Data Center Switch Market Size, Share Analysis 2035

Data Center Switch Market by Type (Core, Distribution, and Access), Technology (Ethernet, Fiber Channel, and InfiniBand), End User (Enterprise, Telecom, Government, and Cloud), Bandwidth, and Geography - Global Forecast to 2035

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

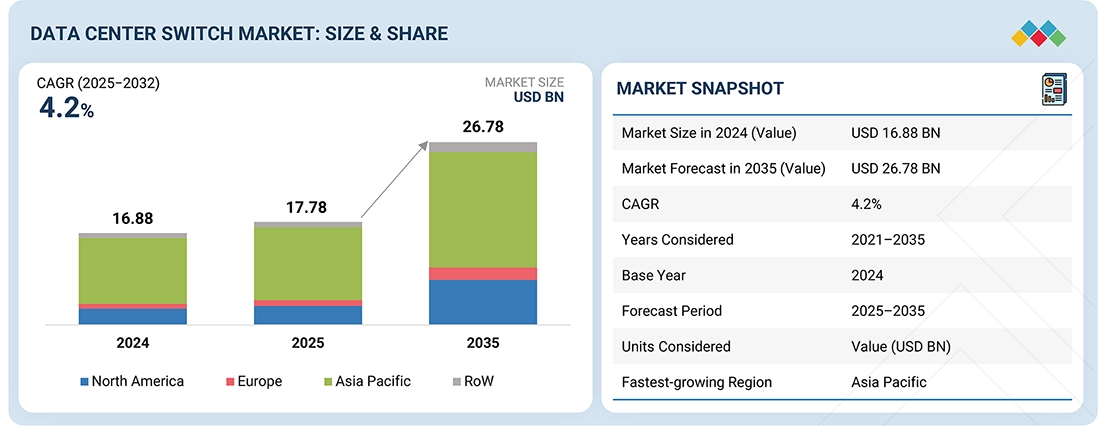

The Data Center Switch market is projected to reach USD 26.78 billion by 2035 from USD 17.78 billion in 2025, at a CAGR of 4.2% from 2025 to 2035. The data center switches market will grow as enterprises, cloud providers, and hyperscalers expand their infrastructure to support exploding traffic driven by AI/ML workloads, cloud computing, and edge deployments. Rising demand for high-bandwidth, low-latency switching—especially 100G, 200G, 400G, and emerging 800G systems—is accelerating network modernization. Additionally, the shift toward leaf–spine architectures and GPU cluster interconnects is driving sustained investment in next-generation data center switching platforms.

KEY TAKEAWAYS

-

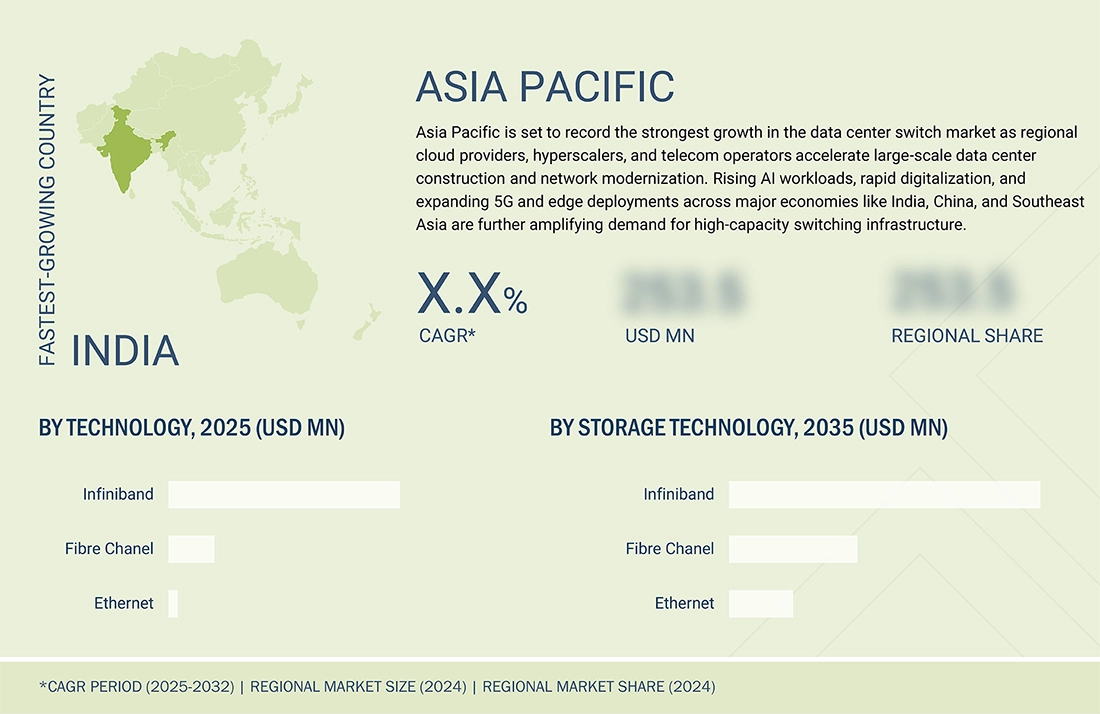

By RegionBy region, the Asia Pacific market is expected to grow at the fastest rate through 2033, driven by massive hyperscale data center build-outs, 5G expansion, and rising AI/ML workload deployments across China, India, Japan, and Southeast Asia.

-

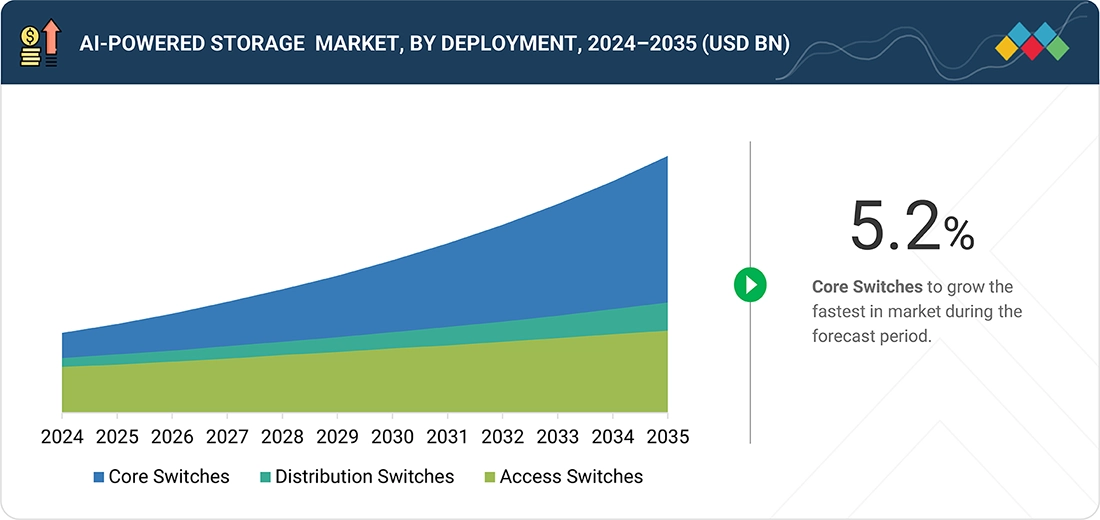

By TypeBy type, core switches are expected to dominate the market through 2033, driven by hyperscale expansion and the need for high-capacity, low-latency backbone connectivity.

