5G Chipsets Market by Type (Modems, RFICs), Frequency (Sub - 6 GHz, 24 - 29 GHz, Above 39 GHz), Process Node (Less than 10 nm, 10 to 28 nm, Above 28 nm), End-use (Telecommunication Infrastructure, Mobile Devices) and Region - Global Growth Driver and Industry Forecast to 2028

Updated on : July 11, 2025

5G Chipsets Market Size & Growth

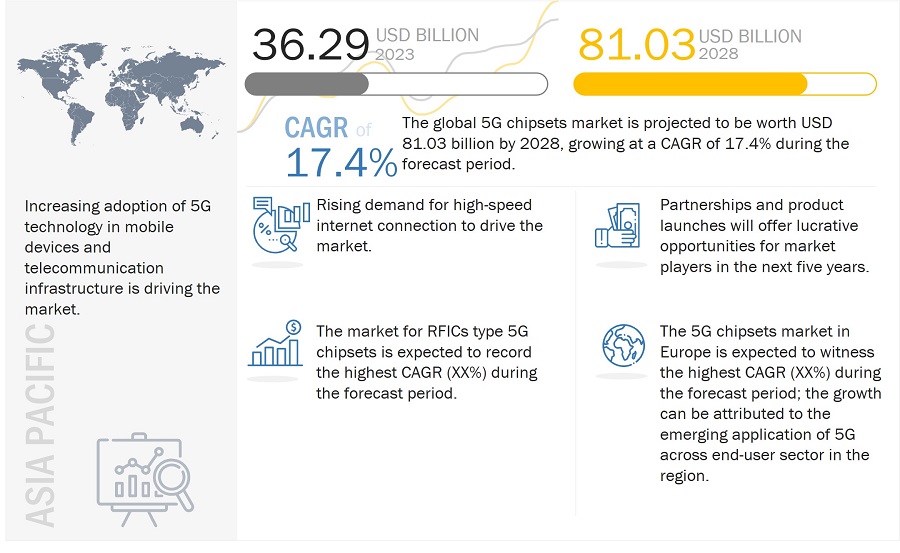

The global 5G chipsets market size is estimated to be USD 36.29 billion in 2023 and is projected to reach USD 81.03 billion by 2028, growing at a CAGR of 17.4% during the forecast period from 2023 to 2028.

5G Chipsets Market Key Takeaways

-

By 2023–2028, the market nearly doubles, climbing from USD 36.29 billion in 2023 to USD 81.03 billion by 2028, with a strong 17.4% CAGR.

-

By dynamics – booming demand for high-speed connectivity, both consumers and businesses are driving rapid adoption, seeking smoother video streaming, gaming, and constant online access.

-

By dynamics – surge in private networks, industries like manufacturing and logistics are rolling out standalone 5G setups—fueling demand for trustworthy, dedicated chipsets.

-

By challenge – device pricing pressures, modern chip architectures and production costs make phones and gadgets pricier, slowing penetration in budget-conscious markets.

-

By opportunity – sub-6?GHz leads, offering wide coverage and versatility, while mmWave chipsets push top-tier speeds but still face real-world signal obstacles.

-

By technology – smaller process nodes win, chipsets built on 10?nm or below deliver better performance, lower power use, and more compact designs.

-

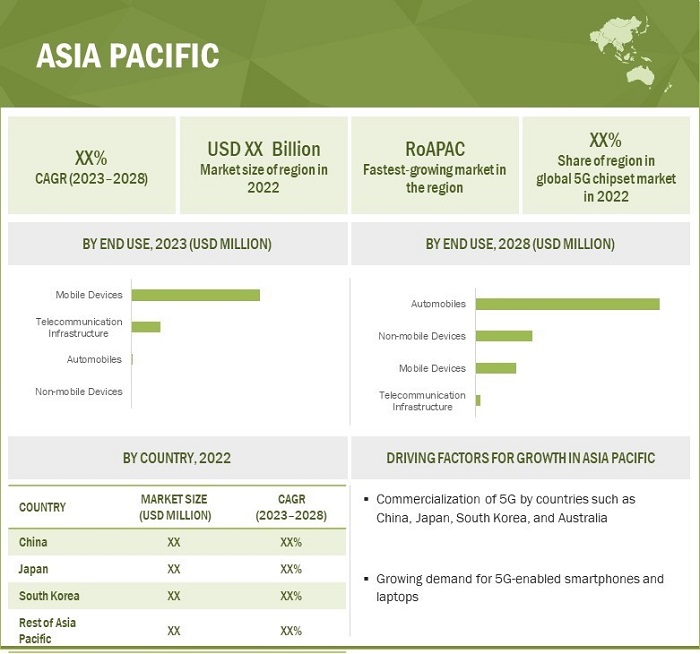

By region – Asia Pacific in front, capturing the largest share thanks to affordable devices, key local manufacturers, and swift rollout in China, India, and South Korea.

Market Size & Forecast Report

-

2023 Market Size: USD 36.29 billion

-

2028 Projected Market Size: USD 81.03 billion

-

CAGR (2023-2028): 17.4%

-

Asia Pacific: Record Highest CAGR

The growing demand for high-speed internet, the need for better network coverage, increased cellular and M2M IoT connections, growing adoption of 5G in automobiles, increase in mobile data traffic, rising demand for high-speed and low-latency 5G infrastructure, and widespread use of chipsets in consumer electronics is driving the 5G chipsets market.

5G Chip Manufacturers Market Insights and Growth Prospects:

The 5G chip manufacturers market is experiencing rapid growth, driven by the global rollout of 5G networks and the increasing demand for high-speed, low-latency connectivity across various industries. These chips are integral to the functioning of 5G infrastructure, mobile devices, and IoT applications, providing enhanced data transmission, network reliability, and performance. Key players in the market, including Qualcomm, MediaTek, Samsung, and Intel, are advancing innovations in semiconductor technology to support the growing need for 5G connectivity. The market is expected to expand significantly, with increasing adoption in smartphones, automotive, healthcare, and other sectors, as 5G technology continues to revolutionize global communications and data exchange.

High-speed internet connectivity has become one of the most essential entities in today’s digitally evolving workplaces, commuter hubs, and even homes. Next-generation technology demands beyond mobile internet and improvements in data speed. Demand for connectivity is expected to be driven by trends such as loT, autonomous cars, smart cities, AR/VR, ultrahigh-definition content, and industrial automation. R&D related to developing next-generation wireless broadband technologies is becoming more intense and widespread. With 3G having become entrenched as the mainstream wireless broadband technology and 4G rapidly expanding its prospects across applications, the industry focus has shifted toward developing 5G technology and solutions. 5G will enable a fully connected world with a highly heterogeneous wireless and fixed-access technology network.

