Wound Care Biologics Market by Product (Biological Skin Substitutes, Topical Agents), Wound Type (Ulcers [Diabetic Foot, Venous, Pressure Ulcers], Surgical & Traumatic Wounds, Burns), End User (Hospitals, ASCs, Burn Centers) & Region – Global Forecast to 2027

The global wound care biologics market in terms of revenue was estimated to be worth $1.8 billion in 2022 and is poised to reach $2.4 billion by 2027, growing at a CAGR of 5.4% from 2022 to 2027. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. Market growth is driven by the increasing incidence of burn injuries and innovations in wound care biologics.

To know about the assumptions considered for the study, Request for Free Sample Report

Wound Care Biologics Market Dynamics

Driver: How does the growing prevalence of diseases & conditions affect the wound healing capabilities?

Physical health conditions, such as chronic wounds and surgical wounds, have a negative effect on wound healing. The prevalence of chronic and surgical wounds has increased significantly over the past decade, primarily due to the growing global geriatric population, the rising number of traumatic wounds, the increasing number of surgeries, and the increasing prevalence of conditions like diabetes. Diabetes can increase the overall incidence and complexity of wounds such as infections, ulcerations (leg or foot ulcers), and chronic wounds, which require treatments and incur exorbitant medical expenses. Clearly, the healing of ulcerations in a timely manner is of central importance in any plan for amputation prevention and limb preservation. Wound care biologic products such as bioengineered dermal substitutes promote the healing of chronic ulcerations via two principal modes of action. Firstly, it provides living, human dermal fibroblasts that deposit matrix proteins and facilitate angiogenesis. It also provides a preformed collagen matrix, receptors, and bound growth factors that facilitate the migration and colonization of the host’s epithelial cells, promoting wound closure. Such advantages offered by wound care biologic products will stimulate their demand for faster healing of wounds.

Opportunity: What is the role of 3D printers in the wound care biologics market?

The use of 3D printers has grown extensively in different tissue engineering applications. More recently, specialized printers, also called skin printers, have been introduced to create skin substitutes. A key example is a printer developed by a team from the University of Toronto (Canada) and the Ross Tilley Burn Center at Sunnybrook Hospital (Canada). Further R&D on skin printing will significantly impact the market due to current limitations that do not allow more than two types of cell lines to be incorporated into skin substitutes (largely attributed to the current lack of technology). This will also be a significant benefit for burn victims, who have so far had only limited options for repairing disfigured skin, such as skin grafts (which are painful and aesthetically unappealing) and hydrotherapy solutions (which provide limited results).

Restraint: Why is the high cost of wound care biologic products a critical restraining factor that is holding back growth of market?

The high cost of chronic wound therapies and wound care biologics may negatively affect their adoption, especially in cost-sensitive markets such as Asia and the RoW. In the case of DFUs—a key application for wound care biologics—this further drives up overall healthcare expenditures, as DFUs are highly prevalent among the 22.3 million Americans with diabetes; they affect as many as 6% of its population. Although many bioengineered products are available in these markets, physicians and patients tend to opt for traditional and basic wound care products due to their low costs. Owing to this significant cost difference, physicians and patients are reluctant to adopt technologically advanced products, which, in turn, is likely to hinder the growth of the market.

Biological skin substitutes segment accounted for the largest share of the wound care biologics industry, by product

The global wound care biologics market is segmented into biological skin substitutes and topical agents based on product. Biological skin substitutes dominated the market in 2021. Factors contributing to the growth of this market segment include the increasing prevalence of target conditions such as ulcers and the rising geriatric population.

Ulcers segment accounted for the largest share in the wound care biologics industry, by wound type

The wound care biologics market is segmented into ulcers, surgical & traumatic wounds, and burns by wound type. The ulcers segment accounted for the largest share of the market in 2021. Factors such as the increasing incidence of diabetes and growing geriatric patient population, the increasing prevalence of DFUs, and the growing incidence of venous leg ulcers are driving the growth of this segment.

Hospitals segment accounted for the largest share in the wound care biologics industry, by end user

The wound care biologics market is segmented into hospitals, ambulatory surgery centers, and burn care centers & wound clinics. In 2021, hospitals accounted for the largest share of the market. This can be attributed to the high demand for wound care biologic products in hospitals and the high patient inflow in this care setting.

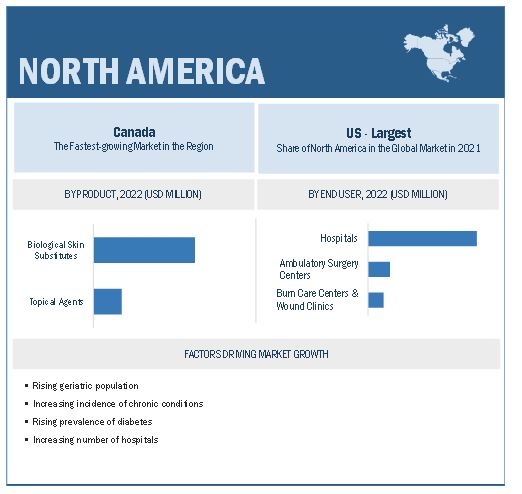

North America accounted for the largest share of the wound care biologics industry

The global wound care biologics market is segmented into five major regions namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. North America accounted for the largest share of the market in 2021. Factors such as the increasing prevalence of chronic disorders, increasing healthcare spending, and the increasing demand for advanced wound treatment options like wound care biologics products are contributing to the large share of this regional segment.

