Aircraft Line Maintenance Market by Service (Component Replacement & Rigging, Defect Rectification, Engine & APU, Aircraft on Ground), Type (Transit Checks, Routine Checks), Aircraft Type (NBA, WBA, VLA), Region (2018-2023)

[155 Pages Report] The aircraft line maintenance market is projected to grow from USD 18.47 Billion in 2017 to USD 23.50 Billion by 2023, at a CAGR of 4.10% from 2018 to 2023.

The objective of this study is to analyze, define, describe, and forecast the aircraft line maintenance market based on service, type, aircraft type, technology, and region. The report also focuses on providing a competitive landscape of the aircraft line maintenance market by profiling companies based on their financial positions, product portfolios, and growth strategies. The study also analyzes the core competencies of companies and their market shares to anticipate the degree of competition prevailing in the market. This report tracks and analyzes competitive developments such as contracts, new product launches, agreements, joint ventures, and partnerships in the aircraft line maintenance market. The base year considered for this study is 2017 and the forecast period is from 2018 to 2023.

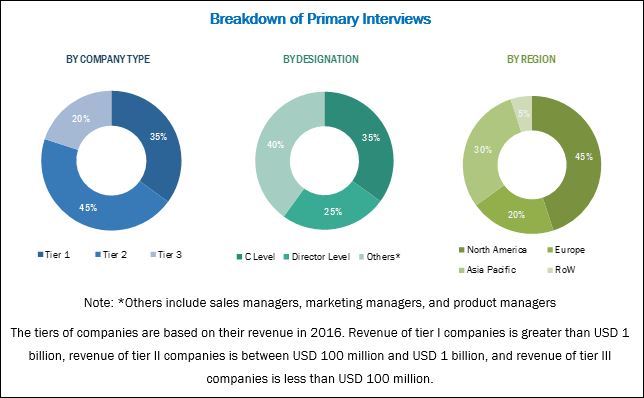

The research methodology used to estimate and forecast the size of the aircraft line maintenance market began with data capturing from the key vendor revenues. Secondary sources referred for this study included annual reports, Yahoo Finance, Market Outlook of Boeing, Airbus, and Embraer, the European Aviation Safety Agency, the United Nations Conference on Trade and Development (UNCTAD), and press releases. The bottom-up procedure was employed to arrive at the overall size of the aircraft line maintenance market by determining the revenue of the key market players. After arriving at the overall size of the aircraft line maintenance market, the market size was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, executives, and engineers. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. Breakdown of profiles of primaries is shown in the figure depicted below:

To know about the assumptions considered for the study, download the pdf brochure

Market Ecosystem

The aircraft line maintenance market has been segmented based on service, type, aircraft type, technology, and region. AMECO (China), ANA Line Maintenance Technics (Japan), Avia Solutions Group (Lithuania), BCT Aviation Maintenance (UK), British Airways (UK), Delta TechOps (US), HAECO (Hong Kong), Lufthansa Technik (Germany), Monarch Aircraft Engineering (UK), Nayak Group (Germany), SAMCO Aircraft Maintenance (Netherlands), SIA Engineering (Singapore), STS Aviation Group (US),Turkish Technic (Turkey), and United Technical Operations (US), among others are the key players operating in the aircraft line maintenance market. Contracts, new product launches, agreements, joint ventures, and partnerships are the major strategies adopted by the key players in the aircraft line maintenance market.

Target Audience for this Report

- MRO Service Providers

- Airline Operators

- Manufacturers of Aircraft Components

- Aircraft OEMs

- Government and Certification Bodies

“This study answers several questions for stakeholders, primarily, which market segments to focus on during the next two to five years to prioritize their efforts and investments.”

