Automotive Air Purifier Market by type (Purifier, Ionizer, & Hybrid), Technology (HEPA, Activated Carbon, Ionic Filter, & Photocatalytic), Vehicle Class (Economy, Mid-Priced, & Luxury), End Market (OE & Aftermarket), and Region - Global Forecast to 2025

[122 Pages Report] The global automotive air purifier market was valued at USD 696.9 million in 2017 and is expected to reach USD 2,286.9 million by 2025 at a CAGR of 16.34 % during the forecast period 2017-2025. The base year for the study is 2017 and the forecast period is 2018–2025. The market is primarily driven by factors such as increasing public awareness related to healthcare and environmental effects of air pollution and rapid urbanization and industrialization.

Objectives of the Report

- To define, segment, and forecast the automotive air purifier market, in terms of volume (‘000 units) and value (USD Million)

- To provide a detailed analysis of various forces acting in the market (drivers, restraints, opportunities, and challenges)

- To segment the market and forecast the market size, by volume and value, on the basis of end-use into the OE market (Built In) and aftermarket (Counter Top)

- To segment the market and forecast the market size, by volume and value, on the basis of type into purifier, ionizer, and hybrid

- To segment the market and forecast the market size, by volume and value, on the basis of vehicle class into economic, mid-priced, and luxury

- To define, describe, and project the market size, by volume, on the basis of technology into high-efficiency particulate arrestor (HEPA) filters, Activated Carbons, Ionic filter, and photocatalytic

- To analyze the regional markets for growth trends, future prospects, and their contribution to the overall market

- To strategically profile the key players and comprehensively analyze their core competencies

- To track and analyze competitive developments such as new product launches and expansions carried out by key industry participants

The research methodology used in the report involves primary and secondary sources and follows bottom-up and top-down approaches for the purpose of data triangulation. The study involves country-level OEM and model-wise analysis of automotive air purification system. This analysis involves historical trends as well as existing penetrations by country as well as aftermarket. The analysis is projected based on various factors such as growth trends in vehicle production and regulations or mandates on the implementation of automotive electronics, which drive the automotive air purifier market. The analysis has been discussed with and validated by primary respondents, including experts from the market, automotive experts, manufacturers, and suppliers. Secondary sources include associations such as International Organization of Motor Vehicle Manufacturers (OICA), American Association of Motor Vehicle Administrators (AAMVA), Automotive Component Manufacturers Association of India (ACMA), and paid databases and directories such as Factiva and Bloomberg.

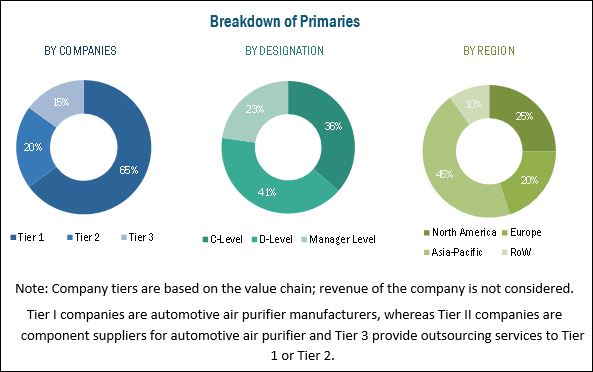

The figure below illustrates the break-up of the profile of industry experts who participated in the primary discussions.

To know about the assumptions considered for the study, download the pdf brochure

The ecosystem of the automotive air purifier market consists of manufacturers such as Panasonic (Japan), Denso (Japan), Bosch (Germany), 3M (US), Mahle (Germany), Mann+Hummel (Germany), Sharp (Japan), Honeywell (US), Koninklijke Philips (Netherlands), Eureka Forbes (India), Xiaomi (China), and others.

Target Audience

- Automotive air purifier manufacturers and component suppliers

- Automotive air purifier manufacturers and filters suppliers

- Automotive OEMs

- Industry associations

- The automobile industry and related end-user industries

Scope of the Report

|

Report Attributes |

Details |

|

Market size: |

$696.9 million in 2017 to $2,286.9 million by 2025 |

|

Growth Rate: |

16.34% |

|

Largest Market: |

Europe |

|

Market Dynamics: |

Drivers, Restraints, Opportunities & Challenges |

|

Forecast Period: |

2018-2025 |

|

Forecast Units: |

Value (USD Million) |

|

Report Coverage: |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered: |

By Technology, By Type, By Vehicle, By End-User,By Region |

|

Geographies Covered: |

North America, Europe, Asia Pacific, and Rest of the World |

|

Report Highlights:

|

Updated financial information/Company Evaluation Quadrant |

|

Key Market Opportunities: |

Developing Countries to Offer Market Growth Opportunities |

|

Key Market Drivers: |

Increasing Public Awareness Related to Healthcare and Environmental Effects of Air Pollution |

