Elastomers Market by Type (Thermoset (Natural Rubber, Synthetic Rubber (SBR, IIR, PBR, NBR, ACM, EPM)), and Thermoplastic (PEBA, SBC, TPO, TPU, TPV)), Application (Automotive, Consumer Goods, Medical, and Industrial) - Global Forecast to 2021

To get the latest information, inquire now!

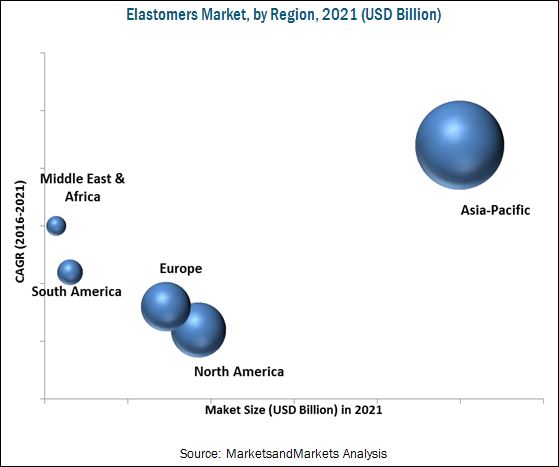

[141 Pages Report] The global market size of elastomers is estimated to reach USD 92.36 billion by 2021, at a CAGR of 4.6% from 2016 to 2021, in terms of value. The base year considered for the study is 2015, while the forecast period is between 2016 and 2021. The elastomers market is driven by the increasing demand from the automotive industry and advancement in the Thermoplastic Elastomer (TPE) processing.

Market Dynamics

Drivers

- Growing demand from the automotive industry

- Advancement in the thermoplastic elastomer (TPE) processing industry

Restraints

- High cost involved in processing of HTE

Opportunities

- Development of bio-based elastomers

Challenges

- Price volatility

- Intra-elastomer segment replacement

Growing demand from the automotive industry

Elastomer is extensively used in the automotive industry due to its properties such as resistance to oil, grease, and ozone; impact strength; and good resilience. It is mainly used in interior designing of vehicles. TPU is the most majorly used elastomer in the automotive industry. After the economic slowdown from 2009 to 2012, the automotive industry is recuperating and growing at a good pace. Demand for elastomers is high in the automotive industry as it can be used as a substitute for rubber and PVC without compromising on any performance parameter. The use of thermoplastic polyurethane elastomer can result in better UV resistance, good mechanical performance, and reduced thickness with finish of a softer touch. Another major advantage of elastomer is that it can be manufactured in any color to match the vehicles color; it also provides better low temperature performance and high abrasion resistance. Owing to the abovementioned properties, elastomer is used for manufacturing gear knobs, cup holders and interior door handles, cover strips, chassis spring seating, and bushings.

Objectives of the study:

- To define, describe, and forecast the elastomers market on the basis of type, application, and region

- To provide analysis of the elastomers market by region, namely, North America, Europe, Asia-Pacific, Middle East & Africa, and South America

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, future prospects, and contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their market shares and core competencies2

Note 1: Micromarkets are the subsegments of the elastomers market included in the report.

Note 2: Core competencies of companies are determined in terms of key developments, SWOT analysis, and key strategies adopted by them to sustain in the market.

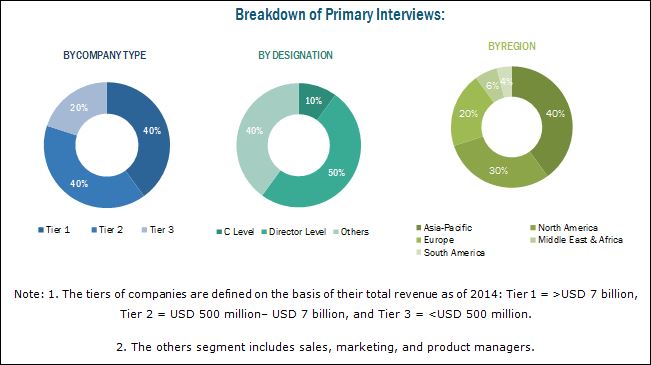

Both, top-down and bottom-up approaches have been used to estimate and validate the size of the global elastomers market and to estimate the size of various other dependent submarkets. The research study involved the use of extensive secondary sources, directories, and databases such as Hoovers, Bloomberg, Chemical Weekly, Factiva, Commonwealth Scientific and Industrial Research Organization (CSIRO), Securities And Exchange Commission (SEC), American National Standards Institute (ANSI), Organization for Economic Co-operation and Development (OECD), and other government and private websites to identify and collect information useful for the technical, market-oriented, and commercial study of the elastomers market.

