5G in Defense Market by Platform (Land, Naval, Airborne), Solution (Communication Network,Chipset, Core Network), End User, Network Type, Installation and Region- Global Forecast to 2028

Update: 11/22/2024

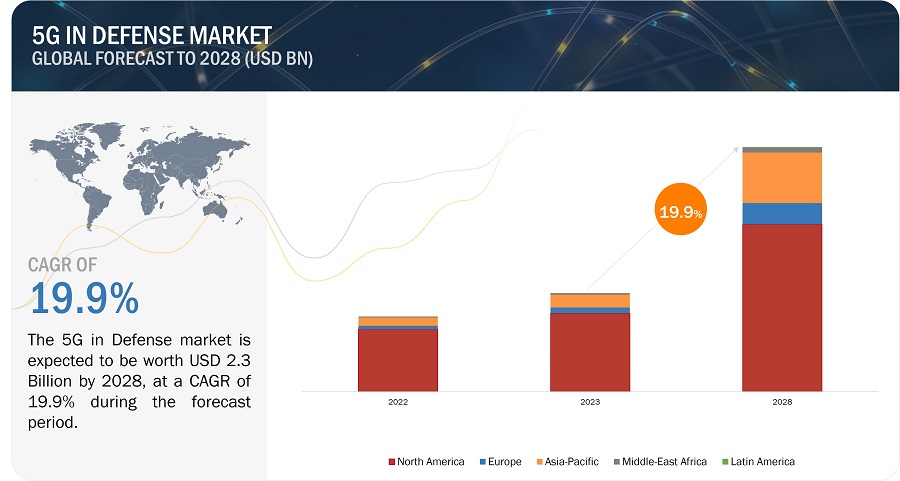

The Global 5G in Defense Market Size was valued at USD 0.9 Billion in 2023 and is estimated to reach USD 2.3 Billion by 2028, growing at a CAGR of 19.9% during the forecast period.

5G in Defense Market Key Takeaways

-

By enhancing battlefield connectivity, defense forces are adopting high-speed, low-latency networks to support capabilities such as real-time surveillance, unmanned systems, and secure data exchange transforming traditional operations into agile, digitally enabled missions.

-

By shifting procurement strategies, military organizations in North America and Europe are increasing investment in 5G infrastructure expanding test zones and collaborations with telecom providers to integrate commercial-grade networks into defense-grade scenarios.

-

By making interoperability a priority, demand for enterprise-grade 5G systems that can integrate with existing radar, satellite, and terrestrial communications is rising, enabling seamless interaction between legacy and cutting-edge platforms.

-

By localizing production, Asia Pacific is gaining ground as a strategic hub, with countries like India, South Korea, and Japan pushing for homegrown 5G defense solutions reducing dependency on imports and boosting domestic manufacturing capabilities.

-

By driving resilient operations, the need for secure and robust networks capable of withstanding cyber threats and electromagnetic interference is leading to increased adoption of hardened 5G architectures critical for missions in contested environments.

-

By evolving training and workforce skills, defense establishments are investing in workforce readiness programs, preparing personnel to operate and maintain complex 5G-enabled systems bridging the technical gap between traditional forces and tech-driven units.

-

By enabling joint exercises and exercises abroad, strategic alliances such as NATO are leveraging 5G deployments in multinational drills especially across Europe and North America to test interoperability, enhance situational awareness, and drive coordinated defense readiness.

Market Size & Forecast Report

-

2023 Market Size: USD 0.9 Billion

-

2028 Projected Market Size: USD 2.3 Billion

-

CAGR (2023-2028): 19.9%

-

Asia Pacific market : Significant Growth Rate

The 5G in Defense Industry is a rapidly growing market, and it is expected to continue to grow in the coming years. The potential of 5G technology to transform the defense sector is significant, primarily through the provision of enhanced, reliable communication and augmented data processing capacities. 5G and AI's synergistic growth could lead to a new era of capabilities for the defense sector. This emerging technology, characterized by its incredibly fast transmission speeds and ability to handle vast amounts of data, will usher in a multitude of critical IoT applications. These applications will involve capturing and processing data almost instantaneously.

5G in Defense Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

5G In defense Market Dynamics:

Drivers: 5G in elevation of growing Situational Awareness drives the market

First responders and public safety officials in the field act as both contributors and recipients of heightened situational awareness. These ground forces can offer valuable data inputs through sensors they employ, body-mounted cameras, and direct observations of the circumstances. Access to both on-site information and off-site data helps optimize decision-making. The capacity for public safety agencies to share actionable intelligence not only allows for superior personnel management but also facilitates coordination with each other, command units, or other agencies. Public safety operations stand to gain from the high speeds and minimal latency that 5G can deliver, technologies such as augmented reality (AR), virtual reality (VR), drone-acquired data, real-time situational intelligence, and more form the basis of these advantages.

With high-speed data transmission, 5G allows real-time or near-real-time collection, processing, and distribution of data. This could include data from various sources such as drones, satellites, sensors, and other surveillance systems, which can be quickly processed and distributed to provide a comprehensive picture of the operational environment.

Situational awareness relies on appropriate data capture solutions, including wearables, cameras, sensors, and drones, along with mechanisms to analyze and prioritize the data for quicker and better decision-making.

Drivers: Technological innovations in 5G network

Technological advancements surrounding 5G networks escalates the need for speedy and dependable transmission networks to satisfy the connectivity needs of advanced devices such as robots, sensors, drones, and autonomous vehicles used by defense entities. The 5G network provides real-time connectivity, machine to machine communication, high network speed, and other capabilities, which are advantageous in linking intelligent devices used by homeland security and intelligence agencies for reconnaissance and intelligence tasks. The 5G networks apply the ultra-high frequency (UHF) radio spectrum, with the frequency range of 300 MHz to 3 GHz, providing frequency hopping for tactical radios used by military, federal, and public agencies. For example, utilizing sub 6 GHz and mmWave 5G networks can be utilized in use-cases such as border surveillance, where high power and low latency, and in smart bases which will utilize low power and long-range networks. Additional advancements include implementing small cell base stations to supplement wireless networks resulting in additional network capacity. The deployment of Network Functions Virtualization (NFV ) both at the edge and core of the 5G network, beam-forming antenna, 5G New Radio (NR) technology, Cellular Vehicle-To-Everything (C-V2X) technology, and Multi-Input Multi-Output (MIMO) antennas contribute to the architecture development, coverage expansion, communication improvement, and high throughput power connection in the radio network. The technological advancements in the 5G frameworks it was developed to improve military base operations effieciency and productivity, create a marketplace for advancing the 5G in defense marketplace.

Restraints: High investments in early phases

The substantial costs involved in the development and deployment of 5G networks pose a significant challenge. The technology necessitates new hardware for both the network infrastructure and the end-user devices intending to utilize it. In addition to the physical infrastructure, ensuring robust network security is also imperative, especially in the defense sector where sensitive data is at stake. These security measures also require substantial investments, thus further amplifying the cost barrier in the path of 5G adoption. 5G technology necessitates a considerable upgrade from existing telecommunications infrastructure. This includes the need for new base stations, antenna systems, and data centers. The higher frequency bands used in 5G also mean that more antennas are needed to cover the same area as previous generations of network technology. Accessing the radio spectrum needed for 5G can be costly. Governments typically auction off these rights, which can lead to high prices. For example, in 2019, the German government raised approximately $7.6 billion through a 5G spectrum auction. Compared to the current network, 5G will require 8-10 times more base stations, resulting in high capital investments by defense forces. During deployment, the total cost of base stations and new hardware adds up to the overall cost.

Restraints: Lack of established protocols and standards

Standards are important for network interoperability, reliability, and security. They describe the technical requirements and processes to be followed, which may support greater integration of 5G networks with legacy systems and technologies. Use cases for 5G in defense can come with unique needs for security, reliability, and performance - which could go unmet in the commercial 5G standards altogether. For example, defense operations may require stronger encryption, lower latency, or tighter device density than civilian scenarios.

Countries have different requirements, or standards, for 5G, which could pose interoperability issues. The lack of a viable global standard could pose a challenge to multinational defense operations or initiatives. Delay in utilization for military applications exists as hardware suppliers are not available. Some of the leading vendors are Huawei (China), Nokia (Finland), and Ericsson (Sweden) amongst others.

In summary, 5G offers considerable potential benefits to the defense sector; however, the established protocols or standards are a considerably large constraint that must be fixed to advance these benefits fully.