To know about the assumptions considered for the study, download the pdf brochure

The wound care biologics market is dominated by players such as Smith & Nephew plc (UK), Organogenesis Inc. (US), MIMEDX (US), Integra LifeSciences (US), and Stryker Corporation (US).

Scope of the Wound Care Biologics Industry

|

Report Metric |

Details |

|

Market Revenue in 2022 |

$1.8 billion |

|

Projected Revenue by 2027 |

$2.4 billion |

|

Revenue Rate |

poised to grow at a CAGR of 5.4% |

|

Market Driver |

How does the growing prevalence of diseases & conditions affect the wound healing capabilities? |

|

Market Opportunity |

What is the role of 3D printers in the wound care biologics market? |

This report categorizes the wound care biologics market to forecast revenue and analyze trends in each of the following submarkets:

By Product

-

Biological Skin Substitutes

- Human Donor Tissue-derived Products

- Acellular Animal-derived Products

- Biosynthetic Products

- Topical Agents

By Wound Type

-

Ulcers

- Diabetic Foot Ulcers

- Venous Ulcers

- Pressure Ulcers

- Other Ulcers

- Surgical & Traumatic Wounds

- Burns

By End User

- Hospitals

- Ambulatory Surgery Centers

- Burn Care Centers & Wound Clinics

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

- Latin America

- Middle East & Africa

Recent Developments of Wound Care Biologics Industry

- In June 2021, MIMEDX (US) received approval from the Japanese Ministry of Health, Labour and Welfare for the commercialization of Epifix in Japan.

- In April 2021, Kerecis (Iceland) launched its Kerecis Omega3 GraftGuide, an intact fish skin that uniquely addresses the challenges of burn healing.

- In January 2021, Integra LifeSciences (US) acquired ACell, Inc. (US). This acquisition enabled Integra to provide more comprehensive and complex wound management solutions.

- In November 2020, Stryker Corporation (US) acquired Wright Medical Group N.V. (Netherlands), a global medical devices company focused on extremities and biologics.

- In May 2019, Organogenesis Inc. (US) entered into an agreement with Vizient (US). This agreement allowed Organogenesis to extend its offerings of advanced wound care products to more than 3,100 hospitals.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the wound care biologics market?

The wound care biologics market boasts a total revenue value of $2.4 billion by 2027.

What is the estimated growth rate (CAGR) of the wound care biologics market?

The global wound care biologics market has an estimated compound annual growth rate (CAGR) of 5.4% and a revenue size in the region of $1.8 billion in 2022.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 27)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS OF THE STUDY

1.2.2 MARKETS COVERED

FIGURE 1 MARKET

1.2.3 YEARS CONSIDERED FOR THE STUDY

1.3 CURRENCY

1.4 LIMITATIONS

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 31)

2.1 RESEARCH DATA

2.2 RESEARCH APPROACH

FIGURE 2 WOUND CARE BIOLOGICS MARKET: RESEARCH DESIGN METHODOLOGY

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Primary sources

2.2.2.2 Key data from primary sources

2.2.2.3 Key industry insights

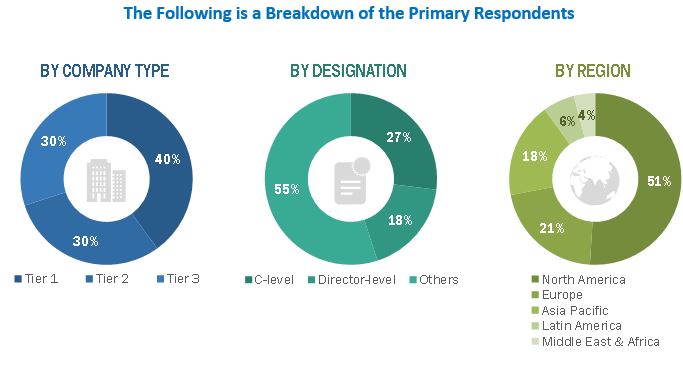

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

2.3.1.1 Approach 1: Company revenue estimation approach

FIGURE 4 BOTTOM-UP APPROACH: COMPANY REVENUE ESTIMATION APPROACH

2.3.1.2 Approach 3: Presentations of companies and primary interviews

2.3.1.3 Growth forecast

2.3.1.4 CAGR projections

FIGURE 5 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

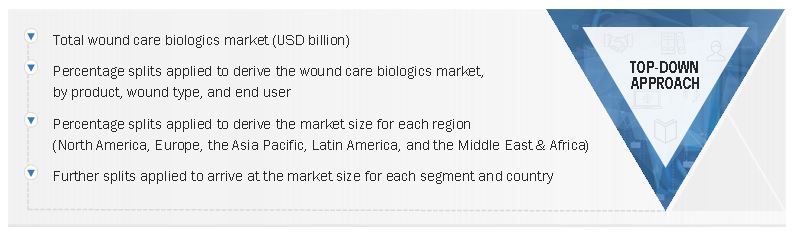

2.3.2 TOP-DOWN APPROACH

FIGURE 6 MARKET: TOP-DOWN APPROACH

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION METHODOLOGY

2.5 MARKET SHARE

2.6 ASSUMPTIONS FOR THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 41)

FIGURE 8 WOUND CARE BIOLOGICS INDUSTRY, BY PRODUCT, 2022 VS. 2027 (USD MILLION)

