Wealth Management Platform Market by Advisory Model (Human Advisory, Robo Advisory, and Hybrid), Business Function (Reporting, Portfolio, Accounting, and Trading Management), Deployment Model, End-User Industry, and Region - Global Forecast to 2022

[137 Pages Report] The wealth management platform market was valued at USD 1.52 Billion in 2016 and is projected to reach USD 3.20 Billion by 2022, at a Compound Annual Growth Rate (CAGR) of 13.4% during the forecast period. The base year considered for this report is 2016, and the forecast period is 20172022.

The major growth drivers of the wealth management platform market are expected to be the constant rise in the number of global High Net Worth Individuals (HNWIs), digitalization and process automation, and compliance with stringent industry regulations.

Objectives of the Study

The main objective of the report is to define, describe, and forecast the global wealth management platform market on the basis of advisory models, business functions, deployment models, end-user industries, and region. The report provides detailed information regarding the major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the market. The report aims to strategically analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the total market. The report attempts to forecast the market size with respect to 5 main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America. The report strategically profiles key players and comprehensively analyzes their core competencies. It also tracks and analyzes competitive developments, such as partnerships, collaborations, and agreements; mergers and acquisitions; new product launches and developments; and Research and Development (R&D) activities in the market.

Research Methodology

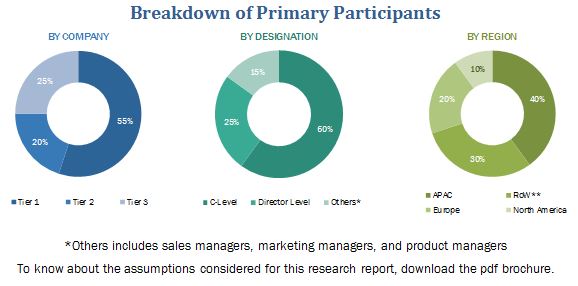

The research methodology used to estimate and forecast the wealth management platform market began with capturing data on key vendor revenues through secondary research, which included directories and databases (D&B Hoovers, Bloomberg Businessweek, and Factiva). The vendor offerings were also taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall market size of the global market that was derived from the revenues of the key players in the market. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key people, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of profiles of the primary participants is depicted in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

The wealth management platform ecosystem comprises major vendors, such as SS&C (US), Fiserv (US), FIS (US), Profile Software (UK), Broadridge (US), InvestEdge (US), Temenos (Switzerland), Finantix (Italy), SEI Investments Company (US), Comarch (Poland), Objectway (Italy), and Dorsum (Hungary). The other stakeholders of the wealth management platform market include vendors, research organizations, managed service providers, third-party providers, and technology providers.

Key Target Audience of the Wealth Management Platform Market

- Service providers and distributors

- Wealth management platform software builders

- Independent Software Vendors (ISVs)

- Enterprises

- End-users

The study answers several questions for the stakeholders, primarily which market segments to focus on in the next 25 years for prioritizing efforts and investments.

Scope of the Report

The research report categorizes the wealth management platform market to forecast the revenues and analyze trends in each of the following subsegments:

By Advisory Model

- Human advisory

- Robo advisory

- Hybrid

By Business Function

- Financial advice management

- Portfolio, accounting, and trading management

- Performance management

- Risk and compliance management

- Reporting

- Others (billing and benchmarking)

By Deployment Model

- Cloud

- On-premises

By End-User Industry

- Banks

- Investment management firms

- Trading and exchange firms

- Brokerage firms

- Others (asset management firms, and custody and compliance providers)

By Region

- North America

- US

- Canada

- Europe

- Germany

- Italy

- UK

- Rest of Europe

- APAC

- China

- Japan

- India

- Rest of APAC

- MEA

- Middle East

- Africa

- Latin America

- Brazil

- Mexico

- Rest of Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the North American Wealth management platform market

- Further breakdown of the European market

- Further breakdown of the APAC market

- Further breakdown of the Latin American market

- Further breakdown of the MEA market

Company Information

- Detailed analysis and profiling of additional market players up to 5.

The increasing business expansions, mergers and acquisitions, joint ventures, and other inorganic strategies undertaken by the vendors are expected to be the key factors in fueling the growth of the market.

The report provides detailed insights into the global wealth management platform market, which has been segmented by advisory model, business function, deployment model, end-user industry, and region. Under the advisory models segment, the human advisory subsegment is expected to hold the largest market share during the forecast period.