Opportunities: Increased defense budgets for R&D and technological advancements

Elevated defense budgets globally offer a significant opportunity for the advancement of 5G in the defense sector. This financial growth allows for more capital to be allocated towards technological upgrades, including 5G implementation. Countries with significant defense budgets, such as the U.S., China, Russia, and India, are likely to invest in 5G to maintain their technological edge in military operations.

Autonomous vehicles, drones, and robots are critical components of the military sector. These are autonomous gadgets that use telecommunication technology such as the 5G network to give real-time services to military agencies in risky, inconvenient, and impossible regions of operation, such as remote monitoring for enemy soldiers. Various governments throughout the world have concentrated on the development of unmanned systems for use in public and national security purposes. Several governments, both developed and developing, have invested billions of dollars in autonomous military projects, including the US, Russia, China, the European Union, India, and others.

In 2022, the world saw a substantial rise in military spending, as total global military expenditure increased by 3.7% in real terms, hitting a record high of $2240 billion. Europe experienced its sharpest annual increase in military spending in over three decades. Most of the global military expenditure was dominated by the United States, China, and Russia, collectively accounting for 56% of the worldwide total.

Opportunities: Rise in virtual networking architecture

The introduction of 5G technology has ushered in a series of innovative breakthroughs into the field of telecommunications and connectivity. Most notably, 5G reduces latency to as low as 1 millisecond. Reduced latency is critical for user applications requiring real-time decision making, such as for autonomous vehicle teleoperated vehicles or some types of remote surgery. 5G is capable of accommodating a significant number of connected devices at scale, up to 1 million devices per square kilometer. 5G is a class of virtual network architecture mechanism using similar concepts based on SDN, network functions virtualization (NFV), in the core network and RAN, to enable multiple virtual networks, that operate on the same physical underlying hardware to enable greater efficiency with resource usage. 5G will also operate in mmWave frequency bands achieving much higher throughput data rates, however, mmWave frequencies have a trade-off of shorter wave propagation distance and an increased chance of being blocked by physical objects. New technology will have to mitigate these disadvantages. Beamforming is a significant new technology development associated with 5G. In beamforming network antennas operate by sending focused beams of data to a single user rather than broadcasting in all directions in an effort to minimize signal quality and data speeds. 5G also increases efficiency and total speed.

Challenges: Complexity of Spectrum Management for 5G Deployment in Defense

Given the increasing demand for spectrum, there's growing interest in dynamic spectrum sharing, where the same frequencies can be used by different services at different times or in different locations. However, implementing spectrum sharing can be technologically complex and requires sophisticated management systems to avoid interference.

Another issue is potential interference between different uses of the spectrum. For instance, there's been concern about potential interference between 5G services in the 24 GHz band and weather satellites that operate in nearby frequencies. Such interference could potentially degrade the accuracy of weather forecasts. Mitigating this risk requires careful planning and coordination between different spectrum users and regulatory bodies.

The radio frequency spectrum, which includes both sub-6 GHz and millimeter-wave (mmWave) bands, is a limited resource governed by international and national regulatory bodies. In many countries, these bodies allocate different parts of the spectrum to different types of services, such as television broadcasting, mobile networks, satellite communications, and radar systems. Balancing the needs of these different services can be challenging, particularly as demand for spectrum increases. 5G networks use higher frequency bands in the mmWave range (24 GHz and above) to provide very high data rates. However, these frequencies have shorter range and are more susceptible to interference and signal degradation due to physical obstructions or atmospheric conditions. To overcome these challenges, 5G networks use technologies such as beamforming and massive MIMO (multiple-input, multiple-output) to improve signal strength and quality.

In the defense sector, effective spectrum management is particularly critical given the need for reliable and secure communications in a variety of challenging environments.

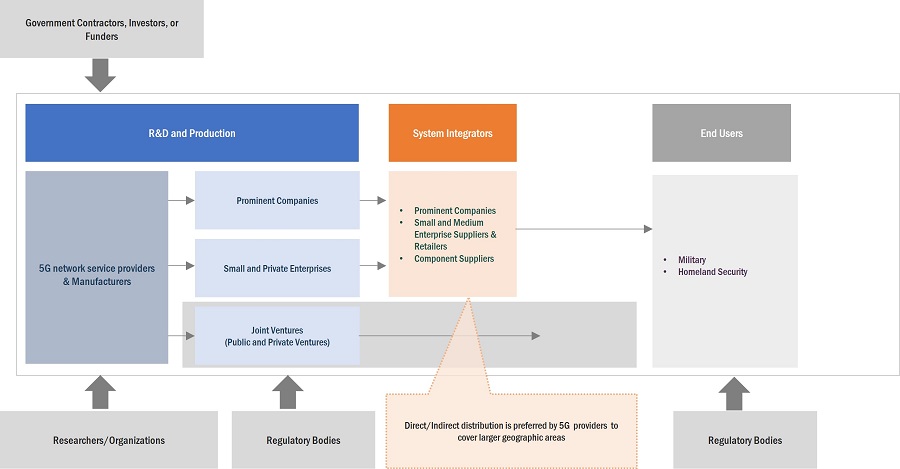

5g In Defense Market Ecosystem

Ericsson (Sweden), Huawei (China), Nokia Networks (Finland), Samsung (South Korea), NEC (Japan), Thales Group (France), L3Harris Technologies, Inc. (US), Raytheon Technologies (US), Ligado Networks (US), Intelsat (Luxembourg), Orange (France), Qualcomm, Inc. (US) and Wind River Systems, Inc. (US). are some of the leading companies in the 5G in Defense market.

Based on platform, the airborne segment is projected to grow at the highest CAGR in the 5G in defense market during the forecast period

Airborne 5G integration in the defense market has the potential to significantly enhance capabilities and transform military aerial operations. On the battlefield, quick management decisions need to be taken to enable operators to switch tactics during defense operations. This is achieved through real-time data sharing leveraging 5G’s low latency. 5G systems deployed on the airborne platform can facilitate secure data sharing to support interoperability between different platforms. Major countries, such as the US, China, France, and India, are increasing their spending on the deployment of 5G on airborne platforms to enhance their surveillance and attack capabilities. 5G can greatly enhance UAV and drone operations. High-speed data transmission allows for real-time video and sensor data streaming, crucial for surveillance, reconnaissance, and combat operations. The ultra-low latency of 5G can also support better remote control of UAVs in environments where every millisecond counts. 5G can ensure seamless data integration between airborne assets and ground or naval forces, creating a unified combat picture and improving joint operations' efficiency. 5G can facilitate communication between multiple drones, enabling swarm drone operations. Such drone swarms can collaboratively undertake tasks, be it for surveillance, electronic warfare, or even offensive operations.

Based on Solution, the core network segment is highest market share the 5G in defense during the forecast period

There is a growing demand for faster connectivity, high-speed data transfer, and highly responsive networks. Core network architectures are currently undergoing transformative changes, thanks to the introduction of concepts like Software-Defined-Networking (SDN) for improved control and Network Function Virtualization (NFV) for streamlined services, among others. These innovations are pivotal for the next-generation applications in 5G and location-centric IoT/wireless sensor network services. The rapid increase of IoT devices in Edge networks propels the expansion of a universally connected internet ecosystem. In the spectrum from Cloud to IoT devices, processing information at the Edge necessitates the creation of robust security measures within the framework of fog computing. Fog Computing distributes compute, communication, control, storage, and decision-making closer to where the data originates, enabling faster processing times and lowering network costs.Fog is an extension of the traditional cloud-based computing model where implementations of the architecture can reside in multiple layers of a network’s topology. By adding layers of fog nodes, applications can be partitioned to run at the optimal network level.

Based on Network Type, the EMBB segment has highest market share in the 5G in defense market during the forecast period

5G's enhanced mobile broadband (eMBB) stands as the pioneering category, introducing the general populace to 5G's advantages. Even in challenging environments, 5G eMBB ensures top-tier internet connectivity. It promises mobile broadband speeds in the gigabit range and greater data bandwidth. When 5G eMBB is integrated with mMTC and URLLC, it fortifies wireless networks to fulfill their essential needs. Incorporating eMBB, URLLC, and mMTC within 5G can significantly bolster large-scale IoT and critical ventures, with sectors like healthcare, defense, and industry standing to benefit immensely.

5G eMBB enables the following:

- Robust indoor connections across numerous devices in areas with high population density.

- A uniform user experience ensured by extensive network coverage.

- Instantaneous communication and connection, even when mobile broadband services are utilized from vehicles in motion.