FIGURE 9 MARKET, BY WOUND TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 10 MARKET, BY END USER, 2022 VS. 2027 (USD MILLION)

FIGURE 11 WOUND CARE BIOLOGICS INDUSTRY, BY REGION, 2022 VS. 2027 (USD MILLION)

4 PREMIUM INSIGHTS (Page No. - 44)

4.1 WOUND CARE BIOLOGICS MARKET OVERVIEW

FIGURE 12 INCREASING PREVALENCE OF DIABETES TO DRIVE MARKET FOR WOUND CARE BIOLOGICS

4.2 MARKET SHARE, BY PRODUCT, 2022 VS. 2027

FIGURE 13 BIOLOGICAL SKIN SUBSTITUTES WILL CONTINUE TO DOMINATE MARKET IN 2027

4.3 MARKET SHARE, BY WOUND TYPE, 2022 VS. 2027

FIGURE 14 ULCERS SEGMENT DOMINATES MARKET

4.4 MARKET SHARE, BY END USER, 2022 VS. 2027

FIGURE 15 HOSPITALS ARE LARGEST END USERS OF WOUND CARE BIOLOGICS

4.5 MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 16 ASIA PACIFIC TO REGISTER HIGHEST GROWTH IN MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 47)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 WOUND CARE BIOLOGICS INDUSTRY: DRIVERS, RESTRAINTS, AND OPPORTUNITIES

5.2.1 DRIVERS

5.2.1.1 Growing prevalence of diseases & conditions affecting wound healing capabilities

5.2.1.1.1 Growing geriatric population

5.2.1.1.2 Increasing prevalence of diabetes and target conditions

FIGURE 18 PREVALENCE OF DIABETES IN ADULTS (20–79 YEARS), BY REGION, 2021 VS. 2045 (MILLION CASES)

TABLE 1 TOTAL HEALTH EXPENDITURE (USD) DUE TO DIABETES (20–79 YEARS) IN 2021, BY COUNTRY

TABLE 2 LIST OF COMMERCIALLY AVAILABLE SKIN SUBSTITUTES, THEIR INDICATIONS, AND SUPPORTING EVIDENCE FOR USE IN CHRONIC WOUNDS

5.2.1.1.3 Increasing number of surgical procedures across the globe

5.2.1.1.4 Increasing number of traumatic wounds

TABLE 3 PREVALENCE OF ROAD ACCIDENTS

5.2.1.2 Increasing incidence of burn injuries

5.2.1.3 Innovations in wound care biologics

5.2.2 MARKET RESTRAINTS

5.2.2.1 High cost of wound care biologic products

TABLE 4 AVERAGE COST OF TREATMENT FOR DIABETIC FOOT ULCERS (2018)

5.2.2.2 Risk of skin substitute failure

TABLE 5 COMPARISON OF OUTCOMES (STSG VS. FTSG PATIENTS)

5.2.3 OPPORTUNITIES

5.2.3.1 Growth potential of emerging economies

TABLE 6 STRATEGIC DEVELOPMENTS IN THE ASIA PACIFIC

5.2.3.2 3D skin printing

5.3 IMPACT OF COVID-19 ON THE MARKET

6 WOUND CARE BIOLOGICS MARKET, BY PRODUCT (Page No. - 57)

6.1 INTRODUCTION

TABLE 7 WOUND CARE BIOLOGICS INDUSTRY, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 8 MARKET, BY PRODUCT, 2021–2027 (USD MILLION)

6.2 BIOLOGICAL SKIN SUBSTITUTES

TABLE 9 KEY PRODUCTS IN THE BIOLOGICAL SKIN SUBSTITUTES MARKET

TABLE 10 MARKET FOR BIOLOGICAL SKIN SUBSTITUTES, BY REGION, 2017–2020 (USD MILLION)

TABLE 11 MARKET FOR BIOLOGICAL SKIN SUBSTITUTES, BY REGION, 2021–2027 (USD MILLION)

TABLE 12 MARKET FOR BIOLOGICAL SKIN SUBSTITUTES, BY TYPE, 2017–2020 (USD MILLION)

TABLE 13 MARKET FOR BIOLOGICAL SKIN SUBSTITUTES, BY TYPE, 2021–2027 (USD MILLION)

