X-ray Inspection System Market Size, Share & Industry Trends Analysis Report by Technology (Film Based Imaging, Digital Imaging, Computed Tomography, Computed Radiography, Direct Radiography), Dimension (2D, 3D), Vertical (Government Infrastructure, Automotive) & Region-Global Forecast to 2028

Updated on : Oct 22, 2024

X-ray Inspection System Market Size & Share

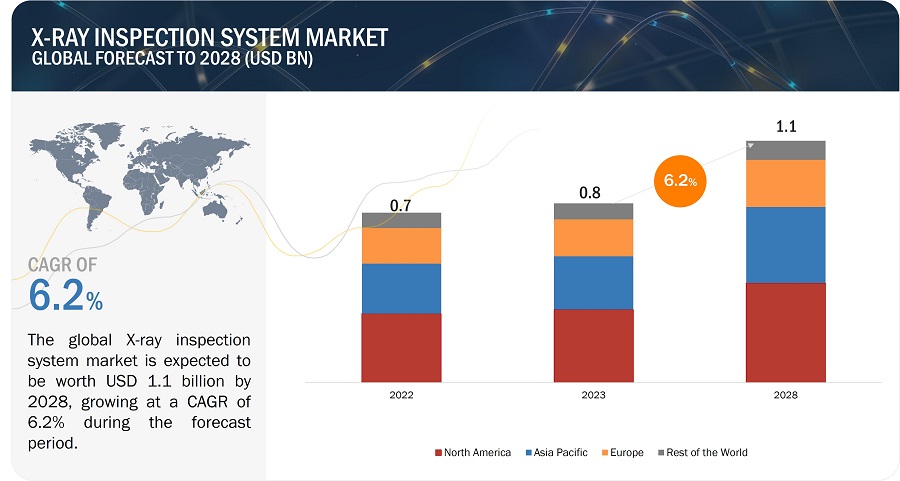

The global X-ray inspection system market size was valued at USD 0.8 billion in 2023 and is estimated to reach USD 1.1 billion by 2028, growing at a CAGR of 6.2% during the forecast period from 2023 to 2028

Growing industrialization and technological advancements has driven the demand for X-ray inspection system. Also, the heightened focus on the safety and quality in various industries such as food and pharmaceuticals, and manufacturing, and incrasing investments by the manufacturers are fueling the market growth.

X-ray Inspection Systems Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

X-ray Inspection System Market Trends

Driver: Increasing awareness among the consumers for quality of the products driving the market

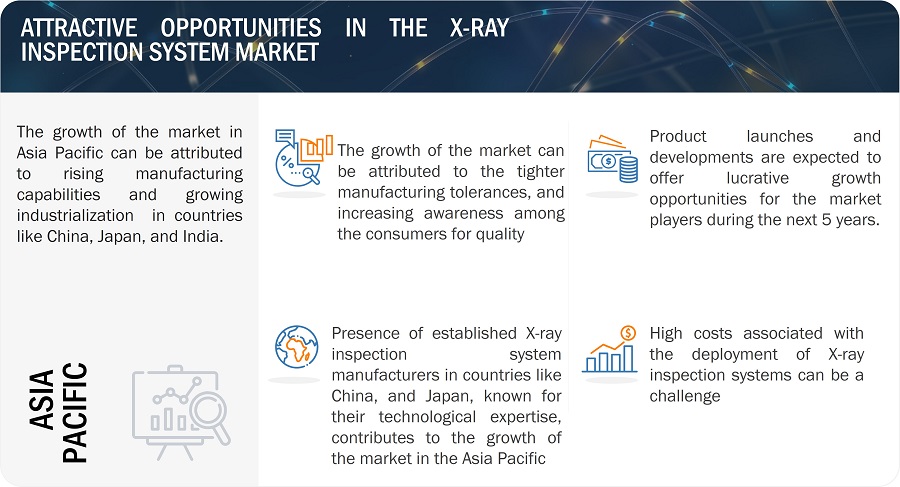

Increasingly, end users are showing a heightened awareness of the importance of product quality and safety. This has led manufacturers to place a higher priority on delivering top-notch products. Moreover, firms specializing in testing, inspection, and certification play a crucial role in ensuring that products meet the necessary quality and standards.

These companies are also dedicated to maintaining their reputation by consistently delivering high-quality products and services to their clientele. As a result of this increased consumer awareness, safety and quality standards have been elevated across various industries..

Restraint: High Costs associated with the X-ray inspection system

While X-ray inspection systems offer a guaranteed return on investment by ensuring the protection of intricate machinery, the initial deployment costs associated with these systems present financial obstacles for certain industry players.

Many end-users view these expenses as burdens on their company's investments, leading them to prefer third-party inspection services. To illustrate, the average selling price (ASP) of an X-ray inspection system spans from thousands of USD to millions of USD, encompassing not only the equipment cost but also the ongoing research and development expenses required to continually advance the technology. Consequently, the substantial costs related to procuring, installing, and maintaining X-ray inspection systems serve as a constraining factor for the market's growth.

Opportunity: Rising level of automation in the field of manufacturing creates opportunity for X-ray inspection system manufacturers

As manufacturers increasingly adopt automation to improve efficiency and precision in their production processes, there is a significant rise in the demand for advanced quality control and inspection solutions like X-ray systems. These systems play a vital role in guaranteeing product quality, safety, and compliance with industry standards.

Automation in manufacturing often involves high-speed production lines and intricate assembly processes, making it challenging for human inspectors to accurately identify defects or irregularities. X-ray inspection systems have become essential tools for defect detection, including cracks, voids, foreign contaminants, or component misalignment, thanks to their capacity to provide detailed and non-destructive product imaging. Furthermore, these systems can operate continuously, 24/7, ensuring consistent and reliable quality control, even in high-volume production settings.

Challenge: Complexity in integration of X-ray inspection system with existing production lines

Incorporating X-ray inspection systems into pre-existing production lines can present a complex and demanding undertaking. Many industrial facilities already have well-established manufacturing processes and equipment in place, and the retrofitting of X-ray systems has the potential to disrupt production workflows.

Challenges related to compatibility, encompassing both physical space constraints and the need for operational synchronization, can surface when attempting to seamlessly integrate X-ray inspection technology. Moreover, the process of customizing X-ray inspection systems to meet the specific requirements of a production line often necessitates time and resources, potentially incurring additional expenses.

Industrial X-Ray Inspection Systems Market Growth

The industrial X-ray inspection systems market is witnessing robust growth, driven by the increasing demand for high-quality, non-destructive testing (NDT) solutions across industries such as aerospace, automotive, electronics, and manufacturing. As companies focus on ensuring product safety, quality, and compliance with stringent regulations, the need for advanced inspection technologies has surged. X-ray inspection systems provide detailed internal images, enabling accurate detection of defects and material inconsistencies without compromising the integrity of the product. Additionally, innovations such as digital radiography, real-time imaging, and AI-driven defect detection are enhancing system efficiency and reliability, further propelling market expansion. With rising industrial automation and a growing emphasis on precision manufacturing, the market for industrial X-ray inspection systems is poised for continued growth in the coming years.

