Alcohol Ingredients Market by Ingredient Type (Yeast, Enzymes, Colorants, flavors & salts, and Others), Beverage Type (Beer, Spirits, Wine, Whisky, Brandy, and Others), & by Region - Global Trends & Forecasts to 2020

This report analyzes the alcohol ingredients market, in terms of region, ingredient type, and beverage type.

The alcohol ingredients market has grown exponentially in the last few years and this trend is projected to continue following the same trend until 2020. The primary factor driving the global success of alcohol ingredients is the increased consumption of alcoholic beverages across the globe. There is an increase in global consumption of alcohol, especially in the Asia-Pacific region. This increasing trend reflects the economic development, increase in the purchasing power of the consumers and increase in the marketing and branding of alcoholic beverages.

The alcohol ingredients market studied in this report is segmented on the basis of ingredient type into yeast; enzymes; colors, flavors & salts; and others. On the basis of beverage type, it is segmented into beer, spirits, wine, whisky, and brandy. The market is also segmented on the basis of regions into North America, Europe, Asia-Pacific, Latin America, and the Rest of the World (RoW); and has been further segmented on the basis of their key countries.

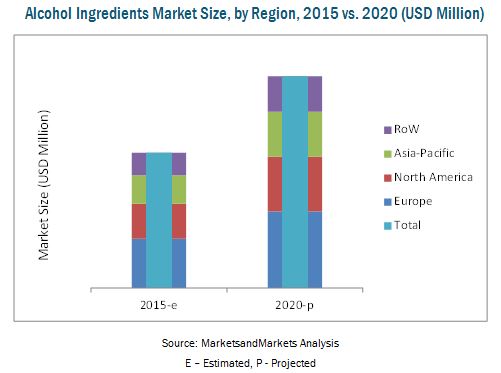

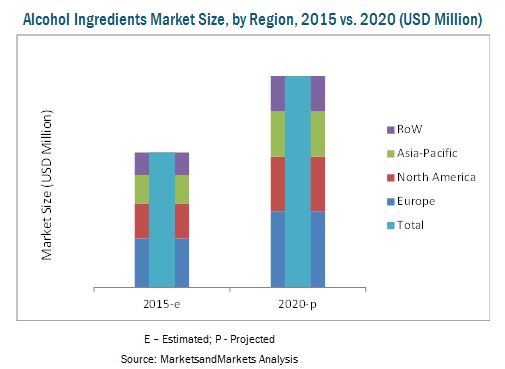

The alcohol ingredients market is projected to reach a value of USD 1.8 billion by 2020. It is projected to grow as a result of innovative products being launched in different beverage applications and due to companies expanding their presence in several regions. The European region dominated the alcohol ingredients market in 2014.

This report provides both, qualitative and quantitative analyses of the market for alcohol ingredients. It includes market dynamics, trends, competitive strategies preferred by key market players, the driving factors that boost the growth of the alcohol ingredients market, and restraints of the market. The report also studies the opportunities in the market for new entrants.

Leading players such as Sensient Technologies Corporation (U.S.), Ashland Inc. (U.S.), Cargill, Incorporated (U.S.), Archer Daniels Midland Company (U.S.), and Chr. Hansen Holdings A/S (Denmark) have been profiled in the report.

Scope of the Report

Alcohol Ingredients Market

On the basis of Ingredient Type, the market is segmented as follows:

- Yeast

- Enzymes

- Colors, flavors & salts

- Others (spices, palm, and supplements)

On the basis of Beverage Type , the market is segmented as follows:

- Beer

-

Spirits

- Vodka

- Rum

- Scotch

- Gin

- Tequila

- Other spirits

- Wine

- Whisky

- Brandy

- Others (RTDs, premixes, cider, and perry)

On the basis of Region, the market is sub-segmented as follows:

- North America

- Europe

- Asia-Pacific

- RoW

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (Up to five)

The primary factor driving the alcohol ingredients market is the rise in the global consumption of alcoholic beverages which is in direct relation to the traditions and cultures followed by the population all around the globe. Alcohol ingredients are prepared by extraction of yeast, enzymes, colors, and flavors from natural sources such as plants, vegetables, and fruits. Alcohol ingredients are used in a wide range of beverage applications, especially in the production of alcoholic beverages.

The worldwide demand for alcohol ingredients is on the rise, particularly in the beverage industry. The demand is governed by the performance quality, their incorporation in beverage applications, and regulations imposed by international and local governments in the production of alcohol ingredients and alcoholic beverages.

