Antimicrobial Packaging Market in 2015

12.4.3.5 Japan: Antimicrobial Packaging Market, By Application

12.4.3.5.1 Healthcare Projected to Grow at the Second-Highest CAGR During 2016 to 2021

12.4.4 India

12.4.4.1 India: Antimicrobial Packaging Market, By Base Material

12.4.4.1.1 Biopolymer Projected to Be the Second-Fastest-Growing Base Material Segment

12.4.4.2 India: Antimicrobial Packaging Market, By Antimicrobial Agent

12.4.4.2.1 Essential Oils Projected to Be the Second-Fastest Growing Segment During 2016 to 2021

12.4.4.3 India: Antimicrobial Packaging Market, By Technology

12.4.4.3.1 Controlled Release Packaging Projected to Be the Fastest-Growing Segment in India

12.4.4.4 India: Antimicrobial Packaging Market, By Pack Type

12.4.4.4.1 the Pouches Segment Dominated the Indian Antimicrobial Packaging Market in 2015

12.4.4.5 India: Antimicrobial Packaging Market, By Application

12.4.4.5.1 the Food & Beverage Segment Dominated the Indian Antimicrobial Packaging Market in 2015

12.4.5 Australia

12.4.5.1 Australia: Antimicrobial Packaging Market, By Base Material

12.4.5.1.1 Plastic Projected to Be the Fastest-Growing Base Material Segment

12.4.5.2 Australia: Antimicrobial Packaging Market, By Antimicrobial Agent

12.4.5.2.1 the Organic Acids Segment Dominated the Australian Antimicrobial Packaging Market in 2015

12.4.5.3 Australia: Antimicrobial Packaging Market, By Technology

12.4.5.3.1 Controlled Release Packaging Projected to Be the Fastest-Growing Segment in Australia

12.4.5.4 Australia: Antimicrobial Packaging Market, By Pack Type

12.4.5.4.1 Pouches Projected to Be the Fastest-Growing Segment During 2016 to 2021

12.4.5.5 Australia: Antimicrobial Packaging Market, By Application

12.4.5.5.1 the Food & Beverage Segment Dominated the Australian Antimicrobial Packaging Market in 2015

12.4.6 Rest of Asia-Pacific

12.4.6.1 Rest of Asia-Pacific: Antimicrobial Packaging Market, By Base Material

12.4.6.1.1 Biopolymer Projected to Be the Second-Fastest-Growing Base Material Segment

12.4.6.2 Rest of Asia-Pacific: Antimicrobial Packaging Market, By Antimicrobial Agent

12.4.6.2.1 Bacteriocins Projected to Be the Fastest-Growing Segment Dominated the Rest of Asia-Pacific Market in 2015

12.4.6.3 Rest of Asia-Pacific: Antimicrobial Packaging Market, By Technology

12.4.6.3.1 Active Packaging Projected to Be the Second-Fastest-Growing Segment in Rest of Asia-Pacific

12.4.6.4 Rest of Asia-Pacific: Antimicrobial Packaging Market, By Pack Type

12.4.6.4.1 Pouches Segment Dominated the Rest of Asia-Pacific Antimicrobial Packaging Market in 2015

12.4.6.5 Rest of Asia-Pacific: Antimicrobial Packaging Market, By Application

12.4.6.5.1 the Food & Beverage Segment Dominated the Rest of Asia-Pacific Antimicrobial Packaging Market in 2015

12.5 RoW

12.5.1 RoW: Antimicrobial Packaging Market, By Country

12.5.1.1 Brazil Dominated the Antimicrobial Packaging Market in the RoW Region in 2015

12.5.1.2 RoW: Antimicrobial Packaging Market , By Base Material

12.5.1.2.1 Plastic Projected to Be the Fastest-Growing Base Material Segment in RoW

12.5.1.3 RoW: Antimicrobial Packaging Market, By Antimicrobial Agent

12.5.1.3.1 the Organic Acids Segment Dominated the Antimicrobial Packaging Market in 2015

12.5.1.4 RoW: Antimicrobial Packaging Market, By Technology

12.5.1.4.1 Controlled Release Packaging Projected to Be the Fastest-Growing Segment in RoW

12.5.1.5 RoW: Antimicrobial Packaging Market, By Pack Type

12.5.1.5.1 the Pouches Segment Dominated the RoW Antimicrobial Packaging Market in 2015

12.5.1.6 RoW: Antimicrobial Packaging Market, By Application

12.5.1.6.1 the Food & Beverage Segment Dominated the RoW Antimicrobial Packaging Market in 2015

