Emotion Detection and Recognition (EDR) Market by Component (Software (Facial Expression Recognition, Speech & Voice Recognition) and Services), Application Area, End User, Vertical, and Region (North America, Europe, APAC, RoW) - Global Forecast to 2027

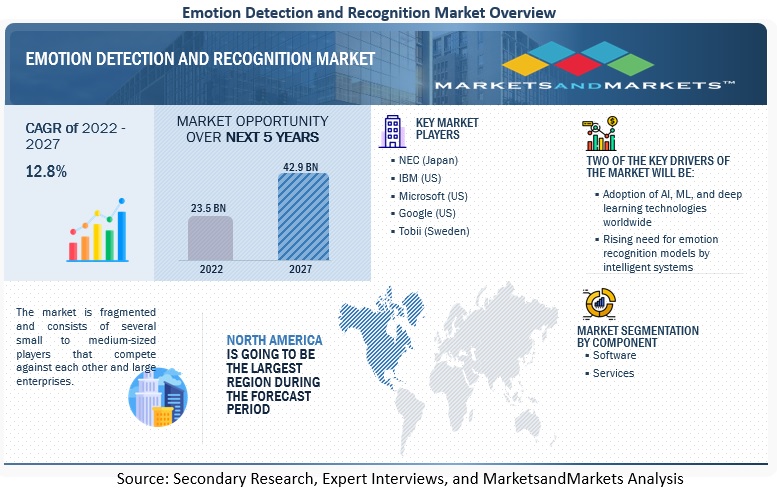

The global Emotion Detection and Recognition Market size was valued at $23.5 billion in 2022 and it is projected to reach $42.9 billion by the end of 2027 at a CAGR of 12.8% during the forecast period. The major factors driving the market growth include the adoption of AI, ML, and deep learning technologies across the globe, rising need for emotion recognition models by intelligent systems, and growing popularity of wearable devices. Moreover, the increasing demand for IoT technology and applications and the increasing government initiatives to leverage benefits of EDR technology will drive the demand for these products in the near future.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact

Amidst the COVID-19 pandemic crisis, various governments and regulatory authorities mandate both public and private organizations to embrace new practices for working remotely and maintaining social distancing. Since then, the digital ways of doing business became the new Business Continuity Plan (BCP) for various organizations.

- Rise in government initiatives on technology advancements in AI for security and public safety during COVID-19.

- Increase in demand in telehealth systems to drive the demand for effective computing technology adoption

- Emerging touchless identity verification systems to increase the demand for effective computing systems

Emotion Detection and Recognition Market Dynamics

Driver: Growing popularity of wearable devices

Skin-conductance sensors are widely used by psychologists and therapists in clinics, hospitals, and other settings. Additionally, bracelets now have emotional components as a result of the Internet of Things (IoT). These emotion-based sensors are simple to use and moderately priced and have a wide range of applications. They can be used to monitor and analyze physical health, access responses to stressful events, and enhance how people deal with stress and anxiety. Emotional Artificial Intelligence (AI)-supported hardware and software may detect and analyze eye movements, facial expressions, voice changes, and more, in addition to monitoring and analyzing skin conductance, breathing, and heart rate. They do not require costly hardware, but rather the installation of some recognition software or new code for PCs or cellphones.

Restraint: High production cost

EDR system manufacture is much expensive and the subsequent return on investment is less substantial, making it difficult for organizations with limited financial resources to use the platform. The bulk of supporting technologies, such as wearable computing and gesture recognition, have high development costs, posing a barrier to the industry's growth. One of the primary challenges to organizations implementing these solutions and services is the expense of educating Al enablers to perform a certain task. Understanding and triggering human emotions is a variable that requires substantial programming, training, and debugging methods. The financial expense of implementing emotion detection technology solutions and the cultural understanding of human society is huge and complicated, leading to a slow adoption rate during the forecast period.

Opportunity: Increasing government initiatives to leverage benefits of EDR technology

Emotion detection technology is becoming increasingly popular with businesses and governments all over the world. For instance, the UK government is utilizing Al to identify and gauge residents' emotions on social media. Additionally, government agencies and EDR organizations are creating councils, defining new norms and rules, and constructing frameworks to implement Al governance solutions. Corporations have organized committees to identify risk issues for Al technology, and local governments and industrial clusters have invested in Al technology and organized committees to perform in-depth investigations on the ethical usage of Al. For instance, in March 2021, the French government funded USD 2.4 billion for Al technology development and organized an international study committee in conjunction with Canada to investigate the consequences and new potential of Al technology.

Challenge: Ethical issues in EDR technology

EDR has been operating for a while, but it has recently come under scrutiny. This is mostly due to the ethical problems that customers and technology developers are becoming increasingly aware of. Scepticism is mostly motivated by inefficiencies and biases in EDR models. This technology is immensely divisive, especially in the realm of law enforcement. Several cases of wrongful incarceration may be traced back to defective facial and emotion detection technologies. As a result, many firms have abandoned EDR, while others are unwilling to adopt it. For instance, following the George Floyd case, IBM stopped providing face and emotion recognition software to law enforcement groups for mass monitoring or racial profiling. After IBM's announcement, Amazon set a one-year embargo on the use of face and EDR technology. Similarly, Microsoft prohibited the police from using their facial recognition technology until new government regulations and policies were enacted.

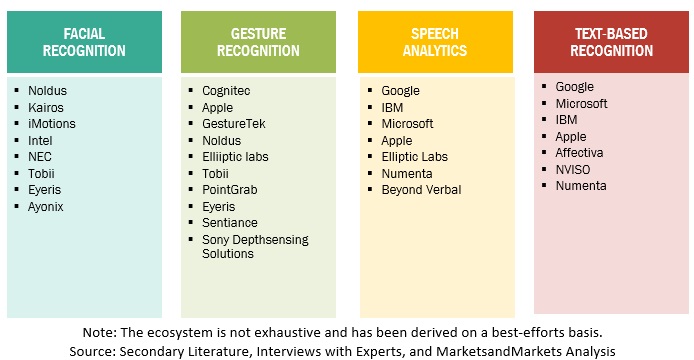

Emotion Detection and Recognition Market Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

By vertical, the healthcare and social assistance segment to grow at the highest market size during the forecast period

Emotion detection technology is becoming increasingly useful in medical emergencies and healthcare, allowing doctors to spend more time with their patients. It also helps patients become more aware of their emotional states and better manage their emotions in stressful or demanding situations. Additionally, AI can help doctors and therapists increase emotional awareness for their patients, such as in expressing empathy, and deliver diagnoses more quickly and with more accuracy. It can also be an important tool to predict how patients will approach therapy and take steps to ensure they are successful and remain in treatment. Thus, these factors drives the healthcare and social assistance segment to grow at the highest market size during the forecast period.

By Software, the biosensing solutions and apps segment to grow at the highest market size during the forecast period

This technology is gaining popularity due to its dependability, precision, and low cost. Moreover, biometric identification technologies provide financial institutions with a competitive edge as clients want better security against fraud and identity theft. Additionally, the consumer electronics business is one that is always growing. This industry has seen a fast increase in new advances in recent years. Alexa, a voice assistant speaker or smartphone with speech and voice recognition capabilities, is a well-known example of these advancements. Due to its security and cost-effectiveness, biometrics is also considered to be one of the most groundbreaking technologies in the consumer electronics market. As a result, the biosensing solutions and applications category is expected to increase at the fastest rate over the projection period.

