Digital Banking Platforms Market by Component (Platforms and Services), Banking Type (Retail Banking, Corporate Banking, and Investment Banking), Banking Mode (Online Banking and Mobile Banking), Deployment Type, and Region - Global Forecast to 2026

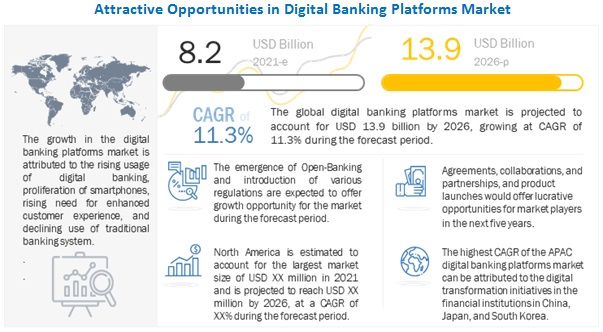

[199 Pages Report] The global digital banking platforms market is projected to grow at a CAGR of 11.3% during the forecast period to reach USD 13.9 billion by 2026 from an estimated USD 8.2 billion in 2021. The digital banking platforms market is gaining traction due to growing demand among banks for delivering enhanced customer experience and increasing adoption of cloud-based solutions by financial institutions.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact

The outbreak of COVID-19 has led to more usage of banking components because remote working and social distancing have helped digital banking gain a huge customer base. In North America, 35% are using online banking more than before coronavirus. The digital-only customers still score significantly lower than their branch-dependent counterparts in overall satisfaction. Nearly 20% of the European banking sector comprises small and medium banks. They come under the direct supervision of the national authority. Financial regulators across APAC have actively encouraged financial institutions to explore alternative ways of doing business, promoting the adoption of regulatory technology (regtech) and digital technologies as a best practice during Covid times.

Market Dynamics

Driver: Growing demand among banks for delivering enhanced customer experience.

Customer-centric solutions enable banks to improve customer loyalty by providing enhanced services and fast resolutions to customer queries. Banks are focused on adopting customer retention policies and attracting new customers by effectively communicating with them. A digital banking platforms omnichannel capabilities help banks facilitate personalized conversations across multiple channels, including the voice, web, and mobile. It enables banks to engage customers across all touchpoints. Monitoring end-to-end customer journeys and tracking all activities help to create an overall view for every customer. Digital banking allows personalization at the scale of 5 and 15% revenue growth for companies in the financial services sector. Consumers expect fast-speed and instant transactions, which is making digital banking platforms more reliable and efficient to use.

Restraint: Lack of digital literacy in emerging countries

Many emerging countries still lack digital literacy, which hinders the wide-scale adoption of online and mobile payments. This negatively impacts the market growth of digital banking platforms. Digital literacy comprises a wide range of skills, such as the ability to read and make sense of technical knowledge, which help individuals operate and make the use of digital technologies. Most countries in the African continent have a low digital literacy rate; therefore, individuals cannot exploit the potential of digital technologies. Technology vendors are also hesitant to make investments due to the low number of digital transactions. Hence, low digital literacy in emerging countries is expected to slow down the growth of the digital banking platforms market.

Opportunity: Emergence of the Banking as a Service (BaaS) model

The Banking as a Service (BaaS) model has significantly shown major growth in the digital banking industry. It is a model in which licensed banks integrate their digital banking services directly into the products of other non-bank businesses. This enables a non-bank business to offer its customers digital banking services, such as mobile bank accounts, debit cards, loans, and payment services, without needing to acquire a banking license of their own. BaaS allows digital banking platforms to connect directly to the bank systems through APIs. FinTech companies are adopting BaaS as an evolving technological trend for building innovative financial services and tailor-made digital strategies.

Challenge: Rising security concerns

The cumulative use of digital banking has elevated concerns among organizations about managing customer and financial data securely. As IoT has become more extensive, organizations require more robust security and privacy to prevent breaches. The issue of security endangers the success of digitization. With the growing number of IoT-enabled systems, the number of security and privacy issues, such as brute-force attacks, distributed attacks, and social phishing will also increase, and every endpoint, gateway, sensor, and smartphone will become a potential target for hackers. For instance, On February 2021, Sequoia Capital informed its investors of a data breach exposing some of their personal and financial information. The company claimed to have been a victim of a phishing attack. Furthermore, in March 2021, CNA Financial suffered a ransomware attack that disturbed the companys employees and customer services for three days. Digital banking platforms help financial institutions mitigate such risks and provide a frictionless experience to their customers.

By Component, the Platforms segment to have a higher growth during the forecast period

Digital banking platforms digitize bank operations, facilitating digital customer interactions and allowing banks to offer a host of digital financial products. The digital banking platform enables banks transition from brick and mortar to multichannel, digital banks. These platforms mostly support modern customer-facing front ends and provide a development environment to connect and integrate mid- and back-office systems. These platforms rely on process automation, web-based services, and Application Programming Interfaces (APIs) to create fully digital banking services. These platforms provide a basis for connecting home-built core banking solutions, SaaS software, and FinTech infrastructure and services. The digital banking platform offers various products such as commercial accounts, retail accounts, mobile banking, investments, real-time transactions, and financial management tools.

By Banking Type, the Retail Banking segment to dominate the market during the forecast period

Retail banking has emerged as an essential enabler in the digital banking platforms market to translate banking models across the globe. The digital revolution has disrupted the marketplace with changing customer behavior and expectations, emerging competitors, and innovative technologies. With the increasing number of channels, financial institutions are changing their operating processes to provide customers with premium services and improve their account management.

