Workflow Management System Market by Component (Software, Services), Software (Production, Messaging-Based, Web-Based, Suite-Based), Services, Deployment Type, Industry Verticals, and Region - Global Forecast to 2021

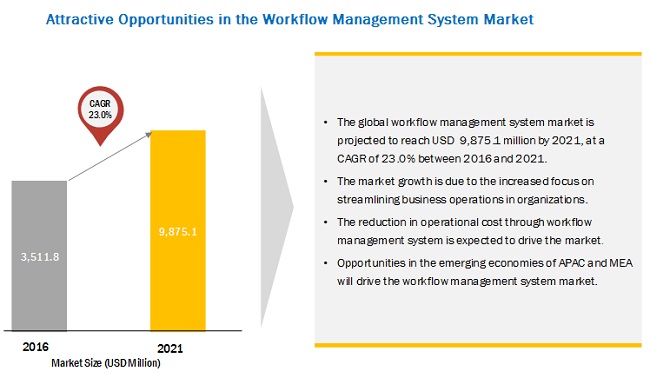

[161 Pages Report] The workflow management system market size is estimated to grow from USD 3,511.8 million in 2016 to USD 9,875.1 million by 2021, at a Compound Annual Growth Rate (CAGR) of 23.0%. A workflow management system defines, executes, and manages workflows through the use of software. It runs on workflow engines, which can deduce the process definition and intermingle with workflow participants. Workflows generally automate a business process. Major growths drivers of the workflow management system market include the increased focus on streamlining business processes, achieving cost-efficiency through workflow management, and increased access to information. The base year considered for the study is 2015, and the forecast has been provided for the period between 2016 and 2021.

By Software Type, production workflow systems type is estimated to hold the largest market size during the forecast period

he workflow management system market on the basis of software type comprises of production workflow systems, messaging workflow systems, web-based workflow systems and suite based workflow systems. The production workflow systems software type is estimated to have the largest market size in 2016, due to the largescale adoption of workflow management systems worldwide. Increased desire for automation of business operations and its collaboration is driving the production workflow systems market.

By Vertical, the IT and Telcom vertical is expected to grow at highest rate during the forecast period

Workflow management system can be used for various applications across industry verticals. The vertical segment of the workflow management system market is further segmented into BFSI, public sector, healthcare, energy and utilities, retail, IT and telecom, travel and hospitality, transportation and logistics and education. The IT and telecom is expected to grow at highest rate due to the demand for IT consulting experts required in workflow management services.

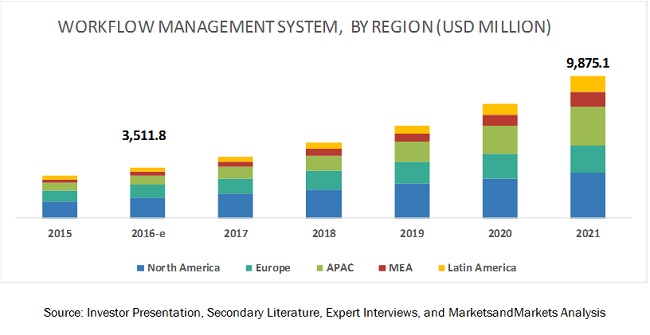

North America to account for the largest market size during the forecast period.

North America is expected to hold the highest market share and dominate the Workflow management system market during the forecast period. The major driver for this region is the high penetration rate in BFSI, manufacturing, and healthcare verticals. Even the data deluge is high due to the increase in the usage of mobile devices and broadband technology. Most of the companies in the workflow management system market are from the U.S. and their first aim is to penetrate the domestic market.

Market Dynamics

Increased focus on streamlining business processes

Workflow management system offers many advantages to organizations in terms of lesser lead times, reduced errors in work handoffs, and microscopic insights into process execution. The coordination and collaboration of work among teams become easier, quality work is delivered as it is executed efficiently, and the whole process becomes flexible. Workflow management system streamlines and coordinates business processes and the tasks associated with them to enhance the overall agility of the business. This system is also effective in providing total transparency of all activities across teams and organizations, as well as increasing customer satisfaction and shortening the time required for products and services to reach the market.

High implementation costs associated with workflow management system

The implementation of workflow management systems requires robust IT infrastructure and support. The systems are complex in nature and involve high costs for the procurement of workflow software, network development & management, implementation of application, and product augmentation. Organizations that do not possess adequate IT infrastructure and capital are less likely to adopt workflow management systems.

