IoT in Aviation Market by End Market (Airports, Airlines, MROs, Manufacturers), Application (Ground Operations, Passenger Experience, Asset Management, Air Traffic Management), Component, Region - Global Forecast to 2025

[164 Pages Report] The global IoT in aviation market by End Market, Application, Component and Region is projected to grow from USD 593 million in 2019 to USD 1,941 million by 2025; it is expected to grow at a CAGR of 21.9% from 2019 to 2025.

Advancements in wireless network technologies increased efficiency and connectivity, and improved passenger experience are some of the major factors driving the market.

By end market, the airlines segment is expected to be a larger contributor to the IoT in aviation market during the forecast period.

The adoption of IoT technology by airlines reduces some of the most common complaints in the industry, such as lost bags, flight delays, and customer service issues. For example, Virgin Atlantic started using IoT in its fleet of Boeing 787 planes and cargo equipment connected via IoT devices. These projects resulted in a reduction in delays by 20% as well as a reduction of 2 hours from daily working hours.

North America is projected to lead the IoT in aviation market during the forecast period.

North America is expected to be the largest market for IoT in aviation during the forecast period. The global need for optimizing operations at airports is fueling investments in the area of IoT, as implementing this technology has the potential to bring transparency in airport operations. With increasing passenger traffic and a fleet size of airlines, airports are required to make data-driven decisions by leveraging new technologies such as IoT, AI, and Blockchain.

Additionally, the presence of major airports and leading IoT in aviation companies in the US has resulted in high investments in the field of IoT in North America. Some of these leading companies include Microsoft Corporation (US), IBM Corporation (US), Cisco Systems, Inc. (US), and Honeywell Aerospace (US).

Key Market Players

Some of the major players in the IoT in aviation market include Microsoft Corporation (US), IBM (US), Huawei (China), Cisco (US), Wind River (US), Amadeus IT Group (Spain), SITAONAIR (Switzerland), Honeywell (US), Blip Systems (Denmark), Tata Sons (India), and Sendum Wireless Corporation (Canada). These players provide IoT solutions and platforms to various aviation companies.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

20172025 |

|

Base year considered |

2018 |

|

Forecast period |

20192025 |

|

Forecast units |

Value (USD) |

|

Segments covered |

End Market, Application, Component, and Region |

|

Regions covered |

North America, Europe, Asia Pacific, and Rest of the World |

|

Companies covered |

Microsoft Corporation (US), IBM (US), Wind River (US), Cisco (US), Amadeus IT Group (Spain), SAP SE (Germany), Huawei (China), Honeywell (US), Blip System (Denmark). |

This research report categorizes the IoT aviation market based on end market, application, component, and region

By End Market:

- Airports

- Airlines

- MROs

- Manufacturers

By Application:

- Ground Operations

- Passenger Processing

- Baggage Tracking

- Airport Maintenance

- Security & Surveillance

- Ground Handling

- Location-based Navigation & Alerts

- Passenger Experience

- Personalized Customer Service

- In-flight Communication

- Connected Cabin

- Asset Management

- Fleet Management

- Crew Management

- Aircraft Maintenance

- Aircraft Manufacturing

- Air Traffic Management

By Component:

- IoT Devices

- Sensors & Actuators

- Processors

- Beacons

- Cameras

- Tags

- IoT Gateway & Networking Devices

- IoT Solutions

- Software & Applications

- IoT Platforms

- Services

- Managed

- Professional

By Region:

- North America

- Europe

- Asia Pacific

- Rest of the World

Key Questions Addressed by the Report

- What will be the revenue pockets for the IoT technology in aviation in the next five years?

- Who are the leading players of IoT in the global aviation market?

- What are the growth prospects for the IoT in Aviation market?

- What are the major challenges faced by players in the IoT in aviation market?