The rise in the global consumption of alcohol, especially in developing regions such as Asia-Pacific drives the market for alcohol ingredients. This has resulted in increasing focus of key alcohol manufacturers to provide better functional ingredients by development in the production processes for alcohol ingredients and favorable functionalities of alcohol ingredients in various beverage applications. This will influence the alcohol ingredients market size.

The alcohol ingredients market is segmented on the basis of beverage type into beer, spirits, wine, whisky, brandy, and others which include RTDs, premixes, cider, and perry.

The market is segmented on the basis of ingredient type into yeast; enzymes; colors, flavors & salts; and others which include spices, palm, and supplements. On the basis of type, the spirits segment is further classified into vodka, rum, scotch, gin, tequila, and other spirits. The market is also segmented on the basis of region into North America, Europe, Asia-Pacific, and the Rest of the World (RoW); and has been further segmented on the basis of their key countries.

The market for alcohol ingredients is projected to reach USD 1.8 Billion by 2020 at a CAGR of 9.4% from 2015 to 2020 in terms of value. with the increasing use of alcohol ingredients in different beverage applications and rising opportunities in emerging markets such as Japan, India, China, and Latin American countries.

The alcohol ingredients market is fragmented and competitive, with a large number of players operating at regional and local levels. The key players in the market adopted new product development, acquisitions, and expansions as their preferred strategies. The key players such as Cargill, Incorporated (U.S.), Sensient Technologies Corporation (U.S.), Archer Daniels Midland Company (U.S.), Ashland Inc. (U.S.), and Chr. Hansen A/S (Denmark) have been profiled in the report.

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency & Pricing

1.5 Package Size

1.6 Limitations of the Study

1.7 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries: By Company Type, Designation and Region

2.2 Factor Analysis

2.2.1 Introduction

2.2.2 Overview of the Parent Industry

2.2.3 Demand-Side Analysis

2.2.3.1 Beverage Industry

2.2.3.2 Increase in Global Population

2.2.4 Supply-Side Analysis

2.2.4.1 Regulatory Compliances for Alcoholic Beverage Manufacturers in Different Countries

2.2.4.2 Barley Production

2.2.4.3 Wheat Production

2.3 Market Size Estimation

2.4 Market Breakdown & Data Triangulation

2.5 Market Share Estimation

2.6 Research Assumptions & Limitations

2.6.1 Assumptions

2.6.2 Limitations

3 Executive Summary (Page No. - 35)

4 Premium Insights (Page No. - 38)

4.1 Attractive Opportunities in the Alcohol Ingredients Market

4.2 Beer is the Most Preferred Beverage Type in the Alcohol Ingredients Market

4.3 Alcohol Ingredients Market in the European Region

4.4 U.S. to Dominate the Overall Alcohol Ingredients Market Through 2020

4.5 Alcohol Ingredients Market, Country-Level Market Leaders

4.6 Spirits Segment Accounted for Second Largest Share in the Alcohol Ingredients Market, 2014

4.7 Alcohol Ingredients Market: Life Cycle Analysis, By Region

5 Market Overview (Page No. - 44)

5.1 Introduction

5.2 Evolution of Alcohol Ingredients

5.3 Market Segmentation

5.3.1 By Beverage Type

5.3.2 By Ingredient Type

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Increasing Consumption of Alcoholic Beverages

