DISRUPTION- DATA MONETIZATION, GOVERNMENT REGULATIONS TO CREATE OPPORTUNITIES IN CONNECTED AND TELEMATICS INDUSTRY, WITH TELEMATICS INSURANCE WORTH ~67 BILLION BY 2026

TOP Connected Mobility and Telematics GROWTH STORIES

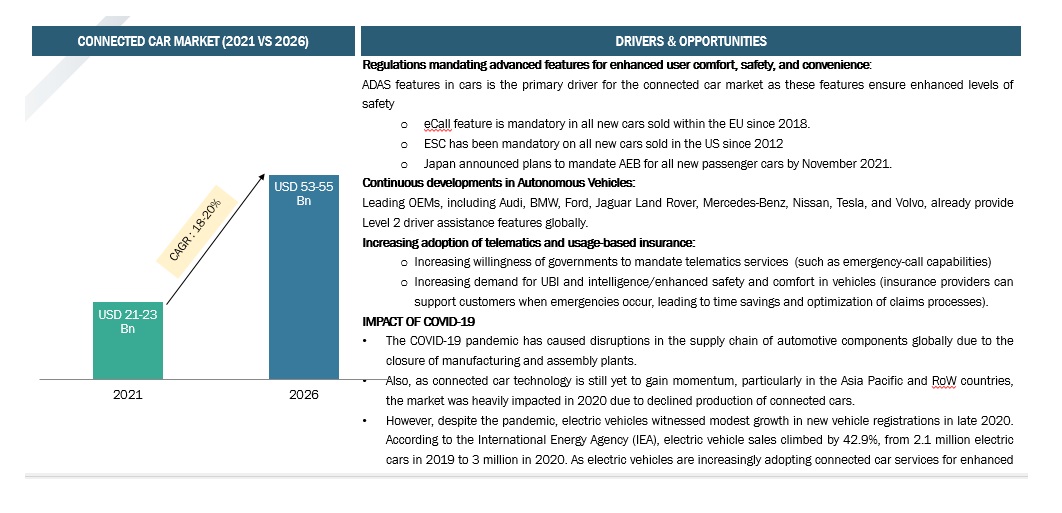

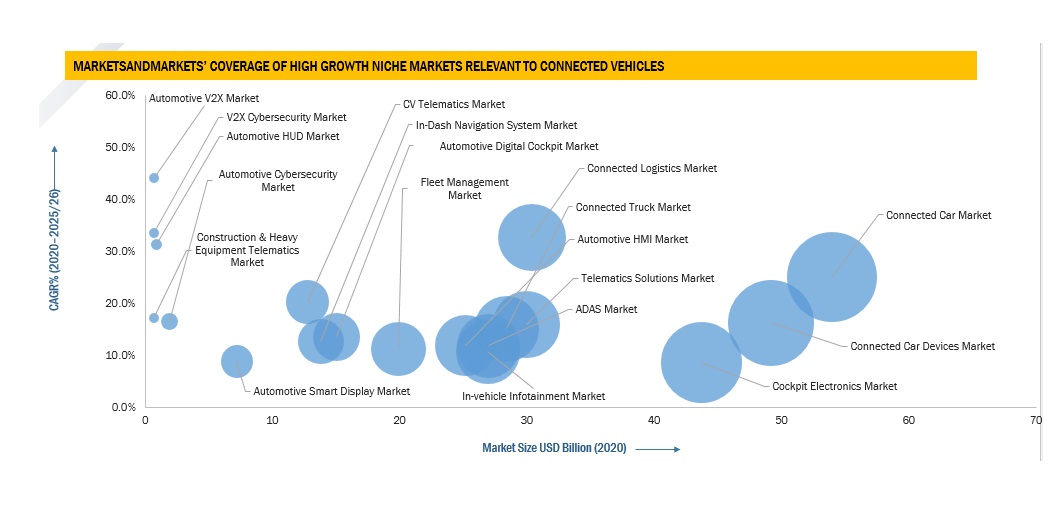

CONNECTED CAR MARKET IS ESTIMATED TO showcase a potential of USD 53-55 billion by 2026, DRIVEN BY safety regulatory standards, autonomous vehicles and emergence of 5g infrastructure etc.

