Western Blotting Market by Product, (Consumables (Antibody), Instrument (Electrophoresis, Blotting System, Imager (Fluorescent))), Application (Biomedical, Clinical Diagnostics), End User (Research Institute, Hospital, Biopharma) & Region - Global Forecast to 2026

Market Growth Outlook Summary

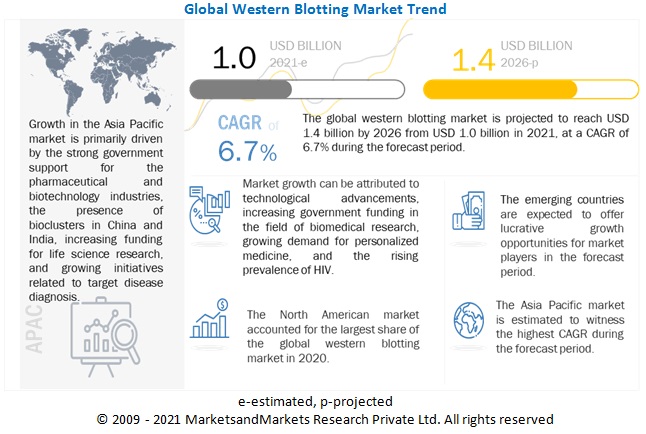

The global western blotting market growth forecasted to transform from $1.0 billion in 2021 to $1.4 billion by 2026, driven by a CAGR of 6.7%. Technological advancements, increasing government funding in the field of biomedical research, growing demand for personalized medicine, and the rising prevalence of HIV are the key factors driving the market growth.

To know about the assumptions considered for the study, Request for Free Sample Report

Western Blotting Market Dynamics

Driver: Technological advancements

In recent years, the western blotting market has witnessed a significant number of new product launches by leading players. These products are developed to increase the accuracy and efficiency of and reduce the processing time of western blotting. Leading companies such as Thermo Fisher Scientific, Inc. (US), Bio-Techne Corporation (US), and Azure Biosystems, Inc. (US) have introduced several next-generation western blotting instruments in the last few years. Some examples in this regard are as follows:

- In April 2021, Bio-Techne Corporation (US) launched Abby, a next-generation chemiluminescence system that automates traditional western blotting. The latest blotting system offers picogram-level sensitivity through chemiluminescence detection along with the ability to perform sequential immunoassays. Abby is accompanied by the latest version of Compass software that adds to its publication-ready data analysis tools and extensive lane view annotation capabilities that save hours typically spent editing in other programs.

- In September 2019, Azure Biosystems, Inc. (US) launched the Azure Imaging System, the next generation of western blot imagers. The new Azure 200, 280, 300, 400, 500, and 600 Imaging Systems offer capabilities ranging from gel documentation to detection of chemiluminescence, NIR fluorescence, and visible fluorescence for western blots.

- In June 2019, Thermo Fisher Scientific, Inc. (US) launched the Invitrogen iBright 1500 imaging series for life science researchers. The new series can be utilized to image fluorescent western blots, chemiluminescent western blots, colorimetric western blots, stained protein and nucleic acid gels, and more.

- In July 2018, Bio-Techne Corporation (US) launched Jess, a member of the ProteinSimple-branded Simple Western family. This system simplifies protein expression analysis and speeds up time to result. Jess automates both the protein separation and immunodetection elements characteristic of traditional protein analysis techniques, eliminating many of the tedious, error-prone steps.

Enhanced company portfolios due to newly launched products are likely to generate more sales for the companies operating in this market, thereby driving the growth of the global market.

Restraint: Emergence of alternative technologies

Western blotting is one of the most widely used protein analysis techniques. It is extensively used by researchers in the biotechnology, pharmaceutical, and diagnostics industries. However, the rising demand for enhancements in terms of ease of use, speed, accuracy, consistency, sensitivity, and the ability to quantify results and handle more samples has resulted in a shift toward alternative technologies. Antibody-based assays such as ELISA and lateral flow immunoassays (LFIA) are the major alternatives to western blotting. Multiplexed bead assays such as Luminex, array-based approaches such as Meso Scale Discovery, and line immunoassays are also likely to impact the demand for western blotting, especially in commercial sectors like diagnostics.

Apart from this, current proteomics tools allow for large-scale, high-throughput analyses for the detection, identification, and functional investigation of proteomes. Advances in protein fractionation and labeling techniques have improved protein identification to include the least abundant proteins. Technological advancements such as the increased resolution of mass spectrometry help extract more information from minimal amounts of samples. Similarly, the emergence of dual-mass analyzers such as LC/MS, GC/MS, FT-MS, and MALDI-TOF/TOF help gather detailed data about protein composition and structure. Improved forms of liquid chromatography and gel electrophoresis have become significant tools in protein identification and separation methods. Two-dimensional gel electrophoresis, which is based on isoelectric focusing and denaturing polyacrylamide gel matrix for protein separation, has also been developed. Such technological advancements with high throughput, enhanced sensitivity, and high resolution in proteomics generate interest in research laboratories and pharmaceutical and biotechnology companies. Such advancements have influenced pharmaceutical companies to shift towards technologically advanced proteomics techniques, which is expected to hinder the demand for western blotting to a certain extent in the coming years.

Opportunity: Emerging economies

The Asia Pacific, Latin America, and the Middle East & Africa are expected to offer potential growth opportunities to market players in the coming years due to the diversified healthcare markets in these regions and increasing R&D initiatives to develop innovative proteomic and genomic techniques along with the development of personalized medicine. Additionally, developments in research infrastructure and the low-cost manufacturing advantage of emerging APAC countries are expected to encourage market players to invest in this region in the coming years. For instance, in June 2019, Merck KGaA (Germany) introduced a national campus tour in China for the company’s first mobile protein research laboratory. The national tour will cover 20 college and biotech campuses in 13 cities across the country, including Beijing, Chengdu, Guangzhou, and Wuhan.

In May 2018, LI-COR, Inc. appointed SPD Scientific Pte Ltd. (Singapore) to distribute LI-COR Biotechnology’s products in Singapore, Malaysia, Thailand, and Vietnam. Similarly, in April 2018, the company appointed SCRUM Inc. (US) to distribute LI-COR’s products in Japan and Bargal Analytical Instruments (Israel) to distribute its products in Israel.

The focus on proteomics research has increased in developing countries, such as China, Brazil, Australia, and India. In these countries, proteomics research is mainly focused on mapping the human proteome and determining the mechanism of action of drugs. Moreover, the establishment of the Proteomics Society, India (PSI) has provided proteomic scientists and researchers in the country with significant opportunities to form research collaborations and conduct workshops on proteomics.

Challenge: Requirement of high procedural efficiency for accurate results

Western blotting requires a complex combination of analytical knowledge, extensive manual handling, dexterity, and strict adherence to protocols to achieve reliable results. Failure rates, however, can be as high as 25%, and data variations between different users can be as high as 35–40%. High efficiency is required for producing and analyzing the data. This efficiency in results is achieved to an extent through the automation of western blotting instruments. Furthermore, it requires a rigorous methodology to produce quantitative data. According to a survey by Bio-Rad Laboratories, nearly 41% of researchers believe that their western blots fail to achieve accurate results a quarter of the time primarily due to incomplete or flawed protocols. Western blots are sensitive to the quantity and purity of samples used, and small deviations can lead to erroneous and variable inferences. The types of samples, antibodies, blocking buffers, detection reagents, and the concentrations to be used are required to be optimized. Moreover, one protocol cannot be applied to all antibodies.

In addition, the technician’s skill in performing western blotting plays a critical role; technicians often face problems in understanding how and why antibodies must be characterized and how to design and use appropriate controls to ensure high-quality results. Hence, technicians in laboratories and setups must be well-versed with the procedures to achieve accuracy in results.