- What are the latest technological trends in the market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 20)

1.1 Objectives of the Study

1.2 IoT in Aviation Market Definition

1.3 Market Scope

1.3.1 Regional Scope

1.3.2 Years Considered for the Study

1.4 Currency

1.5 USD Exchange Rates, 20162018

1.6 Market Stakeholders

2 Research Methodology (Page No. - 24)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.1.3 Market Definition & Scope

2.1.4 Segment Definitions

2.1.4.1 IoT in Aviation Market, By Application

2.1.4.2 Market, By Component

2.1.4.3 Market, By End Market

2.2 Research Approach and Methodology

2.2.1 Bottom-Up Approach

2.2.1.1 IoT Aviation Market

2.2.1.2 Market, By End Markets

2.2.1.3 Market, By Country,

2.2.2 Top-Down Approach

2.2.2.1 IoT Aviation Market, By Application

2.3 Data Triangulation & Validation

2.3.1 Triangulation Through Secondary

2.3.2 Triangulation Through Primaries

2.4 Research Limitations

2.5 Research Assumptions

2.6 Risks

3 Executive Summary (Page No. - 35)

4 Premium Insights (Page No. - 38)

4.1 Attractive Opportunities in IoT in Aviation Market

4.2 Market, By Application

4.3 Market, By End Market

4.4 Market, By Country

5 Market Overview (Page No. - 40)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Advancements in Wireless Network Technologies

5.2.1.2 Optimization of Business Processes and Increase in Connectivity

5.2.1.3 Improved Passenger Experience

5.2.1.4 Data Gathering

5.2.2 Opportunities

5.2.2.1 Reduction in Operational Expenses

5.2.2.2 Automated Aircraft Monitoring and Reporting

5.2.3 Challenges

5.2.3.1 Concerns Related to Data Privacy and Cybersecurity

5.2.3.2 Multiple Stakeholders in the Aviation Industry

6 Industry Trends (Page No. - 44)

6.1 Introduction

6.2 IoT in Megatrends

6.2.1 IoT in Augmented Reality (AR)

6.2.2 IoT in Blockchain

6.2.3 IoT in Wearables

6.3 IoT in Drones

6.4 Internet of Battlefield Things (IoBT)

6.5 Edge Computing in IoT

6.6 Use Cases: IoT in Aviation

6.6.1 IoT Enabled Airbus Factory

6.6.2 IoT in Aircraft Cabin: Airbus Connected Experience Solution

6.6.3 Integration of IoT in Bae Systems Manufacturing Plants

6.6.4 Information Management System in Boeings Manufacturing Plant

6.6.5 Pratt & Whitney Uses IoT Solutions to Reduce Unscheduled Maintenance

6.6.6 General Electric to Use IoT for Predictive Maintenance

6.6.7 Rolls-Royce With Microsoft Use IoT to Address Aftermarket Challenges

6.6.8 Easyjet Airline Uses IoT Wearables

6.6.9 Virgin Atlantic Installs IoT Sensors on Aircraft for Predictive Maintenance

6.6.10 Lufthansa Airlines Electronic Tag to Track Baggage

6.6.11 Delta Airline Installs Iiot Solution on Its Fleet

6.6.12 Klm Airline has Developed an IoT Application to Improve Maintenance Efficiency

6.6.13 Airports in Helsinki, London, and Miami Uses IoT Beacons & Sensors to Track Passengers and Offer Location-Based Services

6.6.14 Dallas Fort Worth and Los Angeles Airport to Install IoT for Smart Bathrooms

7 IoT in Aviation Market, By End Market (Page No. - 49)

7.1 Introduction

7.2 Airports

7.2.1 Airports in London, Miami, and Helsinki have Installed IoT Beacons and Sensors

7.3 Airlines

7.3.1 Qantas, Klm, Virgin Atlantic, and Easyjet are Some of the Pioneering Airlines to Implement Iot

7.4 Maintenance, Repair, and Overhaul (MRO)

7.4.1 IoT Solutions Help Reduce the Rate of Unscheduled Maintenance

7.5 Manufacturers

7.5.1 Airbus, Boeing, and Bae Systems Using IoT Solutions to Optimize Manufacturing Process

8 IoT in Aviation Market, By Application (Page No. - 54)

8.1 Introduction

8.2 Ground Operations

8.2.1 Passenger Processing

8.2.1.1 Passengers Can Receive Checkpoint Information in Real-Time to Make Their Journey More Predictable and Stress-Free

8.2.2 Baggage Tracking

8.2.2.1 Baggage Tracking Reduce Passenger Inconvenience Related With Baggage Mishandling

8.2.3 Airport Maintenance

8.2.3.1 Predictive Cleaning and Smart Dispensers Can Help Optimize the Maintenance Process

8.2.4 Security & Surveillance

8.2.4.1 Increasing Terrorism and Drug Trafficking are Major Reasons for Implementing These Systems to Help Detect Threats at Airports