Irrespective of the rising service standards of the robo advisors segment, the High Net Worth Individuals (HNIWs) are considering the human advisory segment as their first preference, owing to the increased security concerns in the wealth management industry.

The increase in ratio of the HNWIs across the globe is expected to have increased the demand for wealth management platform market solutions. The wealth management industrys advisory model has been transforming and shifting from commission-based to performance-based models. The robo advisory segment is expected to have the highest growth rate during the forecast period, owing to the increasing competition, rapidly changing market dynamics, and evolving clients requirements. Moreover, it has emerged as an effective low-cost alternative for retail investors and comes with certain benefits, such as low-cost fee structure, ease of use, low to zero account minimums, and diversified services, which is why it is expected to gain traction during the forecast period.

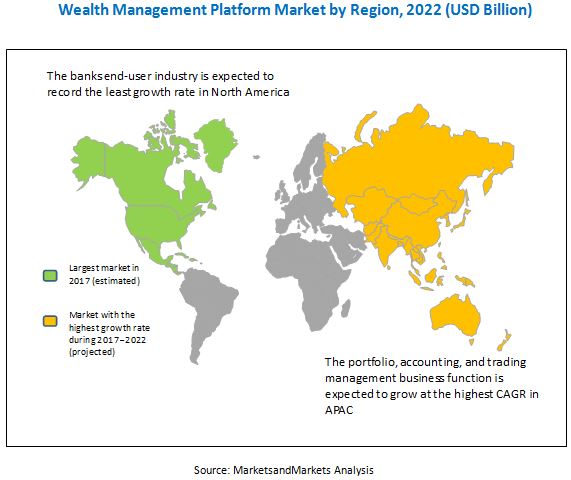

The portfolio, accounting, and trading management business function is expected to hold the largest market share and lead the market during the forecast period. This rise can be attributed to the increased demand for portfolio management, decision support, and trading across multiple programs. With the expanding highly competitive market, the portfolio, accounting, and trading managers are under pressure to handle their existing customers wealth management data, provide them with effective advisory, and concentrate over collaborative activities to strengthen and serve their customers in a better manner.

The rapid adoption of cloud solutions can be observed in the wealth management platform market, owing to the advantages of the cloud technology over that of the on-premises solutions, such as agility, scalability, reduced operational costs, flexible payment options, easy access to data, and self-service capabilities.

Moreover, wealth management firms are expected to gain traction among various end-user industries, owing to the increase in wealth of individuals, healthy economic growth across the globe, and need for compliance with regulations. The trading and exchange firms segment is expected to grow at the highest CAGR, owing to the increased inclination of customers toward trading and exchange to improve the financial gains

The report covers all the major aspects of the wealth management platform market and provides an in-depth analysis for major countries across North America, Europe, Asia Pacific (APAC), the Middle East and Africa (MEA), and Latin America. North America, owing to the early adoption of new and emerging technologies, coupled with expanding data, is expected to continue to dominate the market during the forecast period. APAC is expected to grow at the highest CAGR during the forecast period, owing to the growing data and increasing number of mergers and acquisitions in the region.

Lack of awareness of wealth management solutions and inadequate technical expertise among enterprise professionals are expected to act as the major challenges for the growth of the wealth management platform market. However, the rising innovations in the fintech industry as well as the increased adoption of blockchain and Artificial Intelligence (AI) technologies are expected to facilitate the adoption of wealth management platform solutions worldwide.

The wealth management platform ecosystem comprises vendors, such as SS&C Technologies, Inc. (US), Fiserv, Inc. (US), Fidelity National Information Services (US), Profile Software (UK), Broadridge Financial Solutions, Inc. (US), InvestEdge, Inc. (US), Temenos Group AG (Switzerland), Finantix S.p.A. (Italy), SEI Investments Company (US), Comarch SA (Poland), Objectway S.p.A. (Italy), and Dorsum Ltd. (Hungary). The other stakeholders of the wealth management platform market include managed service providers, third-party providers, and technology providers.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Assumptions for the Study

2.4 Limitations of the Study

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 31)

4.1 Attractive Market Opportunities in the Wealth Management Platform Market

4.2 Market By Region

4.3 Market Top 4 End-User Industries and Regions

4.4 Life Cycle Analysis, By Region, 2017

5 Market Overview and Industry Trends (Page No. - 35)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Digitalization and Process Automation Optimizes Wealth Management Practices

