Network Management Systems Market by Component, Enterprise Size, Deployment Mode, Business Function (Accounting & Legal, Sales & Marketing, and Procurement & Supply Chain) Vertical and Region - Global Forecast to 2027

Updated on : July 13, 2023

Network Management System (NMS) Market Forecast & Statistics, Global Size

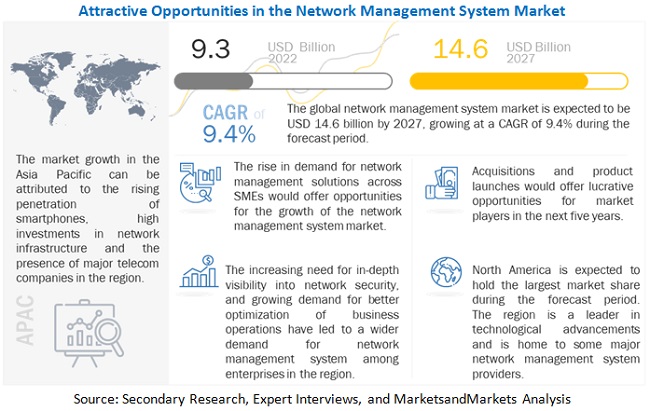

The global Network Management System Market size as per revenue was surpassed $9.3 billion in 2022 and is anticipated to exhibit a CAGR of 9.4% to rise over $14.6 billion by the end of 2027.

Various factors such as prominence of IoT across top players and new entrants, increasing need for in-depth visibility into network security, and growing demand for better optimization of business operations and network management solutions across SMEs are expected to drive the adoption of network management system.

To know about the assumptions considered for the study, Request for Free Sample Report

Network Management System Market Growth Dynamics

Driver: Emergence of SDN across enterprises

SDN is a new paradigm shift that advocates separating the data plane and control plane, making network devices such as switches and routers in the data plane simple packet forwarding devices which a centralized software program can logically control. This software controls the behavior of the entire network. The adoption of SDN has been prevalent across the campus network, branch network, and data center. SD-WAN and Software-Defined Data Center have shown strong demand from enterprises. All the traditional data center components, namely, compute, networking, and storage, are replaced by the underlying software-defined platform. As a result, network infrastructure has been flooded with VMs, hypervisors, x86 servers, and containers.

With these capabilities, SDN introduces new opportunities for network management and configuration management vendors by implementing automation within network management processes. The increased adoption of SDN would drive the demand for NMS tools to cater to the need for software-defined infrastructure in the coming years.

Restraint: Availability of free network management tools

Network management solutions help companies get clear insights into their network performance, bandwidth, and operational efficiency and address all the major challenges such as reducing overall operational costs, identifying optimal routes for interconnecting, and providing accurate insights on the flow of information. Globally, there are a lot of free network management tools available in the market with which network administrators can monitor and analyze their network intensity and operate network infrastructure efficiently. However, the market comprises commercial as well as open-source or free network management solution providers. Moreover, the key players in the market offer free network management tools. These players include Nagios XI, Colasoft Capsa Free, ntop, and PRTG Network Monitor. Free and open-source network management tools are a major concern for NMS solution providers and may restrain the overall NMS market.

Opportunity: Rise in demand for network management solutions across SMEs

Small and Medium-sized Enterprises (SMEs) are embracing new technologies such as cloud, AI, SDN, and IoT to improve the overall business productivity effectively. This technology adoption has changed the nature of network infrastructure, which drives the demand for NMS tools. The network monitoring, performance, application monitoring, and database monitoring solutions play a vital role in managing and running the network efficiently. The increase in network security attacks, improved workforce productivity, and lower cost are the key driving factors for the adoption of NMS tools. Hence, SMEs would open new opportunities for vendors in the NMS market. Vendors are tapping this opportunity and offering packaged and customized low-cost network management solutions and services as per the requirements of the SMEs.

Moreover, vendors are offering cloud-based NMS tools that minimize the Total Cost of Ownership (TCO). Hence, enterprises are widely deploying network management solutions to improve their network performance, reduce the complexities of their IT networks, and streamline their business processes. The demand for NMS is expected to increase in the coming years, as they help manage and share large volumes of networks across various platforms, especially over the cloud. It is expected that the increasing demand for network management solutions across SMEs would create immense opportunities for the NMS vendors.

Challenge: Constraints related to low budget

Network management deployment is a costly affair. It requires a huge sum of investment. In addition to this, the upgradation and network equipment costs are high. Not all companies in the market are willing to have constant upgradation of their equipment and solutions. However, end users require updated solutions because they would not buy an outdated or traditional solution that does not comply with the changing network requirements. Due to the requirement of heavy investments, the revenue of the NMS market is expected to get affected, which in turn, may restrict the growth of the network management system market.

Verticals to outpace the service providers during the forecast period

Based on end users, the network management system market is segmented into service providers and verticals. The verticals segment is having the largest market size as well as the highest growth rate during the forecast period. Verticals mostly rely on NMS solutions to optimize their network infrastructure on a regular basis. In the digital era, the smooth and agile network infrastructure is of the utmost importance for every enterprise to become the frontrunner in the business landscape.

The BFSI vertical to account for the largest market size during the forecast period

The segmentation of the network management system market by the industrial vertical includes BFSI, IT & telecom, government, manufacturing, healthcare, retail, transportation & logistics, and others. Presently, the BFSI vertical is the largest contributor to the NMS market and is expected to remain the same in the future as well. The BFSI vertical is one of the key verticals across the globe. Managing network infrastructure is a crucial part of business operation in the BFSI vertical, due to the rise of online banking. North America is homegrown to big banking and financial firms. Hence, North America has the highest market share in the NMS market across the BFSI vertical.

North America to account for the largest market size during the forecast period

North America has witnessed significant growth in the NMS market. The region is a frontrunner in terms of technology adoption and digitization of society. Enterprises and service providers in this region continuously change their network infrastructure to cope with advanced technologies. The rapid changes in IT infrastructure, such as cloud and virtualization, have significantly increased the pressure on network administrators to manage the network infrastructure. This is expected to increase the demand for NMS solutions across the verticals and service providers.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The bot service providers have implemented various types of organic and inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major players in the network management system market include Cisco (US), IBM (US), Broadcom CA Technologies (US), Micro Focus (UK), Juniper Networks (US), Nokia (Finland), Ericsson (Sweden), ManageEngine, a Division of Zoho Corporation (US), Huawei (China), LiveAction (US), NETSCOUT (US), Progress (Ipswitch) (US), Paessler (Germany), Cubro Network Visibility (Austria), Kentik (US), VIAVI Solutions (US), Kaseya (US), Extreme Networks (US), eG Innovations (US), Colasoft (China), SolarWinds (US), ExtraHop Networks (US), Riverbed (US), Accedian (Canada), BMC Software (US), HelpSystems (US), and AppNeta (US).