8.2.5 Ground Handling

8.2.5.1 Line-Up of Passenger Ladders, Fueling Systems, Ground Power Unit Carts, Food Carts, and Maintenance Operations are Tracked to Ensure Their Timely Operations

8.2.6 Location-Based Navigation & Alerts

8.2.6.1 Provides Options to Passengers to Spend Time on Airports, and Help Airlines and Airports Generate Ancillary Revenues

8.3 Passenger Experience

8.3.1 In-Flight Communication

8.3.1.1 In-Flight Communication Can Build Loyalty Among Frequent Travelers

8.3.2 Connected Cabin

8.3.2.1 Connected Cabins Improves In-Flight Experience

8.3.3 Personalized Customer Service

8.3.3.1 Personalized Customer Services Enhance Passenger Experience and Help Generate Revenue By Airlines

8.4 Asset Management

8.4.1 Fleet Management

8.4.1.1 Fleet Management Reduce Total Miles Flown, Lower Both Emissions and Noise, and Improve Access to Airports

8.4.2 Crew Management

8.4.2.1 Crew Management Solution Can Help Airlines Save 3-15% of Total Crew Costs

8.4.3 Aircraft Maintenance

8.4.3.1 Aircraft Maintenance Improves Airlines and MROs Operations By Predicting Failures in Advance

8.4.4 Aircraft Manufacturing

8.4.4.1 Data Gathered is Used to Analyze and Identify Machines Maintenance Frequency

8.5 Air Traffic Management

9 IoT Aviation Market, By Component (Page No. - 67)

9.1 Introduction

9.2 IoT Devices

9.2.1 Sensors & Actuators

9.2.1.1 Majorly Wireless Sensors are Used Due to Their Ease of Plugging

9.2.2 Processors

9.2.3 Beacons

9.2.3.1 Beacons are Used to Track Passenger Movement and to Navigate Them

9.2.4 Cameras

9.2.4.1 Cameras are Used for Security & Surveillance

9.2.5 Tags

9.2.5.1 Tags are Fixed on Devices That Need to Be Tracked

9.2.6 IoT Gateway & Networking Devices

9.2.6.1 Integration of Protocols for Networking

9.3 IoT Solutions

9.3.1 Software & Applications

9.3.1.1 Enhances Operational Efficiency

9.3.2 Platforms

9.3.2.1 Monitor, Manage, and Control Connected Devices

9.3.2.2 Device Management

9.3.2.3 Application Management

9.3.2.4 Network Management

9.4 Services

9.4.1 Professional Services

9.4.1.1 Deployment, Integration, Consulting, and Maintenance Services

9.4.2 Managed Services

9.4.2.1 Provisioning, Cloud Infrastructure, and Devops Automation

10 Regional Analysis (Page No. - 76)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.1.1 The Necessity to Increase Operational Efficiency is Driving the IoT Aviation Market

