Antimicrobial Plastics Market by Additive (Inorganic, Organic), Type (Commodity Plastics, Engineering Plastics, High Performance Plastics), Application (Packaging, Automotive, Medical & Healthcare, Consumer Goods), & Region - Global Forecast to 2028

Updated on : September 24, 2025

Antimicrobial Plastics Market

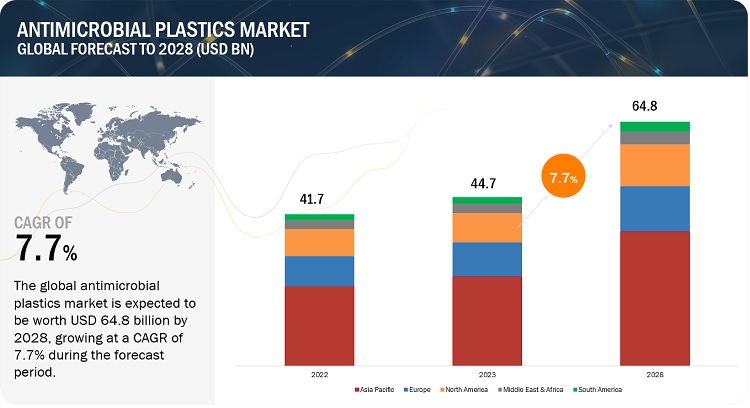

The antimicrobial plastics market size is projected to grow from USD 44.7 billion in 2023 to USD 64.8 billion by 2028, at a CAGR of 7.7%. Packaging industry is one of the major consumer of antimicrobial plastics, especially for food packaging application. This growth is due to the emergence of e-commerce platforms. Packaging has become a necessity for marketing to attract customers. In 2021, the US Food and Drug Administration (FDA) has issued a final rule which allows the use of certain antimicrobial substances in food contact surface materials, including plastics.

Antimicrobial Plastics Market Forecast & Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Attractive Opportunities in the Antimicrobial Plastics Market

Antimicrobial Plastics Market Dynamics

Driver: Growing awareness pertaining to antimicrobial plastics

According to Centers for Medicare & Medicaid Services (CMS) the National Health Expenditures (NHE) and Gross Domestic Product (GDP) of US are projected to grow 5.1% annually up to 2030. However, the NHE patterns are pointedly influenced by the COVID-19 pandemic. In addition, even with social distancing, facemasks, and strict hygiene measures, it is nearly impossible to keep every surface sanitized. Hence, there is a need for self-cleansing property to neutralize the surface from contaminant pathogens and reduce the risk of possible spread. Hence, the awareness of antimicrobial plastics has increased, so there is a strong demand for antimicrobial plastics industry in various applications.

Restraints: Volatility in raw material prices

Plastic is a petrochemical-based material, which is mainly obtained from natural gas and oil; volatility in the prices of these resources affects the price of plastic products. Manufacturers of antimicrobial plastics find it difficult to innovate new products due to price fluctuation, thus impacting their operating profits. There are also cost pressures from customers, and the end-users have to adjust between the cost and performance tradeoff, thereby affecting the performance of final products and their profit margins.

Opportunities : Growth of textile industry

From fiber, yarn, and fabric to garments, global textile and apparel industry has strengths along the whole value chain. India and China are one of the largest textile market across the globe. The traditional handloom, handicrafts, wool, and silk items, as well as the organised textile industry in India, make up a large portion of the widely diversified Indian textile and apparel market. With the advancement of nanotechnology in textile manufacturing, antimicrobials can be implemented in various technical and non-technical textiles. This is expected to create new opportunities for the antimicrobial plastics and additives market in textile industry.

Challenges: Disposal of plastics

Antimicrobial plastics are made of thermoplastics, which is hazardous to the environment. Currently, the recycling rate of plastics worldwide is very low compared to its production; as a result, poor disposal of plastics is done, which is harmful to the environment. This causes slow decomposition, thus creating microplastics and further causing leaking in the ecosystem. Considering these issues, many countries have banned the use of plastics, promoting environmental awareness and limited consumption. Even the biodegradable plastics are biodegradable, they still need to be properly disposed of, as they can release harmful chemicals and pollutants if not treated appropriately. Additionally, there are concerns about the impact of biodegradable plastics on the environment cycle, as they can affect nutrient availability and soil microorganisms

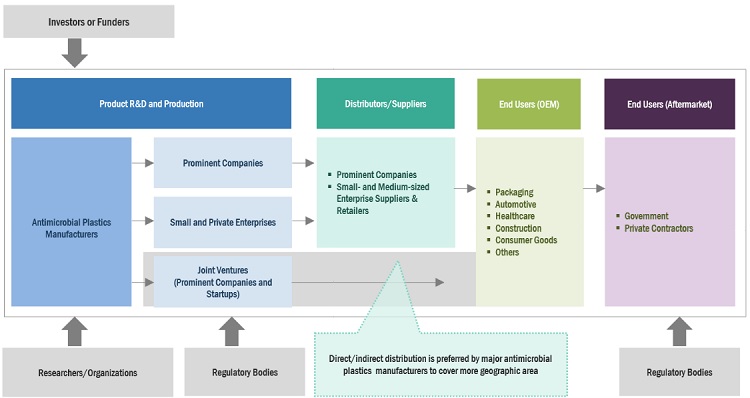

Antimicrobial Plastics Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of antimicrobial plastics. These companies have been in business for a while and have a broad range of products, cutting-edge technologies, and robust international sales and marketing networks. Prominent companies in this market include DuPont De Nemours, Inc. (US), BASF SE (Germany), Microban International (US), Sanitized AG (Germany), Biocote Limited (UK), Avient Corporation (US), and King Plastic Corporation (US).

Based on additive, inorganic is projected to hold the largest market share of antimicrobial plastics.

Inorganic additive are expected to dominate the antimicrobial plastics market during the forecast period. This is majorly due to their advanced properties. Also the increasing demand from major end-use industries including healthcare, packaging, automotive and building & construction is expected to fuel the demand for inorganic additive in antimicrobial plastics industry.

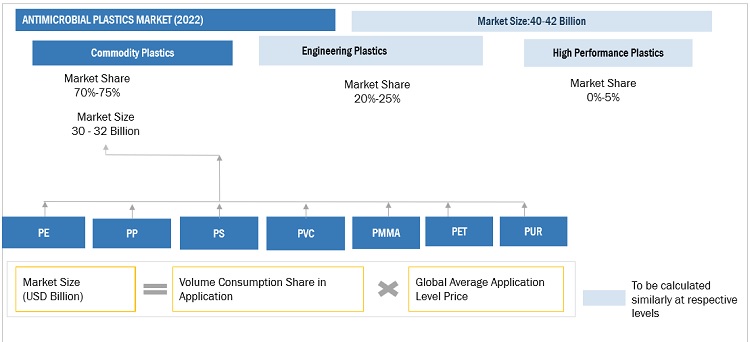

Based on type, commodity plastics was the largest segment for antimicrobial plastics market, in terms of value, in 2022.

