Cloud Workflow Market by Type (Platform and Services), Business Workflow (HR, Accounting & Finance, Sales & Marketing, Customer Service & Support, Operations), Organization Size, Vertical, and Region -Global Forecast to 2023

[127 Pages Report] The cloud workflow market was valued at USD 1.25 billion in 2017 and is expected to reach USD 3.85 billion by 2023, at a Compound Annual Growth Rate (CAGR) of 17.1% during the forecast period. The base year considered for the study is 2017 and the forecast period considered is 2018–2023.RTD

Objectives of the Study

- To determine and forecast the global cloud workflow market by type, organization size, business workflows, vertical, and region from 2018 to 2023, and to analyze various macroeconomic and microeconomic factors that affect market growth

- To forecast the size of the market’s segments with respect to 5 main regions, namely, North America, Europe, Latin America, Asia Pacific (APAC), and the Middle East and Africa (MEA)

- To provide detailed information related to the major factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the cloud workflow market

- To analyze each submarket with respect to the individual growth trends, prospects, and contributions to the total market

- To analyze the market opportunities for stakeholders by identifying the high-growth segments in the market

- To profile the key market players; provide a comparative analysis based on business overviews, regional presence, product offerings, business strategies, and key financials; and illustrate the competitive landscape of the market

- To track and analyze the competitive developments, such as mergers and acquisitions, product developments, partnerships and collaborations, and research and development (R&D) activities in the market

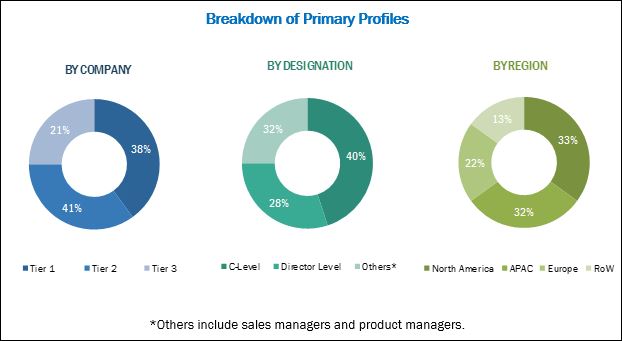

The research methodology used to estimate and forecast the cloud workflow market began with capturing data from the key vendors’ revenue and market size of the individual segments through secondary sources, industry associations, and trade journals, such as the World Analytics Association and the Cloud Native Computing Foundation. The bottom-up procedure was employed to arrive at the overall market size of the cloud workflow market from the individual segments. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with the key industry personnel, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments.

The breakdown of the profiles of the primary participants is depicted in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

The cloud workflow market ecosystem includes players such as SAP (Germany), IBM (US), Appian (US), Pegasystems (US), Micro Focus (UK), Microsoft (US), Ricoh (US), Nintex (US), PNMsoft (England), TrackVia (US), Flokzu (Uruguay), Bitrix (US), Zoho (US), Decisions (US), K2 (US), BP Logix (US), KISSFLOW (India), VIAVI Solutions (US), Cflow (India), Integrify (US), ProcessMaker (US), Process Street (US), Zapier (US), Accelo (US), and bpm'online (US).

Key Target Audience

- Cloud workflow software vendors

- Cloud workflow consulting companies

- Cloud workflow service providers

- System integrators

- Value-added resellers

- Cloud workflow investors

- Business process management providers

- Cloud workflow automation investors

- Technology consultants

Scope of the Cloud Workflow Market Report

The study includes market segments, such as type, organizations size, business workflow, vertical, and region to arrive at the market size of the global cloud workflow market during the forecast period.

By Type

- Platform

- Services

- Consulting

- System Integration and Deployment

- Support and Maintenance

By Organization Size

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

By Business Workflow

- HR

- Accounting and Finance

- Sales and Marketing

- Customer Service and Support

- Procurement and Supply Chain Management

- Operations

- Others (legal and R&D)

By Vertical

- BFSI

- Telecommunication and IT

- Retail and eCommerce

- Healthcare

- Government

- Manufacturing

- Others (transportation and logistics, energy and utilities, and education)

By Region

- North America

- US

- Canada

- Europe

- UK

- Germany

- France

- Rest of Europe

- APAC

- Australia and New Zealand

- China

- Japan

- Rest of APAC

- MEA

- Kingdom of Saudi Arabia (KSA)

- United Arab Emirates (UAE)

- South Africa

- Rest of MEA

- Latin America

- Brazil

- Mexico

- Rest of Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific requirements. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of the additional market players

The cloud workflow market is expected to grow from USD 1.75 billion in 2018 to USD 3.85 billion by 2023, at a CAGR of 17.1% during the forecast period. It is expected to witness significant growth, due to factors such as the increasing adoption of cloud-based workflows, increasing adoption of cloud-based workflow from the SMEs, and the growing focus on streamlining workflows and business processes. The rising use of Artificial Intelligence (AI) presents new business opportunities, and growing focus on digital transformation initiatives are expected to provide growth opportunities for cloud workflow vendors.

