Passenger Security Market by Security Solution (Baggage Inspection Systems, Explosive Trace Detector, Hand Held Scanner, Full Body Scanner, Access Control), End User (Airport, Seaport, Railway), Investment Type, and Region - Global Forecast 2025 to 2035

The modern era of global transportation depends not only on speed and efficiency but also on safety and trust. The passenger security market has evolved into one of the most critical components of the global mobility ecosystem, spanning airports, seaports, and railway networks. From advanced baggage inspection systems to biometric access control, security technologies are transforming the passenger journey, ensuring that transportation remains both secure and seamless.

Between 2025 and 2035, the passenger security market will experience rapid technological advancement and infrastructure investment. Growing concerns over terrorism, smuggling, cyber threats, and pandemics are driving innovation in detection, monitoring, and identity verification systems. As urbanization accelerates and global passenger traffic rebounds, security infrastructure is being redefined to combine intelligence, automation, and adaptability.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNewNew.asp?id=240005713

Market Overview: The Evolution of Passenger Security

The passenger security industry has come a long way from basic metal detectors and manual baggage checks. It now encompasses integrated digital ecosystems of sensors, artificial intelligence, and data analytics that provide real time situational awareness. With more than 7.5 billion air passengers expected by 2035, and rising volumes in maritime and railway transportation, security systems must evolve to handle massive throughput without compromising traveler convenience.

Governments and transport authorities worldwide are investing in modernized security infrastructure. Airports are integrating artificial intelligence to identify potential threats, seaports are adopting biometric verification for crew and passengers, and railway systems are incorporating surveillance networks powered by advanced analytics. The market’s expansion is being accelerated by the convergence of physical and digital security, supported by growing global demand for smart transportation networks.

Technological Transformation in Passenger Security

Between 2025 and 2035, technological innovation will redefine how security systems operate. Artificial intelligence, machine learning, and sensor fusion are being applied across inspection, detection, and verification processes. Automated screening lanes, non intrusive scanning systems, and integrated command centers are enabling faster, more accurate security checks.

Biometrics, such as facial recognition and fingerprint identification, are streamlining passenger flow while ensuring identity assurance. AI based threat detection systems can identify anomalies in behavior or luggage content, reducing false alarms and improving efficiency. In parallel, blockchain is emerging as a tool for secure data management, ensuring passenger information integrity across borders and agencies.

The integration of IoT devices allows airports, seaports, and railway stations to build connected ecosystems where cameras, sensors, and scanners communicate dynamically. These intelligent networks create predictive security environments that can respond proactively to emerging risks.

Market Segmentation by Security Solution

Baggage Inspection Systems

Baggage inspection is the backbone of passenger security infrastructure. The latest generation of inspection systems combines X ray imaging with artificial intelligence to automatically detect prohibited items such as explosives, weapons, and contraband. Dual energy and computed tomography (CT) scanning technologies are enhancing image quality and depth perception, making it easier for operators to identify threats in complex baggage layouts.

The automation of baggage inspection also plays a key role in improving passenger throughput. Machine learning algorithms are continuously trained on massive datasets, allowing systems to recognize potential hazards with minimal human intervention. By 2035, fully autonomous baggage inspection units may dominate major transport hubs, reducing both operational costs and human error.

Explosive Trace Detectors (ETD)

Explosive trace detection systems remain essential for identifying microscopic particles of hazardous substances on luggage, clothing, or surfaces. Modern ETD devices use advanced ion mobility spectrometry and mass spectrometry for rapid, accurate detection. The miniaturization of these systems allows for greater deployment flexibility at checkpoints, cargo areas, and boarding gates.

Integration with AI analytics platforms enhances sensitivity while minimizing false positives. Future ETD systems will likely be networked within broader security ecosystems, where real time data sharing improves coordination between local and international security agencies.

Hand Held Scanners

Hand held scanners remain indispensable for manual screening and secondary inspections. Modern scanners are becoming more versatile, integrating multiple detection capabilities such as metal detection, radiation sensing, and chemical analysis. These portable devices are particularly useful in field operations, remote checkpoints, and rapid deployment scenarios.