Scope of the Report:

Aircraft Line Maintenance Market, by Service

- Component Replacement & Rigging Service

- Defect Rectification Service

- Engine & APU Service

- Aircraft on Ground (AOG) Service

- Line Station Setup & Management Service

Aircraft Line Maintenance Market, by Type

- Transit Checks

- Routine Checks

Aircraft Line Maintenance Market, by Aircraft Type

- Narrow Body Aircraft

- Wide Body Aircraft

- Very Large Aircraft

- Regional Aircraft

- Others

Aircraft Line Maintenance Market, by Technology

- Traditional Line Maintenance

- Digital Line Maintenance

Aircraft Line Maintenance Market, by Region

- North America

- Europe

- Asia Pacific

- RoW

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific requirements of companies. The following customization options are available for this report:

- Regional Analysis

- A further breakdown of the aircraft line maintenance market in the Middle East and Rest of the World (RoW)

- Company Information

- Detailed analysis and profiling of additional market players (up to five)

- Additional Level Segmentation

The aircraft line maintenance market is projected to grow from USD 19.23 Billion in 2018 to USD 23.50 Billion by 2023, at a CAGR of 4.10% from 2018 to 2023. The growth of the aircraft line maintenance market across the globe can be attributed to the increasing number of flights per aircraft, rising number of new aircraft deliveries from OEMs, and increasing requirement for carrying out repair and maintenance of the existing aircraft fleets of airlines.

Based on service, the aircraft line maintenance market has been segmented into component replacement & rigging service, defect rectification service, engine & APU service, Aircraft on Ground (AOG) service, and line station setup & management service. The component replacement & rigging service segment is projected to lead the aircraft line maintenance market during the forecast period. The increased demand for component replacement & rigging services by various airlines for the replacement of their existing legacy aircraft systems is driving the growth of the component replacement & rigging service segment of the aircraft line maintenance market. The component replacement & rigging service segment has been further classified into hydraulic leak rectification, structural repairs, landing gear replacement & removal, windshield changes, and avionics repairs.

Based on type, the aircraft line maintenance market has been segmented into transit checks and routine checks. The routine checks type segment is projected to grow at a higher CAGR as compared to the transit checks segment from 2018 to 2023. Routine checks of an aircraft comprise maintenance pre-flight checks, post-flight checks, service checks, overnight checks, and weekly checks. When an aircraft completes 155 hours of flight, it goes for fill or change of oils and fluids such as hydraulic fluid, starter oil, engine oil, and generator drive fluids. As the number of flights per aircraft is rising, it is projected to lead to an increased requirement for routine checks of aircraft.

Based on aircraft type, the aircraft line maintenance market has been segmented into Narrow Body Aircraft (NBA), Wide Body Aircraft (WBA), Very Large Aircraft (VLA), Regional Aircraft (RA), and others. The wide body aircraft type segment of the aircraft line maintenance market is projected to grow at the highest CAGR during the forecast period. The growth of this segment of the market can be attributed to the increased the number of deliveries of new wide body aircraft across the globe. Wide body aircraft are jet carriers with a fuselage, which is sufficiently wide enough to accommodate two traveler walkways. These aircraft are twin-aisle aircraft, with at least seven seats abreast. Aircraft series such as A330 series, A350 series, B767 series, B787 series, and B777 series are included under the wide body aircraft type segment of the aircraft line maintenance market.

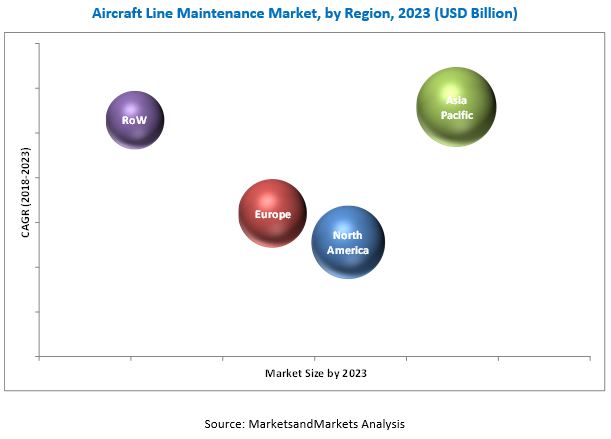

In this report, the aircraft line maintenance market has also been analyzed with respect to 4 main regions, namely, North America, Europe, Asia Pacific, and Rest of the World (RoW). The aircraft line maintenance market in the Asia Pacific region is projected to grow at the highest CAGR from 2018 to 2023. The growth of the Asia Pacific aircraft line maintenance market can be attributed to the increase in the aircraft production in the region and rise in the number of new aircraft delivered. Moreover, increased demand for MRO services from the region is expected to drive the growth of the Asia Pacific line maintenance market from 2018 to 2023. China, India, and Japan are the key markets for aircraft line maintenance in this region. The China aircraft line maintenance market is projected to witness significant growth during the forecast period, owing to the presence of several key providers of aircraft line maintenance services that include AMECO (China) and HAECO (Hong Kong) in the country.