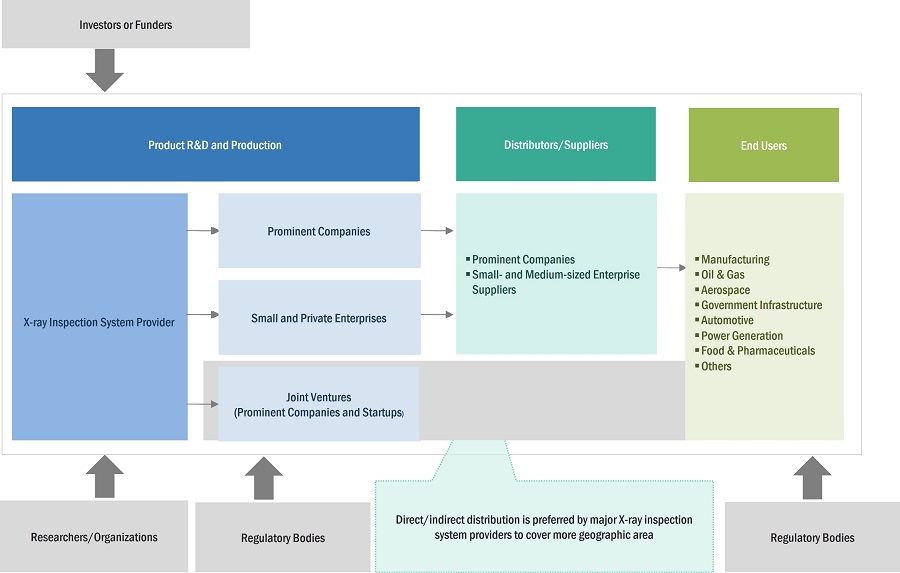

X-Ray Inspection System Market Ecosystem

The market is consolidated, with major companies such as Mettler Toledo, Nordson Corporation, Comet Group, Anritsu, Viscom AG and numerous small- and medium-sized enterprises. Almost all players offer various products in X-ray inspection systems. These systems are used for applications including manufacturing, oil & gas, aerospace, government infrastructure, automotive, power generation, food & pharmaceuticals, and others.

Based on technology, digital imaging segment is expected to dominate during the forecast period.

The market is primarily propelled by the seamless integration of digital imaging-based X-ray inspection systems into pre-existing production lines. This integration not only simplifies the process but also results in reduced expenses associated with film and chemicals. Furthermore, it enhances efficiency and offers superior defect detection capabilities, thereby preventing expensive recalls or the need for rework. These advantages, taken together, establish digital imaging-based X-ray inspection systems as the preferred option for industries in search of high-quality and efficient non-destructive testing and inspection solutions.

Based on vertical, the oil & gas segment is projected to have largest market share during the forecast period.

The increasing global energy requirements are compelling the oil and gas industry to expand and enhance their production processes. X-ray inspection systems play a pivotal role in guaranteeing the efficient and secure operation of essential equipment to meet the rising demand for energy. Additionally, the stringent emphasis on safety and regulatory compliance is further propelling the demand for X-ray inspection systems.

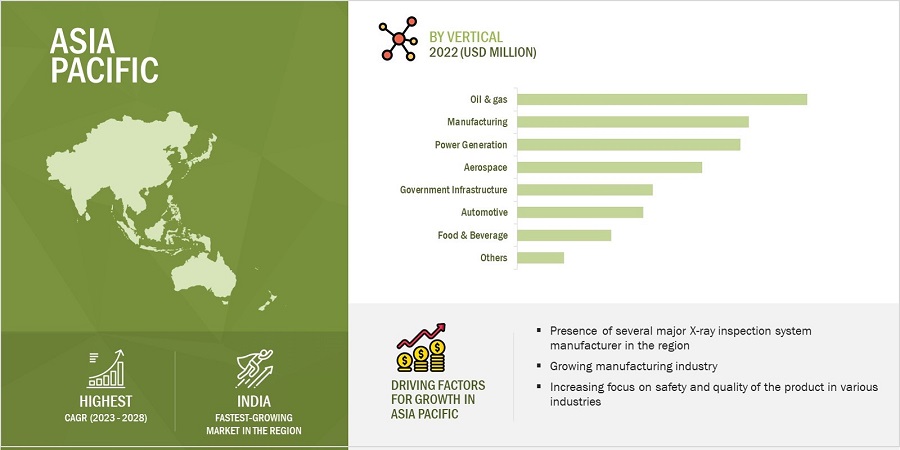

Based on region, Asia Pacific is projected to grow fastest for the X-ray inspection systems market.

In the projected period, the Asia Pacific region is anticipated to experience the most rapid growth. Countries such as China, India, Japan, and South Korea have undergone significant economic development in recent decades. This economic progress has resulted in heightened levels of industrialization, manufacturing, and trade, subsequently boosting the need for X-ray inspection systems across various industries. Additionally, the Asia-Pacific region serves as a prominent manufacturing center, encompassing a strong manufacturing sector that extends into electronics, automotive, aerospace, food and beverages, and various other industries.

X-ray Inspection System Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top X-ray Inspection System Companies - Key Market Players

The X-ray inspection system companies is dominated by a few globally established players such as

- Mettler Toledo (US),

- Nordson Corporation (US),

- Comet Group (Switzerland),

- Anritsu (Japan),

- Viscom AG (Germany),

- North Star Imaging Inc. (US),

- Nikon Corporation (Japan),

- Ishida Co. Ltd. (Japan),

- Omron Corporation (Japan), and

- Toshiba IT & Control Systems Corporation (Japan).

X-ray Inspection System Market Report Scope

|

Report Metric |

Details |

| Estimated Market Size | USD 0.8 billion in 2023 |

| Projected Market Size | USD 1.1 billion by 2028 |

| X-ray Inspection System Market Growth Rate | CAGR of 6.2% |

|

X-ray Inspection Systems Market Size Availability for Years |

2019–2028 |

|

Base Year |

2022 |

|

Forecast Period |

2023–2028 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

By technology, dimension, vertical, and region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and Rest of the world |

|

Companies Covered |

Mettler Toledo (US), Nordson Corporation (US), Comet Group (Switzerland), Anritsu (Japan), Viscom AG (Germany), North Star Imaging Inc. (US), Nikon Corporation (Japan), Ishida Co. Ltd. (Japan), Omron Corporation (Japan), and Toshiba IT & Control Systems Corporation (Japan) |

X-ray Inspection Systems Market Highlights

This research report categorizes the market based on technology, dimension, application, and region

|

Segment |

Subsegment |

|

Based on Technology: |

|

|

Based on Dimension: |

|

|

Based on Vertical: |

|

|

Based on Region: |

|

Recent Developments in X-ray Inspection System Industry

- In July 2023, Nikon Americas Inc, the United States subsidiary of Nikon Corporation, has acquired Avonix Imaging LLC, a US-based company located in Maple Grove, Minnesota. Avonix has served as a strategic manufacturing partner for X-ray CT (computed tomography) equipment to Nikon's Industrial Metrology Business Unit (IMBU) since 2015.