The next generation of hand held scanners is expected to feature wireless connectivity, allowing data synchronization with central command systems. This enhances traceability, accountability, and real time decision making across different security teams.

Full Body Scanners

Full body scanning technology has become increasingly vital in airport and seaport security. Current systems utilize millimeter wave and backscatter X ray technologies to detect concealed weapons or explosives without physical contact. The evolution of privacy preserving algorithms ensures that these scans display only object outlines rather than detailed body images, maintaining passenger dignity and regulatory compliance.

Future scanners will integrate AI for anomaly detection, automatically distinguishing between benign and suspicious objects. Moreover, improvements in scanning speed and radiation safety will make full body scanners standard at both domestic and international transport terminals.

Access Control Systems

Access control represents the digital frontier of passenger security. These systems regulate entry to restricted zones, using biometric identification, smart cards, or mobile credentials. With airports, ports, and train stations expanding in size and complexity, advanced access control systems are essential to prevent unauthorized movement.

The future of access control lies in multimodal biometrics, combining facial, voice, and iris recognition. By 2035, AI enabled access control systems will be integrated with threat intelligence networks, allowing proactive responses to potential breaches and identity fraud.

Market Segmentation by End User

Airports

Airports remain the largest consumers of passenger security systems. The International Civil Aviation Organization (ICAO) has mandated stricter security protocols, pushing global airports to invest in next generation scanning and verification solutions. AI driven baggage inspection, biometric boarding, and automated security gates are streamlining the passenger experience while maintaining stringent safety standards.

Post pandemic recovery has accelerated digital transformation in aviation security. Airports are adopting contactless security systems that combine hygiene, efficiency, and intelligence. From facial recognition boarding to smart surveillance analytics, the aviation sector represents the technological frontier of passenger security evolution.

Seaports

Seaports are expanding their security operations as global maritime trade and passenger ferry traffic increase. Smuggling, illegal immigration, and terrorism threats necessitate sophisticated detection and surveillance systems. Seaport authorities are investing in integrated command centers that link access control, CCTV, and cargo scanning systems into unified networks.

Biometric crew authentication and advanced perimeter intrusion systems are becoming standard practice. Additionally, environmental monitoring sensors are being added to detect hazardous materials, ensuring both passenger and port safety. As autonomous ships and smart ports become mainstream, AI driven security systems will play a central role in operational governance.

Railway Stations

The railway sector is emerging as a fast growing segment of the passenger security market. Urban transit systems and intercity rail networks are modernizing their infrastructure to cope with rising passenger volumes and security threats. Modern rail security includes CCTV analytics, trackside surveillance, and passenger screening portals designed to minimize congestion while ensuring protection.

AI enabled crowd monitoring helps railway authorities identify unusual behavior and prevent potential incidents. By 2035, smart rail stations will be equipped with integrated platforms combining biometric entry, digital ticketing, and real time security analytics.

Market Segmentation by Investment Type

The passenger security market features two major investment categories: greenfield projects and upgradation of existing infrastructure. Greenfield investments, particularly in emerging economies, are creating opportunities for next generation technology deployment from the ground up. Meanwhile, developed nations are focusing on retrofitting existing systems with AI and automation to enhance operational efficiency.

Public private partnerships (PPPs) are playing a significant role in financing major transport security projects. Governments are incentivizing private players to invest in advanced screening technologies and cybersecurity systems. Over the next decade, multi billion dollar investments will reshape the security architecture of global transportation networks.

Regional Outlook (2025–2035)

North America remains a dominant force in the global passenger security market, supported by early adoption of advanced screening technologies and strong regulatory frameworks. The United States Transportation Security Administration (TSA) continues to invest heavily in AI enabled detection systems and biometric identity management.