To know about the assumptions considered for the study, download the pdf brochure

Major manufacturers of elastomers, such BASF SE (Germany), The Dow Chemical Company (U.S.), JSR Corporation (Japan), E. I. du Pont de Nemours and Company (U.S.), and Lanxess AG (Germany) adopted strategies, such as joint ventures, expansions, and acquisitions to achieve growth in the market.

Major Market Developments

- In November 2016, BASF SE collaborated with Hewlett-Packard Enterprise Company (U.S.) for the development of three dimensional printing materials. This collaboration aims at escalating the necessities required to develop resources for large-scale production. BASF also started one dedicated business unit, BASF New Business Gmbh (BNB), at Germany.

- In April 2016, Lanxess entered into a joint venture with Saudi Aramco (Saudi Arabia) to form Arlanxeo for production of elastomer and synthetic rubber to increase its product portfolio. As a result of this joint venture, Lanxess Ag is a foremost supplier of synthetic rubber.

- In May 2015, Zeon Corporation launched a new product, Nipol LX561, for the production of thin disposable gloves. This will increase product portfolio of the company and will help it to meet the growing demand for thin gloves worldwide due to the improved consumer awareness about hygienic management.

- In October 2015, Kuraray Co., Ltd. developed a new product, Photocurable elastomer, which has properties such as superior elasticity and curability. This product launch will help company to improve its product portfolio, especially coatings, molding materials, and adhesives.

Key Target Audience:

- Manufacturers of Elastomers

- Traders, Distributors, and Suppliers of Elastomers

- Regional Manufacturers’ Associations

- Government and Regional Agencies and Research Organizations

“This Study answers several questions for the stakeholders, primarily which market segments to focus in the next two to five years for prioritizing the efforts and investments”.

Scope of the report:

This research report categorizes the elastomers market on the basis of type, application, and region.

On the basis of type:

- SBR (Styrene block copolymers)

- IIR (Butyl Elastomer)

- NBR (Nitrile Elastomer)

- ACM (Acrylic Elastomer)

- EPM (Ethylene-propylene Elastomer)

- PEBA (Thermoplastic polyether block amides)

- SBC (Styrene block copolymers)

- TPO (Thermoplastic Polyolefin)

- TPU (Thermoplastic Polyurethanes)

- TPV (Thermoplastic Vulcanizates)

On the basis of application:

- Automotive

- Consumer Goods

- Medical

- Industrial

- Others

On the basis of region:

- North America

- Europe

- Asia-Pacific

- Middle East & Africa

- South America

- The market has been further analyzed for the key countries in each of these regions

Critical questions which the report answers:

- What are the upcoming trends for elastomers in emerging nations?

- Which are the key players in the market and how intense is the competition?

Available Customizations:

Along the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis:

- Country-level analysis of the elastomers market, based on application

Company Information:

- Detailed analysis and profiling of additional market players

The global elastomers market is estimated to reach USD 92.36 billion by 2021 at a CAGR of 4.6% from 2016 to 2021. The elastomers market has witnessed significant growth in the recent years. Elastomers, due to their properties, such as high thermal stability, greater chemical resistance, high tensile strength, low shrinkage, and greater design flexibility, are used in a wide range of applications, including automotive, medical, consumer goods, industrial, and others.

The main types of elastomers are Thermoplastic Vulcanizates (TPV), silicone (Q), Thermoplastic Polyolefin (TPO), Natural Rubber (NR), Ethylene Propylene Elastomer (EPM), Butyl Elastomer (IIR), and Styrene Butadiene Rubber (SBR). The NR segment is estimated to lead the elastomers market in 2016, due to the suitability of natural rubber in several applications. The TPV segment is estimated to witness the highest growth during the forecast period, due to the increasing adoption of thermoplastic vulcanizates in various applications segments.

Elastomers are used in applications, including automotive, medical, consumer goods, industrial, and others. These are the main applications considered in the report. The automotive application segment is estimated to lead the elastomers market, while the medical segment is projected to witness highest growth during the forecast period, owing to the rising demand for elastomers from these applications.

