Acrylate Market by Chemistry, Application (Paints & Coatings, Plastics, Adhesives & Sealants, Fabrics), End-use Industry (Building & Construction, Packaging, Consumer Goods, Automotive, Textiles, Biomedical), & Region - Global Forecast to 2028

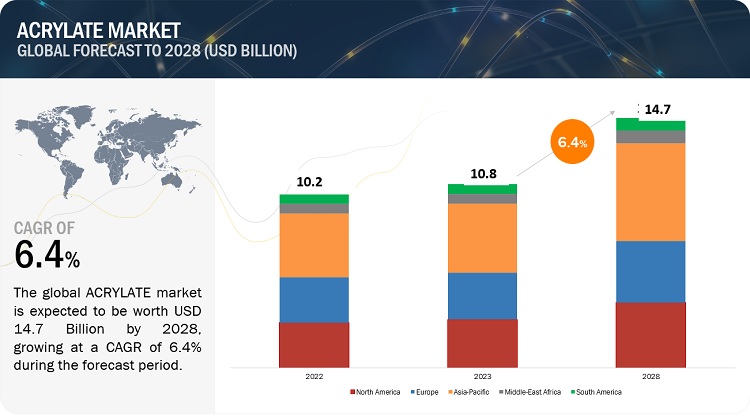

The acrylate market is projected to reach USD 14.7 billion by 2028, at a CAGR of 6.4% from USD 10.8 billion in 2023. The market is growing, and the trend is expected to continue in the long term due to high demand from building & construction, packaging, consumer goods, automotive, textiles, biomedical, cosmetics, and personal care industries.

ATTRACTIVE OPPORTUNITIES IN THE ACRYLATE MARKET

To know about the assumptions considered for the study, Request for Free Sample Report

Acrylate Market Dynamics

Driver: Increased infrastructural and construction activities

Rapid industrialization and urbanization in key countries, such as China and India, have spurred the demand for acrylates in the past few years. The building & construction industry requires high-performance materials for protection and decorative purposes. The quality and performance of acrylate-based systems such as paint, coatings, adhesives & sealants for building and construction purposes must be extremely consistent and cost-effective. As a result, the demand for acrylate-based systems is increasing in the building & construction industry. The increasing population in emerging regions, especially in APAC, and the need for improved infrastructure and residential construction are expected to drive the consumption of acrylates. The global population was estimated to be around 7.9 billion in 2021, with APAC having approximately 60% of the total population. Close to 80% of the global population resides in developing countries where there is an increasing demand for residential housing and urban infrastructure. According to the United Nations, the world population is expected to reach 8.5 billion by 2030 and 9.7 billion by 2050, which will further necessitate requirements for housing, commercial hubs, and transportation infrastructure.

The quality of construction is expected to progress in emerging economies such as Brazil, China, and South Asian Countries owing to improved regulations and standards, accreditations, consumer awareness, and renewed investments. Thus, the consumption of acrylates is expected to increase.

Restraint: Environmental and health hazards

Acrylates pose health and environmental hazards. The use of acrylic acids and acrylic monomers as raw materials for the production of polymers and copolymers is highly dangerous and can cause chronic intoxication. Even at low concentrations, acrylic monomers such as methyl acrylates have been found to produce systemic and embryotoxic effects. Acrylates also have moderate to low acute toxicity in fish, algae, and daphnia, and can cause skin allergies in humans.

Furthermore, acrylates can contribute to air pollution by releasing volatile organic compounds (VOCs) into the atmosphere, which can be hazardous to human health and destroy the ozone layer. If acrylates are not disposed of properly, they can contaminate soil and water sources, posing a threat to local ecosystems and wildlife. Therefore, the environmental and health hazards associated with acrylates will continue to restrain the growth of the market.

Opportunity: Emerging commercialization of bio-based acrylic acid

Acrylic acid, a petroleum-based product, is used as a raw material to produce acrylates. Environmental and health concerns related to petroleum-based products have led to the need for the production of bio-based chemicals. Bio-based acrylic acid is manufactured by the oxydehydration process of glycerol. Bio-acrylic acid has unique properties that make it suitable for new applications, including coatings, adhesives, plastics, and textiles.

Several companies, such as The Dow Chemical Company (U.S.), OPX Biotechnologies Inc. (U.S.), Myriant Corporation (U.S.), Cargill Inc. (U.S.), and Metabolix Inc. (U.S.), are researching bio-based acrylic acid. Arkema (France) has a pilot project to convert bio-based glycerol to acrylic acid. These efforts to produce bio-based materials will provide bio-based acrylic acid and benefit the acrylate market in complying with various environmental regulations.

Challenge: Volatility in raw material prices

The price and availability of raw materials affect the prices of end products. The global acrylate market uses acrylic acid and alcohol as raw materials, and their prices fluctuate with crude oil prices since they are petroleum-based. The rise or fall in crude oil prices impacts the price of raw materials required for acrylates. Oil prices have been highly volatile in recent times, with the ongoing war between Russia and Ukraine potentially affecting crude oil prices. Many European countries have imposed sanctions on Russia due to the escalation of war, disrupting global oil supplies and potentially driving up prices. These fluctuations in crude oil prices have affected the prices of raw materials for acrylates, forcing manufacturers to enhance the efficiency and productivity of their operations to sustain growth while reducing their profit margins.