5.4.1.2 Increasing Global Trade in Alcohol

5.4.2 Restraints

5.4.2.1 High R&D Cost Creates Barrier for Development of Alcohol Ingredients Market

5.4.2.2 Rise in Cost of Raw Materials

5.4.3 Opportunities

5.4.3.1 Changing Food & Beverages Consumption Patterns

5.4.3.2 Emerging Markets Such as Asia-Pacific, Latin America, and Middle East & Africa

5.4.4 Challenges

5.4.4.1 Regulations and Legislations

5.4.4.2 Awareness About Harmful Effects of Alcohol Consumption

5.5 Regulatory Parameters for Alcohol Consumption

6 Industry Trends (Page No. - 53)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Supply Chain Analysis

6.4 Industry Insights

6.5 Porter’s Five Forces Analysis

6.5.1 Threat of New Entrants

6.5.2 Threat of Substitutes

6.5.3 Bargaining Power of Suppliers

6.5.4 Bargaining Power of Buyers

6.5.5 Intensity of Competitive Rivalry

6.6 Strategic Benchmarking

6.6.1 Key Strategies Adopted By Leading Companies in the Alcohol Ingredients Market

7 Alcohol Ingredients Market, By Ingredient Type (Page No. - 59)

7.1 Introduction

7.2 Yeast

7.3 Enzymes

7.4 Colorants, Flavors & Salts

7.5 Others

8 Alcohol Ingredients Market, By Bevrage Type (Page No. - 67)

8.1 Introduction

8.2 Beer

8.3 Spirits

8.3.1 Spirits-By Subtype

8.4 Wine

8.5 Whisky

8.6 Brandy

8.7 Others

9 Alcohol Ingredients Market, By Region (Page No. - 86)

9.1 Introduction

9.2 Pest Analysis

9.2.1 Political/Legal Factors

9.2.1.1 Government Regulations

9.2.2 Economic Factors

9.2.2.1 Increase in Consumption of Alcoholic Beverages

9.2.2.2 Rising Disposable Incomes in Emerging Economies

9.2.3 Social Factors

9.2.3.1 Increasing Awareness About the Alcohol Related Health Problems

9.2.4 Technological Factors

9.2.4.1 Key Players Indulged Into High Investments to Provide Innovative Products

9.3 North America

9.3.1 U.S.

9.3.2 Canada

9.3.3 Mexico

9.4 Europe

9.4.1 Germany

9.4.2 Italy

9.4.3 U.K.

9.4.4 Spain

9.4.5 France

9.4.6 Rest of Europe

9.5 Asia-Pacific

9.5.1 China

9.5.2 Japan

9.5.3 India

9.5.4 Australia

9.5.5 Rest of Asia-Pacific

9.6 RoW

9.6.1 Brazil

9.6.2 Argentina

9.6.3 Others

10 Competitive Landscape (Page No. - 123)

10.1 Overview

10.2 Competitive Situations & Trends

10.2.1 Expansions & Investments

10.2.2 New Product Development

10.2.3 Mergers & Acquisitions

10.2.4 Agreements, Partnerships & Joint Ventures

11 Company Profiles (Page No. - 129)

(Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

11.1 Introduction

11.2 Archer Daniels Midland Company

11.3 Cargill, Incorporated

11.4 Chr. Hansen Holdings A/S

11.5 Koninklijke Dsm N.V

11.6 Sensient Technologies Corporation

11.7 Ashland Inc.

11.8 D.D. Williamson & Co., Inc.

11.9 Döhler Group

11.10 Kerry Group PLC

11.11 Treatt PLC

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted

Companies.

12 Appendix (Page No. - 154)

12.1 Discussion Guide

12.2 Introducing RT: Real-Time Market Intelligence

12.3 Available Customizations

12.4 Related Reports

List of Tables (95 Tables)

Table 1 Regulatory Bodies

Table 2 Alcohol Ingredient Market, By Ingredient Type

Table 3 Industry Insights: Leading Trends Among Key Players

Table 4 Alcohol Ingredients Market Size, By Ingredient Type, 2013–2020 (USD Million)

Table 5 Alcohol Ingredients Market Size, By Ingredient Type, 2013–2020 (KT)

Table 6 Yeast: Alcohol Ingredients Market Size, By Region, 2013–2020 (USD Million)

Table 7 Yeast: Alcohol Ingredients Market Size, By Region, 2013–2020 (KT)

Table 8 Enzymes: Alcohol Ingredients Market Size, By Region, 2013–2020 (USD Million)

Table 9 Enzymes: Alcohol Ingredients Market Size, By Region, 2013–2020 (KT)

Table 10 Colorants, Flavors & Salts: Alcohol Ingredients Market Size, By Region, 2013–2020 (USD Million)

Table 11 Colorants, Flavors, and Salts: Alcohol Ingredients Market Size, By Region, 2013–2020 (KT)

Table 12 Others: Alcohol Ingredients Market Size, By Region, 2013–2020 (USD Million)

Table 13 Others: Alcohol Ingredients Market Size, By Region, 2013–2020 (KT)

Table 14 Alcohol Ingredients Market Size, By Beverage Type, 2013–2020 (USD Million)

Table 15 Beer: Alcohol Ingredients Market Size, By Region, 2013–2020 (USD Million)

Table 16 Beer: Alcohol Ingredients Market Size, By Country, 2013–2020 (USD Million)

Table 17 North America: Beer in Alcohol Ingredients Market Size, By Country, 2013–2020 (USD Million)

Table 18 Asia-Pacific: Beer in Alcohol Ingredients Market Size, By Country, 2013–2020 (USD Million)