Huge growth potential in emerging markets

There is an increasing realization of the benefits of workflow management such as cost-effectiveness, process automation, and process integration, among others. Growing businesses with a clear understanding of these benefits and the usability of the workflow management system would help to gather tremendous opportunity for the adoption of workflow management software.

Less awareness about workflow management system

Although workflow management system speeds up the process of modern business drastically, a majority of the users, consisting of business owners, corporate executives, and the workforce in general, are still unaware about the benefits of proper workflow management and are less enthusiastic about the adoption of its software. The regions of North America and Europe are advanced in the areas of workflow management and make productive use of the software; however, regions such as MEA and Latin America have less knowledge about workflow management and its benefits and are thus less inclined to adopt workflow management system. Continued education about the benefits of the workflow management system is essential to drive its adoption.

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

20142021 |

|

Base year considered |

2015 |

|

Forecast period |

20162021 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

Component, Deployment Type, Vertical, and Region |

|

Geographies covered |

North America, Europe, APAC, MEA, and Latin America |

|

Companies covered |

It includes 15 major vendors, namely, Xerox Corporation (US), IBM (US), Oracle (US), and Pegasystem (US), Software AG (Germany), SourceCode Technology (US), Nintex Global Limited (US), Bizagi (UK), Appian (US), Newgen Software (India) |

The research report categorizes the workflow management system market to forecast the revenues and analyze the trends in each of the following subsegments:

By component

By Software

- Production workflow systems

- Messaging-based workflow systems

- Web-based workflow systems

- Suite-based workflow systems

- Other workflow systems

By Service

- IT consulting

- Integration and implementation

- Training and development

By Deployment

- Cloud

- On-premises

By Industry Vertical

- Banking, financial services, and insurance

- Public sector

- Healthcare

- Energy and utilities

- Retail

- IT and telecom

- Travel and hospitality

- Transportation and logistics

- Education

- Others

By Region

- North America

- Europe

- MEA

- APAC

- Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix that gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the North American workflow management system market

- Further breakdown of the European market

- Further breakdown of the APAC market

- Further breakdown of the MEA market

- Further breakdown of the Latin American market

Company Information

- Detailed analysis and profiling of additional market players

Recent Developments

- In April 2016, Oracle acquired Textura. This acquisition would enable Oracle to offer workflow automation, transparency, and cloud-based capabilities for complex construction projects.

- In September 2016, IBM, with its partner Box, launched a new workflow solution, Box Relay. Box Relay would facilitate employees in a business to build, manage, and track custom or pre-built workflows.

- In August 2016, Xerox launched Xerox DocuMate 6440 scanner powered by Visioneer OneTouch technology which facilitates automation of workflow with one easy touch.

Critical questions the report answers:

- Where will all these developments take the industry in the long term?

- What are the upcoming trends for the workflow management market?

- Which segment provides the most opportunity for growth?

- Who are the key vendors operating in this market?

- What are the opportunities for new market entrants?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 MnM Dive Vendor Comparision Methodology

2.5 Quadrant Description

2.6 Research Assumptions and Limitations

3 Executive Summary (Page No. - 36)

4 Premium Insights (Page No. - 40)

4.1 Attractive Market Opportunities in the Workflow Management System Market

4.2 Market Snapshot By Top Three Industry Verticals, 2016

4.3 Market Snapshot By Region and Software, 2016

4.4 Lifecycle Analysis, By Region, 2016

4.5 Market Investment Scenario

5 Overview (Page No. - 45)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Component

5.2.2 By Deployment Type

5.2.3 By Industry Vertical

5.2.4 By Region

5.3 Evolution

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Increased Focus on Streamlining Business Processes