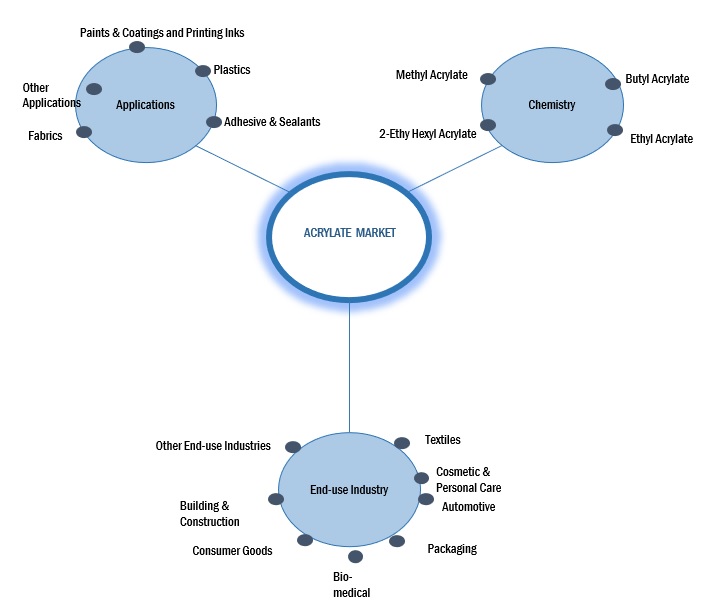

ACRYLATE MARKET ECOSYSTEM DIAGRAM

"Butyl Acrylate was the largest form for acrylate market in 2022, in terms of value."

In the coatings industry, butyl acrylate is used as a raw material to produce a range of coatings, including architectural coatings, industrial coatings, and wood coatings. These coatings are used in various applications, such as in the automotive, aerospace, and construction industries. Similarly, butyl acrylate is used to produce pressure-sensitive adhesives, which are widely used in packaging, labeling, and medical applications. It is also used in the production of heat-sealable coatings for food packaging and in the construction industry to manufacture sealants and caulks.

"Consumer goods was the second fastest end-use industry for acrylate market in 2022, in terms of value."

Acrylates used in the production of coatings are generally used in domestic appliances for protection and a better appearance. Acrylate coatings are mainly used in printing and packaging of consumer goods. Acrylate adhesives use UV, electronic beam, light-emitting diode, peroxide, and amine cure technologies in consumer goods. Pressure-sensitive adhesives that use acrylic technology are used in consumer goods such as glass bottles and metal cans.

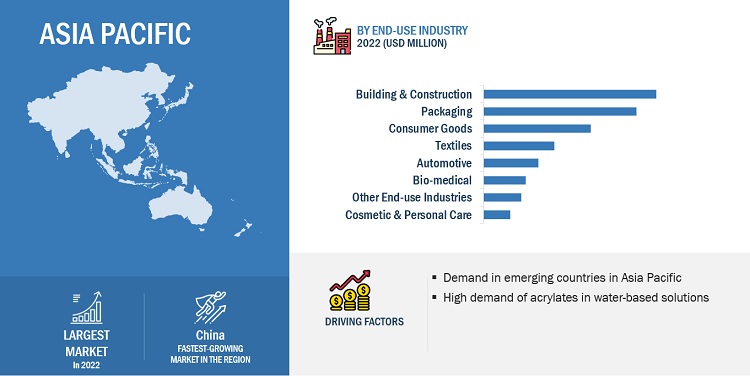

"Asia Pacific was the largest market for acrylate in 2022, in terms of value."

Based on region, the Asia Pacific is a key market to produce acrylates and is projected to grow at a CAGR of 7.3% in terms of value during the forecast period. The availability of low-cost raw materials and labor, coupled with growing awareness among people, makes the region an attractive investment destination for acrylate manufacturers. The rising population, urbanization, and industrialization are some of the factors that will drive the acrylate market in this region.

To know about the assumptions considered for the study, download the pdf brochure

Key Acrylate Market Players

The key players in this market are Arkema S.A. (France), BASF SE (Germany), Dow Inc. (US), Nippon Shokubai Co., Ltd. (Japan), Evonik (Germany), LG Chem (South Korea), Mitsubishi Chemical Group Corporation (Japan), Sasol (South Africa), Sibur (Russia), Wanhua Chemical Group Co. Ltd. (China). Continuous developments in the market—including new product launches, mergers & acquisitions, agreements, and expansions—are expected to help the market grow. Leading manufacturers of acrylate have opted for new product launches to sustain their market position.

Scope of the Report

|

Report Metric |

Details |

|

Years considered for the study |

2019-2028 |

|

Base Year |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Volume (KT); Value (USD Million) |

|

Segments |

Chemistry, Application, End-use Industries, and Region |

|

Regions |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies |

Arkema S.A. (France), BASF SE (Germany), Dow Inc. (US), Nippon Shokubai Co., Ltd. (Japan), Evonik (Germany), LG Chem (South Korea), Mitsubishi Chemical Group Corporation (Japan), Sasol (South Africa), Sibur (Russia), Wanhua Chemical Group Co. Ltd. (China) |

This report categorizes the global acrylate market based on chemistry, application, end-use industry, and region.

