Caps & Closures Market by Type (Plastic Caps & Closures (Screw Caps, Dispensing Caps)), Metal Caps & Closures (Screw & Lug, Crown Caps), Other Caps & Closures (Corks)), Raw Material, End-Use Industry - Global Forecast to 2026

Updated on : September 02, 2025

Caps & Closures Market

The caps & closures market was valued at USD 65.0 billion in 2021 and is projected to reach USD 85.0 billion by 2026, growing at 5.5% cagr from 2021 to 2026. Caps and closures provide easy-to-open packaging. They help achieve the ideal product packaging. With the use of effective caps and closures, customers can easily open and close a bottle, clamshell package, blister pack, or other types of containers. There are various other reasons for using caps and closures other than accessibility, such as easy dispensing of products, improvement in the longevity of products, and protection from contamination and dirt.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on the Global Caps & Closures Market

Caps & closures find extensive use across the pharmaceutical, food & beverages, cosmetics, household goods, and others. They are one of the key components of primary packaging and are the key factors responsible for maintaining the integrity of the product packing. Caps & closures use various polymer and metallic materials such as polypropylene, polyethylene, aluminum, and steel, as the primary raw materials for their production.

The global food & beverage industry operates through multiple online and offline food chains. The industry includes companies involved in raw food materials processing, packaging, and distribution, such as prepared foods and packaged foods, and alcoholic and non-alcoholic beverages. The key factors for the growth of the food & beverage industry before the COVID-19 pandemic include the rise in the number of on-the-go consumers and heightened adoption of ready-to-eat food. Steadily growing population and expendible income coupled with the changing lifestyle were key factors driving the growth of the food & beverage industry.

COVID-19 had a double pronged impact on the food & beverage segment with offline food chains such as restaurants and cafes are entirely shut down in some regions, however, the online food deliveries were available and gained pace. The packaged food & beverage industry is witnessing a notable growth in demand for shelf-stable foods & beverages, including milk products.

Caps & Closures Market Dynamics

Driver: Increase in the demand for bottled water

Bottled water is one of the fastest-growing beverage categories in terms of volume. The increase in consumer demand for bottled water over the forecoming four to five years will drive the demand for tamper-evident caps & closures. Changes in lifestyles and per capita consumption are the factors driving the growth of the bottled water industry. The rise in the income levels of consumers has resulted in the increased sales of premium bottled water. Bottled water manufacturers have thus been encouraged to launch premium bottled water products with attractive capping solutions.

According to the International Bottled Water Association, the growing population of high-net-worth -individuals (HNWI) is a key factor influencing the premiumization of bottled water. Such individuals prefer high-priced bottled water to normal bottled water products. The enthusiasm for products that consumers regard as a healthy alternative to other beverages is driving the demand for bottled water, and eventually, caps & closures.

Restraint: Availability of substitutes to hinder the growth of caps & closures market

The growth of the caps & closures market is threatened by the increase in the use of packages without closures, such as pouches and blister packages. These types of packaging offer various benefits to the packager, such as material cost reduction compared to traditional methods of rigid packaging and sustainability issues. Other options for the food & beverage packaging is the pouch packaging format which is adopted by multiple FMCG companies as a packaging innovation tool to provide additional convenience to consumers. Several new easy-open and easy-reclose options are being added to the multitude of design possibilities across all end-use segments.

Challenges: Stringent environmental regulations

Packaging waste harms the ecosystem as it takes decades to decompose. Caps & closures are mostly made of plastic, which is not easily degradable. Governments across the globe are addressing this issue by imposing strict laws on the packaging industry. In Europe, governments have undertaken key steps to deal with packaging waste and recycling issues. In addition, governments across the developing nations have also become additionally concerned with respect to protecting the environment and have thus adopted measures to promote sustainable packaging. The caps & closures industry needs to adapt to these new regulatory requirements and promote recycling to decrease the carbon footprint. As these laws restrain the companies from sourcing raw materials through unethical practices such as procuring low cost products, the cost of raw materials might increase, thus increasing the operation costs. This affects the overall caps & closures market revenue.

Plastic is the largest raw material segment of the caps & closures market

The types of materials used for caps & closures are determined by the type of product it is required for, the expected life of the pack, the need for reclose-ability, and the desired product image. The important types of closure materials are plastic, metal, glass, rubber & elastomers, wood, and paperboard. Among these, plastic segment is expected to account for the largest share in 2020. Growth in the plastic segment has been propelled by the growth in the consumption of soft drinks.

Beverage packaging sector is the largest end-use segment of the caps & closures market

Beverage packaging is one of the biggest end-use industries for caps & closures. Beverage packaging is used as a medium to enhance the shelf life while retaining the taste and texture of the beverages. The beverage packaging industry has increasingly been using packaging solutions such as pouches and cartons. The demand for advanced differentiating closures from the key beverage companies across the globe drives the market for premium caps in the beverage industry. There are various types of caps & closures that can be utilized to seal or package non-alcoholic beverages. Caps & closures made of plastic, metal, glass and rubber are some of the available options.

APAC is the largest market for caps & closures market

The APAC region is expected to be the largest market, in terms of value. APAC is also expected to grow at the highest CAGR during the forecast period. The rise in the demand for packaged food & bottled beverage is driving the market in APAC region. APAC is a huge market for bottled water. Some of the key factors driving the demand for packaged water include poor-quality tap water, increasing health awareness, higher income levels, and international tourism are driving the bottled water market in APAC, which eventually propels the growth of the caps & closures market.

RPC Group PLC (UK), Crown Holdings Incorporation (US), Amcor Limited Plc (Australia), Rexam PLC (UK), Berry Plastics Corporation (US), Silgan Holdings Inc. (US), AptarGroup Incorporated (US), and Guala Closures Group (Italy). are key players in caps & closures market.

To know about the assumptions considered for the study, download the pdf brochure

Market Interconnections

Caps & Closures Market Players

RPC Group PLC (UK), Crown Holdings Incorporation (US), Amcor Limited Plc (Australia), Rexam PLC (UK), Berry Plastics Corporation (US), Silgan Holdings Inc. (US), AptarGroup Incorporated (US), and Guala Closures Group (Italy) are the key players operating in the caps & closures market.

These companies have adopted several growth strategies to strengthen their position in the market. Expansion, new product development, merger & acquisition, and collaboration are the key growth strategies adopted by these players to enhance their product offering & regional presence to meet the growing demand for to caps & closures from emerging economies.

Caps & Closures Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2021 |

USD 65.0 billion |

|

Revenue Forecast in 2026 |

USD 85.0 billion |

|

CAGR |

5.5% |

|

Market size available for years |

2019–2026 |

|

Base year |

2020 |

|

Forecast period |

2021–2026 |

|

Units considered |

Value (USD Million) |

|

Segments |

Raw Material, Type, End-use Industry and Region |

|

Regions |

APAC, Europe, North America, South America, and Middle East & Africa |

|

Companies |

RPC Group PLC (UK), Crown Holdings Incorporation (US), Amcor Limited Plc (Australia), Rexam PLC (UK), Berry Plastics Corporation (US), Silgan Holdings Inc. (US), AptarGroup Incorporated (US), and Guala Closures Group (Italy). |

This research report categorizes the caps & closures market based on type, application, technology and region.

The Caps & Closures Market, By Raw Material:

- Plastic

- Metals

- Others (Glass Wood, Rubber & elastomers and Paperboard)

The Caps & Closures Market, By Type:

- Plastics Caps & Closures (Screw Caps, Dispensing Caps and Others)

- Metal Caps & Closures (Screw & lung Caps, Crown Caps and Others)

- Other Caps & Closures (Corks, Glass Stoppers and other)

The Caps & Closures Market, By End-use Industry:

- Food

- Beverage

- Healthcare

- Cosmetics & toiletries

- Others (Chemical and Automotive)

The Caps & Closures Market, By Region:

- APAC

- Europe

- North America

- South America

- Middle East & Africa

Recent Developments

- In June 2020, Silgan Holdings acquired the dispensing business of the packaging company Albea (France). Albea’s dispensing business supplies pumps, sprayers, and foam dispensing solutions to major consumer goods companies within the personal care and beauty markets. The business operates 10 manufacturing plants located across North America, Europe, South America, and Asia. This acquisition is expected to be modestly accretive to the company’s earnings in 2020.