- In May 2023, Mettler Toledo Product Inspection has introduced the X2 Series of high-performance X-ray systems, aimed at elevating product safety while maintaining an affordable price range accessible to all food manufacturers. With two X-ray systems currently included in the X2 Series, X-ray inspection is now within reach for manufacturers across different budget ranges. These systems also provide manufacturers with long-lasting and superior-performing software.

- In April 2023, Nikon Corporation has launched VOXLS 40 C 450 which is able to examine objects of varying sizes and densities both internally and externally, making it highly versatile for a wide range of applications across industries, inspection agencies, and academic institutions.

- In April 2023, Nikon Corporation has announced to launch VOXLS 30 C 450 and VOXLS 30 M 450 which provide 450kV and 450 watts of continuous X-ray power. This level of power is notably high for a microfocus system and facilitates the efficient inspection of samples, even those that are thick and dense

- In September 2022, Mettler Toledo's new DXD and DXD+ dual-energy detector technology has been fine-tuned for the precise identification of foreign objects like calcified bone, low-mineral glass, rubber, and select plastics. These particular contaminants are typically challenging to spot within the complex and intricate X-ray images created by products that are overlapping or have various textures, such as pasta packaging, chicken breasts, sausages, and frozen potato-based items.

- In February 2022, Comet Group has launched new computed tomography system UX 50. Boasting a 450 kV output, the UX50 is ideal for examining dense and sizable components, offering unparalleled flexibility due to the option of equipping it with either flat-panel detectors, line detectors, or both.

Frequently Asked Questions (FAQs):

Which are the major companies in the X-ray inspection system market? What are their major strategies to strengthen their market presence?

The major companies in the X-ray inspection system market are – Mettler Toledo (US), Nordson Corporation (US), Comet Group (Switzerland), Anritsu (Japan), Viscom AG (Germany). The major strategies adopted by these players are product launches and developments, collaborations, acquisitions, and expansions.

Which is the potential market for the X-ray inspection system in terms of the region?

The North America region is expected to dominate the market due to the presence of leading players from the X-ray inspection systems market such as Mettler Toledo, Nordson Corporation, and North Star Imaging Inc.

What are the opportunities for new market entrants?

There are significant opportunities in the X-ray inspection system market for start-up companies. These companies are providing innovative products.

What are the drivers and opportunities for the X-ray inspection systems market?

Factors such as tigher manufacturing tolerances, increased densification of circuit board mounting, and increasing awareness among the consumers are among the factors driving the growth of the X-ray inspection system market.

Who are the major applications of the X-ray inspection system that are expected to drive the growth of the market in the next 5 years?

The major application for the X-ray inspection system is oil & gas. The X-ray inspection system also have a demand from manufacturing, aerospace, automotive, government infrastructure, food & pharmaceuticals, and power generation. They are expected to have a significant share in this market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising need for inspection services due to evolving regulations and quality standards- Surging requirement for precise and high-quality automotive components to ensure safety- Rising preference of consumers for defect-free products- Increasing focus of food industry on safety and qualityRESTRAINTS- High costs of deployment and maintenance- Risk of exposure to ionizing radiationOPPORTUNITIES- Integration of robotics into X-ray inspection equipment- Rapid industrialization in emerging economiesCHALLENGES- Integration of X-ray inspection systems with existing production lines- Availability of alternative inspection technologies

- 5.3 VALUE CHAIN ANALYSIS

-

5.4 ECOSYSTEM MAPPING

-

5.5 PRICING ANALYSISAVERAGE PRICING ANALYSIS (ASP) TREND OF X-RAY INSPECTION SYSTEMSAVERAGE SELLING PRICE (ASP) TREND OF X-RAY INSPECTION SYSTEM, BY REGION

-

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

-

5.7 TECHNOLOGY ANALYSISCOMPUTED TOMOGRAPHY (CT) SCANNING3D IMAGINGARTIFICIAL INTELLIGENCE (AI) AND MACHINE LEARNING (ML)COMPUTER VISION

-

5.8 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTS

-

5.9 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.10 CASE STUDY ANALYSIS

-

5.11 TRADE ANALYSISIMPORT SCENARIOEXPORT SCENARIO

-

5.12 PATENT ANALYSIS

-

5.13 KEY CONFERENCES AND EVENTS, 2023–2025TARIFF ANALYSIS

-

5.14 REGULATORY LANDSCAPE AND STANDARDSREGULATORY BODIES, GOVERNMENT AGENCIES AND OTHER ORGANIZATIONSSTANDARDS

- 6.1 INTRODUCTION

-

6.2 FILM-BASED IMAGINGCOST EFFICIENCY AND SUSTAINABILITY FEATURES TO FUEL DEMAND

-

6.3 DIGITAL IMAGINGCOMPUTED TOMOGRAPHY- Increasing complexity of manufacturing and quality control processes to fuel segmental growthCOMPUTED RADIOGRAPHY- Rising focus on reducing operating costs to foster segmental growthDIRECT RADIOGRAPHY- Capacity to swiftly identify defects and enhance safety to boost adoption of technology

- 7.1 INTRODUCTION

-

7.2 2DSIMPLIFIED INTEGRATION AND COST-EFFECTIVENESS TO BOOST SEGMENTAL GROWTH

-

7.3 3DCOMPLEX AND STRINGENT QUALITY CONTROL REQUIREMENTS TO FUEL MARKET GROWTH

- 8.1 INTRODUCTION

-

8.2 MANUFACTURINGADVENT OF INDUSTRY 4.0 IN MANUFACTURING PROCESSES TO BOOST DEMAND

-

8.3 OIL & GASPRESSING NEED TO COMPLY WITH INDUSTRY STANDARDS TO DRIVE MARKET

-

8.4 AEROSPACEHIGH FOCUS ON SAFETY AND PRECISION TO DRIVE DEMAND

-

8.5 GOVERNMENT INFRASTRUCTUREEXPANSION AND MODERNIZATION OF AIRPORTS TO FUEL DEMAND

-

8.6 AUTOMOTIVEABILITY TO DETECT CAST AND WELDED COMPONENTS WITHIN AUTOMOTIVE CHASSIS SYSTEMS TO BOOST DEMAND

-

8.7 POWER GENERATIONGLOBAL SURGE IN ENERGY CONSUMPTION TO FOSTER SEGMENTAL GROWTH

-

8.8 FOOD & PHARMACEUTICALSNEED TO DETECT CONTAMINANTS IN FOOD ITEMS AND PHARMACEUTICALS TO DRIVE MARKET

- 8.9 OTHERS

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICANORTH AMERICA: IMPACT OF RECESSIONUS- Presence of established manufacturers to fuel market growthCANADA- Commitment to sustainability to fuel market growthMEXICO- Increasing need for efficient manufacturing processes to drive market growth

-

9.3 EUROPEEUROPE: IMPACT OF RECESSIONUK- Increasing public–private investments in technology sector to boost demandGERMANY- Thriving automotive sector to offer lucrative opportunities to playersFRANCE- Developing EV market to boost demandITALY- Rising focus on food safety and quality control to drive marketREST OF EUROPE

-

9.4 ASIA PACIFICASIA PACIFIC: IMPACT OF RECESSIONJAPAN- Rising adoption of electric and hybrid vehicle to drive marketCHINA- Growing demand for comprehensive system solutions in industrial applications to drive marketINDIA- Rapid collaborations between government organizations and manufacturers to boost demandREST OF ASIA PACIFIC