North America, Europe, Asia-Pacific, Middle East & Africa, and South America are considered the key market for elastomers in the report. Asia-Pacific is estimated to dominate the elastomers market, owing to the rising demand for elastomers, driven by its increased use in the automotive and medical industries. North America is the second-largest consumer of elastomers, globally. The market in this region is mainly driven by the growth in the automotive industry. The elastomers market is expected to witness significant growth in the coming years. However, factors such as high price of raw materials and rising cost of production may hinder the growth of the market.

Elastomer is extensively used in the automotive industry due to its properties such as resistance to oil, grease, and ozone; impact strength; and good resilience which is in turn driving the market.

Automotive

The demand of elastomers in the automotive industry is primarily driven by its excellent physical properties, such as whetherability, impact resistance, minimum weight, elasticity, softness, flexibility, superior optics, increased heat resistance, thermal stability, adhesive properties, and improved vehicle safety. Therefore, elastomer is used in wide range of applications in the automotive industry including wipers, door handles, rear windows, automotive gaskets, vibration damping pads, rocker panels, bumpers, gear knobs, dashboards, seating fabrics, interiors, body seals, and exterior filler panels. As a lightweight material, elastomer reduces vehicle weight, which in turn leads to the fuel efficiency of vehicle. There is an increasing demand of elastomer in the automotive industry to replace traditional metal.

Medical

The demand for elastomer in medical industry is increasing mainly due to its variable and unique properties, such as fungus resistance, low-temperature flexibility, tensile strength, acid/base resistance, fluid resistance, excellent hydrolytic stability, easy sterilization, and excellent translucency. Owing to these properties, elastomer is used in wide range of applications in the medical industry, such as drug patches, gas supply, drug delivery, medical bags, wound dressing, chest drainage, peristaltic pump catheters, surgical instruments, valves, needleless syringes, ventilation bags, stoppers, vial caps, and bottles. Elastomers are preferred for their recycling ability and cost effectiveness over conventionally used materials in the market such as silicone, latex, and PVC. Use of elastomers in the medical industry is high in the developed countries of North America and Western Europe. This demand is expected to rise in the developing nations of Asia-Pacific in the near future.

Consumer Goods

Elastomer demand in consumer goods market is primarily driven by its excellent physical properties, such as low weight, high flexibility, good printability, enormously robust, excellent temperature resistance, high impact strength, high surface quality, easy processing, and boundless design freedom. Therefore, elastomer is used in range of applications in consumer goods, which includes closures, food containers, toys, kitchenware, handles, cosmetic packaging, lids, sporting goods, furniture, household goods, and home electronics appliances such as refrigerators, clothes washers, dishwashers, and dryers. There is a growth in demand of elastomer in response to increasing use of consumer goods.

Critical questions the report answers:

- What are the upcoming hot bets for elastomers market?

- How market dynamics is changing for different types in different end-uses?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

BASF SE (Germany), The Dow Chemical Company (U.S.), JSR Corporation (Japan), E. I. du Pont de Nemours and Company (U.S.), and Lanxess AG (Germany) are the key companies operational in the elastomers market. Entering into related industries and targeting new markets will enable the elastomer manufacturers to overcome the effects of volatile economy, leading to diversified business portfolio and increase in revenue. Other major manufacturers of elastomers are Zeon Corporation (Japan), Kuraray Co., Ltd. (Japan), Covestro AG (Germany), Nizhnekamskneftekhim PJSC (Russia), and Teknor Apex Company (U.S.).

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Key Data From Secondary Sources

2.1.2 Key Data From Primary Sources

2.2 Market Size Estimation

2.3 Data Triangulation

2.4 Research Assumptions and Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 29)

4.1 Significant Opportunities in the Elastomers Market

4.2 Elastomers Market, By Application, 2014–2021

4.3 Elastomers Market Share, By Region

4.4 Elastomers Market, By Type, 2014–2021

4.5 Elastomers Market Share, By End-Use Industry and By Region

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Demand From the Automotive Industry