The rise in spending of airlines for MRO services and a significant increase in the digitalization of these services are projected to drive the growth of the aircraft line maintenance market. The increased demand for upgrading the existing legacy aircraft systems and replacing them with new aircraft systems is also fueling the growth of the aircraft line maintenance market across the globe.

However, the lack of availability of skilled workforce and lack of common data standards are expected to restrain the growth of the aircraft line maintenance market during the forecast period. Additionally, issues associated with the compliance of various aviation regulations act as a challenge for the growth of the aircraft line maintenance market. The developments in drone inspections, artificial interlinkage, Internet of Things, digital twin, augmented reality, and Big Data analytics offer key growth opportunities for the growth of the aircraft line maintenance market.

The leading players in the aircraft line maintenance market include AMECO (China), ANA Line Maintenance Technics (Japan), Avia Solutions Group (Lithuania), BCT Aviation Maintenance (UK), British Airways (UK), Delta TechOps (US), HAECO (Hong Kong), Lufthansa Technik (Germany), Monarch Aircraft Engineering (UK), Nayak Group (Germany), SAMCO Aircraft Maintenance (Netherlands), SIA Engineering (Singapore), STS Aviation Group (US),Turkish Technic (Turkey), and United Technical Operations (US), among others. These companies have adopted various growth strategies to enhance their presence in emerging economies across the globe.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Market Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 32)

4.1 Attractive Opportunities in the Aircraft Line Maintenance Market

4.2 Engine & APU Service Segment, By Type

4.3 Europe Aircraft Line Maintenance Market, By Type

4.4 Aircraft Line Maintenance Market, By Country

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increase in Global Fleet Size Due to Rise in Global Air Passenger Traffic

5.2.1.2 Rise in the Number of Aviation Accidents Increasing the Importance of Line Maintenance Activities

5.2.1.3 Increase in Adoption of Connected Aircraft to Analyze Predictive, Prescriptive, and Condition-Based Maintenance

5.2.2 Restraints

5.2.2.1 Lack of Skilled Manpower in the Aviation Mro Industry

5.2.2.2 Lack of Common Data Standards and Risks Associated With Cybersecurity

5.2.3 Opportunities

5.2.3.1 Increasing Adoption of Internet of Things (IoT), Artificial Intelligence (AI), Augmented Reality (AR), and Big Data Analytics By Service Providers

