Network Monitoring Market Size, Share, Statistics and Industry Growth Analysis Report by Offering (Equipment, Software & Services), Bandwidth (1&10 Gbps, 40 Gbps, 100 Gbps), Technology (Ethernet, Fiber Optic, InfiniBand), End User and Geography - Global Forecast to 2028

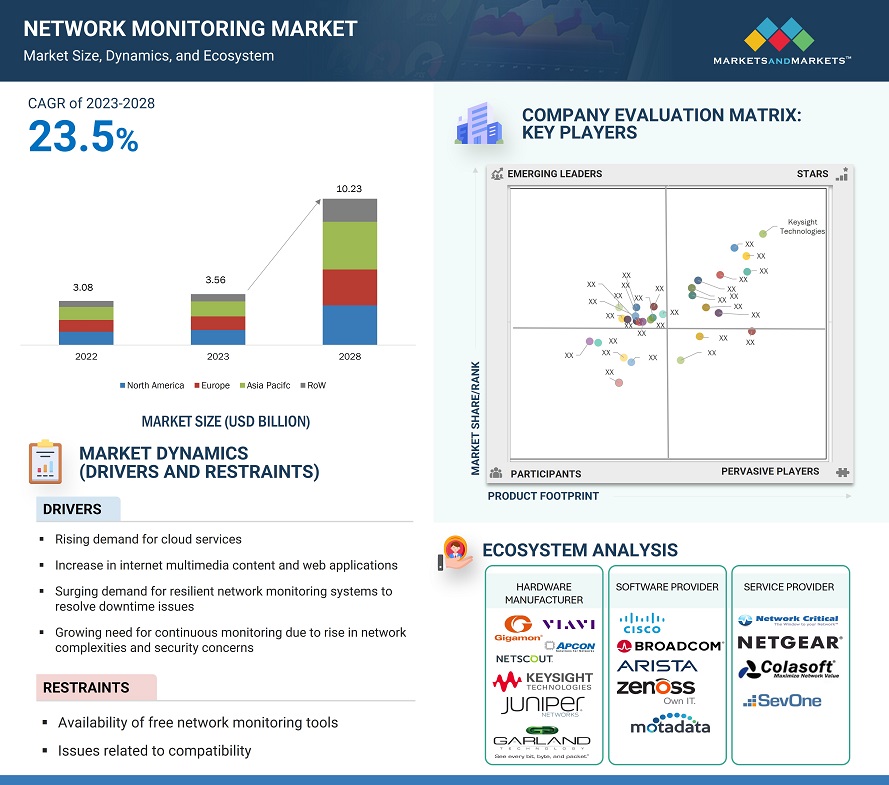

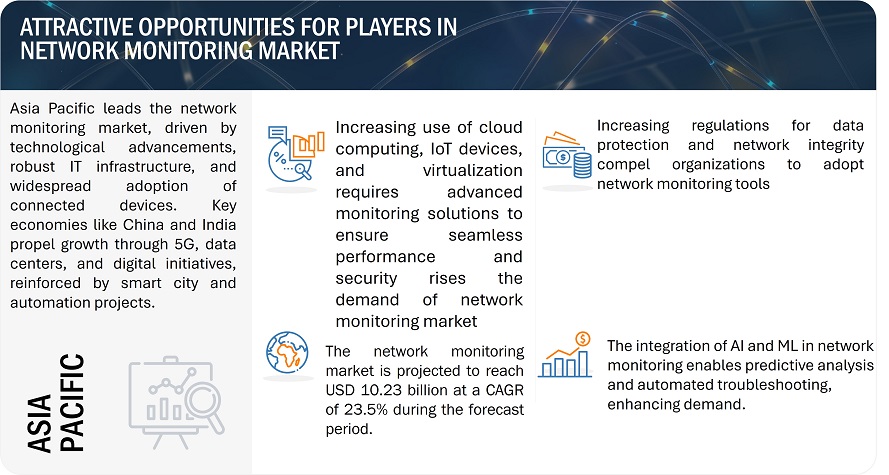

The network monitoring market is projected to grow from USD 3.56 billion in 2023 to reach USD 10.23 billion by 2028; it is expected to grow at a CAGR of 23.5% from 2023 to 2028.