By product segment, the consumables segment accounted for the largest share of the western blotting market.

Based on products, the market is segmented into instruments and consumables. Consumables commanded the major share of the western blotting products market. The large share of this product segment can primarily be attributed to the repeated use of consumables in the western blotting process and the use of reagents in large volumes.

By end user, the academic & research institutes segment accounted for the largest share of the western blotting market.

Based on end users, the market is segmented into academic & research institutes, biopharmaceutical & biotechnology companies, hospitals & diagnostic laboratories, and other end users Academic & research institutes accounted for the largest share of the global market. The large share of the academic & research institutes end-user segment can be attributed to growing government investments for research activities and increasing research in the area of proteomics.

By application, the biomedical research segment accounted for the largest share of the western blotting market.

Based on applications, the global market is segmented into biomedical research, clinical diagnostics, agricultural applications, and other applications. The biomedical research application segment accounted for the largest share of this market. The large share of this segment can be attributed to the increasing research funding for proteomics and protein-based research and increasing research activities by end users such as biopharma & biotech companies.

North America accounted for the largest share of the western blotting market.

North America accounted for the largest share of the global market. The major factors driving the growth of this regional market include the presence of top manufacturers of western blotting products in this region, rise in research funding, increasing investments in proteomics research, and growing focus on personalized medicine.

To know about the assumptions considered for the study, download the pdf brochure

The western blotting market is dominated by a few globally established players such as Bio-Rad Laboratories, Inc. (US), Thermo Fisher Scientific (US), Danaher Corporation (US), Bio-Techne Corporation (US), and Merck KGaA (Germany) are the prominent players operating in the market.

Western Blotting Market Report Scope

|

Report Metric |

Details |

|

Market Revenue in 2021 |

$1.0 billion |

|

Projected Revenue by 2026 |

$1.4 billion |

|

Revenue Rate |

Poised to grow at a CAGR of 6.7% |

|

Market Driver |

Technological Advancements |

|

Market Opportunity |

Emerging Economies |

The study categorizes the western blotting market to forecast revenue and analyze trends in each of the following submarkets:

By Product

-

Consumables

- Reagents & Buffers

-

Antibodies & Conjugates

- Primary Antibodies

- Secondary Antibodies

- Other Antibodies & Conjugates

- Kits

- Membranes & Filter Papers

- Other Consumables

-

Instruments

- Electrophoresis Instruments

-

Blotting Systems

- Semi-dry Blotting Systems

- Wet Blotting Systems

-

Imagers

- Chemiluminescent Imagers

- Fluorescent Imagers

- Other Imagers

By Application

- Biomedical Research

-

Clinical Diagnostics

- HIV

- Lyme Disease

- Hepatitis

- Other Diseases

- Agricultural Applications

- Other Applications

By End User

- Academic & Research Institutes

- Biopharmaceutical & Biotechnology Companies

- Hospitals & Diagnostic Laboratories

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Rest of Asia Pacific

- Latin America

- The Middle East and Africa

Recent Developments

- In September 2021, PerkinElmer, Inc. (US) acquired BioLegend (US), a leading provider of life science antibodies and reagents, including primary antibodies and western blot secondary reagents. This acquisition enhances the company’s existing western blotting product portfolio.

- In August 2021, Abcam Plc (UK) acquired BioVision Inc. (US), a global supplier of life science research tools for research, diagnostics, and drug discovery. The company is a leading provider of biochemical and cell-based assays and produces a wide portfolio of other products, including recombinant proteins, antibodies, enzymes, and biochemical compounds for immunoassay technologies such as western blotting

- In April 2021, Bio-Techne Corporation (US) launched Abby, a next-generation chemiluminescence system that automates traditional western blotting

- In October 2020, Bio-Techne Corporation (US) launched a SARS-CoV-2 Multi-Antigen Serology Module for Jess and Wes Simple Western automated western blotting systems. The new serology assay accelerates COVID-19 research and vaccine development through rapid characterization of human immune responses to multiple SARS-CoV-2 antigens

- In June 2019, Merck KGaA (Germany) introduced a national campus tour in China for the company’s first mobile protein research laboratory. The national tour will cover 20 college and biotech campuses in 13 cities across the country, including Beijing, Chengdu, Guangzhou, and Wuhan.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the western blotting market?

The western blotting market boasts a total revenue value of $1.4 billion by 2026.

What is the estimated growth rate (CAGR) of the western blotting market?

The global market for western blotting has an estimated compound annual growth rate (CAGR) of 6.7% and a revenue size in the region of $1.0 billion in 2021.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 41)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 WESTERN BLOTTING MARKET SEGMENTATION

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 46)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

FIGURE 3 PRIMARY SOURCES

FIGURE 4 WESTERN BLOTTING MARKET: BREAKDOWN OF PRIMARIES

2.1.2.1 Key industry insights

2.2 MARKET SIZE ESTIMATION

FIGURE 5 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS, 2020

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP (SUPPLY SIDE) – COLLECTIVE REVENUE OF ALL WESTERN BLOTTING PRODUCTS

FIGURE 7 GLOBAL MARKET: CAGR PROJECTIONS, 2021–2026

FIGURE 8 GLOBAL MARKET: GROWTH ANALYSIS OF DRIVERS, RESTRAINTS OPPORTUNITIES, AND CHALLENGES

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 9 DATA TRIANGULATION METHODOLOGY

2.4 RESEARCH LIMITATIONS

2.5 GROWTH RATE ASSUMPTIONS

2.6 RISK ANALYSIS

3 EXECUTIVE SUMMARY (Page No. - 57)

FIGURE 10 WESTERN BLOTTING MARKET, BY PRODUCT, 2021 VS. 2026 (USD MILLION)

FIGURE 11 GLOBAL MARKET, BY APPLICATION, 2021 VS. 2026 (USD MILLION)

FIGURE 12 GLOBAL MARKET SHARE, BY END USER, 2020

FIGURE 13 GEOGRAPHICAL SNAPSHOT OF THE GLOBAL MARKET

4 PREMIUM INSIGHTS (Page No. - 60)

4.1 GLOBAL MARKET OVERVIEW

FIGURE 14 TECHNOLOGICAL ADVANCEMENTS AND GROWING DEMAND FOR PERSONALIZED MEDICINE ARE KEY FACTORS DRIVING GROWTH IN THE GLOBAL MARKET

4.2 ASIA PACIFIC: WESTERN BLOTTING MARKET, BY END USER & COUNTRY (2020)

FIGURE 15 ACADEMIC & RESEARCH INSTITUTES ACCOUNTED FOR THE LARGEST SHARE OF THE ASIA PACIFIC MARKET IN 2020

4.3 WESTERN BLOTTING INSTRUMENTS MARKET, BY TYPE, 2020

FIGURE 16 THE BLOTTING SYSTEMS SEGMENT DOMINATED THE MARKET IN 2020

4.4 WESTERN BLOTTING INSTRUMENTS MARKET FOR BLOTTING SYSTEMS, BY TYPE, 2020

FIGURE 17 THE SEMI-DRY BLOTTING SYSTEMS SEGMENT IS PROJECTED TO WITNESS THE HIGHEST GROWTH DURING THE FORECAST PERIOD

4.5 WESTERN BLOTTING INSTRUMENTS MARKET FOR IMAGERS, BY TYPE, 2020

FIGURE 18 THE CHEMILUMINESCENT IMAGERS SEGMENT ACCOUNTED FOR THE LARGEST SHARE OF THE GLOBAL MARKET IN 2020

5 MARKET OVERVIEW (Page No. - 63)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 WESTERN BLOTTING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Technological advancements