12.5.2 Brazil

12.5.2.1 Brazil: Antimicrobial Packaging Market, By Base Material

12.5.2.1.1 Plastic Projected to Be the Fastest-Growing Base Material Segment in Brazil

12.5.2.2 Brazil: Antimicrobial Packaging Market, By Antimicrobial Agent

12.5.2.2.1 Organic Acids Segment Dominated the Brazilian Antimicrobial Packaging Market in 2015

12.5.2.3 Brazil: Antimicrobial Packaging Market, By Technology

12.5.2.3.1 Controlled Release Packaging Projected to Be the Fastest-Growing Segment in Brazil

12.5.2.4 Brazil: Antimicrobial Packaging Market, By Pack Type

12.5.2.4.1 Trays Projected to Be the Second-Fastest Segment From 2016 to 2021

12.5.2.5 Brazil: Antimicrobial Packaging Market, By Application

12.5.2.5.1 Food & Beverages Segment Dominated the Brazilian Antimicrobial Packaging Market in 2015

12.5.3 Argentina

12.5.3.1 Argentina: Antimicrobial Packaging Market, By Base Material

12.5.3.1.1 Plastic Projected to Be the Fastest-Growing Base Material Segment in Argentina

12.5.3.2 Argentina: Antimicrobial Packaging Market, By Antimicrobial Agent

12.5.3.2.1 Bacteriocins Projected to Be the Fastest-Growing Segment From 2016 to 2021

12.5.3.3 Argentina: Antimicrobial Packaging Market, By Technology

12.5.3.3.1 Controlled Release Packaging Projected to Be the Fastest-Growing Segment in Argentina

12.5.3.4 Argentina: Antimicrobial Packaging Market, By Pack Type

12.5.3.4.1 Bags Projected to Be the Second-Fastest Segment From 2016 to 2021

12.5.3.5 Argentina: Antimicrobial Packaging Market, By Application

12.5.3.5.1 Healthcare Projected to Be the Second-Fastest Segment From 2016 to 2021

12.5.4 South Africa

12.5.4.1 South Africa: Antimicrobial Packaging Market, By Base Material

12.5.4.1.1 Biopolymer Projected to Be the Second-Fastest Base Material Segment in South Africa

12.5.4.2 South Africa: Antimicrobial Packaging Market, By Antimicrobial Agent

12.5.4.2.1 Organic Acids Segment Dominated the South African Antimicrobial Packaging Market in 2015

12.5.4.3 South Africa: Antimicrobial Packaging Market, By Technology

12.5.4.3.1 Active Packaging Projected to Be the Second-Fastest Segment in South Africa

12.5.4.4 South Africa: Antimicrobial Packaging Market, By Pack Type

12.5.4.4.1 Pouches Segment Dominated the South African Antimicrobial Packaging Market in 2015

12.5.4.5 South Africa: Antimicrobial Packaging Market, By Application

12.5.4.5.1 Food & Beverage Segment Dominated the South African Antimicrobial Packaging Market in 2015

12.5.5 Others in RoW

12.5.5.1 Others in RoW: Antimicrobial Packaging Market, By Base Material

12.5.5.1.1 Biopolymer Projected to Be the Second-Fastest Base Material Segment

12.5.5.2 Others in RoW: Antimicrobial Packaging Market, By Antimicrobial Agent

12.5.5.2.1 Organic Acids Projected to Be the Fastest-Growing Segment From 2016 to 2021

12.5.5.3 Others in RoW: Antimicrobial Packaging Market, By Technology

12.5.5.3.1 Controlled Release Packaging Projected to Be the Fastest-Growing Segment in Others in RoW

12.5.5.4 Others in RoW: Antimicrobial Packaging Market, By Pack Type

12.5.5.4.1 Bags Projected to Be the Fastest-Growing Segment During 2016 to 2021

12.5.5.5 Others in RoW: Antimicrobial Packaging Market, By Application

12.5.5.5.1 Food & Beverage Projected to Be the Fastest-Growing Segment From 2016 to 2021

13 Competitive Landscape (Page No. - 257)

13.1 Introduction

13.2 Competitive Situation and Trends

13.2.1 New Product Development

13.2.2 Acquisitions

13.2.3 Agreements

13.3 Brand Overview

13.3.1 Sanocoat

13.3.1.1 Introduction

13.3.1.2 Brand Product

13.3.1.3 Brand Image

13.3.1.4 Brand Awareness

13.3.2 Foodtouch

13.3.2.1 Introduction

13.3.2.2 Brand Product

13.3.2.3 Brand Image

13.3.2.4 Brand Awareness

13.3.3 Biomaster

13.3.3.1 Introduction

13.3.3.2 Brand Product

13.3.3.3 Brand Image

13.3.3.4 Brand Awareness

13.3.4 Sanipolymers

13.3.4.1 Introduction

13.3.4.2 Brand Product

13.3.4.3 Brand Image

13.3.4.4 Brand Awareness

14 Company Profiles (Page No. - 265)

(Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

14.1 Introduction

14.2 BASF SE

14.3 The DOW Chemical Company

14.4 Mondi PLC

14.5 Polyone Corporation

14.6 Biocote Limited

14.7 Dunmore Corporation

14.8 Linpac Senior Holdings Limited

14.9 Microban International

14.10 Oplon Pure Science Ltd.

14.11 Takex Labo Co. Ltd.

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

15 Appendix (Page No. - 286)

15.1 Insights of Industry Experts

15.2 Discussion Guide

15.3 Knowledge Store: Marketsandmarkets Subscription Portal

15.4 Introducing RT: Real-Time Market Intelligence

15.5 Available Customizations

15.6 Related Reports

List of Tables (275 Tables)