Based on chemistry, the acrylate market has been segmented as follows:

- Butyl Acrylate

- Ethyl Acrylate

- 2-Ethyl Hexyl Acrylate

- Methyl Acrylate

- Other Chemistries

Based on application, the acrylate market has been segmented as follows:

- Paints, Coatings, & Printing Inks

- Plastics

- Adhesives & Sealants

- Fabrics

- Other Applications

Based on end-use industry, the acrylate market has been segmented as follows:

- Building & Construction

- Packaging

- Consumer Goods

- Automotive

- Textiles

- Bio-medical

- Cosmetic & Personal Care

- Other End-use Industries

Based on region, the acrylate market has been segmented as follows:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In November 2022, Arkema S.A. launched a range of bio-attributed acrylic monomers using the mass balance approach. It is an important step on the sustainable development roadmap of the company and its coating solutions segment.

- In May 2022, Evonik announced a strategic distribution partnership with Vimal Intertrade and Nordmann to serve the emerging Indian and surrounding markets.

- In May 2020, Nippon Shokubai and Riken have successfully developed an efficient polymerization system and high-performance polymers for hardly polymerizable monomers, derived from biomass resources.

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of the acrylate market?

The growth of this market can be attributed to increasing infrastructure and construction activities and rising demand from emerging economies.

Which are the key end-use industries driving the acrylate market?

End-use industries such as building & construction, packaging, consumer goods, automotive, textile, cosmetic & personal care and bio-medical are driving the demand for acrylate market.

Who are the major manufacturers?

Major manufacturers include Arkema S.A. (France), BASF SE (Germany), Dow Inc. (US), Nippon Shokubai Co., Ltd. (Japan), Evonik (Germany), LG Chem (South Korea), Mitsubishi Chemical Group Corporation (Japan), Sasol (South Africa), Sibur (Russia), Wanhua Chemical Group Co. Ltd. (China), among others.

What is the biggest restraint for acrylate market?

The biggest restraint can be environmental & health hazards.

How is COVID-19 affecting the overall acrylate market?

The acrylate market saw a disruption in the supply chain for the supply of raw materials.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growth of construction and automotive sectors- Rapid industrialization and urbanization- Increased use of dispersive adhesives- Rising demand for coatings in end-use industriesRESTRAINTS- Environmental and health hazardsOPPORTUNITIES- Commercialization of bio-based acrylic acidCHALLENGES- Volatility in raw material prices- Stringent regulations and restrictions

-

5.3 PATENT ANALYSISMETHODOLOGYDOCUMENT TYPESINSIGHTSTOP APPLICANTSPATENTS BY BASF SEPATENTS BY EVONIK ROEHM GMBHMAJOR PATENT OWNERS (LAST 10 YEARS)

-

5.4 ECOSYSTEM MAPPING

-

5.5 VALUE CHAIN ANALYSISRAW MATERIAL SUPPLIERSMANUFACTURERSDISTRIBUTORSEND USERS

-

5.6 PORTER’S FIVE FORCES ANALYSISBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESINTENSITY OF COMPETITIVE RIVALRY

-

5.7 TECHNOLOGY ANALYSISFUNCTIONALIZATION TECHNOLOGYCONTROLLED RADICAL POLYMERIZATION

-

5.8 TRADE ANALYSISIMPORT–EXPORT SCENARIO OF ACRYLATE MARKET

-

5.9 TARIFFS AND REGULATIONSNORTH AMERICAASIA PACIFICEUROPEMIDDLE EAST, AFRICA, AND SOUTH AMERICA

- 5.10 KEY CONFERENCES AND EVENTS, 2022–2023

-

5.11 KEY FACTORS AFFECTING BUYING DECISIONSQUALITYSERVICE

-

5.12 CASE STUDY ANALYSISARKEMA S.A.BASF SE

-

5.13 AVERAGE SELLING PRICE ANALYSISAVERAGE SELLING PRICE, BY REGIONAVERAGE SELLING PRICE, BY APPLICATION

- 5.14 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.15 MACROECONOMIC INDICATORSGROSS DOMESTIC PRODUCT TRENDS AND FORECASTSTRENDS IN AUTOMOTIVE INDUSTRY

- 6.1 INTRODUCTION

-

6.2 BUTYL ACRYLATEUSED IN PRODUCTION OF COATINGS, ADHESIVES, AND SEALANTSN-BUTYL ACRYLATET-BUTYL ACRYLATEI-BUTYL ACRYLATE