Europe follows closely with its emphasis on privacy compliant security technologies and the implementation of the European Union Aviation Security Regulation. The region’s growing high speed rail network and intermodal transport systems are generating new opportunities for integrated passenger security solutions.

Asia Pacific is expected to exhibit the fastest growth between 2025 and 2035, driven by rapid urbanization, expanding airport infrastructure, and growing maritime trade. China, India, Japan, and South Korea are leading investments in smart transportation ecosystems that incorporate AI, biometrics, and 5G connectivity.

The Middle East and Africa are modernizing their airport and seaport infrastructure to support tourism and logistics development. Mega hub airports in Dubai, Doha, and Riyadh are setting new benchmarks for global passenger security standards. Latin America is steadily improving its transport security frameworks, with Brazil and Mexico emerging as regional leaders.

Competitive Landscape

The global passenger security market is characterized by high innovation intensity and strategic collaboration. Leading players such as Smiths Detection, L3Harris Technologies, Rapiscan Systems, Thales Group, and Leidos Holdings are continuously developing more efficient scanning and access control systems.

Start ups specializing in AI based threat detection and biometric verification are reshaping competition through rapid technological disruption. Strategic mergers and acquisitions are enabling established companies to expand their portfolios and integrate digital solutions into traditional security systems.

Cybersecurity is becoming an inseparable component of passenger security. As systems become interconnected, protecting digital infrastructure from cyberattacks is as crucial as preventing physical threats. Companies offering end to end security, from perimeter defense to digital data protection, will gain a competitive edge in the coming decade.

Market Drivers and Challenges

The primary market drivers include rising global passenger traffic, heightened terrorism threats, and growing demand for automation in security operations. The adoption of smart airports, digital seaports, and intelligent railway networks is accelerating technology deployment across regions.

Challenges persist. High implementation costs, privacy concerns, and interoperability issues between legacy and modern systems can slow adoption. Furthermore, the need for international regulatory harmonization remains critical to ensure global consistency in passenger screening and data handling.

Continuous research into privacy preserving AI, cost efficient sensor systems, and cross platform integration will help overcome these barriers.

Future Outlook: Passenger Security 2035 and Beyond

The future of passenger security will be defined by predictive intelligence and seamless integration. By 2035, security systems will no longer be reactive but proactive, anticipating threats through data analytics and real time monitoring. AI powered decision systems will manage entire security operations autonomously, ensuring rapid response and reduced human dependency.

Sustainability will also become a key factor. Energy efficient scanners, recyclable sensor materials, and low emission manufacturing processes will align passenger security with global environmental goals. The digitalization of travel, combined with virtual identity management, will enable a more fluid and secure passenger journey across air, sea, and land.

Ultimately, the passenger security market is not just about protecting transportation systems it is about enabling trust in the interconnected world of global mobility. Through intelligent technologies, human centric design, and collaborative governance, the industry is paving the way for safer and smarter travel for generations to come.