By component, the services segment is to grow at the highest CAGR during the forecast period

The increasing adoption of AI and ML in biometrics, as well as security and surveillance, has encouraged the growth of the emotion detection and recognition market, which, in turn, is projected to drive the growth of the services segment. Additionally, with several regions adapting to new image recognition technology trends, the usage rate of image recognition solutions and services by verticals, such as security and surveillance, retail, and automobiles, is increasing. Thus, driving the services segment to grow at the highest CAGR during the forecast period.

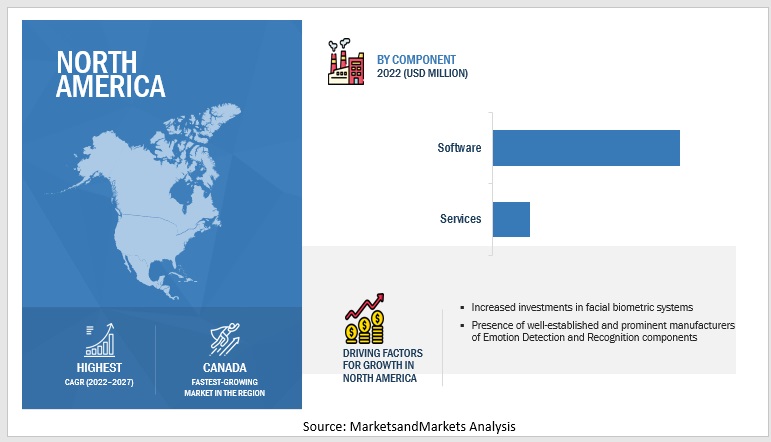

By region, North America to account for the highest market size during the forecast period

Many significant market players are present in North America, providing cutting-edge solutions to all regional end customers. In North America, the US and Canada are anticipated to contribute significantly to the expansion of the market for emotion detection and recognition due to their robust economies. Apart from this aspect, the geographical presence, strategic investments, collaborations, and substantial Research and Development efforts are influencing the extensive deployments of emotion detection and recognition systems. Enhanced emotion detection and recognition solutions are provided by leading vendors like Affectiva, Kairos, and Eyeris as well as a number of startups in the area to meet consumer demands. Thus, these factors are anticipated to support the market for global emotion recognition and detection in North America.

Key Market Players

NEC (Japan), IBM (US), Microsoft (US), Apple (US), Google (US), Tobii (Sweden), Affectiva (US), Elliptic Labs (Norway), Intel (US), Cognitec (Germany), NVISO (Switzerland), Noldus (Netherlands), Gesturetek (Canada), iMotions (Denmark), Numenta (US), PointGrab (Israel), Ayonix (Japan), Pyreos (UK), Eyeris (US), Beyond Verbal (Israel), Kairos (US), Sentiance (Belgium), Raydiant (US), and Sony Depthsensing Solutions (Belgium) are the key players and other players in the EDR market.

Scope of the Report

|

Report Metrics |

Details |

|

Market size in 2022 |

US $23.5 billion |

|

Revenue Forecast Size in 2027 |

US $42.9 billion |

|

Growth Rate |

12.8% CAGR |

|

Segments covered |

Component, Software, Application Area, End User, Vertical And Region |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies covered |

Major vendors in the global EDR market include NEC (Japan), IBM (US), Microsoft (US), Apple (US), Google (US), Tobii (Sweden), Affectiva (US), Elliptic Labs (Norway), Intel (US), Cognitec (Germany), NVISO (Switzerland), Noldus (Netherlands), GestureTek (Canada), iMotions (Denmark), Numenta (US), PointGrab (Israel), Ayonix (Japan), Pyreos (UK), Eyeris (US), Beyond Verbal (Israel), Kairos (US), Sentiance (Belgium), Raydiant (US), and Sony Depthsense Solutions (Belgium). |

The study categorizes the EDR market by component, software, application areas, end users, verticals, and region.

By Component:

- Software

- Services

By Software:

- Facial Expression Recognition

- Biosensing Solutions and Apps

- Speech and Voice Recognition

- Gesture and Posture Recognition

By Application Areas:

- Medical Emergency

- Marketing and Advertising

- Law Enforcement, Surveillance, and Monitoring

- Entertainment and Consumer Electronics

- Other Application areas (robotics and eLearning)

By End Users:

- Enterprises

- Defense and Security Agency

- Commercial

- Industrial

- Other End User (people using wearable devices, mobile phones, and independent institutions)

By Verticals:

- Academia and Research

- Media and Entertainment

- IT and ITES

- Healthcare and Social Assistance

- Telecommunications

- Retail and eCommerce

- Automotive

- BFSI

- Other Verticals (travel, security, energy and power, and consumer electronics)

By Region:

- North America

- Europe

- Middle East and Africa

- Asia Pacific

- Latin America

Recent Developments

- In February 2022, NEC has strengthened its strategic collaboration with SAP to accelerate NEC’s corporate transformation (CX) and to co-create business opportunities. It will utilize the latest SAP solutions to accelerate CX, based on the results of the reforms it has made using SAP solutions. Through this, NEC aims to achieve data-driven management, respond flexibly to changes in the business environment, and maximize the capabilities of its employees.

- In February 2022, IBM acquired Neudesic, a leading US cloud services consultancy specializing primarily in the Microsoft Azure platform, along with bringing skills in multi-cloud. This acquisition will significantly expand IBM's portfolio of hybrid multi-cloud services and further advance the company's hybrid cloud and AI strategy.

- In November 2021, Kyndryl and Microsoft announced a landmark global strategic partnership that will combine their market-leading capabilities in service of enterprise customers. The deal with Microsoft is Kyndryl’s first since recently becoming an independent public company and provides incremental multi-billion-dollar revenue opportunities for the two companies.

- In November 2021, Tobii confirmed that Microsoft implemented support for Tobii Eye Tracker 5 and Tobii Horizon in Flight Simulator. Tobii Eye Tracker 5, engineered for PC gamers, translates the player's eye and head movements into data to enable new levels of game control, game analytics, and streaming. For games like Flight Simulator, where situational awareness makes all the difference, the integration allows users to immerse themselves in the plane's cockpit and take command as a pilot.

- In August 2021, Apple acquired Primephonic, the renowned classical music streaming service that offers an outstanding listening experience with search and browse functionality optimized for classical, premium-quality audio, handpicked expert recommendations, and extensive contextual details on repertoire and recordings.

Frequently Asked Questions (FAQ):

What are the opportunities in the global emotion detection and recognition market?

Increasing demand for IoT technology and applications and increasing government initiatives to leverage benefits of EDR technology are market opportunities are creating opportunities for the global emotion detection and recognition market.

What is the definition of the emotion detection and recognition market?

EDR can be defined as the science of identifying and analyzing various emotional cues such as facial expressions, gesture and posture, tone of speech, and/or other physiological dynamics associated with human emotions, in real or non-real-time.

Which region is expected to show the highest market share in the emotion detection and recognition market?

North America is expected to account for the largest market share during the forecast period.

What are the major market players covered in the report?

