Mist Eliminator Market by Type (Wire-mesh, Vane, Fiber-Bed), End-Use Industry (Oil & Gas, Chemical, Desalination, Power Generation, Pharmaceutical &Medical, Paper & Pulp, Textile, Food & Beverage), Material, Application, Region - Global Forecast to 2025

Updated on : June 18, 2024

Mist Eliminators Market

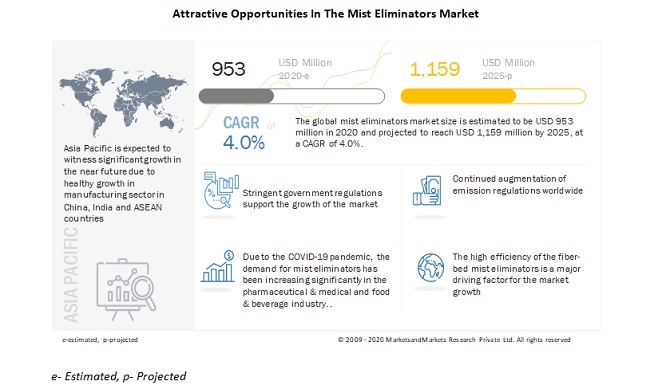

The global mist eliminators market was valued at USD 953 million in 2020 and is projected to reach USD 1,159 million by 2025, growing at 4.0% cagr from 2020 to 2025. The demand for mist eliminators can be attributed to stringent regulations pertaining to emission norms, rising adoption in developing countries, growth of the manufacturing sector, increasing production capacity in the chemical industry, and increasing penetration of mist eliminators in coal-fired power plants in developing countries, are supporting the growth of the mist eliminators market.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Pandemic and Declining Oil Prices Impact on the Global Mist Eliminators Market

The declining oil prices, widening of the supply-demand gap, and COVID-19 pandemic effect had a severe impact on the mist eliminators market. Due to the COVID-19 pandemic, the demand for mist eliminators has been declining due to a slump in the refinery output and postponement of the expansion projects across the globe. According to the EIA, oil & gas production will reach to 94.6 million barrels per day in 2020. Reduced economic activity due to the COVID-19 pandemic has caused changes in energy and oil & gas demand and supply patterns in 2020. This, in turn, has affected the mist eliminators market.

Amid the COVID-19 pandemic, the growing demand from the pharmaceutical and food & beverage industries supports to offset the marginal decline in demand caused due to slowdown in the manufacturing sector across the globe. However, several end-use industries are emphasizing on the optimization of the process, high purity yield, and at the same time, focusing on complying with the regulatory standards, owing to which, the demand for high-performance mist eliminators is increasing across the end-use industries.

Mist Eliminators Market Dynamics

Driver: Increasing demand in the coal-fired power plant, supported by stringent government regulations

Across the globe, it has been observed that the electricity demand is mostly catered through the coal-fired power plant, especially in developing countries such as India, China, and Brazil, among others. According to the Energy Information Administration (EIA), since 2000, the capacity of coal-fired power plants across the globe has increased to double, i.e., 2,047 gigawatts, and around 300 gigawatts is proposed. This is mainly attributed to massive investment in China, Russia, and India, coupled with the significant growth of the manufacturing sector.

According to the Greenpeace analysis, the coal-fired power plant is a major contributor to the emission of SO2, accounting for more than 40% of the total emission. Also, India, Russia, and China are the major contributing countries with 4,586, 3,683, and 2,578 kilotons/year. To evade the emission of SO2 and support sustainable development, several regulatory bodies have imposed restrictions over their emission from the power plant. For instance, the US Environmental Protection Agency (EPA) had regulated six pollutants under the National Ambient Air Quality Standards program, which resulted in a 73% decline in the emission during 1990-2018. This is achieved through several technological modifications at the processing plant.

In the coal-fired power plant, to evade the SO2 emission, the wet flue gas desulfurization method is prevalently used to minimize the SO2 emission. During this, the mist eliminators play a pivotal role in the collection of the SO2 mist from the gas stream and minimize its concentration from the exhaust gas stream. Thus, with the growing stricter regulations on the power industry and increasing power plant capacity, the demand for mist eliminators will increase in the industry.

Restrain: The economic slowdown, declining oil prices, and the impact of COVID-19 on the industry

Most of the North American and European countries, especially the US, Italy, Spain, the UK, France, and Germany, are severely impacted by the COVID-19 pandemic. The suspension of operations in several manufacturing sectors has resulted in a decline in the GDP of these countries. According to the OECD, the European Union (EU) GDP reduced by 3.3% in the first quarter of 2020.

Due to the COVID-19 pandemic, the demand from the industrial sector had declined sharply in the Q-1 and Q-2 2020. This impact was further intensified with the declining oil & gas prices and the massive gap between supply and demand. According to the US Energy Information Administration (EIA), the global oil demand has reached 99.9 million barrels/ day in 2020, down by 90,000 barrels/day from 2019. To mitigate the impact and to recover the oil prices, the OPEC countries and Russia had decided to slash output by 9.7 million barrels/day in May and June 2020.

Thus, this decline in the oil & gas industry across the globe will, in turn, result in a decline in the demand for mist eliminators.

Challenges: Continued augmentation of emission regulations worldwide

According to the U.S. Energy Information Administration (EIA), the UK, the US, Canada, Australia, and Japan are upgrading their emission standards to reduce air pollution. These countries, along with a few emerging countries such as South Africa, Brazil, India, China, and Saudi Arabia, have set five-year targets to reduce pollutant levels. For instance, in January 2020, the EU imposed the 8th Environment Action Programme (EAP), which will guide environmental policies until 2030 and later revise them according to the targets achieved.

At the United Nations Framework Convention on Climate Change held in 2015, several countries initiated to reduce emissions. This is expected to create opportunities for more technologically advanced mist eliminators.

Opportunities: Raw material price fluctuations

- Mist eliminator equipment is made from metal and alloys, polypropylene, and fiber-reinforced plastics, among other components. Fluctuating prices of these materials make it challenging for OEMs to procure high-quality raw materials and manage delivery schedules imposed by suppliers, which further increases the cost of mist eliminators. For instance, the prices of steel increased by 1.4 to 1.8 times from July 2016 to July 2018, which later on decreases till December 2019. However, due to the COVID-19 pandemic, the supply chain across the globe was disrupted, which, in turn, affected the price of raw materials. This makes it difficult to meet commitments and leads to high losses for manufacturers.

Mist Eliminators Market Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

The Wire-mesh segment projected to lead the mist eliminators market from 2020 to 2025

Based on type, the wire-mesh mist eliminators segment is expected to be the largest market for mist eliminators, in terms of volume. The dominant market position of the wire-mesh segment can be attributed to low-pressure drop, moderate efficiency, and low cost compare to fiber-bed mist eliminators. Also, Wire-mesh and vane type of mist eliminators are gaining significant demand in the oil & gas and chemical industries owing to suitability to process conditions and ease of repair & maintenance.