-

6.3 ETHYL ACRYLATEUSED IN PRODUCTION OF PAINTS, PLASTICS, AND PHARMACEUTICAL INTERMEDIATES

-

6.4 METHYL ACRYLATEUSED IN SYNTHETIC CARPETS, PHARMACEUTICAL PRODUCTS, AND ACRYLIC FIBERS

-

6.5 2-ETHYLHEXYL ACRYLATEUSED IN PRODUCTION OF ACRYLIC POLYMERS

- 6.6 OTHER CHEMISTRIES

- 7.1 INTRODUCTION

-

7.2 PAINTS & COATINGS AND PRINTING INKSINCREASED USE OF PAINTS AND INKS TO FUEL DEMAND FOR ACRYLATE MONOMERS

-

7.3 PLASTICSHIGH PRODUCTION OF POLYMERS AND PLASTICS TO BOOST DEMAND FOR ACRYLATES

-

7.4 ADHESIVES & SEALANTSGROWTH OF CONSTRUCTION AND AUTOMOTIVE INDUSTRIES TO INCREASE DEMAND FOR DISPERSIVE ADHESIVES

-

7.5 FABRICSRISE IN TEXTILE INDUSTRY TO DRIVE DEMAND FOR ACRYLATES

- 7.6 OTHER APPLICATIONS

- 8.1 INTRODUCTION

-

8.2 PACKAGINGUSE OF ACRYLIC ADHESIVES IN PACKAGING TO DRIVE MARKET

-

8.3 CONSUMER GOODSINCREASING USE OF COATINGS, FABRICS, AND INKS TO FUEL DEMAND FOR ACRYLATES

-

8.4 BUILDING & CONSTRUCTIONINCREASING USE OF ACRYLIC SEALANTS IN CONSTRUCTION ACTIVITIES TO PROPEL MARKET

-

8.5 AUTOMOTIVERESISTANCE TO ABRASION AND ENVIRONMENTAL FACTORS TO FUEL DEMAND FOR ACRYLATE MONOMERS

-

8.6 TEXTILESUSE OF ACRYLIC FIBERS IN TEXTILE INDUSTRY TO DRIVE MARKET

-

8.7 BIOMEDICALUSE OF ACRYLATE MONOMERS IN TARGETED DRUG DELIVERY TO PROPEL MARKET

-

8.8 COSMETICS & PERSONAL CAREINCREASING USE OF COSMETICS TO FUEL DEMAND FOR ACRYLATES

- 8.9 OTHER END-USE INDUSTRIES

- 9.1 INTRODUCTION

-

9.2 ASIA PACIFICRECESSION IMPACT ON ASIA PACIFICCHINA- Growing construction industry to drive marketJAPAN- Rise in tourism industry to drive marketINDIA- Government infrastructure projects to fuel market growthSOUTH KOREA- Environmental sustainability to boost marketTAIWAN- Export-oriented economy to boost marketAUSTRALIA- Development initiatives by government to drive marketREST OF ASIA PACIFIC

-

9.3 EUROPERECESSION IMPACT ON EUROPEGERMANY- Growth of packaging industry to drive marketUK- Rise in biopharmaceutical industry to propel marketFRANCE- Demand for sustainable packaging to fuel market growthITALY- Growth of packaging industry to fuel demand for acrylatesSPAIN- Increased foreign investments and economic growth to drive marketNETHERLANDS- Renovation strategies to fuel demand for acrylatesBELGIUM- Growth of construction industry to propel marketREST OF EUROPE

-

9.4 NORTH AMERICARECESSION IMPACT ON NORTH AMERICAUS- Need for sustainable packaging products to fuel acrylate demandCANADA- Foreign trade to drive marketMEXICO- Advancements in construction sector to fuel demand for acrylates

-

9.5 SOUTH AMERICABRAZIL- Rising demand for sustainable packaging solutions from agricultural sector to drive acrylate marketARGENTINA- Rising urban population to increase demand for residential and commercial buildingsREST OF SOUTH AMERICA

-

9.6 MIDDLE EAST & AFRICASAUDI ARABIA- Development in real estate sector to fuel demand for acrylatesUAE- Construction pipelines to fuel demand for acrylateREST OF MIDDLE EAST & AFRICA

- 10.1 OVERVIEW

- 10.2 RANKING ANALYSIS OF KEY MARKET PLAYERS, 2022

- 10.3 MARKET SHARE ANALYSIS

- 10.4 REVENUE ANALYSIS OF TOP PLAYERS

- 10.5 MARKET EVALUATION MATRIX

-

10.6 COMPANY EVALUATION MATRIX, 2022 (TIER 1)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

10.7 START-UP/SME EVALUATION MATRIXRESPONSIVE COMPANIESSTARTING BLOCKSPROGRESSIVE COMPANIESDYNAMIC COMPANIES

- 10.8 COMPANY END-USE INDUSTRY FOOTPRINT

- 10.9 COMPANY REGION FOOTPRINT

- 10.10 STRENGTH OF PRODUCT PORTFOLIO

- 10.11 BUSINESS STRATEGY EXCELLENCE

-

10.12 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHER DEVELOPMENTS

-

11.1 KEY PLAYERSARKEMA S.A.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBASF SE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewDOW INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewNIPPON SHOKUBAI CO., LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewEVONIK- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewLG CHEM- Business overview- Products/Solutions/Services offered- MnM viewMITSUBISHI CHEMICAL GROUP CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSASOL- Business overview- Products/Solutions/Services offered- MnM viewSIBUR- Business overview- Products/Solutions/Services offered- MnM viewWANHUA CHEMICAL GROUP CO. LTD.- Business overview- Products/Solutions/Services offered- MnM view

-

11.2 OTHER PLAYERSKH CHEMICALSTHE KURARAY GROUPLABDHI CHEMICALSRESONAC CORPORATIONSHANGHAI HUAYI ACRYLIC ACID CO., LTD.NATIONAL INDUSTRIALIZATION CO. (TASNEE)JURONG GROUPLOBHA CHEMIE PVT. LTD.HIHANG INDUSTRY CO. LTD.BPCLTOAGOSEI CO. LTD.ETERNAL MATERIALS CO. LTD.MERCK MILLIPORETCI CHEMICALSPARSOL CHEMICALS LTD.