Commodity plastics are the in large quantities for a variety of applications. They are used in applications where mechanical properties and service environments are not critical. PE, PP, PS, PVC, PMMA, PET, and PUR are some of the most common used commodity plastics considered for the study. Commodity plastics are manufactured in large quantities and are low cost for the most common disposable items and durable goods such as food containers, lids, packaging films, and trash containers. The extensive applications, easy availability, and low-cost materials are the key factors driving the commodity plastics market.

Based on application, medical & healthcare was the largest segment for antimicrobial plastics market, in terms of value, in 2022.

The medical & healthcare segment led the antimicrobial plastics industry due to the rising spread of life-threatening diseases such as H1N1, nosocomial infections, COVID-19, and other health-related issues.. Innovation in the healthcare industry, for instance, the development of non-toxic plastic equipment, is anticipated to fuel the antimicrobial plastics market. Antimicrobial plastics are used in surgical and medical devices including catheters, cubicle curtains, beds, and dental implants.

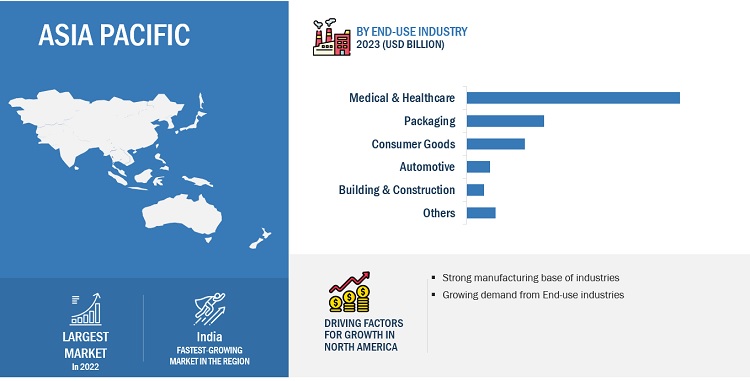

“Asia Pacific accounted for the largest market share for antimicrobial plastics market industry, in terms of value, in 2022”

The antimicrobial plastics market in Asia Pacific is led by the medical & healthcare and automotive segment mainly due to the rising awareness about the use of antimicrobial plastics in vehicles and medical devices to decrease the prevalence of infections. Mobility requirements for people and commodities have expanded in Asian nations due to rapid urbanization, economic success, and a growing population. Despite increased passenger travel anticipated, few people own cars. Because of this imbalance, automotive service providers now have a huge advantage in the Asia Pacific market, which is predominantly dominated by a young population. This demand for new and advanced vehicles is expected to drive the market for antimicrobial plastics in Asia Pacific region.

To know about the assumptions considered for the study, download the pdf brochure

Antimicrobial Plastics Market Players

The key players profiled in the report include DuPont De Nemours, Inc. (US), BASF SE (Germany), Microban International (US), Sanitized AG (Germany), Biocote Limited (UK), Avient Corporation (US), and King Plastic Corporation (US) among others, are the key manufacturers that secured major market share in the last few years. Major focus was given to the contracts and new product development due to the changing requirements of commercial, homeland security and defense & space users across the world.

Antimicrobial Plastics Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2022 |

USD 41.7 Billion |

|

Revenue Forecast in 2028 |

USD 64.8 Billion |

|

CAGR |

7.7% |

|

Years considered for the study |

2017–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Volume (Kiloton) and Value (USD Million/Billion) |

|

Segments covered |

Additive, Type, Application, and Region |

|

Regions covered |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies profiled |

The key players profiled in the report include DuPont De Nemours, Inc. (US), BASF SE (Germany), Microban International (US), Sanitized AG (Germany), Biocote Limited (UK), Avient Corporation (US), and King Plastic Corporation (US). |

This report categorizes the global antimicrobial plastics market based on additive, type, application, and region.

On the basis of additive, the antimicrobial plastics market has been segmented as follows:

-

Inorganic

- Silver

- Zinc

- Copper

-

Organic

- OBPA

- Triclosan

On the basis of type, the antimicrobial plastics market has been segmented as follows:

-

Commodity Plastics

- PP

- PE

- PVC

- PS

- PMMA

- PET

- PUR

-

Engineering Plastics

- ABS

- PC

- PA

- POM

- Others

- High Performance Plastics

On the basis of application, the antimicrobial plastics market has been segmented as follows:

- Packaging

- Medical & Healthcare

- Automotive

- Building & Construction

- Consumer Goods

- Others

On the basis of region, the antimicrobial plastics market has been segmented as follows:

- Asia Pacific

- North America

- Europe

- Middle East & Arica

- South America

Recent Developments

- In April 2020, Cummins Inc. and DuPont Company partnered to supply an antimicrobial additive for N95 respiratory masks. They combined Cummins's NanoNet & NanoForce Technology with DuPont's Hybrid Membrane Technology to make the material.

- In April 2021, Microban International partnered with Continental Accessory and launched the first collection of office and school supplies. These supplies, like notebooks, pencil pouches, and portfolio covers, have antimicrobial properties.

- In November 2021, Microban International partnered with Sunbeam Products, Inc. to manufacture antimicrobial knife handles to make the handles hygienic and bacteria-free.

- In August 2021, Microban International partnered with Verbatim to manufacture USB drives with antimicrobial protection to keep devices safe from bacterial growth.

Frequently Asked Questions (FAQ):

What are the major developments impacting the market?

The demand for plastics in automotive is expected to shift market trends.

Who are major players in antimicrobial plastics market?

The key players profiled in the report include DuPont De Nemours, Inc. (US), BASF SE (Germany), Microban International (US), Sanitized AG (Germany), Biocote Limited (UK), Avient Corporation (US), and King Plastic Corporation (US).

What is the emerging application of antimicrobial plastics?

Consumer goods and sports is the emerging application for antimicrobial plastics market during the forecast period.

What are the various strategies key players are focusing within antimicrobial plastics market?

Key players are majorly focused on new product launch and partnering with local or regional players within the market, in order to attract larger market share globally.

What are the major factors restraining antimicrobial plastics market growth during the forecast period?