5.4.1.2 Achieving Cost-Efficiency Through Workflow Management

5.4.1.3 Increased Access to Information

5.4.2 Restraints

5.4.2.1 High Implementation Costs Associated With Workflow Management System

5.4.2.2 Difficulty in Integrating New and Legacy Systems Through Workflows

5.4.3 Opportunities

5.4.3.1 Huge Growth Potential in Emerging Markets

5.4.3.2 Increased Adoption of Cloud Deployment Model

5.4.3.3 Increased Focus on Digital Transformation Initiatives

5.4.4 Challenges

5.4.4.1 Less Awareness About Workflow Management System

5.4.4.2 Concern Among Employees Due to Workflow Management System Implementation

6 Industry Trends (Page No. - 55)

6.1 Introduction

6.2 Value Chain Analysis

6.2.1 Workflow Management System Software Providers

6.2.2 Workflow Management System Cloud Deployment Platform Providers

6.2.3 Workflow Management System Service Providers

6.2.4 Industry Verticals

6.3 Architecture

6.4 Strategic Benchmarking

7 Workflow Management System Market Analysis, By Component (Page No. - 59)

7.1 Introduction

7.2 Software

7.2.1 Production Workflow Systems

7.2.2 Messaging-Based Workflow Systems

7.2.3 Web-Based Workflow Systems

7.2.4 Suite-Based Workflow Systems

7.2.5 Others

7.3 Services

7.3.1 IT Consulting

7.3.2 Integration and Implementation

7.3.3 Training and Development

8 Workflow Management System Market Analysis, By Deployment Type (Page No. - 75)

8.1 Introduction

8.2 Cloud

8.3 On-Premises

9 Workflow Management System Market Analysis, By Industry Vertical (Page No. - 80)

9.1 Introduction

9.2 Banking, Financial Services, and Insurance

9.3 Public Sector

9.4 Healthcare

9.5 Energy and Utilities

9.6 Retail

9.7 IT and Telecom

9.8 Travel and Hospitality

9.9 Transportation and Logistics

9.10 Education

9.11 Others

10 Geographic Analysis (Page No. - 91)

10.1 Introduction

10.2 North America

10.3 Europe

10.4 Asia-Pacific

10.5 Middle East and Africa

10.6 Latin America

11 Competitive Landscape (Page No. - 110)

11.1 Overview

11.2 Competitive Situation and Trends

11.2.1 New Product Launches and Upgradation

11.2.2 Partnerships, Agreements, and Collaborations

11.2.3 Mergers and Acquisitions

11.2.4 Expansions

11.3 MnM Dive: Workflow Management System Vendor Scorecard

12 Company Profiles (Page No. - 118)

12.1 Introduction

12.2 Xerox Corporation

12.2.1 Business Overview

12.2.2 Products and Services Offered

12.2.3 Recent Developments

12.2.4 MnM View

12.2.4.1 Key Strategies

12.2.4.2 SWOT Analysis

12.3 IBM Corporation

12.3.1 Business Overview

12.3.2 Products Offered

12.3.3 Recent Developments

12.3.4 MnM View

12.3.4.1 Key Strategies

12.3.4.2 SWOT Analysis

12.4 Oracle Corporation

12.4.1 Business Overview

12.4.2 Products Offered

12.4.3 Recent Developments

12.4.4 MnM View

12.4.4.1 Key Strategies

12.4.4.2 SWOT Analysis

12.5 Pegasystems Inc.

12.5.1 Business Overview

12.5.2 Products and Services Offered

12.5.3 Recent Developments

12.5.4 MnM View

12.5.4.1 Key Strategies

12.5.4.2 SWOT Analysis

12.6 Software AG

12.6.1 Business Overview

12.6.2 Products and Services Offered

12.6.3 Recent Developments

12.6.4 MnM View

12.6.4.1 Key Strategies

12.6.4.2 SWOT Analysis

12.7 Sourcecode Technology Holdings, Inc.

12.7.1 Business Overview

12.7.2 Products and Services Offered

12.7.3 Recent Developments

12.7.4 MnM View

12.7.4.1 Key Strategies

12.8 Nintex Global Limited

12.8.1 Business Overview

12.8.2 Solutions Offered

12.8.3 Recent Developments

12.8.4 MnM View

12.8.4.1 Key Strategies

12.9 Bizagi

12.9.1 Business Overview

12.9.2 Products Offered

12.9.3 Recent Developments

12.9.4 MnM View

12.9.4.1 Key Strategies

12.10 Appian

12.10.1 Business Overview

12.10.2 Products and Services Offered

12.10.3 Recent Developments

12.10.4 MnM View

12.10.4.1 Key Strategies

12.11 Newgen Software Technologies Limited

12.11.1 Business Overview

12.11.2 Products Offered

12.11.3 Recent Developments

12.11.4 MnM View

12.11.4.1 Key Strategies

13 Appendix (Page No. - 149)

13.1 Other Developments

13.1.1 Other Developments: New Product Launches, 20142016

13.1.2 Other Developments: Partnerships, Agreements, and Collaborations, 20142016

13.2 Industry Experts

13.3 Discussion Guide

13.4 Introducing RT: Real Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

List of Tables (95 Tables)