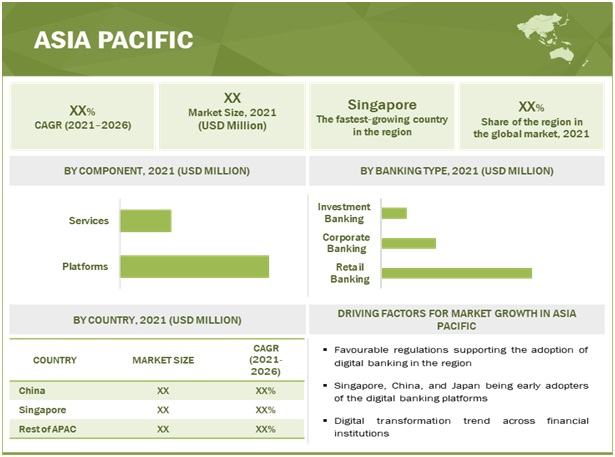

APAC to grow at the highest CAGR during the forecast period

Asia Pacific Digital banking platform market is estimated to have strong growth in the future. Asia Pacific is one of the fastest-developing regions in the world. With the constant rise in technologies, there is a steady growth in the amount of services in the region. The APAC region is expected to have the fastest growth rate in the digital banking platforms market during the forecast period due to its growing adoption of technologies. The high rate of adoption of digital technologies, especially in emerging economies, such as Singapore, Australia, India, China, and Japan, has made APAC a lucrative market in the IT industry. Strong banking capabilities, including digital offerings, strong financial positions, and digital structures, are expected to drive the growth of the digital banking platforms market in the APAC region. Companies in APAC would benefit from the flexible economic conditions, industrialization, the globalization-motivated policies of the government, and the expanding digitalization in the region.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The report includes the study of key players offering Digital banking platforms market. It profiles major vendors in the global Digital banking platform market. The major vendors in the Digital banking platform Market include Alkami (US), Apiture (US), Appway (Switzerland), Backbase (Netherlands), BNY Mellon (US), CR2 (Ireland), EdgeVerve (India), ebankIT (England), Finastra (UK), Fiserv (US), Intellect Design Arena (India), Mambu (Germany), MuleSoft (US), nCino (US), NCR (US), NETinfo (Cyprus), Oracle (US), SAP (Germany), Sopra Banking Software (France), TCS (India), Technisys (US), Temenos (Switzerland), TPS (Pakistan), Velmie (US), and Worldline (France).These players have adopted various strategies to grow in the global Digital banking platform market. The study includes an in-depth competitive analysis of these key players in the market with their company profiles, recent developments, and key market strategies.

Scope of the Report

|

Report Metrics |

Details |

|

Market size value in 2021 |

USD 8.2 Billion |

|

Market size value in 2026 |

USD 13.9 Billion |

|

Growth Rate |

11.3% CAGR |

|

Largest Market |

Asia Pacific |

|

Market Drivers |

|

|

Market Opportunities |

|

|

Market size available for years |

2017-2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021-2026 |

|

Segments covered |

By Component, Deployment Type, Banking Type, Banking Mode, and Region |

|

Regions covered |

North America, Europe, APAC, MEA, Latin America |

|

Companies covered |

Alkami (US), Apiture (US), Appway (Switzerland), Backbase (Netherlands), BNY Mellon (US), CR2 (Ireland), EdgeVerve (India), ebankIT (England), Finastra (UK), Fiserv (US), Intellect Design Arena (India), Mambu (Germany), MuleSoft (US), nCino (US), NCR (US), NETinfo (Cyprus), Oracle (US), SAP (Germany), Sopra Banking Software (France), TCS (India), Technisys (US), Temenos (Switzerland), TPS (Pakistan), Velmie (US), and Worldline (France). |

This research report categorizes the Digital Banking Platforms Market to forecast revenues and analyze trends in each of the following subsegments:

By Component:

- Platforms

- Services

- Professional Services

- Managed Services

By Deployment Type:

- On-premises

- Cloud

By Banking Type:

- Retail Banking

- Corporate Banking

- Investment Banking

By Banking Mode:

- Online Banking

- Mobile Banking

By Region:

- North America

- US

- Canada

- Europe

- UK

- France

- Rest of Europe

- APAC

- China

- Singapore

- Rest of APAC

- MEA

- UAE

- KSA

- Rest of MEA

- Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In September 2021, TCS launched TCS BaNCS Cloud for Asset Servicing, which automates the servicing of all classes of assets across all markets, and is targeted at custodians, broker dealers, asset managers, and investment and private banks.

- In August 2021, Finastra and Salt Edge collaborated to improve the speed of compliance with the Payments Service Directive 2 (PSD2) and other global Open Banking standards for banks and Electronic Money Institutions (EMI) worldwide.

- In July 2021, Temenos and UBL announced a partnership with each other to provide and implement a next-generation digital banking solution. Through this partnership, the digital transformation of UBL would be supported across all channels, products, and segments for its domestic and international markets.

- In April 2021, NCR and Google Cloud collaborated which would allow NCR to expand cloud availability of its digital banking software portfolio, which includes the NCR channels services for retail banking and payment processing platform.

- In July 2020, Finastra and Microsoft signed a partnership for a multiyear cloud to accelerate the digital transformation of financial services. Together, they would provide customers, businesses, and the community with solutions and services that would fit around the needs and lives of customers.

Frequently Asked Questions (FAQ):

How big is the digital banking platforms market?

What is the digital banking platforms market growth?

Which region has the largest market share in the Digital banking platforms Market?

What are the major factors driving the growth digital banking platforms market?

Who are the major vendors in the Digital Banking Platforms Market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 23)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACTSCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 20182020

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 32)

2.1 RESEARCH DATA

FIGURE 6 DIGITAL BANKING PLATFORMS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakdown of primary profiles

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

2.3.1 TOP-DOWN APPROACH

FIGURE 8 MARKET SIZE ESTIMATION: TOP-DOWN APPROACHSUPPLY-SIDE ANALYSIS

2.3.2 BOTTOM-UP APPROACH

FIGURE 9 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACHSUPPLY-SIDE ANALYSIS (1/2)

FIGURE 10 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACHSUPPLY-SIDE ANALYSIS (2/2)

2.4 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.5 ASSUMPTIONS FOR THE STUDY

2.6 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 41)

FIGURE 11 DIGITAL BANKING PLATFORMS MARKET, 20192026

FIGURE 12 TOP LEADING SEGMENTS IN THE MARKET IN 2021

FIGURE 13 MARKET, REGIONAL AND COUNTRY-WISE SHARES, 2021

4 PREMIUM INSIGHTS (Page No. - 44)

4.1 ATTRACTIVE OPPORTUNITIES IN THE DIGITAL BANKING PLATFORMS MARKET

FIGURE 14 EMERGENCE OF OPEN BANKING TO DRIVE THE GROWTH OF THE MARKET

4.2 MARKET, BY COMPONENT

FIGURE 15 PLATFORMS SEGMENT EXPECTED TO LEAD THE MARKET IN 2021

4.3 MARKET, BY SERVICE

FIGURE 16 PROFESSIONAL SERVICES SEGMENT EXPECTED TO ACCOUNT FOR A LARGER MARKET SHARE DURING THE FORECAST PERIOD

4.4 MARKET, BY PROFESSIONAL SERVICES

FIGURE 17 IMPLEMENTATION SEGMENT EXPECTED TO ACCOUNT FOR THE LARGEST MARKET SHARE IN 2021

4.5 MARKET, BY BANKING TYPE

FIGURE 18 RETAIL BANKING SEGMENT EXPECTED TO LEAD THE MARKET DURING 20212026

4.6 MARKET, BY BANKING MODE

FIGURE 19 ONLINE BANKING SEGMENT EXPECTED TO LEAD THE MARKET GROWTH DURING 20212026

4.7 DIGITAL BANKING PLATFORMS MARKET, BY DEPLOYMENT TYPE

FIGURE 20 ON-PREMISES SEGMENT EXPECTED TO LEAD THE MARKET DURING 20212026

4.8 MARKET, BY REGION

FIGURE 21 ASIA PACIFIC EXPECTED TO GROW AT THE HIGHEST RATE DURING THE FORECAST PERIOD

4.9 MARKET, BY COUNTRY

FIGURE 22 SINGAPORE EXPECTED TO REGISTER THE HIGHEST GROWTH DURING THE FORECAST PERIOD

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 49)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 23 DIGITAL BANKING PLATFORMS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Growing demand among banks for delivering enhanced customer experience

