Acrylic Elastomers Market by Type (Acrylic Co-monomer Elastomer/ACM & Ethylene Acrylic Elastomers/AEM), End-Use Industry (Automotive, Construction, Industrial), and Region (North America, APAC, Europe, and Rest of the World) - Global Forecast to 2022

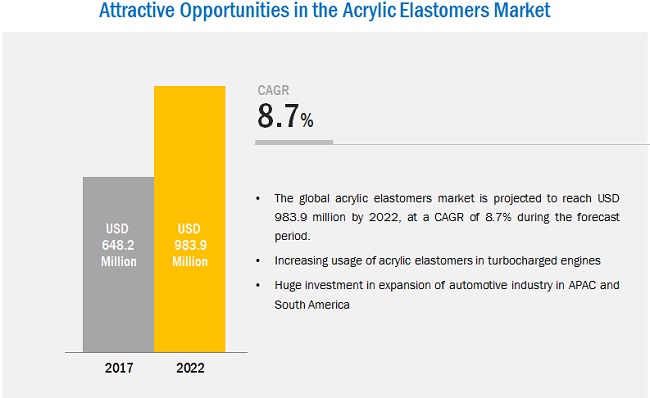

[108 Pages Report] Acrylic Elastomers Market was valued at USD 608.0 million in 2016 and is projected to reach USD 983.9 million by 2022, at a CAGR of 8.7% during the forecast period. The base year considered for the study on the acrylic elastomers market is 2016 and the forecast period considered is between 2017 and 2022.

Objectives of the Study:

- To define, describe, and forecast the acrylic elastomers market based on type, end-use industry, and region

- To provide detailed information regarding key factors such as drivers, restraints, opportunities, and challenges influencing the growth of the acrylic elastomers market

- To strategically analyze micromarkets with respect to individual growth trends, future growth prospects, and contribution to the overall acrylic elastomers market

- To analyze opportunities in the acrylic elastomers market for stakeholders and provide detailed information on the competitive landscape of the market

- To strategically profile key players operating in the acrylic elastomers market and comprehensively analyze their market shares and core competencies

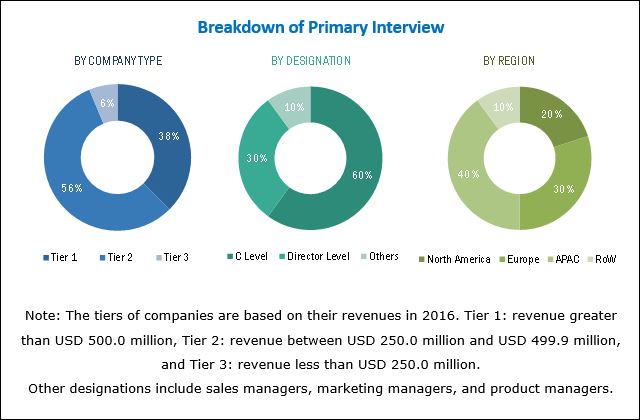

Both, top-down and bottom-up approaches were used to estimate and validate the size of the acrylic elastomers market and estimate the sizes of various other dependent submarkets. The research study involved the extensive use of secondary sources, directories, and databases, such as Hoovers, Bloomberg, Factiva, the Securities and Exchange Commission, the American Acrylic Association, and the World Health Organization, to identify and collect information useful for this technical, market-oriented, and commercial study of the acrylic elastomers market.

To know about the assumptions considered for the study, download the pdf brochure

Key players operating in the acrylic elastomers market include BASF SE (Germany), DowDuPont (US), Zeon Corporation (Japan), NOK Corporation (Japan), and Trelleborg AB (Sweden).

Key Target Audience:

- Manufacturers of Acrylic Elastomers

- Traders, Distributors, and Suppliers of Acrylic Elastomers

- Automotive OEMs

- Government & Regional Agencies and Research Organizations

- Investment Research Firms

“This study answers several questions for various leading players across the value chain of acrylic elastomers, primarily which market segments to focus on, in the next two to five years for prioritizing their efforts and investments.”