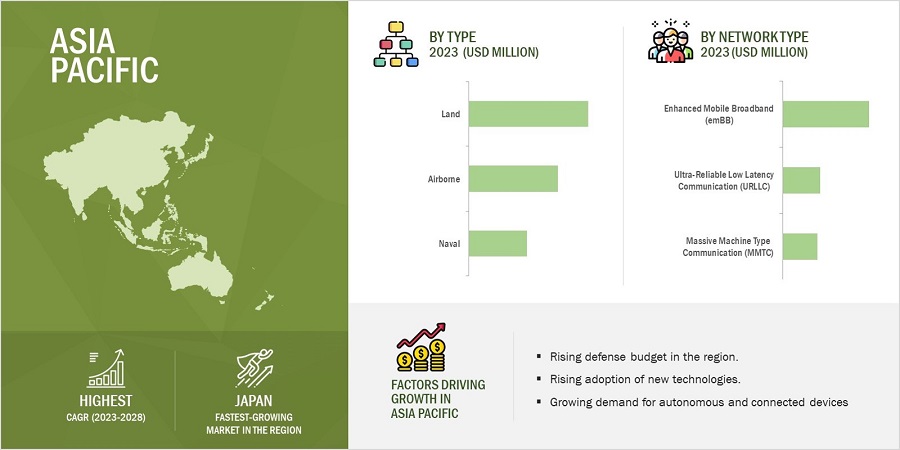

Asia Pacific is expected to account for the highest CAGR in the forecasted period

5G technology in the Asia-Pacific region are experiencing significant growth due to countries such as China, South Korea, and Japan which have advanced considerably in rolling out 5G networks, leading to a surge in demand for 5G technologica solutions. The widespread establishment of 5G networks in these and other countries in the area has propelled the expansion of the 5G testing market. In the Asia Pacific region, several sectors such as manufacturing, healthcare, automotive, and smart cities are embracing 5G technology to revolutionize their processes. To ensure the performance, security, and dependability of their 5G-integrated applications and services, these sectors necessitate faster adaption of technology. This need for sector-specific solutions has spurred the expansion of the 5G market in the Asia Pacific. The worldwide growth has been further facilitated by positive economic scenarios and strategic partnerships.

5G in Defense Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Europe is expected to account for the second highest CAGR in the forecasted period.

Europe covers UK, France, Germany, Italy, and Russia in the study. The market in the European region is projected to register a CAGR of 29.5% during the forecast period. The UK is estimated to account for 19.17% of the Europe 5G in defense market in 2023. The Europe 5G in defense market will be able to grow substantially mainly due to a rising need for high-speed internet access, increasingly popular mobile broadband and IoT applications, and a demand for effective communication networks. Ericsson (Sweden), Nokia (Finland), and Thales Group (France) are prominent players in terms of 5G technology in Europe. Accelerating the market's growth has been the new partnership between mobile operators and governments and private companies' investments to embrace and support 5G in defense. The European market will have a significant opportunity to revolutionize communication and be able to deliver high-speed internet services and applications to many locations with the accelerated deployment of 5G capabilities. An example of this is the European Defence Fund (EDF) has begun a project called 5G COMPAD (5G Communications for Peacekeeping and Defence) to enhance the ability of European military forces with enhanced communication systems that improve functionality while reducing lifecycle costs.

Middle East and Africa is expected to account for the third highest CAGR in the forecasted period.

The Middle East & Africa 5G in defense market is increasing due to various countries recognizing the need to secure their borders. 5G networks provide a competitive advantage in speed, precision, and capability to defeat current missile defense systems. Implementing 5G networks in defense infrastructures addresses connectivity issues typical in remote parts of the region, increases digital inclusivity, provides access to resources in an emergency, and improves economic growth. The energy and utilities industry within the Middle East can benefit from 5G technology because of its ability to provide real-time monitoring, predictive maintenance, and improvement in operational efficiency. Integrating 5G with precision agriculture methods/trends offers ways to improve farming efficiency while ensuring food security in Africa. 5G in defense enables improvements in emergency response and disaster management capabilities, which include greater resilience and coordination during human-made or natural disasters. Resolving the connectivity issues facing rural areas by deploying 5G networks can enable economic growth through e-commerce and empower rural communities.

Key Market Players

The 5G in Defense Companies is dominated by a few globally established players such as:

- Ericsson (Sweden)

- Huawei (China)

- Nokia Networks (Finland)

- Samsung (South Korea)

- NEC (Japan)

- Thales Group (France)

- L3Harris Technologies, Inc. (US)

- Raytheon Technologies (US)

- Ligado Networks (US)

- Wind River Systems, Inc. (US).

are some of the leading companies in the 5G in Defense market. These companies have well-equipped manufacturing facilities and strong distribution networks across North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Scope of the Report

|

Report Metric |

Details |

| Estimated Value | USD 0.9 billion in 2023 |

| Projected Value | USD 2.3 billion by 2028 |

| Growth Rate | CAGR of 19.9% |

|

Market Size Available for Years |

2020–2028 |

|

Base Year Considered |

2022 |

|

Forecast Period |

2023–2028 |

|

Forecast Units |

Value (USD billion) |

|

Segments Covered |

By Platform, By Solution, By End User, By Network Type, By Operational Frequency, By Installation. |

|

Geographies Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Companies Covered |

Ericsson (Sweden), Huawei (China), Nokia Networks (Finland), Samsung Electronics Co Ltd.(South Korea), NEC (Japan), Thales Group (France), L3Harris Technologies, Inc. (US), Raytheon Technologies (US), Ligado Networks (US), and Wind River Systems, Inc. (US). (25 countries) |

5G in Defense Market Highlights

This research report categorizes 5G in defense based on By Platform, By Solution, By End User, By Network Type, By Operational Frequency, By Installation & Region.

|

Segment |

Subsegment |

|

By Solution |

|

|

By Platform |

|

|

By End User |

|

|

By Network Type |

|

|

By Operational Frequency |

|

|

By Installation |

|

|

By Region |

|

Recent Developments

- In February 2023 , Nokia announced that it has been selected by MTN South Africa (MTN SA) for the first time ever as one of its 5G Radio Access Network (RAN) equipment providers..

- In February 2023, The US Navy collaborates with Qualcomm to explore 5G and artificial intelligence technologies. This is a research collaboration agreement to explore s 5G, artificial intelligence, and cloud computing.

- In May 2022, BT and Ericsson announced today a multi-million-pound partnership to deliver commercial 5G private networks for the UK market. This marks the first such agreement in the nation. BT and Ericsson have entered into a multi-year agreement, allowing BT to offer next-generation mobile network technology products to entities in sectors including manufacturing, defense, education, retail, healthcare, transport, and logistics.

- In July 2022, Nokia announced an expansion of its collaboration with Hill Air Force Base and the National Spectrum Consortium. The objective of this partnership is to ensure harmonious coexistence between incumbent radar systems and 5G networks within a shared spectrum. This is achieved by real-time adjustments to the 5G system's behavior whenever the incumbent radar is active.

Key Questions Addressed by the Report:

What is the current size of the 5G In defense market?

The 5G In defense Market is estimated to be USD 0.9 Billion in 2023 to USD 2.3 by 2028, at a CAGR of 19.9% during the forecast period.

What are the key sustainability strategies adopted by leading players operating in the military 5G In defenses market?

Response: Key players have adopted various organic and inorganic strategies to strengthen their position in the 5G in defense. Ericsson (Sweden), Huawei (China), Nokia Networks (Finland), Samsung Electronics Co Ltd. (South Korea), NEC (Japan), Thales Group (France), L3Harris Technologies, Inc. (US), Raytheon Technologies (US), Ligado Networks (US), and Wind River Systems, Inc. (US). are some of the leading companies in the 5G in defense market.

What new emerging technologies and use cases disrupt the 5G in defense market?

Response: Some of the major emerging technologies and use cases disrupting the market include the developing proprietary 5G technologies tailored for defense applications, Offering pilot programs or demonstrations and investing in research and development to create cutting-edge 5G technologies and applications.

Who are the key players and innovators in the ecosystem of the 5G in defense market?

Response: . Ericsson (Sweden), Huawei (China), Nokia Networks (Finland), Samsung Electronics Co Ltd. (South Korea), NEC (Japan).

Which region is expected to hold the highest market share in the 5G In defense market?

