Affective Computing Market by Technology (Touch-based and Touchless), Component (Software (Speech Recognition and Gesture Recognition) and Hardware (Sensors, Cameras, and Storage Devices and Processors)), Vertical, and Region - Global Forecast to 2025

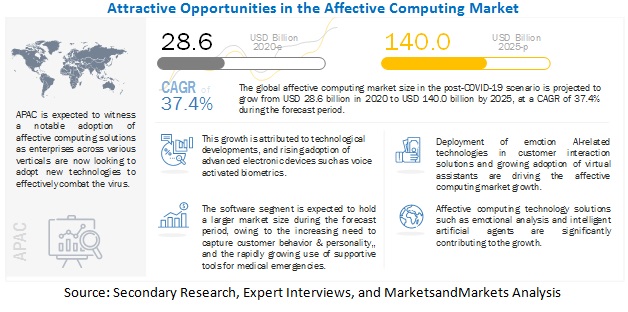

The global affective computing market size was valued at USD 28.6 billion in 2020. It is projected to reach USD 140.0 billion by 2025, growing at a CAGR of 37.4% during the forecast period (2020–2026). Factors such as the proliferation of gesture-enabled IoT devices in smart home automation, growing demand for voice-driven workstations and navigation systems, and integration of in-car infotainment systems are expected to work in favor of the market in the near future.

Affective Computing Market Dynamics

Driver: Technological advancements across the globe

With the emergence of Industry 4.0, technological advancements, such as unobstructed computing, improved human-computer interfaces, and cutting-edge networking technologies are anticipated to enhance the performance of the affective computing system. Affective computing is projected to have significant implications on the future of any company, with a widespread impact on their ergonomics, human factors, project management, and organizational changes. This factor has fueled the adoption of emotion AI/affective computing solutions across various industry verticals globally.

Restraint: High production cost of affective computing systems

The cost incurred in making affective computing systems is more, and the tangible return on investment is low. This factor acts as a major barrier to the growth of the affective computing market, as most of the enabling technologies such as wearable computing and gesture recognition incur substantial development costs. Thus, the companies who lack financial resources do not opt for the platform, even if they are interested in affective computing to increase their productivity.

Opportunity: Increasing government initiatives to leverage the benefits of emotion AI/affective computing technology

Enterprises across various verticals are rapidly adapting initiatives set by governments to leverage the advantage of AI and ML technologies in the COVID-19 crisis. The government of Kerala, a state in India, has procured an AI-powered ‘Thermal and Optical Imaging Camera’ for fever screening to scan people from a safe distance with a motive to combat the virus. With the increasing amount of funding across the globe to fight COVID-19, the government sector is expected to improvise on law enforcement and public safety for citizens and patient scrutiny in the healthcare sector and law enforcement agencies by deploying affective computing systems on a large scale.

Challenge: Lack of knowledge and awareness and technical challenges

The biggest challenge in the AI emotion/affective computing market is that it is not yet fully understood how affective computing will impact business applications and processes. Affective computing is cutting-edge technology and has far more advantages than various existing technologies, including AI-based computing solutions and sentiment computing solutions. There is tremendous hype about the technology as well; however, business leaders are yet to decipher or separate this hype from the real potential. Moreover, the social and economic implication of this technology is not yet analyzed. There is strong ambiguity regarding what affective computing is capable of and what it cannot do.

By software, the analytics software segment is expected to hold a larger share of the affective computing market in 2020

The analytics software segment mainly comprises neural analytics and predictive analytics software, which include programming languages, such as R, Python, and SAS. These analytics software solutions are used to provide different results as per the requirement of users. Analytics software accounts for a major share in the analytics software industry, as it stores all the past data that are used in the analysis of different biological neural network segments and uses statistical time series analysis to provide results for different complex scenarios.

By hardware, the cameras segment is expected to grow at a higher CAGR during the forecast period

Cameras are used widely to enable affective computing solutions, primarily in the areas of security and surveillance that have specific applications across verticals. The fastest-growing application segments of the camera that aid support for the market is commercial facilities, public spaces, and government agencies. There is an increase in the demand for cameras-enabled affective computing solutions for various security and surveillance applications, such as protection from terrorist attacks, and in the household security industry, smart buildings, and outdoor security industry.

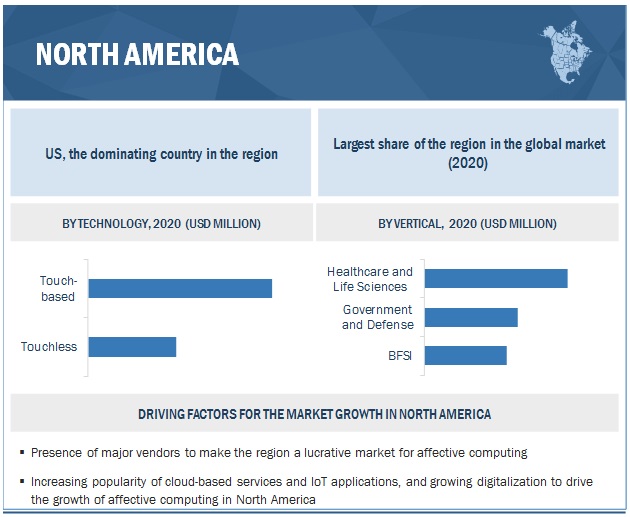

By region, North America is expected to account for the majority of the affective computing market share during the forecast period.

North American has the presence of several prominent market players delivering advanced solutions to all the industry verticals in the regions. Apart from this factor, the geographical presence, strategic investments, partnerships, and significant R&D activities are contributing to the hefty deployments of affective solutions. Key pure-play vendors such as Affectiva, GestureTek, Kairos, and Eyeris, along with several start-ups in the region, are offering enhanced affective computing solutions & services to cater to the needs of customers. Such factors are expected to fuel the growth of the market in North America.

Market Players:

The vendors covered in the affective computing market report include Google (US), Microsoft (US), IBM (US), Apple (US), Affectiva (US), Qualcomm (US), Elliptic Labs (Norway), Eyesight Technologies (Israel), Sony Depthsensing Solutions (Belgium), Intel (US), Pyreos (UK), Cognitec Systems (Germany), Beyond Verbal (Israel), GestureTek (Canada), SightCorp (Noord-Holland), CrowdEmotion (UK), Kairos (US), nViso (Switzerland), PointGrab (US), Eyeris (US), Numenta (US). These players have adopted various growth strategies, such as partnerships, agreements & collaborations, new product launches & product enhancements, and acquisitions to expand their presence in the market.

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2014-2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

Technology, Component, Software, Hardware, Vertical, And Region |

|

Geographies covered |

North America, Europe, Asia Pacific, Rest of the World |

|

Companies covered |

22 major vendors, namely, include Google (US), Microsoft (US), IBM (US), Apple (US), Qualcomm (US), Affectiva (US), Elliptic Labs (Norway), Eyesight Technologies (Israel), Sony Depthsensing Solutions (Belgium), Intel (US), Pyreos (UK), Cognitec Systems (Germany), Beyond Verbal (Israel), GestureTek (Canada), SightCorp (Noord-Holland), CrowdEmotion (UK), Kairos (US), nViso (Switzerland), PointGrab (US), Eyeris (US), Numenta (US). |

This research report categorizes the affective computing market to forecast revenues and analyze trends in each of the following submarkets:

Based on technology:

- Touch-based

- Touchless

Based on the component:

- Software

- Hardware

Based on software:

- Speech Recognition

- Gesture Recognition

- Facial Feature Extraction

- Analytics Software

- Enterprise Software

Based on hardware:

- Sensors

- Cameras

- Storage Devices and Processors

- Others

Based on verticals:

- Academia and Research

- Media and Entertainment

- Government and Defense

- Healthcare and Life Sciences

- IT and Telecom

- Retail and eCommerce

- Automotive

- BFSI

- Others

Based on the region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- Rest of Europe

-

Asia Pacific

- China

- Japan

- Australia

- Rest of APAC

- Rest of World

Recent Developments

- In July 2019, EyeSight Technologies partnered with leading tier 1 automobile company in China to help bring DriverSense, Eyesight Technology’s Driver Monitoring System (DMS), to automakers in the Chinese market.

- In June 2019, Microsoft launched four free “Eyes First” games for people with speech and mobility disabilities. They can play games, such as tile slide, match two, double up, and maze using the eye gaze input.

- In January 2019, Affectiva partnered with Aptiv PLC to enable next-generation vehicle experience. The partnership will deliver innovative and scalable software - derived from deep learning architectures - to enhance perception capabilities in advanced safety solutions and reimagine the future of the in-cabin experience.

- In September 2018, Affectiva unveiled Mobile Lab with automotive AI technology. The mobile lab car features, which are a part of the first multi-modal in-cabin sensing solution, called Affectiva Automotive AI, demonstrate how AI can make driving safer in semi and fully autonomous vehicles.

- In May 2018, Microsoft signed an agreement to acquire XOXCO, a company with conversational AI and bot development capabilities.

Frequently Asked Questions (FAQ):

What is the definition of affective computing?

What is the market size of the affective computing market?

What are the major drivers in the affective computing market?

Who are the key players operating in the affective computing market?