Major vendors, namely, include NEC (Japan), IBM (US), Microsoft (US), Apple (US), Google (US), Tobii (Sweden), Affectiva (US), Elliptic Labs (Norway), Intel (US), Cognitec (Germany), NVISO (Switzerland), Noldus (Netherlands), Gesturetek (Canada), iMotions (Denmark), Numenta (US), PointGrab (Israel), Ayonix (Japan), Pyreos (UK), Eyeris (US), Beyond Verbal (Israel), Kairos (US), Sentiance (Belgium), Raydiant (US), and Sony Depthsense Solutions (Belgium).

What is the current size of the global emotion detection and recognition market?

The global emotion detection and recognition market size is projected to grow from USD 23.5 billion in 2022 to USD 42.9 billion by 2027, at a Compound Annual Growth Rate (CAGR) of 12.8% during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Adoption of AI, ML, and deep learning technologies worldwide- Rising need for emotion recognition models by intelligent systems- Growing popularity of wearable devicesRESTRAINTS- Insufficient database and technical problems to lead to discrepancies and false results- High production costOPPORTUNITIES- Increasing demand for IoT technology and applications- Increasing government initiatives to leverage benefits of EDR technologyCHALLENGES- Privacy and data breach issues- Ethical issues in EDR technology

-

5.3 CASE STUDY ANALYSISCASE STUDY 1: IBM HELPED NVISO CREATE CLOUD SYSTEM THAT ANALYZES FACIAL EXPRESSIONSCASE STUDY 2: FACE RECOGNITION BY COGNITEC DEPLOYED IN VERIDOS EGATES AT BANGLADESH AIRPORTCASE STUDY 3: AFFECTIVA HELPED GIPHY BRING EMOTIONS AND EXPRESSIONS TO DIGITAL COMMUNICATION

- 5.4 VALUE CHAIN ANALYSIS

-

5.5 ECOSYSTEM ANALYSIS

-

5.6 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.7 PRICING ANALYSISAVERAGE SELLING PRICE, BY KEY PLAYER AND APPLICATIONAVERAGE SELLING PRICE, BY SME PLAYER AND APPLICATION

-

5.8 TECHNOLOGY ANALYSISEMOTION DETECTION AND RECOGNITION, ARTIFICIAL INTELLIGENCE, AND MACHINE LEARNINGEMOTION DETECTION AND RECOGNITION AND DEEP LEARNING TECHNOLOGYENHANCED USAGE OF EMOTION DETECTION AND RECOGNITION TECHNOLOGY IN AUTOMOBILESEMOTION DETECTION AND RECOGNITION TECHNOLOGY IN HEALTHCAREEMOTION RECOGNITION TECHNOLOGY FOR TRAINING SCENARIOS, SIMULATIONS, AND VIDEO GAMES

-

5.9 PATENT ANALYSIS

- 5.10 TRENDS AND DISRUPTIONS IMPACTING BUYERS

-

5.11 TARIFF AND REGULATORY LANDSCAPEINTRODUCTIONINFORMATION TECHNOLOGY (IT) ACT, 2000GENERAL DATA PROTECTION REGULATION COMPLIANCEHEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACTEUROPEAN NETWORK AND INFORMATION SECURITY AGENCY

-

5.12 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESS

- 5.13 KEY CONFERENCES AND EVENTS, 2023

- 6.1 INTRODUCTION

-

6.2 FEATURE EXTRACTION AND 3D MODELINGFEATURE EXTRACTION AND 3D MODELING: EMOTION DETECTION AND RECOGNITION MARKET DRIVERS

-

6.3 BIOSENSORS TECHNOLOGYBIOSENSORS TECHNOLOGY: EMOTION DETECTION AND RECOGNITION MARKET DRIVERS

-

6.4 NATURAL LANGUAGE PROCESSINGNATURAL LANGUAGE PROCESSING: EMOTION DETECTION AND RECOGNITION MARKET DRIVERS

-

6.5 MACHINE LEARNINGMACHINE LEARNING: EMOTION DETECTION AND RECOGNITION MARKET DRIVERS

- 6.6 OTHER TECHNOLOGIES

- 7.1 INTRODUCTION

-

7.2 SENSORSSENSORS: EMOTION DETECTION AND RECOGNITION MARKET DRIVERS

-

7.3 CAMERASCAMERAS: EMOTION DETECTION AND RECOGNITION MARKET DRIVERS

-

7.4 STORAGE DEVICES AND PROCESSORSSTORAGE DEVICES AND PROCESSORS: EMOTION DETECTION AND RECOGNITION MARKET DRIVERS

- 7.5 OTHER HARDWARE DEVICES

- 8.1 INTRODUCTION

-

8.2 SOFTWAREADVANCED EMOTION MEASUREMENT SOFTWARE TOOLS TO BOOST MARKETSOFTWARE: EMOTION RECOGNITION AND RECOGNITION MARKET DRIVERS

-

8.3 SERVICESSIGNIFICANT GROWTH IN FACIAL RECOGNITION MONITORING TO GENERATE DEMAND FOR SECURITY SERVICESSERVICES: EMOTION DETECTION AND RECOGNITION MARKET DRIVERSPROFESSIONAL SERVICESMANAGED SERVICES

- 9.1 INTRODUCTION

-

9.2 FACIAL EXPRESSION RECOGNITIONRISING CONCERNS ABOUT ETHICAL PRIVACY REGARDING FACIAL RECOGNITION SOFTWARE TO BOOST MARKETFACIAL EXPRESSION RECOGNITION: EMOTION DETECTION AND RECOGNITION MARKET DRIVERS

-

9.3 BIOSENSING SOLUTIONS AND APPSRISING ACCURACY ACROSS BIOMEDICINE AND LIFE SCIENCES SECTOR TO BOOST SALESBIOSENSING SOLUTIONS AND APPS: EMOTION DETECTION AND RECOGNITION MARKET DRIVERS

-

9.4 SPEECH AND VOICE RECOGNITIONINTEGRATION OF ADVANCED TECHNOLOGIES TO PROPEL GROWTH OF SPEECH AND VOICE RECOGNITION TECHNOLOGIESSPEECH AND VOICE RECOGNITION: EMOTION DETECTION AND RECOGNITION MARKET DRIVERS

-

9.5 GESTURE AND POSTURE RECOGNITIONEFFECTIVE USAGE ACROSS AUTOMOTIVE SECTOR TO FUEL DEMANDGESTURE AND POSTURE RECOGNITION: EMOTION DETECTION AND RECOGNITION MARKET DRIVERS

- 10.1 INTRODUCTION

-

10.2 MEDICAL EMERGENCYNEED TO SECURE CRITICAL PATIENT DATA TO BOOST SEGMENT GROWTHMEDICAL EMERGENCY: EMOTION DETECTION AND RECOGNITION MARKET DRIVERS

-

10.3 MARKETING AND ADVERTISINGDEMAND FOR EMOTION ANALYTICS MEASUREMENT ACROSS TARGET MARKETING AND ADVERTISING TO DRIVE MARKETMARKETING AND ADVERTISING: EMOTION DETECTION AND RECOGNITION MARKET DRIVERS

