Yeast Ingredients Market by Type (Yeast Extract, Autolyzed Yeast, Yeast Cell Wall, Yeast-based Flavor), Application (Food, Feed & Pet Food, Pharmaceuticals), Source (Baker’s Yeast, Brewer’s Yeast), & by Region - Global Trends & Forecast to 2020

The yeast ingredients market was valued at USD 1.7 billion in 2014 and is projected to grow at a CAGR of 8.2%. The base year considered for the study is 2014 and the forecast period considered is from 2015 to 2020. The basic objective of the report is to define, segment, and project the global market size of the yeast ingredients market on the basis of type, application, source, and region. The other objective of the report is to understand the structure of the yeast ingredients market by identifying various segments. The report also helps in analyzing the opportunities in the market for stakeholders, providing a competitive landscape, and projecting the size of the yeast ingredients market and its submarkets in terms of value.

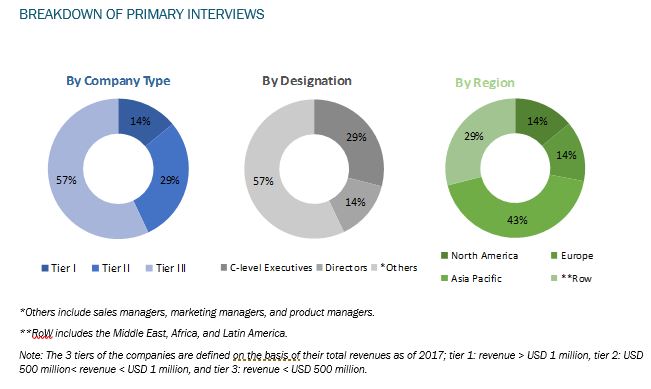

This research study involved secondary sources (which included directories and databases)—such as Hoovers, Forbes, Bloomberg Businessweek, and Factiva—to identify and collect information useful for this technical, market-oriented, and commercial study of the yeast ingredients market. The primary sources involved in the study include industry experts from the core and related industries as well as preferred suppliers, dealers, manufacturers, alliances, standards & certification organizations, and organizations related to all segments of this industry’s value chain. In-depth interviews have been conducted with various primary respondents, such as key industry participants, subject matter experts, C-level executives of key companies, and industry consultants, to obtain and verify critical qualitative and quantitative information as well as to assess future prospects. The following figure depicts the market research methodology applied while drafting the report on the yeast ingredients market.

“To know about the assumptions considered for this research report, download the pdf brochure"

The key participants in the yeast ingredients market, include sterilization equipment manufacturers and suppliers. The key players profiled in the report include Associated British Foods Plc. (UK), Kerry Group Plc. (Ireland, Koninklijke DSM N.V. (DSM) (Netherlands), Sensient Technologies Corporation (US), Angel Yeast Co., Ltd. (China), Lesaffre (France), LALLEMAND Inc. (Canada), Leiber GmbH (Germany), Synergy Flavors (Ireland), and BELDEM S.A. (Belgium).

This report is targeted at the existing stakeholders in the market, which include the following:

- Raw material suppliers

- Agriculture institutes

- R&D institutes

- Yeast ingredients manufacturers/suppliers

- Regulatory bodies

- Organizations such as the FDA, EFSA, USDA, and FSANZ

- Government agencies and NGOs

- Food safety agencies

- Consumers

- Food & beverage manufacturers/suppliers

- Pharmaceutical manufacturers/suppliers

- Personal care/ cosmetics manufacturers/suppliers

- End users

- Food & beverage consumers

- Pharmaceutical consumers

- Personal care/ cosmetics consumers

“The study answers several questions for the stakeholders; primarily, questions regarding which market segments to focus on in the next two to five years, for prioritizing efforts and investments.”