5.2.1.2 Increasing adoption of cloud-based solutions by financial institutions

5.2.1.3 Rising adoption of smartphones

TABLE 3 SMARTPHONE ADOPTION, BY REGION, 2020 VS. 2025

5.2.1.4 Growing need to meet the compliance requirements of new data laws and regulations

5.2.1.5 COVID-19 accelerating the adoption of digital banking

5.2.2 RESTRAINTS

5.2.2.1 Lack of digital literacy in emerging countries

5.2.3 OPPORTUNITIES

5.2.3.1 Increased cross-selling and upselling activities

5.2.3.2 Emergence of the Banking as a Service (BaaS)model

5.2.3.3 Gradual adoption of Open-Banking APIs

5.2.4 CHALLENGES

5.2.4.1 Rising security concerns

5.2.4.2 Difficulty in integrating digital banking platforms with legacy systems

5.2.4.3 Technical Issues leading to losses

5.3 COVID-19 MARKET OUTLOOK FOR DIGITAL BANKING PLATFORMS MARKET

TABLE 4 MARKET: ANALYSIS OF DRIVERS AND OPPORTUNITIES IN THE COVID-19 ERA

TABLE 5 MARKET: ANALYSIS OF CHALLENGES AND RESTRAINTS IN THE COVID-19 ERA

5.3.1 CUMULATIVE GROWTH ANALYSIS

TABLE 6 MARKET: CUMULATIVE GROWTH ANALYSIS

5.4 USE CASES

5.4.1 USE CASE 1: BACKBASE

5.4.2 USE CASE 2: APPWAY

5.4.3 USE CASE 3: FINASTRA

5.4.4 USE CASE 4: TEMENOS

5.4.5 USE CASE 5: ORACLE

5.5 PRICING ANALYSIS

TABLE 7 AVERAGE SELLING PRICE RANGES OF SUBSCRIPTION-BASED DIGITAL BANKING PLATFORM

6 DIGITAL BANKING PLATFORMS MARKET, BY COMPONENT (Page No. - 59)

6.1 INTRODUCTION

6.1.1 COMPONENTS: MARKET DRIVERS

6.1.2 COMPONENTS: COVID-19 IMPACT

FIGURE 24 PLATFORMS SEGMENT TO HOLD A LARGER MARKET SHARE DURING THE FORECAST PERIOD

TABLE 8 MARKET SIZE, BY COMPONENT, 20172020 (USD MILLION)

TABLE 9 MARKET SIZE, BY COMPONENT, 20212026 (USD MILLION)

6.2 PLATFORMS

6.2.1 RISING NEED TO REPLACE LEGACY BANKING PLATFORM DRIVE THE DEMAND FOR DIGITAL BANKING PLATFORMS

TABLE 10 PLATFORMS: DIGITAL BANKING PLATFORMS MARKET SIZE, BY REGION, 20172020 (USD MILLION)

TABLE 11 PLATFORMS: MARKET SIZE, BY REGION, 20212026 (USD MILLION)

6.3 SERVICES

6.3.1 RISING DEPLOYMENT OF DIGITAL BANKING PLATFORMS AND COMPLEXITIES IN INTEGRATION WITH BACK-END SYSTEMS TO FUEL THE DEMAND FOR SERVICES

TABLE 12 MARKET SIZE, BY SERVICE, 20172020 (USD MILLION)

TABLE 13 MARKET SIZE, BY SERVICE, 20212026 (USD MILLION)

TABLE 14 SERVICES: MARKET SIZE, BY REGION, 20172020 (USD MILLION)

TABLE 15 SERVICES: MARKET SIZE, BY REGION, 20212026 (USD MILLION)

6.3.2 PROFESSIONAL SERVICES

TABLE 16 PROFESSIONAL SERVICES: MARKET SIZE, BY TYPE, 20172020 (USD MILLION)

TABLE 17 PROFESSIONAL SERVICES: MARKET SIZE, BY TYPE, 20212026 (USD MILLION)

TABLE 18 PROFESSIONAL SERVICES: MARKET SIZE, BY REGION, 20172020 (USD MILLION)

TABLE 19 PROFESSIONAL SERVICES: MARKET SIZE, BY REGION, 20212026 (USD MILLION)

6.3.2.1 Consulting

TABLE 20 CONSULTING: DIGITAL BANKING PLATFORM MARKET SIZE, BY REGION, 20172020 (USD MILLION)

TABLE 21 CONSULTING: DIGITAL BANKING PLATFORM MARKET SIZE, BY REGION, 20212026 (USD MILLION)

6.3.2.2 Implementation

TABLE 22 IMPLEMENTATION: DIGITAL BANKING PLATFORMS MARKET SIZE, BY REGION, 20172020 (USD MILLION)

TABLE 23 IMPLEMENTATION: MARKET SIZE, BY REGION, 20212026 (USD MILLION)

6.3.2.3 Support and maintenance

TABLE 24 SUPPORT AND MAINTENANCE: MARKET SIZE, BY REGION, 20172020 (USD MILLION)

TABLE 25 SUPPORT AND MAINTENANCE: MARKET SIZE, BY REGION, 20212026 (USD MILLION)

6.3.3 MANAGED SERVICES

TABLE 26 MANAGED SERVICES: MARKET SIZE, BY REGION, 20172020 (USD MILLION)

TABLE 27 MANAGED SERVICES: MARKET SIZE, BY REGION, 20212026 (USD MILLION)

7 DIGITAL BANKING PLATFORMS MARKET, BY BANKING TYPE (Page No. - 70)

7.1 INTRODUCTION

7.1.1 BANKING TYPES: MARKET DRIVERS

7.1.2 BANKING TYPES: COVID-19 IMPACT

FIGURE 25 RETAIL BANKING SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 28 MARKET SIZE, BY BANKING TYPE, 20172020 (USD MILLION)