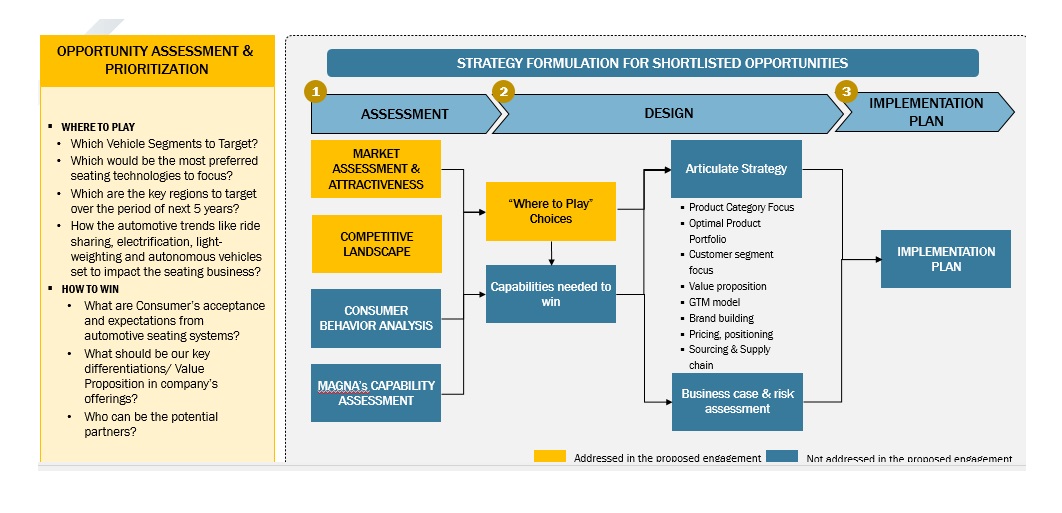

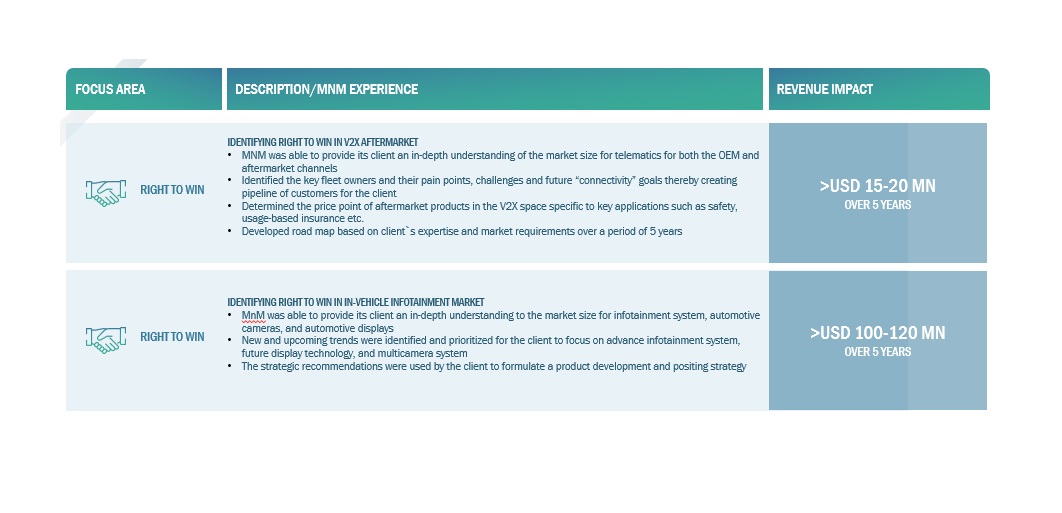

WE HAVE ASSISTED A HOST OF CLIENTS TO TAP HIGH-GROWTH OPPORTUNITIES ACROSS EMERGING APPLICATIONS, COMPETITION, AND END-USE INDUSTRIES TO BUILD USD15-20 MILLION BUSINESS