Table 19 RoW: Beer in Alcohol Ingredients Market Size, By Country, 2013–2020 (USD Million)

Table 20 Spirits: Alcohol Ingredients Market Size, By Region, 2013–2020 (USD Million)

Table 21 Spirits: Alcohol Ingredients Market Size, By Sub-Type, 2013–2020 (USD Million)

Table 22 Spirits: Alcohol Ingredients Market Size, By Country, 2013–2020 (USD Million)

Table 23 North America: Spirits in Alcohol Ingredients Market Size, By Country, 2013–2020 (USD Million)

Table 24 Asia-Pacific: Spirits in Alcohol Ingredients Market Size, By Country, 2013–2020 (USD Million)

Table 25 RoW: Spirits in Alcohol Ingredients Market Size, By Country, 2013–2020 (USD Million)

Table 26 Wine: Alcohol Ingredients Market Size, By Region, 2013–2020 (USD Million)

Table 27 Europe: Wine in Alcohol Ingredients Market Size, By Country, 2013–2020 (USD Million)

Table 28 North America: Wine in Alcohol Ingredients Market Size, By Country, 2013–2020 (USD Million)

Table 29 Asia-Pacific: Wine in Alcohol Ingredients Market Size, By Country, 2013–2020 (USD Million)

Table 30 RoW: Wine in Alcohol Ingredients Market Size, By Country, 2013–2020 (USD Million)

Table 31 Whisky: Alcohol Ingredients Market Size, By Region, 2013–2020 (USD Million)

Table 32 Europe: Whisky in Alcohol Ingredients Market Size, By Country, 2013–2020 (USD Million)

Table 33 North America: Whisky in Alcohol Ingredients Market Size, By Country, 2013–2020 (USD Million)

Table 34 Asia-Pacific: Whisky in Alcohol Ingredients Market Size, By Country, 2013–2020 (USD Million)

Table 35 RoW: Whisky in Alcohol Ingredients Market Size, By Country, 2013–2020 (USD Million)

Table 36 Brandy: Alcohol Ingredients Market Size, By Region, 2013–2020 (USD Million)

Table 37 Europe: Brandy in Alcohol Ingredients Market Size, By Country, 2013–2020 (USD Million)

Table 38 North America: Brandy in Alcohol Ingredients Market Size, By Country, 2013–2020 (USD Million)

Table 39 Asia-Pacific: Brandy in Alcohol Ingredients Market Size, By Country, 2013–2020 (USD Million)

Table 40 RoW: Brandy in Alcohol Ingredients Market Size, By Country, 2013–2020 (USD Million)

Table 41 Others: Alcohol Ingredients Market Size, By Region, 2013–2020 (USD Million)

Table 42 Europe:Others in Alcohol Ingredients Market Size, By Country, 2013–2020 (USD Million)

Table 43 North America: Others in Alcohol Ingredients Market Size, By Country, 2013–2020 (USD Million)

Table 44 Asia-Pacific: Others in Alcohol Ingredients Market Size, By Country, 2013–2020 (USD Million)

Table 45 RoW: Others Alcohol Ingredients Market Size, By Country, 2013–2020 (USD Million)

Table 46 Alcohol Ingredients Market Size, By Region, 2013–2020 (USD Million)

Table 47 Alcohol Ingredients Market Size, By Region, 2013–2020 (KT)

Table 48 Beer: Alcohol Ingredients Market Size, By Region, 2013–2020 (USD Million)

Table 49 Spirits: Alcohol Ingredients Market Size, By Region, 2013–2020 (USD Million)

Table 50 Wine: Alcohol Ingredients Market Size, By Region, 2013–2020 (USD Million)

Table 51 Whisky: Alcohol Ingredients Market Size, By Region, 2013–2020 (USD Million)

Table 52 Brandy: Alcohol Ingredients Market Size, By Region, 2013–2020 (USD Million)

Table 53 Others: Alcohol Ingredients Market Size, By Region, 2013–2020 (USD Million)

Table 54 Yeast: Alcohol Ingredients Market Size, By Region, 2013–2020 (USD Million)

Table 55 Yeast: Alcohol Ingredients Market Size, By Region, 2013–2020 (KT)

Table 56 Enzymes: Alcohol Ingredients Market Size, By Region, 2013–2020 (USD Million)

Table 57 Colorants, Flavors & Salts: Alcohol Ingredients Market Size, By Region, 2013–2020 (USD Million)