SCOPE OF THE REPORT

On the basis of type, the yeast ingredients market has been segmented as follows:

- Yeast extracts

- Autolyzed yeast

- Yeast cell wall

- Yeast-based flavors

On the basis of key applications, the yeast ingredients market has been segmented as follows:

- Food

- Feed & pet food

- Pharmaceuticals

- Other applications

On the basis of source, the yeast ingredients market has been segmented as follows:

- Baker’s yeast

- Brewer’s yeast

On the basis of region, the yeast ingredients market has been segmented as follows:

- North America

- Europe

- Asia-Pacific

- RoW (The Middle East, Africa, and Latin America)

Available Customizations-

With the given market data, MarketsandMarkets offers customizations according to the company’s specific requirements.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the Rest of Asia Pacific yeast ingredients market, by country

- Further breakdown of the Rest of European yeast ingredients market, by country

- Further breakdown of the Rest of the World yeast ingredients market, into Uruguay, Chile, Paraguay, and Cuba

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

The yeast ingredients market is estimated to be valued at USD 1.7 billion in 2014 and is projected to reach USD 2.6 billion by 2020, at a CAGR of 8.2% during the forecast period. Rising effect of busy lifestyles in developing countries has resulted into the increased demand for processed food & beverages, thus giving a substantial boost to the demand for yeast ingredients in food products. For pet food applications, yeast ingredients are used for making in-situ flavors, savory aroma, and enhance the taste, which results into increased palatability. In developing countries, yeast ingredients market is also evolving in response to rapidly increasing demand for livestock products.

Based on the type, the yeast extracts segment dominated the market, holding the largest share in terms of value in 2014. The increase in consumer preference for savory food products and flavors are projected to drive the market for yeast ingredients across the globe. Yeast extracts are prepared from baker’s yeast or brewer’s yeast. These are mainly used as a natural aromatic ingredient for savory food products such as soups, sauces, meat preparations, and savory mixes. Due to these factors the yeast extracts segment is projected to dominate in the yeast ingredients market during the forecast period.

Based on the application, the yeast ingredients market is divided into food, feed & pet food, pharmaceutical, and others. The food segment accounted for the largest share of the global yeast ingredients market in 2014. Increasing health consciousness and fast-evolving indulgence by consumers are driving the demand for low-salt, low-fat, and no-glutamate food products. Manufacturers of processed food products are targeting consumers with better-for-you low-salt products to boost sales in a stagnating and matured market. This is the key trend shaping the global processed food market. Manufacturers are reverting to various yeast derivatives as their ingredient of choice due to consumer preferences for healthy food.

Based on the source, the yeast ingredients market is divided into baker’s yeast and brewer’s yeast. The baker’s yeast segment accounted for the largest share of the global yeast ingredients market in 2014. Compressed baker’s yeast is the most commonly used product. Commercial baker’s yeast includes products in liquid, creamy or compressed forms, and active dry yeast. Baker’s yeast is a rich source of peptides, amino acids, nucleotides, vitamins, and trace elements. Comparatively higher efficiency and efficient propagation with high performance enabled this source of yeast ingredients to grow at a higher CAGR during the forecast period.

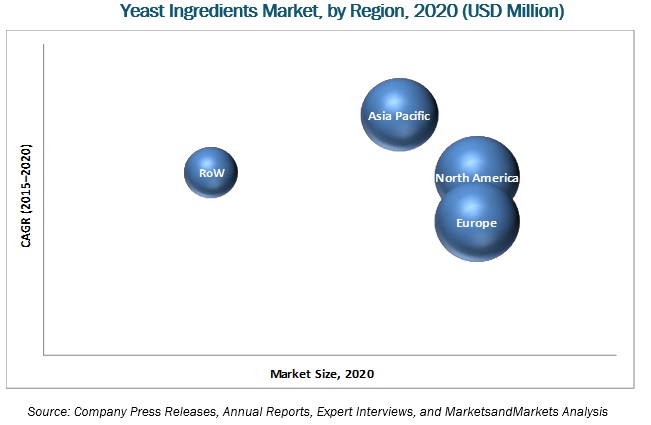

Asia Pacific is projected to witness the fastest growth in the yeast ingredients market during the forecast period. The consumption of food & beverage products in Asia Pacific is rising steadily, driven by the growing population, rising incomes, and increasing urbanization. All these factors support the growth of niche markets such as food ingredients, including yeast ingredients. The market is driven by the growing demand for processed food products in the developing countries, such as India, and China. In the Asia Pacific region, China accounted for the major market of yeast ingredients in 2014. On the account of these factors, the growth of the yeast ingredients market is projected to increase during the forecast period.