5.2.1.2 Increasing government funding in the field of biomedical research

5.2.1.3 Growing demand for personalized medicine

FIGURE 20 NUMBER OF PERSONALIZED MEDICINES IN THE MARKET, 2008–2020

5.2.1.4 Rising global prevalence and incidence of HIV/AIDS

TABLE 1 INCIDENCE OF HIV/AIDS, BY REGION, 2020

5.2.2 RESTRAINTS

5.2.2.1 Emergence of alternative technologies

5.2.3 OPPORTUNITIES

5.2.3.1 Emerging economies

5.2.4 CHALLENGES

5.2.4.1 Requirement of high procedural efficiency for accurate results

5.3 IMPACT OF COVID-19 ON THE GLOBAL MARKET

5.4 PATENT ANALYSIS

5.4.1 NUMBER OF PUBLICATIONS OVER THE LAST 10 YEARS

5.4.2 TOP 10 GRANTED PATENT OWNERS IN THE LAST 20 YEARS

5.4.3 TOP 10 PLAYERS WITH THE HIGHEST NO. OF PATENT APPLICATIONS

5.4.4 LIST OF RECENT PATENTS

5.5 REGULATORY GUIDELINES

5.5.1 NORTH AMERICA

5.5.2 EUROPE

5.5.3 EMERGING MARKETS

5.6 VALUE CHAIN ANALYSIS

FIGURE 21 VALUE CHAIN ANALYSIS: MAJOR VALUE ADDED DURING THE MANUFACTURING AND ASSEMBLY PHASES

5.7 SUPPLY CHAIN ANALYSIS

FIGURE 22 DIRECT DISTRIBUTION—THE PREFERRED STRATEGY FOR PROMINENT COMPANIES

5.8 PORTER’S FIVE FORCES ANALYSIS

TABLE 2 GLOBAL MARKET: PORTER’S FIVE FORCES ANALYSIS

5.8.1 DEGREE OF COMPETITION

5.8.2 BARGAINING POWER OF SUPPLIERS

5.8.3 BARGAINING POWER OF BUYERS

5.8.4 THREAT FROM SUBSTITUTES

5.8.5 THREAT FROM NEW ENTRANTS

5.9 ECOSYSTEM ANALYSIS OF THE GLOBAL MARKET

FIGURE 23 ECOSYSTEM ANALYSIS OF THE GLOBAL MARKET

5.9.1 ROLE IN THE ECOSYSTEM

5.10 TECHNOLOGY ANALYSIS

5.10.1 ALTERNATIVES TO TRADITIONAL WESTERN BLOTTING

5.11 RANGES/SCENARIOS

FIGURE 24 DEPENDING ON HOW THE UNCERTAINTIES UNFOLD, WE SEE A SPECTRUM OF SCENARIOS FOR THE GLOBAL MARKET

5.12 TRADE ANALYSIS

5.12.1 TRADE ANALYSIS FOR WESTERN BLOTTING

TABLE 3 IMPORT DATA FOR HS CODE 90278090, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 4 EXPORT DATA FOR HS CODE 90278090, BY COUNTRY, 2016–2020 (USD MILLION)

5.13 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

6 WESTERN BLOTTING MARKET, BY PRODUCT (Page No. - 82)

6.1 INTRODUCTION

TABLE GLOBAL MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

6.2 CONSUMABLES

TABLE 6 WESTERN BLOTTING CONSUMABLES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 7 WESTERN BLOTTING CONSUMABLES MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 8 NORTH AMERICA: WESTERN BLOTTING CONSUMABLES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 9 EUROPE: WESTERN BLOTTING CONSUMABLES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 10 APAC: WESTERN BLOTTING CONSUMABLES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

6.2.1 REAGENTS & BUFFERS

6.2.1.1 High consumption of reagents & buffers during the western blot process to drive market growth

TABLE 11 GLOBAL MARKET FOR REAGENTS & BUFFERS, BY REGION, 2019–2026 (USD MILLION)

TABLE 12 NORTH AMERICA: MARKET FOR REAGENTS & BUFFERS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 13 EUROPE: MARKET FOR REAGENTS & BUFFERS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 14 APAC: MARKET FOR REAGENTS & BUFFERS, BY COUNTRY, 2019–2026 (USD MILLION)

6.2.2 ANTIBODIES & CONJUGATES

TABLE 15 WESTERN BLOTTING MARKET FOR ANTIBODIES & CONJUGATES, BY TYPE, 2019–2026 (USD MILLION)

TABLE 16 GLOBAL MARKET FOR ANTIBODIES & CONJUGATES, BY REGION, 2019–2026 (USD MILLION)

TABLE 17 NORTH AMERICA: MARKET FOR ANTIBODIES & CONJUGATES, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 18 EUROPE: MARKET FOR ANTIBODIES & CONJUGATES, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 19 APAC: MARKET FOR ANTIBODIES & CONJUGATES, BY COUNTRY, 2019–2026 (USD MILLION)

6.2.2.1 Primary antibodies

6.2.2.1.1 Primary antibodies are mainly used to recognize a specific protein of interest

TABLE 20 GLOBAL MARKET FOR PRIMARY ANTIBODIES, BY REGION, 2019–2026 (USD MILLION)

TABLE 21 NORTH AMERICA: MARKET FOR PRIMARY ANTIBODIES, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 22 EUROPE: MARKET FOR PRIMARY ANTIBODIES, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 23 APAC: MARKET FOR PRIMARY ANTIBODIES, BY COUNTRY, 2019–2026 (USD MILLION)

6.2.2.2 Secondary antibodies

6.2.2.2.1 High sensitivity of secondary antibodies makes it easier to detect proteins of interest in complex protein mixtures

TABLE 24 GLOBAL MARKET FOR SECONDARY ANTIBODIES, BY REGION, 2019–2026 (USD MILLION)

TABLE 25 NORTH AMERICA: MARKET FOR SECONDARY ANTIBODIES, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 26 EUROPE: MARKET FOR SECONDARY ANTIBODIES, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 27 APAC: MARKET FOR SECONDARY ANTIBODIES, BY COUNTRY, 2019–2026 (USD MILLION)

6.2.2.3 Other antibodies & conjugates

TABLE 28 GLOBAL MARKET FOR OTHER ANTIBODIES & CONJUGATES, BY REGION, 2019–2026 (USD MILLION)

TABLE 29 NORTH AMERICA: MARKET FOR OTHER ANTIBODIES & CONJUGATES, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 30 EUROPE: MARKET FOR OTHER ANTIBODIES & CONJUGATES, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 31 APAC: MARKET FOR OTHER ANTIBODIES & CONJUGATES, BY COUNTRY, 2019–2026 (USD MILLION)

6.2.3 KITS

6.2.3.1 Repeat purchases of single-use ready-to-use kits to drive market growth

TABLE 32 WESTERN BLOTTING MARKET FOR KITS, BY REGION, 2019–2026 (USD MILLION)

TABLE 33 NORTH AMERICA: MARKET FOR KITS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 34 EUROPE: MARKET FOR KITS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 35 APAC: MARKET FOR KITS, BY COUNTRY, 2019–2026 (USD MILLION)

6.2.4 MEMBRANES & FILTER PAPERS

6.2.4.1 Extensive usage of membranes & filter papers to support the immobilization and transfer steps during western blotting experiments to drive market growth

TABLE 36 COMPARISON OF NITROCELLULOSE MEMBRANES AND PVDF MEMBRANES

TABLE 37 GLOBAL MARKET FOR MEMBRANES & FILTER PAPERS, BY REGION, 2019–2026 (USD MILLION)

TABLE 38 NORTH AMERICA: MARKET FOR MEMBRANES & FILTER PAPERS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 39 EUROPE: MARKET FOR MEMBRANES & FILTER PAPERS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 40 APAC: MARKET FOR MEMBRANES & FILTER PAPERS, BY COUNTRY, 2019–2026 (USD MILLION)