What are the opportunities for new market entrants in the affective computing market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION

INTRODUCTION TO COVID-19

1.1 COVID-19 HEALTH ASSESSMENT

1.2 COVID-19 ECONOMIC ASSESSMENT

1.2.1 COVID-19 ECONOMIC IMPACT: SCENARIO ASSESSMENT

1.3 OBJECTIVES OF THE STUDY

1.4 MARKET DEFINITION

1.4.1 INCLUSIONS AND EXCLUSIONS

1.5 MARKET SCOPE

1.5.1 MARKET SEGMENTATION

1.5.2 REGIONS COVERED

1.6 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

2.3.1 TOP-DOWN APPROACH

2.3.2 BOTTOM-UP APPROACH

2.4 MARKET FORECAST

2.5 ASSUMPTIONS FOR THE STUDY

2.6 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 ATTRACTIVE MARKET OPPORTUNITIES IN THE AFFECTIVE COMPUTING MARKET

4.2 MARKET, MARKET SHARE OF TOP 3 VERTICALS AND REGIONS, 2020

4.3 MARKET, BY COMPONENT, 2020–2025

4.4 MARKET, BY SOFTWARE, 2020–2025

4.5 MARKET, BY HARDWARE, 2020–2025

5 MARKET OVERVIEW AND INDUSTRY TRENDS

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Growing need for telehealth-related affective computing solutions