Market, By Technology (Volume only)

- HEPA

- Activated Carbon

- PHOTOCATALYTIC

- Ionic filter

Market, By Type

- Purifier

- Ionizer

- Hybrid

Market, By Vehicle class

- Economy priced vehicle

- Mid-priced vehicle

- Luxury vehicles

Market, By End-User

- OE

- Aftermarket

Market, By Region

- Asia Pacific (China, Japan, India, South Korea, and Rest of Asia Pacific)

- Europe (France, Germany, Italy, Spain, the UK, and Rest of Europe)

- North America (Canada, Mexico, and the US)

- Rest of the World (Brazil, Russia, and Others)

Available Customizations

- Market, by propulsion type, by region

- Market, by end user, by country (oe market)

- Detailed analysis and profiling of additional market players (up to 3)

- Detailed analysis and profiling of additional countries (up to 3)

The automotive air purifier market is estimated to be USD 792.7 million in 2018 and is projected to reach a market size of USD 2,286.9 million by 2025, growing at a CAGR of 16.34% during the forecast period. The key growth drivers for the market are the increasing public awareness related to healthcare and environmental effects of air pollution and rapid urbanization and industrialization.

The aftermarket is estimated to hold the largest market share in 2018. However, the OE market for air purifier is estimated to be the fastest growing market during the forecast period and is anticipated to grow at a rapid pace due to increasing consumer demand and rising air pollution. Several OEMs, along with air purifier manufacturers, are integrating the air purifier in the vehicles, which will boost the automotive air purifier OE market.

The luxury vehicle segment is estimated to hold the largest share, by volume and value, of the automotive air purifier market during the forecast period. However, the economy vehicle segment is estimated to be the fastest growing market owing to the rise in demand for comfort & convenience features in the vehicles.

The HEPA segment is projected to be the largest market segment, by volume, of the market during the forecast period. The HEPA segment is followed by ionic filters and activated carbon segment during the forecast period. The ionic filter segment will have steady growth whereas activated carbon will witness considerable growth in the market. The growing concerns about healthcare and environmental effects from air pollution would boost the demand for HEPA and activated carbon segment in vehicles.

The hybrid purifier segment is estimated to witness the fastest growth in the automotive air purifier market due to the rise in public awareness related to healthcare and environmental effects of air pollution. Rapid urbanization and industrialization have also fueled the growth of hybrid air purifier systems that are equipped with more than one type of purification system and provide better output compared to other systems.

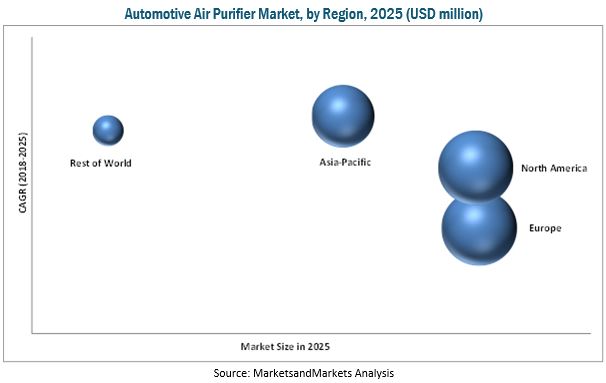

The European region is projected to be the largest market for automotive air purifier in 2025 due to increased production of automobiles and significant adoption of advanced technologies in automotive electronics. Being the largest market of passenger vehicles, the North American market is estimated to hold the second largest market share in 2025. Rapid urbanization and industrialization, coupled with a rise in consumer demand for convenience features in mid-variant cars, are the key factors driving the European market.

The key factor restraining the growth of automotive air purifier market is the high pricing of air purification system, which limits its consumption. However, the cost of the automotive air purifiers is likely to decrease in the coming years because of higher adoption rate by vehicle manufacturers. Also, the number of suppliers for automakers has risen in the recent past. While cost is not a restraining factor in case of premium segment cars, it may substantially affect the economy and mid-segment vehicles. The market is dominated by a few global players and comprises several regional players. Some of the key manufacturers operating in the market are Panasonic (Japan), Denso (Japan), Bosch (Germany), 3M (US), Mahle (Germany), Mann+Hummel (Germany), Sharp (Japan), Honeywell (US), Koninklijke Philips (Netherlands), and Eureka (India).

Frequently Asked Questions (FAQ):

What is the market size for Automotive Air Purifier Market?