Cybersecurity threats have increased the demand for network monitoring solutions as organizations seek robust threat detection and compliance with data protection regulations. The increasing number of data centers and reliance on remote work and digital services have also increased the need for scalable and cost-effective monitoring tools. Another driver that significantly improves the network monitoring capabilities of technologies is advanced AI and machine learning, enabling predictive analytics and automation of issues. Network monitoring systems are increasingly gaining importance in industries such as IT and telecom, financial services, healthcare, and retail. Together, this increase in technology and the demand for enterprise place the network monitoring market at the forefront of continuous growth.

To know about the assumptions considered for the study, download the pdf brochure

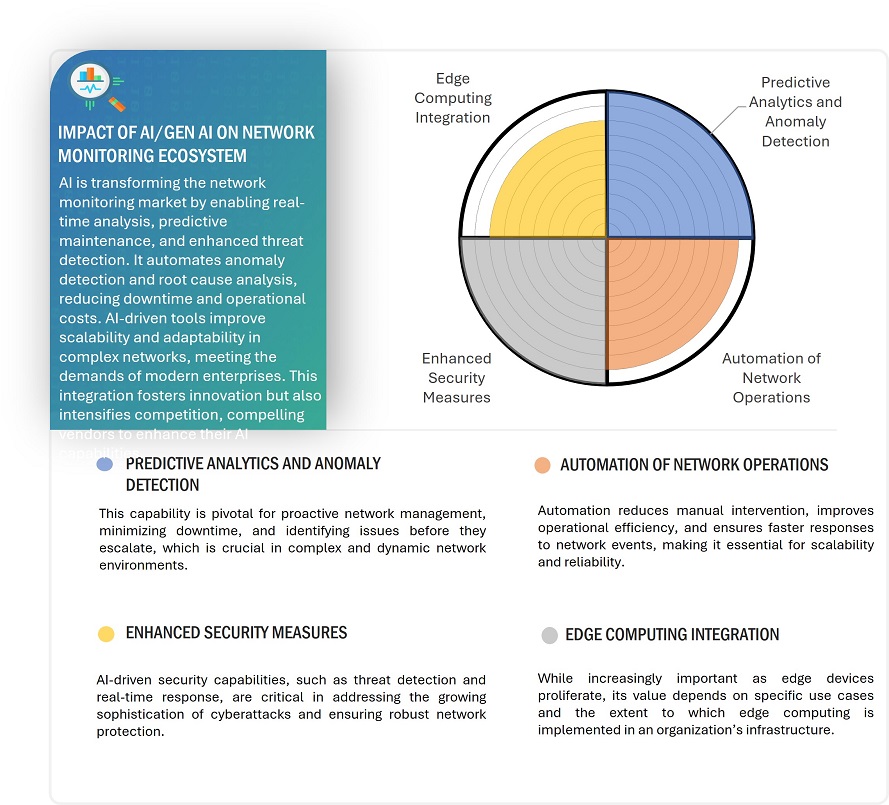

Impact of AI/Gen AI on the Network Monitoring Market

Gen AI is revolutionizing the network monitoring market by developing more intelligent and better ways of managing and securing their networks. The real-time monitoring and analysis of large-sized data enables organizations to identify and address problems early before they become major issues. AI/ gen AI helps in edge computing integration, predictive analytics and anomaly detection, enhanced security measures, automation of network operations, and many others.

Network Monitoring Market Dynamics:

Driver: Growing demand for robust network monitoring systems to prevent downtime

Network device failure can cause downtime and may negatively influence the smooth running of operations, increase workload, and pose serious threats to companies' security. For instance, network congestion, hardware malfunctioning, or high CPU loads can shut down an entire infrastructure or cause delays at a significant cost. Such issues may be prevented by finding the trouble early with help from network monitoring systems, thereby reducing downtime and its cost. These modern solutions have surpassed just simple monitoring capabilities with auto-discovery of devices in the network, network topology mapping, and even some potential security breach detection, which further helps increase the overall efficiency of operation and assists with business continuity.

Not all companies aim for fully redundant networks, eliminating single points of failure, due to architectural constraints, insufficient redundancy, or budget limitations. Such situations call for network monitoring, which helps mitigate the risks and optimize network performance. Proactive detection of failures or service disruptions will keep business network devices up to date, protect expenses, and ensure smooth running. Besides preventing costly outages, advanced network monitoring tools improve productivity by resolving problems before they become worse. This deepening reliance on proactive remedies highlights the urgency and need for robust and resilient network monitoring systems in today's interconnected business world.