- In July 2020, Berry Global Group acquired RPC Group. This acquisition helped to create a leading global supplier of value-added protective solutions and one of the world’s largest plastic packaging companies. In addition, the company has broadened its global footprint consisting of over 290 locations worldwide, including in North and South America, Europe, Asia, Africa, and Australia.

- In July 2020, Silgan Closures launched its new one-piece 55 mm KS2 plastic closure for five-gallon and three-gallon HOD (home and office delivery) water bottles. The closure incorporates multiple new features that set it apart from competitive water bottle closures. Molded from a proprietary blend of resins that resists cracking, the closure features a pierceable shell design that virtually eliminates spillage. The closure also incorporates a flow-in closure liner for a superior bottle seal and a tamper-evident band to ensure product safety.

- In February 2018, Crown Food Europe, a subsidiary of Crown Holdings, introduced a new capping solutions package, which will help food manufacturers to lower the total cost of ownership. The package included the sale of its capping technology, ancillary components, and expert technical support for the machine’s service life. Three of Crown’s capping solutions—Smart Capper, Euro Capper, and Global Capper—were made available for sale as part of this package.

Frequently Asked Questions (FAQ):

What are the upcoming hot bets for the caps & closures market?

Rise in demand for caps & closures from emerging economies and growing popularity of growing demand packed and on-the go food & beverage products.

What are the market dynamics for the different type of caps & closures?

Who are the major manufacturers of caps & closures market?

Who are the major manufacturers of caps & closures market?

RPC Group PLC (UK), Crown Holdings Incorporation (US), Amcor Limited Plc (Australia), Rexam PLC (UK), Berry Plastics Corporation (US), Silgan Holdings Inc. (US), AptarGroup Incorporated (US), and Guala Closures Group (Italy) are the key players operating in the caps & closures market.

What are the major challenges for the manufacturer of caps & closures

The caps & closures industry needs to adapt to the new regulatory requirements and promote recycling to decrease the carbon footprint. As the laws forbid companies from sourcing unethical raw materials, the cost of raw materials might increase, thus increasing the operation costs.

What are the effects of COVID-19 on caps & closures market?

The global food & beverage industry includes various online and offline food chains. The industry includes companies working in processing raw food materials, packaging, and distribution, which include prepared foods and packaged foods, along with alcoholic and non-alcoholic beverages. The primary factors for the growth of the food & beverage industry before the COVID-19 pandemic include the rise in the number of on-the-go consumers and increased adoption of ready-to-eat food.

The demand for personal hygiene and home care products is expected to rise further in the coming days due to the growing awareness among consumers in the wake of the COVID-19 pandemic. Manufacturing companies believe that the pandemic has made consumers more aware of the need to maintain hygiene, at a personal level, as well as at home, to reduce the chances of infection, and this is expected to become a trend in the long run. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 41)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 INCLUSION AND EXCLUSION

TABLE 1 INCLUSION AND EXCLUSION

1.4 MARKET SCOPE

FIGURE 1 CAPS & CLOSURES MARKET SEGMENTATION

1.4.1 YEARS CONSIDERED

1.4.2 REGIONAL SCOPE

FIGURE 2 CAPS & CLOSURES MARKET, BY REGION

1.5 CURRENCY CONSIDERED

1.6 STAKEHOLDERS

1.7 LIMITATIONS

2 RESEARCH METHODOLOGY (Page No. - 46)

2.1 RESEARCH DATA

FIGURE 3 CAPS & CLOSURES MARKET: RESEARCH DESIGN

2.2 MARKET SIZE ESTIMATION

FIGURE 4 APPROACH 1: BASED ON ADJACENT MARKET

FIGURE 5 APPROACH 2: SUPPLY-SIDE APPROACH

FIGURE 6 APPROACH 3: SUPPLY-SIDE APPROACH

2.3 DATA TRIANGULATION

FIGURE 7 CAPS & CLOSURES MARKET: DATA TRIANGULATION

2.3.1 SECONDARY DATA

2.3.2 PRIMARY DATA

FIGURE 8 KEY MARKET INSIGHTS

2.4 RESEARCH ASSUMPTIONS & LIMITATIONS

FIGURE 9 ASSUMPTIONS

2.4.1 RISK ASSESSMENT

TABLE 2 RISKS

3 EXECUTIVE SUMMARY (Page No. - 53)

FIGURE 10 PLASTIC CAPS & CLOSURES SEGMENT TO DOMINATE OVERALL MARKET BY 2026

FIGURE 11 BEVERAGE PACKAGING TO BE LARGEST END USER OF CAPS & CLOSURES MARKET

FIGURE 12 PLASTICS RAW MATERIAL TO BE LARGEST SEGMENT IN CAPS & CLOSURES MARKET DURING THE FORECAST PERIOD

FIGURE 13 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE OF CAPS & CLOSURES MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 56)

4.1 HIGHER DEMAND FOR CAPS & CLOSURES EXPECTED FROM DEVELOPING ECONOMIES

FIGURE 14 EMERGING ECONOMIES OFFER ATTRACTIVE OPPORTUNITIES IN CAPS & CLOSURES MARKET

4.2 ASIA PACIFIC: CAPS & CLOSURES MARKET, BY END-USE INDUSTRY AND COUNTRY

FIGURE 15 CHINA WAS LARGEST MARKET FOR CAPS & CLOSURES IN ASIA PACIFIC IN 2020

4.3 CAPS & CLOSURES MARKET, BY TYPE

FIGURE 16 PLASTIC CAPS & CLOSURES SEGMENT TO LEAD THE MARKET DURING THE FORECAST PERIOD

4.4 CAPS & CLOSURES MARKET, BY END-USE INDUSTRY

FIGURE 17 BEVERAGE PACKAGING PROJECTED TO BE LARGEST END-USE INDUSTRY

4.5 CAPS & CLOSURES MARKET, BY COUNTRY

FIGURE 18 CAPS & CLOSURES MARKET IN CHINA PROJECTED TO WITNESS HIGHEST CAGR FROM 2021 TO 2026

5 MARKET OVERVIEW (Page No. - 59)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 CAPS & CLOSURES MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Consumers’ demand for convenience and concerns about product safety and security

