Antimicrobial Additives Market by Type (Inorganic (Silver, Copper, Zinc), Organic(OBPA, DCOIT, Triclosan)), Application (Plastic, Paints & Coatings, Pulp & Paper),End-use Industry and Region - Global Forecasts to 2026

Updated on : April 10, 2024

Antimicrobial Additives Market

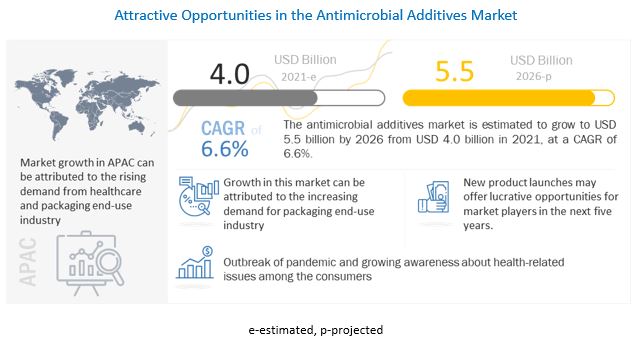

The global antimicrobial additives market was valued at USD 4.0 billion in 2021 and is projected to reach USD 5.5 billion by 2026, growing at 6.6% cagr from 2021 to 2026. Antimicrobials are any substance or materials infused with antimicrobial agents and additives to prevent the growth of infection and fever-causing microorganisms such as bacteria, fungi, algae, yeasts, mildew, and other parasites. The growth of microorganisms on untreated particles causes discoloration, unpleasant odors, and polymer degradation issues. The use of antimicrobial additives inhibits the growth of these microorganisms in the end products. Antimicrobial additives offer enhanced properties such as high dimensional stability, heat & chemical resistance, and chemical stability. The antimicrobial additives market is segments based on type (Organic, Inorganic), application (plastic, paints & coatings, pulp & paper, others), end-use industry (healthcare, packaging, food & beverage, construction, automotive, others).

To know about the assumptions considered for the study, download the pdf brochure

Impact of COVID-19 on antimicrobial additives market.

Covid-19 impact on antimicrobial additives market was less compared to other industries. Owning to the pandemic situation, several countries around the world went into lockdown, to curb the spread of the virus. Due to this the supply and demand chain got disrupted affecting the market. The industries, manufacturing units, infrastructural projects and mining operations got on hold for the past two years due to the pandemic situation.

The fluctuating price of raw materials used to make antimicrobial additives and COVID-19 pandemic have hindered the price of the end product. The companies on a brighter side are expecting the situations to get back to normal and the market to improve in the near future. The countries such as China, US, among the others are back on their feet continuing their regular work.

Antimicrobial Additives Market Dynamics

Driver: Outbreak of pandemic and growing awareness about health related issues among the consumers is driving the antimicrobial additives market

Despite social distancing, facemasks, and strict hygiene measures, it is near to impossible to keep every surface sanitized. Hence, there is a need for self-cleansing property that would neutralize the surface from contaminant pathogens and reduce the risk of possible spread. With the number of COVID-19 positive cases increasing day by day, there is a strong demand for antimicrobial additives in various applications. Consumer awareness pertaining to the importance of antimicrobial additives is growing at a rapid pace, which increases the demand for antimicrobials in the medical and healthcare sector.

Restraints: Volatility in raw material prices

Fluctuating raw material prices of antimicrobial additives are one of the key setbacks that affect the growth of the antimicrobial additives market. The basic raw materials used in the manufacture of antimicrobial additives product are silver, copper, and zinc. The cost of these raw materials is very high. The high cost of silver antimicrobials limits their use in various products, especially, Asia-Pacific and South America.

Silver and zinc, which are used as raw materials for the production of antimicrobial products, are actively traded commodities and their prices fluctuate at regular intervals. Such fluctuations influence the final cost of antimicrobial additives. For example, the soaring prices of silver in recent times have led manufacturers to look for other alternatives in spite of its excellent antimicrobial properties. The manufacturing cost of silver-based antimicrobial additives is high, which increases the overall cost of the products and affects the profit margins of the manufacturers.

Opportunities: Technological & product innovation

The current market demand is concentrated on antimicrobial additives that are cost-effective and meet the minimum standards or regulations mandated in the region. The demand for non-toxic plastics with enhanced features such as high antimicrobial activity, hardness, durability, and transparency, is increasing. Many large-scale plastic and paint & coating manufacturers are using antimicrobial additives in their products such as medical equipment, bottles, and food packaging. So the increasing demand for new and innovative products leads to technological and product innovation.

To know about the assumptions considered for the study, download the pdf brochure

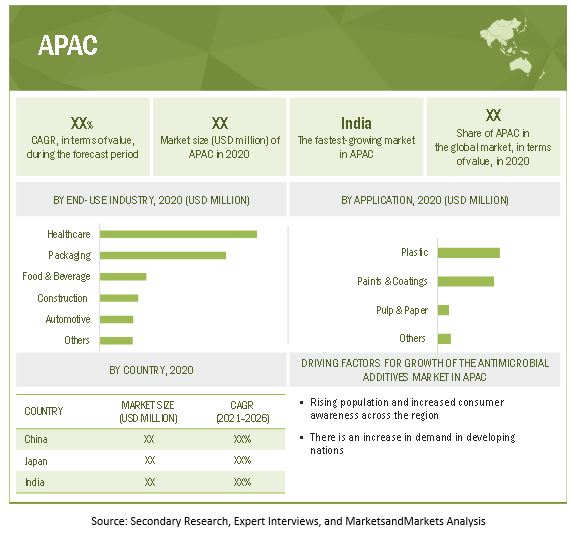

APAC to account for the largest share of the global antimicrobial additives market during the forecast period

APAC is an emerging market for antimicrobial additives market, and it is mainly attributed to high economic growth rate, followed by heavy investment in the healthcare, packaging, and automotive industries. With economic constraints and saturation in the European and North American markets, demand is shifting to the Asia-Pacific region. Growing demand and policies like emission control and the use of environmentally friendly products, have led to innovation in the plastics industry of the region, making it a plastic hub, globally

Antimicrobial Additives Market Ecosystem

Antimicrobial Additives Market Players

The key market players profiled in the report include BASF SE (Germany), DuPont De Nemours (US), Microban International (US), Sanitized AG (Switzerland), LyondellBasell (Netherlands), Avient Corporation (US), Biocote (UK) and Milliken Chemical (US) among others

BASF SE is a diversified chemical solution provider and manufacturer of a broad range of chemical products with high-end industrial applications. Its product portfolio includes agriculture, automotive & transportation, chemicals, coating & solutions, construction, electronics & electric, energy & resources, furniture & wood, home care and cleaning, nutrition, packaging & prints, paint & coatings, personal care & hygiene, pharmaceuticals, plastics & rubber, pulp & paper, textile, leather & footwear. The company operates through seven business segments: chemicals, materials, industrial solutions, surface technologies, nutrition & care, agricultural solutions. and others. BASF offers antimicrobial additives through its industrial solutions segment. It primarily operates in Europe and has an active presence in North America, Asia Pacific, South America, Africa, and the Middle East countries.

The dissolution of DowDupont completed on June 1, 2019, and Dow Chemical Company and DuPont de Nemours Inc. are separate business identities now. DuPont operates under five different segments, namely, Nutrition & biosciences, safety & construction, transportation & industrial, electronics & imaging, and non-core. The company offers antimicrobial solutions through its nutrition & biosciences segment. Currently in more than 40 countries they are turning local insights in global solutions, with diverse and global network of research centers, manufacturing sites and offices. The company has a dominance in The US and other European regions, and they are gradually increasing their presence in South America.