-

9.5 ROWROW: IMPACT OF RECESSIONMIDDLE EAST & AFRICA- Increasing investments in infrastructural development to boost demandSOUTH AMERICA- Stringent government regulations to drive market

- 10.1 OVERVIEW

- 10.2 KEY STRATEGIES ADOPTED BY MAJOR PLAYERS

- 10.3 REVENUE ANALYSIS, 2018–2022

- 10.4 MARKET SHARE ANALYSIS, 2022

-

10.5 COMPANY EVALUATION MATRIX, 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT

-

10.6 START-UPS/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING

-

10.7 COMPETITIVE SCENARIOS AND TRENDSPRODUCT LAUNCHESDEALSOTHERS

-

11.1 KEY PLAYERSMETTLER TOLEDO- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewNORDSON CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCOMET GROUP- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewANRITSU- Business overview- Products/Solutions/Services offered- MnM viewVISCOM AG- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewNORTH STAR IMAGING INC.- Business overview- Products/Solutions/Services offered- Recent developmentsNIKON CORPORATION- Business overview- Products/Solutions/Services offered- Recent developmentsISHIDA CO., LTD.- Business overview- Products/Solutions/Services offeredOMRON CORPORATION- Business overview- Products/Solutions/Services offered- Recent developmentsTOSHIBA IT & CONTROL SYSTEMS CORPORATION- Business overview- Products/Solutions/Services offeredGENERAL ELECTRIC- Business overview- Products/Solutions/Services offeredSMITHS GROUP PLC- Business overview- Products/Solutions/Services offered- Recent developments

-

11.2 OTHER KEY PLAYERSVJTECHNOLOGIES3DX-RAYVISICONSULT GMBHCREATIVE ELECTRONGLENBROOK TECHNOLOGIESSCIENSCOPECASSEL MESSTECHNIK GMBHSESOTEC GMBHWELLMAN X-RAY SOLUTION CO., LTDMARS TOHKEN SOLUTION CO. LTDRAD SOURCE TECHNOLOGIESMANNCORP INC.MINEBEA INTEC GMBHTECHIK INSTRUMENT (SHANGHAI) CO., LTD.MESUTRONIC GMBH

- 12.1 INTRODUCTION

- 12.2 SURFACE MOUNT TECHNOLOGY MARKET, BY END USER INDUSTRY

-

12.3 CONSUMER ELECTRONICSGROWING DEMAND FOR MINIATURIZATION OF CONSUMER ELECTRONICS TO BOOST DEMAND

-

12.4 TELECOMMUNICATIONSEMERGENCE OF WIRELESS COMMUNICATION TECHNOLOGIES TO FOSTER SEGMENTAL GROWTH

-

12.5 AEROSPACE & DEFENSERISING DEMAND FOR HIGH-QUALITY ELECTRONIC COMPONENTS

-

12.6 AUTOMOTIVEEXPANDING ELECTRIC VEHICLE (EV) MARKET TO BOOST DEMAND

-

12.7 MEDICALRISING DIGITIZATION IN MEDICAL INDUSTRY TO DRIVE MARKET

-

12.8 INDUSTRIALINCREASING ADOPTION OF AUTOMATION TECHNOLOGIES TO STRENGTHEN MARKET GROWTH

-

12.9 ENERGY AND POWER SYSTEMSRISING ELECTRICITY CONSUMPTION TO BOOST DEMAND

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 ASSUMPTIONS: RECESSION

- TABLE 2 COMPANIES AND THEIR ROLES IN X-RAY INSPECTION SYSTEM ECOSYSTEM

- TABLE 3 AVERAGE SELLING PRICE (ASP) OF X-RAY INSPECTION SYSTEMS OFFERED BY TOP THREE KEY PLAYERS

- TABLE 4 AVERAGE SELLING PRICE (ASP) TREND OF X-RAY INSPECTION SYSTEMS, BY REGION

- TABLE 5 X-RAY INSPECTION SYSTEM MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- TABLE 7 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 8 KRI-KRI S.A. INSTALLS METTLER TOLEDO’S X-RAY INSPECTION SYSTEM TO MAINTAIN PRODUCT SAFETY

- TABLE 9 METTLER TOLEDO INSTALLS FIVE SAFELINE X-RAY INSPECTION SYSTEMS FOR ANDESEN AND SONS

- TABLE 10 J&J SNACK FOODS INSTALLS X-RAY INSPECTION SYSTEMS OFFERED BY METTLER-TOLEDO SAFELINE

- TABLE 11 LOMA INCORPORATES EIGHT X5 SPACE SAVER X-RAY UNITS INTO KEPAK'S PRODUCTION LINES TO MEET QUALITY STANDARDS FOR CONTAMINANT DETECTION

- TABLE 12 FAMOUS BRANDS CHEESE COMPANY LTD. COLLABORATES WITH ISHIDA TO UPGRADE ITS INSPECTION SYSTEMS

- TABLE 13 TOP 20 PATENT OWNERS IN US IN LAST 10 YEARS

- TABLE 14 X-RAY INSPECTION SYSTEM MARKET: LIST OF PATENTS, 2021–2023

- TABLE 15 X-RAY INSPECTION SYSTEM MARKET: LIST OF CONFERENCES AND EVENTS

- TABLE 16 MFN TARIFF FOR HS CODE 902219-COMPLIANT PRODUCTS EXPORTED BY JAPAN

- TABLE 17 MFN TARIFF FOR HS CODE 902219-COMPLIANT PRODUCTS EXPORTED BY CHINA

- TABLE 18 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 X-RAY INSPECTION SYSTEM MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 23 X-RAY INSPECTION SYSTEM MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 24 X-RAY INSPECTION SYSTEM MARKET, BY DIGITAL IMAGING, 2019–2022 (USD MILLION)

- TABLE 25 X-RAY INSPECTION SYSTEM MARKET, BY DIGITAL IMAGING, 2023–2028 (USD MILLION)

- TABLE 26 FILM-BASED IMAGING: X-RAY INSPECTION SYSTEM MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 27 FILM-BASED IMAGING: X-RAY INSPECTION SYSTEM MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 28 DIGITAL IMAGING: X-RAY INSPECTION SYSTEM MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 29 DIGITAL IMAGING: X-RAY INSPECTION SYSTEM MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 30 COMPUTED TOMOGRAPHY: X-RAY INSPECTION SYSTEM MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 31 COMPUTED TOMOGRAPHY: X-RAY INSPECTION SYSTEM MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 32 COMPUTED RADIOGRAPHY: X-RAY INSPECTION SYSTEM MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 33 COMPUTED RADIOGRAPHY: X-RAY INSPECTION SYSTEM MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 34 DIRECT RADIOGRAPHY: X-RAY INSPECTION SYSTEM MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 35 DIRECT RADIOGRAPHY: X-RAY INSPECTION SYSTEM MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 36 X-RAY INSPECTION SYSTEM MARKET, BY DIMENSION, 2019–2022 (USD MILLION)

- TABLE 37 X-RAY INSPECTION SYSTEM MARKET, BY DIMENSION, 2023–2028 (USD MILLION)

