Smart Airports Market by Airport Technology (Airport 2.0, Airport 3.0 and Airport 4.0), Application (Landside, Terminal Side, and Airside), Airport Size (Small, Medium, and Large), System, End Market, Operation and Region - Global Forecast to 2027

Update: 07/11/2025

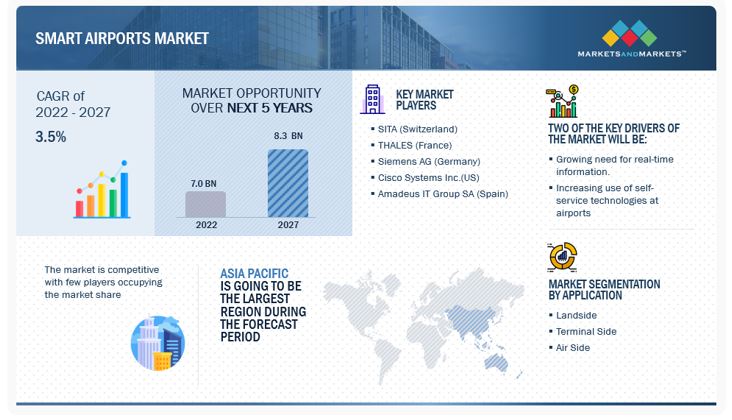

The Global Smart Airports Market Size was valued at USD 7.0 Billion in 2022 and is estimated to reach USD 8.3 Billion by 2027, growing at a CAGR of 3.5% during the forecast period.

Smart Airports Market Key Takeaways

-

By Market Size & Growth, the smart airports market is projected to reach USD 8.3 billion by 2027, growing from USD 7.0 billion in 2022 at a CAGR of 3.5% during the forecast period.

-

By increasing digitalization, airports are rapidly adopting technologies such as IoT, AI, big data analytics, biometrics, and cybersecurity to enhance operational efficiency and passenger experience.

-

By leveraging cloud-based platforms and advanced analytics, airports can optimize operations and create new revenue streams, offering significant market opportunities.

-

By facing high costs, the market growth is restrained due to substantial capital investments and maintenance expenses associated with smart technologies.

-

By region, North America dominates the market owing to its advanced infrastructure, strong technology adoption, and a focus on efficient airport management.

-

By region, Asia Pacific is expected to be the fastest-growing market due to rising air traffic, infrastructure expansion, and government-led modernization initiatives.

-

By region, the Middle East & Africa are investing in airport automation to handle increased passenger volumes and improve service delivery.

-

By region, Europe and Latin America are steadily progressing, with Europe focused on seamless, contactless travel and Latin America boosting digital adoption to support tourism and international connectivity.

Market Size & Forecast Report

-

2022 Market Size: USD 7.0 Billion

-

2027 Projected Market Size: USD 8.3 Billion

-

CAGR (2022-2027): 3.5%

-

Asia Pacific: Record Highest CAGR

The increased usage of self-service technology, as well as the growing need for real-time information, are projected to fuel the expansion of the Smart Airports Industry. Furthermore, the use of the Internet of Things (IoT) at airports and manufacturing procedures is a significant breakthrough in the smart airports business. Companies all around the world are starting to employ cloud-based platforms to increase the operational efficiency. The cloud platform simplifies design by connecting suppliers, systems integrators, software developers, and other design and production ecosystem participants together on a virtual platform.

Smart airports Market Forecast to 2027

To know about the assumptions considered for the study, Request for Free Sample Report

Smart Airports Market Dynamics

Driver: Growing need for real-time information

There is an increasing need for passengers for real-time information to enable their travel experience convenient and comfortable. Smart airports are expected to be equipped with infrastructure that entails providing real-time information to passengers. They would require the establishment of customer touchpoints so that real-time updates about the progress of the journey of a customer can be easily obtained. These touchpoints can also be used to allow the rapid sharing of information within the entire value chain at an airports, thus allowing every entity of the system to work more effectively and efficiently.

According to SITA Air Transport IT Insights 2022, the use of mobile devices for booking, onboarding the airplane, and for bag collection have increased in Q1 2022 as compared to Q1 2020, while automated gates used for identity control, boarding, border control, and bag collection have all seen increase in technology adoption of 3% to 5% since 2020. Real-time information not only improves passenger experience but also process optimization. For instance, crew and staff can be tracked in real-time through their wearable devices. The tracking of passenger flow in real-time can help in queue management. Real-time data of environmental parameters, such as humidity, temperature, and pressure, can also be used by air traffic control to manage and plan traffic to and from the airport.