Government regulations and ban on the use of plastic in certain countries and disposal of plastics are some of the major restraints for the market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing awareness pertaining to antimicrobial plastics- Expansion of various end-use industriesRESTRAINTS- Volatility in raw material prices- Stringent rules and regulations on usage of plastics in certain applicationsOPPORTUNITIES- Growth of textile industryCHALLENGES- Disposal of plastics

-

5.3 PORTER'S FIVE FORCES ANALYSISTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTSBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.4 MACROECONOMIC INDICATORSGDP TRENDS AND FORECAST FOR MAJOR ECONOMIES

-

6.1 SUPPLY CHAIN ANALYSISRAW MATERIAL SUPPLIERMANUFACTURERDISTRIBUTION TO END USERS

-

6.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSESREVENUE SHIFT & REVENUE POCKETS OF ANTIMICROBIAL PLASTICS MARKET

-

6.3 CONNECTED MARKETS: ECOSYSTEM

-

6.4 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

6.5 PRICING ANALYSISAVERAGE SELLING PRICE OF KEY PLAYERS, BY APPLICATIONAVERAGE SELLING PRICE, BY REGION

-

6.6 TECHNOLOGY ANALYSISSILVER ADDITIVESCOPPER ADDITIVESZINC ADDITIVES

-

6.7 CASE STUDIESAVIENT CORPORATION SAVED 30% COST ANNUALLY FOR PRIVATE LABEL TOOTHBRUSH AND DENTAL CARE PRODUCT MANUFACTURERCASE STUDY ON ANTIMICROBIAL SMARTPHONE ACCESSORIES

-

6.8 TRADE DATA STATISTICSIMPORT SCENARIO OF ANTIMICROBIAL PLASTICSEXPORT SCENARIO OF ANTIMICROBIAL PLASTICS

-

6.9 TARIFF AND REGULATORY FRAMEWORKREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSREGULATIONS RELATED TO ANTIMICROBIAL PLASTICS

- 6.10 KEY CONFERENCES & EVENTS IN 2023

-

6.11 PATENT ANALYSISAPPROACHDOCUMENT TYPEJURISDICTION ANALYSISTOP APPLICANTS

- 7.1 INTRODUCTION

-

7.2 INORGANICSILVERZINCCOPPER

-

7.3 ORGANICOXYBISPHENOXARSINE (OBPA)TRICLOSAN

- 8.1 INTRODUCTION

-

8.2 COMMODITY PLASTICSWIDESPREAD APPLICATIONS, EASY AVAILABILITY, AND LOW COST TO DRIVE MARKET DEMANDPOLYETHYLENE (PE)- Growing building & construction sector in Asia Pacific to drive demandPOLYPROPYLENE (PP)- Growing use in packaging and automotive sector to fuel market demandPOLYSTYRENE (PS)- Growing consumer goods sector to boost marketPOLYVINYL CHLORIDE (PVC)- Excellent electrical insulation property to increase demand for PVCPOLYMETHYL-METHACRYLATE (PMMA)- Electronics, automotive, and construction industries support PMMA marketPOLYETHYLENE TEREPHTHALATE (PET)- Expanding manufacturing sector in Asia Pacific to drive demandPOLYURETHANE (PUR)- Growing demand for automotive and construction to boost market

-

8.3 ENGINEERING PLASTICSDEMAND FOR LIGHTER, FLEXIBLE, AND DURABLE MATERIALS TO DRIVE MARKETACRYLONITRILE BUTADIENE STYRENE (ABS)- Technological advancements in electronics industry to drive marketPOLYCARBONATE (PC)- Favorable characteristics of PC to fuel market demandPOLYAMIDE (PA)- Good mechanical capacity, strength, toughness, and other properties to drive marketPOLYOXYMETHYLENE (POM)- Superior properties to increase usage in various industriesOTHER ENGINEERING PLASTICS

-

8.4 HIGH PERFORMANCE PLASTICSMEDICAL & HEALTHCARE AND AUTOMOTIVE APPLICATIONS TO LEAD TO MARKET GROWTH

- 9.1 INTRODUCTION

-

9.2 PACKAGINGGROWING AWARENESS ABOUT HEALTH AND HYGIENE TO DRIVE MARKET

-

9.3 AUTOMOTIVEEXPECTED RISE IN AUTOMOTIVE PRODUCTION IN ASIA PACIFIC TO FUEL DEMAND

-

9.4 CONSUMER GOODSGROWING POPULATION AND RAPID URBANIZATION TO DRIVE MARKET

-

9.5 MEDICAL & HEALTHCAREINCREASING CONSUMER AWARENESS ABOUT PERSONAL HYGIENE AND QUALITY OF MEDICAL EQUIPMENT TO BOOST DEMAND

-

9.6 BUILDING & CONSTRUCTIONINCREASING INVESTMENTS IN CONSTRUCTION INDUSTRY TO FUEL DEMAND

- 9.7 OTHERS

- 10.1 INTRODUCTION

-

10.2 ASIA PACIFICIMPACT OF RECESSIONASIA PACIFIC ANTIMICROBIAL PLASTICS MARKET, BY TYPEASIA PACIFIC ANTIMICROBIAL PLASTICS MARKET, BY APPLICATIONASIA PACIFIC ANTIMICROBIAL PLASTICS MARKET, BY COUNTRY- China- Japan- India- South Korea- Indonesia- Thailand- Malaysia- Australia & New Zealand

-

10.3 NORTH AMERICAIMPACT OF RECESSIONNORTH AMERICA ANTIMICROBIAL PLASTICS MARKET, BY TYPENORTH AMERICA ANTIMICROBIAL PLASTICS MARKET, BY APPLICATIONNORTH AMERICA ANTIMICROBIAL PLASTICS MARKET, BY COUNTRY- US- Canada- Mexico

-

10.4 EUROPEIMPACT OF RECESSIONEUROPE ANTIMICROBIAL PLASTICS MARKET, BY TYPEEUROPE ANTIMICROBIAL PLASTICS MARKET, BY APPLICATIONEUROPE ANTIMICROBIAL PLASTICS MARKET, BY COUNTRY- Germany- Russia- Italy- France- UK- Spain

-

10.5 MIDDLE EAST & AFRICAIMPACT OF RECESSIONMIDDLE EAST & AFRICA ANTIMICROBIAL PLASTICS MARKET, BY TYPEMIDDLE EAST & AFRICA ANTIMICROBIAL PLASTICS MARKET, BY APPLICATIONMIDDLE EAST & AFRICA ANTIMICROBIAL PLASTICS MARKET, BY COUNTRY- Iran- Saudi Arabia- South Africa- UAE

-

10.6 SOUTH AMERICAIMPACT OF RECESSIONSOUTH AMERICA ANTIMICROBIAL PLASTICS MARKET, BY TYPESOUTH AMERICA ANTIMICROBIAL PLASTICS MARKET, BY APPLICATIONSOUTH AMERICA ANTIMICROBIAL PLASTICS MARKET, BY COUNTRY- Brazil