-

By TechnologyBy technology, Ethernet will maintain the largest market share and fastest growth, supported by rapid adoption of 100G–400G+ Ethernet for AI, cloud, and high-performance data center networks.

-

By BandwidthBy bandwidth, the >40 Gbps segment will register the highest CAGR as workloads shift to GPU-intensive AI clusters requiring ultra-high throughput and low latency.

-

By End UserBy end user, cloud service providers will lead the market and experience the strongest growth as hyperscalers scale out global regions and AI-ready data center fabrics.

The AI-powered storage market is expanding rapidly as organizations require high-throughput, low-latency data infrastructures to support increasingly complex AI, ML, and GPU-accelerated workloads. Demand is being propelled by the explosive growth of unstructured data, large-scale model training, and real-time analytics across cloud, edge, and enterprise environments. Advancements in NVMe, all-flash arrays, software-defined storage, and unified file-object architectures are enabling faster data access and improved scalability. Major vendors such as VAST Data, WEKA, NetApp, and Lightbits are launching AI-optimized storage platforms, while cloud providers and hyperscalers continue to invest in next-generation data fabrics to remove GPU bottlenecks. Strategic partnerships between storage vendors, semiconductor suppliers, and AI infrastructure providers are accelerating innovation and strengthening the global ecosystem for AI-centric storage solutions.

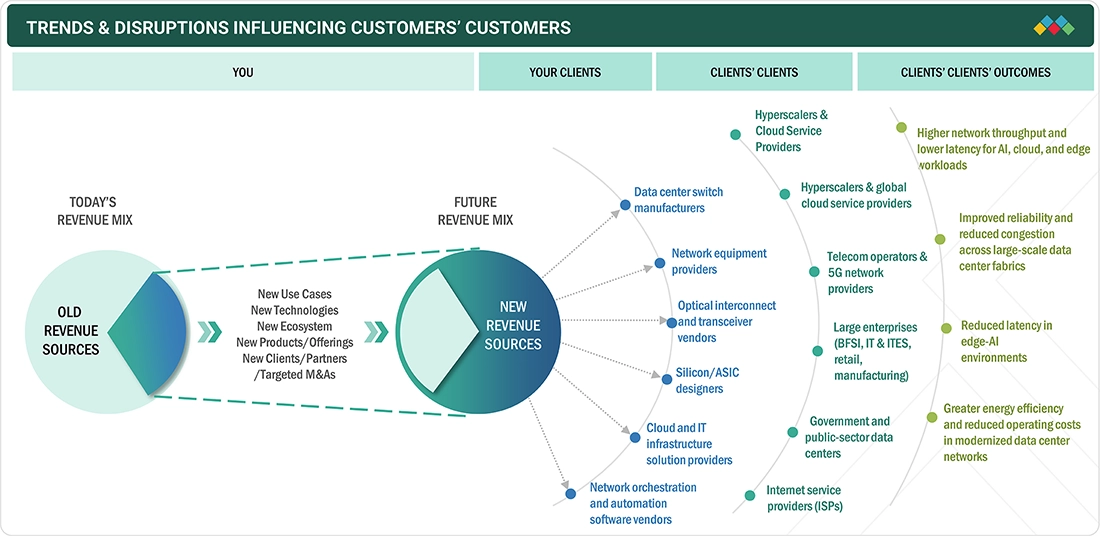

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The data center switches ecosystem brings together switch manufacturers, network equipment providers, optical interconnect suppliers, silicon and ASIC designers, and orchestration software vendors who collectively enable the high-performance networking backbone required for modern digital infrastructure. These players ultimately serve hyperscalers, cloud providers, telecom operators, large enterprises, government data centers, and content delivery networks organizations that depend on resilient, scalable, and low-latency switching fabrics to support rapidly growing AI, cloud, and edge workloads. As a result, end users benefit from higher throughput, improved reliability, faster automation, enhanced scalability for GPU clusters, stronger security, and lower operational costs, enabling them to operate next-generation data centers with greater efficiency and agility.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rapid growth of AI/ML, cloud computing, and hyperscale data centers

-

Shift toward leaf–spine and high-performance fabric networks

Level

-

High cost of deploying next-generation switches

-

Complex integration with legacy infrastructure

Level

-

Expansion of hyperscale and edge data centers globally

-

Adoption of software-defined networking (SDN) and network automation

Level

-

Managing escalating data traffic loads

-

Increasing need for interoperability across diverse hardware, protocols, and vendor ecosystem

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rapid growth of AI/ML, cloud computing, and hyperscale data centers

The explosive rise of AI/ML workloads, large-scale cloud services, and hyperscale data center expansion is significantly increasing demand for high-performance switches capable of handling massive throughput and extremely low latency. As organizations scale GPU clusters, large language model training environments, and real-time analytics platforms, network fabrics must support 100G, 200G, 400G, and emerging 800G bandwidth levels. This rapid escalation in traffic volume and data movement is driving substantial investment in next-generation data center switches that can sustain high-density, high-speed interconnects across modern compute environments.

Restraint: High cost of deploying next-generation switches

Upgrading to advanced switching platforms particularly 400G+ and AI-optimized fabrics—requires significant capital expenditure for new hardware, optics, cabling, and supporting infrastructure. For many mid-sized enterprises, these costs create barriers to modernization, delaying the transition to higher-bandwidth architectures needed to support AI and cloud workloads. As a result, many organizations are forced to operate hybrid environments where legacy switches limit performance, slowing overall adoption of advanced switching technologies.

Opportunity: Expansion of hyperscale and edge data centers globally

The rapid build-out of hyperscale facilities and the emergence of edge data centers are creating strong opportunities for switch vendors to deliver high-capacity, low-latency networking solutions tailored for distributed computing. As cloud regions expand and edge sites proliferate to support 5G, IoT, and real-time AI inference, demand for compact, scalable, and high-throughput switching infrastructure is accelerating. This broad geographic and architectural expansion opens new growth avenues for advanced Ethernet and InfiniBand switch platforms.