- TABLE 38 2D: X-RAY INSPECTION SYSTEM MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 39 2D: X-RAY INSPECTION SYSTEM MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 40 3D: X-RAY INSPECTION SYSTEM MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 41 3D: X-RAY INSPECTION SYSTEM MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 42 X-RAY INSPECTION SYSTEM MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 43 X-RAY INSPECTION SYSTEM MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 44 MANUFACTURING: X-RAY INSPECTION SYSTEM MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 45 MANUFACTURING: X-RAY INSPECTION SYSTEM MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 46 MANUFACTURING: X-RAY INSPECTION SYSTEM MARKET, BY DIGITAL IMAGING, 2019–2022 (USD MILLION)

- TABLE 47 MANUFACTURING: X-RAY INSPECTION SYSTEM MARKET, BY DIGITAL IMAGING, 2023–2028 (USD MILLION)

- TABLE 48 MANUFACTURING: X-RAY INSPECTION SYSTEM MARKET, BY DIMENSION, 2019–2022 (USD MILLION)

- TABLE 49 MANUFACTURING: X-RAY INSPECTION SYSTEM MARKET, BY DIMENSION, 2023–2028 (USD MILLION)

- TABLE 50 MANUFACTURING: X-RAY INSPECTION SYSTEM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 51 MANUFACTURING: X-RAY INSPECTION SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 52 OIL & GAS: X-RAY INSPECTION SYSTEM MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 53 OIL & GAS: X-RAY INSPECTION SYSTEM MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 54 OIL & GAS: X-RAY INSPECTION SYSTEM MARKET, BY DIGITAL IMAGING, 2019–2022 (USD MILLION)

- TABLE 55 OIL & GAS: X-RAY INSPECTION SYSTEM MARKET, BY DIGITAL IMAGING, 2023–2028 (USD MILLION)

- TABLE 56 OIL & GAS: X-RAY INSPECTION SYSTEM MARKET, BY DIMENSION, 2019–2022 (USD MILLION)

- TABLE 57 OIL & GAS: X-RAY INSPECTION SYSTEM MARKET, BY DIMENSION, 2023–2028 (USD MILLION)

- TABLE 58 OIL & GAS: X-RAY INSPECTION SYSTEM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 59 OIL & GAS: X-RAY INSPECTION SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 60 AEROSPACE: X-RAY INSPECTION SYSTEM MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 61 AEROSPACE: X-RAY INSPECTION SYSTEM MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 62 AEROSPACE: X-RAY INSPECTION SYSTEM MARKET, BY DIGITAL IMAGING, 2019–2022 (USD MILLION)

- TABLE 63 AEROSPACE: X-RAY INSPECTION SYSTEM MARKET, BY DIGITAL IMAGING, 2023–2028 (USD MILLION)

- TABLE 64 AEROSPACE: X-RAY INSPECTION SYSTEM MARKET, BY DIMENSION, 2019–2022 (USD MILLION)

- TABLE 65 AEROSPACE: X-RAY INSPECTION SYSTEM MARKET, BY DIMENSION, 2023–2028 (USD MILLION)

- TABLE 66 AEROSPACE: X-RAY INSPECTION SYSTEM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 67 AEROSPACE: X-RAY INSPECTION SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 68 GOVERNMENT INFRASTRUCTURE: X-RAY INSPECTION SYSTEM MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 69 GOVERNMENT INFRASTRUCTURE: X-RAY INSPECTION SYSTEM MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 70 GOVERNMENT INFRASTRUCTURE: X-RAY INSPECTION SYSTEM MARKET, BY DIGITAL IMAGING, 2019–2022 (USD MILLION)

- TABLE 71 GOVERNMENT INFRASTRUCTURE: X-RAY INSPECTION SYSTEM MARKET, BY DIGITAL IMAGING, 2023–2028 (USD MILLION)

- TABLE 72 GOVERNMENT INFRASTRUCTURE: X-RAY INSPECTION SYSTEM MARKET, BY DIMENSION, 2019–2022 (USD MILLION)

- TABLE 73 GOVERNMENT INFRASTRUCTURE: X-RAY INSPECTION SYSTEM MARKET, BY DIMENSION, 2023–2028 (USD MILLION)

- TABLE 74 GOVERNMENT INFRASTRUCTURE: X-RAY INSPECTION SYSTEM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 75 GOVERNMENT INFRASTRUCTURE: X-RAY INSPECTION SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 76 AUTOMOTIVE: X-RAY INSPECTION SYSTEM MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 77 AUTOMOTIVE: X-RAY INSPECTION SYSTEM MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 78 AUTOMOTIVE: X-RAY INSPECTION SYSTEM MARKET, BY DIGITAL IMAGING, 2019–2022 (USD MILLION)

- TABLE 79 AUTOMOTIVE: X-RAY INSPECTION SYSTEM MARKET, BY DIGITAL IMAGING, 2023–2028 (USD MILLION)

- TABLE 80 AUTOMOTIVE: X-RAY INSPECTION SYSTEM MARKET, BY DIMENSION, 2019–2022 (USD MILLION)

- TABLE 81 AUTOMOTIVE: X-RAY INSPECTION SYSTEM MARKET, BY DIMENSION, 2023–2028 (USD MILLION)

- TABLE 82 AUTOMOTIVE: X-RAY INSPECTION SYSTEM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 83 AUTOMOTIVE: X-RAY INSPECTION SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 84 POWER GENERATION: X-RAY INSPECTION SYSTEM MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 85 POWER GENERATION: X-RAY INSPECTION SYSTEM MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 86 POWER GENERATION: X-RAY INSPECTION SYSTEM MARKET, BY DIGITAL IMAGING, 2019–2022 (USD MILLION)

- TABLE 87 POWER GENERATION: X-RAY INSPECTION SYSTEM MARKET, BY DIGITAL IMAGING, 2023–2028 (USD MILLION)

- TABLE 88 POWER GENERATION: X-RAY INSPECTION SYSTEM MARKET, BY DIMENSION, 2019–2022 (USD MILLION)

- TABLE 89 POWER GENERATION: X-RAY INSPECTION SYSTEM MARKET, BY DIMENSION, 2023–2028 (USD MILLION)

- TABLE 90 POWER GENERATION: X-RAY INSPECTION SYSTEM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 91 POWER GENERATION: X-RAY INSPECTION SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 92 FOOD & PHARMACEUTICALS: X-RAY INSPECTION SYSTEM MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 93 FOOD & PHARMACEUTICALS: X-RAY INSPECTION SYSTEM MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 94 FOOD & PHARMACEUTICALS: X-RAY INSPECTION SYSTEM MARKET, BY DIGITAL IMAGING, 2019–2022 (USD MILLION)

- TABLE 95 FOOD & PHARMACEUTICALS: X-RAY INSPECTION SYSTEM MARKET, BY DIGITAL IMAGING, 2023–2028 (USD MILLION)

- TABLE 96 FOOD & PHARMACEUTICALS: X-RAY INSPECTION SYSTEM MARKET, BY DIMENSION, 2019–2022 (USD MILLION)