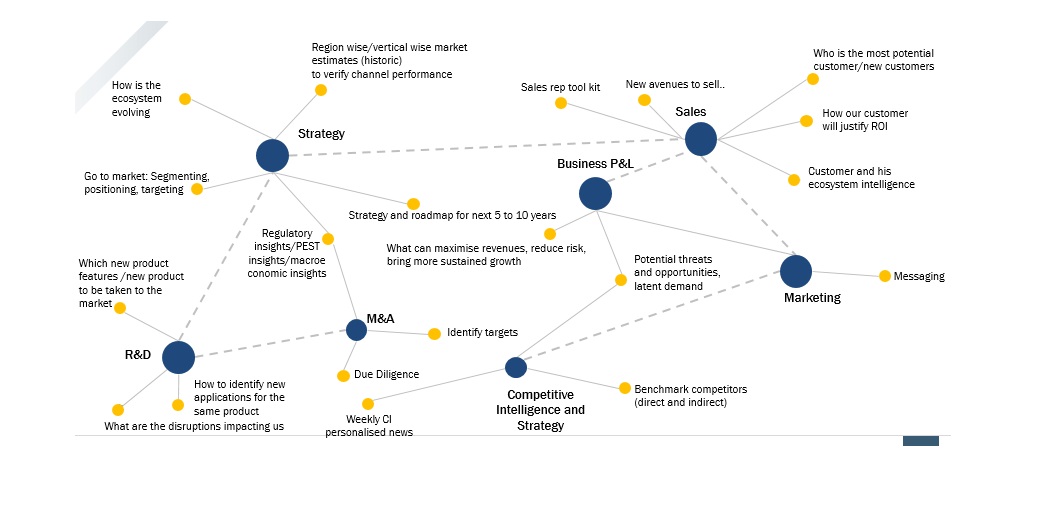

WHY DO COMPANIES NEED HELP TO GROW?

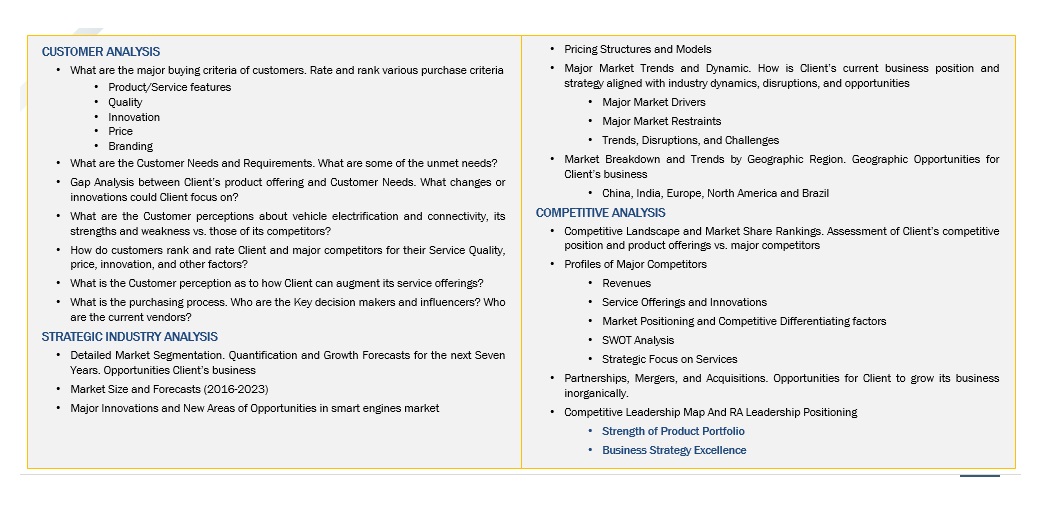

ABSENCE OF ORIGINAL RESEARCH:

- Complex and overlapping markets for library prep and target enrichment kits, hence difficult to calculate market potential and TAM

- Insufficient secondary research for strategic decisions

INTELLIGENCE IS NOT DEMOCRATISED:

- Client unmet needs need to be understood by all market facing employees for new product development and vendor selection.

