Aviation Blockchain Market by End Market (Airports, Airlines, MRO, Manufacturers, Lessors), Application (Smart Contracts, Supply Chain Management, Aircraft Maintenance, Cargo & Baggage Tracking), Deployment, Function, Region - Global Forecast to 2025

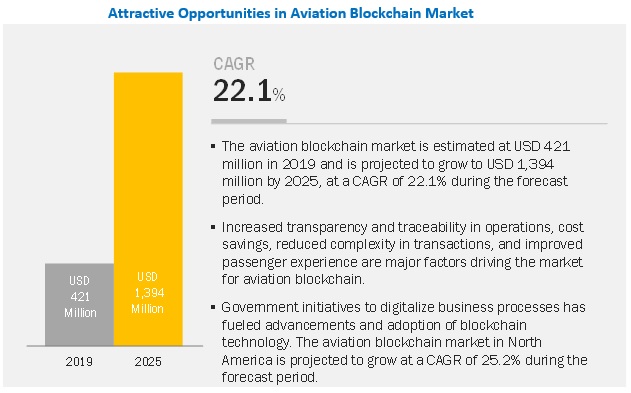

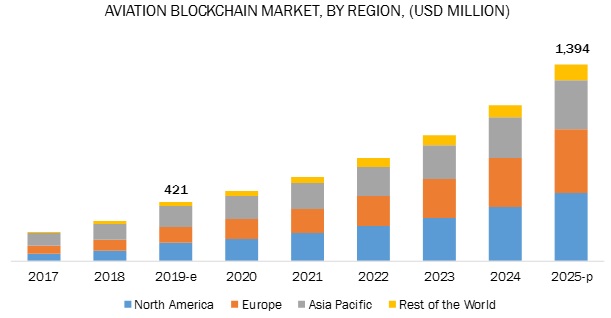

[166 Pages Report] The Aviation Blockchain Market is projected to grow from USD 421 million in 2019 to USD 1,394 million by 2025, at a CAGR of 22.1% during the forecast period. The increased transparency and traceability and improved passenger experience are some of the major factors driving the growth of the aviation blockchain market.

By end market, the airlines segment is estimated to lead the aviation blockchain market in 2019.

The airlines segment is estimated to lead the aviation blockchain market in 2019. Aircraft being stationed on the ground for a longer period is a major concern for the airline as they operate within a limited profit margin and thus, it can incur operational losses. The accurate view of an aircraft configuration and maintenance could help reduce costs and losses related to downtime and unplanned maintenance. Thus, these losses can be avoided by leveraging blockchain technology.

The Aviation Blockchain Market in North America is projected to grow at the highest CAGR during the forecast period.

The aviation blockchain market in North America is projected to grow at the highest CAGR during the forecast period. North America is the most advanced region in terms of technology adoption and infrastructure. Increasing the adoption of technology by airlines and airports in this region is one of the major factors impacting the growth rate of this region. The presence of key market players and major airports are the main factors driving the growth of the North American aviation blockchain market.

Key Market Players

Some of the major players in the aviation blockchain market include Microsoft Corporation (US), IBM (US), Zamna Technologies (UK), Aeron Labs (Belize), Winding Tree (Switzerland), Volantio Inc (US), Filament (US), Infosys (India), Insolar Technologies (Switzerland), LeewayHertz Technologies (US), and Moog Inc. (US). These players provide blockchain platforms and solutions to various aviation companies.

Scope of the Report: Aviation Blockchain Market

|

Report Metric |

Details |

|

Estimated Market Size |

USD 421 Million |

|

Projected Market Size |

USD 1394 Million |

|

CAGR |

22.1% |

|

Market size available for years |

2017–2025 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2025 |

|

Forecast units |

Value (USD) |

|

Segments covered |

End Market, Application, Function, Deployment, and Region |

|

Regions covered |

North America, Europe, Asia Pacific, and Rest of the World |

|

Companies covered |

Microsoft Corporation (US), IBM (US), Zamna Technologies (UK), Aeron Labs (Belize), Winding Tree (Switzerland), Volantio Inc (US), Filament (US), Infosys (India), Insolar Technologies (Switzerland), Leewayhertz Technologies (US), and Moog Inc. (US. |

This research report categorizes the aviation blockchain market based on end market, application, function, deployment, and region.