The oil & gas segment estimated to be the largest end-user of mist eliminators

On the basis of end-user, the oil & gas industry is expected to account more majority share of global mist eliminators. Mist eliminators find application at several stages involved in the upstream, midstream, and downstream operations in the oil & gas industry. With the use of mist eliminators, the throughput rates can be improved, and a better yield of gas-oil products can be achieved. This, in turn, also allows the pure cut of the crude. Also, it is used in the vacuum tower, upstream and downstream processing line, flue gas desulfurization, and gas processing facilities. With growing oil & gas production capacities and stringency of the regulation across the globe, the demand for mist eliminators in the oil & gas industry is increasing steadily. Till 2019, the demand for crude oil was growing steadily. However, due to the COVID-19 pandemic and declining oil & gas prices, and declining refinery throughput, the demand for mist eliminators had declined significantly

The distillation segment is expected to account for the largest share of the market

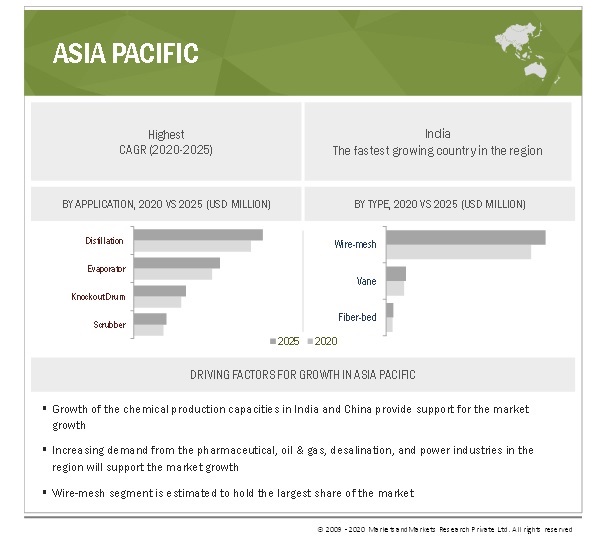

The mist eliminators market, by application, was dominated by the distillation tower segment, followed by the evaporator segment in 2019. This can be attributed to the stringent emission regulations in the petrochemical and oil & gas industry, driving the demand for mist eliminators in new and existing industrial plants. Distillation tower is an integral part of crude oil processing and is also extensively used in petrochemical engineering processes.

In the oil & gas and chemical industries, the efficiency of the distillation tower plays a crucial role to get high purity products. Thus, to achieve it, mist eliminators are prevalently used in the distillation column as it offers better performance, low-pressure drops, and low cost of installation.

APAC estimated to account for the highest share of the global mist eliminators market

APAC is projected to lead the global mist eliminators market from 2020 to 2025. The market in the region is expected to witness a growing demand from the oil & gas and power generation industries due to increasing regulations and energy demand in the region. The growth of the APAC chemical sector is also creating opportunities for the mist eliminators market. According to the CEFIC, the total chemical sales in the APAC was USD 1.9 trillion in 2019. The growing desalination industry is also driving the mist eliminators market in the region. Countries such as China and India mainly depend on coal-fired power plants for the supply of electricity. In these plants, due to stringent government regulations, mist eliminators are widely used for the reduction of SOx emission through flue gas desulfurization.

Due to the COVID-19 pandemic, the economic growth of several countries has been declining owing to the suspension of the manufacturing facilities, declining demand for the oil & gas and industrial product, and disruption of the supply chain. The demand for mist eliminators is therefore expected to decrease in several end-use industries in 2020.

Mist Eliminators Market Players

Key players such as Sulzer Ltd. (Switzerland), CECO Environmental Corp. (US), Munters Group AB (Sweden), Koch-Glitsch LP (US), and DuPont de Nemours (US) have adopted various strategies to strengthen their product portfolios, expand their market presence, and enhance their growth prospects in the mist eliminators market.

Mist Eliminators Market Report Scope

|

Report Metric |

Details |

|

Market size available for years |

2018–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD Million) and Volume (Unit) |

|

Segments covered |

Type, Application, End-Use Industry, Material, and Region |

|

Geographies covered |

North America, Asia Pacific, Europe, South America, Africa, and the Middle East |

|

Companies covered |

Sulzer Ltd. (Switzerland), CECO Environmental Corp.(US), Munters Group AB (Sweden), Koch-Glitsch LP (US), DuPont de Nemours, Inc.(US), Kimre Inc. (US), Hilliard Corporation (US), Monroe Environmental Corporation (US), and Begg Cousland Envirotec Limited (Scotland) are the top 10 manufacturers are covered in the mist eliminators market. |

This research report categorizes the mist eliminators market based on type, material, application, end-use industry, and region.

Mist Eliminators Market, By Type

- Wire-mesh

- Vane

-

Fiber-Bed

- C-glass

- Others

- Others (cyclone and oil mist)

Mist Eliminators Market, By End Use Industry

- Oil & Gas

- Desalination

- Power Generation

- Chemicals

- Paper & Pulp

- Textile

- Pharmaceuticals & Medical

- Food & Beverage

- Others (automotive and glass)

Mist Eliminators Market, By Application

- Distillation Tower

- Evaporator

- Knockout Drum

- Scrubber

- Others (absorber, Steam Drum, Flare Stacks, Air Conditioning)

Mist Eliminators Market, By Material

- Metal

- PP

- FRP

- Others (polytetrafluoroethylene, perfluoroalkoxy alkanes, ethylene tetrafluoroethylene, polyethylene terephthalate )

Mist Eliminators Market, By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East

- Africa

Recent Developments

- In June 2020, CECO Environmental Corp.acquired UK-based Environmental Integrated Solutions Limited, which offers clean air products and technologies such as odor control, VOC abatement, and other air pollution control solutions.

- In October 2019, Sullair, LLC had announced the expansion of the main manufacturing facility based in Michigan City, US. The company is investing USD 30 million to build an 80,000 sq.ft. manufacturing facility, a canopied storage building, and other processing areas.

- In August 2019, Koch-Glitsch had acquired Julius Montz GmbH (Germany), which was involved in structured packings and trays and process systems business.

Frequently Asked Questions (FAQ):

What are the major drivers influencing the growth of the mist eliminators market?

The major drivers influencing the growth of mist eliminators are the increasing demand from the chemical, oil & gas, desalination, and power industry coupled with the stringent government regulation on the manufacturing sector across the globe

What are the different types of mist eliminators, and how their demand varies?

Industrially, several types of mist eliminators are available in the market. Among these types, wire-mesh mist eliminators are prevalently used owing to its moderate efficiency, low-pressure drop, ease of repair & maintenance, and low cost compared to other types such as vane, fiber-bed, and other types

What are the major applications for mist eliminators?

The major applications are distillation, evaporator, scrubber, knockout drum, and others.

What is the impact of the COVID-19 pandemic on the mist eliminators market?

Most of the North American and European countries, especially the US, Italy, Spain, the UK, France, and Germany, are severely impacted by the COVID-19 pandemic. The suspension of operations in several manufacturing sectors has resulted in a decline in demand for mist eliminators.