Restraint: Lack of standardized regulations for blockchain technology

Aviation is one of the highly regulated industries mainly due to the risks associated with its operations. A multitude of bilateral, national, and international regulations and standards bind the actions of aviation stakeholders, such as system manufacturers, service providers, and airports. For the integration of any new technology in aviation, a regulatory framework is a necessity. Aviation blockchain is yet to receive such frameworks or common standards to guide the integration and commercialization of the technology across various stakeholders. The issue will be to either come up with an entirely new framework that runs in line with the current framework or integrate blockchain into the existing set of regulations. Setting a regulatory framework takes years in the aviation industry. Thus, if a common standard or a regulatory framework is not set, it will directly restrain the commercial integration of blockchain globally. Along with this, the lack of common standards around the use of tokens in aviation for the tokenization of tickets and loyalty points could also lead to uncertainties around the commercial integration of blockchain.

Opportunity: Airport operation optimization through digitization

With digital technologies becoming more prevalent, airports are increasingly looking to external experts to help them with digital transformation. They are partnering with external managed service providers to both upgrade existing processes and install new smart systems. With flight delay causing airlines to incur heavy losses, a more efficient airport operation can result in fewer delays. Staff at airports can be better managed with the help of IoT by using tags and IoT wearables. The movement of ground staff can be tracked, and tasks assigned based on their location. Smart solutions are also used to better manage airport assets, such as luggage trolleys, aircraft, and ground staff. Tags are installed on the assets to track their real-time location, which can be further analyzed to optimize the process to be more efficient. This will reduce delays and cut down operational losses.

Terminal building operations, such as cleaning, heating & ventilating, and energy management, can be done through real-time parameter tracking through smart solutions. Smart solutions incorporated at the landside help ease parking processes and improve the travel experience for passengers. These solutions save time, reduce the manpower load, and provide efficient output resulting in optimized airport operations.

Challenge: Proper comprehension of passenger preferences

The concept of smart airports aims at improving efficiency, reducing operational costs, and providing ease to passengers. With increased competition, passenger satisfaction has become the main focus for airlines and airports. Emphasis is given on delivering personalized services to travelers at airports. To provide an enhanced experience to passengers, having information as to what they buy, why they buy it, and how they can be encouraged to buy more at airports is critical. A smart blend of leisure, dining, and retail offers to encourage passengers to spend more time at the airport before departure is an integral part of the smart airport concept. However, the biggest challenge is understanding the needs and preferences of passengers and offering personalized services in the absence of collaborated data.

In most cases, airlines have scattered data collected from different data points. For instance, the ticketing data is usually owned by travel agencies, agents, or airlines, and the marketing data is usually owned by retail or other information partners. In some cases, to use disparate data, airlines create multiple versions of passenger databases. However, they fail to use insights from various databases in a cohesive manner. In such cases, the challenge for airports and airlines is to provide an end-to-end smooth experience to passengers by collaborating the large databases of passenger preferences in a united format.

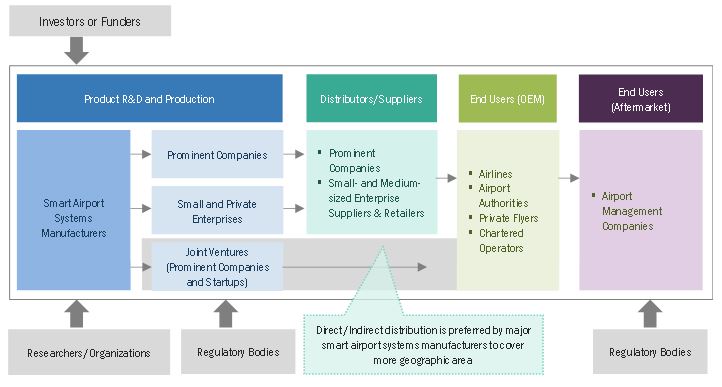

Smart Airports Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of aircraft hydraulic systems. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies include SITA (Switzerland), THALES (France), Siemens AG (Germany), Amadeus IT Group SA (Spain), IBM Corporation (US), Cisco Systems Inc. (US), Indra Sistemas S.A. (Spain), Honeywell International Inc. (US), L3Harris Technologies Inc (US). Airports, airlines, chartered operators, and airport management companies are some of the leading consumers of smart airport technologies.