TABLE 29 MARKET SIZE, BY BANKING TYPE, 20212026 (USD MILLION)

7.2 RETAIL BANKING

7.2.1 INCREASED DEMAND FOR OFFERING ENHANCED CUSTOMER SERVICES TO RETAIL CONSUMERS TO BOOST THE GROWTH OF THE RETAIL BANKING TYPE

TABLE 30 RETAIL BANKING: MARKET SIZE, BY REGION, 20172020 (USD MILLION)

TABLE 31 RETAIL BANKING: MARKET SIZE, BY REGION, 20212026 (USD MILLION)

7.3 CORPORATE BANKING

7.3.1 INCREASED NEED FOR A DIGITAL BANKING PLATFORM TO BOOST THE GROWTH OF THE CORPORATE BANKING TYPE

TABLE 32 CORPORATE BANKING: DIGITAL BANKING PLATFORMS MARKET SIZE, BY REGION, 20172020 (USD MILLION)

TABLE 33 CORPORATE BANKING: MARKET SIZE, BY REGION, 20212026 (USD MILLION)

7.4 INVESTMENT BANKING

7.4.1 RISING COMPETITION FROM FINTECH AND REGTECH VENDORS TO BOOST THE ADOPTION OF DIGITAL BANKING PLATFORMS IN THE INVESTMENT BANKING SEGMENT

TABLE 34 INVESTMENT BANKING: MARKET SIZE, BY REGION, 20172020 (USD MILLION)

TABLE 35 INVESTMENT BANKING: MARKET SIZE, BY REGION, 20212026 (USD MILLION)

8 DIGITAL BANKING PLATFORMS MARKET, BY BANKING MODE (Page No. - 76)

8.1 INTRODUCTION

8.1.1 BANKING MODES: MARKET DRIVERS

8.1.2 BANKING MODES: COVID-19 IMPACT

FIGURE 26 MOBILE BANKING SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 36 MARKET SIZE, BY BANKING MODE, 20172020 (USD MILLION)

TABLE 37 MARKET SIZE, BY BANKING MODE, 20212026 (USD MILLION)

8.2 ONLINE BANKING

8.2.1 INCREASED USAGE OF THE INTERNET VIA THE WEB-BASED MODE TO BOOST THE GROWTH OF ONLINE BANKING

TABLE 38 ONLINE BANKING: MARKET SIZE, BY REGION, 20172020 (USD MILLION)

TABLE 39 ONLINE BANKING: MARKET SIZE, BY REGION, 20212026 (USD MILLION)

8.3 MOBILE BANKING

8.3.1 INCREASING USAGE OF MOBILE DEVICES TO ACCESS BANKING SERVICES TO BOOST THE GROWTH OF MOBILE BANKING

TABLE 40 MOBILE BANKING: MARKET SIZE, BY REGION, 20172020 (USD MILLION)

TABLE 41 MOBILE BANKING: MARKET SIZE, BY REGION, 20212026 (USD MILLION)

9 DIGITAL BANKING PLATFORMS MARKET, BY DEPLOYMENT TYPE (Page No. - 81)

9.1 INTRODUCTION

9.1.1 DEPLOYMENT TYPES: MARKET DRIVERS

9.1.2 DEPLOYMENT TYPES: COVID-19 IMPACT

FIGURE 27 CLOUD DEPLOYMENT TYPE TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 42 MARKET SIZE, BY DEPLOYMENT TYPE, 20172020 (USD MILLION)

TABLE 43 MARKET SIZE, BY DEPLOYMENT TYPE, 20212026 (USD MILLION)

9.2 ON-PREMISES

9.2.1 GROWING SECURITY CONCERNS TO B0OST THE DEMAND FOR ON-PREMISES DEPLOYMENT OF DIGITAL BANKING PLATFORMS

TABLE 44 ON-PREMISES: MARKET SIZE, BY REGION, 20172020 (USD MILLION)

TABLE 45 ON-PREMISES: MARKET SIZE, BY REGION, 20212026 (USD MILLION)

9.3 CLOUD

9.3.1 COST-EFFECTIVENESS OF THE CLOUD-BASED DEPLOYMENT TYPE TO BOOST THE GROWTH OF DIGITAL BANKING PLATFORMS

TABLE 46 CLOUD: MARKET SIZE, BY REGION, 20172020 (USD MILLION)

TABLE 47 CLOUD: MARKET SIZE, BY REGION, 20212026 (USD MILLION)

10 DIGITAL BANKING PLATFORMS MARKET, BY REGION (Page No. - 86)

10.1 INTRODUCTION

FIGURE 28 ASIA PACIFIC TO EXHIBIT THE HIGHEST CAGR IN THE MARKET DURING THE FORECAST PERIOD

FIGURE 29 NORTH AMERICA TO HOLD THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

TABLE 48 MARKET SIZE, BY REGION, 20172020 (USD MILLION)

TABLE 49 MARKET SIZE, BY REGION, 20212026 (USD MILLION)

10.2 NORTH AMERICA

10.2.1 NORTH AMERICA: MARKET DRIVERS

10.2.2 NORTH AMERICA: DIGITAL BANKING PLATFORM REGULATIONS

10.2.3 NORTH AMERICA: IMPACT OF COVID-19 ON THE DIGITAL BANKING PLATFORMS MARKET

FIGURE 30 NORTH AMERICA: MARKET SNAPSHOT

TABLE 50 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 20172020 (USD MILLION)

TABLE 51 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 20212026 (USD MILLION)

TABLE 52 NORTH AMERICA: MARKET SIZE, BY SERVICE, 20172020 (USD MILLION)

TABLE 53 NORTH AMERICA: MARKET SIZE, BY SERVICE, 20212026 (USD MILLION)

TABLE 54 NORTH AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 20172020 (USD MILLION)

TABLE 55 NORTH AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 20212026 (USD MILLION)

TABLE 56 NORTH AMERICA: MARKET SIZE, BY BANKING TYPE, 20172020 (USD MILLION)

TABLE 57 NORTH AMERICA: MARKET SIZE, BY BANKING TYPE, 20212026 (USD MILLION)

TABLE 58 NORTH AMERICA: MARKET SIZE, BY BANKING MODE, 20172020 (USD MILLION)

TABLE 59 NORTH AMERICA: MARKET SIZE, BY BANKING MODE, 20212026 (USD MILLION)

TABLE 60 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 20172020 (USD MILLION)

TABLE 61 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 20212026 (USD MILLION)

TABLE 62 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 20172020 (USD MILLION)

TABLE 63 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 20212026 (USD MILLION)