Response: In 2023, Asia Pacific held the greatest market share for 5G In defense , and during the forecast period, Japan is anticipated to grow at the highest CAGR.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Use of 5G in situational awareness operations- Technological innovations in 5G network- Growing use of autonomous and connected devices integrated with 5G- Transition from legacy systems to cloud-based solutions- Increasing demand for high-speed and low-latency connectivityRESTRAINTS- High investments in early phases- Lack of established protocols and standardsOPPORTUNITIES- Increasing defense budgets for R&D and technological advancements in unmanned systems- Rise in virtual networking architectureCHALLENGES- Complexities in spectrum management

-

5.3 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESSREVENUE SHIFT AND NEW REVENUE POCKETS FOR 5G IN DEFENSE MANUFACTURERS

- 5.4 RECESSION IMPACT ANALYSIS

-

5.5 ECOSYSTEM ANALYSISPROMINENT COMPANIESPRIVATE AND SMALL ENTERPRISESEND USERS

-

5.6 TECHNOLOGY ANALYSISMASSIVE MIMONON-STANDALONE 5G NETWORKS

-

5.7 PRICING ANALYSISAVERAGE SELLING PRICE TRENDS OF 5G IN DEFENSE, BY COMMUNICATION NETWORK

- 5.8 VALUE CHAIN ANALYSIS

-

5.9 CASE STUDY ANALYSISCRITICAL COMMUNICATIONS (CC) AND ULTRA-RELIABLE AND LOW-LATENCY COMMUNICATIONS (URLLC)SUCCESSFUL DEMONSTRATION UNDER US DOD’S 5G-TO-NEXT G INITIATIVE5G EMERGENCY RESCUE PLATFORM

-

5.10 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.11 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.12 TARIFF AND REGULATORY LANDSCAPE

- 5.13 KEY CONFERENCES AND EVENTS, 2023–2024

- 6.1 INTRODUCTION

-

6.2 KEY TECHNOLOGICAL TRENDS IN 5G IN DEFENSE MARKETAUGMENTED REALITY (AR) AND VIRTUAL REALITY (VR)EDGE COMPUTINGCLOUD COMPUTINGSMALL CELL NETWORK

-

6.3 IMPACT OF MEGATRENDSREAL-TIME DATA COLLECTION USING INTERNET OF THINGSINTEGRATION OF ARTIFICIAL INTELLIGENCE IN DEFENSE SOLUTIONS

- 6.4 INNOVATIONS AND PATENT REGISTRATIONS

- 7.1 INTRODUCTION

-

7.2 COMMUNICATION NETWORKSMALL CELLS- Provide better quality cellular coverage and capacity, especially in urban areasMACRO CELLS- Offer extensive coverage crucial for defense operations in remote or less dense areas

-

7.3 CHIPSETAPPLICATION-SPECIFIC INTEGRATED CIRCUIT (ASIC) CHIPSETS- Custom-designed and tailored for specific tasksRADIO FREQUENCY INTEGRATED CIRCUIT (RFIC) CHIPSETS- Process and produce high-frequency signalsMILLIMETER WAVE (MMWAVE) CHIPSETS- Deal with frequency bands from 30 to 300 GHz

-

7.4 CORE NETWORKSOFTWARE-DEFINED NETWORKING (SDN)- Allows for dynamic, programmatically efficient network configurationFOG COMPUTING (FC)- Offers high-speed data transfer protocol used in storage area networksMOBILE EDGE COMPUTING (MEC)- Enables cloud computing capabilities and IT service environment at cellular network edgeNETWORK FUNCTIONS VIRTUALIZATION (NFV)- Enables network operators to easily implement different network functions

- 8.1 INTRODUCTION

-

8.2 LANDADVANCEMENTS IN LAND-BASED MILITARY AND WEAPON SYSTEMS TO DRIVE MARKET- Armored fighting vehicles- Unmanned ground vehicles- Command centers- Dismounted soldier systems

-

8.3 NAVALINCREASING NUMBER OF SENSORS ON SHIPS AND ADVANCEMENTS IN RADAR TECHNOLOGY TO DRIVE MARKET- Aircraft carriers- Amphibious ships- Destroyers- Frigates- Submarines- Unmanned maritime vehicles

-

8.4 AIRBORNEINCREASING SPENDING BY COUNTRIES ON 5G DEPLOYMENT ON AIRBORNE PLATFORMS TO DRIVE MARKET- Military aircraft- Unmanned aerial vehicles- Military helicopters

- 9.1 INTRODUCTION

-

9.2 MILITARY5G TO ENHANCE MILITARY CAPABILITIES AND HELP MAINTAIN TECHNOLOGICAL ADVANTAGE ON BATTLEFIELD

-

9.3 HOMELAND SECURITY5G TO ENHANCE SURVEILLANCE AND TRAINING CAPABILITIES

- 10.1 INTRODUCTION

-

10.2 ENHANCED MOBILE BROADBANDOFFERS HIGH SPEED AND HIGH BANDWIDTH FOR RELIABLE CONNECTIVITY ON THE MOVE

-

10.3 ULTRA-RELIABLE AND LOW-LATENCY COMMUNICATIONSUSED IN INDUSTRIAL AUTOMATION TO INCREASE PRODUCTIVITY

-

10.4 MASSIVE MACHINE-TYPE COMMUNICATIONS5G IN DEFENSE EMPOWERS MASSIVE MACHINE-TYPE COMMUNICATIONS TO SUPPORT SENSOR DEPLOYMENTS

- 11.1 INTRODUCTION

-

11.2 LOWLOW OPERATING FREQUENCY OFFERS COVERAGE AND CAPACITY BENEFITS

-

11.3 MEDIUMMID-BAND SPECTRUM OFFERS MIDDLE GROUND BETWEEN PERFORMANCE AND COVERAGE

-

11.4 HIGHHIGH OPERATIONAL FREQUENCY REQUIRED TO MEET ULTRA-HIGH BROADBAND SPEEDS PROJECTED FOR 5G

- 12.1 INTRODUCTION

-

12.2 UPGRADE5G ARCHITECTURE UPGRADE OPERATES IN MASTER–SLAVE CONFIGURATION

-

12.3 NEW IMPLEMENTATIONNEW IMPLEMENTATION NETWORK PROVIDES END-TO-END 5G EXPERIENCE TO USERS

- 13.1 INTRODUCTION

- 13.2 REGIONAL RECESSION IMPACT ANALYSIS

-

13.3 NORTH AMERICAPESTLE ANALYSIS: NORTH AMERICA- Political- Economic- Social- Technological- Legal- EnvironmentalUS- Increased spending by US DOD and private players to drive marketCANADA- Increased R&D in 5G technology to drive market

-

13.4 EUROPEPESTLE ANALYSIS: EUROPE- Political- Economic- Social- Technological- Legal- EnvironmentalUK- New developments and investment in military equipment to drive marketFRANCE- Increased R&D investment in 5G for defense to drive marketGERMANY- Continuous focus on upgrading battle management and communications systems to drive marketITALY- Increasing development of secure communications systems to drive marketRUSSIA- Increasing deployment of AI in command & control to modernize military forces to drive market

-

13.5 ASIA PACIFICPESTLE ANALYSIS: ASIA PACIFIC- Political- Economic- Social- Technological- Legal- EnvironmentalCHINA- Military technology modernization and increase in defense budget to drive marketJAPAN- Enhancement of defense and surveillance capabilities to drive marketINDIA- Increasing demand for ISR, real-time information, and telecommunication to drive marketSOUTH KOREA- Development of new technologies and increased government investment to drive marketAUSTRALIA- Growing demand for advanced network technology to drive marketMIDDLE EAST & AFRICAPESTLE ANALYSIS: MIDDLE EAST & AFRICA- Political- Economic- Social- Technological- Legal- EnvironmentalSAUDI ARABIA- Increasing military expenditure to drive marketISRAEL- Heavy investment in 5G-related telecommunications to drive marketTURKEY- Rising demand for modern and advanced military networking to drive marketSOUTH AFRICA- Rising demand for modern digital technologies in military equipment to drive marketLATIN AMERICAPESTLE ANALYSIS: LATIN AMERICA- Political- Economic- Social- Technological- Legal- EnvironmentalBRAZIL- Expansion of telecommunication services to drive marketMEXICO- Growing demand for high network speeds and low latency communications systems to drive market