5.2.1.2 Rising need for socially intelligent artificial agents

5.2.1.3 Increasing adoption of wearable devices and growing internet penetration across industry verticals

5.2.1.4 Technological advancements across the globe

5.2.1.5 Growing need for high operational excellence, increased resource utilization, and enhanced productivity

5.2.2 RESTRAINTS

5.2.2.1 High production cost of affective computing systems

5.2.2.2 Gap between academic research and real-life applications

5.2.3 OPPORTUNITIES

5.2.3.1 Growing inclination toward industry-specific solutions

5.2.3.2 Increasing government initiatives to leverage the benefits of emotion AI/affective computing technology

5.2.3.3 Growing adoption of cloud-based applications and services

5.2.3.4 Growing number of partnerships and widening ecosystems

5.2.4 CHALLENGES

5.2.4.1 Complex systems for emotion recognition

5.2.4.2 Lack of knowledge and awareness and technical challenges

5.2.4.3 High power consumption of wearable computing devices

5.3 COVID-19 PANDEMIC-DRIVEN MARKET DYNAMICS AND FACTOR ANALYSIS

5.3.1 DRIVERS AND OPPORTUNITIES

5.3.2 RESTRAINTS AND CHALLENGES

5.4 ETHICS OF MEASURING EMOTIONS

5.5 KEY GUARDRAILS FOR ADOPTION OF AFFECTIVE COMPUTING

5.6 INNOVATION SPOTLIGHT

5.6.1 NEURODATA LAB

5.6.2 EMTEQ

5.6.3 SENSUM

5.7 USE CASES

5.7.1 USE CASES: GAMING

5.7.2 USE CASES: GOVERNMENT AND DEFENSE

5.7.3 USE CASES: AUTOMOTIVE

5.7.4 USE CASES: HIGH-TECH

6 AFFECTIVE COMPUTING MARKET, BY TECHNOLOGY

6.1 INTRODUCTION

6.1.1 MARKET ESTIMATES AND FORECAST, BY TECHNOLOGY, 2014–2025

6.2 TOUCH-BASED

6.2.1 TOUCH-BASED AFFECTIVE COMPUTING: COVID-19 MARKET DRIVERS

6.2.2 MARKET ESTIMATES AND FORECAST, BY REGION, 2014–2025

6.3 TOUCHLESS

6.3.1 TOUCHLESS AFFECTIVE COMPUTING: COVID-19 MARKET DRIVERS

6.3.2 MARKET ESTIMATES AND FORECAST, BY REGION, 2014–2025

7 MARKET, BY COMPONENT

7.1 INTRODUCTION

7.1.1 MARKET ESTIMATES AND FORECAST, BY COMPONENT, 2014–2025

7.2 SOFTWARE

7.2.1 MARKET ESTIMATES AND FORECAST, BY REGION 2014–2025

7.3 HARDWARE

7.3.1 MARKET ESTIMATES AND FORECAST, BY REGION, 2014–2025

8 AFFECTIVE COMPUTING MARKET, BY SOFTWARE

8.1 INTRODUCTION

8.1.1 MARKET ESTIMATES AND FORECAST, BY SOFTWARE, 2014–2025

8.2 SPEECH RECOGNITION

8.2.1 SPEECH RECOGNITION: COVID-19 MARKET DRIVERS

8.2.2 MARKET ESTIMATES AND FORECAST, BY REGION, 2014–2025

8.3 GESTURE RECOGNITION

8.3.1 GESTURE RECOGNITION: COVID-19 MARKET DRIVERS

8.3.2 MARKET ESTIMATES AND FORECAST, BY REGION, 2014–2025

8.4 FACIAL FEATURE EXTRACTION

8.4.1 FACIAL FEATURE EXTRACTION: COVID-19 MARKET DRIVERS

8.4.2 MARKET ESTIMATES AND FORECAST, BY REGION, 2014–2025

8.5 ANALYTICS SOFTWARE

8.5.1 ANALYTICS SOFTWARE: COVID-19 MARKET DRIVERS

8.5.2 MARKET ESTIMATES AND FORECAST, BY REGION, 2014–2025

8.6 ENTERPRISE SOFTWARE

8.6.1 ENTERPRISE SOFTWARE: COVID-19 MARKET DRIVERS

8.6.2 MARKET ESTIMATES AND FORECAST, BY REGION, 2014–2025

9 AFFECTIVE COMPUTING MARKET, BY HARDWARE

9.1 INTRODUCTION

9.1.1 MARKET ESTIMATES AND FORECAST, BY HARDWARE, 2014–2025

9.2 SENSORS

9.2.1 SENSORS: COVID-19 MARKET DRIVERS

9.2.2 MARKET ESTIMATES AND FORECAST, BY REGION, 2014–2025

9.3 CAMERAS

9.3.1 CAMERAS: COVID-19 MARKET DRIVERS

9.3.2 MARKET ESTIMATES AND FORECAST, BY REGION, 2014–2025

9.4 STORAGE DEVICES AND PROCESSORS

9.4.1 STORAGE DEVICES AND PROCESSORS: COVID-19 MARKET DRIVERS

9.4.2 MARKET ESTIMATES AND FORECAST, BY REGION, 2014–2025

9.5 OTHERS

9.5.1 MARKET ESTIMATES AND FORECAST, BY REGION, 2014–2025

10 AFFECTIVE COMPUTING MARKET, BY VERTICAL

10.1 INTRODUCTION

10.1.1 MARKET ESTIMATES AND FORECAST, BY VERTICAL, 2014–2025

10.2 ACADEMIA AND RESEARCH

10.2.1 MARKET SIZE IN ACADEMIA AND RESEARCH: COVID-19 MARKET DRIVERS

10.2.2 MARKET ESTIMATES AND FORECAST, BY REGION, 2014–2025

10.3 MEDIA AND ENTERTAINMENT

10.3.1 MARKET SIZE IN MEDIA AND ENTERTAINMENT: COVID-19 MARKET DRIVERS

10.3.2 MARKET ESTIMATES AND FORECAST, BY REGION, 2014–2025

10.4 GOVERNMENT AND DEFENSE

10.4.1 MARKET SIZE IN GOVERNMENT AND DEFENSE: COVID-19 MARKET DRIVERS

10.4.2 MARKET ESTIMATES AND FORECAST, BY REGION, 2014–2025

10.5 HEALTHCARE AND LIFE SCIENCES

10.5.1 MARKET SIZE IN HEALTHCARE AND LIFESCIENCES: COVID-19 MARKET DRIVERS

10.5.2 MARKET ESTIMATES AND FORECAST, BY REGION, 2014–2025

10.6 IT AND TELECOM

10.6.1 MARKET SIZE IN IT AND TELECOM: COVID-19 MARKET DRIVERS

10.6.2 MARKET ESTIMATES AND FORECAST, BY REGION, 2014–2025

10.7 RETAIL AND ECOMMERCE

10.7.1 MARKET SIZE IN RETAIL AND ECOMMERCE: COVID-19 MARKET DRIVERS

10.7.2 MARKET ESTIMATES AND FORECAST, BY REGION, 2014–2025

10.8 AUTOMOTIVE

10.8.1 MARKET SIZE IN AUTOMOTIVE: COVID-19 MARKET DRIVERS

10.8.2 MARKET ESTIMATES AND FORECAST, BY REGION, 2014–2025

10.9 BANKING, FINANCIAL SERVICES, AND INSURANCE

10.9.1 MARKET SIZE IN BANKING, FINANCIAL SERVICES, AND INSURANCE: COVID-19 MARKET DRIVERS

10.9.2 MARKET ESTIMATES AND FORECAST, BY REGION, 2014–2025

10.10 OTHERS

10.10.1 MARKET ESTIMATES AND FORECAST, BY REGION, 2014–2025

11 AFFECTIVE COMPUTING MARKET, BY REGION

11.1 INTRODUCTION

11.1.1 MARKET ESTIMATES AND FORECAST, BY REGION, 2014–2025

11.2 NORTH AMERICA

11.2.1 NORTH AMERICA: COVID-19 MARKET DRIVERS

11.2.2 MARKET ESTIMATES AND FORECAST, BY TECHNOLOGY, 2014–2025

11.2.3 MARKET ESTIMATES AND FORECAST, BY COMPONENT, 2014–2025

11.2.4 MARKET ESTIMATES AND FORECAST, BY SOFTWARE, 2014–2025

11.2.5 MARKET ESTIMATES AND FORECAST, BY HARDWARE, 2014–2025

11.2.6 MARKET ESTIMATES AND FORECAST, BY VERTICAL, 2014–2025

11.2.7 MARKET ESTIMATES AND FORECAST, BY COUNTRY, 2014–2025

11.2.8 US

11.2.9 MARKET ESTIMATES AND FORECAST, BY TECHNOLOGY, 2014–2025

11.2.10 MARKET ESTIMATES AND FORECAST, BY COMPONENT, 2014–2025

11.2.11 MARKET ESTIMATES AND FORECAST, BY SOFTWARE, 2014–2025

11.2.12 MARKET ESTIMATES AND FORECAST, BY HARDWARE, 2014–2025

11.2.13 MARKET ESTIMATES AND FORECAST, BY VERTICAL, 2014–2025

11.2.14 CANADA

11.2.15 MARKET ESTIMATES AND FORECAST, BY TECHNOLOGY, 2014–2025

11.2.16 MARKET ESTIMATES AND FORECAST, BY COMPONENT, 2014–2025

11.2.17 MARKET ESTIMATES AND FORECAST, BY SOFTWARE, 2014–2025

11.2.18 MARKET ESTIMATES AND FORECAST, BY HARDWARE, 2014–2025

11.2.19 MARKET ESTIMATES AND FORECAST, BY VERTICAL, 2014–2025

11.3 EUROPE

11.3.1 EUROPE: COVID-19 MARKET DRIVERS

11.3.2 MARKET ESTIMATES AND FORECAST, BY TECHNOLOGY, 2014–2025

11.3.3 MARKET ESTIMATES AND FORECAST, BY COMPONENT, 2014–2025

11.3.4 MARKET ESTIMATES AND FORECAST, BY SOFTWARE, 2014–2025

11.3.5 MARKET ESTIMATES AND FORECAST, BY HARDWARE, 2014–2025

11.3.6 MARKET ESTIMATES AND FORECAST, BY VERTICAL, 2014–2025

11.3.7 MARKET ESTIMATES AND FORECAST, BY COUNTRY, 2014–2025

11.3.8 UK

11.3.9 MARKET ESTIMATES AND FORECAST, BY TECHNOLOGY, 2014–2025

11.3.10 MARKET ESTIMATES AND FORECAST, BY COMPONENT, 2014–2025

11.3.11 MARKET ESTIMATES AND FORECAST, BY SOFTWARE, 2014–2025

11.3.12 MARKET ESTIMATES AND FORECAST, BY HARDWARE, 2014–2025

11.3.13 MARKET ESTIMATES AND FORECAST, BY VERTICAL, 2014–2025

11.3.14 GERMANY

11.3.15 MARKET ESTIMATES AND FORECAST, BY TECHNOLOGY, 2014–2025

11.3.16 MARKET ESTIMATES AND FORECAST, BY COMPONENT, 2014–2025

11.3.17 MARKET ESTIMATES AND FORECAST, BY SOFTWARE, 2014–2025

11.3.18 MARKET ESTIMATES AND FORECAST, BY HARDWARE, 2014–2025

11.3.19 MARKET ESTIMATES AND FORECAST, BY VERTICAL, 2014–2025

11.3.20 REST OF EUROPE

11.3.21 MARKET ESTIMATES AND FORECAST, BY TECHNOLOGY, 2014–2025

11.3.22 MARKET ESTIMATES AND FORECAST, BY COMPONENT, 2014–2025

11.3.23 MARKET ESTIMATES AND FORECAST, BY SOFTWARE, 2014–2025

11.3.24 MARKET ESTIMATES AND FORECAST, BY HARDWARE, 2014–2025

11.3.25 MARKET ESTIMATES AND FORECAST, BY VERTICAL, 2014–2025

11.4 APAC

11.4.1 APAC: COVID-19 MARKET DRIVERS

11.4.2 MARKET ESTIMATES AND FORECAST, BY TECHNOLOGY, 2014–2025

11.4.3 MARKET ESTIMATES AND FORECAST, BY COMPONENT, 2014–2025

11.4.4 MARKET ESTIMATES AND FORECAST, BY SOFTWARE, 2014–2025

11.4.5 MARKET ESTIMATES AND FORECAST, BY HARDWARE, 2014–2025

11.4.6 MARKET ESTIMATES AND FORECAST, BY VERTICAL, 2014–2025

11.4.7 MARKET ESTIMATES AND FORECAST, BY COMPONENT, 2014–2025

11.4.8 CHINA

11.4.9 MARKET ESTIMATES AND FORECAST, BY TECHNOLOGY, 2014–2025

11.4.10 MARKET ESTIMATES AND FORECAST, BY COMPONENT, 2014–2025

11.4.11 MARKET ESTIMATES AND FORECAST, BY SOFTWARE, 2014–2025

11.4.12 MARKET ESTIMATES AND FORECAST, BY HARDWARE, 2014–2025

11.4.13 MARKET ESTIMATES AND FORECAST, BY VERTICAL, 2014–2025

11.4.14 JAPAN

11.4.15 MARKET ESTIMATES AND FORECAST, BY TECHNOLOGY, 2014–2025

11.4.16 MARKET ESTIMATES AND FORECAST, BY COMPONENT, 2014–2025

11.4.17 MARKET ESTIMATES AND FORECAST, BY SOFTWARE, 2014–2025

11.4.18 MARKET ESTIMATES AND FORECAST, BY HARDWARE, 2014–2025

11.4.19 MARKET ESTIMATES AND FORECAST, BY VERTICAL, 2014–2025

11.4.20 AUSTRALIA

11.4.21 MARKET ESTIMATES AND FORECAST, BY TECHNOLOGY, 2014–2025

11.4.22 MARKET ESTIMATES AND FORECAST, BY COMPONENT, 2014–2025

11.4.23 MARKET ESTIMATES AND FORECAST, BY SOFTWARE, 2014–2025

11.4.24 MARKET ESTIMATES AND FORECAST, BY HARDWARE, 2014–2025

11.4.25 MARKET ESTIMATES AND FORECAST, BY VERTICAL, 2014–2025

11.4.26 REST OF APAC

11.4.27 MARKET ESTIMATES AND FORECAST, BY TECHNOLOGY, 2014–2025

11.4.28 MARKET ESTIMATES AND FORECAST, BY COMPONENT, 2014–2025

11.4.29 MARKET ESTIMATES AND FORECAST, BY SOFTWARE, 2014–2025