5.2.1.2 Constant Rise in Global Hnwis

5.2.1.3 Compliance With Stringent Industry Regulations

5.2.2 Restraints

5.2.2.1 Higher Dependency on Traditional Methods

5.2.3 Opportunities

5.2.3.1 Rising Innovations in the Fintech Industry

5.2.3.2 Adoption of Blockchain and AI in the Wealth Management Platform Market

5.2.4 Challenges

5.2.4.1 Lack of Awareness About Wealth Management Solutions and Inadequate Technical Expertise Among Enterprise Professionals

5.3 Use Cases

5.3.1 Use Case 1: Streamlining Operations With the Wealth Management Platform

5.3.2 Use Case 2: Generating Up-To-Date Reports in Minimal Time and Enhancing the Customer Relationship

5.3.3 Use Case 3: Easily Managing Customer Portfolios With the Wealth Management Platform

5.4 Regulations for the Wealth Management Industry

5.4.1 Markets in Financial Instruments Directive (MIFID)

5.4.2 Alternative Investment Fund Managers Directive (AIFMD)

5.4.3 Foreign Account Tax Compliance Act (FATCA)

5.4.4 DoddFrank Wall Street Reform and Consumer Protection Act

5.4.5 European Market Infrastructure Regulation (EMIR)

5.4.6 Anti-Money Laundering Directive 2015/849/Eu (AMLD)

5.5 Innovation Spotlight

5.5.1 Integration of AI in Wealth Management

5.5.2 Introduction of Blockchain in Wealth Management Practices

6 Wealth Management Platform Market By Advisory Model (Page No. - 42)

6.1 Introduction

6.2 Human Advisory

6.3 Robo Advisory

6.4 Hybrid

7 Wealth Management Platform Market By Business Function (Page No. - 47)

7.1 Introduction

7.2 Financial Advice Management

7.3 Portfolio, Accounting, and Trading Management

7.4 Performance Management

7.5 Risk and Compliance Management

7.6 Reporting

7.7 Others

8 Wealth Management Platform Market By Deployment Model (Page No. - 55)

8.1 Introduction

8.2 On-Premises

8.3 Cloud

9 Wealth Management Platform Market By End-User Industry (Page No. - 59)

9.1 Introduction

9.2 Banks

9.3 Investment Management Firms

9.4 Trading and Exchange Firms

9.5 Brokerage Firms

9.6 Others

10 Wealth Management Platform Market By Region (Page No. - 65)

10.1 Introduction

10.2 North America

10.2.1 By Advisory Model

10.2.2 By Business Function

10.2.3 By Deployment Model

10.2.4 By End-User Industry

10.2.5 By Country

10.2.5.1 United States

10.2.5.2 Canada

10.3 Europe

10.3.1 By Advisory Model

10.3.2 By Business Function

10.3.3 By Deployment Model

10.3.4 By End-User Industry

10.3.5 By Country

10.3.5.1 Germany

10.3.5.2 Italy

10.3.5.3 United Kingdom

10.3.5.4 Rest of Europe

10.4 Asia Pacific

10.4.1 By Advisory Model

10.4.2 By Business Function

10.4.3 By Deployment Model

10.4.4 By End-User Industry

10.4.5 By Country

10.4.5.1 China

10.4.5.2 Japan

10.4.5.3 India

10.4.5.4 Rest of Asia Pacific

10.5 Latin America

10.5.1 By Advisory Model

10.5.2 By Business Function

10.5.3 By Deployment Model

10.5.4 By End-User Industry

10.5.5 By Country

10.5.5.1 Brazil

10.5.5.2 Mexico

10.5.5.3 Rest of Latin America

10.6 Middle East and Africa

10.6.1 By Advisory Model

10.6.2 By Business Function

10.6.3 By Deployment Model

10.6.4 By End-User Industry

10.6.5 By Subregion

10.6.5.1 Middle East

10.6.5.2 Africa

11 Competitive Landscape (Page No. - 95)

11.1 Introduction

11.2 Prominent Players in the Wealth Management Platform Market

11.3 Competitive Scenario

11.3.1 New Product Launches and Product Upgradations

11.3.2 Partnerships and Collaborations

11.3.3 Business Expansions

11.3.4 Acquisitions

12 Company Profiles (Page No. - 102)

(Business Overview, Solutions & Platform, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

12.1 SS&C

12.2 Fiserv

12.3 Broadridge

12.4 FIS

12.5 Profile Software

12.6 Temenos

12.7 SEI Investments Company

12.8 Investedge

12.9 Finantix

12.10 Comarch

12.11 Objectway

12.12 Dorsum

*Details on Business Overview, Solutions & Platform, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 129)