The global Automotive Air Purifier Market Size is projected to grow from an estimated $696.9 million in 2017 to $2,286.9 million by 2025, registering a CAGR of 16.34%

Who holds the largest market of Automotive Air Purifier Market by region?

The European region is projected to be the largest market for automotive air purifier in 2025 due to increased production of automobiles and significant adoption of advanced technologies in automotive electronics.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Automotive Air Purifier Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Secondary Sources

2.1.1.2 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Sampling Techniques and Data Collection Methods

2.1.2.2 Primary Participants

2.2 Automotive Air Purifier Market Size Estimation

2.2.1 Bottom-Up Approach

2.3 Market Breakdown and Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 34)

4.1 Attractive Opportunities in the Automotive Air Purifier Market

4.2 Market Share, By Country

4.3 Market, By Type

4.4 Market, By Vehicle Class

4.5 Market, By End Market

4.6 Market, By Technology

4.7 Market, By Region

5 Automotive Air Purifier Market Overview (Page No. - 41)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Public Awareness Related to Healthcare and Environmental Effects of Air Pollution

5.2.1.2 Increasing Urbanization and Industrialization

5.2.2 Restraints

5.2.2.1 High Pricing of Air Purification System Limiting Its Consumption

5.2.3 Opportunities

5.2.3.1 Developing Countries to Offer Market Growth Opportunities

5.2.4 Challenges

5.2.4.1 Availability of Cheap and Low-Quality Purification Products

5.2.4.2 Ever-Changing Consumer Requirements Leading to High Cost of R&D Activities for New Entrants

6 Technological Overview (Page No. - 46)

6.1 Evolution

6.2 Air Filteration Technology

6.2.1 Hepa

6.2.2 Activated Carbon

6.2.3 Ionic Filter

6.2.4 Photocatalytic

7 Automotive Air Purifier Market, By Technology (Page No. - 49)

7.1 Introduction

7.2 Hepa

7.3 Activated Carbon

7.4 Photocatalytic

7.5 Ionic Filter

8 Automotive Air Purifier Market, By Type (Page No. - 55)

8.1 Introduction

8.2 Purifier

8.3 Ionizer

8.4 Hybrid

9 Automotive Air Purifier Market, By Vehicle Class (Page No. - 60)

9.1 Introduction

9.2 Economic Priced Vehicles

9.3 Mid-Priced Vehicles

9.4 Luxury Vehicles

10 Automotive Air Purifier Market, By End Market

10.1 Introduction

10.2 OE

10.3 Aftermarket

11 Automotive Air Purifier Market, By End Market & Region (Page No. - 65)

11.1 Introduction

11.2 Asia Pacific

11.2.1 China

11.2.2 India

11.2.3 Japan

11.2.4 South Korea

11.2.5 Rest of Asia Pacific

11.3 Europe

11.3.1 France

11.3.2 Germany

11.3.3 Italy

11.3.4 UK

11.3.5 Spain

11.3.6 Rest of Europe

11.4 North America

11.4.1 Canada

11.4.2 Mexico

11.4.3 US

11.5 Rest of the World (RoW)

11.5.1 Brazil

11.5.2 Russia

11.5.3 Others

12 Company Profiles (Page No. - 92)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

12.1 Panasonic

12.2 Denso

12.3 Bosch

12.4 3M

12.5 Mahle

12.6 Mann+Hummel

12.7 Sharp Corp.

12.8 Honeywell

12.9 Koninklijke Philips N.V.

12.10 Eureka Forbes

12.11 Xiaomi

12.12 Toyota Boshoku

12.13 Freudenberg Group

12.14 Ecomventures

12.15 Xiamen Airbus Electronic Technology

12.16 Oransi

12.17 Guangzhou Olansi Healthcare

12.18 Diamond Air Purifier

12.19 Yadu

12.20 Incen

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 115)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.3 Introducing RT: Real-Time Market Intelligence

13.4 Available Customizations

13.4.1 Automotive Air Purifier Market, By Propulsion Type, By Region

13.4.2 Market, By End User, By Country (Oe Market)

13.4.3 Detailed Analysis and Profiling of Additional Market Players (Up to 3)

13.4.4 Detailed Analysis and Profiling of Additional Countries (Up to 3)

13.5 Related Reports

13.6 Author Details

List of Tables (78 Tables)

Table 1 Currency Exchange Rates (Per 1 USD)

Table 2 World Urbanization Prospects

Table 3 Technology Comparision

Table 4 Automotive Air Purifier Market, By Technology, 2016–2025 (‘000 Units)

