Airport Lighting Market by Type (Runway, Taxiway & Apron Lighting Systems), Position (In-Pavement Lighting, Elevated Lighting & PAPI), Technology (Non-LED and LED), and by Geography - Global Forecast to 2021

The airport lighting market is projected to grow from USD 454.5 Million in 2015 to USD 672.2 Million by 2021, at a CAGR of 7.2% during the forecast period. Factors such as the expansion of airport infrastructure and rising focus on controlling maintenance costs are expected to contribute to the growth of this market. In this market research report, 2015 is considered to be the base year, and 2016 to 2021 is considered as the forecast period.

Objectives of the Report

- To define, describe, and forecast the airport lighting market on the basis of type, position, technology, and geography

- To analyze the degree of competition in the market by identifying various parameters, including key market players

- To identify and analyze the key drivers, restraints, opportunities, and challenges, influencing the airport lighting market

- To analyze the demand side and supply side indicators and provide a factor analysis for the airport lighting market

- To forecast the market size of segments with respect to various regions, which include North America, Europe, Asia-Pacific, the Middle East, and rest of the world (RoW)

- To identify and illustrate political, economic, social, and technological factors influencing the airport lighting market

- To strategically profile key market players and comprehensively analyze their market share and core competencies

- To track and analyze competitive developments such as contracts, joint ventures, mergers & acquisitions, and new product developments in the airport lighting market

The airport lighting market is projected to grow from USD 473.7 Million in 2016 to USD 672.2 Million by 2021, at a CAGR of 7.2% from 2016 to 2021. Airport lights are used to indicate directions to the aircraft, during landing, takeoff, and parking. These lights are installed in runways, taxiways, and aprons. The runway lights are generally white, taxiway lights are blue in color, and apron lights can be of any color. The apron lights can be replaced by reflective markers in smaller airports.

On the basis of type, the airport lighting market has been subsegmented into runway lighting systems, taxiway lighting systems, and apron lighting systems. The runway lighting systems subsegment in the market is projected to grow at the highest CAGR during the forecast period.

On the basis of position, the airport lighting market has been subsegmented into in-pavement/inset lights, elevated lights, and precision approach path indicator. The elevated lights subsegment dominates the market in terms of market size, and is expected to continue its dominance over the next five years. However, the in-pavement/inset lights segment in the market is projected to grow at the highest CAGR during the forecast period.

On the basis of technology, the airport lighting market has been subsegmented into non-LED and LED. The LED subsegment in the market is projected to grow at the highest CAGR from 2016 to 2021.

In the global airport lighting market, the Asia-Pacific (APAC) region is expected to exhibit the highest growth rate during the forecast period. The region acts as a manufacturing and outsourcing destination for the developed economies and attracts a lot of foreign investment. It constantly witnesses up gradation/renovation of airport infrastructure to support increase in air passenger traffic. This poses as a huge market opportunity for airport lighting manufacturers.

Factors restraining the growth of the airport lighting market include visibility issues due to adverse weather conditions.

The airport lighting market is a competitive market, dominated by companies based on their core competencies. Key players operating in the market include ADB Airfield Solutions (U.S.), Honeywell International (U.S.), Inc., ABB (Switzerland), and Hella KGaA Hueck & Co. (Germany), among others. Honeywell International, Inc. is one of the top companies profiled in the market. The company has a strong distribution network, with centres across 70 countries worldwide. Since 1933, Honeywell has been a market leader in the market, with a robust product portfolio and wide customer base.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Years Considered for the Study

1.4 Currency & Pricing

1.5 Distribution Channel Participants

1.6 Market Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

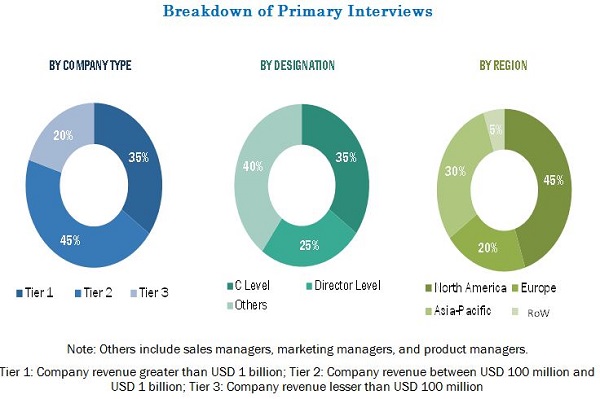

2.1.2.3 Breakdown of Primary Interviews: By Company Type, Designation, and Region

2.2 Factor Analysis

2.2.1 Introduction

2.2.2 Demand-Side Indicators

2.2.2.1 Extension of Runways at Airports

2.2.2.2 Upcoming New Airports Globally

2.2.2.3 Need for Minimizing Risk of Aircraft Collision

2.2.3 Supply-Side Indicators

2.2.3.1 Tax Incentives for Solar Airport Lights

2.2.3.2 Greater Spending on Airport Infrastructure/Modernization of Airports

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Market Breakdown and Data Triangulation