-

10.4 LAW ENFORCEMENT, SURVEILLANCE, AND MONITORINGLIVENESS DETECTION AND SUSPECT TRACKING HELPING MASS SURVEILLANCE TO PROPEL MARKETLAW ENFORCEMENT, SURVEILLANCE, AND MONITORING: EMOTION DETECTION AND RECOGNITION MARKET DRIVERS

-

10.5 ENTERTAINMENT AND CONSUMER ELECTRONICSCOGNITIVE SERVICES ACROSS ENTERTAINMENT INDUSTRY TO PROPEL GROWTHENTERTAINMENT AND CONSUMER ELECTRONICS: EMOTION DETECTION AND RECOGNITION MARKET DRIVERS

- 10.6 OTHER APPLICATION AREAS

- 11.1 INTRODUCTION

-

11.2 ENTERPRISESEFFECTIVE DEMOGRAPHIC ANALYSIS ACROSS ENTERPRISES TO DRIVE MARKETENTERPRISES: EMOTION DETECTION AND RECOGNITION MARKET DRIVERS

-

11.3 DEFENSE AND SECURITY AGENCIESSENSITIVE INFORMATION AND ACCURATE AUTHENTICATION ACROSS DEFENSE AGENCIES TO PROPEL MARKETDEFENSE AND SECURITY AGENCIES: EMOTION DETECTION AND RECOGNITION MARKET DRIVERS

-

11.4 COMMERCIALMOOD DETECTION FOR CONSUMERS ACROSS COMMERCIAL END-USE SECTOR TO DRIVE MARKETCOMMERCIAL: EMOTION DETECTION AND RECOGNITION MARKET DRIVERS

-

11.5 INDUSTRIALENHANCED QUALITY CONTROL AND PATTERN RECOGNITION ACROSS HEAVY INDUSTRIES TO BOOST MARKETINDUSTRIAL: EMOTION DETECTION AND RECOGNITION MARKET DRIVERS

- 11.6 OTHER END USERS

- 12.1 INTRODUCTION

-

12.2 ACADEMIA AND RESEARCHSTUDENT MONITORING, ENHANCED RESEARCH TECHNIQUES, AND AGE DETECTION TO DRIVE DEMAND FOR SOLUTIONSACADEMIA AND RESEARCH: EMOTION DETECTION AND RECOGNITION MARKET DRIVERS

-

12.3 MEDIA AND ENTERTAINMENTINTEGRATION ACROSS VIDEO, AUDIO, AND IMAGERY FIELD TO GAIN TRACTIONMEDIA AND ENTERTAINMENT: EMOTION DETECTION AND RECOGNITION MARKET DRIVERS

-

12.4 IT AND ITESDIGITAL TRANSFORMATION ACROSS ITES COMPANIES THROUGH DEEP INTEGRATION TO DRIVE MARKETIT AND ITES: EMOTION DETECTION AND RECOGNITION MARKET DRIVERS

-

12.5 HEALTHCARE AND SOCIAL ASSISTANCEADVANCED BIOSENSING TOOLS TO REVOLUTIONIZE MEDICAL FIELDHEALTHCARE AND SOCIAL ASSISTANCE: EMOTION DETECTION AND RECOGNITION MARKET DRIVERS

-

12.6 TELECOMMUNICATIONSTRACTION ACROSS CUSTOMER CHURN REDUCTION AND DIGITAL ONBOARDING TO DRIVE DEMAND FOR SOLUTIONSTELECOMMUNICATIONS: EMOTION DETECTION AND RECOGNITION MARKET DRIVERS

-

12.7 RETAIL AND ECOMMERCEUSE OF COGNITIVE SCIENCE TO ATTRACT CUSTOMERS TO DRIVE MARKETRETAIL AND ECOMMERCE: EMOTION DETECTION AND RECOGNITION MARKET DRIVERS

-

12.8 AUTOMOTIVESPECIALLY DESIGNED APIS AND SDKS FOR AUTOMOTIVE INDUSTRY TO GAIN TRACTIONAUTOMOTIVE: EMOTION DETECTION AND RECOGNITION MARKET DRIVERS

-

12.9 BANKING, FINANCIAL SERVICES, AND INSURANCEVARIED USE CASES ACROSS BANKING AND FINANCIAL SERVICES TO PROPEL GROWTH FOR EMOTION MEASUREMENTBANKING, FINANCIAL SERVICES, AND INSURANCE: EMOTION DETECTION AND RECOGNITION MARKET DRIVERS

- 12.10 OTHER VERTICALS

- 13.1 INTRODUCTION

-

13.2 NORTH AMERICANORTH AMERICA: EMOTION DETECTION AND RECOGNITION MARKET DRIVERSNORTH AMERICA: RECESSION IMPACTNORTH AMERICA: REGULATORY LANDSCAPEUS- Presence of major solution vendors and heavy usage of EDR solutions in government sectors to drive marketCANADA- Technological advancement and several initiatives to encourage growth of EDR technology

-

13.3 EUROPEEUROPE: EMOTION DETECTION AND RECOGNITION MARKET DRIVERSEUROPE: RECESSION IMPACTEUROPE: REGULATORY LANDSCAPEUK- Increasing adoption of EDR solutions by various sectors to boost marketGERMANY- Robust economy and increased demand for EDR solutions to boost marketNETHERLANDS- High demand for EDR solutions by security authorities to propel market growthREST OF EUROPE

-

13.4 ASIA PACIFICASIA PACIFIC: EMOTION DETECTION AND RECOGNITION MARKET DRIVERSASIA PACIFIC: RECESSION IMPACTASIA PACIFIC: REGULATORY LANDSCAPECHINA- Being early technology adopter and offering innovative EDR solutions to drive marketJAPAN- Advanced economy with increased investments in deployment and development of EDR solutions to boost marketAUSTRALIA- Being fastest developing country and early adopter of advanced technologies to drive marketREST OF ASIA PACIFIC

-

13.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: EMOTION DETECTION AND RECOGNITION MARKET DRIVERSMIDDLE EAST & AFRICA: RECESSION IMPACTMIDDLE EAST & AFRICA: REGULATORY LANDSCAPEMIDDLE EAST- Growing adoption of EDR solutions by public and private organizations to drive marketAFRICA- Adoption of EDR technology to tackle rising cases of cybercrimes to propel market growth

-

13.6 LATIN AMERICALATIN AMERICA: EMOTION DETECTION AND RECOGNITION MARKET DRIVERSLATIN AMERICA: RECESSION IMPACTLATIN AMERICA: REGULATORY LANDSCAPEBRAZIL- Rising popularity and awareness for EDR solutions to drive marketMEXICO- Rise in digitization and increased internet penetration to boost marketREST OF LATIN AMERICA

- 14.1 OVERVIEW

- 14.2 REVENUE SHARE ANALYSIS OF LEADING PLAYERS

- 14.3 MARKET SHARE ANALYSIS OF TOP MARKET PLAYERS

- 14.4 HISTORICAL REVENUE ANALYSIS

- 14.5 RANKING OF KEY PLAYERS

-

14.6 EVALUATION MATRIX FOR KEY PLAYERSDEFINITIONS AND METHODOLOGYSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

14.7 COMPETITIVE BENCHMARKINGEVALUATION CRITERIA FOR KEY COMPANIESEVALUATION CRITERIA FOR STARTUPS/SMES

-

14.8 EVALUATION MATRIX FOR STARTUPS/SMESDEFINITIONS AND METHODOLOGYPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