- 12.1 INSIGHTS FROM INDUSTRY EXPERTS

- 12.2 DISCUSSION GUIDE

- 12.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.4 CUSTOMIZATION OPTIONS

- 12.5 RELATED REPORTS

- 12.6 AUTHOR DETAILS

- TABLE 1 ECOTOXICOLOGICAL PROPERTIES

- TABLE 2 ENVIRONMENTAL HAZARD LEVELS

- TABLE 3 ENVIRONMENTAL PROPERTIES

- TABLE 4 KEY PLAYERS IN ACRYLATE ECOSYSTEM

- TABLE 5 PORTER’S FIVE FORCES ANALYSIS: ACRYLATE MARKET

- TABLE 6 IMPORT TRADE DATA OF ACRYLATE FOR TOP COUNTRIES, 2020–2022 (USD THOUSAND)

- TABLE 7 EXPORT TRADE DATA OF ACRYLATE FOR TOP COUNTRIES, 2020–2022 (USD THOUSAND)

- TABLE 8 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 ACRYLATE MARKET: KEY CONFERENCES AND EVENTS

- TABLE 10 AVERAGE SELLING PRICE, BY APPLICATION (USD/KG)

- TABLE 11 PROJECTED REAL GROSS DOMESTIC PRODUCT GROWTH (ANNUAL PERCENT CHANGE) OF KEY COUNTRIES, 2018–2025

- TABLE 12 VEHICLE PRODUCTION STATISTICS, BY COUNTRY, 2021–2022 (UNITS)

- TABLE 13 ACRYLATE MARKET, BY CHEMISTRY, 2019–2022 (USD MILLION)

- TABLE 14 ACRYLATE MARKET, BY CHEMISTRY, 2023–2028 (USD MILLION)

- TABLE 15 ACRYLATE MARKET, BY CHEMISTRY, 2019–2022 (KILOTON)

- TABLE 16 ACRYLATE MARKET, BY CHEMISTRY, 2023–2028 (KILOTON)

- TABLE 17 PROPERTIES OF N-BUTYL ACRYLATE

- TABLE 18 PROPERTIES OF T-BUTYL ACRYLATE

- TABLE 19 PROPERTIES OF I-BUTYL ACRYLATE

- TABLE 20 PROPERTIES OF ETHYL ACRYLATE

- TABLE 21 PROPERTIES OF METHYL ACRYLATE

- TABLE 22 PROPERTIES OF 2-ETHYLHEXYL ACRYLATE

- TABLE 23 ACRYLATE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 24 ACRYLATE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 25 ACRYLATE MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 26 ACRYLATE MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 27 ACRYLATE MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 28 ACRYLATE MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 29 ACRYLATE MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 30 ACRYLATE MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 31 ACRYLATE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 32 ACRYLATE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 33 ACRYLATE MARKET, BY REGION, 2019–2022 (KILOTON)

- TABLE 34 ACRYLATE MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 35 ASIA PACIFIC: ACRYLATE MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 36 ASIA PACIFIC: ACRYLATE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 37 ASIA PACIFIC: ACRYLATE MARKET, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 38 ASIA PACIFIC: ACRYLATE MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 39 ASIA PACIFIC: ACRYLATE MARKET, BY CHEMISTRY, 2019–2022 (USD MILLION)

- TABLE 40 ASIA PACIFIC: ACRYLATE MARKET, BY CHEMISTRY, 2023–2028 (USD MILLION)

- TABLE 41 ASIA PACIFIC: ACRYLATE MARKET, BY CHEMISTRY, 2019–2022 (KILOTON)

- TABLE 42 ASIA PACIFIC: ACRYLATE MARKET, BY CHEMISTRY, 2023–2028 (KILOTON)

- TABLE 43 ASIA PACIFIC: ACRYLATE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 44 ASIA PACIFIC: ACRYLATE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 45 ASIA PACIFIC: ACRYLATE MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 46 ASIA PACIFIC: ACRYLATE MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 47 ASIA PACIFIC: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 48 ASIA PACIFIC: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 49 ASIA PACIFIC: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 50 ASIA PACIFIC: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 51 CHINA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 52 CHINA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 53 CHINA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 54 CHINA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 55 JAPAN: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 56 JAPAN: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 57 JAPAN: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 58 JAPAN: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 59 INDIA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 60 INDIA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 61 INDIA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 62 INDIA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 63 SOUTH KOREA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 64 SOUTH KOREA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 65 SOUTH KOREA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 66 SOUTH KOREA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 67 TAIWAN: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 68 TAIWAN: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 69 TAIWAN: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 70 TAIWAN: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 71 AUSTRALIA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 72 AUSTRALIA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 73 AUSTRALIA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 74 AUSTRALIA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 75 REST OF ASIA PACIFIC: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 76 REST OF ASIA PACIFIC: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 77 REST OF ASIA PACIFIC: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 78 REST OF ASIA PACIFIC: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 79 EUROPE: ACRYLATE MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 80 EUROPE: ACRYLATE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 81 EUROPE: ACRYLATE MARKET, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 82 EUROPE: ACRYLATE MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 83 EUROPE: ACRYLATE MARKET, BY CHEMISTRY, 2019–2022 (USD MILLION)