Cloud workflow helps enterprises administer, define, and coordinate business processes without the need of a base platform. The cloud workflow platform offers functionalities such as real-time visibility, and improved efficiency and performance. With the increasing competition and growing regulations around the globe, enterprises are looking for process improvement solutions that not only drive processes but also help enterprises keep pace with the growing regulations. Traditionally, processes were carried out manually, consumed a large amount of time and money, and were prone to errors as manual labor was involved. With the emergence of cloud workflow solutions, enterprises can automate processes, resulting in higher efficiency.

The cloud workflow market is gaining traction owing to the growing need for streamlined business processes. Organizations are burdened with repetitive work procedures that reduce the efficiency and prolong the time required to accomplish business operations, which is why they are increasingly considering the transformation of conventional cloud workflows to automate the functioning of business processes and assist the management in efficient decision-making.

Cloud workflow solutions offer information management and document management and blend seamlessly with existing operations. Organizations are receptive toward the adoption of cloud workflow as it provides several benefits, such as enhanced employee collaboration and communication, as well as, real-time secured access to information. These benefits enhance the decision-making process and help organizations gain a competitive advantage over others, which is essential to face the dynamic business landscape.

The global cloud workflow market has been segmented based on types, business workflows, organization size, verticals, and regions. Based on types, the market is segmented into cloud workflow platform and services. The services comprise consulting, system integration and deployment, and support and maintenance. Cloud workflow platforms and services help clients streamline their business processes, improve accountability, reduce the project duration, improve communication, and reduce manual efforts. The platform helps business workflows improve efficiency and strengthen the security of business information. The emergence of this platform has been beneficial for the main stakeholders in the ecosystem. Cloud workflow platform providers have expanded their offerings and have also been influential in boosting stakeholder revenues across different markets.

Based on business workflow, the market is segmented into human resource (HR), accounting and finance, sales and marketing, customer service and support, procurement and supply chain management, operations, and others (legal and R&D). Based on organization size, the cloud workflow market is categorized into SMEs and large enterprises. Based on verticals, the market is divided into Banking, Financial Services, and Insurance (BFSI); telecommunication and IT; manufacturing; retail and eCommerce; healthcare; government; and others (transportation and logistics, energy and utilities, and education). The regions covered include North America, Europe, APAC, MEA, and Latin America.

Based on type, the services segment is expected to grow at a higher CAGR during the forecast period. The overall services segment has a major influence on the cloud communication platform market. These services help in reducing costs, increasing the overall revenue, and improving performance. With the help of these services, an organization can track, evaluate, and analyze the requirement of the enterprises so that they can make informed decisions.

The cloud workflow market has been segmented on the basis of organization size into large enterprises and SMEs. With the option of deploying workflow solutions on cloud, the market has witnessed an increase in the deployment of cloud-based workflow solutions by SMEs and large enterprises. The SMEs segment is expected to have the larger market size and grow at a higher CAGR during the forecast period, as an increasing number of SMEs are deploying the cloud workflow solution to save the initial investment that is required to deploy workflow solutions at their own premises and enhance their business processes.

Based on business workflow, the operations segment is expected to grow at a higher CAGR during the forecast period. The operations business process utilizes a cloud computing model to assist companies in outsourcing their operational activities. It helps enterprises in enhancing their operational excellence. It also supports enterprises combine the right operational model, right business strategies, right technologies, and right execution paths.

Based on vertical, the telecommunication and IT segment is expected to have the larger market size during the forecast period. This segment is increasingly adopting cloud workflow solutions, due to their reduced operational costs and assistance in improving overall customer satisfaction. The benefits of cloud workflow automation for IT and telecommunication companies include centralization and consolidation of request management systems for enhanced efficiency, improved transparency, visibility for service functions, automation of request Service-Level Agreement (SLA) reporting, and reduction of manual efforts.