Challenge: Managing escalating data traffic loads across AI clusters and multi-cloud environments

AI workloads, GPU clusters, and multi-cloud architectures generate extremely high data traffic volumes that place immense strain on traditional switching infrastructures. Ensuring consistent throughput, minimizing latency, and preventing congestion becomes increasingly complex as organizations connect thousands of GPUs, storage nodes, and compute instances. Maintaining performance at scale demands not only faster switching hardware but also new approaches to power efficiency, thermal management, and network fabric optimization—making traffic escalation a core operational challenge for data center networks.

data-center-switch-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

A leading hyperscale cloud provider deployed Cisco’s 400G Ethernet switching platform to upgrade its leaf–spine fabric and support large-scale AI training clusters requiring massive east–west traffic throughput. | Delivered significantly lower latency and higher network bandwidth, enabling faster AI workload processing and improved GPU cluster efficiency across hyperscale data centers. |

|

A global financial services firm implemented Arista’s 100G/400G spine switches to modernize its data center network, ensuring consistent low-latency performance for real-time analytics, trading applications, and secure multi-cloud connectivity. | Achieved deterministic low latency and enhanced network reliability, improving transaction speeds and application responsiveness for mission-critical workloads. |

|

A high-performance computing (HPC) research center deployed NVIDIA’s InfiniBand switches to interconnect thousands of GPUs, enabling ultra-fast data movement for large-scale simulations, deep learning, and scientific modeling. | Provided near-zero latency and extremely high throughput, resulting in faster simulation runtimes and accelerated AI model training at supercomputing scale. |

|

A telecom operator adopted Juniper’s QFX Series switches to build a scalable edge-to-core network supporting 5G rollout, network slicing, and high-bandwidth content delivery. | Enabled high-performance transport for 5G and edge workloads, reducing congestion and improving service quality for bandwidth-intensive consumer and enterprise applications. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The data center switches market is underpinned by a broad and evolving ecosystem of network equipment vendors, silicon providers, cloud operators, and software innovators working collectively to support the surging traffic demands of AI, cloud computing, and digital transformation. As organizations modernize their infrastructure to enable higher bandwidth, lower latency, and more scalable network fabrics, the ecosystem continues to expand with advancements in Ethernet, InfiniBand, optical interconnects, and automation technologies. Accelerating adoption of AI workloads, 5G expansion, and multi-cloud architectures is driving sustained investment and collaboration across this landscape, reinforcing the critical role of high-performance switching in powering next-generation data centers.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Data Center Switch Market, By Type

Core switches are expected to dominate the data center switches market through 2035, driven by the rapid expansion of hyperscale facilities and the need for high-capacity backbone connectivity supporting AI, cloud, and high-performance computing workloads. As data volumes surge and east–west traffic intensifies, core switches provide the massive throughput, ultra-low latency, and scalable architecture required for large fabric deployments. With enterprises and cloud providers modernizing their infrastructure to support next-generation workloads, core switches will remain the central foundation of high-bandwidth data center networks.

Data Center Switch Market, By technology

Ethernet is expected to maintain the largest market share and highest growth rate through 2035, fueled by rapid adoption of 100G, 200G, 400G, and emerging 800G Ethernet solutions across hyperscale, cloud, and AI-driven data centers. As workloads become more distributed and latency sensitive, Ethernet’s scalability, cost efficiency, and ongoing innovation in RoCEv2 and congestion management make it the preferred networking technology for modern data center environments.

Data Center Switch Market, By Bandwidth

The >40 Gbps segment is expected to register the fastest growth, fueled by hyperscalers, AI clusters, and cloud data centers deploying 100G, 200G, 400G, and emerging 800G switches to support high-density compute environments. Rising adoption of LLM training, distributed storage, and real-time analytics will make this segment the central growth engine of the data center switch market.

Data Center Switch Market, By End User

Cloud service providers are expected to dominate the market through 2035, driven by massive investments in hyperscale data centers, global region expansion, and AI-ready network fabrics. As CSPs deploy 200G–800G networks to support generative AI, scalable computing, and multi-cloud services, they will continue to be the strongest and fastest-growing end-user segment.

REGION

Asia Pacific will grow the fastest in the data center switch market, driven by massive hyperscale data center build-outs, rapid cloud adoption, 5G expansion, and increasing investment in AI and digital infrastructure across China, India, Japan, and Southeast Asia.

Asia Pacific is set to record the strongest growth in the data center switch market as regional cloud providers, hyperscalers, and telecom operators accelerate large-scale data center construction and network modernization. Rising AI workloads, rapid digitalization, and expanding 5G and edge deployments across major economies like India, China, and Southeast Asia are further amplifying demand for high-capacity switching infrastructure.