10.2.4 UNITED STATES

10.2.4.1 The US to hold the largest share of the digital banking platforms market in 2021

TABLE 64 UNITED STATES: MARKET SIZE, BY COMPONENT, 20172020 (USD MILLION)

TABLE 65 UNITED STATES: MARKET SIZE, BY COMPONENT, 20212026 (USD MILLION)

TABLE 66 UNITED STATES: MARKET SIZE, BY SERVICE, 20172020 (USD MILLION)

TABLE 67 UNITED STATES: MARKET SIZE, BY SERVICE, 20212026 (USD MILLION)

TABLE 68 UNITED STATES: MARKET SIZE, BY PROFESSIONAL SERVICE, 20172020 (USD MILLION)

TABLE 69 UNITED STATES: MARKET SIZE, BY PROFESSIONAL SERVICE, 20212026 (USD MILLION)

TABLE 70 UNITED STATES: MARKET SIZE, BY BANKING TYPE, 20172020 (USD MILLION)

TABLE 71 UNITED STATES: MARKET SIZE, BY BANKING TYPE, 20212026 (USD MILLION)

TABLE 72 UNITED STATES: MARKET SIZE, BY BANKING MODE, 20172020 (USD MILLION)

TABLE 73 UNITED STATES: MARKET SIZE, BY BANKING MODE, 20212026 (USD MILLION)

TABLE 74 UNITED STATES: MARKET SIZE, BY DEPLOYMENT TYPE, 20172020 (USD MILLION)

TABLE 75 UNITED STATES: MARKET SIZE, BY DEPLOYMENT TYPE, 20212026 (USD MILLION)

10.2.5 CANADA

10.2.5.1 Increasing adoption of advanced IT technologies to drive the market in Canada during the forecast period

10.3 EUROPE

10.3.1 EUROPE: DIGITAL BANKING PLATFORMS MARKET DRIVERS

10.3.2 EUROPE: DIGITAL BANKING PLATFORM REGULATIONS

10.3.3 EUROPE: IMPACT OF COVID-19 ON THE MARKET

TABLE 76 EUROPE: MARKET SIZE, BY COMPONENT, 20172020 (USD MILLION)

TABLE 77 EUROPE: MARKET SIZE, BY COMPONENT, 20212026 (USD MILLION)

TABLE 78 EUROPE: MARKET SIZE, BY SERVICE, 20172020 (USD MILLION)

TABLE 79 EUROPE: MARKET SIZE, BY SERVICE, 20212026 (USD MILLION)

TABLE 80 EUROPE: MARKET SIZE, BY PROFESSIONAL SERVICE, 20172020 (USD MILLION)

TABLE 81 EUROPE: MARKET SIZE, BY PROFESSIONAL SERVICE, 20212026 (USD MILLION)

TABLE 82 EUROPE: MARKET SIZE, BY BANKING TYPE, 20172020 (USD MILLION)

TABLE 83 EUROPE: MARKET SIZE, BY BANKING TYPE, 20212026 (USD MILLION)

TABLE 84 EUROPE: MARKET SIZE, BY BANKING MODE, 20172020 (USD MILLION)

TABLE 85 EUROPE: MARKET SIZE, BY BANKING MODE, 20212026 (USD MILLION)

TABLE 86 EUROPE: MARKET SIZE, BY DEPLOYMENT TYPE, 20172020 (USD MILLION)

TABLE 87 EUROPE: MARKET SIZE, BY DEPLOYMENT TYPE, 20212026 (USD MILLION)

TABLE 88 EUROPE: MARKET SIZE, BY COUNTRY, 20172020 (USD MILLION)

TABLE 89 EUROPE: MARKET SIZE, BY COUNTRY, 20212026 (USD MILLION)

10.3.4 UNITED KINGDOM

10.3.4.1 Strong presence of several FinTech companies to drive the digital banking platforms market in the UK

TABLE 90 UNITED KINGDOM: MARKET SIZE, BY COMPONENT, 20172020 (USD MILLION)

TABLE 91 UNITED KINGDOM: MARKET SIZE, BY COMPONENT, 20212026 (USD MILLION)

TABLE 92 UNITED KINGDOM: MARKET SIZE, BY SERVICE, 20172020 (USD MILLION)

TABLE 93 UNITED KINGDOM: MARKET SIZE, BY SERVICE, 20212026 (USD MILLION)

TABLE 94 UNITED KINGDOM: MARKET SIZE, BY PROFESSIONAL SERVICE, 20172020 (USD MILLION)

TABLE 95 UNITED KINGDOM: MARKET SIZE, BY PROFESSIONAL SERVICE, 20212026 (USD MILLION)

TABLE 96 UNITED KINGDOM: MARKET SIZE, BY BANKING TYPE, 20172020 (USD MILLION)

TABLE 97 UNITED KINGDOM: MARKET SIZE, BY BANKING TYPE, 20212026 (USD MILLION)

TABLE 98 UNITED KINGDOM: MARKET SIZE, BY BANKING MODE, 20172020 (USD MILLION)

TABLE 99 UNITED KINGDOM: MARKET SIZE, BY BANKING MODE, 20212026 (USD MILLION)

TABLE 100 UNITED KINGDOM: MARKET SIZE, BY DEPLOYMENT TYPE, 20172020 (USD MILLION)

TABLE 101 UNITED KINGDOM: MARKET SIZE, BY DEPLOYMENT TYPE, 20212026 (USD MILLION)

10.3.5 FRANCE

10.3.5.1 Rising usage of online banking mode in the country to drive the growth of the market

10.3.6 REST OF EUROPE

10.4 ASIA PACIFIC

10.4.1 ASIA PACIFIC: DIGITAL BANKING PLATFORMS MARKET DRIVERS

10.4.2 ASIA PACIFIC: DIGITAL BANKING PLATFORM REGULATIONS

10.4.3 ASIA PACIFIC: IMPACT OF COVID-19 ON THE MARKET

FIGURE 31 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 102 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 20172020 (USD MILLION)

TABLE 103 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 20212026 (USD MILLION)

TABLE 104 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 20172020 (USD MILLION)

TABLE 105 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 20212026 (USD MILLION)

TABLE 106 ASIA PACIFIC: MARKET SIZE, BY PROFESSIONAL SERVICE, 20172020 (USD MILLION)

TABLE 107 ASIA PACIFIC: MARKET SIZE, BY PROFESSIONAL SERVICE, 20212026 (USD MILLION)

TABLE 108 ASIA PACIFIC: MARKET SIZE, BY BANKING TYPE, 20172020 (USD MILLION)

TABLE 109 ASIA PACIFIC: MARKET SIZE, BY BANKING TYPE, 20212026 (USD MILLION)