One of the major restraining factors for the growth of the yeast ingredients market is the global shortage of yeast raw materials. The baker’s yeast, which is one of the major raw material is majorly dependent on sugar by-product molasses for their growth, although the shortage of molasses is a major concern for the yeast market in many parts of the world. Such a shortage has arisen due to many reasons, poor sugarcane and sugar beet yield being a major one.

The key players such as Associated British Foods Plc (UK), Kerry Group Plc (Ireland, Koninklijke DSM N.V. (DSM) (Netherlands), Lesaffre (France), and LALLEMAND Inc. (Canada) have been actively strategizing their growth strategies to expand in the yeast ingredients market. These companies have a strong presence in Europe and North America. In addition, these companies have manufacturing facilities across these regions with a strong distribution network.

“To speak to our analyst for a discussion on the above findings, please fill up the required details by clicking on the Speak to Analyst tab”

Table of Contents

1 Introduction

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Years Considered for the Study

1.4 Base Currency Considered for the Market

1.5 Stakeholders

1.6 Limitations

2 Research Methodology

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.2.1 Breakdown of Primaries, By Company Type, Designation & Region

2.2 Factor Analysis

2.2.1 Introduction

2.2.2 Overview of the Parent Industry

2.2.2.1 Key Segments in the Food Sector

2.2.3 Demand-Side Analysis

2.2.3.1 Rising Population

2.2.3.1.1 Increase in Middle-Class Population, 2009–2030

2.2.3.2 Developing Economies, GDP (Purchasing Power Parity), 2013

2.2.4 Supply-Side Analysis

2.2.4.1 Research & Development

2.2.4.2 Yeast Ingredients Manufacturing Technologies

2.3 Market Size Estimation

2.4 Market Breakdown & Data Triangulation

2.5 Research Assumptions & Limitations

2.5.1 Assumptions

2.5.2 Limitations of the Research Study

3 Executive Summary

3.1 Overview

3.2 Yeast Ingredients

4 Premium Insights

4.1 Attractive Opportunities in the Market

4.2 Market for Yeast Ingredients, By Application

4.3 Market for Yeast Ingredients in the Asia-Pacific Region

4.4 U.S. Dominates the Overall Market in 2014

4.5 Market for Yeast Ingredients, By Type, 2014

4.6 Market for Yeast Ingredients: Developed vs Emerging Markets

4.7 Yeast Extract Accounted for the Largest Share in the Market in 2014

4.8 Market for Yeast Ingredients Life Cycle Analysis, By Region

5 Market Overview

5.1 Introduction

5.2 Market Segmentation

5.2.1 Market for Yeast Ingredients, By Type

5.2.2 Market for Yeast Ingredients, By Application

5.2.3 Market of Yeast Ingredients, By Source

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increased Demand for Natural, Healthier and Clean-Labeled Products: A Key Consumer Trend