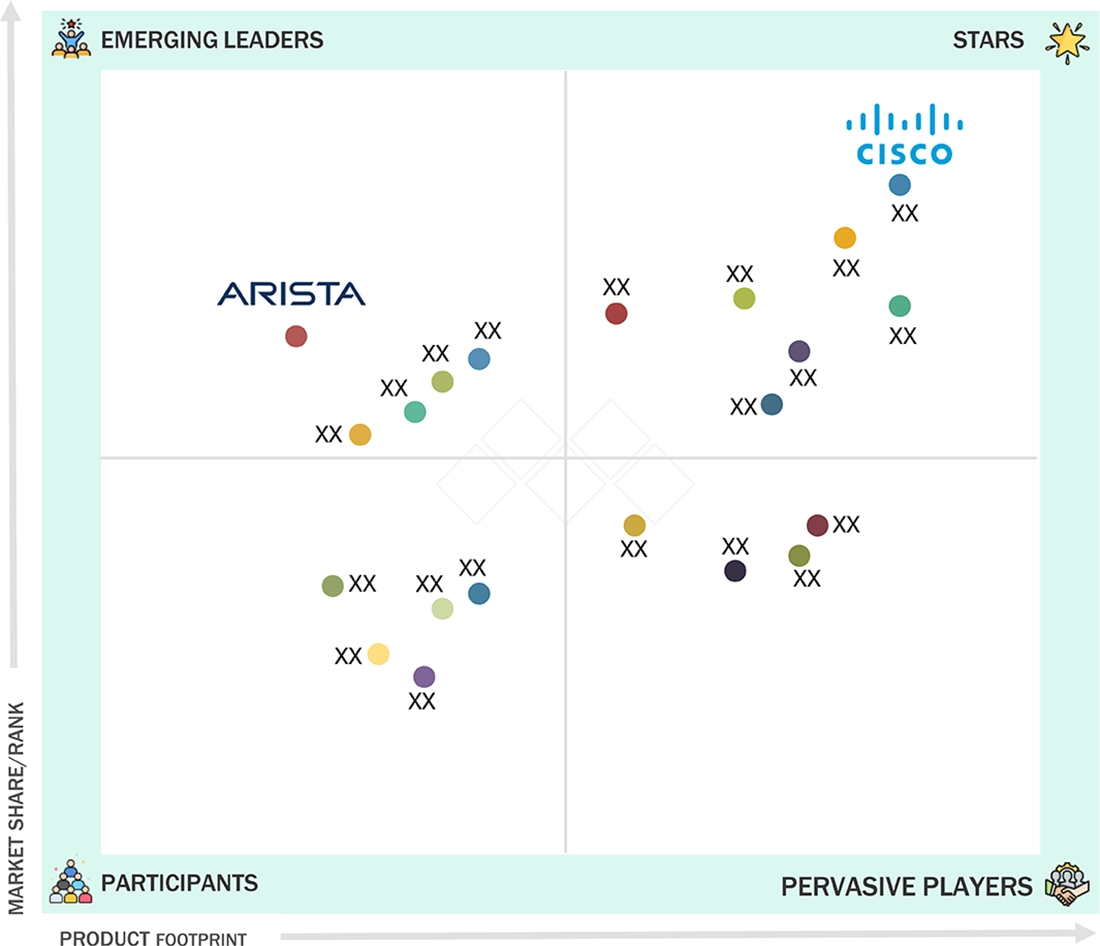

data-center-switch-market: COMPANY EVALUATION MATRIX

In the data center switches market matrix, Cisco (Star) leads with a dominant presence and a comprehensive portfolio of core, aggregation, and top-of-rack switches designed to support high-bandwidth, low-latency networks across hyperscale, enterprise, and telecom environments. Its deep capabilities in Ethernet fabrics, automation platforms such as ACI and Nexus Dashboard, and continuous innovation in 100G/400G/800G switching reinforce Cisco’s position at the forefront of next-generation data center networking. Arista Networks (Emerging Leader) is rapidly gaining momentum with its cloud-driven architecture, high-performance 100G–800G switching platforms, and EOS software ecosystem, which are increasingly preferred by hyperscalers, cloud providers, and AI infrastructure operators. Its strong focus on high-density leaf–spine fabrics and deterministic low-latency performance positions Arista as a critical challenger shaping the future of scalable, software-defined data center networks.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 16.88 BN |

| Market Forecast in 2030 (Value) | USD 26.78 BN |

| Growth Rate | 4.2% |

| Years Considered | 2021–2035 |

| Base Year | 2024 |

| Forecast Period | 2025–2035 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, RoW |

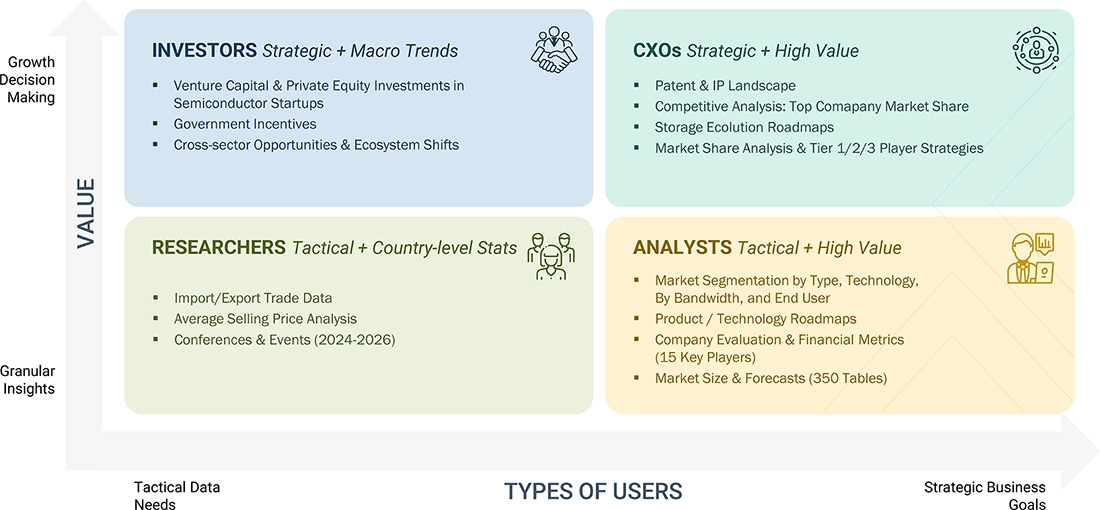

WHAT IS IN IT FOR YOU: data-center-switch-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Hyperscale Cloud Provider | Benchmarking of 100G/200G/400G/800G switch performance; analysis of leaf–spine and AI-fabric architectures; evaluation of vendor capabilities for ultra-low-latency GPU cluster networking | Improve high-density cluster performance; eliminate network bottlenecks; support faster AI/ML workload execution |

| Telecom & 5G Network Provider | Analysis of edge data center switching requirements; benchmarking of carrier-grade switches; assessment of network slicing and 5G transport readiness | Strengthen 5G rollout; enable low-latency edge services; improve traffic handling for high-bandwidth applications |

| Switch Manufacturer / OEM | Competitive benchmarking across core, distribution, and access switches; mapping of regional demand trends; identification of high-growth bandwidth segments (100G–800G) | Enhance product positioning; guide R&D priorities; strengthen go-to-market strategy |

| Government / Public Sector IT | Network security and resiliency assessment; vendor evaluation for mission-critical workloads; benchmarking of secure switching platforms | Improve cybersecurity posture; ensure high reliability for public infrastructure; support compliance with regulatory frameworks |

| Colocation & Hosting Provider | Analysis of multi-tenant network performance needs; evaluation of scalable spine architectures; benchmarking of automation and visibility tools | Improve tenant experience; optimize rack-to-rack performance; enhance manageability and uptime |

| HPC / Research Institution | Performance assessment of InfiniBand vs. high-speed Ethernet; analysis of HPC fabric topologies; guidance on upgrade paths for simulation and AI research networks | Accelerate compute performance; reduce job completion time; enhance scalability for future research workloads |

RECENT DEVELOPMENTS

- January 2025 : Cisco introduced its next-generation Nexus 9800 modular switches featuring 800G Ethernet line cards and advanced telemetry capabilities, designed to deliver ultra-low-latency, high-capacity fabrics for hyperscale AI clusters and large cloud data centers.

- October 2024 : Arista Networks launched new 400G/800G switches based on Broadcom Tomahawk 5 silicon, along with enhancements to its EOS software stack to support AI workloads, congestion control, and high-density leaf–spine deployments across hyperscale environments.

- August 2024 : Juniper Networks unveiled updates to its QFX series and Apstra intent-based networking platform, enabling automated fabric provisioning, improved telemetry, and optimized performance for multi-cloud and edge data center networks.

- July 2024 : NVIDIA (Mellanox) released its latest Quantum-X InfiniBand switches with NDR 400Gb/s capabilities, targeting large GPU clusters and HPC centers requiring ultra-low latency and extreme throughput for AI training and simulation workloads.

- June 2024 : Huawei announced its CloudEngine 18000K series with support for 800G ports and enhanced AI-fabric scheduling, built to support China’s rapidly expanding AI and cloud data center infrastructure with higher scalability and network efficiency.