5.2.3.2 Increasing Upgradation and Replacement of Old Aircraft With New Generation Aircraft

5.2.4 Challenges

5.2.4.1 Compliance With Stringent Aviation Regulations

6 Industry Trends (Page No. - 42)

6.1 Introduction

6.2 Technological Advancements in the Line Maintenance Industry

6.2.1 Drone Inspections

6.2.2 Internet of Things (IoT)

6.2.3 Adaptive Manufacturing in the Aviation Industry

6.2.4 Adoption of Mro Software

7 Aircraft Line Maintenance Market, By Service (Page No. - 45)

7.1 Introduction

7.2 Component Replacement & Rigging Service

7.2.1 Hydraulic Leak Rectification

7.2.2 Structural Repairs

7.2.3 Landing Gear Replacement & Removal

7.2.4 Windshield Changes

7.2.5 Avionics Repairs

7.3 Engine & APU Service

7.3.1 Boroscope Inspection

7.3.2 Engine Cleaning & Washing

7.3.3 Engine & APU Changes

7.3.4 Engine Run-Up

7.4 Line Station Setup & Management Service

7.5 Defect Rectification Service

7.6 Aircraft on Ground (AOG) Service

8 Aircraft Line Maintenance Market, By Type (Page No. - 53)

8.1 Introduction

8.2 Transit Checks

8.3 Routine Checks

9 Aircraft Line Maintenance Market, By Aircraft Type (Page No. - 56)

9.1 Introduction

9.2 Narrow Body Aircraft

9.2.1 A320 Series

9.2.2 B737 Series

9.2.3 B757 Series

9.3 Wide Body Aircraft

9.3.1 A330 Series

9.3.2 A350 Series

9.3.3 B767 Series

9.3.4 B777 Series

9.3.5 B787 Series

9.4 Very Large Body Aircraft

9.4.1 B747 Series

9.4.2 A380 Series

9.5 Regional Aircraft

9.5.1 Bombardier 170/175/190/195

9.5.2 ATR 42/72

9.5.3 Bombardier Crj Series

9.5.4 Embraer 135/140/145

9.5.5 Bombardier Dash 8-100/200/300

9.5.6 Beechcraft 1900

9.5.7 Saab 340

10 Aircraft Line Maintenance Market, By Technology (Page No. - 65)

10.1 Introduction

10.2 Traditional Line Maintenance

10.3 Digital Line Maintenance

11 Regional Analysis (Page No. - 68)

11.1 Introduction

11.2 North America

11.2.1 US

11.2.2 Canada

11.3 Europe

11.3.1 France

11.3.2 UK

11.3.3 Germany

11.3.4 Russia

11.3.5 Ireland

11.3.6 Spain

11.3.7 Netherlands

11.3.8 Rest of Europe

11.4 Asia Pacific

11.4.1 China

11.4.2 Japan

11.4.3 India

11.4.4 Australia

11.4.5 Rest of Asia Pacific

11.5 Rest of the World

11.5.1 Middle East

11.5.2 Latin America

11.5.3 Africa

12 Competitive Landscape (Page No. - 106)

12.1 Introduction

12.2 Competitive Scenario

12.2.1 Contracts

12.2.2 New Product Launches

12.2.3 Expansions

12.2.4 Partnerships

12.2.5 Agreements

13 Company Profiles (Page No. - 112)

(Overview, Products and Services, Financials, Strategy & Development)*

13.1 British Airways

13.2 Delta Air Lines

13.3 Lufthansa

13.4 SIA Engineering Company

13.5 United Airlines

13.6 ANA Line Maintenance Technics

13.7 AMECO

13.8 Avia Solutions Group

13.9 BCT Aviation Maintenance

13.10 HAECO

13.11 Monarch Aircraft Engineering

13.12 Nayak Group

13.13 SAMCO Aircraft Maintenance

13.14 SR Technics

13.15 STS Aviation Group

13.16 Turkish Airlines

*Details on Overview, Products and Services, Financials, Strategy & Development Might Not Be Captured in Case of Unlisted Companies

14 Appendix (Page No. - 147)

14.1 Discussion Guide

14.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.3 Introducing RT: Real-Time Market Intelligence

14.4 Available Customizations

14.5 Related Reports

14.6 Author Details

List of Tables (98 Tables)

Table 1 Table: Aviation Accidents and Fatalities (2016 vs 2015)

Table 2 Aircraft Line Maintenance Market Size, By Service, 2016-2023 (USD Billion)

Table 3 Aircraft Line Maintenance Market for Component Replacement & Rigging Service, By Region, 2016–2023 (USD Billion)

Table 4 Aircraft Line Maintenance Market for Component Replacement & Rigging Service, By Subsegment, 2016–2023 (USD Billion)

Table 5 Aircraft Line Maintenance Market for Engine & APU Service, By Region, 2016–2023 (USD Billion)

Table 6 Aircraft Line Maintenance Market for Engine & Auxiliary Power Unit (APU) Service, By Subsegment, 2016–2023 (USD Billion)

Table 7 Aircraft Line Maintenance Market for Line Station Setup & Management Service, By Region, 2016–2023 (USD Billion)

Table 8 Aircraft Line Maintenance Market for Defect Rectification Service, By Region, 2016–2023 (USD Billion )

Table 9 Aircraft Line Maintenance Market for Aircraft on Ground Service, By Region, 2016–2023 (USD Billion)

Table 10 Aircraft Line Maintenance Market Size, By Type, 2016-2023 (USD Billion)

Table 11 Transit Checks Aircraft Line Maintenance Market Size, By Region, 2016-2023 (USD Billion)

Table 12 Routine Checks Aircraft Line Maintenance Market Size, By Region, 2016-2023 (USD Billion)