Scope of the Report

|

Report Metrics |

Details |

|

Market Size Value in 2022 |

$9.3 billion |

|

Revenue Forecast Size Value in 2027 |

$14.6 billion |

|

Growth Rate |

9.4% CAGR |

|

Key Market Drivers |

Emergence of SDN across enterprises |

|

Key Market Opportunities |

Rise in demand for network management solutions across SMEs |

|

Market size available for years |

2016–2027 |

|

Base year considered |

2022 |

|

Forecast period |

2022–2027 |

|

Forecast units |

USD (Million/Billion) |

|

Market Segmentation |

Component, Solution, Service, Deployment Type, Organization Size, End User, Service Provider, Vertical, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies covered |

Cisco (US), IBM (US), Broadcom CA Technologies (US), Micro Focus (UK), Juniper Networks (US), Nokia (Finland), Ericsson (Sweden), ManageEngine, a Division of Zoho Corporation (US), Huawei (China), LiveAction (US), NETSCOUT (US), Progress (Ipswitch) (US), Paessler (Germany), Cubro Network Visibility (Austria), Kentik (US), VIAVI Solutions (US), Kaseya (US), Extreme Networks (US), eG Innovations (US), Colasoft (China), SolarWinds (US), ExtraHop Networks (US), Riverbed (US), Accedian (Canada), BMC Software (US), HelpSystems (US), and AppNeta (US). |

This research report categorizes the network management system market based on component, solution, service, deployment type, organization size, end user, service provider, vertical, and region.

By Component:

- Platform

- Solutions

- Services

By Solution:

- Network Performance & Monitoring

- Cloud Monitoring

- Virtual Monitoring

- SDN Monitoring

- Network Configuration

- Log & Event Management

- Others (IP address management and VoIP monitoring)

By Service:

- Consulting Services

- Integration & Deployment Services

- Training, Support, and Maintenance Services

By Deployment Type:

- On-premises

- Cloud

By Organization Size:

- Large Enterprises

- SMEs

By End User:

- Service Providers

- Verticals

By Service Provider:

- Telecom Service Providers (TSPs)

- Cloud Service Providers (CSPs)

- Managed Service Providers (MSPs)

- Others (ISPs and cable operators)

By Verticals:

- BFSI

- IT & Telecom

- Government

- Manufacturing

- Healthcare

- Retail

- Transportation & Logistics

- Others (education and hospitality)

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Australia & New Zealand

- Rest of Asia Pacific

-

Middle East and Africa

- Middle East

- Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In May 2022, Ericsson and Intel launched a Tech Hub, which helps Ericsson cloud hub RAN and Intel to enhance their energy efficiency and network performance and reduce time to market.

- In May 2022, LiveAction launched a new partner portal that allows the company’s partner community to work more efficiently and effectively. It would enable or provide their agents to manage and train their order pipeline.

- In February 2022, NetScout launched nGeniusEDGE Server, which provided customers with a high-quality user experience with the visibility and insights they need. It also offers a faster way to identify and resolve performance issues impacting end-users.

- In September 2021, Paessler released a new solution called Paessler Building Monitor, a new SaaS. It provided monitoring based on building data that the system collects through LPWAN technology. It allowed prompting detection and elimination of dangers. It also helped in identifying potential cost savings and optimizations.

Frequently Asked Questions (FAQ):

How big is the Network Management System Market?

What is growth rate of the Network Management System Market?

What are the key trends affecting the global Network Management System Market?

Who are the key players in Network Management System Market?

Who will be the leading hub for Network Management System Market?

What are the key opportunities in Network Management System Market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 35)

2.1 RESEARCH DATA

FIGURE 1 NETWORK MANAGEMENT SYSTEM MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primaries

FIGURE 2 MARKET: BREAKDOWN OF PRIMARIES

2.1.2.2 Industry Expert Insights

2.2 DATA TRIANGULATION

FIGURE 3 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 4 NETWORK MANAGEMENT SYSTEM MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

2.3.1 TOP-DOWN APPROACH

2.3.2 BOTTOM-UP APPROACH

2.4 MARKET FORECAST

TABLE 1 FACTOR ANALYSIS

2.5 COMPETITIVE LEADERSHIP MAPPING METHODOLOGY

FIGURE 5 COMPETITIVE LEADERSHIP MAPPING: CRITERIA WEIGHTAGE

2.6 RESEARCH ASSUMPTIONS & LIMITATIONS

2.6.1 ASSUMPTIONS

2.6.2 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 45)

FIGURE 6 NETWORK MANAGEMENT SYSTEM MARKET: HOLISTIC VIEW

FIGURE 7 MARKET: GROWTH TREND

FIGURE 8 ASIA PACIFIC TO GROW AT THE HIGHEST RATE DURING THE FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 49)

4.1 ATTRACTIVE OPPORTUNITIES IN THE NETWORK MANAGEMENT SYSTEM MARKET

FIGURE 9 GROWTH OF DIGITAL TRANSFORMATION TRENDS TO DRIVE THE MARKET

4.2 MARKET, BY DEPLOYMENT TYPE

FIGURE 10 ON-PREMISE NETWORK MANAGEMENT SYSTEMS TO COMPRISE A LARGER MARKET IN 2022

4.3 NORTH AMERICA: MARKET, BY END USER & COUNTRY

FIGURE 11 VERTICALS AND THE US TO ACCOUNT FOR THE HIGHER RESPECTIVE SHARES OF THEIR SEGMENTS IN NORTH AMERICA IN 2022

4.4 EUROPE: MARKET, BY END USER & KEY COUNTRY

FIGURE 12 VERTICALS AND GERMANY TO ACCOUNT FOR THE LARGEST RESPECTIVE SHARES OF THEIR SEGMENTS IN EUROPE IN 2022

4.5 ASIA PACIFIC: MARKET, BY END USER & KEY COUNTRY

FIGURE 13 VERTICALS AND CHINA TO ACCOUNT FOR THE LARGEST RESPECTIVE SHARES OF THEIR SEGMENTS IN ASIA PACIFIC IN 2022

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 52)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 14 NETWORK MANAGEMENT SYSTEM MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Requirement for in-depth visibility into network security