What is the impact of changing regulatory scenarios on the mist eliminators market?

Several government agencies, such as EPA, REACH, and OSHA, among others, has imposed several regulations pertaining to the emission of the pollutants and other harmful products. For instance, on Sulfuric Acid Industry, Under the Clean Air Act (CAA) as well as the Emergency Planning and Community Right-to-Know Act (EPCRA), the restriction on the emission of the sulfuric acid has been imposed. Similarly, the OSHA and NIOSH have imposed restrictions on the emission of mist. Thereby, the demand for the mist eliminators is increasing in these industries

What are the industry trends in the mist eliminators market?

In the recent past, several manufacturers have expanded their production facilities to cater to the rising demand for mist eliminators and enhance their presence in the target market. Along with this, to alleviate the competitive scenario, these key players are focusing on strengthening their supply chain through either collaborating with suppliers or acquiring regional/local players to enhance their reach to customers. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 38)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 SCOPE OF THE REPORT

1.3 MARKET SCOPE

1.3.1 MIST ELIMINATORS: MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED FOR THE REPORT

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

1.7 LIMITATIONS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 44)

2.1 RESEARCH DATA

FIGURE 1 MIST ELIMINATORS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Critical secondary inputs

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Critical primary inputs

2.1.2.2 Key data from primary sources

2.1.2.3 Key industry insights

2.1.2.4 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION APPROACH

2.2.1 ESTIMATING THE MIST ELIMINATORS MARKET SIZE FROM THE KEY PLAYERS’ MARKET SHARE

FIGURE 2 MARKET SIZE ESTIMATION: SUPPLY-SIDE ANALYSIS

FIGURE 3 MATERIAL SIZE ESTIMATION

2.2.2 ESTIMATION OF THE MARKET SIZE, BASED ON THE END-USER DEMAND

FIGURE 4 MARKET SIZE ESTIMATION: DEMAND-SIDE ANALYSIS

2.3 DATA TRIANGULATION

FIGURE 5 MIST ELIMINATORS MARKET: DATA TRIANGULATION

2.4 ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 55)

FIGURE 6 WIRE-MESH MIST ELIMINATORS ACCOUNTED FOR THE LARGEST MARKET SHARE IN 2019

FIGURE 7 DISTILLATION APPLICATION ACCOUNTED FOR THE LARGEST MARKET SHARE IN 2019

FIGURE 8 GROWTH OPPORTUNITY, BY END-USE INDUSTRY, 2020-2025

FIGURE 9 APAC WAS THE LARGEST MIST ELIMINATORS MARKET IN 2019

4 PREMIUM INSIGHTS (Page No. - 58)

4.1 SIGNIFICANT OPPORTUNITIES IN THE MIST ELIMINATORS MARKET

FIGURE 10 HIGH DEMAND FROM THE OIL & GAS AND POWER GENERATION INDUSTRIES TO DRIVE THE MARKET BETWEEN 2020 AND 2025

4.2 APAC: MIST ELIMINATORS MARKET, BY TYPE AND COUNTRY, 2019

FIGURE 11 WIRE-MESH SEGMENT AND CHINA ACCOUNTED FOR THE LARGEST SHARES

4.3 MIST ELIMINATORS MARKET, BY KEY COUNTRIES

FIGURE 12 SAUDI ARABIA TO REGISTER THE HIGHEST CAGR OVER THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 60)

5.1 INTRODUCTION

TABLE 1 COMPARISON OF CHARACTERISTICS OF DIFFERENT TYPES OF MIST ELIMINATORS

TABLE 2 MIST ELIMINATORS MARKET, BY TYPE

5.2 MARKET DYNAMICS

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE MIST ELIMINATORS MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing demand in the coal-fired power plant, supported by stringent government regulations

FIGURE 14 TOTAL COAL-FIRED POWER CAPACITY (GIGAWATT), BY COUNTRY (TILL JULY 2020)

5.2.1.2 Stringent government regulations support the growth of the market

5.2.1.3 Mist eliminators are widely used to evade the loss incurred due to liquid carryover

5.2.2 RESTRAINTS

5.2.2.1 The economic slowdown, declining oil prices, and the impact of COVID-19 on the industry

5.2.3 OPPORTUNITIES

5.2.3.1 Continued augmentation of emission regulations worldwide

5.2.4 CHALLENGES

5.2.4.1 Raw material price fluctuations

5.2.5 INDUSTRY TRENDS

5.2.5.1 Consolidation and acquisition of facilities

5.2.5.2 Development of new products

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 15 PORTER’S FIVE FORCES ANALYSIS: MIST ELIMINATORS MARKET

5.3.1 BARGAINING POWER OF SUPPLIERS

5.3.2 BARGAINING POWER OF BUYERS

5.3.3 THREAT OF NEW ENTRANTS

5.3.4 THREAT OF SUBSTITUTES

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 FACTORS AFFECTING THE SELECTION OF MIST ELIMINATORS

FIGURE 16 INTENSITY OF THE FACTORS VS. MIST ELIMINATOR TYPES

FIGURE 17 MIST PARTICLES GENERATED IN THE INDUSTRIAL APPLICATION VS. RANGE OF MIST ELIMINATORS

5.5 SUPPLY CHAIN ANALYSIS

5.6 COST STRUCTURE

FIGURE 18 COST STRUCTURE: MIST ELIMINATORS MARKET

TABLE 3 COST STRUCTURE: MIST ELIMINATORS MARKET

5.7 AVERAGE PRICE ANALYSIS

TABLE 4 AVERAGE SELLING PRICE OF MIST ELIMINATORS, BY TYPE VS. REGION

5.8 CUSTOMER BUYING BEHAVIOR (NEEDS AND EXPECTATIONS, DECISION-MAKING PROCESS)

5.8.1 PROCUREMENT VARIATION

5.8.1.1 New Plant Expansion

5.8.1.2 Repair and Maintenance Activities

5.9 YC AND YCC SHIFT

FIGURE 19 YCC SHIFT: YOUR CLIENTS’ CLIENTS’ SHIFT IN IMPERATIVES & OUTCOMES IN APPLICATIONS WILL BRING IN CHANGE IN FUTURE REVENUE MIX!