14.9 COMPETITIVE SCENARIO AND TRENDSPRODUCT LAUNCHES AND ENHANCEMENTSDEALS

-

15.1 KEY PLAYERSNEC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewIBM- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMICROSOFT- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAPPLE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewGOOGLE- Business overview- Products/Solutions/Services offered- MnM viewTOBII- Business overview- Products/Solutions/Services offered- Recent developmentsAFFECTIVA- Business overview- Products/Solutions/Services offered- Recent developmentsELLIPTIC LABS- Business overview- Products/Solutions/Services offered- Recent developmentsINTEL- Business overview- Products/Solutions/Services offered- Recent developmentsCOGNITEC- Business overview- Products/Solutions/Services offered- Recent developmentsNVISO- Business overview- Products/Solutions/Services offered- Recent developmentsNOLDUS- Business overview- Products/Solutions/Services offered- Recent developments

-

15.2 OTHER PLAYERSGESTURETEKIMOTIONSNUMENTAPOINTGRABAYONIXPYREOSEYERISBEYOND VERBALKAIROSSENTIANCERAYDIANTSONY DEPTHSENSING SOLUTIONS

- 16.1 INTRODUCTION TO ADJACENT MARKETS

- 16.2 LIMITATIONS

-

16.3 EMOTION DETECTION AND RECOGNITION ECOSYSTEM AND ADJACENT MARKETSEDGE AI SOFTWARE MARKETSPEECH AND VOICE RECOGNITION MARKET

- 17.1 DISCUSSION GUIDE

- 17.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 17.3 CUSTOMIZATION OPTIONS

- 17.4 RELATED REPORTS

- 17.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES, 2018–2021

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 EMOTION DETECTION AND RECOGNITION MARKET SIZE AND GROWTH, 2016–2021 (USD MILLION, Y-O-Y%)

- TABLE 4 EMOTION DETECTION AND RECOGNITION MARKET SIZE AND GROWTH, 2022–2027 (USD MILLION, Y-O-Y%)

- TABLE 5 EMOTION DETECTION AND RECOGNITION MARKET ECOSYSTEM

- TABLE 6 PORTER’S FIVE FORCES ANALYSIS

- TABLE 7 AVERAGE SELLING PRICE OF KEY PLAYERS FOR TOP APPLICATIONS (USD)

- TABLE 8 AVERAGE SELLING PRICES OF SMES FOR TOP THREE APPLICATIONS (USD)

- TABLE 9 EMOTION DETECTION AND RECOGNITION MARKET: PATENTS

- TABLE 10 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

- TABLE 12 DETAILED LIST OF CONFERENCES AND EVENTS, 2023

- TABLE 13 EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 14 EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 15 SOFTWARE: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 16 SOFTWARE: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 17 SERVICES: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 18 SERVICES: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 19 EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2016–2021 (USD MILLION)

- TABLE 20 EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2022–2027 (USD MILLION)

- TABLE 21 FACIAL EXPRESSION RECOGNITION: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 22 FACIAL EXPRESSION RECOGNITION: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 23 BIOSENSING SOLUTIONS AND APPS: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 24 BIOSENSING SOLUTIONS AND APPS: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 25 SPEECH AND VOICE RECOGNITION: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 26 SPEECH AND VOICE RECOGNITION: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 27 GESTURE AND POSTURE RECOGNITION: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 28 GESTURE AND POSTURE RECOGNITION: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 29 EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2016–2021 (USD MILLION)

- TABLE 30 EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2022–2027 (USD MILLION)

- TABLE 31 MEDICAL EMERGENCY: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 32 MEDICAL EMERGENCY: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 33 MARKETING AND ADVERTISING: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 34 MARKETING AND ADVERTISING: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 35 LAW ENFORCEMENT, SURVEILLANCE, AND MONITORING: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 36 LAW ENFORCEMENT, SURVEILLANCE, AND MONITORING: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 37 ENTERTAINMENT AND CONSUMER ELECTRONICS: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 38 ENTERTAINMENT AND CONSUMER ELECTRONICS: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 39 OTHER APPLICATION AREAS: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 40 OTHER APPLICATION AREAS: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 41 EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2016–2021 (USD MILLION)

- TABLE 42 EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 43 ENTERPRISES: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 44 ENTERPRISES: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 45 DEFENSE AND SECURITY AGENCIES: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 46 DEFENSE AND SECURITY AGENCIES: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 47 COMMERCIAL: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 48 COMMERCIAL: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 49 INDUSTRIAL: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 50 INDUSTRIAL: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 51 OTHER END USERS: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 52 OTHER END USERS: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 53 EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 54 EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 55 ACADEMIA AND RESEARCH: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 56 ACADEMIA AND RESEARCH: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 57 MEDIA AND ENTERTAINMENT: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 58 MEDIA AND ENTERTAINMENT: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 59 IT AND ITES: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 60 IT AND ITES: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 61 HEALTHCARE AND SOCIAL ASSISTANCE: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 62 HEALTHCARE AND SOCIAL ASSISTANCE: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 63 TELECOMMUNICATIONS: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 64 TELECOMMUNICATIONS: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 65 RETAIL AND ECOMMERCE: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 66 RETAIL AND ECOMMERCE: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 67 AUTOMOTIVE: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 68 AUTOMOTIVE: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 69 BANKING, FINANCIAL SERVICES, AND INSURANCE: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 70 BANKING, FINANCIAL SERVICES, AND INSURANCE: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 71 OTHER VERTICALS: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 72 OTHER VERTICALS: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 73 EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 74 EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 75 NORTH AMERICA: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 76 NORTH AMERICA: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 77 NORTH AMERICA: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2016–2021 (USD MILLION)

- TABLE 78 NORTH AMERICA: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2022–2027 (USD MILLION)

- TABLE 79 NORTH AMERICA: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2016–2021 (USD MILLION)

- TABLE 80 NORTH AMERICA: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2022–2027 (USD MILLION)

- TABLE 81 NORTH AMERICA: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2016–2021 (USD MILLION)

- TABLE 82 NORTH AMERICA: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 83 NORTH AMERICA: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 84 NORTH AMERICA: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 85 NORTH AMERICA: EMOTION DETECTION AND RECOGNITION MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

- TABLE 86 NORTH AMERICA: EMOTION DETECTION AND RECOGNITION MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 87 US: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 88 US: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 89 US: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2016–2021 (USD MILLION)

- TABLE 90 US: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2022–2027 (USD MILLION)

- TABLE 91 US: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2016–2021 (USD MILLION)

- TABLE 92 US: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2022–2027 (USD MILLION)

- TABLE 93 US: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2016–2021 (USD MILLION)

- TABLE 94 US: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 95 US: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 96 US: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 97 CANADA: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 98 CANADA: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 99 CANADA: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2016–2021 (USD MILLION)

- TABLE 100 CANADA: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2022–2027 (USD MILLION)

- TABLE 101 CANADA: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2016–2021 (USD MILLION)

- TABLE 102 CANADA: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2022–2027 (USD MILLION)

- TABLE 103 CANADA: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2016–2021 (USD MILLION)