Table 13 Aircraft Line Maintenance Market Size, By Aircraft Type, 2016-2023 (USD Billion)

Table 14 Aircraft Line Maintenance Market Size, By Narrow Body Aircraft Type, 2016-2023 (USD Billion)

Table 15 Narrow Body Aircraft Line Maintenance Market Size, By Region, 2016-2023 (USD Billion)

Table 16 Aircraft Line Maintenance Market Size, By Wide Body Aircraft Type, 2016-2023 (USD Billion)

Table 17 Wide Body Aircraft Line Maintenance Market Size, By Region, 2016-2023 (USD Billion)

Table 18 Aircraft Line Maintenance Market Size, By Very Large Body Aircraft Type, 2016-2023 (USD Billion)

Table 19 Very Large Aircraft Line Maintenance Market Size, By Region, 2016-2023 (USD Billion)

Table 20 Aircraft Line Maintenance Market Size, By Regional Aircraft Type, 2016-2023 (USD Billion)

Table 21 Regional Aircraft Line Maintenance Market Size, By Region, 2016-2023 (USD Billion)

Table 22 Aircraft Line Maintenance Market Size, By Technology, 2016-2023 (USD Billion)

Table 23 Aircraft Line Maintenance Market Size, By Region, 2016-2023 (USD Billion)

Table 24 North America Aircraft Line Maintenance Market Size, By Type, 2016-2023 (USD Billion)

Table 25 North America Aircraft Line Maintenance Market Size, By Service, 2016-2023 (USD Billion)

Table 26 North America Aircraft Line Maintenance Market Size, By Aircraft Type, 2016-2023 (USD Billion)

Table 27 North America Aircraft Line Maintenance Market Size, By Country, 2016-2023 (USD Billion)

Table 28 US Aircraft Line Maintenance Market Size, By Type, 2016-2023 (USD Billion)

Table 29 US Aircraft Line Maintenance Market Size, By Service, 2016-2023 (USD Billion)

Table 30 US Aircraft Line Maintenance Market Size, By Aircraft Type, 2016-2023 (USD Billion)

Table 31 Canada Aircraft Line Maintenance Market Size, By Type, 2016-2023 (USD Billion)

Table 32 Canada Aircraft Line Maintenance Market Size, By Service, 2016-2023 (USD Billion)

Table 33 Canada Aircraft Line Maintenance Market Size, By Aircraft Type, 2016-2023 (USD Billion)

Table 34 Europe Aircraft Line Maintenance Market Size, By Type, 2016-2023 (USD Billion)

Table 35 Europe Aircraft Line Maintenance Market Size, By Service, 2016-2023 (USD Billion)

Table 36 Europe Aircraft Line Maintenance Market Size, By Aircraft Type, 2016-2023 (USD Billion)

Table 37 Europe Aircraft Line Maintenance Market Size, By Country, 2016-2023 (USD Billion)

Table 38 France Aircraft Line Maintenance Market Size, By Type, 2016-2023 (USD Billion)

Table 39 France Aircraft Line Maintenance Market Size, By Service, 2016-2023 (USD Billion)

Table 40 France Aircraft Line Maintenance Market Size, By Aircraft Type, 2016-2023 (USD Billion)

Table 41 UK Aircraft Line Maintenance Market Size, By Type, 2016-2023 (USD Billion)

Table 42 UK Aircraft Line Maintenance Market Size, By Service, 2016-2023 (USD Billion)

Table 43 UK Aircraft Line Maintenance Market Size, By Aircraft Type, 2016-2023 (USD Billion)

Table 44 Germany Aircraft Line Maintenance Market Size, By Type, 2016-2023 (USD Billion)

Table 45 Germany Aircraft Line Maintenance Market Size, By Service, 2016-2023 (USD Billion)

Table 46 Germany Aircraft Line Maintenance Market Size, By Aircraft Type, 2016-2023 (USD Billion)

Table 47 Russia Aircraft Line Maintenance Market Size, By Type, 2016-2023 (USD Billion)

Table 48 Russia Aircraft Line Maintenance Market Size, By Service, 2016-2023 (USD Billion)

Table 49 Russia Aircraft Line Maintenance Market Size, By Aircraft Type, 2016-2023 (USD Billion)