Table 1 Antimicrobial Packaging Market Size, By Base Material,2014-2021 (USD Million)

Table 2 Antimicrobial Packaging Market Size, By Base Material, 2014-2021 (KT)

Table 3 Antimicrobial Plastic Packaging Market Size, By Type,2014-2021 (USD Million)

Table 4 Antimicrobial Plastic Packaging Market Size, By Type, 2014-2021 (KT)

Table 5 Antimicrobial Plastic Packaging Market Size, By Pack Type,2014-2021 (USD Million)

Table 6 Antimicrobial Plastic Packaging Market Size, By Pack Type,2014-2021 (KT)

Table 7 Antimicrobial Plastic Packaging Market Size, By Application,2014-2021 (USD Million)

Table 8 Antimicrobial Plastic Packaging Market Size, By Application,2014-2021 (KT)

Table 9 Antimicrobial Paper & Paperboard Packaging Market Size, By Pack Type, 2014-2021 (USD Million)

Table 10 Antimicrobial Paper & Paperboard Packaging Market Size, By Pack Type, 20142021 (KT)

Table 11 Antimicrobial Paper & Paperboard Packaging Market Size, By Application, 2014-2021 (USD Million)

Table 12 Antimicrobial Paper & Paperboard Packaging Market Size, By Application, 2014-2021 (KT)

Table 13 Antimicrobial Biopolymer Packaging Market Size, By Pack Type,2014-2021 (USD Million)

Table 14 Antimicrobial Biopolymer Packaging Market Size, By Pack Type,2014-2021 (KT)

Table 15 Antimicrobial Biopolymer Packaging Market Size, By Application,2014-2021 (USD Million)

Table 16 Antimicrobial Biopolymer Packaging Market Size, By Application,2014-2021 (KT)

Table 17 Antimicrobial Other Base Material Packaging Market Size, By Pack Type, 2014-2021 (USD Million)

Table 18 Antimicrobial Other Base Material Packaging Market Size, By Pack Type, 2014-2021 (KT)

Table 19 Antimicrobial Other Base Material Packaging Market Size, By Application, 2014-2021 (USD Million)

Table 20 Antimicrobial Other Base Material Packaging Market Size, By Application, 2014-2021 (KT)

Table 21 Antimicrobial Packaging Market Size, By Antimicrobial Agent,20142021 (USD Million)

Table 22 Antimicrobial Packaging Market Size, By Antimicrobial Agent,20142021 (KT)

Table 23 Organic Acids in Antimicrobial Packaging Market Size, By Application, 20142021 (USD Million)

Table 24 Organic Acids in Antimicrobial Packaging Market Size, By Application, 20142021 (KT)

Table 25 Bacteriocins in Antimicrobial Packaging Market Size, By Application, 20142021 (USD Million)

Table 26 Bacteriocins in Antimicrobial Packaging Market Size, By Application, 20142021 (KT)

Table 27 Enzymes in Antimicrobial Packaging Market Size, By Application,20142021 (USD Million)

Table 28 Enzymes in Antimicrobial Packaging Market Size, By Application,20142021 (KT)

Table 29 Essential Oils in Antimicrobial Packaging Market Size, By Application, 20142021 (USD Million)

Table 30 Essential Oils in Antimicrobial Packaging Market Size, By Application, 20142021 (KT)

Table 31 Metal Ions & Oxidizers in Antimicrobial Packaging Market Size, By Application, 20142021 (USD Million)

Table 32 Metal Ions & Oxidizers in Antimicrobial Packaging Market Size, By Application, 20142021 (KT)

Table 33 Others in Antimicrobial Packaging Market Size, By Application,20142021 (USD Million)

Table 34 Others in Antimicrobial Packaging Market Size, By Application,20142021 (KT)

Table 35 Antimicrobial Packaging Market Size, By Pack Type,20142021 (USD Million)

Table 36 Antimicrobial Packaging Market Size, By Pack Type, 20142021 (KT)

Table 37 Antimicrobial Pouch Packaging Market Size, By Application,20142021 (USD Million)

Table 38 Antimicrobial Pouch Packaging Market Size, By Application,20142021 (KT)

Table 39 Antimicrobial Carton Packaging Market Size, By Application,20142021 (USD Million)

Table 40 Antimicrobial Carton Packaging Market Size, By Application,20142021 (KT)

Table 41 Antimicrobial Tray Packaging Market Size, By Application,20142021 (USD Million)

Table 42 Antimicrobial Tray Packaging Market Size, By Application,20142021 (KT)

Table 43 Antimicrobial Bags Market Size, By Application, 20142021 (USD Million)

Table 44 Antimicrobial Bags Market Size, By Application, 20142021 (KT)