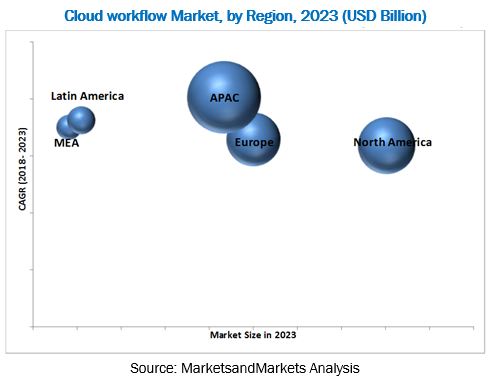

Asia Cloud Computing Association (ACCA) revealed in its 2016 Cloud Readiness Index that APAC is in a strong position to lead the next wave of global innovation and technology. Among regions, Asia Pacific is expected to grow at the highest CAGR in the cloud workflow market during the forecast period. This can be attributed to the increasing adoption of new technologies, rising investment for digital transformation, and the growing Gross Domestic Product (GDPs) in APAC countries. Majority APAC countries such as Australia, Singapore, China, and Japan are rapidly investing in technology transformation.

The cloud workflow market has been demonstrating considerable growth, but the lack of a secure cloud may restrain the growth of this market.

Key players operating in the cloud workflow market include SAP (Germany), IBM (US), Appian (US), Pegasystems (US), Micro Focus (UK), Microsoft (US), Ricoh (US), Nintex (US), PNMsoft (England), TrackVia (US), Flokzu (Uruguay), Bitrix (US), Zoho (US), Decisions (US), K2 (US), BP Logix (US), KISSFLOW (India), VIAVI Solutions (US), Cflow (India), Integrify (US), ProcessMaker (US), Process Street (US), Zapier (US), Accelo (US), and bpm'online (US). These companies focus on the adoption of various growth strategies, including new product launches, product enhancements, partnerships, and collaborations, to strengthen their position in the cloud workflow market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Breakdown of Primaries

2.1.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Cloud Workflow Market: Research Assumptions

2.4 Limitations

3 Executive Summary (Page No. - 23)

4 Premium Insights (Page No. - 27)

4.1 Attractive Market Opportunities in the Global Cloud Workflow Market

4.2 Market By Service Type, 2018 vs 2023

4.3 Market By Organization Size, 2018 vs 2023

4.4 Market By Vertical, 2018 vs 2023

4.5 Market Investment Scenario

5 Market Overview and Industry Trends (Page No. - 30)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Adoption of Cloud

5.2.1.2 Rising Adoption of Cloud-Based Workflows Among SMEs

5.2.1.3 Growing Focus on Streamlining Workflows and Business Processes

5.2.2 Restraints

5.2.2.1 Lack of Secure Cloud

5.2.3 Opportunities

5.2.3.1 Rising Use of the AI Technology

5.2.3.2 Growing Focus on Digital Transformation Initiatives

5.2.4 Challenges

5.2.4.1 Enterprises’ Inclination Toward Bpm Solutions

5.2.4.2 Lack of Awareness of Cloud-Based Workflow Solutions

5.3 Use Cases

6 Cloud Workflow Market, By Type (Page No. - 34)

6.1 Introduction

6.2 Platform

6.3 Services

6.3.1 Consulting

6.3.2 System Integration and Deployment

6.3.3 Support and Maintenance

7 Market By Organization Size (Page No. - 40)

7.1 Introduction

7.2 Small and Medium-Sized Enterprises

7.3 Large Enterprises

8 Cloud Workflow Market, By Vertical (Page No. - 44)

8.1 Introduction

8.2 Banking, Financial Services, and Insurance

8.3 Telecommunications and IT

8.4 Manufacturing

8.5 Retail and Ecommerce

8.6 Healthcare

8.7 Government

8.8 Others

9 Market By Business Workflow (Page No. - 53)

9.1 Introduction

9.2 Human Resources

9.3 Accounting and Finance

9.4 Sales and Marketing

9.5 Customer Service and Support

9.6 Procurement and Supply Chain Management

9.7 Operations

9.8 Others

10 Cloud Workflow Market, By Region (Page No. - 61)

10.1 Introduction

10.2 North America

10.2.1 United States

10.2.2 Canada

10.3 Europe

10.3.1 United Kingdom

10.3.2 Germany

10.3.3 France

10.3.4 Rest of Europe

10.4 Asia Pacific

10.4.1 Australia and New Zealand

10.4.2 China

10.4.3 Japan

10.4.4 Rest of Asia Pacific

10.5 Middle East and Africa

10.5.1 Kingdom of Saudi Arabia

10.5.2 United Arab Emirates

10.5.3 South Africa

10.5.4 Rest of Middle East and Africa

10.6 Latin America

10.6.1 Brazil

10.6.2 Mexico

10.6.3 Rest of Latin America

11 Competitive Landscape (Page No. - 82)

11.1 Overview

11.2 Market Ranking Analysis for the Cloud Workflow Market

11.3 Competitive Scenario

11.3.1 New Product Launches

11.3.2 Business Expansions

11.3.3 Mergers and Acquisitions

11.3.4 Agreements, Collaborations, and Partnerships

12 Company Profiles (Page No. - 88)

12.1 Introduction

(Business Overview, Platforms and Services Offered, Recent Developments, SWOT Analysis, and MnM View)*