5.2.1.2 Need for maintaining QoE and QoS

5.2.1.3 Investment in hybrid IT infrastructure for analyzing and managing network traffic

5.2.1.4 Demand for better optimization of business operations

5.2.1.5 Emergence of SDN across enterprises

5.2.2 RESTRAINTS

5.2.2.1 Availability of free network management tools

5.2.3 OPPORTUNITIES

5.2.3.1 Exponential growth in global IP traffic and cloud traffic

5.2.3.2 Prominence of IoT across top players and new entrants

5.2.3.3 Rise in demand for network management solutions across SMEs

5.2.4 CHALLENGES

5.2.4.1 Lack of awareness to select network management solutions as per business needs

5.2.4.2 Constraints related to low budget

5.3 CASE STUDY ANALYSIS

5.3.1 GOVERNMENT: BETTER DATA CENTER PERFORMANCE MONITORING WITH SOFTWARE-BASED SMART VISIBILITY

5.3.2 IT & TELECOM: REAL-TIME MONITORING AND NETWORK MANAGEMENT

5.3.3 BANKING, FINANCIAL SERVICES, AND INSURANCE: EXTENDED INITIAL 125 SITE ROLLOUT TO 825 SITES

5.3.4 GOVERNMENT: EFFECTIVE MONITORING AND MANAGING A DIVERSE DISTRIBUTED NETWORK INFRASTRUCTURE

5.3.5 RETAILER: OPTIMIZING BANDWIDTH VARIATIONS

5.3.6 EDUCATION: ENHANCED NETWORK INFRASTRUCTURE RESULTING IN GREATER NETWORK PERFORMANCE

5.3.7 ENTERTAINMENT: IMPROVED NETWORK CAPACITY PLANNING TO BOOST BETTER NETWORK PERFORMANCE

5.3.8 INTERNET SERVICE PROVIDER: SIMPLIFIED NETWORK OPERATIONS AND REDUCED ERRORS WITH AUTOMATION

5.3.9 TRANSPORTATION & LOGISTICS: SIGNIFICANT INCREASE IN NETWORK PERFORMANCE BY REDUCING TRAFFIC INCIDENTS

5.3.10 MANAGED SERVICE PROVIDER: PANORAMIC VIEW OF THE NETWORK

5.3.11 CLOUD SERVICE PROVIDER: POWERFUL NETWORK TROUBLESHOOTING CAPABILITIES

5.3.12 MANUFACTURING: GAINING REAL-TIME OPERATIONAL VISIBILITY

5.3.13 HEALTHCARE: SIMPLIFIED, RELIABLE IT NETWORK MONITORING TOOL TO OPTIMIZE A COMPLEX NETWORK ENVIRONMENT

5.3.14 TELECOMMUNICATION: IMPROVED NETWORK VISIBILITY ALLOWING FAST PROBLEM IDENTIFICATION AND RESOLUTION

5.4 SUPPLY CHAIN ECOSYSTEM

5.5 INDUSTRY REGULATIONS

5.5.1 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT

5.5.2 HEALTH LEVEL SEVEN

5.5.3 DIGITAL IMAGING AND COMMUNICATIONS IN MEDICINE

5.5.4 GENERAL DATA PROTECTION REGULATION

5.5.5 GRAMM–LEACH–BLILEY ACT

5.5.6 THE INTERNATIONAL ORGANIZATION FOR STANDARDIZATION 27001

5.6 TECHNOLOGY ANALYSIS

5.6.1 ARTIFICIAL INTELLIGENCE

5.6.2 INTERNET OF THINGS

5.6.3 SD-WAN

5.6.4 5G

5.6.5 EDGE COMPUTING

6 NETWORK MANAGEMENT SYSTEM MARKET, BY COMPONENT (Page No. - 68)

6.1 INTRODUCTION

FIGURE 15 SERVICES TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 2 MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 3 MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

6.1.1 COMPONENT: MARKET DRIVERS

6.1.2 COMPONENT: COVID-19 IMPACT

6.2 PLATFORMS

6.2.1 ANALYZING AND IDENTIFYING SECURITY BREACHES OVER NETWORK

TABLE 4 NETWORK MANAGEMENT PLATFORMS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 5 NETWORK MANAGEMENT PLATFORMS MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3 SOLUTIONS

6.3.1 HUGE INVESTMENT IN NETWORK INFRASTRUCTURES TO OPTIMIZE AND UPGRADE ENTERPRISE NETWORKS

TABLE 6 NETWORK MANAGEMENT SOLUTIONS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 7 NETWORK MANAGEMENT SOLUTIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

6.4 SERVICES

6.4.1 INCREASE IN ADOPTION OF NETWORK MANAGEMENT ACROSS ENTERPRISES AND SERVICE PROVIDERS

TABLE 8 NETWORK MANAGEMENT SERVICES MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 9 NETWORK MANAGEMENT SERVICES MARKET, BY REGION, 2022–2027 (USD MILLION)

7 NETWORK MANAGEMENT SYSTEM MARKET, BY SOLUTION (Page No. - 74)

7.1 INTRODUCTION

FIGURE 16 NETWORK PERFORMANCE & MONITORING SEGMENT TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

TABLE 10 NETWORK MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 11 NETWORK MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2022–2027 (USD MILLION)

7.1.1 SOLUTION: MARKET DRIVERS

7.1.2 SOLUTION: COVID-19 IMPACT

7.2 NETWORK PERFORMANCE & MONITORING

7.2.1 NMS SWIFTLY MONITORS, DETECTS, AND DIAGNOSES NETWORK-RELATED ISSUES

TABLE 12 NETWORK PERFORMANCE & MONITORING SOLUTIONS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 13 NETWORK PERFORMANCE & MONITORING SOLUTIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 CLOUD MONITORING

7.3.1 ENTERPRISES ARE MOVING FROM CENTRALIZED MANAGEMENT TO A DECENTRALIZED PLANE

TABLE 14 CLOUD MONITORING SOLUTIONS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 15 CLOUD MONITORING SOLUTIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

7.4 VIRTUAL MONITORING

7.4.1 EMERGENCE OF MICROSERVICES AND CONTAINERIZATION PAVED WAY FOR VIRTUALIZATION

TABLE 16 VIRTUAL MONITORING SOLUTIONS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 17 VIRTUAL MONITORING SOLUTIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

7.5 SOFTWARE-DEFINED NETWORKING MONITORING

7.5.1 ADOPTION OF SDN MONITORING TOOL IS STILL IN THE NASCENT PHASE

TABLE 18 SOFTWARE-DEFINED NETWORKING MONITORING SOLUTIONS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 19 SOFTWARE-DEFINED NETWORKING MONITORING SOLUTIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

7.6 NETWORK CONFIGURATION

7.6.1 EMERGENCE OF GDPR ACTS AS A MAJOR DRIVING FORCE FOR THE GROWTH OF NETWORK CONFIGURATION

TABLE 20 NETWORK CONFIGURATION SOLUTIONS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 21 NETWORK CONFIGURATION MARKET, BY REGION, 2022–2027 (USD MILLION)

7.7 LOG & EVENT MANAGEMENT

7.7.1 ENTERPRISES USE LOG & EVENT MANAGEMENT TO INVESTIGATE SECURITY ATTACKS AND NORMALIZE NETWORK PERFORMANCE

TABLE 22 LOG & EVENT MANAGEMENT SOLUTIONS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 23 LOG & EVENT MANAGEMENT SOLUTIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

7.8 OTHER SOLUTIONS

TABLE 24 OTHER SOLUTIONS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 25 OTHER SOLUTIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

8 NETWORK MANAGEMENT SYSTEM MARKET, BY SERVICE (Page No. - 85)

8.1 INTRODUCTION

FIGURE 17 TRAINING, SUPPORT, AND MAINTENANCE SERVICES TO GROW AT THE LARGEST CAGR DURING THE FORECAST PERIOD

TABLE 26 NETWORK MANAGEMENT SERVICES MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 27 NETWORK MANAGEMENT SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

8.1.1 SERVICE: MARKET DRIVERS

8.1.2 SERVICE: COVID-19 IMPACT

8.2 CONSULTING SERVICES

8.2.1 STRONG AND IN-DEPTH CONSULTING EXPERTISE IMPORTANT IN NETWORK DEPLOYMENT, DESIGN, AND MANAGEMENT

TABLE 28 NETWORK MANAGEMENT CONSULTING SERVICES MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 29 NETWORK MANAGEMENT CONSULTING SERVICES MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 INTEGRATION & DEPLOYMENT SERVICES

8.3.1 NEED TO ENHANCE SERVICE DELIVERY AND MANAGE NETWORK PERFORMANCE MONITORING COSTS NECESSITATE INTEGRATION

TABLE 30 NETWORK MANAGEMENT INTEGRATION & DEPLOYMENT SERVICES MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 31 NETWORK MANAGEMENT INTEGRATION & DEPLOYMENT SERVICES MARKET, BY REGION, 2022–2027 (USD MILLION)

8.4 TRAINING, SUPPORT, AND MAINTENANCE SERVICES

8.4.1 ORGANIZATIONS ARE ADOPTING THIS SERVICE DUE TO INCREASED OPERATIONAL EFFICIENCY WITH A LOWER COST

TABLE 32 NETWORK MANAGEMENT TRAINING, SUPPORT, AND MAINTENANCE SERVICES MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 33 NETWORK MANAGEMENT TRAINING, SUPPORT, AND MAINTENANCE SERVICES MARKET, BY REGION, 2022–2027 (USD MILLION)