Table 45 Antimicrobial Cup & Lid Packaging Market Size, By Application,20142021 (USD Million)

Table 46 Cups & Lids in Antimicrobial Packaging Market Size, By Application, 20142021 (KT)

Table 47 Other Antimicrobial Packaging Market Size, By Application,20142021 (USD Million)

Table 48 Other Antimicrobial Packaging Market Size, By Application,20142021 (KT)

Table 49 Antimicrobial Packaging Market Size, By Technology,20142021 (USD Million)

Table 50 By Market Size, By Technology, 20142021 (KT)

Table 51 By Market Size, By Application,2014-2021 (USD Million)

Table 52 By Market Size, By Application, 2014-2021 (KT)

Table 53 By Market Size, By Region,2014-2021 (USD Million)

Table 54 By Market Size, By Region, 2014-2021 (KT)

Table 55 North America: Antimicrobial Packaging Market Size, By Country,2014-2021 (USD Million)

Table 56 North America: By Market Size, By Country,2014-2021 (KT)

Table 57 North America: By Market Size, By Base Material, 2014-2021 (USD Million)

Table 58 North America: By Market Size, By Base Material, 2014-2021 (KT)

Table 59 North America: By Market Size, By Antimicrobial Agent, 2014-2021 (USD Million)

Table 60 North America: By Market Size, By Antimicrobial Agent, 2014-2021 (KT)

Table 61 North America: By Market Size, By Technology, 2014-2021 (USD Million)

Table 62 North America: By Market Size, By Technology, 2014-2021 (KT)

Table 63 North America: By Market Size, By Pack Type, 2014-2021 (USD Million)

Table 64 North America: By Market Size, By Pack Type, 2014-2021 (KT)

Table 65 North America: By Market Size, By Application, 2014-2021 (USD Million)

Table 66 North America: By Market Size, By Application, 2014-2021 (KT)

Table 67 U.S.: By Market Size, By Base Material,2014-2021 (USD Million)

Table 68 U.S.: By Market Size, By Base Material,2014-2021 (KT)

Table 69 U.S.: By Market Size, By Antimicrobial Agent,2014-2021 (USD Million)

Table 70 U.S.: By Market Size, By Antimicrobial Agent,2014-2021 (KT)

Table 71 U.S.: By Market Size, By Technology,2014-2021 (USD Million)

Table 72 U.S.: By Market Size, By Technology,2014-2021 (KT)

Table 73 U.S.: By Market Size, By Pack Type,2014-2021 (USD Million)

Table 74 U.S.: By Market Size, By Pack Type, 2014-2021 (KT)

Table 75 U.S.: By Market Size, By Application,2014-2021 (USD Million)

Table 76 U.S.: By Market Size, By Application, 2014-2021 (KT)

Table 77 Canada: By Market Size, By Base Material,2014-2021 (USD Million)

Table 78 Canada: By Market Size, By Base Material,2014-2021 (KT)

Table 79 Canada: By Market Size, By Antimicrobial Agent, 2014-2021 (USD Million)

Table 80 Canada: By Market Size, By Antimicrobial Agent, 2014-2021 (KT)

Table 81 Canada: By Market Size, By Technology,2014-2021 (USD Million)

Table 82 Canada: By Market Size, By Technology,2014-2021 (KT)

Table 83 Canada: By Market Size, By Pack Type,2014-2021 (USD Million)

Table 84 Canada: By Market Size, By Pack Type,2014-2021 (KT)

Table 85 Canada: By Market Size, By Application,2014-2021 (USD Million)

Table 86 Canada: By Market Size, By Application,2014-2021 (KT)

Table 87 Mexico: By Market Size, By Base Material,2014-2021 (USD Million)

Table 88 Mexico: By Market Size, By Base Material,2014-2021 (KT)

Table 89 Mexico: By Market Size, By Antimicrobial Agent, 2014-2021 (USD Million)

Table 90 Mexico: By Market Size, By Antimicrobial Agent, 2014-2021 (KT)

Table 91 Mexico: By Market Size, By Technology,2014-2021 (USD Million)

Table 92 Mexico: By Market Size, By Technology,2014-2021 (KT)

Table 93 Mexico: By Market Size, By Pack Type,2014-2021 (USD Million)

Table 94 Mexico: By Market Size, By Pack Type,2014-2021 (KT)

Table 95 Mexico: By Market Size, By Application,2014-2021 (USD Million)

Table 96 Mexico: By Market Size, By Application,2014-2021 (KT)

Table 97 Europe: By Market Size, By Country,2014-2021 (USD Million)

Table 98 Europe: By Market Size, By Country,2014-2021 (KT)

Table 99 Europe: By Market Size, By Base Material,2014-2021 (USD Million)

Table 100 Europe: By Market Size, By Base Material,2014-2021 (KT)

Table 101 Europe: By Market Size, By Antimicrobial Agent, 2014-2021 (USD Million)

Table 102 Europe: By Market Size, By Antimicrobial Agent, 2014-2021 (KT)