6.2.5 OTHER CONSUMABLES

TABLE 41 GLOBAL MARKET FOR OTHER CONSUMABLES, BY REGION, 2019–2026 (USD MILLION)

TABLE 42 NORTH AMERICA: MARKET FOR OTHER CONSUMABLES, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 43 EUROPE: MARKET FOR OTHER CONSUMABLES, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 44 APAC: GLOBAL MARKET FOR OTHER CONSUMABLES, BY COUNTRY, 2019–2026 (USD MILLION)

6.3 INSTRUMENTS

TABLE 45 WESTERN BLOTTING INSTRUMENTS MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 46 NORTH AMERICA: WESTERN BLOTTING INSTRUMENTS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 47 EUROPE: WESTERN BLOTTING INSTRUMENTS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 48 APAC: WESTERN BLOTTING INSTRUMENTS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 49 WESTERN BLOTTING INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

6.3.1 GEL ELECTROPHORESIS INSTRUMENTS

6.3.1.1 Increased demand for 2D electrophoresis due to its high separation performance is one of the major factors driving the growth of the market

TABLE 50 GLOBAL MARKET FOR GEL ELECTROPHORESIS INSTRUMENTS, BY REGION, 2019–2026 (USD MILLION)

TABLE 51 NORTH AMERICA: MARKET FOR GEL ELECTROPHORESIS INSTRUMENTS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 52 EUROPE: MARKET FOR GEL ELECTROPHORESIS INSTRUMENTS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 53 APAC: MARKET FOR GEL ELECTROPHORESIS INSTRUMENTS, BY COUNTRY, 2019–2026 (USD MILLION)

6.3.2 BLOTTING SYSTEMS

TABLE 54 COMPARISON BETWEEN PROTEIN BLOTTING SYSTEMS

TABLE 55 WESTERN BLOTTING MARKET FOR BLOTTING SYSTEMS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 56 GLOBAL MARKET FOR BLOTTING SYSTEMS, BY REGION, 2019–2026 (USD MILLION)

TABLE 57 NORTH AMERICA: MARKET FOR BLOTTING SYSTEMS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 58 EUROPE: MARKET FOR BLOTTING SYSTEMS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 59 APAC: MARKET FOR BLOTTING SYSTEMS, BY COUNTRY, 2019–2026 (USD MILLION)

6.3.2.1 Wet blotting systems

6.3.2.1.1 Wet systems are most commonly used for the transfer of proteins from gels to membranes

TABLE 60 GLOBAL MARKET FOR WET BLOTTING SYSTEMS, BY REGION, 2019–2026 (USD MILLION)

TABLE 61 NORTH AMERICA: MARKET FOR WET BLOTTING SYSTEMS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 62 EUROPE: MARKET FOR WET BLOTTING SYSTEMS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 63 APAC: MARKET FOR WET BLOTTING SYSTEMS, BY COUNTRY, 2019–2026 (USD MILLION)

6.3.2.2 Semi-dry blotting systems

6.3.2.2.1 Minimal usage of buffers during the process and rapid transfer of proteins from gels to membranes are major factors driving the demand for semi-dry blotting systems

TABLE 64 GLOBAL MARKET FOR SEMI-DRY BLOTTING SYSTEMS, BY REGION, 2019–2026 (USD MILLION)

TABLE 65 NORTH AMERICA: MARKET FOR SEMI-DRY BLOTTING SYSTEMS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 66 EUROPE: MARKET FOR SEMI-DRY BLOTTING SYSTEMS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 67 APAC: MARKET FOR SEMI-DRY BLOTTING SYSTEMS, BY COUNTRY, 2019–2026 (USD MILLION)

6.3.3 IMAGERS

TABLE 68 GLOBAL MARKET FOR IMAGERS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 69 GLOBAL MARKET FOR IMAGERS, BY REGION, 2019–2026 (USD MILLION)

TABLE 70 NORTH AMERICA: MARKET FOR IMAGERS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 71 EUROPE: MARKET FOR IMAGERS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 72 APAC: MARKET FOR IMAGERS, BY COUNTRY, 2019–2026 (USD MILLION)

6.3.3.1 Chemiluminescent imagers

6.3.3.1.1 Low cost of these imagers, easy handling, and sensitivity are some of the key factors contributing to the large share of this market

TABLE 73 GLOBAL MARKET FOR CHEMILUMINESCENT IMAGERS, BY REGION, 2019–2026 (USD MILLION)

TABLE 74 NORTH AMERICA: MARKET FOR CHEMILUMINESCENT IMAGERS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 75 EUROPE: MARKET FOR CHEMILUMINESCENT IMAGERS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 76 APAC: MARKET FOR CHEMILUMINESCENT IMAGERS, BY COUNTRY, 2019–2026 (USD MILLION)

6.3.3.2 Fluorescent imagers

6.3.3.2.1 Fluorescent imagers serve as one-stop imaging systems as they avoid multiple film exposures and development steps

TABLE 77 WESTERN BLOTTING MARKET FOR FLUORESCENT IMAGERS, BY REGION, 2019–2026 (USD MILLION)

TABLE 78 NORTH AMERICA: MARKET FOR FLUORESCENT IMAGERS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 79 EUROPE: MARKET FOR FLUORESCENT IMAGERS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 80 APAC: MARKET FOR FLUORESCENT IMAGERS, BY COUNTRY, 2019–2026 (USD MILLION)

6.3.3.3 Other imagers

TABLE 81 GLOBAL MARKET FOR OTHER IMAGERS, BY REGION, 2019–2026 (USD MILLION)

TABLE 82 NORTH AMERICA: MARKET FOR OTHER IMAGERS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 83 EUROPE: MARKET FOR OTHER IMAGERS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 84 APAC: MARKET FOR OTHER IMAGERS, BY COUNTRY, 2019–2026 (USD MILLION)

7 WESTERN BLOTTING MARKET, BY APPLICATION (Page No. - 117)

7.1 INTRODUCTION

TABLE 85 GLOBAL MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

7.2 BIOMEDICAL RESEARCH

7.2.1 INCREASING RESEARCH FUNDING FOR PROTEOMICS AND PROTEIN-BASED RESEARCH—A MAJOR DRIVER FOR THIS APPLICATION SEGMENT

TABLE 86 GLOBAL MARKET FOR BIOMEDICAL RESEARCH APPLICATIONS, BY REGION, 2019–2026 (USD MILLION)

TABLE 87 NORTH AMERICA: MARKET FOR BIOMEDICAL RESEARCH APPLICATIONS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 88 EUROPE: MARKET FOR BIOMEDICAL RESEARCH APPLICATIONS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 89 APAC: MARKET FOR BIOMEDICAL RESEARCH APPLICATIONS, BY COUNTRY, 2019–2026 (USD MILLION)

7.3 CLINICAL DIAGNOSTICS

TABLE 90 GLOBAL MARKET FOR CLINICAL DIAGNOSTIC APPLICATIONS, BY REGION, 2019–2026 (USD MILLION)

TABLE 91 NORTH AMERICA: MARKET FOR CLINICAL DIAGNOSTIC APPLICATIONS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 92 EUROPE: MARKET FOR CLINICAL DIAGNOSTIC APPLICATIONS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 93 APAC: MARKET FOR CLINICAL DIAGNOSTIC APPLICATIONS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 94 MARKET FOR CLINICAL DIAGNOSTIC APPLICATIONS, BY DISEASE TYPE, 2019–2026 (USD MILLION)

7.3.1 HIV

7.3.1.1 Western blotting is the most widely used method for HIV diagnosis—a key factor driving market growth

TABLE 95 GLOBAL MARKET FOR HIV DIAGNOSIS, BY REGION, 2019–2026 (USD MILLION)