Upgrades & Service segment to dominate market share during the forecast period

Based on end market, the smart airports market has been segmented into implementation and upgrades & services. Airports are adopting digital transformation in order to distinguish their passenger experiences. Existing systems and solutions are being upgraded with sophisticated technology and solutions to improve the passenger experience and operational efficiency. The market is being driven by the demand for better maintenance and services to ensure their continuing operation.

Endpoint Devices to lead the market for Smart Airports during the forecast period

Based on System, the Smart Airports market has been segmented into Communication & connectivity, endpoint devices, data storage, software & solution. Airports employ reliable endpoint devices like as biometrics, RFID, beacons, and so on to speed up the screening process. The use of end point devices has improved airport operations and the customer experience. Furthermore, advancements in endpoint devices have improved security standards and optimized the screening process at airports. Thus, driving the market for the segment.

Airside segment to witness higher demand during the forecast period

Based on Application, the Smart Airports market has been classified into landside, Terminal side, Airside. Rapid growth in worldwide passenger traffic is predicted to boost demand for the smart solution on the airside. Smart operations at the airside are primarily utilized to better manage ground employees and reduce aircraft turnaround time. As a result, the need for smart solutions for airside operations, such as sophisticated aircraft parking solutions, advanced maintenance, and health monitoring systems, has been expanding in recent years, thus driving the market.

Medium to acquire the largest market share during the forecast period

Based on Airport Size, the Smart Airports market has been classified into small, medium, and large. Medium airports mostly cater to the domestic passenger traffic and airlines. The increased in the domestic air passenger footprint has encouraged the demand for the smart solutions at the airports. The solution will enhance the passenger experience and airport operations.

Airport 3.0 to acquire the largest market share during the forecast period

Based on Airport Technology, the Smart Airports market has been classified into airport 2.0, airport 3.0 and airport 4.0. The ongoing modernization of existing airports and various medium size airport are upgrading their airport solutions with smart technologies, to enhance the airport operations.

Non-Aeronautical segment to hold major market share during the forecast period

Based on operation, the Smart Airports market has been classified into aeronautical and non-aeronautical. The increase in the air passenger travel will drive the aviation industry, that will proportionally enhance the market for the aviation industry. Airports are focused on particular digital advertising, among other things (intelligent transport services, inventory management) to respond to consumer demands and fuel the growth of the non-aeronautical segment.

Asia Pacific is projected to witness the highest market share during the forecast period

Asia Pacific leads the Smart Airports market. The key factor driving the increase in passenger traffic in the area include an increase in the region's middle-class population's disposable income, expansion in international tourism, and affordable airfares in rising countries like India. The growing number of passengers will increase the demand for automation of processes like as baggage handling and self-check-in services. This will help to the exceptional development of smart airports in the Asia-Pacific region, which will contribute to the overall growth of the market.

Smart airports Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Major players operating in the Smart Airports Companies include SITA (Switzerland), THALES (France), Siemens AG (Germany), Amadeus IT Group SA (Spain), IBM Corporation (US), Cisco Systems Inc. (US), Indra Sistemas S.A. (Spain), Honeywell International Inc. (US), L3Harris Technologies Inc (US).

Scope of the Report

|

Report Metric |

Details |

|

Growth Rate |

3.5% |

|

Estimated Market Size in 2022 |

USD 7.0 Billion |

|

Projected Market Size in 2027 |

USD 8.3 Billion |

|

Market size available for years |

2018-2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments Covered |

By End Market, By Application, By System, By Airport Size,By Airport Technology By Size, By Region |

|

Geographies Covered |

North America, Asia Pacific, Europe, and Rest of the World |

|

Companies Covered |

SITA (Switzerland), THALES (France), Siemens AG (Germany), Amadeus IT Group SA (Spain), IBM Corporation (US), Cisco Systems Inc. (US), Indra Sistemas S.A. (Spain), Honeywell International Inc. (US), L3Harris Technologies Inc (US), Raytheon Technologies Corporation (US) andamong others |