Table 103 Europe: By Market Size, By Technology,2014-2021 (USD Million)

Table 104 Europe: By Market Size, By Technology,2014-2021 (KT)

Table 105 Europe: By Market Size, By Pack Type,2014-2021 (USD Million)

Table 106 Europe: By Market Size, By Pack Type,2014-2021 (KT)

Table 107 Europe: By Market Size, By Application,2014-2021 (USD Million)

Table 108 Europe: By Market Size, By Application,2014-2021 (KT)

Table 109 Germany: By Market Size, By Base Material,2014-2021 (USD Million)

Table 110 Germany: By Market Size, By Base Material,2014-2021 (KT)

Table 111 Germany: By Market Size, By Antimicrobial Agent, 2014-2021 (USD Million)

Table 112 Germany: By Market Size, By Antimicrobial Agent, 2014-2021 (KT)

Table 113 Germany: By Market Size, By Technology,2014-2021 (USD Million)

Table 114 Germany: By Market Size, By Technology,2014-2021 (KT)

Table 115 Germany: By Market Size, By Pack Type,2014-2021 (USD Million)

Table 116 Germany: By Market Size, By Pack Type,2014-2021 (KT)

Table 117 Germany: By Market Size, By Application,2014-2021 (USD Million)

Table 118 Germany: By Market Size, By Application,2014-2021 (KT)

Table 119 France: By Market Size, By Base Material,2014-2021 (USD Million)

Table 120 France: By Market Size, By Base Material,2014-2021 (KT)

Table 121 France: By Market Size, By Antimicrobial Agent, 2014-2021 (USD Million)

Table 122 France: By Market Size, By Antimicrobial Agent, 2014-2021 (KT)

Table 123 France: By Market Size, By Technology,2014-2021 (USD Million)

Table 124 France: By Market Size, By Technology,2014-2021 (KT)

Table 125 France: By Market Size, By Pack Type,2014-2021 (USD Million)

Table 126 France: By Market Size, By Pack Type,2014-2021 (KT)

Table 127 France: By Market Size, By Application,2014-2021 (USD Million)

Table 128 France: By Market Size, By Application,2014-2021 (KT)

Table 129 U.K.: By Market Size, By Base Material,2014-2021 (USD Million)

Table 130 U.K.: By Market Size, By Base Material,2014-2021 (KT)

Table 131 U.K.: By Market Size, By Antimicrobial Agent,2014-2021 (USD Million)

Table 132 U.K.: By Market Size, By Antimicrobial Agent,2014-2021 (KT)

Table 133 U.K.: By Market Size, By Technology,2014-2021 (USD Million)

Table 134 U.K.: By Market Size, By Technology,2014-2021 (KT)

Table 135 U.K.: By Market Size, By Pack Type,2014-2021 (USD Million)

Table 136 U.K.: By Market Size, By Pack Type, 2014-2021 (KT)

Table 137 U.K.: By Market Size, By Application,2014-2021 (USD Million)

Table 138 U.K.: By Market Size, By Application, 2014-2021 (KT)

Table 139 Italy: By Market Size, By Base Material,2014-2021 (USD Million)

Table 140 Italy: By Market Size, By Base Material,2014-2021 (KT)

Table 141 Italy: By Market Size, By Antimicrobial Agent, 2014-2021 (USD Million)

Table 142 Italy: By Market Size, By Antimicrobial Agent, 2014-2021 (KT)

Table 143 Italy: By Market Size, By Technology,2014-2021 (USD Million)

Table 144 Italy: By Market Size, By Technology,2014-2021 (KT)

Table 145 Italy: By Market Size, By Pack Type,2014-2021 (USD Million)

Table 146 Italy: By Market Size, By Pack Type, 2014-2021 (KT)

Table 147 Italy: By Market Size, By Application,2014-2021 (USD Million)

Table 148 Italy: By Market Size, By Application,2014-2021 (KT)

Table 149 Rest of Europe: By Market Size, By Base Material, 2014-2021 (USD Million)

Table 150 Rest of Europe: By Market Size, By Base Material, 2014-2021 (KT)

Table 151 Rest of Europe: By Market Size, By Antimicrobial Agent, 2014-2021 (USD Million)

Table 152 Rest of Europe: By Market Size, By Antimicrobial Agent, 2014-2021 (KT)

Table 153 Rest of Europe: By Market Size, By Technology, 2014-2021 (USD Million)

Table 154 Rest of Europe: By Market Size, By Technology, 2014-2021 (KT)

Table 155 Rest of Europe: By Market Size, By Pack Type, 2014-2021 (USD Million)

Table 156 Rest of Europe: By Market Size, By Pack Type, 2014-2021 (KT)

Table 157 Rest of Europe: By Market Size, By Application, 2014-2021 (USD Million)

Table 158 Rest of Europe: By Market Size, By Application, 2014-2021 (KT)

Table 159 Asia-Pacific: By Market Size, By Country,20142021 (USD Million)