- TABLE 84 EUROPE: ACRYLATE MARKET, BY CHEMISTRY, 2023–2028 (USD MILLION)

- TABLE 85 EUROPE: ACRYLATE MARKET, BY CHEMISTRY, 2019–2022 (KILOTON)

- TABLE 86 EUROPE: ACRYLATE MARKET, BY CHEMISTRY, 2023–2028 (KILOTON)

- TABLE 87 EUROPE: ACRYLATE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 88 EUROPE: ACRYLATE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 89 EUROPE: ACRYLATE MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 90 EUROPE: ACRYLATE MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 91 EUROPE: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 92 EUROPE: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 93 EUROPE: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 94 EUROPE: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 95 GERMANY: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 96 GERMANY: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 97 GERMANY: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 98 GERMANY: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 99 UK: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 100 UK: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 101 UK: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 102 UK: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 103 FRANCE: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 104 FRANCE: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 105 FRANCE: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 106 FRANCE: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 107 ITALY: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 108 ITALY: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 109 ITALY: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 110 ITALY: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 111 SPAIN: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 112 SPAIN: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 113 SPAIN: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 114 SPAIN: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 115 NETHERLANDS: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 116 NETHERLANDS: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 117 NETHERLANDS: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 118 NETHERLANDS: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 119 BELGIUM: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 120 BELGIUM: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 121 BELGIUM: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 122 BELGIUM: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 123 REST OF EUROPE: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 124 REST OF EUROPE: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 125 REST OF EUROPE: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 126 REST OF EUROPE: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 127 NORTH AMERICA: ACRYLATE MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 128 NORTH AMERICA: ACRYLATE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 129 NORTH AMERICA: ACRYLATE MARKET, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 130 NORTH AMERICA: ACRYLATE MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 131 NORTH AMERICA: ACRYLATE MARKET, BY CHEMISTRY, 2019–2022 (USD MILLION)

- TABLE 132 NORTH AMERICA: ACRYLATE MARKET, BY CHEMISTRY, 2023–2028 (USD MILLION)

- TABLE 133 NORTH AMERICA: ACRYLATE MARKET, BY CHEMISTRY, 2019–2022 (KILOTON)

- TABLE 134 NORTH AMERICA: ACRYLATE MARKET, BY CHEMISTRY, 2023–2028 (KILOTON)

- TABLE 135 NORTH AMERICA: ACRYLATE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 136 NORTH AMERICA: ACRYLATE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 137 NORTH AMERICA: ACRYLATE MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 138 NORTH AMERICA: ACRYLATE MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 139 NORTH AMERICA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 140 NORTH AMERICA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 141 NORTH AMERICA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 142 NORTH AMERICA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 143 US: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 144 US: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 145 US: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 146 US: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 147 CANADA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 148 CANADA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 149 CANADA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 150 CANADA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 151 MEXICO: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 152 MEXICO: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 153 MEXICO: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 154 MEXICO: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 155 SOUTH AMERICA: ACRYLATE MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 156 SOUTH AMERICA: ACRYLATE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 157 SOUTH AMERICA: ACRYLATE MARKET, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 158 SOUTH AMERICA: ACRYLATE MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 159 SOUTH AMERICA: ACRYLATE MARKET, BY CHEMISTRY, 2019–2022 (USD MILLION)

- TABLE 160 SOUTH AMERICA: ACRYLATE MARKET, BY CHEMISTRY, 2023–2028 (USD MILLION)

- TABLE 161 SOUTH AMERICA: ACRYLATE MARKET, BY CHEMISTRY, 2019–2022 (KILOTON)

- TABLE 162 SOUTH AMERICA: ACRYLATE MARKET, BY CHEMISTRY, 2023–2028 (KILOTON)

- TABLE 163 SOUTH AMERICA: ACRYLATE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 164 SOUTH AMERICA: ACRYLATE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 165 SOUTH AMERICA: ACRYLATE MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 166 SOUTH AMERICA: ACRYLATE MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 167 SOUTH AMERICA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 168 SOUTH AMERICA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 169 SOUTH AMERICA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 170 SOUTH AMERICA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 171 BRAZIL: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 172 BRAZIL: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 173 BRAZIL: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 174 BRAZIL: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 175 ARGENTINA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 176 ARGENTINA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 177 ARGENTINA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 178 ARGENTINA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 179 REST OF SOUTH AMERICA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 180 REST OF SOUTH AMERICA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 181 REST OF SOUTH AMERICA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 182 REST OF SOUTH AMERICA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 183 MIDDLE EAST & AFRICA: ACRYLATE MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 184 MIDDLE EAST & AFRICA: ACRYLATE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 185 MIDDLE EAST & AFRICA: ACRYLATE MARKET, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 186 MIDDLE EAST & AFRICA: ACRYLATE MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 187 MIDDLE EAST & AFRICA: ACRYLATE MARKET, BY CHEMISTRY, 2019–2022 (USD MILLION)

- TABLE 188 MIDDLE EAST & AFRICA: ACRYLATE MARKET, BY CHEMISTRY, 2023–2028 (USD MILLION)

- TABLE 189 MIDDLE EAST & AFRICA: ACRYLATE MARKET, BY CHEMISTRY, 2019–2022 (KILOTON)

- TABLE 190 MIDDLE EAST & AFRICA: ACRYLATE MARKET, BY CHEMISTRY, 2023–2028 (KILOTON)