- 14.1 INTRODUCTION

- 14.2 COMPANY OVERVIEW

- 14.3 MARKET RANKING ANALYSIS, 2022

- 14.4 REVENUE ANALYSIS OF KEY MARKET PLAYERS, 2020–2022

- 14.5 MARKET SHARE ANALYSIS, 2022

-

14.6 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

14.7 START-UP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESSTARTING BLOCKSDYNAMIC COMPANIES

- 14.8 COMPETITIVE BENCHMARKING

-

14.9 COMPETITIVE SCENARIOMARKET EVALUATION FRAMEWORKPRODUCT LAUNCHESDEALS

- 15.1 INTRODUCTION

-

15.2 KEY PLAYERSERICSSON- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewNOKIA- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewNEC CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSAMSUNG ELECTRONICS CO., LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewHUAWEI- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTHALES GROUP- Business overview- Products/Solutions/Services offered- Recent developmentsRAYTHEON TECHNOLOGIES CORPORATION- Business overview- Products/Solutions/Services offered- Recent developmentsINTELSAT- Business overview- Products/solutions/services offered- Recent developmentsQUALCOMM, INC.- Business overview- Products/Solutions/Services offered- Recent developmentsCISCO SYSTEMS, INC.- Business overview- Products/Solutions/Services offeredVERIZON COMMUNICATIONS, INC.- Business overview- Products/Solutions/Services offered- Recent developmentsDEUTSCHE TELEKOM AG- Business overview- Products/Solutions/Services offered- Recent developmentsORANGE S.A.- Business overview- Products/Solutions/Services offered- Recent developmentsGOGO, INC.- Business overview- Products/Solutions/Services offeredLIGADO NETWORKS- Business overview- Products/Solutions/Services offered- Recent developmentsWIND RIVER SYSTEMS, INC.- Business overview- Products/Solutions/Services offeredANALOG DEVICES, INC.- Business overview- Products/Solutions/Services offered- Recent developmentsINTEL CORPORATION- Business overview- Products/Solutions/Services offered- Recent developmentsL3HARRIS TECHNOLOGIES, INC.- Business overview- Products/Solutions/Services offered

-

15.3 OTHER PLAYERSCOMBA TELECOMSTERLITE TECHNOLOGIES LTD.T-MOBILE US, INC.TELECOM ITALIAMARVELLMEDIATEK INC.

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS

- TABLE 1 INCLUSIONS AND EXCLUSIONS IN 5G IN DEFENSE MARKET

- TABLE 2 USD EXCHANGE RATES

- TABLE 3 DETAILS OF PRIMARY INTERVIEWEES

- TABLE 4 ROLE OF COMPANIES IN MARKET ECOSYSTEM

- TABLE 5 AVERAGE SELLING PRICE TRENDS OF 5G IN DEFENSE, BY COMMUNICATION NETWORK, 2022 (USD/UNIT)

- TABLE 6 ULTRA-RELIABLE AND LOW-LATENCY COMMUNICATIONS (URLLC)

- TABLE 7 5G IN DEFENSE MARKET: IMPACT OF PORTER’S FIVE FORCES

- TABLE 8 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE PLATFORMS (%)

- TABLE 9 KEY BUYING CRITERIA FOR TOP THREE PLATFORMS

- TABLE 10 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 11 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 12 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 13 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 14 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 15 5G IN DEFENSE MARKET: KEY CONFERENCES AND EVENTS, 2023−2024

- TABLE 16 INNOVATIONS AND PATENT REGISTRATIONS, 2020–2023

- TABLE 17 5G IN DEFENSE MARKET, BY SOLUTION, 2020–2022 (USD MILLION)

- TABLE 18 5G IN DEFENSE MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 19 5G IN DEFENSE MARKET, BY COMMUNICATION NETWORK, 2020–2022 (USD MILLION)

- TABLE 20 5G IN DEFENSE MARKET, BY COMMUNICATION NETWORK, 2023–2028 (USD MILLION)

- TABLE 21 5G IN DEFENSE MARKET, BY CHIPSET, 2020–2022 (USD MILLION)

- TABLE 22 5G IN DEFENSE MARKET, BY CHIPSET, 2023–2028 (USD MILLION)

- TABLE 23 5G IN DEFENSE MARKET, BY CORE NETWORK, 2020–2022 (USD MILLION)

- TABLE 24 5G IN DEFENSE MARKET, BY CORE NETWORK, 2023–2028 (USD MILLION)

- TABLE 25 5G IN DEFENSE MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 26 5G IN DEFENSE MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 27 5G IN DEFENSE MARKET, BY END USER, 2020–2022 (USD MILLION)

- TABLE 28 5G IN DEFENSE MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 29 5G IN DEFENSE MARKET, BY NETWORK TYPE, 2020–2022 (USD MILLION)

- TABLE 30 5G IN DEFENSE MARKET, BY NETWORK TYPE, 2023–2028 (USD MILLION)

- TABLE 31 5G IN DEFENSE MARKET, BY OPERATIONAL FREQUENCY, 2020–2022 (USD MILLION)

- TABLE 32 5G IN DEFENSE MARKET, BY OPERATIONAL FREQUENCY, 2023–2028 (USD MILLION)

- TABLE 33 5G IN DEFENSE MARKET, BY INSTALLATION, 2020–2022 (USD MILLION)

- TABLE 34 5G IN DEFENSE MARKET, BY INSTALLATION, 2023–2028 (USD MILLION)

- TABLE 35 REGIONAL RECESSION IMPACT ANALYSIS

- TABLE 36 5G IN DEFENSE MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 37 5G IN DEFENSE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 38 NORTH AMERICA: 5G IN DEFENSE MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 39 NORTH AMERICA: 5G IN DEFENSE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 40 NORTH AMERICA: 5G IN DEFENSE MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 41 NORTH AMERICA: 5G IN DEFENSE MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 42 NORTH AMERICA: 5G IN DEFENSE MARKET, BY END USER, 2020–2022 (USD MILLION)

- TABLE 43 NORTH AMERICA: 5G IN DEFENSE MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 44 NORTH AMERICA: 5G IN DEFENSE MARKET, BY NETWORK TYPE, 2020–2022 (USD MILLION)

- TABLE 45 NORTH AMERICA: 5G IN DEFENSE MARKET, BY NETWORK TYPE, 2023–2028 (USD MILLION)

- TABLE 46 US: 5G IN DEFENSE MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 47 US: 5G IN DEFENSE MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 48 US: 5G IN DEFENSE MARKET, BY NETWORK TYPE, 2020–2022 (USD MILLION)

- TABLE 49 US: 5G IN DEFENSE MARKET, BY NETWORK TYPE, 2023–2028 (USD MILLION)

- TABLE 50 CANADA: 5G IN DEFENSE MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 51 CANADA: 5G IN DEFENSE MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 52 CANADA: 5G IN DEFENSE MARKET, BY NETWORK TYPE, 2020–2022 (USD MILLION)

- TABLE 53 CANADA: 5G IN DEFENSE MARKET, BY NETWORK TYPE, 2023–2028 (USD MILLION)

- TABLE 54 EUROPE: 5G IN DEFENSE MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 55 EUROPE: 5G IN DEFENSE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 56 EUROPE: 5G IN DEFENSE MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 57 EUROPE: 5G IN DEFENSE MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 58 EUROPE: 5G IN DEFENSE MARKET, BY NETWORK TYPE, 2020–2022 (USD MILLION)

- TABLE 59 EUROPE: 5G IN DEFENSE MARKET, BY NETWORK TYPE, 2023–2028 (USD MILLION)

- TABLE 60 UK: 5G IN DEFENSE MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 61 UK: 5G IN DEFENSE MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 62 UK: 5G IN DEFENSE MARKET, BY NETWORK TYPE, 2020–2022 (USD MILLION)

- TABLE 63 UK: 5G IN DEFENSE MARKET, BY NETWORK TYPE, 2023–2028 (USD MILLION)

- TABLE 64 FRANCE: 5G IN DEFENSE MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 65 FRANCE: 5G IN DEFENSE MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 66 FRANCE: 5G IN DEFENSE MARKET, BY NETWORK TYPE, 2020–2022 (USD MILLION)

- TABLE 67 FRANCE: 5G IN DEFENSE MARKET, BY NETWORK TYPE, 2023–2028 (USD MILLION)

- TABLE 68 GERMANY: 5G IN DEFENSE MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 69 GERMANY: 5G IN DEFENSE MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 70 GERMANY: 5G IN DEFENSE MARKET, BY NETWORK TYPE, 2020–2022 (USD MILLION)

- TABLE 71 GERMANY: 5G IN DEFENSE MARKET, BY NETWORK TYPE, 2023–2028 (USD MILLION)

- TABLE 72 ITALY: 5G IN DEFENSE MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 73 ITALY: 5G IN DEFENSE MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 74 ITALY: 5G IN DEFENSE MARKET, BY NETWORK TYPE, 2020–2022 (USD MILLION)

- TABLE 75 ITALY: 5G IN DEFENSE MARKET, BY NETWORK TYPE, 2023–2028 (USD MILLION)

- TABLE 76 RUSSIA: 5G IN DEFENSE MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 77 RUSSIA: 5G IN DEFENSE MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 78 RUSSIA: 5G IN DEFENSE MARKET, BY NETWORK TYPE, 2020–2022 (USD MILLION)