Table of Contents

- 5.1 INTRODUCTION

-

5.2 PORTERS FIVE FORCE ANALYSISTHREAT FROM NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.3 MACROECONOMICS INDICATORSINTRODUCTIONGDP TRENDS AND FORECASTTRENDS IN GLOBAL DATA CENTER SWITCH MARKET

-

5.4 TRADE ANALYSISIMPORT SCENARIOEXPORT SCENARIO

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 PRICING ANALYSIS

- 5.8 KEY CONFERENCES AND EVENTS, 2025–2026

- 5.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.10 INVESTMENT AND FUNDING SCENARIO

- 5.11 CASE STUDY ANALYSIS

-

5.12 IMPACT OF 2025 US TARIFF – DATA CENTER SWITCH MARKETINTRODUCTIONKEY TARIFF RATESPRICE IMPACT ANALYSISIMPACT ON COUNTRIES/REGIONSIMPACT ON APPLICATIONS

- 6.1 KEY EMERGING TECHNOLOGIES

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.3 ADJACENT TECHNOLOGIES

- 6.4 TECHNOLOGY ROADMAP

- 6.5 PATENT ANALYSIS

- 6.6 FUTURE APPLICATIONS

-

6.7 IMPACT OF AI/GEN AI ON DATA CENTER SWITCH MARKETTOP USE CASES AND MARKET POTENTIALBEST PRACTICES IN DATA CENTER SWITCH USAGECASE STUDIES OF AI IMPLEMENTATION IN THE DATA CENTER SWITCH MARKETINTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERSCLIENTS’ READINESS TO ADOPT AI IN THE DATA CENTER SWITCH MARKET

-

7.1 REGIONAL REGULATIONS AND COMPLIANCEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSINDUSTRY STANDARDS

- 8.1 DECISION-MAKING PROCESS

-

8.2 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIAKEY STAKEHOLDERS IN THE BUYING PROCESSBUYING CRITERIA

- 8.3 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 8.4 UNMET NEEDS FROM VARIOUS APPLICATIONS

- 8.5 MARKET PROFITABILITY

- 9.1 INTRODUCTION

-

9.2 CORE SWITCHESSPINE SWITCHESHIGH-CAPACITY MODULAR SWITCHESAI FABRIC/HPC CORE SWITCHES

-

9.3 DISTRIBUTION SWITCHESAGGREGATION SWITCHESLEAF SWITCHESUNIFIED ACCESS DISTRIBUTION SWITCHES

-

9.4 ACCESS SWITCHESTOP-OF-RACK (TOR) SWITCHESEND-OF-ROW (EOR) SWITCHESACCESS EDGE SWITCHES

- 10.1 INTRODUCTION

-

10.2 ETHERNETL2/L3 ETHERNET SWITCHING100G/200G/400G ETHERNETAI/ML-OPTIMIZED ETHERNET

-

10.3 FIBRE CHANNEL16G FC32G FC64G FC

-

10.4 INFINIBANDSDR/DDR/QDRFDREDR/HDR/NDR

- 11.1 INTRODUCTION

- 11.2 ≤1 GBPS

- 11.3 >1 GBPS TO ≤10 GBPS

- 11.4 >10 GBPS TO ≤40 GBPS

- 11.5 >40 GBPS

- 12.1 INTRODUCTION

-

12.2 FILE-AND-OBJECT-BASED STORAGEFILE STORAGEOBJECT STORAGE

- 12.3 BLOCK STORAGE

- 13.1 INTRODUCTION

- 13.2 ENTERPRISES

- 13.3 TELECOMMUNICATIONS INDUSTRY

- 13.4 GOVERNMENT ORGANIZATIONS

- 13.5 CLOUD SERVICE PROVIDERS

- 14.1 INTRODUCTION

-

14.2 NORTH AMERICAUSCANADAMEXICO

-

14.3 EUROPEGERMANYUKFRANCEITALYREST OF EUROPE

-

14.4 ASIA PACIFICCHINAJAPANSOUTH KOREAINDIAREST OF ASIA PACIFIC

-

14.5 ROWMIDDLE EAST & AFRICA- GCC- Rest of the Middle EastSOUTH AMERICA

- 15.1 INTRODUCTION

- 15.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 15.3 REVENUE ANALYSIS

- 15.4 MARKET SHARE ANALYSIS, 2024

- 15.5 COMPANY VALUATION AND FINANCIAL METRICS

- 15.6 PRODUCT/BRAND COMPARISON

-

15.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT: KEY PLAYERS, 2024- Company Footprint- Region Footprint- End User Footprint- Bandwidth Footprint- Type Footprint

-

15.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024- Detailed List of Key Startups/SMEs- Competitive Benchmarking of Key Startups/SMEs

-

15.9 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALS

-

16.1 KEY PLAYERSCISCOHUAWEI TECHNOLOGIES INC.HEWLETT PACKARD ENTERPRISE (HPE)ARISTA NETWORKSJUNIPER NETWORKSNECMELLANOX TECHNOLOGIESEXTREME NETWORKSFORTINETZTE

- 16.2 OTHER PLAYERS

- 17.1 RESEARCH DATA

-

17.2 SECONDARY DATAKEY DATA FROM SECONDARY SOURCESPRIMARY DATA- Key Data from Primary Sources- Key Primary Participants- Breakdown of Primary Interviews- Key Industry InsightsMARKET SIZE ESTIMATION- Bottom-Up Approach- Top-Down Approach- Base Number CalculationMARKET FORECAST APPROACH- Supply Side- Demand SideDATA TRIANGULATIONRESEARCH ASSUMPTIONSRESEARCH LIMITATIONS AND RISK ASSESSMENT

- 18.1 DISCUSSION GUIDE

- 18.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 18.3 AVAILABLE CUSTOMIZATIONS

- 18.4 RELATED REPORTS

- 18.5 AUTHOR DETAILS

- Data Center Switch, by TYPE

- INTRODUCTION

The Data Center Switch has been segmented by type.

TABLE 1Data Center Switch, By type, 2021–2024 (USD MILLION)

|

Type |

2021 |

2022 |

2023 |

2024 |

CAGR (2021–2024) |

|

Core Switches |

xx |

xx |

xx |

xx |

xx% |

|

Distribution Switches |

xx |

xx |

xx |

xx |

xx% |

|

Access Switches |

xx |

xx |

xx |

xx |

xx% |

|

Total |

xx |

xx |

xx |

xx |

xx% |

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

TABLE 2Data Center Switch, By type, 2025–2035 (USD MILLION)

|

Type |

2025 |

2026 |

2027 |

2028 |

2029 |

2031 |

2033 |

2035 |

CAGR |

|

Core Switches |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx% |

|

Distribution Switches |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx% |

|

Access Switches |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx% |

|

Total |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx% |

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

- Data Center Switch, by technology

- INTRODUCTION

The Data Center Switch has been segmented based on technology.

TABLE 3Data Center Switch, By technology, 2021–2024 (USD MILLION)

|

Technology |

2021 |

2022 |

2023 |

2024 |

CAGR (2021–2024) |

|

Ethernet |

xx |

xx |

xx |

xx |

xx% |

|

Fibre Channel |

xx |

xx |

xx |

xx |

xx% |

|

Infiniband |

xx |

xx |

xx |

xx |

xx% |

|

Total |

xx |

xx |

xx |

xx |

xx% |

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

TABLE 4Data Center Switch, By technology, 2025–2035 (USD MILLION)

|

Technology |

2025 |

2026 |

2027 |

2028 |

2029 |

2031 |

2033 |

2035 |

CAGR |

|

Ethernet |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx% |

|

Fibre Channel |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx% |

|

Infiniband |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx% |

|

Total |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx% |

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

- Data Center Switch, by bandwidth

- INTRODUCTION

The Data Center Switch has been segmented based on bandwidth.