Scope of the Report:

This research report categorizes the acrylic elastomers market based on type, end-use industry, and region.

Acrylic Elastomers Market, by Type:

- ACM

- AEM

Acrylic Elastomers Market, by End-Use Industry:

- Automotive

- Construction

- Industrial

- Others (Wire & Cable and Paints & Coatings)

Acrylic Elastomers Market, by Region:

- North America

- APAC

- Europe

- RoW

The acrylic elastomers market has been further analyzed based on key countries in each of these regions.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Regional Analysis:

- Country-level analysis of the acrylic elastomers market

Company Information:

- Detailed analysis and profiling of additional market players

The acrylic elastomers market is projected to grow from USD 648.2 million in 2017 to USD 983.9 million by 2022, at a CAGR of 8.7% during the forecast period. The growth of the acrylic elastomers market can be attributed to the rising demand for acrylic elastomers from the automotive industry. Additionally, key automobile producers in APAC countries, especially in India, are focused on increasing their automotive manufacturing capacities, thereby driving the demand for acrylic elastomers. Superior properties of acrylic elastomers, such as excellent heat and oil resistance, have made them an ideal choice for under-the-hood automotive applications.

Based on type, the acrylic elastomers market has been segmented into Acrylic Co-monomer Elastomer (ACM) and Ethylene Acrylic Elastomer (AEM). The ACM segment accounted for a larger share of the acrylic elastomers market in 2017 as compared to the AEM segment. This large share can be attributed to the increasing demand for ACM in the APAC region.

Based on end-use industry, the acrylic elastomers market has been segmented into automotive, construction, industrial, and others. The automotive end-use industry segment accounted for the largest share of the acrylic elastomers market in 2017. The increasing use of acrylic elastomers to develop under-the-hood automotive components is projected to drive the demand for acrylic elastomers from the automotive industry. Additionally, increase in automobile production worldwide is influencing the growth of the automotive end-use industry segment of the acrylic elastomers market.

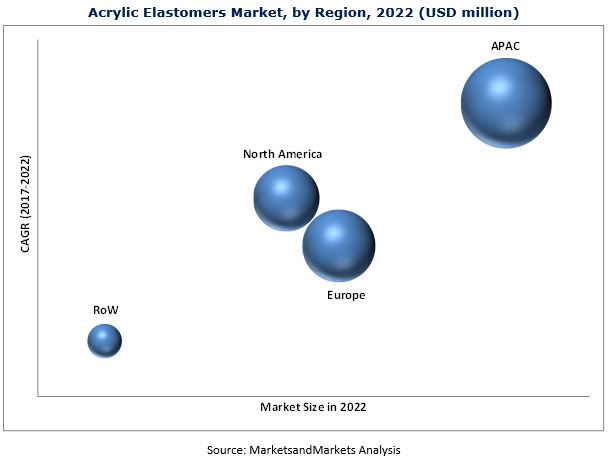

Based on region, the acrylic elastomers market has been segmented into APAC, North America, Europe, and RoW. The APAC region is expected to lead the acrylic elastomers market during the forecast period. The growth of the APAC acrylic elastomers market can be attributed to the rising demand for lightweight and high-powered automobiles, which incorporates acrylic elastomer components in engines. Established manufacturers of automobiles are focused on expanding their production capacities in the APAC region.