10.2.2 Canada

10.2.2.1 High Investments in IoT is Expected to Drive the IoT Aviation Market

10.3 Europe

10.3.1 France

10.3.1.1 Partnerships Between Aircraft OEMs and IoT Players Driving the Market

10.3.2 UK

10.3.2.1 Adoption of IoT Technology at Airports is Increasing With the Growth in Passenger Traffic

10.3.3 Germany

10.3.3.1 Partnerships Between Airlines and IoT Platform Providers are Driving the Market

10.3.4 Rest of Europe

10.3.4.1 Presences of Major IoT Players is Driving the Market in Rest of Europe

10.4 Asia Pacific

10.4.1 China

10.4.1.1 Large Aircraft Fleet and Initiatives of Digital Transformation Driving the Demand for IoT Technology

10.4.2 India

10.4.2.1 New Airport Projects Driving the Demand for IoT Technology

10.4.3 Japan

10.4.3.1 Advancements in Electronics and the Presence of IoT Players are Driving the IoT Aviation Market

10.4.4 Rest of Asia Pacific

10.4.4.1 Demand for IoT is Driven By Increased Passenger Traffic

10.5 Rest of the World

10.5.1 Latin America

10.5.1.1 Presence of Aircraft OEMs Driving the IoT Aviation Market

10.5.2 Middle East

10.5.2.1 Airlines & Airports Investing in IoT to Enhance Passenger Experience

10.5.3 Africa

10.5.3.1 Growth in Passenger Traffic Driving the IoT Aviation Market

11 Competitive Landscape (Page No. - 106)

11.1 Introduction

11.2 Competitive Analysis

11.2.1 Competitive Leadership Mapping

11.2.1.1 Visionary Leaders

11.2.1.2 Innovators

11.2.1.3 Dynamic Differentiators

11.2.1.4 Emerging Companies

11.3 Competitive Scenario

11.3.1 Contracts and Agreements

11.3.2 New Product Launches

11.3.3 Collaborations and Partnerships

12 Company Profiles (Page No. - 114)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

12.1 IBM Corporation

12.2 Huawei Technologies Co., LTD.

12.3 Cisco Systems, Inc.

12.4 SITAONAIR

12.5 Tata Sons Private Limited.

12.6 Honeywell International Inc.

12.7 Aeris

12.8 Happiest Minds Technologies

12.9 Amadeus It Group Sa

12.10 Walkbase

12.11 Sendum Wireless Corporation

12.12 Microsoft Corporation

12.13 Palantir Technologies

12.14 Blip Systems

12.15 Tech Mahindra Limited

12.16 SAP SE

12.17 Arrow Electronics, Inc.

12.18 Wind River Systems, Inc.

12.19 Undagrid

12.20 Zestiot

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 158)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets Subscription Portal

13.3 Available Customizations

13.4 Related Reports

List of Tables (123 Tables)

Table 1 IoT in Aviation Market, By End Market, 20172025 (USD Million)

Table 2 Market for Airports, By Region, 20172025 (USD Million)

Table 3 Market for Airlines, By Region, 20172025 (USD Million)

Table 4 Market for MROs, By Region, 20172025 (USD Million)

Table 5 Market for Manufacturers, By Region, 20172025 (USD Million)

Table 6 Market, By Application, 20172025 (USD Million)

Table 7 Ground Operations in Aviation Market, By Subapplication, 20172025 (USD Million)

Table 8 Ground Operations in Aviation Market, By Region, 20172025 (USD Million)

Table 9 Passenger Processing Market, By Region, 20172025 (USD Million)

Table 10 Baggage Tracking Market, By Region, 20172025 (USD Million)

Table 11 Airport Maintenance Market, By Region, 20172025 (USD Million)

Table 12 Security & Surveillance Market, By Region, 20172025 (USD Million)

Table 13 Ground Handling Market Size, By Region, 20172025 (USD Million)

Table 14 Location-Based Navigation & Alerts Market Size, By Region, 20172025 (USD Million)

Table 15 Passenger Experience in Aviation Market, By Subapplication, 20172025 (USD Million)

Table 16 Passenger Experience Market Size, By Region, 20172025 (USD Million)

Table 17 In-Flight Communication Market Size, By Region, 20172025 (USD Million)

Table 18 Connected Cabin Market Size, By Region, 20172025 (USD Million)

Table 19 Personalized Customer Service Market Size, By Region, 20172025 (USD Million)

Table 20 Asset Management in Aviation Market Size, By Subapplication, 20172025 (USD Million)

Table 21 Asset Management in Aviation Market Size, By Region, 20172025 (USD Million)

Table 22 Fleet Management Market Size, By Region, 20172025 (USD Million)

Table 23 Crew Management Market Size, By Region, 20172025 (USD Million)

Table 24 Aircraft Maintenance Market Size, By Region, 20172025 (USD Million)

Table 25 Aircraft Manufacturing Market Size, By Region, 20172025 (USD Million)

Table 26 Air Traffic Management in Aviation Market Size, By Region, 20172025 (USD Million)

Table 27 IoT in Aviation Market, By Component, 20172025 (USD Million)

Table 28 IoT Devices Market Size in Aviation, By Type, 20172025 (USD Million)

Table 29 IoT Devices Market Size in Aviation, By Region, 20172025 (USD Million)

Table 30 IoT Sensors & Actuators in Aviation Market, By Region, 20172025 (USD Million)

Table 31 IoT Processors in Aviation Market, By Region, 20172025 (USD Million)