Table 58 Others: Alcohol Ingredients Market Size, By Region, 2013–2020 (USD Million)

Table 59 North America: Alcohol Ingredients Market Size, By Country, 2013–2020 (USD Million)

Table 60 North America: Alcohol Ingredients Market Size, By Beverage Type, 2013–2020 (USD Million)

Table 61 U.S.: Alcohol Ingredients Market Size, By Beverage Type, 2013–2020 (USD Million)

Table 62 Canada: Alcohol Ingredients Market Size, By Beverage Type, 2013–2020 (USD Million)

Table 63 Mexico: Alcohol Ingredients Market Size, By Beverage Type, 2013–2020 (USD Million)

Table 64 North America: Alcohol Ingredients Market Size, By Ingredient Type, 2013–2020 (USD Million)

Table 65 North America: Alcohol Ingredients Market Size, By Ingredient Type, 2013–2020 (KT)

Table 66 Europe: Alcohol Ingredients Market Size, By Country, 2013–2020 (USD Million)

Table 67 Europe: Alcohol Ingredients Market Size, By Beverage Type, 2013–2020 (USD Million)

Table 68 Germany: Alcohol Ingredients Market Size, By Beverage Type, 2013–2020 (USD Million)

Table 69 Italy: Alcohol Ingredients Market Size, By Beverage Type, 2013–2020 (USD Million)

Table 70 U.K: Alcohol Ingredients Market Size, By Beverage Type, 2013–2020 (USD Million)

Table 71 Spain: Alcohol Ingredients Market Size, By Beverage Type, 2013–2020 (USD Million)

Table 72 France: Alcohol Ingredients Market Size, By Beverage Type, 2013–2020 (USD Million)

Table 73 Rest of Europe: Alcohol Ingredients Market Size, By Beverage Type, 2013–2020 (USD Million)

Table 74 Europe: Alcohol Ingredients Market Size, By Ingredient Type, 2013–2020 (USD Million)

Table 75 Europe: Alcohol Ingredients Market Size, By Ingredient Type, 2013–2020 (KT)

Table 76 Asia-Pacific: Alcohol Ingredients Market Size, By Country, 2013–2020 (USD Million)

Table 77 Asia-Pacific: Alcohol Ingredients Market Size, By Beverage Type, 2013–2020 (USD Million)

Table 78 China: Alcohol Ingredients Market Size, By Beverage Type, 2013–2020 (USD Million)

Table 79 Japan: Alcohol Ingredients Market Size, By Beverage Type, 2013–2020 (USD Million)

Table 80 India: Alcohol Ingredients Market Size, By Beverage Type, 2013–2020 (USD Million)

Table 81 Australia: Alcohol Ingredients Market Size, By Beverage Type, 2013–2020 (USD Million)

Table 82 Rest of Asia-Pacific: Alcohol Ingredients Market Size, By Beverage Type, 2013–2020 (USD Million)

Table 83 Asia-Pacific: Alcohol Ingredients Market Size, By Ingredient Type, 2013–2020 (USD Million)

Table 84 Asia-Pacific: Alcohol Ingredients Market Size, By Ingredient Type, 2013–2020 (KT)

Table 85 RoW: Alcohol Ingredients Market Size, By Country, 2013–2020 (USD Million)

Table 86 RoW: Alcohol Ingredients Market Size, By Beverage Type, 2013–2020 (USD Million)

Table 87 Brazil: Alcohol Ingredients Market Size, By Beverage Type, 2013–2020 (USD Million)

Table 88 Argentina: Alcohol Ingredients Market Size, By Beverage Type, 2013–2020 (USD Million)

Table 89 Others: Alcohol Ingredients Market Size, By Beverage Type, 2013–2020 (USD Million)

Table 90 RoW: Alcohol Ingredients Market Size, By Ingredient Type, 2013–2020 (USD Million)

Table 91 RoW: Alcohol Ingredients Market Size, By Ingredient Type, 2013–2020 (KT)

Table 92 Expansions & Investments, 2011-2015

Table 93 New Product Development, 2011-2015

Table 94 Mergers & Acquisitions, 2013-2015

Table 95 Agreements, Partnerships & Joint Ventures, 2011-2015

List of Figures (56 Figures)

Figure 1 Alcohol Ingredients Market Segmentation

Figure 2 Alcohol Ingredients Market: Research Design

Figure 3 Impact of Key Factors Influencing the Parent Industry

Figure 4 Global Population is Projected to Reach ~9.5 Billion By 2050

Figure 5 Middle-Class Population in Asia-Pacific is Projected to Grow & Account for the Largest Share in the Global Market By 2030