Restraint: Rising accessibility of free network monitoring tools

Network monitoring has become an important practice for organizations to identify valuable insights from network traffic, bandwidth, and overall operational efficiency. These tools address critical problems such as reducing operational costs and downtime, mitigating security vulnerability, optimizing interconnectivity routes, resolving configuration errors, and managing large volumes of network performance data. In addition, they help identify and alleviate issues like latency and bandwidth constraints while providing precise information on data flow within the network.

Traditionally, larger corporations only used network monitoring software. The technological context has changed, and today, such solutions are also available to SMBs, non-profits, and other small organizations. Business administrators of all sizes can have devices like network taps and data monitoring switches to ensure better service reliability and improved network performance.

In addition, the network monitoring market provides several free network traffic monitoring tools that are highly efficient and easily accessible. These popular options include Wireshark, Ntopng, NetFlow Analyzer, SolarWinds Response Time Viewer, GlassWire, Paessler PRTG Network Monitor, Iperf, and EtherApe. All these cost-effective alternatives allow organizations to run a network infrastructure with smooth operations to improve service delivery.

Opportunity: Rising impact of IoT and the BYOD trend on network monitoring

The BYOD trend has caused an immense impact on the digital landscape of organizations, where workers can use personal mobile devices to perform both business and personal tasks. Such an approach has rapidly raised the penetration of mobile devices with the diverse applications, services, and functionalities offered by mobile devices. With BYOD becoming increasingly mainstream, a considerable amount of sensitive information, including usernames, passwords, and other financial information, gets stored and exchanged through the same devices, resulting in new security challenges. As organizations increasingly depend on mobile devices, intense monitoring and analytics solutions have become extremely important.

Concurrent to this is the rampant increase of IoT devices and shifting trends toward working remotely; therefore, network administrators face challenges of increased complexities. Devices at home that are connected to the corporate world, for example, a work machine connected to the home network and devices of employees connected to the systems in the company, have brought together vulnerabilities to be monitored. These increases in connected devices and data flows require sophisticated monitoring tools in businesses with sensitive information that can maintain reliability.

As remote work becomes the new normal, organizations need to advance their network management strategies. These monitoring solutions must be extensive and proactive in addressing what the BYOD trend and constantly increasing IoT connections bring to play to ensure that businesses sustain their operational efficiency and security over critical data and counter the risks of security loss in a highly complex networking environment.

Challenge: High costs associated with network monitoring

As many businesses rely on the networks for critical functions, the demand for upgrading infrastructure to provide higher capacity and capabilities rises. Modern networks need support from traditional IT applications to advanced services such as telephony and video conferencing and multimedia applications that require more bandwidth and specialized protocols like multicasting and autoconfiguration. Also, adding IP virtualization increases the cost. Despite the expense, sound network management is a need for a successful business. Saving cost by skimping on monitoring can lead to more significant loss due to downtime or data breaches or operating inefficiency. However, smaller and even medium-sized firms face considerable budgetary pressure that compromises robust network security and adequate performance. The increasing complexity of modern networks deteriorates the situation, requiring companies to dedicate considerable time and resources to monitoring activities. This further shifts attention and investment from core business operations, thus creating a trade-off between maintaining network reliability and pursuing growth objectives. These demands have to be balanced in business firms by making cost-effective measures and scalable network monitoring suitable for their operational as well as budgetary needs.

Network Monitoring Market Ecosystem:

Keysight Technologies (US), Gigamon (US), NETSCOUT (US), Viavi (US), and Apcon (US) are prominent players in the network monitoring market. The top five players accounted for a share of 30-40% in the market in 2022. The network monitoring market ecosystem includes equipment manufacturers, software providers, and service providers.

Growing demand for 40 Gbps network monitoring equipment to drive market expansion

Network monitoring hardware with 40 Gbps is increasingly deployed in data centers and core networks, illustrating the increasing demand for speedy and efficient solutions. An explosion of data centers and the widespread introduction of servers and virtualization technologies create a massive demand for broader bandwidth capabilities. These cutting-edge monitoring solutions provide best-in-class and cost-efficient switching, reducing the number of switches in the same network infrastructure.

Following up on these developments, Garland Technology has widened its global footprint by the unveiling of its latest passive TAP. The 40 Gbps SR4 fiber network TAP assures absolute visibility through 100%, preventing SPAN Ports from imposing restrictions on any form of network security and performance monitoring systems. The device aims to manage OM3 and OM4 types of multi-mode fibers to provide easy network monitoring for greater system efficiency. The adoption of this sophisticated equipment highlights the approach in developing networks to optimize them since high bandwidths are quite challenging to deal with. Going by this pattern of progression, there is a chance that demand for 40 Gbps network monitoring solutions will have great speed within the forecasted period.