5G Chipsets Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

The 5G chips industry Research is on the cusp of a technological revolution, as artificial intelligence (AI) is revolutionizing the design process by enabling automated and intelligent chip design. Machine learning algorithms analyze vast datasets to optimize layout, power consumption, and performance.

5G Chipsets Market Trends and Dynamics:

Here are some of the ways AI is being used in 5G chipsets today:

- Network Optimization: Al algorithms analyze real-time data to optimize network parameters, enhancing overall performance and efficiency.

- Self-Organizing Networks (SON): Al enables autonomous adjustments in network configurations, ensuring optimal functionality and reducing manual intervention.

- Predictive maintenance: Al is employed for predictive analytics, identifying potential issues in 5G infrastructure before they lead to downtime, thus improving reliability.

- Beamforming Optimization: Machine learning algorithms dynamically adjust beamforming parameters, optimizing signal direction and improving data transfer rates.

- Design Acceleration: Al expedites the chipset design process by simulating scenarios, predicting performance outcomes, and reducing time-to-market.

AI has the potential to revolutionize the 5G ICs market in the following ways:

- Dynamic Resource Allocation: Al can dynamically allocate network resources based on real-time demand, optimizing bandwidth and enhancing user experience.

- Edge Computing Integration: Al at the edge enhances processing capabilities, reducing latency and enabling applications like autonomous vehicles and augmented reality.

- Security Enhancement: Al-powered cybersecurity can identify and respond to threats in real-time, fortifying the 5G network against potential attacks.

- Customization for Diverse Applications: Al allows the customization of 5G chips to meet specific requirements of diverse applications, from smart cities to industrial loT.

The future of 5G chipsets is bright with AI. We expect to see even more innovative products from the 5G chip manufacturers as AI technology develops.

Here are some of the challenges that need to be addressed for AI to reach its full potential in 5G chipsets market:

- Data Privacy and Security: Implementing robust measures to safeguard sensitive data is crucial to prevent unauthorized access and maintain user trust.

- Skills and expertise: The industry needs professionals in telecommunications and Al to implement and manage these advanced technologies effectively.

- Regulation: Adhering to evolving regulations and standards in the Al and telecommunications industries is essential for widespread adoption. Despite these challenges, the future of 5G chips with Al is full of promise. Al has the potential to transform the 5G chipsets industry in the coming years, making it more efficient, safer, and sustainable.

Driver: High use of M2M communication technology

The speed and reliability of 5G are expected to have a massive impact on machine-to-machine (M2M) and IoT. Key reasons for the increased adoption of new M2M technologies are better connectivity for smooth communication and low power requirements. The existing capacity of mobile networks must handle billions of nodes that are anticipated to ascend in the next couple of years to achieve effective M2M communication. Currently, the network capacity cannot manage M2M and human-based communications and their different communication patterns, such as latency time. For this reason, a next-level cellular network for mobile communication featuring hyper-connectivity and larger bandwidth is required (e.g., a 5G network). M2M communication technology will be widely used in heavy manufacturing and process industries (e.g., food industries) to increase the efficiency of different processes and reduce human interference with machines. M2M communication is thus expected to drive the 5G chipsets market.

Restraints: High cost of 5G chips for mobile devices

The high price of 5G chips contributes to increased initial deployment expenses for manufacturers and mobile device producers. This cost is incurred when integrating 5G capabilities into smartphones, tablets, and other mobile devices. The cost of 5G chipsets is a substantial component of the overall manufacturing cost of 5G-enabled devices. This, in turn, affects the retail price of these devices, potentially limiting their affordability for a significant portion of the consumer market. High chipset costs may restrict research, development, and innovation resources in the 5G chipset market. This can potentially slow down technological advancements, limiting the pace of improvements and optimizations.

Opportunities: The emergence of private 5G networks to address wireless communication requirements in industrial IoT

Private 5G networks offer low-latency communication and high reliability, which are crucial for industrial applications. 5G chipsets play a pivotal role in delivering these capabilities, ensuring that the communication infrastructure meets the stringent requirements of industrial environments. Industrial IoT applications generate large volumes of data that require high bandwidth and capacity for efficient and real-time communication. 5G chipsets enable the transmission of massive amounts of data at faster speeds, facilitating the seamless operation of IloT devices and systems. Private 5G networks cater to industrial use cases, including smart manufacturing, predictive maintenance, remote monitoring, and augmented reality applications. The versatility of 5G chips makes them suitable for addressing the diverse communication requirements of these use cases. As industries worldwide recognize the benefits of private 5G networks for their lloT needs, the demand for 5G chips is expected to grow globally.

Challenges: Design challenges for RF devices operating at higher frequency

5G technology operates at higher frequency bands than previous generations, utilizing millimeter-wave (mmWave) frequencies. The design challenge arises because higher frequencies present unique characteristics and technical obstacles that demand careful consideration in RF device design. Higher frequency signals, such as those in the mmWave spectrum, have shorter wavelengths. This results in challenges related to signal propagation and range. Signals at higher frequencies are more prone to absorption by atmospheric gases and are susceptible to obstacles like buildings and foliage, requiring sophisticated design techniques to overcome these limitations. As the 5G landscape evolves, ensuring standardization and compatibility across different devices and manufacturers becomes crucial. Design challenges include meeting industry standards and ensuring interoperability within the diverse ecosystem of 5G-enabled devices.

5G Chipsets Market Segmentation

RFICs type 5G chipsets accounted for a large share of the 5G chipset market in 2023

Radio frequency integrated circuits (RFICS) have been segmented into RF transceivers and RF front end (FE). RFICS plays a vital role in cellular devices and infrastructure equipment. RFICs will play a crucial role, especially in 5G networks, in producing and commercializing consumer electronic devices, next-generation base stations, and other radio access products. They are developed to reinforce the overall performance of the 5G base station in terms of high efficiency and compact form factors. Qualcomm Technologies, Inc. (US); Qorvo (US); Broadcom (US); Analog Devices, Inc. (US); and SAMSUNG (South Korea) are among the top players developing RFICS for 5G communication.

Mobile devices end-use accounted for a more significant proportion of the 5G chipsets market in 2023

With the proliferation of data-intensive applications such as high-definition video streaming, augmented reality (AR), and virtual reality (VR), there is a growing demand for increased data capacity. 5G's higher bandwidth and data capacity make it well-suited to handle the requirements of these applications on mobile devices. 5G technology offers significantly faster data speeds and lower latency than previous generations. This translates into a vastly improved connectivity experience for mobile device users, enabling faster downloads, smoother streaming, and better overall performance.