- Bleak knowledge about upcoming technologies and growing applications such as oncology and rare diseases and non-medical applications

GROWTH PROGRAM DESIGN AND EXECUTION:

- Lack of GTM knowledge and practice in competitive intel, pricing and product features, especially in connected mobility and telematics

SOME UNKNOWNS & ADJACENCIES

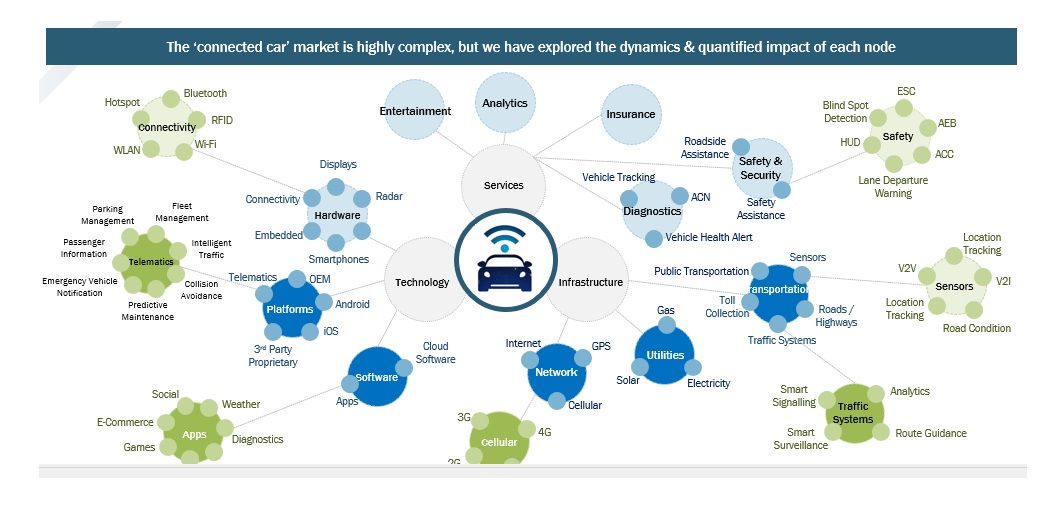

- What will be the role of connected infrastructure in electric and autonomous cars development?

- How connected cars would impact the demand for sensors & electronics - cameras, radars, LiDARs, ECUs?

- How connectivity in cars would drive the adoption of telematics insurance/UBI in the coming years?

- How growing electrification in off-highway industry will impact the adoption of connectivity in the off-highway industry?

- What potential does data monetization market hold as the penetration of connected cars is expected to reach more than 90% globally by 2026?

- How developments in high-speed trains create revenue pockets for connected and telematics service providers in railway industry?

