$67+ BN OF POTENTIAL OPPORTUNITY IS OPENING UP IN Blockchain INDUSTRY

Download PDFDISRUPTION - Blockchain solutions for innovative applications beyond cryptocurrencies is OPENING UP A HUGE OPPORTUNITY worth $67+ BN that is set to transform the IT infrastructure

TOP BLOCKCHAIN GROWTH STORIES

THERE IS ~USD 43 BN POTENTIAL WITHIN BLOCKCHAIN APPLICATIONS, IN WHICH 40% IS CONTRIBUTED BY BFSI VERTICAL

WE HAVE ASSISTED A HOST OF CLIENTS TAP HIGH GROWTH OPPORTUNITIES ACROSS EMERGING APPLICATIONS, COMPETITION AND END USE INDUSTRIES

WHY DO COMPANIES NEED

HELP TO GROW ?

ABSENCE OF ORIGINAL RESEARCH:

- Complex and overlapping markets for library prep and target enrichment kits, hence difficult to calculate market potential and TAM

- Insufficient secondary research for strategic decisions

INTELLIGENCE IS NOT DEMOCRATISED:

- Client unmet needs need to be understood by all market facing employees for new product development and vendor selection.

- Bleak knowledge about upcoming technologies and growing applications such as identity management, NFT, CBDC

GROWTH PROGRAM DESIGN AND EXECUTION:

- Lack of GTM knowledge and practice in competitive intel, pricing and product features

SOME UNKNOWNS & ADJACENCIES

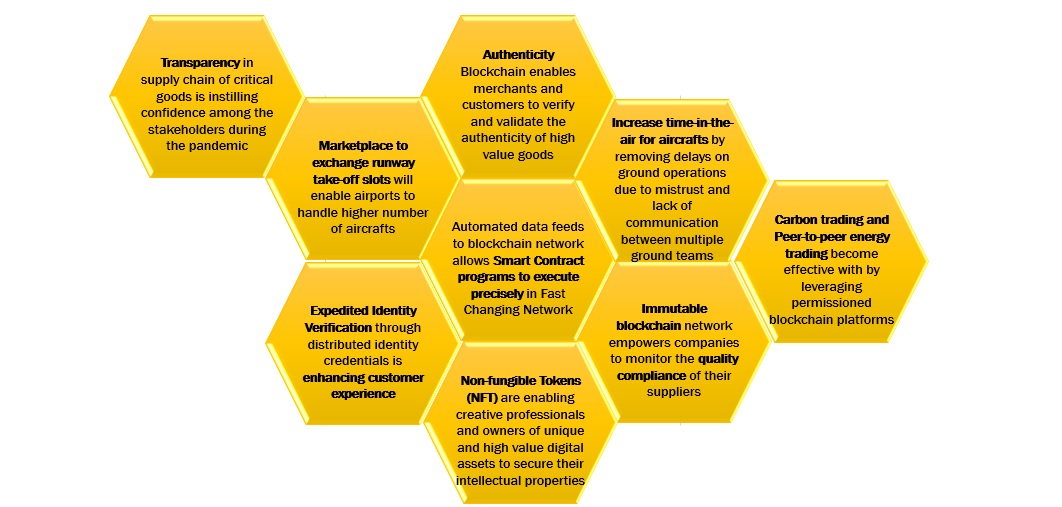

- Blockchain is gaining traction for innovative use cases such as OEM assembly line, fintech solutions, identity verification, financial track record verification, sovereign identity, and ground operations optimization in airports.

- Technologies such as AI, IoT, Automation, and Analytics enable blockchain to widen its horizon by leveraging blockchain's capabilities to develop unique and unconventional solutions for the industry problems.

- Luxury brands such as Louis Vuitton (LVMH) developed, AURA - a Ethereum blockchain-based platform, a unique identifier tagged to each of the luxury product enables the customer to access its online certificate which has been cryptographically signed by the brand and all those involved in its supply chain (design, raw materials, manufacturing, distribution).

- IBM developed the TrustChain Initiative with Helzberg Diamond and Richline Group. TrustChain blockchain solution is used to trace jewels from mines to retailers. This solutions enables jewellers to certify their products as ethically sourced jewels and not through illegal means.

40+ BLOCKCHAIN COMPANIES GROWING THEIR REVENUES WORTH >USD 5 BN ARE RELYING ON MARKETSANDMARKETS

GROWTH PROBLEMS ENCOUNTERED BY Blockchain COMPANIES

Customer prioritization and assessing unmet needs:

- What are the disruptions in our clients' businesses? How can we support them for our own growth?