5.2.1.2 Advancement in the Thermoplastic Elastomer (TPE) Processing Industry

5.2.2 Restraints

5.2.2.1 High Cost Involved in Processing of Hte

5.2.3 Opportunities

5.2.3.1 Development of Bio-Based Elastomers

5.2.3.2 Evolution of Emerging Applications

5.2.4 Challenges

5.2.4.1 Price Volatility

5.2.4.2 Intra-Elastomer Segment Replacement

6 Industry Trends (Page No. - 41)

6.1 Introduction

6.2 Value Chain Analysis

6.2.1 Producers

6.2.2 Suppliers & Distributors

6.2.3 End-Use Industry

6.3 Porter’s Five Forces Analysis

6.3.1 Threat of New Entrants

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Buyers

6.3.4 Bargaining Power of Suppliers

6.3.5 Intensity of Competitive Rivalry

7 Elastomers Market, By Type (Page No. - 47)

7.1 Introduction

7.2 Thermoset Elastomer

7.2.1 Natural Rubber

7.2.2 Synthetic Rubber

7.2.2.1 Styrene-Butadiene Elastomer

7.2.2.2 Butyl Elastomer

7.2.2.3 Butadiene (Polybutadiene) Elastomer

7.2.2.4 Nitrile Elastomer

7.2.2.5 Acrylic Elastomer

7.2.2.6 Ethylene-Propylene Elastomer

7.2.2.7 Silicone (Q) Elastomers

7.2.2.8 Fluoroelastomers

7.2.2.8.1 Fluorocarbon (FKM) Elastomer

7.2.2.8.2 Fluorsilicone (FQ) Elastomer

7.2.2.8.3 Perfluorocarbon (FFKM) Elastomer

7.3 Thermoplastic Elastomer

7.3.1 Styrene Block Copolymer

7.3.2 Thermoplastic Polyurethane

7.3.3 Thermoplastic Polyolefins

7.3.4 Thermoplastic Vulcanizates

7.3.5 Thermoplasticpolyester Elastomers

7.3.6 Polyether Block Amide

8 Elastomer Market, By End-Use Industry (Page No. - 56)

8.1 Introduction

8.2 Automotive

8.2.1 Tire

8.2.2 Other Automotives

8.3 Medical

8.4 Consumer Goods

8.4.1 Footwear

8.5 Industrial

8.5.1 Wire & Cable

8.6 Others

8.6.1 Building & Construction

8.6.2 Photovoltaics

8.6.3 Mining, Oil & Gas

9 Elastomers Market, By Region (Page No. - 62)

9.1 Introduction

9.2 Asia-Pacific

9.2.1 China

9.2.2 India

9.2.3 Japan

9.2.4 South Korea

9.2.5 Thailand

9.2.6 Rest of Asia-Pacific

9.3 Europe

9.3.1 Germany

9.3.2 France

9.3.3 Italy

9.3.4 U.K.

9.3.5 Spain

9.3.6 Rest of Europe

9.4 North America

9.4.1 U.S.

9.4.2 Canada

9.4.3 Mexico

9.5 South America

9.5.1 Brazil

9.5.2 Rest of South America

9.6 Middle East & Africa

9.6.1 Saudi Arabia

9.6.2 South Africa

9.6.3 Rest of Middle East & Africa

10 Competitive Landscape (Page No. - 97)

10.1 Overview

10.1.1 New Product Launches

10.1.2 Expansions

10.1.3 Collaborations & Joint Ventures

10.1.4 Mergers & Acqusitions

10.1.5 Agreements

10.2 Global Market Share Analysis: Elastomers

11 Company Profiles (Page No. - 104)

(Overview, Financial*, Products & Services, Strategy, and Developments)

11.1 BASF SE

11.2 The DOW Chemical Company

11.3 JSR Corporation

11.4 E. I. Du Pont De Nemours and Company

11.5 Lanxess AG

11.6 Zeon Corporation

11.7 Kuraray Co., Ltd.

11.8 Covestro AG

11.9 Nizhnekamskneftekhim PJSC

11.10 Teknor Apex

*Details Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 130)

12.1 Insights From Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets Subscription Portal

12.4 Introducing RT: Real Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

12.7 Author Details

List of Tables (74 Tables)

Table 1 Elastomers Market Size, By Region, 2015–2021 (USD Billion)

Table 2 Market Segmentation Elastomers Market, By Type

Table 3 Elastomers Market, By End-Use Industry

Table 4 Elastomers Market Size, By Type, 2014-2026 (Kiloton)