TABLE 96 NORTH AMERICA: MARKET FOR HIV DIAGNOSIS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 97 EUROPE: MARKET FOR HIV DIAGNOSIS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 98 APAC: TERN BLOTTING MARKET FOR HIV DIAGNOSIS, BY COUNTRY, 2019–2026 (USD MILLION)

7.3.2 HEPATITIS

7.3.2.1 Growing incidence of hepatitis C to drive market growth

TABLE 99 WESTERN BLOTTING MARKET FOR HEPATITIS DIAGNOSIS, BY REGION, 2019–2026 (USD MILLION)

TABLE 100 NORTH AMERICA: MARKET FOR HEPATITIS DIAGNOSIS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 101 EUROPE: MARKET FOR HEPATITIS DIAGNOSIS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 102 APAC: MARKET FOR HEPATITIS DIAGNOSIS, BY COUNTRY, 2019–2026 (USD MILLION)

7.3.3 LYME DISEASE

7.3.3.1 Western blots are generally considered the most reliable tests currently available for Lyme disease diagnosis

TABLE 103 GLOBAL MARKET FOR LYME DISEASE DIAGNOSIS, BY REGION, 2019–2026 (USD MILLION)

TABLE 104 NORTH AMERICA: MARKET FOR LYME DISEASE DIAGNOSIS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 105 EUROPE: MARKET FOR LYME DISEASE DIAGNOSIS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 106 APAC: MARKET FOR LYME DISEASE DIAGNOSIS, BY COUNTRY, 2019–2026 (USD MILLION)

7.3.4 OTHER DISEASES

TABLE 107 GLOBAL MARKET FOR OTHER DISEASES, BY REGION, 2019–2026 (USD MILLION)

TABLE 108 NORTH AMERICA: MARKET FOR OTHER DISEASES, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 109 EUROPE: MARKET FOR OTHER DISEASES, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 110 APAC: MARKET FOR OTHER DISEASES, BY COUNTRY, 2019–2026 (USD MILLION)

7.4 AGRICULTURAL APPLICATIONS

7.4.1 GROWING CULTIVATION OF GENETICALLY MODIFIED CROPS TO DRIVE MARKET GROWTH

TABLE 111 GLOBAL MARKET FOR AGRICULTURAL APPLICATIONS, BY REGION, 2019–2026 (USD MILLION)

TABLE 112 NORTH AMERICA: MARKET FOR AGRICULTURAL APPLICATIONS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 113 EUROPE: MARKET FOR AGRICULTURAL APPLICATIONS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 114 APAC: MARKET FOR AGRICULTURAL APPLICATIONS, BY COUNTRY, 2019–2026 (USD MILLION)

7.5 OTHER APPLICATIONS

TABLE 115 GLOBAL MARKET FOR OTHER APPLICATIONS, BY REGION, 2019–2026 (USD MILLION)

TABLE 116 NORTH AMERICA: MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 117 EUROPE: MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 118 APAC: MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2019–2026 (USD MILLION)

8 WESTERN BLOTTING MARKET, BY END USER (Page No. - 133)

8.1 INTRODUCTION

TABLE 119 GLOBAL MARKET, BY END USER, 2019–2026 (USD MILLION)

8.2 ACADEMIC & RESEARCH INSTITUTES

8.2.1 INCREASING GOVERNMENT INVESTMENTS FOR RESEARCH ACTIVITIES TO DRIVE GROWTH IN THIS MARKET SEGMENT

TABLE 120 GLOBAL MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY REGION, 2019–2026 (USD MILLION)

TABLE 121 NORTH AMERICA: MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 122 EUROPE: MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 123 APAC: MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2019–2026 (USD MILLION)

8.3 BIOPHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

8.3.1 GROWING DRUG DISCOVERY AND CLINICAL STUDIES TO DRIVE THE DEMAND FOR WESTERN BLOTTING IN THE PHARMA-BIOTECH INDUSTRY

TABLE 124 GLOBAL MARKET FOR BIOPHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY REGION, 2019–2026 (USD MILLION)

TABLE 125 NORTH AMERICA: MARKET FOR BIOPHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 126 EUROPE: MARKET FOR BIOPHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 127 APAC: MARKET FOR BIOPHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2019–2026 (USD MILLION)

8.4 HOSPITALS & DIAGNOSTIC LABORATORIES

8.4.1 GROWING PATIENT POPULATION AND TESTING VOLUMES TO DRIVE MARKET GROWTH

TABLE 128 GLOBAL MARKET FOR HOSPITALS & DIAGNOSTIC LABORATORIES, BY REGION, 2019–2026 (USD MILLION)

TABLE 129 NORTH AMERICA: MARKET FOR HOSPITALS & DIAGNOSTIC LABORATORIES, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 130 EUROPE: MARKET FOR HOSPITALS & DIAGNOSTIC LABORATORIES, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 131 APAC: WESTERN BLOTTING FOR HOSPITALS & DIAGNOSTIC LABORATORIES, BY COUNTRY, 2019–2026 (USD MILLION)

8.5 OTHER END USERS

TABLE 132 GLOBAL MARKET FOR OTHER END USERS, BY REGION, 2019–2026 (USD MILLION)

TABLE 133 NORTH AMERICA: MARKET FOR OTHER END USERS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 134 EUROPE: MARKET FOR OTHER END USERS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 135 APAC: MARKET FOR OTHER END USERS, BY COUNTRY, 2019–2026 (USD MILLION)

9 WESTERN BLOTTING MARKET, BY REGION (Page No. - 143)

9.1 INTRODUCTION

9.2 NORTH AMERICA

FIGURE 25 NORTH AMERICA: WESTERN BLOTTING MARKET SNAPSHOT

TABLE 136 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 137 NORTH AMERICA: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 138 NORTH AMERICA: WESTERN BLOTTING INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 139 NORTH AMERICA: WESTERN BLOTTING INSTRUMENTS MARKET FOR BLOTTING SYSTEMS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 140 NORTH AMERICA: WESTERN BLOTTING INSTRUMENTS MARKET FOR IMAGERS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 141 NORTH AMERICA: WESTERN BLOTTING CONSUMABLES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 142 NORTH AMERICA: WESTERN BLOTTING CONSUMABLES MARKET FOR ANTIBODIES & CONJUGATES, BY TYPE, 2019–2026 (USD MILLION)

TABLE 143 NORTH AMERICA: WESTERN BLOTTING MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 144 NORTH AMERICA: MARKET FOR CLINICAL DIAGNOSTIC APPLICATIONS, BY DISEASE TYPE, 2019–2026 (USD MILLION)

TABLE 145 NORTH AMERICA: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.2.1 US

9.2.1.1 The US dominates the North American market

TABLE 146 US: WESTERN BLOTTING MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 147 US: WESTERN BLOTTING INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 148 US: WESTERN BLOTTING INSTRUMENTS MARKET FOR BLOTTING SYSTEMS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 149 US: WESTERN BLOTTING INSTRUMENTS MARKET FOR IMAGERS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 150 US: WESTERN BLOTTING CONSUMABLES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 151 US: WESTERN BLOTTING CONSUMABLES MARKET FOR ANTIBODIES & CONJUGATES, BY TYPE, 2019–2026 (USD MILLION)

TABLE 152 US: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 153 US: MARKET FOR CLINICAL DIAGNOSTIC APPLICATIONS, BY DISEASE TYPE, 2019–2026 (USD MILLION)

TABLE 154 US: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.2.2 CANADA

9.2.2.1 Strong infrastructure and availability of funding for biomedical research to support market growth in Canada

TABLE 155 CANADA: WESTERN BLOTTING MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 156 CANADA: WESTERN BLOTTING INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 157 CANADA: WESTERN BLOTTING INSTRUMENTS MARKET FOR BLOTTING SYSTEMS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 158 CANADA: WESTERN BLOTTING INSTRUMENTS MARKET FOR IMAGERS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 159 CANADA: WESTERN BLOTTING CONSUMABLES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 160 CANADA: WESTERN BLOTTING CONSUMABLES MARKET FOR ANTIBODIES & CONJUGATES, BY TYPE, 2019–2026 (USD MILLION)