By End Market:

- Airports

- Airlines

- MRO

- Manufacturers

- Lessors

By Application:

- Passenger Identity Management

- Cargo & Baggage Tracking

- Flight & Crew Data Management

- Frequent Flyer Programs

- Smart Contract

- Travel Insurance

- E-ticketing & Ticket Tokenization

- Aircraft Refueling

- Airline Revenue Sharing

- Leasing

- Supply Chain Management

- Parts Tracking

- Parts Health Monitoring

- Inventory Management

- Aircraft Maintenance

By Deployment:

- Public

- Private

- Hybrid

By function:

- Record-keeping

- Transactions

By Region:

- North America

- Europe

- Asia Pacific

- Rest of the World

Recent Developments

- In November 2019, the German airline, Hahn Air, became the first carrier to issue a ticket enabled by blockchain technology provided by open-source travel distribution platform Winding Tree. Using the Winding Tree platform, Hahn Air can list inventory, manage reservation requests, and receive payments once the booking process is complete.

- In October 2019, Insolar announced that it is partnered with Microsoft, Oracle, and national innovation agencies of Switzerland, the UK, and Germany. The partnership with Microsoft and Oracle is for the integration of the Insolar platform with their respective cloud services, Azure, and Oracle Cloud. With this partnership, Insolar expanded its presence in the European region.

- In June 2019, 14bis Supply Tracking announced the availability of its digital and physical asset management product that provides provenance of aerospace parts from the factory to disposal. This product will help 14bis Supply Tracking address major challenges faced by manufacturers in the area of the supply chain.

- In May 2019, Microsoft partnered with GE Aviation’s Digital Group to develop TRUEngine, a Microsoft Azure-based blockchain technology, to track the life of each aircraft part, replacing the current paper documentation process which is cumbersome and inefficient.

- In May 2018, EdgeVerve, an Infosys Product subsidiary, announced a new blockchain-powered application for supply chain management as part of its product line. With this product launch, IBM strengthened its position in the growing market of blockchain-based supply chain management.

Key Questions Addressed by the Report

- What will be the revenue pockets for the blockchain technology in aviation in the next five years?

- Who are the leading players of blockchain in the global aviation market?

- What are the growth prospects for blockchain technology in the aviation market?

- What are the major challenges faced by players in the aviation blockchain market?

- What are the latest technological trends in the market?

Frequently Asked Questions (FAQ):

What will be the revenue pockets for the blockchain technology in aviation in the next five years?

Who are the leading players of blockchain in the global aviation market?

What are the growth prospects for blockchain technology in the aviation market?

What are the major challenges faced by players in the aviation blockchain market?

What are the latest technological trends in the market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 21)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Regional Scope

1.3.2 Years Considered for the Study

1.4 Currency

1.5 USD Exchange Rates, 2016–2018

1.6 Market Stakeholders

2 Research Methodology (Page No. - 25)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.1.3 Market Definition & Scope

2.1.4 Segment Definitions

2.1.4.1 Aviation Blockchain Market, By Application

2.1.4.2 Market, By End Market

2.1.4.3 Market, By Deployment

2.1.4.4 Market, By Function

2.1.4.5 Market, By Vertical

2.2 Research Approach and Methodology

2.2.1 Bottom-Up Approach

2.2.1.1 Aviation Blockchain Market

2.2.1.2 Market, By End Market

2.2.1.3 Market, By Application

2.2.1.4 Total Aviation Blockchain Market, By Country

2.2.2 Top-Down Approach

2.2.2.1 Market, By Function and Deployment

2.3 Data Triangulation & Validation

2.3.1 Triangulation Through Secondary

2.3.2 Triangulation Through Primaries

2.4 Research Limitations

2.5 Research Assumptions

2.6 Risks

3 Executive Summary (Page No. - 36)

4 Premium Insights (Page No. - 39)

4.1 Attractive Opportunities in Aviation Blockchain Market

4.2 Market, By Application

4.3 Market, By End Market

4.4 Market, By Country

5 Market Overview (Page No. - 41)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increased Transparency and Traceability