TABLE 110 ASIA PACIFIC: MARKET SIZE, BY BANKING MODE, 20172020 (USD MILLION)

TABLE 111 ASIA PACIFIC: MARKET SIZE, BY BANKING MODE, 20212026 (USD MILLION)

TABLE 112 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT TYPE, 20172020 (USD MILLION)

TABLE 113 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT TYPE, 20212026 (USD MILLION)

TABLE 114 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 20172020 (USD MILLION)

TABLE 115 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 20212026 (USD MILLION)

10.4.4 CHINA

10.4.4.1 Rapid changes in the digital banking platforms ecosystem to drive its adoption in China

TABLE 116 CHINA: DIGITAL BANKING PLATFORMS MARKET SIZE, BY COMPONENT, 20172020 (USD MILLION)

TABLE 117 CHINA: MARKET SIZE, BY COMPONENT, 20212026 (USD MILLION)

TABLE 118 CHINA: MARKET SIZE, BY SERVICE, 20172020 (USD MILLION)

TABLE 119 CHINA: MARKET SIZE, BY SERVICE, 20212026 (USD MILLION)

TABLE 120 CHINA: MARKET SIZE, BY PROFESSIONAL SERVICE, 20172020 (USD MILLION)

TABLE 121 CHINA: MARKET SIZE, BY PROFESSIONAL SERVICE, 20212026 (USD MILLION)

TABLE 122 CHINA: MARKET SIZE, BY BANKING TYPE, 20172020 (USD MILLION)

TABLE 123 CHINA: MARKET SIZE, BY BANKING TYPE, 20212026 (USD MILLION)

TABLE 124 CHINA: MARKET SIZE, BY BANKING MODE, 20172020 (USD MILLION)

TABLE 125 CHINA: MARKET SIZE, BY BANKING MODE, 20212026 (USD MILLION)

TABLE 126 CHINA: MARKET SIZE, BY DEPLOYMENT TYPE, 20172020 (USD MILLION)

TABLE 127 CHINA: MARKET SIZE, BY DEPLOYMENT TYPE, 20212026 (USD MILLION)

10.4.5 SINGAPORE

10.4.5.1 Rapid adoption of innovative digital technologies across the banking sector to fuel the growth of the market in Singapore

10.4.6 REST OF ASIA PACIFIC

10.5 LATIN AMERICA

10.5.1 LATIN AMERICA: DIGITAL BANKING PLATFORM MARKET DRIVERS

10.5.2 LATIN AMERICA: DIGITAL BANKING PLATFORM REGULATIONS

10.5.3 LATIN AMERICA: IMPACT OF COVID-19 ON THE DIGITAL BANKING PLATFORMS MARKET

TABLE 128 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 20172020 (USD MILLION)

TABLE 129 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 20212026 (USD MILLION)

TABLE 130 LATIN AMERICA: MARKET SIZE, BY SERVICE, 20172020 (USD MILLION)

TABLE 131 LATIN AMERICA: MARKET SIZE, BY SERVICE, 20212026 (USD MILLION)

TABLE 132 LATIN AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 20172020 (USD MILLION)

TABLE 133 LATIN AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 20212026 (USD MILLION)

TABLE 134 LATIN AMERICA: MARKET SIZE, BY BANKING TYPE, 20172020 (USD MILLION)

TABLE 135 LATIN AMERICA: MARKET SIZE, BY BANKING TYPE, 20212026 (USD MILLION)

TABLE 136 LATIN AMERICA: MARKET SIZE, BY BANKING MODE, 20172020 (USD MILLION)

TABLE 137 LATIN AMERICA: MARKET SIZE, BY BANKING MODE, 20212026 (USD MILLION)

TABLE 138 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 20172020 (USD MILLION)

TABLE 139 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 20212026 (USD MILLION)

TABLE 140 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 20172020 (USD MILLION)

TABLE 141 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 20212026 (USD MILLION)

10.5.4 BRAZIL

10.5.4.1 Entry of FinTech startups boost innovation in digital banking platform in Brazil

10.5.5 MEXICO

10.5.5.1 Huge adoption of cloud-based services provides growth opportunities in Mexico

10.5.6 REST OF LATIN AMERICA

10.6 MIDDLE EAST AND AFRICA

10.6.1 MIDDLE EAST AND AFRICA: DIGITAL BANKING PLATFORMS MARKET DRIVERS

FIGURE 32 STATISTICS OF FINANCIAL PENETRATION IN MIDDLE EAST AND AFRICA

10.6.2 MIDDLE EAST AND AFRICA: DIGITAL BANKING PLATFORM REGULATIONS

10.6.3 MIDDLE EAST AND AFRICA: IMPACT OF COVID-19 ON THE MARKET

TABLE 142 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 20172020 (USD MILLION)

TABLE 143 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 20212026 (USD MILLION)

TABLE 144 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 20172020 (USD MILLION)

TABLE 145 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 20212026 (USD MILLION)

TABLE 146 MIDDLE EAST AND AFRICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 20172020 (USD MILLION)

TABLE 147 MIDDLE EAST AND AFRICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 20212026 (USD MILLION)

TABLE 148 MIDDLE EAST AND AFRICA: MARKET SIZE, BY BANKING TYPE, 20172020 (USD MILLION)

TABLE 149 MIDDLE EAST AND AFRICA: MARKET SIZE, BY BANKING TYPE, 20212026 (USD MILLION)

TABLE 150 MIDDLE EAST AND AFRICA: MARKET SIZE, BY BANKING MODE, 20172020 (USD MILLION)

TABLE 151 MIDDLE EAST AND AFRICA: MARKET SIZE, BY BANKING MODE, 20212026 (USD MILLION)

TABLE 152 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT TYPE, 20172020 (USD MILLION)

TABLE 153 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT TYPE, 20212026 (USD MILLION)

TABLE 154 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 20172020 (USD MILLION)

TABLE 155 MIDDLE EAST AND AFRICA: DIGITAL BANKING PLATFORMS MARKET SIZE, BY COUNTRY, 20212026 (USD MILLION)