Table 5 Elastomers Market Size, By Type, 2014-2021 (USD Million)

Table 6 Elastomer Market Size, By End-Use Industry, 2014–2021 (Kiloton)

Table 7 Elastomer Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 8 Elastomers Market Size, By Region, 2014–2021 (Kiloton)

Table 9 Elastomers Market Size, By Region, 2014–2021 (USD Billion)

Table 10 Asia-Pacific: Elastomers Market Size, By Country, 2014–2021 (Kiloton)

Table 11 Asia-Pacific: Elastomers Market Size, By Country, 2014–2021 (USD Million)

Table 12 Asia-Pacific: Elastomers Market Size, By End-Use Industry, 2014–2021 (Kiloton)

Table 13 Asia-Pacific: Elastomers Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 14 China: Elastomers Market Size, By End-Use Industry, 2014–2021 (Kiloton)

Table 15 China: Elastomers Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 16 India: Elastomers Market Size, By End-Use Industry, 2014–2021 (Kiloton)

Table 17 India: Elastomers Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 18 Japan: Elastomers Market Size, By End-Use Industry, 2014–2021 (Kiloton)

Table 19 Japan: Elastomers Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 20 South Korea: Elastomers Market Size, By End-Use Industry, 2014–2021 (Kiloton)

Table 21 South Korea: Elastomers Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 22 Thailand: Elastomers Market Size, By End-Use Industry, 2014–2021 (Kiloton)

Table 23 Thailand: Elastomers Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 24 Rest of Asia-Pacific: Elastomers Market Size, By End-Use Industry, 2014–2021 (Kiloton)

Table 25 Rest of Asia-Pacific: Elastomers Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 26 Europe: Elastomers Market Size, By Country, 2014–2021 (Kiloton)

Table 27 Europe: Elastomers Market Size, By Country, 2014–2021 (USD Million)

Table 28 Europe: Elastomers Market Size, By End-Use Industry, 2014–2021 (Kiloton)

Table 29 Europe: Elastomers Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 30 Germany: Elastomers Market Size, By End-Use Industry, 2014–2021 (Kiloton)

Table 31 Germany: Elastomers Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 32 France: Elastomers Market Size, By End-Use Industry, 2014–2021 (Kiloton)

Table 33 France: Elastomers Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 34 Italy: Elastomers Market Size, By End-Use Industry, 2014–2021 (Kiloton)

Table 35 Italy: Elastomers Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 36 U.K.: Elastomers Market Size, By End-Use Industry, 2014–2021 (Kiloton)

Table 37 U.K.: Elastomers Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 38 Spain: Elastomers Market Size, By End-Use Industry, 2014–2021 (Kiloton)

Table 39 Spain: Elastomers Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 40 Rest of Europe: Elastomers Market Size, By End-Use Industry, 2014–2021 (Kiloton)

Table 41 Rest of Europe.: Elastomers Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 42 North America: Elastomers Market Size, By Country, 2014–2021 (Kiloton)

Table 43 North America: Elastomers Market Size, By Country, 2014–2021 (USD Million)

Table 44 North America: Elastomers Market Size, By End-Use Industry, 2014–2021 (Kiloton)

Table 45 North America: Elastomers Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 46 U.S.: Elastomers Market Size, By End-Use Industry, 2014–2021 (Kiloton)

Table 47 U.S.: Elastomers Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 48 Canada: Elastomers Market Size, By End-Use Industry, 2014–2021 (Kiloton)

Table 49 Canada: Elastomers Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 50 Mexico: Elastomers Market Size, By End-Use Industry, 2014–2021 (Kiloton)

Table 51 Mexico: Elastomers Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 52 South America: Elastomers Market Size, By Country, 2014–2021 (Kiloton)

Table 53 South America: Elastomers Market Size, By Country, 2014–2021 (USD Million)

Table 54 South America: Elastomers Market Size, By End-Use Industry, 2014–2021 (Kiloton)

Table 55 South America: Elastomers Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 56 Brazil: Elastomers Market Size, By End-Use Industry, 2014–2021 (Kiloton)

Table 57 Brazil: Elastomers Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 58 Rest of South America: Elastomers Market Size, By End-Use Industry, 2014–2021 (Kiloton)

Table 59 Rest of South America: Elastomers Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 60 Middle East & Africa: Elastomers Market Size, By Country, 2014–2021 (Kiloton)