5.2.1.2 Multivariate Applications of Blockchain

5.2.1.3 Reduced Costs and Transactional Complexities

5.2.2 Restraints

5.2.2.1 Lack of Regulations and Common Standards

5.2.3 Opportunities

5.2.3.1 Integration of Blockchain With Other Upcoming Aviation Technologies

5.2.4 Challenges

5.2.4.1 Blockchain Technology in Its Nascent Stage

5.2.4.2 Slow Integration and Reluctance Toward Change in the Aviation Industry

6 Industry Trends (Page No. - 45)

6.1 Introduction

6.2 Technology Trends

6.2.1 Blockchain in Internet of Things (IoT)

6.2.1.1 Blockchain of Things

6.2.2 Blockchain in Artificial Intelligence (AI)

6.2.2.1 Autonomous Blockchain

6.3 Industry Activities and Projects

6.3.1 Blockchain Challenges and Research Projects

6.3.1.1 Aviation Blockchain Challenge

6.3.1.2 Aviation Blockchain Sandbox

6.4 Consortiums & Alliances

6.4.1 Collaborations to Promote the Adoption of Blockchain in Aviation

6.4.1.1 Enterprise Ethereum Alliance (EEA)

6.4.1.2 Hyperledger Consortium

6.5 Use Cases

6.5.1 Ge Aviation Formed Partnership With Microsoft Azure to Develop Blockchain Based Solution to Streamline Tracking of Aircraft Parts and Reduce Inefficiencies

6.5.2 Air France Klm Partnered With Winding Tree to Develop Blockchain-Based Solution to Offer Attractive Travel to Customers

6.5.3 Accenture in Collaboration With Thales Developed Blockchain Prototype Supply Chain Activities for Aerospace & Defense Industry

6.5.4 Sita Collaborated With British Airways and International Airports to Explore Smart Contracts in Aviation Industry

6.5.5 Singapore Airlines is Using Blockchain to Help Passengers Maximize Their Loyalty Points and Enhance Customer Experience

6.5.6 Volantio is Helping Airlines and Passengers Overcome Overbooking Challenge Using Blockchain Technology

6.5.7 Air New Zealand Partnered With Winding Tree to Leverage Blockchain to Streamline Operations

6.5.8 Russian Airline S7 is Using Blockchain-Based Platform to Sell Tickets

6.5.9 Moog is Using Blockchain-Based Solution for 3D Printing of Aircraft Parts

6.5.10 Fizzy is A Smart Contract for Travel Insurance

7 Aviation Blockchain Market, By End Market (Page No. - 50)

7.1 Introduction

7.2 Airlines

7.2.1 Airlines Can Incorporate Blockchain in Cargo & Baggage Tracking and Smart Contracts Applications

7.3 Mro

7.3.1 Blockchain in Mro is Used for Smart Contracts, Supply Chain Management, and Aircraft Maintenance

7.4 Airports

7.4.1 Airports are Adopting Blockchain in Smart Cargo & Baggage Tracking, Passenger Identity Management, and Smart Contracts