Network monitoring equipment market for data monitoring switches (network packet brokers) is projected to grow at the highest CAGR from during forecast period

The network monitoring equipment market, especially for data monitoring switches (network packet brokers), is expected to witness the highest CAGR during the forecast period. This growth is driven by increasing investments in advanced network packet broker technologies to meet the rising demand for efficient network management. Key demand drivers for this are the requirement for automated and simplified data centers, high penetration of cloud service, rising adoption of bare metal switches, and increased bandwidth in a data center.

Furthermore, advancements in network packet brokers (NPBs) due to increasing multimedia content, web applications, and the rise in its consumption are fueling the growth of the network data provider market. These trends are making organizations use innovative NPB solutions to effectively handle complex environments in the network. Top market companies are targeting developing high-class Network Packet Broker technologies suitable for applications involving different industries. The thrust towards innovation and efficiency enables the network packet broker market to grow well in the forthcoming years. The growth drivers also include growing needs for efficient traffic management, enhanced network visibility, and the increased volume of data going through networks because of increasing IoT devices, cloud services, and remote work environments. Network packet brokers are also critical in aggregating, filtering, and directing data traffic to monitoring tools, hence ensuring seamless network performance and robust security.

Network Monitoring Market by Region

To know about the assumptions considered for the study, download the pdf brochure

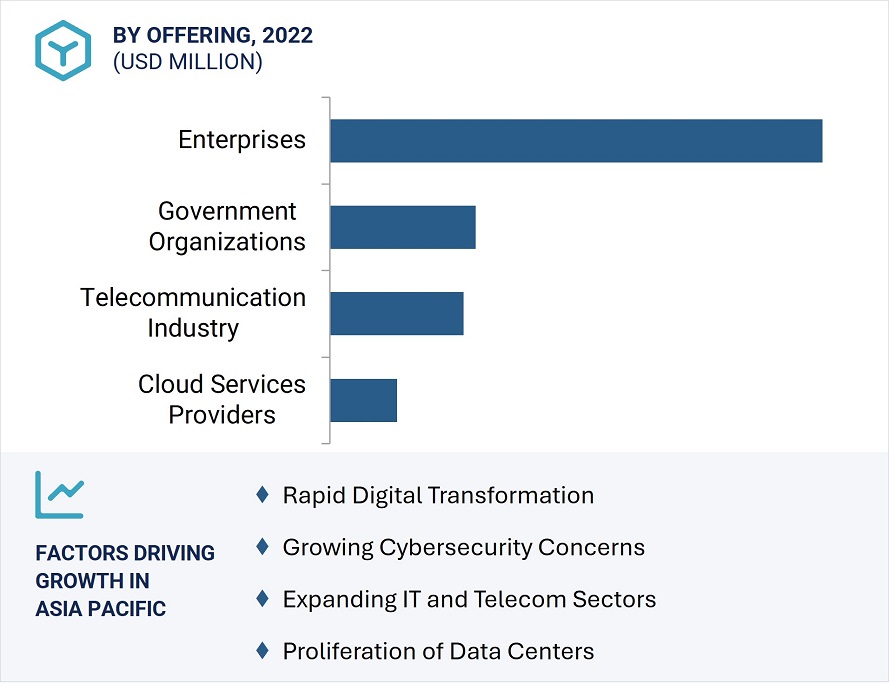

Asia Pacific to lead network monitoring market growth during the forecast period

The Asia Pacific region will witness the fastest growth in the network monitoring market during the forecast period. Digital technologies are increasingly being adopted by companies in countries such as China, Japan, and India, thereby creating a significant demand for network monitoring solutions. Internet penetration and the new population entering the internet in the region are producing significant volumes of data, which in turn is fueling demand for cloud-based services.

The improved digital activity calls for implementing high-performance network monitoring solutions to effectively manage network infrastructure, especially in data centers. To this end, monitoring companies are strategically spreading across the region to leverage the growing demand for advanced monitoring tools that would enhance the evolving digital ecosystem. These factors combine to position Asia Pacific as a source of growth for the network monitoring market.