5.9.1 YC SHIFT

5.9.2 YCC SHIFT

5.10 REGULATORY LANDSCAPE

5.11 KEY EXPORTING AND IMPORTING COUNTRIES

TABLE 5 INTENSITY OF TRADE, BY KEY COUNTRIES

5.12 FORECAST IMPACT FACTORS AND COVID-19 IMPACT

5.13 ECOSYSTEM MAP

5.14 TECHNOLOGY ANALYSIS

5.15 PATENT ANALYSIS

FIGURE 20 NUMBER OF GRANTED PATENTS PER YEAR

TABLE 6 JURISDICTION VS. GRANTED PATENTS

TABLE 7 NUMBER OF GRANTED PATENTS, BY KEY PLAYERS (TILL AUGUST 2020)

TABLE 8 PATENT DETAILS OF KEY PLAYERS

5.16 MACROECONOMIC INDICATORS

5.16.1 GLOBAL GDP OUTLOOK

FIGURE 21 IMF-PROJECTED GOVERNMENT FISCAL BALANCES RELATIVE TO GDP

FIGURE 22 WORLD GDP GROWTH OUTLOOK

TABLE 9 WORLD GDP GROWTH PROJECTION

5.17 ADJACENT MARKETS

5.17.1 FIBERGLASS MARKET

TABLE 10 FIBERGLASS MARKET SNAPSHOT

TABLE 11 FIBERGLASS MARKET SIZE, BY GLASS TYPE, 2018—2025 (USD MILLION)

5.17.2 INDUSTRIAL FILTERS MARKET

FIGURE 23 LIQUID FILTER MEDIA ACCOUNTED FOR THE LARGER SHARE IN THE INDUSTRIAL FILTERS MARKET

TABLE 12 INDUSTRIAL FILTERS MARKET SIZE, BY TYPE, 2016–2023 (USD MILLION)

5.17.3 FLUE GAS DESULFURIZATION SYSTEM MARKET

TABLE 13 FGD: AVAILABLE TECHNOLOGIES

5.18 CASE STUDY

6 MIST ELIMINATORS MARKET, BY TYPE (Page No. - 89)

6.1 INTRODUCTION

TABLE 14 PERFORMANCE FACTORS COMPARISON OF THE MIST ELIMINATORS

FIGURE 24 WIRE-MESH SEGMENT TO MAINTAIN ITS ASCENDENCY DURING THE FORECAST PERIOD

TABLE 15 MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (UNIT)

TABLE 16 MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

6.2 WIRE-MESH

6.2.1 LOW COST, HIGH LIQUID CAPACITY, AND WIDE APPLICATION AREA SUPPORT MARKET GROWTH

TABLE 17 WIRE-MESH: MIST ELIMINATORS MARKET SIZE, BY REGION, 2018–2025 (UNIT)

TABLE 18 WIRE-MESH: MIST ELIMINATORS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

6.3 VANE TYPE

6.3.1 VANE TYPE ARE USED AS AN ALTERNATIVE TO WIRE-MESH IN SEVERAL END-USE INDUSTRIES

TABLE 19 VANE TYPE: MIST ELIMINATORS MARKET SIZE, BY REGION, 2018–2025 (UNIT)

TABLE 20 VANE TYPE: MIST ELIMINATORS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

6.4 FIBER-BED

6.4.1 STRINGENT REGULATION AND HIGH EFFICIENCY SUPPORT THE MARKET GROWTH

TABLE 21 FIBER-BED: MIST ELIMINATORS MARKET SIZE, BY REGION, 2018–2025 (UNIT)

TABLE 22 FIBER-BED: MIST ELIMINATORS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 23 FIBER-BED MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (UNIT)

TABLE 24 FIBER-BED MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

6.5 OTHERS

TABLE 25 OTHERS: MIST ELIMINATORS MARKET SIZE, BY REGION, 2018–2025 (UNIT)

TABLE 26 OTHERS: MIST ELIMINATORS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

7 MIST ELIMINATORS MARKET, BY END-USE INDUSTRY (Page No. - 96)

7.1 INTRODUCTION

FIGURE 25 OIL & GAS SEGMENT TO MAINTAIN LEAD DURING THE FORECAST PERIOD

TABLE 27 MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (UNIT)

TABLE 28 MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

7.2 OIL & GAS

7.2.1 TURMOIL IN THE OIL & GAS INDUSTRY WILL SIGNIFICANTLY IMPACT THE MARKET DEMAND

FIGURE 26 GLOBAL CRUDE OIL PRODUCTION, 2018 – 2021 (MILLION BARRELS PER DAY)

FIGURE 27 CRUDE OIL PRICE ANALYSIS AND TREND (TILL AUGUST 2020)

TABLE 29 MIST ELIMINATORS MARKET SIZE IN OIL & GAS, BY REGION, 2018–2025 (UNIT)

TABLE 30 MIST ELIMINATORS MARKET SIZE IN OIL & GAS, BY REGION, 2018–2025 (USD MILLION)

7.3 DESALINATION

7.3.1 GROWING INVESTMENT IN THE EXPANSION OF DESALINATION CAPACITY SUPPORTS THE MARKET GROWTH

FIGURE 28 DESALINATION PLANT CAPACITY, BY REGION AND TECHNOLOGY (2018)

TABLE 31 MIST ELIMINATORS MARKET SIZE IN DESALINATION, BY REGION, 2018–2025 (UNIT)

TABLE 32 MIST ELIMINATORS MARKET SIZE IN DESALINATION, BY REGION, 2018–2025 (USD MILLION)

7.4 POWER GENERATION

7.4.1 STRINGENT REGULATIONS TO REDUCE SOX EMISSION SUPPORT THE MARKET GROWTH

FIGURE 29 PROPOSED COAL-FIRED POWER PLANT CAPACITY, BY REGION, 2019

TABLE 33 MIST ELIMINATORS MARKET SIZE IN POWER GENERATION, BY REGION, 2018–2025 (UNIT)

TABLE 34 MIST ELIMINATORS MARKET SIZE IN POWER GENERATION, BY REGION, 2018–2025 (USD MILLION)

7.5 CHEMICAL

7.5.1 STEADY GROWTH OF CHEMICAL INDUSTRY IN DEVELOPING REGIONS TO DRIVE THE MARKET

TABLE 35 MIST ELIMINATORS MARKET SIZE IN CHEMICALS, BY REGION, 2018–2025 (UNIT)

TABLE 36 MIST ELIMINATORS MARKET SIZE IN CHEMICALS, BY REGION, 2018–2025 (USD MILLION)

7.6 PAPER & PULP

7.6.1 STRINGENT GOVERNMENT REGULATIONS DRIVE THE MARKET GROWTH

TABLE 37 MIST ELIMINATORS MARKET SIZE IN PAPER & PULP, BY REGION, 2018–2025 (UNIT)

TABLE 38 MIST ELIMINATORS MARKET SIZE IN PAPER & PULP, BY REGION, 2018–2025 (USD MILLION)

7.7 TEXTILE

7.7.1 GROWTH OF TEXTILE INDUSTRY IN DEVELOPING COUNTRIES TO DRIVE THE MARKET

TABLE 39 MIST ELIMINATORS MARKET SIZE IN TEXTILE, BY REGION, 2018–2025 (UNIT)

TABLE 40 MIST ELIMINATORS MARKET SIZE IN TEXTILE, BY REGION, 2018–2025 (USD MILLION)

7.8 PHARMACEUTICAL & MEDICAL

7.8.1 EXPECTED DOUBLE-DIGIT GROWTH IN DEVELOPING COUNTRIES WILL SUPPORT MARKET GROWTH

TABLE 41 MIST ELIMINATORS MARKET SIZE IN PHARMACEUTICAL & MEDICAL, BY REGION, 2018–2025 (UNIT)