7.5 Manufacturers

7.5.1 Aircraft Manufacturers are Adopting Blockchain Technology to Increase Operational Efficiency

7.6 Lessors

7.6.1 Lessors Use Smart Contracts for Supply Chain Management Applications

8 Aviation Blockchain Market, By Application (Page No. - 56)

8.1 Introduction

8.2 Cargo & Baggage Tracking

8.2.1 Blockchain Can Help in Tracking the Status and Location of Valuable Assets Such as Passenger Bags and Cargo

8.3 Passenger Identity Management

8.3.1 Passenger Biometrics, Personal Details, and Travel History Can Be Stored in Blockchain

8.4 Flight & Crew Data Management

8.4.1 Blockchain Solution Provides Real-Time Flight Information to All Stakeholders

8.5 Frequent Flyer Programs

8.5.1 Reconciliation of Frequent Flyer Points is Done By Tokenizing Miles Flown Into A Digital Currency Using Blockchain

8.6 Smart Contracts

8.6.1 Smart Contracts Help Streamline Procurement Processes

8.6.2 Travel Insurance

8.6.2.1 Smart Contracts Can Track Insurance Claims

8.6.3 E-Ticketing & Ticket Tokenization

8.6.3.1 E-Ticketing & Tokenization Replaces the Need for Paper Tickets

8.6.4 Aircraft Refueling

8.6.4.1 Use of Smart Contracts for Aircraft Refueling Can Automate the Payment Process Eliminating Delays

8.6.5 Airline Revenue Sharing

8.6.5.1 Blockchain Presents an Opportunity to Create A Unified System That Uses Predetermined Criteria to Share Revenue

8.6.6 Leasing

8.6.6.1 Entire History of an Aircraft Can Be Traced and Tracked Using Blockchain

8.7 Supply Chain Management

8.7.1 Blockchain Technology is A Viable Option to Streamline the Procurement Process Through the Use of Smart Contracts

8.7.2 Parts Tracking

8.7.2.1 Blockchain-Based Supply Chain Solutions Could Efficiently Track and Trace the Movement, Modification, and Maintenance of Components

8.7.3 Parts Health Monitoring

8.7.3.1 Parts Health Monitoring Enable Users to Accurately Trace the Components Journey From the Beginning

8.7.4 Inventory Management

8.7.4.1 Procurement Strategy Can Be Formulated By Analyzing Historical Data and Real-Time Health Conditions Using Blockchain

8.8 Aircraft Maintenance

8.8.1 Blockchain Can Be Used to Track the Fitness of Individual Parts of Aircraft By Monitoring Data

9 Aviation Blockchain Market, By Deployment (Page No. - 67)

9.1 Introduction

9.2 Public

9.2.1 Aviation-Based Applications of Public Blockchain Include Tokenization and Cryptocurrency

9.3 Private

9.3.1 Private Blockchain is Primarily Deployed for Record-Keeping and Secured Applications

9.4 Hybrid

9.4.1 Hybrid Blockchain is A Combination of Public and Private Blockchains

10 Aviation Blockchain Market, By Function (Page No. - 71)

10.1 Introduction

10.2 Record-Keeping

10.2.1 Components Details Such as Manufacturing Date, Repairs, Ownership, and Maintenance Can Be Stored on Blockchain, Thus Enabling Tracking the History of Components

10.3 Transactions

10.3.1 Blockchain Can Facilitate A Range of Transactions, Including Billing Among Airlines, Between Travel Agents and Airlines, Determining Loyalty Points Settlements and Travel Insurance

11 Aviation Blockchain Market, By Vertical (Page No. - 75)

11.1 Introduction

11.2 Civil & Commercial

11.3 Military

11.3.1 Location and Availability of Parts

11.3.1.1 Authenticity of Parts and Supply

11.3.1.2 Smart Contracts and Payments

12 Regional Analysis (Page No. - 77)

12.1 Introduction

12.2 North America

12.2.1 US

12.2.1.1 Presence of Major Manufacturers and Blockchain Providers Such as IBM, Microsoft, and Volantio is Driving the Market for Aviation Blockchain in the US

12.2.2 Canada

12.2.2.1 Adoption of the Blockchain in Healthcare, Media and Entertainment, Government Bodies, and Manufacturing Verticals is Fueling the Market in Canada

12.3 Europe

12.3.1 France

12.3.1.1 Partnerships and Collaborations Between Aircraft Manufacturers and Tech Companies is A Major Factor Fueling the Market for Aviation Blockchain in France

12.3.2 UK

12.3.2.1 Increasing Adoption of Blockchain Technology to Replace Paper Documents in Airports is A Significant Driver of the Market in the UK

12.3.3 Germany

12.3.3.1 Government Support is One of the Major Factors Fueling the Market in Germany

12.3.4 Russia

12.3.4.1 Successful Execution of Pilot Blockchain Projects By Leading Airlines in Partnership With the Banking Sector is Driving the Aviation Blockchain Market in Russia