Antimicrobial Additives Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2021 |

USD 4.0 billion |

|

Revenue Forecast in 2026 |

USD 5.5 billion |

|

CAGR |

6.6% |

|

Years considered for the study |

2016–2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021–2026 |

|

Units considered |

Value (USD Million), Volume (Kiloton |

|

Segments covered |

Type, Application, End-use industry and Region |

|

Regions covered |

APAC, North America, Europe, Middle East & Africa, and South America |

|

Companies profiled |

BASF SE (Germany), DuPont De Nemours (US), Microban International (US), Sanitized AG (Switzerland), LyondellBasell (Netherlands), Avient Corporation (US), Biocote (UK) and Milliken Chemical (US) among others. Top 25 major players covered |

This report categorizes the global antimicrobial additives market based on type, application, end-use industry and region.

On the basis of type, the antimicrobial additives market has been segmented as follows:

- Inorganic

- Organic

On the basis of application, the antimicrobial additives market has been segmented as follows:

- Plastic

- Paints & Coatings

- Pulp & Paper

- Others

On the basis of end-use industry, the antimicrobial additives market has been segmented as follows:

- Healthcare

- Packaging

- Food & Beverage

- Construction

- Automotive

- Others

On the basis of region, the antimicrobial additives market has been segmented as follows:

- APAC

- North America

- Europe

- Middle East & Arica

- South America

Recent Developments:

- In January 2020, BASF closed its acquisition of the polyamide business from Solvay and broadened the capabilities of engineering plastics for innovative solutions.

- In February 2021, DuPont completed the merger of Nutrition & Bioscience business which is a DuPont subsidiary with a subsidiary of International Flavors & Fragrances Inc. ("IFF")

FAQs

At what CAGR, the antimicrobial additives market will grow from 2021-2026?">

The antimicrobial additives market will grow at a CAGR of 6.6% from 2021–2026.

What will be the market worth of the antimicrobial additives market by the end of 2026?

The global market for antimicrobial additives was US$ 4.0 billion in 2021 and is expected to reach US$ 5.5 billion by 2026.

Who are the leading manufacturers in antimicrobial additives market?

BASF SE (Germany), DuPont De Nemours (US), Microban International (US), Sanitized AG (Switzerland), LyondellBasell (Netherlands), Avient Corporation (US), Biocote (UK), and Milliken Chemical (US) among others are the leading manufacturers in antimicrobial additives market.

What is the Type of segment-leading growth in the antimicrobial additives market?

By type, the inorganic antimicrobial additives type would grow at a highest CAGR during the forecast period.

What are the high growth type of antimicrobial additives?

Inorganic antimicrobial additives is the largest type of antimicrobial additive in terms of value, in the global market in 2020. The dominance of the inorganic antimicrobial additives segment is projected to continue during the forecast period owing to its advanced properties. The increasing demand from the various end-use industries such as healthcare, packaging, automotive and construction is fueling the growth of inorganic antimicrobial additives. This segment is also projected to witness the highest growth between 2021 and 2026 in terms of value.

What are the major factors impacting market growth during the forecast period?

The market growth is primarily due to the growing awareness regarding health related issues and increased use of antimicrobial additives in end-use industry in regions like APAC and Middle East & Africa. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 41)

1.1 OBJECTIVES OF STUDY

1.2 MARKET DEFINITION

1.2.1 ANTIMICROBIAL ADDITIVES MARKET: INCLUSIONS AND EXCLUSIONS

1.2.2 ANTIMICROBIAL ADDITIVES MARKET DEFINITION AND INCLUSIONS, BY TYPE

1.2.3 ANTIMICROBIAL ADDITIVES MARKET DEFINITION AND INCLUSIONS, BY APPLICATION

1.2.4 ANTIMICROBIAL ADDITIVES MARKET DEFINITION AND INCLUSIONS, BY END-USE INDUSTRY

1.3 MARKET SCOPE

FIGURE 1 ANTIMICROBIAL ADDITIVES MARKET SEGMENTATION

1.3.1 REGIONS COVERED

1.3.2 YEARS CONSIDERED FOR STUDY

1.4 CURRENCY

1.5 UNITS CONSIDERED

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 47)

2.1 RESEARCH DATA

FIGURE 2 ANTIMICROBIAL ADDITIVES MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews – demand and supply sides

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): COLLECTIVE SHARE OF TOP PLAYERS

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL PRODUCTS

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 –BOTTOM-UP (DEMAND SIDE): END-USE INDUSTRY DEMAND AND THEIR AVERAGE SELLING PRICE

2.2.2 TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3 –TOP-DOWN

2.3 DATA TRIANGULATION

FIGURE 7 ANTIMICROBIAL ADDITIVES MARKET: DATA TRIANGULATION

2.4 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

2.4.1 SUPPLY SIDE

FIGURE 8 MARKET CAGR PROJECTIONS FROM SUPPLY SIDE

2.4.2 DEMAND SIDE

FIGURE 9 MARKET GROWTH PROJECTIONS FROM DEMAND SIDE: DRIVERS AND OPPORTUNITIES

2.5 FACTOR ANALYSIS

2.6 ASSUMPTIONS

2.7 LIMITATIONS

2.8 RISK ASSESSMENT

TABLE 1 ANTIMICROBIAL ADDITIVES MARKET: RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 57)

FIGURE 10 HEALTHCARE END-USE INDUSTRY LED ANTIMICROBIAL ADDITIVES MARKET IN 2020

FIGURE 11 PLASTICS APPLICATION TO LEAD ANTIMICROBIAL ADDITIVES MARKET DURING FORECAST PERIOD

FIGURE 12 INORGANIC ANTIMICROBIAL ADDITIVES TO DOMINATE MARKET DURING FORECAST PERIOD

FIGURE 13 ASIA PACIFIC ACCOUNTED FOR LARGEST MARKET SHARE IN 2020

4 PREMIUM INSIGHTS (Page No. - 61)

4.1 ATTRACTIVE OPPORTUNITIES IN ANTIMICROBIAL ADDITIVES MARKET

FIGURE 14 GROWING HEALTHCARE END-USE INDUSTRY TO DRIVE ANTIMICROBIAL ADDITIVES MARKET DURING FORECAST PERIOD

4.2 ANTIMICROBIAL ADDITIVES MARKET SIZE, BY REGION

FIGURE 15 ASIA PACIFIC TO BE LARGEST MARKET FOR ANTIMICROBIAL ADDITIVES DURING FORECAST PERIOD

4.3 ASIA PACIFIC: ANTIMICROBIAL ADDITIVES MARKET, BY APPLICATION AND COUNTRY, 2020

FIGURE 16 CHINA AND PLASTICS SEGMENT ACCOUNTED FOR LARGEST SHARES

4.4 ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY

FIGURE 17 HEALTHCARE TO BE LARGEST END-USE INDUSTRY IN ANTIMICROBIAL ADDITIVES MARKET

4.5 ANTIMICROBIAL ADDITIVES MARKET SIZE, BY APPLICATION VS. REGION

FIGURE 18 PLASTICS SEGMENT WAS LEADING APPLICATION OF ANTIMICROBIAL ADDITIVES IN MOST REGIONS

4.6 ANTIMICROBIAL ADDITIVES MARKET, BY KEY COUNTRIES

FIGURE 19 INDIA TO REGISTER HIGHEST CAGR BETWEEN 2021 AND 2026

5 MARKET OVERVIEW (Page No. - 64)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 20 ANTIMICROBIAL ADDITIVES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Outbreak of the pandemic and growing awareness about health-related issues among consumers

5.2.1.2 Growth of end-use industries

TABLE 2 SPENDING IN HEALTHCARE INDUSTRY, BY COUNTRY/REGION

5.2.1.3 Increasing use of silver-based products as antimicrobial additives

5.2.2 RESTRAINTS

5.2.2.1 Volatility in raw material prices

5.2.3 OPPORTUNITIES

5.2.3.1 Untapped opportunities in the agriculture and cosmetics industries

5.2.3.2 Growth of the textile industry

TABLE 3 TEXTILE INDUSTRY SIZE, BY COUNTRY/REGION, 2017–2025 (USD BILLION)