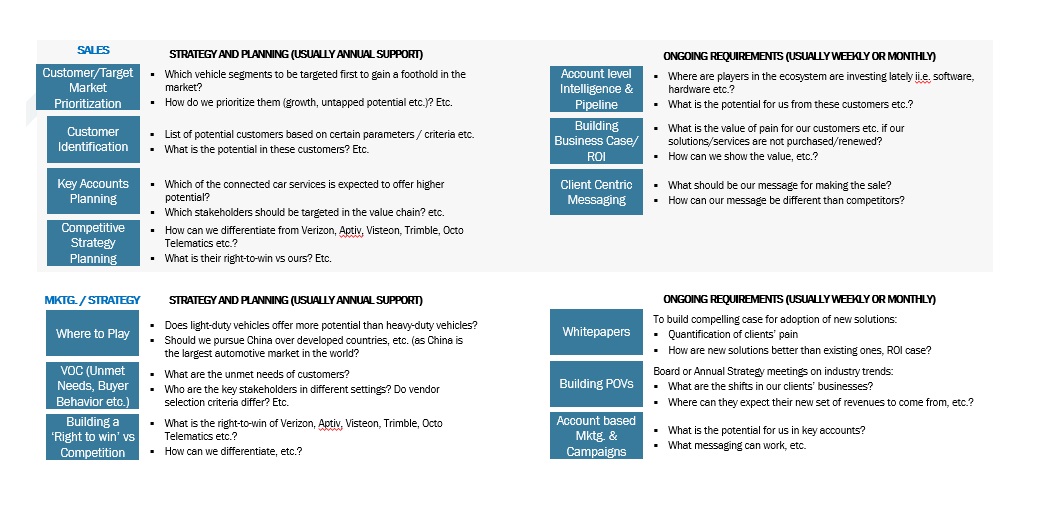

GROWTH PROBLEMS ENCOUNTERED BY Connected Mobility and Telematics COMPANIES

Customer prioritization and assessing unmet needs:

- What are the disruptions in our clients’ businesses? How can we support them for our own growth?

- Who are the most potential customers expected to be benefitted going forward- OEMs, ISPs, TSPs, data centers etc.?

- What are the key unmet needs of customers? Who are the key stakeholders in different settings? Which new solutions/services that are expected to witness higher adoption in the coming years?

Where to Play:

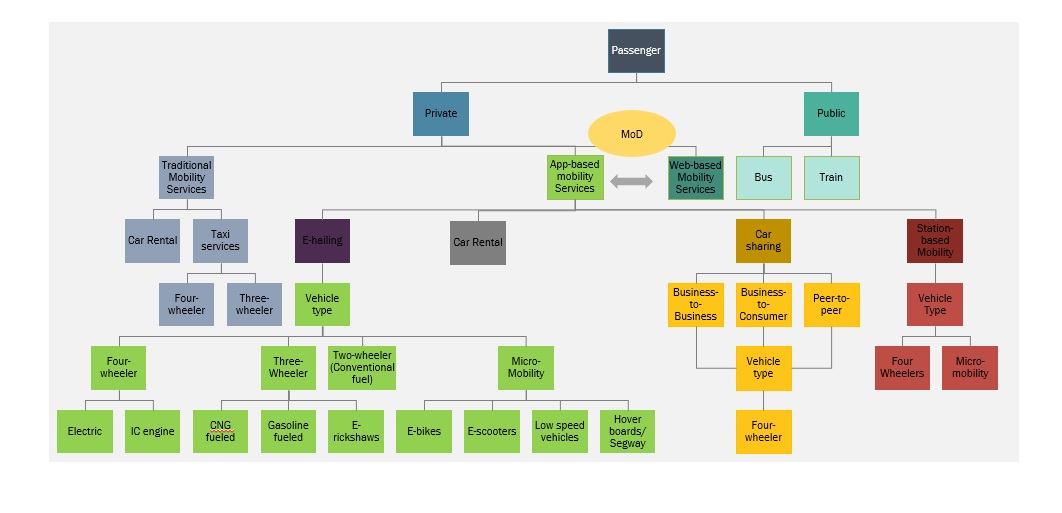

- Which applications areas should we focus on? Should it be on-/off- highway/locomotives etc.?

- Which regions should we place our bets on? Should we continue with developed countries or do developing countries offer more growth opportunities?

Building a compelling Right to Win (RTW):

- For M&A, which are the right targets for us? Should we target OEM or aftermarket platforms for connected car solutions/services? Should we enter new markets directly or through partners?

- How can we differentiate from top players? What is their right-to-win vs ours?