2.5 Research Assumptions and Limitations

2.5.1 Research Assumptions

2.5.2 Research Limitations

3 Executive Summary (Page No. - 31)

4 Premium Insights (Page No. - 36)

4.1 Attractive Market Opportunities in the Airport Lighting Market

4.2 Market, By Technology

4.3 Market, By Type

4.4 Market, By Position

4.5 Market, By Region

4.6 Life Cycle Analysis, By Geography

5 Market Overview (Page No. - 40)

5.1 Introduction

5.2 Evolution of Airport Lighting

5.3 Market Segmentation

5.3.1 By Type

5.3.2 By Position

5.3.3 By Technology

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Expansion of Airport Infrastructure

5.4.1.2 Control of Maintenance Costs

5.4.1.3 Increasing Focus Towards Reducing Energy Consumption

5.4.2 Restraints

5.4.2.1 Visibility Issues Due to Adverse Weather Conditions

5.4.3 Opportunities

5.4.3.1 Transition to Electric and Solar-Powered LED Technology

5.4.4 Challenges

5.4.4.1 Compatibility-Related Issues of LED Lighting With the Existing Electrical Infrastructure

6 Industry Trends (Page No. - 46)

6.1 Introduction

6.2 Technology Trend

6.2.1 Usage of Airport Lighting Control and Monitoring Systems (ALCMS)

6.3 Key Trend Analysis

7 Airport Lighting Market, By Type (Page No. - 50)

7.1 Introduction

7.2 By Type

7.2.1 Runway Lighting Systems

7.2.1.1 By Region

7.2.2 Taxiway Lighting Systems

7.2.2.1 By Region

7.2.3 Apron Lighting Systems

7.2.3.1 By Region

8 Airport Lighting Market, By Position (Page No. - 57)

8.1 Introduction

8.1.1 By Position

8.1.1.1 In-Pavement/Inset Airfield Lights

8.1.1.1.1 By Region

8.1.1.2 Elevated Airfield Lights

8.1.1.2.1 By Region

8.1.1.3 Precision Approach Path Indicator (PAPI)

8.1.1.3.1 By Region

9 Airport Lighting Market, By Technology (Page No. - 61)

9.1 Introduction

9.1.1 By Technology

9.1.1.1 Non-LED

9.1.1.1.1 By Region

9.1.1.2 LED

9.1.1.2.1 By Region

10 Regional Analysis (Page No. - 65)

10.1 Introduction

10.2 North America

10.2.1 By Type

10.2.2 By Position

10.2.3 By Technology

10.2.4 By Country

10.2.4.1 U.S.

10.2.4.1.1 By Type

10.2.4.1.2 By Position

10.2.4.1.3 By Technology

10.2.4.2 Canada

10.2.4.2.1 By Type

10.2.4.2.2 By Position

10.2.4.2.3 By Technology

10.3 Europe

10.3.1 By Type

10.3.2 By Position

10.3.3 By Technology

10.3.4 By Country

10.3.4.1 U.K.

10.3.4.1.1 By Type

10.3.4.1.2 By Position

10.3.4.1.3 By Technology

10.3.4.2 Germany

10.3.4.2.1 By Type

10.3.4.2.2 By Position

10.3.4.2.3 By Technology

10.3.4.3 France

10.3.4.3.1 By Type

10.3.4.3.2 By Position

10.3.4.3.3 By Technology

10.3.4.4 Russia

10.3.4.4.1 By Type

10.3.4.4.2 By Position

10.3.4.4.3 By Technology

10.4 Asia-Pacific

10.4.1 By Type

10.4.2 By Position

10.4.3 By Technology

10.4.4 By Country

10.4.4.1 Japan

10.4.4.1.1 By Type

10.4.4.1.2 By Position

10.4.4.1.3 By Technology

10.4.4.2 China

10.4.4.2.1 By Type

10.4.4.2.2 By Position

10.4.4.2.3 By Technology

10.4.4.3 Australia

10.4.4.3.1 By Type

10.4.4.3.2 By Position

10.4.4.3.3 By Technology

10.4.4.4 India

10.4.4.4.1 By Type

10.4.4.4.2 By Position

10.4.4.4.3 By Technology

10.5 the Middle East

10.5.1 By Type

10.5.2 By Position

10.5.3 By Technology

10.5.4 By Country

10.5.4.1 Saudi Arabia

10.5.4.1.1 By Type

10.5.4.1.2 By Position

10.5.4.1.3 By Technology

10.5.4.2 U.A.E.

10.5.4.2.1 By Type

10.5.4.2.2 By Position

10.5.4.2.3 By Technology

10.6 Rest of the World

10.6.1 By Type

10.6.2 By Position

10.6.3 By Technology