Table of Contents

1 Introduction

1.1 Objectives of the Study

1.2 Market Definition

1.2.1 Regional Scope

1.2.2 Years Considered for the Study

1.3 Currency & Pricing

1.4 Market Stakeholders

2 Research Methodology

2.1 Research Data

2.2 Secondary Data

2.3 Market Definition & Scope

2.4 Market Segmentation

2.5 Exclusions & Limitation

2.5.1 Exclusion

2.5.2 Limitation

2.5.3 Primary Data

2.6 Breakdown of Primaries

2.7 Research Approach & Methodology

2.8 Market Breakdown & Data Triangulation

2.9 Market Sizing & Forecasting

3 Executive Summary

4 Premium Insights

4.1 Attractive Growth Opportunities in Passenger Security Market

4.2 Passenger Security Market for Baggage Inspection Systems, By Type

4.3 Airport Passenger Security Market, By Hub

4.4 Passenger Security Market, By Region

5 Market Overview

5.1 Respondent Profiling

5.2 Respondent Profiling – Demand Side

5.3 Market Overview: Snapshot

6 Industry Trends

6.1 Introduction

6.2 Technology Trends

6.3 Innovations & Patent Registrations

7 By Security Solution

7.1 Baggage Inspection Systems

7.1.1 Computed Tomography

7.1.2 X-Ray Scanners

7.2 Explosive Trace Detectors

7.3 Hand-Held Scanners

7.4 Walk-Through Metal Detectors

7.5 Full-Body Scanners

7.6 Perimeter Intrusion Detection Systems

7.7 Video Management Systems

7.8 Access Control/Biometric Systems

7.9 Bar-Coded Boarding Systems

7.10 Cybersecurity Solutions

8 By End User

8.1 Commercial Airports

8.1.1 Large Hub (Above 9.5 Million)

8.1.2 Medium Hub (2.5-9.5 Million)

8.1.3 Small Hub (Less Than 2.5 Million))

8.2 Seaport

8.3 Railway Stations

9 By Investment Type

9.1 Introduction

9.2 New Demand

9.3 Replacement

10 Regional Analysis

10.1 Introduction

10.2 North America

10.2.1 US

10.2.1 Canada

10.3 Europe

10.3.1 Russia

10.3.2 Germany

10.3 Europe

10.3.1 Russia

10.3.2 Germany

10.3.3 UK

10.3.4 Italy

10.3.5 France

10.3.6 Spain

10.4 Asia Pacific

10.4.1 China

10.4.2 Japan

10.4.3 India

10.4.4 South Korea

10.4.5 Philippines

10.4.6 Australia

10.5 Middle East & Africa

10.5.1 UAE

10.5.2 Saudi Arabia

10.5.3 Turkey

10.5.4 South Africa

10.6 South America

10.6.5 Brazil

10.6.6 Mexico

11 Competitive Landscape

11.1 Introduction

11.2 Major Players, 2018

11.3 Competitive Scenario

11.4 Competitive Leadership Mapping

11.5 Competitive Scenario

12 Company Profiles

12.1 Adani Systems Inc.

12.2 Advanced Perimeter Systems Ltd.

12.3 Autoclear, LLC.

12.4 Axis Communications AB.

12.5 Bosch Sicherheitssysteme GmbH

12.6 C.E.I.A. SPA

12.7 Flir Systems, Inc.

12.8 Honeywell International Inc.

12.9 L3 Security & Detection Systems

12.10 Navtech Radar

12.11 Rapiscan Systems

12.12 Sensurity Ltd.

12.13 Siemens

12.14 SITA

12.15 Smiths Detection Group Ltd.

13 Appendix

List of Tables (136 Tables)

Table 1 Baggage Inspection Systems Market Size, By Region, 2017–2024 (USD Million)

Table 2 Explosives Trace Detectors Market Size, By Region, 2017–2024 (USD Million)

Table 3 Hand-Held Scanners Market Size, By Region, 2017–2024 (USD Million)

Table 4 Walk-Through Metal Detectors Market Size, By Region, 2017–2024 (USD Million)

Table 5 Full-Body Scanners Market Size, By Region, 2017–2024 (USD Million)

Table 6 Perimeter Intrusion Detection Systems Market Size, By Region, 2017–2024 (USD Million)

Table 7 Video Management Systems Market Size, By Region, 2017–2024 (USD Million)

Table 8 Access Control/Biometric Systems Market Size, By Region, 2017–2024 (USD Million)

Table 9 Bar-Coded Boarding Systems Market Size, By Region, 2017–2024 (USD Million)

Table 10 Cybersecurity Solutions Market Size, By Region, 2017–2024 (USD Million)

Table 11 Baggage Inspection Systems Market Size, By Type, 2017–2024 (USD Million)

Table 12 Passenger Security Size, By End User 2017–2024 (USD Million)

Table 13 Commercial Airports Market Size, By Airport Hub 2017–2024 (USD Million)

Table 14 Commercial Airports Market Size, By Region 2017–2024 (USD Million)

Table 15 Seaport Market Size, By Region 2017–2024 (USD Million)