- 11.1 INTRODUCTION

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

-

11.3 MARKET SHARE ANALYSISDUPONT DE NEMOURS, INC.BASF SEMICROBAN INTERNATIONAL, LTD.SANITIZED AG

- 11.4 RANKING OF KEY MARKET PLAYERS

- 11.5 REVENUE ANALYSIS OF KEY MARKET PLAYERS, 2018–2022

- 11.6 COMPANY PRODUCT FOOTPRINT ANALYSIS

-

11.7 COMPANY EVALUATION QUADRANT (TIER 1)STARSEMERGING LEADERSPARTICIPANTSPERVASIVE PLAYERS

- 11.8 STARTUP/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION QUADRANT

-

11.9 STARTUP/SME EVALUATION QUADRANTPROGRESSIVE COMPANIESRESPONSIVE COMPANIESSTARTING BLOCKSDYNAMIC COMPANIES

-

11.10 COMPETITIVE SCENARIOSPRODUCT LAUNCHESDEALSOTHER DEVELOPMENTS

-

12.1 MAJOR PLAYERSDUPONT DE NEMOURS, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBASF SE- Business overview- Products/Solutions/Services offered- MnM viewMICROBAN INTERNATIONAL, LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MNM viewAVIENT CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewPARX MATERIALS N.V.- Business overview- Products/Solutions/Services offered- Recent developments- MNM viewSANITIZED AG- Business overview- Products/Solutions/Services offered- Recent developmentsBIOCOTE LIMITED- Business overview- Products/Solutions/Services offered- Recent developmentsKING PLASTIC CORPORATION- Business overview- Products/Solutions/Services offered- Recent developmentsMILLIKEN & COMPANY- Business overview- Products/Solutions/Services offeredRTP COMPANY- Business overview- Products/Solutions/Services offered

-

12.2 OTHER KEY MARKET PLAYERSAMERICHEM INC.TEKNOR APEX COMPANYPOLYGIENE GROUP ABSCIESSENT LLCVALTRIS SPECIALTY CHEMICALSBIOSAFE INC.POLYCHEM ALLOY INC.AMERICAN POLYFILM, INC.POREX CORPORATIONCHROMA COLOR CORPORATIONCELANESE CORPORATIONPALRAM INDUSTRIES LTD.WELL PLASTICS LTD.RAY PRODUCTSORGANIC PLAST

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

-

13.3 ENGINEERING PLASTICS MARKETMARKET DEFINITIONMARKET OVERVIEWENGINEERING PLASTICS MARKET, BY REGION- Asia Pacific- Europe- North America- Middle East & Africa- South America

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 NATURAL GAS AND OIL PRICES (USD PER BARREL)

- TABLE 2 TEXTILE INDUSTRY, BY COUNTRY/REGION, 2018–2025 (USD BILLION)

- TABLE 3 PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 GDP TRENDS AND FORECAST, BY MAJOR ECONOMIES, 2020–2027 (USD BILLION)

- TABLE 5 ANTIMICROBIAL PLASTICS MARKET ECOSYSTEM

- TABLE 6 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

- TABLE 7 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 8 AVERAGE SELLING PRICES OF KEY PLAYERS FOR TOP THREE APPLICATIONS (USD/KG)

- TABLE 9 AVERAGE SELLING PRICES OF ANTIMICROBIAL PLASTICS, BY REGION, 2021–2028 (USD/KG)

- TABLE 10 IMPORTS OF ANTIMICROBIAL PLASTICS, BY REGION, 2013–2021 (USD MILLION)

- TABLE 11 EXPORTS OF ANTIMICROBIAL PLASTICS, BY REGION, 2013–2021 (MILLION)

- TABLE 12 DETAILED LIST OF CONFERENCES & EVENTS

- TABLE 13 PATENT APPLICATIONS ARE 51% OF TOTAL COUNT

- TABLE 14 LIST OF PATENTS BY ECOLAB, INC.

- TABLE 15 LIST OF PATENTS BY BASF SE

- TABLE 16 TOP 10 PATENT OWNERS IN US, 2012–2022

- TABLE 17 ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2017–2021 (KILOTON)

- TABLE 18 ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 19 ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 20 ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 21 COMMODITY PLASTICS: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2017–2021 (KILOTON)

- TABLE 22 COMMODITY PLASTICS: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2022–2028 (KILOTON)

- TABLE 23 COMMODITY PLASTICS: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 24 COMMODITY PLASTICS: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 25 PE: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2017–2021 (KILOTON)

- TABLE 26 PE: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2022–2028 (KILOTON)

- TABLE 27 PE: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 28 PE: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 29 PP: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2017–2021 (KILOTON)

- TABLE 30 PP: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2022–2028 (KILOTON)

- TABLE 31 PP: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 32 PP: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 33 PS: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2017–2021 (KILOTON)

- TABLE 34 PS: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2022–2028 (KILOTON)

- TABLE 35 PS: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 36 PS: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 37 PVC: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2017–2021 (KILOTON)

- TABLE 38 PVC: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2022–2028 (KILOTON)

- TABLE 39 PVC: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 40 PVC: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 41 PMMA: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2017–2021 (KILOTON)

- TABLE 42 PMMA: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2022–2028 (KILOTON)

- TABLE 43 PMMA: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 44 PMMA: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 45 PET: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2017–2021 (KILOTON)

- TABLE 46 PET: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2022–2028 (KILOTON)

- TABLE 47 PET: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 48 PET: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 49 PUR: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2017–2021 (KILOTON)

- TABLE 50 PUR: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2022–2028 (KILOTON)

- TABLE 51 PUR: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 52 PUR: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 53 ENGINEERING PLASTICS: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2017–2021 (KILOTON)

- TABLE 54 ENGINEERING PLASTICS: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2022–2028 (KILOTON)

- TABLE 55 ENGINEERING PLASTICS: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 56 ENGINEERING PLASTICS: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 57 ABS: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2017–2021 (KILOTON)

- TABLE 58 ABS: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2022–2028 (KILOTON)

- TABLE 59 ABS: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 60 ABS: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 61 PC: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2017–2021 (KILOTON)

- TABLE 62 PC: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2022–2028 (KILOTON)

- TABLE 63 PC: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 64 PC: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 65 PA: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2017–2021 (KILOTON)

- TABLE 66 PA: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2022–2028 (KILOTON)

- TABLE 67 PA: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 68 PA: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 69 POM: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2017–2021 (KILOTON)

- TABLE 70 POM: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2022–2028 (KILOTON)

- TABLE 71 POM: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 72 POM: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 73 OTHER ENGINEERING PLASTICS: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2017–2021 (KILOTON)