Table 160 Asia-Pacific: By Market Size, By Country,20142021 (KT)

Table 161 Asia-Pacific: By Market Size, By Base Material, 20142021 (USD Million)

Table 162 Asia-Pacific: By Market Size, By Base Material, 20142021 (KT)

Table 163 Asia-Pacific: By Market Size, By Antimicrobial Agent, 20142021 (USD Million)

Table 164 Asia-Pacific: By Market Size, By Antimicrobial Agent, 20142021 (KT)

Table 165 Asia-Pacific: By Market Size, By Technology,20142021 (USD Million)

Table 166 Asia-Pacific: By Market Size, By Technology,20142021 (KT)

Table 167 Asia-Pacific: By Market Size, By Pack Type,20142021 (USD Million)

Table 168 Asia-Pacific: By Market Size, By Pack Type,20142021 (KT)

Table 169 Asia-Pacific: By Market Size, By Application,20142021 (USD Million)

Table 170 Asia-Pacific: By Market Size, By Application,20142021 (KT)

Table 171 China: By Market Size, By Base Material,20142021 (USD Million)

Table 172 China: By Market Size, By Base Material,20142021 (KT)

Table 173 China: By Market Size, By Antimicrobial Agent, 20142021 (USD Million)

Table 174 China: By Market Size, By Antimicrobial Agent, 20142021 (KT)

Table 175 China: By Market Size, By Technology,20142021 (USD Million)

Table 176 China: By Market Size, By Technology,20142021 (KT)

Table 177 China: By Market Size, By Pack Type,20142021 (USD Million)

Table 178 China: By Market Size, By Pack Type,20142021 (KT)

Table 179 China: By Market Size, By Application,20142021 (USD Million)

Table 180 China: By Market Size, By Application,20142021 (KT)

Table 181 Japan: By Market Size, By Base Material,20142021 (USD Million)

Table 182 Japan: By Market Size, By Base Material,20142021 (KT)

Table 183 Japan: By Market Size, By Antimicrobial Agent, 20142021 (USD Million)

Table 184 Japan: By Market Size, By Antimicrobial Agent, 20142021 (KT)

Table 185 Japan: By Market Size, By Technology,20142021 (USD Million)

Table 186 Japan: By Market Size, By Technology,20142021 (KT)

Table 187 Japan: By Market Size, By Pack Type,20142021 (USD Million)

Table 188 Japan: By Market Size, By Pack Type,20142021 (KT)

Table 189 Japan: By Market Size, By Application,20142021 (USD Million)

Table 190 Japan: By Market Size, By Application,20142021 (KT)

Table 191 India: By Market Size, By Base Material,20142021 (USD Million)

Table 192 India: By Market Size, By Base Material,20142021 (KT)

Table 193 India: By Market Size, By Antimicrobial Agent, 20142021 (USD Million)

Table 194 India: By Market Size, By Antimicrobial Agent, 20142021 (KT)

Table 195 India: By Market Size, By Technology,20142021 (USD Million)

Table 196 India: By Market Size, By Technology,20142021 (KT)

Table 197 India: By Market Size, By Pack Type,20142021 (USD Million)

Table 198 India: By Market Size, By Pack Type,20142021 (KT)

Table 199 India: By Market Size, By Application,20142021 (USD Million)

Table 200 India: By Market Size, By Application,20142021 (KT)

Table 201 Australia: By Market Size, By Base Material, 20142021 (USD Million)

Table 202 Australia: By Market Size, By Base Material, 20142021 (KT)

Table 203 Australia: By Market Size, By Antimicrobial Agent, 20142021 (USD Million)

Table 204 Australia: By Market Size, By Antimicrobial Agent, 20142021 (KT)

Table 205 Australia: By Market Size, By Technology,20142021 (USD Million)

Table 206 Australia: By Market Size, By Technology,20142021 (KT)

Table 207 Australia: By Market Size, By Pack Type,20142021 (USD Million)

Table 208 Australia: By Market Size, By Pack Type,20142021 (KT)

Table 209 Australia: By Market Size, By Application,20142021 (USD Million)

Table 210 Australia: By Market Size, By Application,20142021 (KT)

Table 211 Rest of Asia-Pacific: By Market Size, By Base Material, 20142021 (USD Million)

Table 212 Rest of Asia-Pacific: By Market Size, By Base Material, 20142021 (KT)

Table 213 Rest of Asia-Pacific: By aging Market Size, By Antimicrobial Agent, 20142021 (USD Million)

Table 214 Rest of Asia-Pacific: By Market Size, By Antimicrobial Agent, 20142021 (KT)

Table 215 Rest of Asia-Pacific: By Market Size, By Technology, 20142021 (USD Million)

Table 216 Rest of Asia-Pacific: By Market Size, By Technology, 20142021 (KT)

Table 217 Rest of Asia-Pacific: By Market Size, By Pack Type, 20142021 (USD Million)

Table 218 Rest of Asia-Pacific: By Market Size, By Pack Type, 20142021 (KT)