Table 16 Railway Stations Market Size, By Region 2017–2024 (USD Million)

Table 17 Passenger Security Size, By Investment Type, 2017–2024 (USD Million))

Table 18 Replacement Market Size, By Region, 2017–2024 (USD Million)

Table 19 New Demand Market Size, By Region, 2017–2024 (USD Million)

Table 20 Passenger Security Size, By Region, 2017–2024 (USD Million)

Table 21 North America Passenger Security Size, By Country, 2017–2024 (USD Million)

Table 22 North America Passenger Security Size, By End User, 2017–2024 (USD Million)

Table 23 North America Passenger Security Size, By Investment Type, 2017–2024 (USD Million)

Table 24 North America: Commercial Airport Passenger Security Size, By Airport Hub, 2017–2024 (USD Million)

Table 25 North America Passenger Security Size, By Security Solution, 2017–2024 (USD Million)

Table 26 US Passenger Security Size, By Investment Type, 2017–2024 (USD Million)

Table 27 US Passenger Security Size, By End User,2017–2024 (USD Million)

Table 28 US Commercial Airport Passenger Security Size, By Airport Hub, 2017–2024 (USD Million)

Table 29 Canada Passenger Security Size, By Investment Type, 2017–2024 (USD Million)

Table 30 Canada Passenger Security Size, End User, 2017–2024 (USD Million)

Table 31 Canada Commercial Airport Passenger Security Size, By Airport Hub, 2017–2024 (USD Million)

Table 32 Europe Passenger Security Size, By Country, 2017–2024 (USD Million)

Table 33 Europe Passenger Security Size, By End User, 2017–2024 (USD Million)

Table 34 Europe Commercial Airport Passenger Security Size, By, Airport Hub2017–2024 (USD Million)

Table 35 Europe Passenger Security Size, By Investment Type, 2017–2024 (USD Million)

Table 36 Europe Passenger Security Size, By Security Solution, 2017–2024 (USD Million)

Table 37 Russia Passenger Security Size, By Investment Type, 2017–2024 (USD Million)

Table 38 Russia Passenger Security Size, By End User, 2017–2024 (USD Million)

Table 39 Russia Commercial Airport Passenger Security Size, By, Airport Hub 2017–2024 (USD Million)

Table 40 Germany Passenger Security Market Size, By Investment Type, 2017–2024 (USD Million)

Table 41 Germany Passenger Security Size, By End User, 2017–2024 (USD Million)

Table 42 Germany Commercial Airport Passenger Security Size, By, Airport Hub 2017–2024 (USD Million)

Table 43 UK Passenger Security Size, By Investment Type, 2017–2024 (USD Million)

Table 44 UK Passenger Security Size, By End User, 2017–2024 (USD Million)

Table 45 UK Commercial Airport Passenger Security Size, By, Airport Hub 2017–2024 (USD Million)

Table 46 Italy Passenger Security Size, By Investment Type, 2017–2024 (USD Million)

Table 47 Italy Passenger Security Size, By End User, 2017–2024 (USD Million)

Table 48 Italy Commercial Airport Passenger Security Size, By, Airport Hub 2017–2024 (USD Million)

Table 49 France Passenger Security Size, By Investment Type, 2017–2024 (USD Million)

Table 50 France Passenger Security Size, By End User, 2017–2024 (USD Million)

Table 51 France Commercial Airport Passenger Security Size, By, Airport Hub 2017–2024 (USD Million)

Table 52 Spain Passenger Security Size, By Investment Type, 2017–2024 (USD Million)

Table 53 Spain Passenger Security Size, By End User, 2017–2024 (USD Million)

Table 54 Spain Commercial Airport Passenger Security Size, By, Airport Hub 2017–2024 (USD Million)

Table 55 Asia Pacific Passenger Security Size, By Country, 2017–2024 (USD Million)

Table 56 Asia Pacific Passenger Security Size, By End User, 2017–2024 (USD Million)