5.2.1.2 Increase in demand for bottled water

5.2.1.3 Product differentiation and decreasing package sizes

5.2.2 RESTRAINTS

5.2.2.1 Availability of substitutes to hinder the growth of caps & closures market

5.2.3 OPPORTUNITIES

5.2.3.1 Manufacturers of caps and closures focus on sustainable caps & closures

5.2.3.2 Emerging economies provide lucrative opportunities for market growth

5.2.3.3 Product innovation

5.2.4 CHALLENGES

5.2.4.1 Stringent environmental regulations

5.2.4.2 Mature markets in developed regions

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 20 PORTER’S FIVE FORCES ANALYSIS: CAPS & CLOSURES MARKET

TABLE 3 CAPS & CLOSURES MARKET: PORTER’S FIVE FORCES ANALYSIS

5.3.1 THREAT OF NEW ENTRANTS

5.3.2 THREAT OF SUBSTITUTES

5.3.3 BARGAINING POWER OF SUPPLIERS

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 RANGE SCENARIO ANALYSIS

FIGURE 21 RANGE SCENARIO FOR THE CAPS & CLOSURES MARKET

5.4.1 OPTIMISTIC SCENARIO

5.4.2 PESSIMISTIC SCENARIO

5.4.3 REALISTIC SCENARIO

5.5 COVID-19 IMPACT ON CAPS & CLOSURES MARKET

5.5.1 IMPACT OF COVID-19 ON PLASTIC PACKAGING

5.5.2 IMPACT OF COVID-19 ON END-USE SECTORS FOR CAPS & CLOSURES

5.5.2.1 Impact of COVID-19 on food & beverage industry

5.5.2.2 Impact of COVID-19 on pharmaceutical industry

5.5.2.3 Impact of COVID-19 on personal & homecare industry

5.6 YC-YCC DRIVERS

FIGURE 22 YC-YCC DRIVERS

5.7 MARKET MAPPING/ ECOSYSTEM MAP

FIGURE 23 ECOSYSTEM MAP

5.8 CAPS & CLOSURES PATENT ANALYSIS

5.8.1 INTRODUCTION

5.8.2 METHODOLOGY

5.8.3 DOCUMENT TYPE

TABLE 4 TOTAL NUMBER OF PATENTS FOR CAPS & CLOSURES

FIGURE 24 CAPS & CLOSURES MARKET: GRANTED PATENT, LIMITED PATENT, AND PATENT APPLICATION

FIGURE 25 PUBLICATION TRENDS - 2010-2020

5.8.4 INSIGHT

5.8.5 LEGAL STATUS OF PATENTS

FIGURE 26 REGISTERED PATENTS’ CURRENT STATUS

FIGURE 27 JURISDICTION ANALYSIS

5.8.6 TOP COMPANIES/ APPLICANTS

FIGURE 28 TOP APPLICANTS OF CAPS & CLOSURES PATENTS

TABLE 5 LIST OF PATENTS BY CROWN PACKAGING TECHNOLOGY INC.

TABLE 6 LIST OF PATENTS BY REXAM BEVERAGE CAN CO.

TABLE 7 LIST OF PATENTS BY JFE STEEL CORP.

TABLE 8 LIST OF TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

5.9 SUPPLY CHAIN ANALYSIS

FIGURE 29 CAPS & CLOSURES MARKET: SUPPLY CHAIN

5.10 TECHNOLOGY ANALYSIS

5.10.1 SYSTEMS FOR PRODUCTION OF PLASTIC CLOSURES

5.10.1.1 Continuous compression molding

5.10.1.1.1 Advantages of compression molding technology

5.10.1.2 Slitting & folding of caps

5.11 REGULATORY ANALYSIS

5.11.1 TETHERED CAPS IN EU

5.11.2 FEDERAL PACKAGING REGULATIONS IN THE US

5.11.2.1 Environmental impact of materials used in food packaging

5.11.2.2 Use of recycled content

5.11.3 CONSUMER PRODUCT SAFETY COMMISSION

5.11.4 REGULATIONS IN NORTH AMERICA

5.11.5 REGULATIONS IN ASIA PACIFIC

5.12 PRICING ANALYSIS

FIGURE 30 CAPS & CLOSURES MARKET, AVERAGE PRICE ANALYSIS, BY RAW MATERIAL (USD),2020

FIGURE 31 CAPS & CLOSURES AVERAGE PRICE ANALYSIS, BY TYPE, 2020 (USD)

5.13 TRADE ANALYSIS

TABLE 9 LIST OF EXPORTERS FOR PRODUCT: 3923 ARTICLES FOR THE CONVEYANCE OR PACKAGING OF GOODS, OF PLASTICS; STOPPERS, LIDS, CAPS AND OTHER, 2016-2020 (USD THOUSAND)

TABLE 10 LIST OF IMPORTERS FOR PRODUCT: 3923 ARTICLES FOR THE CONVEYANCE OR PACKAGING OF GOODS, OF PLASTICS; STOPPERS, LIDS, CAPS AND OTHER, 2016-2020 (IN USD THOUSAND)

5.14 CASE STUDY ANALYSIS

TABLE 11 PHOENIX CASE STUDY: RICHARD PLASTICS

6 CAPS & CLOSURES MARKET, BY RAW MATERIAL (Page No. - 84)

6.1 INTRODUCTION

FIGURE 32 PLASTICS SEGMENT TO REGISTER HIGHEST GROWTH RATE THROUGH 2026

TABLE 12 MARKET SIZE, BY RAW MATERIAL, 2015–2018 (USD BILLION)

TABLE 13 MARKET SIZE, BY RAW MATERIAL, 2015–2018 (MILLION TON)

TABLE 14 MARKET SIZE, BY RAW MATERIAL, 2019–2026 (USD BILLION)

TABLE 15 CAPS & CLOSURES MARKET SIZE, BY RAW MATERIAL, 2019–2026 (MILLION TON)

6.2 PLASTIC

TABLE 16 PLASTIC: CAPS & CLOSURES MARKET SIZE, BY TYPE, 2015–2018 (USD BILLION)

TABLE 17 PLASTIC: MARKET SIZE, BY TYPE, 2015–2018 (MILLION TON)

TABLE 18 PLASTIC: MARKET SIZE, BY TYPE, 2019–2026 (USD BILLION)

TABLE 19 PLASTIC: MARKET SIZE, BY TYPE, 2019–2026 (MILLION TON)

6.2.1 POLYPROPYLENE

6.2.2 POLYETHYLENE

6.2.3 PVC

6.2.4 OTHER PLASTIC FILMS

6.3 METALS

TABLE 20 METAL: CAPS & CLOSURES MARKET SIZE, BY TYPE, 2015–2018 (USD BILLION)

TABLE 21 METAL: MARKET SIZE, BY TYPE, 2015–2018 (MILLION TON)

TABLE 22 METAL: MARKET SIZE, BY TYPE, 2019–2026 (USD BILLION)

TABLE 23 METAL: MARKET SIZE, BY TYPE, 2019–2026 (MILLION TON)

6.3.1 ALUMINUM

6.3.2 STAINLESS STEEL

6.4 OTHERS

TABLE 24 OTHERS: CAPS & CLOSURES MARKET SIZE, BY TYPE, 2015–2018 (USD BILLION)

TABLE 25 OTHERS: MARKET SIZE, BY TYPE, 2015–2018 (MILLION TON)

TABLE 26 OTHERS: MARKET SIZE, BY TYPE, 2019–2026 (USD BILLION)

TABLE 27 OTHERS: MARKET SIZE, BY TYPE, 2019–2026 (MILLION TON)

6.4.1 GLASS

6.4.2 WOOD

6.4.3 RUBBER & ELASTOMERS

6.4.4 PAPERBOARD

6.4.5 PAPER

7 CAPS & CLOSURES MARKET, BY TYPE (Page No. - 93)

7.1 INTRODUCTION

FIGURE 33 PLASTIC CAPS & CLOSURES SEGMENT TO REGISTER HIGHEST GROWTH THROUGH 2026

TABLE 28 CAPS & CLOSURES MARKET SIZE, BY TYPE, 2015–2018 (USD BILLION)

TABLE 29 MARKET SIZE, BY TYPE, 2015–2018 (BILLION UNITS)

TABLE 30 MARKET SIZE, BY TYPE, 2019–2026 (USD BILLION)

TABLE 31 MARKET SIZE, BY TYPE, 2019–2026 (BILLION UNITS)

7.2 PLASTIC CAPS & CLOSURES

TABLE 32 PLASTIC CAPS & CLOSURES MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (USD BILLION)

TABLE 33 PLASTIC MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (BILLION UNITS)

TABLE 34 PLASTIC MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD BILLION)

TABLE 35 PLASTIC MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (BILLION UNITS)

TABLE 36 PLASTIC MARKET SIZE, BY TYPE, 2015–2018 (USD BILLION)

TABLE 37 PLASTICMARKET SIZE, BY TYPE, 2015–2018 (BILLION UNITS)

TABLE 38 PLASTIC MARKET SIZE, BY TYPE, 2019–2026 (USD BILLION)

TABLE 39 PLASTIC MARKET SIZE, BY TYPE, 2019–2026 (BILLION UNITS)

7.2.1 SCREW CAPS

TABLE 40 SCREW CAPS: PLASTIC CAPS & CLOSURES MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (USD BILLION)

TABLE 41 SCREW CAPS: PLASTIC CAPS & CLOSURES SIZE, BY END-USE INDUSTRY, 2015–2018 (BILLION UNITS)