TABLE 161 CANADA: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 162 CANADA: MARKET FOR CLINICAL DIAGNOSTIC APPLICATIONS, BY DISEASE TYPE, 2019–2026 (USD MILLION)

TABLE 163 CANADA: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.3 EUROPE

TABLE 164 EUROPE: WESTERN BLOTTING MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 165 EUROPE: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 166 EUROPE: WESTERN BLOTTING INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 167 EUROPE: WESTERN BLOTTING INSTRUMENTS MARKET FOR BLOTTING SYSTEMS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 168 EUROPE: WESTERN BLOTTING INSTRUMENTS MARKET FOR IMAGERS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 169 EUROPE: WESTERN BLOTTING CONSUMABLES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 170 EUROPE: WESTERN BLOTTING CONSUMABLES MARKET FOR ANTIBODIES & CONJUGATES, BY TYPE, 2019–2026 (USD MILLION)

TABLE 171 EUROPE: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 172 EUROPE: MARKET FOR CLINICAL DIAGNOSTIC APPLICATIONS, BY DISEASE TYPE, 2019–2026 (USD MILLION)

TABLE 173 EUROPE: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.3.1 GERMANY

9.3.1.1 Germany is the largest market for western blotting in Europe

TABLE 174 GERMANY: WESTERN BLOTTING MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 175 GERMANY: WESTERN BLOTTING INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 176 GERMANY: WESTERN BLOTTING INSTRUMENTS MARKET FOR BLOTTING SYSTEMS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 177 GERMANY: WESTERN BLOTTING INSTRUMENTS MARKET FOR IMAGERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 178 GERMANY: WESTERN BLOTTING CONSUMABLES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 179 GERMANY: WESTERN BLOTTING CONSUMABLES MARKET FOR ANTIBODIES & CONJUGATES, BY TYPE, 2019–2026 (USD MILLION)

TABLE 180 GERMANY: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 181 GERMANY: MARKET FOR CLINICAL DIAGNOSTIC APPLICATIONS, BY DISEASE TYPE, 2019–2026 (USD MILLION)

TABLE 182 GERMANY: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.3.2 FRANCE

9.3.2.1 Proteomics research in France is strongly supported by the government—a key factor driving market growth

TABLE 183 FRANCE: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 184 FRANCE: WESTERN BLOTTING INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 185 FRANCE: WESTERN BLOTTING INSTRUMENTS MARKET FOR BLOTTING SYSTEMS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 186 FRANCE: WESTERN BLOTTING INSTRUMENTS MARKET FOR IMAGERS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 187 FRANCE: WESTERN BLOTTING CONSUMABLES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 188 FRANCE: WESTERN BLOTTING CONSUMABLES MARKET FOR ANTIBODIES & CONJUGATES, BY TYPE, 2019–2026 (USD MILLION)

TABLE 189 FRANCE: WESTERN BLOTTING MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 190 FRANCE: MARKET FOR CLINICAL DIAGNOSTIC APPLICATIONS, BY DISEASE TYPE, 2019–2026 (USD MILLION)

TABLE 191 FRANCE: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.3.3 UK

9.3.3.1 Government support for disease diagnostics and the favorable investment scenario to drive the market in the UK

TABLE 192 UK: WESTERN BLOTTING MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 193 UK: WESTERN BLOTTING INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 194 UK: WESTERN BLOTTING INSTRUMENTS MARKET FOR BLOTTING SYSTEMS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 195 UK: WESTERN BLOTTING INSTRUMENTS MARKET FOR IMAGERS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 196 UK: WESTERN BLOTTING CONSUMABLES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 197 UK: WESTERN BLOTTING CONSUMABLES MARKET FOR ANTIBODIES & CONJUGATES, BY TYPE, 2019–2026 (USD MILLION)

TABLE 198 UK: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 199 UK: MARKET FOR CLINICAL DIAGNOSTIC APPLICATIONS, BY DISEASE TYPE, 2019–2026 (USD MILLION)

TABLE 200 UK: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.3.4 ITALY

9.3.4.1 Growth in this market is mainly driven by increasing life science R&D in the country

TABLE 201 ITALY: WESTERN BLOTTING MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 202 ITALY: WESTERN BLOTTING INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 203 ITALY: WESTERN BLOTTING INSTRUMENTS MARKET FOR BLOTTING SYSTEMS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 204 ITALY: WESTERN BLOTTING INSTRUMENTS MARKET FOR IMAGERS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 205 ITALY: WESTERN BLOTTING CONSUMABLES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 206 ITALY: WESTERN BLOTTING CONSUMABLES MARKET FOR ANTIBODIES & CONJUGATES, BY TYPE, 2019–2026 (USD MILLION)

TABLE 207 ITALY: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 208 ITALY: MARKET FOR CLINICAL DIAGNOSTIC APPLICATIONS, BY DISEASE TYPE, 2019–2026 (USD MILLION)

TABLE 209 ITALY: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.3.5 SPAIN

9.3.5.1 Well-established network for translational medicine research to drive market growth in Spain

TABLE 210 SPAIN: WESTERN BLOTTING MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 211 SPAIN: WESTERN BLOTTING INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 212 SPAIN: WESTERN BLOTTING INSTRUMENTS MARKET FOR BLOTTING SYSTEMS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 213 SPAIN: WESTERN BLOTTING INSTRUMENTS MARKET FOR IMAGERS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 214 SPAIN: WESTERN BLOTTING CONSUMABLES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 215 SPAIN: WESTERN BLOTTING CONSUMABLES MARKET FOR ANTIBODIES & CONJUGATES, BY TYPE, 2019–2026 (USD MILLION)

TABLE 216 SPAIN: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 217 SPAIN: MARKET FOR CLINICAL DIAGNOSTIC APPLICATIONS, BY DISEASE TYPE, 2019–2026 (USD MILLION)

TABLE 218 SPAIN: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.3.6 REST OF EUROPE (ROE)

TABLE 219 ROE: WESTERN BLOTTING MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 220 ROE: WESTERN BLOTTING INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 221 ROE: WESTERN BLOTTING INSTRUMENTS MARKET FOR BLOTTING SYSTEMS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 222 ROE: WESTERN BLOTTING INSTRUMENTS MARKET FOR IMAGERS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 223 ROE: WESTERN BLOTTING CONSUMABLES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 224 ROE: WESTERN BLOTTING CONSUMABLES MARKET FOR ANTIBODIES & CONJUGATES, BY TYPE, 2019–2026 (USD MILLION)

TABLE 225 ROE: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 226 ROE: MARKET FOR CLINICAL DIAGNOSTIC APPLICATIONS, BY DISEASE TYPE, 2019–2026 (USD MILLION)

TABLE 227 ROE: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.4 ASIA PACIFIC

FIGURE 26 ASIA PACIFIC: WESTERN BLOTTING MARKET SNAPSHOT

TABLE 228 APAC: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 229 APAC: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 230 APAC: WESTERN BLOTTING INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 231 APAC: WESTERN BLOTTING INSTRUMENTS MARKET FOR BLOTTING SYSTEMS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 232 APAC: WESTERN BLOTTING INSTRUMENTS MARKET FOR IMAGERS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 233 APAC: WESTERN BLOTTING CONSUMABLES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 234 APAC: WESTERN BLOTTING CONSUMABLES MARKET FOR ANTIBODIES & CONJUGATES, BY TYPE, 2019–2026 (USD MILLION)