Figure 6 Unfavorable Climatic Conditions Affect the Supply of Barley

Figure 7 Aggregate Wheat Production, 2009-2013 (Million Tons)

Figure 8 Market Size Estimation Methodology: Bottom-Up Approach

Figure 9 Market Size Estimation Methodology: Top-Down Approach

Figure 10 Data Triangulation Methodology

Figure 11 Assumptions of the Research Study

Figure 12 Limitations of the Research Study

Figure 13 Alcohol Ingredients Market Snapshot (2015 vs 2020): Yeast is Estimated to Maintain Highest Market Share Till 2020

Figure 14 Alcohol Ingredients Market Share Regional Overview, 2014

Figure 15 Emerging Economies Offer Attractive Opportunities in the Alcohol Ingredients Market

Figure 16 Wine is Expected to Grow at the Highest Rate as Compared to Other Types of Alcoholic Beverages

Figure 17 Yeast Dominated the European Market, Followed By Enzymes, in 2014

Figure 18 India is Projected to Be the Fastest-Growing Country-Level Market for Alcohol Ingredients

Figure 19 U.S to Dominate the Alcohol Ingredients Market During the Forecast Period

Figure 20 Spirits Segment to Dominate the Global Alcohol Ingredients Market After Beer, 2015-2020

Figure 21 Alcohol Ingredients Market in Asia-Pacific Experiencing the Highest Growth

Figure 22 Development of Alcohol Ingredients

Figure 23 Alcohol Ingredients Market Segmentation

Figure 24 Alcohol Ingredients Market Segmentation, By Beverage Type

Figure 25 Alcohol Ingredients Market Segmentation, By Ingredient Type

Figure 26 Increasing Deamand for Driving the Growth of Alcohol Ingredients Market

Figure 27 Product Development & Production of Alcohol Ingredients Contribute the Most to the Overall Value Chain

Figure 28 Manufacturers Play A Vital Role in the Supply Chain for Alcohol Ingredients

Figure 29 Porter’s Five Forces Analysis Alcohol: Ingredients Market

Figure 30 Global Strategic Expansion of Key Companies

Figure 31 Yeast Segment Dominated the Alcohol Ingredients Market in 2014

Figure 32 Europe Dominated the Yeast Segment of Alcohol Ingredients Market in 2014

Figure 33 Beer Segment Dominated the Alcohol Ingredients Market in 2014

Figure 34 Europe Dominated the Beer Segment of Alcohol Ingredients Market in 2014

Figure 35 Regional Snapshot (2014): Markets in Asia-Pacific are Emerging as New Hot Spots

Figure 36 North American Alcohol Ingredients Market Snapshot: U.S. is Projected to Be the Global Leader Between 2015 & 2020

Figure 37 European Alcohol Ingredients Market Snapshot: Germany Projected to Be the Global Leader Between 2015 & 2020

Figure 38 Asia-Pacific Alcohol Ingredients Market Snapshot: China Projected to Be the Global Leader Between 2015 & 2020

Figure 39 Key Companies Preferred New Product Developments, Acquisition & Expansion Strategies From 2011 to 2015

Figure 40 Alcohol Ingredients Market Share, By Key Player, 2014

Figure 41 New Product Developments: the Key Strategy, 2011–2015

Figure 42 Annual Developments in the Alcohol Ingredients Market, 2011-2015

Figure 43 Geographical Revenue Mix of Top Five Market Players

Figure 44 Archer Daniels Midland Company: Company Snapshot

Figure 45 Archer Daniel Midland Company: SWOT Analysis

Figure 46 Cargill Incorporated: Company Snapshot

Figure 47 Cargill, Incorporated: SWOT Analysis

Figure 48 Chr. Hansen Holdings A/S: Company Snapshot

Figure 49 Chr. Hansen Holdings A/S: SWOT Analysis

Figure 50 Koninklijke Dsm N.V: Company Snapshot

Figure 51 Koninklijke Dsm N.V: SWOT Analysis

Figure 52 Sensient Technologies Corporation: Company Snapshot

Figure 53 Sensient Technologies Corporation: SWOT Analysis

Figure 54 Ashland Inc.: Company Snapshot

Figure 55 Kerry Group PLC : Company Snapshot

Figure 56 Treatt PLC.: Company Snapshot

Growth opportunities and latent adjacency in Alcohol Ingredients Market