- TABLE 104 CANADA: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 105 CANADA: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 106 CANADA: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 107 EUROPE: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 108 EUROPE: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 109 EUROPE: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2016–2021 (USD MILLION)

- TABLE 110 EUROPE: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2022–2027 (USD MILLION)

- TABLE 111 EUROPE: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2016–2021 (USD MILLION)

- TABLE 112 EUROPE: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2022–2027 (USD MILLION)

- TABLE 113 EUROPE: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2016–2021 (USD MILLION)

- TABLE 114 EUROPE: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 115 EUROPE: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 116 EUROPE: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 117 EUROPE: EMOTION DETECTION AND RECOGNITION MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

- TABLE 118 EUROPE: EMOTION DETECTION AND RECOGNITION MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 119 UK: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 120 UK: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 121 UK: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2016–2021 (USD MILLION)

- TABLE 122 UK: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2022–2027 (USD MILLION)

- TABLE 123 UK: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2016–2021 (USD MILLION)

- TABLE 124 UK: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2022–2027 (USD MILLION)

- TABLE 125 UK: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2016–2021 (USD MILLION)

- TABLE 126 UK: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 127 UK: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 128 UK: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 129 GERMANY: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 130 GERMANY: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 131 GERMANY: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2016–2021 (USD MILLION)

- TABLE 132 GERMANY: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2022–2027 (USD MILLION)

- TABLE 133 GERMANY: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2016–2021 (USD MILLION)

- TABLE 134 GERMANY: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2022–2027 (USD MILLION)

- TABLE 135 GERMANY: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2016–2021 (USD MILLION)

- TABLE 136 GERMANY: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 137 GERMANY: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 138 GERMANY: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 139 NETHERLANDS: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 140 NETHERLANDS: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 141 NETHERLANDS: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2016–2021 (USD MILLION)

- TABLE 142 NETHERLANDS: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2022–2027 (USD MILLION)

- TABLE 143 NETHERLANDS: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2016–2021 (USD MILLION)

- TABLE 144 NETHERLANDS: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2022–2027 (USD MILLION)

- TABLE 145 NETHERLANDS: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2016–2021 (USD MILLION)

- TABLE 146 NETHERLANDS: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 147 NETHERLANDS: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 148 NETHERLANDS: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 149 REST OF EUROPE: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 150 REST OF EUROPE: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 151 REST OF EUROPE: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2016–2021 (USD MILLION)

- TABLE 152 REST OF EUROPE: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2022–2027 (USD MILLION)

- TABLE 153 REST OF EUROPE: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2016–2021 (USD MILLION)

- TABLE 154 REST OF EUROPE: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2022–2027 (USD MILLION)

- TABLE 155 REST OF EUROPE: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2016–2021 (USD MILLION)

- TABLE 156 REST OF EUROPE: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 157 REST OF EUROPE: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 158 REST OF EUROPE: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 159 ASIA PACIFIC: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 160 ASIA PACIFIC: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 161 ASIA PACIFIC: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2016–2021 (USD MILLION)

- TABLE 162 ASIA PACIFIC: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2022–2027 (USD MILLION)

- TABLE 163 ASIA PACIFIC: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2016–2021 (USD MILLION)

- TABLE 164 ASIA PACIFIC: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2022–2027 (USD MILLION)

- TABLE 165 ASIA PACIFIC: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2016–2021 (USD MILLION)

- TABLE 166 ASIA PACIFIC: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 167 ASIA PACIFIC: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 168 ASIA PACIFIC: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 169 ASIA PACIFIC: EMOTION DETECTION AND RECOGNITION MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

- TABLE 170 ASIA PACIFIC: EMOTION DETECTION AND RECOGNITION MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 171 CHINA: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 172 CHINA: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 173 CHINA: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2016–2021 (USD MILLION)

- TABLE 174 CHINA: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2022–2027 (USD MILLION)

- TABLE 175 CHINA: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2016–2021 (USD MILLION)

- TABLE 176 CHINA: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2022–2027 (USD MILLION)

- TABLE 177 CHINA: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2016–2021 (USD MILLION)

- TABLE 178 CHINA: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 179 CHINA: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 180 CHINA: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 181 JAPAN: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 182 JAPAN: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 183 JAPAN: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2016–2021 (USD MILLION)

- TABLE 184 JAPAN: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2022–2027 (USD MILLION)

- TABLE 185 JAPAN: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2016–2021 (USD MILLION)

- TABLE 186 JAPAN: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2022–2027 (USD MILLION)

- TABLE 187 JAPAN: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2016–2021 (USD MILLION)

- TABLE 188 JAPAN: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 189 JAPAN: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 190 JAPAN: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 191 AUSTRALIA: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 192 AUSTRALIA: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 193 AUSTRALIA: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2016–2021 (USD MILLION)

- TABLE 194 AUSTRALIA: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2022–2027 (USD MILLION)

- TABLE 195 AUSTRALIA: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2016–2021 (USD MILLION)

- TABLE 196 AUSTRALIA: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2022–2027 (USD MILLION)

- TABLE 197 AUSTRALIA: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2016–2021 (USD MILLION)

- TABLE 198 AUSTRALIA: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 199 AUSTRALIA: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 200 AUSTRALIA: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 201 REST OF ASIA PACIFIC: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 202 REST OF ASIA PACIFIC: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 203 REST OF ASIA PACIFIC: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2016–2021 (USD MILLION)

- TABLE 204 REST OF ASIA PACIFIC: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2022–2027 (USD MILLION)

- TABLE 205 REST OF ASIA PACIFIC: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2016–2021 (USD MILLION)

- TABLE 206 REST OF ASIA PACIFIC: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2022–2027 (USD MILLION)

- TABLE 207 REST OF ASIA PACIFIC: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2016–2021 (USD MILLION)

- TABLE 208 REST OF ASIA PACIFIC: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 209 REST OF ASIA PACIFIC: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 210 REST OF ASIA PACIFIC: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 211 MIDDLE EAST & AFRICA: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 212 MIDDLE EAST & AFRICA: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 213 MIDDLE EAST & AFRICA: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2016–2021 (USD MILLION)

- TABLE 214 MIDDLE EAST & AFRICA: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2022–2027 (USD MILLION)

- TABLE 215 MIDDLE EAST & AFRICA: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2016–2021 (USD MILLION)

- TABLE 216 MIDDLE EAST & AFRICA: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2022–2027 (USD MILLION)

- TABLE 217 MIDDLE EAST & AFRICA: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2016–2021 (USD MILLION)

- TABLE 218 MIDDLE EAST & AFRICA: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 219 MIDDLE EAST & AFRICA: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 220 MIDDLE EAST & AFRICA: EMOTION DETECTION AND RECOGNITION MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

- TABLE 221 MIDDLE EAST & AFRICA: EMOTION DETECTION AND RECOGNITION MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 222 MIDDLE EAST: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 223 MIDDLE EAST: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 224 MIDDLE EAST: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2016–2021 (USD MILLION)

- TABLE 225 MIDDLE EAST: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2022–2027 (USD MILLION)

- TABLE 226 MIDDLE EAST: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2016–2021 (USD MILLION)

- TABLE 227 MIDDLE EAST: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2022–2027 (USD MILLION)

- TABLE 228 MIDDLE EAST: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2016–2021 (USD MILLION)