TABLE 235 APAC: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 236 APAC: MARKET FOR CLINICAL DIAGNOSTIC APPLICATIONS, BY DISEASE TYPE, 2019–2026 (USD MILLION)

TABLE 237 APAC: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.4.1 JAPAN

9.4.1.1 Growing research initiatives towards the development of precision medicine are supporting market growth in Japan

TABLE 238 JAPAN: WESTERN BLOTTING MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 239 JAPAN: WESTERN BLOTTING INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 240 JAPAN: WESTERN BLOTTING INSTRUMENTS MARKET FOR BLOTTING SYSTEMS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 241 JAPAN: WESTERN BLOTTING INSTRUMENTS MARKET FOR IMAGERS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 242 JAPAN: WESTERN BLOTTING CONSUMABLES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 243 JAPAN: WESTERN BLOTTING CONSUMABLES MARKET FOR ANTIBODIES & CONJUGATES, BY TYPE, 2019–2026 (USD MILLION)

TABLE 244 JAPAN: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 245 JAPAN: MARKET FOR CLINICAL DIAGNOSTIC APPLICATIONS, BY DISEASE TYPE, 2019–2026 (USD MILLION)

TABLE 246 JAPAN: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.4.2 CHINA

9.4.2.1 Increasing government support for the biomedical and biotechnology industries to drive market growth

TABLE 247 CHINA: WESTERN BLOTTING MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 248 CHINA: WESTERN BLOTTING INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 249 CHINA: WESTERN BLOTTING INSTRUMENTS MARKET FOR BLOTTING SYSTEMS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 250 CHINA: WESTERN BLOTTING INSTRUMENTS MARKET FOR IMAGERS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 251 CHINA: WESTERN BLOTTING CONSUMABLES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 252 CHINA: WESTERN BLOTTING CONSUMABLES MARKET FOR ANTIBODIES & CONJUGATES, BY TYPE, 2019–2026 (USD MILLION)

TABLE 253 CHINA: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 254 CHINA: MARKET FOR CLINICAL DIAGNOSTIC APPLICATIONS, BY DISEASE TYPE, 2019–2026 (USD MILLION)

TABLE 255 CHINA: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.4.3 INDIA

9.4.3.1 Growing pharmaceutical & biotechnology industry in India, backed by government initiatives, to drive market growth

TABLE 256 INDIA: WESTERN BLOTTING MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 257 INDIA: WESTERN BLOTTING INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 258 INDIA: WESTERN BLOTTING INSTRUMENTS MARKET FOR BLOTTING SYSTEMS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 259 INDIA: WESTERN BLOTTING INSTRUMENTS MARKET FOR IMAGERS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 260 INDIA: WESTERN BLOTTING CONSUMABLES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 261 INDIA: WESTERN BLOTTING CONSUMABLES MARKET FOR ANTIBODIES & CONJUGATES, BY TYPE, 2019–2026 (USD MILLION)

TABLE 262 INDIA: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 263 INDIA: MARKET FOR CLINICAL DIAGNOSTIC APPLICATIONS, BY DISEASE TYPE, 2019–2026 (USD MILLION)

TABLE 264 INDIA: BLOTTING MARKET, BY END USER, 2019–2026 (USD MILLION)

9.4.4 ROAPAC

TABLE 265 ROAPAC: WESTERN BLOTTING MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 266 ROAPAC: WESTERN BLOTTING INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 267 ROAPAC: WESTERN BLOTTING INSTRUMENTS MARKET FOR BLOTTING SYSTEMS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 268 ROAPAC: WESTERN BLOTTING INSTRUMENTS MARKET FOR IMAGERS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 269 ROAPAC: WESTERN BLOTTING CONSUMABLES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 270 ROAPAC: WESTERN BLOTTING CONSUMABLES MARKET FOR ANTIBODIES & CONJUGATES, BY TYPE, 2019–2026 (USD MILLION)

TABLE 271 ROAPAC: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 272 ROAPAC: MARKET FOR CLINICAL DIAGNOSTIC APPLICATIONS, BY DISEASE TYPE, 2019–2026 (USD MILLION)

TABLE 273 ROAPAC: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.5 LATIN AMERICA

9.5.1 INCREASING ADOPTION OF PROTEOMICS TECHNOLOGIES IN THE REGION TO DRIVE MARKET GROWTH

TABLE 274 LATAM: WESTERN BLOTTING MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 275 LATAM: WESTERN BLOTTING INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 276 LATAM: WESTERN BLOTTING INSTRUMENTS MARKET FOR BLOTTING SYSTEMS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 277 LATAM: WESTERN BLOTTING INSTRUMENTS MARKET FOR IMAGERS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 278 LATAM: WESTERN BLOTTING CONSUMABLES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 279 LATAM: WESTERN BLOTTING CONSUMABLES MARKET FOR ANTIBODIES & CONJUGATES, BY TYPE, 2019–2026 (USD MILLION)

TABLE 280 LATAM: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 281 LATAM: MARKET FOR CLINICAL DIAGNOSTIC APPLICATIONS, BY DISEASE TYPE, 2019–2026 (USD MILLION)

TABLE 282 LATAM: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.6 MIDDLE EAST & AFRICA

9.6.1 PRESENCE OF A LARGER PATIENT POPULATION TO DRIVE THE MARKET IN THIS REGION

TABLE 283 MEA: WESTERN BLOTTING MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 284 MEA: WESTERN BLOTTING INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 285 MEA: WESTERN BLOTTING INSTRUMENTS MARKET FOR BLOTTING SYSTEMS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 286 MEA: WESTERN BLOTTING INSTRUMENTS MARKET FOR IMAGERS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 287 MEA: WESTERN BLOTTING CONSUMABLES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 288 MEA: WESTERN BLOTTING CONSUMABLES MARKET FOR ANTIBODIES & CONJUGATES, BY TYPE, 2019–2026 (USD MILLION)

TABLE 289 MEA: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 290 MEA: MARKET FOR CLINICAL DIAGNOSTIC APPLICATIONS, BY DISEASE TYPE, 2019–2026 (USD MILLION)

TABLE 291 MEA: MARKET, BY END USER, 2019–2026 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 206)

10.1 KEY PLAYER STRATEGIES

10.2 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN THE WESTERN BLOTTING MARKET

10.3 MARKET SHARE ANALYSIS

FIGURE 27 GLOBAL MARKET: MARKET SHARE ANALYSIS OF KEY PLAYERS, 2020

TABLE 292 GLOBAL MARKET: DEGREE OF COMPETITION

10.4 REVENUE ANALYSIS

FIGURE 28 REVENUE ANALYSIS FOR KEY COMPANIES (2017–2020)

10.5 COMPANY EVALUATION QUADRANT

FIGURE 29 GLOBAL MARKET (GLOBAL) COMPANY EVALUATION MATRIX, 2020

10.5.1 STARS

10.5.2 PERVASIVE PLAYERS

10.5.3 EMERGING LEADERS

10.5.4 PARTICIPANTS

10.6 COMPETITIVE LEADERSHIP MAPPING (START-UPS) (2020)

10.6.1 PROGRESSIVE COMPANIES

10.6.2 STARTING BLOCKS

10.6.3 DYNAMIC COMPANIES

10.6.4 RESPONSIVE COMPANIES

FIGURE 30 COMPETITIVE LEADERSHIP MAPPING: WESTERN BLOTTING MARKET

10.7 COMPETITIVE BENCHMARKING

TABLE 293 COMPANY PRODUCT FOOTPRINT (25 COMPANIES)

TABLE 294 COMPANY REGIONAL FOOTPRINT (25 COMPANIES)