6.2.1 HUMAN DONOR TISSUE-DERIVED PRODUCTS

6.2.1.1 High efficacy of human donor tissue-derived products to support market demand

TABLE 14 KEY PRODUCTS IN THE HUMAN DONOR TISSUE-DERIVED PRODUCTS MARKET

TABLE 15 HUMAN DONOR TISSUE-DERIVED PRODUCTS MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 16 HUMAN DONOR TISSUE-DERIVED PRODUCTS MARKET, BY REGION, 2021–2027 (USD MILLION)

6.2.2 ACELLULAR ANIMAL-DERIVED PRODUCTS

6.2.2.1 Recognition of the importance of ECM in wound treatment has led to the development of acellular wound care biologics

TABLE 17 KEY PRODUCTS IN THE ACELLULAR ANIMAL-DERIVED PRODUCTS MARKET

TABLE 18 ACELLULAR ANIMAL-DERIVED PRODUCTS MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 19 ACELLULAR ANIMAL-DERIVED PRODUCTS MARKET, BY REGION, 2021–2027 (USD MILLION)

6.2.3 BIOSYNTHETIC PRODUCTS

6.2.3.1 Increased bioburden of infected wounds to stimulate market growth

TABLE 20 BIOSYNTHETIC PRODUCTS MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 21 BIOSYNTHETIC PRODUCTS MARKET, BY REGION, 2021–2027 (USD MILLION)

6.3 TOPICAL AGENTS

6.3.1 INCREASE IN THE NUMBER OF CHRONIC ULCERS OVER THE LAST FEW YEARS TO PROPEL MARKET GROWTH

TABLE 22 MARKET FOR TOPICAL AGENTS, BY REGION, 2017–2020 (USD MILLION)

TABLE 23 MARKET FOR TOPICAL AGENTS, BY REGION, 2021–2027 (USD MILLION)

7 WOUND CARE BIOLOGICS MARKET, BY WOUND TYPE (Page No. - 67)

7.1 INTRODUCTION

TABLE 24 WOUND CARE BIOLOGICS INDUSTRY, BY WOUND TYPE, 2017–2020 (USD MILLION)

TABLE 25 MARKET, BY WOUND TYPE, 2021–2027 (USD MILLION)

7.1.1 PRIMARY NOTES

7.1.1.1 Key industry insights

7.2 ULCERS

TABLE 26 MARKET FOR ULCERS, BY REGION, 2017–2020 (USD MILLION)

TABLE 27 MARKET FOR ULCERS, BY REGION, 2021–2027 (USD MILLION)

TABLE 28 MARKET FOR ULCERS, BY TYPE, 2017–2020 (USD MILLION)

TABLE 29 MARKET FOR ULCERS, BY TYPE, 2021–2027 (USD MILLION)

7.2.1 DIABETIC FOOT ULCERS

7.2.1.1 Increasing prevalence of diabetes to drive market growth

TABLE 30 MARKET FOR DIABETIC FOOT ULCERS, BY REGION, 2017–2020 (USD MILLION)

TABLE 31 MARKET FOR DIABETIC FOOT ULCERS, BY REGION, 2021–2027 (USD MILLION)

7.2.2 VENOUS ULCERS

7.2.2.1 Rising prevalence of obesity to drive market growth

TABLE 32 MARKET FOR VENOUS ULCERS, BY REGION, 2017–2020 (USD MILLION)

TABLE 33 MARKET FOR VENOUS ULCERS, BY REGION, 2021–2027 (USD MILLION)

7.2.3 PRESSURE ULCERS

7.2.3.1 Growing geriatric population to drive market growth

TABLE 34 MARKET FOR PRESSURE ULCERS, BY REGION, 2017–2020 (USD MILLION)

TABLE 35 MARKET FOR PRESSURE ULCERS, BY REGION, 2021–2027 (USD MILLION)

7.2.4 OTHER ULCERS

TABLE 36 COMMERCIALLY AVAILABLE WOUND CARE BIOLOGIC PRODUCTS FOR OTHER ULCERS

TABLE 37 MARKET FOR OTHER ULCERS, BY REGION, 2017–2020 (USD MILLION)

TABLE 38 MARKET FOR OTHER ULCERS, BY REGION, 2021–2027 (USD MILLION)

7.3 SURGICAL & TRAUMATIC WOUNDS

7.3.1 RISING VOLUME OF SURGICAL PROCEDURES TO DRIVE MARKET GROWTH

TABLE 39 MARKET FOR SURGICAL & TRAUMATIC WOUNDS, BY REGION, 2017–2020 (USD MILLION)

TABLE 40 MARKET FOR SURGICAL & TRAUMATIC WOUNDS, BY REGION, 2021–2027 (USD MILLION)

7.4 BURNS

7.4.1 HIGH INCIDENCE OF BURN INJURIES IN EMERGING COUNTRIES TO DRIVE MARKET GROWTH

TABLE 41 MARKET FOR BURNS, BY REGION, 2017–2020 (USD MILLION)

TABLE 42 MARKET FOR BURNS, BY REGION, 2021–2027 (USD MILLION)

8 WOUND CARE BIOLOGICS MARKET, BY END USER (Page No. - 80)

8.1 INTRODUCTION

TABLE 43 WOUND CARE BIOLOGICS INDUSTRY, BY END USER, 2017–2020 (USD MILLION)