12.3.5 Rest of Europe

12.3.5.1 Increasing Government Initiatives Toward Adoption of Blockchain are Driving the Market for Aviation Blockchain in Rest of Europe

12.4 Asia Pacific

12.4.1 China

12.4.1.1 Airlines and Airports in China are Embracing Blockchain Technology to Provide Self-Service Experience to Passengers

12.4.2 India

12.4.2.1 Presence of Blockchain Providers Such as Infosys and Volantio is Driving the Market for Aviation Blockchain in India

12.4.3 Singapore

12.4.3.1 Singapore Airline Introduced Blockchain-Based Solutions for Frequent Flyer Program

12.4.4 Australia

12.4.4.1 Partnerships Between Airlines and Tech Companies to Identify New Revenue Streams Leveraging Blockchain are Driving the Market

12.4.5 Rest of Asia Pacific

12.4.5.1 Increase in Number of Greenfield Airports in Developing Countries is Driving the Market

12.5 Rest of the World

12.5.1 Latin America

12.5.1.1 Presence of Manufacturers Such as Embraer and A Large Number of Airports is Driving the Market for Aviation Blockchain in Latin America

12.5.2 Middle East

12.5.2.1 Airlines and Airports are Adopting Blockchain Technology to Enhance Customer Experience

12.5.3 Africa

12.5.3.1 Most of the Aviation Blockchain Projects in Africa are in the R&D Stage

13 Competitive Landscape (Page No. - 114)

13.1 Introduction

13.2 Competitive Leadership Mapping (Overall Market)

13.2.1 Visionary Leaders

13.2.2 Innovators

13.2.3 Dynamic Differentiators

13.2.4 Emerging Companies

13.3 Competitive Scenario

13.3.1 Agreements

13.3.2 New Product Launches

13.3.3 Collaborations & Partnerships

13.3.4 Other Strategies

14 Company Profiles (Page No. - 125)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

14.1 14bis Supply Tracking (Safeflights Inc.)

14.2 Aeron Labs

14.3 Avinoc LTD

14.4 Credits.Com Pte. LTD.

14.5 Filament

14.6 IBM

14.7 Infosys

14.8 Insolar Technologies

14.9 Leewayhertz Technologies

14.10 Microsoft Corporation

14.11 Moog Inc.

14.12 Olistics

14.13 Parts Pedigree

14.14 Quillhash Technologies Pvt. LTD.

14.15 Skybuys

14.16 Sorablocks

14.17 Sweetbridge, Inc.

14.18 Volantio Inc

14.19 Winding Tree

14.20 Zamna Technologies Limited

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

15 Appendix (Page No. - 160)

15.1 Discussion Guide

15.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

15.3 Available Customizations

15.4 Related Reports

15.5 Author Details

List of Tables (109 Tables)

Table 1 Application, By End Market

Table 2 Aviation Blockchain Market Size, By End Market, 2017—2025 (USD Million)

Table 3 Market for Airlines, By Region, 2017—2025 (USD Million)

Table 4 Market for Mro, By Region, 2017—2025 (USD Million)

Table 5 Market for Airports, By Region, 2017—2025 (USD Million)

Table 6 Market for Manufacturers, By Region, 2017—2025 (USD Million)

Table 7 Market for Lessors, By Region, 2017—2025 (USD Million)

Table 8 Market Size, By Application, 2017—2025 (USD Million)

Table 9 Market in Cargo & Baggage Tracking, By Region, 2017—2025 (USD Million)

Table 10 Market in Passenger Identity Management, By Region, 2017—2025 (USD Million)

Table 11 Market in Flight & Crew Data Management, By Region, 2017—2025 (USD Million)

Table 12 Market in Frequent Flyer Programs, By Region, 2017—2025 (USD Million)

Table 13 Market in Smart Contracts, By Subapplication, 2017—2025 (USD Million)

Table 14 Market in Smart Contracts, By Region, 2017—2025 (USD Million)

Table 15 Market in Supply Chain Management, By Subapplication, 2017—2025 (USD Million)

Table 16 Market in Supply Chain Management, By Region, 2017—2025 (USD Million)

Table 17 Market in Aircraft Maintenance, By Region, 2017—2025 (USD Million)