- TABLE 74 OTHER ENGINEERING PLASTICS: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2022–2028 (KILOTON)

- TABLE 75 OTHER ENGINEERING PLASTICS: ANTIMICROBIAL PLASTICS MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

- TABLE 76 OTHER ENGINEERING PLASTICS: ANTIMICROBIAL PLASTICS MARKET SIZE, BY REGION, 2022–2028 (USD MILLION)

- TABLE 77 HIGH PERFORMANCE PLASTICS: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2017–2021 (KILOTON)

- TABLE 78 HIGH PERFORMANCE PLASTICS: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2022–2028 (KILOTON)

- TABLE 79 HIGH PERFORMANCE PLASTICS: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 80 HIGH PERFORMANCE PLASTICS: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 81 ANTIMICROBIAL PLASTICS MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 82 ANTIMICROBIAL PLASTICS MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 83 ANTIMICROBIAL PLASTICS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 84 ANTIMICROBIAL PLASTICS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 85 PACKAGING: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2017–2021 (KILOTON)

- TABLE 86 PACKAGING: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2022–2028 (KILOTON)

- TABLE 87 PACKAGING: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 88 PACKAGING: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 89 AUTOMOTIVE: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2017–2021 (KILOTON)

- TABLE 90 AUTOMOTIVE: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2022–2028 (KILOTON)

- TABLE 91 AUTOMOTIVE: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 92 AUTOMOTIVE: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 93 CONSUMER GOODS: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2017–2021 (KILOTON)

- TABLE 94 CONSUMER GOODS: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2022–2028 (KILOTON)

- TABLE 95 CONSUMER GOODS: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 96 CONSUMER GOODS: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 97 MEDICAL & HEALTHCARE: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2017–2021 (KILOTON)

- TABLE 98 MEDICAL & HEALTHCARE: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2022–2028 (KILOTON)

- TABLE 99 MEDICAL & HEALTHCARE: ANTIMICROBIAL PLASTICS MARKET SIZE, BY REGION, 2017–2021 (USD MILLION)

- TABLE 100 MEDICAL & HEALTHCARE: ANTIMICROBIAL PLASTICS MARKET SIZE, BY REGION, 2022–2028 (USD MILLION)

- TABLE 101 BUILDING & CONSTRUCTION: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2017–2021 (KILOTON)

- TABLE 102 BUILDING & CONSTRUCTION: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2022–2028 (KILOTON)

- TABLE 103 BUILDING & CONSTRUCTION: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 104 BUILDING & CONSTRUCTION: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 105 OTHER APPLICATIONS: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2017–2021 (KILOTON)

- TABLE 106 OTHER APPLICATIONS: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2022–2028 (KILOTON)

- TABLE 107 OTHER APPLICATIONS: ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 108 OTHER APPLICATIONS: ANTIMICROBIAL PLASTICS MARKETS, BY REGION, 2022–2028 (USD MILLION)

- TABLE 109 ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2017–2021 (KILOTON)

- TABLE 110 ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2022–2028 (KILOTON)

- TABLE 111 ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 112 ANTIMICROBIAL PLASTICS MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 113 ASIA PACIFIC: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2017–2021 (KILOTON)

- TABLE 114 ASIA PACIFIC: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 115 ASIA PACIFIC: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 116 ASIA PACIFIC: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 117 ASIA PACIFIC: ANTIMICROBIAL PLASTICS MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 118 ASIA PACIFIC: ANTIMICROBIAL PLASTICS MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 119 ASIA PACIFIC: ANTIMICROBIAL PLASTICS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 120 ASIA PACIFIC: ANTIMICROBIAL PLASTICS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 121 ASIA PACIFIC: ANTIMICROBIAL PLASTICS MARKET, BY COUNTRY, 2017–2021 (KILOTON)

- TABLE 122 ASIA PACIFIC: ANTIMICROBIAL PLASTICS MARKET, BY COUNTRY, 2022–2028 (KILOTON)

- TABLE 123 ASIA PACIFIC: ANTIMICROBIAL PLASTICS MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 124 ASIA PACIFIC: ANTIMICROBIAL PLASTICS MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 125 CHINA: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2017–2021 (KILOTON)

- TABLE 126 CHINA: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 127 CHINA: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 128 CHINA: ANTIMICROBIAL PLASTICS MARKET SIZE, BY, 2022–2028 (USD MILLION)

- TABLE 129 JAPAN: ANTIMICROBIAL PLASTICS MARKET SIZE, BY, 2017–2021 (KILOTON)

- TABLE 130 JAPAN: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 131 JAPAN: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 132 JAPAN: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 133 INDIA: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2017–2021 (KILOTON)

- TABLE 134 INDIA: ANTIMICROBIAL PLASTICS MARKET SIZE, BY, 2022–2028 (KILOTON)

- TABLE 135 INDIA: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 136 INDIA: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 137 SOUTH KOREA: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2017–2021 (KILOTON)

- TABLE 138 SOUTH KOREA: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 139 SOUTH KOREA: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 140 SOUTH KOREA: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 141 INDONESIA: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2017–2021 (KILOTON)

- TABLE 142 INDONESIA: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 143 INDONESIA: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 144 INDONESIA: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 145 THAILAND: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2017–2021 (KILOTON)

- TABLE 146 THAILAND: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 147 THAILAND: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 148 THAILAND: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 149 MALAYSIA: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2017–2021 (KILOTON)

- TABLE 150 MALAYSIA: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 151 MALAYSIA: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 152 MALAYSIA: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 153 AUSTRALIA & NEW ZEALAND: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2017–2021 (KILOTON)

- TABLE 154 AUSTRALIA & NEW ZEALAND: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 155 AUSTRALIA & NEW ZEALAND: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 156 AUSTRALIA & NEW ZEALAND: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 157 NORTH AMERICA: ANTIMICROBIAL PLASTICS MARKET SIZE, BY TYPE, 2017–2021 (KILOTON)

- TABLE 158 NORTH AMERICA: ANTIMICROBIAL PLASTICS MARKET SIZE, BY TYPE, 2022–2028 (KILOTON)

- TABLE 159 NORTH AMERICA: ANTIMICROBIAL PLASTICS MARKET SIZE, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 160 NORTH AMERICA: ANTIMICROBIAL PLASTICS MARKET SIZE, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 161 NORTH AMERICA: ANTIMICROBIAL PLASTICS MARKET SIZE, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 162 NORTH AMERICA: ANTIMICROBIAL PLASTICS MARKET SIZE, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 163 NORTH AMERICA: ANTIMICROBIAL PLASTICS MARKET SIZE, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 164 NORTH AMERICA: ANTIMICROBIAL PLASTICS MARKET SIZE, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 165 NORTH AMERICA: ANTIMICROBIAL PLASTICS MARKET SIZE, BY COUNTRY, 2017–2021 (KILOTON)