11.4.30 MARKET ESTIMATES AND FORECAST, BY HARDWARE, 2014–2025

11.4.31 MARKET ESTIMATES AND FORECAST, BY VERTICAL, 2014–2025

11.5 REST OF THE WORLD

11.5.1 ROW: COVID-19 MARKET DRIVERS

11.5.2 MARKET ESTIMATES AND FORECAST, BY TECHNOLOGY, 2014–2025

11.5.3 MARKET ESTIMATES AND FORECAST, BY COMPONENT, 2014–2025

11.5.4 MARKET ESTIMATES AND FORECAST, BY SOFTWARE, 2014–2025

11.5.5 MARKET ESTIMATES AND FORECAST, BY HARDWARE, 2014–2025

11.5.6 MARKET ESTIMATES AND FORECAST, BY VERTICAL, 2014–2025

11.5.7 MARKET ESTIMATES AND FORECAST, BY COUNTRY, 2014–2025

11.5.8 MIDDLE EAST & AFRICA

11.5.9 LATIN AMERICA

12 COMPETITIVE LANDSCAPE

12.1 INTRODUCTION

12.2 COMPETITIVE LEADERSHIP MAPPING

12.2.1 VISIONARY LEADERS

12.2.2 DYNAMIC DIFFERENTIATORS

12.2.3 INNOVATORS

12.2.4 EMERGING COMPANIES

12.3 COMPETITIVE SCENARIO

12.3.1 NEW PRODUCT LAUNCHES AND PRODUCT ENHANCEMENTS

12.3.2 PARTNERSHIPS AND COLLABORATIONS

12.3.3 MERGERS AND ACQUISITIONS

13 COMPANY PROFILES

13.1 INTRODUCTION

13.2 GOOGLE

13.2.1 BUSINESS OVERVIEW

13.2.2 PRODUCTS OFFERED

13.2.3 RECENT DEVELOPMENTS

13.2.4 SWOT ANALYSIS

13.3 MICROSOFT

13.3.1 BUSINESS OVERVIEW

13.3.2 PRODUCTS OFFERED

13.3.3 RECENT DEVELOPMENTS

13.3.4 SWOT ANALYSIS

13.4 IBM

13.4.1 BUSINESS OVERVIEW

13.4.2 PRODUCTS OFFERED

13.4.3 SWOT ANALYSIS

13.5 APPLE

13.5.1 BUSINESS OVERVIEW

13.5.2 SERVICES OFFERED

13.5.3 RECENT DEVELOPMENTS

13.5.4 SWOT ANALYSIS

13.6 QUALCOMM

13.6.1 BUSINESS OVERVIEW

13.6.2 PRODUCTS OFFERED

13.6.3 RECENT DEVELOPMENTS

13.6.4 SWOT ANALYSIS

13.7 AFFECTIVA

13.7.1 BUSINESS OVERVIEW

13.7.2 PRODUCTS OFFERED

13.7.3 RECENT DEVELOPMENTS

13.8 ELLIPTIC LABS

13.8.1 BUSINESS OVERVIEW

13.8.2 PRODUCTS OFFERED

13.8.3 RECENT DEVELOPMENTS

13.9 EYESIGHT TECHNOLOGIES

13.9.1 BUSINESS OVERVIEW

13.9.2 PRODUCTS OFFERED

13.9.3 RECENT DEVELOPMENTS

13.10 SONY DEPTHSENSING SOLUTIONS

13.10.1 BUSINESS OVERVIEW

13.10.2 PRODUCTS OFFERED

13.11 INTEL

13.11.1 BUSINESS OVERVIEW

13.11.2 PRODUCTS OFFERED

13.11.3 RECENT DEVELOPMENTS

13.12 PYREOS

13.13 COGNITEC SYSTEMS

13.14 BEYOND VERBAL

13.15 GESTURETEK

13.16 SIGHTCORP

13.17 CROWDEMOTION

13.18 KAIROS

13.19 NVISO

13.20 POINTGRAB

13.21 EYERIS

13.22 NUMENTA

13.23 OTHER RELATED COMPANIES

13.24 RIGHT TO WIN

14 ADJACENT MARKETS

14.1 INTRODUCTION TO ADJACENT MARKETS

14.2 LIMITATIONS

14.3 AFFECTIVE COMPUTING ECOSYSTEM AND ADJACENT MARKETS

14.4 EDGE AI SOFTWARE MARKET

14.4.1 EDGE AI SOFTWARE MARKET, BY DATA SOURCE

14.4.2 EDGE AI SOFTWARE MARKET, BY VERTICAL

14.5 FACIAL RECOGNITION MARKET

14.5.1 FACIAL RECOGNITION MARKET, BY SOFTWARE TOOL

14.5.2 FACIAL RECOGNITION MARKET, BY VERTICAL

14.6 EMOTION DETECTION AND RECOGNITION MARKET

14.6.1 EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE TOOL

14.6.2 EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA

15 APPENDIX

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

LIST OF TABLES (361 Tables)

TABLE 1 FACTOR ANALYSIS

TABLE 2 AFFECTIVE COMPUTING MARKET SIZE AND GROWTH RATE, 2014–2019 (USD MILLION)

TABLE 3 MARKET SIZE AND GROWTH RATE, PRE-COVID-19 SCENARIO, 2019–2025 (USD MILLION)

TABLE 4 MARKET SIZE AND GROWTH RATE, POST-COVID-19 SCENARIO, 2019–2025 (USD MILLION)

TABLE 5 ELEMENTARY MOTIVATIONS FOR THE ADOPTION OF HEALTH-RELATED AFFECTIVE COMPUTING

TABLE 6 EMERGING APPLICATIONS FOR END USERS

TABLE 7 KEY GUARDRAILS FOR ADOPTION OF AFFECTIVE COMPUTING

TABLE 8 USE CASES: GAMING

TABLE 9 USE CASES: GOVERNMENT AND DEFENSE

TABLE 10 USE CASES: AUTOMOTIVE

TABLE 11 USE CASES: HIGH TECH

TABLE 12 AFFECTIVE COMPUTING MARKET SIZE, BY TECHNOLOGY, 2014–2019 (USD MILLION)

TABLE 13 PRE-COVID-19: MARKET SIZE, BY TECHNOLOGY, 2019–2025 (USD MILLION)

TABLE 14 POST-COVID-19: MARKET SIZE, BY TECHNOLOGY, 2019–2025 (USD MILLION)

TABLE 15 TOUCH-BASED MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 16 PRE-COVID-19: TOUCH-BASED MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 17 POST-COVID-19: TOUCH-BASED MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 18 TOUCHLESS MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 19 PRE-COVID-19: TOUCHLESS MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 20 POST-COVID-19: TOUCHLESS AFFECTIVE COMPUTING MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 21 MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 22 PRE-COVID-19: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 23 POST-COVID-19: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 24 SOFTWARE MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 25 PRE-COVID-19: AFFECTIVE COMPUTING SOFTWARE MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 26 POST-COVID-19: AFFECTIVE COMPUTING SOFTWARE MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 27 AFFECTIVE COMPUTING HARDWARE MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 28 PRE-COVID-19: AFFECTIVE COMPUTING HARDWARE MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 29 POST-COVID-19: AFFECTIVE COMPUTING HARDWARE MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 30 NORTH AMERICA: MARKET SIZE, BY SOFTWARE, 2014–2019 (USD MILLION)

TABLE 31 PRE-COVID-19: NORTH AMERICA: AFFECTIVE COMPUTING MARKET SIZE, BY SOFTWARE, 2019–2025 (USD MILLION)

TABLE 32 POST-COVID-19: NORTH AMERICA: MARKET SIZE, BY SOFTWARE, 2019–2025 (USD MILLION)

TABLE 33 SPEECH RECOGNITION MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 34 PRE-COVID-19: SPEECH RECOGNITION MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 35 POST-COVID-19: SPEECH RECOGNITION MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 36 GESTURE RECOGNITION MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 37 PRE-COVID-19: GESTURE RECOGNITION MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 38 POST-COVID-19: GESTURE RECOGNITION MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 39 FACIAL FEATURE EXTRACTION MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 40 PRE-COVID-19: FACIAL FEATURE EXTRACTION MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 41 POST-COVID-19: FACIAL FEATURE EXTRACTION MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 42 ANALYTICS SOFTWARE MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 43 PRE-COVID-19: ANALYTICS SOFTWARE MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 44 POST-COVID-19: ANALYTICS SOFTWARE MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 45 ENTERPRISE SOFTWARE MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 46 PRE-COVID-19: ENTERPRISE SOFTWARE MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 47 POST-COVID-19: ENTERPRISE SOFTWARE MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 48 AFFECTIVE COMPUTING MARKET SIZE, BY HARDWARE, 2014–2019 (USD MILLION)

TABLE 49 PRE-COVID-19: MARKET SIZE, BY HARDWARE, 2019–2025 (USD MILLION)

TABLE 50 POST-COVID-19: MARKET SIZE, BY HARDWARE, 2019–2025 (USD MILLION)

TABLE 51 SENSORS MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 52 PRE-COVID-19: SENSORS MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 53 POST-COVID-19: SENSORS MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 54 CAMERAS MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 55 PRE-COVID-19: CAMERAS MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 56 POST-COVID-19: CAMERAS MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 57 STORAGE DEVICES AND PROCESSORS MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 58 PRE-COVID-19: STORAGE DEVICES AND PROCESSORS MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 59 POST-COVID-19: STORAGE DEVICES AND PROCESSORS MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 60 OTHER HARDWARE MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 61 PRE-COVID-19: OTHER HARDWARE MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 62 POST-COVID-19: OTHER HARDWARE MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 63 AFFECTIVE COMPUTING MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 64 PRE-COVID-19: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 65 POST-COVID-19: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 66 MARKET SIZE IN ACADEMIA AND RESEARCH, BY REGION, 2014–2019 (USD MILLION)

TABLE 67 PRE-COVID-19: MARKET SIZE IN ACADEMIA AND RESEARCH MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 68 POST-COVID-19: MARKET SIZE IN ACADEMIA AND RESEARCH MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 69 MARKET SIZE IN MEDIA AND ENTERTAINMENT, BY REGION, 2014–2019 (USD MILLION)

TABLE 70 PRE-COVID-19: MARKET SIZE IN MEDIA AND ENTERTAINMENT, BY REGION, 2019–2025 (USD MILLION)

TABLE 71 POST-COVID-19: MARKET SIZE IN MEDIA AND ENTERTAINMENT, BY REGION, 2019–2025 (USD MILLION)

TABLE 72 AFFECTIVE COMPUTING MARKET SIZE IN GOVERNMENT AND DEFENSE, BY REGION, 2014–2019 (USD MILLION)

TABLE 73 PRE-COVID-19: MARKET SIZE IN GOVERNMENT AND DEFENSE, BY REGION, 2019–2025 (USD MILLION)

TABLE 74 POST-COVID-19: MARKET SIZE IN GOVERNMENT AND DEFENSE, BY REGION, 2019–2025 (USD MILLION)

TABLE 75 MARKET SIZE IN HEALTHCARE AND LIFESCIENCES, BY REGION, 2014–2019 (USD MILLION)

TABLE 76 PRE-COVID-19: MARKET SIZE IN HEALTHCARE AND LIFESCIENCES, BY REGION, 2019–2025 (USD MILLION)

TABLE 77 POST-COVID-19: MARKET SIZE IN HEALTHCARE AND LIFESCIENCES, BY REGION, 2019–2025 (USD MILLION)