TABLE 5Data Center Switch, By bandwidth, 2021–2024 (USD MILLION)

|

Bandwidth |

2021 |

2022 |

2023 |

2024 |

CAGR (2021–2024) |

|

≤1 GBPS |

xx |

xx |

xx |

xx |

xx% |

|

>1 GBPS to ≤10 GBPS |

xx |

xx |

xx |

xx |

xx% |

|

>10 GBPS to ≤40 GBPS |

xx |

xx |

xx |

xx |

xx% |

|

>40 GBPS |

|

|

|

|

|

|

Total |

xx |

xx |

xx |

xx |

xx% |

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

TABLE 6Data Center Switch, By bandwidth, 2025–2035 (USD MILLION)

|

Bandwidth |

2025 |

2026 |

2027 |

2028 |

2029 |

2031 |

2033 |

2035 |

CAGR |

|

≤1 GBPS |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx% |

|

>1 GBPS to ≤10 GBPS |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx% |

|

>10 GBPS to ≤40 GBPS |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx% |

|

>40 GBPS |

|

|

|

|

|

|

|

|

|

|

Total |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx% |

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

- Data Center Switch, by End User

- INTRODUCTION

The Data Center Switch has been segmented based on end user.

TABLE 7Data Center Switch, By end user, 2021–2024 (USD MILLION)

|

End User |

2021 |

2022 |

2023 |

2024 |

CAGR (2021–2024) |

|

Enterprises

|

xx |

xx |

xx |

xx |

xx% |

|

Telecommunication Industry |

xx |

xx |

xx |

xx |

xx% |

|

Government Organizations |

xx |

xx |

xx |

xx |

xx% |

|

Cloud Service Providers |

xx |

xx |

xx |

xx |

xx% |

|

Total |

xx |

xx |

xx |

xx |

xx% |

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

TABLE 8Data Center Switch, By end user, 2025–2035 (USD MILLION)

|

End User |

2025 |

2026 |

2027 |

2028 |

2029 |

2031 |

2033 |

2035 |

CAGR |

|

Enterprises

|

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx% |

|

Telecommunication Industry |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx% |

|

Government Organizations |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx% |

|

Cloud Service Providers |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx% |

|

Total |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx% |

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

- Data Center Switch, by region

- INTRODUCTION

The Data Center Switch has been segmented based on region.

TABLE 9Data Center Switch, By region, 2021–2024 (USD MILLION)

|

Region |

2021 |

2022 |

2023 |

2024 |

CAGR (2021–2024) |

|

North America

|

xx |

xx |

xx |

xx |

xx% |

|

Europe |

xx |

xx |

xx |

xx |

xx% |

|

Asia Pacific |

xx |

xx |

xx |

xx |

xx% |

|

RoW |

xx |

xx |

xx |

xx |

xx% |

|

Total |

xx |

xx |

xx |

xx |

xx% |

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

TABLE 10Data Center Switch, By Region, 2025–2035 (USD MILLION)