TABLE 42 MIST ELIMINATORS MARKET SIZE IN PHARMACEUTICAL & MEDICAL, BY REGION, 2018–2025 (USD MILLION)

7.9 FOOD & BEVERAGE

7.9.1 GROWING CONCERN ABOUT THE QUALITY OF PRODUCTS WILL DRIVE THE MARKET

TABLE 43 MIST ELIMINATORS MARKET SIZE IN FOOD & BEVERAGE, BY REGION, 2018–2025 (UNIT)

TABLE 44 MIST ELIMINATORS MARKET SIZE IN FOOD & BEVERAGE, BY REGION, 2018–2025 (USD MILLION)

7.10 OTHERS

TABLE 45 MIST ELIMINATORS MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2018–2025 (UNIT)

TABLE 46 MIST ELIMINATORS MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2018–2025 (USD MILLION)

8 MIST ELIMINATORS MARKET, BY APPLICATION (Page No. - 110)

8.1 INTRODUCTION

FIGURE 30 DISTILLATION TOWER SEGMENT TO MAINTAIN ITS LEAD DURING THE FORECAST PERIOD

TABLE 47 MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (UNIT)

TABLE 48 MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.2 DISTILLATION TOWER

8.2.1 IT HELPS MAINTAIN THE QUALITY OF THE END-PRODUCT AND PERFORMANCE

TABLE 49 MIST ELIMINATORS MARKET SIZE IN DISTILLATION TOWER, BY REGION, 2018–2025 (UNIT)

TABLE 50 MIST ELIMINATORS MARKET SIZE IN DISTILLATION TOWER, BY REGION, 2018–2025 (USD MILLION)

8.3 EVAPORATOR

8.3.1 EFFECTIVE PERFORMANCE OF MIST ELIMINATORS DRIVES THE MARKET

TABLE 51 MIST ELIMINATORS MARKET SIZE IN EVAPORATOR, BY REGION, 2018–2025 (UNIT)

TABLE 52 MIST ELIMINATORS MARKET SIZE IN EVAPORATOR, BY REGION, BY REGION, 2018–2025 (USD MILLION)

8.4 KNOCKOUT DRUM

8.4.1 REDUCTION IN CAPITAL INVESTMENT AND IMPROVED EFFICIENCY TO DRIVE THE MARKET

TABLE 53 MIST ELIMINATORS MARKET SIZE IN KNOCKOUT DRUM, BY REGION, 2018–2025 (UNIT)

TABLE 54 MIST ELIMINATORS MARKET SIZE IN KNOCKOUT DRUM, BY REGION, 2018–2025 (USD MILLION)

8.5 SCRUBBER

8.5.1 STRINGENT REGULATION SUPPORT THE MARKET GROWTH

TABLE 55 MIST ELIMINATORS MARKET SIZE IN SCRUBBER, BY REGION, 2018–2025 (UNIT)

TABLE 56 MIST ELIMINATORS MARKET SIZE IN SCRUBBER, BY REGION, 2018–2025 (USD MILLION)

8.6 OTHERS

TABLE 57 MIST ELIMINATORS MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2018–2025 (UNIT)

TABLE 58 MIST ELIMINATORS MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2018–2025 (USD MILLION)

9 MIST ELIMINATORS MARKET, BY MATERIAL (Page No. - 118)

9.1 INTRODUCTION

TABLE 59 SELECTION OF MATERIAL VS. TYPE OF CHEMICAL HANDLED

TABLE 60 MIST ELIMINATORS MARKET SIZE, BY MATERIAL, 2018–2025 (TON)

9.2 METAL

9.2.1 IT IS MAINLY USED IN FABRICATION DUE TO LOW COST, HIGH STRENGTH, AND SUITABILITY FOR USE IN SEVERAL INDUSTRIAL APPLICATIONS

TABLE 61 METAL: MIST ELIMINATORS MARKET SIZE, BY REGION, 2018–2025 (TON)

9.3 POLYPROPYLENE

9.3.1 HIGH PERFORMANCE CHARACTERISTIC OF MATERIAL MAKES IT SUITABLE FOR SEVERAL INDUSTRIAL APPLICATIONS

TABLE 62 POLYPROPYLENE: MIST ELIMINATORS MARKET SIZE, BY REGION, 2018–2025 (TON)

9.4 FRP

9.4.1 STRINGENT REGULATION AND HIGH EFFICIENCY SUPPORT THE MARKET GROWTH

TABLE 63 FRP: MIST ELIMINATORS MARKET SIZE, BY REGION, 2018–2025 (TON)

9.5 OTHERS

TABLE 64 OTHERS: MIST ELIMINATORS MARKET SIZE, BY REGION, 2018–2025 (TON)

10 MIST ELIMINATORS MARKET, BY REGION (Page No. - 122)

10.1 INTRODUCTION

FIGURE 31 SAUDI ARABIA TO BE THE FASTEST-GROWING MIST ELIMINATORS MARKET

TABLE 65 MIST ELIMINATORS MARKET SIZE, BY REGION, 2018–2025 (UNIT)

TABLE 66 MIST ELIMINATORS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

10.2 APAC

FIGURE 32 APAC: MIST ELIMINATORS MARKET SNAPSHOT

TABLE 67 APAC: MIST ELIMINATORS MARKET SIZE, BY COUNTRY, 2018–2025 (UNIT)

TABLE 68 APAC: MIST ELIMINATORS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 69 APAC: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (UNIT)

TABLE 70 APAC: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 71 APAC: MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (UNIT)

TABLE 72 APAC: MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 73 APAC: MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (UNIT)

TABLE 74 APAC: MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 75 APAC: MIST ELIMINATORS MARKET SIZE, BY MATERIAL, 2018–2025 (TON)

TABLE 76 APAC: FIBER-BED MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (UNIT)

TABLE 77 APAC: FIBER-BED MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

10.2.1 CHINA

10.2.1.1 Strong recovery from the repercussion of the COVID-19 pandemic will support market recovery

TABLE 78 CHINA: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (UNIT)

TABLE 79 CHINA: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 80 CHINA: MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (UNIT)

TABLE 81 CHINA: MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 82 CHINA: MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (UNIT)

TABLE 83 CHINA: MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.2.2 JAPAN

10.2.2.1 Growing investment in the energy and power industry supports the market growth

TABLE 84 JAPAN: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (UNIT)

TABLE 85 JAPAN: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 86 JAPAN: MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (UNIT)

TABLE 87 JAPAN: MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 88 JAPAN: MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (UNIT)

TABLE 89 JAPAN: MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.2.3 INDIA

10.2.3.1 Growing FDI investment in the manufacturing industry will support the market growth

TABLE 90 INDIA: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (UNIT)

TABLE 91 INDIA: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 92 INDIA: MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (UNIT)

TABLE 93 INDIA: MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 94 INDIA: MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (UNIT)

TABLE 95 INDIA: MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.2.4 SOUTH KOREA

10.2.4.1 Steady growth of the manufacturing sector will provide an impetus for market growth

TABLE 96 SOUTH KOREA: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (UNIT)