- TABLE 79 RUSSIA: 5G IN DEFENSE MARKET, BY NETWORK TYPE, 2023–2028 (USD MILLION)

- TABLE 80 ASIA PACIFIC: 5G IN DEFENSE MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 81 ASIA PACIFIC: 5G IN DEFENSE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 82 ASIA PACIFIC: 5G IN DEFENSE MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 83 ASIA PACIFIC: 5G IN DEFENSE MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 84 ASIA PACIFIC: 5G IN DEFENSE MARKET, BY END USER, 2020–2022 (USD MILLION)

- TABLE 85 ASIA PACIFIC: 5G IN DEFENSE MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 86 ASIA PACIFIC: 5G IN DEFENSE MARKET, BY NETWORK TYPE, 2020–2022 (USD MILLION)

- TABLE 87 ASIA PACIFIC: 5G IN DEFENSE MARKET, BY NETWORK TYPE, 2023–2028 (USD MILLION)

- TABLE 88 CHINA: 5G IN DEFENSE MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 89 CHINA: 5G IN DEFENSE MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 90 CHINA: 5G IN DEFENSE MARKET, BY NETWORK TYPE, 2020–2022 (USD MILLION)

- TABLE 91 CHINA: 5G IN DEFENSE MARKET, BY NETWORK TYPE, 2023–2028 (USD MILLION)

- TABLE 92 JAPAN: 5G IN DEFENSE MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 93 JAPAN: 5G IN DEFENSE MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 94 JAPAN: 5G IN DEFENSE MARKET, BY NETWORK TYPE, 2020–2022 (USD MILLION)

- TABLE 95 JAPAN: 5G IN DEFENSE MARKET, BY NETWORK TYPE, 2023–2028 (USD MILLION)

- TABLE 96 INDIA: 5G IN DEFENSE MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 97 INDIA: 5G IN DEFENSE MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 98 INDIA: 5G IN DEFENSE MARKET, BY NETWORK TYPE, 2020–2022 (USD MILLION)

- TABLE 99 INDIA: 5G IN DEFENSE MARKET, BY NETWORK TYPE, 2023–2028 (USD MILLION)

- TABLE 100 SOUTH KOREA: 5G IN DEFENSE MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 101 SOUTH KOREA: 5G IN DEFENSE MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 102 SOUTH KOREA: 5G IN DEFENSE MARKET, BY NETWORK TYPE, 2020–2022 (USD MILLION)

- TABLE 103 SOUTH KOREA: 5G IN DEFENSE MARKET, BY NETWORK TYPE, 2023–2028 (USD MILLION)

- TABLE 104 AUSTRALIA: 5G IN DEFENSE MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 105 AUSTRALIA: 5G IN DEFENSE MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 106 AUSTRALIA: 5G IN DEFENSE MARKET, BY NETWORK TYPE, 2020–2022 (USD MILLION)

- TABLE 107 AUSTRALIA: 5G IN DEFENSE MARKET, BY NETWORK TYPE, 2023–2028 (USD MILLION)

- TABLE 108 MIDDLE EAST & AFRICA: 5G IN DEFENSE MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 109 MIDDLE EAST & AFRICA: 5G IN DEFENSE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 110 MIDDLE EAST & AFRICA: 5G IN DEFENSE MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 111 MIDDLE EAST & AFRICA: 5G IN DEFENSE MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 112 MIDDLE EAST & AFRICA: 5G IN DEFENSE MARKET, BY END USER, 2020–2022 (USD MILLION)

- TABLE 113 MIDDLE EAST & AFRICA: 5G IN DEFENSE MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 114 MIDDLE EAST & AFRICA: 5G IN DEFENSE MARKET, BY NETWORK TYPE, 2020–2022 (USD MILLION)

- TABLE 115 MIDDLE EAST & AFRICA: 5G IN DEFENSE MARKET, BY NETWORK TYPE, 2023–2028 (USD MILLION)

- TABLE 116 SAUDI ARABIA: 5G IN DEFENSE MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 117 SAUDI ARABIA: 5G IN DEFENSE MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 118 SAUDI ARABIA: 5G IN DEFENSE MARKET, BY NETWORK TYPE, 2020–2022 (USD MILLION)

- TABLE 119 SAUDI ARABIA: 5G IN DEFENSE MARKET, BY NETWORK TYPE, 2023–2028 (USD MILLION)

- TABLE 120 ISRAEL: 5G IN DEFENSE MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 121 ISRAEL: 5G IN DEFENSE MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 122 ISRAEL: 5G IN DEFENSE MARKET, BY NETWORK TYPE, 2020–2022 (USD MILLION)

- TABLE 123 ISRAEL: 5G IN DEFENSE MARKET, BY NETWORK TYPE, 2023–2028 (USD MILLION)

- TABLE 124 TURKEY: 5G IN DEFENSE MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 125 TURKEY: 5G IN DEFENSE MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 126 TURKEY: 5G IN DEFENSE MARKET, BY NETWORK TYPE, 2020–2022 (USD MILLION)

- TABLE 127 TURKEY: 5G IN DEFENSE MARKET, BY NETWORK TYPE, 2023–2028 (USD MILLION)

- TABLE 128 SOUTH AFRICA: 5G IN DEFENSE MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 129 SOUTH AFRICA: 5G IN DEFENSE MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 130 SOUTH AFRICA: 5G IN DEFENSE MARKET, BY NETWORK TYPE, 2020–2022 (USD MILLION)

- TABLE 131 SOUTH AFRICA: 5G IN DEFENSE MARKET, BY NETWORK TYPE, 2023–2028 (USD MILLION)

- TABLE 132 LATIN AMERICA: 5G IN DEFENSE MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 133 LATIN AMERICA: 5G IN DEFENSE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 134 LATIN AMERICA: 5G IN DEFENSE MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 135 LATIN AMERICA: 5G IN DEFENSE MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 136 LATIN AMERICA: 5G IN DEFENSE MARKET, BY END USER, 2020–2022 (USD MILLION)

- TABLE 137 LATIN AMERICA: 5G IN DEFENSE MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 138 LATIN AMERICA: 5G IN DEFENSE MARKET, BY NETWORK TYPE, 2020–2022 (USD MILLION)

- TABLE 139 LATIN AMERICA: 5G IN DEFENSE MARKET, BY NETWORK TYPE, 2023–2028 (USD MILLION)

- TABLE 140 BRAZIL: 5G IN DEFENSE MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 141 BRAZIL: 5G IN DEFENSE MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 142 BRAZIL: 5G IN DEFENSE MARKET, BY NETWORK TYPE, 2020–2022 (USD MILLION)

- TABLE 143 BRAZIL: 5G IN DEFENSE MARKET, BY NETWORK TYPE, 2023–2028 (USD MILLION)

- TABLE 144 MEXICO: 5G IN DEFENSE MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 145 MEXICO: 5G IN DEFENSE MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 146 MEXICO: 5G IN DEFENSE MARKET, BY NETWORK TYPE, 2020–2022 (USD MILLION)

- TABLE 147 MEXICO: 5G IN DEFENSE MARKET, BY NETWORK TYPE, 2023–2028 (USD MILLION)

- TABLE 148 KEY DEVELOPMENTS OF LEADING PLAYERS IN 5G IN DEFENSE MARKET, 2020–2023

- TABLE 149 COMPANY PRODUCT FOOTPRINT

- TABLE 150 COMPANY PLATFORM FOOTPRINT

- TABLE 151 COMPANY SOLUTION FOOTPRINT

- TABLE 152 COMPANY REGION FOOTPRINT

- TABLE 153 5G IN DEFENSE MARKET: PRODUCT LAUNCHES, FEBRUARY 2022

- TABLE 154 5G IN DEFENSE MARKET: DEALS, JANUARY 2020–SEPTEMBER 2023

- TABLE 155 ERICSSON: COMPANY OVERVIEW

- TABLE 156 ERICSSON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 157 ERICSSON: DEALS

- TABLE 158 NOKIA: COMPANY OVERVIEW

- TABLE 159 NOKIA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 160 NOKIA: DEALS

- TABLE 161 NEC CORPORATION: COMPANY OVERVIEW

- TABLE 162 NEC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 163 NEC CORPORATION: DEALS

- TABLE 164 SAMSUNG ELECTRONICS CO., LTD.: COMPANY OVERVIEW

- TABLE 165 SAMSUNG ELECTRONICS CO., LTD.: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 166 SAMSUNG ELECTRONICS CO., LTD.: DEALS

- TABLE 167 HUAWEI: COMPANY OVERVIEW

- TABLE 168 HUAWEI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 169 HUAWEI: DEALS