5.2.4 CHALLENGES

5.2.4.1 Government regulations on the usage of plastics in certain applications

5.2.4.2 Decline in construction activities

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 21 PORTER’S FIVE FORCES ANALYSIS OF ANTIMICROBIAL ADDITIVES MARKET

TABLE 4 ANTIMICROBIAL ADDITIVES MARKET: PORTER’S FIVE FORCES ANALYSIS

5.3.1 THREAT OF SUBSTITUTES

5.3.2 THREAT OF NEW ENTRANTS

5.3.3 BARGAINING POWER OF SUPPLIERS

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 TECHNOLOGY ANALYSIS

5.5 MACROECONOMIC INDICATORS

5.5.1 GDP TRENDS AND FORECAST OF MAJOR ECONOMIES

TABLE 5 GDP TRENDS AND FORECAST, BY MAJOR ECONOMIES, 2018–2026 (USD BILLION)

5.6 COVID-19 IMPACT

5.6.1 INTRODUCTION

5.6.2 COVID-19 HEALTH ASSESSMENT

FIGURE 22 COUNTRY-WISE SPREAD OF COVID-19

5.6.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 23 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2021

5.6.3.1 COVID-19 impact on the economy—scenario assessment

FIGURE 24 FACTORS IMPACTING GLOBAL ECONOMY

5.7 IMPACT OF COVID-19: CUSTOMER ANALYSIS

6 INDUSTRY TRENDS (Page No. - 77)

6.1 SUPPLY CHAIN ANALYSIS

FIGURE 25 ANTIMICROBIAL ADDITIVES MARKET: SUPPLY CHAIN

6.1.1 RAW MATERIAL

6.1.2 MANUFACTURING OF ANTIMICROBIAL ADDITIVES

6.1.3 DISTRIBUTION

6.1.4 END USERS

6.2 ANTIMICROBIAL ADDITIVES MARKET: REALISTIC, PESSIMISTIC, OPTIMISTIC, AND NON-COVID-19 SCENARIOS

FIGURE 26 MARKET SIZE UNDER REALISTIC, PESSIMISTIC, OPTIMISTIC, AND NON-COVID-19 SCENARIOS

TABLE 6 ANTIMICROBIAL ADDITIVES MARKET FORECAST SCENARIO, 2019–2026 (USD MILLION)

6.2.1 NON-COVID-19 SCENARIO

6.2.2 OPTIMISTIC SCENARIO

6.2.3 PESSIMISTIC SCENARIO

6.2.4 REALISTIC SCENARIO

6.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

6.3.1 REVENUE SHIFTS & REVENUE POCKETS FOR ANTIMICROBIAL ADDITIVES MARKET

FIGURE 27 REVENUE SHIFT FOR ANTIMICROBIAL ADDITIVES MARKET

6.4 CONNECTED MARKETS: ECOSYSTEM

TABLE 7 ANTIMICROBIAL ADDITIVES MARKET: SUPPLY CHAIN

FIGURE 28 ANTIMICROBIAL ADDITIVES MARKET: ECOSYSTEM

6.5 CASE STUDY ANALYSIS

6.5.1 A CASE STUDY ON ANTIMICROBIAL TECHNOLOGY IN A HOSPITAL

6.5.2 A CASE STUDY ON ANTIMICROBIAL TECHNOLOGY IN A SCHOOL

6.6 TRADE ANALYSIS

6.6.1 IMPORT SCENARIO OF ANTIMICROBIAL ADDITIVES

FIGURE 29 ANTIMICROBIAL ADDITIVE IMPORTS, BY KEY COUNTRY, 2013–2020

TABLE 8 ANTIMICROBIAL ADDITIVE IMPORTS, BY REGION, 2013–2020 (USD MILLION)

6.6.2 EXPORT SCENARIO OF ANTIMICROBIAL ADDITIVES

FIGURE 30 ANTIMICROBIAL ADDITIVE EXPORTS, BY KEY COUNTRY, 2013–2020

TABLE 9 ANTIMICROBIAL ADDITIVE EXPORTS, BY REGION, 2013–2020 (USD MILLION)

6.7 AVERAGE SELLING PRICE

FIGURE 31 AVERAGE SELLING PRICE OF ANTIMICROBIAL ADDITIVES, BY REGION (USD/KG)

TABLE 10 AVERAGE SELLING PRICE OF ANTIMICROBIAL ADDITIVES, BY REGION (USD/KG)

6.8 REGULATORY LANDSCAPE

6.8.1 REGULATIONS RELATED TO ANTIMICROBIAL ADDITIVES MARKET

6.9 PATENT ANALYSIS

6.9.1 APPROACH

6.9.2 DOCUMENT TYPE

TABLE 11 GRANTED PATENTS ACCOUNT FOR 22% OF ALL PATENTS IN THE GIVEN PERIOD.

FIGURE 32 PATENTS REGISTERED FOR ANTIMICROBIAL ADDITIVES MARKET, 2010–2020

FIGURE 33 PATENT PUBLICATION TRENDS FOR ANTIMICROBIAL ADDITIVES MARKET, 2010–2020

FIGURE 34 LEGAL STATUS OF PATENTS

6.9.3 JURISDICTION ANALYSIS

FIGURE 35 MAXIMUM PATENTS FILED BY COMPANIES IN CHINA

6.9.4 TOP APPLICANTS

FIGURE 36 ROHM & HAAS COMPANY REGISTERED MAXIMUM NUMBER OF PATENTS BETWEEN 2010 AND 2020

TABLE 12 LIST OF PATENTS BY ROHM & HAAS

TABLE 13 LIST OF PATENTS BY DOW GLOBAL TECHNOLOGIES LLC.

TABLE 14 LIST OF PATENTS BY ARGENLAB GLOBAL LTD.

TABLE 15 TOP 10 PATENT OWNERS IN US, 2010–2020

7 ANTIMICROBIAL ADDITIVES MARKET, BY TYPE (Page No. - 92)

7.1 INTRODUCTION

FIGURE 37 INORGANIC ANTIMICROBIAL ADDITIVES TO DOMINATE MARKET DURING FORECAST PERIOD

TABLE 16 ANTIMICROBIAL ADDITIVES MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 17 ANTIMICROBIAL ADDITIVES MARKET SIZE, BY TYPE, 2020–2026 (KILOTON)

TABLE 18 ANTIMICROBIAL ADDITIVES MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 19 ANTIMICROBIAL ADDITIVES MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

7.2 INORGANIC ANTIMICROBIAL ADDITIVES

FIGURE 38 ASIA PACIFIC TO BE LARGEST MARKET FOR INORGANIC ANTIMICROBIAL ADDITIVES BETWEEN 2021 AND 2026

TABLE 20 INORGANIC ANTIMICROBIAL ADDITIVES MARKET SIZE, BY REGION, 2016–2019 (KILOTON)

TABLE 21 INORGANIC ANTIMICROBIAL ADDITIVES MARKET SIZE, BY REGION, 2020–2026 (KILOTON)

TABLE 22 INORGANIC ANTIMICROBIAL ADDITIVES MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 23 INORGANIC ANTIMICROBIAL ADDITIVES MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

7.2.1 SILVER

7.2.2 COPPER

7.2.3 ZINC

7.3 ORGANIC ANTIMICROBIAL ADDITIVES

FIGURE 39 ASIA PACIFIC TO DRIVE DEMAND FOR ORGANIC ANTIMICROBIAL ADDITIVES BETWEEN 2021 AND 2026

TABLE 24 ORGANIC ANTIMICROBIAL ADDITIVES MARKET SIZE, BY REGION, 2016–2019 (KILOTON)

TABLE 25 ORGANIC ANTIMICROBIAL ADDITIVES MARKET SIZE, BY REGION, 2020–2026 (KILOTON)

TABLE 26 ORGANIC ANTIMICROBIAL ADDITIVES MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 27 ORGANIC ANTIMICROBIAL ADDITIVES MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