- TABLE 97 FOOD & PHARMACEUTICALS: X-RAY INSPECTION SYSTEM MARKET, BY DIMENSION, 2023–2028 (USD MILLION)

- TABLE 98 FOOD & PHARMACEUTICALS: X-RAY INSPECTION SYSTEM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 99 FOOD & PHARMACEUTICALS: X-RAY INSPECTION SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 100 OTHERS: X-RAY INSPECTION SYSTEM MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 101 OTHERS: X-RAY INSPECTION SYSTEM MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 102 OTHERS: X-RAY INSPECTION SYSTEM MARKET, BY DIGITAL IMAGING, 2019–2022 (USD MILLION)

- TABLE 103 OTHERS: X-RAY INSPECTION SYSTEM MARKET, BY DIGITAL IMAGING, 2023–2028 (USD MILLION)

- TABLE 104 OTHERS: X-RAY INSPECTION SYSTEM MARKET, BY DIMENSION, 2019–2022 (USD MILLION)

- TABLE 105 OTHERS: X-RAY INSPECTION SYSTEM MARKET, BY DIMENSION, 2023–2028 (USD MILLION)

- TABLE 106 OTHERS: X-RAY INSPECTION SYSTEM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 107 OTHERS: X-RAY INSPECTION SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 108 X-RAY INSPECTION SYSTEM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 109 X-RAY INSPECTION SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 110 NORTH AMERICA: X-RAY INSPECTION SYSTEM MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 111 NORTH AMERICA: X-RAY INSPECTION SYSTEM MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 112 NORTH AMERICA: X-RAY INSPECTION SYSTEM MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 113 NORTH AMERICA: X-RAY INSPECTION SYSTEM MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 114 EUROPE: X-RAY INSPECTION SYSTEM MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 115 EUROPE: X-RAY INSPECTION SYSTEM MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 116 EUROPE: X-RAY INSPECTION SYSTEM MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 117 EUROPE: X-RAY INSPECTION SYSTEM MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 118 ASIA PACIFIC: X-RAY INSPECTION SYSTEM MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 119 ASIA PACIFIC: X-RAY INSPECTION SYSTEM MARKET BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 120 ASIA PACIFIC: X-RAY INSPECTION SYSTEM MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 121 ASIA PACIFIC: X-RAY INSPECTION SYSTEM MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 122 ROW: X-RAY INSPECTION SYSTEM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 123 ROW: X-RAY INSPECTION SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 124 ROW: X-RAY INSPECTION SYSTEM MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 125 ROW: X-RAY INSPECTION SYSTEM MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 126 X-RAY INSPECTION SYSTEM MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 127 X-RAY INSPECTION SYSTEM MARKET SHARE ANALYSIS, 2022

- TABLE 128 COMPANY FOOTPRINT

- TABLE 129 TECHNOLOGY: COMPANY FOOTPRINT

- TABLE 130 VERTICAL: COMPANY FOOTPRINT

- TABLE 131 REGION: COMPANY FOOTPRINT

- TABLE 132 X-RAY INSPECTION SYSTEM MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- TABLE 133 X-RAY INSPECTION SYSTEM MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES, BY TECHNOLOGY

- TABLE 134 X-RAY INSPECTION SYSTEM MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES, BY VERTICAL

- TABLE 135 X-RAY INSPECTION SYSTEM MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES, BY REGION

- TABLE 136 X-RAY INSPECTION SYSTEM MARKET: PRODUCT LAUNCHES, 2020−2023

- TABLE 137 X-RAY INSPECTION SYSTEM MARKET: DEALS, 2020–2023

- TABLE 138 X-RAY INSPECTION SYSTEM MARKET: OTHERS, 2021–2023

- TABLE 139 METTLER TOLEDO: COMPANY OVERVIEW

- TABLE 140 METTLER TOLEDO: PRODUCTS/SOLUTIONS/OFFERED

- TABLE 141 METTLER TOLEDO: PRODUCT LAUNCHES

- TABLE 142 NORDSON CORPORATION: COMPANY OVERVIEW

- TABLE 143 NORDSON CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 144 NORDSON CORPORATION: DEALS

- TABLE 145 COMET GROUP: COMPANY OVERVIEW

- TABLE 146 COMET GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 147 COMET GROUP: PRODUCT LAUNCHES

- TABLE 148 ANRITSU: COMPANY OVERVIEW

- TABLE 149 ANRITSU: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 150 VISCOM AG: COMPANY OVERVIEW

- TABLE 151 VISCOM AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 152 VISCOM AG: PRODUCT LAUNCHES

- TABLE 153 NORTH STAR IMAGING INC.: COMPANY OVERVIEW

- TABLE 154 NORTH STAR IMAGING INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 155 NORTH STAR IMAGING INC.: PRODUCT LAUNCHES

- TABLE 156 NORTH STAR IMAGING INC.: OTHERS

- TABLE 157 NIKON CORPORATION: COMPANY OVERVIEW

- TABLE 158 NIKON CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 159 NIKON CORPORATION: PRODUCT LAUNCHES

- TABLE 160 NIKON CORPORATION: DEALS

- TABLE 161 ISHIDA CO., LTD.: COMPANY OVERVIEW

- TABLE 162 ISHIDA CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 163 OMRON CORPORATION: COMPANY OVERVIEW

- TABLE 164 OMRON CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 165 OMRON CORPORATION: PRODUCT LAUNCHES

- TABLE 166 TOSHIBA IT & CONTROL SYSTEMS CORPORATION: COMPANY OVERVIEW

- TABLE 167 TOSHIBA IT & CONTROL SYSTEMS CORPORATION: PRODUCTS/ SOLUTIONS/SERVICES OFFERED

- TABLE 168 GENERAL ELECTRIC: COMPANY OVERVIEW

- TABLE 169 GENERAL ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 170 SMITHS GROUP PLC: COMPANY OVERVIEW

- TABLE 171 SMITHS GROUP PLC: PRODUCTS/SOLUTIONS/OFFERED

- TABLE 172 SMITHS GROUP PLC: PRODUCT LAUNCHES

- TABLE 173 SMITHS GROUP PLC: DEALS

- TABLE 174 SURFACE MOUNT TECHNOLOGY MARKET, BY END USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 175 SURFACE MOUNT TECHNOLOGY MARKET, BY END USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 176 CONSUMER ELECTRONICS: SURFACE MOUNT TECHNOLOGY MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 177 CONSUMER ELECTRONICS: SURFACE MOUNT TECHNOLOGY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 178 TELECOMMUNICATIONS: SURFACE MOUNT TECHNOLOGY MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 179 TELECOMMUNICATIONS: SURFACE MOUNT TECHNOLOGY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 180 AEROSPACE & DEFENSE: SURFACE MOUNT TECHNOLOGY MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 181 AEROSPACE & DEFENSE: SURFACE MOUNT TECHNOLOGY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 182 AUTOMOTIVE: SURFACE MOUNT TECHNOLOGY MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 183 AUTOMOTIVE: SURFACE MOUNT TECHNOLOGY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 184 MEDICAL: SURFACE MOUNT TECHNOLOGY MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 185 MEDICAL: SURFACE MOUNT TECHNOLOGY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 186 INDUSTRIAL: SURFACE MOUNT TECHNOLOGY MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 187 INDUSTRIAL: SURFACE MOUNT TECHNOLOGY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 188 ENERGY & POWER SYSTEMS: SURFACE MOUNT TECHNOLOGY MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 189 ENERGY & POWER SYSTEMS: SURFACE MOUNT TECHNOLOGY MARKET, BY REGION, 2023–2028 (USD MILLION)