13.1 Key Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets Subscription Portal

13.4 Available Customization

13.5 Related Reports

13.6 Author Details

List of Tables (68 Tables)

Table 1 United States Dollar Exchange Rate, 20142016

Table 2 Wealth Management Platform Market: Assumptions

Table 3 Market Size and Growth Rate, 20152022 (USD Million, Y-O-Y %)

Table 4 Market Size By Advisory Model, 20152022 (USD Million)

Table 5 Human Advisory: Market Size By Region, 20152022 (USD Million)

Table 6 Robo Advisory: Market Size By Region, 20152022 (USD Million)

Table 7 Hybrid: Market Size By Region, 20152022 (USD Million)

Table 8 Wealth Management Platform Market Size, By Business Function, 20152022 (USD Million)

Table 9 Financial Advice Management: Market Size By Region, 20152022 (USD Million)

Table 10 Portfolio, Accounting, and Trading Management: Market Size By Region, 20152022 (USD Million)

Table 11 Performance Management: Market Size By Region, 20152022 (USD Million)

Table 12 Risk and Compliance Management: Market Size By Region, 20152022 (USD Million)

Table 13 Reporting: Market Size By Region, 20152022 (USD Million)

Table 14 Others: Market Size By Region, 20152022 (USD Million)

Table 15 Market Size By Deployment Model, 20152022 (USD Million)

Table 16 On-Premises: Market Size By Region, 20152022 (USD Million)

Table 17 Cloud: Market Size By Region, 20152022 (USD Million)

Table 18 Wealth Management Platform Market Size, By End-User Industry, 20152022 (USD Million)

Table 19 Banks: Market Size By Region, 20152022 (USD Million)

Table 20 Investment Management Firms: Market Size By Region, 20152022 (USD Million)

Table 21 Trading and Exchange Firms: Market Size By Region, 20152022 (USD Million)

Table 22 Brokerage Firms: Market Size By Region, 20152022 (USD Million)

Table 23 Others: Market Size By Region, 20152022 (USD Million)

Table 24 Wealth Management Platform Market Size, By Region, 20152022 (USD Million)

Table 25 North America: Market Size By Advisory Model, 20152022 (USD Million)

Table 26 North America: Market Size By Business Function, 20152022 (USD Million)

Table 27 North America: Market Size By Deployment Model, 20152022 (USD Million)

Table 28 North America: Market Size By End-User Industry, 20152022 (USD Million)

Table 29 North America: Market Size By Country, 20152022 (USD Million)

Table 30 United States: Market Size By End-User Industry, 20152022 (USD Million)

Table 31 Canada: Wealth Management Platform Market Size, By End-User Industry, 20152022 (USD Million)

Table 32 Europe: Market Size By Advisory Model, 20152022 (USD Million)

Table 33 Europe: Market Size By Business Function, 20152022 (USD Million)

Table 34 Europe: Market Size By Deployment Model, 20152022 (USD Million)

Table 35 Europe: Market Size By End-User Industry, 20152022 (USD Million)

Table 36 Europe: Market Size By Country, 20152022 (USD Million)

Table 37 Germany: Market Size By End-User Industry, 20152022 (USD Million)

Table 38 Italy: Wealth Management Platform Market Size, By End-User Industry, 20152022 (USD Million)

Table 39 United Kingdom: Market Size By End-User Industry, 20152022 (USD Million)

Table 40 Rest of Europe: Market Size By End-User Industry, 20152022 (USD Million)

Table 41 Asia Pacific: Market Size By Advisory Model, 20152022 (USD Million)

Table 42 Asia Pacific: Market Size By Business Function, 20152022 (USD Million)

Table 43 Asia Pacific: Market Size By Deployment Model, 20152022 (USD Million)

Table 44 Asia Pacific: Market Size By End-User Industry, 20152022 (USD Million)

Table 45 Asia Pacific: Market Size By Country, 20152022 (USD Million)

Table 46 China: Wealth Management Platform Market Size, By End-User Industry, 20152022 (USD Million)

Table 47 Japan: Market Size By End-User Industry, 20152022 (USD Million)

Table 48 India: Market Size By End-User Industry, 20152022 (USD Million)

Table 49 Rest of Asia Pacific: Market Size By End-User Industry, 20152022 (USD Million)

Table 50 Latin America: Wealth Management Platform Market Size, By Advisory Model, 20152022 (USD Million)