10.6.4 UNITED ARAB EMIRATES

10.6.4.1 Technological advancements in cloud computing have led to the adoption of digital banking platforms in the UAE

10.6.5 KINGDOM OF SAUDI ARABIA

10.6.5.1 Rapid advancements in IoT has propelled the growth of the market in KSA

10.6.6 REST OF MIDDLE EAST AND AFRICA

11 COMPETITIVE LANDSCAPE (Page No. - 130)

11.1 OVERVIEW

FIGURE 33 KEY DEVELOPMENTS BY LEADING PLAYERS IN THE DIGITAL BANKING PLATFORMS MARKET BETWEEN 2019 AND 2021

11.2 TOP VENDORS IN THE MARKET

FIGURE 34 MAJOR VENDORS, 2021

11.3 COMPETITIVE SCENARIO

FIGURE 35 MARKET EVALUATION FRAMEWORK

11.3.1 PRODUCT LAUNCHES

TABLE 156 NEW SERVICE/PRODUCT LAUNCHES, 20192021

11.3.2 DEALS

TABLE 157 DEALS, 20192021

11.3.3 OTHERS

TABLE 158 OTHERS, 20192021

12 COMPANY PROFILES (Page No. - 135)

12.1 MAJOR PLAYERS

(Business Overview, Products, Key Insights, Recent Developments, MnM View)*

12.1.1 ORACLE

TABLE 159 ORACLE: BUSINESS OVERVIEW

FIGURE 36 ORACLE: COMPANY SNAPSHOT

TABLE 160 ORACLE: PRODUCTS OFFERED

TABLE 161 ORACLE: DIGITAL BANKING PLATFORM MARKET: DEALS

TABLE 162 ORACLE: DIGITAL BANKING PLATFORM MARKET: OTHERS

12.1.2 TEMENOS

TABLE 163 TEMENOS: BUSINESS OVERVIEW

FIGURE 37 TEMENOS: COMPANY SNAPSHOT

TABLE 164 TEMENOS: PRODUCTS OFFERED

TABLE 165 TEMENOS: DIGITAL BANKING PLATFORM MARKET: DEALS

12.1.3 EDGEVERVE

TABLE 166 EDGEVERVE: BUSINESS OVERVIEW

FIGURE 38 EDGEVERVE SYSTEMS: COMPANY SNAPSHOT

TABLE 167 EDGEVERVE SYSTEMS: PRODUCTS OFFERED

TABLE 168 EDGEVERVE SYSTEMS: DIGITAL BANKING PLATFORM MARKET: PRODUCT LAUNCHES

TABLE 169 EDGEVERVE SYSTEMS: DIGITAL BANKING PLATFORM MARKET: DEALS

12.1.4 FINASTRA

TABLE 170 FINASTRA: BUSINESS OVERVIEW

TABLE 171 FINASTRA: PRODUCTS OFFERED

TABLE 172 FINASTRA: DIGITAL BANKING PLATFORM MARKET: DEALS

TABLE 173 FINASTRA: DIGITAL BANKING PLATFORM MARKET: OTHERS

12.1.5 TCS

TABLE 174 TCS: BUSINESS OVERVIEW

FIGURE 39 TCS: COMPANY SNAPSHOT

TABLE 175 TCS: PRODUCTS OFFERED

TABLE 176 TCS: DIGITAL BANKING PLATFORM MARKET: PRODUCT LAUNCHES

TABLE 177 TCS: DIGITAL BANKING PLATFORM MARKET: DEALS

12.1.6 FISERV

TABLE 178 FISERV: BUSINESS OVERVIEW

FIGURE 40 FISERV: COMPANY SNAPSHOT

TABLE 179 FISERV: PRODUCTS OFFERED

TABLE 180 FISERV: DIGITAL BANKING PLATFORM MARKET: DEALS

12.1.7 WORLDLINE

TABLE 181 WORLDLINE: BUSINESS OVERVIEW

FIGURE 41 WORLDLINE: COMPANY SNAPSHOT

TABLE 182 WORLDLINE: PRODUCTS OFFERED

TABLE 183 WORLDLINE: DIGITAL BANKING PLATFORM MARKET: DEALS

12.1.8 BNY MELLON

TABLE 184 BNY MELLON: BUSINESS OVERVIEW

FIGURE 42 BNY MELLON: COMPANY SNAPSHOT

TABLE 185 BNY MELLON: PRODUCTS OFFERED

TABLE 186 BNY MELLON: DIGITAL BANKING PLATFORM MARKET: PRODUCT LAUNCHES

TABLE 187 BNY MELLON: DIGITAL BANKING PLATFORM MARKET: DEALS

12.1.9 SAP

TABLE 188 SAP: BUSINESS OVERVIEW

FIGURE 43 SAP: COMPANY SNAPSHOT

TABLE 189 SAP: PRODUCTS OFFERED

TABLE 190 SAP: DIGITAL BANKING PLATFORM MARKET: PRODUCT LAUNCHES

TABLE 191 SAP: DIGITAL BANKING PLATFORM MARKET: DEALS

12.1.10 NCR

TABLE 192 NCR: BUSINESS OVERVIEW

FIGURE 44 NCR: COMPANY SNAPSHOT

TABLE 193 NCR: PRODUCTS OFFERED

TABLE 194 NCR: DIGITAL BANKING PLATFORM MARKET: DEALS

12.1.11 SOPRA BANKING SOFTWARE

TABLE 195 SOPRA BANKING SOFTWARE: BUSINESS OVERVIEW

FIGURE 45 SOPRA BANKING SOFTWARE: COMPANY SNAPSHOT

TABLE 196 SOPRA BANKING SOFTWARE: PRODUCTS OFFERED

TABLE 197 SOPRA BANKING SOFTWARE: DIGITAL BANKING PLATFORM MARKET: PRODUCT LAUNCHES

TABLE 198 SOPRA BANKING SOFTWARE: DIGITAL BANKING PLATFORM MARKET: DEALS

12.1.12 NCINO

TABLE 199 NCINO: BUSINESS OVERVIEW

FIGURE 46 NCINO: COMPANY SNAPSHOT

TABLE 200 NCINO: PRODUCTS OFFERED

TABLE 201 NCINO: DIGITAL BANKING PLATFORM MARKET: DEALS

12.1.13 INTELLECT DESIGN ARENA

TABLE 202 INTELLECT DESIGN ARENA: BUSINESS OVERVIEW

FIGURE 47 INTELLECT DESIGN ARENA: COMPANY SNAPSHOT

TABLE 203 INTELLECT DESIGN ARENA: PRODUCTS OFFERED

TABLE 204 INTELLECT DESIGN ARENA: DIGITAL BANKING PLATFORM MARKET: PRODUCT LAUNCHES

12.1.14 MULESOFT

TABLE 205 MULESOFT: BUSINESS OVERVIEW

FIGURE 48 MULESOFT: COMPANY SNAPSHOT

TABLE 206 MULESOFT: PRODUCTS OFFERED

TABLE 207 MULESOFT: DIGITAL BANKING PLATFORM MARKET: DEALS

*Details on Business Overview, Products, Key Insights, Recent Developments, MnM View might not be captured in case of unlisted companies.