The 5G chipset market is witnessing intense competition among semiconductor manufacturers to produce more efficient, compact, and cost-effective solutions. As technology continues to evolve, the market is expected to see innovations in 5G ICs that enable enhanced functionality and improved energy efficiency, paving the way for a new generation of 5G-enabled devices.

The 5G chipsets market for 24-39 GHz frequency accounted for the highest CAGR during the forecast period

24-39 GHz or mmWave frequency band can offer ultra-high-speed mobile broadband 5G service. This spectrum is likely to play a vital role in addressing the issue of mobile data traffic. This spectrum is a mixture of licensed and unlicensed spectrum. There is an increased demand for wireless data bandwidth; additionally, the mobile data experience for users is expanding and developing continuously. Thus, the cellular industry looks forward to this frequency spectrum being utilized in developing new 5G wireless technologies. mmWave frequencies suffer high propagation loss; however, the small form factor of mmWave antenna allows for dense packing of antenna arrays. The increasing number of antenna elements enhances coverage through tighter beams. mmWave-based network devices will likely be employed for short ranges (between 50 and 200 m).

5G chipsets market for 10-28 nm process nodes to account for the highest share of the market during the forecast period

5G chips with process nodes ranging from 10 to 28 nm primarily include baseband processors for 5G infrastructure and RFIC components. Snapdragon X55 5G modem, offered by Qualcomm, pairs with a single-chip 14 nm RF transceiver for 5G sub-6 GHz for smartphones and other 5G devices. Layerscape architecture, provided by NXP, a family of programmable 5G baseband processors, uses the IP of IQ- Analog Corp (US). It was prototyped in Global Foundries' 14 nm FinFET manufacturing process. mmWAVE 5G RF chips, an offering of Samsung Electronics, are produced by TSMC on 16 nm and 28 nm production lines. 22 nm ULP RF technology of TSMC integrates critical mmWave mobile communication devices, such as mmWave front-end modules, including switches, low-noise amplifiers (LNAs), and power amplifiers (PAs), onto a single chip. Further, ADRV9026, offered by Analog Devices, integrated with an RF transceiver for 5G TDD and FDD massive MIMO, macro-cell, and small-cell base stations, is built on 28 nm CMOS.

Some of the recent development by the 5G chips manufacturers are listed below:

- November 2022, Qualcomm Technologies, Inc. launched its latest premium mobile platform, Snapdragon 8 Gen 2. Global OEMs will adopt this new mobile platform and brands, including ASUS Republic of Gamers, HONOR, IQOO, Motorola, Nubia, OnePlus, OPPO, RED MAGIC, Redmi, SHARP, Sony Corporation, Vivo, Xiaomi, XINGJI/MEIZU, and ZTE.

- October 2022, SAMSUNG announced the industry’s first 512-gigabyte (GB) Compute Express Link (CXL) DRAM module. The new CXL DRAM is built with an application-specific integrated circuit (ASIC) CXL controller. It is the first to pack 512GB of DDR5 DRAM, featuring four times the memory capacity and one-fifth the system latency over the previous Samsung CXL offering.

- August 2022, MediaTek Inc. (Taiwan) launched its latest addition to its 5G portfolio, the T830 platform for 5G fixed wireless access (FWA) routers and mobile hotspot customer-premise equipment (CPE). It is built with an M80 modem that supports advanced release 16 capabilities for sub-6GHz band operations, making the platform ideal for 5G networks worldwide.

- May 2022, MediaTek announced its Dimensity 1050 System-on-Chip (SoC). It was the first mmWave 5G chips offered by the player to support next-generation 5G smartphones to provide seamless connectivity, displays, gaming, and power efficiency. This combines the mmWave 5G and sub-6GHz to migrate among network bands seamlessly. It is built on the ultra-efficient TSMC 6 nm production process with an octa-core CPU.

- February 2022, Qualcomm Technologies, Inc. launched its first 5G Al processor integrated with a 5G Modem-RF System. The player also announced its new portfolio of Snapdragon X65 and X62 5G M.2 Modules, developed in collaboration with Foxconn Industrial Internet and Quectel. This brings the leading 5G connectivity of Qualcomm Technologies to laptop and desktop computers, enabling easy 5G adoption for PCs.

- In September 2021, Qorvo introduced two bulk acoustic wave (BAW) filters to support the ongoing global deployment of 5G base stations. The new QPQ3500 and QPQ3501 filters offer base station OEM pin compatibility. The QPQ3500 (Band 42) supports China and Europe, while the QPQ3501 (Bands 42 and 52) addresses 5G base station requirements in China and India.

- In August 2021, SAMSUNG (South Korea) introduced three new chipsets to be integrated into next-generation 5G mobile devices. Chipsets include a third-generation mmWave radio frequency integrated circuit (RFIC) chip, a second-generation 5G modem SoC, and a digital front-end (DFE) RFIC-integrated chip.

Some of the recent collaboration by 5G chips manufacturers across the globe

- November 2022, Qualcomm Technologies, Inc. partnered with Siemens to reimagine building automation by applying a 5G private network (PN) based on the Snapdragon X55 5G Modem- RF System in the Americas.

- In November 2022, Qorvo expanded its collaboration with MediaTek Inc. to enable the power of connectivity in a new generation of 5G smartphones, Wi-Fi equipment, and cars. Qorvo

- works closely with MediaTek Inc. to accelerate innovation and deliver cutting-edge performance to leading customers in mobile, networking, automobile, and other markets.

- In November 2022, Marvell collaborated with Nokia to advance the ReefShark chipset portfolio of Nokia. The companies have worked closely on the new OCTEON 10 data processing unit (DPU), which augments the ReefShark family with best-in-class 5G transport built on cutting-edge 5 nm processor and hardware acceleration technology. The jointly developed solution equips mobile network operators to rapidly evolve their networks and deliver innovative new 5G services at high performance and capacity with ultra-low latency and energy efficiency.

- In October 2022, the technology company HFCL Limited (India) announced its collaboration with Qualcomm Technologies Inc. (US) to design and develop 5G outdoor small cell products for HFCL. According to HFCL, the investment will provide a faster rollout of 5G networks and improve the user experience while enhancing the efficient utilization of the 5G spectrum.

- March 2022, NXP Semiconductor partnered with Compal to power a new integrated small cell solution offered by Compal to address 5G network densification with NXP's Layerscape and Layerscape access family of processors. This small-cell solution delivers high performance for enhanced 5G coverage across public and private networks.