5.3.1.2 Rising Consumption of Convenience Food Products

5.3.1.3 Multi-Functionality of Yeast Ingredients, A Key Feature

5.3.1.4 Research & Development Driving Innovation

5.3.2 Restraints

5.3.2.1 Competition for Basic Raw Materials

5.3.3 Opportunities

5.3.3.1 Growth Opportunities in the Untapped Markets

5.3.3.2 New Variants of Yeast Ingredients for Improved Functionality

5.3.4 Challenges

5.3.4.1 Infrastructural Challenges Faced By Yeast Ingredient Manufacturers

6 Industry Trends

6.1 Introduction

6.2 Supply Chain

6.3 Industry Insights

6.4 Porter’s Five Forces Analysis

6.4.1 Threat of New Entrants

6.4.2 Threat of Substitutes

6.4.3 Bargaining Power of Suppliers

6.4.4 Bargaining Power of Buyers

6.4.5 Intensity of Competitive Rivalry

6.5 Strategic Benchmarking

6.5.1 Strategic Expansions, Acquisitions, and New Product Developments

7 Market for Yeast Ingredients, By Type

7.1 Introduction

7.1.1 Yeast Extract

7.1.2 Autolyzed Yeast

7.1.3 Yeast Cell Wall

7.1.4 Yeast-Based Flavors

8 Market for Yeast Ingredients, By Application

8.1 Introduction

8.2 Food

8.3 Feed & Pet Food

8.4 Pharmaceuticals

8.5 Other Applications

9 Market for Yeast Ingredients, By Source

9.1 Introduction

9.2 Baker’s Yeast

9.3 Brewer’s Yeast

10 Market for Yeast Ingredients, By Region

10.1 Introduction

10.1.1 Political/Legal Factors

10.1.1.1 Government Regulations

10.1.2 Economic Factors

10.1.2.1 Fluctuating Raw Material Prices

10.1.2.2 Rising Middle-Class Population With High Disposable Income

10.1.3 Social Factor

10.1.3.1 Human Health Concerns

10.1.4 Technological Factors

10.1.4.1 R&D Initiatives

10.2 North America

10.2.1 U.S.

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 Italy

10.3.2 U.K.

10.3.3 Germany

10.3.4 Spain

10.3.5 France

10.3.6 Rest of Europe

10.4 Asia-Pacific

10.4.1 China

10.4.2 Japan

10.4.3 India

10.4.4 Australia

10.4.5 Rest of Asia-Pacific

10.5 Rest of the World (RoW)

10.5.1 Latin America

10.5.2 Africa

10.5.3 Middle East

11 Competitive Landscape

11.1 Overview

11.2 Competitive Situations & Trends

12 Company Profiles

12.1 Introduction

12.2 Associated British Foods Plc

12.3 Kerry Group Plc

12.4 Koninklijke DSM N.V.

12.5 Sensient Technologies Corporation

12.6 Angel Yeast Co., Ltd.

12.7 Lesaffre

12.8 Lallemand Inc.

12.9 Leiber GmbH

12.10 Synergy Flavors

12.11 Beldem S.A.

13 Appendix

13.1 Discussion Guide

13.2 Introducing RT: Real-Time Market Intelligence

13.3 Available Customizations

13.4 Related Reports

List of Tables (66 Tables)

Table 1 Yeast Ingredients Types & Their Descriptions

Table 2 Yeast Ingredients Applications & Their Descriptions

Table 3 Yeast Ingredients Market, By Source

Table 4 Yeast Ingredients Market Size, By Type, 2013–2020 (USD Million)

Table 5 Yeast Ingredients Market Size, By Type, 2013–2020 (KT)

Table 6 Yeast Extract Market Size, By Region, 2013–2020 (USD Million)

Table 7 Yeast Extract Market Size, By Region, 2013–2020 (KT)

Table 8 Autolyzed Yeast Market Size, By Region, 2013–2020 (USD Million)

Table 9 Autolyzed Yeast Market Size, By Region, 2013–2020 (KT)

Table 10 Yeast Cell Wall Market Size, By Region, 2013–2020 (USD Million)

Table 11 Yeast Cell Wall Market Size, By Region, 2013–2020 (KT)

Table 12 Yeast-Based Flavors Market Size, By Region, 2013–2020 (USD Million)

Table 13 Yeast-Based Flavors Market Size, By Region, 2013–2020 (KT)

Table 14 Market for Yeast Ingredients Size, By Application, 2013–2020 (USD Million)

Table 15 By Market Size, By Application, 2013–2020 (KT)

Table 16 By Market Size for Food, By Region, 2013–2020 (USD Million)

Table 17 By Market Size for Food, By Region, 2013–2020 (KT)

Table 18 By Market Size for Feed & Pet Food, By Region, 2013–2020 (USD Million)

Table 19 By Market Size for Feed & Pet Food, By Region, 2013–2020 (KT)

Table 20 By Market Size for Pharmaceuticals, By Region, 2013–2020 (USD Million)