TABLE 42 SCREW CAPS: PLASTIC CAPS & CLOSURES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD BILLION)

TABLE 43 SCREW CAPS: PLASTIC CAPS & CLOSURES SIZE, BY END-USE INDUSTRY, 2019–2026 (BILLION UNITS)

7.2.2 DISPENSING CAPS

7.2.2.1 Flip-top caps closures

7.2.2.2 Disc-top closures

7.2.2.3 Trigger caps & closures

TABLE 44 DISPENSING CAPS: PLASTIC CAPS & CLOSURES MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (USD BILLION)

TABLE 45 DISPENSING CAPS: PLASTIC CAPS & CLOSURES SIZE, BY END-USE INDUSTRY, 2015–2018 (BILLION UNITS)

TABLE 46 DISPENSING CAPS: PLASTIC CAPS & CLOSURES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD BILLION)

TABLE 47 DISPENSING CAPS: PLASTIC CAPS & CLOSURES SIZE, BY END-USE INDUSTRY, 2019–2026 (BILLION UNITS)

7.2.3 LIQUID CARTON CLOSURES

TABLE 48 LIQUID CARTONS CLOSURES: PLASTIC CAPS & CLOSURES MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (USD BILLION)

TABLE 49 LIQUID CARTONS CLOSURES: PLASTIC CAPS & CLOSURES SIZE, BY END-USE INDUSTRY, 2015–2018 (BILLION UNITS)

TABLE 50 LIQUID CARTONS CLOSURES: PLASTIC CAPS & CLOSURES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD BILLION)

TABLE 51 LIQUID CARTONS CLOSURES: PLASTIC CAPS & CLOSURES SIZE, BY END-USE INDUSTRY, 2019–2026 (BILLION UNITS)

7.2.4 PLASTIC LOTION PUMPS

TABLE 52 PLASTIC LOTION PUMPS: PLASTIC CAPS & CLOSURES MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (USD BILLION)

TABLE 53 PLASTIC LOTION PUMPS: PLASTIC CAPS & CLOSURES SIZE, BY END-USE INDUSTRY, 2015–2018 (BILLION UNITS)

TABLE 54 PLASTIC LOTION PUMPS: PLASTIC CAPS & CLOSURES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD BILLION)

TABLE 55 PLASTIC LOTION PUMPS: PLASTIC CAPS & CLOSURES SIZE, BY END-USE INDUSTRY, 2019–2026 (BILLION UNITS)

7.2.5 PLASTIC AEROSOL SPRAYS

TABLE 56 PLASTIC AEROSOL SPRAYS: PLASTIC CAPS & CLOSURES MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (USD BILLION)

TABLE 57 PLASTIC AEROSOL SPRAYS: PLASTIC CAPS & CLOSURES SIZE, BY END-USE INDUSTRY, 2015–2018 (BILLION UNITS)

TABLE 58 PLASTIC AEROSOL SPRAYS: PLASTIC CAPS & CLOSURES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD BILLION)

TABLE 59 PLASTIC AEROSOL SPRAYS: PLASTIC CAPS & CLOSURES SIZE, BY END-USE INDUSTRY, 2019–2026 (BILLION UNITS)

7.2.6 OTHERS

7.2.6.1 Child-resistant closures

7.2.6.2 Tamper evident closures

7.2.6.3 Overcaps

TABLE 60 OTHERS: PLASTIC CAPS & CLOSURES SIZE, BY END-USE INDUSTRY, 2015–2018 (USD BILLION)

TABLE 61 OTHERS: PLASTIC CAPS & CLOSURES MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (BILLION UNITS)

TABLE 62 OTHERS: PLASTIC CAPS & CLOSURES SIZE, BY END-USE INDUSTRY, 2019–2026 (USD BILLION)

TABLE 63 OTHERS: PLASTIC CAPS & CLOSURES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (BILLION UNITS)

7.3 METAL CAPS & CLOSURES

TABLE 64 METAL CAPS & CLOSURES MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (USD BILLION)

TABLE 65 METAL CAPS & CLOSURES SIZE, BY END-USE INDUSTRY, 2015–2018 (BILLION UNITS)

TABLE 66 METAL CAPS & CLOSURES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD BILLION)

TABLE 67 METAL CAPS & CLOSURES SIZE, BY END-USE INDUSTRY, 2019–2026 (BILLION UNITS)

TABLE 68 METAL CAPS & CLOSURES MARKET SIZE, BY TYPE, 2015–2018 (USD BILLION)

TABLE 69 METAL CAPS & CLOSURES SIZE, BY TYPE, 2015–2018 (BILLION UNITS)

TABLE 70 METAL CAPS & CLOSURES SIZE, BY TYPE, 2019–2026 (USD BILLION)

TABLE 71 METAL CAPS & CLOSURES SIZE, BY TYPE, 2019–2026 (BILLION UNITS)

7.3.1 SCREW & LUG

TABLE 72 SCREW & LUG CAPS: METAL CAPS & CLOSURES SIZE, BY END-USE INDUSTRY, 2015–2018 (USD BILLION)

TABLE 73 SCREW & LUG CAPS: METAL CAPS & CLOSURES SIZE, BY END-USE INDUSTRY, 2015–2018 (BILLION UNITS)

TABLE 74 SCREW & LUG CAPS: METAL CAPS & CLOSURES SIZE, BY END-USE INDUSTRY, 2019–2026 (USD BILLION)

TABLE 75 SCREW & LUG CAPS: METAL CAPS & CLOSURES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (BILLION UNITS)

7.3.2 CAN ENDS

TABLE 76 CAN ENDS CAPS: METAL CAPS & CLOSURES MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (USD BILLION)

TABLE 77 CAN ENDS CAPS: METAL CAPS & CLOSURES MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (BILLION UNITS)

TABLE 78 CAN ENDS CAPS: METAL CAPS & CLOSURES SIZE, BY END-USE INDUSTRY, 2019–2026 (USD BILLION)

TABLE 79 CAN ENDS CAPS: METAL CAPS & CLOSURES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (BILLION UNITS)

7.3.3 CROWN CAPS

TABLE 80 CROWN CAPS: METAL CAPS & CLOSURES SIZE, BY END-USE INDUSTRY, 2015–2018 (USD BILLION)

TABLE 81 CROWN CAPS: METAL CAPS & CLOSURES MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (BILLION UNITS)

TABLE 82 CROWN CAPS: METAL CAPS & CLOSURES SIZE, BY END-USE INDUSTRY, 2019–2026 (USD BILLION)

TABLE 83 CROWN CAPS: METAL CAPS & CLOSURES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (BILLION UNITS)

7.3.4 OTHER METAL CLOSURES

TABLE 84 OTHER METAL CAPS & CLOSURES: METAL CAPS & CLOSURES SIZE, BY END-USE INDUSTRY, 2015–2018 (USD BILLION)

TABLE 85 OTHER METAL CAPS & CLOSURES: METAL CAPS & CLOSURES MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (BILLION UNITS)

TABLE 86 OTHER METAL CAPS & CLOSURES: METAL CAPS & CLOSURES SIZE, BY END-USE INDUSTRY, 2019–2026 (USD BILLION)

TABLE 87 OTHER METAL CAPS & CLOSURES: METAL CAPS & CLOSURES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (BILLION UNITS)

7.4 OTHER CAPS & CLOSURES

TABLE 88 OTHER SIZE, BY END-USE INDUSTRY, 2015–2018 (USD BILLION)

TABLE 89 OTHER SIZE, BY END-USE INDUSTRY, 2015–2018 (BILLION UNITS)

TABLE 90 OTHER SIZE, BY END-USE INDUSTRY, 2019–2026 (USD BILLION)

TABLE 91 OTHER SIZE, BY END-USE INDUSTRY, 2019–2026 (BILLION UNITS)

TABLE 92 OTHER SIZE, BY TYPE, 2015–2018 (USD BILLION)

TABLE 93 OTHER SIZE, BY TYPE, 2015–2018 (BILLION UNITS)

TABLE 94 OTHER SIZE, BY TYPE, 2019–2026 (USD BILLION)