- FIGURE 1 X-RAY INSPECTION SYSTEM MARKET: SEGMENTATION

- FIGURE 2 X-RAY INSPECTION SYSTEM MARKET: RESEARCH DESIGN

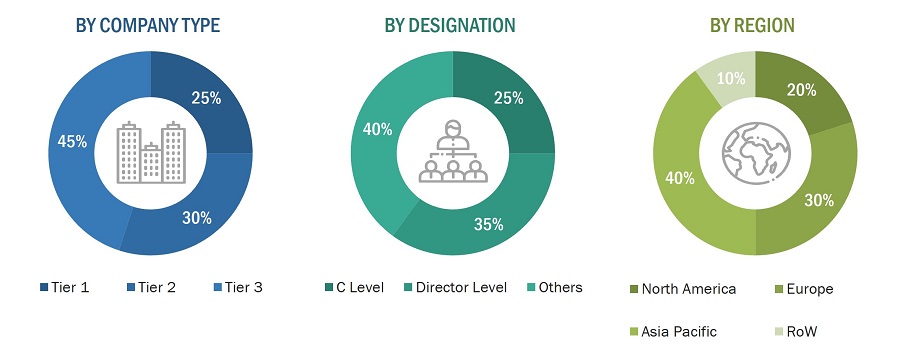

- FIGURE 3 BREAKDOWN OF PRIMARIES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH (SUPPLY SIDE)—REVENUE GENERATED BY COMPANIES FROM SALES OF X-RAY INSPECTION SYSTEMS

- FIGURE 5 X-RAY INSPECTION SYSTEM MARKET: BOTTOM-UP APPROACH

- FIGURE 6 X-RAY INSPECTION SYSTEM MARKET: TOP-DOWN APPROACH

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 DIGITAL IMAGING TO DISPLAY HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 9 2D DIMENSION SEGMENT TO DOMINATE MARKET IN 2028

- FIGURE 10 MANUFACTURING SEGMENT TO EXHIBIT HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 11 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 12 STRINGENT MANUFACTURING STANDARDS TO FUEL DEMAND FOR X-RAY INSPECTION SYSTEMS DURING FORECAST PERIOD

- FIGURE 13 DIGITAL IMAGING CAPTURED LARGEST MARKET SHARE IN 2022

- FIGURE 14 2D SEGMENT TO SECURE LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 15 OIL & GAS SEGMENT AND NORTH AMERICA TO DOMINATE MARKET IN 2028

- FIGURE 16 INDIA TO REGISTER HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 17 X-RAY INSPECTION SYSTEM MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 X-RAY INSPECTION SYSTEM MARKET: IMPACT ANALYSIS OF DRIVERS

- FIGURE 19 X-RAY INSPECTION SYSTEM MARKET: IMPACT ANALYSIS OF RESTRAINTS

- FIGURE 20 X-RAY INSPECTION SYSTEM MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- FIGURE 21 X-RAY INSPECTION SYSTEM MARKET: IMPACT ANALYSIS OF CHALLENGES

- FIGURE 22 X-RAY INSPECTION SYSTEM MARKET: VALUE CHAIN ANALYSIS

- FIGURE 23 X-RAY INSPECTION SYSTEM MARKET: ECOSYSTEM MAPPING

- FIGURE 24 AVERAGE SELLING PRICE (ASP) OF X-RAY INSPECTION SYSTEMS OFFERED BY TOP THREE KEY PLAYERS

- FIGURE 25 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

- FIGURE 26 X-RAY INSPECTION SYSTEM MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 27 KEY STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE VERTICALS

- FIGURE 28 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- FIGURE 29 IMPORT DATA FOR X-RAY INSPECTION SYSTEMS, BY COUNTRY, 2018–2022 (USD MILLION)

- FIGURE 30 EXPORT DATA FOR X-RAY INSPECTION SYSTEMS, BY COUNTRY, 2018–2022 (USD MILLION)

- FIGURE 31 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

- FIGURE 32 NUMBER OF PATENTS GRANTED PER YEAR, 2013–2023

- FIGURE 33 X-RAY INSPECTION SYSTEM MARKET, BY TECHNOLOGY

- FIGURE 34 DIGITAL IMAGING SEGMENT TO RECORD HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 35 X-RAY INSPECTION SYSTEM MARKET, BY DIMENSION

- FIGURE 36 3D SEGMENT TO RECORD HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 37 X-RAY INSPECTION SYSTEM MARKET, BY VERTICAL

- FIGURE 38 MANUFACTURING SEGMENT TO DISPLAY HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 39 ASIA PACIFIC TO DOMINATE X-RAY INSPECTION SYSTEM MARKET FOR MANUFACTURING DURING FORECAST PERIOD

- FIGURE 40 ASIA PACIFIC TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 41 X-RAY INSPECTION SYSTEM MARKET, BY REGION

- FIGURE 42 ASIA PACIFIC TO DISPLAY HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 43 NORTH AMERICA: X-RAY INSPECTION SYSTEM MARKET SNAPSHOT

- FIGURE 44 EUROPE: X-RAY INSPECTION SYSTEM MARKET SNAPSHOT

- FIGURE 45 ASIA PACIFIC: X-RAY INSPECTION SYSTEM MARKET SNAPSHOT

- FIGURE 46 REVENUE ANALYSIS OF FIVE KEY PLAYERS, 2018–2022

- FIGURE 47 X-RAY INSPECTION SYSTEM MARKET SHARE ANALYSIS, 2022

- FIGURE 48 X-RAY INSPECTION SYSTEM MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 49 X-RAY INSPECTION SYSTEM MARKET: START-UPS/SMES EVALUATION MATRIX, 2022

- FIGURE 50 METTLER TOLEDO: COMPANY SNAPSHOT

- FIGURE 51 NORDSON CORPORATION: COMPANY SNAPSHOT

- FIGURE 52 COMET GROUP: COMPANY SNAPSHOT

- FIGURE 53 ANRITSU: COMPANY SNAPSHOT

- FIGURE 54 VISCOM AG: COMPANY SNAPSHOT

- FIGURE 55 NIKON CORPORATION: COMPANY SNAPSHOT

- FIGURE 56 OMRON CORPORATION: COMPANY SNAPSHOT

- FIGURE 57 GENERAL ELECTRIC: COMPANY SNAPSHOT

- FIGURE 58 SMITHS GROUP PLC: COMPANY SNAPSHOT

To estimate the size of the X-ray inspection system market, the study utilized four major activities. Exhaustive secondary research was conducted to gather information on the market, as well as its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. Finally, market breakdown and data triangulation methods were utilized to estimate the market size for different segments and subsegments.

Secondary Research

In the secondary research process, various sources have been referred to for identifying and collecting information for this study on the X-ray inspection system market. Secondary sources for this research study include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; certified publications; articles by recognized authors; directories; and databases. The secondary data was collected and analyzed to determine the overall market size, further validated through primary research.