- TABLE 191 MIDDLE EAST & AFRICA: ACRYLATE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 192 MIDDLE EAST & AFRICA: ACRYLATE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 193 MIDDLE EAST & AFRICA: ACRYLATE MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 194 MIDDLE EAST & AFRICA: ACRYLATE MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 195 MIDDLE EAST & AFRICA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 196 MIDDLE EAST & AFRICA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 197 MIDDLE EAST & AFRICA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 198 MIDDLE EAST & AFRICA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 199 SAUDI ARABIA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 200 SAUDI ARABIA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 201 SAUDI ARABIA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 202 SAUDI ARABIA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 203 UAE: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 204 UAE: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 205 UAE: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 206 UAE: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 207 REST OF MIDDLE EAST & AFRICA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 208 REST OF MIDDLE EAST & AFRICA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 209 REST OF MIDDLE EAST & AFRICA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 210 REST OF MIDDLE EAST & AFRICA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 211 ACRYLATE MARKET: DEGREE OF COMPETITION

- TABLE 212 ACRYLATE MARKET: REVENUE ANALYSIS

- TABLE 213 MARKET EVALUATION MATRIX

- TABLE 214 PRODUCT LAUNCHES, 2018–2023

- TABLE 215 DEALS, 2018–2023

- TABLE 216 OTHER DEVELOPMENTS, 2018–2023

- TABLE 217 ARKEMA S.A.: COMPANY OVERVIEW

- TABLE 218 ARKEMA S.A.: PRODUCTS OFFERED

- TABLE 219 ARKEMA S.A.: PRODUCT LAUNCHES

- TABLE 220 ARKEMA S.A.: DEALS

- TABLE 221 ARKEMA S.A.: OTHERS

- TABLE 222 BASF SE: COMPANY OVERVIEW

- TABLE 223 BASF SE: PRODUCTS OFFERED

- TABLE 224 BASF SE: DEALS

- TABLE 225 BASF SE: OTHERS

- TABLE 226 DOW INC.: COMPANY OVERVIEW

- TABLE 227 DOW INC.: PRODUCTS OFFERED

- TABLE 228 DOW INC.: PRODUCT LAUNCHES

- TABLE 229 DOW INC.: OTHERS

- TABLE 230 NIPPON SHOKUBAI CO., LTD.: COMPANY OVERVIEW

- TABLE 231 NIPPON SHOKUBAI CO., LTD.: PRODUCTS OFFERED

- TABLE 232 NIPPON SHOKUBAI CO., LTD.: DEALS

- TABLE 233 NIPPON SHOKUBAI CO., LTD.: OTHERS

- TABLE 234 EVONIK: COMPANY OVERVIEW

- TABLE 235 EVONIK: PRODUCTS OFFERED

- TABLE 236 EVONIK: DEALS

- TABLE 237 EVONIK: OTHERS

- TABLE 238 LG CHEM: COMPANY OVERVIEW

- TABLE 239 LG CHEM: PRODUCTS OFFERED

- TABLE 240 MITSUBISHI CHEMICAL GROUP CORPORATION: COMPANY OVERVIEW

- TABLE 241 MITSUBISHI CHEMICAL GROUP CORPORATION: PRODUCTS OFFERED

- TABLE 242 MITSUBISHI CHEMICAL GROUP CORPORATION: DEALS

- TABLE 243 SASOL: COMPANY OVERVIEW

- TABLE 244 SASOL: PRODUCTS OFFERED

- TABLE 245 SIBUR: COMPANY OVERVIEW

- TABLE 246 SIBUR: PRODUCTS OFFERED

- TABLE 247 WANHUA CHEMICAL GROUP CO. LTD.: COMPANY OVERVIEW

- TABLE 248 WANHUA CHEMICAL GROUP CO. LTD.: PRODUCTS OFFERED

- FIGURE 1 ACRYLATE MARKET SEGMENTATION

- FIGURE 2 ACRYLATE MARKET: RESEARCH DESIGN

- FIGURE 3 ACRYLATE MARKET: BOTTOM-UP APPROACH

- FIGURE 4 ACRYLATE MARKET: TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 6 DEMAND-SIDE FORECAST PROJECTIONS

- FIGURE 7 ACRYLATE MARKET: DATA TRIANGULATION

- FIGURE 8 BUTYL ACRYLATE SEGMENT TO DOMINATE DURING FORECAST PERIOD

- FIGURE 9 PAINTS & COATINGS AND PRINTING INKS TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 10 PACKAGING INDUSTRY TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 11 ASIA PACIFIC TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 12 HIGH MARKET GROWTH POTENTIAL IN ASIA PACIFIC

- FIGURE 13 BUILDING & CONSTRUCTION SEGMENT AND CHINA ACCOUNTED FOR LARGEST MARKET SIZE IN 2022

- FIGURE 14 BUTYL ACRYLATE TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 15 PAINTS & COATINGS AND PRINTING INKS TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 16 BUILDING & CONSTRUCTION TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 17 CHINA TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN ACRYLATE MARKET

- FIGURE 19 GRANTED PATENTS

- FIGURE 20 PUBLICATION TRENDS (LAST 10 YEARS)