TABLE 78 MARKET SIZE IN IT AND TELECOM, BY REGION, 2014–2019 (USD MILLION)

TABLE 79 PRE-COVID-19: MARKET SIZE IN IT AND TELECOM, BY REGION, 2019–2025 (USD MILLION)

TABLE 80 POST-COVID-19: MARKET SIZE IN IT AND TELECOM, BY REGION, 2019–2025 (USD MILLION)

TABLE 81 AFFECTIVE COMPUTING MARKET SIZE IN RETAIL AND ECOMMERCE, BY REGION, 2014–2019 (USD MILLION)

TABLE 82 PRE-COVID-19: MARKET SIZE IN RETAIL AND ECOMMERCE, BY REGION, 2019–2025 (USD MILLION)

TABLE 83 POST-COVID-19: MARKET SIZE IN RETAIL AND ECOMMERCE, BY REGION, 2019–2025 (USD MILLION)

TABLE 84 MARKET SIZE IN AUTOMOTIVE, BY REGION, 2014–2019 (USD MILLION)

TABLE 85 PRE-COVID-19: MARKET SIZE IN AUTOMOTIVE, BY REGION, 2019–2025 (USD MILLION)

TABLE 86 POST-COVID-19: MARKET SIZE IN AUTOMOTIVE, BY REGION, 2019–2025 (USD MILLION)

TABLE 87 MARKET SIZE IN BANKING, FINANCIAL SERVICES, AND INSURANCE, BY REGION, 2014–2019 (USD MILLION)

TABLE 88 PRE-COVID-19: MARKET SIZE IN BANKING, FINANCIAL SERVICES, AND INSURANCE, BY REGION, 2019–2025 (USD MILLION)

TABLE 89 POST-COVID-19: MARKET SIZE IN BANKING, FINANCIAL SERVICES, AND INSURANCE, BY REGION, 2019–2025 (USD MILLION)

TABLE 90 AFFECTIVE COMPUTING MARKET SIZE IN OTHER VERTICALS, BY REGION, 2014–2019 (USD MILLION)

TABLE 91 PRE-COVID-19: MARKET SIZE IN OTHER VERTICALS, BY REGION, 2019–2025 (USD MILLION)

TABLE 92 POST-COVID-19: MARKET SIZE IN OTHER VERTICALS, BY REGION, 2019–2025 (USD MILLION)

TABLE 93 MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 94 PRE-COVID-19: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 95 POST-COVID-19: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 96 NORTH AMERICA: MARKET SIZE, BY TECHNOLOGY, 2014–2019 (USD MILLION)

TABLE 97 PRE-COVID-19: NORTH AMERICA: MARKET SIZE, BY TECHNOLOGY, 2019–2025 (USD MILLION)

TABLE 98 POST-COVID-19: NORTH AMERICA: MARKET SIZE, BY TECHNOLOGY, 2019–2025 (USD MILLION)

TABLE 99 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 100 PRE-COVID-19: NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 101 POST-COVID-19: NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 102 NORTH AMERICA: MARKET SIZE, BY SOFTWARE, 2014–2019 (USD MILLION)

TABLE 103 PRE-COVID-19: NORTH AMERICA: MARKET SIZE, BY SOFTWARE, 2019–2025 (USD MILLION)

TABLE 104 POST-COVID-19: NORTH AMERICA MARKET SIZE, BY SOFTWARE, 2019–2025 (USD MILLION)

TABLE 105 NORTH AMERICA: MARKET SIZE, BY HARDWARE, 2014–2019 (USD MILLION)

TABLE 106 PRE-COVID-19: NORTH AMERICA: MARKET SIZE, BY HARDWARE, 2019–2025 (USD MILLION)

TABLE 107 POST-COVID-19: NORTH AMERICA: MARKET SIZE, BY HARDWARE, 2019–2025 (USD MILLION)

TABLE 108 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 109 PRE-COVID-19: NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 110 POST-COVID-19: NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 111 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 112 PRE-COVID-19: NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

TABLE 113 POST-COVID-19: NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

TABLE 114 US: AFFECTIVE COMPUTING MARKET SIZE, BY TECHNOLOGY, 2014–2019 (USD MILLION)

TABLE 115 PRE-COVID-19: US: MARKET SIZE, BY TECHNOLOGY, 2019–2025 (USD MILLION)

TABLE 116 POST-COVID-19: US: MARKET SIZE, BY TECHNOLOGY, 2019–2025 (USD MILLION)

TABLE 117 US: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 118 PRE-COVID-19: US: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 119 POST-COVID-19: US: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 120 UNITED STATES: MARKET SIZE, BY SOFTWARE, 2014–2019 (USD MILLION)

TABLE 121 PRE-COVID-19: UNITED STATES MARKET SIZE, BY SOFTWARE, 2019–2025 (USD MILLION)

TABLE 122 POST-COVID-19: UNITED STATES MARKET SIZE, BY SOFTWARE, 2019–2025 (USD MILLION)

TABLE 123 US: AFFECTIVE COMPUTING MARKET SIZE, BY HARDWARE, 2014–2019 (USD MILLION)

TABLE 124 PRE-COVID-19: US: MARKET SIZE, BY HARDWARE, 2019–2025 (USD MILLION)

TABLE 125 POST-COVID-19: US: MARKET SIZE, BY HARDWARE, 2019–2025 (USD MILLION)

TABLE 126 US: MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 127 PRE-COVID-19: US: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 128 POST-COVID-19: US: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 129 CANADA: MARKET SIZE, BY TECHNOLOGY, 2014–2019 (USD MILLION)

TABLE 130 PRE-COVID-19: CANADA: MARKET SIZE, BY TECHNOLOGY, 2019–2025 (USD MILLION)

TABLE 131 POST-COVID-19: CANADA: MARKET SIZE, BY TECHNOLOGY, 2019–2025 (USD MILLION)

TABLE 132 CANADA: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 133 PRE-COVID-19: CANADA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 134 POST-COVID-19: CANADA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 135 CANADA: MARKET SIZE, BY SOFTWARE, 2014–2019 (USD MILLION)

TABLE 136 PRE-COVID-19: CANADA AFFECTIVE COMPUTING MARKET SIZE, BY SOFTWARE, 2019–2025 (USD MILLION)

TABLE 137 POST-COVID-19: CANADA: MARKET SIZE, BY SOFTWARE, 2019–2025 (USD MILLION)

TABLE 138 CANADA: MARKET SIZE, BY HARDWARE, 2014–2019 (USD MILLION)

TABLE 139 PRE-COVID-19: CANADA: MARKET SIZE, BY HARDWARE, 2019–2025 (USD MILLION)

TABLE 140 POST-COVID-19: CANADA: MARKET SIZE, BY HARDWARE, 2019–2025 (USD MILLION)

TABLE 141 CANADA: MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 142 PRE-COVID-19: CANADA: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 143 POST-COVID-19: CANADA: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 144 EUROPE: AFFECTIVE COMPUTING MARKET SIZE, BY TECHNOLOGY, 2014–2019 (USD MILLION)

TABLE 145 PRE-COVID-19: EUROPE: MARKET SIZE, BY TECHNOLOGY, 2019–2025 (USD MILLION)

TABLE 146 POST-COVID-19: EUROPE: MARKET SIZE, BY TECHNOLOGY, 2019–2025 (USD MILLION)

TABLE 147 EUROPE: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 148 PRE-COVID-19: EUROPE: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 149 POST-COVID-19: EUROPE: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 150 EUROPE: MARKET SIZE, BY SOFTWARE, 2014–2019 (USD MILLION)

TABLE 151 PRE-COVID-19: EUROPE: MARKET SIZE, BY SOFTWARE, 2019–2025 (USD MILLION)

TABLE 152 POST-COVID-19: EUROPE: MARKET SIZE, BY SOFTWARE, 2019–2025 (USD MILLION)

TABLE 153 EUROPE: MARKET SIZE, BY HARDWARE, 2014–2019 (USD MILLION)

TABLE 154 PRE-COVID-19: EUROPE: MARKET SIZE, BY HARDWARE, 2019–2025 (USD MILLION)

TABLE 155 POST-COVID-19: EUROPE: MARKET SIZE, BY HARDWARE, 2019–2025 (USD MILLION)

TABLE 156 EUROPE: MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 157 PRE-COVID-19: EUROPE: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 158 POST-COVID-19: EUROPE: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 159 EUROPE: AFFECTIVE COMPUTING MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 160 PRE-COVID-19: EUROPE: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

TABLE 161 POST-COVID-19: EUROPE: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

TABLE 162 UK: MARKET SIZE, BY TECHNOLOGY, 2014–2019 (USD MILLION)

TABLE 163 PRE-COVID-19: UK: MARKET SIZE, BY TECHNOLOGY, 2019–2025 (USD MILLION)

TABLE 164 POST-COVID-19: UK: MARKET SIZE, BY TECHNOLOGY, 2019–2025 (USD MILLION)

TABLE 165 UK: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 166 PRE-COVID-19: UK: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 167 POST-COVID-19: UK: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 168 UK: AFFECTIVE COMPUTING MARKET SIZE, BY SOFTWARE, 2014–2019 (USD MILLION)