Table 57 Asia Pacific Commercial Airport Passenger Security Size, By, Airport Hub2017–2024 (USD Million)

Table 58 Asia Pacific Passenger Security Size, By Investment Type, 2017–2024 (USD Million)

Table 59 Asia Pacific Passenger Security Size, By Security Solution, 2017–2024 (USD Million)

Table 60 China Passenger Security Size, By Investment Type, 2017–2024 (USD Million)

Table 61 China Passenger Security Size, By End User, 2017–2024 (USD Million)

Table 62 China Commercial Airport Passenger Security Market Size, By, Airport Hub 2017–2024 (USD Million)

Table 63 Japan Passenger Security Size, By Investment Type, 2017–2024 (USD Million)

Table 64 Japan Passenger Security Size, By End User, 2017–2024 (USD Million)

Table 65 Japan Commercial Airport Passenger Security Size, By, Airport Hub 2017–2024 (USD Million)

Table 66 India Passenger Security Size, By Investment Type, 2017–2024 (USD Million)

Table 67 India Passenger Security Size, By End User, 2017–2024 (USD Million)

Table 68 India Commercial Airport Passenger Security Market Size, By, Airport Hub 2017–2024 (USD Million)

Table 69 South Korea Passenger Security Size, By Investment Type, 2017–2024 (USD Million)

Table 70 South Korea Passenger Security Size, By End User, 2017–2024 (USD Million)

Table 71 South Korea Commercial Airport Passenger Security Size, By, Airport Hub 2017–2024 (USD Million)

Table 72 South Korea Commercial Airport Passenger Security Size, By, Airport Hub 2017–2024 (USD Million)

Table 73 Philippines Passenger Security Size, By End User, 2017–2024 (USD Million)

Table 74 Philippines Commercial Airport Passenger Security Size, By, Airport Hub 2017–2024 (USD Million)

Table 75 Australia Passenger Security Size, By Investment Type, 2017–2024 (USD Million)

Table 76 Australia Passenger Security Size, By End User, 2017–2024 (USD Million)

Table 77 Australia Commercial Airport Passenger Security Size, By, Airport Hub 2017–2024 (USD Million)

Table 78 Middle East & Africa Passenger Security Size, By Country, 2017–2024 (USD Million)

Table 79 Middle East & Africa Passenger Security Size, By End User, 2017–2024 (USD Million)

Table 80 Middle East & Africa Commercial Airport Passenger Security Size, By, Airport Hub2017–2024 (USD Million)

Table 81 Middle East & Africa Passenger Security Size, By Investment Type, 2017–2024 (USD Million)

Table 82 Middle East & Africa Passenger Security Size, By Security Solution, 2017–2024 (USD Million)

Table 83 UAE Passenger Security Size, By Investment Type, 2017–2024 (USD Million)

Table 84 UAE Passenger Security Size, By End User, 2017–2024 (USD Million)

Table 85 UAE Commercial Airport Passenger Security Size, By, Airport Hub 2017–2024 (USD Million)

Table 86 Saudi Arabiapassenger Security Size, By Investment Type, 2017–2024 (USD Million)

Table 87 Saudi Arabia Passenger Security Size, By End User, 2017–2024 (USD Million)

Table 88 Saudi Arabia Commercial Airport Passenger Security Size, By, Airport Hub 2017–2024 (USD Million)

Table 89 Turkey Passenger Security Size, By Investment Type, 2017–2024 (USD Million)

Table 90 Turkey Passenger Security Size, By End User, 2017–2024 (USD Million)

Table 91 Turkey Commercial Airport Passenger Security Size, By, Airport Hub 2017–2024 (USD Million)

Table 92 South Africa Passenger Security Size, By Investment Type, 2017–2024 (USD Million)

Table 93 South Africa Passenger Security Size, By End User, 2017–2024 (USD Million)

Table 94 South Africa Commercial Airport Passenger Security Market Size, By, Airport Hub 2017–2024 (USD Million)