Table 5 Hepa: Market, By Region, 2016–2025 (‘000 Units)

Table 6 Activated Carbon: Market, By Region, 2016–2025 (‘000 Units)

Table 7 Photocatalytic: Market, By Region, 2016–2025 (‘000 Units)

Table 8 Ionic Filter: Market, By Region, 2016–2025 (‘000 Units)

Table 9 Market, By Type, 2016–2025 (‘000 Units)

Table 10 Market, By Type, 2016–2025 (USD Million)

Table 11 Purifier: Market, By Region, 2016–2025 (‘000 Units)

Table 12 Purifier: Market, By Region, 2016–2025 (USD Million)

Table 13 Ionizer: Market, By Region, 2016–2025 (‘000 Units)

Table 14 Ionizer: Market, By Region, 2016–2025 (USD Million)

Table 15 Hybrid: Market, By Region, 2016–2025 (‘000 Units)

Table 16 Hybrid: Market, By Region, 2016–2025 (USD Million)

Table 17 Automotive Air Purifier Market, By Vehicle Class, 2016–2025 (‘000 Units)

Table 18 Market, By Vehicle Class, 2016–2025 (USD Million)

Table 19 Economic Priced Vehicles: Market, By Region, 2016–2025 (‘000 Units)

Table 20 Economic Priced Vehicles: Market, By Region, 2016–2025 (‘000 Million)

Table 21 Mid-Priced Vehicles: Market, By Region, 2016–2025 (‘000 Units)

Table 22 Mid-Priced Vehicles: Market, By Region, 2016–2025 (USD Million)

Table 23 Luxury Vehicles: Market, By Region, 2016–2025 (‘000 Units)

Table 24 Luxury Vehicles: Market, By Region, 2016–2025 (USD Million)

Table 25 Market, By Region, 2016–2025 (‘000 Units)

Table 26 Market, By Region, 2016–2025 (USD Million)

Table 27 Market, By End Market, 2016–2025 (‘000 Units)

Table 28 Automotive Air Purifier Market, By End Market, 2016–2025 (USD Million)

Table 29 Asia Pacific: Market, By Country, 2016–2025 (‘000 Units)

Table 30 Asia Pacific: Market, By Country, 2016–2025 (USD Million)

Table 31 Asia Pacific: Market, By End Market, 2016–2025 (‘000 Units)

Table 32 Asia Pacific: Market, By End Market, 2016–2025 (USD Million)

Table 33 China: Market, By End Market, 2016–2025 (‘000 Units)

Table 34 China: Market, By End Market, 2016–2025 (USD Million)

Table 35 India: Market, By End Market, 2016–2025 (‘000 Units)

Table 36 India: Market, By End Market, 2016–2025 (USD Million)

Table 37 Japan: Market, By End Market, 2016–2025 (‘000 Units)

Table 38 Japan: Market, By End Market, 2016–2025 (USD Million)

Table 39 South Korea: Market, By End Market, 2016–2025 (‘000 Units)

Table 40 South Korea: Market, By End Market, 2016–2025 (USD Million)

Table 41 Rest of Asia Pacific: Market, By End Market, 2016–2025 (‘000 Units)

Table 42 Rest of Asia Pacific: Market, By End Market, 2016–2025 (USD Million)

Table 43 Europe: Automotive Air Purifier Market, By Country, 2016–2025 (‘000 Units)

Table 44 Europe: Market, By Country, 2016–2025 (USD Million)

Table 45 Europe: Market, By End Market, 2016–2025 (‘000 Units)

Table 46 Europe: Market, By End Market, 2016–2025 (USD Million)

Table 47 France: Market, By End Market, 2016–2025 (‘000 Units)

Table 48 France: Market, By End Market, 2016–2025 (USD Million)

Table 49 Germany: Market, By End Market, 2016–2025 (‘000 Units)

Table 50 Germany: Market, By End Market, 2016–2025 (USD Million)

Table 51 Italy: Market, By End Market, 2016–2025 (‘000 Units)

Table 52 Italy: Market, By End Market, 2016–2025 (USD Million)

Table 53 UK: Automotive Air Purifier Market, By End Market, 2016–2025 (‘000 Units)

Table 54 UK: Market, By End Market, 2016–2025 (USD Million)

Table 55 Spain: Market, By End Market, 2016–2025 (‘000 Units)

Table 56 Spain: Market, By End Market, 2016–2025 (USD Million)

Table 57 Rest of Europe: Market, By End Market, 2016–2025 (‘000 Units)

Table 58 Rest of Europe: Market, By End Market, 2016–2025 (USD Million)

Table 59 North America: Market, By Country, 2016–2025 (‘000 Units)