Table 32 IoT Beacons in Aviation Market, By Region, 20172025 (USD Million)

Table 33 IoT Cameras in Aviation Market, By Region, 20172025 (USD Million)

Table 34 IoT Tags in Aviation Market, By Region, 20172025 (USD Million)

Table 35 IoT Gateway & Networking Devices in Aviation Market, By Region, 20172025 (USD Million)

Table 36 IoT Solutions in Aviation Market Size, By Type , 20172025 (USD Million)

Table 37 IoT Solutions in Aviation Market Size, By Region, 20172025 (USD Million)

Table 38 IoT Software & Applications in Aviation Market, By Region, 20172025 (USD Million)

Table 39 Platforms in Aviation Market, By Region, 20172025 (USD Million)

Table 40 IoT Services in Aviation Market, By Type, 20172025 (USD Million)

Table 41 IoT Aviation Market Size, By Region, 20172025 (USD Million)

Table 42 North America: Market Size, By End Market, 20172025 (USD Million)

Table 43 North America: Market Size, By Application, 20172025 (USD Million)

Table 44 North America: Ground Operations in Aviation Market Size, By Subapplication, 20172025 (USD Million)

Table 45 North America: Passenger Experience in Aviation Market Size, By Subapplication, 20172025 (USD Million)

Table 46 North America: Asset Management in Aviation Market Size, By Subapplication, 20172025 (USD Million)

Table 47 North America: IoT Aviation Market Size, By Component, 20172025 (USD Million)

Table 48 North America: IoT Devices Market in Aviation, By Type, 20172025 (USD Million)

Table 49 North America: IoT Solutions Market in Aviation, By Type, 20172025 (USD Million)

Table 50 North America: Market Size, By Country, 20172025 (USD Million)

Table 51 US: IoT Aviation Market Size, By End Market, 20172025 (USD Million)

Table 52 US: Market Size, By Component, 20172025 (USD Million)

Table 53 US: Market Size, By Application, 20172025 (USD Million)

Table 54 Canada: IoT Aviation Market Size, By End Market, 20172025 (USD Million)

Table 55 Canada: Market Size, By Component, 20172025 (USD Million)

Table 56 Canada: Market Size, By Application, 20172025 (USD Million)

Table 57 Europe: Market Size, By End Market, 20172025 (USD Million)

Table 58 Europe: Market Size, By Application, 20172025 (USD Million)

Table 59 Europe: Ground Operations in Aviation Market Size, By Subapplication, 20172025 (USD Million)

Table 60 Europe: Passenger Experience in Aviation Market Size, By Subapplication, 20172025 (USD Million)

Table 61 Europe: Asset Management in Aviation Market Size, By Subapplication, 20172025 (USD Million)

Table 62 Europe: IoT in Aviation Market Size, By Component, 20172025 (USD Million)

Table 63 Europe: IoT Devices in Aviation Market Size, By Type, 20172025 (USD Million)

Table 64 Europe: IoT Solutions in Aviation Market Size, By Type, 20172025 (USD Million)

Table 65 Europe: IoT Aviation Market Size, By Country, 20172025 (USD Million)

Table 66 France: Market Size, By End Market, 20172025 (USD Million)

Table 67 France: Market Size, By Component, 20172025 (USD Million)

Table 68 France: Market Size, By Application, 20172025 (USD Million)

Table 69 UK: Market Size, By End Market, 20172025 (USD Million)

Table 70 UK: Market Size, By Component, 20172025 (USD Million)

Table 71 UK: Market Size, By Application, 20172025 (USD Million)

Table 72 Germany: IoT Aviation Market Size, By End Market, 20172025 (USD Million)

Table 73 Germany: Market Size, By Component, 20172025 (USD Million)

Table 74 Germany: Market Size, By Application, 20172025 (USD Million)

Table 75 Rest of Europe: Market Size, By End Market, 20172025 (USD Million)

Table 76 Rest of Europe: Market Size, By Component, 20172025 (USD Million)

Table 77 Rest of Europe: Market Size, By Application, 20172025 (USD Million)

Table 78 Asia Pacific: IoT Aviation Market Size, By End Market, 20172025 (USD Million)

Table 79 Asia Pacific: Market Size, By Application, 20172025 (USD Million)

Table 80 Asia Pacific: Ground Operations in Aviation Market Size, By Subapplication, 20172025 (USD Million)