Table 1 Global Workflow Management System Market Size and Growth Rate, 20142021 (USD Million)

Table 2 Global Market Size, By Component, 20142021 (USD Million)

Table 3 Market Size, By Component, 20142021 (USD Million)

Table 4 Market Size, By Software, 20142021 (USD Million)

Table 5 Production Workflow Systems: Market Size, By Region, 20142021 (USD Million)

Table 6 Production Workflow Systems: Market Size, By Deployment Type, 20142021 (USD Million)

Table 7 Messaging-Based Workflow Systems: Market Size, By Region, 20142021 (USD Million)

Table 8 Messaging-Based Workflow Systems: Market Size, By Deployment Type, 20142021 (USD Million)

Table 9 Web-Based Workflow Systems: Market Size, By Region, 20142021 (USD Million)

Table 10 Web-Based Workflow Systems: Market Size, By Deployment Type, 20142021 (USD Million)

Table 11 Suite-Based Workflow Systems: Market Size, By Region, 20142021 (USD Million)

Table 12 Suite-Based Workflow Systems: Market Size, By Deployment Type, 20142021 (USD Million)

Table 13 Others: Market Size, By Region, 20142021 (USD Million)

Table 14 Others: Market Size, By Deployment Type, 20142021 (USD Million)

Table 15 Workflow Management System Market Size, By Service Type, 20142021 (USD Million)

Table 16 IT Consulting: Market Size, By Region, 20142021 (USD Million)

Table 17 Integration and Implementation: Market Size, By Region, 20142021 (USD Million)

Table 18 Training and Development: Market Size, By Region, 20142021 (USD Million)

Table 19 Software Market Size, By Deployment Type, 20142021 (USD Million)

Table 20 Cloud: Market Size, By Region, 20142021 (USD Million)

Table 21 Cloud: Market Size, By Software, 20142021 (USD Million)

Table 22 On-Premises: Market Size, By Region, 20142021 (USD Million)

Table 23 On-Premises: Market Size, By Software 20142021 (USD Million)

Table 24 Workflow Management System Market Size, By Industry Vertical, 20142021 (USD Million)

Table 25 Banking, Financial Services, and Insurance: Market Size, By Region, 20142021 (USD Million)

Table 26 Public Sector: Market Size, By Region, 20142021 (USD Million)

Table 27 Healthcare: Market Size, By Region, 20142021 (USD Million)

Table 28 Energy and Utilities: Market Size, By Region, 20142021 (USD Million)

Table 29 Retail: Market Size, By Region, 20142021 (USD Million)

Table 30 IT and Telecom: Market Size, By Region, 20142021 (USD Million)

Table 31 Travel and Hospitality: Market Size, By Region, 20142021 (USD Million)

Table 32 Transportation and Logistics: Market Size, By Region, 20142021 (USD Million)

Table 33 Education: Market Size, By Region, 20142021 (USD Million)

Table 34 Others: Market Size, By Region, 20142021 (USD Million)

Table 35 Workflow Management System Market Size, By Region, 20142021 (USD Million)

Table 36 North America: Market Size, By Component, 20142021 (USD Million)

Table 37 North America: Market Size, By Software, 20142021 (USD Million)

Table 38 North America: Market Size, By Deployment Type, 20142021 (USD Million)

Table 39 North America: Market Size, By Service Type, 20142021 (USD Million)

Table 40 North America: Market Size, By Industry Vertical, 20142021 (USD Million)

Table 41 US: Market Size, By Component, 20142021 (USD Million)

Table 42 US: Market Size, By Software, 20142021 (USD Million)

Table 43 US: Market Size, By Deployment Type, 20142021 (USD Million)

Table 44 US: Market Size, By Service Type, 20142021 (USD Million)

Table 45 US: Market Size, By Industry Vertical, 20142021 (USD Million)

Table 46 Canada: Market Size, By Component, 20142021 (USD Million)

Table 47 Canada: Market Size, By Software, 20142021 (USD Million)

Table 48 Canada: Market Size, By Deployment Type, 20142021 (USD Million)