- November 2021, MediaTek Inc. (Taiwan) announced a collaboration with AMD to co-engineer industry-leading Wi-Fi solutions, starting with the AMD RZ600 Series Wi-Fi 6E modules containing the new Filogic 330P chipset of MediaTek Inc. The Filogic 330P chipset will power next-generation AMD Ryzen-series laptop and desktop PCs in 2022 and beyond, delivering fast Wi-Fi speeds with low latency and less interference from other signals.

5G Chipsets Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top 5G Chipsets Companies - Key Market Players

The 5G Chipsets companies have implemented various types of organic as well as inorganic growth strategies, such as new product launches and acquisitions, to strengthen their offerings in the 5G chipset market.

The major players in the 5G Chipsets market are

- Qualcomm Technologies, Inc. (US),

- MediaTek Inc. (Taiwan),

- Huawei Technologies Co., Ltd. (China),

- SAMSUNG (South Korea),

- Broadcom (US) among others.

The other companies profiled in the report are Qorvo, Inc (US), Skyworks Solutions, Inc. (US), Analog Devices, Inc. (US), Marvell (US), Anokiwave, Inc (US), NXP Semiconductors (Netherlands), Xilinx (Acquired by AMD) (US), Texas Instruments Incorporated (US), Murata Manufacturing Co., Ltd. (Japan), Renesas Electronics Corporation (Japan), Infineon Technologies AG (Germany), MACOM (US), u-blox (Switzerland), Sivers IMA (Sweden), Unisoc (Shanghai) Technologies Co., Ltd. (China), Arm Limited (UK), Cadence Design Systems, Inc. (US), Fibocom Wireless Inc. (China), Quectel (China), and OMMIC (France).

5G Chipsets Market Report Scope

|

Report Metric |

Details |

| Estimated Market Size | USD 36.3 Billion in 2023 |

| Projected Market Size | USD 81.0 Billion by 2028 |

| Growth Rate | CAGR of 17.4% |

|

Years considered |

2019–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD million/billion) |

|

Segments covered |

Type, End – Use, Process Node, and Frequency |

|

Regions covered |

North America, Europe, APAC, and the Rest of the World |

|

Companies covered |

Qualcomm Technologies, Inc. (US), MediaTek Inc. (Taiwan), Huawei Technologies Co., Ltd. (China), SAMSUNG (South Korea), and Broadcom (US), Qorvo, Inc (US), Skyworks Solutions, Inc. (US), Analog Devices, Inc. (US), Marvell (US), Anokiwave, Inc (US), NXP Semiconductors (Netherlands), Xilinx (Acquired by AMD) (US), Texas Instruments Incorporated (US), Murata Manufacturing Co., Ltd. (Japan), Renesas Electronics Corporation (Japan), Infineon Technologies AG (Germany), MACOM (US), u-blox (Switzerland), Sivers IMA (Sweden), Unisoc (Shanghai) Technologies Co., Ltd. (China), Arm Limited (UK), Cadence Design Systems, Inc. (US), Fibocom Wireless Inc. (China), Quectel (China), and OMMIC (France). The study includes an in-depth competitive analysis of these key players in the 5G Chipsets market with their company profiles' |

5G Chipsets Market Highlights

In this report, the overall 5G Chipsets market has been segmented based on Type, End – Use, Process Node, and Frequency

|

Segment |

Subsegment |

|

By Type: |

|

|

By End–Use: |

|

|

By Region: |

|

Recent Developments in 5G Chipsets Industry

- In December 2022, MediaTek Inc. announced its newest chipset for premium 5G smartphones. Smartphones, the Dimensity 8200. The new chipset delivers unparalleled power efficiency. It also integrates an octa-core CPU with four Arm Cortex-A78 cores operating up to 3.1 GHz and a powerful Mali-G610 graphics engine for better application performance.

- In December 2022, Skyworks Solution launched the SKY66319-11, a highly efficient, wide instantaneous bandwidth possessing a fully input/output matched power amplifier (PA) with high gain and linearity. The compact 5 × 5 mm PA is designed for TDD 4G LTE and 5G systems operating from 4400 to 5000 MHz. The active biasing circuitry is integrated to compensate PA performance over temperature, voltage, and process variation

- In December 2022, Skyworks Solutions, Inc. introduced the highest efficiency portfolio of Wi-Fi front-end modules (FEMs) in the industry in collaboration with Broadcom, addressing the power, performance, and thermal requirements of Wi-Fi 6/6E-enabled devices in next-generation enterprise and internet of things (IoT) products.

- In November 2022, Qualcomm Technologies, Inc. partnered with Siemens to reimagine building automation by applying a 5G private network (PN) based on the Snapdragon X55 5G Modem-RF System in the Americas.

Frequently Asked Questions (FAQ):

Who are the top 5 players in the 5G Chipsets market share?

The major vendors operating in the industry market are Qualcomm Technologies, Inc. (US), MediaTek Inc. (Taiwan), Huawei Technologies Co., Ltd. (China), SAMSUNG (South Korea), and Broadcom (US).

What are some of the technological advancements in the 5G chipsets market share?

Massive Multiple Input, Multiple Output (MIMO) is considered the key enabler for 5G wireless networks and implies techniques that increase cellular coverage and capacity using large numbers of antennas. Inside a mobile device, there are limits to fitting antennas, but 5G is designed to support massive MIMO, using up to 256 antenna elements in the base station. That sets the stage for intelligent beamforming and beam-tracking in spectrum bands under 6GHz. A Massive MIMO system significantly enhances the throughput of the system along with simplifying the signal processing required.

What are the factors driving the growth of the 5G chipsets market?

Growing mobile data traffic and faster data rates.

What are their major strategies to strengthen their market presence?

The major strategies adopted by these players are product launches and contracts.

Which major countries are considered in the APAC region?

The report includes an analysis of China, Japan, South Korea, and the Rest of Asia Pacific.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising demand for high-speed internet and broad network coverage- High use of M2M communication technology- Growing mobile data trafficRESTRAINTS- High cost of 5G chipsets for mobile devicesOPPORTUNITIES- Rising demand for 5G network in automobiles, smart cities, and healthcare sector- Emergence of private 5G networks to address wireless communication requirements in industrial IoTCHALLENGES- Design challenges for RF devices operating at higher frequency

-

5.3 VALUE CHAIN ANALYSIS

-

5.4 5G ECOSYSTEM ANALYSIS

- 5.5 PORTER’S FIVE FORCES ANALYSIS

- 5.6 PRICING ANALYSIS

-

5.7 PATENT ANALYSIS

- 5.8 TRADE ANALYSIS

-

5.9 TARIFF AND REGULATORY LANDSCAPEREGULATORY LANDSCAPETARIFF

-

5.10 CASE STUDY ANALYSISUSCELLULAR USES ERICSSON’S 5G MMWAVE EXTENDED RANGE FWA SERVICES TO DELIVER HIGH-SPEED BROADBAND SERVICESTUSASS AND ERICSSON CONNECTED GREENLAND WITH 5GINSEEGO’S 5G SOLUTIONS ENHANCED DIGITAL INFRASTRUCTURES OF SMART CITIES IN SOUTHERN EUROPE