List of Key Secondary Sources

|

SOURCE NAME |

WEBLINK |

|

American Society for Nondestructive Testing |

|

|

The British Institute of Non-Destructive Testing |

|

|

The Indian Society for Non-Destructive Testing |

|

|

Canadian Industrial Radiography Safety Association |

|

|

European Federation for Non Destructive Testing |

|

|

Nondestructive Testing Management Association |

|

|

Association for Research in Vision and Ophthalmology |

|

|

International Atomic Energy Agency |

|

|

SPIE |

Primary Research

To gather insights on market statistics, revenue data, market breakdowns, size estimations, and forecasting, primary interviews were conducted. Additionally, primary research was used to comprehend the various technology, application, vertical, and regional trends. Interviews with stakeholders from the demand side, including CIOs, CTOs, CSOs, and customer/end-user installation teams using X-ray inspection system, were also conducted to understand their perspective on suppliers, products, component providers, and their current and future use of X-ray inspection system, which will impact the overall market. Several primary interviews were conducted across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

To estimate and validate the size of the X-ray inspection system market and its submarkets, both top-down and bottom-up approaches were utilized. Secondary research was conducted to identify the key players in the market, and primary and secondary research was used to determine their market share in specific regions. The entire process involved studying the annual and financial reports of top players and conducting extensive interviews with industry leaders such as CEOs, VPs, directors, and marketing executives. Secondary sources were used to determine all percentage shares and breakdowns, which were then verified through primary sources. All parameters that could impact the markets covered in this research study were accounted for, analyzed in detail, verified through primary research, and consolidated to obtain the final quantitative and qualitative data.

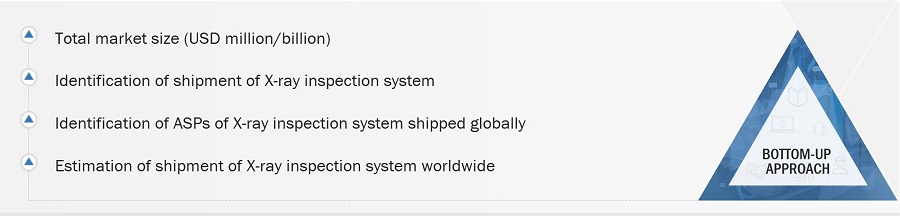

Global X-ray Inspection System Market Size: Botton Up Approach

- First, companies offering X-ray inspection system have been identified, and their product mapping with respect to different parameters, such as technology, dimension, and vertical, has been carried out.

- The market size has been estimated based on the demand for different X-ray inspection system technologies, and dimensions for different applications. The anticipated change in demand for X-ray inspection system offered by these companies in the recession and company revenues have been analyzed and estimated.

- Primary research has been conducted with a few major players operating in the market to validate the global market size. Discussions included the recession impact on the X-ray inspection system ecosystem.

- Then, the size of the X-ray inspection system market has been validated through secondary sources, which include the International Trade Centre (ITC), world trade organization, and world economic forum.

- The CAGR of the market has been calculated considering the historical and future market trends and the impact of recession by understanding the adoption rate of X-ray inspection system for different applications.

- The estimates at every level have been verified and cross-checked through discussions with key opinion leaders, such as corporate executives (CXOs), directors, and sales heads, as well as with the domain experts in MarketsandMarkets.

- Various paid and unpaid information sources, such as company websites, annual reports, press releases, research journals, magazines, white papers, and databases, have also been studied.

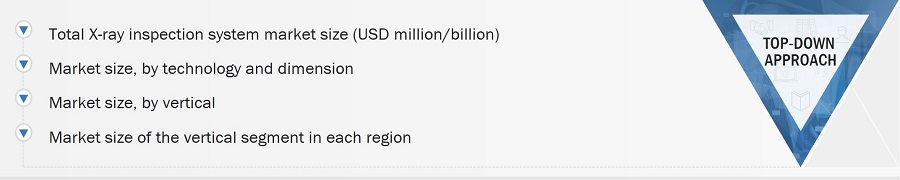

Global X-ray Inspection System Market Size: Top Down Approach

The top-down approach has been used to estimate and validate the total size of the X-ray inspection system market.

- Focusing initially on the R&D investments and expenditures being made in the ecosystem of the X-ray inspection system market; further splitting the market on the basis of technology, dimension, vertical and region and listing the key developments.

- Identifying leading players in the X-ray inspection system market through secondary research and verifying them through brief discussions with industry experts

- Analyzing revenue, product mix, geographic presence, and key applications for which products are served by all identified players to estimate and arrive at percentage splits for all key segments.

- Discussing splits with industry experts to validate the information and identify key growth pockets across all key segments.

- Breaking down the total market based on verified splits and key growth pockets across all segments.

Data Triangulation

Once the overall size of the X-ray inspection system market was determined using the methods described above, it was divided into multiple segments and subsegments. Market engineering was performed for each segment and subsegment using market breakdown and data triangulation methods, as applicable, to obtain accurate statistics. To triangulate the data, various factors and trends from the demand and supply sides were studied. The market was validated using both top-down and bottom-up approaches.

Market Definition

An X-ray inspection system is a technological device or equipment developed for the non-destructive scrutiny and imaging of objects or materials through X-rays. It operates by directing X-ray radiation through the object under examination and recording the transmitted X-rays on the opposing side. These systems encompass diverse components, such as radiation sources, intensifying screens, penetrometers, industrial X-ray films, processing chemicals, and photographic processing equipment, among others. X-ray inspection systems find extensive applications in various domains, including government infrastructure, industrial quality control, and materials analysis.

Key Stakeholders

- Raw material suppliers

- Original equipment manufacturers (OEMs)

- OEM technology solution providers

- Technology and solution providers

- Rental service providers

- Intellectual property (IP) core and licensing providers

- Suppliers and distributors

- Government and other regulatory bodies

- Technology investors

- Research institutes and organizations

- Market research and consulting firms

Report Objectives

- To define, describe, and forecast the X-ray inspection system market based on technology, dimension, vertical, and region.

- To forecast the market size, in terms of value, for the concerned segments with regard to four main regions, namely, Americas, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To strategically analyze the micromarkets with regard to the individual growth trends, prospects, and contribution to the X-ray inspection system market

- To provide detailed information regarding the major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the X-ray inspection system market

- To analyze opportunities in the market for stakeholders and the details of the competitive landscape for the market leaders

- To provide a detailed overview of the X-ray inspection system value chain

- To benchmark players within the market using proprietary “Competitive Leadership Mapping” framework, which analyzes market players on various parameters within the broad categories of business and product strategy

- To analyze competitive developments such as partnerships, acquisitions, expansions, agreements, collaborations, contracts, and product launches, along with research and development (R&D) in the X-ray inspection system market

- To strategically profile key players of the X-ray inspection system market and comprehensively analyze their market shares and core competencies

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players (up to 5)

- Additional country-level analysis of the X-ray inspection system market

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the X-ray inspection system market.

Growth opportunities and latent adjacency in X-ray Inspection System Market

I'd like to see sample before deciding payment. So please share the sample of the report.