Table 50 Ireland Aircraft Line Maintenance Market Size, By Type, 2016-2023 (USD Billion)

Table 51 Ireland Aircraft Line Maintenance Market Size, By Service, 2016-2023 (USD Billion)

Table 52 Ireland Aircraft Line Maintenance Market Size, By Aircraft Type, 2016-2023 (USD Billion)

Table 53 Spain Aircraft Line Maintenance Market Size, By Type, 2016-2023 (USD Billion)

Table 54 Spain Aircraft Line Maintenance Market Size, By Service, 2016-2023 (USD Billion)

Table 55 Spain Aircraft Line Maintenance Market Size, By Aircraft Type, 2016-2023 (USD Billion)

Table 56 Netherlands Aircraft Line Maintenance Market Size, By Type, 2016-2023 (USD Billion)

Table 57 Netherlands Aircraft Line Maintenance Market Size, By Service, 2016-2023 (USD Billion)

Table 58 Netherlands Aircraft Line Maintenance Market Size, By Aircraft Type, 2016-2023 (USD Billion)

Table 59 Rest of Europe Aircraft Line Maintenance Market Size, By Type, 2016-2023 (USD Billion)

Table 60 Rest of Europe Aircraft Line Maintenance Market Size, By Service, 2016-2023 (USD Billion)

Table 61 Rest of Europe Aircraft Line Maintenance Market Size, By Aircraft Type, 2016-2023 (USD Billion)

Table 62 Asia Pacific Aircraft Line Maintenance Market Size, By Type, 2016-2023 (USD Billion)

Table 63 Asia Pacific Aircraft Line Maintenance Market Size, By Service, 2016-2023 (USD Billion)

Table 64 Asia Pacific Aircraft Line Maintenance Market Size, By Aircraft Type, 2016-2023 (USD Billion)

Table 65 Asia Pacific Aircraft Line Maintenance Market Size, By Country, 2016-2023 (USD Billion)

Table 66 China Aircraft Line Maintenance Market Size, By Type, 2016-2023 (USD Billion)

Table 67 China Aircraft Line Maintenance Market Size, By Service, 2016-2023 (USD Billion)

Table 68 China Aircraft Line Maintenance Market Size, By Aircraft Type, 2016-2023 (USD Billion)

Table 69 Japan Aircraft Line Maintenance Market Size, By Type, 2016-2023 (USD Billion)

Table 70 Japan Aircraft Line Maintenance Market Size, By Service, 2016-2023 (USD Billion)

Table 71 Japan Aircraft Line Maintenance Market Size, By Aircraft Type, 2016-2023 (USD Billion)

Table 72 India Aircraft Line Maintenance Market Size, By Type, 2016-2023 (USD Billion)

Table 73 India Aircraft Line Maintenance Market Size, By Service, 2016-2023 (USD Billion)

Table 74 India Aircraft Line Maintenance Market Size, By Aircraft Type, 2016-2023 (USD Billion)

Table 75 Australia Aircraft Line Maintenance Market Size, By Type, 2016-2023 (USD Billion)

Table 76 Australia Aircraft Line Maintenance Market Size, By Service, 2016-2023 (USD Billion)

Table 77 Australia Aircraft Line Maintenance Market Size, By Aircraft Type, 2016-2023 (USD Billion)

Table 78 Rest of Asia Pacific Aircraft Line Maintenance Market Size, By Type, 2016-2023 (USD Billion)

Table 79 Rest of Asia Pacific Aircraft Line Maintenance Market Size, By Service, 2016-2023 (USD Billion)

Table 80 Rest of Asia Pacific Aircraft Line Maintenance Market Size, By Aircraft Type, 2016-2023 (USD Billion)

Table 81 Rest of the World Aircraft Line Maintenance Market Size, By Type, 2016-2023 (USD Billion)

Table 82 Rest of the World Aircraft Line Maintenance Market Size, By Service, 2016-2023 (USD Billion)

Table 83 Rest of the World Aircraft Line Maintenance Market Size, By Aircraft Type, 2016-2023 (USD Billion)

Table 84 Rest of the World Aircraft Line Maintenance Market Size, By Region, 2016-2023 (USD Billion)

Table 85 Middle East Aircraft Line Maintenance Market Size, By Type, 2016-2023 (USD Billion)