Table 49 Canada: Market Size, By Service Type, 20142021 (USD Million)

Table 50 Canada: Market Size, By Industry Vertical, 20142021 (USD Million)

Table 51 Europe: Market Size, By Component, 20142021 (USD Million)

Table 52 Europe: Market Size, By Software, 20142021 (USD Million)

Table 53 Europe: Market Size, By Deployment Type, 20142021 (USD Million)

Table 54 Europe: Market Size, By Service Type, 20142021 (USD Million)

Table 55 Europe: Market Size, By Industry Vertical, 20142021 (USD Million)

Table 56 UK: Market Size, By Component, 20142021 (USD Million)

Table 57 UK: Market Size, By Software, 20142021 (USD Million)

Table 58 UK: Market Size, By Deployment Type, 20142021 (USD Million)

Table 59 UK: Market Size, By Service Type, 20142021 (USD Million)

Table 60 UK: Market Size, By Industry Vertical, 20142021 (USD Million)

Table 61 Rest of Europe: Market Size, By Component, 20142021 (USD Million)

Table 62 Rest of Europe: Market Size, By Software, 20142021 (USD Million)

Table 63 Rest of Europe: Market Size, By Deployment Type, 20142021 (USD Million)

Table 64 Rest of Europe: Market Size, By Service Type, 20142021 (USD Million)

Table 65 Rest of Europe: Market Size, By Industry Vertical, 20142021 (USD Million)

Table 66 Asia-Pacific: Workflow Management System Market Size, By Component, 20142021 (USD

Table 67 Asia-Pacific: Market Size, By Software, 20142021 (USD Million)

Table 68 Asia-Pacific: Market Size, By Deployment Type, 20142021 (USD Million)

Table 69 Asia-Pacific: Market Size, By Service Type, 20142021 (USD Million)

Table 70 Asia-Pacific: Market Size, By Industry Vertical, 20142021 (USD Million)

Table 71 China: Market Size, By Software, 20142021 (USD Million)

Table 72 China: Market Size, By Deployment Type, 20142021 (USD Million)

Table 73 China: Market Size, By Service Type, 20142021 (USD Million)

Table 74 China: Market Size, By Industry Vertical, 20142021 (USD Million)

Table 75 Rest of APAC: Market Size, By Component, 20142021 (USD Million)

Table 76 Rest of APAC: Market Size, By Software, 20142021 (USD Million)

Table 77 Rest of APAC: Market Size, By Deployment Type, 20142021 (USD Million)

Table 78 Rest of APAC: Market Size, By Service Type, 20142021 (USD Million)

Table 79 Rest of APAC: Market Size, By Industry Vertical, 20142021 (USD Million)

Table 80 Middle East and Africa: Market Size, By Component, 20142021 (USD Million)

Table 81 Middle East and Africa: Market Size, By Software, 20142021 (USD Million)

Table 82 Middle East and Africa: Market Size, By Deployment Type, 20142021 (USD Million)

Table 83 Middle East and Africa: Market Size, By Service Type, 20142021 (USD Million)

Table 84 Middle East and Africa: Market Size, By Industry Vertical, 20142021 (USD Million)

Table 85 Latin America: Market Size, By Component, 20142021 (USD Million)

Table 86 Latin America: Market Size, By Software, 20142021 (USD Million)

Table 87 Latin America: Workflow Management System Market Size, By Deployment Type, 201420

Table 88 Latin America: Market Size, By Service Type, 20142021 (USD Million)

Table 89 Latin America: Market Size, By Industry Vertical, 20142021 (USD Million)

Table 90 New Product Launches and Upgradation, 2016

Table 91 Partnerships, Agreements, and Collaborations, 2016

Table 92 Mergers and Acquisitions, 20142016

Table 93 Expansions, 20142015

Table 94 Other Developments: New Product Launches, 20142016

Table 95 Partnerships and Collaborations, 20172019

List of Figures (61 Figures)

Figure 1 Workflow Management System Market: Research Methodology

Figure 2 Breakdown of Primary Interviews: By Company, Designation, and Region

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Market Breakdown and Data Triangulation

Figure 6 Vendor Dive Matrix: Criteria Weightage

Figure 7 Vendor Dive Matrix

Figure 8 Market Assumptions

Figure 9 Market Limitations

Figure 10 Workflow Management System Market Snapshot: Cloud Deployment is Expected to Grow at Highest CAGR From 2016 to 2021