Table 21 By Market Size for Pharmaceuticals, By Region, 2013–2020 (KT)

Table 22 By Market Size for Other Applications, By Region, 2013–2020 (USD Million)

Table 23 By Market Size for Other Applications, By Region, 2013–2020 (KT)

Table 24 By Market Size, By Source, 2013–2020 (USD Million)

Table 25 By Market Size, By Source, 2013–2020 (KT)

Table 26 Baker’s Yeast Market Size, By Region, 2013–2020 (USD Million)

Table 27 Baker’s Yeast Market Size, By Region, 2013–2020 (KT)

Table 28 Brewer’s Yeast Market Size, By Region, 2013–2020 (USD Million)

Table 29 Brewer’s Yeast Market Size, By Region, 2013–2020 (KT)

Table 30 Yeast Ingredients Market Size, By Region, 2013–2020 (USD Million)

Table 31 Yeast Ingredients Market Size, By Region, 2013–2020 (KT)

Table 32 North America: By Market Size, By Country, 2013–2020 (USD Million)

Table 33 North America: By Market Size, By Country, 2013–2020 (KT)

Table 34 North America: By Market Size, By Application, 2013–2020 (USD Million)

Table 35 North America: By Market Size, By Application, 2013–2020 (KT)

Table 36 North America: By Market Size, By Source, 2013–2020 (USD Million)

Table 37 North America: By Market Size, By Source, 2013–2020 (KT)

Table 38 North America: By Market Size, By Type, 2013–2020 (USD Million)

Table 39 North America: By Market Size, By Type, 2013–2020 (KT)

Table 40 Europe: By Market Size, By Country, 2013–2020 (USD Million)

Table 41 Europe: By Market Size, By Country, 2013–2020 (KT)

Table 42 Europe: By Market Size, By Application, 2013–2020 (USD Million)

Table 43 Europe: By Market Size, By Application, 2013–2020 (KT)

Table 44 Europe: By Market Size, By Source, 2013–2020 (USD Million)

Table 45 Europe: By Market Size, By Source, 2013–2020 (KT)

Table 46 Europe: By Market Size, By Type, 2013–2020 (USD Million)

Table 47 Europe: By Market Size, By Type, 2013–2020 (KT)

Table 48 Asia-Pacific: By Market Size, By Country, 2013–2020 (USD Million)

Table 49 Asia-Pacific: By Market Size, By Country, 2013–2020 (KT)

Table 50 Asia-Pacific: By Market Size, By Application, 2013–2020 (USD Million)

Table 51 Asia-Pacific: By Market Size, By Application, 2013–2020 (KT)

Table 52 Asia-Pacific: By Market Size, By Source, 2013–2020 (USD Million)

Table 53 Asia-Pacific: By Market Size, By Source, 2013–2020 (KT)

Table 54 Asia-Pacific: By Market Size, By Type, 2013–2020 (USD Million)

Table 55 Asia-Pacific: By Market Size, By Type, 2013–2020 (KT)

Table 56 RoW: By Market Size, By Country, 2013–2020 (USD Million)

Table 57 RoW: By Market Size, By Country, 2013–2020 (KT)

Table 58 RoW: By Market Size, By Application, 2013–2020 (USD Million)

Table 59 RoW: By Market Size, By Application, 2013–2020 (KT)

Table 60 RoW: By Market Size, By Source, 2013–2020 (USD Million)

Table 61 RoW: By Market Size, By Source, 2013–2020 (KT)

Table 62 RoW: Yeast Ingredients Market Size, By Type, 2013–2020 (USD Million)

Table 63 RoW: Yeast Ingredients Market Size, By Type, 2013–2020 (KT)

Table 64 New Product Development, 2014–2015

Table 65 Investments & Expansions, 2013–2015

Table 66 Acquisitions, 2011

List of Figures (57 Figures)