These also include widespread adoption of cloud computing, 5G deployment, and penetration of lot devices that are together demanding robust network management and monitoring solutions. With an expanding e-commerce sector and the increased need for remote working and online education, the region also needs efficient network performance monitoring and enhanced cybersecurity measures. International technology players and regional cloud providers continue to grow data centers in the Asia Pacific region.

Network Monitoring Market Key Players:

Major players in the network monitoring market include Gigamon (US), NETSCOUT (US), Keysight Technologies (US), Viavi (US), APCON (US), Garland Technology (US), Cisco (US), Broadcom (US), Arista Networks (US), Juniper Networks, Inc. (US), Zenoss (US), Network Critical (UK), CALIENT Technologies (CALIENT) (US), Netgear (US), Motadata (US), Riverbed Technology (US), Datadog (US), Kentik (US), Auvik Networks (Canada), LogicMonitor (US) and Paessler (Germany) are among a few emerging companies in the network monitoring market.

Network Monitoring Market Report Scope:

|

Report Metric |

Detail |

|

Estimated Market Size |

USD 3.56 billion in 2023 |

|

Expected Market Size |

USD 10.23 billion by 2028 |

|

Growth Rate |

CAGR of 23.5% |

|

Market size available for years |

2023—2028 |

|

Base year |

2021 |

|

Forecast period |

2023—2028 |

|

Segments covered |

Offerings, Bandwidth, Technology, End User, and Region |

|

Geographic regions covered |

North America , Europe, Asia Pacific, and RoW |

|

Companies covered |

Gigamon (US), NETSCOUT (US), Keysight Technologies (US), Viavi (US), APCON (US), and Garland Technology (US), Cisco (US), Broadcom (US), Arista Networks (US), Juniper Networks, Inc. (US), Zenoss (US), Network Critical (UK), CALIENT (US), Netgear (US), Motadata (US), LogicMonitor (US), Colasoft (US), SevOne (US), Riverbed Technology (US), Accedian Networks (Canada), ExtraHop (US), Solarwinds (US), ManageEngine (US), LiveAction (US), Auvik Networks (Canada), Paessler (Germany), Flowmon Networks (Czech Republic), AppNeta (US), Zabbix (Latvia) and Datadog (US) |

This research report categorizes the network monitoring market share based on offerings, bandwidth, technology, end-user, and region.

Based on Offerings, the Network Monitoring Market been Segmented as follows:

- Equipment

- Network TAPs

- Data Monitoring Switches

- Software & Services

Based on Bandwidth, the Network Monitoring Market been Segmented as follows:

- 1&10 Gbps

- 40 Gbps

- 100 Gbps

Based on Technology, the Network Monitoring Market been Segmented as follows:

- Ethernet

- Fiber Optic

- InfiniBand

Based on End User, the Network Monitoring Market been Segmented as follows:

- Enterprises

- Telecommunications Industry

- Government Organisations

- Cloud Service Providers

Based on Region, the Network Monitoring Market been Segmented as follows:

-

North America

- US

- Canada

- Mexico

-

Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

-

Rest of the World (RoW)

- Middle East & Africa

- South America

Recent Developments:

- In March 2022, Viavi has launched a fiber test solution that can replace six instruments. FiberComplete PRO reduces the time and effort for almost every aspect of the test and reliability of network certification.

- In February 2022, Gigamon has launched its ThreatINSIGHT GuidedSaaS NDR as the first NDR solution, which provides 365-day rich network metadata retention.

- In February 2022, NETSCOUT announced the availability of nGeniusEDGE Server. This comprehensive, plug-and-play solution provides customers with the visibility and insights they need to ensure a high-quality end-user experience regardless of where employees work.

- In February 2022, Garland Technology has signed a partnership with Iris Networks to bring its network TAP and packet broker solutions to more companies across the UK and increase its presence in the country.

- In October 2021, Keysight Technologies announced the launch of a new series of Industrial Visibility solutions, which include a network packet broker and taps that enable electric utilities to meet North American Electric Reliability Corporation (NERC) Critical Infrastructure Protection (CIP) monitoring requirements.

Frequently Asked Questions (FAQs)

What are the estimated and projected sizes of the global network monitoring market in 2023 and 2028, respectively? What is the projected CAGR of the market during the forecast period?

The network monitoring market is projected to grow from USD 3.56 billion in 2023 to USD 10.23 billion at a CAGR of 23.5%.

Who are the winners in the global Network Monitoring market?

Keysight Technologies (US), Gigamon (US), NETSCOUT (US), Viavi (US), and Apcon (US) are the winners in the global network monitoring market.