9 NETWORK MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT TYPE (Page No. - 91)

9.1 INTRODUCTION

FIGURE 18 ON-PREMISES DEPLOYMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 34 MARKET, BY DEPLOYMENT TYPE, 2016–2021 (USD MILLION)

TABLE 35 MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

9.1.1 DEPLOYMENT TYPE: MARKET DRIVERS

9.1.2 DEPLOYMENT TYPE: COVID-19 IMPACT

9.2 ON-PREMISES

9.2.1 RISE IN ISSUES RELATED TO NETWORK INFRASTRUCTURE AND SECURITY TO DRIVE ON-PREMISE NMS SOLUTIONS

TABLE 36 ON-PREMISES NETWORK MANAGEMENT MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 37 ON-PREMISES NETWORK MANAGEMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 CLOUD

9.3.1 LOW COST AND EASE OF IMPLEMENTATION TO MAKE CLOUD A HIGHLY PREFERRED DELIVERY MODEL

TABLE 38 CLOUD-BASED NETWORK MANAGEMENT MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 39 CLOUD-BASED NETWORK MANAGEMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

10 NETWORK MANAGEMENT SYSTEM MARKET, BY ORGANIZATION SIZE (Page No. - 96)

10.1 INTRODUCTION

FIGURE 19 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 40 MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 41 MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.1.1 ORGANIZATION SIZE: MARKET DRIVERS

10.1.2 ORGANIZATION SIZE: COVID-19 IMPACT

10.2 LARGE ENTERPRISES

10.2.1 OPTIMIZING NETWORK INFRASTRUCTURE AND TROUBLESHOOTING NETWORK DEVICES DRIVE ADOPTION OF NMS SOLUTIONS

TABLE 42 LARGE ENTERPRISES MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 43 LARGE ENTERPRISES MARKET, BY REGION, 2022–2027 (USD MILLION)

10.3 SMALL & MEDIUM-SIZED ENTERPRISES

10.3.1 SMES FOCUS ON UPGRADING NETWORK INFRASTRUCTURE TO IMPROVE OVERALL PRODUCTIVITY

TABLE 44 SMALL & MEDIUM-SIZED ENTERPRISES MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 45 SMALL & MEDIUM-SIZED ENTERPRISES MARKET, BY REGION, 2022–2027 (USD MILLION)

11 NETWORK MANAGEMENT SYSTEM MARKET, BY END USER (Page No. - 102)

11.1 INTRODUCTION

FIGURE 20 VERTICALS TO OUTPACE SERVICE PROVIDERS DURING THE FORECAST PERIOD

TABLE 46 MARKET, BY END USER, 2016–2021 (USD MILLION)

TABLE 47 MARKET, BY END USER, 2022–2027 (USD MILLION)

11.1.1 END USER: MARKET DRIVERS

11.1.2 END USER: COVID-19 IMPACT

11.2 SERVICE PROVIDERS

11.2.1 GLOBAL INCREASE IN NUMBER OF SERVICE PROVIDERS TO BOOST NMS MARKET GROWTH

TABLE 48 SERVICE PROVIDERS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 49 SERVICE PROVIDERS MARKET, BY REGION, 2022–2027 (USD MILLION)

11.3 VERTICALS

11.3.1 INCREASED NEED FOR MANAGING AND OPTIMIZING NETWORK INFRASTRUCTURE DRIVES WIDE ADOPTION ACROSS VERTICALS

TABLE 50 VERTICALS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 51 VERTICALS MARKET, BY REGION, 2022–2027 (USD MILLION)

12 NETWORK MANAGEMENT SYSTEM MARKET, BY SERVICE PROVIDER (Page No. - 107)

12.1 INTRODUCTION

FIGURE 21 MANAGED SERVICE PROVIDERS TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 52 MARKET, BY SERVICE PROVIDER, 2016–2021 (USD MILLION)

TABLE 53 MARKET, BY SERVICE PROVIDER, 2022–2027 (USD MILLION)

12.1.1 SERVICE PROVIDER: MARKET DRIVERS

12.1.2 SERVICE PROVIDER: COVID-19 IMPACT

12.2 TELECOM SERVICE PROVIDERS

12.2.1 TSPS HELP MANAGE THE ENTIRE TELECOM NETWORK AND IMPROVE SPEED, RELIABILITY, AND EFFICIENCY

TABLE 54 TELECOM SERVICE PROVIDERS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 55 TELECOM SERVICE PROVIDERS MARKET, BY REGION, 2022–2027 (USD MILLION)

12.3 CLOUD SERVICE PROVIDERS

12.3.1 CSPS AUTOMATICALLY DETECT SECURITY ATTACKS AND MONITOR NETWORK INFRASTRUCTURE FOR REAL-TIME SECURITY CONTROL

TABLE 56 CLOUD SERVICE PROVIDERS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 57 CLOUD SERVICE PROVIDERS MARKET, BY REGION, 2022–2027 (USD MILLION)

12.4 MANAGED SERVICE PROVIDERS

12.4.1 MSPS MANAGE CUSTOMER NETWORK INFRASTRUCTURE WITH SCALABLE, SECURE, AND COST-EFFECTIVE NMS TOOLS

TABLE 58 MANAGED SERVICE PROVIDERS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 59 MANAGED SERVICE PROVIDERS MARKET, BY REGION, 2022–2027 (USD MILLION)

12.5 OTHER SERVICE PROVIDERS

TABLE 60 OTHER SERVICE PROVIDERS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 61 OTHER SERVICE PROVIDERS MARKET, BY REGION, 2022–2027 (USD MILLION)

13 NETWORK MANAGEMENT SYSTEM MARKET, BY VERTICAL (Page No. - 114)

13.1 INTRODUCTION

FIGURE 22 BANKING, FINANCIAL SERVICES, AND INSURANCE SEGMENT TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

TABLE 62 MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 63 MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

13.1.1 VERTICAL: MARKET DRIVERS

13.1.2 VERTICAL: COVID-19 IMPACT

13.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

13.2.1 UNSUSPENDED NETWORK CONNECTIVITY AND NETWORK AVAILABILITY CRUCIAL IN THIS VERTICAL

TABLE 64 BANKING, FINANCIAL SERVICES, AND INSURANCE VERTICAL MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 65 BANKING, FINANCIAL SERVICES, AND INSURANCE VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

13.3 IT & TELECOM

13.3.1 IT & TELECOM TO GAIN TRACTION DUE TO LARGE-SCALE ADOPTION OF DIGITAL TRANSFORMATION

TABLE 66 IT & TELECOM VERTICAL MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 67 IT & TELECOM VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

13.4 GOVERNMENT

13.4.1 NMS TO HELP AGENCIES TRACK AND TROUBLESHOOT ISSUES

TABLE 68 GOVERNMENT VERTICAL MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 69 GOVERNMENT VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

13.5 MANUFACTURING

13.5.1 INCREASE IN MANUFACTURING UNITS AND REMOTE LOCATIONS TO CREATE A POTENTIAL MARKET FOR NMS SOLUTIONS AND SERVICES

TABLE 70 MANUFACTURING VERTICAL MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 71 MANUFACTURING VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

13.6 HEALTHCARE

13.6.1 NMS OFFERS UNINTERRUPTED CONNECTIVITY TO HEALTHCARE SPECIALISTS, IMPROVING THEIR SERVICE DELIVERY EFFICIENCY

TABLE 72 HEALTHCARE VERTICAL MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 73 HEALTHCARE VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

13.7 RETAIL

13.7.1 NMS HELPS RETAIL STAKEHOLDERS GAIN IN-DEPTH NETWORK VISIBILITY AT REMOTE SITES

TABLE 74 RETAIL VERTICAL MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 75 RETAIL VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