Table 86 Middle East Aircraft Line Maintenance Market Size, By Service, 2016-2023 (USD Billion)

Table 87 Middle East Aircraft Line Maintenance Market Size, By Aircraft Type, 2016-2023 (USD Billion)

Table 88 Latin America Aircraft Line Maintenance Market Size, By Type, 2016-2023 (USD Billion)

Table 89 Latin America Aircraft Line Maintenance Market Size, By Service, 2016-2023 (USD Billion)

Table 90 Latin America Aircraft Line Maintenance Market Size, By Aircraft Type, 2016-2023 (USD Billion)

Table 91 Africa Aircraft Line Maintenance Market Size, By Type, 2016-2023 (USD Billion)

Table 92 Africa Aircraft Line Maintenance Market Size, By Service, 2016-2023 (USD Billion)

Table 93 Africa Aircraft Line Maintenance Market Size, By Aircraft Type, 2016-2023 (USD Billion)

Table 94 Contracts, 2015-2018

Table 95 New Product Launches, 2018

Table 96 Expansions, 2015-2018

Table 97 Partnerships, 2018

Table 98 Agreements, 2015–2018

List of Figures (33 Figures)

Figure 1 Aircraft Line Maintenance Market Segmentation

Figure 2 Research Process Flow

Figure 3 Research Design

Figure 4 Data Triangulation Methodology

Figure 5 Component Replacement & Rigging Service Segment Projected to Lead Aircraft Line Maintenance Market From 2018 to 2023

Figure 6 Routine Checks Segment Projected to Grow at A Higher CAGR During Forecast Period as Compared to Transit Checks Segment

Figure 7 Wide Body Aircraft Projected to Lead Aircraft Line Maintenance Market During Forecast Period

Figure 8 Asia Pacific Estimated to Account for Largest Share of Aircraft Line Maintenance Market in 2018

Figure 9 Increase in Number of Aircraft Flights is Expected to Drive the Aircraft Line Maintenance Market From 2018 to 2023

Figure 10 Engine Run-Up Subsegment Projected to Lead the Engine & APU Service Segment From 2018 to 2023

Figure 11 Routine Checks Segment in Europe Projected to Grow at A Higher CAGR From 2018 to 2023 as Compared to Transit Checks Segment

Figure 12 Aircraft Line Maintenance Market in India is Expected to Grow at Highest CAGR During Forecast Period

Figure 13 Aircraft Line Maintenance Market: Drivers, Restraints, Opportunities, and Challenges

Figure 14 Growth in Global Air Passenger Traffic By Commercial Airlines, 2006-2016

Figure 15 Active Connected Aircraft Share By Region, 2016

Figure 16 The Component Replacement & Rigging Service Segment is Expected to Lead the Aircraft Line Maintenance Market From 2018 to 2023

Figure 17 The Transit Checks Type Segment is Projected to Lead the Aircraft Line Maintenance Market From 2018 to 2023

Figure 18 The Narrow Body Aircraft Type Segment is Projected to Lead the Aircraft Line Maintenance Market From 2018 to 2023

Figure 19 The Digital Line Maintenance Technology Segment is Projected to Lead the Aircraft Line Maintenance Market From 2018 to 2023

Figure 20 The Asia Pacific Region is Expected to Lead the Aircraft Line Maintenance Market in 2018

Figure 21 North America Aircraft Line Maintenance Market

Figure 22 Aircraft Line Maintenance Market Europe Snapshot

Figure 23 Asia Pacific Aircraft Line Maintenance Market Snapshot

Figure 24 Companies Adopted Contracts as Key Growth Strategy Between 2015 and 2018

Figure 25 British Airways: Company Snapshot

Figure 26 Delta Air Lines: Company Snapshot

Figure 27 Lufthansa: Company Snapshot

Figure 28 SIA Engineering Company: Company Snapshot

Figure 29 United Airlines: Company Snapshot

Figure 30 ANA Line Maintenance Technics: Company Snapshot

Figure 31 Avia Solutions Group: Company Snapshot

Figure 32 HAECO: Company Snapshot

Figure 33 Turkish Airlines: Company Snapshot

Growth opportunities and latent adjacency in Aircraft Line Maintenance Market