TABLE 44 MARKET, BY END USER, 2021–2027 (USD MILLION)

8.2 HOSPITALS

8.2.1 INCREASING NUMBER OF HOSPITALS & HIGH PATIENT INFLOW IN THIS CARE SETTING TO SUPPORT MARKET GROWTH

TABLE 45 MARKET FOR HOSPITALS, BY REGION, 2017–2020 (USD MILLION)

TABLE 46 MARKET FOR HOSPITALS, BY REGION, 2021–2027 (USD MILLION)

8.3 AMBULATORY SURGERY CENTERS

8.3.1 GROWING NUMBER OF SURGICAL PROCEDURES PERFORMED IN ASCS WILL ENSURE MARKET GROWTH IN THIS SEGMENT

TABLE 47 NUMBER OF BURN PATIENTS PER 1,000 ASC ADMISSIONS

TABLE 48 PRICE ASSESSMENT OF WOUND CARE BIOLOGICS IN AMBULATORY SURGERY CENTERS IN THE US

TABLE 49 MARKET FOR AMBULATORY SURGERY CENTERS, BY REGION, 2017–2020 (USD MILLION)

TABLE 50 MARKET FOR AMBULATORY SURGERY CENTERS, BY REGION, 2021–2027 (USD MILLION)

8.4 BURN CARE CENTERS & WOUND CLINICS

8.4.1 RISING GERIATRIC POPULATION AND THE SUBSEQUENT INCREASE IN THE DEMAND FOR ASSISTED LIVING FACILITIES TO SUPPORT MARKET GROWTH

TABLE 51 MARKET FOR BURN CARE CENTERS & WOUND CLINICS, BY REGION, 2017–2020 (USD MILLION)

TABLE 52 MARKET FOR BURN CARE CENTERS & WOUND CLINICS, BY REGION, 2021–2027 (USD MILLION)

9 WOUND CARE BIOLOGICS MARKET, BY REGION (Page No. - 87)

9.1 INTRODUCTION

TABLE 53 WOUND CARE BIOLOGICS INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 54 WOUND CARE BIOLOGICS INDUSTRY, BY REGION, 2021–2027 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 19 NORTH AMERICA: WOUND CARE BIOLOGICS MARKET SNAPSHOT

TABLE 55 NORTH AMERICA: MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 56 NORTH AMERICA: MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 57 NORTH AMERICA: MARKET, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 58 NORTH AMERICA: MARKET, BY PRODUCT, 2021–2027 (USD MILLION)

TABLE 59 NORTH AMERICA: MARKET, BY WOUND TYPE, 2017–2020 (USD MILLION)

TABLE 60 NORTH AMERICA: MARKET, BY WOUND TYPE, 2021–2027 (USD MILLION)

TABLE 61 NORTH AMERICA: MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 62 NORTH AMERICA: MARKET, BY END USER, 2021–2027 (USD MILLION)

9.2.1 US

9.2.1.1 Increasing prevalence of diabetes and non-healing foot ulcers to support the uptake of wound biologics products

TABLE 63 US: MARKET, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 64 US: MARKET, BY PRODUCT, 2021–2027 (USD MILLION)

TABLE 65 US: MARKET, BY WOUND TYPE, 2017–2020 (USD MILLION)

TABLE 66 US: MARKET, BY WOUND TYPE, 2021–2027 (USD MILLION)

TABLE 67 US: MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 68 US: MARKET, BY END USER, 2021–2027 (USD MILLION)

9.2.2 CANADA

9.2.2.1 Rising geriatric patient pool to drive market growth for wound biologics in Canada

TABLE 69 INCIDENCE OF DIABETES IN CANADA, 2019 VS. 2029

TABLE 70 CANADA: WOUND CARE BIOLOGICS MARKET, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 71 CANADA: MARKET, BY PRODUCT, 2021–2027 (USD MILLION)

TABLE 72 CANADA: MARKET, BY WOUND TYPE, 2017–2020 (USD MILLION)

TABLE 73 CANADA: MARKET, BY WOUND TYPE, 2021–2027 (USD MILLION)

TABLE 74 CANADA: MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 75 CANADA: MARKET, BY END USER, 2021–2027 (USD MILLION)

9.3 EUROPE

TABLE 76 EUROPE: MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 77 EUROPE: MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 78 EUROPE: MARKET, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 79 EUROPE: MARKET, BY PRODUCT, 2021–2027 (USD MILLION)

TABLE 80 EUROPE: MARKET, BY WOUND TYPE, 2017–2020 (USD MILLION)

TABLE 81 EUROPE: MARKET, BY WOUND TYPE, 2021–2027 (USD MILLION)

TABLE 82 EUROPE: MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 83 EUROPE: MARKET, BY END USER, 2021–2027 (USD MILLION)

9.3.1 UK

9.3.1.1 Increasing incidence of venous ulcers to drive the market growth

TABLE 84 UK: WOUND CARE BIOLOGICS MARKET, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 85 UK: MARKET, BY PRODUCT, 2021–2027 (USD MILLION)