- TABLE 166 NORTH AMERICA: ANTIMICROBIAL PLASTICS MARKET SIZE, BY COUNTRY, 2022–2028 (KILOTON)

- TABLE 167 NORTH AMERICA: ANTIMICROBIAL PLASTICS MARKET SIZE, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 168 NORTH AMERICA: ANTIMICROBIAL PLASTICS MARKET SIZE, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 169 US: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2017–2021 (KILOTON)

- TABLE 170 US: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 171 US: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 172 US: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 173 CANADA: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2017–2021 (KILOTON)

- TABLE 174 CANADA: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 175 CANADA: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 176 CANADA: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 177 MEXICO: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2017–2021 (KILOTON)

- TABLE 178 MEXICO: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 179 MEXICO: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 180 MEXICO: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 181 EUROPE: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2017–2021 (KILOTON)

- TABLE 182 EUROPE: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 183 EUROPE: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 184 EUROPE: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 185 EUROPE: ANTIMICROBIAL PLASTICS MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 186 EUROPE: ANTIMICROBIAL PLASTICS MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 187 EUROPE: ANTIMICROBIAL PLASTICS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 188 EUROPE: ANTIMICROBIAL PLASTICS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 189 EUROPE: ANTIMICROBIAL PLASTICS MARKET, BY COUNTRY, 2017–2021 (KILOTON)

- TABLE 190 EUROPE: ANTIMICROBIAL PLASTICS MARKET, BY COUNTRY, 2022–2028 (KILOTON)

- TABLE 191 EUROPE: ANTIMICROBIAL PLASTICS MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 192 EUROPE: ANTIMICROBIAL PLASTICS MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 193 GERMANY: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2017–2021 (KILOTON)

- TABLE 194 GERMANY: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 195 GERMANY: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 196 GERMANY: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 197 RUSSIA: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2017–2021 (KILOTON)

- TABLE 198 RUSSIA: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 199 RUSSIA: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 200 RUSSIA: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 201 ITALY: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2017–2021 (KILOTON)

- TABLE 202 ITALY: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 203 ITALY: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 204 ITALY: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 205 FRANCE: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2017–2021 (KILOTON)

- TABLE 206 FRANCE: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 207 FRANCE: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 208 FRANCE: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 209 UK: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2017–2021 (KILOTON)

- TABLE 210 UK: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 211 UK: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 212 UK: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 213 SPAIN: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2017–2021 (KILOTON)

- TABLE 214 SPAIN: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 215 SPAIN: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 216 SPAIN: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 217 MIDDLE EAST & AFRICA: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2017–2021 (KILOTON)

- TABLE 218 MIDDLE EAST & AFRICA: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 219 MIDDLE EAST & AFRICA: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 220 MIDDLE EAST & AFRICA: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 221 MIDDLE EAST & AFRICA: ANTIMICROBIAL PLASTICS MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 222 MIDDLE EAST & AFRICA: ANTIMICROBIAL PLASTICS MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 223 MIDDLE EAST & AFRICA: ANTIMICROBIAL PLASTICS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 224 MIDDLE EAST & AFRICA: ANTIMICROBIAL PLASTICS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 225 MIDDLE EAST & AFRICA: ANTIMICROBIAL PLASTICS MARKET, BY COUNTRY, 2017–2021 (KILOTON)

- TABLE 226 MIDDLE EAST & AFRICA: ANTIMICROBIAL PLASTICS MARKET, BY COUNTRY, 2022–2028 (KILOTON)

- TABLE 227 MIDDLE EAST & AFRICA: ANTIMICROBIAL PLASTICS MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 228 MIDDLE EAST & AFRICA: ANTIMICROBIAL PLASTICS MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 229 IRAN: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2017–2021 (KILOTON)

- TABLE 230 IRAN: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 231 IRAN: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 232 IRAN: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 233 SAUDI ARABIA: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2017–2021 (KILOTON)

- TABLE 234 SAUDI ARABIA: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 235 SAUDI ARABIA: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 236 SAUDI ARABIA: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 237 SOUTH AFRICA: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2017–2021 (KILOTON)

- TABLE 238 SOUTH AFRICA: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 239 SOUTH AFRICA: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 240 SOUTH AFRICA: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 241 UAE: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2017–2021 (KILOTON)

- TABLE 242 UAE: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 243 UAE: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 244 UAE: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 245 SOUTH AMERICA: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2017–2021 (KILOTON)

- TABLE 246 SOUTH AMERICA: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 247 SOUTH AMERICA: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 248 SOUTH AMERICA: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 249 SOUTH AMERICA: ANTIMICROBIAL PLASTICS MARKET, BY APPLICATION, 2017–2021 (KILOTON)

- TABLE 250 SOUTH AMERICA: ANTIMICROBIAL PLASTICS MARKET, BY APPLICATION, 2022–2028 (KILOTON)

- TABLE 251 SOUTH AMERICA: ANTIMICROBIAL PLASTICS MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 252 SOUTH AMERICA: ANTIMICROBIAL PLASTICS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 253 SOUTH AMERICA: ANTIMICROBIAL PLASTICS MARKET, BY COUNTRY, 2017–2021 (KILOTON)

- TABLE 254 SOUTH AMERICA: ANTIMICROBIAL PLASTICS MARKET, BY COUNTRY, 2022–2028 (KILOTON)

- TABLE 255 SOUTH AMERICA: ANTIMICROBIAL PLASTICS MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 256 SOUTH AMERICA: ANTIMICROBIAL PLASTICS MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 257 BRAZIL: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2017–2021 (KILOTON)

- TABLE 258 BRAZIL: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2022–2028 (KILOTON)

- TABLE 259 BRAZIL: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 260 BRAZIL: ANTIMICROBIAL PLASTICS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 261 OVERVIEW OF STRATEGIES ADOPTED BY ANTIMICROBIAL PLASTICS MANUFACTURERS

- TABLE 262 DEGREE OF COMPETITION

- TABLE 263 TYPE FOOTPRINT

- TABLE 264 APPLICATION FOOTPRINT

- TABLE 265 COMPANY REGION FOOTPRINT

- TABLE 266 DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 267 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 268 PRODUCT LAUNCHES (2018–2022)

- TABLE 269 DEALS (2018–2022)

- TABLE 270 EXPANSIONS (2018–2022)

- TABLE 271 DUPONT DE NEMOURS, INC.: COMPANY OVERVIEW

- TABLE 272 DUPONT DE NEMOURS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 273 DUPONT DE NEMOURS, INC.: DEALS

- TABLE 274 DUPONT DE NEMOURS, INC.: OTHER DEVELOPMENTS

- TABLE 275 BASF SE: COMPANY OVERVIEW

- TABLE 276 BASF SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 277 MICROBAN INTERNATIONAL, LTD.: COMPANY OVERVIEW