Key players operating in the acrylic elastomers market include BASF SE (Germany), DowDuPont (US), Zeon Corporation (Japan), NOK Corporation (Japan), and Trelleborg AB (Sweden). These leading players have adopted various growth strategies such as new product launches, acquisitions, mergers, expansions, partnerships, and joint ventures to strengthen their position in the acrylic elastomers market and widen their customer base. For instance, in April 2018, DowDuPont invested USD 100 million to expand the manufacturing capacity of ‘Vamac’ acrylic elastomers, in addition to other products. This development strategy enabled the company to enhance its presence in the acrylic elastomers market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Unit Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Assumptions

2.4.1 Market Size

2.4.2 Annual Production

2.4.3 Growth Rate

2.5 Limitations

2.5.1 Developments and Products, By Key Players

2.5.2 Market Size (Value) of Acrylic Elastomers

2.5.3 Risk Factors

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 27)

4.1 Significant Opportunities in the Acrylic Elastomers Market

4.2 Acrylic Elastomers Market, By End-Use Industry

4.3 Acrylic Elastomers Market in APAC, By Country and End-Use Industry

4.4 Acrylic Elastomers Market Size, By Type

5 Market Overview (Page No. - 29)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Advanced Properties of Acrylic Elastomers Compared to Conventional Elastomers

5.2.1.2 Increasing Usage of Acrylic Elastomers in Turbocharged Engines

5.2.2 Challenges

5.2.2.1 High Prices of Aem Prompting Oems to Opt for Thermoplastics

5.2.3 Opportunities

5.2.3.1 Huge Investment in Automotive Industry in APAC and South America

5.2.4 Restraints

5.2.4.1 Emerging Demand for Electric Vehicles in China

5.3 Porter’s Five Forces Analysis

5.3.1 Bargaining Power of Suppliers

5.3.2 Bargaining Power of Buyers

5.3.3 Threat of New Entrants

5.3.4 Threat of Substitutes

5.3.5 Intensity of Competitive Rivalry

6 Macroeconomic Overview (Page No. - 35)

6.1 Introduction

6.2 Trends and Forecast of GDP

6.3 Trends of Automotive Industry

6.4 Trends of Construction Industry

6.4.1 Construction Industry in North America

6.4.2 Construction Industry in Europe

6.4.3 Construction Industry in APAC

7 Acrylic Elastomers Market, By Type (Page No. - 40)

7.1 Introduction

7.2 Acrylic Co-Monomer Elastomers

7.3 Ethylene Acrylic Elastomers

8 Acrylic Elastomers Market, By End-Use Industry (Page No. - 44)

8.1 Introduction

8.2 Automotive

8.2.1 Hoses

8.2.2 Gaskets

8.2.3 Seals and O-Rings

8.2.4 Others

8.3 Construction

8.3.1 Floor Coating

8.3.2 Others

8.4 Industrial

8.4.1 Industrial Machinery

8.5 Others

9 Acrylic Elastomers Market, By Region (Page No. - 50)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.2 Canada

9.2.3 Mexico

9.3 APAC

9.3.1 China

9.3.2 Japan

9.3.3 India

9.3.4 South Korea

9.3.5 Rest of APAC

9.4 Europe

9.4.1 Germany

9.4.2 France

9.4.3 UK

9.4.4 Spain

9.4.5 Italy

9.4.6 Rest of Europe

9.5 RoW

9.5.1 Brazil

9.5.2 Others

10 Competitive Landscape (Page No. - 79)

10.1 Overview

10.2 Market Ranking

10.2.1 Dowdupont

10.2.2 Zeon Corporation

10.2.3 NOK Corporation

10.2.4 BASF SE

10.2.5 Trelleborg AB

10.3 Competitive Scenario

10.3.1 Expansions

10.3.2 New Product Launches

10.3.3 Mergers

11 Company Profile (Page No. - 83)

Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View

11.1 Dowdupont

11.2 Zeon Corporation

11.3 NOK Corporation

11.4 BASF SE

11.5 Trelleborg AB

11.6 Kuraray Co., Ltd.

11.7 Der-Gom SRL

11.8 Changzhou Haiba Ltd.

11.9 Chengdu Dowhon Industrial Co., Ltd.

11.10 Denka Company Limited

*Details Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 101)

12.1 Insights From Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets Subscription Portal

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Related Reports

12.6 Author Details

List of Tables (72 Tables)