12.2 SAP

12.3 IBM

12.4 Pega

12.5 Microsoft

12.6 Appian

12.7 Micro Focus

12.8 Ricoh USA

12.9 Nintex

12.10 Pnmsoft

12.11 K2

12.12 Kissflow

12.13 Bp Logix

12.14 Viavi Solutions

12.15 Cavintek

12.16 Key Innovators

12.16.1 Integrify

12.16.2 Processmaker

12.16.3 Process Street

12.16.4 Zapier

12.16.5 Accelo

12.16.6 Bpm'online

12.16.7 Trackvia

12.16.8 Flokzu

12.16.9 Bitrix

12.16.10 Decisions LLC

12.16.11 Zoho

*Details on Business Overview, Platforms and Services Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 121)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.3 Available Customizations

13.4 Related Reports

13.5 Author Details

List of Tables (65 Tables)

Table 1 Cloud Workflow Market Size, By Type, 2016–2023 (USD Million)

Table 2 Platform: Market Size By Region, 2016–2023 (USD Million)

Table 3 Services: Market Size By Region, 2016–2023 (USD Million)

Table 4 Services: Market Size By Type, 2016–2023 (USD Million)

Table 5 Consulting Market Size, By Region, 2016–2023 (USD Million)

Table 6 System Integration and Deployment: Market Size By Region, 2016-2023 (USD Million)

Table 7 Support and Maintenance: Market Size By Region, 2016-2023 (USD Million)

Table 8 Cloud Workflow Market Size, By Organization Size, 2016–2023 (USD Million)

Table 9 Market Size By Region, 2016-2023 (USD Million)

Table 10 Small and Medium-Sized Enterprises: Market Size By Region, 2016-2023 (USD Million)

Table 11 Large Enterprises: Market Size By Region, 2016-2023 (USD Million)

Table 12 Market Size By Vertical, 2016-2023 (USD Million)

Table 13 Market Size By Region, 2016-2023 (USD Million)

Table 14 Banking, Financial Services, and Insurance: Market Size By Region, 2016-2023 (USD Million)

Table 15 Telecommunications and IT: Market Size By Region, 2016-2023 (USD Million)

Table 16 Manufacturing: Market Size By Region, 2016-2023 (USD Million)

Table 17 Retail and Ecommerce: Market Size By Region, 2016-2023 (USD Million)

Table 18 Healthcare: Market Size By Region, 2016-2023 (USD Million)

Table 19 Government: Market Size By Region, 2016-2023 (USD Million)

Table 20 Others: Market Size By Region, 2016-2023 (USD Million)

Table 21 Cloud Workflow Market Size, By Business Workflow, 2016-2023 (USD Million)

Table 22 Market Size By Region, 2016-2023 (USD Million)

Table 23 Human Resources: Market Size By Region, 2016-2023 (USD Million)

Table 24 Accounting and Finance: Market Size By Region, 2016-2023 (USD Million)

Table 25 Sales and Marketing: Market Size By Region, 2016-2023 (USD Million)

Table 26 Customer Service and Support: Market Size By Region, 2016-2023 (USD Million)

Table 27 Procurement and Supply Chain Management: Market Size By Region, 2016-2023 (USD Million)

Table 28 Operations: Market Size By Region, 2016-2023 (USD Million)

Table 29 Others: Market Size By Region, 2016-2023 (USD Million)

Table 30 Cloud Workflow Market Size, By Region, 2016—2013 (USD Million)

Table 31 North America: Market Size By Country, 2016–2023 (USD Million)

Table 32 North America: Market Size By Type, 2016—2013 (USD Million)

Table 33 North America: Market Size By Service, 2016—2013 (USD Million)

Table 34 North America: Market Size By Business Workflow, 2016—2013 (USD Million)

Table 35 North America: Market Size By Organization Size, 2016—2013 (USD Million)

Table 36 North America: Market Size By Vertical, 2016—2013 (USD Million)

Table 37 Europe: Cloud Workflow Market Size, By Country, 2016—2013 (USD Million)

Table 38 Europe: Market Size By Type, 2016—2013 (USD Million)

Table 39 Europe: Market Size By Service, 2016—2013 (USD Million)