10.8 COMPETITIVE SCENARIO

10.8.1 PRODUCT LAUNCHES

TABLE 295 GLOBAL MARKET: PRODUCT LAUNCHES, JANUARY 2018–OCTOBER 2021

10.8.2 DEALS

TABLE 296 GLOBAL MARKET: DEALS, JANUARY 2018–OCTOBER 2021

10.8.3 OTHER DEVELOPMENTS

TABLE 297 GLOBAL MARKET: OTHER DEVELOPMENTS, JANUARY 2018–OCTOBER 2021

11 COMPANY PROFILES (Page No. - 220)

11.1 KEY COMPANIES

(Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)*

11.1.1 BIO-RAD LABORATORIES, INC.

TABLE 298 BIO-RAD LABORATORIES, INC.: BUSINESS OVERVIEW

FIGURE 31 COMPANY SNAPSHOT: BIO-RAD LABORATORIES, INC. (2020)

11.1.2 THERMO FISHER SCIENTIFIC INC.

TABLE 299 THERMO FISHER SCIENTIFIC INC.: BUSINESS OVERVIEW

FIGURE 32 COMPANY SNAPSHOT: THERMO FISHER SCIENTIFIC INC. (2020)

11.1.3 DANAHER CORPORATION

TABLE 300 DANAHER CORPORATION: BUSINESS OVERVIEW

FIGURE 33 COMPANY SNAPSHOT: DANAHER CORPORATION (2020)

11.1.4 BIO-TECHNE CORPORATION

TABLE 301 BIO-TECHNE CORPORATION: BUSINESS OVERVIEW

FIGURE 34 BIO-TECHNE CORPORATION: COMPANY SNAPSHOT (2021)

11.1.5 MERCK KGAA

TABLE 302 MERCK KGAA: BUSINESS OVERVIEW

FIGURE 35 COMPANY SNAPSHOT: MERCK KGAA (2020)

11.1.6 PERKINELMER, INC.

TABLE 303 PERKINELMER, INC.: BUSINESS OVERVIEW

FIGURE 36 PERKINELMER, INC.: COMPANY SNAPSHOT (2020)

11.1.7 ABCAM PLC

TABLE 304 ABCAM PLC: BUSINESS OVERVIEW

FIGURE 37 COMPANY SNAPSHOT: ABCAM PLC (2020)

11.1.8 ENZO BIOCHEM, INC.

TABLE 305 ENZO BIOCHEM, INC.: BUSINESS OVERVIEW

FIGURE 38 COMPANY SNAPSHOT: ENZO BIOCHEM, INC. (2020)

11.1.9 LI-COR, INC.

TABLE 306 LI-COR, INC.: BUSINESS OVERVIEW

11.1.10 ADVANSTA INC.

TABLE 307 ADVANSTA INC.: BUSINESS OVERVIEW

11.1.11 CELL SIGNALING TECHNOLOGY, INC.

TABLE 308 CELL SIGNALING TECHNOLOGY, INC.: BUSINESS OVERVIEW

11.1.12 AZURE BIOSYSTEMS, INC.

TABLE 309 AZURE BIOSYSTEMS, INC.: BUSINESS OVERVIEW

11.1.13 BOSTER BIOLOGICAL TECHNOLOGY

TABLE 310 BOSTER BIOLOGICAL TECHNOLOGY: BUSINESS OVERVIEW

11.1.14 GENO TECHNOLOGY INC.

TABLE 311 GENO TECHNOLOGY INC.: BUSINESS OVERVIEW

11.1.15 STRESSMARQ BIOSCIENCES INC.

TABLE 312 STRESSMARQ BIOSCIENCES INC.: BUSINESS OVERVIEW

*Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

11.2 OTHER COMPANIES

11.2.1 F. HOFFMANN-LA ROCHE LTD.

11.2.2 ROCKLAND IMMUNOCHEMICALS, INC.

11.2.3 PRECISION BIOSYSTEMS

11.2.4 CLEAVER SCIENTIFIC LTD.

11.2.5 PROTEINTECH GROUP

11.2.6 ABNOVA CORPORATION

11.2.7 SINO BIOLOGICAL INC.

11.2.8 ABBEXA LTD.

11.2.9 COVALAB S.A.S.

11.2.10 BIORBYT LTD.

12 APPENDIX (Page No. - 267)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

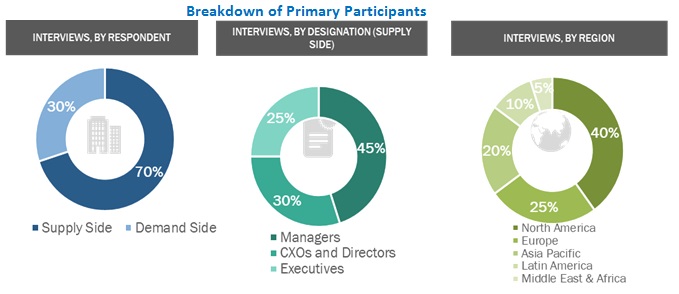

This market research study involved the extensive use of secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and financial study of the global western blotting market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information and assess market growth prospects. The global size of thIs market (estimated through various secondary research approaches) was then triangulated with primary research inputs to arrive at the final market size.

Secondary Research

The secondary sources referred to for this research study include publications from organizations such as the World Bank, World Health Organization (WHO), Centers for Disease Control and Prevention (CDC), National Institutes of Health (NIH), Pharmaceutical Research and Manufacturers of America (PhRMA), International Service for the Acquisition of Agri-biotech Applications (ISAAA), National Health Services (NHS), Proteomics Society, India (PSI), Joined United Nations Joint Programme on AIDS (UNAIDS), National AIDS Control Organization (NACO), Brazilian Biotech (Brbiotech), AIDS Education and Research Trust (AVERT), The U.S. President’s Emergency Plan for AIDS Relief (PEPFAR), and International Federation of Pharmaceutical Manufacturers & Associations (IFPMA)

Secondary sources also include corporate and regulatory filings (such as annual reports, SEC filings, investor presentations, and financial statements); business magazines and research journals; press releases; and trade, business, and professional associations. Secondary data was collected and analyzed to arrive at the overall size of the global market, which was validated through primary research.

Primary Research

Extensive primary research was conducted after acquiring basic knowledge about the global western blotting market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand side (such as personnel from academic & research centers, pharmaceutical & biotechnology companies, diagnostic laboratories, and CROs) and supply side (such as C-level and D-level executives, product managers, and marketing and sales managers of key manufacturers, distributors, and channel partners from tier 1 and tier 2 companies offering western blotting products) across five major regions—North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. Approximately 70% and 30% of primary interviews were conducted with supply-side and demand-side participants, respectively. This primary data was collected through questionnaires, e-mails, online surveys, personal interviews, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Data Triangulation

After arriving at the overall size of the western blotting market through the methodology mentioned above, this market was split into several segments and subsegments. Market breakdown procedures were employed, wherever applicable, to arrive at the exact market value for the key segments and subsegments. The extrapolated market data was triangulated by studying various macroindicators and regional trends from both demand and supply-side participants.

Report Objectives

- To define, describe, and forecast the global western blotting market by product, application, end user, and region

- To strategically analyze micromarkets with respect to individual growth trends, future prospects, and contributions to the total market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To provide detailed information regarding the major factors influencing the growth of the market, such as drivers, restraints, opportunities, and challenges

- To forecast the size of the market segments with respect to five main regions, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To strategically analyze the market structure and profile key players of the global market and comprehensively analyze their core competencies

- To track and analyze competitive developments such as expansions, acquisitions, and new product launches in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization option is available for the report:

Portfolio Assessment

- Product Matrix, which gives a detailed comparison of the product portfolios of the top 3 companies

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

Geographical Analysis

- Further breakdown of the RoE market into countries

- Further breakdown of the RoAPAC market into countries

- Further breakdown of the LATAM market into countries

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Western Blotting Market