13.8 TRANSPORTATION & LOGISTICS

13.8.1 NMS HELPS NETWORK ADMINISTRATORS MONITOR, ANALYZE, AND SECURE SUPPLY CHAIN AND TRANSPORTATION NETWORKS

TABLE 76 TRANSPORTATION & LOGISTICS VERTICAL MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 77 TRANSPORTATION & LOGISTICS VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

13.9 OTHER VERTICALS

TABLE 78 OTHER VERTICALS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 79 OTHER VERTICALS MARKET, BY REGION, 2022–2027 (USD MILLION)

14 NETWORK MANAGEMENT SYSTEM MARKET, BY REGION (Page No. - 125)

14.1 INTRODUCTION

14.1.1 REGION: COVID-19 IMPACT

FIGURE 23 ASIA PACIFIC TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 80 MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 81 MARKET, BY REGION, 2022–2027 (USD MILLION)

14.2 NORTH AMERICA

14.2.1 NORTH AMERICA: MARKET DRIVERS

FIGURE 24 NORTH AMERICA: MARKET SNAPSHOT

TABLE 82 NORTH AMERICA: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 83 NORTH AMERICA: NETWORK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 84 NORTH AMERICA: NETWORK MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 85 NORTH AMERICA: NETWORK MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 86 NORTH AMERICA: NETWORK MANAGEMENT SERVICES MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 87 NORTH AMERICA: NETWORK MANAGEMENT SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 88 NORTH AMERICA: NETWORK MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT TYPE, 2016–2021 (USD MILLION)

TABLE 89 NORTH AMERICA: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 90 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 91 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 92 NORTH AMERICA: MARKET, BY END USER, 2016–2021 (USD MILLION)

TABLE 93 NORTH AMERICA: MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 94 NORTH AMERICA: MARKET, BY SERVICE PROVIDER, 2016–2021 (USD MILLION)

TABLE 95 NORTH AMERICA: MARKET, BY SERVICE PROVIDER, 2022–2027 (USD MILLION)

TABLE 96 NORTH AMERICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 97 NORTH AMERICA: NETWORK MANAGEMENT SYSTEM MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 98 NORTH AMERICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 99 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

14.2.2 US

14.2.2.1 Rapid adoption of advanced technologies and infrastructure provide an edge to the US in North America

14.2.3 CANADA

14.2.3.1 Significant increase in cyber-attacks and technological advancements pressure businesses across Canada

14.3 EUROPE

14.3.1 EUROPE: NETWORK MANAGEMENT SYSTEM MARKET DRIVERS

TABLE 100 EUROPE: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 101 EUROPE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 102 EUROPE: NETWORK MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 103 EUROPE: NETWORK MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 104 EUROPE: NETWORK MANAGEMENT SERVICES MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 105 EUROPE: NETWORK MANAGEMENT SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 106 EUROPE: NETWORK MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT TYPE, 2016–2021 (USD MILLION)

TABLE 107 EUROPE: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 108 EUROPE: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 109 EUROPE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 110 EUROPE: MARKET, BY END USER, 2016–2021 (USD MILLION)

TABLE 111 EUROPE: MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 112 EUROPE: MARKET, BY SERVICE PROVIDER, 2016–2021 (USD MILLION)

TABLE 113 EUROPE: MARKET, BY SERVICE PROVIDER, 2022–2027 (USD MILLION)

TABLE 114 EUROPE: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 115 EUROPE: NETWORK MANAGEMENT SYSTEM MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 116 EUROPE: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 117 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

14.3.2 UK

14.3.2.1 Adoption trends and growing demand for advanced technologies enable the UK to attract NMS solutions providers

14.3.3 GERMANY

14.3.3.1 Rapid growth due to high adoption across verticals and service providers

14.3.4 FRANCE

14.3.4.1 High internet penetration and strong infrastructure create opportunities in France

14.3.5 REST OF EUROPE

14.4 ASIA PACIFIC

14.4.1 ASIA PACIFIC: NETWORK MANAGEMENT SYSTEM MARKET DRIVERS

FIGURE 25 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 118 ASIA PACIFIC: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 119 ASIA PACIFIC: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 120 ASIA PACIFIC: NETWORK MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 121 ASIA PACIFIC: NETWORK MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 122 ASIA PACIFIC: NETWORK MANAGEMENT SERVICES MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 123 ASIA PACIFIC: NETWORK MANAGEMENT SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 124 ASIA PACIFIC: MARKET, BY DEPLOYMENT TYPE, 2016–2021 (USD MILLION)

TABLE 125 ASIA PACIFIC: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 126 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 127 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 128 ASIA PACIFIC: MARKET, BY END USER, 2016–2021 (USD MILLION)

TABLE 129 ASIA PACIFIC: NETWORK MANAGEMENT SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 130 ASIA PACIFIC: MARKET, BY SERVICE PROVIDER, 2016–2021 (USD MILLION)

TABLE 131 ASIA PACIFIC: MARKET, BY SERVICE PROVIDER, 2022–2027 (USD MILLION)

TABLE 132 ASIA PACIFIC: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 133 ASIA PACIFIC: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 134 ASIA PACIFIC: MARKET, BY COUNTRY/REGION, 2016–2021 (USD MILLION)

TABLE 135 ASIA PACIFIC: MARKET, BY COUNTRY/REGION, 2022–2027 (USD MILLION)

14.4.2 CHINA

14.4.2.1 Aggressive adoption of advanced technologies and investment in infrastructure make China a leader in Asia Pacific

14.4.3 JAPAN

14.4.3.1 Continuous development in advanced technologies helps Japan with significant presence for NMS solutions across Asia Pacific

14.4.4 INDIA

14.4.4.1 Huge investment capital for developing and safeguarding network infrastructure to appeal to NMS solution providers in India

14.4.5 AUSTRALIA & NEW ZEALAND

14.4.5.1 Adopting an aggressive approach to cater to the demand for advanced business NMS service in order to prevent cyberthreats

14.4.6 REST OF ASIA PACIFIC

14.5 MIDDLE EAST & AFRICA

14.5.1 MIDDLE EAST & AFRICA: NETWORK MANAGEMENT SYSTEM MARKET DRIVERS

TABLE 136 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 137 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 138 MIDDLE EAST & AFRICA: NETWORK MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 139 MIDDLE EAST & AFRICA: NETWORK MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 140 MIDDLE EAST & AFRICA: NETWORK MANAGEMENT SERVICES MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 141 MIDDLE EAST & AFRICA: NETWORK MANAGEMENT SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 142 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT TYPE, 2016–2021 (USD MILLION)

TABLE 143 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 144 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 145 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 146 MIDDLE EAST & AFRICA: MARKET, BY END USER, 2016–2021 (USD MILLION)

TABLE 147 MIDDLE EAST & AFRICA: NETWORK MANAGEMENT SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 148 MIDDLE EAST & AFRICA: MARKET, BY SERVICE PROVIDER, 2016–2021 (USD MILLION)

TABLE 149 MIDDLE EAST & AFRICA: MARKET, BY SERVICE PROVIDER, 2022–2027 (USD MILLION)

TABLE 150 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 151 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 152 MIDDLE EAST & AFRICA: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 153 MIDDLE EAST & AFRICA: MARKET, BY REGION, 2022–2027 (USD MILLION)

14.5.2 MIDDLE EAST

14.5.2.1 Supportive government initiatives to boost higher adoption of digital technologies for economic diversification in the Middle East