Figure 1 Yeast Ingredients Market, By Type

Figure 2 Yeast Ingredients Market, By Application

Figure 3 Yeast Ingredients Market, By Source

Figure 4 Yeast Ingredients Market: Research Design

Figure 5 Bakery Segment Accounted for ~31% in the Food Sector in 2013

Figure 6 Impact of Key Factors Influencing the Parent Industry

Figure 7 Global Population is Projected to Reach ~9.5 Billion By 2050

Figure 8 Market Size Estimation Methodology: Bottom-Up Approach

Figure 9 Market Size Estimation Methodology: Top-Down Approach

Figure 10 Data Triangulation Methodology

Figure 11 Limitations of the Research Study

Figure 12 Yeast Ingredients Market Snapshot (2015 vs 2020): Market for Yeast Extract is Projected to Grow at the Highest Cagr

Figure 13 Yeast Ingredients Market for Food Will Cover the Major Share By 2020

Figure 14 Asia-Pacific is the Fastest-Growing Region for the Yeast Ingredients Market in 2014

Figure 15 Key Market Players Adopted New Product Launches as the Key Strategy From 2011 to 2015

Figure 16 Emerging Economies Offer Attractive Opportunities in the Market

Figure 17 Meat Products to Grow at the Highest Rate

Figure 18 Yeast Extract Captured the Largest Share in the Emerging Asia-Pacific Market in 2014

Figure 19 India is Projected to Be the Fastest-Growing Country-Level Market for Yeast Ingredients

Figure 20 Europe Dominated the Market in 2014

Figure 21 Emerging Markets to Grow Faster Than the Developed Markets

Figure 22 Yeast Extract Segment Was the Largest Market in 2014, Globally

Figure 23 The Yeast Ingredients Market in Asia-Pacific is Experiencing High Growth

Figure 24 Yeast Ingredients Market Segmentation

Figure 25 Rising Consumption of Healthier and Convenience Food Products is the Key Driver of the Market

Figure 26 Buyers of Yeast Ingredients Pull Demand in the Supply Chain

Figure 27 Development Fo New Products is the Most Prevailing Strategic Trend in the Yeast Ingredients Industry

Figure 28 Porter’s Five Forces Analysis

Figure 29 Strategic Expansion Initiatives of Key Companies

Figure 30 Yeast Ingredients Market Size, By Type, 2015 vs 2020

Figure 31 Yeast Ingredients Market Size, By Application, 2015 vs 2020

Figure 32 Asian-Pacific Market for Yeast Ingredients is Projected to Grow at the Highest Pace From 2015 to 2020

Figure 33 Geographic Snapshot (2014): The Markets in Asia-Pacific are Emerging as New Hot Spots

Figure 34 The North American Market for Yeast Ingredients Snapshot: The U.S. is Projected to Be the Global Leader Between 2015 & 2020

Figure 35 The U.S. to Become the Largest Market for Yeast Ingredients By 2020

Figure 36 Rising Demand for Healthy Food Products to Support the Growth of Yeast Ingredients Market in Europe

Figure 37 Asia-Pacific Market for Yeast Ingredients Snapshot: India is the Most Lucrative Market

Figure 38 Increasing Consumption of Processed Food Products is Driving the Market for Yeast Ingredients in RoW

Figure 39 Key Companies Preferred to Launch New Products Over the Last Five Years

Figure 40 New Product Launches Fueled Growth & Innovation

Figure 41 New Product Launches: The Key Strategy, 2010–2015

Figure 42 Annual Developments in the Market, 2010–2015

Figure 43 Geographical Revenue Mix of Top Players

Figure 44 ABF: Company Snapshot

Figure 45 ABF: SWOT Analysis

Figure 46 Kerry: Company Snapshot

Figure 47 Kerry: SWOT Analysis

Figure 48 DSM: Company Snapshot

Figure 49 Sensient: Company Snapshot

Figure 50 Sensient: SWOT Analysis

Figure 51 Angel Yeast: Company Snapshot

Figure 52 Angel Yeast: SWOT Analysis

Figure 53 Lesaffre: Company Snapshot

Figure 54 Lallemand: Company Snapshot

Figure 55 Leiber GmbH: Company Snapshot

Figure 56 Synergy: Company Snapshot

Figure 57 Beldem: Company Snapshot

Growth opportunities and latent adjacency in Yeast Ingredients Market