|

Region |

2025 |

2026 |

2027 |

2028 |

2029 |

2031 |

2033 |

2035 |

CAGR |

|

North America

|

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx% |

|

Europe |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx% |

|

Asia Pacific |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx% |

|

RoW |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx% |

|

Total |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx |

xx% |

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

LIST OF TABLES

|

TABLE 1 |

DATA CENTER SWITCH: RISK ANALYSIS |

|

TABLE 2 |

DATA CENTER SWITCH: IMPACT OF PORTER’S FIVE FORCES |

|

TABLE 3 |

GDP PERCENTAGE CHANGE, BY KEY COUNTRY, 2021–2029 |

|

TABLE 4 |

ROLE OF PLAYERS IN DATA CENTER SWITCH ECOSYSTEM |

|

TABLE 5 |

AVERAGE SELLING PRICE OF OFFERED BY TOP 3 PLAYERS (USD/UNIT), 2024 |

|

TABLE 6 |

AVERAGE SELLING PRICE OF DATA CENTER SWITCH, BY REGION, 2021–2024 (USD/UNIT) |

|

TABLE 7 |

IMPORT DATA FOR HS CODE-COMPLIANT PRODUCTS, BY COUNTRY, 2020–2024 (USD MILLION) |

|

TABLE 8 |

EXPORT DATA FOR HS CODE-COMPLIANT PRODUCTS, BY COUNTRY, 2020–2024 (USD MILLION) |

|

TABLE 9 |

DATA CENTER SWITCH: KEY CONFERENCES AND EVENTS, 2025–2026 |

|

TABLE 10 |

US ADJUSTED RECIPROCAL TARIFF RATES |

|

TABLE 11 |

INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END USERS (%) |

|

TABLE 12 |

KEY BUYING CRITERIA FOR TOP THREE END USERS |

|

TABLE 13 |

UNMET NEEDS IN DATA CENTER SWITCH BY END USERS |

|

TABLE 14 |

NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS |

|

TABLE 15 |

EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS |

|

TABLE 16 |

ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS |

|

TABLE 17 |

REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS |

|

TABLE 18 |

LIST OF APPLIED/GRANTED PATENTS RELATED TO DATA CENTER SWITCH, AUGUST 2023–JULY 2025 |

|

TABLE 19 |

TOP USE CASES AND MARKET POTENTIAL |

|

TABLE 20 |

BEST PRACTICES: COMPANIES IMPLEMENTING USE CASES |

|

TABLE 21 |

DATA CENTER SWITCH: CASE STUDIES RELATED TO AI IMPLEMENTATION |

|

TABLE 22 |

INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS |

|

TABLE 23 |

DATA CENTER SWITCH, BY TYPE, 2021–2024 (USD MILLION) |

|

TABLE 24 |

DATA CENTER SWITCH, BY TYPE, 2025–2032 (USD MILLION) |

|

TABLE 25 |

TYPE: DATA CENTER SWITCH, BY REGION, 2021–2024 (USD MILLION) |

|

TABLE 26 |

TYPE: DATA CENTER SWITCH, BY REGION, 2025–2032 (USD MILLION) |

|

TABLE 27 |

TYPE: DATA CENTER SWITCH, BY END USER, 2021–2024 (USD MILLION) |

|

TABLE 28 |

TYPE: DATA CENTER SWITCH, BY END USER, 2025–2032 (USD MILLION) |

|

TABLE 29 |

DATA CENTER SWITCH, BY TECHNOLOGY, 2021–2024 (USD MILLION) |

|

TABLE 30 |

DATA CENTER SWITCH, BY TECHNOLOGY, 2025–2032 (USD MILLION) |

|

TABLE 31 |

TECHNOLOGY: DATA CENTER SWITCH, BY REGION, 2021–2024 (USD MILLION) |

|

TABLE 32 |

TECHNOLOGY: DATA CENTER SWITCH, BY REGION, 2025–2032 (USD MILLION) |

|

TABLE 33 |

TECHNOLOGY: DATA CENTER SWITCH, BY END USER, 2021–2024 (USD MILLION) |

|

TABLE 34 |

TECHNOLOGY: DATA CENTER SWITCH, BY END USER, 2025–2032 (USD MILLION) |

|

TABLE 35 |

DATA CENTER SWITCH, BY BANDWIDTH, 2021–2024 (USD MILLION) |

|

TABLE 36 |

DATA CENTER SWITCH, BY BANDWIDTH, 2025–2032 (USD MILLION) |

|

TABLE 37 |

BANDWIDTH: DATA CENTER SWITCH, BY REGION, 2021–2024 (USD MILLION) |

|

TABLE 38 |

BANDWIDTH: DATA CENTER SWITCH, BY REGION, 2025–2032 (USD MILLION) |

|

TABLE 39 |

BANDWIDTH: DATA CENTER SWITCH, BY END USER, 2021–2024 (USD MILLION) |

|

TABLE 40 |

BANDWIDTH: DATA CENTER SWITCH, BY END USER, 2025–2032 (USD MILLION) |

|

TABLE 41 |

DATA CENTER SWITCH, BY END USER, 2021–2024 (USD MILLION) |

|

TABLE 42 |

DATA CENTER SWITCH, BY END USER, 2025–2032 (USD MILLION) |

|

TABLE 43 |

END USER: DATA CENTER SWITCH, BY REGION, 2021–2024 (USD MILLION) |

|

TABLE 44 |

APPLICATION: DATA CENTER SWITCH, BY REGION, 2025–2032 (USD MILLION) |

|

TABLE 45 |

END USER: DATA CENTER SWITCH, BY TYPE, 2021–2024 (USD MILLION) |

|

TABLE 46 |

END USER: DATA CENTER SWITCH, BY TYPE, 2025–2032 (USD MILLION) |

|

TABLE 47 |

DATA CENTER SWITCH, BY REGION, 2021–2024 (USD MILLION) |

|

TABLE 48 |

DATA CENTER SWITCH, BY REGION, 2025–2032 (USD MILLION) |

|

TABLE 48 |

NORTH AMERICA: DATA CENTER SWITCH, BY TYPE, 2021–2024 (USD MILLION) |

|

TABLE 49 |

NORTH AMERICA: DATA CENTER SWITCH, BY TYPE, 2025–2032 (USD MILLION) |

|

TABLE 50 |

NORTH AMERICA: DATA CENTER SWITCH, BY TECHNOLOGY, 2021–2024 (USD MILLION) |

|

TABLE 51 |

NORTH AMERICA: DATA CENTER SWITCH, BY TECHNOLOGY, 2025–2032 (USD MILLION) |

|

TABLE 52 |

NORTH AMERICA: DATA CENTER SWITCH, BY BANDWIDTH, 2021–2024 (USD MILLION) |

|

TABLE 53 |

NORTH AMERICA: DATA CENTER SWITCH, BY BANDWIDTH, 2025–2032 (USD MILLION) |

|

TABLE 53 |

NORTH AMERICA: DATA CENTER SWITCH, BY STORAGE ARCHITECTURE, 2021–2024 (USD MILLION) |

|

TABLE 55 |

NORTH AMERICA: DATA CENTER SWITCH, BY STORAGE ARCHITECTURE, 2025–2032 (USD MILLION) |

|

TABLE 56 |

NORTH AMERICA: DATA CENTER SWITCH, BY END USER, 2021–2024 (USD MILLION) |

|

TABLE 57 |

NORTH AMERICA: DATA CENTER SWITCH, BY END USER, 2025–2032 (USD MILLION) |

|

TABLE 58 |

NORTH AMERICA: DATA CENTER SWITCH, BY COUNTRY, 2021–2024 (USD MILLION) |

|

TABLE 59 |

NORTH AMERICA: DATA CENTER SWITCH, BY COUNTRY, 2025–2032 (USD MILLION) |

|

TABLE 60 |

EUROPE: DATA CENTER SWITCH, BY TYPE, 2021–2024 (USD MILLION) |

|

TABLE 61 |

EUROPE: DATA CENTER SWITCH, BY TYPE, 2025–2032 (USD MILLION) |

|

TABLE 62 |

EUROPE: DATA CENTER SWITCH, BY TECHNOLOGY, 2021–2024 (USD MILLION) |

|

TABLE 63 |