Figure 11 Workflow Management System Market: Top Three Growing Segments During the Period 2016 -2021

Figure 12 North America is Expected to Hold the Largest Market Share in 2016

Figure 13 Emerging Economies Offer Attractive Market Opportunities in the Workflow Management System Market During the Forecast Period

Figure 14 Banking, Financial Services, and Insurance Vertical is Estimated to have the Largest Market Size in the Workflow Management System Market in 2016

Figure 15 North America is Expected to have the Largest Market Size in 2016

Figure 16 Regional Lifecycle: Asia-Pacific is Expected to Exhibit the Highest Growth Potential

Figure 17 Workflow Management System Market: Asia-Pacific is Expected to have the Highest Investment Potential in the Market

Figure 18 Market Segmentation By Component

Figure 19 Market Segmentation By Deployment Type

Figure 20 Market Segmentation By Industry Vertical

Figure 21 Market Segmentation By Region

Figure 22 Evolution of the Workflow Management System Market

Figure 23 Market Drivers, Restraints, Opportunities, and Challenges

Figure 24 Market Value Chain Analysis

Figure 25 Workflow Management System Architecture

Figure 26 Strategic Benchmarking: New Product Launches, 2014-2016

Figure 27 Suite-Based Workflow Systems Software Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 28 Middle East and Africa is Expected to Be the Fastest-Growing Region for Production Workflow Systems Software During the Forecast Period

Figure 29 Asia-Pacific is Expected to Be the Fastest-Growing Region for Messaging-Based Workflow Systems Software During the Forecast Period

Figure 30 Asia-Pacific is Expected to Be the Fastest-Growing Region for Web-Based Workflow Systems Software During the Forecast Period

Figure 31 Asia-Pacific is Expected to Be the Fastest-Growing Region for Suite-Based Workflow Systems Software During the Forecast Period

Figure 32 Asia-Pacific is Expected to Be the Fastest-Growing Region for Other Workflow Systems Software During the Forecast Period

Figure 33 IT Consulting Segment is Expected to have the Highest CAGR During the Forecast Period

Figure 34 Cloud Deployment Segment is Expected to have the Highest CAGR During the Forecast Period

Figure 35 Asia-Pacific is Expected to Be the Fastest-Growing Region for Cloud Deployments During the Forecast Period

Figure 36 IT and Telecom, Retail, and Education Verticals are Expected to Dominate the Workflow Management System Market in Terms of CAGR During the Forecast Period

Figure 37 Asia-Pacific is Expected to Be the Fastest-Growing Region for IT and Telecom Industry Vertical During the Forecast Period

Figure 38 North America is Expected to Continue to Lead the Market in Terms of Market Size During the Forecast Period

Figure 39 Geographic Snapshot: Asia-Pacific is Expected to Emerge as A New Hotspot for the Workflow Management System Market By 2021

Figure 40 North America Market Snapshot

Figure 41 Asia-Pacific Market Snapshot

Figure 42 Companies Adopted New Product Launch as the Key Growth Strategy Between 2014 and 2016

Figure 43 Market Evaluation Framework

Figure 44 Battle for Market Share: New Product Launches and Partnerships Were the Key Strategies During the Forecast Period (2016-2021)

Figure 45 Evaluation Overview: Product Offering

Figure 46 Evaluation Overview: Business Strategy

Figure 47 Geographic Revenue Mix of Top 4 Market Players

Figure 48 Xerox Corporation: Company Snapshot

Figure 49 Xerox Corporation: SWOT Analysis

Figure 50 IBM Corporation: Company Snapshot

Figure 51 IBM Corporation: SWOT Analysis

Figure 52 Oracle Corporation: Company Snapshot

Figure 53 Oracle Corporation: SWOT Analysis

Figure 54 Pegasystems Inc.: Company Snapshot

Figure 55 Pegasystems Inc.: SWOT Analysis

Figure 56 Software AG: Company Snapshot

Figure 57 Sourcecode Technology Holdings, Inc.,: Company Snapshot

Figure 58 Nintex Global Limited: Company Snapshot

Figure 59 Bizagi: Company Snapshot

Figure 60 Appian: Company Snapshot

Figure 61 Newgen Software Technologies Limited: Company Snapshot

Growth opportunities and latent adjacency in Workflow Management System Market