TABLE 169 PRE-COVID-19: UK: MARKET SIZE, BY SOFTWARE, 2019–2025 (USD MILLION)

TABLE 170 POST-COVID-19: UK: MARKET SIZE, BY SOFTWARE, 2019–2025 (USD MILLION)

TABLE 171 UK: MARKET SIZE, BY HARDWARE, 2014–2019 (USD MILLION)

TABLE 172 PRE-COVID-19: UK: MARKET SIZE, BY HARDWARE, 2019–2025 (USD MILLION)

TABLE 173 POST-COVID-19: UK: MARKET SIZE, BY HARDWARE, 2019–2025 (USD MILLION)

TABLE 174 UK: MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 175 PRE-COVID-19: UK: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 176 POST-COVID-19: UK: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 177 GERMANY: AFFECTIVE COMPUTING MARKET SIZE, BY TECHNOLOGY, 2014–2019 (USD MILLION)

TABLE 178 PRE-COVID-19: GERMANY: MARKET SIZE, BY TECHNOLOGY, 2019–2025 (USD MILLION)

TABLE 179 POST-COVID-19: GERMANY: MARKET SIZE, BY TECHNOLOGY, 2019–2025 (USD MILLION)

TABLE 180 GERMANY: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 181 PRE-COVID-19: GERMANY: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 182 POST-COVID-19: GERMANY: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 183 GERMANY: MARKET SIZE, BY SOFTWARE, 2014–2019 (USD MILLION)

TABLE 184 PRE-COVID-19: GERMANY: MARKET SIZE, BY SOFTWARE, 2019–2025 (USD MILLION)

TABLE 185 POST-COVID-19: GERMANY: MARKET SIZE, BY SOFTWARE, 2019–2025 (USD MILLION)

TABLE 186 GERMANY: MARKET SIZE, BY HARDWARE, 2014–2019 (USD MILLION)

TABLE 187 PRE-COVID-19: GERMANY: MARKET SIZE, BY HARDWARE, 2019–2025 (USD MILLION)

TABLE 188 POST-COVID-19: GERMANY: MARKET SIZE, BY HARDWARE, 2019–2025 (USD MILLION)

TABLE 189 GERMANY: MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 190 PRE-COVID-19: GERMANY: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 191 POST-COVID-19: GERMANY: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 192 REST OF EUROPE: MARKET SIZE, BY TECHNOLOGY, 2014–2019 (USD MILLION)

TABLE 193 PRE-COVID-19: REST OF EUROPE: AFFECTIVE COMPUTING MARKET SIZE, BY TECHNOLOGY, 2019–2025 (USD MILLION)

TABLE 194 POST-COVID-19: REST OF EUROPE: MARKET SIZE, BY TECHNOLOGY, 2019–2025 (USD MILLION)

TABLE 195 REST OF EUROPE: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 196 PRE-COVID-19: REST OF EUROPE: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 197 POST-COVID-19: REST OF EUROPE: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 198 REST OF EUROPE: MARKET SIZE, BY SOFTWARE, 2014–2019 (USD MILLION)

TABLE 199 PRE-COVID-19: REST OF EUROPE: MARKET SIZE, BY SOFTWARE, 2019–2025 (USD MILLION)

TABLE 200 POST-COVID-19: REST OF EUROPE: MARKET SIZE, BY SOFTWARE, 2019–2025 (USD MILLION)

TABLE 201 REST OF EUROPE: MARKET SIZE, BY HARDWARE, 2014–2019 (USD MILLION)

TABLE 202 PRE-COVID-19: REST OF EUROPE: MARKET SIZE, BY HARDWARE, 2019–2025 (USD MILLION)

TABLE 203 POST-COVID-19: REST OF EUROPE: MARKET SIZE, BY HARDWARE, 2019–2025 (USD MILLION)

TABLE 204 REST OF EUROPE: MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 205 PRE-COVID-19: REST OF EUROPE: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 206 POST-COVID-19: REST OF EUROPE: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 207 APAC: MARKET SIZE, BY TECHNOLOGY, 2014–2019 (USD MILLION)

TABLE 208 PRE-COVID-19: APAC: MARKET SIZE, BY TECHNOLOGY, 2019–2025 (USD MILLION)

TABLE 209 POST-COVID-19: APAC: MARKET SIZE, BY TECHNOLOGY, 2019–2025 (USD MILLION)

TABLE 210 APAC: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 211 PRE-COVID-19: APAC: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 212 POST-COVID-19: APAC: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 213 APAC: AFFECTIVE COMPUTING MARKET SIZE, BY SOFTWARE, 2014–2019 (USD MILLION)

TABLE 214 PRE-COVID-19: APAC: MARKET SIZE, BY SOFTWARE, 2019–2025 (USD MILLION)

TABLE 215 POST-COVID-19: APAC: MARKET SIZE, BY SOFTWARE, 2019–2025 (USD MILLION)

TABLE 216 APAC: MARKET SIZE, BY HARDWARE, 2014–2019 (USD MILLION)

TABLE 217 PRE-COVID-19: APAC: MARKET SIZE, BY HARDWARE, 2019–2025 (USD MILLION)

TABLE 218 POST-COVID-19: APAC: MARKET SIZE, BY HARDWARE, 2019–2025 (USD MILLION)

TABLE 219 APAC: MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 220 PRE-COVID-19: APAC: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 221 POST-COVID-19: APAC: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 222 APAC: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 223 PRE-COVID-19: APAC: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

TABLE 224 POST-COVID-19: APAC: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

TABLE 225 CHINA: AFFECTIVE COMPUTING MARKET SIZE, BY TECHNOLOGY, 2014–2019 (USD MILLION)

TABLE 226 PRE-COVID-19: CHINA: MARKET SIZE, BY TECHNOLOGY, 2019–2025 (USD MILLION)

TABLE 227 POST-COVID-19: CHINA: MARKET SIZE, BY TECHNOLOGY, 2019–2025 (USD MILLION)

TABLE 228 CHINA: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 229 PRE-COVID-19: CHINA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 230 POST-COVID-19: CHINA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 231 CHINA: MARKET SIZE, BY SOFTWARE, 2014–2019 (USD MILLION)

TABLE 232 PRE-COVID-19: CHINA: MARKET SIZE, BY SOFTWARE, 2019–2025 (USD MILLION)

TABLE 233 POST-COVID-19: CHINA: MARKET SIZE, BY SOFTWARE, 2019–2025 (USD MILLION)

TABLE 234 CHINA: MARKET SIZE, BY HARDWARE, 2014–2019 (USD MILLION)

TABLE 235 PRE-COVID-19: CHINA: MARKET SIZE, BY HARDWARE, 2019–2025 (USD MILLION)

TABLE 236 POST-COVID-19: CHINA: MARKET SIZE, BY HARDWARE, 2019–2025 (USD MILLION)

TABLE 237 CHINA: MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 238 PRE-COVID-19: CHINA: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 239 POST-COVID-19: CHINA: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 240 JAPAN: AFFECTIVE COMPUTING MARKET SIZE, BY TECHNOLOGY, 2014–2019 (USD MILLION)

TABLE 241 PRE-COVID-19: JAPAN: MARKET SIZE, BY TECHNOLOGY, 2019–2025 (USD MILLION)

TABLE 242 POST-COVID-19: JAPAN: MARKET SIZE, BY TECHNOLOGY, 2019–2025 (USD MILLION)

TABLE 243 JAPAN: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 244 PRE-COVID-19: JAPAN: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 245 POST-COVID-19: JAPAN: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 246 JAPAN: MARKET SIZE, BY SOFTWARE, 2014–2019 (USD MILLION)

TABLE 247 PRE-COVID-19: JAPAN: MARKET SIZE, BY SOFTWARE, 2019–2025 (USD MILLION)

TABLE 248 POST-COVID-19: JAPAN: MARKET SIZE, BY SOFTWARE, 2019–2025 (USD MILLION)

TABLE 249 JAPAN: MARKET SIZE, BY HARDWARE, 2014–2019 (USD MILLION)

TABLE 250 PRE-COVID-19: JAPAN: MARKET SIZE, BY HARDWARE, 2019–2025 (USD MILLION)

TABLE 251 POST-COVID-19: JAPAN: MARKET SIZE, BY HARDWARE, 2019–2025 (USD MILLION)

TABLE 252 JAPAN: MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 253 PRE-COVID-19: JAPAN: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 254 POST-COVID-19: JAPAN: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 255 AUSTRALIA: AFFECTIVE COMPUTING MARKET SIZE, BY TECHNOLOGY, 2014–2019 (USD MILLION)

TABLE 256 PRE-COVID-19: AUSTRALIA: MARKET SIZE, BY TECHNOLOGY, 2019–2025 (USD MILLION)

TABLE 257 POST-COVID-19: AUSTRALIA: MARKET SIZE, BY TECHNOLOGY, 2019–2025 (USD MILLION)

TABLE 258 AUSTRALIA: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 259 PRE-COVID-19: AUSTRALIA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 260 POST-COVID-19: AUSTRALIA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 261 AUSTRALIA: MARKET SIZE, BY SOFTWARE, 2014–2019 (USD MILLION)