Table 60 North America: Market, By Country, 2016–2025 (USD Million)

Table 61 North America: Market, By End Market, 2016–2025 (‘000 Units)

Table 62 North America: Market, By End Market, 2016–2025 (USD Million)

Table 63 Canada: Market, By End Market, 2016–2025 (‘000 Units)

Table 64 Canada: Market, By End Market, 2016–2025 (USD Million)

Table 65 Mexico: Market, By End Market, 2016–2025 (‘000 Units)

Table 66 Mexico: Market, By End Market, 2016–2025 (USD Million)

Table 67 US: Automotive Air Purifier Market, By End Market, 2016–2025 (‘000 Units)

Table 68 US: Market, By End Market, 2016–2025 (USD Million)

Table 69 RoW: Market, By Country, 2016–2025 (‘000 Units)

Table 70 RoW: Market, By Country, 2016–2025 (USD Million)

Table 71 RoW: Market, By End Market, 2016–2025 (‘000 Units)

Table 72 RoW: Market, By End Market, 2016–2025 (USD Million)

Table 73 Brazil: Market, By End Market, 2016–2025 (‘000 Units)

Table 74 Brazil: Market, By End Market, 2016–2025 (USD Million)

Table 75 Russia: Market, By End Market, 2016–2025 (‘000 Units)

Table 76 Russia: Market, By End Market, 2016–2025 (USD Million)

Table 77 Others: Market, By End Market, 2016–2025 (‘000 Units)

Table 78 Others: Automotive Air Purifier Market, By End Market, 2016–2025 (USD Million)

List of Figures (44 Figures)

Figure 1 Automotive Air Purifier Market Segmentation

Figure 2 Market: Research Design

Figure 3 Research Design Model

Figure 4 Breakdown of Primary Interviews

Figure 5 Market: Bottom-Up Approach

Figure 6 Data Triangulation

Figure 7 Market, By Type, 2018 vs 2025

Figure 8 Market, By Vehicle Class, 2018 vs 2025

Figure 9 Market, By End Use, 2018 vs 2025

Figure 10 Automotive Air Purifier Market, By Technology, 2018 vs 2025 (Volume)

Figure 11 Market, By Region, 2018 vs 2025

Figure 12 Market, By Region, Snapshot

Figure 13 Increasing Public Awareness Related to Healthcare and Environmental Effects of Air Pollution to Boost the Growth of the Market From 2018 to 2025

Figure 14 India to Be the Fastest Growing Market for Automotive Air Purifier, By Value, 2018–2025

Figure 15 Purifier Market to Have the Largest Market Size During the Forecast Period

Figure 16 Luxury Vehicle Segment to Be the Largest Market for Automotive Air Purifier, 2018 vs 2025

Figure 17 Aftermarket to Be the Largest End Market for Market, 2018 vs 2025

Figure 18 Ionic Filter to Hold the Largest Market Share of the Market, 2018 vs 2025 (‘000 Units)

Figure 19 Europe to Be the Largest Market for Automotive Air Purifier, 2018 vs 2025

Figure 20 Factors Governing the Automotive Air Purifier Market

Figure 21 Evolution of Air Purifiers

Figure 22 Market, By Technology, 2018 vs 2025 (‘000 Units)

Figure 23 Market, By Type, 2018 vs 2025 (USD Million)

Figure 24 Market, By Vehicle Class, 2018 vs 2025 (USD Million)

Figure 25 Market, By Region, 2018 vs 2025

Figure 26 Asia Pacific: Market Snapshot

Figure 27 Europe: Market, By Country, 2017 vs 2025 (USD Million)

Figure 28 North America Market Snapshot

Figure 29 RoW: Automotive Air Purifier Market, By Country, 2017 vs 2025 (‘000 Units)

Figure 30 Panasonic: Company Snapshot

Figure 31 Panasonic: SWOT Analysis

Figure 32 Denso: Company Snapshot

Figure 33 Denso: SWOT Analysis

Figure 34 Bosch: Company Snapshot

Figure 35 Bosch: SWOT Analysis

Figure 36 3M: Company Snapshot

Figure 37 3M: SWOT Analysis

Figure 38 Mahle: Company Snapshot

Figure 39 Mahle: SWOT Analysis

Figure 40 Mann+Hummel: Company Snapshot

Figure 41 Mann+Hummel: SWOT Analysis

Figure 42 Sharp: Company Snapshot

Figure 43 Honeywell: Company Snapshot

Figure 44 Koninklijke Philips: Company Snapshot

Growth opportunities and latent adjacency in Automotive Air Purifier Market