Table 95 South America Passenger Security Size, By Country, 2017–2024 (USD Million)

Table 96 South America Passenger Security Size, By End User, 2017–2024 (USD Million)

Table 97 South America Commercial Airport Passenger Security Size, By, Airport Hub2017–2024 (USD Million)

Table 98 South America Passenger Security Size, By Investment Type, 2017–2024 (USD Million)

Table 99 South America Passenger Security Size, By Security Solution, 2017–2024 (USD Million)

Table 100 Brazil Passenger Security Market Size, By Investment Type, 2017–2024 (USD Million)

Table 101 Brazil Passenger Security Size, By End User, 2017–2024 (USD Million)

Table 102 Brazil Commercial Airport Passenger Security Market Size, By, Airport Hub 2017–2024 (USD Million)

Table 103 Mexico Passenger Security Size, By Investment Type, 2017–2024 (USD Million)

Table 104 Mexico Passenger Security Size, By End User, 2017–2024 (USD Million)

Table 105 Mexico Commercial Airport Passenger Security Market Size, By, Airport Hub 2017–2024 (USD Million)

Table 106 Contracts, April 2013–February 2019

Table 107 New Product Launches, April 2013–February 2019

Table 108 Partnerships, Mergers, and Acquisitions, April 2013–February 2019

Table 109 Products/Services/Solutions Offered

Table 110 Recent Developments

Table 111 Products/Services/Solutions Offered

Table 112 Products/Services/Solutions Offered

Table 113 Recent Developments

Table 114 Products/Services/Solutions Offered

Table 115 Products/Services/Solutions Offered

Table 116 Recent Developments

Table 117 Products/Services/Solutions Offered

Table 118 Products/Services/Solutions Offered

Table 119 Recent Developments

Table 120 Products/Services/Solutions Offered

Table 121 Products/Services/Solutions Offered

Table 122 Products/Services/Solutions Offered

Table 123 Recent Developments

Table 124 Products/Services/Solutions Offered

Table 125 Recent Developments

Table 126 Products/Services/Solutions Offered

Table 127 Recent Developments

Table 128 Products/Services/Solutions Offered

Table 129 Recent Developments

Table 130 Products/Services/Solutions Offered

Table 131 Recent Developments

Table 132 Products/Services/Solutions Offered

Table 133 Products/Services/Solutions Offered

Table 134 Recent Developments

Table 135 Products/Services/Solutions Offered

Table 136 Recent Developments

List of Figures (44 Figures)

Figure 1 Markets Covered

Figure 2 Limitations

Figure 3 The Following Figure Depicts the Research Methodology Applied in Developing This Report on the Passenger Security Market

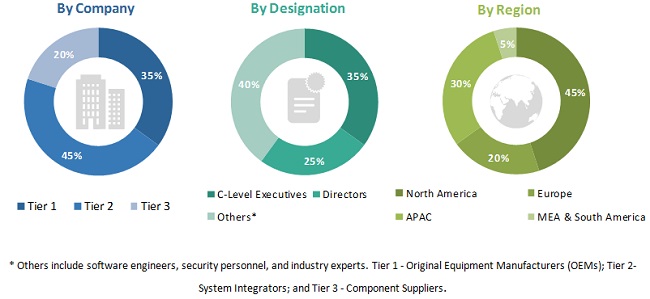

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Market Size Estimation Methodology: Bottom-Up Approach

Figure 7 Assumptions of the Research Study

Figure 8 Cybersecurity Solutions Segment Projected to Lead the Passenger Security From 2019 to 2024

Figure 9 Commercial Airports Segment Projected to Lead the Passenger Security From 2019 to 2024

Figure 10 The New Demand Segment Projected to Lead the Passenger Security From 2019 to 2024

Figure 11 Asia Pacific Segment Projected to Lead the Passenger Security From 2019 to 2024

Figure 12 Increase in Passenger Traffic and Development of Airport, Seaport, and Railway Infrastructures are Major Factors Driving the Passenger Security Market