TABLE 262 PRE-COVID-19: AUSTRALIA: MARKET SIZE, BY SOFTWARE, 2019–2025 (USD MILLION)

TABLE 263 POST-COVID-19: AUSTRALIA: MARKET SIZE, BY SOFTWARE, 2019–2025 (USD MILLION)

TABLE 264 AUSTRALIA: MARKET SIZE, BY HARDWARE, 2014–2019 (USD MILLION)

TABLE 265 PRE-COVID-19: AUSTRALIA: MARKET SIZE, BY HARDWARE, 2019–2025 (USD MILLION)

TABLE 266 POST-COVID-19: AUSTRALIA: MARKET SIZE, BY HARDWARE, 2019–2025 (USD MILLION)

TABLE 267 AUSTRALIA: MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 268 PRE-COVID-19: AUSTRALIA: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 269 POST-COVID-19: AUSTRALIA: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 270 REST OF APAC: MARKET SIZE, BY TECHNOLOGY, 2014–2019 (USD MILLION)

TABLE 271 PRE-COVID-19: REST OF APAC: AFFECTIVE COMPUTING MARKET SIZE, BY TECHNOLOGY, 2019–2025 (USD MILLION)

TABLE 272 POST-COVID-19: REST OF APAC: MARKET SIZE, BY TECHNOLOGY, 2019–2025 (USD MILLION)

TABLE 273 REST OF APAC: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 274 PRE-COVID-19: REST OF APAC: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 275 POST-COVID-19: REST OF APAC: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 276 REST OF APAC: MARKET SIZE, BY SOFTWARE, 2014–2019 (USD MILLION)

TABLE 277 PRE-COVID-19: REST OF APAC: MARKET SIZE, BY SOFTWARE, 2019–2025 (USD MILLION)

TABLE 278 POST-COVID-19: REST OF APAC: MARKET SIZE, BY SOFTWARE, 2019–2025 (USD MILLION)

TABLE 279 REST OF APAC: MARKET SIZE, BY HARDWARE, 2014–2019 (USD MILLION)

TABLE 280 PRE-COVID-19: REST OF APAC: MARKET SIZE, BY HARDWARE, 2019–2025 (USD MILLION)

TABLE 281 POST-COVID-19: REST OF APAC: MARKET SIZE, BY HARDWARE, 2019–2025 (USD MILLION)

TABLE 282 REST OF APAC: MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 283 PRE-COVID-19: REST OF APAC: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 284 POST-COVID-19: REST OF APAC: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 285 ROW: MARKET SIZE, BY TECHNOLOGY, 2014–2019 (USD MILLION)

TABLE 286 PRE-COVID-19: ROW: MARKET SIZE, BY TECHNOLOGY, 2019–2025 (USD MILLION)

TABLE 287 POST-COVID-19: RO MARKET SIZE, BY TECHNOLOGY, 2019–2025 (USD MILLION)

TABLE 288 ROW: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 289 PRE-COVID-19: ROW: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 290 POST-COVID-19: ROW: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 291 ROW: MARKET SIZE, BY SOFTWARE, 2014–2019 (USD MILLION)

TABLE 292 PRE-COVID-19: ROW: MARKET SIZE, BY SOFTWARE, 2019–2025 (USD MILLION)

TABLE 293 POST-COVID-19: ROW: MARKET SIZE, BY SOFTWARE, 2019–2025 (USD MILLION)

TABLE 294 ROW: MARKET SIZE, BY HARDWARE, 2014–2019 (USD MILLION)

TABLE 295 PRE-COVID-19: ROW: MARKET SIZE, BY HARDWARE, 2019–2025 (USD MILLION)

TABLE 296 POST-COVID-19: ROW: MARKET SIZE, BY HARDWARE, 2019–2025 (USD MILLION)

TABLE 297 ROW: MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 298 PRE-COVID-19: ROW: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 299 POST-COVID-19: ROW: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 300 ROW: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 301 PRE-COVID-19: ROW: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

TABLE 302 POST-COVID-19: ROW: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

TABLE 303 EVALUATION CRITERIA

TABLE 304 NEW PRODUCT LAUNCHES AND PRODUCT ENHANCEMENTS, 2018–2019

TABLE 305 PARTNERSHIPS AND COLLABORATIONS, 2017–2019

TABLE 306 MERGERS AND ACQUISITIONS, 2017–2018

TABLE 307 RIGHT TO WIN

TABLE 308 EDGE AI SOFTWARE MARKET SIZE, BY DATA SOURCE, 2016–2023 (USD MILLION)

TABLE 309 NORTH AMERICA: EDGE AI SOFTWARE MARKET SIZE, BY DATA SOURCE, 2016–2023 (USD MILLION)

TABLE 310 EUROPE: EDGE AI SOFTWARE MARKET SIZE, BY DATA SOURCE, 2016–2023 (USD MILLION)

TABLE 311 APAC: EDGE AI SOFTWARE MARKET SIZE, BY DATA SOURCE, 2016–2023 (USD MILLION)

TABLE 312 MEA: EDGE AI SOFTWARE MARKET SIZE, BY DATA SOURCE, 2016–2023 (USD MILLION)

TABLE 313 LATIN AMERICA: EDGE AI SOFTWARE MARKET SIZE, BY DATA SOURCE, 2016–2023 (USD MILLION)

TABLE 314 EDGE AI SOFTWARE MARKET SIZE, BY VERTICAL, 2016–2023 (USD MILLION)

TABLE 315 NORTH AMERICA: EDGE AI SOFTWARE MARKET SIZE, BY VERTICAL, 2016–2023 (USD MILLION)

TABLE 316 EUROPE: EDGE AI SOFTWARE MARKET SIZE, BY VERTICAL, 2016–2023 (USD MILLION)

TABLE 317 APAC: EDGE AI SOFTWARE MARKET SIZE, BY VERTICAL, 2016–2023 (USD MILLION)

TABLE 318 MEA: EDGE AI SOFTWARE MARKET SIZE, BY VERTICAL, 2016–2023 (USD MILLION)

TABLE 319 LATIN AMERICA: EDGE AI SOFTWARE MARKET SIZE, BY VERTICAL, 2016–2023 (USD MILLION)

TABLE 320 FACIAL RECOGNITION SOFTWARE TOOLS MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

TABLE 321 FACIAL RECOGNITION SOFTWARE TOOLS MARKET SIZE, BY TYPE, 2017–2024 (USD MILLION)

TABLE 322 2D FACIAL RECOGNITION MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

TABLE 323 3D FACIAL RECOGNITION MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

TABLE 324 FACIAL ANALYTICS MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

TABLE 325 NORTH AMERICA: FACIAL RECOGNITION MARKET SIZE, BY SOFTWARE TOOL, 2017–2024 (USD MILLION)

TABLE 326 EUROPE: FACIAL RECOGNITION MARKET SIZE, BY SOFTWARE TOOL, 2017–2024 (USD MILLION)

TABLE 327 APAC: FACIAL RECOGNITION MARKET SIZE, BY SOFTWARE TOOL, 2017–2024 (USD MILLION)

TABLE 328 MEA: FACIAL RECOGNITION MARKET SIZE, BY SOFTWARE TOOL, 2017–2024 (USD MILLION)

TABLE 329 LATIN AMERICA: FACIAL RECOGNITION MARKET SIZE, BY SOFTWARE TOOL, 2017–2024 (USD MILLION)

TABLE 330 FACIAL RECOGNITION MARKET SIZE, BY VERTICAL, 2017—2024 (USD MILLION)

TABLE 331 FACIAL RECOGNITION MARKET SIZE IN BANKING, FINANCIAL SERVICES, AND INSURANCE, BY REGION, 2017–2024 (USD MILLION)

TABLE 332 FACIAL RECOGNITION MARKET SIZE IN GOVERNMENT AND DEFENSE, BY REGION, 2017–2024 (USD MILLION)

TABLE 333 FACIAL RECOGNITION MARKET SIZE IN RETAIL AND ECOMMERCE, BY REGION, 2017–2024 (USD MILLION)

TABLE 334 FACIAL RECOGNITION MARKET SIZE IN HEALTHCARE, BY REGION, 2017–2024 (USD MILLION)

TABLE 335 FACIAL RECOGNITION MARKET SIZE IN EDUCATION, BY REGION, 2017–2024 (USD MILLION)

TABLE 336 FACIAL RECOGNITION MARKET SIZE IN AUTOMOTIVE, BY REGION, 2017–2024 (USD MILLION)

TABLE 337 FACIAL RECOGNITION MARKET SIZE IN OTHER VERTICALS, BY REGION, 2017–2024 (USD MILLION)

TABLE 338 NORTH AMERICA: FACIAL RECOGNITION MARKET SIZE, BY VERTICAL, 2017–2024 (USD MILLION)

TABLE 339 EUROPE: FACIAL RECOGNITION MARKET SIZE, BY VERTICAL, 2017–2024 (USD MILLION)

TABLE 340 APAC: FACIAL RECOGNITION MARKET SIZE, BY VERTICAL, 2017–2024 (USD MILLION)

TABLE 341 MEA: FACIAL RECOGNITION MARKET SIZE, BY VERTICAL, 2017–2024 (USD MILLION)