Table 81 Asia Pacific: Passenger Experience in Aviation Market Size, By Subapplication, 20172025 (USD Million)

Table 82 Asia Pacific: Asset Management in Aviation Market Size, By Subapplication, 20172025 (USD Million)

Table 83 Asia Pacific: Market Size, By Component, 20172025 (USD Million)

Table 84 Asia Pacific: IoT Devices in Aviation Market Size, By Type, 20172025 (USD Million)

Table 85 Asia Pacific: IoT Solutions in Aviation Market Size, By Type, 20172025 (USD Million)

Table 86 Asia Pacific: Market Size, By Country, 20172025 (USD Million)

Table 87 China: IoT Aviation Market Size, By End Market, 20172025 (USD Million)

Table 88 China: Market Size, By Component, 20172025 (USD Million)

Table 89 China: Market Size, By Application, 20172025 (USD Million)

Table 90 India: IoT Aviation Market Size, By End Market, 20172025 (USD Million)

Table 91 India: Market Size, By Component, 20172025 (USD Million)

Table 92 India: Market Size, By Application, 20172025 (USD Million)

Table 93 Japan: Market Size, By End Market, 20172025 (USD Million)

Table 94 Japan: Market Size, By Component, 20172025 (USD Million)

Table 95 Japan: Market Size, By Application, 20172025 (USD Million)

Table 96 Rest of Asia Pacific: Market Size, By End Market, 20172025 (USD Million)

Table 97 Rest of Asia Pacific: Market Size, By Component, 20172025 (USD Million)

Table 98 Rest of Asia Pacific: Market Size, By Application, 20172025 (USD Million)

Table 99 Rest of the World: Market Size, By End Market, 20172025 (USD Million)

Table 100 Rest of the World: Market Size, By Application, 20172025 (USD Million)

Table 101 Rest of the World: Ground Operations in Aviation Market Size, By Subapplication, 20172025 (USD Million)

Table 102 Rest of the World: Passenger Experience in Aviation Market Size, By Subapplication, 20172025 (USD Million)

Table 103 Rest of the World: Asset Management in Aviation Market Size, By Subapplication, 20172025 (USD Million)

Table 104 Rest of the World: IoT in Aviation Market Size, By Component, 20172025 (USD Million)

Table 105 Rest of the World: IoT Devices in Aviation Market Size, By Type, 20172025 (USD Million)

Table 106 Rest of the World: IoT Solutions in Aviation Market Size, By Type, 20172025 (USD Million)

Table 107 Rest of the World: Market Size, By Region, 20172025 (USD Million)

Table 108 Latin America: Market Size, By End Market, 20172025 (USD Million)

Table 109 Latin America: Market Size, By Component, 20172025 (USD Million)

Table 110 Latin America: Market Size, By Application, 20172025 (USD Million)

Table 111 Middle East: Market Size, By End Market, 20172025 (USD Million)

Table 112 Middle East: Market Size, By Component, 20172025 (USD Million)

Table 113 Middle East: Market Size, By Application, 20172025 (USD Million)

Table 114 Africa: IoT Aviation Market Size, By End Market, 20172025 (USD Million)

Table 115 Africa: IoT Aviation Market Size, By Component, 20172025 (USD Million)

Table 116 Africa: IoT Aviation Market Size, By Application, 20172025 (USD Million)

Table 117 Contracts, January 2017September 2019

Table 118 New Product Launches, January 2017September 2019

Table 119 Collaborations and Partnerships, January 2017September 2019

Table 120 IBM: SWOT Analysis

Table 121 Huawei: SWOT Analysis

Table 122 Cisco: SWOT Analysis

Table 123 Tata Son: SWOT Analysis

List of Figures (39 Figures)

Figure 1 Markets Covered

Figure 2 Research Flow

Figure 3 Research Design: IoT in Aviation Market

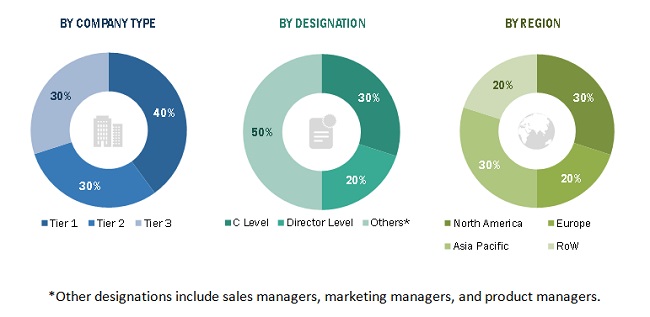

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 5 IoT Aviation Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Data Triangulation