- TABLE 229 MIDDLE EAST: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 230 MIDDLE EAST: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 231 MIDDLE EAST: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 232 AFRICA: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 233 AFRICA: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 234 AFRICA: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2016–2021 (USD MILLION)

- TABLE 235 AFRICA: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2022–2027 (USD MILLION)

- TABLE 236 AFRICA: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2016–2021 (USD MILLION)

- TABLE 237 AFRICA: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2022–2027 (USD MILLION)

- TABLE 238 AFRICA: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2016–2021 (USD MILLION)

- TABLE 239 AFRICA: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 240 AFRICA: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 241 AFRICA: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 242 LATIN AMERICA: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 243 LATIN AMERICA: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 244 LATIN AMERICA: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2016–2021 (USD MILLION)

- TABLE 245 LATIN AMERICA: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2022–2027 (USD MILLION)

- TABLE 246 LATIN AMERICA: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2016–2021 (USD MILLION)

- TABLE 247 LATIN AMERICA: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2022–2027 (USD MILLION)

- TABLE 248 LATIN AMERICA: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2016–2021 (USD MILLION)

- TABLE 249 LATIN AMERICA: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 250 LATIN AMERICA: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 251 LATIN AMERICA: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 252 LATIN AMERICA: EMOTION DETECTION AND RECOGNITION MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

- TABLE 253 LATIN AMERICA: EMOTION DETECTION AND RECOGNITION MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 254 BRAZIL: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 255 BRAZIL: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 256 BRAZIL: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2016–2021 (USD MILLION)

- TABLE 257 BRAZIL: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2022–2027 (USD MILLION)

- TABLE 258 BRAZIL: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2016–2021 (USD MILLION)

- TABLE 259 BRAZIL: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2022–2027 (USD MILLION)

- TABLE 260 BRAZIL: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2016–2021 (USD MILLION)

- TABLE 261 BRAZIL: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 262 BRAZIL: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 263 BRAZIL: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 264 MEXICO: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 265 MEXICO: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 266 MEXICO: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2016–2021 (USD MILLION)

- TABLE 267 MEXICO: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2022–2027 (USD MILLION)

- TABLE 268 MEXICO: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2016–2021 (USD MILLION)

- TABLE 269 MEXICO: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2022–2027 (USD MILLION)

- TABLE 270 MEXICO: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2016–2021 (USD MILLION)

- TABLE 271 MEXICO: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 272 MEXICO: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 273 MEXICO: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 274 REST OF LATIN AMERICA: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 275 REST OF LATIN AMERICA: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 276 REST OF LATIN AMERICA: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2016–2021 (USD MILLION)

- TABLE 277 REST OF LATIN AMERICA: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2022–2027 (USD MILLION)

- TABLE 278 REST OF LATIN AMERICA: EDR MARKET, BY APPLICATION AREA, 2016–2021 (USD MILLION)

- TABLE 279 REST OF LATIN AMERICA: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2022–2027 (USD MILLION)

- TABLE 280 REST OF LATIN AMERICA: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2016–2021 (USD MILLION)

- TABLE 281 REST OF LATIN AMERICA: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 282 REST OF LATIN AMERICA: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 283 REST OF LATIN AMERICA: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 284 EMOTION DETECTION AND RECOGNITION MARKET: DEGREE OF COMPETITION

- TABLE 285 KEY COMPANY SOFTWARE FOOTPRINT

- TABLE 286 KEY COMPANY VERTICAL FOOTPRINT

- TABLE 287 KEY COMPANY REGION FOOTPRINT

- TABLE 288 KEY COMPANY OVERALL FOOTPRINT

- TABLE 289 DETAILED LIST OF STARTUPS/SMES

- TABLE 290 EMOTION DETECTION AND RECOGNITION MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS, 2020–2023

- TABLE 291 EMOTION DETECTION AND RECOGNITION MARKET: DEALS, 2020–2023

- TABLE 292 NEC: BUSINESS OVERVIEW

- TABLE 293 NEC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 294 NEC: PRODUCT LAUNCHES

- TABLE 295 NEC: DEALS

- TABLE 296 IBM: BUSINESS OVERVIEW

- TABLE 297 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 298 IBM: PRODUCT LAUNCHES

- TABLE 299 IBM: DEALS

- TABLE 300 MICROSOFT: BUSINESS OVERVIEW

- TABLE 301 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 302 MICROSOFT: PRODUCT LAUNCHES

- TABLE 303 MICROSOFT: DEALS

- TABLE 304 APPLE: BUSINESS OVERVIEW

- TABLE 305 APPLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 306 APPLE: PRODUCT LAUNCHES

- TABLE 307 APPLE: DEALS

- TABLE 308 GOOGLE: BUSINESS OVERVIEW

- TABLE 309 GOOGLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 310 GOOGLE: DEALS

- TABLE 311 TOBII: BUSINESS OVERVIEW

- TABLE 312 TOBII: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 313 TOBII: PRODUCT LAUNCHES

- TABLE 314 TOBII: DEALS

- TABLE 315 AFFECTIVA: BUSINESS OVERVIEW

- TABLE 316 AFFECTIVA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 317 AFFECTIVA: PRODUCT LAUNCHES

- TABLE 318 AFFECTIVA: DEALS

- TABLE 319 ELLIPTIC LABS: BUSINESS OVERVIEW

- TABLE 320 ELLIPTIC LABS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 321 ELLIPTIC LABS: PRODUCT LAUNCHES

- TABLE 322 ELLIPTIC LABS: DEALS

- TABLE 323 INTEL: BUSINESS OVERVIEW

- TABLE 324 INTEL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 325 INTEL: PRODUCT LAUNCHES

- TABLE 326 INTEL: DEALS

- TABLE 327 COGNITEC: BUSINESS OVERVIEW

- TABLE 328 COGNITEC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 329 COGNITEC: PRODUCT LAUNCHES

- TABLE 330 COGNITEC: DEALS

- TABLE 331 NVISO: BUSINESS OVERVIEW

- TABLE 332 NVISO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 333 NVISO: PRODUCT LAUNCHES

- TABLE 334 NVISO: DEALS

- TABLE 335 NOLDUS: BUSINESS OVERVIEW

- TABLE 336 NOLDUS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 337 NOLDUS: PRODUCT LAUNCHES

- TABLE 338 NOLDUS: DEALS

- TABLE 339 ADJACENT MARKETS AND FORECASTS

- TABLE 340 EDGE AI SOFTWARE MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 341 EDGE AI SOFTWARE MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 342 LARGE ENTERPRISES: EDGE AI SOFTWARE MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 343 LARGE ENTERPRISES: EDGE AI SOFTWARE MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 344 SMES: EDGE AI SOFTWARE MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 345 SMES: EDGE AI SOFTWARE MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 346 SPEECH AND VOICE RECOGNITION MARKET, BY DEPLOYMENT MODE, 2018–2021 (USD MILLION)

- TABLE 347 SPEECH AND VOICE RECOGNITION MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 348 ON-PREMISES/EMBEDDED: SPEECH AND VOICE RECOGNITION MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 349 ON-PREMISES/EMBEDDED: SPEECH AND VOICE RECOGNITION MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 350 ON-CLOUD: SPEECH AND VOICE RECOGNITION MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 351 ON-CLOUD: SPEECH AND VOICE RECOGNITION MARKET, BY REGION, 2022–2027 (USD MILLION)