Table 18 Market Size, By Deployment, 2017—2025 (USD Million)

Table 19 Public Market Size, By Region, 2017—2025 (USD Million)

Table 20 Private Market Size, By Region, 2017—2025 (USD Million)

Table 21 Hybrid Market Size, By Region, 2017—2025 (USD Million)

Table 22 Market Size, By Function, 2017—2025 (USD Million)

Table 23 Market for Record-Keeping, By Region, 2017—2025 (USD Million)

Table 24 Market for Transactions, By Region, 2017—2025 (USD Million)

Table 25 Market Size, By Region, 2017—2025 (USD Million)

Table 26 North America: Market Size, By End Market, 2017—2025 (USD Million)

Table 27 North America: Market Size, By Function, 2017—2025 (USD Million)

Table 28 North America: Market Size, By Deployment, 2017—2025 (USD Million)

Table 29 North America: Market Size, By Application, 2017—2025 (USD Million)

Table 30 North America: Market Size, By Country, 2017–2025 (USD Million)

Table 31 US: Market Size, By End Market, 2017—2025 (USD Million)

Table 32 US: Market Size, By Function, 2017—2025 (USD Million)

Table 33 US: Market Size, By Deployment, 2017—2025 (USD Million)

Table 34 US: Market Size, By Application, 2017—2025 (USD Million)

Table 35 Canada: Market Size, By End Market, 2017–2025 (USD Million)

Table 36 Canada: Market Size, By Function, 2017–2025 (USD Million)

Table 37 Canada: Market Size, By Deployment, 2017–2025 (USD Million)

Table 38 Canada: Market Size, By Application, 2017–2025 (USD Million)

Table 39 Europe: Market Size, By End Market, 2017—2025 (USD Million)

Table 40 Europe: Market Size, By Application, 2017—2025 (USD Million)

Table 41 Europe: Market Size, By Function, 2017—2025 (USD Million)

Table 42 Europe: Market Size, By Deployment, 2017—2025 (USD Million)

Table 43 Europe: Market Size, By Country, 2017—2025 (USD Million)

Table 44 France: Market Size, By End Market, 2017—2025 (USD Million)

Table 45 France: Market Size, By Function, 2017—2025 (USD Million)

Table 46 France: Market Size, By Deployment, 2017—2025 (USD Million)

Table 47 France: Market Size, By Application, 2017—2025 (USD Million)

Table 48 UK: Aviation Blockchain Market Size, By End Market, 2017—2025 (USD Million)

Table 49 UK: Market Size, By Application, 2017—2025 (USD Million)

Table 50 UK: Market Size, By Deployment, 2017—2025 (USD Million)

Table 51 UK: Market Size, By Function, 2017—2025 (USD Million)

Table 52 Germany: Market Size, By End Market, 2017—2025 (USD Million)

Table 53 Germany: Market Size, By Application, 2017—2025 (USD Million)

Table 54 Germany: Market Size, By Deployment, 2017—2025 (USD Million)

Table 55 Germany: Market Size, By Function, 2017—2025 (USD Million)

Table 56 Russia: Market Size, By End Market, 2017—2025 (USD Million)

Table 57 Russia: Market Size, By Application, 2017—2025 (USD Million)

Table 58 Russia: Market Size, By Deployment, 2017—2025 (USD Million)

Table 59 Russia: Market Size, By Function, 2017—2025 (USD Million)

Table 60 Rest of Europe: Market Size, By End Market, 2017—2025 (USD Million)

Table 61 Rest of Europe: Market Size, By Function, 2017—2025 (USD Million)

Table 62 Rest of Europe: Market Size, By Deployment, 2017—2025 (USD Million)

Table 63 Rest of Europe: Market Size, By Application, 2017—2025 (USD Million)

Table 64 Asia Pacific: Market Size, By End Market, 2017—2025 (USD Million)

Table 65 Asia Pacific: Market Size, By Function, 2017—2025 (USD Million)

Table 66 Asia Pacific: Market Size, By Deployment, 2017—2025 (USD Million)