7.3.1 OXYBISPHENOX ARSINE (OBPA)

7.3.2 4,5-DICHLORO-2-(N-OCTYL)-4-ISOTHIAZOLIN-3-ONE (DCOIT)

7.3.3 TRICLOSAN

7.3.4 OTHERS

8 ANTIMICROBIAL ADDITIVES MARKET, BY APPLICATION (Page No. - 102)

8.1 INTRODUCTION

FIGURE 40 PLASTICS APPLICATION TO LEAD ANTIMICROBIAL ADDITIVES MARKET BETWEEN 2021 AND 2026

TABLE 28 ANTIMICROBIAL ADDITIVES MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 29 ANTIMICROBIAL ADDITIVES MARKET SIZE, BY APPLICATION, 2020–2026 (KILOTON)

TABLE 30 ANTIMICROBIAL ADDITIVES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 31 ANTIMICROBIAL ADDITIVES MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

8.2 PLASTICS

8.2.1 GROWING DEMAND FOR PLASTIC PRODUCTS IN END-USE INDUSTRIES TO DRIVE DEMAND FOR ANTIMICROBIAL ADDITIVES

FIGURE 41 ASIA PACIFIC TO LEAD ANTIMICROBIAL ADDITIVES MARKET IN PLASTICS APPLICATION DURING FORECAST PERIOD

TABLE 32 ANTIMICROBIAL ADDITIVES MARKET SIZE IN PLASTICS APPLICATION, BY REGION, 2016–2019 (KILOTON)

TABLE 33 ANTIMICROBIAL ADDITIVES MARKET SIZE IN PLASTICS APPLICATION, BY REGION, 2020–2026 (KILOTON)

TABLE 34 ANTIMICROBIAL ADDITIVES MARKET SIZE IN PLASTICS APPLICATION, BY REGION, 2016–2019 (USD MILLION)

TABLE 35 ANTIMICROBIAL ADDITIVES MARKET SIZE IN PLASTICS APPLICATION, BY REGION, 2020–2026 (USD MILLION)

8.3 PAINTS & COATINGS

8.3.1 INCREASING CONSUMER AWARENESS DRIVING ANTIMICROBIAL ADDITIVES MARKET IN PAINTS & COATINGS SEGMENT

FIGURE 42 EUROPE TO BE SECOND-LARGEST ANTIMICROBIAL ADDITIVES MARKET IN PAINTS & COATINGS APPLICATION DURING FORECAST PERIOD

TABLE 36 ANTIMICROBIAL ADDITIVES MARKET SIZE IN PAINTS & COATINGS APPLICATION, BY REGION, 2016–2019 (KILOTON)

TABLE 37 ANTIMICROBIAL ADDITIVES MARKET SIZE IN PAINTS & COATINGS APPLICATION, BY REGION, 2020–2026 (KILOTON)

TABLE 38 ANTIMICROBIAL ADDITIVES MARKET SIZE IN PAINTS & COATINGS APPLICATION, BY REGION, 2016–2019 (USD MILLION)

TABLE 39 ANTIMICROBIAL ADDITIVES MARKET SIZE IN PAINTS & COATINGS APPLICATION, BY REGION, 2020–2026 (USD MILLION)

8.4 PULP & PAPER

8.4.1 USE OF ANTIMICROBIAL PAPER IN OFFICE ENVIRONMENTS TO DRIVE MARKET

FIGURE 43 ASIA PACIFIC TO BE FASTEST-GROWING ANTIMICROBIAL ADDITIVES MARKET IN PULP & PAPER APPLICATION DURING FORECAST PERIOD

TABLE 40 ANTIMICROBIAL ADDITIVES MARKET SIZE IN PULP & PAPER APPLICATION, BY REGION, 2016–2019 (KILOTON)

TABLE 41 ANTIMICROBIAL ADDITIVES MARKET SIZE IN PULP & PAPER APPLICATION, BY REGION, 2020–2026 (KILOTON)

TABLE 42 ANTIMICROBIAL ADDITIVES MARKET SIZE IN PULP & PAPER APPLICATION, BY REGION, 2016–2019 (USD MILLION)

TABLE 43 ANTIMICROBIAL ADDITIVES MARKET SIZE IN PULP & PAPER APPLICATION, BY REGION, 2020–2026 (USD MILLION)

8.5 OTHERS

FIGURE 44 ASIA PACIFIC TO BE FASTEST-GROWING MARKET FOR ANTIMICROBIAL ADDITIVES IN OTHER APPLICATIONS

TABLE 44 ANTIMICROBIAL ADDITIVES MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2016–2019 (KILOTON)

TABLE 45 ANTIMICROBIAL ADDITIVES MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2020–2026 (KILOTON)

TABLE 46 ANTIMICROBIAL ADDITIVES MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2016–2019 (USD MILLION)

TABLE 47 ANTIMICROBIAL ADDITIVES MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2020–2026 (USD MILLION)

9 ANTIMICROBIAL ADDITIVES MARKET, BY END-USE INDUSTRY (Page No. - 114)

9.1 INTRODUCTION

FIGURE 45 HEALTHCARE END-USE INDUSTRY TO LEAD ANTIMICROBIAL ADDITIVES MARKET BETWEEN 2021 AND 2026

TABLE 48 ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 49 ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (KILOTON)

TABLE 50 ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 51 ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD MILLION)

9.2 HEALTHCARE

9.2.1 INCREASING AWARENESS ABOUT ADVANTAGES OF ANTIMICROBIAL ADDITIVES IN HEALTHCARE INDUSTRY TO DRIVE MARKET

FIGURE 46 ASIA PACIFIC TO BE FASTEST-GROWING MARKET FOR ANTIMICROBIAL ADDITIVES IN HEALTHCARE END-USE INDUSTRY DURING FORECAST PERIOD

TABLE 52 ANTIMICROBIAL ADDITIVES MARKET SIZE IN HEALTHCARE END-USE INDUSTRY, BY REGION, 2016–2019 (KILOTON)

TABLE 53 ANTIMICROBIAL ADDITIVES MARKET SIZE IN HEALTHCARE END-USE INDUSTRY, BY REGION, 2020–2026 (KILOTON)

TABLE 54 ANTIMICROBIAL ADDITIVES MARKET SIZE IN HEALTHCARE END-USE INDUSTRY, BY REGION, 2016–2019 (USD MILLION)

TABLE 55 ANTIMICROBIAL ADDITIVES MARKET SIZE IN HEALTHCARE END-USE INDUSTRY BY REGION, 2020–2026 (USD MILLION)

9.3 PACKAGING

9.3.1 GROWING DEMAND FOR PACKAGED FOOD DRIVING ANTIMICROBIAL ADDITIVES MARKET IN PACKAGING INDUSTRY

FIGURE 47 ASIA PACIFIC TO DOMINATE ANTIMICROBIAL ADDITIVES MARKET IN PACKAGING END-USE INDUSTRY BETWEEN 2021 AND 2026

TABLE 56 ANTIMICROBIAL ADDITIVES MARKET SIZE IN PACKAGING END-USE INDUSTRY, BY REGION, 2016–2019 (KILOTON)

TABLE 57 ANTIMICROBIAL ADDITIVES MARKET SIZE IN PACKAGING END-USE INDUSTRY, BY REGION, 2020–2026 (KILOTON)

TABLE 58 ANTIMICROBIAL ADDITIVES MARKET SIZE IN PACKAGING END-USE INDUSTRY, BY REGION, 2016–2019 (USD MILLION)

TABLE 59 ANTIMICROBIAL ADDITIVES MARKET SIZE IN PACKAGING END-USE INDUSTRY, BY REGION, 2020–2026 (USD MILLION)

9.4 FOOD & BEVERAGE

9.4.1 GROWING DEMAND FOR PRESERVED FOOD TO DRIVE DEMAND FOR ANTIMICROBIAL ADDITIVES IN FOOD & BEVERAGE INDUSTRY

FIGURE 48 EUROPE TO BE LARGEST MARKET FOR ANTIMICROBIAL ADDITIVES IN FOOD & BEVERAGE END-USE INDUSTRY

TABLE 60 ANTIMICROBIAL ADDITIVES MARKET SIZE IN FOOD & BEVERAGE END-USE INDUSTRY, BY REGION, 2016–2019 (KILOTON)