OBSTACLES TO GROWTH FOR CURRENT PLAYERS

- Not able to keep pace with fast evolving automotive industry – New technologies/services/solutions are emerging driving developments in hardware

- Impact of lack of infrastructure in potential markets such as Asia Pacific countries for adoption of connected mobility

- Constant cybersecurity threats/challenges for OEMs to design a secure and safe connected car ecosystem

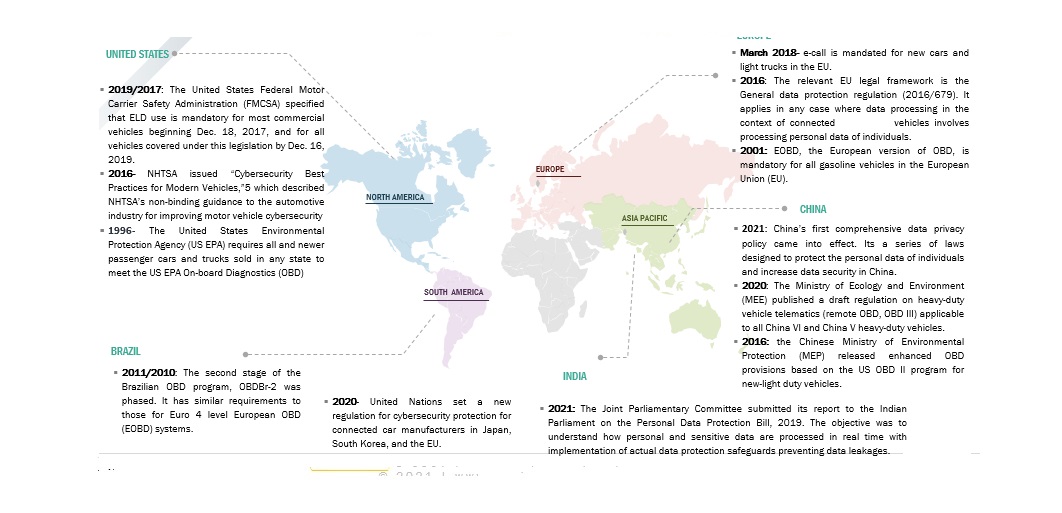

- Varying data protection regulations in different countries/regions, posing challenges for OEMs

- Integration of various stakeholders such as ISPs, TSPs in integrated mobility

- Lack of standardization in data types and formats across different OEM platforms

- Limitations of a telematics solutions for a heterogeneous fleet (As a single telematics solution is suitable for a homogeneous fleet

KEY UNCERTAINTIES/ PERSPECTIVES WHICH INDUSTRY LEADERS SEEK ANSWERS TO:

KEY QUESTIONS OF Connected Mobility and Telematics COMPANIES

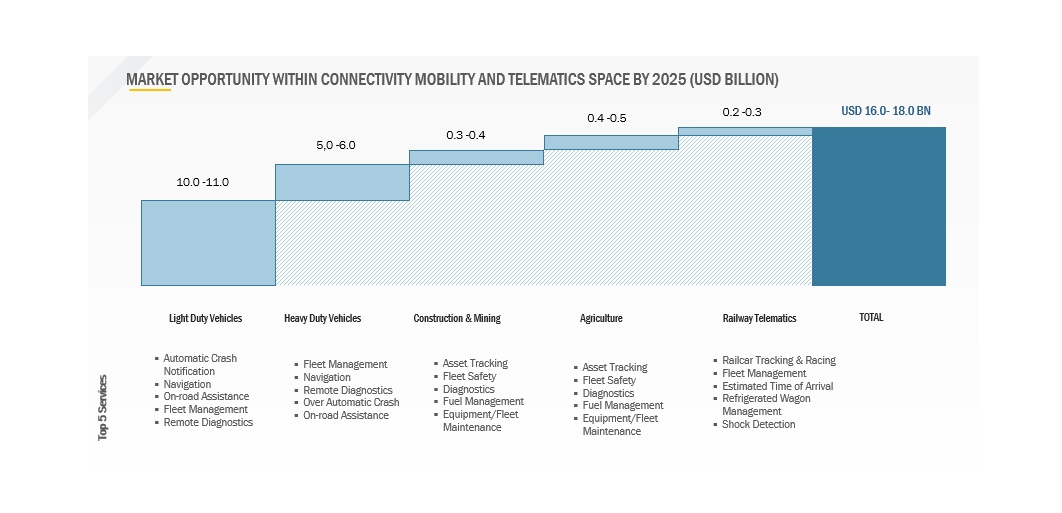

- Which are the most promising telematics services in on- & off-highway segments in the coming years?