Table 67 Asia Pacific: Market Size, By Application, 2017—2025 (USD Million)

Table 68 Asia Pacific: Market Size, By Country, 2017—2025 (USD Million)

Table 69 China: Market Size, By End Market, 2017—2025 (USD Million)

Table 70 China: Market Size, By Function, 2017—2025 (USD Million)

Table 71 China: Market Size, By Deployment, 2017—2025 (USD Million)

Table 72 China: Market Size, By Application, 2017—2025 (USD Million)

Table 73 India: Market Size, By End Market, 2017—2025 (USD Million)

Table 74 India: Market Size, By Function, 2017—2025 (USD Million)

Table 75 India: Market Size, By Deployment, 2017—2025 (USD Million)

Table 76 India: Market Size, By Application, 2017—2025 (USD Million)

Table 77 Singapore: Market Size, By End Market, 2017—2025 (USD Million)

Table 78 Singapore: Market Size, By Function, 2017—2025 (USD Million)

Table 79 Singapore: Market Size, By Deployment, 2017—2025 (USD Million)

Table 80 Singapore: Market Size, By Application, 2017—2025 (USD Million)

Table 81 Australia: Market Size, By End Market, 2017—2025 (USD Million)

Table 82 Australia: Market Size, By Function, 2017—2025 (USD Million)

Table 83 Australia: Market Size, By Deployment, 2017—2025 (USD Million)

Table 84 Australia: Market Size, By Application, 2017—2025 (USD Million)

Table 85 Rest of Asia Pacific: Market Size, By End Market, 2017—2025 (USD Million)

Table 86 Rest of Asia Pacific: Market Size, By Function, 2017—2025 (USD Million)

Table 87 Rest of Asia Pacific: Market Size, By Deployment, 2017—2025 (USD Million)

Table 88 Rest of Asia Pacific: Market Size, By Application, 2017—2025 (USD Million)

Table 89 Rest of the World: Market Size, By End Market, 2017—2025 (USD Million)

Table 90 Rest of the World: Market Size, By Function, 2017—2025 (USD Million)

Table 91 Rest of the World: Market Size, By Deployment, 2017—2025 (USD Million)

Table 92 Rest of the World: Market Size, By Application, 2017—2025 (USD Million)

Table 93 Rest of the World: Market Size, By Region, 2017—2025 (USD Million)

Table 94 Latin America: Market Size, By End Market, 2017—2025 (USD Million)

Table 95 Latin America: Market Size, By Function, 2017—2025 (USD Million)

Table 96 Latin America: Market Size, By Deployment, 2017—2025 (USD Million)

Table 97 Latin America: Market Size, By Application, 2017—2025 (USD Million)

Table 98 Middle East: Market Size, By End Market, 2017—2025 (USD Million)

Table 99 Middle East: Market Size, By Function, 2017—2025 (USD Million)

Table 100 Middle East: Market Size, By Deployment, 2017–2025 (USD Million)

Table 101 Middle East: Market Size, By Application, 2017—2025 (USD Million)

Table 102 Africa: Market Size, By End Market, 2017—2025 (USD Million)

Table 103 Africa: Market Size, By Function, 2017—2025 (USD Million)

Table 104 Africa: Market Size, By Deployment, 2017—2025 (USD Million)

Table 105 Africa: Market Size, By Application, 2017—2025 (USD Million)

Table 106 Agreements, January 2017– November 2019

Table 107 New Product Launches, January 2017– November 2019

Table 108 Collaborations & Partnerships, January 2017–November 2019

Table 109 Other Strategies, January 2017–November 2019

List of Figures (32 Figures)

Figure 1 Markets Covered

Figure 2 Research Flow

Figure 3 Research Design: Aviation Blockchain Market

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Data Triangulation

Figure 8 Assumptions for the Research Study

Figure 9 By End Market, Airports Segment Projected to Lead Aviation Blockchain Market During Forecast Period

Figure 10 By Application, Passenger Identity Management Segment Projected to Grow at the Highest Rate During Forecast Period

Figure 11 By Function, Record-Keeping Segment Expected to Lead this Market During Forecast Period