TABLE 61 ANTIMICROBIAL ADDITIVES MARKET SIZE IN FOOD & BEVERAGE END-USE INDUSTRY, BY REGION, 2020–2026 (KILOTON)

TABLE 62 ANTIMICROBIAL ADDITIVES MARKET SIZE IN FOOD & BEVERAGE END-USE INDUSTRY, BY REGION, 2016–2019 (USD MILLION)

TABLE 63 ANTIMICROBIAL ADDITIVES MARKET SIZE IN FOOD & BEVERAGE END-USE INDUSTRY, BY REGION, 2020–2026 (USD MILLION)

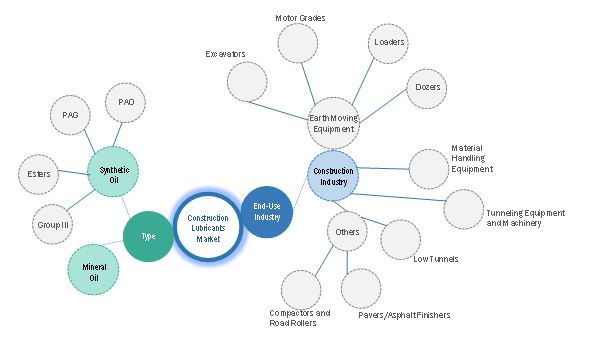

9.5 CONSTRUCTION

9.5.1 HUGE INVESTMENT IN CONSTRUCTION PROJECTS TO DRIVE DEMAND FOR ANTIMICROBIAL ADDITIVES IN CONSTRUCTION INDUSTRY

FIGURE 49 NORTH AMERICA TO BE SECOND-LARGEST ANTIMICROBIAL ADDITIVES MARKET IN CONSTRUCTION END-USE INDUSTRY DURING FORECAST PERIOD

TABLE 64 ANTIMICROBIAL ADDITIVES MARKET SIZE IN CONSTRUCTION END-USE INDUSTRY, BY REGION, 2016–2019 (KILOTON)

TABLE 65 ANTIMICROBIAL ADDITIVES MARKET SIZE IN CONSTRUCTION END-USE INDUSTRY, BY REGION, 2020–2026 (KILOTON)

TABLE 66 ANTIMICROBIAL ADDITIVES MARKET SIZE IN CONSTRUCTION END-USE INDUSTRY, BY REGION, 2016–2019 (USD MILLION)

TABLE 67 ANTIMICROBIAL ADDITIVES MARKET SIZE IN CONSTRUCTION END-USE INDUSTRY, BY REGION, 2020–2026 (USD MILLION)

9.6 AUTOMOTIVE

9.6.1 WELL-ESTABLISHED AUTOMOTIVE INDUSTRY TO DRIVE ANTIMICROBIAL ADDITIVES MARKET

FIGURE 50 ASIA PACIFIC TO BE FASTEST-GROWING ANTIMICROBIAL ADDITIVES MARKET IN AUTOMOTIVE INDUSTRY DURING FORECAST PERIOD

TABLE 68 ANTIMICROBIAL ADDITIVES MARKET SIZE IN AUTOMOTIVE END-USE INDUSTRY, BY REGION, 2016–2019 (KILOTON)

TABLE 69 ANTIMICROBIAL ADDITIVES MARKET SIZE IN AUTOMOTIVE END-USE INDUSTRY, BY REGION, 2020–2026 (KILOTON)

TABLE 70 ANTIMICROBIAL ADDITIVES MARKET SIZE IN AUTOMOTIVE END-USE INDUSTRY, BY REGION, 2016–2019 (USD MILLION)

TABLE 71 ANTIMICROBIAL ADDITIVES MARKET SIZE IN AUTOMOTIVE END-USE INDUSTRY, BY REGION, 2020–2026 (USD MILLION)

9.7 OTHERS

FIGURE 51 NORTH AMERICA TO BE SECOND-LARGEST ANTIMICROBIAL ADDITIVES MARKET IN OTHER END-USE INDUSTRIES

TABLE 72 ANTIMICROBIAL ADDITIVES MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2016–2019 (KILOTON)

TABLE 73 ANTIMICROBIAL ADDITIVES MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2020–2026 (KILOTON)

TABLE 74 ANTIMICROBIAL ADDITIVES MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2016–2019 (USD MILLION)

TABLE 75 ANTIMICROBIAL ADDITIVES MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2020–2026 (USD MILLION)

10 ANTIMICROBIAL ADDITIVES MARKET, BY REGION (Page No. - 132)

10.1 INTRODUCTION

FIGURE 52 ASIA PACIFIC TO LEAD ANTIMICROBIAL ADDITIVES MARKET BETWEEN 2021 AND 2026

TABLE 76 ANTIMICROBIAL ADDITIVES MARKET SIZE, BY REGION, 2016–2019 (KILOTON)

TABLE 77 ANTIMICROBIAL ADDITIVES MARKET SIZE, BY REGION 2020–2026 (KILOTON)

TABLE 78 ANTIMICROBIAL ADDITIVES MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 79 ANTIMICROBIAL ADDITIVES MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

10.2 ASIA PACIFIC

FIGURE 53 ASIA PACIFIC: ANTIMICROBIAL ADDITIVES MARKET SNAPSHOT

10.2.1 ASIA PACIFIC: ANTIMICROBIAL ADDITIVES MARKET, BY TYPE

TABLE 80 ASIA PACIFIC: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 81 ASIA PACIFIC: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY TYPE 2020–2026 (KILOTON)

TABLE 82 ASIA PACIFIC: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 83 ASIA PACIFIC: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

10.2.2 ASIA PACIFIC: ANTIMICROBIAL ADDITIVES MARKET, BY APPLICATION

TABLE 84 ASIA PACIFIC: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 85 ASIA PACIFIC: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY APPLICATION, 2020–2026 (KILOTON)

TABLE 86 ASIA PACIFIC: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 87 ASIA PACIFIC: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

10.2.3 ASIA PACIFIC: ANTIMICROBIAL ADDITIVES MARKET, BY END-USE INDUSTRY

TABLE 88 ASIA PACIFIC: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 89 ASIA PACIFIC: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (KILOTON)

TABLE 90 ASIA PACIFIC: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 91 ASIA PACIFIC: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD MILLION)

10.2.4 ASIA PACIFIC: ANTIMICROBIAL ADDITIVES MARKET, BY COUNTRY

TABLE 92 ASIA PACIFIC: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 93 ASIA PACIFIC: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY COUNTRY, 2020–2026 (KILOTON)

TABLE 94 ASIA PACIFIC: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 95 ASIA PACIFIC: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

10.2.4.1 China

10.2.4.1.1 Increasing investment in automotive, healthcare, construction, and consumer goods industries driving market

TABLE 96 CHINA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 97 CHINA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (KILOTON)

TABLE 98 CHINA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 99 CHINA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD MILLION)

10.2.4.2 Japan

10.2.4.2.1 Growth of healthcare industry boosting demand for antimicrobial additives

TABLE 100 JAPAN: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 101 JAPAN: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (KILOTON)

TABLE 102 JAPAN: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 103 JAPAN: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD MILLION)

10.2.4.3 India

10.2.4.3.1 Favorable economic policies to drive market

TABLE 104 INDIA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 105 INDIA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (KILOTON)

TABLE 106 INDIA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 107 INDIA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD MILLION)

10.2.4.4 South Korea

10.2.4.4.1 Increasing FDI to generate high demand from end-use industries

TABLE 108 SOUTH KOREA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 109 SOUTH KOREA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (KILOTON)

TABLE 110 SOUTH KOREA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 111 SOUTH KOREA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD MILLION)