Smart airports Market Highlights

This research report categorizes the Smart Airports Market based on Component, Type, End User, Platform, Application and Region.

|

Aspect |

Details |

|

Smart Airports Market, By End Market |

|

|

Smart Airports Market, By Application |

|

|

Smart Airports Market, By System |

|

|

Smart Airports Market, By Airport Size |

|

|

Smart Airports Market, By Airport Technology |

|

|

Smart Airports Market, By Region |

|

Recent Developments

- In June 2022, Raytheon Technologies Corporation-Collins Aerospace announced the invention of AirPlan allows airports to manage all of its resources, including gates, check-in counters, and luggage belts, via a single application on any computer or mobile device connected to their network. AirPlan can give airport operations with tools that allow them to see the status of each resource in one location and with an easy-to-use user interface. Airports can swiftly and easily relocate personnel, deploy ground employees, and check passengers in for flights, improving operations and giving a better customer experience.

- In June 2022, Thales Group introduces HELIXVIEW, a new innovative, stationary, compact, and lightweight Cabin Baggage Explosive Detection System (EDS CB) that eliminates the need for passengers to remove things from bags. HELIXVIEW is a C3-compliant scanner (next EDS CB standard) that blends electronic scanning based on X-ray nanotechnology with 3D image reconstruction. It also leverages on Thales' expertise in Artificial Intelligence (AI) and Cybersecurity to develop an intelligent and cost-effective airport solution. HELIXVIEW improves airport security while also providing travelers with more convenient travel options.

- In November 2021, Honeywell International Inc. Honeywell unveiled the next generation of its Honeywell NAVITAS software suite platform today, a System of Systems (SoS) solution that will assist airport operators and aviation navigation service providers in making more informed and accurate choices throughout airside operations, from approach to gate. The most recent modifications allow for the automation and digitalization of air traffic services, which aid in effective ground movement, situational awareness, control and monitoring of airside and Air Traffic Management (ATM) equipment, information management, and integration.

- In March 2021, Thales Group unveiled a digital secondary surveillance radar with increased performance and reliability for safer air traffic management – up to 2,000 flight tracks and 64 simultaneous data outputs to air traffic centers.

Frequently Asked Questions (FAQs) Addressed by the Report

What are your views on the growth prospect of the Smart Airport market?

The smart airport market is being driven by modernization initiatives of the existing airports with advanced technology solution to enhance the passenger overall experience and operational efficiency.

What are the key sustainability strategies adopted by leading players operating in the Smart Airports market?

Key players have adopted various organic and inorganic strategies to strengthen their position in the Smart Airports market. The major players include SITA (Switzerland), THALES (France), Siemens AG (Germany), Amadeus IT Group SA (Spain), IBM Corporation (US), Cisco Systems Inc. (US), Indra Sistemas S.A. (Spain), Honeywell International Inc. (US), L3Harris Technologies Inc (US). These players have adopted various strategies, such as acquisitions, contracts, expansions, new product launches, and partnerships & agreements, to expand their presence in the market.

What are the new emerging technologies and use cases disrupting the Smart Airports market?

Some of the major emerging technologies and use cases disrupting the market include the implementation of AI, IoT, and other advanced technologies to provide a better customer experience.

Who are the key players and innovators in the ecosystem of the Smart Airport market?

The key players in the Smart Airports market include SITA (Switzerland), THALES (France), Siemens AG (Germany), Amadeus IT Group SA (Spain), IBM Corporation (US), Cisco Systems Inc. (US), Indra Sistemas S.A. (Spain), Honeywell International Inc. (US), L3Harris Technologies Inc (US).y.

Which region is expected to hold the highest market share in the Smart Airports market?

The Smart Airports market in North America is projected to hold the highest market share during the forecast period due to the presence of several large airports in the region.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

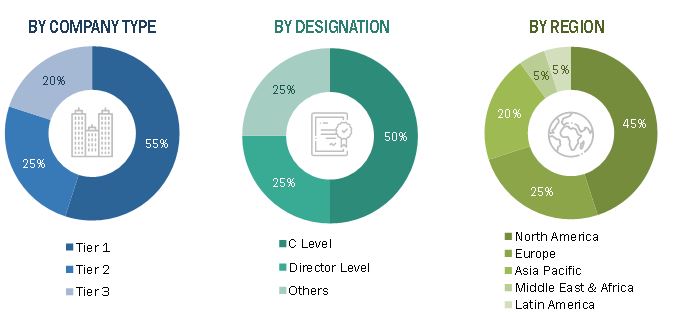

The study involved four major activities in estimating the current market size for the Smart Airports market. Exhaustive secondary research was conducted to collect information on the market, the peer markets, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg, BusinessWeek, and different magazines, were referred to identify and collect information for this study. Secondary sources also included annual reports, press releases & investor presentations of companies, certified publications, articles by recognized authors, and simulator databases.