Figure 8 Assumptions for the Research Study

Figure 9 By End Market, Airlines Segment Projected to Lead IoT Aviation Market During Forecast Period

Figure 10 By Application, Passenger Experience Segment Projected to Grow at the Highest Rate During Forecast Period

Figure 11 By Component, IoT Solutions Segment Projected to Grow at A Higher CAGR During Forecast Period as Compared to IoT Devices Segment

Figure 12 North America Estimated to Account for Largest Share of IoT Aviation Market in 2019

Figure 13 Advancements in Wireless Network Technologies is One of the Major Drivers of the Market

Figure 14 Asset Management Segment Expected to Lead the Market During Forecast Period

Figure 15 Airports Expected to Grow at the Highest CAGR During Forecast Period

Figure 16 UK IoT in Aviation Market Projected to Grow at the Highest CAGR During Forecast Period

Figure 17 Market Dynamics of the IoT Aviation Market

Figure 18 Market Size, By End Market, 2019 & 2025 (USD Million)

Figure 19 Market, By Application, 2019 & 2025 (USD Million)

Figure 20 Market, By Component, 2019 & 2025 (USD Million)

Figure 21 North America Estimated to Account for the Largest Share of IoT Aviation Market in 2019

Figure 22 North America Market Snapshot

Figure 23 Europe Market Snapshot

Figure 24 Asia Pacific Market Snapshot

Figure 25 Companies Adopted Contracts as A Key Growth Strategy Between January 2017 and September 2019

Figure 26 IoT Aviation Market Competitive Leadership Mapping, 2018

Figure 27 Strength of Product Portfolio

Figure 28 Business Strategy Excellence

Figure 29 IBM: Company Snapshot

Figure 30 Huawei Technologies Co. LTD: Company Snapshot

Figure 31 Cisco Systems, Inc.: Company Snapshot

Figure 32 Tata Communication: Company Snapshot

Figure 33 TCS: Company Snapshot

Figure 34 Honeywell International Inc.: Company Snapshot

Figure 35 Amadeus It Group Sa: Company Snapshot

Figure 36 Microsoft Corporation: Company Snapshot

Figure 37 Tech Mahindra Limited: Company Snapshot

Figure 38 SAP SE: Company Snapshot

Figure 39 Arrow Electronics, Inc.: Company Snapshot

The study considered major activities to estimate the current market size for IoT in aviation market. Exhaustive secondary research was undertaken to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg, BusinessWeek, and Aerospace Magazine, were referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The IoT in aviation market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by various end-users, such as airports, airlines, MROs, and manufacturers. The supply side is characterized by advancements in IoT technology and the development of hardware and software for IoT systems. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the IoT in aviation market. These methods were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details.

- Key players in the industry and markets were identified through extensive secondary research.

- The industrys supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market sizeusing the market size estimation processes explained abovethe market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends, from both the demand and supply sides, in the IoT in aviation market.

Report Objectives

- To define, describe, segment, and forecast the size of the IoT in aviation market based on type, platform, material, end-use, and region

- To forecast the market size of various segments of the IoT in aviation market with respect to four major regions: North America, Europe, Asia Pacific, and Rest of the World, along with major countries in each region

- To identify and analyze key drivers, opportunities, and challenges influencing the growth of the IoT in aviation market

- To identify industry trends, market trends, and technology trends currently prevailing in the IoT in aviation market

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contribution to the overall market

- To analyze the degree of competition in the IoT in aviation market by identifying key market players

- To analyze competitive developments, such as partnerships, contracts, expansions, collaborations, product launches, and acquisitions of key players in the IoT in aviation market

- To strategically profile key market players and comprehensively analyze their market ranking and core competencies

Available Customizations

Along with the market data, MarketsandMarkets offers customizations according to a companys specific needs.

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Further sub-segmentation

- Further breakdown of the application segment

Growth opportunities and latent adjacency in IoT in Aviation Market