TABLE 97 SOUTH KOREA: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 98 SOUTH KOREA: MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (UNIT)

TABLE 99 SOUTH KOREA: MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 100 SOUTH KOREA: MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (UNIT)

TABLE 101 SOUTH KOREA: MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.2.5 AUSTRALIA & NEW ZEALAND

10.2.5.1 Growing investment in the oil & gas capacity expansion in the country will spur the demand

TABLE 102 AUSTRALIA & NEW ZEALAND: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (UNIT)

TABLE 103 AUSTRALIA & NEW ZEALAND: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 104 AUSTRALIA & NEW ZEALAND: MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (UNIT)

TABLE 105 AUSTRALIA & NEW ZEALAND: MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 106 AUSTRALIA & NEW ZEALAND: MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (UNIT)

TABLE 107 AUSTRALIA & NEW ZEALAND: MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.2.6 ASEAN COUNTRIES

10.2.6.1 Investment in the oil & gas and chemical industries will boost the market

TABLE 108 ASEAN COUNTRIES: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (UNIT)

TABLE 109 ASEAN COUNTRIES: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 110 ASEAN COUNTRIES: MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (UNIT)

TABLE 111 ASEAN COUNTRIES: MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 112 ASEAN COUNTRIES: MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (UNIT)

TABLE 113 ASEAN COUNTRIES: MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.2.7 REST OF APAC

TABLE 114 REST OF APAC: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (UNIT)

TABLE 115 REST OF APAC: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 116 REST OF APAC: MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (UNIT)

TABLE 117 REST OF APAC: MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 118 REST OF APAC: MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (UNIT)

TABLE 119 REST OF APAC: MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.3 NORTH AMERICA

FIGURE 33 NORTH AMERICA: MIST ELIMINATORS MARKET SNAPSHOT

TABLE 120 NORTH AMERICA: MIST ELIMINATORS MARKET SIZE, BY COUNTRY, 2018–2025 (UNIT)

TABLE 121 NORTH AMERICA: MIST ELIMINATORS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 122 NORTH AMERICA: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (UNIT)

TABLE 123 NORTH AMERICA: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 124 NORTH AMERICA: MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (UNIT)

TABLE 125 NORTH AMERICA: MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 126 NORTH AMERICA: MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (UNIT)

TABLE 127 NORTH AMERICA: MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 128 NORTH AMERICA: MIST ELIMINATORS MARKET SIZE, BY MATERIAL, 2018–2025 (TON)

TABLE 129 NORTH AMERICA: FIBER-BED MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (UNIT)

TABLE 130 NORTH AMERICA: FIBER-BED MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

10.3.1 US

10.3.1.1 Slump in the oil & gas and chemical production will have a significant impact on the market

TABLE 131 US: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (UNIT)

TABLE 132 US: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 133 US: MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (UNIT)

TABLE 134 US: MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 135 US: MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (UNIT)

TABLE 136 US: MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.3.2 CANADA

10.3.2.1 Uncertain end-use industry growth will have an impact on the market

TABLE 137 CANADA: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (UNIT)

TABLE 138 CANADA: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 139 CANADA: MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (UNIT)

TABLE 140 CANADA: MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 141 CANADA: MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (UNIT)

TABLE 142 CANADA: MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.3.3 MEXICO

10.3.3.1 Growing investment in the expansion of desalination capacity supports the market growth

TABLE 143 MEXICO: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (UNIT)

TABLE 144 MEXICO: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 145 MEXICO: MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (UNIT)

TABLE 146 MEXICO: MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 147 MEXICO: MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (UNIT)

TABLE 148 MEXICO: MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.4 EUROPE

TABLE 149 GDP GROWTH RATE, BY COUNTRY

TABLE 150 EUROPE: MIST ELIMINATORS MARKET SIZE, BY COUNTRY, 2018–2025 (UNIT)

TABLE 151 EUROPE: MIST ELIMINATORS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 152 EUROPE: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (UNIT)

TABLE 153 EUROPE: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 154 EUROPE: MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (UNIT)

TABLE 155 EUROPE: MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 156 EUROPE: MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (UNIT)

TABLE 157 EUROPE: MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 158 EUROPE: MIST ELIMINATORS MARKET SIZE, BY MATERIAL, 2018–2025 (TON)

TABLE 159 EUROPE: FIBER-BED MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (UNIT)

TABLE 160 EUROPE: FIBER-BED MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

10.4.1 GERMANY

10.4.1.1 Strong economic recovery post the COVID-19 pandemic will support market growth

TABLE 161 GERMANY: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (UNIT)

TABLE 162 GERMANY: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 163 GERMANY: MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (UNIT)

TABLE 164 GERMANY: MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 165 GERMANY: MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (UNIT)

TABLE 166 GERMANY: MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.4.2 FRANCE

10.4.2.1 Government initiative to boost the manufacturing sector will drive the market

TABLE 167 FRANCE: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (UNIT)

TABLE 168 FRANCE: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 169 FRANCE: MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (UNIT)

TABLE 170 FRANCE: MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 171 FRANCE: MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (UNIT)

TABLE 172 FRANCE: MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.4.3 UK

10.4.3.1 Stringent government regulations and manufacturing sector recovery will drive the market

FIGURE 34 UK MANUFACTURING OUTPUT: Q1-2020 AND Q4-2019

TABLE 173 UK: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (UNIT)

TABLE 174 UK: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 175 UK: MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (UNIT)

TABLE 176 UK: MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 177 UK: MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (UNIT)

TABLE 178 UK: MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.4.4 SPAIN

10.4.4.1 A strong focus on the revival of the economy to support market growth

TABLE 179 SPAIN: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (UNIT)

TABLE 180 SPAIN: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 181 SPAIN: MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (UNIT)

TABLE 182 SPAIN: MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 183 SPAIN: MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (UNIT)

TABLE 184 SPAIN: MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.4.5 ITALY

10.4.5.1 The recovery of the manufacturing sector will drive the

TABLE 185 ITALY: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (UNIT)

TABLE 186 ITALY: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 187 ITALY: MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (UNIT)

TABLE 188 ITALY: MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 189 ITALY: MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (UNIT)

TABLE 190 ITALY: MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.4.6 RUSSIA

10.4.6.1 Recovery of the oil prices will help to boost the economy and market growth

TABLE 191 RUSSIA: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (UNIT)

TABLE 192 RUSSIA: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 193 RUSSIA: MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (UNIT)

TABLE 194 RUSSIA: MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 195 RUSSIA: MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (UNIT)

TABLE 196 RUSSIA: MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.4.7 BENELUX

10.4.7.1 Government support to boost the industrial sector will drive the market

TABLE 197 BENELUX: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (UNIT)

TABLE 198 BENELUX: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 199 BENELUX: MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (UNIT)

TABLE 200 BENELUX: MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 201 BENELUX: MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (UNIT)

TABLE 202 BENELUX: MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.4.8 NORDIC COUNTRIES