- What will be the impact of increasing investments in high-speed rails on adopting telematics in railways?

- How would automotive telematics impact the insurance industry for estimating insurance premiums and analyzing driver behavior?

- Why is fleet management gaining popularity among heavy-duty/off-duty vehicles over light-duty vehicles?

- Which telematics services would showcase the highest demand in L4/L5 autonomous vehicles?

- What would be the acceptance of services like EV charging station maps, remote diagnostics, etc., in the future?

KEY QUESTIONS OF COMPANIES IN ADJACENT MARKETS

- How would the growing connected car market impact the V2X market in the coming years?

- How will the insurance services market see a successive increase with the growth of MaaS as more vehicles will be integrated and connected in the near future?

- How the automotive sensors market value will be impacted by the increasing adoption of automation/connectivity in automobiles?

- How will connected car software development companies get benefitted from increasing penetration of connected cars globally?

- How will data centers /OEMs manage the huge amount of data generated by connected cars for storage/analysis/refinement etc.?

- How will data centers /OEMs manage the huge amount of data generated by connected cars for storage/analysis/refinement etc.?

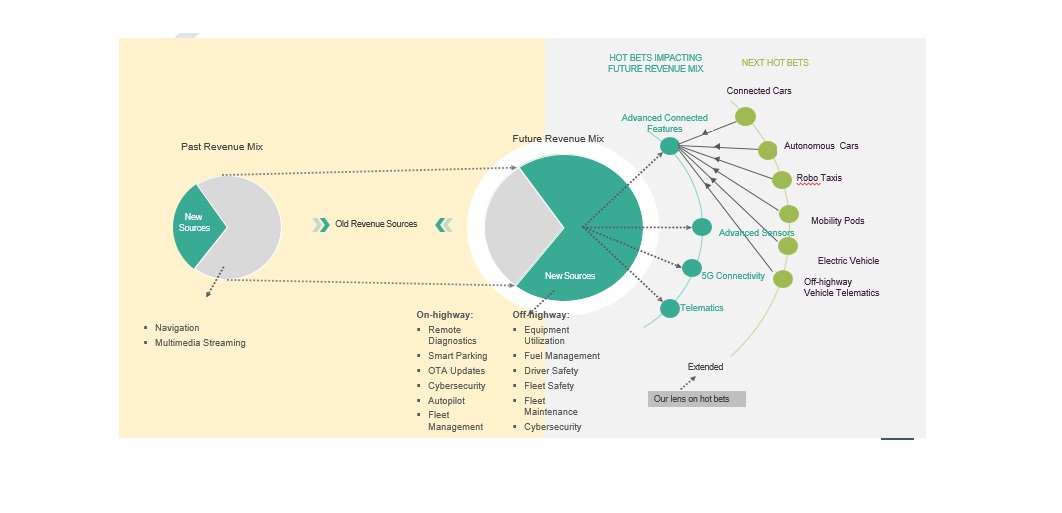

What is driving change

in your business

- Product life cycles getting shorter.

- Ecosystems getting converged.

- Newer technologies and new use-cases disrupting.

- New markets, new geographies, new clients, competition and partners.

Are changes only impacting you or your clients and their clients as well?