10.2.4.5 Indonesia

10.2.4.5.1 Rising use of antimicrobial additives in various end-use industries, including electronics and food & beverage, to drive market

TABLE 112 INDONESIA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 113 INDONESIA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (KILOTON)

TABLE 114 INDONESIA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 115 INDONESIA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD MILLION)

10.2.4.6 Vietnam

10.2.4.6.1 High demand from automotive, packaging, and electronics goods industries to drive demand for antimicrobial additives

TABLE 116 VIETNAM: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 117 VIETNAM: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (KILOTON)

TABLE 118 VIETNAM: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 119 VIETNAM: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD MILLION)

10.2.4.7 Thailand

10.2.4.7.1 Growing usage of antimicrobial additives in packaging supporting demand for antimicrobial additives

TABLE 120 THAILAND: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 121 THAILAND: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (KILOTON)

TABLE 122 THAILAND: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 123 THAILAND: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD MILLION)

10.3 NORTH AMERICA

FIGURE 54 NORTH AMERICA: ANTIMICROBIAL ADDITIVES MARKET SNAPSHOT

10.3.1 NORTH AMERICA: ANTIMICROBIAL ADDITIVES MARKET, BY TYPE

TABLE 124 NORTH AMERICA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 125 NORTH AMERICA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY TYPE, 2020–2026 (KILOTON)

TABLE 126 NORTH AMERICA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 127 NORTH AMERICA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

10.3.2 NORTH AMERICA: ANTIMICROBIAL ADDITIVES MARKET, BY APPLICATION

TABLE 128 NORTH AMERICA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 129 NORTH AMERICA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY APPLICATION, 2020–2026 (KILOTON)

TABLE 130 NORTH AMERICA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 131 NORTH AMERICA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

10.3.3 NORTH AMERICA: ANTIMICROBIAL ADDITIVES MARKET, BY END-USE INDUSTRY

TABLE 132 NORTH AMERICA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 133 NORTH AMERICA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (KILOTON)

TABLE 134 NORTH AMERICA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 135 NORTH AMERICA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD MILLION)

10.3.4 NORTH AMERICA: ANTIMICROBIAL ADDITIVES MARKET, BY COUNTRY

TABLE 136 NORTH AMERICA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 137 NORTH AMERICA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY COUNTRY, 2020–2026 (KILOTON)

TABLE 138 NORTH AMERICA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 139 NORTH AMERICA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

10.3.4.1 US

10.3.4.1.1 Presence of key players fueling demand for antimicrobial additives

TABLE 140 US: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 141 US: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (KILOTON)

TABLE 142 US: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 143 US: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD MILLION)

10.3.4.2 Canada

10.3.4.2.1 Rising demand from automotive, healthcare, and packaging end-use industries to boost market

TABLE 144 CANADA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 145 CANADA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (KILOTON)

TABLE 146 CANADA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 147 CANADA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD MILLION)

10.3.4.3 Mexico

10.3.4.3.1 Construction industry to drive antimicrobial additives market

TABLE 148 MEXICO: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 149 MEXICO: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (KILOTON)

TABLE 150 MEXICO: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 151 MEXICO: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD MILLION)

10.4 EUROPE

FIGURE 55 EUROPE: ANTIMICROBIAL ADDITIVES MARKET SNAPSHOT

10.4.1 EUROPE: ANTIMICROBIAL ADDITIVES MARKET, BY TYPE

TABLE 152 EUROPE: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 153 EUROPE: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY TYPE, 2020–2026 (KILOTON)

TABLE 154 EUROPE: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 155 EUROPE: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

10.4.2 EUROPE: ANTIMICROBIAL ADDITIVES MARKET, BY APPLICATION

TABLE 156 EUROPE: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 157 EUROPE: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY APPLICATION, 2020–2026 (KILOTON)

TABLE 158 EUROPE: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 159 EUROPE: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

10.4.3 EUROPE: ANTIMICROBIAL ADDITIVES MARKET, BY END-USE INDUSTRY

TABLE 160 EUROPE: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 161 EUROPE: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (KILOTON)

TABLE 162 EUROPE: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 163 EUROPE: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD MILLION)

10.4.4 EUROPE: ANTIMICROBIAL ADDITIVES MARKET, BY COUNTRY

TABLE 164 EUROPE: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 165 EUROPE: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY COUNTRY, 2020–2026 (KILOTON)

TABLE 166 EUROPE: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 167 EUROPE: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

10.4.4.1 Germany

10.4.4.1.1 Growth in packaging and automotive end-use industries to drive market

TABLE 168 GERMANY: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 169 GERMANY: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (KILOTON)

TABLE 170 GERMANY: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 171 GERMANY: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD MILLION)

10.4.4.2 Italy

10.4.4.2.1 High investment in healthcare industry to drive market

TABLE 172 ITALY: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 173 ITALY: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (KILOTON)

TABLE 174 ITALY: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 175 ITALY: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD MILLION)

10.4.4.3 France

10.4.4.3.1 Construction and healthcare end-use industries driving demand for antimicrobial additives

TABLE 176 FRANCE: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 177 FRANCE: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (KILOTON)

TABLE 178 FRANCE: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 179 FRANCE: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD MILLION)

10.4.4.4 UK

10.4.4.4.1 High demand from construction and automotive end-use industries to propel market

TABLE 180 UK: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 181 UK: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (KILOTON)

TABLE 182 UK: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 183 UK: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD MILLION)

10.4.4.5 Spain

10.4.4.5.1 Increased consumer spending and developed automotive sector in this country to drive antimicrobial additives market

TABLE 184 SPAIN: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 185 SPAIN: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (KILOTON)

TABLE 186 SPAIN: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 187 SPAIN: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD MILLION)

10.5 MIDDLE EAST & AFRICA

10.5.1 MIDDLE EAST & AFRICA: ANTIMICROBIAL ADDITIVES MARKET, BY TYPE

TABLE 188 MIDDLE EAST & AFRICA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 189 MIDDLE EAST & AFRICA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY TYPE, 2020–2026 (KILOTON)

TABLE 190 MIDDLE EAST & AFRICA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 191 MIDDLE EAST & AFRICA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

10.5.2 MIDDLE EAST & AFRICA: ANTIMICROBIAL ADDITIVES MARKET, BY APPLICATION

TABLE 192 MIDDLE EAST & AFRICA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 193 MIDDLE EAST & AFRICA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY APPLICATION, 2020–2026 (KILOTON)

TABLE 194 MIDDLE EAST & AFRICA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 195 MIDDLE EAST & AFRICA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

10.5.3 MIDDLE EAST & AFRICA: ANTIMICROBIAL ADDITIVES MARKET, BY END-USE INDUSTRY

TABLE 196 MIDDLE EAST & AFRICA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 197 MIDDLE EAST & AFRICA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (KILOTON)

TABLE 198 MIDDLE EAST & AFRICA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 199 MIDDLE EAST & AFRICA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD MILLION)

10.5.4 MIDDLE EAST & AFRICA: ANTIMICROBIAL ADDITIVES MARKET, BY COUNTRY

TABLE 200 MIDDLE EAST & AFRICA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 201 MIDDLE EAST & AFRICA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY COUNTRY, 2020–2026 (KILOTON)

TABLE 202 MIDDLE EAST & AFRICA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 203 MIDDLE EAST & AFRICA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

10.5.4.1 Saudi Arabia

10.5.4.1.1 Healthcare, food & beverage, and construction industries boosting market

TABLE 204 SAUDI ARABIA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 205 SAUDI ARABIA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (KILOTON)

TABLE 206 SAUDI ARABIA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 207 SAUDI ARABIA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD MILLION)

10.5.4.2 UAE

10.5.4.2.1 Rising investment in real estate to drive demand for antimicrobial additives

TABLE 208 UAE: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 209 UAE: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (KILOTON)

TABLE 210 UAE: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 211 UAE: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD MILLION)

10.5.4.3 Qatar

10.5.4.3.1 Foreign direct investments in end-use industries to drive market

TABLE 212 QATAR: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 213 QATAR: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (KILOTON)