Which region will likely capture the largest Network Monitoring market share between 2023 and 2028?

Asia Pacific is projected to account for the largest share of the Network Monitoring market from 2023 to 2029.

Which factors are driving the network monitoring market and are expected to create opportunities for market players in the future?

Rising demand for cloud services is the major factor driving the Network Monitoring market’s growth. Additionally, potential benefits of network monitoring for small and medium sized enterprises are expected to act as an opportunity for market players during the forecast period.

What major strategies players in the network monitoring market have adopted in recent years?

Key players have adopted product launches and acquisitions to strengthen their position in the network monitoring market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

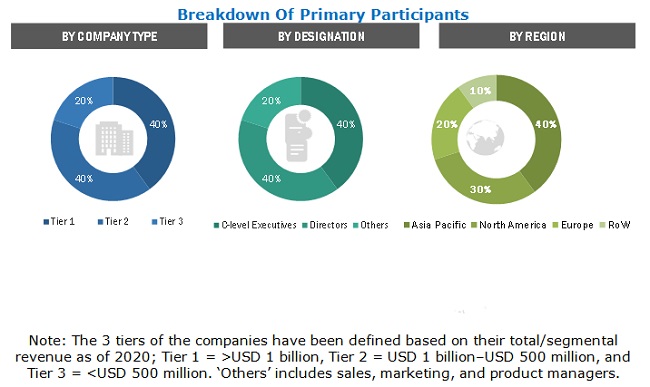

The study involved four major activities in estimating the size for network monitoring market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. The bottom-up approach was employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources were used to identify and collect information important for this study. These include annual reports, press releases & investor presentations of companies, white papers, technology journals, and certified publications, articles by recognized authors, directories, and databases.

Secondary research was mainly used to obtain key information about the supply chain of the industry, the total pool of market players, classification of the market according to industry trends to the bottom-most level, regional markets, and key developments from the market and technology-oriented perspectives.

Primary research was also conducted to identify the segmentation types, key players, competitive landscape, and key market dynamics such as drivers, restraints, opportunities, challenges, and industry trends, along with key strategies adopted by players operating in the network monitoring y market. Extensive qualitative and quantitative analyses were performed on the complete market engineering process to list key information and insights throughout the report.

Primary Research

Extensive primary research has been conducted after acquiring knowledge about the network monitoring market scenario through secondary research. Several primary interviews have been conducted with experts from both demand (end users) and supply side (network monitoring offering providers) across 4 major geographic regions: North America, Europe, Asia Pacific, and RoW. Approximately 80% and 20% of the primary interviews have been conducted from the supply and demand side, respectively. These primary data have been collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches were implemented, along with several data triangulation methods, to estimate and validate the size of the network monitoring market and various other dependent submarkets. Key players in the market were identified through secondary research, and their market share in the respective regions was determined through primary and secondary research. This entire research methodology included the study of annual and financial reports of the top players, as well as interviews with experts (such as CEOs, VPs, directors, and marketing executives) for key insights (quantitative and qualitative).

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study were accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Network Monitoring Market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the market size estimation process as explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, market breakdown and data triangulation procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends from both demand and supply side. Along with this, the market has been validated using top-down and bottom-up approaches.

Report Objectives

- To define, describe, segment, and forecast the network monitoring market, in terms of value, based on bandwidth, offering, technology, end user, and region

- To forecast the size of the market, by region—North America, Europe, Asia Pacific, and the Rest of the World (RoW)—in terms of value

- To forecast the market size, in terms of volume, by offering

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze the micromarkets1 with respect to the individual growth trends, prospects, and their contribution to the network monitoring market

- To map the competitive landscape based on company profiles, key player strategies, and key developments

- To provide a detailed overview of the network monitoring value chain and ecosystem

- To provide information about the key technology trends and patents related to the network monitoring market

- To provide information regarding trade data related to the market

- To identify the key players operating in the market and comprehensively analyze their market shares and core competencies2

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the network monitoring ecosystem

- To benchmark the market players using the proprietary company evaluation matrix framework, which analyzes them on various parameters within the broad categories of market ranking/share and product portfolio

- To analyze competitive developments such as contracts, acquisitions, product launches, collaborations, partnerships, and research and development (R&D) in the network monitoring

- To analyze the impact of COVID-19 on the growth of the network monitoring market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix that gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to 7)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Network Monitoring Market