- TABLE 278 MICROBAN INTERNATIONAL, LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 279 MICROBAN INTERNATIONAL, LTD.: PRODUCT LAUNCHES

- TABLE 280 MICROBAN INTERNATIONAL, LTD.: DEALS

- TABLE 281 MICROBAN INTERNATIONAL, LTD.: OTHER DEVELOPMENTS

- TABLE 282 AVIENT CORPORATION: COMPANY OVERVIEW

- TABLE 283 AVIENT CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 284 AVIENT CORPORATION: PRODUCT LAUNCHES

- TABLE 285 AVIENT CORPORATION: DEALS

- TABLE 286 PARX MATERIALS N.V.: COMPANY OVERVIEW

- TABLE 287 PARX MATERIALS N.V.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 288 PARX MATERIALS N.V.: OTHER DEVELOPMENTS

- TABLE 289 SANITIZED AG: COMPANY OVERVIEW

- TABLE 290 SANITIZED AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 291 SANITIZED AG: PRODUCT LAUNCHES

- TABLE 292 SANITIZED AG: DEALS

- TABLE 293 BIOCOTE LIMITED: COMPANY OVERVIEW

- TABLE 294 BIOCOTE LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 295 BIOCOTE LIMITED: DEALS

- TABLE 296 KING PLASTIC CORPORATION: COMPANY OVERVIEW

- TABLE 297 KING PLASTIC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 298 KING PLASTIC CORPORATION: PRODUCT LAUNCHES

- TABLE 299 MILLIKEN & COMPANY: COMPANY OVERVIEW

- TABLE 300 MILLIKEN & COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 301 RTP COMPANY: COMPANY OVERVIEW

- TABLE 302 RTP COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 303 AMERICHEM INC.: COMPANY OVERVIEW

- TABLE 304 TEKNOR APEX COMPANY: COMPANY OVERVIEW

- TABLE 305 POLYGIENE GROUP AB: COMPANY OVERVIEW

- TABLE 306 SCIESSENT LLC: COMPANY OVERVIEW

- TABLE 307 VALTRIS SPECIALTY CHEMICALS: COMPANY OVERVIEW

- TABLE 308 BIOSAFE INC.: COMPANY OVERVIEW

- TABLE 309 POLYCHEM ALLOY INC.: COMPANY OVERVIEW

- TABLE 310 AMERICAN POLYFILM, INC.: COMPANY OVERVIEW

- TABLE 311 POREX CORPORATION: COMPANY OVERVIEW

- TABLE 312 CHROMA COLOR CORPORATION: COMPANY OVERVIEW

- TABLE 313 CELANESE CORPORATION: COMPANY OVERVIEW

- TABLE 314 PALRAM INDUSTRIES LTD.: COMPANY OVERVIEW

- TABLE 315 WELL PLASTICS LTD.: COMPANY OVERVIEW

- TABLE 316 RAY PRODUCTS: COMPANY OVERVIEW

- TABLE 317 ORGANIC PLAST: COMPANY OVERVIEW

- TABLE 318 ENGINEERING PLASTICS MARKET, BY REGION, 2017–2020 (USD MILLION)

- TABLE 319 ENGINEERING PLASTICS MARKET, BY REGION, 2017–2020 (KILOTON)

- TABLE 320 ENGINEERING PLASTICS MARKET, BY REGION, 2021–2027 (USD MILLION)

- TABLE 321 ENGINEERING PLASTICS MARKET, BY REGION, 2021–2027 (KILOTON)

- TABLE 322 ASIA PACIFIC: ENGINEERING PLASTICS MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

- TABLE 323 ASIA PACIFIC: ENGINEERING PLASTICS MARKET, BY COUNTRY, 2017–2020 (KILOTON)

- TABLE 324 ASIA PACIFIC: ENGINEERING PLASTICS MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

- TABLE 325 ASIA PACIFIC: ENGINEERING PLASTICS MARKET, BY COUNTRY, 2021–2027 (KILOTON)

- TABLE 326 EUROPE: ENGINEERING PLASTICS MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

- TABLE 327 EUROPE: ENGINEERING PLASTICS MARKET, BY COUNTRY, 2017–2020 (KILOTON)

- TABLE 328 EUROPE: ENGINEERING PLASTICS MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

- TABLE 329 EUROPE: ENGINEERING PLASTICS MARKET, BY COUNTRY, 2021–2027 (KILOTON)

- TABLE 330 NORTH AMERICA: ENGINEERING PLASTICS MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

- TABLE 331 NORTH AMERICA: ENGINEERING PLASTICS MARKET, BY COUNTRY, 2017–2020 (KILOTON)

- TABLE 332 NORTH AMERICA: ENGINEERING PLASTICS MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

- TABLE 333 NORTH AMERICA: ENGINEERING PLASTICS MARKET, BY COUNTRY, 2021–2027 (KILOTON)

- TABLE 334 MIDDLE EAST & AFRICA: ENGINEERING PLASTICS MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

- TABLE 335 MIDDLE EAST & AFRICA: ENGINEERING PLASTICS MARKET, BY COUNTRY, 2017–2020 (KILOTON)

- TABLE 336 MIDDLE EAST & AFRICA: ENGINEERING PLASTICS MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

- TABLE 337 MIDDLE EAST & AFRICA: ENGINEERING PLASTICS MARKET, BY COUNTRY, 2021–2027 (KILOTON)

- TABLE 338 SOUTH AMERICA: ENGINEERING PLASTICS MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

- TABLE 339 SOUTH AMERICA: ENGINEERING PLASTICS MARKET, BY COUNTRY, 2017–2020 (KILOTON)

- TABLE 340 SOUTH AMERICA: ENGINEERING PLASTICS MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

- TABLE 341 SOUTH AMERICA: ENGINEERING PLASTICS MARKET, BY COUNTRY, 2021–2027 (KILOTON)

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1, BOTTOM-UP (SUPPLY SIDE), COLLECTIVE SHARE OF TOP PLAYERS

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (DEMAND SIDE)

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3 (TOP-DOWN)

- FIGURE 5 DATA TRIANGULATION

- FIGURE 6 SUPPLY SIDE MARKET CAGR PROJECTIONS

- FIGURE 7 DEMAND SIDE MARKET GROWTH: DRIVERS AND OPPORTUNITIES

- FIGURE 8 COMMODITY PLASTICS SEGMENT ACCOUNTED FOR LARGEST SHARE IN 2022

- FIGURE 9 MEDICAL & HEALTHCARE PROJECTED TO BE FASTEST-GROWING APPLICATION DURING FORECAST PERIOD

- FIGURE 10 ASIA PACIFIC ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 11 MEDICAL & HEALTHCARE APPLICATION TO DRIVE MARKET DURING FORECAST PERIOD