-

5.11 TECHNOLOGY ANALYSISCOMPLEMENTARY TECHNOLOGY- Message queuing telemetry transport (MQTT)- Massive multiple input, multiple output (MIMO)ADJACENT TECHNOLOGY- Internet of Things (IoT)- Network slicing in radio access network (RAN)

- 6.1 INTRODUCTION

-

6.2 MODEMSHIGH USE OF 5G BASEBAND PROCESSORS IN SMARTPHONES

-

6.3 RADIO FREQUENCY INTEGRATED CIRCUITS (RFICS)CRUCIAL ROLE IN DESIGNING 5G CHIPSETSRF TRANSCEIVERS- Increasing demand for wideband RF transceivers in 5G communicationRF FE- Power amplifiers- Switches- Low-noise amplifiers- Filters- Others

- 7.1 INTRODUCTION

-

7.2 TELECOMMUNICATION INFRASTRUCTUREMACRO CELL- Features large coverage area and high-efficiency outputSMALL CELLS- Essential for applications demanding high bandwidthCUSTOMER PREMISES EQUIPMENT (CPE)- Rising demand in various industries

-

7.3 MOBILE DEVICESSMARTPHONES- Rising demand for 5G smartphonesTABLETS & LAPTOPS- Development of 5G-enabled tablets and laptopsMOBILE HUBS- Growing use of mobile hubs to provide scalable and reliable mobile communication and data processing capabilities to smart mobile objectsROBOTS/DRONES- Rising adoption of autonomous robots with 5G wireless networking capabilitiesWEARABLES- Rising demand for wearables tethered via wireless technologies to smartphonesAR/VR DEVICES- 5G to offer heavy bandwidth required by AR/VR devices

-

7.4 NON-MOBILE DEVICESIOT GATEWAYS- Enhanced capacity and coverage of 5G networkSURVEILLANCE CAMERAS- Rising criminal and fraudulent activities

-

7.5 AUTOMOBILES5G CHIPSETS TO WITNESS HIGH ADOPTION IN TELEMATICSCELLULAR V2X- 5G V2X to foster synergies between automobile and other verticals

- 8.1 INTRODUCTION

-

8.2 SUB–6 GHZHIGH DEMAND FOR SUB-6 GHZ 5G CHIPSETS FROM QUALCOMM, MEDIATEK, AND SAMSUNG

-

8.3 24–39 GHZGROWING NEED TO ADDRESS MOBILE DATA TRAFFIC ISSUE

-

8.4 ABOVE 39 GHZINCREASING ADOPTION OF ABOVE 39 GHZ SPECTRUM FOR FIXED POINT-TO-POINT AND POINT-TO-MULTIPOINT SATELLITE OPERATIONS

- 9.1 INTRODUCTION

-

9.2 LESS THAN 10 NMRISING DEPLOYMENT OF 5–7 NM 5G CHIPSETS IN SMARTPHONES

-

9.3 10–28 NMHIGH ADOPTION OF PROCESS NODES RANGING FROM 10–28 NM IN MOBILE DEVICES

-

9.4 ABOVE 28 NMINCREASING APPLICATIONS OF RF COMPONENTS WITH PROCESS NODES ABOVE 28 NM IN 5G INFRASTRUCTURE

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACTUS- Collaboration of Department of Defense (DoD) with industry players and academia under 5G-to-Next G initiativeCANADA- Rising investments in clean energy, drive-less vehicle, and smart city projectsMEXICO- Deployment of 5G network by companies on trial basis

-

10.3 EUROPEEUROPE: RECESSION IMPACTUK- UK to dominate market in Europe with increasing PPP activitiesGERMANY- Developments by Vodafone and T-Mobile companies in 5GFRANCE- Deployment of connected car technologies by renowned car manufacturersREST OF EUROPE

-

10.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTCHINA- Expanding 5G chipsets marketJAPAN- Rising development and deployment of 5G infrastructureSOUTH KOREA- Increasing collaborations between government and private companies to launch 5G mobile networksREST OF ASIA PACIFIC

-

10.5 ROWROW: RECESSION IMPACTMIDDLE EAST & AFRICA- Increasing demand for 5G in UAE, Saudi Arabia, and QatarSOUTH AMERICA- Rising demand for smartphones and mobile networks in Brazil, Mexico, Chile, and Argentina

- 11.1 OVERVIEW

- 11.2 REVENUE ANALYSIS

- 11.3 MARKET SHARE ANALYSIS

-

11.4 COMPANY EVALUATION QUADRANT, 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.5 SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION QUADRANT, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

11.6 COMPETITIVE SCENARIOS AND TRENDSPRODUCT LAUNCHESDEALSOTHERS

-

12.1 KEY PLAYERSQUALCOMM TECHNOLOGIES, INC.- Business overview- Products offered- Recent developments- MnM viewSAMSUNG- Business overview- Products offered- Recent developments- MnM viewMEDIATEK INC.- Business overview- Products offered- Recent developments- MnM viewHUAWEI TECHNOLOGIES CO., LTD.- Business overview- Products offered- Recent developments- MnM viewBROADCOM- Business overview- Products offered- Recent developments- MnM viewQORVO- Business overview- Products offered- Recent developments- MnM viewSKYWORKS SOLUTIONS, INC.- Business overview- Products offered- Recent developments- MnM viewANALOG DEVICES- Business overview- Products offered- Recent developmentsMARVELL- Business overview- Products offered- Recent developmentsANOKIWAVE INC.- Business overview- Products offered- Recent developmentsNXP SEMICONDUCTOR- Business overview- Products offered- Recent developments

-

12.2 OTHER PLAYERSXILINXTEXAS INSTRUMENTS INCORPORATEDMURATA MANUFACTURING CO., LTD.RENESAS ELECTRONICS CORPORATIONINFINEON TECHNOLOGIES AGMACOMU-BLOXSIVERS IMAUNISOC (SHANGHAI) TECHNOLOGIES CO., LTD.ARM LIMITEDCADENCE DESIGN SYSTEMS, INC.FIBOCOM WIRELESS INC.QUECTELOMMIC

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 RELATED REPORTS

- 13.4 AUTHOR DETAILS

- TABLE 1 ASSUMPTIONS RELATED TO RECESSION

- TABLE 2 5G CHIPSETS MARKET, 2019–2022 (USD BILLION)