TABLE 214 QATAR: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 215 QATAR: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD MILLION)

10.5.4.4 South Africa

10.5.4.4.1 Growing demand from packaging industry to fuel market growth

TABLE 216 SOUTH AFRICA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 217 SOUTH AFRICA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (KILOTON)

TABLE 218 SOUTH AFRICA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 219 SOUTH AFRICA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD MILLION)

10.6 SOUTH AMERICA

10.6.1 SOUTH AMERICA: ANTIMICROBIAL ADDITIVES MARKET, BY TYPE

TABLE 220 SOUTH AMERICA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 221 SOUTH AMERICA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY TYPE, 2020–2026 (KILOTON)

TABLE 222 SOUTH AMERICA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 223 SOUTH AMERICA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

10.6.2 SOUTH AMERICA: ANTIMICROBIAL ADDITIVES MARKET, BY APPLICATION

TABLE 224 SOUTH AMERICA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 225 SOUTH AMERICA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY APPLICATION, 2020–2026 (KILOTON)

TABLE 226 SOUTH AMERICA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 227 SOUTH AMERICA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

10.6.3 SOUTH AMERICA: ANTIMICROBIAL ADDITIVES MARKET, BY END-USE INDUSTRY

TABLE 228 SOUTH AMERICA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 229 SOUTH AMERICA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (KILOTON)

TABLE 230 SOUTH AMERICA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 231 SOUTH AMERICA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD MILLION)

10.6.4 SOUTH AMERICA: ANTIMICROBIAL ADDITIVES MARKET, BY COUNTRY

TABLE 232 SOUTH AMERICA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 233 SOUTH AMERICA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY COUNTRY, 2020–2026 (KILOTON)

TABLE 234 SOUTH AMERICA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 235 SOUTH AMERICA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

10.6.4.1 Brazil

10.6.4.1.1 Economic growth to drive market for antimicrobial additives

TABLE 236 BRAZIL: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 237 BRAZIL: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (KILOTON)

TABLE 238 BRAZIL: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 239 BRAZIL: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD MILLION)

10.6.4.2 Argentina

10.6.4.2.1 Increase in infrastructure projects to drive demand from construction industry

TABLE 240 ARGENTINA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 241 ARGENTINA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (KILOTON)

TABLE 242 ARGENTINA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 243 ARGENTINA: ANTIMICROBIAL ADDITIVES MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD MILLION)

10.6.4.3 Venezuela

10.6.4.3.1 Healthcare end-use industry to drive demand for antimicrobial additives

11 COMPETITIVE LANDSCAPE (Page No. - 217)

11.1 INTRODUCTION

11.2 STRATEGIES ADOPTED BY KEY PLAYERS

TABLE 244 OVERVIEW OF STRATEGIES ADOPTED BY KEY ANTIMICROBIAL ADDITIVE MANUFACTURERS

11.3 MARKET SHARE ANALYSIS

11.3.1 RANKING OF KEY MARKET PLAYERS, 2020

FIGURE 56 RANKING OF TOP FIVE PLAYERS IN ANTIMICROBIAL ADDITIVES MARKET, 2020

11.3.2 MARKET SHARE OF KEY PLAYERS

TABLE 245 ANTIMICROBIAL ADDITIVES MARKET: DEGREE OF COMPETITION

FIGURE 57 DUPONT DE NEMOURS INC WAS LEADING PLAYER IN ANTIMICROBIAL ADDITIVES MARKET IN 2020

11.3.2.1 DuPont De Nemours Inc.

11.3.2.2 BASF SE

11.3.2.3 Avient Corporation

11.3.2.4 Microban International Ltd.

11.3.2.5 Sanitized AG

11.3.3 REVENUE ANALYSIS OF TOP FIVE PLAYERS

FIGURE 58 REVENUE ANALYSIS OF KEY COMPANIES IN PAST FIVE YEARS

11.4 COMPANY PRODUCT FOOTPRINT ANALYSIS

FIGURE 59 ANTIMICROBIAL ADDITIVES MARKET: COMPANY FOOTPRINT

TABLE 246 ANTIMICROBIAL ADDITIVES MARKET: END-USE INDUSTRY FOOTPRINT

TABLE 247 ANTIMICROBIAL ADDITIVES MARKET: APPLICATION FOOTPRINT

TABLE 248 ANTIMICROBIAL ADDITIVES MARKET: COMPANY REGION FOOTPRINT

11.5 COMPANY EVALUATION QUADRANT (TIER 1)

11.5.1 STARS

11.5.2 EMERGING LEADERS

11.5.3 PARTICIPANTS

FIGURE 60 COMPANY EVALUATION QUADRANT FOR ANTIMICROBIAL ADDITIVES MARKET (TIER 1)

11.6 START-UP/SMES EVALUATION QUADRANT

TABLE 249 ANTIMICROBIAL ADDITIVES MARKET: DETAILED LIST OF KEY STARTUP/SMES

11.6.1 PROGRESSIVE COMPANIES

11.6.2 RESPONSIVE COMPANIES

11.6.3 STARTING BLOCKS

FIGURE 61 START-UP/SMES EVALUATION MATRIX FOR ANTIMICROBIAL ADDITIVES MARKET

11.7 COMPETITIVE SITUATION AND TRENDS

11.7.1 NEW PRODUCT LAUNCHES

TABLE 250 ANTIMICROBIAL ADDITIVES MARKET: NEW PRODUCT LAUNCHES (2018–2021)

11.7.2 DEALS

TABLE 251 ANTIMICROBIAL ADDITIVES MARKET: DEALS (2018–2021)

11.7.3 OTHER DEVELOPMENTS

TABLE 252 ANTIMICROBIAL ADDITIVES MARKET: EXPANSIONS, INVESTMENTS, AND INNOVATIONS (2016–2021)