Table 219 Rest of Asia-Pacific: By Market Size, By Application, 20142021 (USD Million)

Table 220 Rest of Asia-Pacific: By Market Size, By Application, 20142021 (KT)

Table 221 RoW: By Market Size, By Country,2014-2021 (USD Million)

Table 222 RoW: By Market Size, By Country, 2014-2021 (KT)

Table 223 RoW: By Market Size, By Base Material,2014-2021 (USD Million)

Table 224 RoW: By Market Size, By Base Material,2014-2021 (KT)

Table 225 RoW: By Market Size, By Antimicrobial Agent, 2014-2021 (USD Million)

Table 226 RoW: By Market Size, By Antimicrobial Agent, 2014-2021 (KT)

Table 227 RoW: By Market Size, By Technology,2014-2021 (USD Million)

Table 228 RoW: By Market Size, By Technology,2014-2021 (KT)

Table 229 RoW: By Market Size, By Pack Type,2014-2021 (USD Million)

Table 230 RoW: By Market Size, By Pack Type, 2014-2021 (KT)

Table 231 RoW: By Market Size, By Application,2014-2021 (USD Million)

Table 232 RoW: By Market Size, By Application,2014-2021 (KT)

Table 233 Brazil: By Market Size, By Base Material,2014-2021 (USD Million)

Table 234 Brazil: By Market Size, By Base Material,2014-2021 (KT)

Table 235 Brazil: By Market Size, By Antimicrobial Agent, 2014-2021 (USD Million)

Table 236 Brazil: By Market Size, By Antimicrobial Agent, 2014-2021 (KT)

Table 237 Brazil: By Market Size, By Technology,2014-2021 (USD Million)

Table 238 Brazil: By Market Size, By Technology,2014-2021 (KT)

Table 239 Brazil: By Market Size, By Pack Type,2014-2021 (USD Million)

Table 240 Brazil: By Market Size, By Pack Type,2014-2021 (KT)

Table 241 Brazil: By Market Size, By Application,2014-2021 (USD Million)

Table 242 Brazil: By Market Size, By Application,2014-2021 (KT)

Table 243 Argentina: By Market Size, By Base Material, 2014-2021 (USD Million)

Table 244 Argentina: By Market Size, By Base Material, 2014-2021 (KT)

Table 245 Argentina: By Market Size, By Antimicrobial Agent, 2014-2021 (USD Million)

Table 246 Argentina: By Market Size, By Antimicrobial Agent, 2014-2021 (KT)

Table 247 Argentina: By Market Size, By Technology,2014-2021 (USD Million)

Table 248 Argentina: By Market Size, By Technology,2014-2021 (KT)

Table 249 Argentina: By Market Size, By Pack Type,2014-2021 (USD Million)

Table 250 Argentina: By Market Size, By Pack Type,2014-2021 (KT)

Table 251 Argentina: By Market Size, By Application,2014-2021 (USD Million)

Table 252 Argentina: By Market Size, By Application,2014-2021 (KT)

Table 253 South Africa: By Market Size, By Base Material, 2014-2021 (USD Million)

Table 254 South Africa: By Market Size, By Base Material, 2014-2021 (KT)

Table 255 South Africa: By Market Size, By Antimicrobial Agent, 2014-2021 (USD Million)

Table 256 South Africa: By Market Size, By Antimicrobial Agent, 2014-2021 (KT)

Table 257 South Africa: By Market Size, By Technology, 2014-2021 (USD Million)

Table 258 South Africa: By Market Size, By Technology, 2014-2021 (KT)

Table 259 South Africa: By Market Size, By Pack Type,2014-2021 (USD Million)

Table 260 South Africa: By Market Size, By Pack Type,2014-2021 (KT)

Table 261 South Africa: By Market Size, By Application, 2014-2021 (USD Million)

Table 262 South Africa: By Market Size, By Application, 2014-2021 (KT)

Table 263 Others in RoW: By By Market Size, By Base Material, 2014-2021 (USD Million)

Table 264 Others in RoW: By Market Size, By Base Material, 2014-2021 (KT)

Table 265 Others in RoW: By Market Size, By Antimicrobial Agent, 2014-2021 (USD Million)

Table 266 Others in RoW: By Market Size, By Antimicrobial Agent, 2014-2021 (KT)

Table 267 Others in RoW: By Market Size, By Technology, 2014-2021 (USD Million)

Table 268 Others in RoW: By Market Size, By Technology, 2014-2021 (KT)

Table 269 Others in RoW: By Market Size, By Pack Type, 2014-2021 (USD Million)

Table 270 Others in RoW: By Market Size, By Pack Type, 2014-2021 (KT)

Table 271 Others in RoW: By Market Size, By Application, 2014-2021 (USD Million)

Table 272 Others in RoW: By Market Size, By Application, 2014-2021 (KT)

Table 273 New Product Development, 20082015

Table 274 Acquisitions, 20122015

Table 275 Agreements, 20132015

List of Figures (63 Figures)