Table 1 Trends and Forecast of GDP, 2016–2022 (USD Billion)

Table 2 Automotive Production, Million Unit (2011–2016)

Table 3 Contribution of Construction Industry to the GDP of North America, 2014–2016 (USD Billion)

Table 4 Contribution of Construction Industry to the GDP of Europe, 2014–2016 (USD Billion)

Table 5 Contribution of Construction Industry to the GDP of APAC, 2014–2016 (USD Billion)

Table 6 Acrylic Elastomers Market Size, By Type, 2015–2022 (Ton)

Table 7 Acrylic Elastomers Market Size, By Type, 2015–2022 (USD Million)

Table 8 Acrylic Elastomers Market Size, By End-Use Industry, 2015–2022 (Ton)

Table 9 Acrylic Elastomers Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 10 Acrylic Elastomers Market Size in Automotive, By Region, 2015–2022 (Ton)

Table 11 Acrylic Elastomers Market Size in Automotive, By Region, 2015–2022 (USD Million)

Table 12 Acrylic Elastomers Market Size in Construction, By Region, 2015–2022 (Ton)

Table 13 Acrylic Elastomers Market Size in Construction, By Region, 2015–2022 (USD Million)

Table 14 Acrylic Elastomers Market Size in Industrial, By Region, 2015–2022 (Ton)

Table 15 Acrylic Elastomers Market Size in Industrial, By Region, 2015–2022 (USD Million)

Table 16 Acrylic Elastomers Market Size, By Region, 2015–2022 (Ton)

Table 17 Acrylic Elastomers Market Size, By Region, 2015–2022 (USD Million)

Table 18 Acrylic Elastomers Market Size, By End-Use Industry, 2015–2022 (Ton)

Table 19 Acrylic Elastomers Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 20 Acrylic Elastomers Market Size, By Type, 2015–2022 (Ton)

Table 21 Acrylic Elastomers Market Size, By Type, 2015–2022 (USD Million)

Table 22 North America: Market Size, By Country, 2015–2022 (Ton)

Table 23 North America: Market Size, By Region, 2015–2022 (USD Million)

Table 24 North America: Market Size, By End-Use Industry, 2015–2022 (Ton)

Table 25 North America: Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 26 US: Market Size, By End-Use Industry, 2015–2022 (Ton)

Table 27 US: Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 28 Canada: Market Size, By End-Use Industry, 2015–2022 (Ton)

Table 29 Canada: Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 30 Mexico: Market Size, By End-Use Industry, 2015–2022 (Ton)

Table 31 Mexico: Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 32 APAC: Market Size, By Country, 2015–2022 (Ton)

Table 33 APAC: Market Size, By Country, 2015-2022 (USD Million)

Table 34 APAC: Market Size, By End-Use Industry, 2015–2022 (Ton)

Table 35 APAC: Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 36 China: Market Size, By End-Use Industry, 2015–2022 (Ton)

Table 37 China: Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 38 Japan: Market Size, By End-Use Industry, 2015–2022 (Ton)

Table 39 Japan: Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 40 India: Market Size, By End-Use Industry, 2015–2022 (Ton)

Table 41 India: Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 42 South Korea: Market Size, By End-Use Industry, 2015–2022 (Ton)

Table 43 South Korea: Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 44 Rest of APAC: Acrylic Elastomers Market Size, By End-Use Industry, 2015–2022 (Ton)

Table 45 Rest of APAC: Acrylic Elastomers Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 46 Europe: Market Size, By Country, 2015–2022 (Ton)

Table 47 Europe: Market Size, By Country, 2015–2022 (USD Million)

Table 48 Europe: Market Size, By End-Use Industry, 2015–2022 (Ton)

Table 49 Europe: Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 50 Germany: Market Size, By End-Use Industry, 2015–2022 (Ton)

Table 51 Germany: Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 52 France: Acrylic Elastomers Market Size, By End-Use Industry, 2015–2022 (Ton)