12 COMPANY PROFILES (Page No. - 233)

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

12.1 MAJOR PLAYERS

12.1.1 BASF SE

FIGURE 62 BASF SE: COMPANY SNAPSHOT

TABLE 253 BASF SE: COMPANY OVERVIEW

12.1.2 DUPONT DE NEMOURS, INC.

FIGURE 63 DUPONT DE NEMOURS, INC.: COMPANY SNAPSHOT

TABLE 254 DUPONT DE NEMOURS, INC.: COMPANY OVERVIEW

12.1.3 MICROBAN INTERNATIONAL LTD.

TABLE 255 MICROBAN INTERNATIONAL LTD.: COMPANY OVERVIEW

12.1.4 SANITIZED AG

TABLE 256 SANITIZED AG: COMPANY OVERVIEW

12.1.5 LYONDELLBASELL

FIGURE 64 LYONDELLBASELL: COMPANY SNAPSHOT

TABLE 257 LYONDELLBASELL: COMPANY OVERVIEW

12.1.6 AVIENT CORPORATION

FIGURE 65 AVIENT CORPORATION: COMPANY SNAPSHOT

TABLE 258 AVIENT CORPORATION: BUSINESS OVERVIEW

12.1.7 BIOCOTE

TABLE 259 BIOCOTE: COMPANY OVERVIEW

12.1.8 MILLIKEN CHEMICAL

TABLE 260 MILLIKEN CHEMICAL: BUSINESS OVERVIEW

12.1.9 KING PLASTIC CORPORATION

TABLE 261 KING PLASTIC CORPORATION: COMPANY OVERVIEW

12.1.10 STERITOUCH LTD.

TABLE 262 STERITOUCH LTD.: COMPANY OVERVIEW

12.1.11 LIFE MATERIAL TECHNOLOGIES LIMITED

TABLE 263 LIFE MATERIAL TECHNOLOGIES LIMITED: BUSINESS OVERVIEW

12.2 OTHER MARKET PLAYERS

12.2.1 RTP COMPANY

TABLE 264 RTP COMPANY: COMPANY OVERVIEW

12.2.2 ADDMASTER LIMITED

TABLE 265 ADDMASTER LIMITED: COMPANY OVERVIEW

12.2.3 CROMA COLOR CORPORATION

TABLE 266 CROMA COLOR CORPORATION: COMPANY OVERVIEW

12.2.4 NOLLA ANTIMICROBIAL LTD.

TABLE 267 NOLLA ANTIMICROBIAL LTD.: COMPANY OVERVIEW

12.2.5 SCIESSENT LLC

TABLE 268 SCIESSENT LLC.: COMPANY OVERVIEW

12.2.6 SHANGHAI LANGYI FUNCTIONAL MATERIALS CO., LTD.

TABLE 269 SHANGHAI LANGYI FUNCTIONAL MATERIALS CO., LTD: COMPANY OVERVIEW

12.2.7 BIOSAFE INC.

TABLE 270 BIOSAFE INC.: COMPANY OVERVIEW

12.2.8 TEKNOR APEX

TABLE 271 TEKNOR APEX: COMPANY OVERVIEW

12.2.9 TROY CORPORATION

TABLE 272 TROY CORPORATION: COMPANY OVERVIEW

12.2.10 MOMENTIVE PERFORMANCE MATERIALS INC.

TABLE 273 MOMENTIVE PERFORMANCE MATERIALS INC.: COMPANY OVERVIEW

12.2.11 ARKEMA GROUP

TABLE 274 ARKEMA GROUP: COMPANY OVERVIEW

12.2.12 PARX MATERIALS

TABLE 275 PARX MATERIALS: COMPANY OVERVIEW

12.2.13 POREX CORPORATION

TABLE 276 POREX CORPORATION: COMPANY OVERVIEW

12.2.14 AMERICHEM INC.

TABLE 277 AMERICHEM INC.: COMPANY OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

13 ADJACENT & RELATED MARKETS (Page No. - 264)

13.1 INTRODUCTION

13.2 LIMITATION

13.3 THERMAL ENERGY STORAGE MARKET

13.3.1 MARKET DEFINITION

13.3.2 MARKET OVERVIEW

13.4 PLASTIC ADDITIVES MARKET, BY REGION

TABLE 278 PLASTIC ADDITIVES MARKET SIZE, BY REGION, 2016–2019 (KILOTON)

TABLE 279 PLASTIC ADDITIVES MARKET SIZE, BY REGION, 2020–2026 (KILOTON)

TABLE 280 PLASTIC ADDITIVES MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 281 PLASTIC ADDITIVES MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

13.4.1 ASIA PACIFIC

13.4.1.1 By country

TABLE 282 ASIA PACIFIC: PLASTIC ADDITIVES MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 283 ASIA PACIFIC: PLASTIC ADDITIVES MARKET SIZE, BY COUNTRY, 2020–2026 (KILOTON)

TABLE 284 ASIA PACIFIC: PLASTIC ADDITIVES MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 285 ASIA PACIFIC: PLASTIC ADDITIVES MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

13.4.2 EUROPE

13.4.2.1 By country

TABLE 286 EUROPE: PLASTIC ADDITIVES MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 287 EUROPE: PLASTIC ADDITIVES MARKET SIZE, BY COUNTRY, 2020–2026 (KILOTON)

TABLE 288 EUROPE: PLASTIC ADDITIVES MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 289 EUROPE: PLASTIC ADDITIVES MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

13.4.3 NORTH AMERICA

13.4.3.1 By country

TABLE 290 NORTH AMERICA: PLASTIC ADDITIVES MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 291 NORTH AMERICA: PLASTIC ADDITIVES MARKET SIZE, BY COUNTRY, 2020–2026 (KILOTON)

TABLE 292 NORTH AMERICA: PLASTIC ADDITIVES MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 293 NORTH AMERICA: PLASTIC ADDITIVES MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

13.4.4 MIDDLE EAST & AFRICA

13.4.4.1 By country

TABLE 294 MIDDLE EAST & AFRICA: PLASTIC ADDITIVES MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 295 MIDDLE EAST & AFRICA: PLASTIC ADDITIVES MARKET SIZE, BY COUNTRY, 2020–2026 (KILOTON)

TABLE 296 MIDDLE EAST & AFRICA: PLASTIC ADDITIVES MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 297 MIDDLE EAST & AFRICA: PLASTIC ADDITIVES MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

13.4.5 SOUTH AMERICA

13.4.5.1 By country

TABLE 298 SOUTH AMERICA: PLASTIC ADDITIVES MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 299 SOUTH AMERICA: PLASTIC ADDITIVES MARKET SIZE, BY COUNTRY, 2020–2026 (KILOTON)

TABLE 300 SOUTH AMERICA: PLASTIC ADDITIVES MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 301 SOUTH AMERICA: PLASTIC ADDITIVES MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

14 APPENDIX (Page No. - 274)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

Additives Market Overview

The Additives Market is a rapidly growing industry that offers a variety of specialty chemicals that are added to various materials to enhance their properties. These materials can include plastics, coatings, adhesives, and more. The global additives market is projected to reach a value of USD 91.86 billion by 2025, growing at a CAGR of 6.3% during the forecast period.

Antimicrobial Additives are a type of Additives that are used in various materials to inhibit the growth of microorganisms such as bacteria, fungi, and viruses. They are commonly used in the healthcare industry, food packaging, and consumer goods.

The increasing demand for antimicrobial additives due to the growing concern for health and hygiene is expected to drive the growth of the global antimicrobial additives market. The use of antimicrobial additives in the packaging of food and beverages, healthcare facilities, and other consumer goods is expected to increase in the future.

Futuristic Growth Use-cases of Additives Market

Some of the futuristic growth use-cases of the Additives Market include the development of sustainable and eco-friendly additives, the use of advanced technology in manufacturing processes, and the use of additives in the aerospace industry to improve the performance of materials used in aircraft.

Top Players in Additives Market

Some of the top players in the Additives Market include BASF SE, Clariant International Ltd., Evonik Industries AG, Solvay S.A., and The Dow Chemical Company.

Additives Market Impact on Different Industries

The Additives Market is expected to impact several industries in the future, including automotive, construction, packaging, and healthcare. The use of additives in these industries is expected to increase due to the growing demand for improved performance, increased efficiency, and safety.

Speak to our Analyst today to know more about Additives Market!

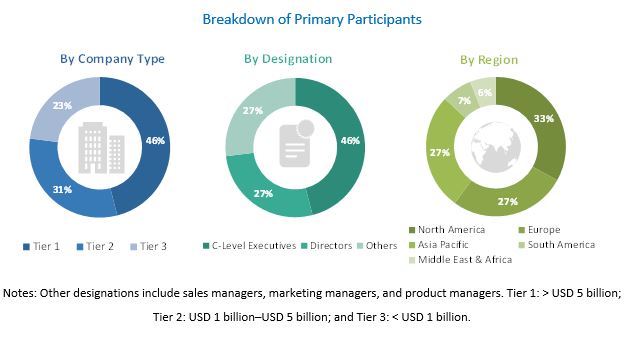

The study involved four major activities in estimating the market size for the antimicrobial additives market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Post that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. Findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives.

Primary Research

The antimicrobial additives market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of end-use industries. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the antimicrobial additives market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

The key players in the industry were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the healthcare, packaging, automotive and construction industry among others.

Report Objectives

- To analyze and forecast the size of the antimicrobial additives market in terms of value and volume

- To provide detailed information regarding key factors, such as drivers, restraints, challenges and opportunities influencing the growth of the market

- To define, describe, and segment the antimicrobial additives market based on type, application and end-use industry.

- To forecast the size of the market segments for regions such as APAC, North America, Europe, South America, and the Middle East & Africa

- To strategically analyze the segmented markets with respect to individual growth trends, prospects, and contribution to the overall market

- To identify and analyze opportunities for stakeholders in the market

- To strategically profile key players and comprehensively analyze their core competencies

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional type

Company Information

- Detailed analysis and profiles of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Antimicrobial Additives Market