Table 61 Middle East & Africa: Elastomers Market Size, By Country, 2014–2021 (USD Million)

Table 62 Middle East & Africa: Elastomers Market Size, By End-Use Industry, 2014–2021 (Kiloton)

Table 63 Middle East & Africa: Elastomers Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 64 Saudi Arabia: Elastomers Market Size, By End-Use Industry, 2014–2021 (Kiloton)

Table 65 Saudi Arabia: Elastomers Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 66 South Africa: Elastomers Market Size, By End-Use Industry, 2014–2021 (Kiloton)

Table 67 South Africa: Elastomers Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 68 Rest of Middle East & Africa: Elastomers Market Size, By End-Use Industry, 2014–2021 (Kiloton)

Table 69 Rest of Middle East & Africa: Elastomers Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 70 New Product Launches (2012-2016)

Table 71 Expansions (2012-2016)

Table 72 Collaborations & Joint Ventures (2012-2016)

Table 73 Mergers & Acquisitions (2012-2016)

Table 74 Agreements (2012-2016)

List of Figures (43 Figures)

Figure 1 Elastomers: Market Segmentation

Figure 2 Elastomers Market: Research Design

Figure 3 Key Industry Insights

Figure 4 Breakdown of Primary Interviews

Figure 5 Bottom-Up Approach

Figure 6 Top-Down Approach

Figure 7 Elastomers: Data Triangulation

Figure 8 Natural Rubber Will Continue to Dominate the Elastomers Market Till 2021

Figure 9 Automotive Industry Will Continue to Drive the Elastomers Market Till 2021

Figure 10 Asia-Pacific to Be the Fastest-Growing Elastomers Market Between 2016 and 2021

Figure 11 Attractive Opportunities in the Elastomers Market, 2016 vs 2021 (USD Million)

Figure 12 The Elastomers Market in Automotive Accounted for the Largest Share, 2014–2021

Figure 13 Asia-Pacific Accounted for the Largest Share of the Global Elastomers Market in 2015

Figure 14 Natural Rubbers to Dominate the Elastomers Market

Figure 15 Automotive Was the Largest End-Use Industry of Elastomers, 2015

Figure 16 Elastomers Market, By Region

Figure 17 Drivers, Restraints, Opportunities, and Challenges in the Elastomers Market

Figure 18 Elastomers: Value Chain Analysis

Figure 19 Porter’s Five Forces Analysis: Elastomers Market

Figure 20 Natural Rubber to Dominate the Elastomers Market During the Forecast Period

Figure 21 Medical to Be the Fastest Growing End-Use Industry During the Forecast Period

Figure 22 India, China, and Thailand to Emerge as the New Hotspots in Global Elastomers Market, 2016–2021

Figure 23 Regional Snapshot (2015): Asia-Pacific Was the Largest Market for Elastomers

Figure 24 China to Remain the Leading Player in the Elastomers Market in Asia-Pacific, 2016–2021

Figure 25 The U.S. Was the Key Elastomers Market in North America, 2015

Figure 26 The U.S. to Remain the Leading Player in the Elastomers Market in North America, 2016–2021

Figure 27 Companies Adopted New Product Launches as the Key Growth Strategy, 2012-2016

Figure 28 Top Companies Adopted New Product Launches as the Key Growth Strategy Between 2012 and 2016

Figure 29 Lanxess AG Dominated the Global Elastomers Market, 2015

Figure 30 BASF SE: Company Snapshot

Figure 31 BASF SE: SWOT Analysis

Figure 32 The DOW Chemical Company: Company Snapshot

Figure 33 The DOW Chemical Company: SWOT Analysis

Figure 34 JSR Corporation: Company Snapshot

Figure 35 JSR Corporation: SWOT Analysis

Figure 36 E. I. Du Pont De Nemours and Company: Company Snapshot

Figure 37 E. I. Du Pont De Nemours and Company: SWOT Analysis

Figure 38 Lanxess AG: Company Snapshot

Figure 39 Lanxess AG: SWOT Analysis

Figure 40 Zeon Corporation: Company Snapshot

Figure 41 Kuraray Co., Ltd.: Company Snapshot

Figure 42 Covestro AG: Company Snapshot

Figure 43 Nizhnekamskneftekhim PJSC: Company Snapshot

Growth opportunities and latent adjacency in Elastomers Market