14.5.3 AFRICA

14.5.3.1 Changing competitive landscape in a rapidly growing market for NMS solutions in Africa

14.6 LATIN AMERICA

14.6.1 LATIN AMERICA: NETWORK MANAGEMENT SYSTEM MARKET DRIVERS

TABLE 154 LATIN AMERICA: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 155 LATIN AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 156 LATIN AMERICA: NETWORK MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 157 LATIN AMERICA: NETWORK MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 158 LATIN AMERICA: NETWORK MANAGEMENT SERVICES MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 159 LATIN AMERICA: NETWORK MANAGEMENT SERVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 160 LATIN AMERICA: MARKET, BY DEPLOYMENT TYPE, 2016–2021 (USD MILLION)

TABLE 161 LATIN AMERICA: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 162 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 163 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 164 LATIN AMERICA: MARKET, BY END USER, 2016–2021 (USD MILLION)

TABLE 165 LATIN AMERICA: NETWORK MANAGEMENT SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 166 LATIN AMERICA: MARKET, BY SERVICE PROVIDER, 2016–2021 (USD MILLION)

TABLE 167 LATIN AMERICA: MARKET, BY SERVICE PROVIDER, 2022–2027 (USD MILLION)

TABLE 168 LATIN AMERICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 169 LATIN AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 170 LATIN AMERICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 171 LATIN AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

14.6.2 BRAZIL

14.6.2.1 Increase in adoption of advanced technologies among enterprises in Brazil to drive growth

14.6.3 MEXICO

14.6.3.1 Steady growth with a high capacity in network and telecommunication offers ample opportunity for Mexico

14.6.4 REST OF LATIN AMERICA

15 COMPETITIVE LANDSCAPE (Page No. - 167)

15.1 OVERVIEW

15.2 KEY PLAYER STRATEGIES

TABLE 172 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN THE NETWORK MANAGEMENT SYSTEM MARKET

15.3 REVENUE ANALYSIS

FIGURE 26 REVENUE ANALYSIS FOR KEY COMPANIES IN THE PAST FIVE YEARS (USD MILLION)

15.4 MARKET SHARE ANALYSIS

FIGURE 27 MARKET SHARE ANALYSIS, 2021

TABLE 173 MARKET: DEGREE OF COMPETITION

15.5 KEY PLAYER EVALUATION QUADRANT

15.5.1 STARS

15.5.2 EMERGING LEADERS

15.5.3 PERVASIVE PLAYERS

15.5.4 PARTICIPANTS

FIGURE 28 KEY NETWORK MANAGEMENT SYSTEM MARKET PLAYER EVALUATION MATRIX, 2021

15.6 STARTUP/SME EVALUATION QUADRANT

15.6.1 PROGRESSIVE COMPANIES

15.6.2 RESPONSIVE COMPANIES

15.6.3 DYNAMIC COMPANIES

15.6.4 STARTING BLOCKS

FIGURE 29 STARTUP/SME MARKET EVALUATION MATRIX, 2021

15.7 COMPETITIVE SCENARIO

15.7.1 PRODUCT LAUNCHES

TABLE 174 PRODUCT LAUNCHES, SEPTEMBER 2019–JUNE 2022

15.7.2 DEALS

TABLE 175 DEALS, SEPTEMBER 2019–JUNE 2022

16 COMPANY PROFILES (Page No. - 178)

16.1 INTRODUCTION

16.2 KEY PLAYERS

(Business Overview, Solutions, Recent Developments, MnM View)*

16.2.1 CISCO

TABLE 176 CISCO: BUSINESS OVERVIEW

FIGURE 30 CISCO: COMPANY SNAPSHOT

TABLE 177 CISCO: SOLUTIONS OFFERED

TABLE 178 CISCO: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 179 CISCO: DEALS

16.2.2 IBM

TABLE 180 IBM: BUSINESS OVERVIEW

FIGURE 31 IBM: COMPANY SNAPSHOT

TABLE 181 IBM: SOLUTIONS OFFERED

TABLE 182 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 183 IBM: DEALS

16.2.3 BROADCOM (CA TECHNOLOGIES)

TABLE 184 BROADCOM: BUSINESS OVERVIEW

FIGURE 32 BROADCOM (CA TECHNOLOGIES): COMPANY SNAPSHOT

TABLE 185 BROADCOM: SOLUTIONS OFFERED

TABLE 186 BROADCOM: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 187 BROADCOM: DEALS

16.2.4 MICRO FOCUS

TABLE 188 MICRO FOCUS: BUSINESS OVERVIEW

FIGURE 33 MICRO FOCUS: COMPANY SNAPSHOT

TABLE 189 MICRO FOCUS: SOLUTIONS OFFERED

TABLE 190 MICRO FOCUS: PRODUCT LAUNCHES AND ENHANCEMENTS

16.2.5 JUNIPER NETWORKS

TABLE 191 JUNIPER NETWORKS: BUSINESS OVERVIEW

FIGURE 34 JUNIPER NETWORKS: COMPANY SNAPSHOT

TABLE 192 JUNIPER NETWORKS: SOLUTIONS OFFERED

TABLE 193 JUNIPER NETWORKS: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 194 JUNIPER NETWORKS: DEALS

16.2.6 NOKIA

TABLE 195 NOKIA: BUSINESS OVERVIEW

FIGURE 35 NOKIA: COMPANY SNAPSHOT

TABLE 196 NOKIA: SOLUTIONS OFFERED

TABLE 197 NOKIA: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 198 NOKIA: DEALS

16.2.7 ERICSSON

TABLE 199 ERICSSON: BUSINESS OVERVIEW

FIGURE 36 ERICSSON: COMPANY SNAPSHOT

TABLE 200 ERICSSON: SOLUTIONS OFFERED

TABLE 201 ERICSSON: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 202 ERICSSON: DEALS

16.2.8 MANAGEENGINE, A DIVISION OF ZOHO CORPORATION

TABLE 203 MANAGEENGINE: BUSINESS OVERVIEW

TABLE 204 MANAGEENGINE: SOLUTIONS OFFERED

TABLE 205 MANAGEENGINE: PRODUCT LAUNCHES AND ENHANCEMENTS

16.2.9 HUAWEI

TABLE 206 HUAWEI: BUSINESS OVERVIEW

TABLE 207 HUAWEI: SOLUTIONS OFFERED

TABLE 208 HUAWEI: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 209 HUAWEI: DEALS

16.2.10 LIVEACTION

TABLE 210 LIVEACTION: BUSINESS OVERVIEW

TABLE 211 LIVEACTION: SOLUTIONS OFFERED

TABLE 212 LIVEACTION: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 213 LIVEACTION: DEALS

16.2.11 NETSCOUT

TABLE 214 NETSCOUT: BUSINESS OVERVIEW

TABLE 215 NETSCOUT: SOLUTIONS OFFERED

TABLE 216 NETSCOUT: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 217 NETSCOUT: DEALS

16.2.12 PROGRESS (IPSWITCH)

TABLE 218 PROGRESS: BUSINESS OVERVIEW

TABLE 219 PROGRESS: SOLUTIONS OFFERED

TABLE 220 PROGRESS: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 221 PROGRESS: DEALS

16.2.13 PAESSLER

TABLE 222 PAESSLER: BUSINESS OVERVIEW

TABLE 223 PAESSLER: SOLUTIONS OFFERED

TABLE 224 PAESSLER: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 225 PAESSLER: DEALS