- FIGURE 1 GLOBAL EMOTION DETECTION AND RECOGNITION MARKET: RESEARCH DESIGN

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): REVENUE OF SOFTWARE/SERVICES OF EMOTION DETECTION AND RECOGNITION MARKET

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL SOFTWARE/SERVICES OF EMOTION DETECTION AND RECOGNITION

- FIGURE 5 GLOBAL EMOTION DETECTION AND RECOGNITION MARKET SIZE AND Y-O-Y GROWTH RATE

- FIGURE 6 NORTH AMERICA TO HOLD LARGEST MARKET SHARE IN 2022

- FIGURE 7 GLOBAL ADOPTION OF ARTIFICIAL INTELLIGENCE, MACHINE LEARNING, AND DEEP LEARNING TECHNOLOGIES TO DRIVE SOLUTIONS

- FIGURE 8 HEALTHCARE AND SOCIAL ASSISTANCE SEGMENT AND NORTH AMERICA TO HOLD LARGEST MARKET SHARES IN 2022

- FIGURE 9 SOFTWARE SEGMENT TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 10 BIOSENSING SOLUTIONS AND APPS SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 11 DEFENSE AND SECURITY AGENCY SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 12 LAW ENFORCEMENT, SURVEILLANCE, AND MONITORING SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 13 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

- FIGURE 14 EMOTION DETECTION AND RECOGNITION MARKET: IMPLEMENTATION AND WORK PROCESS

- FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: EMOTION DETECTION AND RECOGNITION MARKET

- FIGURE 16 VALUE CHAIN ANALYSIS: EMOTION AND DETECTION RECOGNITION MARKET

- FIGURE 17 EMOTION DETECTION AND RECOGNITION MARKET: ECOSYSTEM

- FIGURE 18 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 19 EMOTION DETECTION AND RECOGNITION MARKET: TECHNOLOGY ANALYSIS

- FIGURE 20 PATENT ANALYSIS: EMOTION DETECTION AND RECOGNITION MARKET

- FIGURE 21 TRENDS AND DISRUPTIONS IMPACTING BUYERS

- FIGURE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

- FIGURE 23 SERVICES SEGMENT TO WITNESS HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 24 FACIAL EXPRESSION RECOGNITION SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 25 MEDICAL EMERGENCY SEGMENT TO RECORD HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 26 COMMERCIAL SEGMENT TO ACCOUNT FOR HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 27 MEDIA AND ENTERTAINMENT SEGMENT TO ACCOUNT FOR HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 28 ASIA PACIFIC TO GROW AT HIGHEST CAGR BY 2027

- FIGURE 29 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 30 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 31 REVENUE SHARE ANALYSIS OF EMOTION DETECTION AND RECOGNITION MARKET, 2022

- FIGURE 32 SEGMENTAL REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS

- FIGURE 33 RANKING OF TOP FIVE EMOTION DETECTION AND RECOGNITION PLAYERS

- FIGURE 34 EVALUATION QUADRANT FOR KEY PLAYERS: CRITERIA WEIGHTAGE

- FIGURE 35 EVALUATION MATRIX FOR KEY PLAYERS, 2022

- FIGURE 36 EVALUATION QUADRANT FOR STARTUPS/SMES: CRITERIA WEIGHTAGE

- FIGURE 37 EVALUATION MATRIX FOR STARTUPS/SMES, 2022

- FIGURE 38 NEC: COMPANY SNAPSHOT

- FIGURE 39 IBM: COMPANY SNAPSHOT

- FIGURE 40 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 41 APPLE: COMPANY SNAPSHOT

- FIGURE 42 GOOGLE: COMPANY SNAPSHOT

- FIGURE 43 TOBII: COMPANY SNAPSHOT

- FIGURE 44 ELLIPTIC LABS: COMPANY SNAPSHOT

- FIGURE 45 INTEL: COMPANY SNAPSHOT

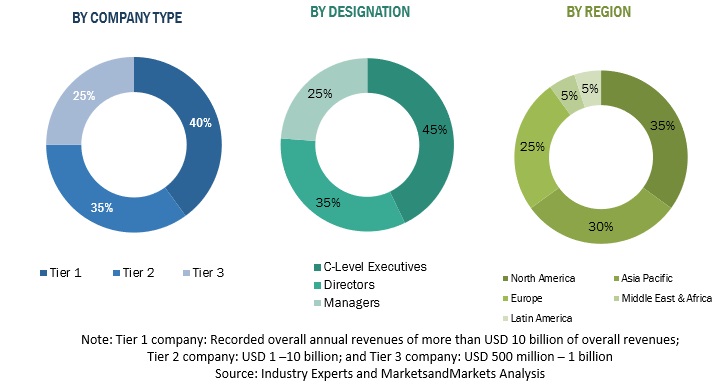

The study involved major activities in estimating the current market size for the EDR market. Exhaustive secondary research was done to collect information on the EDR industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the EDR market.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information regarding the study. The secondary sources included annual reports, press releases, investor presentations of EDR software and service vendors, forums, certified publications, and white papers. The secondary research was used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives, all of which were further validated by primary sources. The factors considered for estimating the regional market size are technological initiatives undertaken by governments of different countries, Gross Domestic Product (GDP) growth, ICT spending, recent market developments, and market ranking analysis of major EDR solution providers.

Primary Research

Various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, including Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the EDR market.

In the complete market engineering process, the top-down and bottom-up approaches were extensively used, along with several data triangulation methods, to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

After the complete market engineering process (including calculations for market statistics, market breakups, market size estimations, market forecasts, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. The primary research was also conducted to identify the segmentation types; industry trends; the competitive landscape of EDR market players; and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies.

Following is the breakup of the primary study:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the size of the global EDR market and estimate the size of various other dependent sub-segments in the overall EDR market. The research methodology used to estimate the market size includes the following details: The key players in the market were identified through secondary research, and their revenue contributions in respective regions were determined through primary and secondary research. This entire procedure included the study of the annual and financial reports of the top market players, and extensive interviews were conducted for key insights from the industry leaders, such as CEOs, VPs, directors, and marketing executives. All percentage splits and breakups were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

EDR is the study of recognizing and interpreting different emotional signals, such as facial expressions, posture and movement, speech inflection, and/or other physiological dynamics, in real-time or non-real-time. It provides businesses with the ability to identify, process, and analyze data in multiple structured and unstructured forms for various business purposes.

Key Stakeholders

- Technology Providers

- System Integrators

- End Users

Report Objectives

To define, describe, and forecast the EDR market based on offerings, organization sizes, offering types, verticals, and regions

- To forecast the market size of five main regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To analyze the subsegments of the market with respect to individual growth trends, prospects, and contributions to the overall market

- To provide detailed information related to the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the EDR market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the EDR market

- To profile the key players of the EDR market and comprehensively analyze their market size and core competencies.

- To track and analyze competitive developments, such as new product launches; mergers and acquisitions; and partnerships, agreements, and collaborations in the global EDR market.

Customization Options

With the given market data, MarketsandMarkets offers customizations based on company-specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle Eastern & African market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Emotion Detection and Recognition (EDR) Market