10.6.4 By Country

10.6.4.1 Brazil

10.6.4.1.1 By Type

10.6.4.1.2 By Position

10.6.4.1.3 By Technology

10.6.4.2 South Africa

10.6.4.2.1 By Type

10.6.4.2.2 By Position

10.6.4.2.3 By Technology

11 Competitive Landscape (Page No. - 105)

11.1 Overview

11.2 Market Share Analysis: By Company

11.3 Top 3 Brand Analysis

11.4 Competitive Situation & Trends

11.4.1 Contracts

11.4.2 Joint Ventures

11.4.3 New Product Launches

11.4.4 Expansions

11.4.5 Mergers & Acquisitions

11.4.6 Others (Divestments&Certifications)

12 Company Profiles (Page No. - 113)

(Company at A Glance, Business Overview, Products Offered, Key Strategy, Recent Developments, SWOT Analysis & MnM View)*

12.1 Introduction

12.2 Financial Highlights

12.3 Honeywell International, Inc.

12.4 Hella KGaA Hueck & Co.

12.5 Carmanah Technologies Corp.

12.6 Eaton Corporation PLC

12.7 ABB

12.8 ATG Airports

12.9 Vosla GmbH

12.10 Avlite Systems

12.11 ADB Airfield Solutions

12.12 Avionics Ltd.

*Details on Company at A Glance, Recent Financials, Products Offered, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 140)

13.1 Insights From Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Introducing RT: Real Time Market Intelligence

13.5 Available Customization

13.6 Related Reports

List of Tables (85 Tables)

Table 1 Key Airport Projects in APAC Region, 2015

Table 2 Research Assumptions

Table 3 Market Drivers: Region Wise

Table 4 List of Key Patents

Table 5 Airport Construction Projects, 2015

Table 6 Market Size, By Type, 2014-2021 (USD Million)

Table 7 Runway Lighting Systems Market Size, By Region, 2014-2021 (USD Million)

Table 8 Taxiway Lighting Systems Market Size, By Region, 2014-2021 (USD Million)

Table 9 Apron Lighting Systems Market Size, By Region, 2014-2021 (USD Million)

Table 10 Market Size, By Position, 2014-2021 (USD Million)

Table 11 In-Pavement/Inset Lights Market Size, By Region, 2014-2021 (USD Million)

Table 12 Elevated Airfield Lights Market Size, By Region, 2014-2021 (USD Million)

Table 13 PAPI Market Size, By Region, 2014-2021 (USD Million)

Table 14 Market Size, By Technology, 2014-2021 (USD Million)

Table 15 Non-LED Airport Lighting Market Size, By Region, 2014-2021 (USD Million)

Table 16 LED Airport Lighting Market Size, By Region, 2014-2021 (USD Million)

Table 17 North America: Market, By Type, 2014-2021 (USD Million)

Table 18 North America: Market, By Position,2014-2021 (USD Million)

Table 19 North America: Market, By Technology,2014-2021 (USD Million)

Table 20 North America: Market, By Country,2014-2021 (USD Million)

Table 21 U.S.: Airport Lighting Market, By Type, 2014-2021 (USD Million)

Table 22 U.S.: Market, By Position, 2014-2021 (USD Million)

Table 23 U.S.: Market, By Technology, 2014-2021 (USD Million)

Table 24 Canada: Airport Lighting Market, By Type, 2014-2021 (USD Million)

Table 25 Canada: Market, By Position, 2014-2021 (USD Million)

Table 26 Canada: Market, By Technology, 2014-2021 (USD Million)

Table 27 Europe: Airport Lighting Market, By Type, 2014-2021 (USD Million)

Table 28 Europe: Market, By Position, 2014-2021 (USD Million)

Table 29 Europe: Market, By Technology, 2014-2021 (USD Million)

Table 30 Europe: Market, By Country, 2014-2021 (USD Million)

Table 31 U.K.: Market, By Type, 2014-2021 (USD Million)

Table 32 U.K.: Market, By Position, 2014-2021 (USD Million)

Table 33 U.K.: Market, By Technology, 2014-2021 (USD Million)