Figure 12 By Deployment, Hybrid Segment Projected to Lead the Market During Forecast Period

Figure 13 North America in Aviation Blockchain Market Expected to Grow at the Highest Rate During Forecast Period

Figure 14 Increased Transparency and Traceability in Business Operations is One of the Major Factors Driving Aviation Blockchain Market

Figure 15 Smart Contracts Projected to Lead Aviation Blockchain During Forecast Period

Figure 16 Airports Expected to Grow at the Highest CAGR During Forecast Period

Figure 17 UK Market Projected to Grow at the Highest CAGR During Forecast Period

Figure 18 Market Dynamics of the Aviation Blockchain Market

Figure 19 Market Size, By End Market, 2019 & 2025 (USD Million)

Figure 20 Market Size, By Application, 2019 & 2025 (USD Million)

Figure 21 Market Size, By Deployment, 2019 & 2025 (USD Million)

Figure 22 Market, By Function, 2019 & 2025 (USD Million)

Figure 23 Market in North America Expected to Grow at the Highest Rate in 2019

Figure 24 North America Market Snapshot

Figure 25 Europe Market Snapshot

Figure 26 Asia Pacific Market Snapshot

Figure 27 Companies Adopted Collaborations and Partnerships as A Key Growth Strategy Between January 2017 and November 2019

Figure 28 Aviation Blockchain Market (Global) Competitive Leadership Mapping, 2018

Figure 29 Strength of Product Portfolio

Figure 30 Business Strategy Excellence

Figure 31 Infosys: Company Snapshot

Figure 32 Moog: Company Snapshot

The study considered major activities to estimate the current market size of the aviation blockchain market. Exhaustive secondary research was undertaken to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg, BusinessWeek, and Aerospace Magazine were referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

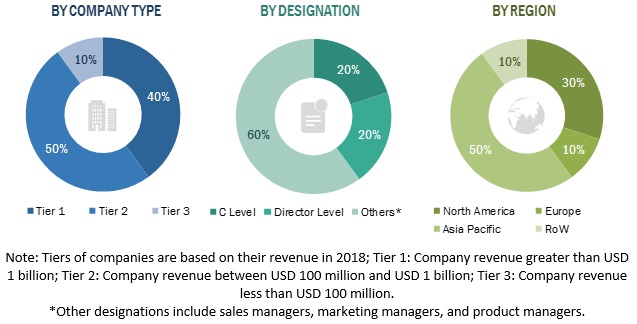

Extensive primary research was conducted after obtaining information about the aviation blockchain market scenario in aviation through secondary research. Several primary interviews were conducted with market experts from both, the demand and supply side across four regions, namely, North America, Europe, Asia Pacific, and Rest of the World (RoW). Approximately 30% and 70% of primary interviews were conducted with industry experts from the demand and supply side, respectively. Primary data was collected through questionnaires, emails, and telephonic interviews. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the aviation blockchain market. These methods were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details.

- Key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes explained above—the market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends, from both the demand and supply sides, in the aviation blockchain market.

Report Objectives

- To define, describe, segment, and forecast the size of the aviation blockchain market based on application, function, deployment, end market, and region

- To forecast the market size of various segments of the aviation blockchain market with respect to four major regions: North America, Europe, Asia Pacific, and Rest of the World, along with major countries in each region

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the aviation blockchain market

- To identify industry trends, market trends, and technology trends currently prevailing in the aviation blockchain market

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contribution to the overall market

- To analyze the degree of competition in the aviation blockchain market by identifying key market players

- To analyze competitive developments, such as partnerships, contracts, expansion, funding, collaborations, product launch, mergers, and acquisitions of key players in the aviation blockchain market

- To identify detailed financial positions, key products, unique selling points, and key developments of leading companies in the aviation blockchain market

- To strategically profile key market players and comprehensively analyze their market ranking and core competencies

Available Customizations

Along with the market data, MarketsandMarkets offers customizations according to a company’s specific needs.

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Further sub-segmentation

- Further breakdown of the application segment

By Vertical

- Quantitative insights can be provided for vertical segment

Growth opportunities and latent adjacency in Aviation Blockchain Market