TABLE 95 OTHER SIZE, BY TYPE, 2019–2026 (BILLION UNITS)

7.4.1 CORKS

TABLE 96 CORKS: CAPS & CLOSURES MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (USD BILLION)

TABLE 97 CORKS: OTHER CAPS & CLOSURES MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (BILLION UNITS)

TABLE 98 CORKS: CAPS & CLOSURES SIZE, BY END-USE INDUSTRY, 2019–2026 (USD BILLION)

TABLE 99 CORKS: OTHER CAPS & CLOSURES SIZE, BY END-USE INDUSTRY, 2019–2026 (BILLION UNITS)

7.4.2 GLASS STOPPERS

TABLE 100 GLASS STOPPERS: CAPS & CLOSURESSIZE, BY END-USE INDUSTRY, 2015–2018 (USD BILLION)

TABLE 101 GLASS STOPPERS: CAPS & CLOSURES MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (BILLION UNITS)

TABLE 102 GLASS STOPPERS: CAPS & CLOSURES SIZE, BY END-USE INDUSTRY, 2019–2026 (USD BILLION)

TABLE 103 GLASS STOPPERS: CAPS & CLOSURES SIZE, BY END-USE INDUSTRY, 2019–2026 (BILLION UNITS)

7.4.3 RUBBER & ELASTOMER STOPPERS

TABLE 104 RUBBER & ELASTOMER STOPPERS: CAPS & CLOSURES SIZE, BY END-USE INDUSTRY, 2015–2018 (USD BILLION)

TABLE 105 RUBBER & ELASTOMER STOPPERS: OTHER CAPS & CLOSURES SIZE, BY END-USE INDUSTRY, 2015–2018 (BILLION UNITS)

TABLE 106 RUBBER & ELASTOMER STOPPERS: OTHER CAPS & CLOSURES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD BILLION)

TABLE 107 RUBBER & ELASTOMER STOPPERS: OTHER CAPS & CLOSURES SIZE, BY END-USE INDUSTRY, 2019–2026 (BILLION UNITS)

7.4.4 OTHERS

TABLE 108 OTHERS: MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (USD BILLION)

TABLE 109 OTHERS: MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (BILLION UNITS)

TABLE 110 OTHERS: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD BILLION)

TABLE 111 OTHERS: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (BILLION UNITS)

8 CAPS & CLOSURES MARKET, BY END-USE INDUSTRY (Page No. - 123)

8.1 INTRODUCTION

FIGURE 34 BEVERAGE PACKAGING INDUSTRY TO BE LARGEST CONSUMER OF CAPS & CLOSURES

TABLE 112 MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (USD BILLION)

TABLE 113 MARKET SIZE, BY END-USE INDUSTRY 2015–2018 (BILLION UNITS)

TABLE 114 MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD BILLION)

TABLE 115 MARKET SIZE, BY END-USE INDUSTRY 2019–2026 (BILLION UNITS)

8.2 FOOD PACKAGING

8.3 BEVERAGE PACKAGING

8.4 HEALTHCARE PACKAGING

8.5 COSMETIC & TOILETRY

8.6 OTHERS

9 CAPS & CLOSURES MARKET, BY REGION (Page No. - 127)

9.1 ASIA PACIFIC

FIGURE 35 ASIA PACIFIC: PLASTIC CAPS & CLOSURES MARKET SNAPSHOT

9.1.1 IMPACT OF COVID-19 IN APAC

TABLE 116 APAC: CAPS & CLOSURES MARKET SIZE, BY COUNTRY, 2015–2018 (USD BILLION)

TABLE 117 APAC: MARKET SIZE, BY COUNTRY, 2015–2018 (BILLION UNITS)

TABLE 118 APAC: MARKET SIZE, BY RAW MATERIAL, 2015–2018 (USD BILLION)

TABLE 119 APAC: MARKET SIZE, BY RAW MATERIAL, 2015–2018 (MILLION TON)

TABLE 120 APAC: MARKET SIZE, BY TYPE, 2015–2018 (USD BILLION)

TABLE 121 APAC: MARKET SIZE, BY TYPE, 2015–2018 (BILLION UNITS)

TABLE 122 APAC: MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (USD BILLION)

TABLE 123 APAC: MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (BILLION UNITS)

TABLE 124 APAC: MARKET SIZE, BY COUNTRY, 2019–2026 (USD BILLION)

TABLE 125 APAC: MARKET SIZE, BY COUNTRY, 2019–2026 (BILLION UNITS)

TABLE 126 APAC: MARKET SIZE, BY RAW MATERIAL, 2019–2026 (USD MILLION)

TABLE 127 APAC: MARKET SIZE, BY RAW MATERIAL, 2019–2026 (MILLION TON)

TABLE 128 APAC: MARKET SIZE, BY TYPE, 2019–2026 (USD BILLION)

TABLE 129 APAC: MARKET SIZE, BY TYPE, 2019–2026 (BILLION UNITS)

TABLE 130 APAC: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD BILLION)

TABLE 131 APAC: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (BILLION UNITS)

9.1.2 CHINA

9.1.2.1 Increasing demand for ready-to-eat foods, carbonated drinks, and medical emergencies offering growth opportunities

TABLE 132 CHINA: CAPS & CLOSURES MARKET SIZE, BY TYPE, 2015–2018 (USD BILLION)

TABLE 133 CHINA: MARKET SIZE, BY TYPE, 2015–2018 (BILLION UNITS)

TABLE 134 CHINA: MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (USD BILLION)

TABLE 135 CHINA: MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (BILLION UNITS)

TABLE 136 CHINA: MARKET SIZE, BY TYPE, 2019–2026 (USD BILLION)

TABLE 137 CHINA: MARKET SIZE, BY TYPE, 2019–2026 (BILLION UNITS)

TABLE 138 CHINA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD BILLION)

TABLE 139 CHINA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (BILLION UNITS)

9.1.3 JAPAN

9.1.3.1 Rising beverage and pharmaceutical sectors to fuel the demand for caps & closures

TABLE 140 JAPAN: CAPS & CLOSURES MARKET SIZE, BY TYPE, 2015–2018 (USD BILLION)

TABLE 141 JAPAN: MARKET SIZE, BY TYPE, 2015–2018 (BILLION UNITS)

TABLE 142 JAPAN: MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (USD BILLION)

TABLE 143 JAPAN: MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (BILLION UNITS)

TABLE 144 JAPAN: MARKET SIZE, BY TYPE, 2019–2026 (USD BILLION)

TABLE 145 JAPAN: MARKET SIZE, BY TYPE, 2019–2026 (BILLION UNITS)

TABLE 146 JAPAN: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD BILLION)

TABLE 147 JAPAN: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (BILLION UNITS)

9.1.4 INDIA

9.1.4.1 High growth of food & beverage, pharmaceutical, and cosmetics industry to fuel the caps & closure market

TABLE 148 INDIA: CAPS & CLOSURES MARKET SIZE, BY TYPE, 2015–2018 (USD BILLION)

TABLE 149 INDIA: MARKET SIZE, BY TYPE, 2015–2018 (BILLION UNITS)

TABLE 150 INDIA:MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (USD BILLION)

TABLE 151 INDIA: MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (BILLION UNITS)

TABLE 152 INDIA: MARKET SIZE, BY TYPE, 2019–2026 (USD BILLION)

TABLE 153 INDIA: MARKET SIZE, BY TYPE, 2019–2026 (BILLION UNITS)

TABLE 154 INDIA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD BILLION)

TABLE 155 INDIA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (BILLION UNITS)

9.1.5 AUSTRALIA

9.1.5.1 High growth potential of packaging industry due to increasing disposable income and rising population

TABLE 156 AUSTRALIA: CAPS & CLOSURES MARKET SIZE, BY TYPE, 2015–2018 (USD BILLION)

TABLE 157 AUSTRALIA: MARKET SIZE, BY TYPE, 2015–2018 (BILLION UNITS)

TABLE 158 AUSTRALIA: MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (USD BILLION)