16.2.14 CUBRO NETWORK SECURITY

TABLE 226 CUBRO NETWORK SECURITY: BUSINESS OVERVIEW

TABLE 227 CUBRO NETWORK SECURITY: SOLUTIONS OFFERED

TABLE 228 CUBRO NETWORK SECURITY: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 229 CUBRO NETWORK SECURITY: DEALS

16.2.15 KENTIK

TABLE 230 KENTIK: BUSINESS OVERVIEW

TABLE 231 KENTIK: SOLUTIONS OFFERED

TABLE 232 KENTIK: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 233 KENTIK: DEALS

16.2.16 VIAVI SOLUTIONS

TABLE 234 VIAVI SOLUTIONS: BUSINESS OVERVIEW

TABLE 235 VIAVI SOLUTIONS: SOLUTIONS OFFERED

TABLE 236 VIAVI SOLUTIONS: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 237 VIAVI SOLUTIONS: DEALS

16.2.17 KASEYA

TABLE 238 KASEYA: BUSINESS OVERVIEW

TABLE 239 KASEYA: SOLUTIONS OFFERED

TABLE 240 KASEYA: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 241 KASEYA: DEALS

16.2.18 EXTREME NETWORKS

TABLE 242 EXTREME NETWORKS: BUSINESS OVERVIEW

TABLE 243 EXTREME NETWORKS: SOLUTIONS OFFERED

TABLE 244 EXTREME NETWORKS: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 245 EXTREME NETWORKS: DEALS

16.2.19 EG INNOVATIONS

TABLE 246 EG INNOVATIONS: BUSINESS OVERVIEW

TABLE 247 EG INNOVATIONS: SOLUTIONS OFFERED

TABLE 248 EG INNOVATIONS: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 249 EG INNOVATIONS: DEALS

16.2.20 COLASOFT

TABLE 250 COLASOFT: BUSINESS OVERVIEW

TABLE 251 COLASOFT: SOLUTIONS OFFERED

TABLE 252 COLASOFT: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 253 COLASOFT: DEALS

16.2.21 SOLARWINDS

TABLE 254 SOLARWINDS: BUSINESS OVERVIEW

TABLE 255 SOLARWINDS: SOLUTIONS OFFERED

TABLE 256 SOLARWINDS: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 257 SOLARWINDS: DEALS

16.2.22 EXTRAHOP NETWORKS

TABLE 258 EXTRAHOP NETWORKS: BUSINESS OVERVIEW

TABLE 259 EXTRAHOP NETWORKS: SOLUTIONS OFFERED

TABLE 260 EXTRAHOP NETWORKS: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 261 EXTRAHOP NETWORKS: DEALS

16.2.23 RIVERBED

TABLE 262 RIVERBED: BUSINESS OVERVIEW

TABLE 263 RIVERBED: SOLUTIONS OFFERED

TABLE 264 RIVERBED: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 265 RIVERBED: DEALS

16.2.24 ACCEDIAN

TABLE 266 ACCEDIAN: BUSINESS OVERVIEW

TABLE 267 ACCEDIAN: SOLUTIONS OFFERED

TABLE 268 ACCEDIAN: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 269 ACCEDIAN: DEALS

16.2.25 BMC SOFTWARE

TABLE 270 BMC SOFTWARE: BUSINESS OVERVIEW

TABLE 271 BMC SOFTWARE: SOLUTIONS OFFERED

TABLE 272 BMC SOFTWARE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 273 BMC SOFTWARE: DEALS

16.2.26 HELPSYSTEMS

TABLE 274 HELPSYSTEMS: BUSINESS OVERVIEW

TABLE 275 HELPSYSTEMS: SOLUTIONS OFFERED

TABLE 276 HELPSYSTEMS: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 277 HELPSYSTEMS: DEALS

16.2.27 APPNETA

TABLE 278 APPNETA: BUSINESS OVERVIEW

TABLE 279 APPNETA: SOLUTIONS OFFERED

TABLE 280 APPNETA: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 281 APPNETA: DEALS

*Details on Business Overview, Solutions, Recent Developments, MnM View might not be captured in case of unlisted companies.

17 ADJACENT MARKETS (Page No. - 263)

17.1 INTRODUCTION

17.1.1 LIMITATIONS

17.1.2 NETWORK AUTOMATION MARKET

17.1.2.1 Market definition

17.1.2.2 Network automation market, by component

TABLE 282 NETWORK AUTOMATION MARKET, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 283 NETWORK AUTOMATION MARKET, BY COMPONENT, 2020–2025 (USD MILLION)

17.1.2.3 Network automation market, by solution

TABLE 284 NETWORK AUTOMATION MARKET, BY SOLUTION, 2014–2019 (USD MILLION)

TABLE 285 NETWORK AUTOMATION MARKET, BY SOLUTION, 2020–2025 (USD MILLION)

17.1.2.4 Network automation market, by service

TABLE 286 NETWORK AUTOMATION MARKET, BY PROFESSIONAL SERVICE, 2014–2019 (USD MILLION)

TABLE 287 NETWORK AUTOMATION MARKET, BY PROFESSIONAL SERVICE, 2020–2025 (USD MILLION)

17.1.2.5 Network automation market, by network type

TABLE 288 NETWORK AUTOMATION MARKET, BY NETWORK TYPE, 2014–2019 (USD MILLION)

TABLE 289 NETWORK AUTOMATION MARKET, BY NETWORK TYPE, 2020–2025 (USD MILLION)

17.1.2.6 Network automation market, by deployment mode

TABLE 290 NETWORK AUTOMATION MARKET, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 291 NETWORK AUTOMATION MARKET, BY DEPLOYMENT MODE, 2020–2025 (USD MILLION)

17.1.2.7 Network automation market, by end user

TABLE 292 NETWORK AUTOMATION MARKET, BY END USER, 2014–2019 (USD MILLION)

TABLE 293 NETWORK AUTOMATION MARKET, BY END USER, 2020–2025 (USD MILLION)

17.1.2.8 Network automation market, by organization size

TABLE 294 NETWORK AUTOMATION MARKET, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 295 NETWORK AUTOMATION MARKET, BY ORGANIZATION SIZE, 2020–2025 (USD MILLION)

17.1.2.9 Network automation market, by vertical

TABLE 296 NETWORK AUTOMATION MARKET, BY ENTERPRISE VERTICAL, 2014–2019 (USD MILLION)

TABLE 297 NETWORK AUTOMATION MARKET, BY ENTERPRISE VERTICAL, 2020–2025 (USD MILLION)

17.1.3 WAN OPTIMIZATION MARKET

17.1.3.1 Market definition

17.1.3.2 WAN optimization market, by component

TABLE 298 WAN OPTIMIZATION MARKET, BY COMPONENT, 2018–2025 (USD MILLION)

17.1.3.3 WAN optimization market, by end user

17.1.3.3.1 Small and medium-sized enterprises

TABLE 299 SMALL AND MEDIUM-SIZED ENTERPRISES: WAN OPTIMIZATION MARKET, BY REGION, 2018–2025 (USD MILLION)

17.1.3.3.2 Large enterprises

TABLE 300 LARGE ENTERPRISES: WAN OPTIMIZATION MARKET, BY REGION, 2018–2025 (USD MILLION)

17.1.3.4 WAN optimization market, by vertical

17.1.3.4.1 Banking, financial services, and insurance

TABLE 301 BANKING, FINANCIAL SERVICES, AND INSURANCE: WAN OPTIMIZATION MARKET, BY REGION, 2018–2025 (USD MILLION)

17.1.3.4.2 Healthcare

TABLE 302 HEALTHCARE: WAN OPTIMIZATION MARKET, BY REGION, 2018–2025 (USD MILLION)