Table 34 Germany: Airport Lighting Market, By Type, 2014-2021 (USD Million)

Table 35 Germany: Market, By Position, 2014-2021 (USD Million)

Table 36 Germany: Market, By Technology,2014-2021 (USD Million)

Table 37 France: Airport Lighting Market, By Type, 2014-2021 (USD Million)

Table 38 France: Market, By Position, 2014-2021 (USD Million)

Table 39 France: Market, By Technology, 2014-2021 (USD Million)

Table 40 Russia: Airport Lighting Market, By Type, 2014-2021 (USD Million)

Table 41 Russia: Market, By Position, 2014-2021 (USD Million)

Table 42 Russia: Market, By Technology, 2014-2021 (USD Million)

Table 43 APAC: Airport Lighting Market, By Type, 2014-2021 (USD Million)

Table 44 APAC: Airport Lighting Market, By Position, 2014-2021 (USD Million)

Table 45 APAC: Airport Lighting Market, By Technology, 2014-2021 (USD Million)

Table 46 APAC: Airport Lighting Market, By Country, 2014-2021 (USD Million)

Table 47 Japan: Airport Lighting Market, By Type, 2014-2021 (USD Million)

Table 48 Japan: Airport Lighting Market, By Position, 2014-2021 (USD Million)

Table 49 Japan: Airport Lighting Market, By Technology, 2014-2021 (USD Million)

Table 50 China: Airport Lighting Market, By Type, 2014-2021 (USD Million)

Table 51 China: Airport Lighting Market, By Position, 2014-2021 (USD Million)

Table 52 China: Airport Lighting Market, By Technology, 2014-2021 (USD Million)

Table 53 Australia: Airport Lighting Market, By Type, 2014-2021 (USD Million)

Table 54 Australia: Airport Lighting Market, By Position, 2014-2021 (USD Million)

Table 55 Australia: Airport Lighting Market, By Technology,2014-2021 (USD Million)

Table 56 India: Airport Lighting Market, By Type, 2014-2021 (USD Million)

Table 57 India: Airport Lighting Market, By Position, 2014-2021 (USD Million)

Table 58 India: Airport Lighting Market, By Technology, 2014-2021 (USD Million)

Table 59 Middle East: Airport Lighting Market, By Type, 2014-2021 (USD Million)

Table 60 Middle East: Airport Lighting Market, By Position,2014-2021 (USD Million)

Table 61 Middle East: Airport Lighting Market, By Technology,2014-2021 (USD Million)

Table 62 Middle East: Airport Lighting Market, By Country,2014-2021 (USD Million)

Table 63 Saudi Arabia: Airport Lighting Market, By Type, 2014-2021 (USD Million)

Table 64 Saudi Arabia: Market, By Position,2014-2021 (USD Million)

Table 65 Saudi Arabia: Market, By Technology,2014-2021 (USD Million)

Table 66 U.A.E.: Airport Lighting Market, By Type, 2014-2021 (USD Million)

Table 67 U.A.E.: Market, By Position, 2014-2021 (USD Million)

Table 68 U.A.E.: Market, By Technology, 2014-2021 (USD Million)

Table 69 RoW: Airport Lighting Market, By Type, 2014-2021 (USD Million)

Table 70 RoW: Market, By Position, 2014-2021 (USD Million)

Table 71 RoW: Market, By Technology, 2014-2021 (USD Million)

Table 72 RoW: Market, By Country, 2014-2021 (USD Million)

Table 73 Brazil: Market, By Type, 2014-2021 (USD Million)

Table 74 Brazil: Market, By Position, 2014-2021 (USD Million)

Table 75 Brazil: Market, By Technology, 2014-2021 (USD Million)

Table 76 South Africa: Market, By Type, 2014-2021 (USD Million)

Table 77 South Africa: Market, By Position,2014-2021 (USD Million)

Table 78 South Africa: Market, By Technology,2014-2021 (USD Million)

Table 79 Top 3 Market Players in Market

Table 80 Contracts, 2012-2016

Table 81 Joint Ventures, 2014

Table 82 New Product Launches 2013-2015

Table 83 Expansions, 2013

Table 84 Mergers & Acquisitions, 2014-2016

Table 85 Others (Divestments & Certifications), 2014-2016

List of Figures (42 Figures)

Figure 1 Airport Lighting Market Segmentation

Figure 2 Years Considered for the Study

Figure 3 Market Stakeholders

Figure 4 Research Design: Market

Figure 5 Bottom-Up Approach

Figure 6 Top-Down Approach

Figure 7 Market Breakdown and Data Triangulation

Figure 8 Research Limitations

Figure 9 Market, By Region, 2016 vs. 2021

Figure 10 Runway Lighting Systems Segment is Estimated to Lead the Airport Lighting Market in 2016