- TABLE 3 MARKET, 2023–2028 (USD BILLION)

- TABLE 4 USE CASES FOR PRIVATE 5G

- TABLE 5 MARKET: VALUE CHAIN ANALYSIS

- TABLE 6 5G CHIP MANUFACTURERS MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 7 AVERAGE PRICE OF 5G CHIPSET COMPONENTS

- TABLE 8 RECENT PATENT REGISTRATIONS

- TABLE 9 EXPORT DATA FOR ELECTRONIC INTEGRATED CIRCUITS, BY COUNTRY, 2017–2021

- TABLE 10 IMPORT DATA FOR ELECTRONIC INTEGRATED CIRCUITS, BY COUNTRY, 2017–2021

- TABLE 11 TARIFF FOR ELECTRONIC INTEGRATED CIRCUITS AS PROCESSORS AND CONTROLLERS EXPORTED BY US, 2021

- TABLE 12 TARIFF FOR ELECTRONIC INTEGRATED CIRCUITS AS PROCESSORS AND CONTROLLERS EXPORTED BY CHINA, 2021

- TABLE 13 TARIFF FOR ELECTRONIC INTEGRATED CIRCUITS AS PROCESSORS AND CONTROLLERS EXPORTED BY GERMANY, 2021

- TABLE 14 MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 15 5G CHIPSET MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 16 MODEMS: 5G CHIP MANUFACTURERS MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 17 MODEMS: MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 18 MODEMS: MARKET, BY END USE, 2019–2022 (MILLION UNITS)

- TABLE 19 MODEMS: MARKET, BY END USE, 2023–2028 (MILLION UNITS)

- TABLE 20 MODEMS: MARKET, BY TELECOMMUNICATION INFRASTRUCTURE, 2019–2022 (USD MILLION)

- TABLE 21 MODEMS: 5G CHIP MANUFACTURERS MARKET, BY TELECOMMUNICATION INFRASTRUCTURE, 2023–2028 (USD MILLION)

- TABLE 22 MODEMS: MARKET, BY MOBILE DEVICES, 2019–2022 (USD MILLION)

- TABLE 23 MODEMS: MARKET, BY MOBILE DEVICES, 2023–2028 (USD MILLION)

- TABLE 24 MODEMS: MARKET, BY MOBILE DEVICE, 2019–2022 (MILLION UNITS)

- TABLE 25 MODEMS: MARKET, BY MOBILE DEVICES, 2023–2028 (MILLION UNITS)

- TABLE 26 MODEMS: MARKET, BY NON-MOBILE DEVICES, 2019–2022 (USD MILLION)

- TABLE 27 MODEMS: MARKET, BY NON-MOBILE DEVICE, 2023–2028 (USD MILLION)

- TABLE 28 RFICS: 5G CHIPSETS MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 29 RFICS: MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 30 RFICS: MARKET, BY END USE, 2019–2022 (MILLION UNITS)

- TABLE 31 RFICS: MARKET, BY END USE, 2023–2028 (MILLION UNITS)

- TABLE 32 RFICS: MARKET, BY TELECOMMUNICATION INFRASTRUCTURE, 2019–2022 (USD MILLION)

- TABLE 33 RFICS: MARKET, BY TELECOMMUNICATION INFRASTRUCTURE, 2023–2028 (USD MILLION)

- TABLE 34 RFICS: 5G CHIPSET MANUFACTURERS MARKET, BY MOBILE DEVICES, 2019–2022 (USD MILLION)

- TABLE 35 RFICS: MARKET, BY MOBILE DEVICES, 2023–2028 (USD MILLION)

- TABLE 36 RFICS: 5G CHIPS MARKET, BY MOBILE DEVICE, 2019–2022 (MILLION UNITS)

- TABLE 37 RFICS: MARKET, BY MOBILE DEVICES, 2023–2028 (MILLION UNITS)

- TABLE 38 RFICS: MARKET, BY NON-MOBILE DEVICES, 2019–2022 (USD MILLION)

- TABLE 39 RFICS: MARKET, BY NON-MOBILE DEVICE, 2023–2028 (USD MILLION)

- TABLE 40 RFICS: MARKET, BY NON-MOBILE DEVICE, 2019–2022 (MILLION UNITS)

- TABLE 41 RFICS: MARKET, BY NON-MOBILE DEVICES, 2023–2028 (MILLION UNITS)

- TABLE 42 5G CHIPSET MARKET, BY RFICS TYPE, 2019–2022 (USD MILLION)

- TABLE 43 MARKET, BY RFICS TYPE, 2023–2028 (USD MILLION)

- TABLE 44 RF TRANSCEIVERS: MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 45 RF TRANSCEIVERS: MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 46 RF TRANSCEIVERS: MARKET, BY END USE, 2019–2022 (MILLION UNITS)

- TABLE 47 RF TRANSCEIVERS: MARKET, BY END USE, 2023–2028 (MILLION UNITS)

- TABLE 48 RF FE: 5G CHIPS MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 49 RF FE: MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 50 RF FE: MARKET, BY END USE, 2019–2022 (MILLION UNITS)

- TABLE 51 RF FE: MARKET, BY END USE, 2023–2028 (MILLION UNITS)

- TABLE 52 5G CHIPSETS MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 53 MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 54 AVAILABILITY OF 5G DEVICES