- FIGURE 12 ASIA PACIFIC PROJECTED TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 13 COMMODITY PLASTICS SEGMENT AND CHINA ACCOUNTED FOR LARGEST SHARES IN 2022

- FIGURE 14 MEDICAL & HEALTHCARE APPLICATION DOMINATED MARKET ACROSS REGIONS

- FIGURE 15 MARKET IN INDIA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN ANTIMICROBIAL PLASTICS MARKET

- FIGURE 17 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 18 ANTIMICROBIAL PLASTICS MARKET SUPPLY CHAIN

- FIGURE 19 FUTURE REVENUE MIX

- FIGURE 20 ANTIMICROBIAL PLASTICS MARKET ECOSYSTEM

- FIGURE 21 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 22 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 23 AVERAGE SELLING PRICES OF KEY PLAYERS FOR TOP THREE APPLICATIONS

- FIGURE 24 AVERAGE SELLING PRICES OF ANTIMICROBIAL PLASTICS, BY REGION, 2021–2028

- FIGURE 25 IMPORTS OF ANTIMICROBIAL PLASTICS, BY KEY COUNTRIES (2013–2021)

- FIGURE 26 EXPORTS OF ANTIMICROBIAL PLASTICS, BY KEY COUNTRIES (2013–2021)

- FIGURE 27 PATENTS REGISTERED IN ANTIMICROBIAL PLASTICS MARKET, 2012–2022

- FIGURE 28 PATENT PUBLICATION TRENDS, 2012–2022

- FIGURE 29 LEGAL STATUS OF PATENTS FILED IN ANTIMICROBIAL PLASTICS MARKET

- FIGURE 30 MAXIMUM PATENTS FILED IN US JURISDICTION

- FIGURE 31 M.S. TECHNOLOGIES, L.L.C. REGISTERED MAXIMUM NUMBER OF PATENTS BETWEEN 2012 AND 2022

- FIGURE 32 COMMODITY PLASTICS SEGMENT TO DOMINATE ANTIMICROBIAL PLASTICS MARKET DURING FORECAST PERIOD

- FIGURE 33 MEDICAL & HEALTHCARE SEGMENT PROJECTED TO BE LARGEST APPLICATION OF ANTIMICROBIAL PLASTICS DURING FORECAST PERIOD

- FIGURE 34 ASIA PACIFIC MARKET PROJECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 35 ASIA PACIFIC: ANTIMICROBIAL PLASTICS MARKET SNAPSHOT

- FIGURE 36 NORTH AMERICA: ANTIMICROBIAL PLASTICS MARKET SNAPSHOT

- FIGURE 37 EUROPE: ANTIMICROBIAL PLASTICS MARKET SNAPSHOT

- FIGURE 38 ANTIMICROBIAL PLASTICS MARKET SHARE, BY COMPANY, 2022

- FIGURE 39 RANKING OF TOP FOUR PLAYERS IN ANTIMICROBIAL PLASTICS MARKET, 2022

- FIGURE 40 REVENUE ANALYSIS OF KEY COMPANIES FOR PAST FIVE YEARS

- FIGURE 41 COMPANY PRODUCT FOOTPRINT

- FIGURE 42 COMPANY EVALUATION QUADRANT

- FIGURE 43 STARTUP/SME EVALUATION QUADRANT FOR ANTIMICROBIAL PLASTICS MARKET

- FIGURE 44 DUPONT DE NEMOURS, INC.: COMPANY SNAPSHOT

- FIGURE 45 BASF SE: COMPANY SNAPSHOT

- FIGURE 46 AVIENT CORPORATION: COMPANY SNAPSHOT

The study involved four major activities in estimating the market size for antimicrobial plastics. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Post that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

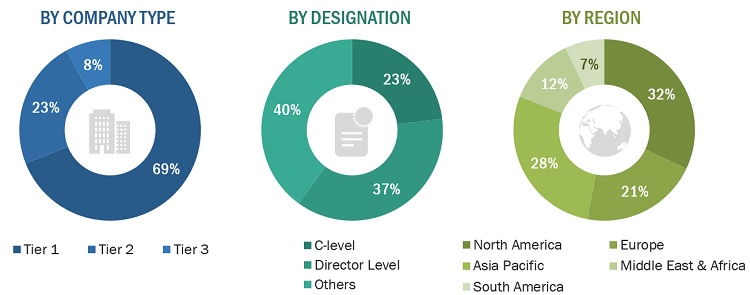

Secondary Research

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. The findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives. The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Primary Research

The antimicrobial plastics market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the packaging, medical & healthcare, building & construction, automotive, consumer goods and others. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Breakdown of Primary Participants

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2022 available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

DuPont de Nemours, Inc. |

Director of Marketing |

|

BASF SE |

Manager- Sales & Marketing |

|

Microban International |

Sales Manager |

|

Biocote |

Production Manager |

|

King Plastics Corporation |

Operation Manager |

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the antimicrobial plastics market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Antimicrobial plastics Market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Antimicrobial Plastics Market: Top-Down Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the antimicrobial plastics industry.

Market Definition

Antimicrobial plastics are polymer materials infused with antimicrobial agents and additives to kill microorganisms, such as bacteria, algae, and fungi, and inhibit their growth on the end-use products. The continuous and repeated use of plastic materials causes hygiene-related concerns, increasing the risk of contamination and pathogenic diseases. Commodity plastics, engineering plastics, and high performance plastics are majorly used in applications such as medical & healthcare and packaging.

Key Stakeholders

- Antimicrobial plastics manufacturers

- Antimicrobial plastics suppliers

- Raw material suppliers

- Service providers

- End users, such as automotive, textile, and other companies

- Government bodies

Report Objectives

- To define, describe, and forecast the antimicrobial plastics market in terms of value and volume

- To provide detailed information regarding the drivers, opportunities, restraints, and challenges influencing market growth

- To estimate and forecast the market size by type, application, and region

- To forecast the size of the market for five main regions: Europe, North America, Asia Pacific, South America, and the Middle East & Africa, along with their key countries

- To strategically analyze micromarkets1 with respect to their growth trends, prospects, and contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments, such as deals and expansions, in the market

- To analyze the impact of the recession on the market

- To analyze the impact of COVID-19 on the market and end-use industries

- To strategically profile key players and comprehensively analyze their growth strategies

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application type

Company Information

- Detailed analysis and profiles of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Antimicrobial Plastics Market