Table 40 Europe: Market Size By Business Workflow, 2016—2013 (USD Million)

Table 41 Europe: Market Size By Organization Size, 2016—2013 (USD Million)

Table 42 Europe: Market Size By Vertical, 2016—2013 (USD Million)

Table 43 Asia Pacific: Cloud Workflow Market Size, By Country, 2016—2013 (USD Million)

Table 44 Asia Pacific: Market Size By Type, 2016—2013 (USD Million)

Table 45 Asia Pacific: Market Size By Service, 2016—2013 (USD Million)

Table 46 Asia Pacific: Market Size By Business Workflow, 2016—2013 (USD Million)

Table 47 Asia Pacific: Market Size By Organization Size, 2016—2013 (USD Million)

Table 48 Asia Pacific : Market Size By Vertical, 2016—2013 (USD Million)

Table 49 Middle East and Africa: Cloud Workflow Market Size, By Country, 2016—2013 (USD Million)

Table 50 Middle East and Africa: Market Size By Type, 2016—2013 (USD Million)

Table 51 Middle East and Africa: Market Size By Service, 2016—2013 (USD Million)

Table 52 Middle East and Africa: Market Size By Business Workflow, 2016—2013 (USD Million)

Table 53 Middle East and Africa: Market Size By Organization Size, 2016—2013 (USD Million)

Table 54 Middle East and Africa: Market Size By Vertical, 2016—2013 (USD Million)

Table 55 Latin America: Cloud Workflow Market Size, By Country, 2016—2013 (USD Million)

Table 56 Latin America: Market Size By Type, 2016—2013 (USD Million)

Table 57 Latin America: Market Size By Service, 2016—2013 (USD Million)

Table 58 Latin America: Market Size By Business Workflow, 2016—2013 (USD Million)

Table 59 Latin America: Market Size By Organization Size, 2016—2013 (USD Million)

Table 60 Latin America: Market Size By Vertical, 2016—2013 (USD Million)

Table 61 Market Ranking, 2018

Table 62 New Product Launches, 2015–2018

Table 63 Business Expansions, 2016

Table 64 Mergers and Acquisitions, 2015—2018

Table 65 Agreements, Collaborations, and Partnerships, 2015–2018

List of Figures (38 Figures)

Figure 1 Global Cloud Workflow Market Segmentation

Figure 2 Regional Scope

Figure 3 Global Market Research Design

Figure 4 Research Methodology

Figure 5 Breakdown of Primary Interviews: By Company, Designation, and Region

Figure 6 Data Triangulation

Figure 7 Market Size Estimation Methodology: Bottom-Up Approach

Figure 8 Market Size Estimation Methodology: Top-Down Approach

Figure 9 Cloud Workflow Market Size, 2016–2023

Figure 10 Regional Snapshot

Figure 11 Cloud Workflow Market: Top 5 Segments, 2018–2023

Figure 12 Increasing Complexities in Workflows and Need of Streamlined Business Process are Expected to Drive the Cloud Workflow Market Growth During the Forecast Period

Figure 13 System Integration and Deployment Segment is Expected to Hold the Largest Market Share During the Forecast Period

Figure 14 Small and Medium-Sized Enterprises Segment is Expected to Hold the Larger Market Share During the Forecast Period

Figure 15 Telecommunication and IT Vertical is Expected to Hold the Largest Market Share During the Forecast Period

Figure 16 Asia Pacific is Expected to Emerge as the Best Market for Investments During the Forecast Period

Figure 17 Cloud Workflow Market: Drivers, Restraints, Opportunities, and Challenges

Figure 18 Services Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 19 Small and Medium-Sized Enterprises Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 20 Government Vertical is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 21 Customer Service and Support Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 22 Asia Pacific is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 23 North America: Market Snapshot

Figure 24 Asia Pacific: Market Snapshot

Figure 25 Key Developments By the Leading Players in the Cloud Workflow Market During 2016–2018

Figure 26 Market Evaluation Framework

Figure 27 SAP: Company Snapshot

Figure 28 SAP: SWOT Analysis

Figure 29 IBM: Company Snapshot

Figure 30 IBM: SWOT Analysis

Figure 31 Pega: Company Snapshot

Figure 32 Pega: SWOT Analysis

Figure 33 Microsoft: Company Snapshot

Figure 34 Microsoft: SWOT Analysis

Figure 35 Appian: Company Snapshot

Figure 36 Appian: SWOT Analysis

Figure 37 Micro Focus: Company Snapshot

Figure 38 Viavi Solutions: Company Snapshot

Growth opportunities and latent adjacency in Cloud Workflow Market