- TABLE 55 TELECOMMUNICATION INFRASTRUCTURE: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 56 TELECOMMUNICATION INFRASTRUCTURE: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 57 TELECOMMUNICATION INFRASTRUCTURE: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 58 TELECOMMUNICATION INFRASTRUCTURE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 59 MACRO CELL: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 60 MACRO CELL: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 61 MACRO CELL: MARKET FOR RFICS, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 62 MACRO CELL: MARKET FOR RFICS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 63 MACRO CELL: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 64 MACRO CELL: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 65 SMALL CELLS: 5G CHIPSET MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 66 SMALL CELLS: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 67 SMALL CELLS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 68 SMALL CELLS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 69 CPE: 5G CHIP MANUFACTURERS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 70 CPE: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 71 CPE: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 72 CPE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 73 MOBILE DEVICES: 5G CHIPSETS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 74 MOBILE DEVICES: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 75 MOBILE DEVICES: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 76 MOBILE DEVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 77 SMARTPHONES: 5G CHIPSET MANUFACTURERS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 78 SMARTPHONES: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 79 SMARTPHONES: MARKET FOR RFICS, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 80 SMARTPHONES: MARKET FOR RFICS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 81 TABLETS & LAPTOPS: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 82 TABLETS & LAPTOPS: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 83 TABLETS & LAPTOPS: MARKET FOR RFICS, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 84 TABLETS & LAPTOPS: MARKET FOR RFICS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 85 MOBILE HUBS: 5G CHIPSET MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 86 MOBILE HUBS: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 87 MOBILE HUBS: MARKET FOR RFICS, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 88 MOBILE HUBS: MARKET FOR RFICS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 89 ROBOTS/DRONES: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 90 ROBOTS/DRONES: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 91 WEARABLES: 5G CHIP MANUFACTURERS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 92 WEARABLES: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 93 AR/VR DEVICES: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 94 AR/VR DEVICES: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 95 NON-MOBILE DEVICES: 5G CHIPSETS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 96 NON-MOBILE DEVICES: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 97 NON-MOBILE DEVICES: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 98 NON-MOBILE DEVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 99 IOT GATEWAYS: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 100 IOT GATEWAYS: 5G CHIPS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 101 IOT GATEWAYS: MARKET FOR RFICS, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 102 IOT GATEWAYS: MARKET FOR RFICS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 103 SURVEILLANCE CAMERAS: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 104 SURVEILLANCE CAMERAS: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 105 SURVEILLANCE CAMERAS: MARKET FOR RFICS, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 106 SURVEILLANCE CAMERAS: MARKET FOR RFICS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 107 AUTOMOBILES: 5G CHIPSET MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 108 AUTOMOBILES: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 109 AUTOMOBILES: MARKET FOR RFICS, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 110 AUTOMOBILES: MARKET FOR RFICS, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 111 AUTOMOBILES: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 112 AUTOMOBILES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 113 5G CHIPSETS MARKET, BY FREQUENCY, 2019–2022 (USD MILLION)

- TABLE 114 5G CHIPS MARKET, BY FREQUENCY, 2023–2028 (USD MILLION)

- TABLE 115 MARKET, BY PROCESS NODE, 2019–2022 (USD MILLION)

- TABLE 116 MARKET, BY PROCESS NODE, 2023–2028 (USD MILLION)

- TABLE 117 MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 118 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 119 NORTH AMERICA: MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 120 NORTH AMERICA: MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 121 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 122 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 123 5G ACTIVITIES IN EUROPE

- TABLE 124 EUROPE: 5G CHIP MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 125 EUROPE: MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 126 EUROPE: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 127 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 128 ASIA PACIFIC: 5G CHIPSETS MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 129 ASIA PACIFIC: MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 130 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 131 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 132 ROW: MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 133 ROW: MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 134 ROW: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 135 ROW: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 136 MARKET: DEGREE OF COMPETITION

- TABLE 137 MARKET: COMPANY FOOTPRINT

- TABLE 138 MARKET: TYPE FOOTPRINT

- TABLE 139 MARKET: APPLICATION FOOTPRINT

- TABLE 140 5G CHIPSET MANUFACTURERS MARKET: REGIONAL FOOTPRINT

- TABLE 141 MARKET: PRODUCT LAUNCHES, FEBRUARY 2019–DECEMBER 2022

- TABLE 142 MARKET: DEALS, FEBRUARY 2019–DECEMBER 2022

- TABLE 143 5G CHIPSETS MARKET: OTHERS, FEBRUARY 2020–OCTOBER 2022

- TABLE 144 QUALCOMM TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 145 SAMSUNG: COMPANY OVERVIEW

- TABLE 146 MEDIATEK INC.: COMPANY OVERVIEW

- TABLE 147 HUAWEI TECHNOLOGIES CO., LTD.: COMPANY OVERVIEW

- TABLE 148 BROADCOM: COMPANY OVERVIEW

- TABLE 149 QORVO: COMPANY OVERVIEW

- TABLE 150 SKYWORKS SOLUTIONS, INC.: COMPANY OVERVIEW

- TABLE 151 ANALOG DEVICES: COMPANY OVERVIEW

- TABLE 152 MARVELL: COMPANY OVERVIEW

- TABLE 153 ANOKIWAVE INC.: COMPANY OVERVIEW

- TABLE 154 NXP SEMICONDUCTOR: COMPANY OVERVIEW

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 BOTTOM-UP APPROACH

- FIGURE 3 TOP-DOWN APPROACH

- FIGURE 4 DATA TRIANGULATION

- FIGURE 5 GDP GROWTH PROJECTIONS TILL 2023 FOR MAJOR ECONOMIES

- FIGURE 6 PROJECTIONS FOR 5G CHIPSETS MARKET, 2019–2028

- FIGURE 7 YEARLY GROWTH TREND IN MARKET

- FIGURE 8 RFICS SEGMENT TO ACCOUNT FOR LARGER SHARE OF MARKET DURING FORECAST PERIOD

- FIGURE 9 AUTOMOBILE SEGMENT TO REGISTER HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

- FIGURE 10 10–28 NM SEGMENT TO HOLD LARGEST SHARE OF MARKET IN 2028

- FIGURE 11 ASIA PACIFIC TO ACCOUNT FOR LARGEST SHARE OF MARKET DURING FORECAST PERIOD

- FIGURE 12 GROWING DEMAND FOR HIGH-SPEED INTERNET AND BROAD NETWORK COVERAGE

- FIGURE 13 WEARABLES SEGMENT TO REGISTER HIGHEST CAGR BETWEEN 2023 AND 2028

- FIGURE 14 CPE SEGMENT TO EXHIBIT HIGHEST CAGR BETWEEN 2023 AND 2028

- FIGURE 15 MOBILE DEVICES SEGMENT AND CHINA TO HOLD LARGEST SHARES OF ASIA PACIFIC 5G CHIPSET MARKET IN 2023

- FIGURE 16 SUB–6 GHZ SEGMENT TO HOLD LARGEST SHARE OF 5G CHIPSET MARKET IN 2028

- FIGURE 17 EUROPE TO RECORD HIGHEST CAGR BETWEEN 2023 AND 2028

- FIGURE 18 5G CHIPSETS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 GLOBAL MOBILE SUBSCRIPTIONS PER 100 PEOPLE

- FIGURE 20 GLOBAL IOT CONNECTIONS, 2020 VS. 2026

- FIGURE 21 GLOBAL M2M CONNECTIONS (BILLION UNITS)

- FIGURE 22 MOBILE 5G DATA TRAFFIC, 2018–2028 (EB PER MONTH)