- TABLE 170 THALES GROUP: COMPANY OVERVIEW

- TABLE 171 THALES GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 172 THALES GROUP: DEALS

- TABLE 173 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY OVERVIEW

- TABLE 174 RAYTHEON TECHNOLOGIES CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 175 RAYTHEON TECHNOLOGIES CORPORATION: DEALS

- TABLE 176 INTELSAT: COMPANY OVERVIEW

- TABLE 177 INTELSAT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 178 INTELSAT: DEALS

- TABLE 179 QUALCOMM, INC.: COMPANY OVERVIEW

- TABLE 180 QUALCOMM, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 181 QUALCOMM, INC.: DEALS

- TABLE 182 CISCO SYSTEMS, INC.: COMPANY OVERVIEW

- TABLE 183 CISCO SYSTEMS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 184 VERIZON COMMUNICATIONS, INC.: COMPANY OVERVIEW

- TABLE 185 VERIZON COMMUNICATIONS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 186 VERIZON COMMUNICATIONS, INC.: DEALS

- TABLE 187 DEUTSCHE TELEKOM AG: COMPANY OVERVIEW

- TABLE 188 DEUTSCHE TELEKOM AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 189 DEUTSCHE TELEKOM AG: DEALS

- TABLE 190 ORANGE S.A.: COMPANY OVERVIEW

- TABLE 191 ORANGE S.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 192 ORANGE S.A.: PRODUCT LAUNCHES

- TABLE 193 ORANGE S.A.: DEALS

- TABLE 194 GOGO, INC.: COMPANY OVERVIEW

- TABLE 195 GOGO, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 196 LIGADO NETWORKS: COMPANY OVERVIEW

- TABLE 197 LIGADO NETWORKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 198 LIGADO NETWORKS: DEALS

- TABLE 199 WIND RIVER SYSTEMS, INC.: COMPANY OVERVIEW

- TABLE 200 WIND RIVER SYSTEMS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 201 ANALOG DEVICES, INC.: COMPANY OVERVIEW

- TABLE 202 ANALOG DEVICES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 203 ANALOG DEVICES, INC.: DEALS

- TABLE 204 INTEL CORPORATION: COMPANY OVERVIEW

- TABLE 205 INTEL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 206 INTEL CORPORATION: DEALS

- TABLE 207 L3HARRIS TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 208 L3HARRIS TECHNOLOGIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 209 COMBA TELECOM: COMPANY OVERVIEW

- TABLE 210 STERLITE TECHNOLOGIES LTD.: COMPANY OVERVIEW

- TABLE 211 T-MOBILE US, INC.: COMPANY OVERVIEW

- TABLE 212 TELECOM ITALIA: COMPANY OVERVIEW

- TABLE 213 MARVELL: COMPANY OVERVIEW

- TABLE 214 MEDIATEK INC.: COMPANY OVERVIEW

- FIGURE 1 5G IN DEFENSE MARKET SEGMENTATION

- FIGURE 2 RESEARCH FLOW

- FIGURE 3 RESEARCH DESIGN

- FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 6 DATA TRIANGULATION METHODOLOGY

- FIGURE 7 ASSUMPTIONS FOR RESEARCH STUDY

- FIGURE 8 AIRBORNE SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST MARKET

- FIGURE 9 COMMUNICATION NETWORK SEGMENT TO DOMINATE MARKET FROM 2023 TO 2028

- FIGURE 10 EMBB SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 11 MILITARY SEGMENT TO REGISTER HIGHER CAGR THAN HOMELAND SECURITY SEGMENT DURING FORECAST PERIOD

- FIGURE 12 MEDIUM SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 13 NEW IMPLEMENTATION SEGMENT TO REGISTER HIGHER CAGR THAN UPGRADE SEGMENT DURING FORECAST PERIOD

- FIGURE 14 ASIA PACIFIC MARKET TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 15 INCREASING USE OF 5G FOR IOT, ENHANCED AR & VR, ADVANCED AUTONOMOUS SYSTEMS, AND CYBERSECURITY TO DRIVE MARKET

- FIGURE 16 LAND SEGMENT TO LEAD MARKET FROM 2023 TO 2028

- FIGURE 17 COMMUNICATION NETWORK SEGMENT TO COMMAND LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 18 MILITARY SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 19 EMBB SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 20 NEW IMPLEMENTATION SEGMENT TO COMMAND LARGER MARKET SHARE THAN UPGRADE SEGMENT DURING FORECAST PERIOD

- FIGURE 21 LOW SEGMENT TO HAVE LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 22 5G IN DEFENSE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 23 REVENUE SHIFT IN 5G IN DEFENSE MARKET

- FIGURE 24 RECESSION IMPACT ANALYSIS: OPTIMISTIC, PESSIMISTIC, AND NEUTRAL SCENARIOS

- FIGURE 25 ECOSYSTEM ANALYSIS

- FIGURE 26 VALUE CHAIN ANALYSIS

- FIGURE 27 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE PLATFORMS

- FIGURE 29 KEY BUYING CRITERIA FOR TOP THREE PLATFORMS

- FIGURE 30 EVOLUTION OF 5G IN DEFENSE: ROADMAP FROM 2017 TO 2030

- FIGURE 31 5G IN DEFENSE MARKET, BY SOLUTION, 2023 VS. 2028 (USD MILLION)

- FIGURE 32 5G IN DEFENSE MARKET, BY COMMUNICATION NETWORK, 2023 & 2028 (USD MILLION)

- FIGURE 33 5G IN DEFENSE MARKET, BY CHIPSET, 2023 VS. 2028 (USD MILLION)

- FIGURE 34 5G IN DEFENSE MARKET, BY CORE NETWORK, 2023 VS. 2028 (USD MILLION)

- FIGURE 35 5G IN DEFENSE MARKET, BY PLATFORM, 2023 VS. 2028 (USD MILLION)

- FIGURE 36 5G IN DEFENSE MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 37 5G IN DEFENSE MARKET, BY NETWORK TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 38 5G IN DEFENSE MARKET, BY OPERATIONAL FREQUENCY, 2023 VS. 2028 (USD MILLION)

- FIGURE 39 5G IN DEFENSE MARKET, BY INSTALLATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 40 ASIA PACIFIC MARKET TO REGISTER HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 41 NORTH AMERICA: 5G IN DEFENSE MARKET SNAPSHOT

- FIGURE 42 EUROPE: 5G IN DEFENSE MARKET SNAPSHOT

- FIGURE 43 ASIA PACIFIC: 5G IN DEFENSE MARKET SNAPSHOT

- FIGURE 44 MIDDLE EAST & AFRICA: 5G IN DEFENSE MARKET SNAPSHOT

- FIGURE 45 LATIN AMERICA: 5G IN DEFENSE MARKET SNAPSHOT

- FIGURE 46 RANKING OF KEY PLAYERS IN 5G IN DEFENSE MARKET, 2022

- FIGURE 47 REVENUE ANALYSIS OF KEY MARKET, 2020–2022

- FIGURE 48 MARKET SHARE ANALYSIS, 2022

- FIGURE 49 5G IN DEFENSE MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 50 5G IN DEFENSE MARKET: START-UP/SME EVALUATION MATRIX, 2022