TABLE 159 AUSTRALIA: MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (BILLION UNITS)

TABLE 160 AUSTRALIA: MARKET SIZE, BY TYPE, 2019–2026 (USD BILLION)

TABLE 161 AUSTRALIA: MARKET SIZE, BY TYPE, 2019–2026 (BILLION UNITS)

TABLE 162 AUSTRALIA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD BILLION)

TABLE 163 AUSTRALIA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (BILLION UNITS)

9.1.6 REST OF APAC

9.1.6.1 Rising consumption of packed food to drive the market

TABLE 164 REST OF APAC: CAPS & CLOSURES MARKET SIZE, BY TYPE, 2015–2018 (USD BILLION)

TABLE 165 REST OF APAC: MARKET SIZE, BY TYPE, 2015–2018 (BILLION UNITS)

TABLE 166 REST OF APAC: MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (USD BILLION)

TABLE 167 REST OF APAC: MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (BILLION UNITS)

TABLE 168 REST OF APAC: MARKET SIZE, BY TYPE, 2019–2026 (USD BILLION)

TABLE 169 REST OF APAC: MARKET SIZE, BY TYPE, 2019–2026 (BILLION UNITS)

TABLE 170 REST OF APAC:MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD BILLION)

TABLE 171 REST OF APAC: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (BILLION UNITS)

9.2 EUROPE

9.2.1 IMPACT OF COVID-19 IN EUROPE

FIGURE 36 EUROPE: CAPS & CLOSURES MARKET SNAPSHOT

TABLE 172 EUROPE: MARKET SIZE, BY COUNTRY, 2015–2018 (USD BILLION)

TABLE 173 EUROPE: MARKET SIZE, BY COUNTRY, 2015–2018 (BILLION UNITS)

TABLE 174 EUROPE: MARKET SIZE, BY RAW MATERIAL, 2015–2018 (USD BILLION)

TABLE 175 EUROPE: MARKET SIZE, BY RAW MATERIAL, 2015–2018 (MILLION TON)

TABLE 176 EUROPE: MARKET SIZE, BY TYPE, 2015–2018 (USD BILLION)

TABLE 177 EUROPE: MARKET SIZE, BY TYPE, 2015–2018 (BILLION UNITS)

TABLE 178 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (USD BILLION)

TABLE 179 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (BILLION UNITS)

TABLE 180 EUROPE: MARKET SIZE, BY COUNTRY, 2019–2026 (USD BILLION)

TABLE 181 EUROPE: MARKET SIZE, BY COUNTRY, 2019–2026 (BILLION UNITS)

TABLE 182 EUROPE: MARKET SIZE, BY RAW MATERIAL, 2019–2026 (USD BILLION)

TABLE 183 EUROPE: MARKET SIZE, BY RAW MATERIAL, 2019–2026 (MILLION TON)

TABLE 184 EUROPE: MARKET SIZE, BY TYPE, 2019–2026 (USD BILLION)

TABLE 185 EUROPE: MARKET SIZE, BY TYPE, 2019–2026 (BILLION UNITS)

TABLE 186 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD BILLION)

TABLE 187 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (BILLION UNITS)

9.2.2 GERMANY

9.2.2.1 Demand for bottled water and carbonated drinks to grow during the forecast period

TABLE 188 GERMANY: CAPS & CLOSURES MARKET SIZE, BY TYPE, 2015–2018 (USD BILLION)

TABLE 189 GERMANY: MARKET SIZE, BY TYPE, 2015–2018 (BILLION UNITS)

TABLE 190 GERMANY: MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (USD BILLION)

TABLE 191 GERMANY: MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (BILLION UNITS)

TABLE 192 GERMANY: MARKET SIZE, BY TYPE, 2019–2026 (USD BILLION)

TABLE 193 GERMANY: MARKET SIZE, BY TYPE, 2019–2026 (BILLION UNITS)

TABLE 194 GERMANY: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD BILLION)

TABLE 195 GERMANY: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (BILLION UNITS)

9.2.3 UK

9.2.3.1 Increased demand for convenience food to boost the market in the UK

TABLE 196 UK: CAPS & CLOSURES MARKET SIZE, BY TYPE, 2015–2018 (USD BILLION)

TABLE 197 UK: MARKET SIZE, BY TYPE, 2015–2018 (BILLION UNITS)

TABLE 198 UK: MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (USD BILLION)

TABLE 199 UK: MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (BILLION UNITS)

TABLE 200 UK: MARKET SIZE, BY TYPE, 2019–2026 (USD BILLION)

TABLE 201 UK: MARKET SIZE, BY TYPE, 2019–2026 (BILLION UNITS)

TABLE 202 UK: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD BILLION)

TABLE 203 UK: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (BILLION UNITS)

9.2.4 FRANCE

TABLE 204 FRANCE: CAPS & CLOSURES MARKET SIZE, BY TYPE, 2015–2018 (USD BILLION)

TABLE 205 FRANCE: MARKET SIZE, BY TYPE, 2015–2018 (BILLION UNITS)

TABLE 206 FRANCE: MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (USD BILLION)

TABLE 207 FRANCE: MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (BILLION UNITS)

TABLE 208 FRANCE: MARKET SIZE, BY TYPE, 2019–2026 (USD BILLION)

TABLE 209 FRANCE: MARKET SIZE, BY TYPE, 2019–2026 (BILLION UNITS)

TABLE 210 FRANCE: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD BILLION)

TABLE 211 FRANCE: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (BILLION UNITS)

9.2.5 SPAIN

9.2.5.1 Growing food industry is propelling the market

TABLE 212 SPAIN: CAPS & CLOSURES MARKET SIZE, BY TYPE, 2015–2018 (USD BILLION)

TABLE 213 SPAIN: MARKET SIZE, BY TYPE, 2015–2018 (BILLION UNITS)

TABLE 214 SPAIN: MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (USD BILLION)

TABLE 215 SPAIN: CAPS & CLOSURES MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (BILLION UNITS)

TABLE 216 SPAIN: MARKET SIZE, BY TYPE, 2019–2026 (USD BILLION)

TABLE 217 SPAIN: MARKET SIZE, BY TYPE, 2019–2026 (BILLION UNITS)

TABLE 218 SPAIN: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD BILLION)

TABLE 219 SPAIN: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (BILLION UNITS)

9.2.6 REST OF EUROPE

TABLE 220 REST OF EUROPE: CAPS & CLOSURES MARKET SIZE, BY TYPE, 2015–2018 (USD BILLION)

TABLE 221 REST OF EUROPE: MARKET SIZE, BY TYPE, 2015–2018 (BILLION UNITS)

TABLE 222 REST OF EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (USD BILLION)

TABLE 223 REST OF EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (BILLION UNITS)

TABLE 224 REST OF EUROPE: MARKET SIZE, BY TYPE, 2019–2026 (USD BILLION)

TABLE 225 REST OF EUROPE: MARKET SIZE, BY TYPE, 2019–2026 (BILLION UNITS)

TABLE 226 REST OF EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD BILLION)

TABLE 227 REST OF EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (BILLION UNITS)

9.3 NORTH AMERICA

9.3.1 IMPACT OF COVID-19 IN NORTH AMERICA

FIGURE 37 NORTH AMERICA: CAPS & CLOSURES MARKET SNAPSHOT

TABLE 228 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2015–2018 (USD BILLION)

TABLE 229 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2015–2018 (BILLION UNITS)

TABLE 230 NORTH AMERICA: MARKET SIZE, BY RAW MATERIAL, 2015–2018 (USD BILLION)

TABLE 231 NORTH AMERICA: MARKET SIZE, BY RAW MATERIAL, 2015–2018 (MILLION TON)

TABLE 232 NORTH AMERICA: MARKET SIZE, BY TYPE, 2015–2018 (USD BILLION)

TABLE 233 NORTH AMERICA: MARKET SIZE, BY TYPE, 2015–2018 (BILLION UNITS)

TABLE 234 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (USD BILLION)

TABLE 235 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (BILLION UNITS)