- Who are the most potential customers going forward? Should we prioritize innovative unique use cases from Automotive, Aerospace, Luxury Goods, etc. over conventional use cases from BFSI, Healthcare, and Supply Chain?

- What are the key unmet needs of customers? Who are the key stakeholders in different verticals? Do vendor selection criteria differ by vertical? Which new product features should be added to the existing products?

Where to Play:

- Which applications and use cases should we focus on? Should it be decentralized identity, carbon credit management, NFT, CBDC, or any other?

- Which regions should we place our bets on? Should we continue with developed countries or do developing countries offer more growth opportunities?

Building a compelling Right to Win (RTW):

- For M&A, which are the right targets for us? Should we target adjacent technology companies or customer companies? Should we enter new markets directly or through partners?

- How can we differentiate from top players? What is their right-to-win vs ours?

OBSTACLES TO GROWTH FOR CURRENT PLAYERS

- Predicting competition and customer preference in the non-regulated blockchain space

- Innovative solutions from start-ups and emerging companies are acting as threat for established technology providers in sustaining leadership positions

- Converting pilot / BAAS-based blockchain projects into full-fledged blockchain deals

- Limited clarity on pricing models for complex scenarios

KEY UNCERTAINTIES/ PERSPECTIVES WHICH INDUSTRY LEADERS SEEK ANSWERS TO:

KEY QUESTIONS OF BLOCKCHAIN COMPANIES

- Will blockchain replace traditional banking systems as the primary form of financial systems?

- Can blockchain become an alternative and possibly eventually replace internet giants with a decentralized peer to peer network architecture?

- Will there be a significant shift in opportunity for blockchain in areas such logistics and healthcare sectors, especially in the post COVID-19 scenario, over the next 5 to 10 years? If yes, what will be the market potential in these sectors over the same period?

- Will blockchain as a technology sustain itself or live up to its potential opportunity hype in-stated currently?

KEY QUESTIONS OF COMPANIES IN ADJACENT MARKETS

- What are the regulations surrounding data privacy and security?

- Will there be data loss / privacy issues while interoperating between different blockchain platforms ?

- What will be the impact of automation and analytics on Blockchain market?

- How to tackle the privacy violations in decentralized data node-based environment ?

What is driving change

in your business

- Product life cycles getting shorter.

- Ecosystems getting converged.

- Newer technologies and new use-cases disrupting.

- New markets, new geographies, new clients, competition and partners.

Are changes only impacting you or your clients and their clients as well?

The trial will be a guided tour by our representative to help you discover the shift in revenue sources of your clients and clients' clients that will impact your revenue. This is your opportunity to unlock the research IP worth $100 million

RI STORY: FOR A Japanese financial firm, MNM helped Identify~USD 10 million revenue by tapping into the BLOCKChAIN market globally.

THE FOCUS OF MNM RESEARCH IS ON HIGH-GROWTH MARKETS AND EMERGING TECHNOLOGIES, WHICH WILL BECOME ~80% OF THE REVENUES OF BLOCKCHAIN PLAYERS FROM EV ECOSYSTEM IN THE NEXT 5-10 YEARS

MARKETSANDMARKETS' COVERAGE OF HIGH-GROWTH NICHE MARKETS (NON-EXHAUSTIVE)

INDICATIVE LIST OF OTHER PROJECTS EXECUTED FOR Blockchain COMPANIES:

- STUDY

- Blockchain Market

- Blockchain as a Service (BaaS) Market

- Blockchain Devices Market

- Crypto Asset Management Market

WE HAVE A COMPREHENSIVE UNDERSTANDING OF THE BLOCKCHAIN ECOSYSTEM THROUGH OUR PROPRIETARY PLATFORM 'KNOWLEDGESTORE'.

impacting you and

your clients

Blockchain COMPANIES

Leading IT Company in US

The research and discussions with the MarketsandMarkets team were insightful and influential towards driving our team's strategic direction. After engaging with the analyst team, we were able to have focused use cases, a targeted market segment, and strategic partners to consider as part of our GTM. The insights shared by MarketsandMarkets captured some useful information that we could leverage to develop our point of view for the next steps. The market reports were a great start for the project, but the analyst hours made a rough diamond turn into a polished gem of a project

Second Panel

Third Panel