EUROPE: DATA CENTER SWITCH, BY TECHNOLOGY, 2025–2032 (USD MILLION) |

|

TABLE 64 |

EUROPE: DATA CENTER SWITCH, BY BANDWIDTH, 2021–2024 (USD MILLION) |

|

TABLE 65 |

EUROPE: DATA CENTER SWITCH, BY BANDWIDTH, 2025–2032 (USD MILLION) |

|

TABLE 66 |

EUROPE: DATA CENTER SWITCH, BY STORAGE ARCHITECTURE, 2021–2024 (USD MILLION) |

|

TABLE 67 |

EUROPE: DATA CENTER SWITCH, BY STORAGE ARCHITECTURE, 2025–2032 (USD MILLION) |

|

TABLE 68 |

EUROPE: DATA CENTER SWITCH, BY END USER, 2021–2024 (USD MILLION) |

|

TABLE 69 |

EUROPE: DATA CENTER SWITCH, BY END USER, 2025–2032 (USD MILLION) |

|

TABLE 70 |

EUROPE: DATA CENTER SWITCH, BY COUNTRY, 2021–2024 (USD MILLION) |

|

TABLE 71 |

EUROPE: DATA CENTER SWITCH, BY COUNTRY, 2025–2032 (USD MILLION) |

|

TABLE 72 |

ASIA PACIFIC: DATA CENTER SWITCH, BY TYPE, 2021–2024 (USD MILLION) |

|

TABLE 73 |

ASIA PACIFIC: DATA CENTER SWITCH, BY TYPE, 2025–2032 (USD MILLION) |

|

TABLE 73 |

ASIA PACIFIC: DATA CENTER SWITCH, BY TECHNOLOGY, 2021–2024 (USD MILLION) |

|

TABLE 75 |

ASIA PACIFIC: DATA CENTER SWITCH, BY TECHNOLOGY, 2025–2032 (USD MILLION) |

|

TABLE 76 |

ASIA PACIFIC: DATA CENTER SWITCH, BY BANDWIDTH, 2021–2024 (USD MILLION) |

|

TABLE 77 |

ASIA PACIFIC: DATA CENTER SWITCH, BY BANDWIDTH, 2025–2032 (USD MILLION) |

|

TABLE 78 |

ASIA PACIFIC: DATA CENTER SWITCH, BY STORAGE ARCHITECTURE, 2021–2024 (USD MILLION) |

|

TABLE 79 |

ASIA PACIFIC: DATA CENTER SWITCH, BY STORAGE ARCHITECTURE, 2025–2032 (USD MILLION) |

|

TABLE 80 |

ASIA PACIFIC: DATA CENTER SWITCH, BY END USER, 2021–2024 (USD MILLION) |

|

TABLE 81 |

ASIA PACIFIC: DATA CENTER SWITCH, BY END USER, 2025–2032 (USD MILLION) |

|

TABLE 82 |

ASIA PACIFIC: DATA CENTER SWITCH, BY COUNTRY, 2021–2024 (USD MILLION) |

|

TABLE 83 |

ASIA PACIFIC: DATA CENTER SWITCH, BY COUNTRY, 2025–2032 (USD MILLION) |

|

TABLE 84 |

ROW: DATA CENTER SWITCH, BY TYPE, 2021–2024 (USD MILLION) |

|

TABLE 85 |

ROW: DATA CENTER SWITCH, BY TYPE, 2025–2032 (USD MILLION) |

|

TABLE 86 |

ROW: DATA CENTER SWITCH, BY TECHNOLOGY, 2021–2024 (USD MILLION) |

|

TABLE 87 |

ROW: DATA CENTER SWITCH, BY TECHNOLOGY, 2025–2032 (USD MILLION) |

|

TABLE 88 |

ROW: DATA CENTER SWITCH, BY BANDWIDTH, 2021–2024 (USD MILLION) |

|

TABLE 89 |

ROW: DATA CENTER SWITCH, BY BANDWIDTH, 2025–2032 (USD MILLION) |

|

TABLE 90 |

ROW: DATA CENTER SWITCH, BY STORAGE ARCHITECTURE, 2021–2024 (USD MILLION) |

|

TABLE 91 |

ROW: DATA CENTER SWITCH, BY STORAGE ARCHITECTURE, 2025–2032 (USD MILLION) |

|

TABLE 92 |

ROW: DATA CENTER SWITCH, BY END USER, 2021–2024 (USD MILLION) |

|

TABLE 93 |

ROW: DATA CENTER SWITCH, BY END USER, 2025–2032 (USD MILLION) |

|

TABLE 94 |

ROW: DATA CENTER SWITCH, BY COUNTRY, 2021–2024 (USD MILLION) |

|

TABLE 95 |

ROW: DATA CENTER SWITCH, BY COUNTRY, 2025–2032 (USD MILLION) |

|

TABLE 96 |

OVERVIEW OF STRATEGIES ADOPTED BY DATA CENTER SWITCH PROVIDERS |

|

TABLE 97 |

DEGREE OF COMPETITION, 2024 |

|

TABLE 98 |

DATA CENTER SWITCH: REGIONAL FOOTPRINT, 2024 |

|

TABLE 99 |

DATA CENTER SWITCH: TYPE FOOTPRINT, 2024 |

|

TABLE 100 |

DATA CENTER SWITCH: TECHNOLOGY FOOTPRINT, 2024 |

|

TABLE 101 |

DATA CENTER SWITCH: BANDWIDTH FOOTPRINT, 2024 |

|

TABLE 102 |

DATA CENTER SWITCH: END USER FOOTPRINT, 2024 |

|

TABLE 103 |

DATA CENTER SWITCH: LIST OF KEY STARTUPS/SMES, 2024 |

|

TABLE 104 |

DATA CENTER SWITCH: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, 2024 |

|

TABLE 105 |

DATA CENTER SWITCH: PRODUCT LAUNCHES, JANUARY 2021−SEPTEMBER 2025 |

|

TABLE 106 |

DATA CENTER SWITCH: DEALS, JANUARY 2021−SEPTEMBER 2025 |

|

TABLE 107 |

CISCO: COMPANY OVERVIEW |

|

TABLE 108 |

CISCO: PRODUCTS OFFERED |

|

TABLE 109 |

CISCO: PRODUCT LAUNCHES |

|

TABLE 110 |

CISCO: DEALS |

|

TABLE 111 |

HEWLETT PACKARD ENTERPRISE (HPE): COMPANY OVERVIEW |

|

TABLE 112 |

HEWLETT PACKARD ENTERPRISE (HPE): PRODUCTS OFFERED |

|

TABLE 113 |

HEWLETT PACKARD ENTERPRISE (HPE): PRODUCT LAUNCHES |

|

TABLE 114 |

HEWLETT PACKARD ENTERPRISE (HPE): DEALS |

|

TABLE 115 |

ARISTA NETWORKS: COMPANY OVERVIEW |

|

TABLE 116 |

ARISTA NETWORKS: PRODUCTS OFFERED |

|

TABLE 117 |

ARISTA NETWORKS: PRODUCT LAUNCHES |

|

TABLE 118 |

ARISTA NETWORKS: DEALS |

|

TABLE 119 |

HUAWEI TECHNOLOGIES: COMPANY OVERVIEW |

|

TABLE 120 |

HUAWEI TECHNOLOGIES: PRODUCTS OFFERED |

|

TABLE 121 |

HUAWEI TECHNOLOGIES: PRODUCT LAUNCHES |

|

TABLE 122 |

HUAWEI TECHNOLOGIES: DEALS |

|

TABLE 123 |

JUNIPER NETWORKS: COMPANY OVERVIEW |

|

TABLE 124 |

JUNIPER NETWORKS: PRODUCTS OFFERED |

|

TABLE 125 |

JUNIPER NETWORKS: PRODUCT LAUNCHES |

|

TABLE 126 |

JUNIPER NETWORKS: DEALS |

|

TABLE 127 |

NEC: COMPANY OVERVIEW |

|

TABLE 128 |

NEC: PRODUCTS OFFERED |

|

TABLE 129 |

NEC: PRODUCT LAUNCHES |

|

TABLE 130 |

NEC: DEALS |

|

TABLE 131 |

LENEVO: COMPANY OVERVIEW |

|

TABLE 132 |

EXTREME NETWORKS: COMPANY OVERVIEW |

|

TABLE 133 |

FORTINET: COMPANY OVERVIEW |

|

TABLE 134 |

ZTE: COMPANY OVERVIEW |

|

TABLE 135 |

D-LINK: COMPANY OVERVIEW |

|

TABLE 136 |

SILICOM: COMPANY OVERVIEW |

|

TABLE 137 |

QUANTA CLOUD TECHNOLOGY: COMPANY OVERVIEW |

|

TABLE 138 |

BAY MICROSYSTEM: COMPANY OVERVIEW |

|

TABLE 139 |

CUMULUS NETWORKS: COMPANY OVERVIEW |

|

TABLE 140 |

EDGECORE NETWORKS: COMPANY OVERVIEW |

|

TABLE 141 |

CENTEC NETWORKS: COMPANY OVERVIEW |

|

TABLE 142 |

H3C: COMPANY OVERVIEW |

|

TABLE 143 |

MELLANOX TECHNOLOGIES: COMPANY OVERVIEW |

|

|

|

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Data Center Switch Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Data Center Switch Market