TABLE 236 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2026 (USD BILLION)

TABLE 237 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2026 (BILLION UNITS)

TABLE 238 NORTH AMERICA: MARKET SIZE, BY RAW MATERIAL, 2019–2026 (USD BILLION)

TABLE 239 NORTH AMERICA: MARKET SIZE, BY RAW MATERIAL, 2019–2026 (MILLION TON)

TABLE 240 NORTH AMERICA: MARKET SIZE, BY TYPE, 2019–2026 (USD BILLION)

TABLE 241 NORTH AMERICA: MARKET SIZE, BY TYPE, 2019–2026 (BILLION UNITS)

TABLE 242 NORTH AMERICA:MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD BILLION)

TABLE 243 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (BILLION UNITS)

9.3.2 US

9.3.2.1 US dominated the caps & closures market in North America

TABLE 244 US: MARKET SIZE, BY TYPE, 2015–2018 (USD BILLION)

TABLE 245 US: MARKET SIZE, BY TYPE, 2015–2018 (BILLION UNITS)

TABLE 246 US: MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (USD BILLION)

TABLE 247 US: MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (BILLION UNITS)

TABLE 248 US: MARKET SIZE, BY TYPE, 2019–2026 (USD BILLION)

TABLE 249 US:MARKET SIZE, BY TYPE, 2019–2026 (BILLION UNITS)

TABLE 250 US: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD BILLION)

TABLE 251 US: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (BILLION UNITS)

9.3.3 CANADA

9.3.3.1 Increase in demand for convenient packaging to drive the caps & closures market

TABLE 252 CANADA: MARKET SIZE, BY TYPE, 2015–2018 (USD BILLION)

TABLE 253 CANADA: MARKET SIZE, BY TYPE, 2015–2018 (BILLION UNITS)

TABLE 254 CANADA: MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (USD BILLION)

TABLE 255 CANADA: MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (BILLION UNITS)

TABLE 256 CANADA: MARKET SIZE, BY TYPE, 2019–2026 (USD BILLION)

TABLE 257 CANADA: MARKET SIZE, BY TYPE, 2019–2026 (BILLION UNITS)

TABLE 258 CANADA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD BILLION)

TABLE 259 CANADA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (BILLION UNITS)

9.3.4 MEXICO

9.3.4.1 High growth potential of packaging industry due to increasing disposable income and rising population

TABLE 260 MEXICO: CAPS & CLOSURES MARKET SIZE, BY TYPE, 2015–2018 (USD BILLION)

TABLE 261 MEXICO: MARKET SIZE, BY TYPE, 2015–2018 (BILLION UNITS)

TABLE 262 MEXICO: MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (USD BILLION)

TABLE 263 MEXICO: MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (BILLION UNITS)

TABLE 264 MEXICO: MARKET SIZE, BY TYPE, 2019–2026 (USD BILLION)

TABLE 265 MEXICO: MARKET SIZE, BY TYPE, 2019–2026 (BILLION UNITS)

TABLE 266 MEXICO: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD BILLION)

TABLE 267 MEXICO: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (BILLION UNITS)

9.4 MIDDLE EAST & AFRICA

9.4.1 IMPACT OF COVID-19 IN MIDDLE EAST & AFRICA

TABLE 268 MIDDLE EAST & AFRICA: CAPS & CLOSURES MARKET SIZE, BY COUNTRY, 2019–2026 (USD BILLION)

TABLE 269 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2019–2026 (BILLION UNITS)

TABLE 270 MIDDLE EAST & AFRICA: MARKET SIZE, BY RAW MATERIAL, 2019–2026 (USD MILLION)

TABLE 271 MIDDLE EAST & AFRICA: MARKET SIZE, BY RAW MATERIAL, 2019–2026 (MILLION TON)

TABLE 272 MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2019–2026 (USD BILLION)

TABLE 273 MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2019–2026 (BILLION UNITS)

TABLE 274 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD BILLION)

TABLE 275 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (BILLION UNITS)

9.4.2 SAUDI ARABIA

9.4.2.1 Increasing demand for bottled water due to extremely hot and dry atmospheric conditions

TABLE 276 SAUDI ARABIA: CAPS & CLOSURES MARKET SIZE, BY TYPE, 2019–2026 (USD BILLION)

TABLE 277 SAUDI ARABIA: MARKET SIZE, BY TYPE, 2019–2026 (BILLION UNITS)

TABLE 278 SAUDI ARABIA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD BILLION)

TABLE 279 SAUDI ARABIA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (BILLION UNITS)

9.4.3 UAE

9.4.3.1 Rising beverage and pharmaceutical sectors to fuel the demand for caps & closures

TABLE 280 UAE: CAPS & CLOSURES MARKET SIZE, BY TYPE, 2019–2026 (USD BILLION)

TABLE 281 UAE: MARKET SIZE, BY TYPE, 2019–2026 (BILLION UNITS)

TABLE 282 UAE: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD BILLION)

TABLE 283 UAE: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (BILLION UNITS)

9.4.4 SOUTH AFRICA

9.4.4.1 High growth potential for packaging industry due to increasing disposable income and rising population

TABLE 284 SOUTH AFRICA: CAPS & CLOSURES MARKET SIZE, BY TYPE, 2015–2018 (USD BILLION)

TABLE 285 SOUTH AFRICA: MARKET SIZE, BY TYPE, 2015–2018 (BILLION UNITS)

TABLE 286 SOUTH AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (USD BILLION)

TABLE 287 SOUTH AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (BILLION UNITS)

TABLE 288 SOUTH AFRICA: MARKET SIZE, BY TYPE, 2019–2026 (USD BILLION)

TABLE 289 SOUTH AFRICA: MARKET SIZE, BY TYPE, 2019–2026 (BILLION UNITS)

TABLE 290 SOUTH AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD BILLION)

TABLE 291 SOUTH AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (BILLION UNITS)

9.4.5 REST OF MIDDLE EAST & AFRICA

9.4.5.1 High growth potential of packaging industry due to increasing disposable income and rising population

TABLE 292 REST OF MIDDLE EAST & AFRICA: CAPS & CLOSURES MARKET SIZE, BY TYPE, 2019–2026 (USD BILLION)

TABLE 293 REST OF THE MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2019–2026 (BILLION UNITS)

TABLE 294 REST OF THE MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD BILLION)

TABLE 295 REST OF THE MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (BILLION UNITS)

9.5 SOUTH AMERICA

9.5.1 IMPACT OF COVID-19 IN SOUTH AMERICA

TABLE 296 SOUTH AMERICA: CAPS & CLOSURES MARKET SIZE, BY COUNTRY, 2019–2026 (USD BILLION)

TABLE 297 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2026 (BILLION UNITS)

TABLE 298 SOUTH AMERICA:MARKET SIZE, BY RAW MATERIAL, 2019–2026 (USD BILLION)

TABLE 299 SOUTH AMERICA: MARKET SIZE, BY RAW MATERIAL, 2019–2026 (MILLION TON)

TABLE 300 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2019–2026 (USD BILLION)

TABLE 301 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2019–2026 (BILLION UNITS)

TABLE 302 SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD BILLION)

TABLE 303 SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (BILLION UNITS)

9.5.2 BRAZIL

9.5.2.1 Rise in awareness regarding healthcare issues and robust investment in healthcare industry to drive the market

TABLE 304 BRAZIL: CAPS & CLOSURES MARKET SIZE, BY TYPE, 2015–2018 (USD BILLION)

TABLE 305 BRAZIL: MARKET SIZE, BY TYPE, 2015–2018 (BILLION UNITS)

TABLE 306 BRAZIL: MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (USD BILLION)

TABLE 307 BRAZIL: MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (BILLION UNITS)

TABLE 308 BRAZIL: MARKET SIZE, BY TYPE, 2019–2026 (USD BILLION)

TABLE 309 BRAZIL: MARKET SIZE, BY TYPE, 2019–2026 (BILLION UNITS)

TABLE 310 BRAZIL: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD BILLION)

TABLE 311 BRAZIL: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (BILLION UNITS)