10.4.8.1 Sustainable development and stringent government regulations are major driving factors for market growth

TABLE 203 NORDIC COUNTRIES: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (UNIT)

TABLE 204 NORDIC COUNTRIES: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 205 NORDIC COUNTRIES: MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (UNIT)

TABLE 206 NORDIC COUNTRIES: MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 207 NORDIC COUNTRIES: MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (UNIT)

TABLE 208 NORDIC COUNTRIES: MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.4.9 REST OF EUROPE

TABLE 209 REST OF EUROPE: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (UNIT)

TABLE 210 REST OF EUROPE: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 211 REST OF EUROPE: MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (UNIT)

TABLE 212 REST OF EUROPE: MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 213 REST OF EUROPE: MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (UNIT)

TABLE 214 REST OF EUROPE: MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.5 MIDDLE EAST

TABLE 215 MIDDLE EAST: MIST ELIMINATORS MARKET SIZE, BY COUNTRY, 2018–2025 (UNIT)

TABLE 216 MIDDLE EAST: MIST ELIMINATORS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 217 MIDDLE EAST: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (UNIT)

TABLE 218 MIDDLE EAST: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 219 MIDDLE EAST: MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (UNIT)

TABLE 220 MIDDLE EAST: MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 221 MIDDLE EAST: MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (UNIT)

TABLE 222 MIDDLE EAST: MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 223 MIDDLE EAST: MIST ELIMINATORS MARKET SIZE, BY MATERIAL, 2018–2025 (TON)

TABLE 224 MIDDLE EAST: FIBER-BED MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (UNIT)

TABLE 225 MIDDLE EAST: FIBER-BED MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

10.5.1 SAUDI ARABIA

10.5.1.1 Growing investment in the expansion of desalination capacity supports the market growth

TABLE 226 SAUDI ARABIA: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (UNIT)

TABLE 227 SAUDI ARABIA: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 228 SAUDI ARABIA: MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (UNIT)

TABLE 229 SAUDI ARABIA: MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 230 SAUDI ARABIA: MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (UNIT)

TABLE 231 SAUDI ARABIA: MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.5.2 UAE

10.5.2.1 The oil & gas and desalination industries, together, hold a significant share of the market

TABLE 232 UAE: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (UNIT)

TABLE 233 UAE: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 234 UAE: MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (UNIT)

TABLE 235 UAE: MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 236 UAE: MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (UNIT)

TABLE 237 UAE: MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.5.3 QATAR

10.5.3.1 The expansion of chemical and petrochemicals facility will create demand for mist eliminators

TABLE 238 QATAR: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (UNIT)

TABLE 239 QATAR: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 240 QATAR: MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (UNIT)

TABLE 241 QATAR: MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 242 QATAR: MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (UNIT)

TABLE 243 QATAR: MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.5.4 KUWAIT

10.5.4.1 The solar-powered desalination plant will drive the market

TABLE 244 KUWAIT: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (UNIT)

TABLE 245 KUWAIT: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 246 KUWAIT: MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (UNIT)

TABLE 247 KUWAIT: MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 248 KUWAIT: MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (UNIT)

TABLE 249 KUWAIT: MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.5.5 OMAN

10.5.5.1 Growing investment in the expansion of desalination capacity supports the market growth

TABLE 250 OMAN: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (UNIT)

TABLE 251 OMAN: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 252 OMAN: MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (UNIT)

TABLE 253 OMAN: MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 254 OMAN: MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (UNIT)

TABLE 255 OMAN: MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.5.6 REST OF MIDDLE EAST

TABLE 256 REST OF MIDDLE EAST: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (UNIT)

TABLE 257 REST OF MIDDLE EAST: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 258 REST OF MIDDLE EAST: MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (UNIT)

TABLE 259 REST OF MIDDLE EAST: MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 260 REST OF MIDDLE EAST: MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (UNIT)

TABLE 261 REST OF MIDDLE EAST: MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.6 SOUTH AMERICA

TABLE 262 SOUTH AMERICA: MIST ELIMINATORS MARKET SIZE, BY COUNTRY, 2018–2025 (UNIT)

TABLE 263 SOUTH AMERICA: MIST ELIMINATORS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 264 SOUTH AMERICA: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (UNIT)

TABLE 265 SOUTH AMERICA: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 266 SOUTH AMERICA: MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (UNIT)

TABLE 267 SOUTH AMERICA: MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 268 SOUTH AMERICA: MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (UNIT)

TABLE 269 SOUTH AMERICA: MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 270 SOUTH AMERICA: MIST ELIMINATORS MARKET SIZE, BY MATERIAL, 2018–2025 (TON)

TABLE 271 SOUTH AMERICA: FIBER-BED MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (UNIT)

TABLE 272 SOUTH AMERICA: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

10.6.1 BRAZIL

10.6.1.1 Turmoil in the chemical and oil & gas industries will affect the market growth

TABLE 273 BRAZIL: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (UNIT)

TABLE 274 BRAZIL: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 275 BRAZIL: MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (UNIT)

TABLE 276 BRAZIL: MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 277 BRAZIL: MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (UNIT)

TABLE 278 BRAZIL: MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.6.2 ARGENTINA

10.6.2.1 Sluggish growth of the manufacturing sector in the country will have a negative impact on the market growth

TABLE 279 ARGENTINA: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (UNIT)

TABLE 280 ARGENTINA: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 281 ARGENTINA: MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (UNIT)

TABLE 282 ARGENTINA: MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 283 ARGENTINA: MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (UNIT)

TABLE 284 ARGENTINA: MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.6.3 REST OF SOUTH AMERICA

TABLE 285 REST OF SOUTH AMERICA: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (UNIT)

TABLE 286 REST OF SOUTH AMERICA: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 287 REST OF SOUTH AMERICA: MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (UNIT)

TABLE 288 REST OF SOUTH AMERICA: MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 289 REST OF SOUTH AMERICA: MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (UNIT)

TABLE 290 REST OF SOUTH AMERICA: MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 018–2025 (USD MILLION)

10.7 AFRICA

TABLE 291 AFRICA: MIST ELIMINATORS MARKET SIZE, BY COUNTRY, 2018–2025 (UNIT)

TABLE 292 AFRICA: MIST ELIMINATORS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 293 AFRICA: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (UNIT)

TABLE 294 AFRICA: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 295 AFRICA: MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (UNIT)

TABLE 296 AFRICA: MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 297 AFRICA: MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (UNIT)

TABLE 298 AFRICA: MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 299 AFRICA: MIST ELIMINATORS MARKET SIZE, BY MATERIAL, 2018–2025 (TON)

TABLE 300 AFRICA: FIBER-BED MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (UNIT)

TABLE 301 AFRICA: FIBER-BED MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

10.7.1 SOUTH AFRICA

10.7.1.1 The steady growth of the manufacturing industry will drive the market

TABLE 302 SOUTH AFRICA: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (UNIT)

TABLE 303 SOUTH AFRICA: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 304 SOUTH AFRICA: MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (UNIT)

TABLE 305 SOUTH AFRICA: MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 306 SOUTH AFRICA: MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (UNIT)