Table 51 Latin America: Market Size By Business Function, 20152022 (USD Million)

Table 52 Latin America: Market Size By Deployment Model, 20152022 (USD Million)

Table 53 Latin America: Market Size By End-User Industry, 20152022 (USD Million)

Table 54 Latin America: Market Size By Country, 20152022 (USD Million)

Table 55 Brazil: Wealth Management Platform Market Size, By End-User Industry, 20152022 (USD Million)

Table 56 Mexico: Market Size By End-User Industry, 20152022 (USD Million)

Table 57 Rest of Latin America: Market Size By End-User Industry, 20152022 (USD Million)

Table 58 Middle East and Africa: Market Size By Advisory Model, 20152022 (USD Million)

Table 59 Middle East and Africa: Market Size By Business Function, 20152022 (USD Million)

Table 60 Middle East and Africa: Market Size By Deployment Model, 20152022 (USD Million)

Table 61 Middle East and Africa: Market Size By End-User Industry, 20152022 (USD Million)

Table 62 Middle East and Africa: Market Size By Subregion, 20152022 (USD Million)

Table 63 Middle East: Market Size, By End-User Industry, 20152022 (USD Million)

Table 64 Africa: Wealth Management Platform Market Size, By End-User Industry, 20152022 (USD Million)

Table 65 New Product Launches and Product Upgradations, 2017

Table 66 Partnerships and Collaborations, 20152017

Table 67 Business Expansions, 20152017

Table 68 Acquisitions, 20152017

List of Figures (39 Figures)

Figure 1 Wealth Management Platform Market Segmentation

Figure 2 Regional Scope

Figure 3 Market Research Design

Figure 4 Breakdown of Primary Interviews: By Company, Designation, and Region

Figure 5 Data Triangulation

Figure 6 Market Size Estimation Methodology: Bottom-Up Approach

Figure 7 Market Size Estimation Methodology: Top-Down Approach

Figure 8 Wealth Management Platform Market to Witness Significant Growth in the Global Market During the Forecast Period

Figure 9 Market By Advisory Model, 2017 vs 2022

Figure 10 Market By Business Function, 20172022

Figure 11 Market By Deployment Model, 20172022

Figure 12 Market By End-User Industry, 20172022

Figure 13 Constant Rise in the Global High Net Worth Individual to Drive the Growth of Wealth Management Platform Market

Figure 14 North America to have the Highest Market Share in 2017

Figure 15 Investment Management Firms End-User Industry, and North America to have the Highest Market Shares in 2017

Figure 16 Asia Pacific to Enter the Growth Phase During 20172022

Figure 17 Drivers, Restraints, Opportunities, and Challenges: Wealth Management Platform Market

Figure 18 Number of High Net Worth Individuals, By Region, 2016

Figure 19 Human Advisory Segment to have the Largest Market Size During the Forecast Period

Figure 20 Financial Advice Management Business Function to have the Largest Market Size During the Forecast Period

Figure 21 On-Premises Deployment Model to have the Larger Market Size During the Forecast Period

Figure 22 Trading and Exchange Firms End-User Industry to Grow at the Highest CAGR During the Forecast Period

Figure 23 Asia Pacific to Register the Highest CAGR During the Forecast Period

Figure 24 North America to have the Largest Market Size During the Forecast Period

Figure 25 North America: Market Snapshot

Figure 26 Asia Pacific: Market Snapshot

Figure 27 Key Developments By the Leading Players in the Wealth Management Platform Market, 20152017

Figure 28 Market Evaluation Framework

Figure 29 SS&C: Company Snapshot

Figure 30 SS&C: SWOT Analysis

Figure 31 Fiserv: Company Snapshot

Figure 32 Fiserv: SWOT Analysis

Figure 33 Broadridge: Company Snapshot

Figure 34 Broadridge: SWOT Analysis

Figure 35 FIS: Company Snapshot

Figure 36 FIS: SWOT Analysis

Figure 37 Profile Software: SWOT Analysis

Figure 38 Temenos: Company Snapshot

Figure 39 SEI Investments Company: Company Snapshot

Growth opportunities and latent adjacency in Wealth Management Platform Market

Analyse the Internal Research Requirement on Wealth Management Market & Global and Region wise size break down, consolidated and across business functions.

Detailed understanding of the market segment and major player for Entity & Wealth Management software market.

Gather insights into Wealth and Asset Management domain and leading technology providers in India.