9.5.3 ARGENTINA

9.5.3.1 Government initiatives for ease of doing business and growing economy are supporting market growth

TABLE 312 ARGENTINA: CAPS & CLOSURES MARKET SIZE, BY TYPE, 2015–2018 (USD BILLION)

TABLE 313 ARGENTINA: MARKET SIZE, BY TYPE, 2015–2018 (BILLION UNITS)

TABLE 314 ARGENTINA: MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (USD BILLION)

TABLE 315 ARGENTINA: MARKET SIZE, BY END-USE INDUSTRY, 2015–2018 (BILLION UNITS)

TABLE 316 ARGENTINA: MARKET SIZE, BY TYPE, 2019–2026 (USD BILLION)

TABLE 317 ARGENTINA: MARKET SIZE, BY TYPE, 2019–2026 (BILLION UNITS)

TABLE 318 ARGENTINA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD BILLION)

TABLE 319 ARGENTINA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (BILLION UNITS)

9.5.4 REST OF SOUTH AMERICA

TABLE 320 REST OF SOUTH AMERICA: CAPS & CLOSURES MARKET SIZE, BY TYPE, 2019–2026 (USD BILLION)

TABLE 321 REST OF SOUTH AMERICA: MARKET SIZE, BY TYPE, 2019–2026 (BILLION UNITS)

TABLE 322 REST OF SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD BILLION)

TABLE 323 REST OF SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (BILLION UNITS)

10 COMPETITIVE LANDSCAPE (Page No. - 200)

10.1 OVERVIEW

FIGURE 38 COMPANIES ADOPTED ACQUISITION AS KEY GROWTH STRATEGY BETWEEN 2016 AND 2021

10.2 MARKET RANKING ANALYSIS

10.2.1 BERRY GLOBAL GROUP, INC.

10.2.2 CROWN HOLDINGS, INC.

10.2.3 SILGAN HOLDINGS, INC.

10.2.4 BERICAP GMBH & CO. KG

10.2.5 GUALA CLOSURES SPA

10.3 MARKET SHARE ANALYSIS

TABLE 324 CAPS & CLOSURES MARKET: MARKET SHARE OF KEY PLAYERS

FIGURE 39 MARKET SHARE ANALYSIS

10.4 COMPANY EVALUATION QUADRANT

10.4.1 STAR

10.4.2 EMERGING LEADERS

10.4.3 PERVASIVE

FIGURE 40 COMPETITIVE LEADERSHIP MAPPING: CAPS & CLOSURES MARKET, 2020

TABLE 325 COMPANY PRODUCT TYPE FOOTPRINT

TABLE 326 COMPANY REGION FOOTPRINT

10.5 SME MATRIX, 2020

10.5.1 PROGRESSIVE COMPANIES

10.5.2 RESPONSIVE COMPANIES

10.5.3 DYNAMIC COMPANIES

10.5.4 STARTING BLOCKS

FIGURE 41 SME MATRIX: CAPS & CLOSURES MARKET, 2020

10.6 COMPETITIVE SCENARIO

10.6.1 MERGER & ACQUISITION

TABLE 327 MERGER & ACQUISITION, 2016–2021

11 COMPANY PROFILES (Page No. - 212)

11.1 MAJOR PLAYERS

(Business Overview, Products/solutions/services offered, Recent developments: Deals, Deals, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats)*

11.1.1 BERRY GLOBAL GROUP, INC.

TABLE 328 BERRY GLOBAL GROUP, INC.: COMPANY OVERVIEW

FIGURE 42 BERRY GLOBAL GROUP, INC.: COMPANY SNAPSHOT

11.1.2 AMCOR PLC

TABLE 329 AMCOR PLC: COMPANY OVERVIEW

FIGURE 43 AMCOR PLC: COMPANY SNAPSHOT

11.1.3 CROWN HOLDINGS, INC.

TABLE 330 CROWN HOLDINGS, INC.: COMPANY OVERVIEW

FIGURE 44 CROWN HOLDINGS, INC.: COMPANY SNAPSHOT

11.1.4 SILGAN HOLDINGS, INC.

TABLE 331 SILGAN HOLDINGS, INC.: COMPANY OVERVIEW

FIGURE 45 SILGAN HOLDINGS, INC.: COMPANY SNAPSHOT

11.1.5 APTARGROUP, INC.

TABLE 332 APTARGROUP, INC.: BUSINESS OVERVIEW

FIGURE 46 APTARGROUP, INC.: COMPANY SNAPSHOT

11.1.6 BERICAP GMBH & CO. KG

TABLE 333 BERICAP GMBH & CO. KG: BUSINESS OVERVIEW

11.1.7 GUALA CLOSURES SPA

TABLE 334 GUALA CLOSURES SPA: BUSINESS OVERVIEW

11.1.8 ALCOPACK GROUP

TABLE 335 ALCOPACK GROUP: BUSINESS OVERVIEW

11.1.9 CORAL PRODUCTS

TABLE 336 CORAL PRODUCTS: BUSINESS OVERVIEW

11.1.10 HERTI JSC

TABLE 337 HERTI JSC: BUSINESS OVERVIEW

11.2 ADDITIONAL COMPANIES

11.2.1 UNITED CAPS

11.2.2 CAPS & CLOSURES PTY LTD.

11.2.3 CAPRITE AUSTRALIA PTY. LTD.

11.2.4 PANO CAP (CANADA) LIMITED

11.2.5 PHOENIX CLOSURES

11.2.6 MJS PACKAGING

11.2.7 J.L. CLARK

11.2.8 TRIMAS

11.2.9 COMAR, LLC

11.2.10 OSIAS BERK COMPANY

11.2.11 ITC PACKAGING

11.2.12 DYZDN METAL PACKAGING

11.2.13 EMA PHARMACEUTICALS

11.2.14 ALUPAC INDIA

11.2.15 GLOBAL CLOSURE SYSTEMS

*Details on Business Overview, Products/solutions/services offered, Recent developments: Deals, Deals, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 246)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

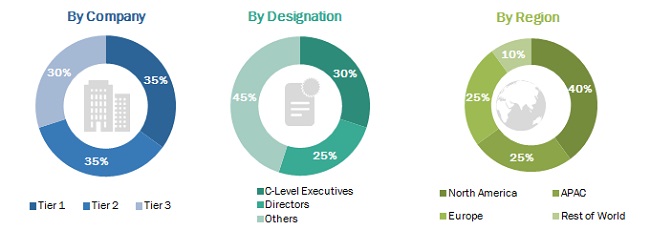

The study involved four major activities in estimating the current market size for the caps & closures market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers and Bloomberg BusinessWeek, were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, food safety organizations, regulatory bodies, and databases.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. Primary interviews were conducted to gather insights, such as market statistics, data of revenue collected from the products & services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding various trends related to type, raw material, end-use industry and region. Stakeholders from the demand side, such as food packaging, beverage packaging, cosmetic & toiletries, healthcare packaging, and other companies of the customer/end users who are using caps & closures were interviewed to understand the buyers’ perspective on suppliers, products, service providers, and their current use of caps & closures and outlook of their business, which will affect the overall market.

Following is the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the total size of the caps & closures market. These methods were also used extensively to estimate the size of the various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value and volume, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives:

- To estimate and forecast the caps & closures market in terms of value and volume

- To elaborate on the drivers, restraints, opportunities, and challenges in the market

- To define, describe, and forecast the market size based on raw material, type, end-use industry, and region

- To forecast the market size along with segments and submarkets in key regions: North America, Europe, APAC, the Middle East & Africa, and South America with their key countries

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and their contribution to the total market

- To analyze growth opportunities in the market for stakeholders and provide details on the competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their market shares and core competencies2

- To analyze competitive developments such as merger & acquisition, expansion & investment, agreement, partnership & joint venture, and new product development in the caps & closures market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations according to client-specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix, which provides a detailed comparison of the market for different caps & closures

Geographic Analysis

- A further breakdown of the caps & closures market for additional countries

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Caps & Closures Market