Primary Research

The Smart Airports market comprises several stakeholders, such as raw material providers, Smart Airports manufacturers and suppliers, and regulatory organizations in the supply chain. While the demand side of this market is characterized by various end users, the supply side is characterized by technological advancements in actuator technologies. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Smart Airport market. These methods were also used extensively to estimate the size of various subsegments of the market. The research methodology used to estimate the market size includes the following:

- Key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Market size Estimation Methodology: Bottom-Up Approach

The bottom-up approach was employed to arrive at the overall size of the smart airports market from the demand for such systems and components by end users in each country, and the average cost of integration for both brownfield and greenfield. These calculations led to the estimation of the overall market size.

Market size Estimation Methodology: Top-Down Approach

In the top-down approach, the overall market size was used to estimate the size of the individual markets (mentioned in market segmentation) through percentage splits obtained from secondary and primary research.

The most appropriate and immediate parent market size was used to calculate the specific market segments to implement the top-down approach. The bottom-up approach was also implemented to validate the market segment revenues obtained.

A market share was then estimated for each company to verify the revenue share used earlier in the bottom-up approach. With data triangulation procedures and data validation through primaries, the overall parent market size and each market size were determined and confirmed in this study. The data triangulation procedure used for this study is explained in the market breakdown and triangulation section.

Data Triangulation

After arriving at the overall market size-using the market size estimation process explained above-the market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides of the smart airports market.

Transforming Air Travel: The Growing Market for Smart Airport Systems and Intelligent Airports

The aviation industry is rapidly evolving, with technological advancements leading to the development of smart airport systems that improve efficiency and passenger experience. These intelligent airports are equipped with a range of cutting-edge technologies, including airport kiosks, biometric systems, and smart baggage handling systems.

Smart airport systems offer several benefits, including faster check-in and boarding processes, streamlined baggage handling, and improved security. Airport kiosks, for example, allow passengers to check in and print boarding passes, reducing wait times and eliminating the need for manual check-in processes. Biometric systems, such as facial recognition and fingerprint scanning, enable faster and more secure identity verification, reducing the risk of fraud and enhancing security.

In addition to improving passenger experience, smart airport systems also offer benefits for airlines and airport operators. For example, smart baggage handling systems use sensors and tracking technologies to ensure that baggage is transported efficiently and accurately, reducing the risk of lost or delayed baggage. This can improve airline efficiency and reduce costs associated with baggage handling.

Growth opportunities:

The smart airports market is expected to experience significant growth in the coming years, with increasing passenger traffic, technological advancements, and demand for efficient and sustainable airport operations driving this growth. With smart airport systems offering a range of benefits for passengers, airlines, and airport operators, there are many opportunities for companies to innovate and invest in this rapidly evolving industry. Key areas for growth include airport kiosks, biometric systems, and smart baggage handling systems, as well as other technologies that enhance efficiency, security, and the overall passenger experience. By capitalizing on these growth opportunities, companies can position themselves as leaders in the smart airports market and contribute to the continued transformation of the aviation industry.

Report Objectives

- To identify and analyze key drivers, restraints, challenges, and opportunities influencing the growth of the Smart Airports market

- To analyze the impact of macro and micro indicators on the market

- To forecast the market size of segments for five regions, namely, North America, Europe, Asia Pacific, and Rest of the World, along with major countries in each of these regions

- To strategically analyze micro markets with respect to individual technological trends, prospects, and their contribution to the overall market

- To strategically profile key market players and comprehensively analyze their market ranking and core competencies

- To provide a detailed competitive landscape of the market, along with an analysis of business and corporate strategies, such as contracts, agreements, partnerships, and expansions.

- To identify detailed financial positions, key products, unique selling points, and key developments of leading companies in the market

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 4)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Smart Airports Market