The trial will be a guided tour by our representative to help you discover the shift in revenue sources of your clients and clients' clients that will impact your revenue. This is your opportunity to unlock the research IP worth $100 million

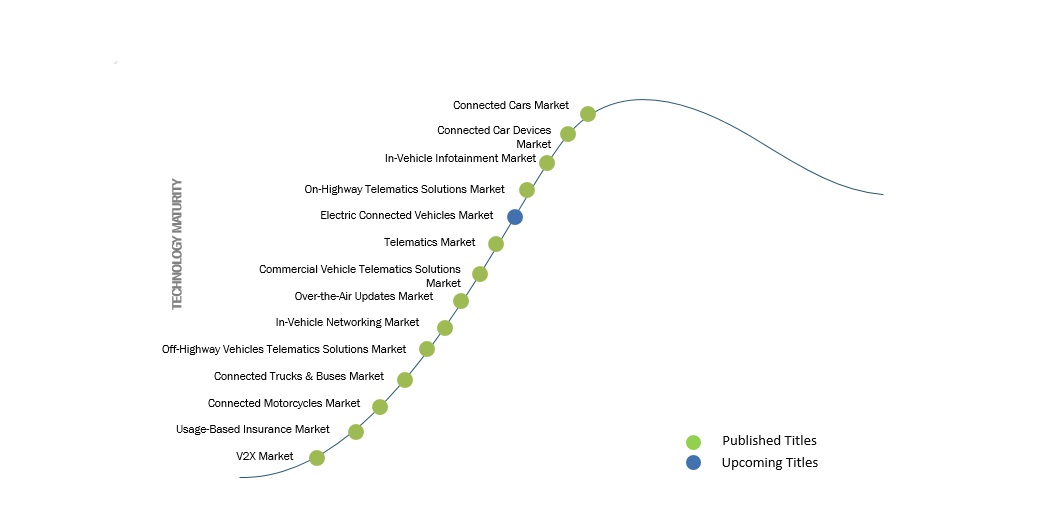

mnm RESEARCH FOCUS IS ON HIGH GROWTH MARKETS & EMERGING TECHNOLOGIES WHICH WILL BECOME ~80% OF THE REVENUES OF AUTO PLAYERS IN THE NEXT 5-6 YEARS

INDICATIVE LIST OF OTHER PROJECTS EXECUTED FOR Connected Mobility and Telematics COMPANIES:

- STUDY

- Global Automotive IIP(Integrated Infotainment

- Automotive UBI Market

- Connected Rail Market Sizing and Forecast

- Opportunity Analysis in the In-Vehicle Infotainment Market

- Tractor Telematics Market

TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS: we track shifting revenue opportunities towards Connected technologies IN THE on & off-highway INDUSTRY

impacting you and

your clients

Connected Mobility and Telematics COMPANIES

JIM NAAS,

PRODUCT DIRECTOR, WEASLER,

WEASLER ENGINEERING, A CENTROMOTION ORGANIZATION

Our organization was interested in learning more about the attractiveness of a particular market space. We contacted MarketsandMarkets to help us based on previous positive experiences we had with them. The results did not disappoint! We discussed our objectives with them, and the team at MarketsandMarkets developed and executed a proposal that met our needs precisely. We were very impressed by their level of expertise, the quality of the analysis and their insightful recommendations. We would not hesitate in working with them again in the future

CALVIN FENNELL,

Regional Sales Director – Infrastructure Solutions,

ASTEC INDUSTRIES

I am happy to confirm that the info is realistic for our markets and scope. Further, it is of sufficient validity so as to form the basis for us to set sales targets for the regions with the challenge to the Regional Sales Managers to prove the data wrong. I would like to thank and commend the Markets and Market team for a report well done and in particular for involving me in the processes over the duration.

KIMBERLY MURPHY,

GLOBAL MARKETING DIRECTOR,

BENTLY NEVADA

MarketsandMarkets™ showed consistent rigor for success and relentlessly worked with Bently Nevada stakeholders to positively impact go-to-market strategy. Their proactiveness and flexibility has been instrumental in achieving the objectives to grow our sales pipeline in key industrial markets

Second Panel

Third Panel