17.1.3.4.3 Information technology and telecom

TABLE 303 INFORMATION TECHNOLOGY & TELECOM: WAN OPTIMIZATION MARKET, BY REGION, 2018–2025 (USD MILLION)

17.1.3.4.4 Manufacturing

TABLE 304 MANUFACTURING: WAN OPTIMIZATION MARKET, BY REGION, 2018–2025 (USD MILLION)

17.1.3.4.5 Retail

TABLE 305 RETAIL: WAN OPTIMIZATION MARKET, BY REGION, 2018–2025 (USD MILLION)

17.1.3.4.6 Media and entertainment

TABLE 306 MEDIA AND ENTERTAINMENT: WAN OPTIMIZATION MARKET, BY REGION, 2018–2025 (USD MILLION)

17.1.3.4.7 Energy

TABLE 307 ENERGY: WAN OPTIMIZATION MARKET, BY REGION, 2018–2025 (USD MILLION)

17.1.3.4.8 Education

TABLE 308 EDUCATION: WAN OPTIMIZATION MARKET, BY REGION, 2018–2025 (USD MILLION)

17.1.3.5 WAN optimization market, by region

17.1.3.5.1 Europe

TABLE 309 EUROPE: WAN OPTIMIZATION MARKET, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 310 EUROPE: WAN OPTIMIZATION MARKET, BY SOLUTION, 2018–2025 (USD MILLION)

TABLE 311 EUROPE: WAN OPTIMIZATION MARKET, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 312 EUROPE: WAN OPTIMIZATION MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 313 EUROPE: WAN OPTIMIZATION MARKET, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 314 EUROPE: WAN OPTIMIZATION MARKET, BY VERTICAL, 2018–2025 (USD MILLION)

TABLE 315 EUROPE: WAN OPTIMIZATION MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

18 APPENDIX (Page No. - 279)

18.1 DISCUSSION GUIDE

18.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

18.3 AVAILABLE CUSTOMIZATIONS

18.4 RELATED REPORTS

18.5 AUTHOR DETAILS

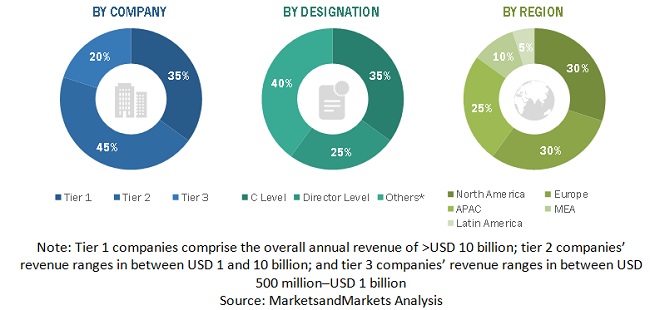

This research study involved the extensive use of secondary sources, directories, and databases such as Dun & Bradstreet (D&B) Hoovers, and Bloomberg BusinessWeek to identify and collect information useful for a technical, market-oriented, and commercial study of the network management system market. The primary sources were mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, alliances, and organizations related to all segments of the value chain of this market. In-depth interviews were conducted with various primary respondents that included key industry participants, subject matter experts, C-level executives of key market players, and industry consultants to obtain and verify critical qualitative and quantitative information. The following illustrative figure shows the market research methodology applied in making this report on the network management system market.

Secondary Research

The market for companies offering network management system for different verticals was estimated and projected based on the secondary data made available through paid and unpaid sources and by analyzing their product portfolios in the ecosystem of the market. It also involved rating products of companies based on their performance and quality. In the secondary research process, various sources were referred to for identifying and collecting information for this study on the network management system market. The secondary sources included annual reports, press releases and investor presentations of companies, white papers, journals, and certified publications and articles by recognized authors, directories, and databases.

Secondary research was mainly used to obtain key information about the supply chain of the market, the total pool of key players, market classification, and segmentation according to industry trends to the bottommost level, regional markets, and key developments from both, market and technology-oriented perspectives that were further validated by primary sources.

Primary Research

In the primary research process, various sources from both, the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts such as Chief Executive Officers (CEOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), Managing Directors (MDs), technology and innovation directors, and related key executives from different key companies and organizations operating in the network management system market..

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In this approach for market estimation, the key network management system vendors, such as Cisco (US), IBM (US), Broadcom CA Technologies (US), Micro Focus (UK), Juniper Networks (US), Nokia (Finland), Ericsson (Sweden), ManageEngine, a Division of Zoho Corporation (US), Huawei (China), LiveAction (US), NETSCOUT (US), Progress (Ipswitch) (US), Paessler (Germany), Cubro Network Visibility (Austria), Kentik (US), VIAVI Solutions (US), Kaseya (US), Extreme Networks (US), eG Innovations (US), Colasoft (China), SolarWinds (US), ExtraHop Networks (US), Riverbed (US), Accedian (Canada), BMC Software (US), HelpSystems (US), and AppNeta (US) contribute almost 60-65% to the global network management system market. After confirming these companies through primary interviews with industry experts, their total revenue through annual reports, Securities and Exchange Commission (SEC) filings, and paid databases was estimated. These companies’ revenue pertaining to the Business Units (BUs) that offer network management system was identified through similar sources. Then through primaries, the data of revenue generated was collected through specific network management system. The collective revenue of key companies that offer network management system comprises 60%–65% of the market, which was again confirmed through primary interviews with industry experts. With the assumption that the rest of the market is contributed by smaller players (part of the unorganized market), the market size of organized players (55%–60%) and unorganized players (40%–45%) collectively was assumed to be the market size of the global network management system market for Financial Year (FY) 2022.

- The pricing trend is assumed to vary over time.

- All the forecasts are made with the standard assumption that the accepted currency is USD.

- For the conversion of various currencies to USD, average historical exchange rates are used according to the year specified. For all the historical and current exchange rates required for calculations and currency conversions, the US Internal Revenue Service's website is used.

- All the forecasts are made under the standard assumption that the globally accepted currency USD remains constant during the next five years.

- Vendor-side analysis: The market size estimates of associated solutions and services are factored in from the vendor side by assuming an average of licensing and subscription-based models of leading and innovative vendors in the market.

Demand/end-user analysis: End users operating in verticals across regions are analyzed in terms of market spending on network management system based on some of the key use cases. These factors for the network management system industry per region are separately analyzed, and the average spending was extrapolated with an approximation based on assumed weightage. This factor is derived by averaging various market influencers, including recent developments, regulations, mergers and acquisitions, enterprise/SME adoption, startup ecosystem, IT spending, technology propensity and maturity, use cases, and the estimated number of organizations per region.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and predict the network management system market by component (platform, solutions and services), solution, service, deployment type, organization size, end user, service provider, vertical, and region

- To provide detailed information related to major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of segments for five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as partnerships, new product launches, and mergers and acquisitions, in the network management system market

- To analyze the impact of the COVID-19 pandemic on the network management system market

Available customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakup of the North American network management system market

- Further breakup of the European market

- Further breakup of the Asia Pacific market

- Further breakup of the Latin American market

- Further breakup of the Middle East and Africa market

Company Information

- Detailed analysis and profiling of additional market players up to 5

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Network Management Systems Market

Interested in Systems & Network management, Business intelligence , Security

Interested in Software solutions for o Systems & Network management o Business intelligence o Security

Understanding the market sizing of Network Management software market

Interested in Network Management and related markets

Network Performance Management, Windows Active Directory Management, IT Security, IT Help Desk, Application Management, SaaS-based Application Performance Management