TABLE 342 LATIN AMERICA: FACIAL RECOGNITION MARKET SIZE, BY VERTICAL, 2017–2024 (USD MILLION)

TABLE 343 EMOTION DETECTION AND RECOGNITION MARKET SIZE, BY SOFTWARE TOOL, 2017–2024 (USD MILLION)

TABLE 344 FACIAL EXPRESSION RECOGNITION MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

TABLE 345 BIOSENSING TOOLS AND APPS MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

TABLE 346 SPEECH AND VOICE RECOGNITION MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

TABLE 347 GESTURE AND POSTURE RECOGNITION MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

TABLE 348 NORTH AMERICA: EMOTION DETECTION AND RECOGNITION MARKET SIZE, BY SOFTWARE TOOL, 2017–2024 (USD MILLION)

TABLE 349 EUROPE: EMOTION DETECTION AND RECOGNITION MARKET SIZE, BY SOFTWARE TOOL, 2017–2024 (USD MILLION)

TABLE 350 APAC: EMOTION DETECTION AND RECOGNITION MARKET SIZE, BY SOFTWARE TOOL, 2017–2024 (USD MILLION)

TABLE 351 ROW: EMOTION DETECTION AND RECOGNITION MARKET SIZE, BY SOFTWARE TOOL, 2017–2024 (USD MILLION)

TABLE 352 EMOTION DETECTION AND RECOGNITION MARKET SIZE, BY APPLICATION AREA, 2017–2024 (USD MILLION)

TABLE 353 EMOTION DETECTION AND RECOGNITION MARKET SIZE IN MEDICAL EMERGENCY, BY REGION, 2017–2024 (USD MILLION)

TABLE 354 EMOTION DETECTION AND RECOGNITION MARKET SIZE IN MARKETING AND ADVERTISING, BY REGION, 2017–2024 (USD MILLION)

TABLE 355 EMOTION DETECTION AND RECOGNITION MARKET SIZE IN LAW ENFORCEMENT, SURVEILLANCE, AND MONITORING, BY REGION, 2017–2024 (USD MILLION)

TABLE 356 EMOTION DETECTION AND RECOGNITION MARKET SIZE IN ENTERTAINMENT AND CONSUMER ELECTRONICS, BY REGION, 2017–2024 (USD MILLION)

TABLE 357 EMOTION DETECTION AND RECOGNITION MARKET SIZE IN OTHER APPLICATION AREAS, BY REGION, 2017–2024 (USD MILLION)

TABLE 358 NORTH AMERICA: EMOTION DETECTION AND RECOGNITION MARKET SIZE, BY APPLICATION AREA, 2017–2024 (USD MILLION)

TABLE 359 EUROPE: EMOTION DETECTION AND RECOGNITION MARKET SIZE, BY APPLICATION AREA, 2017–2024 (USD MILLION)

TABLE 360 APAC: EMOTION DETECTION AND RECOGNITION MARKET SIZE, BY APPLICATION AREA, 2017–2024 (USD MILLION)

TABLE 361 ROW: EMOTION DETECTION AND RECOGNITION MARKET SIZE, BY APPLICATION AREA, 2017–2024 (USD MILLION)

LIST OF FIGURES (37 Figures)

FIGURE 1 COVID-19: THE GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

FIGURE 3 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

FIGURE 4 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

FIGURE 6 GLOBAL AFFECTIVE COMPUTING MARKET: RESEARCH DESIGN

FIGURE 7 RESEARCH METHODOLOGY

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP AND TOP-DOWN APPROACHES

FIGURE 9 MARKET TO GROW AT MODERATE CAGR DURING THE FORECAST PERIOD DUE TO COVID-19 IMPACT

FIGURE 10 NORTH AMERICA TO ACCOUNT FOR THE HIGHEST MARKET SHARE IN 2020

FIGURE 11 FASTEST-GROWING SEGMENTS OF THE MARKET

FIGURE 12 CONSTANTLY EVOLVING AND INCREASING NEED FOR RESOURCE OPTIMIZATION AND HIGH-SECURITY MEASURES IN ENTERPRISES TO PUSH THE DEMAND FOR AFFECTIVE COMPUTING SOLUTIONS

FIGURE 13 GOVERNMENT AND DEFENSE SEGMENT AND NORTH AMERICA TO HAVE THE HIGHEST MARKET SHARES IN 2020

FIGURE 14 SOFTWARE SEGMENT TO HAVE A HIGHER MARKET SHARE DURING THE FORECAST PERIOD

FIGURE 15 ANALYTICS SOFTWARE SEGMENT TO HOLD THE HIGHEST MARKET SHARE IN 2020

FIGURE 16 STORAGE DEVICES AND PROCESSORS SEGMENT TO HOLD THE HIGHEST MARKET SHARE IN 2020

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: AFFECTIVE COMPUTING MARKET

FIGURE 18 TOUCH-BASED SEGMENT TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

FIGURE 19 SOFTWARE SEGMENT TO WITNESS A HIGHER CAGR DURING THE FORECAST PERIOD

FIGURE 20 ANALYTICS SOFTWARE TO WITNESS THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 21 CAMERAS TO EXPERIENCE THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 22 HEALTHCARE AND LIFE SCIENCES VERTICAL TO HOLD THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

FIGURE 23 NORTH AMERICA TO ACCOUNT FOR THE LARGEST SIZE IN THE MARKET DURING THE FORECAST PERIOD

FIGURE 24 NORTH AMERICA: MARKET SNAPSHOT

FIGURE 25 APAC: MARKET SNAPSHOT

FIGURE 26 AFFECTIVE COMPUTING MARKET (GLOBAL), COMPETITIVE LEADERSHIP MAPPING, 2018

FIGURE 27 KEY DEVELOPMENTS BY THE LEADING PLAYERS IN THE MARKET BETWEEN 2017 AND 2019

FIGURE 28 GOOGLE: COMPANY SNAPSHOT

FIGURE 29 GOOGLE: SWOT ANALYSIS

FIGURE 30 MICROSOFT: COMPANY SNAPSHOT

FIGURE 31 MICROSOFT: SWOT ANALYSIS

FIGURE 32 IBM: COMPANY SNAPSHOT

FIGURE 33 IBM: SWOT ANALYSIS

FIGURE 34 APPLE: COMPANY SNAPSHOT

FIGURE 35 APPLE: SWOT ANALYSIS

FIGURE 36 QUALCOMM: COMPANY SNAPSHOT

FIGURE 37 QUALCOMM: SWOT ANALYSIS

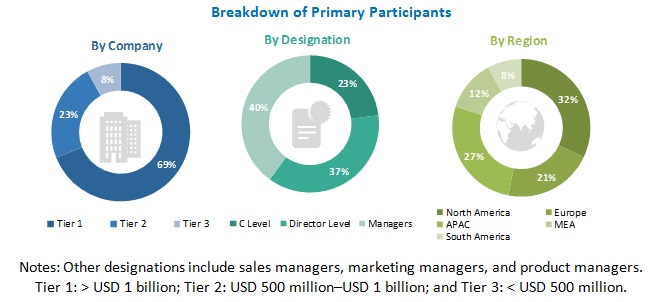

The study involved four major activities in estimating the current size of the affective computing market. Exhaustive secondary research was done to collect information on the affective computing market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the size of the segments and subsegments of the market.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet have been referred to identify and collect information for this study. These secondary sources included annual reports, press releases and investor presentations of companies, whitepapers, certified publications and articles by recognized authors, gold standard and silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The affective computing market comprises several stakeholders, Machine learning/Artificial Intelligence (AI) solution and service providers cognitive and AI technology experts/providers, business intelligence tools and system experts/providers, end-users/consumers/enterprise users, telecommunication providers, Internet of Things (IoT) device/wearable device manufacturers, managed service providers, technology consultants, training and education service providers, government agencies, affective computing providers, system integrators, and Value-Added Resellers (VARs). The demand side of the market consists of financial institutions, investors, and insurance companies. The supply side includes Affective Computing solutions providers. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the affective computing market. These methods were also used extensively to estimate the size of various segments in the market. The research methodology used to estimate the market size includes the following:

Key players in the market have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To determine and forecast the global affective computing market by technology, component, software, hardware, vertical, and region from 2020 to 2025, and analyze the various macroeconomic and microeconomic factors that affect the market growth

- To forecast the size of the market segments with respect to 4 main regions, namely, North America, Europe, Asia Pacific (APAC), Rest of the World (RoW)

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the overall market

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- The report includes both pre-COVID-19 and post-COVID-19 scenarios to analyze the affective computing market. The study shows in-depth qualitative analysis along with the quantitative market estimates and forecasts for both the scenarios

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the European market includes the Rest of Europe includes Italy, Netherlands, and Switzerland, among others.

- Further breakdown of the Asia Pacific market includes South Korea, India, and Singapore, among others

- Further breakdown of the Rest of the World market comprises Latin America, the Middle East, and Africa

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Affective Computing Market

Looking for statistics around benefits of affective computing technology

Gather insights into emotion engineering and affective computing in the korea.

Understand the market forecast for emotion recognition from physiological signals.

Understand the market forecast for emotion recognition from physiological signals.

Interested in the Software, hardware sensors and Verticals forecast of Affective Computing Market.