TABLE 86 UK: MARKET, BY WOUND TYPE, 2017–2020 (USD MILLION)

TABLE 87 UK: MARKET, BY WOUND TYPE, 2021–2027 (USD MILLION)

TABLE 88 UK: MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 89 UK: WOUND CARE BIOLOGICS INDUSTRY, BY END USER, 2021–2027 (USD MILLION)

9.3.2 GERMANY

9.3.2.1 The large diabetic population in Germany supports the uptake of wound biologics in Germany

TABLE 90 GERMANY: WOUND CARE BIOLOGICS MARKET, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 91 GERMANY: MARKET, BY PRODUCT, 2021–2027 (USD MILLION)

TABLE 92 GERMANY: MARKET, BY WOUND TYPE, 2017–2020 (USD MILLION)

TABLE 93 GERMANY: MARKET, BY WOUND TYPE, 2021–2027 (USD MILLION)

TABLE 94 GERMANY: MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 95 GERMANY: MARKET, BY END USER, 2021–2027 (USD MILLION)

9.3.3 FRANCE

9.3.3.1 Rising government support to drive the demand for wound care biologics products in France

TABLE 96 FRANCE: MARKET, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 97 FRANCE: MARKET, BY PRODUCT, 2021–2027 (USD MILLION)

TABLE 98 FRANCE: MARKET, BY WOUND TYPE, 2017–2020 (USD MILLION)

TABLE 99 FRANCE: MARKET, BY WOUND TYPE, 2021–2027 (USD MILLION)

TABLE 100 FRANCE: MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 101 FRANCE: MARKET, BY END USER, 2021–2027 (USD MILLION)

9.3.4 REST OF EUROPE

TABLE 102 ROE: WOUND CARE BIOLOGICS MARKET, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 103 ROE: MARKET, BY PRODUCT, 2021–2027 (USD MILLION)

TABLE 104 ROE: MARKET, BY WOUND TYPE, 2017–2020 (USD MILLION)

TABLE 105 ROE: MARKET, BY WOUND TYPE, 2021–2027 (USD MILLION)

TABLE 106 ROE: MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 107 ROE: MARKET, BY END USER, 2021–2027 (USD MILLION)

9.4 ASIA PACIFIC

FIGURE 20 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 108 ASIA PACIFIC: MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 109 ASIA PACIFIC: MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 110 ASIA PACIFIC: MARKET, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 111 ASIA PACIFIC: MARKET, BY PRODUCT, 2021–2027 (USD MILLION)

TABLE 112 ASIA PACIFIC: MARKET, BY WOUND TYPE, 2017–2020 (USD MILLION)

TABLE 113 ASIA PACIFIC: MARKET, BY WOUND TYPE, 2021–2027 (USD MILLION)

TABLE 114 ASIA PACIFIC: MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 115 ASIA PACIFIC: MARKET, BY END USER, 2021–2027 (USD MILLION)

9.4.1 CHINA

9.4.1.1 Increasing incidence of DFUs to propel the market growth

TABLE 116 CHINA: WOUND CARE BIOLOGICS MARKET, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 117 CHINA: MARKET, BY PRODUCT, 2021–2027 (USD MILLION)

TABLE 118 CHINA: BIOLOGICS MARKET, BY WOUND TYPE, 2017–2020 (USD MILLION)

TABLE 119 CHINA: MARKET, BY WOUND TYPE, 2021–2027 (USD MILLION)

TABLE 120 CHINA: MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 121 CHINA: WOUND CARE BIOLOGICS INDUSTRY, BY END USER, 2021–2027 (USD MILLION)

9.4.2 JAPAN

9.4.2.1 Growing geriatric population to drive the adoption of wound care products

TABLE 122 JAPAN: MARKET, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 123 JAPAN: MARKET, BY PRODUCT, 2021–2027 (USD MILLION)

TABLE 124 JAPAN: MARKET, BY WOUND TYPE, 2017–2020 (USD MILLION)

TABLE 125 JAPAN: MARKET, BY WOUND TYPE, 2021–2027 (USD MILLION)

TABLE 126 JAPAN: MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 127 JAPAN: MARKET, BY END USER, 2021–2027 (USD MILLION)

9.4.3 INDIA

9.4.3.1 Growing medical tourism in the country to support the market growth for wound biologics

TABLE 128 INDIA: WOUND CARE BIOLOGICS MARKET, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 129 INDIA: MARKET, BY PRODUCT, 2021–2027 (USD MILLION)

TABLE 130 INDIA: MARKET, BY WOUND TYPE, 2017–2020 (USD MILLION)

TABLE 131 INDIA: MARKET, BY WOUND TYPE, 2021–2027 (USD MILLION)

TABLE 132 INDIA: BIOLOGICS MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 133 INDIA: WOUND CARE BIOLOGICS INDUSTRY, BY END USER, 2021–2027 (USD MILLION)

9.4.4 REST OF ASIA PACIFIC

TABLE 134 ROAPAC: MARKET, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 135 ROAPAC MARKET, BY PRODUCT, 2021–2027 (USD MILLION)