Figure 11 LED Technology Segment is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 12 Gaining More Contracts is the Key Strategy for Companies in the Market

Figure 13 Increasing Global Demand for Airport Lights is Driving the Growth of the Market

Figure 14 Non-LED Technology Segment is Estimated to Account for the Largest Share in the Market in 2016

Figure 15 Runway Lighting Systems Segment is Expected to Account for the Largest Share in the Market Between 2016 and 2021

Figure 16 In-Pavement/Inset Lights Segment is Estimated to Account for the Largest Share in 2016

Figure 17 Asia-Pacific Airport Lighting Market is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 18 Middle East to Witness Significant Growth During the Forecast Period

Figure 19 Market, By Type

Figure 20 Market, By Position

Figure 21 Market, By Technology

Figure 22 Market Dynamics for the Market

Figure 23 Market Size, By Type, 2016 vs. 2021 (USD Million)

Figure 24 Market: Geographic Snapshot (2016-2021)

Figure 25 North American Airport Lighting Market Snapshot: U.S. Estimated to Command the Largest Market Share in 2016

Figure 26 European Airport Lighting Market Snapshot: In-Pavement/Inset Lights Estimated to Command the Largest Market Share in 2016

Figure 27 Asia-Pacific Airport Lighting Market Snapshot: China Estimated to Register the Highest Market Share in 2016

Figure 28 Middle East Airport Lighting Market Snapshot: Saudi Arabia Estimated to Register the Highest Market Share in 2016

Figure 29 Rest of the World Airport Lighting Market Snapshot: Brazil is Estimated to Register Highest Market Share in 2016

Figure 30 Companies Adopted Contracts as the Key Growth Strategy During the Studied Period (2012-2016)

Figure 31 Market Share Analysis, 2015

Figure 32 Battle for Market Share: Gaining New Contracts is the Key Strategy

Figure 33 Geographical Revenue Mix,2015

Figure 34 Honeywell International, Inc.: Company Snapshot

Figure 35 Honeywell International, Inc: SWOT Analysis

Figure 36 Hella KGaA Hueck & Co.: Company Snapshot

Figure 37 Hella KGaA Hueck & Co.: SWOT Analysis

Figure 38 Carmanah Technologies Corp.: Company Snapshot

Figure 39 Carmanah Tachnologies.: SWOT Analysis

Figure 40 Eaton Corporation PLC: Company Snapshot

Figure 41 Eaton Corporation:SWOT Analysis

Figure 42 ABB: Company Snapshot

The research methodology used to estimate and forecast the airport lighting market begins with capturing data on key airport lighting equipment revenues through secondary research. The airport lighting system offerings are also taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall market size from the revenue of key players in the market. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key personnel, such as CEOs, VPs, directors, and executives. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process, and arrive at the exact statistics for all segments and subsegments. The breakdown of profiles of primaries is depicted in the below figure:

To know about the assumptions considered for the study, download the pdf brochure

The ecosystem of the airport lighting market comprises type, position, and technology industries. Various airport lighting solution providers include ADB Airfield Solutions (U.S.), Honeywell International, Inc. (U.S.), ABB (Switzerland), and Hella KGaA Hueck & Co. (Germany), among others. Contracts comprise the major strategy adopted by key players in the global airport lighting market. This report would help the airport lighting manufacturers, suppliers, distributers, and sub-component manufacturers to identify hot revenue pockets in this market.

Target Audience for this Report

- Airport Lighting Manufacturers

- Original Equipment Manufacturers

- Sub-component Manufacturers

- Technology Support Providers

“Study answers several questions for the stakeholders, primarily which market segments to focus in next two to five years for prioritizing the efforts and investments”.

Scope of the Report:

Airport Lighting Market, By Type

- Runway Lighting Systems

- Taxiway Lighting Systems

- Apron Lighting Systems

Airport Lighting Market, By Position

- In-Pavement/Inset Lights

- Elevated Lights

- Precision Approach Path Indicator

Airport Lighting Market, By Geography

- North America

- Europe

- Asia-Pacific

- Middle East

- Rest of the World

Available Customizations

- Along with the market data, MarketsandMarkets offers customizations as per specific needs of a company. The following customization options are available for the report:

- Geographic Analysis

- Further breakdown of the RoW airport lighting market

- Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Airport Lighting Market

Understand the annual spend in the global, US, North-American, and South-American Airfield Ground Lighting markets.

We are a trading company providing airport equipment. For now we want to expand our business and look for some good supplier in airfield lighting.