- FIGURE 51 ERICSSON: COMPANY SNAPSHOT

- FIGURE 52 NOKIA: COMPANY SNAPSHOT

- FIGURE 53 NEC CORPORATION: COMPANY SNAPSHOT

- FIGURE 54 SAMSUNG ELECTRONICS CO., LTD.: COMPANY SNAPSHOT

- FIGURE 55 HUAWEI: COMPANY SNAPSHOT

- FIGURE 56 THALES GROUP: COMPANY SNAPSHOT

- FIGURE 57 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

- FIGURE 58 QUALCOMM, INC.: COMPANY SNAPSHOT

- FIGURE 59 CISCO SYSTEMS, INC.: COMPANY SNAPSHOT

- FIGURE 60 VERIZON COMMUNICATIONS, INC.: COMPANY SNAPSHOT

- FIGURE 61 ORANGE S.A.: COMPANY SNAPSHOT

- FIGURE 62 GOGO, INC.: COMPANY SNAPSHOT

- FIGURE 63 ANALOG DEVICES, INC.: COMPANY SNAPSHOT

- FIGURE 64 INTEL CORPORATION: COMPANY SNAPSHOT

- FIGURE 65 L3HARRIS TECHNOLOGIES, INC.: COMPANY SNAPSHOT

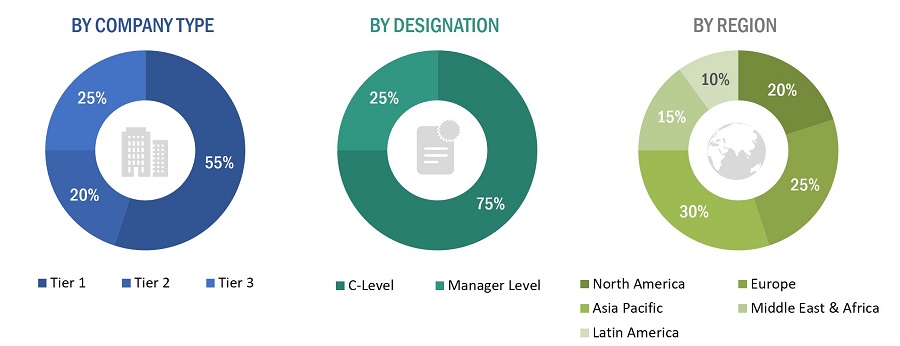

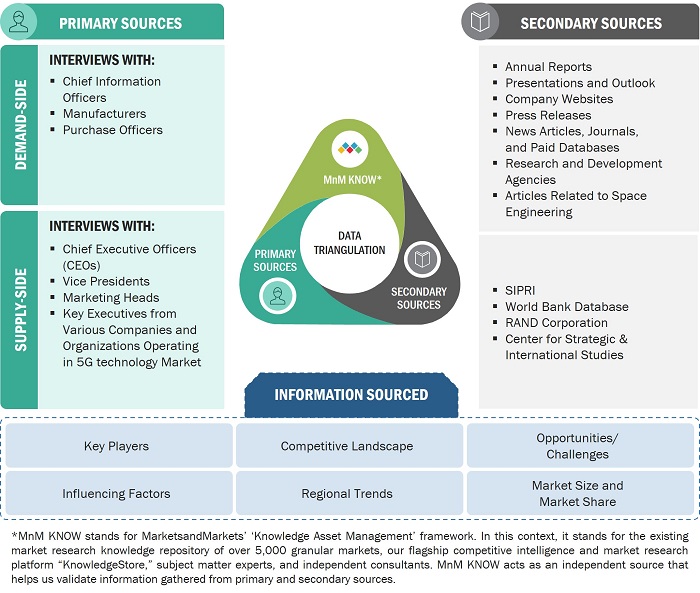

The research study conducted on the 5G in Defense Market involved extensive use of secondary sources, including directories, databases of articles, journals on 5G technology, company newsletters, and information portals such as Hoover’s, Bloomberg, and Factiva to identify and collect information useful for this extensive, technical, market-oriented, and commercial study of the 5G in defense market. Primary sources are several industry experts from the core and related industries, alliances, organizations, Original Equipment Manufacturers (OEMs), vendors, suppliers, and technology developers. These sources relate to all segments of the value chain of the 5G in defense market.

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among others, to obtain and verify critical qualitative and quantitative information and to assess future prospects of the market.

Secondary Research

In the secondary research process, various secondary sources were referred to identify and collect information for this study on the 5G in defense market. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers and certified publications; articles from recognized authors; manufacturer's associations; directories; and databases. Secondary research was mainly used to obtain key information about the supply chain of the 5G industry, the monetary chain of the market, the total pool of key players, market classification and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

Extensive primary research was conducted to obtain qualitative and quantitative information for this report on the 5G in defense market. Several primary interviews were conducted with the market experts from both demand- and supply-side across major regions, namely, North America, Europe, Asia Pacific, the Middle East, Latin America, and Africa. Primary sources from the supply-side included industry experts such as business development managers, sales heads, technology and innovation directors, and related key executives from various key companies and organizations operating in the 5G in defense market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

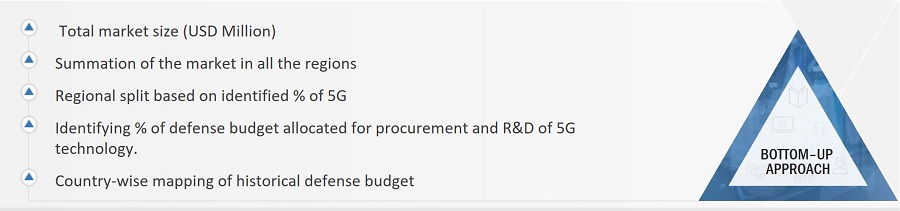

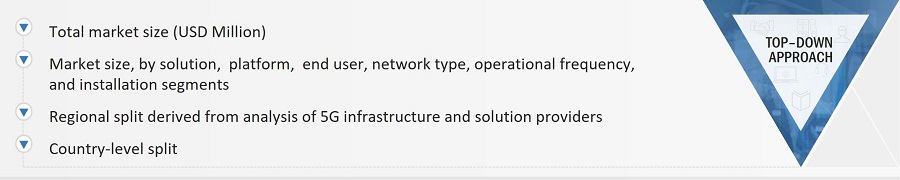

Both the top-down and bottom-up approaches were used to estimate and validate the size of the 5G in defense market. The following figure represents the overall market size estimation process employed for this study on the market.

The research methodology used to estimate the market size included the following details:

- Secondary research identified key players in the 5G in defense market, and their market share was determined through primary and secondary research. This included a study of annual and financial reports of top market players and extensive interviews of leaders such as Chief Executive Officers (CEOs), directors, and marketing executives of leading companies operating in the market.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data on the 5G in defense market.

- This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Market size estimation methodology: Bottom-up Approach

Market size estimation methodology: Top-down Approach

In the top-down approach, the overall size of the 5G in defense market was used to estimate the size of individual markets (mentioned in the market segmentation) through percentage splits obtained from secondary and primary research. The size of the most appropriate, immediate parent market was used to implement the top-down approach to calculate the sizes of specific market segments. The approach was also implemented to validate the revenues obtained for various market segments.

Market share was estimated for each company to verify the revenue share used earlier in the bottom-up approach. With the data triangulation procedure and data validation through primary, this study determined and confirmed the overall size of the parent market and each market segment. The following figure shows the overall market size estimation process employed for this study.

Data Triangulation

After arriving at the overall market size from the market size estimation process, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for market segments and subsegments, the data triangulation procedure has been implemented, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated using both top-down and bottom-up approaches.

Market Definition

5G represents the fifth generation of mobile networks. Offering speeds up to 100 times quicker than its predecessor, 4G, 5G is unlocking unprecedented possibilities for individuals and enterprises. This enhanced connectivity, combined with reduced latency and expanded bandwidth, is propelling societal progress, revolutionizing sectors, and significantly improving daily interactions. Once considered visions of the future, services like e-health, interconnected vehicular and traffic systems, and sophisticated mobile cloud gaming are now a reality.

The 5G technology will pave the way for countless essential IoT applications, enabling nearly instantaneous data capture and response. Coupled with immersive platforms such as virtual and augmented reality, 5G is set to revolutionize how we communicate and engage with the world around us.

Within the defense realm, these enhanced capabilities will usher in fresh opportunities for operational units to collaborate within a rich digital environment, ensuring protection in almost real-time. This potential is magnified when 5G is synergized with other groundbreaking innovations like defense-centric cloud solutions and artificial intelligence. The increased speed and bandwidth of 5G will enable quicker transmission of large data files, critical for real-time intelligence, surveillance, and reconnaissance.

Key Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

- Ministry of Defense

- Regulatory Bodies

- R&D Companies

- Providers of 5G in Defense Markets systems & hardware

- Commercial

- Space Organization

- Armed Forces

- Cybersecurity companies

- Space Organization

- Satellite Operators

Report Objectives

- To define, describe, and forecast the size of the 5G in Defense Market based on type, platform, application, system, point of sale, and region from 2023 to 2028.

- To forecast the size of various segments of the market with respect to major regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW), which comprises the Middle East & Africa, Latin America

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the 5G in Defense Market across the globe.

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and their contribution to the 5G in Defense Market.

- To analyze opportunities for stakeholders in the market by identifying key market trends

- To analyze competitive developments such as contracts, acquisitions and expansions, agreements, joint ventures and partnerships, new product launches, and Research & Development (R&D) activities in the 5G in Defense Market.

- To provide a detailed competitive landscape of the -market, in addition to an analysis of business and corporate strategies adopted by leading market players.

- To strategically profile key market players and comprehensively analyze their core competencies2.

1. Micro markets refer to further segments and subsegments of the 5G in defense market included in the report.

2. Core competencies of the companies were captured in terms of their key developments and strategies adopted by them to sustain their position in the market.

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company.

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in 5G in Defense Market