Figure 13 Computed Tomography Scanners Expected Segment to Lead the Airport Passenger Security From 2019 to 2024

Figure 14 Large Hub Segment Expected to Lead the Airport Passenger Security From 2019 to 2024

Figure 15 Asia Pacific Expected to Lead the Passenger Security From 2019 to 2024

Figure 16 Respondent Profiling, By Type

Figure 17 Respondent Profiling, By Country

Figure 18 Supply Side Respondents, By Designation

Figure 19 Respondent Profiling, By Type of Designation

Figure 20 Respondent Profiling, By Type of Ownership

Figure 21 Respondent Profiling, By Type of Organization

Figure 22 Respondent Profiling, By Country

Figure 23 Percentage of It Budget Spent on Cybersecurity, 2017 vs 2018

Figure 24 Passenger Security, By Security Solution, 2017–2024 (USD Million)

Figure 25 Passenger Security, By End User, 2019 & 2024 (USD Million)

Figure 26 Passenger Security, By End User, 2019 & 2024 (USD Million)

Figure 27 New Demand Segment Projected to Lead the Passenger Security Market From 2019 to 2024

Figure 28 Passenger Security Market Snapshot

Figure 29 North America Passenger Security Market Snapshot

Figure 30 Europe Passenger Security Market Snapshot

Figure 31 Asia Pacific Passenger Security Market Snapshot

Figure 32 Middle East & Africa Passenger Security Market Snapshot

Figure 33 South America Passenger Security Market Snapshot

Figure 34 Major Players in the Market, 2018

Figure 35 Companies Adopted New Product Launches as the Key Growth Strategy From April 2013 to February 2019

Figure 36 Axis Communications: Company Snapshot

Figure 37 SWOT Analysis: Axis Communications AB

Figure 38 SWOT Analysis: Bosch Sicherheitssysteme GmbH

Figure 39 Flir Systems Inc.: Company Snapshot

Figure 40 Honeywell International Inc.: Company Snapshot

Figure 41 SWOT Analysis: Honeywell International Inc.

Figure 42 Siemens: Company Snapshot

Figure 43 SWOT Analysis: SITA

Figure 44 SWOT Analysis: Smiths Detection Systems Ltd.

The study involved four major activities to estimate the current size of the passenger security market. Exhaustive secondary research was undertaken to collect information on the market, the peer markets, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both, top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg, BusinessWeek, and various periodicals were referred to identify and collect information for this study. Secondary sources also included annual reports, press releases & investor presentations of companies, certified publications, articles by recognized authors, and passenger security databases.

Primary Research

The passenger security market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations in the supply chain. The demand-side of this market is characterized by various end users, such as component manufacturers as well as facility providers and OEMs. The supply-side is characterized by technology advancements in security solutions and the development of Cybersecurity solutions. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the passenger security market. These methods were also used extensively to estimate the size of various subsegments of the market. The research methodology used to estimate the market size includes the following:

- Key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation process explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides of the passenger security industry.

Report Objectives

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the passenger security market

- To analyze the impact of macro and micro indicators on the market

- To forecast the market size of segments for five regions, namely, North America, Europe, Asia Pacific, Middle East & Africa, and South America, along with major countries in each of these regions

- To strategically analyze micromarkets with respect to individual technological trends, prospects, and their contribution to the overall market

- To strategically profile key market players and comprehensively analyze their market ranking and core competencies

- To provide a detailed competitive landscape of the market, along with an analysis of business and corporate strategies, such as contracts, agreements, partnerships, acquisitions, and new product developments

- To identify detailed financial positions, key products, unique selling points, and key developments of leading companies in the market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations according to a company’s specific needs

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiles of additional market players (up to 5)

Growth opportunities and latent adjacency in Passenger Security Market

Hello, I'm thinking of buying this report. But before buying, I have some questions. 1. Is this market size the world market size? 2. I want to know about executive summary(p3) and railway station. Can I buy only the pages which are related to railway station? 3. How can I buy this report?