TABLE 136 ROAPAC: MARKET, BY WOUND TYPE, 2017–2020 (USD MILLION)

TABLE 137 ROAPAC: MARKET, BY WOUND TYPE, 2021–2027 (USD MILLION)

TABLE 138 ROAPAC: MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 139 ROAPAC: MARKET, BY END USER, 2021–2027 (USD MILLION)

9.5 LATIN AMERICA

9.5.1 RISING PREVALENCE OF CHRONIC DISEASES TO SUPPORT THE MARKET GROWTH

TABLE 140 LATIN AMERICA: WOUND CARE BIOLOGICS MARKET, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 141 LATIN AMERICA: MARKET, BY PRODUCT, 2021–2027 (USD MILLION)

TABLE 142 LATIN AMERICA: MARKET, BY WOUND TYPE, 2017–2020 (USD MILLION)

TABLE 143 LATIN AMERICA: MARKET, BY WOUND TYPE, 2021–2027 (USD MILLION)

TABLE 144 LATIN AMERICA: MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 145 LATIN AMERICA: WOUND CARE BIOLOGICS INDUSTRY, BY END USER, 2021–2027 (USD MILLION)

9.6 MIDDLE EAST & AFRICA

9.6.1 SIGNIFICANT GROWTH IN HEALTHCARE INFRASTRUCTURE TO DRIVE THE MARKET GROWTH FOR WOUND BIOLOGICS

TABLE 146 MIDDLE EAST & AFRICA: MARKET, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 147 MIDDLE EAST & AFRICA: MARKET, BY PRODUCT, 2021–2027 (USD MILLION)

TABLE 148 MIDDLE EAST & AFRICA: MARKET, BY WOUND TYPE, 2017–2020 (USD MILLION)

TABLE 149 MIDDLE EAST & AFRICA: MARKET, BY WOUND TYPE, 2021–2027 (USD MILLION)

TABLE 150 MIDDLE EAST & AFRICA: MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 151 MIDDLE EAST & AFRICA: MARKET, BY END USER, 2021–2027 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 130)

10.1 OVERVIEW

10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

10.2.1 OVERVIEW OF STRATEGIES DEPLOYED BY PLAYERS IN THE WOUND CARE BIOLOGICS MARKET

TABLE 152 OVERVIEW OF STRATEGIES DEPLOYED BY KEY WOUND CARE BIOLOGICS MANUFACTURING COMPANIES

10.3 MARKET SHARE ANALYSIS

10.3.1 MARKET

FIGURE 21 MARKET SHARE, BY KEY PLAYER (2021)

TABLE 153 WOUND CARE BIOLOGICS INDUSTRY: DEGREE OF COMPETITION

10.4 COMPANY EVALUATION QUADRANT

10.4.1 LIST OF EVALUATED VENDORS

10.4.2 STARS

10.4.3 EMERGING LEADERS

10.4.4 PERVASIVE PLAYERS

10.4.5 PARTICIPANTS

FIGURE 22 WOUND CARE BIOLOGICS INDUSTRY: COMPETITIVE LEADERSHIP MAPPING, 2021

10.5 COMPETITIVE LEADERSHIP MAPPING FOR START-UPS/SMES (2021)

10.5.1 PROGRESSIVE COMPANIES

10.5.2 STARTING BLOCKS

10.5.3 RESPONSIVE COMPANIES

10.5.4 DYNAMIC COMPANIES

FIGURE 23 WOUND CARE BIOLOGICS MARKET: COMPETITIVE LEADERSHIP MAPPING FOR START-UPS/SMES, 2021

10.6 COMPETITIVE SCENARIO

10.6.1 PRODUCT LAUNCHES & REGULATORY APPROVALS

TABLE 154 KEY PRODUCT LAUNCHES & REGULATORY APPROVALS

10.6.2 DEALS

TABLE 155 KEY DEALS

10.6.3 OTHER DEVELOPMENTS

TABLE 156 OTHER DEVELOPMENTS

11 COMPANY PROFILES (Page No. - 139)

11.1 KEY PLAYERS

(Business overview, Products offered, Recent developments, MnM view, Key Strengths/Right to win, Strategic choices made, and Weakness and competitive threats)*

11.1.1 SMITH & NEPHEW PLC

TABLE 157 SMITH & NEPHEW PLC: BUSINESS OVERVIEW

FIGURE 24 SMITH & NEPHEW PLC: COMPANY SNAPSHOT (2021)

11.1.2 ORGANOGENESIS INC.

TABLE 158 ORGANOGENESIS INC.: BUSINESS OVERVIEW

FIGURE 25 ORGANOGENESIS INC.: COMPANY SNAPSHOT (2021)

11.1.3 MIMEDX

TABLE 159 MIMEDX: BUSINESS OVERVIEW

FIGURE 26 MIMEDX: COMPANY SNAPSHOT (2021)

11.1.4 INTEGRA LIFESCIENCES

TABLE 160 INTEGRA LIFESCIENCES: BUSINESS OVERVIEW

FIGURE 27 INTEGRA LIFESCIENCES: COMPANY SNAPSHOT (2021)