Table 53 France: Acrylic Elastomers Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 54 UK: Market Size, By End-Use Industry, 2015–2022 (Ton)

Table 55 UK: Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 56 Spain: Market Size, By End-Use Industry, 2015–2022 (Ton)

Table 57 Spain: Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 58 Italy: Market Size, By End-Use Industry, 2015–2022 (Ton)

Table 59 Italy: Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 60 Rest of Europe: Acrylic Elastomers Market Size, By End-Use Industry, 2015–2022 (Ton)

Table 61 Rest of Europe: Acrylic Elastomers Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 62 RoW: Market Size, By Country, 2015–2022 (Ton)

Table 63 RoW: Market Size, By Country, 2015–2022 (USD Million)

Table 64 RoW: Market Size, By End-Use Industry, 2015–2022 (Ton)

Table 65 RoW: Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 66 Brazil: Market Size, By End-Use Industry, 2015–2022 (Ton)

Table 67 Brazil: Market Size, By Application, 2015–2022 (USD Million)

Table 68 Others: Market Size, By End-Use Industry, 2015–2022 (Ton)

Table 69 Others: Market Size, By Application, 2015–2022 (USD Million)

Table 70 Expansions, 2015–2017

Table 71 New Product Launches, 2015–2017

Table 72 Mergers, 2015–2017

List of Figures (37 Figures)

Figure 1 Acrylic Elastomers Market Segmentation

Figure 2 Acrylic Elastomers Market: Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 ACM Expected to Register Higher CAGR During Forecast Period

Figure 7 Automotive Industry Dominates Acrylic Elastomers Market, By Value

Figure 8 Acrylic Elastomers Market Size, By Country, 2016 (USD Million)

Figure 9 Acrylic Elastomers Market Share (Value), By Region, 2016

Figure 10 Automotive Industry to Drive Acrylic Elastomers Market, 2017 vs 2022

Figure 11 Automotive to Be the Fastest-Growing End-Use Industry

Figure 12 China to Be the Largest Market for Acrylic Elastomers in APAC

Figure 13 ACM to Be the Larger Segment

Figure 14 Factors Governing the Acrylic Elastomers Market

Figure 15 Porter’s Five Force Analysis: Acrylic Elastomers Market

Figure 16 Trends and Forecast of GDP, 2017–2022 (USD Billion)

Figure 17 Automotive Production in Key Countries, Million Unit (2015 vs 2016)

Figure 18 ACM to Account for the Larger Share of Acrylic Elastomers Market

Figure 19 Automotive to Be the Largest End-Use Industry of Acrylic Elastomers

Figure 20 India, Mexico, and Spain Emerging as Hotspots in the Global Acrylic Elastomers Market, 2017–2022

Figure 21 North America Snapshot: US Accounted for Largest Market Share in 2016

Figure 22 Automotive Industry to Drive Acrylic Elastomers Market Between 2017 and 2022

Figure 23 Automotive Industry to Lead Acrylic Elastomers Market in RoW

Figure 24 Companies Majorly Adopted the Strategy of Expansions Between 2015 and 2017

Figure 25 Market Ranking of Key Players in 2016

Figure 26 Dowdupont: Company Snapshot

Figure 27 Dowdupont: SWOT Analysis

Figure 28 Zeon Corporation: Company Snapshot

Figure 29 Zeon Corporation: SWOT Analysis

Figure 30 NOK Corporation: Company Snapshot

Figure 31 NOK Corporation: SWOT Analysis

Figure 32 BASF SE: Company Snapshot

Figure 33 BASF SE: SWOT Analysis

Figure 34 Trelleborg AB: Company Snapshot

Figure 35 Trelleborg AB: SWOT Analysis

Figure 36 Kuraray Co., Ltd.: Company Snapshot

Figure 37 Denka Company Limited: Company Snapshot

Growth opportunities and latent adjacency in Acrylic Elastomers Market