12.2 STARTUP/SME PLAYERS

12.2.1 INTRODUCTION

12.2.2 BACKBASE

12.2.3 APPWAY

12.2.4 TECHNISYS

12.2.5 TPS

12.2.6 MAMBU

12.2.7 CR2

12.2.8 EBANKIT

12.2.9 NETINFO

12.2.10 APITURE

12.2.11 VELMIE

12.2.12 ALKAMI

13 APPENDIX (Page No. - 185)

13.1 ADJACENT MARKETS

13.1.1 LIMITATIONS

13.1.2 IOT IN BFSI MARKET

13.1.2.1 Market overview

13.1.2.2 IoT in BFSI market by component

TABLE 208 IOT IN BFSI MARKET SIZE, BY COMPONENT, 20162023 (USD MILLION)

TABLE 209 IOT IN BFSI MARKET SIZE, BY SOLUTION, 20162023 (USD MILLION)

TABLE 210 IOT IN BFSI MARKET SIZE, BY SERVICE, 20162023 (USD MILLION)

TABLE 211 PROFESSIONAL SERVICES: IOT IN BFSI MARKET SIZE, BY TYPE, 20162023 (USD MILLION)

13.1.2.3 IoT in BFSI market by end user

TABLE 212 IOT IN BFSI MARKET SIZE, BY END USER, 20162023 (USD MILLION)

13.1.2.4 IoT in BFSI market by organization size

TABLE 213 IOT IN BFSI MARKET SIZE, BY ORGANIZATION SIZE, 20162023 (USD MILLION)

13.1.2.5 IoT in BFSI market by region

TABLE 214 IOT IN BFSI MARKET SIZE, BY REGION, 20162023 (USD MILLION)

13.1.3 WEALTH MANAGEMENT PLATFORM MARKET

13.1.3.1 Market overview

13.1.3.2 Wealth Management Platform market, by advisory model

TABLE 215 WEALTH MANAGEMENT PLATFORM MARKET SIZE, BY ADVISORY MODEL, 20152022 (USD MILLION)

13.1.3.3 Wealth Management Platform market, by business function

TABLE 216 WEALTH MANAGEMENT PLATFORM MARKET SIZE, BY BUSINESS FUNCTION, 20152022 (USD MILLION)

13.1.3.4 Wealth Management Platform market, by deployment model

TABLE 217 WEALTH MANAGEMENT PLATFORM MARKET SIZE, BY DEPLOYMENT MODEL, 20152022 (USD MILLION)

13.1.3.5 Wealth Management Platform market, by end-user industry

TABLE 218 WEALTH MANAGEMENT PLATFORM MARKET SIZE, BY END-USER INDUSTRY, 20152022 (USD MILLION)

13.1.3.6 Wealth Management Platform market, by region

TABLE 219 WEALTH MANAGEMENT PLATFORM MARKET SIZE, BY REGION, 20152022 (USD MILLION)

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATION

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

The study involved four major activities in estimating the current size of the Digital Banking Platforms Market. Exhaustive secondary research was done to collect information on the industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and sub segments of the Digital Banking Platforms Market.

Secondary Research

The market size of companies offering Digital Banking Platforms and services was arrived at based on the secondary data available through paid and unpaid sources. It was also arrived at by analyzing the product portfolio of major companies and rating them based on their performance and quality. In the secondary research process, various sources were referred to, for identifying and collecting information for the study. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The other secondary sources such as Association for Financial Technology (AFT), World Economic Outlook (WEO), and Global Findex database were used to collect secondary data. The market trends and initiatives in various countries were extracted from government associations, such as Euro Banking Association (EBA), Singapore FinTech Association (SFA), American Bankers Association (ABA), Canadian Bankers Association (CBA), Australian Banking Association (ABA), and Indian Banks' Association (IBA). Secondary research was used to obtain key information about industry insights, the markets monetary chain, the overall pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

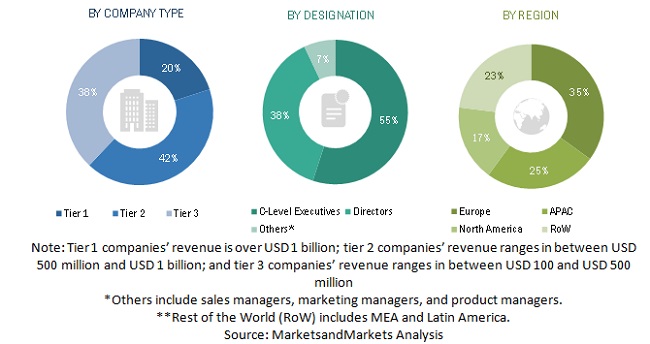

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Technology Officers (CTOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from digital banking platforms and service vendors, system integrators, professional and managed service providers, industry associations, and consultants; and key opinion leaders.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the digital banking platforms market and various other dependent submarkets in the overall market

In the top-down approach, the estimation of the digital banking platforms market was prepared from the global digital transformation market. The global digital transformation market has nine key verticals: healthcare; IT and telecom; manufacturing; retail; Banking, Financial Services, and Insurance (BFSI); media and entertainment, education, government, and other verticals (transportation and logistics, and travel and hospitality). The BFSI vertical has been considered for estimating the market size of digital banking platforms. The BFSI vertical comprises commercial banks, insurance companies, non-banking financial companies, cooperative organizations, pension funds, mutual funds, and other small financial entities, which have their offices and branches spread across geographic locations. The share of digital banking platforms in the BFSI vertical was estimated through secondary sources, in-house research databases, and primary interviews. The digital banking platforms area was studied and analyzed for its regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CEOs, VPs, directors, and marketing executives. These market numbers were further triangulated with the existing MarketsandMarkets repository for validation.

Data Triangulation

Report Objectives

- To determine and forecast the global digital banking platforms market by component, (platforms and services), banking type, banking mode, deployment type, and region from 2021 to 2026, and analyze various macroeconomic and microeconomic factors that affect the market growth

- To forecast the size of the markets segments with respect to five main regions: North America, Europe, Latin America, Asia Pacific (APAC), and the Middle East and Africa (MEA)

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the overall market

- To provide detailed information regarding major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the digital banking platforms market

- To profile key market players and provide a comparative analysis based on their business overviews, service offerings, regional presence, business strategies, and key financials

- To track and analyze competitive developments, such as mergers and acquisitions, product developments, partnerships and collaborations, and Research and Development (R&D) activities, in the market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Digital Banking Platforms Market

Understanding digital banking market and segmentation

Understanding key trends like technology adoption, market trends

Interested in Fintech Services on Digital Banking Engagement Platforms

Interested in Fiserv capabilities