Figure 1 Antimicrobial Packaging Market: Research Design

Figure 2 Market Size Estimation Methodology: Bottom-Up Approach

Figure 3 Market Size Estimation Methodology: Top-Down Approach

Figure 4 Data Triangulation Methodology

Figure 5 Assumptions Made for This Study

Figure 6 Controlled Release Packaging Segment is Projected to Grow at the Highest CAGR From 2016 to 2021

Figure 7 Food & Beverages: the Largest Application for Antimicrobial Packaging

Figure 8 Bacteriocins to Grow at A Higher Rate Than Other Antimicrobial Agents Between 2016 and 2021

Figure 9 Asia-Pacific is the Key Contributor to the Global Antimicrobial Packaging Market, 2015

Figure 10 Emerging Economies Offer Attractive Opportunities in Antimicrobial Packaging Market

Figure 11 Organic Acids Segment is Estimated to Capture the Largest Share in 2016

Figure 12 Japan is Projected to Be the Fastest-Growing Country-Level Market for Antimicrobial Packaging

Figure 13 Plastic Accounted for the Largest Share in the Antimicrobial Packaging Market in 2015

Figure 14 Pouches, as A Pack Type, is Projected to Account for the Largest Market Share

Figure 15 Antimicrobial Packaging Market, Average Price Analysis, By Region

Figure 16 Antimicrobial Packaging Market, Average Price Analysis, By Base Material

Figure 17 Antimicrobial Packaging Market, Average Price Analysis, By Antimicrobial Agent

Figure 18 Evolution of Antimicrobial Packaging

Figure 19 Antimicrobial Packaging Market, By Material

Figure 20 Antimicrobial Packaging Market, By Pack Type

Figure 21 Antimicrobial Packaging Market, By Antimicrobial Agent

Figure 22 Antimicrobial Packaging Market, By Technology

Figure 23 Antimicrobial Packaging Market, By Application

Figure 24 Antimicrobial Packaging Market, By Region

Figure 25 Wide Application and Increasing Demand in Asia-Pacific: Major Drivers for the Growth of the Antimicrobial Packaging Market

Figure 26 Price Fluctuations in Natural Gas From 2008-2011

Figure 27 Price Fluctuations in Aluminum, 2011-2015

Figure 28 Meat Production in North America, 2014

Figure 29 Revenue Generated By Pharmaceuticals and Medicines in the U.S.(2014-2015)

Figure 30 Supply Chain Analysis

Figure 31 Porters Five Forces Analysis

Figure 32 Plastic Segment Projected to Dominate the Antimicrobial Packaging Market in 2021

Figure 33 LDPE is Projected to Dominate the Plastic Segment in 2021

Figure 34 Paper & Paperboard Market Size, By Application,2016 vs. 2021 (USD Million)

Figure 35 Biopolymer Market Size, By Pack Type, 2015 vs. 2021 (KT)

Figure 36 Organic Acids Segment is Projected to Dominate the Antimicrobial Packaging Market By 2021

Figure 37 Pouches Projected to Dominate the Antimicrobial Packaging Market By 2021

Figure 38 Controlled Release Packaging is Projected to Dominate the Antimicrobial Packaging Market By 2021

Figure 39 Food & Beverage Segment Projected to Dominate the Antimicrobial Packaging Market By 2021

Figure 40 World Meat Consumption, 2010-2014 (Thousand Tons)

Figure 41 Pharmaceutical Production in the European Union

Figure 42 China Projected to Witness Fastest Growth in the Antimicrobial Packaging Market From 2016 to 2020

Figure 43 North America: Market Snapshot

Figure 44 Europe: Market Snapshot

Figure 45 German Food & Beverage Industry, 2013

Figure 46 French Personal Care Products Industry, 2014-2015

Figure 47 Asia-Pacific: Market Snapshot

Figure 48 Retail Sales of Cosmetics Products in China (20092014)

Figure 49 Per Capita Poultry Meat Consumption Estimates, 20122021 (KG/Year)

Figure 50 RoW: Market Snapshot

Figure 51 Brazilian Food Processing Industry, 2009-2014 (USD Billion)

Figure 52 New Product Development is the Major Strategy Adopted By Companies, 20062015

Figure 53 New Product Development is the Major Strategy Used By Companies to Develop A Competitive Advantage in 2015

Figure 54 New Product Development: the Key Strategy, 20112015

Figure 55 Geographic Revenue Mix of Top Five Market Players, 2015

Figure 56 BASF SE: Company Snapshot

Figure 57 BASF SE: SWOT Analysis

Figure 58 The DOW Chemical Company: Company Snapshot

Figure 59 The DOW Chemical Company: SWOT Analysis

Figure 60 Mondi PLC: Company Snapshot

Figure 61 Mondi PLC: SWOT Analysis

Figure 62 Polyone Corporation.: Company Snapshot

Figure 63 Polyone Corporation: SWOT Analysis

Growth opportunities and latent adjacency in Antimicrobial Packaging Market