TABLE 307 SOUTH AFRICA: MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.7.2 REST OF AFRICA

TABLE 308 REST OF AFRICA: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (UNIT)

TABLE 309 REST OF AFRICA: MIST ELIMINATORS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 310 REST OF AFRICA: MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (UNIT)

TABLE 311 REST OF AFRICA: MIST ELIMINATORS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 312 REST OF AFRICA: MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (UNIT)

TABLE 313 REST OF AFRICA: MIST ELIMINATORS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 219)

11.1 INTRODUCTION

FIGURE 35 ACQUISITION IS THE KEY STRATEGY ADOPTED BY PLAYERS BETWEEN 2017 AND 2020

11.2 MARKET SHARE OF KEY PLAYERS (2019)

FIGURE 36 MARKET SHARE OF KEY PLAYERS

11.2.1 COMPANIES’ PRODUCT AND INTENSITY MAPPING

TABLE 314 PRODUCT MAPPING OF THE KEY PLAYERS INVOLVED IN THE MIST ELIMINATORS MARKET

TABLE 315 INFORMATION OF KEY PLAYERS’ GEOGRAPHICAL PRESENCE, PRODUCTION LOCATION, MATERIAL OF CONSTRUCTION, AND KEY SEGMENTS

TABLE 316 STRATEGIC POSITIONING OF THE KEY PLAYERS

11.3 COMPANY EVALUATION MATRIX

11.3.1 STAR

11.3.2 PERVASIVE

11.3.3 EMERGING LEADER

11.3.4 PRODUCT FOOTPRINT

FIGURE 37 MIST ELIMINATORS MARKET: COMPANY EVALUATION MATRIX, 2020

11.4 MARKET EVALUATION FRAMEWORK

FIGURE 38 MARKET EVALUATION FRAMEWORK: MARKET EXPANSION AND ACQUISITION

11.5 COMPETITIVE SCENARIO

11.6 REVENUE ANALYSIS OF TOP PLAYERS

TABLE 317 REVENUE ANALYSIS OF KEY PLAYERS

12 COMPANY PROFILES (Page No. - 230)

(Business Overview, Impact of COVID-19 on business segments, Products Offered, Recent Developments, Strategic Overview, Winning Imperative)*

12.1 SULZER LTD.

FIGURE 39 SULZER LTD.: COMPANY SNAPSHOT

12.2 CECO ENVIRONMENTAL CORPORATION

FIGURE 40 CECO ENVIRONMENTAL CORPORATION: COMPANY SNAPSHOT

12.3 MUNTERS GROUP AB

FIGURE 41 MUNTERS GROUP AB: COMPANY SNAPSHOT

12.4 KOCH-GLITSCH LP

12.5 SULLAIR, LLC

12.6 KIMRE INC.

12.7 AIR QUALITY ENGINEERING, INC.

12.8 DUPONT DE NEMOURS, INC.

FIGURE 42 DUPONT DE NEMOURS, INC.: COMPANY SNAPSHOT

12.9 AMACS

12.10 HILLIARD CORPORATION

12.11 MONROE ENVIRONMENTAL CORPORATION

12.12 BEGG COUSLAND ENVIROTEC LIMITED

12.13 BOEGGER INDUSTECH LIMITED

12.14 GALIAKOTWALA ENGINEERING COMPANY PVT. LTD.

12.15 EVERGREEN TECHNOLOGIES PVT LTD.

12.16 WEB WIRE MESH CO., LTD

12.17 GREEN MIST ELIMINATOR FACTORY

12.18 DIVERSIFIED AIR SYSTEMS INC.

12.19 AER CONTROL SYSTEMS

12.20 VARUN ENGINEERING PVT LTD.

12.21 7-WAY SOLUTIONS

*Details on Business Overview, Impact of COVID-19 on business segments, Products Offered, Recent Developments, Strategic Overview, Winning Imperative might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 258)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

The study involved four major activities for estimating the current size of the global mist eliminators market. Exhaustive secondary research was carried out to collect information on the market, the peer market, and the parent market. The COVID-19 pandemic impact on the demand with respect to end-use industries, application areas, and countries was comprehended. The next step was to validate these findings, assumptions and sizes with the industry experts across the supply chain of mist eliminators through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the mist eliminators market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to to identify and collect information for this study on the mist eliminators market. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; regulatory bodies, trade directories, and databases.

Primary Research

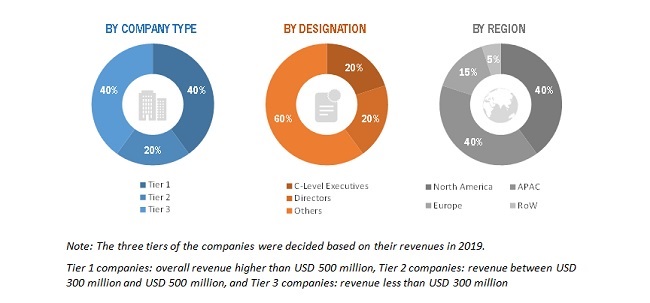

Various primary sources from both the supply and demand sides of the mist eliminators market were interviewed to obtain qualitative and quantitative information. The primary sources from the supply-side included industry experts, such as Chief Executive Officers (CEOs), vice presidents, marketing directors, sales professionals, and related key executives from various leading companies and organizations operating in the mist eliminators industry. The primary sources from the demand-side included key executives from end-use industries. The breakdown of the profiles of primary respondents is as follows:

BREAKDOWN OF PRIMARY INTERVIEWS

To know about the assumptions considered for the study, download the pdf brochure

Note: The three tiers of the companies were decided based on their revenues in 2019.

Tier 1 companies: overall revenue higher than USD 500 million, Tier 2 companies: revenue between USD 300 million and USD 500 million, and Tier 3 companies: revenue less than USD 300 million

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the size of the global mist eliminators market. These approaches were also used extensively to estimate the size of various segments of the market. The research methodology used to estimate the market size included the following details:

- The key players were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- The impact of the COVID-19 pandemic was ascertained

- All percentage split and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments of the mist eliminators market. The data was triangulated by studying various factors and trends from both the demand- and supply-side.

Report Objectives

- To define, analyze, and project the size of the mist eliminators market in terms of value and volume based on type, application, end-use industry and region

- To project the size of the market and its segments with respect to the five main regions, namely, North America, Europe, Asia Pacific, Middle East, Africa, and South America

- To provide detailed information about the key factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the market

- To strategically analyze the micromarkets with respect to individual growth trends, COVID-19 pandemic impact, prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a detailed competitive landscape of the market leaders

- To analyze the competitive developments, such as new product launches, expansions, and acquisitions, in the mist eliminators market

- To strategically profile the key players operating in the market and comprehensively analyze their market shares and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs. The following customization options are available for the mist eliminators report:

Product Analysis

- Product matrix, which offers a detailed comparison of the product portfolio of companies

Regional Analysis

- Further analysis of the mist eliminators market for additional countries

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Mist Eliminator Market