- FIGURE 21 JURISDICTION ANALYSIS

- FIGURE 22 ACRYLATE MARKET: ECOSYSTEM

- FIGURE 23 ACRYLATE MARKET: VALUE CHAIN ANALYSIS

- FIGURE 24 ACRYLATE MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 25 SUPPLIER SELECTION CRITERIA

- FIGURE 26 AVERAGE SELLING PRICE, BY REGION (USD/KG)

- FIGURE 27 AVERAGE SELLING PRICE, BY KEY PLAYER (USD/KILOTON)

- FIGURE 28 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS IN ACRYLATE MARKET

- FIGURE 29 BUTYL ACRYLATE TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 30 PAINTS & COATINGS AND PRINTING INKS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 31 BUILDING & CONSTRUCTION INDUSTRY TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 32 CHINA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 33 ASIA PACIFIC: ACRYLATE MARKET SNAPSHOT

- FIGURE 34 EUROPE: ACRYLATE MARKET SNAPSHOT

- FIGURE 35 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 36 COMPANIES ADOPTED ACQUISITIONS AND EXPANSIONS AS KEY GROWTH STRATEGIES BETWEEN 2018 AND 2023

- FIGURE 37 RANKING OF TOP FIVE PLAYERS IN ACRYLATE MARKET, 2022

- FIGURE 38 ACRYLATE MARKET SHARE, BY COMPANY (2022)

- FIGURE 39 ACRYLATE MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 40 ACRYLATE MARKET: START-UP/SME MATRIX, 2022

- FIGURE 41 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN ACRYLATE MARKET

- FIGURE 42 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN ACRYLATE MARKET

- FIGURE 43 ARKEMA S.A.: COMPANY SNAPSHOT

- FIGURE 44 BASF SE: COMPANY SNAPSHOT

- FIGURE 45 DOW INC.: COMPANY SNAPSHOT

- FIGURE 46 NIPPON SHOKUBAI CO. LTD.: COMPANY SNAPSHOT

- FIGURE 47 EVONIK: COMPANY SNAPSHOT

- FIGURE 48 LG CHEM: COMPANY SNAPSHOT

- FIGURE 49 MITSUBISHI CHEMICAL GROUP CORPORATION: COMPANY SNAPSHOT

- FIGURE 50 SASOL: COMPANY SNAPSHOT

- FIGURE 51 WANHUA CHEMICAL GROUP CO. LTD.: COMPANY SNAPSHOT

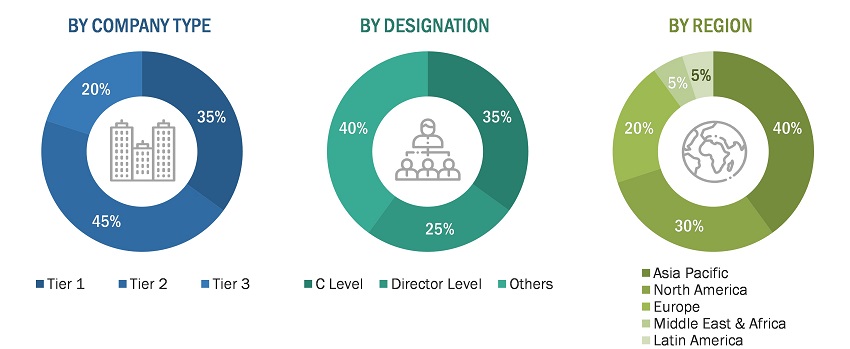

The study involved four major activities in estimating the market size of the acrylate market. Exhaustive secondary research was done to collect information on the market, the peer market, and the grandparent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, articles from recognized authors, gold standard and silver standard websites, and databases. Secondary research has been used to obtain key information about the value chain of the industry, monetary chain of the market, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The acrylate market comprises several stakeholders in the value chain, which include raw material suppliers, manufacturers, and end users. Various primary sources from the supply and demand sides of the acrylate market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in end-use sectors. The primary sources from the supply side include manufacturers, associations, and institutions involved in the acrylate industry. Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, raw material, application type, end-use industries, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of acrylate and outlook of their business, which will affect the overall market.

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2022 available in the public domain, product portfolios, and geographical presence. Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the size of the acrylate market.

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of the key market players, along with extensive interviews for opinions with leaders such as directors and marketing executives.

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Market Definition

Acrylates are the salts, esters, and conjugate bases of acrylic acid. The major types of acrylate monomers include butyl acrylate, ethyl acrylate, methyl acrylate, and 2-ethyl hexyl acrylate. These are moderately soluble in water and are completely soluble in alcohols, ethers, and other organic solvents. Acrylates are used in paints & coatings, adhesives, fabrics, and other applications as they improve the resistance of polymers to light, heat, aging, acids, and bases; they also impart properties such as durability and hardness.

Key Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

Report Objectives

- To define, describe, and forecast the size of the acrylate market, in terms of value and volume.

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To estimate and forecast the market size based on chemistry, application, end-use industry, and region.

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, Middle East & Africa, and South America, along with their key countries

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders.

- To track and analyze recent developments such as expansions, new product launches, partnerships & agreements, and acquisitions in the market.

- To strategically profile key market players and comprehensively analyze their core competencies.

Available Customizations:

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis:

- Further breakdown of a region with respect to a particular country or additional application

Company Information:

- Detailed analysis and profiles of additional market players

Tariff & Regulations:

- Regulations and Impact on PTFE market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Acrylate Market