- FIGURE 23 GLOBAL MOBILE DATA USAGE, 2022 VS. 2028

- FIGURE 24 5G CHIPSET MANUFACTURERS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 25 5G TECHNOLOGY ECOSYSTEM

- FIGURE 26 AVERAGE SELLING PRICE OF 5G CHIPSETS, BY END USE

- FIGURE 27 GLOBAL AVERAGE PRICE TREND OF 5G CHIPSETS

- FIGURE 28 5G CHIPSETS MARKET: PATENT ANALYSIS

- FIGURE 29 EXPORT DATA FOR HS CODE 854231, BY COUNTRY, 2017–2021 (USD MILLION)

- FIGURE 30 IMPORT DATA FOR HS CODE 854231, BY COUNTRY, 2017–2021 (USD MILLION)

- FIGURE 31 5G CAPABILITIES

- FIGURE 32 RFICS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 33 SMARTPHONES SEGMENT TO HOLD LARGEST SHARE OF MARKET FOR MODEMS DURING FORECAST PERIOD

- FIGURE 34 RF TRANSCEIVERS SEGMENT TO REGISTER HIGHER CAGR IN MARKET FOR RFICS DURING FORECAST PERIOD

- FIGURE 35 MOBILE DEVICES SEGMENT TO HOLD LARGEST SHARE OF MARKET DURING FORECAST PERIOD

- FIGURE 36 NORTH AMERICA TO REGISTER HIGHEST CAGR IN MARKET FOR MACRO CELLS DURING FORECAST PERIOD

- FIGURE 37 SMARTPHONES SEGMENT TO ACCOUNT FOR LARGEST SHARE OF MARKET FOR MOBILE DEVICES DURING FORECAST PERIOD

- FIGURE 38 MODEMS SEGMENT TO HOLD LARGER SHARE OF MARKET FOR SMARTPHONES DURING FORECAST PERIOD

- FIGURE 39 RF FE SEGMENT TO ACCOUNT FOR LARGER SHARE OF MARKET FOR RFICS IN ROBOTS BETWEEN 2023 AND 2028

- FIGURE 40 SURVEILLANCE CAMERAS SEGMENT TO LEAD MARKET FOR NON-MOBILE DEVICES DURING FORECAST PERIOD

- FIGURE 41 RFICS SEGMENT TO DOMINATE 5G CHIPSET MARKET FOR IOT GATEWAYS BETWEEN 2023 AND 2028

- FIGURE 42 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR IN MARKET FOR AUTOMOBILES BETWEEN 2023 AND 2028

- FIGURE 43 24–39 GHZ SEGMENT TO REGISTER HIGHEST CAGR IN MARKET FROM 2023 TO 2028

- FIGURE 44 10–28 NM SEGMENT TO RECORD HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

- FIGURE 45 SOUTH AMERICA AND MEXICO TO BE NEW HOTSPOTS FOR MARKET DURING FORECAST PERIOD

- FIGURE 46 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 47 EUROPE: MARKET SNAPSHOT

- FIGURE 48 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 49 ROW: MARKET SNAPSHOT

- FIGURE 50 THREE-YEAR REVENUE ANALYSIS OF TOP FIVE PLAYERS IN MARKET

- FIGURE 51 MARKET SHARE, 2022

- FIGURE 52 GLOBAL MARKET: KEY COMPANY EVALUATION QUADRANT, 2022

- FIGURE 53 GLOBAL 5G CHIPSETS MARKET: SME EVALUATION QUADRANT, 2022

- FIGURE 54 QUALCOMM TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- FIGURE 55 SAMSUNG: COMPANY SNAPSHOT

- FIGURE 56 MEDIATEK INC.: COMPANY SNAPSHOT

- FIGURE 57 HUAWEI TECHNOLOGIES CO., LTD.: COMPANY SNAPSHOT

- FIGURE 58 BROADCOM: COMPANY SNAPSHOT

- FIGURE 59 QORVO: COMPANY SNAPSHOT

- FIGURE 60 SKYWORKS: COMPANY SNAPSHOT

- FIGURE 61 ANALOG DEVICES: COMPANY SNAPSHOT

- FIGURE 62 MARVELL: COMPANY SNAPSHOT

- FIGURE 63 NXP SEMICONDUCTOR: COMPANY SNAPSHOT

The study involves four major activities for estimating the size of the 5G chipsets market. Exhaustive secondary research has been conducted to collect information related to the market. The next step has been validating these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Bottom-up approaches have been used to estimate and validate the size of the 5G Chipsets market and other dependent submarkets. The leading players in the market have been identified through secondary research, and their market share in the key regions has been determined through primary and secondary research. This entire procedure includes the study of the annual and financial reports of the top players and extensive interviews with the industry experts such as chief executive officers, vice presidents, directors, and marketing executives for key insights.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information important for this study. Secondary sources such as The Organization for Economic Co-operation and Development (OECD), Center for Security and Emerging Technology, The Japan External Trade Organization (JETRO), Semiconductor Industry Association, and SEMI have been used to identify and collect information for an extensive technical and commercial study of the 5G chipsets market.

Primary Research

Extensive primary research was conducted after understanding and analyzing the 5G chipsets market through secondary research. Several primary interviews were conducted with key opinion leaders from both the demand- and supply-side vendors across major regions—North America, Europe, APAC, and RoW. Approximately 30% of the primary interviews were conducted with the demand-side vendors and 70% with the supply-side vendors. This primary data was mainly collected through telephonic interviews/web conferences, which consist of 85% of total primary interviews, as well as questionnaires and e-mails.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The 5G Chipsets market consists of by type: Modems and RFICs. 5G chipsets is usually employed in the following end – uses; telecommunication, mobile devices, non–mobile devices, and automobile. Top-down and bottom-up approaches have been used to estimate and validate the size of the 5G chipsets market and other dependent submarkets. The leading players in the market have been identified through secondary research, and their market share in the key regions has been determined through primary and secondary research. This entire procedure includes the study of the annual and financial reports of the top players and extensive interviews with the industry experts such as chief executive officers, vice presidents, directors, and marketing executives for key insights.

Data Triangulation

After arriving at the overall market size from the market size estimation process explained earlier, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market has been validated using both top-down and bottom-up approaches.

Study Objectives:

- To describe and forecast the 5G Chipsets market, in terms of value, by type, process node, frequency, end – use.

- To describe and forecast the 5G Chipset market, in terms of value, for four main regions – North America, Europe, APAC, and the Rest of the World.

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To study the complete value chain of the 5G Chipsets market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the 5G Chipsets ecosystem

- To profile key players and comprehensively analyze their market position in terms of ranking and core competencies2, and provide a detailed competitive landscape of the market

- To analyze the competitive developments, such as joint ventures, collaborations, agreements, contracts, partnerships, mergers & acquisitions, new product developments, and research and development (R&D), in the 5G Chipsets market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report.

Company information:

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in 5G Chipsets Market