11.1.5 STRYKER CORPORATION

TABLE 161 STRYKER CORPORATION: BUSINESS OVERVIEW

FIGURE 28 STRYKER CORPORATION: COMPANY SNAPSHOT (2021)

11.1.6 MÖLNLYCKE HEALTH CARE AB

TABLE 162 MÖLNLYCKE HEALTH CARE AB: BUSINESS OVERVIEW

FIGURE 29 MÖLNLYCKE HEALTH CARE AB: COMPANY SNAPSHOT (2021)

11.1.7 VERICEL CORPORATION

TABLE 163 VERICEL CORPORATION: BUSINESS OVERVIEW

FIGURE 30 VERICEL CORPORATION: COMPANY SNAPSHOT (2021)

11.1.8 ANIKA THERAPEUTICS, INC.

TABLE 164 ANIKA THERAPEUTICS, INC.: BUSINESS OVERVIEW

FIGURE 31 ANIKA THERAPEUTICS, INC.: COMPANY SNAPSHOT (2021)

11.1.9 BIOVENTUS LLC

TABLE 165 BIOVENTUS LLC: BUSINESS OVERVIEW

FIGURE 32 BIOVENTUS LLC: COMPANY SNAPSHOT (2021)

11.1.10 ABBVIE INC.

TABLE 166 ABBVIE INC.: BUSINESS OVERVIEW

FIGURE 33 ABBVIE INC.: COMPANY SNAPSHOT (2021)

11.1.11 KERECIS

TABLE 167 KERECIS: BUSINESS OVERVIEW

11.1.12 MARINE POLYMER TECHNOLOGIES, INC.

TABLE 168 MARINE POLYMER TECHNOLOGIES, INC.: BUSINESS OVERVIEW

11.2 OTHER PLAYERS

11.2.1 MERAKRIS THERAPEUTICS

TABLE 169 MERAKRIS THERAPEUTICS: COMPANY OVERVIEW

11.2.2 POLYMEDICS INNOVATIONS GMBH

TABLE 170 POLYMEDICS INNOVATIONS GMBH: COMPANY OVERVIEW

11.2.3 FIBROHEAL WOUNDCARE PVT. LTD.

TABLE 171 FIBROHEAL WOUNDCARE PVT. LTD.: COMPANY OVERVIEW

11.2.4 ANAMAY BIOTECH, INC.

TABLE 172 ANAMAY BIOTECH, INC.: COMPANY OVERVIEW

11.2.5 VIRCHOW BIOTECH PRIVATE LIMITED

TABLE 173 VIRCHOW BIOTECH PRIVATE LIMITED: COMPANY OVERVIEW

11.2.6 MEDLINE INDUSTRIES, LP

TABLE 174 MEDLINE INDUSTRIES, LP: COMPANY OVERVIEW

11.2.7 TIDES MEDICAL

TABLE 175 TIDES MEDICAL: COMPANY OVERVIEW

11.2.8 VISCUS BIOLOGICS LLC

TABLE 176 VISCUS BIOLOGICS LLC: COMPANY OVERVIEW

11.2.9 STABILITY BIOLOGICS

TABLE 177 STABILITY BIOLOGICS: COMPANY OVERVIEW

11.2.10 MTF BIOLOGICS

TABLE 178 MTF BIOLOGICS: COMPANY OVERVIEW

11.2.11 SKYE BIOLOGICS HOLDINGS, LLC

TABLE 179 SKYE BIOLOGICS HOLDINGS, LLC: COMPANY OVERVIEW

11.2.12 ALLOSOURCE

TABLE 180 ALLOSOURCE: COMPANY OVERVIEW

11.2.13 SURGILOGIX

TABLE 181 SURGILOGIX: COMPANY OVERVIEW

*Details on Business overview, Products offered, Recent developments, MnM view, Key Strengths/Right to win, Strategic choices made, and Weakness and competitive threats might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 174)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

This study involved four major activities in estimating the current size of the wound care biologics market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate segments and subsegments' market size.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to identify and collect information for this study.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources were mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, and organizations related to all segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, to obtain and verify the critical qualitative and quantitative information as well as assess future prospects.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the wound care biologics market's total size. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research

- The revenues generated by leading players operating in the wound care biologics market have been determined through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size applying the process mentioned above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, segment and forecast the global wound care biologics market, by product, wound type, end user, and region

- To provide detailed information regarding the major factors influencing market growth (drivers, restraints, and opportunities)

- To analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall wound care biologics market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market segments with respect to five main regions: North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players and analyze their product portfolios, market positions, and core competencies

- To track and analyze company developments such as product launches & approvals, partnerships, acquisitions, agreements, and other developments

- To benchmark players within the market using the proprietary Competitive Leadership Mapping framework, which analyzes market players on various parameters within the broad categories of business and product excellence

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Country Information

- Wound care biologics market size and growth rate estimates for countries in the Rest of Europe, the Rest of Asia Pacific, Latin America, and Middle East & Africa

Company profiles

- Additional five company profiles of players operating in the wound care biologics market.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Wound Care Biologics Market